#debt collector? sally

Explore tagged Tumblr posts

Text

bold of you to assume i can’t assign a just dance character to every jhariah song. multiple just dance characters even

#pressure bomb? lumen#sasuke? ruben#debt collector? sally#pin eye? wanderlust AND ari#control baby oh don’t even get me started#star says#just dance#jhariah

23 notes

·

View notes

Note

Thoughts about sorawo and toriko?

oh my god so many. keep in mind i havent reread the novels in maybe a year now so i might be off with some of the stuff im about to say...

i have many thoughts on sorawo and toriko SEPARATELY But from the phrasin of this and also assumin u meant like them romantically iwill sally forth. bonus drawing if u make it all the way thru this word vomit

i think the main reason i love the main pairing together is because of the slow burn and also because i think they are (slowly) growing together and enabling each other to become better versions of themselves. and they both (while stumbling and not through perfect efforts) try to leave each other space and push each other to recover from their respective traumas. its all very sweet and very human. sorawo's side is more obvious: i think meeting toriko has allowed sorawo to feel like she has more self control over her life, and also (slowly) i think befriending toriko means for sorawo, shes slowly opening her heart for other people in her life. esp with the series opening the way that it does with sorawo going "nobody would miss me if i died. except the debt collectors" and then toriko entering and not leaving her alone which then starts a whole domino cascade of events that end up with sorawo being surrounded with people who do love and care for her. aueugsdhfshfrg (emotional). on a side note i like how miyazawa gives sorawo agency in her growth---i think too often a character who is traumatized gets sort of shuttled in to a specific road of recovery, and if they display behaviors or opinions that appear antithetical to their recovery, i feel like they get infantilized like oh you dont know your own mind and stuff. but with sorawo miyazawa lets her take things at her own pace, set her own boundaries, and have like idk emotions seen as more "flawed" than usual. i enjoy it it also feels very human and compassionate of the story

toriko is a whole other story. i think her growth is a lot more subtle since we dont see a lot of her pov and we have to infer what is happening from sorawo's erm... unreliable narration at times. with toriko i think at first she reaches out to sorawo for the same reason sorawo is drawn to her---they're both very lonely and isolated people. over time however, i think toriko (esp in vol 8) has shown a lot of growth as she is now able to take sorawo's apparent rejections less personally if that makes sense? like she's gained the self confidence to stand on her own two feet which is a change from the start of the series where she was depending on different people (satsuki then sorawo) to make herself feel more complete. idk if that makes sense and i might be completely off on that mark lmao again i havent read the novels in a hot sec. i think sorawo's part in this is sorawo treats toriko as an equal for the most part, which is something she didnt probably get with satsuki. i imagine this allowed toriko to feel more loved, but also allowed her to do a lot more self reflectiona nd growth. love her to bits sorry if any of this is wrong also i feel like im forgetting things

tldr i love stories where traumatized characters meet each other by chance and then become best friends (accomplices) and then fall for each other while becoming better versions of themselves in the meanwhile. and soratori is really good at exploring the dynamics of this <3 yay

heres buff toriko i was drawing for fun. i have myreasons for this but #1 reason is that the world is made out of pudding

15 notes

·

View notes

Photo

There are also cases where the man that owned everything was incredibly irresponsible with his spending, and upon death his debt collectors went after wives/daughters. This is what happened to Thomas Jefferson's daughter Martha Rudolph. Between her shit husband, shit father-in-law, and shit father, the debt caused her to spend a good portion of her life in poverty relying on church charity and essentially sofa surfing with relatives. This was with selling all of her famous father's properties (including slaves, except Sally Hemings and Jefferson's children with her). Monticello sat on the market for 5 years and sold for $7k instead of the $70k+ it was valued at. The debt was so bad it threatened her daughter's marriage prospects. Martha's strategy to survive was to ensure her sons and son-in-laws got amazing jobs, which being Thomas Jefferson's daughter helped influence. Can you imagine being a woman in that kind of position in that time period without a famous and popular but actually a really shit father?

161K notes

·

View notes

Text

Dealing with Forster and Garbus? Here’s What You Need to Do

Have you recently received a lawsuit notice from Forster & Garbus, LLP? If so, you may be feeling overwhelmed and uncertain about your next steps.

Ignoring the situation won’t make it go away—in fact, it could make things much worse.

When debt goes unpaid, you might start receiving calls and letters from collection agencies and law firms you’ve never heard of. While it may be tempting to avoid these communications, doing so can lead to serious financial consequences. If Forster & Garbus has sued you, ignoring the lawsuit could result in a default judgment against you. That means the firm could gain the legal authority to freeze your bank account or garnish your wages.

However, by responding promptly and strategically, you can protect yourself and potentially improve your outcome. In this article, we’ll break down who Forster & Garbus is, why they may be contacting you, and the best way to handle a debt collection lawsuit from them.

Who is Forster and Garbus, and Should You Be Concerned?

If you’ve been contacted by Forster and Garbus, LLP, you might be wondering who they are and why they are reaching out to you. This law firm, based in Suffolk County, Long Island, New York, operates primarily as a debt collection firm. They represent major creditors and lenders in lawsuits against consumers who have defaulted on their debts.

However, Forster and Garbus does more than just represent creditors in legal actions. The firm also owns a separate debt collection agency, Professional Credit Services, Inc., which operates from the same address. Like many collection agencies, this subsidiary purchases defaulted accounts for a fraction of their original value and then attempts to collect the full balance from consumers.

If you’ve received a letter or lawsuit from Forster and Garbus, it’s crucial to understand your rights and options before responding.

How to Contact Forster and Garbus

If you need to verify or dispute a debt, here’s the official contact information for Forster & Garbus:

Phone Number: (800) 245-9943

Mailing Address: 60 Motor Parkway, Commack, New York 11725

If Forster and Garbus has filed a lawsuit against you, it’s essential to act quickly. Ignoring their communication can result in a default judgment, which could lead to wage garnishment or frozen bank accounts.

Who Does Forster and Garbus Collect For?

Forster & Garbus represents a variety of major creditors, including:

Banks & Credit Card Companies: Capital One, Citibank, Discover, Macy’s, and others.

Student Loan Lenders: National Collegiate Trust, Sallie Mae, and other private lenders.

These institutions hire Forster and Garbus to collect debts on their behalf, and in some cases, the firm may also purchase debts outright through its collection agency.

Is Forster and Garbus a Legitimate Business or a Scam?

Forster and Garbus, LLP is a legally recognized law firm and debt collection agency—not a scam. They have been in operation for decades and are known for representing creditors in court. However, like many debt collectors, they have received complaints regarding their aggressive collection tactics.

Under the Fair Debt Collection Practices Act (FDCPA), debt collectors must follow strict guidelines when contacting consumers. If Forster & Garbus is harassing you, misrepresenting your debt, or engaging in unethical practices, you have the right to report them to the Consumer Financial Protection Bureau (CFPB) or the Federal Trade Commission (FTC).

While they are not a scam, you should always verify any debt they claim you owe. Debt collectors sometimes pursue the wrong person, attempt to collect on debts that are past the statute of limitations, or fail to provide proper documentation. If you receive a debt notice from Forster & Garbus, consider requesting a Debt Validation Letter before making any payments.

Forster and Garbus Reviews: Consumer Experiences & Complaints

If you’ve been contacted by Forster and Garbus, LLP, you may be wondering what other consumers have experienced when dealing with this law firm. To provide insight, we’ve compiled reviews from various sources, including the

Better Business Bureau (BBB), Google Reviews, and the Consumer Financial Protection Bureau (CFPB).

Better Business Bureau (BBB) Reviews

BBB Rating: 1/5 stars

Total Complaints in the Last 3 Years: 9 complaints

Consumers have raised concerns about the firm’s handling of debt collections, settlements, and legal proceedings. Some common complaints include:

Unresponsive Communication: Many consumers claim that Forster & Garbus fails to return calls or emails, even after agreements are made.

Incorrect Debt Information: Reports indicate that some individuals were pursued for debts they did not owe or were not properly notified about.

Legal Judgments Without Notification: Some consumers claim they were unaware of court filings until after a judgment was placed against them.

Failure to Honor Settlements: There are multiple complaints about consumers paying agreed settlements, only to find that their case remains unresolved or still pending in court.

One reviewer stated:

“Someone fraudulently used my credit card, yet Forster & Garbus sued me. After being forced to settle, they never removed the court filing as promised. Even years later, my case still appears as unresolved.”

Another consumer shared:

“My husband was disabled and never mentioned the debt to me. After he passed, I found out they had placed a judgment against my house. Despite numerous attempts to contact them, I received no response.”’

Google Reviews Summary

Overall Rating: 2.1/5 stars

Total Reviews: 76 reviews

Many consumers on Google report similar frustrations with Forster & Garbus, including:

Lack of Proper Communication: Several reviewers noted that after reaching settlements in court, they never received payment instructions and had to chase the firm for months.

Billing Errors & Discrepancies: Some claim that agreed-upon amounts were changed or increased without explanation. ● Aggressive Collection Tactics: Consumers report being repeatedly contacted, even after making payments.

One reviewer wrote:

“I went to court and got a signed settlement agreement, but Forster & Garbus never contacted me with payment instructions. When I finally reached someone, the website showed my full debt amount instead of the settlement terms. No one would fix it, and now I may have to report them to the FTC.”

Another complaint stated:

“I settled my debt over the phone in less than an hour, but it took three weeks just to receive a written confirmation. Their process is incredibly slow and frustrating.”

CFPB Consumer Complaints

The Consumer Financial Protection Bureau (CFPB) has taken action against Forster and Garbus in the past for improper debt collection practices, including filing mass lawsuits against consumers without proper review. Many consumers have reported:

Being sued without receiving proper documentation or validation of the debt.

Receiving judgments against them without being notified of legal proceedings.

Difficulties reaching representatives or obtaining correct payment information.

For more information, you can visit the CFPB’s official statement on Forster & Garbus:

Are There Any Positive Reviews?

While the majority of consumer experiences are negative, some individuals have reported positive interactions, particularly when they were able to communicate effectively with the firm. Those who were proactive in responding to lawsuits or setting up payments often reached resolutions faster and with less frustration.

Should You Be Concerned?

If you are dealing with Forster & Garbus, it is important to: ✅ Verify the debt before making any payments. Request a Debt Validation Letter to ensure accuracy.

✅ Keep records of all communication with the firm, including emails, letters, and phone calls.

✅ Respond to lawsuits promptly to avoid default judgments that could lead to wage garnishment or bank account freezes.

✅ Report any unethical practices to the CFPB, BBB, or your state attorney general’s office if you feel your rights are being violated.

While Forster and Garbus is a legitimate law firm, their collection practices have raised serious concerns. If you are unsure how to handle their claims against you, consider seeking legal advice or using MyDebtRep for guidance on how to respond.

Understanding Unfair Debt Collection Practices: A Guide to Protecting Your Rights Against Forster & Garbus

Dealing with debt collectors can be stressful, particularly when they engage in aggressive or unfair collection tactics. If Forster & Garbus is

attempting to collect a debt from you, it’s important to understand your rights under the law and how to respond to their collection efforts.

Debt collectors must follow specific legal guidelines, as outlined in the Fair Debt Collection Practices Act (FDCPA) and other consumer protection laws. If Forster & Garbus crosses the line into harassment or deceptive practices, you have legal options to push back and protect yourself.

Below, we explore common concerns about debt collection, legal time limits, and how you can take action against unfair collection practices.

What Happens If Your Debt Is Sold to Forster & Garbus?

If your original creditor sells your debt to Forster & Garbus, it means they have transferred their right to collect the balance. This typically happens when an account is past due for several months and the creditor decides to recover some of their losses by selling it to a third-party debt buyer or collection law firm like Forster & Garbus.

Once they own the debt, Forster & Garbus can:

Contact you by phone, mail, or other legal means to demand payment

Attempt to negotiate a settlement or payment plan

Report the debt to the credit bureaus, affecting your credit score ● File a lawsuit against you if the debt is still within the legal time limit

However, if your debt was sold, you have the right to request validation under the FDCPA. You can ask Forster & Garbus to prove that the debt is legitimate and that they have the legal authority to collect it. If they cannot provide documentation, you may be able to dispute or challenge the debt.

What Should You Do If Forster & Garbus Harasses You?

Debt collectors are legally prohibited from using harassment, threats, or deceptive tactics to collect money from you. If Forster & Garbus engages in any of the following actions, they may be violating the FDCPA:

Calling you repeatedly to intimidate or annoy you

Calling early in the morning or late at night (outside of 8 AM – 9 PM local time)

Contacting your family, friends, or employer to pressure you into paying

Using threatening, abusive, or profane language

Falsely claiming that they will have you arrested or sued if you don’t pay

Attempting to collect more than you actually owe

Failing to provide written notice of the debt within five days of initial contact

How to Protect Yourself from Harassment

If Forster & Garbus is harassing you, take the following steps:

Keep Records – Save copies of letters, emails, and record the dates and times of phone calls.

Request Written Communication Only – You can send a letter asking them to stop calling and only contact you by mail. 3. Send a Cease-and-Desist Letter – Under the FDCPA, you can demand that they stop all communication with you.

Report Violations – If harassment continues, file a complaint with the Consumer Financial Protection Bureau (CFPB), the Federal Trade Commission (FTC), or your state’s attorney general.

Consult an Attorney – If Forster & Garbus violates your rights, you may be able to sue them for damages and recover legal fees.

How Long Can Forster & Garbus Try to Collect a Debt?

Debt collectors can attempt to collect a debt indefinitely, but there are legal limits on how long they can sue you for unpaid debts.

The statute of limitations on debt collection varies by state but typically ranges from 3 to 10 years. Once the statute of limitations expires, Forster & Garbus can still attempt to collect, but they cannot sue you in court.

⚠️ Warning: If you make a payment or acknowledge the debt in writing, you may restart the statute of limitations, giving them the ability to sue you again.

Can Forster & Garbus Sue You Over a Debt?

Yes. If the debt is legally enforceable and within the statute of limitations, Forster & Garbus can file a lawsuit against you in civil court.

If they win the case, they may obtain a judgment that allows them to:

Garnish your wages (take money from your paycheck) ● Freeze or seize funds in your bank account

Place a lien on your property

How to Defend Yourself Against a Debt Collection Lawsuit

Respond to the lawsuit – Ignoring a lawsuit can result in a default judgment against you.

Request proof of the debt – Force Forster & Garbus to provide documentation that proves you owe the amount claimed. ● Check for statute of limitations violations – If the debt is too old, you may be able to have the case dismissed.

Hire a consumer rights attorney – An attorney can help you negotiate a settlement or defend you in court.

Equip Yourself to Handle Debt Collectors

Navigating the complexities of debt collection requires accurate information and effective resources. To help you take control, I’ve created the MyDebtRep.com E-Book, “How To Stop A Collection Agency” for just $29.95. This budget-friendly guide offers actionable steps to protect your rights and manage debt collectors effectively.

Take the first step towards reclaiming your peace of mind today. Visit MyDebtRep.com to learn more.

Can Forster and Garbus Garnish My Wages?

If you are being pursued by Forster & Garbus for an unpaid debt, you may be wondering whether they can garnish your wages. Wage garnishment is a serious financial consequence that can make it difficult to cover your basic living expenses. The short answer is yes, Forster & Garbus can garnish your wages, but only if they first take the necessary legal steps to obtain a court judgment against you.

Understanding the legal process of wage garnishment, your rights as a consumer, and the defenses available to you can help you take action to protect yourself and your income. In this guide, we’ll break down everything

you need to know about wage garnishment by Forster & Garbus, including how it happens, how much they can take, and what you can do to fight back.

How Can Forster and Garbus Garnish Your Wages?

Forster & Garbus is a debt collection law firm that represents creditors and debt buyers in lawsuits against consumers. They do not have the automatic right to garnish your wages simply because they claim you owe a debt.

Instead, they must go through a legal process, which typically involves the following steps:

Filing a Lawsuit Against You

If you allegedly owe a debt that Forster & Garbus is attempting to collect, they may choose to file a lawsuit against you in civil court. The lawsuit will include a Summons and Complaint, which outlines:

The total amount they claim you owe

The name of the original creditor (or debt buyer if the debt was sold) ● The legal basis for their claim

You Must Be Properly Notified

To proceed with the lawsuit, Forster & Garbus must serve you with the Summons and Complaint according to your state’s laws. This may involve:

Personal service (hand-delivering the documents to you) ● Certified mail

Leaving the documents at your residence if personal service isn’t possible

You Have a Limited Time to Respond

Once served, you typically have 20–30 days to respond, depending on your state’s laws. Your options include:

Filing an Answer to dispute the debt or challenge the lawsuit ● Negotiating a settlement before the court enters a judgment ● Ignoring the lawsuit (which can lead to a default judgment)

⚠️ Ignoring the lawsuit is the worst thing you can do! If you fail to respond, the court may enter a default judgment against you, allowing Forster & Garbus to take collection actions, including wage garnishment.

Obtaining a Court Judgment

If Forster & Garbus wins the lawsuit—either by default (because you didn’t respond) or through litigation—they will receive a judgment against you. This judgment gives them legal authority to pursue collection methods such as:

Wage garnishment

Bank account levies

Property liens

Only after securing a court judgment can Forster & Garbus request a wage garnishment order from the court. Once approved, this order is sent to your employer, requiring them to withhold a portion of your paycheck.

Are There Any Situations Where a Lawsuit Isn’t Required?

Yes, but they are rare. While most debts require a lawsuit before garnishment, some exceptions exist where a creditor can garnish wages without first suing you. These include:

Federal student loans (handled through administrative wage garnishment)

Unpaid taxes (IRS or state tax authorities can garnish wages without a court order)

Unpaid child support and alimony (government agencies can garnish wages automatically)

Forster and Garbus primarily deals with consumer debt lawsuits, such as credit cards, medical bills, and personal loans. Since these debts require a

court judgment before garnishment, you always have an opportunity to fight back.

How Much of Your Wages Can Be Garnished?

Once Forster and Garbus obtains a judgment and a wage garnishment order, the amount they can take is limited by federal and state laws.

Federal Limits on Wage Garnishment

Under the Consumer Credit Protection Act (CCPA), wage garnishment is limited to:

25% of your disposable earnings (your earnings after taxes and mandatory deductions), OR

The amount by which your weekly earnings exceed 30 times the federal minimum wage ($7.25/hour)

�� Example: If you earn $600 per week after taxes, your maximum wage garnishment would be $150 per week (25% of $600).

State-Specific Garnishment Limits

Some states provide stronger protections than federal law. Certain states:

Reduce the percentage that can be garnished

Exempt more income from garnishment

Completely prohibit wage garnishment for consumer debts

If your state has stricter laws, those laws take precedence over federal limits.

Your Rights & Options If Facing Wage Garnishment

Even if a judgment has been entered against you, you still have legal options to protect your income.

Verify the Debt

You have the right to request debt validation to confirm that:

The debt is legally enforceable

Forster & Garbus has the right to collect it

The amount is accurate

Claim Exemptions

Certain types of income cannot be garnished, including:

Social Security benefits

Disability payments (SSI or SSDI)

Veterans’ benefits

Child support & alimony payments

Unemployment benefits

If your wages include exempt income, you can file an exemption claim with the court to protect those funds.

Challenge the Garnishment in Court

You may be able to reduce or stop the garnishment by arguing:

The debt isn’t yours

The statute of limitations has expired

The garnishment causes financial hardship

Negotiate a Settlement

Even after a judgment, you may be able to:

Set up a payment plan to stop garnishment

Negotiate a lump-sum settlement for a reduced amount

Forster & Garbus may agree to stop garnishment if you can offer a reasonable repayment plan.

File for Bankruptcy (Last Resort)

If you are overwhelmed by debt, bankruptcy can immediately stop wage garnishment through an automatic stay.

Chapter 7 bankruptcy may eliminate the debt entirely ● Chapter 13 bankruptcy sets up a structured repayment plan

Consult a bankruptcy attorney to see if this option is right for you.

Forster & Garbus can garnish your wages, but only if they first obtain a court judgment against you. Wage garnishment is not automatic—you have the right to fight back by responding to lawsuits, claiming exemptions, or negotiating a settlement.

If you’re facing a lawsuit or wage garnishment, act quickly to protect your rights. Understanding the process, knowing your state’s laws, and seeking legal assistance can help minimize financial damage and prevent aggressive collection actions.

What Can I Do?

�� Struggling with Debt Collectors? Take Back Control Today! �� �� Introducing the MyDebtRep.com E-Book:

“How to Stop a Collection Agency”

�� Written by a Former Debt Collector! Gain insider knowledge and stop collection harassment, protect your rights, and keep more of your hard-earned money!

�� Dealing with Aggressive Collectors? You Have Options! ✔️ Legally Stop Harassing Calls �� – Send a Cease & Desist Letter ✔️ Verify the Debt Before Paying �� – Request a Debt Validation Letter

✔️ Challenge Unfair Collection Tactics ⚖️ – Know Your Rights Under the FDCPA

�� Why You Need This Guide:

✅ Step-by-Step Instructions – Easy to follow, no legal experience needed!

✅ Pre-Written Legal Letters – Save time & stop collectors in their tracks! ✅ Proven Negotiation Strategies – Pay less, or nothing at all! ✅ Protect Your Wages & Assets – Avoid wage garnishments & lawsuits!

✍️ Exclusive Ready-to-Use Legal Templates:

�� Cease & Desist Letters – Stop unwanted calls IMMEDIATELY �� Debt Validation Requests – Make collectors prove the debt is legit

�� Settlement Negotiation Letters – Cut your debt for pennies on the dollar

�� Why Pay Lawyers Thousands? Do It Yourself for Just $29.95! �� Save on Legal Fees – No expensive attorneys needed! �� Instant Access – Download & take action RIGHT NOW!

�� Fight Back with Confidence – Debt collectors don’t want you to know these secrets!

�� Reclaim Your Peace of Mind & Financial Freedom! �� Avoid Wage Garnishment & Lawsuits

�� Protect Your Income, Bank Accounts & Assets

�� Get Rid of Debt Collectors Once and For All

�� Take the First Step Towards Debt Freedom – Download Now! �� One-Time Payment: Only $29.95 – A lifetime of financial protection!

⏳ Every Day You Wait, Collectors Gain More Power! Act Now! �� Get Your Copy & Stop Debt Collectors Today!

#ForsterAndGarbus#DebtCollection#DebtCollectors#KnowYourRights#DebtRelief#DebtDispute#CreditRepair#ConsumerProtection#FDCPA#FairDebtCollection#StopDebtCollectors#DebtHelp#FinancialFreedom#DebtSettlement#LegalRights#CreditScore#FinanceTips#MoneyMatters#DebtNegotiation#FinancialWellness#ProtectYourRights#AvoidScams

1 note

·

View note

Text

Title: "Bay Area Arrears"

Plot Summary:

In this episode of McMillan & Wife, Sally and Commissioner McMillan find themselves embroiled in a puzzling case that hits close to home—the Bay Area Arrears.

Act 1: The Disappearance

A wealthy philanthropist and art collector, Mr. Winston, goes missing just days before a charity event he was hosting. His disappearance raises eyebrows in the Bay Area community as he was known for his generous contributions. Sally and McMillan are called to investigate.

Act 2: The Clues Unfold

As they delve into Winston's life, they discover financial irregularities and hidden debts that suggest possible motives for his disappearance. Clues lead them through the opulent world of high society, encountering secretive art dealings and strained family relationships.

Act 3: Unraveling the Puzzle

Sally, using her intuition and knack for undercover work, infiltrates a lavish auction house event disguised as an art connoisseur. Meanwhile, McMillan follows a trail of financial transactions that lead to a shocking revelation—Winston had been conned by an intricate Ponzi scheme.

Act 4: The Showdown

The pieces start falling into place as Sally and McMillan race against time to prevent a significant loss of funds for Winston's charity. Confronting the con artists behind the scheme, they orchestrate a clever plan to expose the culprits and recover the stolen funds before the charity event deadline.

Act 5: Resolution

With the case solved and the funds safely retrieved, the charity event becomes a success, honoring Winston's legacy. Sally and McMillan reflect on the intricacies of high-stakes white-collar crime and the vulnerabilities that even the most affluent can face.

Closing Scene:

As the sun sets over the Bay Area, Sally and McMillan exchange a knowing glance, reaffirming their partnership's strength in unraveling complex mysteries that lie beneath the veneer of sophistication in San Francisco.

0 notes

Link

Stefanie Gray explains why, as a teenager, she was so anxious to leave her home state of Florida to go to college.

“I went to garbage schools and I��m from a garbage low-income suburb where everyone sucks Oxycontin all day,” she says. “I needed to get out.”

She got into Hunter College in New York, but both her parents had died and she had nowhere near enough to pay tuition, so she borrowed. “I just had nothing and was poor as hell, so I took out loans,” she says.

This being 2006, just a year after the infamous Bankruptcy Bill of 2005 was passed, she believed news stories about student loans being non-dischargeable in bankruptcy. She believed they would be with her for life, or until they were paid off.

“My understanding was, it’s better to purchase 55 big-screen TVs on a credit card, and discharge that in a court of law, then be a student who’s getting an education,” she says.

Still, she asked for financial aid: “I was like, ‘My parents are dead, I'm a literal fucking orphan, I have no siblings. I'm just taking out this money to put my ass through school.”

Instead of a denial, she got plenty of credit, including a slice of what were called “direct-to-consumer” loans, that came with a whopping 14% interest rate. One of her loans also came from a company called MyRichUncle that, before going bankrupt in 2009, would briefly become famous for running an ad disclosing a kickback system that existed between student lenders and college financial aid offices.

Gray was not the cliché undergrad, majoring in intersectional basket-weaving with no plan to repay her loans. She took geographical mapping, with the specific aim of getting a paying job quickly. But she graduated in the middle of the post-2008 crash, when “53% of people 18 to 29 were unemployed or underemployed.”

“I couldn't even get a job scrubbing toilets at a local motel,” she recalls. “They told me straight up that I was over-educated. I was like, “Literally, I'll do your housekeeping. I don't give a shit, just let me make money and not get evicted and end up homeless.”

The lender Sallie Mae at the time had an amusingly loathsome policy of charging a repeating $150 fee every three months just for the privilege of applying for forbearance. Gray was so pissed about having to pay $50 a month just to say she was broke that she started a change.org petition that ended up gathering 170,000 signatures.

She personally delivered those to the Washington offices of Sallie Mae and ended up extracting a compromise out of the firm: they’d still charge the fee, but she could at least apply it to her balance, as opposed to just sticking it in the company’s pocket as an extra. This meager “partial” victory over a student lender was so rare, the New York Times wrote about it.

“I definitely poked the bear,” she says.

Gray still owed a ton of student debt — it had ballooned from $36,000 to $77,000, in fact — and collectors were calling her nonstop, perhaps with a little edge thanks to who she was. “They were telling me I should hit up people I know for money, which was one thing,” she recalls. “But when they started talking about giving blood, or selling plasma… I don’t know.”

Sallie Mae ultimately sued Gray four times. In doing so, they made a strange error. It might have slipped by, but for luck. “By the grace of God,” Gray said, she met a man in the lobby of a courthouse, a future state Senator named Kevin Thomas, who took a look at her case. “Huh, I’ve got some ideas,” he said, eventually pointing to a problem right at the top of her lawsuit.

Sallie Mae did not represent itself in court as Sallie Mae. The listed plaintiff was “SLM Private Credit Student Loan Trust VL Funding LLC.” As was increasingly the case with mortgages and other forms of debt, student loans by then were typically gathered, pooled, and chopped into slices called tranches, to be marketed to investors. Gray, essentially, was being sued by a tranche of student loan debt, a little like being sued by the coach section of an airline flight.

When Thomas advised her to look up the plaintiff’s name, she discovered it wasn’t registered to do business in the State of New York, which prompted the judge to rule that the entity lacked standing to sue. He fined Sallie Mae $10,000 for “nonsense” and gave Gray another rare victory over a student lender, which she ended up writing about herself this time, in The Guardian.

Corporate creditors often play probabilities and mass-sue even if they don’t always have great cases, knowing a huge percentage of borrowers either won’t show up in court (as with credit card holders) or will agree to anything to avoid judgments, the usual scenario with student borrowers.

“What usually happens in pretty much 99% of these cases is you beg and plead and say, ‘Please don't put a judgment against me, I'll do anything… because a judgment against you means you're not going to be able to buy a home, you’re not going to be able to do basically anything involving credit for the next 20 years.”

…

The passage of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 was a classic demonstration of how America works, or doesn’t, depending on your point of view. While we focus on differences between Republicans and Democrats, it’s their uncanny habit of having just a sliver of enough agreement to pass crucial industry-friendly bills that really defines the parties.

Whether it’s NAFTA, the Iraq War authorization, or the Obama stimulus, there are always just enough aisle-crossers to get the job done, and the tally usually tracks with industry money with humorous accuracy. In this law signed by George Bush, sponsored by Republican Chuck Grassley, and greased by millions in donations from entities like Sallie Mae, the crucial votes were cast by a handful of aisle-crossing Democrats, including especially the Delawareans Joe Biden and Tom Carper. Hillary Clinton, who took $140,000 from bank interests in her Senate run, had voted for an earlier version.

Party intrigue is only part of the magic of American politics. Public relations matter, too, and the Bankruptcy Bill turned out to be the poster child for another cherished national phenomenon: the double-lie.

…

Years later, pundits still debate whether there really ever was an epidemic of debt-fleeing deadbeats, or whether legislators in 2005 who just a few years later gave “fresh starts” to bankrupt Wall Street banks ever cared about “moral hazard,” or if it’s fair to cut off a single Mom in a trailer when Donald Trump got to brag about “brilliantly” filing four commercial bankruptcies, and so on.

In other words, we argue the why of the bill, but not the what. What did that law say, exactly? For years, it was believed that it absolutely closed the door on bankruptcy for whole classes of borrowers, and one in particular: students. Nearly fifteen years after the bill’s passage, journalists were still using language like, “The bill made it completely impossible to discharge student loan debt.”

…

The phrase “Just asking questions” today often carries a negative connotation. It’s the language of the conspiracy theorist, we’re told. But sometimes in America we’re just not told the whole story, and when the press can’t or won’t do it, it’s left to individual people to fill in the blanks. In a few rare cases, they find out something they weren’t supposed to, and in rarer cases still, they learn enough to beat the system. This is one of those stories.

…

Smith’s explanation of the history of the student loan exemption and where it all went wrong is biting and psychologically astute. In his telling, the courts’ historically sneering attitude toward student borrowers has its roots in an ages-old generational debate.

“This started out as an an argument between the Greatest Generation and Baby Boomers,” Smith notes. “A lot of the law was created by people railing against draft-dodging deadbeat hippies.”

He points to a 1980 ruling by a judge named Richard Merrick, who in denying relief to a former student, wrote the following:

The arrogance of former students who had received so much from society, frequently including draft deferment, and who had given back so little in return, accompanied by their vehemence in asserting their constitutional and statutory rights, frequently were not well received by legislators and jurists, senior to them, who had lived through the Depression, had worked their ways through college and graduate school, had served in World War II, and had been paying the taxes which made possible the student loans.

Smith laughs about this I didn’t climb the hills at Normandy with a knife in my teeth just to eat the debt on your useless-ass liberal arts degree perspective, noting that “when those guys who did all that complaining went to school, only rich prep school kids went to college, and by the way, tuition was like ten bucks.” Still, he wasn’t completely unsympathetic to the conservative position.

…

This concern about “deadbeats” gaming the system — kids taking out fat loans to go to school and bailing on them before the end of the graduation party — led that 1985 court to take a hardcore position against students who made “virtually no attempt to repay.” They established a three-pronged standard that came to be known as the “Brunner test” for determining if a student faced enough “undue hardship” to be granted relief from student debt.

Among other things, the court ruled that a newly graduated student had to do more than demonstrate a temporary inability to handle bills. Instead, a “total incapacity now and in the future to pay” had to be present for a court to grant relief. Over the course of the next decades, it became axiomatic that basically no sentient being could pass the Brunner test.

…

In 2015, he was practicing law at the Texas litigation firm Bickel and Brewer when he came across a case involving a former Pace University student named Lesley Campbell, who was seeking to discharge a $15,000 loan she took out while studying for a bar exam. Smith believed a loan given out to a woman who’d already completed her studies, and who used the money to pay for rent and groceries, was not covering an “educational benefit” as required by law. A judge named Carla Craig agreed and canceled Campbell’s loan, and Campbell v. Citibank became one of the earlier dents in the public perception that there were no exceptions to the prohibition on discharging student debts.

“I thought, ‘Wait, what? This might be important,’” says Smith.

By law, Smith believed, lenders needed to be wary of three major exceptions to the non-dischargeability rule:

— If a loan was not made to a student attending a Title IV accredited school, he thought it was probably not a “qualified educational loan.”

— If the student was not a full-time student — in practice, this meant taking less than six credits — the loan was probably dischargeable.

— And if the loan was made in an amount over and above the actual cost of attending an accredited school, the excess might not be “eligible” money, and potentially dischargeable.

Practically speaking, this means if you got a loan for an unaccredited school, were not a full-time student, or borrowed for something other than school expenses, you might be eligible for relief in court.

Smith found companies had been working around these restrictions in the blunt predatory spirit of a giant-sized Columbia Record Club. Companies lent hundreds of thousands to teenagers over and above the cost of tuition, or to people who’d already graduated, or to attendees of dubious unaccredited institutions, or to a dozen other inappropriate destinations. Then they called these glorified credit card balances non-dischargeable educational debts — Gray got one of these “direct-to-consumer” specials — and either sold them into the financial system as investments, borrowed against them as positive assets, or both.

…

Smith thought these practices were nuts, and tried to convince his bosses to start suing financial companies.

“They were like, ‘You do know what we do around here, right?’ We defend banks,” he recalls, laughing. “I said, ‘Not these particular banks.’ They said it didn’t matter, it was a question of optics, and besides, who was going to pay off in the end? A bunch of penniless students?”

Furious, Smith stormed off, deciding to hang his own shingle and fight the system on his own. “My sister kept saying to me, ‘You have to stop trying to live in a John Grisham novel,’” he recalls, laughing. “There were parts of it where I was probably super melodramatic, saying things like, ‘I'm going to go find justice.’”

Slowly however, Smith did find clients, and began filing and winning cases. With each suit, he learned more and more about student lenders. In one critical moment, he discovered that the same companies who were representing in court that their loans were absolutely non-dischargeable were telling investors something entirely different. In one prospectus for a trust packed full of loans managed by Sallie Mae, investors were told that the process for creating the aforementioned “direct-to-consumer” loans:

Does not involve school certification as an additional control and, therefore, may be subject to some additional risk that the loans are not used for qualified education expenses… You will bear any risk of loss resulting from the discharge.

Sallie Mae was warning investors that the loans might be discharged in bankruptcy. Why the honesty? Because the parties who’d be packaging and selling these student loan-backed instruments included Credit Suisse, JP Morgan Chase, and Deutsche Bank.

“It’s one thing to lie to a bunch of broke students. They don’t matter,” Smith says. “It’s another to lie to JP Morgan Chase and Deutsche Bank. You screw those people, they’ll fight back.”

…

In June of 2018, a case involving a Navy veteran named Kevin Rosenberg went through the courts. Rosenberg owed hundreds of thousands of dollars and tried to keep current on his loans, but after his hiking and camping store folded in 2017, he found himself busted and unable to pay. His case was essentially the opposite of Brunner: he clearly hadn’t tried to game the system, he made a good faith effort to pay, and he demonstrated a long-term inability to make good. All of this was taken into consideration by a judge named Cecilia Morris, who ruled that Rosenberg qualified for “undue hardship.”

“Most people… believe it impossible to discharge student loans,” Morris wrote. “This Court will not participate in perpetuating these myths.” The ruling essentially blew up the legend of the unbeatable Brunner standard.

Given a fresh start, Rosenberg moved to Norway to become an Arctic tour guide. “I want people to know that this is a viable option,” he said at the time. The ruling attracted a small flurry of news attention, including a feature in the Wall Street Journal, as the case sent a tremor through the student lending world. More and more people were now testing their luck in bankruptcy, suing their lenders, and asking more and more uncomfortable questions about the nature of the education business.

In the summer of 2012, a former bond trader named Michael Grabis sat in the waiting room of a Manhattan financial company, biding time before a job interview. In the eighties, Grabis’s father was a successful bond trader who worked in a swank office atop the World Trade Center, but after the 1987 crash, the family fell out of the smart set overnight. His father lost his job and spiraled, his mother had to look for a job, and “we just became working class people.”

Michael tried to rewrite the family story, going to school and going into the bond business himself, first with the Bank of New York, and eventually for Schwab. But he, too, lost his job in a crash, in 2008, and now was trying to break the pattern of bubble economy misery. However, he’d exited Pennsylvania’s Lafayette College in the nineties carrying tens of thousands in student loans. That number had since been compounded by fees and penalties, and the usual letters, notices, and phone calls from debt collectors came nonstop.

Now, awaiting a job interview, his phone rang again. It was a collection call for Sallie Mae, and it wasn’t just one voice on the line.

“They had two women call at once,” Grabis recalls. “They told me I’d made bad life choices, that I lived in too expensive a city, that I had to move to a cheaper place, so I could afford to pay them,” Grabis explains. “I tried to tell them I was literally at that moment trying to get a job to help pay my bills, but these people are trained to just hound you without listening. I was shaking when I got off the phone, and ended up having a bad interview.”

Two years later, more out of desperation and anger than any real expectation of relief, Grabis went to federal court in the Southern District of New York and filed for bankruptcy. At the time, he, too, believed student loans could not be eliminated. But the more he read about the way student loans were constructed and sold — he’d had experience in doing shovel-work constructing mortgage-backed securities, so he understood the Student Loan Asset-Backed Securities (SLABS) market — he started to develop a theory. Everyone dealing with the finances of higher education in America knew the system was rotten, he thought. But what if someone could prove it?

The 2005 Bankruptcy Act says former students can’t discharge loans for “qualified educational expenses,” i.e. loans given to students so that they might attend tax-exempt non-profit educational institutions. Historically, that exemption covered almost all higher education loans.

What if America’s universities no longer deserve their non-profit status? What if they’re no longer schools, and are instead first and foremost crude profit-making ventures, leveraging federal bankruptcy law and the I.R.S. code into a single, ongoing predatory lending scheme?

This is essentially what Grabis argued, in a motion filed last January. He named Navient, Lafayette College, the U.S. Department of Education, Joe Biden, his own exasperated judge, and a host of other “unknown co-perpetrators” as part of a scheme against him, claiming the entirety of America’s higher education business had become an illegal moneymaking scam.

“They created a fraud,” he says flatly.

…

Grabis doesn’t have a lawyer, his case has been going on for the better part of six years, and at first blush, his argument sounds like a Hail Mary from a desperate debtor. The only catch is, he might be right.

By any metric, something unnatural is going on in the education business. While other industries in America suffered declines thanks to financial crises, increased exposure to foreign competition, and other factors, higher education has grown suspiciously fat in the last half-century. Tuition costs are up 100% at universities over and above inflation since 2000, despite the 2008 crash, with some schools jacking up prices at three, four times the rate of inflation dating back to the seventies.

Bloat at the administrative level makes the average university look like a parody of an NFL team, where every brain-dead cousin to the owner gets on the payroll. According to Education Week, “fundraisers, financial aid advisers, global recruitment staff, and many others grew by 60 percent between 1993 and 2009,” which is ten times the rate of growth for tenured faculty positions.

…

Hovering over all this is a fact not generally known to the public: many American universities, even ones claiming to be broke, are sitting atop mountains of reserve cash. In 2013, after the University of Wisconsin blamed post-crash troubles for raising tuition 5.5%, UW system president Kevin Reilly in 2013 admitted that the school actually held $638 million in reserve, separate and distinct from the school endowment. Moreover, Reilly said, other big schools were doing the same thing. UW’s reserve was 25% of its operating budget, for instance, but the University of Minnesota’s was 29%, while Illinois maintained a whopping 34% buffer.

When Alan Collinge of Student Loan Justice looked into it, he found many other schools were sitting atop mass reserves even as they pleaded poverty to raise tuition rates. “They’re all doing it,” he said.

In the mortgage bubble that led to the 2008 crash, financiers siphoned fortunes off home loans that were unlikely to be repaid. Student loans are the same game, but worse. All the key players get richer as that $1.7 trillion pile of debt expands, and the fact that everyone knows huge percentages of student borrowers will never pay is immaterial. More campus palaces get built, more administrators get added to payrolls, and perhaps most importantly, the list of assets grows for financial companies, whether or not the loans perform.

…

“As long as it’s collateralized at Navient, they can borrow against that,” Smith says. “They say, ‘Look, we've got $3 billion in assets, which are just consumer loans in negative amortization that are not being repaid, but are being artificially kept out of default so Navient can borrow against that from other banks.

“When I realized that, I was like, ‘Oh, my god. They’re happy that the loans are growing instead of being repaid, because it gives them more collateral to borrow against.’” Smith’s comments echo complaints made by virtually every student borrower in trouble I’ve ever interviewed: lenders are not motivated to reduce the size of balances by actually getting paid. Instead, the game is about keeping loans alive and endlessly growing the balance, through new fees, penalties, etc.

There are two ways of approaching reform of the system. One is the Bernie Sanders route, which would involve debt forgiveness and free higher education. A market-based approach meanwhile dreams of reintroducing discipline into student lending; if students could default, schools couldn’t endlessly raise costs on the back of unlimited government-backed credit.

Which idea is more correct can be debated, but the one thing we know for sure is that the current system is the worst of both worlds, enriching all the most undeserving actors, and hitting that increasingly prevalent policy sweet spot of privatized profit and socialized risk. Whether it gets blown up in bankruptcy courts or simply collapses eventually under its own financial weight — there’s an argument that the market will be massively disrupted if and when the administration ends the Covid-19 deferment of student loan payments — the lie can’t go on much longer.

“It’s just obvious that this has become a printing money operation,” says Grabis. “The colleges charge whatever they want, then they go to the government and continuously increase the size of the loans.” If you’re on the inside, that’s a beautiful thing. What about for everyone else?

2 notes

·

View notes

Text

So, tumblr, by popular demand, (Hah! Get me!), here’s a loooong post on my living room display cabinet.

I started collecting 1930s ceramics when I was 17, shortly after my grandfather died. My dad, as his only child, was given the job of sorting through the contents of his flat, which is how I first came into possession of a couple of Art Deco nicknacks - a plastic jewellery box, which sadly fell to pieces, a chrome and enamel powder bowl, and an electric clock with a peach mirror glass face. Also this amazing uplighter seen, along with the clock and few pieces from the china collection, in the living room of my previous flat.

But back to my mid teens. At around this time I saw Cabaret on the big screen for the second time, and resolved shortly afterwards to reinvent myself as a Sally Bowles/Louise Brooks hybrid.

Thus the 30s became my thing. For life it turns out. Since I was still living in my childhood home in my tiny childhood bedroom, it started with beads and earrings as I didn’t have room to collect much else. The necklace I’m wearing here was one of the first things I ever bought – from the long gone Twentieth Century Box in the King’s Road – and the dress belonged to my great grandmother.

At some point though I bought this little Art Deco jug, which proved to be the thin end of the wedge. I knew it was a piece of cheap tat – it didn’t have a stamp on the base and cost a mere £1.75 from Camden Market – but I loved it then and I still do, crazing, cheap lustre finish, indelible stains and all

Before long it had found a friend in a Shelley jug and they’ve been together ever since. I acquired a few small pieces of Carlton Ware here and there, as it was cheap and commonplace, but the china collection didn’t really get going in earnest till I came face to face with these ...

... and these...

... Paragon cups, saucers, and tea plates. It was the delicate flower handles that did for me. My heart literally stopped when I spotted the whole lot filling a display case on a stall in the Barrett Street Antiques Market in St Christopher’s Place. I’d never heard of Paragon, which is comparable in quality to Shelley, before; and I’ve only ever met one other person who avidly collected it. The colour work here is a combination of basic transfer and hand painting, and I’d never seen anything so beautiful, nor coveted anything quite so desperately, in all my puff. Back then were three trios in each design, and they would have cost entry-level graphic designer me two weeks wages so it was a no go. I chatted to the dealer for ages, heaved a sigh of resignation, and left. Then fate stepped in in the form of some freaky, life-changing events: 1) My paternal grandmother died and left me five grand, and 2) The company I was working for decided on a radical restructure and I was one of those made redundant. I decided to use the money to start my own business – an illustration agency – and marked this momentous decision by returning to Barrett Street to buy the Paragon. I didn’t have the space to display it all until I moved into my own place a couple of years later but there was no looking back once I did.

Most of these pieces are made by Paragon too, the exception being the Royal Doulton cup and saucer on the right, which was a gift. The un-lidded sugar bowl on the left cost me two quid in a car boot sale while the lidded one in the front cost me under a fiver from another late King’s Road haunt called Eat Your Heart Out. With two notable exceptions, I’ve never parted with serious money for any of this stuff. I also rarely buy to sell, so not all of my collection is in perfect condition. Obviously it’s great when it is, but the cumulative effect of seeing it altogether is way more important. And the cumulative effect is pure joy. Which puts me in mind of the book I mentioned a couple of posts ago, which posits the idea that liking colourful stuff is not a mark of shallow, unsophisticated character, and that joy is not something innate without stimulus, but rather a reaction to the objects and environments that surround us. This resonated deeply with me.

I used to write in an alcove in the L-shaped hallway of my previous flat. It was a nicely decorated hall. Yellow-gold marbled wallpaper with paintwork a shade lighter and a yellow gold carpet to match. The light was good too. But I didn’t have many pictures in those days so the walls were blank apart from my grandmothers mirror; nor were there any shelves on which to house books or display tchotchkes. One day I started writing in my living room instead, which contained all of these things including my trusty display cabinet, and I realised I felt creatively stimulated; galvanised even. From then on I’ve always worked surrounded by colour, pictures, objects and books.

So, on with the show.

This adorable little person is a powder bowl from Germany. I don’t often go for figurative ceramics but I completely fell in love with her. She came from a junk shop and cost me about quarter of what she was worth at the time I bought her. Behind her is a Parrot Ware biscuit barrel, a gift from my potter friend Steve, who is also an avid collector of ceramics, and has contributed many pieces to my collection over the years. Behind that is a Parrot Ware plate I found in a junk shop in Lye in the West Midlands. To the left of her is a Paragon chintz ware trio, another gift from Steve.

The coffee cup and saucer is the only piece of Clarice Cliff I own. It was a present from a family friend back when I first started collecting. Then, as now, Cliff, Susie Cooper and Charlotte Rhead were the big names and overpriced accordingly, so I decided to concentrate on the more affordable end of the market. The hand painted Poole vase is, I think, from the 60s, as is the Royal Winton plate behind it, but I think they blend in well enough. The same can be said about this Brentleigh Ware breakfast for one set...

It came from a car boot sale many years ago. The rain was chucking it down and the sellers were so desperate to go home they practically gave it to me. How could I refuse?

This is the only glass piece in the cabinet. I’ve occasionally seen these swizzle sticks for sale individually but this is the only set I’ve seen with the matching base. Behind it is a pair of hand painted Czechoslovakian vases of the type that Cliff clearly ripped off. For that reason alone I feel they should be worth a whole lot more than they are. Russian folk art, as reinterpreted by the likes of Natalia Goncharova for Diaghilev’s Ballet Russes, was also a huge influence on the Art Deco movement. The majority of my pieces are simply 30s as opposed to full on Deco but the colour palette is often in keeping.

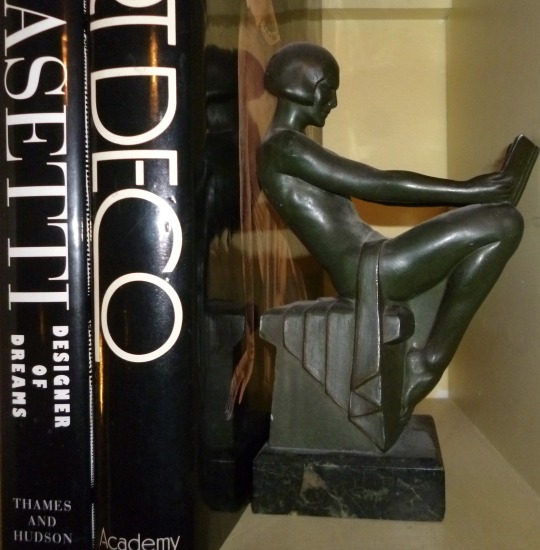

The green cheese dish is a Royal Winton piece I bought in the 80s, while the yellow one, a more recent acquisition from a charity shop, is Crown Ducal. Which brings me to something else. Video may not have killed the radio star but eBay definitely murdered the antique market. Some time in the mid 90s I consciously stopped adding to the collection. It was harder to find at a reasonable price and I also felt I’d reached Peak Thirties so to speak. Contributor No 1: Knowing how much I loved the period, my stepgrandmother had promised me a pair of French bronze book ends when she died. And although my mum and stepfather were divorced by the time she did, he honoured her promise on the understanding that I’d never sell them.

(AS IF!! These are the balls-out Art Deco bookends of my wildest dreams. I will never, ever sell them. Excuse the dust, by the way. These live, along with a lot more china, in my hall book case, and are lucky if they see a duster once a year.)

Contributor No 2: Prior to working in the World’s Loveliest Gift Shop® RIP, I worked for Steve for the six years he had one. But whereas Lynne restored and upcycled vintage furniture as a sideline, Steve's was vintage ceramics. His brother, who is also an antique dealer, occasionally sold stuff through the shop too. One day I came into work and had an instantaneous repetition of my Paragon experience.

This immaculate, unused Deco-tastic tea for two set is the reason I painted my living room purple. It’s most likely Czechoslovakian too, as indicated by the tiny plate. Too small to be a plate for cake or sandwiches, it was most likely for lemon slices, lemon tea being the norm in that part of the world. The moment I clapped eyes on it I was a gibbering wreck. I didn’t care how many days pay it would take me to work off the debt; it was indisputably Meant To Be.

Having thus snapped up the tea set and inherited the bookends, I decided I actually had sufficient on the 30s front, much to the consternation of my friends. But a handful of years later things began to change. eBay had stuck the boot in so hard that the vintage china dealers, who had previously pushed up the prices to you’re-’avin’-a-laugh-mate heights, started to throw in the towel on their businesses. And vintage ceramics started to show up in charity shops and car boot sales again – at it-would-be-churlish-not-to prices.

I started to find pieces like this...

...and this...

...and this...

...and this...

...and this...

...and this...

...going cheap as chips in the chazzas.

And those dealers who had somehow managed to weather the storm, were no longer charging stratospheric prices. (Unless they were flogging Cliff or Cooper or Rhead), so I was able to add things like this...

...and this...

...to the mix without feeling the pinch.

Should I emerge from this period of history with body and soul intact and raise the collateral I’m hoping to, one of the cosmetic changes I’d like to bring about in my home is to replace the built in hi-fi cupboard in the corner of the living room with another display cabinet, so I can move some of the china that’s languishing elsewhere in the flat into the living room too. Yes, I know it’ll end up looking like the ceramics wing of the V&A, but, frankly, what’s wrong with that?

Poor abandoned things.

Can’t you see they’re gagging to come and join their friends?

I imagine you’re losing the will to live now so I’ll sign off with my two Beswick fish, which are from the late 60s/early 70s and, despite having no connection with my other treasures, have lived on top of my display cabinet for aeons. Group similar colours together and you can get away with murder. Toodles!

11 notes

·

View notes

Text

#1yrago Student debt crisis watch: pay $18,000 of your $24,000 loan, owe $24,000

Kaitlin Cawley finished grad school with $95,000 in student loans, including a $24,000 variable-rate loan that started at 9.4% and now stands at 11%, a loan that the US government lender Sallie Mae brokered for her when she was 20.

Sallie Mae's portal makes it almost impossible to find out how much you've paid into your loans; after a lengthy runaround, Cawley found that she had paid back $18,000 of her $24,000 loan, but that she still owed the full amount, thanks to sky-high interest and stiff penalties the government assessed against her because she opted to save tens of thousands of dollars by going to grad school outside of the USA.

Cawley comes from a working-class background and her family was not able to substantially offset the expense of her university. She attended anyway, convinced that postsecondary education was the path to social mobility. Despite an advanced degree, Cawley lives in relative penury, largely thanks to her student debt.

Americans owe $1.4 trillion in student debt. Student debts are largely not dischargeable through bankruptcy, and is the only form of debt that you can be forced to pay your Social Security into.

The President of the United States has declared bankruptcy six times. His university defrauded its students of millions of dollars, which they are still paying back. He enacted a policy that makes it impossible for defrauded students to escape their loans; while his Secretary of Education has killed the rules that prevented debt-collectors with a track-record of committing illegal acts from collecting student debts.

Last month, the student debt industry's top expert was revealed to be an imaginary person, puppeted by industry executives.

https://boingboing.net/2018/05/17/debt-traps-2.html

31 notes

·

View notes

Text

Working in student loan debt settlement makes me want to tell all these debt collectors that they're fucking class traitors and no matter how much they deep throat Navient's boots (or Sallie Mae, or AES, or whoever) that they'll never afford 2 yachts and 5 houses and never really be the ruling class and they'd be better off just deleting people's files until they got fired

1 note

·

View note

Text

Fall behind on your student loan payments, lose your job.

Few people realize that the loans they take out to pay for their education could eventually derail their careers. But in 19 states, government agencies can seize state-issued professional licenses from residents who default on their educational debts. Another state, South Dakota, suspends driver’s licenses, making it nearly impossible for people to get to work.

As debt levels rise, creditors are taking increasingly tough actions to chase people who fall behind on student loans. Going after professional licenses stands out as especially punitive.

Firefighters, nurses, teachers, lawyers, massage therapists, barbers, psychologists and real estate brokers have all had their credentials suspended or revoked.

https://www.nytimes.com/2017/11/18/business/student-loans-licenses.html

[States are: Washington State, California, New Mexico, South Dakota, North Dakota, Minnesota, Iowa, Illinois, Alaska, Hawaii, Texas, Arkansas, Mississippi, Louisiana, Georgia, Florida, Tennessee, Kentucky, Massachusetts, and Virginia]

There are a lot of anxious graduate students at universities around the country right now.

That's because to help pay for more than $1 trillion in tax cuts for U.S. corporations, the House Republican tax plan would raise taxes on grad students in a very big way. These students make very little money to begin with. And many would have to pay about half of their modest student stipends in taxes.

"The past week this is what I've been talking about with other graduate students, with classmates. I think we're all shocked," says Tamar Oostrom. She's in her third year of getting her Ph.D. in economics at the Massachusetts Institute of Technology.

She and her classmates have been crunching the numbers. "This bill would increase our tax by 300 or 400 percent. I think it's absolutely crazy," Oostrom says.

https://www.npr.org/2017/11/14/563879136/house-gop-tax-plan-would-hit-grad-students-with-massive-tax-hike

As the majority of research is conducted in universities by grad students, research would take a major hit, too.

Education Secretary Betsy DeVos has made another sweeping change to the student loan system that consumer advocates claim favors student loan collectors over the American people repaying those loans.

The latest move from DeVos — who only weeks ago rescinded a number of student loan servicing protections put in place by the previous administration — will put all federal student loan servicing under the control of just one company starting in 2019.

There are currently nine student loan servicers handling these accounts for the federal government.

Late Friday afternoon, DeVos announced the upcoming changes via an amendment [PDF] to the contracting process, which will see the student loan servicing contract awarded to just one of the following: Navient (the servicer spun off from Sallie Mae), GreatNet, or the Pennsylvania Higher Education Assistance Agency (PHEAA).

Whichever company ultimately receives the contract will be required to build a platform to collect on and service an estimated 32 million federal direct student loans.

https://consumerist.com/2017/05/22/education-secretary-devos-to-give-all-student-loan-accounts-to-one-company-strip-away-more-protections/

https://studentloans.net/student-loan-debt-statistics/

Do you see the picture being painted? It is becoming much, much harder to pay off student loans. It is becoming much, much harder to have student loans forgiven. If you don’t pay off your student loans, you can become jobless and therefore homeless. In some places, you can even lose your drivers licence. This would make it harder to pay off student loans and will result in you having a harder time not being homeless or living in poverty. There will be less grad students, less students pursuing higher education in general, because of how big of a financial burden there is. There will be less scientific research being done, and science will take a hit. There will be less educated in this country, and wealthy individuals will be more likely to be educated.

Meanwhile, billionaires will become richer. Income inequality will become more prominent.

This is a class war against the unemployed, the unable to work, the students, the homeless, and those who aren’t born into rich families.

5K notes

·

View notes

Text

‘Debt collectors are chasing me for a £1.99 toy ice cream van’

‘Debt collectors are chasing me for a £1.99 toy ice cream van’

Sally says: The offer for the replica 1966 Wall’s ice cream van, complete with authentic jingle mechanism, was too good to miss. The invitation confirmed you did not have to join the Corgi Club to benefit. It proclaimed “What’s the catch? There isn’t one” and “You need never pay another penny or hear from us again”. It didn’t quite work out that way for you. Nor, it seems, for several other…

View On WordPress

0 notes

Text

The Magazine of Fantasy & Science Fiction, Mar/Apr 2017

One of the most consistently highly rated collections that I've read in quite a while. 4.3125 out of 5.

"Driverless" by Robert Grossbach Jacob Rittenberg was the leader of the Driverless Car industry with his QuikTrip company and his innovative updates. One night he's taken to an emergency meeting of other D.C. companies, the military, and high-ranking politicians. There's a problem with the cars. They are holding their passengers hostage. An intriguing and entirely possible look at what could happen as AI programming improves and driverless cars become more common. 4.5 out of 5.

"The Toymaker's Daughter" by Arundhati Hazra The toys carved by her father are painted by the young girl. She tells stories about who and what they are, stories that have a special power. It leads to an overwhelming and painful series of consequences. So sweet, so sad, yet with an ending that I loved. 4.5 out of 5.

"Ten Half-Pennies" by Matthew Hughes Young Baldemar became tired of being forced to pay bullies to get safe passage to his school and hired Vunt, a collector, to scare the boys away. After faithfully paying the fee, he is taken under Vunt's protection in other ways. Vunt begins training him and hiring him for various jobs. Baldemar's education grows with age and experience. The day soon comes to repay the old debt. Nicely developed, especially for a novelet. (Thrilled that there will be another story in the series in the next issue of the magazine, sitting on my shelf waiting for its turn.) 5 out of 5.

"The Man Who Put the Bomp" by Richard Chwedyk The safe house for neglected and abused saurs is suddenly in possession of a pink child's car called VOOM!, causing excitement and apprehension. Axel, dealing with new dreams and feelings of becoming smarter, is fascinated by the possibilities for adventure. The saurs were bio-engineered toys, yet they were alive, could think and communicate and learn. They began to demand autonomy, forcing Toyco to release ownership and control of both the existing saurs as well as the plans to make more. But something is changing, something that brings Nicholas Danner to the old house. I wanted to kill all the stupid humans who refused to see what the saurs were, who didn't care if they were hurt. I wanted...I needed to protect them all, from mad scientist Geraldine to young Axel. Even prickly Agnes who makes more sense than not, if you bother to look past her nastiness. 5 out of 5.

"A Green Silk Dress and a Wedding-Death" by Cat Hellisen Heloise Oudejan struggled each and every day, hampered by severe short-sightedness and a life gutting fish for market. Until a strange sighting, deformed fish, and the capture of a sea creature drives Heloise to take a chance and make a sacrifice. This reminds me quite a bit of "The Shape of Water" in many ways. And like that film and book, this story seduced me with an outsider heroine, a woman who did what she needed to do to survive, never expecting any happiness in her life. A heroine dismissed, even abused by those around her. Now she has a chance for change, if she's brave enough to take it. 3.5 out of 5.

"Miss Cruz" by James Sallis An unnamed musician discovers a talent that could be a force for good or evil. Now he must decide whether to embrace it or lock it safely away inside him. Very eerie. I can't decide if Miss Cruz is part of it or not. Perhaps she is just a mcguffin. Absolutely strange. 3.5 out of 5.

"The Avenger" by Albert E. Cowdrey Jeanne Wooster came to William Warlock, attorney at law, hoping for justice in form of murder for the untimely death of her husband. Marv, the man she blames for it is protected by the sheriff, his cousin, in her town. Marv's anger and resentment grows as his half-baked plans go awry. Brilliant and absorbing from start to finish, with a fitting ending. 4 out of 5.

"Daisy" by Eleanor Arnason Daisy, a Pacific Giant Octopus, has been stolen from Art Pancakes, local loan shark and high-end drug dealer. He wants her back, hiring Emily Olsen, a private investigator and former lawyer whose license to practice law is still valid. I guessed a very small part of what happened and why, but Arnason went delightfully farther. Good luck, Daisy! 4.5 out of 5.

#book review#magazine review#science fiction#fantasy#The Magazine of Fantasy & Science Fiction#Eleanor Arnason#Albert E. Cowdrey#James Sallis#Cat Hellisen#Robert Grossbach#Arundhati Hazra#Matthew Hughes#Richard Chwedyk

0 notes

Note

Bloody painter general hcs and maybe with an s/o 🥺

Yay, my first Helen request! These are kind of long because I try to write more for general character headcanons.

General Headcanons:

Helen is generally a very quiet person, and usually only speaks when spoken to. He simply enjoys listening to people talk in the background so he can focus on his work, and when there aren't any people talking near him he likes to listen to podcasts as background noise.

He is an avid collector of pieces of drama in the mansion. He mostly uses it for blackmail but some pieces of information he finds genuinely interesting. He has a huge ass journal filled to the brim with every piece of drama he's ever heard, categorized by person.

He has his own art room in the mansion he likes to retreat to so he can do his works. One day he invited Toby in to join him and it's now become a regular thing which led them to host the art club that they have at the mansion.

Somewhat interested in video games for the strategic aspects and will join BEN on occasion whenever he plays. Every now and then BEN, Helen, Jeff, and Toby will play GTA together and just dick around for a few hours playing different minigames.

A wizard at pancake art. Whenever it's a resident's birthday he'll make their face into a few pancakes and maybe make an item they like or a character they're a fan of.

Enjoys being outside quite often. He'll often sit out in the yard on the grass and draw for a few hours or go for a long walk through the woods. If he doesn't go outside for at least 3 or 4 hours a day he starts to feel really antsy and doesn't know what to do with himself.

Very good with finances. He will offer the other residents tips and help them organize their finances to avoid them running out of money or going into debt.

Surprisingly good with kids. Sally loves being around him because of how gentle he is with her and how kind he is. He also designs coloring books for her to use and has given some to a few of the other residents as well.

With a s/o:

The strong silent type. He'll let you drone on and on for hours and just listen to you, nodding along and providing occasional commentary. If anyone so much as even looks at you the wrong way he'll be sure to give them an ice-cold glare that'll definitely get them to back off.

Loves drawing and painting you. You are his muse and he will draw you in as many positions in as many different ways as he can. One of his favorite pieces he's done of you was when the two of you were just chilling outside and he drew you admiring the scenery.

He isn't the most outwardly affectionate but he will never turn you away if you wanna hold his hand or cuddle yourself up to him no matter where the two of you are.

Dates with him are surprisingly active. He loves taking you out for a loud and fun night on the town until both of you are completely tuckered out.

On occasion though, you can expect a nice quiet picnic dinner below the stars.

#creepypasta#creepypasta headcanon#creepypasta x reader#creepypasta headcanons#bloody painter#bloody painter headcanon#bloody painter x reader#bloody painter headcanons

106 notes

·

View notes

Text

Student debt crisis watch: pay $18,000 of your $24,000 loan, owe $24,000