#cp2000

Explore tagged Tumblr posts

Text

#BD Traders Mart#Delta VFD#industrial automation#industrial engineering#industrial equipment#MS300#ME300#C2000#CP2000#Inverter

0 notes

Text

Travel Nurses, Lexington Tax Group Has Your Back! 🏥💼

Hey there, incredible travel nurses!

We know you're out there saving lives, traveling from hospital to hospital, and pouring your heart into your work. It's inspiring, to say the least! But with all that movement and chaos, dealing with your 1099 taxes can be a real headache. That's where we come in. 🎉

At Lexington Tax Group, We Speak Your Language:

Navigating 1099 Taxes: Confused by all those forms? So were we, once! But now, we're pros at it.

Stress-Free Tax Planning & Filing: Taxes don't have to be a nightmare. Let us handle the scary stuff.

Flexible Appointments: You're busy saving lives; we get that. We'll work with your schedule.

Free Initial Consultation: We're so confident you'll love us; the first chat is on us!

A Partnership You Can Count On:

We understand the life of a travel nurse isn't 9 to 5, Monday to Friday. It's late nights, early mornings, and everything in between. Our expert team at Lexington Tax Group is committed to being your financial partner on this incredible journey of healing.

We believe in what you do, and we want to make your life a little easier. We'll maximize your deductions, negotiate with the IRS if you need us to, and be there with friendly, professional support tailored just for you.

Ready to Get Started?

Tax season doesn't have to be taxing (see what we did there?). Click the link below to schedule your free consultation, or just give us a call. We can't wait to meet you and help you on your way to a worry-free financial future!

www.LexingtonTaxGroup.com

0 notes

Text

Diamond Tel 99X, 1990 Diamond Tel M90X, 1988 Nokia EX1100C, 1990 Oki 750, 1990 Radio Shack CT-300, 1988 Panasonic EB392, 1988 Panasonic TP500, 1990 Mobira, 1988 Uniden CP2000, 1988 Motorola 4500X, 1986 Nokia Talkman, 1984 Mitsubish Mesa, 1990 Motorola 220, 1990

#Cell phone#cell phones#1990s#1990#1980s#1988#vintage#technology!#Diamond Tel 99X#Diamond Tel M90X#Nokia EX1100C#Oki 750#Radio Shack CT300#Panasonic EB392#Panasonic TP500#Mobira#Uniden CP2000#Motorola 4500X#Nokia Talkman#Mitsubishi Mesa#Motorola 220#Hide and Queue

26 notes

·

View notes

Text

Used Sheet Fed / Offset Machine for SALE

Heidelberg - Speedmaster SM 52-5

Buy Directly from SELLER -

Number of color: 5

Max sheet size: 37x52 cm / 14.57X20.47 inch

Manufacturer: Heidelberg

Year: 2003

Machine Availability: Immediately

Price: On Request

Location: UK

#print #offsetprinting #machinedalal

0 notes

Text

داریو دلتا

اینورترها بهعنوان یکی از ابزارهای حیاتی در سیستمهای اتوماسیون صنعتی و کنترل موتور، نقش مهمی در بهینهسازی مصرف انرژی و بهبود عملکرد ماشینآلات صنعتی ایفا میکنند. در این میان، اینورتر دلتا به دلیل ویژگیهای فنی برجسته و قابلیتهای کاربردی متنوع، مورد توجه بسیاری از صنایع قرار گرفته است. بارزکنترل بهعنوان یکی از معتبرترین عرضهکنندگان اینورتر دلتا در ایران، مجموعهای کامل از محصولات این شرکت را به مشتریان خود ارائه میدهد.

اینورتر دلتا: راهکاری پیشرفته برای صنایع مختلف

اینورتر دلتا با ویژگیهای پیشرفتهای که ارائه میدهد، یک گزینه مناسب برای کنترل سرعت و عملکرد موتورهای AC در بسیاری از صنایع محسوب میشود. مهمترین مزایای استفاده از اینورتر دلتا عبارتند از:

صرفهجویی در مصرف انرژی: اینورتر دلتا با کنترل دقیق فرکانس و ولتاژ، امکان تنظیم بهینه مصرف انرژی را فراهم میکند و باعث کاهش هزینههای انرژی در طولانی مدت میشود.

کنترل دقیق سرعت و گشتاور: یکی از مزایای کلیدی اینورتر دلتا، کنترل دقیق سرعت و گشتاور موتور است که بهبود عملکرد ماشینآلات را تضمین میکند. این قابلیت بهویژه در صنایعی که نیاز به دقت بالا در عملکرد موتور دارند، بسیار کاربردی است.

افزایش طول عمر موتور: با استفاده از اینورتر دلتا، میتوان از شروعهای نرم و کاهش استرسهای مکانیکی بر روی موتور بهرهبرد، که در نتیجه به افزایش طول عمر موتور کمک میکند.

پشتیبانی از پروتکلهای ارتباطی مدرن: اینورترهای دلتا با پشتیبانی از پروتکلهای ارتباطی مختلف از جمله Modbus و CANopen، به راحتی با سیستمهای اتوماسیون صنعتی مختلف ادغام میشوند و امکان کنترل و مانیتورینگ از راه دور را فراهم میکنند.

اینورترهای دلتا در بارزکنترل

بارزکنترل به عنوان یکی از پیشگامان عرضه تجهیزات اتوماسیون صنعتی در ایران، طیف گستردهای از اینورترهای دلتا را با بهترین قیمت و خدمات پس از فروش به مشتریان خود عرضه میکند. اینورترهای ارائه شده توسط بارزکنترل شامل مدلهای مختلفی هستند که برای انواع کاربردها مناسباند:

سری VFD-L: این سری از اینورترها برای کاربردهای عمومی و ساده طراحی شدهاند. مناسب برای ماشینآلات کوچک و سیستمهای تهویه مطبوع.

سری VFD-E: این سری با ویژگیهای پیشرفتهتر مانند ورودیها و خروجیهای متنوع و قابلیتهای ارتباطی قوی، برای پروژههای بزرگتر و پیچیدهتر مناسب است.

سری VFD-CP2000: یکی از پیشرفتهترین مدلهای اینورتر دلتا که برای کاربردهای صنعتی بزرگ، همچون سیستمهای پمپاژ، تهویه و ماشینآلات سنگین طراحی شده است.

چرا بارزکنترل؟

خرید از یک تامینکننده معتبر مانند بارزکنترل به شما این اطمینان را میدهد که محصولاتی با کیفیت و اصلی دریافت میکنید. بارزکنترل با سالها تجربه در زمینه فروش و خدمات پس از فروش تجهیزات اتوماسیون صنعتی، یکی از گزینههای برتر در این حوزه است. مزایای خرید از بارزکنترل شامل موارد زیر است:

مشاوره تخصصی: تیم مجرب بارزکنترل به شما کمک میکند تا اینورتر مناسب با نیازهای خاص صنعتی خود را انتخاب کنید. این مشاوره رایگان به شما امکان میدهد تا بهینهترین راهکار را برای کنترل موتورهای خود انتخاب کنید.

گارانتی معتبر: تمامی محصولات ارائه شده توسط بارزکنترل دارای گارانتی معتبر و خدمات پس از فروش میباشند که باعث آرامش خاطر شما از کیفیت و دوام محصولات میشود.

قیمت رقابتی: بارزکنترل با همکاری مستقیم با تولیدکنندگان برتر مانند دلتا، محصولات را با قیمتهای رقابتی و مقرون به صرفه ارائه میدهد.

تحویل سریع: یکی از ویژگیهای بارزکنترل، تحویل سریع محصولات به مشتریان است. این امر بهویژه در صنایع پرشتاب که نیاز به تعویض یا نصب سریع تجهیزات دارند، اهمیت ویژهای دارد.

0 notes

Text

اینورتر دلتا چیست؟ خرید از بارز کنترل

💡خرید اینورتر دلتا از فروشگاه بارز کنترل، انتخابی عالی برای کنترل سرعت موتورهای صنعتی و بهینهسازی مصرف انرژی! ⚙️ با مدلهایی مثل VFD-M، C2000 و CP2000، عملکرد دقیق و کنترل بهینهتری رو تجربه کنید. مناسب برای صنایع مختلف و کاربردهای گوناگون. 🌱

0 notes

Text

IRS expands chatbots to underreporters

Taxpayers who receive CP2000 notices can now get help from bots for basic questions, rather than having to wait for a rep.

0 notes

Text

EMC-R6AA - Thẻ mở rộng Delta đầu ra 6 relay, tương tích với các dòng sản phẩm C2000, CP2000. Xem ngay: https://hoplongtech.com/products/emc-r6aa

0 notes

Text

0 notes

Text

0 notes

Text

Biến tần VFD450CP43A-00 Delta

Biến tần VFD450CP43A-00 Delta thuộc dòng CP2000, nguồn cung cấp 3 pha 400V, công suất 45kW, dòng điện định mức đầu ra 91A/73A, truyền thông MODBUS và BACnet tốc độ cao, dùng cho bơm, quạt, máy đùn nhựa, máy thổi khí,...

#bientan #delta #hoplongtech

Thông tin chi tiết xem thêm tại: https://hoplongtech.com/products/vfd450cp43a-00

0 notes

Link

VFD150CP4EB-21 Delta - 460V/3Pha - 20/15hp - 35/26A

Biến tần VFD150CP4EB-21 Delta là dòng VFD-CP2000, công suất của động cơ 20/15hp, công suất ra định mức 25/19kVA, dòng vào định mức 35/26A, dòng ra định mức 32/24A, khả năng quá tải 120% trong vòng 1 phút trong mỗi 5 phút, .... Hãy cùng đọc thêm những thông tin chi tiết của sản phẩm này dưới bài viết sau đây

0 notes

Photo

Received A CP2000 Notice From the IRS? What It Means & How To Respond

What is a CP2000 Notice from the IRS? One of the best things you can do during tax season is to keep good records of all your sources of income. Why? You never know when the IRS might find an error.

The IRS sends out CP2000 Notices every year that identify discrepancies in reported income. Often this is because someone forgets to report a stream of income that the IRS wants to assess. With more and more people earning income outside of a traditional W-2 job, there’s a chance you could forget to report income and get a CP2000 Notice as a result. This article will walk you through what a CP2000 Notice is, how to respond, and some best practices you can follow to avoid getting one in the first place. A CP2000 Notice is a computer-generated letter notifying you there is a discrepancy between the income you reported and the information the IRS has on file for you. Self-employed individuals -– including gig workers -– who accidentally forget to report income might receive a CP2000 Notice. Keeping detailed records of your income can make it easier to respond to a CP2000 Notice if you get one NEED HELP WITH AN OFFER IN COMPROMISE, TAX DEBT HELP, TAX PREPARATION, AUDIT REPRESENTATION OR STOP WAGE GARNISHMENTS ADVANCE TAX RELIEF LLC Call (713)300-3965 www.advancetaxrelief.com BBB A+ RATED

What Is a CP2000 Notice From the IRS? A CP2000 Notice is a letter indicating a discrepancy between the information in the tax return the IRS has on file for you and the information provided by an employer or other entity you might have earned income from. You might receive a CP2000 Notice if you forget to report a source of income, an employer incorrectly reports your wages, or it could be a simple administrative error on the IRS’s end.

Sometimes individuals accidentally forget to report income. Gig workers, for example, aren’t classified as W-2 employees. As a result, taxes aren’t withheld from their gross pay. According to the IRS, gig workers, freelancers, and other self-employed individuals are responsible for paying these taxes.

Self-employed individuals must pay an additional 15.3% (this is often called the self-employment tax) which goes to Social Security and Medicare. When you work a traditional W-2 job, your employer typically pays this tax on your behalf. However, when you work for yourself, you’re on the hook to cover this tax.

The notice doesn’t necessarily mean you or your employer did anything wrong; it just means the IRS is trying to figure out why the information it has doesn’t match the information you reported on your taxes.

How Many People Get a CP2000 Notice? A CP2000 Notice is fairly common. Millions of individuals receive CP2000 Notices every year. While it's one of the most common notices sent out by the IRS, it's usually issued for minor issues like underreported income or a computer error.

Will a CP2000 Notice Stop My Refund? It could, but it likely won’t. A CP2000 Notice flags discrepancies after your taxes have already been filed. It can take a while for the IRS’s systems to notice the mismatch and issue you a notice.

There’s a good chance that getting a CP2000 Notice won’t halt your refund. Instead, you might be asked to pay back the IRS whatever it decides you owe.

Will a CP2000 Notice Trigger an Audit? A CP2000 could trigger an audit, but it probably won’t. Instead, once you receive your letter, you’ll be asked to agree or disagree with the IRS. You might be slightly more likely to experience an audit though if the CP2000 Notice was generated due to underreported self-employment income.

A CP2000 Notice might make the IRS curious about how a tax filer prepared their overall tax return. If someone forgets to report their income, the IRS might examine whether they were also too aggressive in their deductions. This could prompt the IRS to dive deeper, resulting in an audit. If you're self-employed or earn income from a small business, it's always a good idea to document your earnings and expenses. This way, if you receive a CP2000 Notice and the IRS initiates an audit, you have adequate documentation to support your reported income. How Do I Respond to a CP2000 Notice? As shown in the steps below, responding to a CP2000 Notice is pretty straightforward. The one thing to keep in mind is that you should do so promptly. Not responding in the timeframe provided by the IRS could result in being assessed a penalty or extra fees.

Step #1: Read the Notice and Review Your Data Before you respond to the notice, read it in full and review your data. A CP2000 Notice is issued by a computer system that is far from perfect. While you might have accidentally underreported your income, there’s also a chance the IRS’s file on you is incorrect too.

Find the tax return in question and review your records. Compare it with the information provided in the CP2000 Notice. Look at any W-2s, 1098s, and 1099s that you might have reported for that year. Once you determine whether or not the CP2000 Notice is correct, you can submit your response to the IRS.

Step #2: Respond to the IRS You have two options on how you can respond to a CP2000 Notice. If it is correct and you excluded a source of income, sign the response letter provided by the IRS and return it to them. Once the IRS receives your agreement, they will send you a tax bill.

If you find the CP2000 Notice is incorrect, you can disagree with it. To do so, you will need to provide a signed statement identifying why you disagree, and you will need to provide documentation backing up your claim. This notice can be mailed to the address printed on the original CP2000 Notice letter.

When you submit your statement, attach it to a copy of the CP2000 Notice response form with the corrected tax form, your original tax form, and any additional documents that might help your case. Make a note in your statement that you would like an appeal if the IRS still insists that you owe more than you reported.

The IRS can be slow and because there are penalties involved, ensure you keep copies of all documents for yourself. If you disagree, consider sending your response via certified mail. This will give you documentation that you sent your response promptly in case any of your materials get lost en route to the IRS.

Step #3: Follow-up After you submit your response, be sure to follow up with the IRS. You'll either need a tax bill to pay what you owe or a resolution if you contest their findings. Even though the IRS initiated a review process by sending you a CP2000 Notice in the first place, it's still your responsibility to ensure everything is handled promptly to avoid penalties.

Can I Dispute a CP2000? Yes, as previously mentioned, you can dispute a CP2000 Notice by asking the IRS for an appeal. If you do so promptly, the IRS can issue an appeal hearing to review your case. If disagreement persists, the case is moved to the IRS Office of Appeals for additional consideration.

If you don’t respond quickly, the IRS can proceed with issuing a Notice of Deficiency. This would kick your case up to the U.S. Tax Court and could become a bigger headache than you might want to deal with.

The Takeaway: Don't Fret if You Received a CP2000 Notice While receiving any letter from the IRS can raise your blood pressure, a CP2000 Notice isn’t necessarily one that you should stress over. Seeking professional help when handling back taxes can help you avoid the discussed errors. At Advance Tax Relief, we offer specialized tax resolution services to help you deal with IRS debt.

Our experts can help rectify erroneous tax bills and guide you in picking a suitable repayment program. Contact us today (713)300-3965 for back tax filing and tax relief services.

Advance Tax Relief is rated one of the best tax relief companies nationwide.

#TaxPreparation #TaxLevy #BackTaxes #TaxReliefHelp #WageGarnishment #OfferInCompromise #TaxDebtRelief

0 notes

Text

Used Sheet Fed / Offset Machine for SALE

Heidelberg - Speedmaster SM 102-2-P

Buy Directly from SELLER -

Number of color: 4

Max sheet size: 72x102 cm / 28.35X40.16 inch

Manufacturer: Heidelberg

Year: 2006

Machine Availability: Immediately from stock

Price: On Request

Location: United Kingdom

#print #offset #machinedalal

0 notes

Text

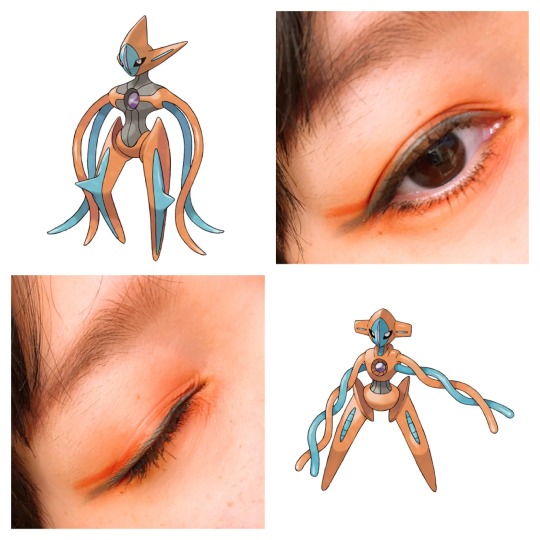

今日はデオキシスメイク🧡💙アイメイク以外はチーク無しで濃いめにブラウンリップ塗ってデオキシスみたいにミステリアス&クールなイメージで。こういう配色すごく好きだわ。

やっぱHOTTOPICのこのシャドウの色味、基本的にイエベ秋向きの色味だからか、すごく使いやすい気がする。

���ンボのcrochetパターン見つけたから編みたいな。巾着ポーチが作れるみたい。あんまりデカすぎなさそうだし、持ち歩きコスメとか入れるのに良さげ。白と赤の毛糸たくさん持ってるし。早くWindsorに帰りたいw

GBLのハイパープレミア、意外にもこのメンバーで結構勝ててる。ライチュウとフワライドのCP低めだけども、それでもそこそこ勝てるのはゲージ溜まるの早いから。結局GBLってゲージの早い者勝ちみたいなところはある。いくら強力な技でもゲージなかなか貯まらんとバリア消費もできんし。それでもHPは常にジリジリと削られていくから、やっぱ早い者勝ちって感じ。ライチュウが最速やから3連発ぐらいゲージ技打ってどうにかバリア消費させるように持ってく。ドリュウズは効果イマイチでもドリルライナーでそこそこ削れちゃうから、バリア消費なければラッキーって感じかな。苦手な水タイプは一応ゲージだけ貯めといて、ライチュウかフワライドに交代。フワライドのこごえるかぜはバリア使われても相手の攻撃力は下げれるから、少しでも時間稼ぎのために役立つし、バリア消費もできるしね。しかもフワライド結構固いし。効果抜群のあく技でもわりと耐えれるからすげえって思うw HPほとんどない中からこごえるかぜ打てることもよくあるし。もちろんシャドウボールの強さはやぱ格別やけども。

とりあえずフワライドのCPを少しでも上げれるよう、相棒にしました。最高の相棒になってギリギリまでCPブースト上げ���いな。最大までCP上げるにはアメXLが100個以上必要になるから相棒にでもしておかないとなかなかアメXL集まらんよな。ハロウィン終わったからコミュディも無いだろうし。フワライドの強化ができたらライチュウを相棒にしよ。

今朝珍しく野生でカビゴンがいて、CP2000越えだし、カビゴンだし個体値低くてもジム防衛に役立ちそうだなと思ってゲット。でも、木の実あげてハイパーボールでもなかなか捕まらなくて。それでもなぜか逃げないし。金ズリ3回ぐらい上げてどうにかゲットしたんだけども、個体値低っ!なんか岡田斗司夫っぽかったからこのニックネームにした。

岡田斗司夫って頭良くて色々知っててしかも話も上手くて、面白いおじさんだし生活力は高いけど、生まれた時は心臓病で死にかけてたらしいので、そういう意味では個体値は低いといえる。実際世代が違えば乳幼児期に死んでただろうし。でも全体的な戦闘力(CP)には恵まれた人間だなあと思う。そういう意味でもこのカビゴンは岡田斗司夫みたいだなと思った。

ᙏ̤̫͚

今日は疲れたから昼ごはん食べて、すぐホテルに帰ってきて寝てたなあ。それにしてもカードの世界は奥深い。PSAとかいうカードの価値を判断する会社があるんだけども、1枚最低でも手数料$25かかって、保険とか、価値の高いカードだと割増料金でどんどん手数料が上がるの。それでもものすごい行列になってて。私たちはVIPだから早めに入れて、ほとんど並ばずに手続きできたんだけども、手続きの最中、ふと見るとすごい人だか��だった。ロバートはヴィンテージのスポーツカードで状態に関わらず$1000以上する価値のカードを持ってて。でもPSAのことをイマイチ信用できないから、送るのを躊躇ってたんだけども、カードショップの店員さんたちの強いすすめで2枚だけ送ってた。でもさ、高価なカードを郵便でやり取りするのが怖すぎじゃね?とか思いつつ。なんかあった時のために保険とかもかけてるけども。実際どうなることやら。

私たちの隣は小中学生ぐらいの子供がポケカの手続きやってて、びっくりしたなあ。こんな子供もPSAを利用していることが。私たちがリアル小中学生の頃はカードの価値とか考えずにカードゲームで遊んで楽しいねって感じだったもの。確実にまだバイトもできない年齢だろうから、親が払うんだろうけども、そこそこ高価な手数料を払うのに理解のある親にも驚く。時代の変化についていけてないとつくづく思った。あんま見えなかったんだけども、ポケカは日本語版だったらしく、日本語で書かなくちゃいけませんか?とか店員さんに聞いてたんだけども、店員さんも私も日本語わからないからキャラ名や番号を英語で書いてくれれば大丈夫、とか言ってた。確かにPSAってアメリカの会社だから日本語わかる人なんていないだろうしねw(日本支社もあるらしいけど送るのはアメリカだし)

0 notes