#crs new faces 2023 announced

Explore tagged Tumblr posts

Text

Inside Track on Music Row January 2023

This month's column is a mix of the good news from 2022 so we can reflect on happy times and first for our music community and also some wonderful things coming up as we move in 2023.

This month’s column is a mix of the good news from 2022 so we can reflect on happy times and first for our music community and also some wonderful things coming up as we move in 2023. VERSE OF THE MONTH: May you trust God that you are exactly where you are meant to be – Saint Theresa. ALBUM NEWS: Country music visionary ERNEST had a record year. After dropping his first full-length album…

View On WordPress

#Album#average joe&039;s new hites#bluegrass nights at the the ryman 2023#boys club for girls releases double single#brothers of the hear#Charles Kelley#cole swindell celebrates 2022#craig campbell elected to eagleville council#Craig Morgan#crs new faces 2023 announced#dabid morris on tour#Drake White#dustin lynch&039;s friends benefit concert success#eddie montgomery releases debut solo album#ernest releaes album flower shops#gulf coast jam#karen peck and new river nominated for grammy for gospel music#lily rose#luke bryan crah my playa tour in mexico 2023#michael austin releaes god made dirt#miranda lambert teams up with tractor supply#mitch rossell#music row#nashville music#oak ridge boys celebrate 40th anniversary#opry news ashley mcrybe and terri clark#outback presents hires senior booking manager fallon nell#randy rogers band raises money for rrb golf jam#remembering charlie monk#singer

0 notes

Text

MUSE

Release date : 19 July 2024

Official page

Announcement

Pre-order notice

Teaser

Promotion Schedule

Highlight medley

Recording Behind

Official YouTube playlist

Official Merch

Thanks to Eng translation

Jimin's second release after this first solo album FACE. Several parts of the concept reference the smeraldo flower, a fictional plant from the Bangtan Universe (BU)

Right before the announcement, a discussion channel was opened on the official BTS account on Instagram to tease it. It featured a picture of a music sheet titled "La Lettra", that ended up being "전하지 못한 진심" (the truth untold) (src #1, src #2, src #3) from the album Love Yourself 轉 Tear. As for the "You will always find the first letter" hint, it was implying to check the first letter of each circled word to get "Closer Than This", a track of the album released in December 2023. The last picture sent on the channel is of a handwritten letter (eng trans).

It seems Jimin worked on MUSE and FACE at the same time since in the documentary Jimin's Production Diary that followed Jimin during FACE conception, he has the same nails as in the MUSE teaser (see this Bangtan Bomb at 0:13, cr.). In addition, there was a handwritten letter in the documentary that was titled 전하지 못한 진심(The Truth Untold) (src).

People also pointed out that in his Festa letter, released just a few days before the announcement, Jimin promised to come back with a letter, possibly hinting at the "La Lettra" music sheet (src).

On the day of the album release, the BT21 account posted a cute video of Chimmy (the character created by Jimin) with a smeraldo flower.

The album comes in two versions : BLOOMING and SERENADE. There is also an exclusive Weverse version. On the BLOOMING ver. the ME letters are bigger while on the SERENADE ver. the US letters are.

Tracklist

The pre-release track and the main track titles were teased through a crossword poster on the Instagram channel (archive).

Rebirth (intro)

Interlude : showtime

Smeraldo Garden Marching Band (feat. Loco)

Slow Dance (feat. Sofia Carson)

Be Mine

Who

Closer Than This (see this post)

You can find all the lyrics and their translation on Bangtan Subs website, here.

Colin made a thread with his lyrics translations.

Mood Photo, concept photo & concept clips

Release date: 21-22 June, 6-7 July 2024

Mood Photo - BLOOMING ver. (BTS💜ARMY Weverse post)

Mood Photo - SERENADE Ver.

Concept Photo & Concept Clip - SERENADE ver.

Photo Sketch

Jacket Shoot Sketch

Melon exclusive photos (archive)

Outfit and accessories : belt (cr. BangtanStyling)

Smeraldo Garden Marching Band video

Release date: 28 June 2024

Lyrics

Teaser clip

Behind

Photo Sketch

Outfits & accessories: black suit

youtube

Jimin mentioned this title in the Jimin's Production Diary documentary (src). It's also mentioned in the Weverse magazine article "When you look into Jimin’s heart, this is what you find".

The concept is inspired by Sgt. Pepper's Lonely Hearts Club Band, an album from the Beatles (src).

Like in the choreo for "Permission to Dance", the dance here features some sign language that says "love" (src #1, src #2).

Who

Release date: 19 July 2024

Teaser

Photo Sketch

Shoot Sketch

Dance analysis by JiminUncut

youtube

The MV was filmed on the New York backlot street at Korda Studio, in Hungary (src).

The Truth Untold : 전하지 못한 진심' 전시 개최 안내

Held on: 11 October - 3 November 2024

Announcement

Promotion, articles, and interviews

Nylon: "Jimin shares a new photo to go with his sunny, just-released single - exclusive"

Weverse Magazine: "Producers for Jimin’s album MUSE Pdogg and GHSTLOOP: “In that sense, love becomes his muse”"

NME: "Jimin – ‘Muse’ review: in the mood for love"

'Who' @ The Tonight Show Starring Jimmy Fallon (teaser, Instagram post with pictures of the set, the performance was filmed at Suanbo Waikiki Hotel (src))

10 notes

·

View notes

Text

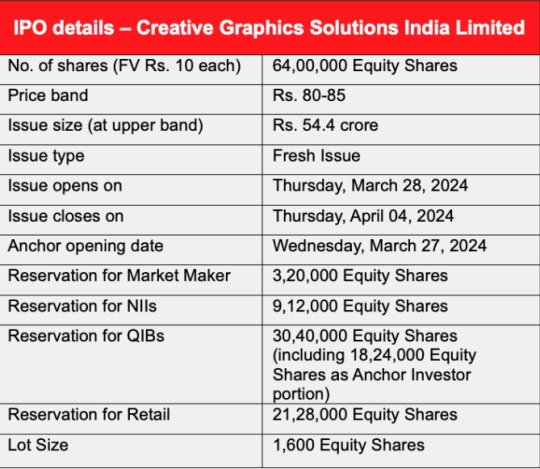

Creative Graphics Solutions India Limited IPO opens for retail investors today – 28 March 2024

Today, 28 March, the retail portion of the Creative Graphics Solutions IPO opens for subscription. The anchor portion of the public issue that opened yesterday has apparently received a good response from investors including financial institutions.

On 22 March 2024, the Noida-headquartered Creative Graphics Solutions India Limited, one of India’s leading organized and integrated packaging ecosystem players, announced that its initial public offering (IPO) will open on Thursday, 28 March 2024. The anchor portion will be opened on Wednesday, 27 March 2024, and the issue will conclude on Thursday, 4 April 2024. The company intends to raise approximately Rs 54.4 crore (at the upper band) from the offering and aims to be listed on the NSE Emerge platform. The price band for the issue has been fixed at Rs 80 to Rs. 85 per share, and the lot size will be 1,600 equity shares.

Corporate Capital Ventures is the Book Running Lead Manager, and Bigshare Services Private Limited is the Registrar for the issue. According to the press release from Creative Graphics, Corporate Capital Ventures Private Limited has completed a string of successful SME IPOs in recent months, including Alpex Solar, Esconet Technologies, Rockingdeals, Accent Microcell, Oriana Power, Droneacharya and Crayons Advertising.

Creative Graphics is a product of the MSMEx SME IPO Cohort program, mentored by Amit Kumar, founder and CEO at MSMEx.

The Noida-based company’s IPO comprises a fresh issue of 64,00,000 Equity Shares with a face value of Rs 10 through the book-building route. As many as 3.2 lakh equity shares are reserved for the Market Maker, 9.12 lakh equity shares allocated for NIIs, 30.4 lakh equity shares for QIBs (including 18.24 lakh equity shares as the Anchor investor portion), and the Retail (RII) portion accounts for 21.28 lakh equity shares.

According to the Red Herring Prospectus document, the company intends to utilise the net proceeds from the IPO to meet the working capital requirements of the company, repay/prepay, in part or full of certain of the company’s borrowings, meet the capital expenditure of the company, fund inorganic growth through unidentified acquisition for the company, and general corporate expenses.

Creative Graphics specializes in manufacturing flexographic printing plates, including digital flexo plates, conventional flexo printing plates, letter press plates, metal back plates, and coating plates. The company serves its customer base in India, Thailand, Qatar, Kuwait, Nepal, and Africa. It operates seven manufacturing facilities in various states – Noida (Uttar Pradesh), Vasai, Pune (Maharashtra), Chennai (Tamil Nadu), Baddi (Himachal Pradesh), Hyderabad (Telangana), and Ahmedabad (Gujarat).

Founded by Deepanshu Goel, a first-generation entrepreneur and incorporated in 2014, Creative Graphics has expanded its business through its wholly owned subsidiaries – Creative Graphics Premedia Private Limited (CG Premedia) and Wahren India Private Limited. While CG Premedia offers end-to-end premedia services, from design adaptation to print production, Wahren India supplies high-quality packaging solutions for the pharmaceutical industry. It produces Alu-Alu Foil, Blister Foil, Tropical Alu-Alu Foil, CR Foil, and Pharmaceutical Sachets.

The company clocked a revenue of Rs 48.07 crore and earned a profit (PAT) of Rs. 7.24 crore during the first half (H1) of the current FY 2023-24 financial year, which ended 30 September 2023. It registered revenue of Rs. 90.14 crore and a profit (PAT) of Rs. 8.64 crore in FY2022-23.

Our take

We have known Creative Graphics for the past decade and have also admired its fast growth in establishing new plants across the country. We appreciate the need for companies in the printing and packaging industry to expand and raise capital for scaling up their operations. Creative Graphics' team has always been enthusiastic about vertical integration and diversification to new areas of packaging. The company’s IPO will hopefully open a path for other companies in the industry needing to raise capital for scaling up.

For more information, please visit: https://creativegraphics.group/

Disclaimer: CREATIVE GRAPHICS SOLUTIONS LIMITED is proposing, subject to applicable statutory and regulatory requirements, receipt of requisite approvals, market conditions and other considerations, to make an initial public offer of its Equity Shares and has filed the RHP with the NSE Emerge. The RHP is available on the website of BRLM and the website of NSE. Any potential investors should note that investment in equity shares involves a high degree of risk, and for details relating to the same, please refer to the RHP, including the section titled “Risk Factors”, beginning on page 28.

The Equity Shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the "Securities Act) or any state securities laws in the United States, and unless so registered, and may not be issued or sold within the United States, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in accordance with any applicable U.S. state securities laws. The Equity Shares are being issued and sold outside the United States in 'offshore transactions in reliance on Regulation "S* under the Securities Act and the applicable laws of each jurisdiction where such issues and sales are made. There will be no public offering in the United States.

First published on 23 March 2024, this article has been updated on the morning of 28 March 2024 – editor.

0 notes

Text

Creative Graphics Solutions India Limited IPO opens for retail investors today – 28 March 2024

Today, 28 March, the retail portion of the Creative Graphics Solutions IPO opens for subscription. The anchor portion of the public issue that opened yesterday has apparently received a good response from investors, including financial institutions.

On 22 March 2024, Noida-headquartered Creative Graphics Solutions India Limited, one of India’s leading organized and integrated packaging ecosystem players, announced that its initial public offering (IPO) will open on Thursday, 28 March 2024. The anchor portion opened on Wednesday, 27 March 2024, and the issue will conclude on Thursday, 4 April 2024. The company intends to raise approximately Rs 54.4 crore (at the upper band) from the offering and aims to be listed on the NSE Emerge platform. The price band for the issue has been fixed at Rs 80 to Rs. 85 per share, and the lot size will be 1,600 equity shares.

Corporate Capital Ventures is the Book Running Lead Manager, and Bigshare Services Private Limited is the Registrar for the issue. According to the press release from Creative Graphics, Corporate Capital Ventures Private Limited has completed a string of successful SME IPOs in recent months, including Alpex Solar, Esconet Technologies, Rockingdeals, Accent Microcell, Oriana Power, Droneacharya and Crayons Advertising.

Creative Graphics is a product of the MSMEx SME IPO Cohort program, mentored by Amit Kumar, founder and CEO at MSMEx.

The Noida-based company’s IPO comprises a fresh issue of 64,00,000 Equity Shares with a face value of Rs 10 through the book-building route. As many as 3.2 lakh equity shares are reserved for the Market Maker, 9.12 lakh equity shares allocated for NIIs, 30.4 lakh equity shares for QIBs (including 18.24 lakh equity shares as the Anchor investor portion), and the Retail (RII) portion accounts for 21.28 lakh equity shares.

According to the Red Herring Prospectus document, the company intends to utilise the net proceeds from the IPO to meet the working capital requirements of the company, repay/prepay, in part or full of certain of the company’s borrowings, meet the capital expenditure of the company, fund inorganic growth through unidentified acquisition for the company, and general corporate expenses.

Creative Graphics specializes in manufacturing flexographic printing plates, including digital flexo plates, conventional flexo printing plates, letter press plates, metal back plates, and coating plates. The company serves its customer base in India, Thailand, Qatar, Kuwait, Nepal, and Africa. It operates seven manufacturing facilities in various states – Noida (Uttar Pradesh), Vasai, Pune (Maharashtra), Chennai (Tamil Nadu), Baddi (Himachal Pradesh), Hyderabad (Telangana), and Ahmedabad (Gujarat).

Founded by Deepanshu Goel, a first-generation entrepreneur and incorporated in 2014, Creative Graphics has expanded its business through its wholly owned subsidiaries – Creative Graphics Premedia Private Limited (CG Premedia) and Wahren India Private Limited. While CG Premedia offers end-to-end premedia services, from design adaptation to print production, Wahren India supplies high-quality packaging solutions for the pharmaceutical industry. It produces Alu-Alu Foil, Blister Foil, Tropical Alu-Alu Foil, CR Foil, and Pharmaceutical Sachets.

The company clocked a revenue of Rs 48.07 crore and earned a profit (PAT) of Rs. 7.24 crore during the first half (H1) of the current FY 2023-24 financial year, which ended 30 September 2023. It registered revenue of Rs. 90.14 crore and a profit (PAT) of Rs. 8.64 crore in FY2022-23.

Our take

We have known Creative Graphics for the past decade and have also admired its fast growth in establishing new plants across the country. We appreciate the need for companies in the printing and packaging industry to expand and raise capital for scaling up their operations. Creative Graphics' team has always been enthusiastic about vertical integration and diversification to new areas of packaging. The company’s IPO will hopefully open a path for other companies in the industry needing to raise capital for scaling up.

For more information, please visit: https://creativegraphics.group/

Disclaimer: CREATIVE GRAPHICS SOLUTIONS LIMITED is proposing, subject to applicable statutory and regulatory requirements, receipt of requisite approvals, market conditions and other considerations, to make an initial public offer of its Equity Shares and has filed the RHP with the NSE Emerge. The RHP is available on the website of BRLM and the website of NSE. Any potential investors should note that investment in equity shares involves a high degree of risk, and for details relating to the same, please refer to the RHP, including the section titled “Risk Factors”, beginning on page 28.

The Equity Shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the "Securities Act) or any state securities laws in the United States, and unless so registered, and may not be issued or sold within the United States, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in accordance with any applicable U.S. state securities laws. The Equity Shares are being issued and sold outside the United States in 'offshore transactions in reliance on Regulation "S* under the Securities Act and the applicable laws of each jurisdiction where such issues and sales are made. There will be no public offering in the United States.

First published on 23 March 2024, this article has been updated on the morning of 28 March 2024 – editor.

0 notes

Text

Trident Techlabs IPO Price, GMP, Date, Review, Allotment Details Dec 2023

New Post has been published on https://wealthview.co.in/trident-techlabs-ipo-price-gmp/

Trident Techlabs IPO Price, GMP, Date, Review, Allotment Details Dec 2023

Trident Techlabs IPO: Trident Techlabs, a rising star in the engineering solutions space, is gearing up for its Initial Public Offering (IPO) in December 2023. This blog post dives deep into the crucial details you need to know before taking the plunge: Price, GMP, Date, Review, and Allotment Details.

Trident Techlabs IPO Dates:

Issue Open Date:

Issue Close Date:

Listing Date:

The official date is yet to be announced, but keep your eyes peeled for it sometime in December 2023. We will update you soon.

Trident Techlabs IPO Price and Grey Market Premium:

Price Band: While the official price band is under wraps, expect it to fall somewhere between ₹[.] and ₹[.] per share. We will update soon.

Grey Market Premium (GMP): This indicator of market sentiment will emerge once the subscription opens. Stay tuned for its rise and fall!

Trident Techlabs IPO Offer Details:

Issue Size: Trident Techlabs is looking to raise big bucks by offering 50 lakh shares, each with a face value of ₹10.

Total Issue Size: Get ready for an estimated haul of ₹[.] Cr, making it a promising IPO for growth and potential returns.

Reservation for Retail Investors: Don’t worry, small investors! The company will reserve a portion of the shares just for you – the exact percentage will be announced soon.

The Objectives of the Issue:

Expansion Plans: Trident Techlabs has its sights set on expanding its engineering solutions portfolio and geographical reach. The IPO proceeds will fuel this ambitious journey.

Technology Focus: Expect investments in cutting-edge technologies like AI and IoT to stay ahead of the curve.

Investing Smart:

Minimum Lot Size: While the official number is yet to be revealed, 1000 shares per lot is a standard practice. Remember, this is the minimum number of shares you can bid for.

Planning Power: Understanding the lot size helps you plan your investment and calculate your potential returns.

Trident Techlabs Company Profile:

Engineering Expertise: From aerospace and defense to automotive and telecommunications, Trident Techlabs tackles diverse challenges with its array of engineering solutions.

Trusted Brand: Renowned for its expertise and innovation, the company boasts a strong client base and a proven track record of success.

Financials:

Revenue Growth: The company’s revenue has been on a steady upward climb, showcasing its potential for future profitability.

Profitability: While still in its growth phase, Trident Techlabs has demonstrated consistent improvement in its bottom line, indicating a promising future.

.

Risks and Cautions:

Market Volatility: Remember, the IPO market can be unpredictable. Be prepared for fluctuations and do your own research before investing.

Competition: The engineering solutions space is crowded. Understand Trident Techlabs’ competitive edge and potential challenges.

Conclusion:

The Trident Techlabs IPO presents an exciting opportunity for tech-savvy investors. However, remember to conduct thorough research, analyze the risks, and invest wisely based on your own financial goals. Don’t let the hype cloud your judgment.

Also Read: How to Apply for IPO?

Stay tuned for further updates as the IPO date approaches, and remember to share this blog post with your fellow investors!

#Allotment Details#GMP#IPO#Price#Review#Trident Techlabs IPO Date#Trident Techlabs IPO GMP#UPCOMING IPO#Learn

0 notes

Text

HDFC Bank has invested $3.7 million for a minority stake in the fintech start-up Mintoak

One of India’s biggest private banks, HDFC Bank, bought a small share of Mintoak Innovations Private Limited on Wednesday for Rs 31.1 crore.

The bank said in a regulatory filing that it had signed contracts on December 13 to buy 21,471 fully paid-up Compulsory Convertible Preference Shares (CCPS) with a face value of Rs. 20 each at a premium of Rs. 9,711 for a total of Rs. 9,731 per CCPS that will be issued by Mintoak.

With this deal, HDFC Bank will have a 7.75% stake in the company.

Mintoak is a fintech start-up that offers a payments-led platform with value-added services for merchants to connect with their customers and for acquirers to improve their relationships with merchants through digital engagements.

Mintoak had a turnover of Rs 11.28 crore and a net profit of Rs 1.47 crore for the fiscal year that ended on March 31, 2022.

The deal should be done by January 31, 2023. The release said,

Mintoak is a new fintech company that was started in Mumbai in 2017 by Raman Khanduja, Rama Tadepalli, and Sanjay Nazareth. It links commercial banks with small and medium-sized businesses (SMEs) by letting merchants accept all kinds of payment methods.

In 2020, Pravega Ventures led a funding round for Mintoak that brought in $2 million.

On the other hand, HDFC Capital, a subsidiary of HDFC Group, said in November that it would back 15 Indian proptech start-ups.

Before this, HDFC Bank’s banking arm announced in August that it would put between INR 49.9 Cr and INR 69.9 Cr into the insurtech start-up Go Digit Life Insurance in exchange for nearly 9.94% of the company’s equity.

In June, HDFC said that it would revamp its digital services and work with new tech start-ups to offer services like a payment platform to its customers.

0 notes

Text

CRB Announces Nominees For CRS 2023's New Faces Of Country Music Show

CRB Announces Nominees For CRS 2023’s New Faces Of Country Music Show

Country Radio Broadcasters (CRB) has announced the nominees for the New Faces of Country Music Show, which will take place on Wednesday, Mar. 15 at the Omni Nashville Hotel during CRS 2023. This year’s nominees are Priscilla Block, Callista Clark, Jackson Dean, Ernest, Jelly Roll, Frank Ray, Elvie Shane, and Nate Smith. The New Faces of Country Music Show was created in 1970 and recognizes…

View On WordPress

0 notes

Text

Canada to Support Internationally Educated Health Professionals

Canada is pledging $1.5 million to remove barriers on immigrants who want to work in health care.

The parliamentary secretary to Immigration Minister Sean Fraser announced nearly $1.5 million in funding to help newcomers work in the Canadian health sector faster.

The funds are intended to promote collaboration and information sharing in the health sector. Specifically, to help internationally educated health care professionals get their credentials recognized faster.

The project builds on the success of the National Newcomer Navigation Network (N4), an online platform for foreign health care professionals who wish to work in Canada. N4 was launched in 2019 by the Children’s Hospital of Eastern Ontario’s (CHEO).

Discover if You Are Eligible for Canadian Immigration

“CHEO has a proven track record of ensuring health and social service sector professionals have the knowledge and tools they need to provide equitable care and services to newcomers,” said Marie-France Lalonde, Parliamentary Secretary to the immigration minister. “We are pleased to continue working with the National Newcomer Navigation Network to support health care professionals educated abroad in securing jobs in Canada’s health care sector. These services will help more newcomers succeed, while also helping to build a better future for all Canadians”.

In addition to helping internationally educated health care professionals work in Canada, the funds will enable N4 to serve as a platform where newcomers can find information on foreign qualification and credential recognition in all provinces and territories outside Quebec.

“Newcomers are an integral part of our communities,” said Alex Munter, CEO and President of CHEO. “Their full inclusion in our health-care workforce will help us address staffing shortages, while also incorporating richly diverse voices of lived experience and better supporting other newcomers.”

This funding comes from a dedicated stream within Immigration, Refugees and Citizenship Canada’s Settlement Program, which invests in projects that support future settlement programming. IRCC has allocated a total of nearly $1.02 billion in settlement services in 2022-2023, an increase of about 11% from 2021-2022, according to public records obtained by CIC News.

Canada is facing a tight labour market, especially in the health sector. Statistic Canada recently reported record levels of job vacancies in health care and social assistance. In March, out of more than 1 million job vacancies, health care and social assistance employers were seeking to fill 154,500 vacancies.

Express Entry programs for health care professionals

Health care professionals may be eligible for the Federal Skilled Worker Program (FSWP) and the Canadian Experience Class (CEC). These two federal immigration programs are managed by the Express Entry system.

Express Entry is an online system that manages immigration applications for the federal government. It uses the Comprehensive Ranking System (CRS) to rank eligible candidates on their skilled work experience, age, education, and official language ability, among other factors. The highest-scoring candidates get invited to apply for permanent residence in bi-weekly Express Entry draws.

Although draws for CEC and FSWP candidates have been paused during the pandemic, Minister Fraser previously announced that these draws would resume in early July. The minister also said the processing standard for new Express Entry applicants would return to six months.

PNP for health care professionals

Although IRCC gets the final say on who can immigrate to Canada, the provinces can nominate eligible candidates through the Provincial Nominee Program (PNP). Some PNPs are dedicated specifically for health care professionals, while others have more general work experience requirements but may hold immigration nomination draws targeting candidates in the sector.

Multiple provinces have more than one program that welcomes health care professionals. Sometimes PNPs draw candidates from the Express Entry system and invite them to apply for a provincial nomination. If these candidates are nominated, they get 600 CRS points added to their Express Entry score. This award is more than enough to allow the candidate to be invited to apply for permanent residence.

Here are some of the PNP pathways for health care professionals:

Ontario invites health care professionals to apply through its Human Capital Priorities Stream.

British Columbia offers a Health Care Professional category under its Skills Immigration and Express Entry pathways.

Saskatchewan has recently launched an International Health Worker EOI pool specifically for health care professionals.

Nova Scotia’s Labour Market Priorities Stream occasionally holds draws inviting health care professionals to apply for a provincial nomination.

New Brunswick’s Internationally Educated Nurses (IEN) program is a pathway for foreign nurses who can speak English or French.

To find more, CanadaVisa offers a PNP finder to help people match with the best PNP for their Canadian immigration journey.

Quebec

Quebec operates its own immigration system. Certain programs like the PNP and Express Entry are not available in Quebec.

Quebec offers its Regular Skilled Worker Program and the Quebec Experience Program. Health care professionals may be eligible for either of these programs. Both of these programs require candidates to have a working knowledge of the French language.

Caregiver pilot programs

Caregivers may be able to apply for permanent residence through the Home Child Care Provider Pilot or Home Support Worker Pilot if they have a job offer to work in one of the two eligible occupations, and meet the other eligibility criteria. Work experience must fall under National Occupational Classification (NOC) codes 4411 or 4412.

Through these pilots, candidates can get an open work permit to come to Canada and work temporarily.

To become eligible for permanent residence, candidates need at least 24 months of full-time work experience in the 36 months before applying. They also need language test results showing a Canadian Language Benchmark (CLB) of 5 or more, and one year of post-secondary education. As with all permanent residency applicants, they will also need to pass admissibility checks.

Discover if You Are Eligible for Canadian Immigration

Credit Goes To News Website – This Original Content Owner News Website. This Is Not My Content So If You Want To Read Original Content You Can Follow the Below Links Get the Original Source link Here.

0 notes

Text

Lineup Announced for New Faces of Country Music® Show at CRS 2024

The Country Radio Broadcasters (CRB) has unveiled the lineup for the New Faces of Country Music® Show at CRS 2024. This year's showcase will feature performances by George Birge (Records Nashville), Dillon Carmichael (Riser House), Corey Kent (SMN/RCA), M

The Country Radio Broadcasters (CRB) has unveiled the lineup for the New Faces of Country Music® Show at CRS 2024. This year’s showcase will feature performances by George Birge (Records Nashville), Dillon Carmichael (Riser House), Corey Kent (SMN/RCA), Megan Moroney(SMN/Columbia), and Conner Smith (Valory Music).Chuck Aly, CRS New Faces Committee Chairman, states, “With five of 2023’s top 10…

View On WordPress

0 notes