#cost of fintech company in dubai

Explore tagged Tumblr posts

Text

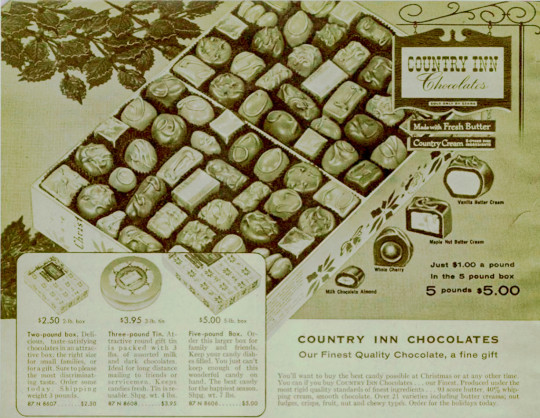

Starting a Fintech Company in Dubai

Dubai, the thriving economic hub of the United Arab Emirates, has emerged as a fertile ground for innovation and business growth. In recent years, the city has become a hotspot for Fintech entrepreneurs. If you’re contemplating starting your own Fintech company in Dubai, this blog will guide you through the crucial aspects of this exciting journey.

Understanding the Fintech Business in Dubai

To embark on your Fintech venture in Dubai, it’s essential to comprehend the local financial landscape. The Dubai government has been actively fostering a conducive environment for Fintech companies. With an increasing emphasis on digitalization and financial technology, Dubai has become a magnet for Fintech startups. Understanding the regulatory framework and the target market will be key to your success.

Key Trends in Dubai Fintech Business

Dubai’s Fintech industry is constantly evolving. Keeping an eye on the latest trends is vital. Innovations like blockchain, digital wallets, and peer-to-peer lending have gained traction. Additionally, Dubai’s Fintech landscape is seeing a surge in Insurtech and Regtech solutions. Staying updated with these trends will help you tailor your offerings to the local market.

Benefits of Starting a Fintech Company in Dubai

Starting a Fintech company in Dubai offers numerous advantages. The city’s strategic location provides access to a vast market in the Middle East and beyond. Moreover, Dubai’s forward-thinking approach to business and finance, coupled with a favorable tax regime, provides fertile ground for Fintech startups to flourish. With growing investor interest and an increasingly tech-savvy population, Dubai is brimming with potential for Fintech entrepreneurs.

Business Structuring and Planning

Before diving into the Fintech world, a solid business plan is crucial. Consider the structure of your company, whether it’s a free zone company, onshore company, or a branch office. Each option has its unique benefits and requirements. Your business plan should also outline your goals, target market, and revenue model.

Steps Involved in Starting a Fintech Company in Dubai

The journey to launching your Fintech company in Dubai involves several steps. These include obtaining the necessary licenses, understanding the regulatory framework, and ensuring compliance. Connecting with local partners or accelerators can help you navigate the complex regulatory landscape.

Cost of Setting Up a Fintech Company in Dubai

The cost of setting up a Fintech company in Dubai can vary widely depending on factors like business structure, office space, and license fees. It’s essential to create a comprehensive budget that accounts for all expenses, including registration, office space, and hiring staff.

Grow Your Business with Private Wolf

Private Wolf, a prominent Fintech consulting firm in Dubai, offers invaluable support to startups. Whether it’s assistance with licensing, compliance, or accessing the local network, they can be a vital partner in your entrepreneurial journey. Their expertise can help you streamline operations and accelerate your growth.

Starting a Fintech company in Dubai is an exciting endeavor. With the right knowledge and strategic planning, you can tap into the city’s vibrant Fintech ecosystem and position your company for success in this dynamic sector.

M.Hussnain

Private Wolf facebook Instagram Twitter Linkedin

#cost calculator#cost of fintech company in dubai#fintech company in dubai#start a company in dubai#start a fintech company in dubai

0 notes

Text

Stinkpump Linkdump

Next Tuesday (December 5), I'm at Flyleaf Books in Chapel Hill, NC, with my new solarpunk novel The Lost Cause, which 350.org's Bill McKibben called "The first great YIMBY novel: perceptive, scientifically sound, and extraordinarily hopeful."b

Once again, I greet the weekend with more assorted links than I can fit into my nearly-daily newsletter, so it's time for another linkdump. This is my eleventh such assortment; here are the previous volumes:

https://pluralistic.net/tag/linkdump/

I've written a lot about Biden's excellent appointees, from his National Labor Relations Board general counsel Jennifer Abruzzo to Consumer Financial Protection Bureau chair Rohit Chopra to FTC Chair Lina Khan to DoJ antitrust boss Jonathan Kanter:

https://pluralistic.net/2023/09/14/prop-22-never-again/#norms-code-laws-markets

But I've also written a bunch about how Biden's appointment strategy is an incoherent mess, with excellent appointees picked by progressives on the Unity Task Force being cancelled out by appointees given to the party's reactionary finance wing, producing a muddle that often cancels itself out:

https://pluralistic.net/2023/11/08/fiduciaries/#but-muh-freedumbs

It's not just that the finance wing of the Democrats chooses assholes (though they do!), it's that they choose comedic bunglers. The Dems haven't put anyone in government who's as much of an embarrassment as George Santos, but they keep trying. The latest self-inflicted Democratic Party injury is Prashant Bhardjwan, a serial liar and con-artist who is, incredibly, the Biden Administration's pick to oversee fintech for the Office of the Comptroller of the Currency (OCC):

https://www.americanbanker.com/news/did-the-occ-hire-a-con-artist-to-oversee-fintech

When the 42 year old Bhardjwan was named Deputy Comptroller and Chief Financial Technology Officer for OCC, the announcement touted his "nearly 30 years of experience serving in a variety of roles across the financial sector." Apparently Bhardjwan joined the finance sector at the age of 12. He's the Doogie Houser of Wall Street:

https://www.occ.gov/news-issuances/news-releases/2023/nr-occ-2023-31.html

That wasn't the only lie on Bhardjwan's CV. He falsely claimed to have served as CIO of Fifth Third Bank from 2006-2010. Fifth Third has never heard of him:

https://www.theinformation.com/articles/the-occ-crowned-its-first-chief-fintech-officer-his-work-history-was-a-web-of-lies

Bhardjwan told a whole slew of these easily caught lies, suggesting that OCC didn't do even a cursory background search on this guy before putting him in charge of fintech – that is, the radioactively scammy sector that gave us FTX and innumerable crypto scams, to say nothing of the ever-sleazier payday lending sector:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When it comes to appointing corrupt officials, the Biden administration has lots of company. Lots of eyebrows went up when the UN announced that the next climate Conference of the Parties (COP) would be chaired by Sultan Ahmed Al-Jaber, who is also the chair of Dubai's national oil company. Then the other shoe dropped: leaks revealed that Al-Jaber had colluded with the Saudis to use COP28 to get poor Asian and African nations hooked on oil:

https://www.bbc.com/news/science-environment-67508331

There's an obvious reason for this conspiracy: the rich world is weaning itself off of fossil fuels. Today, renewables are vastly cheaper than oil and there's no end in sight to the plummeting costs of solar, wind and geothermal. While global electrification faces powerful logistical and material challenges, these are surmountable. Electrification is a solvable problem:

https://pluralistic.net/2021/12/09/practical-visionary/#popular-engineering

And once we do solve that problem, we will forever transform our species' relationship to energy. As Deb Chachra explains in her brilliant new book How Infrastructure Works, we would only need to capture 0.4% of the solar radiation that reaches the Earth's surface to give every person on earth the energy budget of a Canadian (AKA, a "cold American"):

https://pluralistic.net/2023/10/17/care-work/#charismatic-megaprojects

If COP does its job, we will basically stop using oil, forever. This is an existential threat to the ruling cliques of petrostates from Canada to the UAE to Saudi. As Bill McKibben writes, this isn't the first time a monied rich-world industry that had corrupted its host governments faced a similar crisis:

https://billmckibben.substack.com/p/a-corrupted-cop

Big Tobacco spent decades fueling science denial, funneling money to sellout scientists who deliberately cast doubt on both sound science and the very idea that we could know anything. As Tim Harford describes in The Data Detective, Darrell Huff's 1954 classic How to Lie With Statistics was part of a tobacco-industry-funded project to undermine faith in statistics itself (the planned sequel was called How To Lie With Cancer Statistics):

https://pluralistic.net/2021/01/04/how-to-truth/#harford

But anything that can't go on forever will eventually stop. When the families of the people murdered by tobacco disinformation campaigns started winning eye-popping judgments against the tobacco industry, the companies shifted their marketing to the Global South, on the theory that they could murder poor brown people with impunity long after rich people in the north forced an end to their practice. Big Tobacco had a willing partner in Uncle Sam for this project: the US Trade Representative arm-twisted the world's poorest countries into accepting "Investor-State Dispute Settlements" as part of their treaties. These ISDS clauses allowed tobacco companies to sue governments that passed tobacco control legislation and force them to reverse their democratically enacted laws:

https://ash.org/what-is-isds-and-what-does-it-mean-for-tobacco-control/

As McKibben points out, the oil/climate-change playbook is just an update to the tobacco/cancer-denial conspiracy (indeed, the same think-tanks and PR agencies are behind both). The "Oil Development Sustainability Programme" – the Orwellian name the Saudis gave to their plan to push oil on poor countries – maps nearly perfectly onto Big Tobacco's attack on the Global South. Nearly perfectly: second-hand smoke in Indonesia won't give Americans cancer, but convincing Africa to go hard on fossil fuels will contribute to an uninhabitable planet for everyone, not just poor people.

This is an important wrinkle. Wealthy countries have repeatedly demonstrated a deep willingness to profit from death and privation in the poor world – but we're less tolerant when it's our own necks on the line.

What's more, it's far easier to put the far-off risks of emissions out of your mind than it is to ignore the present-day sleaze and hypocrisy of corporate crooks. When I quit smoking, 23 years ago, my doctor told me that if my only motivation was avoiding cancer 30 years from now, I'd find it hard to keep from yielding to temptation as withdrawal set in. Instead, my doctor counseled me to find an immediate reason to stay off the smokes. For me, that was the realization that every pack of cigarettes I bought was enriching the industry that invented the denial playbook that the climate wreckers were using to render our planet permanently unsuited for human habitation. Once I hit on that, resisting tobacco got much easier:

https://pluralistic.net/2021/06/03/i-quit/

Perhaps OPEC Secretary General Haitham Al-Ghais is worried about that the increasing consensus that Big Oil cynically and knowingly created this crisis. That would explain his new flight of absurdity, claiming that the world is being racist to oil companies, "unjustly vilifying" the industry for its role in the climate emergency:

https://www.cnbc.com/2023/11/27/opec-says-oil-industry-unjustly-vilified-ahead-of-climate-talks-.html

Words aren't deeds, but words have power. The way we talk about things makes a difference to how we act on those things. When discussions of Israel-Palestine get hung up on words, it's easy to get frustrated. The labels we apply to the rain of death and the plight of hostages are so much less important than the death and the hostages themselves.

But how we name the thing will have an enormous impact on what happens next. Take the word "genocide," which Israel hawks insist must not be applied to the bombing campaign and siege in Gaza, nor to the attacks on Palestinians in the West Bank. On this week's On The Media, Brooke Gladstone interviews Ernesto Verdeja, executive director of The Institute for the Study of Genocide:

https://www.wnycstudios.org/podcasts/otm/segments/genocide-powerful-word-so-why-its-definition-so-controversial-on-the-media

Verdeja lays out the history of the word "genocide" and connects it to the Israeli government and military's posture on Palestine and Palestinians, and concludes that the only real dispute among genocide scholars is whether the current campaign it itself an act of genocide, or a prelude to an act of genocide.

I'm not a genocide scholar, but I am a Jew who has always believed in Palestinian solidarity, and Verdeja's views do not strike me as outrageous, or (more importantly) antisemitic. The conflation of opposition to Israel's system of apartheid with opposition to Jews is a cheap trick, one that's belied by Israel itself, where there is a vast, longstanding political opposition to Israeli occupation, settlements, and military policing. Are all those Israeli Jews secret antisemites?

Jews are not united in support for Israel's oppression of Palestinians. The hardliners who insist that any criticism of Israel is antisemitic are peddling an antisemitic lie: that all Jews everywhere are loyal to Israel, and that we all take our political positions from the Knesset. Israel hawks only strengthen that lie when they accuse me and my fellow Jews of being "self-hating Jews."

This leads to the absurd circumstance in which gentiles police Jews' views on Israel. It's weird enough when white-nationalist affiliated evangelicals who support Israel in order to further the end-times prophesied in Revelations slam Jews for being antisemitic. But in Germany, it's even weirder. There, regional, non-Jewish officials charged with policing antisemitism have censured Jewish groups for adopting policies on Israel that mainstream Israeli political parties have in their platforms:

https://jewishcurrents.org/the-strange-logic-of-germanys-antisemitism-bureaucrats

Antisemitism is real. As Jesse Brown describes in his recent Canadaland editorial, there is a real and documented rise in racially motivated terror against Jews in Canada, including school shootings and a firebombing. Likewise, it's true that some people who support the Palestinian cause are antisemites:

https://www.canadaland.com/podcast/is-jesse-a-zionist-editorial/

But to stand in horror at Israel's military action and its vast civilian death-toll is not itself antisemitic. This is obvious – so obvious that the need to say it is a tribute to Israel hardliners – Jewish and gentile – and their ability to peddle the racist lie that Israel is Jews and Jews are Israel, and that every Jew is in support of, and responsible for, Israeli war-crimes and crimes against humanity.

One need not choose between opposition to Hamas and its terror and opposition to Israel and its bombings. There is no need for a hierarchy of culpability. As Naomi Klein says, we can "side with the child over the gun":

https://www.theguardian.com/commentisfree/2023/oct/11/why-are-some-of-the-left-celebrating-the-killings-of-israeli-jews

Moral consistency is not moral equivalency. If you're a Jew like me who wants to work for an end to the occupation and peace in the region, you could join Jewish Voice For Peace (like me):

https://www.jewishvoiceforpeace.org

Now, for a jarring tone shift. In these weekend linkdumps, I put a lot of thought into how to transition from one subject to the next, but honestly, there's no good transition from Israel-Palestine to anything else (yet – though someday, perhaps). So let's just say, "word games can be important, but they can also be trivial, and here are a few of the latter."

Start with a goodie, from the always brilliant medievalist Eleanor Janeaga, who tackles the weirdos who haunt social media in order to dump on people with PhDs who call themselves "doctor":

https://going-medieval.com/2023/11/29/doctor-does-actually-mean-someone-with-a-phd-sorry/

Janega points out that the "doctor" honorific was applied to scholars for centuries before it came to mean "medical doctor." But beyond that, Janega delivers a characteristically brilliant history of the (characteristically) weird and fascinating tale of medieval scholarship. Bottom line, we call physicians "doctor" because they wanted to be associated with the brilliance of scholars, and thought that being addressed as "doctor" would add to their prestige. So yeah, if you've got a PhD, you can call yourself doctor.

It's not just doctors; the professions do love their wordplay. especially lawyers. This week on Lowering The Bar, I learned about "a completely ludicrous court fight that involved nine law firms that combined for 66 pages of briefing, declarations, and exhibits, all inflicted on a federal court":

https://www.loweringthebar.net/2023/11/federal-court-ends-double-spacing-fight.html

The dispute was over the definition of "double spaced." You see, the judge in the case told counsel they could each file briefs of up to 100 pages of double-spaced type. Yes, 100 pages! But apparently, some lawyer burn to write fat trilogies, not mere novellas. Defendants accused the plaintiffs in this case of spacing their lines a mere 24 points apart, which allowed them to sneak 27 lines of type onto each page, while defendants were confined to the traditional 23 lines.

But (the court found), the defendants were wrong. Plaintiffs had used Word's "double-spacing" feature, but had not ticked the "exact double spacing" box, and that's how they ended up with 27 lines per page. The court refused to rule on what constituted "double-spacing" under the Western District of Tennessee’s local rules, but it ruled that the plaintiffs briefs could fairly be described as "double-spaced." Whew.

That's your Saturday linkdump, jarring tone-shift and all. All that remains is to close out with a cat photo (any fule kno that Saturday is Caturday). Here's Peeve, whom I caught nesting most unhygienically in our fruit bowl last night. God, cats are gross:

https://www.flickr.com/photos/doctorow/53370882459/

It's EFF's Power Up Your Donation Week: this week, donations to the Electronic Frontier Foundation are matched 1:1, meaning your money goes twice as far. I've worked with EFF for 22 years now and I have always been - and remain - a major donor, because I've seen firsthand how effective, responsible and brilliant this organization is. Please join me in helping EFF continue its work!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/12/02/melange/#defendants_motion_to_require_adherence_with_formatting_requirements_of_local_rule_7.1

Stinkpump Linkdump

#pluralistic#israel palestine#israel#palestine#linkdump#linkdumps#moral injury#occ#office of comptroller of the currency#Prashant Bhardjwan#finance#fintech#cop#bill mckibben#petrostates#Sultan Ahmed Al-Jaber#jesse brown#on the media#genocide#Adnoc#saudi arabia#Oil Development Sustainability Programme#odsp#language#caturday

56 notes

·

View notes

Text

here's a heads up for the next civilizational step - feudalism 2 ! you can already see it beginning to form. the centralization of states that dominated the 19th and 20th centuries (sidebar. considering switching to the french style when referencing centuries, in this case eg. XIXth and XXth - do we like ?) emerged at a time when the productive parts of the economy (laborers, natural resources, capital (real and money)) had a much tougher time moving around – not so much the case today. financial capital can move around relatively easily, increases in productivity and infrastructure have made it so that startup cost to for example build a new factory elsewhere are much lower than before, relatively speaking. people can move around much more easily (source: the tumblr dashboard, linkedin recruiters). we’ve already seen countries deliberately change their legislative systems in order to attract money and people from abroad – think city states and tax havens like singapore, dubai, monaco, belize. the national bank of lithuania (a country with a population of 3m) gave revolut (fintech company) a banking license which counts for the whole of the EU, so now there are something like 50m bank accounts registered in and insured by the national bank of lithuania. this kind of competitive advantage-seeking behavior will only continue (because as long as there are arbitrage opportunities, it will work). the easiest way for countries on the losing side of this trade to hedge their losses is to enforce a feudal serf-citizen status. a french passport will not mean a right to participate in the french political system, but rather an obligation to the state treasury. the US already does this – if you have a US passport, you have to disclose your income to the IRS even if you live and work elsewhere, and have that other country designated as your tax home; you have to annually disclose to the IRS all international bank accounts holding more than $10k (if you don’t, that’s okay. every bank you can think of (excl. in switzerland) voluntarily provides detailed info on every account held by US citizens – look up FBAR and the array of international agreements to support this). the UK has long struggled with people pulling out every penny and asset out of the UK economy because of high tax rates, and while there’s no chance france will pass a marginal 90% income tax rate over 400k EUR/y, the solution will simply be to put the money and declare income elsewhere – while still living and working in france. The only solution (from a state’s view) is the american model of you being a serf, and being subject to THEIR rules regardless of where you go

#the right honorable lord reese-mogg talks about this#almost certain china does this as well#also for context czech rep is tax heaven i fr have to get my citizenship sorted so i can move but still pay tax here

8 notes

·

View notes

Text

Influencer Marketing for Fintech Brands in Dubai, UAE, GCC, MENA Region

Fintech companies are quickly gaining popularity all over the world, and Dubai, UAE has identified itself as a potent player in carrying Fintech companies. The core of this sector is innovation and therefore it is in a continuous search on how to reach the target market in a unique way. This is where influencer marketing for Fintech brands in Dubai comes into play.

That is why, the Influence marketing for Fintech brands in UAE becomes mandatory rather than a luxury. The discussion reveals that such an approach can be used by fintech organizations to improve the gap between products and consumer knowledge.

This blog post will explore the various ways in which FinTech brands can leverage creators, the value of influencer marketing, and how brands can effectively work with social media influencers.

How Can FinTech Brands in UAE Strategically Collaborate with FinTech Creators in the Middle East?

Choosing the Right Influencers

The first significant challenge that Fintech brands have to contend with is the finding of the right fintech influencers. This means that the strategy needs to be distinct from general consumer niche marketing since the target audience is structured within the financial sector. Some of the usual popular opinion leaders in this area are financial analysts, technology bloggers, and investment consultants who would usually have a large fan base among potential FinTech consumers in GCC region.

Establishing Clear Objectives

Collaboration with fintech influencers should be focused on certain goals, which should be written down. Regardless of whether the aim is to generate brand recognition, drive leads, or increase users’ engagement, such objectives are going to be set at the beginning to help identify the most suitable influencer marketing agency for FinTech brands in UAE, Middle East.

Creating Authentic Content

Authenticity is key. It is something that fintech influencers should be allowed to do to tweak the message in a way that they find will appealed to the audience. To increase people’s trust and credibility some ideas of content creation can be tutorials, live Q&A sessions, and financial planning webinars.

Leveraging Data and Analytics

There is also the aspect of performance tracking when working with an influencer marketing platform for FinTech brands. Evaluation enables changes to be made to the strategies so as to enhance the results. These are the types of data: engagement rates, conversion rates, and ROI.

Why Should FinTech Brands Choose Influencer Marketing to Reach Their Potential Customers?

Enhanced Trust and Credibility

Another major benefit of influencer marketing services for FinTech brands in MENA region is the passive or inherent trust, which audiences have placed on the promoters themselves. This is because when one influential personality comes out to recommend a given brand to his or her followers, such a brand will definitely gain a lot of recognition from the targeted group.

Targeted Audience Reach

Thus, brands benefit from fintech influencers because they help them attract a more specific audience. Whether you are looking at Facebook Influencer marketing for FinTech brands in UAE, Tiktok Influencer marketing for FinTech brands in Middle East or variations in other social platforms, the audience segmentation is very achievable.

Cost-Effective Marketing

Compared to other forms of advertising such as the print, electronic or billboard, this form of advertisement is cheaper. It’s about getting access to the audience of a person who already has their trust and attention partially earned.

Improved Engagement Rates

Awareness is usually considered to be an undeniably valuable component of any marketing plan and the same can be said about engagement. Fintech influencer content is likely to appeal more to the audience because it is considered to be much closer to reality and everyday life. The upshot of this higher engagement is usually a corresponding better ROI.

How to Use Social Media Influencers for FinTech Brands?

Facebook Influencer marketing for FinTech brands

Facebook Influencer marketing for FinTech brands in UAE can be even more beneficial because Facebook provides shifting and diverse advertising opportunities and sir for branding. The use of Facebook Live sessions, advertisements, and posts from money influence personalities can go a long way.

TikTok Influencer marketing for FinTech brands in the Middle East

Another path is Influencer marketing for FinTech brands in MENA region using TikTok which is still not highly explored but promising. Specifically due to its content sharing mechanism, TikTok is a great way to reach the younger audiences with short and entertaining pieces of content. Simple financial tips, a few tricks to make investment, or possibly cheerful animations will help to attract the attention of potential users.

Instagram Influencer marketing for FinTech brands

Instagram Influencer marketing for fintech primarily focuses on visuals. It is Instagram Stories, IGTV, and posts that showcase personal finance tips, and technology updates arranged in an appealing manner that can generate more traffic. Getting in touch with influential fintech social media personalities who are indeed savvy in matters concerning finances will aid in establishing content that will be appealing to the eye as well as filled with lots of informative data.

Linkedin Influencer marketing for FinTech brands

In regards to the best platforms, influencer marketing through LinkedIn is appropriate for B2B FinTech brands in GCC region. This platform enables FinTech brands to target the professional user group. LinkedIn has enabled its influencers to hold webinars, author articles, and proffer case studies that in turn boost your B2B FinTech solutions, thereby amplifying a brand’s reach.

Conclusion

The rise of influencer marketing shows that it opens various prospects for FinTech brands in Dubai. Evaluating the customer experience, focusing on the target audience, and a multiple-approach approach are the foundations of effective influencer marketing. Whether your niche is Facebook, Tiktok, Instagram, or Linkedln let the right influencer marketing company for FinTech brands get your products closer to consumers.

To tackle FinTech’s dynamic marketing strategies, it will be vital in the future to adapt these strategies to constantly target a more refined audience.

Want to raise the bar of your audience interaction? Get in touch with Grynow now to avail unmatched expertise!!

#Influencer marketing for fintech brands in Dubai#Influencer marketing for Fintech brands in UAE#Best influencer marketing agency for fintech brands in dubai#Top influencer marketing agency for fintech brands in UAE

2 notes

·

View notes

Text

White-Label Cryptocurrency MLM Software Development Solutions: Myths vs. Reality

The digital economy is evolving rapidly, and the blend of cryptocurrency with multi-level marketing (MLM) creates exciting business opportunities. Startups and established companies are eager to launch crypto MLM platforms, but many hold back due to misunderstandings about white-label solutions. These pre-built, customizable platforms are surrounded by myths that often overshadow their benefits. Let’s debunk these myths and explore how white-label crypto MLM software can be a practical, cost-effective, and secure business choice.

What Is White-Label Cryptocurrency MLM Software?

White-label solutions are like ready-made templates that businesses can rebrand and customize. For crypto MLM, these platforms come with essential features such as commission tracking, wallet integrations, and user dashboards. Here’s why they’re becoming popular:

Affordable Entry: Skip the high costs of building software from scratch.

Quick Launch: Deploy your platform in weeks instead of months.

Adaptable Design: Modify features, themes, and workflows to suit your brand.

For example, a small e-commerce business in Southeast Asia used a white-label solution to create a crypto rewards program, attracting 10,000 users in just six months.

Myth 1: “Only Big Companies Can Afford White-Label Solutions”

Myth: Many assume white-label platforms are too pricey for startups. Reality: These solutions are designed to be budget-friendly.

Lower Initial Investment: Custom development can cost

80k+,whilewhite−labeloptionsstartat

80k+,whilewhite−labeloptionsstartat10k–$20k.

Transparent Pricing: Reputable providers offer clear packages (e.g.,

15kforsetup+

15kforsetup+2k/month for support).

Case Study: A Nigerian fintech startup, CoinSphere, launched a crypto MLM platform for $14k and hit 8,000 users in four months.

Myth 2: “You Can’t Customize the Platform”

Myth: Critics say white-label software is “one-size-fits-all.” Reality: Modern solutions prioritize flexibility.

Branding Freedom: Add your logo, color schemes, and language preferences.

Feature Add-Ons: Integrate tools like AI-driven analytics or NFT marketplaces.

Example: A European crypto exchange customized its MLM platform to include Ethereum staking, increasing user retention by 35%.

Myth 3: “White-Label Software Isn’t Secure”

Myth: People fear pre-built platforms are easy targets for hackers. Reality: Security is a top priority for credible providers.

Advanced Protections: Features like biometric logins, end-to-end encryption, and multi-signature wallets.

Regular Audits: Many providers hire third-party firms to test for vulnerabilities.

Data Insight: A 2023 study showed that 78% of security breaches occurred in poorly coded custom platforms, not white-label systems.

Myth 4: “You Need a Tech Team to Manage It”

Myth: Entrepreneurs worry they’ll need coding skills to run the platform. Reality: User-friendly interfaces and support make management simple.

Dashboard Simplicity: Monitor transactions, commissions, and user growth in real-time.

Training & Support: Most providers offer tutorials and 24/7 assistance.

Success Story: A health coach in Australia launched a crypto MLM platform for her wellness community without prior tech experience.

Myth 5: “White-Label Platforms Can’t Scale”

Myth: Some believe these solutions can’t handle rapid growth. Reality: Scalability is built into the design.

Cloud Infrastructure: Automatically adjusts to handle traffic spikes.

Modular Upgrades: Easily add features like live chat or token swaps as your user base grows.

Example: A Dubai-based crypto MLM platform scaled from 1,000 to 50,000 users in a year without downtime.

Myth 6: “Regulatory Compliance Is Too Complicated”

Myth: Businesses fear legal risks with pre-built software. Reality: Many solutions include compliance tools.

KYC/AML Integration: Verify user identities and track transactions to meet regulations.

Geofencing: Restrict access in regions with strict crypto laws.

Case Study: A U.S. company avoided penalties by using a white-label platform with built-in compliance checks.

The Reality: Why White-Label Solutions Are a Smart Choice

The crypto MLM market is growing fast, with projections estimating a $12 billion valuation by 2027. White-label software helps businesses stay ahead:

Speed: Launch quickly to capitalize on trends.

Cost Control: Avoid unpredictable expenses of custom development.

Community Focus: Use built-in referral systems and social sharing to grow organically.

For instance, a Singaporean startup used gamified rewards in their white-label platform to double user engagement in three months.

How to Choose the Right White-Label Provider

Not all providers are equal. Keep these tips in mind:

Check Reviews: Look for providers with proven success in crypto MLM.

Test Security: Ask for audit reports or compliance certifications.

Evaluate Support: Ensure they offer training and troubleshooting.

A Canadian company avoided pitfalls by partnering with a provider that offered a 30-day trial and live demo.

Conclusion: The Future of Crypto MLM Is Accessible

White-label cryptocurrency MLM software isn’t a compromise—it’s a strategic advantage. By busting myths around cost, customization, security, and scalability, it’s clear these solutions empower businesses to innovate without heavy investments. Whether you’re a startup or an enterprise, white-label platforms offer a reliable way to enter the crypto MLM space, adapt to changes, and build a loyal community.

The key is to partner with a trusted provider, focus on your unique value proposition, and leverage the flexibility of white-label solutions. The crypto world moves fast, and with the right tools, you won’t just keep up—you’ll lead.

Ready to start? Begin by researching providers, outlining your goals, and taking the leap. Your crypto MLM platform could be just weeks away from going live.

#cryptocurrency mlm software development#smart contract based mlm software development#cryptocurrency mlm software development company#White-label Cryptocurrency MLM Software Development solutions#Blockchain Based Cryptocurrency MLM Software Development Company

0 notes

Text

ACCA Salary in the UK: 2025 Updated Information

The Association of Chartered Certified Accountants (ACCA) remains one of the most recognized qualifications in the finance and accounting industry. With growing demand for skilled accountants, the ACCA salary in the UK in 2025 has seen a steady rise, offering excellent earning potential and career stability.

In this blog, we will discuss the latest 2025 salary trends for ACCA professionals, compare CFA vs ACCA, explore the benefits of an ACCA MBA, outline ACCA course details, explain ACCA eligibility, and provide insights into ACCA registration fees. We will also compare the ACCA salary in Dubai to provide a global perspective.

ACCA Salary in the UK (2025 Update)

The average ACCA salary in UK in 2025 varies depending on experience, job role, and industry. Here’s an updated breakdown:

Entry-Level (0-2 years): £28,000 - £38,000 per year

Mid-Level (3-6 years): £45,000 - £65,000 per year

Senior-Level (7+ years): £85,000 - £120,000 per year

Top-Level (CFOs, Finance Directors): £150,000+ per year

Key Factors Affecting ACCA Salary in 2025

Industry Demand – The UK finance sector has seen a rise in demand for ACCA-qualified professionals in 2025, especially in fintech, investment banking, and audit.

Economic Growth – A growing UK economy has resulted in higher salary packages for finance professionals.

AI and Automation – With AI automating routine tasks, ACCA professionals with expertise in financial analysis and strategic decision-making are earning more.

Location-Based Salaries – London-based ACCA professionals earn approximately 15-20% higher than those in other UK cities.

CFA vs ACCA: Which One is Better in 2025?

The CFA vs ACCA debate continues in 2025, as both qualifications cater to different career paths.

CFA: Best for careers in investment banking, asset management, and portfolio analysis.

ACCA: Ideal for careers in auditing, taxation, corporate finance, and accounting.

While CFA-qualified professionals often earn higher salaries in investment banking, ACCA professionals enjoy more career flexibility, making ACCA a safer long-term investment for those looking for stable career progression.

ACCA MBA: Is It Still Relevant in 2025?

The demand for ACCA MBA professionals has increased in 2025, as companies seek finance leaders with both technical accounting expertise and business management skills.

Benefits of an ACCA MBA in 2025

Higher Salaries – ACCA professionals with an MBA now earn 30-40% more than those without an MBA.

Increased Job Prospects – More multinational corporations in the UK are preferring finance managers with an MBA.

Fast-Track to Leadership – ACCA MBAs are securing roles like CFO and Financial Controller faster than before.

ACCA Course Details (2025 Updated Syllabus)

The ACCA course details remain largely unchanged, but in 2025, more emphasis is placed on digital accounting, AI in finance, and sustainability reporting. The 13 ACCA exams are categorized into:

Applied Knowledge

Applied Skills

Strategic Professional

In 2025, optional modules related to ESG (Environmental, Social, and Governance) reporting and AI-driven accounting systems are becoming more popular.

ACCA Eligibility in 2025

The ACCA eligibility criteria remain unchanged in 2025:

Minimum Age – 18 years old

Educational Requirements – Two A-Levels and three GCSEs (including Maths and English)

Exemptions – Graduates in finance, accounting, or business may receive exemptions

ACCA Registration Fees (2025 Update)

ACCA registration fees in 2025 have increased slightly due to inflation:

Initial Registration Fee: £95

Annual Subscription Fee: £130

Exam Fees:

Applied Knowledge: £90 - £125 per exam

Applied Skills: £130 - £150 per exam

Strategic Professional: £175 - £270 per exam

Candidates should plan their finances accordingly to cover tuition, study materials, and resit costs.

ACCA Salary in Dubai vs ACCA Salary in the UK (2025 Comparison)

Many professionals compare the ACCA salary in dubai with that of the UK before making career decisions. In 2025, salaries in Dubai remain competitive due to the tax-free income advantage.

ACCA Salary in Dubai (2025 Update)

Entry-Level (0-2 years): AED 9,000 - AED 17,000 per month

Mid-Level (3-6 years): AED 18,000 - AED 30,000 per month

Senior-Level (7+ years): AED 35,000+ per month

UK vs Dubai: Which Offers Better ACCA Salary in 2025?

UK Advantage: Higher base salary, strong financial sector, more job security.

Dubai Advantage: Tax-free income, high demand for ACCA professionals in MNCs and financial firms.

For those willing to relocate, Dubai offers an attractive package, but the UK provides long-term career stability and access to the EU finance job market.

Conclusion

The ACCA salary in the UK in 2025 remains strong, with salaries increasing due to rising demand for financial professionals. Whether you're comparing CFA vs ACCA, considering an ACCA MBA, or evaluating opportunities in Dubai vs the UK, the ACCA qualification continues to provide excellent global career prospects.By understanding ACCA course details, ACCA eligibility, and ACCA registration fees, aspiring accountants can make informed decisions about their future. With the increasing importance of AI, sustainability reporting, and strategic finance, ACCA remains one of the most valuable finance qualifications in 2025.

#acca salary in dubai#acca registration fees#acca eligibility#acca course details#acca salary in uk#acca mba#cfa vs acca

0 notes

Text

Why do Startups and New Businesses Prefer the UAE?

The UAE’s rapid economic shift in the last few years has acted as a beacon for investors across the world, especially startups and newly established businesses. Thanks to its strategic advantages, it has become a popular business hub and is now viewed as a catalyst for growth and innovation in the international business community.

After all, the UAE boasts of having one of the most diversified economies in the world, Dubai topping the list. Also, in 2023, Dubai's GDP was approximately AED 429 billion, which was a 3.3% increase from 2022.

The numbers provide strong evidence of the UAE’s prosperity. But the economic diversification is just one reason. In this blog post, we will take a look at other core reasons why the UAE is a preferred destination for startups and new businesses.

WHY STARTUPS AND SMES PREFER THE UAE?

1. Policies and Ease of Setup

One of the UAE’s strongest advantages lies in its pro-business regulatory environment. Startups can benefit from:

100% Foreign Ownership: The UAE allows 100% foreign ownership in most sectors, thus eliminating the need for local sponsors and allowing entrepreneurs to have full control of their businesses.

Quick Setup Process: The business registration process in the UAE is straightforward, with some Free Zones offering company incorporation in minimum possible time.

Industry-Specific Free Zones: With over 40 Free Zones tailored to specific industries (e.g., media, logistics, finance), startups can access benefits like subsidized facilities and reduced operational costs.

2. Connectivity and Location

The UAE’s position as a gateway between East and West makes it a strategic location for startups aiming to expand internationally. Key benefits include:

Global Connectivity: The UAE’s world-class ports and airports (e.g., Dubai International Airport and Jebel Ali Port) provide seamless access to over 200 destinations worldwide.

Access to Emerging Markets: The UAE’s close proximity to big markets like Africa, Asia, and Europe, along with other Gulf countries proves as a boon to businesses, enabling them to tap into a huge consumer base.

3. Low Tax Environment

The UAE’s favorable tax regime is a key draw for startups, the chief ones being:

Zero Personal Income Tax: Entrepreneurs and employees do not have to pay income tax, enabling higher disposable income and talent retention.

Competitive Corporate Tax: The newly introduced 9% corporate tax applies only to businesses earning over AED 375,000 annually, leaving smaller startups largely unaffected.

No Capital Gains Tax: This allows startups to reinvest profits and grow their businesses more efficiently.

4. Robust Corporate Ecosystem

The UAE’s government has prioritized innovation and technology as part of its growth strategy. Startups in high-growth sectors, including fintech, AI, renewable energy, and healthcare, benefit from:

Incubators and Accelerators: Programs like Hub71 (Abu Dhabi), Dubai Future Accelerators, and Sharjah Entrepreneurship Center (Sheraa) provide seed funding, and access to global networks.

Innovation Challenges: The UAE hosts competitions like the Dubai Smart City Accelerator and GITEX Future Stars, enabling startups to pitch ideas to investors and win funding.

5. Funding and Networking Opportunities

Securing investment is critical for startups, and the UAE offers a robust ecosystem of investors, including:

Venture Capital and Angel Investors: With entities like BECO Capital, Wamda, and Dubai Angel Investors, startups have access to regional and global funding.

Networking Events: Platforms like STEP Conference and AIM Startup connect entrepreneurs with investors, partners, and peers, fostering collaboration and funding opportunities.

6. Modern Infrastructure

The UAE’s state-of-the-art infrastructure supports startups with:

Digital Infrastructure: High-speed internet, 5G connectivity, and cloud-based solutions make it easy for startups to scale digitally.

Flexible Workspaces: Coworking spaces cater specifically to startups, offering scalable office solutions.

7. Talent Magnet

The UAE’s exceptional quality of life attracts top-tier talent, which is crucial for startups looking to build strong teams:

Multicultural Workforce: The UAE’s diverse population provides access to skilled professionals from around the world, particularly in industries like technology, finance, and media.

Golden Visas for Entrepreneurs: The UAE’s Golden Visa program offers long-term residency to entrepreneurs, investors, and specialized professionals, promoting stability and long-term commitment.

The UAE is waiting for you!

The UAE’s strategic combination of business-friendly policies, connectivity and proximity to big markets, innovation-driven ecosystems, and access to funding makes it the ultimate destination for startups and new businesses.

Entrepreneurs are not only supported by robust infrastructure and government initiatives but also welcomed into a vibrant community of forward-thinking professionals.

Whether you’re in tech, finance, healthcare, or sustainability, the UAE offers the tools, resources, and opportunities to help your startup thrive on a global scale.

The UAE is ready for you. Are you? If you too want to leverage the UAE’s dynamic economy, contact Nimbus Consultancy. We are a trusted business setup advisory firm in the UAE helping entrepreneurs and SMEs expand their business in one of the world’s most happening commercial region.

#company formation uae#uae free zone company formation#company setup services in uae#best business consultants in dubai#how to start a company in dubai#mainland company setup

0 notes

Text

Boosting Software Performance: Agile Advisors and QA Testing Services in Dubai

Table of Contents:

Introduction

The Importance of QA Testing Services in Dubai

Benefits of Choosing Agile Advisors for QA Testing

Types of QA Testing Services in UAE

Manual Testing

Automated Testing

Performance Testing

Security Testing

How Agile Advisors Can Enhance Your QA Testing Process

The Future of QA Testing in Dubai

Conclusion

1. Introduction

Quality assurance (QA) testing is a crucial step in the software development lifecycle. It ensures that products are dependable, usable, and useful. Businesses in the United Arab Emirates, especially in Dubai, are putting more emphasis on offering top-notch software products to satisfy the expanding needs of the digital market. QA Testing Services are useful in this situation. As agile approaches gain popularity, businesses in Dubai are turning to Agile Advisors for help streamlining their testing procedures.

This blog will cover the value of QA testing services in Dubai, the advantages of working with Agile Advisors, and the ways that QA testing improves the software development process.

2. The Importance of QA Testing Services in Dubai

Dubai has emerged as a centre for innovation, particularly in the electronics industry. As more companies move toward digital transformation, the demand for dependable and thoroughly tested software is greater than ever. QA testing services make finding defects, enhancing user experience, and ensuring that goods satisfy both functional and non-functional needs possible.

Businesses cannot afford the delays brought on by subpar software in a fast-moving market. Therefore, QA testing services help prevent expensive problems by making sure the product runs properly before being released.

3. Benefits of Choosing Agile Advisors for QA Testing

Agile Advisors specialize in helping businesses adopt agile practices, which are proven to improve the efficiency and effectiveness of the QA testing process. Some of the key benefits of working with Agile Advisors for QA testing include:

Faster Time to Market: Agile methodologies emphasize iterative testing, allowing for continuous feedback and faster releases.

Cost Efficiency: Agile testing focuses on delivering value early and often, which can reduce testing costs in the long run.

Enhanced Collaboration: Agile Advisors foster collaboration between development, testing, and business teams, resulting in better outcomes.

Continuous Improvement: Agile practices encourage frequent retrospectives, ensuring that the testing process improves over time.

Adaptability: Agile testing allows teams to quickly adapt to changes in project scope or requirements, ensuring flexibility throughout the project.

4. Types of QA Testing Services in UAE

In Dubai, businesses have access to a variety of QA testing services, each serving different needs depending on the project type. These include:

Manual Testing

In manual testing, human testers carry out test cases without using automated tools. Smaller projects or applications that undergo frequent changes are best suited for this testing.

Automated Testing

Automated testing uses scripts and tools to perform tests, which can save time for repetitive tasks. Automated testing is highly efficient for large-scale applications and systems with complex functionality.

Performance Testing

Performance testing evaluates how a system performs under different conditions. This service is crucial for ensuring that applications can handle high traffic loads and perform well under stress.

Security Testing

Security testing ensures that software applications are resistant to cyber threats and vulnerabilities. This is essential for businesses handling sensitive data, such as in the fintech, healthcare, and e-commerce sectors.

5. How Agile Advisors Can Enhance Your QA Testing Process

Agile Advisors bring a wealth of knowledge in agile methodologies, which directly improve the QA testing process. Here’s how they can help:

Improved Workflow: Agile Advisors introduce frameworks like Scrum or Kanban, streamlining the testing process for greater efficiency.

Real-time Collaboration: By promoting close collaboration between developers, testers, and business stakeholders, Agile Advisors ensure that the testing process aligns with business goals.

Incremental Delivery: Agile Advisors help implement incremental testing, allowing software features to be tested and deployed continuously, ensuring higher product quality at every stage.

Scalability: Agile methodologies are highly scalable, meaning your QA testing can grow with your business, adapting to larger projects or new technologies.

6. The Future of QA Testing in Dubai

QA testing has a promising future as Dubai develops further as a tech hub. In the upcoming years, emerging technologies like blockchain, machine learning, and artificial intelligence (AI) will probably impact software testing. By automating increasingly complicated processes and increasing accuracy, AI-powered testing solutions are already starting to transform the QA sector.

Furthermore, there will be a greater need for reliable QA testing services in Dubai due to the rising demand for cloud-based solutions, web applications, and mobile apps. Agile framework integration will continue to be crucial to ensuring that QA procedures are effective and adaptable.

7. Conclusion

In conclusion, companies looking to produce high-calibre software products that satisfy the needs of a constantly changing digital landscape must have access to QA testing services in Dubai. Collaborating with Agile Advisors may improve your testing procedure and get more dependable, economical, and timely results.

Regardless of your company's age, making sure your software is error-free and functions as intended is essential for success in the cutthroat UAE market. By utilizing Agile Advisors' experience, you can remain ahead of the competition and improve your QA testing.

Please get in touch with our team right now for more details on how Agile Advisors can help with QA testing in Dubai!

0 notes

Text

Top Industries for Offshore Companies in Dubai

Financial Services and Banking Dubai is renowned for its advanced financial services sector, serving as a gateway to the Middle East and global markets. Businesses in this sector can easily tap into the city's strong banking infrastructure, offering access to multi-currency accounts, global transactions, and cross-border investments. Financial technology (fintech) and investment management are rapidly growing industries within this sector. Many international banks, financial institutions, and insurance companies have set up operations in Dubai to benefit from the city's thriving financial ecosystem.

Real Estate Development Dubai’s real estate industry is world-class, with iconic skyscrapers, luxury properties, and commercial spaces. Companies involved in real estate development can benefit from tax exemptions, high returns on investment, and access to a growing real estate market. Dubai's real estate market attracts investors from all over the world, making it a lucrative industry to explore. The government has also introduced initiatives to attract foreign investments into real estate, further enhancing its appeal.

E-commerce and Retail With a high-tech, digitally connected environment, Dubai has become a hub for e-commerce and online retail businesses. Businesses operating in this space can benefit from low operational costs, a wide customer base, and easy access to regional markets. Dubai's infrastructure, including state-of-the-art logistics services, makes it an ideal location for e-commerce businesses to thrive. The city is home to major shopping platforms, such as Noon and Souq, which facilitate seamless trade both locally and internationally.

Technology and IT Services Dubai's focus on innovation and technology has made it a hotbed for IT companies. The city’s government has initiated various programs to support the tech industry, including smart city projects and AI-driven businesses. Companies can gain a competitive edge in this rapidly evolving sector by tapping into Dubai's technological infrastructure and global connections. Cloud services, cybersecurity firms, software development, and digital marketing agencies are some of the most successful industries in Dubai.

Shipping and Logistics Dubai is a global hub for shipping and logistics, with its strategic location providing access to key international trade routes. Businesses involved in shipping, logistics, and freight forwarding can capitalize on Dubai’s top-notch maritime infrastructure, including the world-renowned Jebel Ali Port and Dubai International Airport. These businesses benefit from Dubai’s excellent connectivity to global markets and a well-established logistics ecosystem, making it one of the top industries in the city.

0 notes

Text

Digital Payment Systems in UAE: Transforming the Future of Transactions

Digital Payment Systems in UAE have revolutionized the way businesses and consumers handle transactions, driving convenience and efficiency across the economy. With the UAE's focus on innovation and technology, digital payment platforms have gained immense popularity, becoming an integral part of daily life. These systems offer a wide range of solutions, including mobile wallets, online banking, contactless payments, and blockchain-based transactions, catering to diverse user needs.

One of the key drivers behind the rapid adoption of digital payments in the UAE is the government’s push towards a cashless society. Initiatives such as the Smart Dubai project and the UAE Vision 2021 have emphasized the importance of digital transformation, making electronic payments more secure, accessible, and seamless. Businesses benefit from faster processing times, reduced operational costs, and enhanced customer satisfaction, while consumers enjoy the ease and safety of cash-free transactions.

The UAE’s banking sector, fintech startups, and global payment platforms have contributed significantly to this growth. Innovations like payment gateways, QR code scanning, and biometric authentication have made digital payment systems more reliable and user-friendly. The strong regulatory framework and focus on cybersecurity further ensure the safety of financial transactions, boosting trust among users.

In addition to domestic adoption, digital payment systems in the UAE facilitate cross-border transactions, supporting the country’s global business environment. Tourists and expatriates also benefit from the widespread availability of digital payment options, enhancing their overall experience in the region.

Effective research marketing has played a vital role in promoting digital payment systems in the UAE. By analyzing consumer behavior, payment trends, and market demands, businesses can develop targeted campaigns to drive adoption. The integration of data analytics, AI, and customer insights helps companies position their payment solutions effectively, fostering greater acceptance and usage among diverse audiences. Research-driven strategies enable brands to understand the preferences of UAE's tech-savvy population, ensuring that their offerings remain relevant and competitive in a rapidly evolving market.

As digital payment systems continue to evolve, businesses and individuals in the UAE must stay updated on the latest trends and technologies. By embracing these advancements and leveraging market research insights, they can contribute to a more connected, efficient, and cashless economy that aligns with the nation’s vision for the future.

0 notes

Text

The Advantages of Using a Private Cloud Server in Dubai: A Complete Guide

Introduction

In today's increasingly digital world, businesses need reliable and secure solutions to store, process, and manage their data. Cloud computing has evolved as one of the leading technologies that facilitate smooth operations for businesses of all sizes. Among the various cloud models available, a private cloud server stands out as one of the most preferred options for businesses seeking enhanced security, control, and customization.

Dubai, the thriving commercial hub of the Middle East, is known for its rapid technological advancements. In this highly competitive environment, the demand for scalable and secure IT infrastructure is growing, which is where a Private Cloud Server Dubai plays a pivotal role. This article explores the benefits, features, and considerations associated with using a private cloud server in Dubai.

What is a Private Cloud Server?

A Private Cloud Server refers to a cloud computing environment that is exclusively used by one organization. Unlike public cloud models where resources are shared among multiple clients, a private cloud offers dedicated resources to a single entity, which ensures that data and applications remain isolated from other organizations. In a private cloud, the infrastructure can be hosted either on-premises within the organization’s data center or externally by a third-party provider.

For businesses operating in Dubai, a private cloud solution allows them to leverage the benefits of cloud computing without compromising on security, performance, or regulatory compliance.

Key Benefits of a Private Cloud Server in Dubai

Enhanced Security and Compliance

One of the most significant advantages of a Private Cloud Server Dubai is its superior level of security. Since the resources are dedicated to one organization, businesses have full control over how their data is stored, accessed, and managed. Private clouds are often equipped with robust security measures, including encryption, firewalls, and multi-factor authentication, ensuring that sensitive business information remains protected.

In Dubai, businesses are also required to adhere to a range of data privacy and protection laws, such as the Dubai International Financial Centre (DIFC) Data Protection Law. Using a private cloud solution can help businesses comply with these legal requirements, ensuring that their operations remain secure and compliant with regional regulations.

Customization and Control

Private cloud hosting allows businesses to customize the infrastructure to their specific requirements. From choosing hardware configurations to defining resource allocation, a private cloud gives organizations complete control over their cloud environment. In Dubai, businesses can tailor their private cloud servers to suit their needs, ensuring optimal performance and efficiency.

The flexibility to adjust the cloud environment based on growth or fluctuating needs is especially beneficial for fast-growing companies in dynamic industries such as e-commerce, healthcare, and finance. With a private cloud server, companies can scale resources up or down without disruptions.

Improved Performance and Reliability

Public cloud providers host multiple organizations on shared servers, which can sometimes result in resource contention, slowdowns, and overall performance issues. With a private cloud server, all resources are reserved exclusively for one organization, ensuring higher levels of performance, reliability, and uptime.

Dubai’s bustling business environment relies heavily on continuous access to critical systems and applications. A private cloud offers reduced latency, faster load times, and uninterrupted access, which is essential for businesses where even a short period of downtime can lead to significant financial losses. For industries like e-commerce or fintech, consistent system performance is a critical success factor.

Cost-Effectiveness in the Long Run

While a private cloud may involve a larger initial investment compared to a public cloud, over time it can be more cost-effective for businesses with substantial and predictable workloads. By customizing their infrastructure and reducing the need for continuous resource sharing with other companies, businesses can optimize their cost structures.

Private cloud servers also offer companies in Dubai greater predictability when it comes to managing IT costs. Without hidden charges based on data transfer and usage, organizations can plan their budgets effectively. Additionally, with the ability to scale resources based on actual needs, businesses can avoid over-provisioning, ultimately saving money.

Disaster Recovery and Business Continuity

Business continuity planning is essential for organizations of all sizes. A private cloud server provides a reliable and secure backup infrastructure that ensures operations can continue in case of a disaster. By implementing a private cloud, businesses in Dubai can incorporate disaster recovery protocols that automatically replicate and back up critical data across different servers, helping to ensure business continuity in the face of unforeseen circumstances.

Private clouds offer integrated disaster recovery solutions tailored to specific needs, meaning that recovery times can be significantly reduced compared to traditional backup methods. Whether it’s a power outage, natural disaster, or system failure, businesses can restore their services swiftly without disrupting operations.

Factors to Consider When Choosing a Private Cloud Server in Dubai

Provider Reliability and Support

When opting for a Private Cloud Server Dubai, it’s vital to choose a reliable provider with a track record of providing stable and secure hosting services. Ideally, the cloud service provider should also offer round-the-clock support and quick resolution of any technical issues. Opting for a provider with data centers in Dubai or the broader UAE region ensures faster data access and compliance with local regulations.

Scalability and Flexibility

Ensure that the private cloud provider offers sufficient scalability to meet your business’s future needs. You should have the ability to adjust resources, storage, and computing power easily as your company grows or experiences fluctuations in demand. Dubai is home to some of the fastest-growing companies in the world, and scalability is critical to sustaining growth.

Location of Data Centers

Data sovereignty laws in Dubai and the UAE may dictate where your data can be stored. Choose a cloud service provider whose data centers are located within the UAE or compliant with local legal frameworks to avoid potential legal and regulatory issues. Local data storage guarantees compliance with data protection regulations and ensures faster access times due to reduced latency.

Conclusion

A Private Cloud Server Dubai offers businesses unmatched security, performance, and control. With growing demands for data storage and processing, companies in Dubai can significantly benefit from the advantages of private cloud computing. By ensuring that sensitive business data is securely stored and optimized for fast access, businesses can enhance operations, comply with regulations, and maintain a competitive edge.

While there are initial costs involved in setting up a private cloud infrastructure, the long-term advantages—such as improved reliability, customizable features, and scalable solutions—make it a valuable investment for Dubai-based companies looking to safeguard their future. As Dubai continues to advance as a global business hub, leveraging private cloud technology can empower organizations to thrive in a rapidly changing digital landscape.

Get In Touch

UAE Office :- 50th Floor, Conrad Office Tower, Sheikh Zayed Road, Dubai. UAE

India Office :- L-2/81D, DDA, Kalkaji, New Delhi – 110019

+971 56 738 5010

+91 99108 73034

0 notes

Text

The Ultimate T2T Hybrid Hackathon Dubai Event by PLI & XDC -Success Reviews

The Ultimate T2T Hybrid Hackathon March 2022 Dubai Event, Powered By PLI & XDC which had been organized at Hotel Hyatt Regency, Healthcare City, Dubai on 27th of March has been a huge success with a total of 50 Blockchain Developers participating online as well as onsite. The participants were given the opportunity to register as team or as an individual.

The aim for organizing such Hybrid Hackathon by PLUGIN, a part of XDC network, was to create unique opportunities for Blockchain Developers, across the globe, who intend to convert their Dreams into Reality. The participants came up with different innovative use cases which would play a major role in reducing the global warming and enhance the lives of commoners across the globe. The Hackathon was live streamed on Zoom meeting for continuous 14 hours.

Participants got an opportunity to listen and had live interaction with a number of well known Blockchain Penalists such as Vijaya Marisetty — Professor of Fintech and Financial Analytics, University of Twente and University of Hyderabad; Murthy Chitlur — Technologist, Author, DeFi, Fintech, New Street Technologies Pvt Ltd; Mr. Manohara K — Founder & CEO at Unmarshal; Vinay Krishna — Founder & CEO at LedgerFi IT Solutions; Dr. Baljeet Malhotra — Founder & CEO at TeejLab Inc along with Dr. Holger Bartel — CEO at DigiOptions DeFi. The panelists were hosted by Mr. Srinivas Mahankali — Chief Business Officer-Blockchain (APAC) at SecureKloud Technologies who made the session more lively with his crisp Blockchain bytes.

The hackathon was attended by XDC Ecosystem partners such as LedgerFi, Unmarshal, XDSea NFT, StorX Network and FlovTec. The participants and Ecosystem Partners were welcomed by Mr. Vinod Khurana — CEO, Suvik Group of Companies and Co-Founder, PLUGIN, a Secure, Scalable Decentralized Oracle Platform; who gave a welcome speech and shared insight on the importance of Blockchain in their daily life which includes improving healthcare, better banking transactions, smarter supply chains etc.

There were more than 30 use cases of different domains up for the participants to work upon. These included sectors such as Finance, DeFi, Insurance, HealthCare, NFT, Environment, Supply chain to name a few. Hackathon participants had a whole day full of fun, coding, and hacking, competing for a total prize of USD 10,000 worth of XDC tokens. As they say, Participation is the Key, in addition each of the participating developer being awarded PLI tokens worth USD 100 along with the Certificate of Participation and other goodies.

About Plugin : Plugin: Decentralized Oracle Network https://www.goplugin.co/ Plugin (PLI), a Secure, Scalable Decentralized Oracle Platform, provides cost-effective solutions to any smart contract, which runs on XDC Network. Pugin enables smart contract to connect with the real-time world and the data that it receives from the data feed partners, is trustable by maintaining a high degree of security. Off-chain computation takes care of receiving a feed from multiple providers and aggregates the same.

Contact: Vinod Khurana @ Suvik Technologies FZE Sharjah Research, Technology and Innovation Park. Al Sharjah, United Arab Emirates https://goplugin.co/

Media Contact: Organization: Synergy Global Enterprise LLC Name: Gopi Divecha Address: 111 North Bridge Road #21–01, Singapore 179098 Website: https://pixelproduction.com/ Email: [email protected] WhatsApp: https://wa.me/+6586940671

0 notes

Text

Top Free Zones in the UAE for Entrepreneurs - Raes Associates

The United Arab Emirates (UAE) has become a global hub for business and innovation, particularly for entrepreneurs looking to establish or expand their ventures. One of the key attractions of the UAE is its free zones in the UAE, which offer numerous benefits including 100% foreign ownership, tax exemptions, and simplified business setup processes. In this blog post, we'll explore some of the top UAE free zone company setup options that cater to entrepreneurs.

1. Dubai Multi Commodities Centre (DMCC)

Overview

DMCC is one of the largest and fastest-growing free zones in the UAE, particularly favored by companies in the commodities sector.

Key Benefits

100% foreign ownership

No corporate tax for 50 years

Wide range of business activities permitted

Access to a vibrant business community and networking opportunities

Ideal For

Businesses in commodities trading, fintech, and technology sectors.

2. Sharjah Airport International Free Zone (SAIF Zone)

Overview

SAIF Zone is strategically located near Sharjah International Airport, making it an ideal choice for businesses focused on logistics and trade.

Key Benefits

100% foreign ownership

No import or export duties

Flexibility in leasing options

Cost-effective setup and operational fees

Ideal For

Logistics, warehousing, and manufacturing companies.

3. Abu Dhabi Global Market (ADGM)

Overview

ADGM is a financial free zone located in the capital city, Abu Dhabi. It aims to promote financial services and innovation.

Key Benefits

100% foreign ownership

No corporate tax

Robust regulatory framework

Access to a growing market in the UAE and beyond

Ideal For

Financial services, fintech startups, and investment firms.

4. Fujairah Free Zone

Overview

Situated near Fujairah Port, this free zone is perfect for businesses involved in shipping and logistics.

Key Benefits

100% foreign ownership

No corporate tax

Proximity to key shipping routes

Efficient customs procedures

Ideal For

Shipping, logistics, and maritime-related businesses.

5. Ras Al Khaimah Economic Zone (RAKEZ)

Overview

RAKEZ combines multiple free zones under one umbrella, offering diverse options for businesses in various sectors.

Key Benefits

100% foreign ownership

No corporate tax

Affordable setup costs

Access to both local and international markets

Ideal For

A wide range of industries, including manufacturing, trading, and service-based businesses.

6. Ajman Free Zone

Overview

Ajman Free Zone is known for its affordability and ease of doing business, making it attractive for startups.

Key Benefits

100% foreign ownership

No corporate tax

Flexible licensing options

Low operational costs

Ideal For

Small and medium-sized enterprises (SMEs) across various industries.

Conclusion

The UAE's free zones present unparalleled opportunities for entrepreneurs looking to establish their businesses in a thriving environment. With benefits like full foreign ownership, tax exemptions, and streamlined processes, these zones provide the perfect launchpad for startups and established businesses alike. Whether you're in logistics, finance, or tech, there’s a free zone tailored to your needs.

0 notes

Text

The Future of Business in Dubai: Trends to Watch in 2024

Dubai continues to solidify its position as a global business hub, attracting entrepreneurs and investors worldwide. With the city’s strategic initiatives and a keen eye on future growth, the landscape of business in Dubai is rapidly evolving. Here are the top trends to watch in 2024 if you’re considering a Setup Dubai Business.

Rise of Digital Transformation

Digital transformation is reshaping every industry in Dubai. Businesses are increasingly leveraging AI, blockchain, and IoT to streamline operations and enhance customer experiences. In 2024, companies that adopt these technologies will gain a competitive edge, particularly in sectors like retail, logistics, and finance. When planning a Business Setup in Dubai, incorporating digital strategies from the start will be crucial.

2. Sustainability and Green Business Initiatives

Dubai is committed to becoming a global leader in sustainability, with initiatives like the Dubai Clean Energy Strategy 2050. Businesses focusing on eco-friendly practices, renewable energy, and sustainable products are expected to thrive. Entrepreneurs should consider integrating sustainable practices into their business models to align with the emirate’s long-term vision.

3. Growth of E-Commerce and Online Services

The e-commerce sector in Dubai is booming, driven by a tech-savvy population and high internet penetration rates. In 2024, more businesses are expected to go digital, offering products and services online. For new entrepreneurs, setting up an e-commerce business in Dubai’s free zones, which offer incentives like 100% foreign ownership and tax exemptions, can be highly lucrative.

4. Expansion of Free Zones

Free Zones continue to be a significant draw for foreign investors due to their favorable business environment. In 2024, new Free Zones and expansions are likely, offering more opportunities for businesses to operate with benefits like full repatriation of profits and no import duties. A Setup Dubai Business in a Free Zone is ideal for those looking for a hassle-free entry into the market.

5. Healthcare and Wellness Industry Boom

The healthcare and wellness sector is set to grow in response to increasing demand for quality healthcare services. Dubai’s government is investing heavily in healthcare infrastructure, making it an attractive sector for investment. Medical technology, telemedicine, and wellness services will be key areas for new business ventures.

6. Rise of Fintech and Digital Payments

Fintech is revolutionizing the financial sector in Dubai, with a strong push towards digital payments and cashless transactions. The government’s support for innovation in fintech will continue into 2024, creating opportunities for startups focusing on payment solutions, digital banking, and financial services.

Flexible Workspaces and Remote Work

The pandemic has accelerated the shift towards flexible workspaces and remote work. Dubai is adapting to this trend by offering more co-working spaces and remote business setup options. For those considering a Business Setup in Dubai, flexible office solutions can reduce overhead costs and provide agility.

Final Thoughts

As a leading business consultancy in Dubai, we understand that staying ahead of emerging trends is vital for success. The business landscape in Dubai is evolving, with digital transformation, sustainability, and innovation taking center stage in 2024. By aligning your business strategy with these trends, you can position your company for growth and long-term success in this dynamic market. Whether you’re planning a new Business Setup in Dubai or looking to expand, our team is here to guide you through every step, ensuring your venture thrives in the competitive Dubai business environment.

0 notes

Text

0 notes

Text

Measuring ROI in IT Recruitment: Beyond Cost-per-Hire Metrics

Hey there, fellow entrepreneurs and business owners! Whether you're running a tech startup in London, a software development firm in New York, or an IT consultancy in Dubai, I bet you're all too familiar with the headache of recruiting top tech talent. And if you're anything like me, you've probably wondered if all that time, effort, and money you're pouring into recruitment is really paying off.