#cryptofree

Explore tagged Tumblr posts

Text

Check this out: Get free Crypto!

🎉 Unbelievable Offer Alert! Shop on #Temu etc via #SocialGoodApp and grab an amazing 1500% Cashback! 😍

🚀Your rewards come in $SG, skyrocketing even more than #Bitcoin !

🌟 Download the app and claim your $700 Bonus! https://referral.socialgood.inc/?id=TFHUMH

#BoostSocialGoodPrice #Airdrop

0 notes

Text

Fastest way to earn Nano tokens! No fees, no tricks. https://bananot.net/ #NanoDrop #CryptoFree

0 notes

Quote

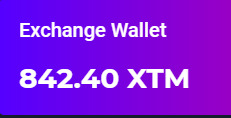

Torum Earn Daily 6.5 XTM & Weekly 28.5 XTM

Join with my Referral Link to Receive 35 XTM https://www.torum.com/signup?referral_code=shashidhar

Follow these steps 1 - Verify Email 2 - Verify Mobile Number through WhatsApp 2 - Start Earning XTM

Future Development - NFT Marketplace - DeFi Staking Platform - Mining Simulator Video Game

#airdrops#airdrop#freemoney#free crypto#crypto#cryptocurrency#cryptonews#bitcoin#bitcoin news#binance#coinbase#forextrader#blockchain#cryptofree#money#investors#investing

3 notes

·

View notes

Video

youtube

CryptoFree.Zone | Earn Free Bitcoin Free Bitcoin Cloud Mining Site | Ear...

#cryptofree#cryptofree.zone#cryptofree.zone review#earn free bitoin#free bitcoin#bitcoin cloud mining#earn daily 10#free mining#cloud mining#earn#free#btc'#2019#urdu#hindi

4 notes

·

View notes

Text

7 Techniques to Successful Crypto Trading

7 Techniques to Successful Crypto Trading

With the skyrocketing prices of Bitcoin, Ethereum, Litecoin, and other cryptocurrencies, more and more people are looking into cryptocurrency trading to make quick profits.

The crypto market is highly volatile, with steep price jumps in a matter of minutes, and smart traders are capitalizing on this volatility. Now before we go into the seven techniques to succeed in cryptocurrency trading, let’s discuss first the basics of trading, and if this is something you’d like to into.

Full details are discussed in this eBook …

Click here to download the free Crypto Trading eBook instantly without email id registration.

#cryptotradingtips#cryptotradingguide#cryptomoney#cryptocourse#cryptofree#cryptocurrency tips#cryptocurrencyguide#cryptocurrency markets#cryptocurreny trading#cryptobeginners

0 notes

Photo

Flash Giveaway 100B $MoonDogeCoin to 5 lucky winners who: 1.Follow & Retweet 2.Join Telegram : https://t.me/moondogecoins 3. Tag your 3 freind 4. Visit https://moondoge.website Grab a big bag of $MoonDoge Coin... We are just getting started! Now listed on #Pancakeswap #airdrop #airdrops #faucet #faucets #moondogecoin #md #free #freecrypto #cryptofree https://www.instagram.com/p/CObPaDCr4WA/?igshid=zb8sevzeulz2

0 notes

Text

Here is my referral link for BEE Network. Get 1 free BEE when you join BEE: odiemo. Download at https://bee.games/download.html

https://bee.games/download.html

0 notes

Photo

#bounty #airdrop #bitcoin #crypto #ico #btc #ethereum #chocolate #airdropalert #cryptocurrency #token #cryptocurrencies #airdrops #ieo #cryptofree #cryptoearned #blockchain #cryptoearning #btcexchange #tokenfree #biticon #cryptoearnings #cryptoexchange #cryptoearn #twix #wa #devocapital #snickers #mars #bhfyp😋😋😎😎😎😍😍😘😘😘😘😘😘😘😘😘😘😘😘😘 (at Ernakulam City, Kerala) https://www.instagram.com/p/CIQs09ssZuL/?igshid=18h61xuyq788

#bounty#airdrop#bitcoin#crypto#ico#btc#ethereum#chocolate#airdropalert#cryptocurrency#token#cryptocurrencies#airdrops#ieo#cryptofree#cryptoearned#blockchain#cryptoearning#btcexchange#tokenfree#biticon#cryptoearnings#cryptoexchange#cryptoearn#twix#wa#devocapital#snickers#mars#bhfyp😋😋😎😎😎😍😍😘😘😘😘😘😘😘😘😘😘😘😘😘

0 notes

Text

What exciting VR games will be launched in 2020?

Half of 2020 has passed. In the first half of the year, we have seen some outstanding VR games successfully launched. At the beginning of the second half of the year, the well-known IP "Iron Man VR" game warmed up. What other VR games are worth looking forward to next?

1. "Dreams" (PSVR)-July 22nd** ** In the high-profile, Media Molecule creation tool finally successfully added features that support VR technology. "Dreams" is a development engine that allows players to make their own games and share them online. So far, its description of supporting VR functions has made players exciting. Dreams will implement a free update of this feature for its game owners. 2. "Onward" (Quest)-July 30** ** The highly anticipated "Onward" is about to land on Oculus Quest. As one of the popular military simulation shooting games, "Onward", with the support of VR all-in-one machines, will realize multiplayer, single player and cooperative modes, and support the same game modes as the PC VR version. There is no doubt that "Onward" will become one of the biggest winners of VR games in 2020. 3. "Solaris: Offworld Combat" (Rift, Quest)-August** ** Aiming to surpass the predecessor "Firewall: Zero Hour", "Solaris Offworld Combat" is a VR shooting game specially designed for 4V4 multiplayer combat, creating more new props and items full of competitive elements, including weapon pickup and rebirth tools. How to play. Based on the previous game development and design experience in the past, "Solaris: Offworld Combat" will be a high-quality experience VR shooting game. 4. "Star Wars: Squadrons" (PSVR, PC VR)-October 2nd** ** "Star Wars: Squadrons" will provide a way to play in VR virtual reality, bringing a more immersive game experience. "Star Wars: Squadrons" includes single-player campaigns and multi-player campaigns, realizing the space flight combat experience of driving X-wing and TIE fighters in VR. This may be the most anticipated VR game in 2020. 5. "Medal of Honor: Above And Beyond" (Rift)-2020** ** As the best game developer, Respawn Entertainment has teamed up with Oculus to develop this new VR game "Medal of Honor: Above And Beyond" (Medal of Honor: Above And Beyond). It will be listed in 2020 and is exclusively owned by Oculus. This game is set in World War II, including single player campaigns and multiplayer campaigns. 6. "Lone Echo 2" (Rift)-2020** ** Oculus announced that it will launch a sequel to the popular space adventure game "Lone Echo". "Lone Echo 2" will continue the storyline of the first part. Players will play the role of the intelligent robot Jack, and the love between Jack and Liv will continue to be a highlight of the game. 7. "The Walking Dead: Onslaught" (PSVR, PC VR)-2020** ** The VR game "The Walking Dead: Onslaught" launched by Survios will be released on PC VR and PSVR. The actor Norman Radus in the TV series "The Walking Dead" will continue to play the role of Darryl Dixon in this game. Players can play other important roles in the TV series "The Walking Dead", which is very worth looking forward to. . The VOID store in Disney Town in the United States was terminated by Disney for breach of contract According to foreign media reports, the The VOID store in Disney Town, California, USA, was posted with a notice of breach of contract and is currently closed, and the lease has also been terminated by Disney. The VOID provides high-end VR experiences supported by Disney IP, such as "Star Wars: Secrets of the Empire", "Avengers: Damage Control" and "Invincible Destruction VR". Since March of this year, the VOID and other types of offline VR entertainment venues have been basically closed due to closure orders related to the COVID-19 pandemic, although some places have now reopened.

As far as The VOID in Anaheim is concerned, it was closed on March 17. According to sources familiar with The VOID's Disneyland business, employees have been on paid leave until the end of March and have been on unpaid leave since then. status. The source also said that the management of The VOID is negotiating with Disney on the notice. The current generation of VR arcade game rooms and other types of VR-driven offline entertainment venues did not have a solid foundation at the beginning. Therefore, under this epidemic crisis, many places failed to survive and eventually declared death. Another blow is that Facebook and its subsidiary Beat Games told offline stores last week to withdraw one of the most popular games before the end of July, that is, "Beat Saber" owned by Facebook. The VOID is a start-up company headquartered in Utah, USA. It provides advanced VR experiences powered by backpack computers. A family of four takes about 30 minutes to experience VR in VR, and the total cost may exceed $100. These experiences are stories composed of multiple rooms, usually enhanced by wind, heat and tactile effects that are not easily available when experiencing at home. The VOID's first major project is content related to the IP of "Ghostbusters", which joined Disney's accelerator launch plan in 2017. The VOID also has an offline store in Disney Springs, Florida, as well as offline stores in other major cities around the world. Facebook announces cooperation with CBSE in India to provide AR skills training to students and teachers Facebook announced the launch of a course in cooperation with the Central Board of Secondary Education (CBSE) of India to teach digital security and online health and augmented reality (AR) related courses to students and teachers. Users can access the course through the CBSE website. Digital security and online health courses will be launched in phases. In the first phase, from July to October, it will be implemented in CBSE and other national education committees. In the second stage, the curriculum will be provided to the State Board of Education.

The course will cover online safety, privacy, and mental health, and will use Instagram's guide to help students build healthy habits, which was created in collaboration with The Jed Foundation and Young Active Citizen Leaders (YLAC). In the first phase, from July to October, Facebook will also provide 10,000 teachers with augmented reality courses. In the second phase, these teachers will continue to train 30,000 students in India. The augmented reality course will teach the basics of augmented reality and train students and teachers how to use Facebook's Spark AR Studio platform to create augmented reality experiences. This will help students learn AR and will also help Facebook generate more AR content. CBSE Chairman Manoj Ahuja said in a statement: “Incorporating technology and digital security into school curricula will ensure that students will not only gain knowledge for success in the digital economy, but will also learn and collaborate in a safe online environment.” Technical education has been valued and accepted by more and more people. In March of this year, CBSE of India signed a Memorandum of Understanding (MoU) with Intel to provide artificial intelligence (AI) skills training to approximately 100,000 students in 22,000 schools in India. This AI course will be offered to intermediate students from VIII to X levels. As early as September 2019, CBSE cooperated with Microsoft to launch a three-day capacity building program for high school teachers. Its purpose is to help teachers use information and communication technology (ICT) solutions for teaching in the classroom. Then, about 1,000 teachers nominated by CBSE received training in using various Microsoft 365 tools, including Paint 3D, Minecraft, Teams, Flipgrid and Outlook.

0 notes

Video

How To Claim Free Crypto Everyday with Binance Crypto Box? Crypto Box Bi...

#youtube#FreeCrypto CryptoBox Binance Code CryptoBoxBinance CryptoBoxCode FreeCode Crypto Cryptocurrency BinanceCryptoBox CryptoFree

0 notes

Link

Click the ROLL button to get your free bitcoins. The amount of free bitcoins that you get will depend on the number that you roll and paid out according to the payout table below. You can come back and play every hour to win free bitcoins each time!

1 note

·

View note

Photo

coindenex https://exchange.coindenex.com/signup

#crypto tag#crypto#cryptocurreny trading#cryptocurrency#cryptofree#bitcoin#@like#denmark#@denmark#world trade organization#trade#trade finance#news#world news#worldwide

1 note

·

View note

Text

#airdrops #airdrop #crypto #bitcoin #airdropalert #btc #bounty #ethereum #ico #token #cryptofree #cryptoexchange #cryptoearn #cryptocurrencies #ieo #cryptoearnings #btcexchange #cryptoearning #cryptoearned #tokenfree #devocapital #wa #biticon #cryptocurrency #airdropbot #tokens #blockchain #binance #eth #bhfyp

1 note

·

View note

Text

Confirmed to become listed on the wave of decentralized governance: Aave founder talks about DeFi challenges and economic model plans

In addition to liquidity mining and token pledge rewards, Aave founder Stani Kulechov also unmasked that the economic model "Aavenomics" and governance plan will enable LEND token holders to vote on smart contract changes, making the Aave protocol ecosystem completely decentralized. Extended reading: "Aave COO confirms the liquidity mining plan, and elaborates fearlessly to explore the details"

Original title: "Aave founder Stani Kulechov: DeFi's liquidity may be dispersed across different networks" Compiled by: Staking Rewards Translation: Porridge Overnight When speaking about DeFi liquidity, Stani Kulechov, founder and CEO of Aave, said that the existing market liquidity is targeted in Ethereum, which is very beneficial to Aave, but that he believes that liquidity may be dispersed in the foreseeable future. In a number of different networks, this involves their efforts to fully capture these fluidities. Additionally , that he also mentioned that even though Aave currently holds the management key, in the next month or two, they'll achieve decentralized governance, allowing LEND token holders to vote on smart contract changes.

SR: Are you able to briefly introduce yourself as well as your cryptocurrency business? Stani: I did so some coding work when I was a teenager, nonetheless it wasn't until I was studying law at the Academy of Helsinki that I must say i entered the cryptocurrency field. Ethereum really brought me in to this world. I do believe it's so cool. You'll have some immutable and traceable smart contracts. I have always been thinking about finance, and so i started to consider just how to apply it to the financial field. Particularly I do believe it could completely change lending. If you can lend money to the others without having to do background checks or trust them, this will make lending smoother and faster. I acquired deeper and deeper in to the Ethereum community and started to consider just how to put it to use to create a decentralized and trustless financial system. I first started with ETHLend, and then ETHLend evolved in to today's Aave. Both ETHLend and Aave have borrowed crucial aspects of the original financial system, that we think is very important, because old-fashioned finance has many cool components that have shown to be effective. Traditional finance, or "OldFi, " inspired some aspects of ETHLend and Aave, but then we tried to boost it and decentralize it. Why choose DeFi? SR: What do you consider could be the most prominent advantageous asset of decentralized finance (DeFi) weighed against old-fashioned finance? What is the trick weapon of DeFi? What exactly are you personally most thinking about? Stani: I do believe one of the primary features of DeFi over "OldFi" is that it generally does not require trust and transparency. Users can get a handle on the flow of their funds. They are able to do that without trusting anyone. Compared with old-fashioned finance, DeFi has a high rate of return, which is excessively attractive to conventional depositors. It is 2020 and money shouldn't be dormant. Once people realize that their money can perhaps work for them around the clock, there's absolutely no reason to deposit all your money in a conventional bank, where you have minimal interest. Additionally , DeFi doesn't require any trust, or disclosure of your identity, back ground, and so forth It creates the financial system far more convenient and fair for everyone, even those excluded from the original financial system. Additionally , for technical users, DeFi also provides more opportunities, such as lightning loans, that may never be performed in the original financial system. For me, it's really great to observe that the DeFi industry has fully gone up to now. Now there are so many projects that have contributed to the ecosystem, and new projects emerge each day predicated on previous ideas. I do believe this composability could be the secret weapon of DeFi, which could be the most exciting part for me personally. The DeFi community, plus the Ethereum community, have now been spending so much time to greatly help one another and grow together, which has produced some very good ideas, which are made on each other's foundation and contribute to new projects and innovations. The technical composability in DeFi is really more in regards to the human composability of town, which is why things happen faster in DeFi, and it's also problematic for you to keep up with everything that happens on the market. In the DeFi field, people always have the willingness to innovate, and the reason why OldFi lags behind is really because there are not too many people in this community who're constantly striving to boost. Challenges facing DeFi SR: In your opinion, what are the notable challenges that DeFi has to over come before it may be undoubtedly adopted? How does Aave solve these challenges? Stani: Before DeFi enters conventional applications, among the challenges it must over come is always to make DeFi more user-friendly. For most people, the thought of DeFi is revolutionary. When I introduce the concept of DeFi to newcomers, they normally are astonished, specially just how much interest you can earn from deposits, because no normal bank permits you do. I do believe for most people, the definition of "blockchain" or "cryptocurrency" could be scary, so making sure an individual experience is as intuitive that you can could be the key. At Aave, we will help users integrate some tools. Argent is a good example since it is simple and simple to use, and it's also an easy task to access Aave along with other DeFi protocols directly from the wallet. For conventional adoption of DeFi, it is crucial to really have a platform like Argent, that may simplify the whole process and supply users with a seamless platform to explore DeFi options. We have been nearer to conventional adoption than many people think, and an individual experience is improving each day. The feedback from the Aave community can also be one of our most useful assets to over come these challenges. When people use DApps, we have been always spending so much time to boost an individual experience. We've been asking "how to produce it easier for end users to accomplish this", "is the process intuitive" and so on. We have been very fortunate to have this active and responsive community. Staking vs lending SR: How can you start to see the relationship between Staking and lending of PoS crypto assets in the foreseeable future? Maybe there is competition? Or will it be harmful? Stani: I do believe staking plays an essential role in security for blockchain networks. Some PoS encrypted assets could have functions made to protect the protocol itself. For instance , "Aavenomics" is a staking mechanism that allows the pledger to supply security to the liquidity provider of the Aave protocol. It is a key section of protocol scalability and attracting liquidity providers. I do not see various staking mechanisms competing with each other, but various ways of participating in the network, and each method has a unique risk and reward mechanism. For that reason the pledger can select the way they want. Risk SR of the Aave platform: How can you assess or quantify the risks active in the Aave platform? Such as for instance financial security. Stani: We simply take safety very seriously, and I must say i think safety should function as the top priority of DeFi. The composability of DeFi rocks !. If among the components is insecure, it will expose the ecosystem to new threats. For that reason measures to mitigate risks in DeFi are extremely crucial. For the Aave protocol, we have completed 2 security audits, one is through Open Zeppelin and the other is through Trail of Bits. You can find the results of the 2 audits on our internet site. We always desire to be transparent about risks and regularly issue security updates which will contain any new information. We also have an ongoing bug reward program. If anyone finds a bug in the code, we will reward you. Our risk management team has spent lots of time analyzing and evaluating the risks involved in using Aave. We have also released a risk framework. Before adding a fresh currency to the Aave agreement, we will conduct an extensive risk assessment. It may be within our risk framework. Is Aave centralized or decentralized? SR: Have you got the proper to utilize the private key of the smart contract? How can you store it? Maybe there is an urgent situation shutdown? What are the plans to produce smart contracts immutable? Stani: At this time we do have access to the private key. In the first launch phase, we want to ensure the security of the protocol in the event any issues arise. However , we will soon launch decentralized governance, and the ownership of the Aave protocol will undoubtedly be utilized in the governance smart contract. When the governance is deployed, LEND token holders will be able to vote on changes to the smart contract. DeFi composability SR: What do you consider about cooperation or integration with other DeFi agreements? Stani: The composability of DeFi is amongst the coolest areas of the ecosystem, and we work hard to ensure our partnership and integration always support this composability. We have seen the synergy of numerous projects in the DeFi field, and we believe that it is cool to create together between projects to boost an individual experience. Needless to say, we must measure the security issues of integration. Interoperability SR: You think blockchain interoperability is a meaningful development that could promote DeFi? Stani: I agree with this point of view. At the moment, the liquidity of DeFi is targeted in Ethereum, which is very beneficial to Aave. However , I really believe that the liquidity of DeFi in the foreseeable future may be dispersed among a number of different networks, which requires our efforts in order that we could capture these liquidity. Bitcoin and DeFiSR: What role do you consider Bitcoin will play in the DeFi field? Stand: Unlocking Bitcoin's liquidity in DeFi has huge potential. Conservative cryptocurrency holders usually hold Bitcoin, and in Bitcoin's own network, you certainly can do limited things. To be able to use Bitcoin in DeFi brings lots of liquidity to the field and promote the growth of DeFi. Eventually, Bitcoin may be used as a tool to enter DeFi. How exactly to evaluate collateral SR: How can you identify which assets are suitable as DeFi collateral? Stani: Before adding any assets to the Aave agreement, our risk management team will conduct an extensive risk assessment relative to the danger framework I mentioned previously. In the event that you read our risk framework, you'll find most of the currencies available in the Aave agreement and explain why they could be used as collateral. Currency that is only allowed for deposit and lending (not as collateral) is less risky to the agreement, so if assets can be used as collateral, they must meet stricter standards. Additionally , each currency added to the Aave agreement as collateral will increase the agreement's bankruptcy risk, since it implies that the agreement is more vunerable to market fluctuations. Additionally , the centralized currency accepted as collateral will expose the agreement to centralization risks (having a currency that uses single point of failure advances the threat of the Aave agreement). Basically, we will first go through the risks of smart contracts and give attention to the security of the code, and then we will study the counterparties in governance (to measure the governance of currency and managers). If these risks aren't excessive, we will study market risks., Including volatility risk and liquidity risk. They are the primary things that we must consider before adding new collateral.

Future plans SR: Are you able to share Aave's roadmap for the following year? Will there be any such thing we could are expectant of? Stani: We just released the second currency market of the Aave agreement-the Uniswap market! It is a big step we have taken and the second market in our multi-market strategy (the OG Aave market we released in January was the first). The Uniswap market allows Uniswap liquidity providers to borrow through Aave and Uniswap to be used for DeFi loans, thereby increasing the demand for stablecoins. The Aave protocol can be the protocol for creating the currency market. Soon we will introduce the Set market and so on. This is all I do want to say now. Ultimately, it is possible to create your own currency market! Additionally , in the next month or two, we will publish our token economics or "Aavenomics" and our governance. LEND token holders will be able to vote on smart contract changes, thereby enabling the Aave protocol ecosystem Completely decentralized. Another interesting section of Aavenomics is that it could put LEND in the security module to supply a safety net for liquidity providers to resist various protocol risks. Similarly, we will have plans to incentivize liquidity providers.

0 notes

Text

Crypto Briefing: Understanding DeFi Transaction Routing in one single Article 1inch. exchange

The fragmentation problem in the DEX industry will probably continue for some time, and also this trend is precisely the opportunity for 1inch. exchange. Published by: Liam Kelly, Ashwath Balakrishnan Translation: Lu Jiangfei Crypto Briefing authorizes blockchain news translation and publishes Chinese version One of the most significant explanations why 1inch. exchange can flourish in the DeFi field is that they "concentrate" decentralized liquidity in one place. Particularly following the rise of Yield Farming, the 1inch. exchange platform is promoting somewhat.

Breakdown of key content

* 1inch. exchange targets serving the retail (retail) user market eager to explore decentralized exchanges. * By integrating numerous decentralized exchanges (DEX) and tokens, users can exchange just about all types of ECR-20 tokens. * Nevertheless , since DEX is mostly built on Ethereum, it could cause gas fees to be too much. 1inch. exchange has now become a significant the main booming Decentralized Finance (DeFi) industry. Initially, it played the role of a one-stop liquidity aggregation "gathering place", nonetheless it has gradually evolved in to an exceptionally practical " "Swiss Army Knife", its sustained effectiveness is closely related to the ever-changing DeFi world. Yes, many users have noticed the powerful function of 1inch. exchange. Recently, DeFi supporter and crypto venture investor Qiao Wang launched an informal survey on Twitter. He hopes to learn in regards to the usefulness of different DeFi platforms from his 17, 000 followers, and lists including Balancer, Uniswap, Compound Many well-known projects including. In the long run, Qiao Wang concluded that in terms of product/market fit, the most notable three DeFi projects are Uniswap, Curve and 1inch. exchange.

Since the saying goes, when there is no investigation, there is absolutely no to speak. Qiao Wang's survey answers are more thought-provoking than anything. By better determining the product/market fit, understanding the liquidity of different DeFi platforms, and determining whether there is "business overlap" involving the platforms, is it possible to more accurately judge the differences between these DeFi platforms. In this specific article, we shall deeply analyze the essence of 1inch. exchange, explain platform functions, explore its operating principles, and explain why this DeFi tool is essential for just about any user. What is 1inch. exchange? 1inch. exchange is really a DEX aggregator which will help route just about all DeFi transactions. By integrating with various DEX providers, 1inch users can get probably the most affordable transaction, the lowest transaction delay, and may use various ERC-20 tokens for transactions. The aforementioned picture is from Dune Analytics: various digital assets exchanged on 1inch. exchange every month Platforms include: Uniswap, Kyber Protocol, Aave, Curve. fi, Airswap, mStable, Balancer, dForce Swap, 0x API, 0x Relayers (Bamboo, Radar Relay), Bancor, and Oasis, in addition to a number of other resources of liquidity (including private Market maker). The aforementioned picture is from Dune Analytics: monthly cross-DEX transaction distribution on 1inch. exchange Frequently, 1inch. exchange routing is going to be exchanged through one or more platform. This multi-routing procedure is named split trade. For example , between aDAI (Aave's interest-bearing DAI token) and DAI This simple exchange mode is adopted. The picture above is from 1inch. exchange Many of these transactions occur on Uniswap, and just a small portion are conducted on Balancer. The specific transaction ratio will fluctuate in line with the changing exchange rates on both platforms. Before performing such specific transactions, Uniswap also provides users with two "unlocking" processes, one is "unlimited unlocking" and one other is "single unlocking" one at a time. Most DApps require users to enable them to connect to the user's digital wallet, but 1inch is really a non-custodial decentralized application, so it won't ever hold user funds, but at the same time it may continue to connect to various encrypted wallets. Once "unlocked", transaction activities will occur, and every time the application form calls and verifies the unlocking, it may save yourself gas. For users who usually connect to the DeFi protocol, this feature can save yourself them lots of money. 1inch refers to this sort of unlocking as "infinity unlock" because it is different from the one-time unlock transaction-because the user needs to pay gas fees every time the unlock is named, so "unlock the transaction one by one" This kind of unlocking is higher priced. Nevertheless , "unlocking transactions one at a time" is relatively safer, because once threatened, users are not always linked to the protocol. In the DeFi platforms listed in the aforementioned figure, users may also hide some DEXs that they do not desire to connect to. The operation is simple, follow on the switch button. If the selected DEX is closed, the transaction will not be Will pass these platforms. In essence, 1inch is more like an efficient DeFi routing platform. It does not search various exchanges to get the best transaction price. It just sorts out all of the data for users, and means that users can get it no matter how "exchange" Probably the most affordable price. Even though operating platform can be a bit daunting initially, even if you really are a novice, you will get a really intuitive user experience in just a couple of minutes. Next, let them discuss 1inch's "growth mode" in the Yield Farming boom and analyze the specific circumstances behind these "exchanges. " What role does 1inch. exchange play in Yield Farming? The so-called Yield Farming essentially transfers users' idle cryptocurrency to various lending platforms, and they can earn interest from these assets. Although Yield Farming may have more complex definitions in some different forms, the aforementioned explanation is at least in this essay. If you wish to learn more about Yield Farming, I would suggest the next two articles:

* Just how to Yield Farm on Uniswap and Not Get Rekt * Yield Farming on DeFi: Beginner's Guide to Earning Interest in your Crypto Next, let's take a look at what sort of so-called "Yield Farmer" user can use 1inch. exchange to maximize his income-the so-called "Yield" (Yield) Right. First, by opening a tab (tab) on 1inch. exchange, you are able to connect with websites such as for example LoanScan, DeFi Rate, DeFi Prime, and so forth Currently, users pays awareness of the lending rates on different platforms whenever you want. For now, the cost and exchange rate of the stable currency DAI on Aave is extremely good. If users hold DAI, the operation of "Yield Farming" is relatively simple: they can get on Aave directly and exchange their DAI in to aDAI, which really is a stable currency DAI's interest-bearing token on Aave. As the operation is too simple, users barely require a transaction routing service provider like 1inch. Nevertheless the problem is that when the user holds other assets, such as for example Chainlink's LINK token, the process of manual exchange in to aDAI token is going to be very troublesome:

* Currently, the user needs to find a decentralized exchange or even a liquidity pool, and also this liquidity pool needs to give a competitive price for the exchange between LINK and DAI. * Then, the user needs to transfer the DAI exchanged from the decentralized exchange or liquidity pool with the leverage to Aave and exchange it in to aDAI. This method is extremely awkward, since the user may not be able to secure the most effective price when performing each step-at now, 1inch should be able to work. On 1inch, users can complete the complete process with only one click, making certain traders' orders won't have low slippage dilemmas. (Blockchain news note: There is a gap involving the price of the slippage market value order and the cost point of the final transaction) Nevertheless , with the popularity of DeFi, Ethereum gas fees will also be rising, which means that simple transactions may be relatively cheaper. If users start interacting with multiple smart contracts, the gas fee charged will increase rapidly. This might be one of the most obvious dilemmas undergone when using 1inch, but from yet another perspective, this issue is really a problem with the underlying blockchain (Ethereum), not a problem with 1inch itself. Exploring the Ethereum gas cost problem on 1inch Now, let us give yet another example, that we possibly may comprehend yet another problem solved by 1inch: If a user holds aDAI tokens, but currently he or she finds that Aave is stable on Synthetix The interest-bearing token aSUSD of SUSD includes a better exchange rate, and this user really wants to switch to aSUSD. What should I do currently? On 1inch, users can route through any number of liquidity pools and DEX, convert their aDAI tokens in to DAI, then convert DAI in to SUSD, last but not least exchange SUSD in to aSUSD tokens-most importantly, each one of these operations can be completed with one click. Unfortuitously, even though the operation is extremely convenient, it will bring high gas costs to users.

The aforementioned picture is from 1inch. exchange: If you wish to convert 50 aDAI to about 50 aSUSD, the user needs to pay more than $30 to execute this transaction. Consequently , most users might not accept this operation. One of the most significant explanations why such specific transaction costs are so costly on 1inch is that the gas cost on the Ethereum network is too much. Since most DEXs are made on the Ethereum blockchain, gas fees are a problem that cannot be circumvented. However in order to resolve this issue, 1inch has integrated an original feature: CHI GasToken token. Before explaining the CHI GasToken token, we should first discuss GasToken. GasToken allows users to take a position the gas price. When the price is low, users can buy and store gas for future use. The developers behind 1inch took this concept one step further and created the CHI GasToken token. For active DeFi users, by using this token or equivalent GasToken is definitely a good habit. The aforementioned picture is from Dune Analytics: When users use GasToken denominated in USD, they can save yourself gas on 1inch. exchange The team behind 1inch In June 2019, Sergej Kunz and Anton Bukov announced the creation of 1inch. exchange at the ETH Ny Hackathon. Both of these have become experienced software engineers with not exactly 30 years of experience. Sergej Kunz spent some time working as a software engineer in many German organizations, probably the most well-known that is Porsche. Anton Bukov worked being an iOS and macOS developer and entered the cryptocurrency industry in August 2017. Since that time, he's been cooperating with the NEAR agreement to simply help build an interoperable bridge between NEAR and Ethereum until June 2020. 1inch is fabled for publishing reports on DeFi vulnerabilities. Currently, many such reports have been published. The DeFi platforms involved include Balancer and Bancor. With regards to hackathons, the 1inch team often uses hackathons to require help, such as for example product building and expanding more intuitive user interfaces. Before founding 1inch, Sergej Kunz and Anton Bukov also participated in a hackathon, during which additionally they developed an arbitrage robot for the DeFi project. The 1inch platform indicator 1inch's liquidity summary function provides DeFi users with great practicability and may help DeFi users obtain the best price from all aspects. This kind of aggregation service can greatly improve the user connection with DEX, however for simple users who don't desire to complicate CHI tokens and keep transaction costs low, Uniswap might be a better choice. After all, Uniswap provides a cheaper Methods of obtaining liquidity. Nearly all of 1inch's user group are frequent users who often use the product. By the writing with this article, 1inch has approximately 300 unique users each day, and also this indicator peaked on June 24, 2020 (730 users). The aforementioned image is from Dune Analytics: Daily user volume on 1inch. exchange since its inception The 1inch user group is mainly made up of retail accounts, and the transaction volume is between $500 and $8, 000 to fully prove this. So far, there are no more than 100 large-scale transactions with a value greater than USD 1 million on the 1inch platform. The aforementioned picture is from Dune Analytics: the distribution of transaction volume by transaction amount on the 1inch platform Exactly why there are numerous small transactions on the 1inch platform may also be caused by whale split transactions, because DeFi liquidity cannot promote large transactions with no significant decline. Conclusion At this stage, DeFi liquidity is really mainly "concentrated" in many pools, such as for example Uniswap, Kyber, Balancer, Bancor, 0x, and Curve. They are also the primary players in most DEX liquidity. Each DEX's token liquidity pool has different depths, such as for example:

* Uniswap may have a deeper LINK-ETH pool, allowing traders to acquire better prices; * Kyber might provide better trading terms for SNX-ETH. Nevertheless the problem is that loyalty to the liquidity pool isn't in the most effective interests of traders, and it is really boring to test the most effective prices of different DEXs every time you trade-but 1inch successfully solved this issue. In the future, with the increasing popularity of DEX aggregation services, the liquidity pool may be transferred to the rear end of the user experience, which means that liquidity may be dispersed among a few DEX as time goes on, so whoever includes a cleaner front-end aggregation service A refreshing interface and user experience can attract more users. Nevertheless , in case a DEX ultimately becomes a "liquidity black hole" and its own growth far exceeds that of other competitors, the "market power" of DEX aggregation services such as for example 1inch may be greatly weakened. Nevertheless , this dilemma is really perhaps not that essential, because each DEX has its own advantages, and the types of assets and traders which are attracted will also be different. So from this perspective, you'll find that today's DEX industry still includes a certain degree of fragmentation, and also this problem will probably continue for some time. This trend precisely brings opportunities for DEX aggregation services—— 1inch is undoubtedly the present leader in forex trading segment.

0 notes

Text

The sum total market value of DeFi has risen 700% in 2 months. There are still individuals who cannot see, look down, understand, and cannot keep up

DeFi has all of the benefits of decentralized applications. There's absolutely no barrier to entry. Anybody on the planet can use the DeFi application on the chain at any time, completely breaking the geographical and time constraints.

This article represents the author's personal opinion, maybe not the positioning of Mars Finance. The content is supposed to convey more market information and doesn't constitute any investment advice.

Author丨 JackyLHH Source | Vernacular Blockchain

Because the Bitcoin block reward halving was settled in May, we can see that the focus of the whole crypto industry has shifted to ETH 2. 0, IPFS, and DeFi. With the entire cryptocurrency market in "no waves", the tokens of many DeFi projects behaved extremely dazzlingly-there is a huge price increase of 2 to 4 times. The decentralized lending platform Compound has turned into a recent star. Through the strategy of "borrowing to mine", the sum total value of the loaned crypto assets has increased by about 850 million US dollars in just a couple weeks, and the price of its Token COMP is even higher. It hit a higher of $372. 27 on June 21.

Chart: The cost trend of Compound Token COMP, source: CoinGecko At precisely the same time, according to statistics from DeFi Market Cap, the present total market value of DeFi projects has exceeded US$7. 4 billion, and two months ago, the sum total market value was less than US$1 billion. Put simply, in just over two months, the sum total market value of DeFi projects has skyrocketed by significantly more than 700%. Additionally , the lock-up funds on DeFi projects also have shown explosive growth, that has exceeded US$2. 08 billion.

* On April 14, the sum total market value of DeFi was US$1 billion;

* On June 9, the sum total market value of DeFi reached US$2 billion;

* On June 16th, COMP started mining by generation, which trigger a DeFi boom;

* On June 25, the sum total market value of DeFi exceeded $6 billion;

* On July 4, DeFi had a complete market value of US$6. 6 billion;

* On July five, DeFi had a complete market value of US$7 billion. Whether it's the sum total market value, the scale of locked-up funds, or the Token price, DeFi projects show a blowout development. Could be the spring of DeFi coming? How will it develop as time goes on and how will it affect our lives? Today, we will speak about these topics.

DeFi VS CeFi

Before delving in to DeFi, we must know very well what DeFi is and its particular main benefits and drawbacks. DeFi is in accordance with CeFi, that is the abbreviation of Centralized Finance. Even though term CeFi has only been coined lately, it's definitely not a fresh thing. The present conventional financial system could be called CeFi, such as for example conventional banks, stock exchanges, various financial institutions, etc. DeFi could be the abbreviation of Decentralized Finance (decentralized finance), also called Open Finance. DeFi uses blockchain technology and smart contract technology to displace the traditional trust centered on people or third-party institutions with decentralized protocols to build a transparent and open financial system. To understand it simply, CeFi requires you to trust the intermediary (person or organization), and DeFi requires you to trust the agreement (code).

After centuries of development, CeFi has mature services and products and good user experience, but its flaws are that it is relatively closed and requires permission to make use of it. Like many underdeveloped areas in Africa, you can still find numerous individuals who can't take pleasure in the services given by banks along with other financial institutions. One of many major benefits of DeFi is that it is open and transparent, no permission is required, and anybody on the planet can use it without any restrictions. For example , anybody can mortgage ETH assets to DeFi projects MakerDAO or Compound, and lend out the crypto asset DAI that is anchored 1: 1 with the USD. Of course, DeFi still has many shortcomings, such as for example poor user experience, high learning barriers, and immature services and products.

DeFi development status and main representative projects

In terms of market value, the sum total market value of the present DeFi project has exceeded US$7. 4 billion, and the scale of locked-up crypto assets has exceeded US$2. 08 billion, showing a blowout development. It may be said that DeFi has turned into a force that can't be underestimated in the blockchain industry. Let us look at the current DeFi from how many user growth. In accordance with Dune Analytics statistics, as of July 8 in 2010, the sum total number of DeFi users was approximately 240, 000. In the beginning of 2018, this data hadn't broken 100. From the figure below, we can also begin to see the rapid growth of DeFi users.

Figure: DeFi user growth, source: Dune Analytics DeFi was born following the emergence of the programmable Ethereum blockchain. From a distribution point of view, most of the current DeFi projects are concentrated on the Ethereum blockchain, followed by public chains such as for example EOS and TRON. From the perspective of product form, the present DeFi already includes decentralized wallets, KYC and identity authentication, decentralized trading platforms, decentralized lending, staking, stable coins, along with other infrastructure. The whole ecosystem is consistently improving. Picture: DeFi's ecological services and products, source: defiprime Below, we introduce a few representative DeFi services and products: 1 . DeFi dark horse: Compound Compound is just a decentralized borrowing platform on Ethereum. Counting on the Token distribution principle of "borrowing is mining", it has attracted numerous investors to make use of it for mortgage and borrowing in just a couple weeks. Until now, how many Compound users has exceeded 30, 000, and the amount of crypto assets available for borrowing has exceeded 1 . 57 billion U. S. dollars, and the loaned crypto assets are almost 900 million U. S. dollars, which makes it the DeFi with the greatest total borrowing among decentralized lending platforms (accounted for). The top three crypto assets with the most mortgages and loans on Compound are DAI, USDC, and ETH. The initial two are stable currencies which can be 1: 1 anchored to the U. S. dollar.

Figure: Loan data on Compound, source: Compound official website Figure: The composition of the sum total borrowings of DeFi projects, source: DeBank 2. Stable currency lever: MakerDAO MakerDAO is definitely an old decentralized borrowing platform on the Ethereum blockchain. Its market value has long occupied the very best of the DeFi rankings (recently surpassed by Compound). Its stable currency DAI has always been regarded as the biggest competitor of the centralized stable currency USDT. In accordance with its official website, you can find currently significantly more than 400 DApps with MakerDAO embedded, and the sum total value of locked crypto assets exceeds 623 million U. S. dollars, ranking 2nd in the sounding decentralized borrowing platforms (the first is Compound, Is 685 million U. S. dollars). The collateral assets supported by MakerDAO have changed from the single ETH to guide a number of encrypted assets, including BAT, USDC, WBTC, TUSD, KNC, and ZRX, among which USDC, WBTC, and TUSD are stable currency assets. 3. DeFi with the most users: Uniswap Uniswap is just a decentralized trading platform on the Ethereum blockchain. It mainly provides liquidity services for ETH and ERC-20 Token. It is also the DeFi application with the biggest number of users. In accordance with data from Dune Analytics, Uniswap has 92, 000 users, accounting for 38. 61% of the sum total number of DeFi users. In line with the Ethereum browser, Uniswap transactions account for 36. 971% of how many DEX transactions on Ethereum.

4. DeFi with the most Token usage: Brave browser Brave browser was founded by Brendan Eich, the father of JavaScript. It is targeted on privacy protection. The biggest feature could be the introduction of the Token economic incentive mechanism. The native token of the Brave browser is known as BAT, that is the absolute most used token in DeFi in the next quarter of the year, with a transaction level of US$931 million, which exceeds the sum ETH and DAI. The aforementioned is just the end of the iceberg in the DeFi ecosystem, and there are numerous familiar applications, including the web version of the small fox wallet (MetaMask), Veil emphasizing predicting the marketplace, StakeWith. US for staking, stable currency WBTC, and infrastructure Bancor, 0x, etc ., tied to the size of the content, usually do not introduce an excessive amount of.

DeFi's impact and future prospects

The DeFi ecosystem has become more and more prosperous, and much more and much more exemplary projects have emerged. What impact will these projects have on our lives? On July 1 in 2010, Ethereum founder V God sent 8 tweets to talk about DeFi. V God said that lots of flashy things are very exciting, but they are short-term; from the long-term perspective, the truth is that DeFi interest rates can't be greater than the very best interest of conventional finance by more than one percentage point. In the above, we mentioned that conventional centralized finance (CeFi) requires access permission, so many people are shut out. There are certainly a large number of people on the planet who can't take pleasure in the services given by financial institutions, and DeFi can just make up for it. This defect. DeFi has all of the benefits of decentralized applications. There's absolutely no barrier to entry. Anybody on the planet can use the DeFi application on the chain at any time, completely breaking the geographical and time constraints. Now DeFi has slowly progressed into a complete financial ecosystem that may execute a variety of operations, including payment, borrowing, borrowing, saving, trading, investment, income, management, hedging, margin trading, etc. There are many benefits of DeFi, but we can not ignore that we now have still many shortcomings in the present stage. For example , the consumer experience just isn't as good as conventional centralized finance. Still another example could be the high learning threshold, the item just isn't mature enough, plus some hacker attacks often occur. Events (such since the recent lightning loan attack on Balancer). In the future, DeFi and CeFi will learn from one another, and the boundaries between the two can be increasingly blurred. The application of DeFi can be more and more convenient as CeFi when it comes to user experience, and certain underlying services of CeFi will gradually connect to the blockchain, using blockchain technology to improve the transparency and convenience of its services. For users, an item that is safe and certainly will meet their needs is just a good product, no matter whether it's CeFi or DeFi. There is a competitive relationship between DeFi and CeFi, but it just isn't grayscale, however the two will coexist for some time and jointly support a broader financial market. DeFi is just a promising development direction, and it's also also a significant the main planet financial system as time goes on. The spring of DeFi has come, but lots of people think that DeFi is currently being overhyped, and also this intervention is likely to be "take over" risks. You won't be too late to consider after returning to rationality. Maybe DeFi must go through a tortuous road before it enters the highlight moment? This article only represents the author's views, and doesn't represent the official position of Mars Finance. Adding WeChat befabing and joining the Mars Finance reader exchange group enables us to create more valuable interactions and connections.

0 notes