#cpa career in usa

Explore tagged Tumblr posts

Text

What is The Syllabus of CMA?

The Certified Management Accountant (CMA) program is renowned for its comprehensive syllabus, equipping professionals with the skills necessary for strategic financial management. The CMA syllabus comprises two parts, each focusing on distinct aspects of management accounting.

Part 1 of the CMA exam delves into financial reporting, planning, performance, and control. This section covers topics such as financial statement analysis, budgeting, cost management, and internal controls. It emphasizes the analytical skills needed for effective decision-making within organizations.

Part 2 of the CMA exam centers on financial decision-making. It includes topics like financial statement analysis, risk management, investment decisions, and professional ethics. This part of the syllabus focuses on strategic financial management, preparing candidates to navigate the complexities of financial strategy and execution.

The CMA program emphasizes a practical approach, ensuring candidates can apply their knowledge in real-world scenarios. With a focus on both financial and non-financial industries, the CMA syllabus is designed to be globally relevant, making it a valuable qualification for management accountants worldwide.

Overall, the CMA syllabus provides a well-rounded education in management accounting, incorporating essential skills for professionals aspiring to excel in financial management roles across various industries.

#us cpa demand#demand for cpa in us#cpa demand in USA#CPA scope in us#cpa career in USA#us cpa jobs#us cpa#cpa jobs opportunities in us#career in us cpa#cpa USA#us cpa course#scope of cpa in USA#scope of us cpa#cpa jobs in USA#Career options after CPA in USA#cpa job opportunities in USA#cpa jobs in usa for indian

0 notes

Text

Ready to advance your career? Explore the CPA USA course details, including requirements, exam format, and career benefits. Elevate your expertise in the accounting world! 🌎📚

Join now: https://tinyurl.com/bdfw8auf

Connect with us for more information: 📲+91 9903100338 📧[email protected]

#CPA USA#Global Career#Finance Success#CPA USA Course Online#CPA USA Course#CPA USA Course Details#Finance Career#International Recognition#Professional Growth#India Education#Accounting#Career Growth#CPA#Accounting Career#education#higher education#finance and accounting#e learning#online courses#big4#ipfc

0 notes

Text

What are the Highest-Paying Accounting Jobs in the United States?

Accounting offers a wide range of career opportunities, many of which come with lucrative salaries. Among the highest-paying accounting jobs in the United States, some roles stand out due to their specialized nature and the level of responsibility they entail.

At the top of the list is the Chief Financial Officer (CFO). As a key member of the executive team, the CFO is responsible for managing the company’s financial operations, including strategic planning, financial reporting, and risk management. CFOs typically earn between $150,000 and $300,000 annually, with those at large corporations often making even more.

Another high-paying role is that of a Partner in a public accounting firm. Partners are responsible for overseeing significant client accounts and ensuring the overall profitability of the firm. Compensation for partners can vary widely but often ranges from $200,000 to over $1 million, depending on the size and success of the firm.

For those with a focus on taxation, a Tax Director or Head of Tax is a lucrative position. These professionals are responsible for the strategic tax planning of an organization, ensuring compliance with tax laws while minimizing tax liability. Salaries for tax directors typically range from $120,000 to $250,000 annually.

Financial Controllers, who manage the day-to-day accounting operations and ensure accurate financial reporting, also command high salaries, typically ranging from $100,000 to $200,000. Similarly, Forensic Accountants, who specialize in investigating financial discrepancies and fraud, can earn between $80,000 and $150,000, depending on their experience and the complexity of their cases. (Glassdoor)

These high-paying accounting roles require significant experience, advanced education, and specialized skills. However, they offer substantial financial rewards and opportunities for career growth, making them attractive options for ambitious accounting professionals.

#cpa certification#cpa course details#accounting jobs for indians in usa#cpa course full form#accounting job openings in usa#accounting career in usa for indians#accounting career scope usa

0 notes

Text

youtube

Know & Grow Ep-7: Difficulty Level of US CPA Exam

✨Welcome to our channel! Are you thinking about becoming a CPA? Buckle up! This KNOWN & GROW Episode dives deep into the challenge you'll face with the CPA Exam. We'll explore the reasons behind the 50% pass rate and break down what makes this exam so tough.

#how hard is the cpa exam#is the cpa exam hard#cpa exam difficulty#how difficult cpa exam#cpa exam#certified public accountant#why is cpa hard#is the cpa really that hard#how difficult is the cpa exam#study cpa exam#is the cpa exam really that hard#is cpa a good career#difficulty of cpa exam#cpa usa difficulty level#cpa difficulty#far exam difficulty#audit exam difficulty#the most difficult cpa exam#scope of us cpa#cpa online classes#Youtube

0 notes

Text

Study Accounting in the USA

Studying accounting in the USA offers a robust education that prepares students for a variety of professional paths. With a strong emphasis on practical skills and theoretical knowledge, accounting programs in the USA are designed to meet the needs of the ever-evolving business landscape. If you’re considering this field, now is the time to study accounting in the USA.

What is Accounting?

Accounting is the systematic process of recording, measuring, and communicating financial information. It plays a vital role in decision-making for businesses and individuals alike.

What to Expect When Studying Accounting

Students can expect a challenging yet rewarding curriculum that includes coursework in mathematics, finance, and business ethics. Practical assignments and case studies are common.

CPA in the USA

Becoming a Certified Public Accountant (CPA) is a significant milestone for accounting graduates. It requires passing the CPA exam and meeting state-specific education and experience requirements.

Is Accounting Right for You?

If you enjoy working with numbers, analyzing data, and solving problems, a career in accounting may be a great fit.

Why Study Accounting in the USA?

The USA is home to some of the world’s leading accounting programs, providing students with access to top-tier education and networking opportunities. Choosing to study accounting in the USA can open doors to numerous career paths.

Undergraduate and Advanced Education

Bachelor’s Degrees in Accounting

A Bachelor’s degree in accounting typically covers essential topics such as financial reporting, auditing, tax, and management accounting.

Master’s Degrees in Accounting

For those looking to advance their careers, a Master’s degree (e.g., MAcc or MBA with an accounting focus) can provide deeper insights and specialized knowledge.

Accounting Internships

Internships are crucial for gaining practical experience. Many universities have partnerships with local businesses and firms, making it easier for students to secure internships during their studies.

Careers in Accounting

Graduates can pursue various roles, including:

Certified Public Accountant (CPA)

Financial Analyst

Tax Advisor

Auditor

Management Accountant

Find a Great School for Accounting

When searching for the right school to study accounting in the USA, consider factors such as accreditation, faculty expertise, campus resources, and alumni success. Here are some of the best universities for accounting, along with their programs, application dates, financial aid options, and costs.

Where to Study Accounting

Top Schools in Accounting

University of Texas at Austin

Programs: Bachelor of Business Administration (BBA) in Accounting, Master in Professional Accounting (MPA)

Details: Highly ranked for its accounting program. Offers extensive career services and networking opportunities.

Application Dates: Opening: August 1, Closing: December 1

Financial Aid: Scholarships, grants, loans available.

Cost: Approx. $11,000 (in-state), $40,000 (out-of-state).

University of Illinois Urbana-Champaign

Programs: Bachelor of Science in Accountancy, Master of Accounting Science (MAS)

Details: Known for its rigorous curriculum and strong research focus. Offers a wide range of internships and job placements.

Application Dates: Opening: September 1, Closing: January 5

Financial Aid: Scholarships, financial aid packages.

Cost: Approx. $15,000 (in-state), $34,000 (out-of-state).

University of Southern California

Programs: Bachelor of Science in Accounting, Master of Accounting

Details: Strong emphasis on experiential learning and career readiness. Located in Los Angeles, providing access to major firms.

Application Dates: Opening: August 1, Closing: December 1

Financial Aid: Need-based and merit-based scholarships.

Cost: Approx. $60,000 (both in-state and out-of-state).

New York University

Programs: Bachelor of Science in Accounting, Master of Science in Accounting

Details: Offers a global perspective on accounting practices. Strong connections to the finance industry in New York City.

Application Dates: Opening: September 1, Closing: November 1 (Early Decision)

Financial Aid: Scholarships, federal aid.

Cost: Approx. $56,000 (both in-state and out-of-state).

Indiana University Bloomington

Programs: Bachelor of Science in Accounting, Master of Science in Accounting

Details: Offers a well-rounded program with a focus on practical experience. Strong alumni network and job placement rates.

Application Dates: Opening: September 1, Closing: March 1

Financial Aid: Scholarships, grants, loans available.

Cost: Approx. $11,000 (in-state), $38,000 (out-of-state).

Northeastern University

Programs: Master of Science in Accounting

Details: Focuses on experiential learning through co-op programs. Strong emphasis on integrating technology with accounting practices.

Application Dates: Opening: October 1, Closing: July 1

Financial Aid: Scholarships and assistantships.

Cost: Approx. $50,000.

Boston College

Programs: Master of Science in Accounting

Details: Known for its strong ethical focus in business education. Offers personalized career services and networking opportunities.

Application Dates: Opening: September 1, Closing: May 1

Financial Aid: Scholarships and loans.

Cost: Approx. $55,000.

Best Universities for Bachelor’s Degrees in Accounting

University of Texas at Austin

Programs: Bachelor of Business Administration (BBA) in Accounting, Master in Professional Accounting (MPA)

Application Dates:

Opening: August 1

Closing: December 1

Financial Aid: Scholarships, grants, loans available

Cost: Approx. $11,000 (in-state), $40,000 (out-of-state)

University of Illinois Urbana-Champaign

Programs: Bachelor of Science in Accountancy, Master of Accounting Science (MAS)

Application Dates:

Opening: September 1

Closing: January 5

Financial Aid: Scholarships, financial aid packages

Cost: Approx. $15,000 (in-state), $34,000 (out-of-state)

University of Southern California

Programs: Bachelor of Science in Accounting, Master of Accounting

Application Dates:

Opening: August 1

Closing: December 1

Financial Aid: Need-based and merit-based scholarships

Cost: Approx. $60,000 (both in-state and out-of-state)

New York University

Programs: Bachelor of Science in Accounting, Master of Science in Accounting

Application Dates:

Opening: September 1

Closing: November 1 (Early Decision)

Financial Aid: Scholarships, federal aid

Cost: Approx. $56,000 (both in-state and out-of-state)

Indiana University Bloomington

Programs: Bachelor of Science in Accounting, Master of Science in Accounting

Application Dates:

Opening: September 1

Closing: March 1

Financial Aid: Scholarships, grants, loans available

Cost: Approx. $11,000 (in-state), $38,000 (out-of-state)

Best Universities for Master’s Degrees in Accounting

University of Texas at Austin

Programs: Master in Professional Accounting (MPA)

Application Dates:

Opening: August 1

Closing: April 1

Financial Aid: Scholarships, assistantships

Cost: Approx. $40,000 (for non-residents)

University of Southern California

Programs: Master of Accounting

Application Dates:

Opening: August 1

Closing: December 1

Financial Aid: Scholarships and grants

Cost: Approx. $60,000

University of Illinois Urbana-Champaign

Programs: Master of Accounting Science (MAS)

Application Dates:

Opening: September 1

Closing: January 5

Financial Aid: Scholarships, financial aid packages

Cost: Approx. $34,000

Northeastern University

Programs: Master of Science in Accounting

Application Dates:

Opening: October 1

Closing: July 1

Financial Aid: Scholarships and assistantships

Cost: Approx. $50,000

Boston College

Programs: Master of Science in Accounting

Application Dates:

Opening: September 1

Closing: May 1

Financial Aid: Scholarships and loans

Cost: Approx. $55,000

Program Overview for Accounting Courses in the USA

Most accounting programs include core subjects such as financial accounting, managerial accounting, auditing, and taxation.

Eligibility Criteria for Accounting in the USA

Typically, students need to meet the following criteria:

High school diploma or equivalent

Minimum GPA requirement

Standardized test scores (e.g., SAT, ACT)

Documents Required to Apply for Accounting Courses in the USA

Academic transcripts

Letters of recommendation

Personal statement

Proof of English proficiency (for international students)

Application Process to Study Accounting in the USA

Research and shortlist universities.

Prepare necessary documents.

Submit applications before deadlines.

Attend interviews if required.

Cost of Studying Accounting in the USA

Tuition fees vary widely based on the institution, with public universities generally being more affordable than private ones. Additional costs include textbooks, housing, and living expenses.

Scholarships for Accounting in the USA

Many universities offer scholarships specifically for accounting students. Additionally, external organizations provide financial aid based on merit and need.

Job Security and Careers

Accounting is often regarded as a stable career choice due to the consistent demand for skilled professionals. Graduates can expect job security in various sectors, including public accounting, corporate finance, and government agencies. This makes the decision to study accounting in the USA a wise investment.

Career Scope of Accounting in the USA

The demand for accountants is expected to grow, with opportunities in various industries, including technology, healthcare, and finance. This makes it a great time to study accounting in the USA.

Highlights

Strong job security

Diverse career opportunities

Access to top-tier educational institutions

Frequently Asked Questions

What are the benefits of studying accounting?

Studying accounting provides a solid foundation for a stable career, opportunities for advancement, and the ability to work in various industries.

What scholarships are available for accounting students?

Many schools offer scholarships based on academic performance, financial need, or specific criteria related to accounting.

What are the career opportunities for accounting graduates?

Graduates can work in public accounting, corporate finance, government agencies, and non-profit organizations, among others.

By choosing to study accounting in the USA, you’re investing in a future filled with opportunities and growth. Whether you pursue a bachelor’s or master’s degree, the skills and knowledge gained will pave the way for a successful career in this essential field. Take the first step today and study accounting in the USA!

0 notes

Text

CMA USA Course: A Comprehensive Guide to Eligibility, Syllabus, Fees, and Career Opportunities in 2025

The Certified Management Accountant (CMA) USA certification has gained immense popularity for its global recognition and valuable opportunities in finance and management roles.

If you're preparing for the CMA USA course in 2025, this detailed guide will walk you through every aspect— from eligibility requirements to exam structure and career opportunities. By the end of this blog, you'll have a clear roadmap to navigate through your CMA USA journey.

1. What is CMA USA?

CMA USA is a globally recognized credential awarded by the Institute of Management Accountants (IMA). This certification focuses on two critical areas:

Financial Management

Strategic Management

It sets professionals apart in the accounting and finance sectors by validating expertise in financial planning, analysis, control, decision support, and professional ethics.

Why is CMA USA Important in 2025?

In 2025, the demand for certified financial professionals with advanced skills in strategic decision-making will continue to grow. CMAs often earn more than their non-certified counterparts, and they are sought after by leading organizations worldwide.

2. Eligibility Criteria for CMA USA 2025

Before diving into the CMA USA syllabus and exam structure, let’s first understand the eligibility criteria for 2025:

Education:

Bachelor’s degree from an accredited institution.

Alternatively, professional certifications like CA, CPA, or ICWA can also qualify you.

Work Experience:

2 years of relevant professional experience in management accounting or financial management. This requirement can be completed before or after passing the exams.

Membership:

You need to be a member of the Institute of Management Accountants (IMA) to enroll in the CMA USA course.

3. CMA USA Exam Structure 2025

The CMA USA exam is divided into two parts, each with a distinct focus:

Part 1: Financial Planning, Performance, and Analytics

External Financial Reporting Decisions

Planning, Budgeting, and Forecasting

Performance Management

Cost Management

Internal Controls

Technology and Analytics

Part 2: Strategic Financial Management

Financial Statement Analysis

Corporate Finance

Decision Analysis

Risk Management

Investment Decisions

Professional Ethics

Each part includes 100 multiple-choice questions (MCQs) and 2 essay-type questions. Candidates are allotted 4 hours to complete each part of the exam.

4. CMA USA Syllabus 2025 – What’s New?

The CMA USA syllabus is constantly evolving to stay relevant to the dynamic business world. In 2025, expect more emphasis on:

Data Analytics: Focus on how financial managers use big data and analytics to make decisions.

Sustainability Reporting: Due to increasing awareness of ESG (Environmental, Social, Governance) factors, professionals are required to understand the basics of sustainability reporting.

Digital Transformation: A significant part of the 2025 syllabus will cover digital technologies that impact financial processes and decision-making.

For an in-depth understanding of each section, candidates are recommended to use official IMA textbooks or resources from established coaching centers like iProledge Academy.

5. CMA USA Course Fees in 2025

The fees for the CMA USA course in 2025 are structured as follows:

IMA Membership: $250 annually

Entrance Fee: $280

Exam Fees (for both parts): $460 per part

Many CMA coaching institutes, including iProledge Academy, offer special packages that include exam preparation, mock tests, and assistance with registration. Always check for any discounts or scholarships that may be available for 2025.

6. Study Plan for CMA USA 2025

To pass the CMA USA exam in 2025, you need a solid study plan. Here’s a month-by-month guide to ensure you're well-prepared:

January to March:

Focus on understanding the basics of financial planning and analysis.

Regularly solve MCQs and past papers for Part 1.

April to June:

Start with essay-type questions for Part 1.

Review weak areas using resources from iProledge Academy.

July to September:

Move to Part 2 and focus on strategic financial management topics like risk management and investment decisions.

Take mock tests to simulate exam conditions.

October to December:

Intensive revision. Focus on time management during the exam.

Attending revision webinars and last-minute tips from coaching centers.

7. Career Opportunities After CMA USA in 2025

The CMA USA certification opens doors to lucrative careers across multiple industries. In 2025, CMAs will be in high demand for roles such as:

Financial Analyst

Risk Manager

Corporate Controller

Finance Director

Chief Financial Officer (CFO)

Countries like the USA, Canada, UK, and India offer some of the highest-paying jobs for CMA USA professionals. Employers value the strategic skills that CMAs bring, especially when it comes to financial decision-making and ethical management.

8. Top Institutes for CMA USA Coaching

Choosing the right coaching institute can make all the difference in your CMA USA journey. Here’s what you should look for:

Experienced Faculty: Instructors who are themselves certified CMAs.

Comprehensive Study Material: Ensure that the study material is up-to-date and covers the latest syllabus.

Mock Exams and Revision Sessions: The more practice, the better prepared you'll be.

Support: Institutes like iProledge Academy provide extensive student support, including doubt-clearing sessions, mentorship, and career counseling.

9. FAQs

Q1: Is CMA USA worth pursuing in 2025?

Absolutely! With its global recognition and demand in the financial and managerial sectors, CMA USA offers numerous career opportunities.

Q2: How long does it take to complete the CMA USA course?

On average, it takes about 6-12 months to complete both parts of the exam, depending on your study plan.

Q3: What’s the passing rate for CMA USA in 2025?

The global pass rate for the CMA USA exam is approximately 45-50%, making it a challenging but achievable certification with the right preparation.

0 notes

Video

youtube

🔴What is Passing rate of EA Exam | Preparation Tips | Best Enrolled Agent Coaching |EA Online Classes 🎓 Welcome to our channel!

🎓In today’s video, we’re diving into everything you need to know about becoming an Enrolled Agent (EA). We’ll cover the passing rates of the EA exam and share top tips to help you prepare effectively. Whether you're just starting your journey or looking for that extra edge to succeed, this video is packed with valuable insights.

🔹Learn more: https://fintram.com/enrolled-agent/

🔴Empower Your Career with FinTram Global Fintram Global is a leading learning platform, transforming professionals around the world and enabling them to learn anytime and anywhere. We are the house of Global Professional Educators and our Finance domain expertise stands apart. We are the Global learning provider for CFP, US CPA, US CMA, ACCA, IFRS, and various CPE Courses. We are also an Authorised Education Provider for FPSB India, an Approved Channel Partner for Becker Professional Education – USA, and the Gold – Approved Learning Partner with ACCA UK.

🔗Stay Connected with us:

LinkedIn - https://www.linkedin.com/company/fintram-global-offical/

Facebook - https://www.facebook.com/fintramglobal/

Instagram - https://www.instagram.com/fintramglobal/

If you have any questions or comments, feel free to leave them below. Your feedback is valuable to us!

🔴HashTags

#EnrolledAgent, #whatisanenrolledagent, #TaxProfessional, #IRS, #TaxExpert, #TaxConsultant, #TaxCareer, #TaxEducation, #TaxPlanning, #EA, #enrolledagentexam, #eapassingratesShow less

0 notes

Text

What Are The Advantages Of CMA USA Over CA?

What Are The Advantages Of CMA USA Over CA?

Leave a Comment / Courses / By admin

After finishing your tenth and twelfth grades, it can be difficult to establish your interests and future professional path. If you have an aptitude for numbers and want to pursue a career in accounting, consider CA, US CMA, CPA, or CIMA. A CA or CPA degree is a preferable option for those who want to study accounting exclusively. However, if you are more interested in the management side of accounting, courses such as US CMA and CIMA are worth considering. If you’re unsure about the difference between accounting and management accounting, which makes it tough to pick between US CMA and CA, this guide can assist clarify your worries by differentiating between US CMA and CA and showing the benefits of choosing CMA USA / US CMA over CA

Before beginning with the advantages of CMA USA over CA let us first see what is CMA USA and CA.

What is CMA USA ?

CMA USA or commonly called US CMA. The Certified Management Accountant (CMA) credential is a professional certification in the fields of management accounting and financial management. It indicates that the holder has expertise in financial planning, analysis, control, decision support, and professional ethics and controlled by the board Institute of Management Accountants (IMA)

What is CA ?

Chartered Accountants (CA) are professional accountants qualified to perform various specialised tasks within the accounting field. Their typical responsibilities include auditing financial statements, filing corporate tax returns, and offering financial advice and controlled by the board ICAI – The Institute of Chartered Accountants of India

Now let us know more about CMA USA and CA Differences CMA USA CABoard IMA (Institute of Management Accountants)ICAI – The Institute of Chartered Accountants of IndiaCourse Duration 6-9 Months 5 Years Eligibility CriteriaThe applicant should have either a Passing mark sheet for class 12th.A National Diploma in Commerce or a diploma in Rural Service Examination from a recognized board. The applicant should have successfully completed their 10th and 12th examination to appear for the entry-level CA foundation course with a 50% aggregate score in 12th. Scope Financial Risk Manager Internal Auditor Cost Accountant CFOTaxation Advisory Internal Auditing Forensic Auditing Statutory Audit Actuary ProfessionalSalary INR 5 to 20 LPAINR 6 to 10 LPA

After knowing the difference between CMA USA and CA let us now know the advantages of CMA USA over CA

Advantages of CMA USA over CA

Short course with good exposure This short professional course can be completed in 6 to 9 months, depending on your learning pace and career goals. The US CMA program provides industry-relevant knowledge and strategic management skills, fostering both professional and personal growth. Upon successful completion, you could have the opportunity to work with multinational companies like Accenture, Big 4 audit firms, and US-based banks.

Globally accepted Unlike CA, the US CMA is a globally approved certification in North America, the Middle East, Europe, Australia, and some Asian nations. If you want to advance your career overseas, you should acquire a qualification that is recognised in your preferred country. One key factor for the recent surge in US CMA applications is the potential to work abroad.

Can be pursued after 12th You can enrol in this course right after completing your 12th standard and pursue it alongside your graduation degree. The US CMA course combines accounting and finance knowledge with a deep understanding of management strategies. Other globally recognized courses you can pursue after 12th grade include ACCA, CA, and the FRM course.

Be on the management side of business A Chartered Accountancy degree will largely focus your abilities and experience on accounting-related activities such as budgeting and taxation. With a management accounting degree, you’ll be able to make strategic decisions based on financial information.

Huge Demand in Indian Market as well If you’re contemplating CA because of its popularity in the Indian market, you might be shocked to find that the US CMA is also in high demand. Following the epidemic, many Indian businesses have begun to build financial teams led by skilled Certified Management Accountants who can strategically manage cash flows. The increasing demand for insurance policies and goods expands potential for US CMAs in India.

These are the few pointers that explain the advantage of choosing CMA USA over CA. Keeping the exposure, growth , duration , salary , job opportunities and few other essential factors in consideration CMA USA has more exponential growth over CA.

Conclusion :

Choosing between CMA USA and CA depends on your career goals and interests. If you are looking for a globally recognized certification with a shorter duration and a focus on strategic management, CMA USA is an excellent choice. It offers diverse job opportunities, high demand in both international and Indian markets, and the flexibility to pursue it alongside your graduation. In contrast, CA is a more traditional route with a focus on accounting and auditing, primarily within the Indian context. Both certifications have their unique benefits, but CMA USA stands out for those seeking a rapid and international career trajectory.

FAQs on advantages of CMA USA over CA

What is the primary difference between CMA USA and CA?

CMA USA focuses on management accounting and strategic decision-making, while CA emphasises auditing, taxation, and financial reporting.

Can I pursue CMA USA right after completing my 12th grade?

Yes, you can enrol in the CMA USA course after completing your 12th grade and pursue it alongside your graduation.

How long does it take to complete the CMA USA course?

The CMA USA course can be completed in 6 to 9 months, depending on your learning pace and career goals.

Is the CMA USA certification recognized globally?

Yes, the CMA USA certification is globally recognized in North America, the Middle East, Europe, Australia, and several Asian countries.

What are the job prospects for CMA USA in India?

CMA USA holders are in high demand in India, especially after the pandemic, as many Indian firms are building financial teams led by Certified Management Accountants to manage cash flows strategically.

0 notes

Text

youtube

Picture getting a global accounting certificate that lets you land top jobs in just 6-8 months by passing only two exams. Now, it’s possible with a US CMA certification which is recognised across 170+ countries. Learn core accounting skills such as financial reporting, corporate finance, budgeting, forecasting, cost management, and more.

𝗧𝗵𝗲 𝗪𝗼𝗿𝗹𝗱 𝗼𝗳 𝗖𝗠𝗔 Certified Management Accountant (CMA) is the globally recognised highest credential in management accounting administered by the Institute for Management Accountants (IMA), USA. The US CMA Course is recognised across 170+ countries. It is the most sought-after accounting and finance certification by companies and recruiters worldwide. The CMA course is an advanced-level credential appropriate for accountants and financial professionals. The US CMA certification covers accounting, business, finance and analytics. It helps to master 12 core skills that are extensively required to lead the world of accounting and finance.

𝐋𝐞𝐚𝐝 𝐓𝐡𝐞 𝐖𝐨𝐫𝐥𝐝 𝐎𝐟 𝐀𝐜𝐜𝐨𝐮𝐧𝐭𝐢𝐧𝐠 𝐀𝐧𝐝 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐖𝐢𝐭𝐡 𝐈𝐦𝐚𝐫𝐭𝐢𝐜𝐮𝐬 ✅ ᴍᴏɴᴇʏ ʙᴀᴄᴋ ɢᴜᴀʀᴀɴᴛᴇᴇ We have complete faith in your abilities and the exceptional education we offer. We want to assure you that with our Money Back Guarantee if you are unable to pass all your CMA exams,we will refund you 50% of the course fee. Your success is our highest priority.

✅ ᴛᴏᴘ ᴘʟᴀᴄᴇᴍᴇɴᴛꜱ After becoming a CMA, learners can work with Fortune 500 companies and pursue global management and accounting careers. The students will also be prepared to work with the top brands in financial industry, accounting, consulting, and MNCs across multiple business domains. ✅ ɢᴜᴀʀᴀɴᴛᴇᴇᴅ ɪɴᴛᴇʀᴠɪᴇᴡꜱ Our CMA program includes a comprehensive pre-placement boot camp, resume-building services, and interview preparation sessions. We provide soft skills training, placement assistance, and guaranteed interviews with top companies. ✅ ᴜɴʟɪᴍɪᴛᴇᴅ ᴀᴄᴄᴇꜱꜱ ᴛᴏ ꜱᴛᴜᴅʏ ᴍᴀᴛᴇʀɪᴀʟꜱ All students will have limitless access to CMA course books, a question bank, practice papers, MCQs, flashcards, learning videos, live classes, and revision tools. The study content is powered by Surgent which has a passing rate of 95% in CMA Exams ✅ ᴇxᴘᴇʀᴛ ᴍᴇɴᴛᴏʀɪɴɢ Experienced Imarticus faculty with CMA, CA, CFA, and CPA qualifications provide personalised mentoring sessions to all learners. Exam-specific doubt-clearing sessions are also available to ensure that concepts are crystal clear and students pass the exams on the first attempt. ✅ ʙᴀꜱɪᴄꜱ ᴛᴏ ᴘʀᴀᴄᴛɪᴄᴀʟꜱ CMA study at Imarticus begins with the fundamentals of accounting and then moves on to core CMA Curriculum. Besides this, students get additional learning on practical tools such as MS Excel, Advanced Excel, Financial Modelling, etc which not only prepares the

0 notes

Text

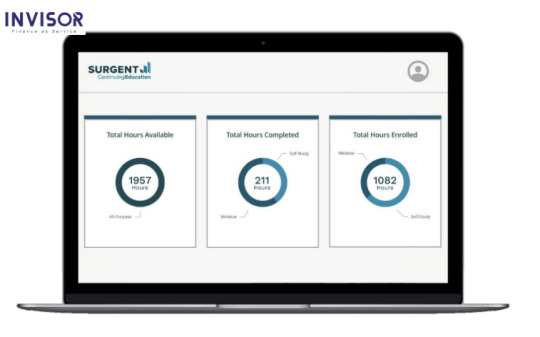

CPA Course

When choosing a CPA course, consider factors such as cost, reputation, pass rates, and the learning format that best suits your needs. It's essential to choose a course that will adequately prepare you for the exam and set you up for success in your accounting career. For more details visit https://www.invisor.in/cpa-usa

0 notes

Text

Tips for Future CPAs to Achieve Success

Get ready for a successful CPA career with Miles Education! Varun Jain, the world's favorite CPA/CMA instructor, shares essential tips to navigate the job market. Learn from the best to make your CPA exam journey achievable.

To know more, visit: https://bit.ly/48TdyoO

0 notes

Text

Boost your accounting career with the globally recognized CPA USA course. Gain expertise, increase earning potential, and unlock international opportunities in finance with our comprehensive CPA program.

Join now: https://tinyurl.com/bdfw8auf

Connect with us for more information: 📲+91 9903100338 📧[email protected]

#CPA USA#CPA USA Course#CPA USA Course Online#Finance Success#Global Career#International Recognition#Finance Career#Professional Growth#India Education#Career Growth#CPA#education#e learning#finance and accounting#higher education#online courses#accounting career#big4#ipfc

0 notes

Text

What is Driving the Increasing Demand for Accountants in the USA?

The demand for accountants in the USA has been growing steadily, driven by several key factors that underscore the importance of the profession in today’s economy. One of the primary drivers is the overall growth of the economy, which has led to an expansion of businesses across various sectors. As companies grow, their financial operations become more complex, necessitating the expertise of accountants to manage financial records, perform audits, and ensure compliance with ever-changing tax laws and regulations.

Another significant factor contributing to the rising demand for accountants is the increasing complexity of financial regulations. Over the past decade, there have been numerous changes in tax laws and accounting standards, particularly following major financial crises. These changes require businesses to stay compliant, which in turn boosts the need for skilled accountants who can interpret and apply these regulations effectively. Accountants are crucial in helping organizations navigate these complexities and avoid costly penalties.

Technology is also playing a pivotal role in reshaping the accounting profession. The integration of data analytics, artificial intelligence, and other advanced technologies has expanded the scope of accounting beyond traditional bookkeeping. Accountants are now expected to provide strategic insights and data-driven recommendations that can influence business decisions. This shift has created a demand for accountants who are not only proficient in traditional accounting practices but also in leveraging technology to enhance financial analysis and reporting.

Furthermore, globalization has increased the demand for accountants who understand international financial regulations and can manage the complexities of cross-border transactions

for accountants, especially those with expertise in international finance, foreign exchange, and global tax laws. Companies operating in multiple countries need professionals who can ensure compliance with diverse regulations and optimize global financial strategies.

Additionally, the rise of new business models, such as e-commerce and digital services, has further complicated financial reporting and tax compliance. Accountants are essential in helping these businesses navigate the unique challenges associated with digital transactions and international sales.

As the demand for accountants in the USA continues to grow, so does the need for specialized skills. Accountants with expertise in areas like forensic accounting, environmental accounting, and cybersecurity are particularly in demand. These specialties address specific industry needs, such as investigating financial fraud, managing environmental costs, and protecting against cyber threats.

In conclusion, the increasing demand for accountants in the USA is driven by economic growth, regulatory changes, technological advancements, and globalization. As businesses become more complex and interconnected, the need for skilled accountants who can provide accurate financial information and strategic insights will continue to rise. This trend ensures a stable and lucrative career path for those entering the accounting profession.

#accounting jobs for indians in usa#cpa course details#accounting job openings in usa#accounting career in usa for indians#accounting career scope usa

0 notes

Text

youtube

🔴Known & Grown Ep - 6: US CPA Salary in India & Abroad

✨Welcome to our channel! Are you thinking about getting your US CPA license and working in India and abroad? Today's video dives deep into what you can expect to earn. We'll cover: Average US CPA salary in India (freshers & experienced) How your salary can vary based on location, industry, and company size

Apply Now - https://fintram.com/us-cpa-course/

#cpa career and salary#real accounting salaries#us cpa salaries#cpa india salaries#cpa salaries#cpa usa jobs and salaries#us cpa jobs and salaries#us cpa jobs in india#us cpa jobs#us cpa course details#cpa usa jobs#cpa usa jobs in india#us cpa salary in india#cpa usa salary in india#how much cpa usa earns#cpa usa scope#cpa usa course details#cpa exam#cpa#should i become a cpa#is a cpa worth it#Youtube

0 notes

Text

youtube

Welcome to our exclusive interview with Dr Naela Jamal Rushdi as we delve into the world of financial planning and discuss the pathway to achieving the prestigious Certified Financial Planner (CFP) Certification! 📊✨ In this enlightening conversation, Dr. Naela Jamal Rushdi, a seasoned financial expert and CFP professional, shares invaluable insights into the significance of obtaining the CFP Certification and its transformative impact on your career in the financial industry. Thank you for watching this video! If there are any video suggestions that you would like us to make, please drop them in the comments. LIKE, SHARE, and SUBSCRIBE! 🔴About FinTram Global: FinTram Global is a leading learning platform, transforming professionals worldwide and enabling them to learn anytime and anywhere. We are the house of Global Professional Educators and our Finance domain expertise stands apart. We are the Global learning provider for ACCA, IFRS, US CPA, CFP, EA , US CMA and various CPE Courses. We have also an Authorised Education Provider for FPSB India, an Approved Channel Partner for Becker Professional Education – USA and the Gold - Approved Learning Partner with ACCA UK.

0 notes

Text

Mastering Financial Management: Your Guide to CMA, IFRS, and CPA Certification in Dubai

Are you ready to elevate your career in finance to new heights? Whether you’re aiming for management positions, seeking to specialize in international financial reporting standards, or aiming to become a Certified Public Accountant (CPA), or Certified Management Accountant (CMA) Dubai offers exceptional opportunities for professionals like you. With the right guidance and training, you can unlock doors to success in the dynamic world of finance.

At Emerge Management Training Center, we understand the importance of staying ahead in today’s competitive landscape. That’s why we offer comprehensive courses tailored to meet the demands of aspiring finance professionals in Dubai. From Certified Management Accountant (CMA) to International Financial Reporting Standards (IFRS) and Certified Public Accountant (CPA) certification, we provide the best-in-class training to help you excel in your career.

Mastering Financial Management with CMA Courses:

Our CMA USA course in Dubai is designed to equip you with the knowledge and skills required to excel in management accounting roles. Led by experienced instructors, our CMA classes in Dubai cover essential topics such as financial planning, analysis, control, decision support, and professional ethics. With IMA’s comprehensive curriculum and hands-on approach, you’ll gain the confidence to tackle real-world challenges and drive business success.

Becoming an Expert in IFRS with Our Training in Dubai:

In today’s global economy, proficiency in International Financial Reporting Standards (IFRS) is essential for finance professionals. Our IFRS training in Dubai provides you with a deep understanding of international accounting principles, enabling you to navigate complex financial reporting requirements with ease. Whether you’re looking to enhance your career prospects or expand your knowledge base, our expert-led courses ensure you stay ahead of the curve in the ever-evolving field of accounting and finance.

Achieve CPA Certification with the Best Exam Prep Classes in Dubai:

Aspiring to become a Certified Public Accountant (CPA)? Our CPA Exam prep classes in Dubai UAE are designed to help you succeed. With a focus on exam readiness and comprehensive coverage of CPA exam topics, our courses prepare you to ace the CPA exam with confidence. From financial accounting and reporting to auditing and taxation, we provide the guidance and support you need to achieve your goals and advance your career in accounting.

Why Choose Emerge Professional Development?

Experienced Instructors: Learn from industry experts with extensive experience in finance and accounting.

Comprehensive Curriculum: Our courses cover all aspects of CMA, IFRS, and CPA certification, ensuring you’re well-prepared for success.

Flexible Learning Options: Choose from in-person classes, online sessions, or a blend of both to suit your schedule and preferences.

Career Support: Gain access to career guidance, networking opportunities, and job placement assistance to take your career to new heights.

Don’t let opportunities pass you by. Invest in your future with professional development courses from Emerge. Visit our website today to learn more about our CMA Dubai, IFRS, and CPA certification programs in Dubai. Unlock your potential and take the next step towards a successful career in finance.

Contact us:

+971 4352 1133 | +971 504577375

www.emerge.pro

#CMA#CMA Classes#CMA Dubai#CMA USA#CPA#CPA Classes#CPA Dubai#CPA USA#Emerge#Emerge Management Training Center#EMTC#IFRS#IFRS Certificate

0 notes