#construction is one of the world's largest producers of carbon

Explore tagged Tumblr posts

Text

“William wants to focus on energy efficient housing projects rather than traditionally-designed ones in the Duchy of Cornwall”

#construction is one of the world's largest producers of carbon#reducing emissions is impossible without looking at housing first#building net zero homes and especially remodeling homes to be net zero is very very expensive#but I'm glad to see baldy addresing this#hopefully looking into it with earthshot as well#ily baldy#william#ju rambles#architecture and the environment are my two passions what can I say

4 notes

·

View notes

Text

On her fingers, Chicago’s Chief Sustainability Officer Angela Tovar counted the city buildings that will soon source all of their power from renewable energy: O’Hare International Airport, Midway International Airport, City Hall.

[Note: This is an even huger deal than it sounds like. Chicago O'Hare International Airport is, as of 2023, the 9th busiest airport in the world.]

Chicago’s real estate portfolio is massive. It includes 98 fire stations, 81 library locations, 25 police stations and two of the largest water treatment plants on the planet — in all, more than 400 municipal buildings.

It takes approximately 700,000 megawatt hours per year to keep the wheels turning in the third largest city in the country. Beginning Jan. 1, every single one of them will come solely from clean, renewable energy, mostly sourced from Illinois’ newest and largest solar farm. The move is projected to cut the Windy City’s carbon footprint by approximately 290,000 metric tons of carbon dioxide each year, the equivalent of taking 62,000 cars off the road, the city said.

Chicago is one of several cities across the country that are not only shaking up their energy mix but also taking advantage of their bulk-buying power to spur new clean energy development.

The city — and much of Illinois — already has one of the cleanest energy mixes in the country, with over 50% of the state’s electricity coming from nuclear power. But while nuclear energy is considered “clean,” carbon-free energy, it is not considered renewable.

Chicago’s move toward renewable energy has been years in the making. The goal of sourcing the city’s energy purely from renewable sources was first established by Mayor Rahm Emanuel in 2017. In 2022, Mayor Lori Lightfoot struck a deal with electricity supplier Constellation to purchase renewable energy from developer Swift Current Energy for the city, beginning in 2025.

Swift Current began construction on the 3,800-acre, 593-megawatt solar farm in central Illinois as part of the same five-year, $422 million agreement. Straddling two counties in central Illinois, the Double Black Diamond Solar project is now the largest solar installation east of the Mississippi River. It can produce enough electricity to power more than 100,000 homes, according to Swift Current’s vice president of origination, Caroline Mann.

Chicago alone has agreed to purchase approximately half the installation’s total output, which will cover about 70 percent of its municipal electricity needs. City officials plan to cover the remaining 30 percent through the purchase of renewable energy credits.

“That’s really a feature and not a bug of our plan,” said deputy chief sustainability officer Jared Policicchio. He added that he hopes the built-in market will help encourage additional clean energy development locally, albeit on a much smaller scale: “Our goal over the next several years is that we reach a point where we’re not buying renewable energy credits.”

Los Angeles, Houston, Seattle, Orlando, Florida, and more than 700 other U.S. cities and towns have signed similar purchasing agreements since 2015, according to a 2022 study from World Resources Institute, but none of their plans mandate nearly as much new renewable energy production as Chicago’s.

“Part of Chicago’s goal was what’s called additionality, bringing new resources into the market and onto the grid here,” said Popkin. “They were the largest municipal deal to do this.”

Chicago also secured a $400,000 annual commitment from Constellation and Swift Current for clean energy workforce training, including training via Chicago Women in Trades, a nonprofit aiming to increase the number of women in union construction and manufacturing jobs.

The economic benefits extend past the city’s limits: According to Swift Current, approximately $100 million in new tax revenue is projected to flow into Sangamon County and Morgan County, which are home to the Double Black Diamond Solar site, over the project’s operational life.

“Cities and other local governments just don’t appreciate their ability to not just support their residents but also shape markets,” said Popkin. “Chicago is demonstrating directly how cities can lead by example, implement ambitious goals amidst evolving state and federal policy changes, and leverage their purchasing power to support a more equitable renewable energy future.” ...

Chicago will meet its goal of transitioning all its municipal buildings to renewable energy by 2025, the first step in a broader goal to source energy for all buildings in the city from renewables by 2035 — making it the largest city in the country to do so, according to the Sierra Club.

With the incoming Trump administration promising to decrease federal support for decarbonizing the economy, Dane says it will be increasingly important for cities, towns and states to drive their own efforts to reduce emissions, build greener economies and meet local climate goals. He says moves like Chicago’s prove that they are capable.

“That is an imperative thing to know, that state, city, county action is a durable pathway, even under the next administration, and [it] needs to happen,” said Dane. “The juice is definitely still worth the squeeze.”

-via WBEZ, December 24, 2024

#chicago#united states#north america#renewables#renewable energy#solar power#solar farm#environment#climate action#illinois#decarbonization#airports#good news#hope

1K notes

·

View notes

Text

okay

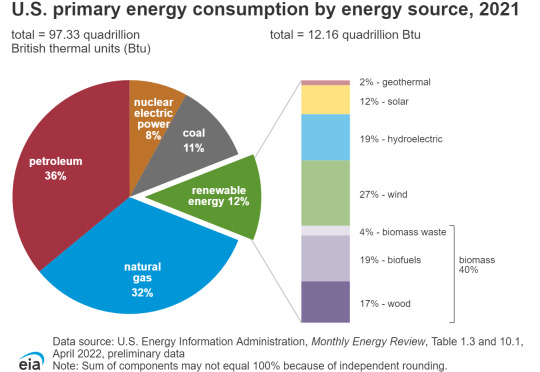

For decades, nuclear power has been the largest source of clean energy in the United States, accounting for 19% of total energy produced last year

false. first sentence. off to a great start. you may notice this is a 2022 chart but i can tell you the only new reactors started since then are vogtle 3 and 4 (you may notice that's not a new power plant but new reactors at an existing plant), years late and $17b over budget, vogtle as a whole produces 1.1gwh, we use about 29 million annually. point being: it has not risen to 19%, the last reactor since vogtle was watts bar in 2016 and since then we've decommissioned 14 of them

The industry directly employs nearly 60,000 workers in good paying jobs

weirdly low estimate, almost by half

maintains these jobs for decades

"maintains" is doing a lot of work here, does that include toxic exposure payouts? because they are still fighting pretty hard to get those in the world's first nuclear contamination site, hanford

and supports hundreds of thousands of other workers

✅ true! 475,000 according to the NEI link above

In the midst of transformational changes taking place throughout the U.S. energy system

sure

the Biden-Harris Administration is continuing to build on President Biden’s unprecedented goal of a carbon free electricity sector by 2035

have they developed carbon free cement yet? (yes.) at scale? (no.) are we just not counting construction emissions because they're one-time emissions investments or how does this work exactly, i would love to know because i think we're also not counting emissions from waste transport to longterm storage because we haven't started doing that. anyway they've built a train for it even though we don't have a storage site so that's umm. that's uhh. fine i'm sure

while also ensuring that consumers across the country have access to affordable, reliable electric power

i guess you can still say "across the country" if you exclude texas as an outlier

and creating good-paying clean energy jobs.

i guess you can still call them good paying clean energy jobs if everybody who mines and refines the uranium dies of cancer because you just pulled out of the largest disarmament program in history due to it being geopolitically inadmissible (for russia... to continue... selling us the uranium from decommissioning...? i'm still trying to figure out the optics of that one but anyway as i have previously stated we didn't actually stop buying it in cases where it's "liable to cause supply chain issues")

Alongside renewable power sources like wind and solar, a new generation of nuclear reactors is now capturing the attention of a wide range of stakeholders

weird way to say that

for nuclear energy’s ability to produce clean, reliable energy and meet the needs of a fast-growing economy, driven by President Biden’s Investing in America agenda and manufacturing boom.

this is a carrier sentence to inject the president's name, but i would like to question which sectors of the growing economy are driving the most energy demand because i'm sure there are no nasty truths being elided there (it's computing)

The Administration recognizes that decarbonizing our power system, which accounts for a quarter of all the nation’s greenhouse gas emissions, represents a pivotal challenge requiring all the expertise and ingenuity our nation can deliver.

it's time once again for... the energy flow sankey chart! the reason the power system accounts for a quarter of greenhouse gas emissions is in no small part because 67% of it is lost to waste heat. has the nation's expertise and ingenuity started working on that yet

The Biden-Harris Administration is today hosting a White House Summit on Domestic Nuclear Deployment, highlighting the collective progress being made from across the public and private sectors

oh boy! a summit! talking about it is the same as doing it

Under President Biden’s leadership, the Administration has taken a number of actions to strengthen our nation’s energy and economic security by reducing – and putting us on the path to eliminating – our reliance on Russian uranium for civil nuclear power and building a new supply chain for nuclear fuel

gosh, i got ahead of myself and already criticized both of those things

including: signing on to last year’s multi-country declaration at COP28 to triple nuclear energy capacity globally by 2050

everybody criticized that

developing new reactor designs

which ones, the bill gates project that just got cancelled because utilities pulled out (edit: that's nuscale, the bill gates project is terrapower), the rolls royce submarine, or the one that just got regulatory approval (edit: this is also nuscale)

extending the service lives of existing nuclear reactors

yep! you sure showed the embrittlement at diablo canyon by doing nothing about it

and growing the momentum behind new deployments

nonsense clause, but it has this really ominous undercurrent due to its vagueness

Recognizing the importance of both the existing U.S. nuclear fleet and continued build out of large nuclear power plants, the U.S. is also taking steps to mitigate project risks associated with large nuclear builds and position U.S. industry to support an aggressive deployment target.

this one is not nonsense but they can't just out and out say "we are deregulating the industry because opening the process for public comment is most often the thing that slows it down" because then somebody might realize they're bulldozing ahead no matter what any constituent says, does, or actually wants

To help drive reactor deployment while ensuring ratepayers and project stakeholders are better protected, theAdministration is announcing today the creation of a Nuclear Power Project Management and Delivery working group that will draw on leading experts from across the nuclear and megaproject construction industry to help identify opportunities to proactively mitigate sources of cost and schedule overrun risk

i'm sure a revolving door working group packed with industry insiders can solve this without compromising their commitment to the profit motive, not that it particularly matters since the cost is passed on to the consumer in the form of fees on the electric bill

The United States Army is also announcing that it will soon release a Request for Information to inform a deployment program for advanced reactors to power multiple Army sites in the United States

good god... that is a fresh nightmare i did not see coming

Additionally, the Department of Energy released today a new primer highlighting the expected enhanced safety of advanced nuclear reactors

"expected" really serves to demonstrate several points i've made

i'm going to stop going line by line here because i know this is already too boring and long for anyone to read this far, unless anybody wants to know what i think about parts 50, 52, and 53 of the NRC licensing guidance -- which many of you have very clearly stated over the years that you don't -- and while i do want to acknowledge that it does go into more detail and even answer some of the questions i raised (vogtle comes up, diablo canyon comes up, a list of which SMR designs is given, or at least a list of the companies responsible for them),

what i would like to focus on is one conspicuous absence:

the reason we need a new fleet of reactors is because they are an essential part of the bomb production chain. they are the beginning of the refinement process, and we cannot carry out the plan (already underway) to replace the minutemen missiles currently in silos with sentinel missiles without significant new construction. we cannot start the president's desired wars with russia and china without the new sentinels. he's not going to be the one to carry this out, he's ensuring whoever is his successor in about 2030 or more likely 2040 will be armed to do so. limited amount of time left to prevent that

93 notes

·

View notes

Text

Excerpt from this story from Truthout:

It takes approximately 700,000 megawatt hours of electricity to power Chicago’s more than 400 municipal buildings every year. As of January 1, every single one of them — including 98 fire stations, two international airports, and two of the largest water treatment plants on the planet — is running on renewable energy, thanks largely to Illinois’ newest and largest solar farm. The move is projected to cut the carbon footprint of the country’s third-largest city by approximately 290,000 metric tons of carbon dioxide each year — the equivalent of taking 62,000 cars off the road, according to the city. Local decarbonization efforts like Chicago’s are taking on increasing significance as President-elect Donald Trump promises to reduce federal support for climate action. With the outgoing Biden administration doubling down on an international pledge to get the U.S. to net-zero emissions by 2050, cities, states, and private-sector players across the country will have to pick up the slack.

Chicago is one of several U.S. cities that are taking advantage of their bulk-buying power to spur new carbon-free energy development.

Chicago’s switch to renewable energy has been almost a decade in the making. The goal of sourcing the city’s power purely from carbon-free sources was first established by then-Mayor Rahm Emanuel in 2017. His successor, Mayor Lori Lightfoot, struck a 2022 deal with Constellation, an electricity supplier, to purchase the city’s energy from the developer Swift Current Energy beginning in 2025.

Swift Current began construction on the 3,800-acre, 593-megawatt solar farm in central Illinois as part of the same five-year, $422 million agreement. Straddling two counties in central Illinois, the Double Black Diamond Solar project is now the largest solar installation east of the Mississippi River. It can produce enough electricity to power more than 100,000 homes, according to Swift Current’s vice president of origination, Caroline Mann.

Chicago alone has agreed to purchase approximately half the installation’s total output, which will cover about 70 percent of its municipal buildings’ electricity needs. City officials plan to cover the remaining 30 percent through the purchase of renewable energy credits.

“That’s really a feature and not a bug of our plan,” said Deputy Chief Sustainability Officer Jared Policicchio. He added that he hopes the city’s demand for 100 percent renewable energy will encourage additional clean energy development locally, albeit on a much smaller scale, which will create new sources of power that the city can then purchase directly, in lieu of credits. “Our goal over the next several years is that we reach a point where we’re not buying renewable energy credits.”

More than 700 other U.S. cities and towns have signed similar purchasing agreements since 2015, according to a 2022 study from the World Resources Institute. Only one city, Houston, has a larger renewable energy deal than Chicago, according to Matthew Popkin, the cities and communities U.S. program manager at Rocky Mountain Institute, a nonprofit whose research focuses on decarbonization. However, he added, no other contract has added as much new renewable power to the grid as Chicago’s.

23 notes

·

View notes

Text

DID YOU KNOW? This is what an oil platform looks like before being submerged in the ocean.

The largest object in the world is made of concrete.

Wonders of engineering.

The record-holding largest object in the world is built of concrete. It is the Troll A marine platform, which extracts gas in the North Sea.

It is owned by Shell Oil and is the heaviest object ever transported by water from where it was constructed, on the coast, to its final location in the sea.

It was completed in 1991 and was moved by 10 ships over several days. It weighs 1,050,000 tons, and its construction used 245,000 cubic meters of concrete and approximately 100,000 tons of reinforced steel.

The Troll A in the North Sea is located 80 kilometers offshore northwest of Bergen, Norway. The platform is the largest ever transported, weighing 683,600 tons and standing 472 meters tall. The Troll A belongs to the gravity base foundations, meaning it rests on the seabed due to its weight. The construction of the platform cost $650 million at the time.

The Troll A platform is a milestone in engineering and has set several records in the Guinness Book. In 1996, it set the record as the largest oil platform in the world, a record later surpassed by the Petronius platform. In 2006, singer Katie Melua held a concert at its base, setting the record for the deepest underwater concert, 303 meters below sea level.

The Troll A platform has contributed to Norway's economic development, as the country is one of the world's largest exporters of natural gas. Additionally, the platform has helped reduce carbon dioxide emissions and improve air quality, as natural gas is a cleaner alternative compared to coal or diesel.

The technology used in the construction and operation of the Troll A platform has been revolutionary. Shell has developed technology to produce, liquefy, store, and offload gas onto floating liquefied natural gas carriers (FLNG) at sea. These advanced technologies allow access to remote natural gas fields and serve larger fields with various FLNG installations.

The environmental impact of the Troll A platform has been minimized thanks to directional drilling, which has played a crucial role in accessing the Troll field while simultaneously reducing environmental impact. Directional drilling tools provide real-time data to guide the drilling process, ensuring precise well placement.

In summary, the Troll A in the North Sea is a natural gas extraction platform owned by Shell that has contributed to Norway's economic development and helped reduce carbon dioxide emissions and improve air quality. The technology used in its construction and operation has been revolutionary and has minimized environmental impact.

Credtis to the rightful owner

3 notes

·

View notes

Text

Sustainable Fashion: A Guide to Ethical Choices Sustainable Fashion: A Guide to Ethical Choices

In today's world, conscious consumerism is on the rise. People are increasingly aware of the impact their choices have on the environment and society. This shift has also extended to the fashion industry, leading to a growing demand for sustainable and ethical clothing.

What is Sustainable Fashion?

Sustainable fashion refers to clothing and accessories that are produced in a way that minimizes environmental impact and ensures fair labor practices. It encompasses everything from the choice of materials to the manufacturing processes and the overall lifecycle of a garment.

Why is Sustainable Fashion Important?

Environmental Impact: The fashion industry is one of the world's largest polluters. By choosing sustainable options, you can help reduce waste, conserve resources, and minimize carbon emissions.

Ethical Considerations: Sustainable fashion ensures that workers are treated fairly and that the production process does not exploit people or the planet.

Quality and Durability: Sustainable garments are often made with higher quality materials and better construction techniques, ensuring they last longer and reduce waste.

How to Choose Sustainable Fashion:

Research Brands: Look for brands that prioritize sustainability in their practices. Many brands now have certifications or labels that indicate their commitment to ethical and environmentally friendly production.

Consider Materials: Opt for natural fibers like organic cotton, linen, and bamboo, which are renewable and biodegradable. Avoid synthetic fabrics like polyester, which are derived from fossil fuels and can release harmful chemicals during production.

Check for Fair Trade Certifications: Fair Trade labels guarantee that the products were made under fair working conditions and that workers received a living wage.

Buy Less, Wear More: Invest in high-quality, timeless pieces that you can wear for years to come. Reduce impulse purchases and focus on building a sustainable wardrobe.

Support Secondhand and Vintage: Give pre-loved clothing a new life by shopping at thrift stores, consignment shops, or online marketplace

Sustainable Fashion Tips:

Wash Clothes Less Frequently: Excessive washing can contribute to the degradation of fabrics and release microplastics into the water.

Air Dry Clothes: Avoid using a dryer, which can shrink or damage garments and consume a lot of energy.

Repair and Mend: Instead of discarding damaged clothes, learn to repair or mend them to extend their lifespan.

Donate or Recycle: When you're ready to part with old clothes, donate them to charity or recycle them. Many clothing retailers now have recycling programs.

By making conscious choices and supporting sustainable fashion brands, you can contribute to a more ethical and environmentally friendly fashion industry. Together, we can create a future where style and sustainability go hand in hand.

3 notes

·

View notes

Text

Aluminum Market: Products, Applications & Beyond

Aluminum is a versatile element with several beneficial properties, such as a high strength-to-weight ratio, corrosion resistance, recyclability, electrical & thermal conductivity, longer lifecycle, and non-toxic nature. As a result, it witnesses high demand from industries like automotive & transportation, electronics, building & construction, foil & packaging, and others. The high applicability of the metal is expected to drive the global aluminum market at a CAGR of 5.24% in the forecast period from 2023 to 2030.

Aluminum – Mining Into Key Products:

Triton Market Research’s report covers bauxite, alumina, primary aluminum, and other products as part of its segment analysis.

Bauxite is anticipated to grow with a CAGR of 5.67% in the product segment over the forecast years.

Bauxite is the primary ore of aluminum. It is a sedimentary rock composed of aluminum-bearing minerals, and is usually mined by surface mining techniques. It is found in several locations across the world, including India, Brazil, Australia, Russia, and China, among others. Australia is the world’s largest bauxite-producing nation, with a production value of over 100 million metric tons in 2022.

Moreover, leading market players Rio Tinto and Alcoa Corporation operate their bauxite mines in the country. These factors are expected to propel Australia’s growth in the Asia-Pacific aluminum market, with an anticipated CAGR of 4.38% over the projected period.

Alumina is expected to grow with a CAGR of 5.42% in the product segment during 2023-2030.

Alumina or aluminum oxide is obtained by chemically processing the bauxite ore using the Bayer process. It possesses excellent dielectric properties, high stiffness & strength, thermal conductivity, wear resistance, and other such favorable characteristics, making it a preferable material for a range of applications.

Hydrolysis of aluminum oxide results in the production of high-purity alumina, a uniform fine powder characterized by a minimum purity level of 99.99%. Its chemical stability, low-temperature sensitivity, and high electrical insulation make HPA an ideal choice for manufacturing LED lights and electric vehicles. The growth of these industries is expected to contribute to the progress of the global HPA market.

EVs Spike Sustainability Trend

As per the estimates from the International Energy Agency, nearly 2 million electric vehicles were sold globally in the first quarter of 2022, with a whopping 75% increase from the preceding year. Aluminum has emerged as the preferred choice for auto manufacturers in this new era of electromobility. Automotive & transportation leads the industry vertical segment in the studied market, garnering $40792.89 million in 2022.

In May 2021, RusAl collaborated with leading rolled aluminum products manufacturer Gränges AB to develop alloys for automotive applications. Automakers are increasingly substituting stainless steel with aluminum in their products owing to the latter’s low weight, higher impact absorption capacity, and better driving range.

Also, electric vehicles have a considerably lower carbon footprint compared to their traditional counterparts. With the growing need for lowering emissions and raising awareness of energy conservation, governments worldwide are encouraging the use of EVs, which is expected to propel the demand for aluminum over the forecast period.

The Netherlands is one of the leading countries in Europe in terms of EV adoption. The Dutch government has set an ambitious goal that only zero-emission passenger cars (such as battery-operated EVs, hydrogen FCEVs, and plug-in hybrid EVs) will be sold in the nation by 2030. Further, according to the Canadian government, the country’s aluminum producers have some of the lowest CO2 footprints in the world.

Alcoa Corporation and Rio Tinto partnered to form ELYSIS, headquartered in Montréal, Canada. In 2021, it successfully produced carbon-free aluminum at its Industrial Research and Development Center in Saguenay. The company is heralding the beginning of a new era for the global aluminum market with its ELYSIS™ technology, which eliminates all direct GHG emissions from the smelting process, and is the first technology ever to emit oxygen as a byproduct.

Wrapping Up

Aluminum is among the most widely used metals in the world today, and is anticipated to underpin the global transition to a low-carbon economy. Moreover, it is 100% recyclable and can retain its properties & quality post the recycling process.

Reprocessing the metal is a more energy-efficient option compared to extracting the element from an ore, causing less environmental damage. As a result, the demand for aluminum in the sustainable energy sector has thus increased. The efforts to combat climate change are thus expected to bolster the aluminum market’s growth over the forecast period.

#Aluminum Market#aluminum#chemicals and materials#specialty chemicals#market research#market research reports#triton market research

4 notes

·

View notes

Text

Steel Wire Rod Prices, News, Trend, Graph, Chart, Monitor and Forecast

Steel Wire Rod prices have been experiencing fluctuations due to a combination of supply chain constraints, raw material costs, global economic conditions, and market demand. The steel industry plays a crucial role in infrastructure development, construction, automotive, and various industrial applications, making wire rods a fundamental component in many sectors. The pricing dynamics of steel wire rods are influenced by multiple factors, including iron ore and scrap metal prices, energy costs, production capacities, geopolitical events, and trade policies. As global economies recover from economic slowdowns and industrial activities resume, steel wire rod prices have shown both volatility and resilience, reflecting shifts in supply and demand dynamics.

One of the key drivers impacting steel wire rod prices is the fluctuation in raw material costs, particularly iron ore and scrap metal. Iron ore prices have been highly volatile due to supply disruptions, logistical challenges, and changing demand from major steel-producing nations such as China and India. Scrap metal, another essential raw material for steel production, has also seen price swings based on collection rates, recycling efficiency, and transportation costs. The availability and pricing of these raw materials directly affect the cost of producing steel wire rods, leading to periodic adjustments in market prices. Additionally, the cost of energy, including electricity and gas, plays a crucial role in steel manufacturing. Rising energy costs increase production expenses, forcing manufacturers to pass on the cost burden to consumers, ultimately influencing steel wire rod pricing trends.

Get Real time Prices for Steel Wire Rod: https://www.chemanalyst.com/Pricing-data/steel-wire-rod-1378

Global trade policies and geopolitical tensions have also been critical in shaping the steel wire rod market. Tariffs, import restrictions, and anti-dumping duties imposed by major economies impact international trade flows and pricing structures. Countries such as the United States and the European Union have implemented protective measures to support domestic steel industries, resulting in supply constraints and price hikes in some regions. Additionally, trade disputes between major steel-producing nations create uncertainty in the market, leading to speculative trading and price fluctuations. Currency exchange rates further add to the complexity, as fluctuations in the value of major currencies impact the cost of imports and exports, affecting pricing trends across different markets.

Demand from end-user industries is another major factor that determines steel wire rod prices. The construction sector, which is one of the largest consumers of steel wire rods, experiences cyclical demand fluctuations based on infrastructure projects, real estate development, and public investments. During periods of economic growth and increased infrastructure spending, demand for steel wire rods rises, pushing prices higher. Conversely, during economic downturns or slowdowns in construction activities, demand weakens, leading to price corrections. The automotive industry also significantly influences steel wire rod prices, as these materials are used in the manufacturing of vehicle components such as fasteners, suspension systems, and reinforcement structures. Any disruption in automotive production, whether due to supply chain issues or reduced consumer demand, can affect the pricing and demand outlook for steel wire rods.

Market dynamics within key steel-producing regions further contribute to price trends. China, the world’s largest producer and consumer of steel, has a substantial influence on global steel wire rod prices. The country’s steel production policies, environmental regulations, and economic growth rates all affect supply and demand dynamics. Government-mandated production cuts to reduce carbon emissions have led to supply shortages, driving prices higher. Additionally, China's demand for construction and infrastructure projects directly impacts the global steel market, with any policy changes or economic slowdowns reverberating through international markets. Other significant steel-producing regions, such as India, Europe, and North America, also play a role in shaping pricing trends, with production capacities, technological advancements, and industry regulations affecting overall supply and demand balances.

The COVID-19 pandemic brought unprecedented disruptions to the steel industry, causing temporary plant shutdowns, labor shortages, and logistical bottlenecks. These factors led to supply constraints and a sharp rise in steel wire rod prices in the post-pandemic recovery phase. As industries resumed operations and demand surged, supply chains struggled to keep up, resulting in price spikes. However, as supply chains stabilized and production capacities adjusted, steel wire rod prices moderated in some regions. The long-term impact of the pandemic continues to influence market behavior, with manufacturers and consumers adapting to new economic realities and evolving supply chain strategies.

Sustainability and environmental concerns are increasingly shaping the steel wire rod market. Governments and regulatory bodies worldwide are implementing stricter environmental policies to reduce carbon emissions and promote sustainable manufacturing practices. The steel industry, being one of the largest contributors to industrial emissions, is under pressure to adopt cleaner technologies and reduce its carbon footprint. This transition toward green steel production, including the use of hydrogen-based steelmaking and electric arc furnaces, adds new cost considerations to the industry. As a result, production costs are expected to rise in the long run, potentially affecting steel wire rod prices. Additionally, companies investing in sustainable practices and low-carbon steel production may experience higher operational expenses, which could be passed on to consumers through price adjustments.

Looking ahead, the steel wire rod market is expected to remain dynamic, with prices influenced by macroeconomic conditions, industrial demand, and evolving trade policies. Market participants, including manufacturers, suppliers, and consumers, will need to closely monitor raw material costs, production capacities, and geopolitical developments to navigate price volatility effectively. Technological advancements in steel manufacturing and supply chain efficiencies may help stabilize prices to some extent, but external factors such as inflation, monetary policies, and infrastructure investments will continue to play a crucial role. While short-term price fluctuations are inevitable, long-term growth prospects for the steel wire rod market remain positive, driven by increasing urbanization, infrastructure development, and industrial expansion in emerging economies.

Get Real time Prices for Steel Wire Rod: https://www.chemanalyst.com/Pricing-data/steel-wire-rod-1378

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Steel Wire Rod#Steel Wire Rod Price#Steel Wire Rod Prices#India#united kingdom#united states#Germany#business#research#chemicals#Technology#Market Research#Canada#Japan#China

0 notes

Text

The Global Synthetic Rubber Market: Key Players, Trends, and Future Predictions

Synthetic rubber is an essential material used across various industries, including automotive, construction, aerospace, healthcare, and electronics. With its superior durability, resistance to heat and chemicals, and flexibility, synthetic rubber has become a crucial component in modern manufacturing. The global synthetic rubber market is witnessing significant growth, driven by technological advancements, sustainability initiatives, and rising demand from emerging economies.

This article explores the key players, current trends, and future predictions shaping the synthetic rubber market.

Key Players in the Synthetic Rubber Market

The global synthetic rubber market is highly competitive, with several multinational companies dominating production and innovation. Some of the leading players include:

1. Arlanxeo

A joint venture between Saudi Aramco and Lanxess, Arlanxeo is one of the world’s largest producers of synthetic rubber. The company specializes in high-performance rubber solutions used in automotive and industrial applications.

2. Apcotex Industries Limited

Apcotex Industries Limited is a leading Indian manufacturer of synthetic rubber and latex products. The company produces Nitrile Butadiene Rubber (NBR), High Styrene Rubber (HSR), and Carboxylated Styrene Butadiene Rubber (XSBR), catering to industries such as automotive, construction, footwear, and adhesives. Apcotex is known for its focus on product innovation and sustainable manufacturing practices.

3. Goodyear Tire & Rubber Company

Goodyear is a significant player in the synthetic rubber industry, producing high-performance rubber for its own tire production and other industrial applications. The company invests heavily in research and development to enhance rubber durability and sustainability.

4. Kumho Petrochemical

Based in South Korea, Kumho Petrochemical is a global leader in synthetic rubber, latex, and resins. The company focuses on innovation in eco-friendly rubber production to reduce environmental impact.

5. Dow Chemical Company

A key innovator in the synthetic rubber industry, Dow Chemical produces high-performance elastomers used in automotive, aerospace, and industrial applications. The company is known for developing sustainable alternatives to traditional rubber.

These companies continue to drive market growth through advancements in technology, sustainability, and product innovation.

Current Trends in the Synthetic Rubber Market

The synthetic rubber industry is evolving with new trends that focus on sustainability, performance enhancements, and digital transformation.

1. Rising Demand from the Automotive Industry

The automotive sector accounts for over 60% of global synthetic rubber consumption, primarily for tire manufacturing. With the rise of electric vehicles (EVs), manufacturers are developing low rolling resistance synthetic rubber to improve energy efficiency.

2. Growth in Sustainable and Bio-Based Synthetic Rubber

Environmental concerns are driving the industry toward sustainable alternatives to petroleum-based synthetic rubber. Companies are investing in:

Bio-based rubber from renewable sources like sugarcane and soybean oil.

Recycling technologies to reduce synthetic rubber waste and repurpose old materials.

Carbon footprint reduction strategies by optimizing production processes.

3. Expansion in Emerging Markets

Countries like India, Brazil, and Indonesia are experiencing rapid industrialization, increasing the demand for synthetic rubber in automotive, construction, and manufacturing industries. The Asia-Pacific region is expected to dominate the market due to its growing infrastructure and manufacturing sectors.

4. Advancements in High-Performance Synthetic Rubber

Companies are developing specialized synthetic rubber with improved properties such as:

Higher temperature resistance for aerospace and industrial applications.

Better chemical resistance for medical and pharmaceutical uses.

Improved durability and elasticity for sports and footwear industries.

5. Increasing Use of AI and Automation in Production

Manufacturers are adopting Artificial Intelligence (AI) and automation to optimize rubber production, enhance quality control, and reduce energy consumption. Smart factories are being integrated into production lines, improving efficiency and reducing waste.

Future Predictions for the Synthetic Rubber Market

The global synthetic rubber market is expected to reach $50 billion by 2030, driven by sustainability efforts, technological advancements, and increasing industrial applications. Here are some key predictions:

1. Transition to More Eco-Friendly Production Methods

Governments worldwide are imposing stricter environmental regulations, pushing manufacturers toward greener production techniques. The industry will see:

More investment in bio-based synthetic rubber.

Increased adoption of recyclable rubber materials.

New policies promoting sustainable supply chains.

2. Growing Demand for Specialty Rubber Products

Synthetic rubber will continue expanding beyond traditional applications into:

3D printing and smart textiles.

Wearable technology and medical implants.

High-performance coatings for extreme environments.

3. Innovation in Electric Vehicle (EV) Tires

The rise of EVs and autonomous vehicles will create demand for:

Lighter, more durable tires to improve range efficiency.

Self-healing synthetic rubber to enhance tire longevity.

Quieter rubber compounds to reduce road noise in electric cars.

4. Increasing Market Share for Asia-Pacific Region

Asia-Pacific will remain the fastest-growing market, with China, India, and Japan leading production and innovation in synthetic rubber. Investments in infrastructure, automotive, and consumer goods will drive demand.

5. Stronger Global Trade and Supply Chain Resilience

With recent supply chain disruptions, manufacturers will diversify their production bases to reduce dependence on a single region. Companies will:

Expand manufacturing units closer to demand centers.

Invest in local raw material sourcing.

Develop strategic partnerships to enhance supply chain flexibility.

Conclusion

The global synthetic rubber market is experiencing rapid transformation, driven by sustainability efforts, technological innovations, and increasing demand from emerging industries. While traditional sectors like automotive and construction continue to drive consumption, the rise of bio-based rubber, AI-driven production, and specialized applications is reshaping the industry’s future.

Companies that invest in eco-friendly production, digital transformation, and high-performance materials will thrive in the evolving synthetic rubber landscape. As global demand continues to grow, synthetic rubber will remain an indispensable material for industries worldwide.

0 notes

Text

Embrace Sustainable Style: The Allure of Plant-Faced Men's Jumpers

In today’s world, fashion and sustainability are no longer mutually exclusive. With the growing awareness of environmental issues, more people are seeking ways to incorporate eco-friendly choices into their wardrobe without compromising on style. One of the best ways to embrace sustainable fashion is by choosing clothing made from plant-based materials. Plant Faced Mens Jumpers offer a perfect combination of comfort, durability, and style while making a positive impact on the environment. These jumpers represent a shift toward more responsible consumption, and they’re quickly becoming a must-have item for eco-conscious individuals who want to dress fashionably without contributing to environmental harm.

The fashion industry is one of the largest polluters in the world, with synthetic fabrics and wasteful production methods causing significant damage to the planet. By opting for clothing made from plant-based materials such as organic cotton, hemp, or bamboo, consumers can significantly reduce their carbon footprint. Plant-based fabrics are naturally biodegradable and require fewer pesticides and chemicals to produce, making them a better choice for the planet. Men’s jumpers made from these sustainable materials not only offer a soft, breathable feel but also provide an eco-friendly alternative to traditional, petroleum-based textiles.

Best Sustainable Fashion Melbourne are designed with both style and sustainability in mind. Whether you’re dressing for a casual outing or looking for something to layer on cooler days, these jumpers provide a versatile, comfortable option that works for any occasion. They are available in a variety of designs, from simple, classic cuts to more contemporary, fashion-forward styles. The great thing about these jumpers is that they look as good as they feel. With their sleek, modern aesthetic, you won’t have to sacrifice style for sustainability. They can easily be paired with jeans, chinos, or even shorts, making them a go-to item in any wardrobe.

One of the standout features of plant-based fabrics is their incredible softness and comfort. Materials like organic cotton have a luxurious feel against the skin, providing a gentle touch that synthetic fabrics often lack. Additionally, plant-based fabrics are highly breathable, making them perfect for layering during colder months or wearing on their own when the weather is milder. This means you can enjoy all-day comfort while still making an eco-friendly choice.

As the demand for sustainable fashion continues to rise, the selection of plant-based clothing options has expanded significantly. More brands are now offering plant-faced men's jumpers in a variety of colors, patterns, and designs. Whether you prefer a neutral, understated look or a vibrant pop of color, you’ll find a jumper that suits your personal style. These garments are not only fashion-forward but also contribute to a more sustainable and ethical fashion industry. By choosing plant-based jumpers, you're supporting brands that prioritize responsible sourcing, ethical labor practices, and environmental stewardship.

Another key benefit of plant-based clothing is its durability. Unlike fast fashion items that may fall apart after a few washes, plant-faced jumpers are made to last. The fibers in these materials are naturally strong, so they maintain their shape and color over time. This long-lasting quality makes them a smart investment, as they won’t need to be replaced as frequently as other types of clothing. By choosing durable, plant-based options, you're reducing the need for constant replacements, which helps to cut down on waste in landfills and minimizes the overall impact of your wardrobe.

In addition to the environmental and durability benefits, plant-faced men’s jumpers are also easy to care for. Most of these jumpers are machine washable, and the natural fibers used in their construction typically require less water and energy to care for compared to synthetic fabrics. This makes plant-based clothing an even more appealing choice for individuals looking to reduce their environmental footprint in all areas of life.

Whether you're a long-time advocate for sustainable fashion or simply looking to make more eco-conscious choices, plant-faced men's jumpers offer a stylish and practical solution. They are a great addition to any wardrobe, providing a chic, comfortable, and environmentally friendly option for everyday wear. By choosing clothing made from plant-based materials, you’re not only improving your personal style but also supporting the shift toward a more sustainable and ethical fashion industry.

In conclusion, plant-faced men's jumpers offer an excellent way to incorporate sustainability into your wardrobe without sacrificing style. These jumpers provide a comfortable, durable, and fashionable alternative to traditional clothing, and they allow you to make a positive environmental impact with every purchase. With a growing variety of options to choose from, it’s easier than ever to dress sustainably and look great at the same time. So, if you're looking for a trendy yet eco-friendly addition to your wardrobe, plant-faced jumpers are an excellent choice.

0 notes

Text

Best Quality Shoes Manufacturers, Suppliers, and Dealers in India – Carbon Footwear

When it comes to footwear, India has established itself as a global hub for the manufacturing and supply of high-quality shoes. The country boasts a rich history of craftsmanship combined with modern manufacturing techniques, making it a leader in the global footwear industry. Whether it's leather shoes, athletic footwear, casual shoes, or customized designs, Indian manufacturers have consistently delivered durable, stylish, and affordable options to consumers worldwide.

In this article, we will explore the industry of shoes manufacturers in India, focusing on the importance of quality, the various types of shoes produced, and why Carbon Footwear is an emerging name in this sector, providing top-quality shoes for both domestic and international markets.

Introduction to Shoes Manufacturing Industry in India

India ranks as one of the largest footwear producers in the world, second only to China. With over 15% of the world’s footwear production coming from India, the country has emerged as a key player in both the domestic and international markets. This growth has been driven by a combination of skilled labor, affordable raw materials, and evolving fashion trends that demand versatility and innovation in shoe manufacturing.

The Indian footwear industry covers a wide range of products, including formal shoes, casual shoes, sports shoes, and specialized footwear like orthopedic and safety shoes. Carbon Footwear has entered this competitive market, providing high-quality shoes while maintaining a strong focus on craftsmanship, durability, and comfort.

Types of Shoes Manufactured in India

Indian shoes manufacturers cater to a diverse range of footwear needs, producing various types of shoes that serve different purposes. Here are some of the popular categories:

1. Leather Shoes

India is renowned for its leather production, and leather shoes are a hallmark of the country's manufacturing capabilities. Leather shoes are popular for formal wear, business attire, and luxury markets.

2. Sports and Athletic Shoes

With the rising popularity of fitness and sports in India, the demand for high-quality athletic shoes has surged. Sports shoes are designed with comfort, flexibility, and performance in mind. Manufacturers integrate advanced technology like cushioning systems and breathable fabrics to improve comfort and functionality.

3. Casual Shoes

Casual shoes include sneakers, loafers, sandals, and more. These shoes prioritize comfort and style for daily wear. Indian manufacturers have adapted global trends to produce stylish, trendy, and affordable casual footwear.

4. Safety Shoes

For industrial and construction workers, safety shoes are an essential part of protective gear. These shoes are made from durable materials and are often reinforced with steel toes, slip-resistant soles, and waterproof linings.

5. Orthopedic Shoes

Specialized shoes for people with foot conditions or specific medical needs are increasingly produced in India. These shoes focus on providing comfort, support, and mobility.

Benefits of Choosing Indian Shoes Manufacturers

When you choose Indian shoes manufacturers like Carbon Footwear, you benefit from several advantages that make the country a global leader in footwear production:

Cost-Effective Solutions: Indian manufacturers offer high-quality shoes at competitive prices, making it affordable for businesses and retailers to source in bulk without compromising on quality.

Skilled Craftsmanship: The tradition of shoemaking in India goes back centuries. Today, skilled artisans work alongside advanced machinery to create shoes that offer the perfect balance between tradition and modernity.

Innovation and Technology: Indian manufacturers incorporate the latest technologies in design, materials, and production to meet global standards.

Customization: Many manufacturers provide the option to customize shoes, including design, materials, and branding, making them ideal for businesses looking for unique products.

Sustainability: With growing awareness around environmental issues, Indian manufacturers have also begun adopting sustainable practices, using eco-friendly materials and reducing their carbon footprint.

Key Qualities of Best Shoes Manufacturers in India

When it comes to selecting the best shoes manufacturers in India, several key qualities distinguish top-tier producers from the rest:

1. Quality of Materials

The best shoes are made using premium materials that ensure durability, comfort, and style. Whether it's leather, synthetic materials, or advanced textiles, leading manufacturers ensure that their materials meet high-quality standards.

2. Craftsmanship

Quality shoes are a result of expert craftsmanship. Experienced workers who understand the intricacies of shoe production are essential to ensuring every pair is perfectly made.

3. Innovation

With the fast pace of fashion and consumer preferences, innovation in design and production is critical. The best manufacturers stay ahead of trends and incorporate the latest technologies in shoe production.

4. Reliability

Top shoe manufacturers ensure consistency in production, meeting deadlines and maintaining the same quality across all batches. Reliability is key for businesses looking to build long-term partnerships.

5. Eco-Friendly Practices

As sustainability becomes more important, the best manufacturers are adopting eco-friendly production methods, reducing waste, and using materials that have a lower environmental impact.

Why Choose Carbon Footwear for High-Quality Shoes?

Carbon Footwear has quickly established itself as a trusted name among shoes manufacturers in India. While originally known for their engineering expertise, the company has expanded its operations to include footwear manufacturing, bringing with it a commitment to excellence, precision, and quality.

1. Focus on Quality

Carbon Footwear places a strong emphasis on delivering shoes that meet international standards of quality. Every step of the production process, from material selection to final inspection, is carefully monitored to ensure the highest standards.

2. Customization and Flexibility

Carbon Footwear offers flexible solutions for businesses looking to customize their shoe designs. Whether you need branded footwear or specialized designs for a particular market, Steewo can accommodate your needs.

3. State-of-the-Art Facilities

By leveraging the latest machinery and production techniques, Carbon Footwear ensures that their footwear is produced efficiently and to the highest level of precision.

4. Customer-Centric Approach

Carbon Footwear prioritizes customer satisfaction by providing exceptional service, including fast delivery, transparent communication, and reliable after-sales support.

Supply Chain and Distribution Network of Shoes in India

India’s vast and well-connected supply chain for footwear ensures that shoes produced here reach global markets with ease. Leading manufacturers like Carbon Footwear take advantage of the country’s robust logistics networks, allowing for the efficient distribution of shoes both within India and internationally.

Carbon Footwear ensures that their shoes are available across various retail outlets, online platforms, and wholesale distributors, ensuring customers can easily access their products.

The Role of Innovation and Technology in Shoes Manufacturing

Innovation is critical in today’s competitive footwear market. Indian shoes manufacturers are increasingly adopting advanced technologies to streamline production, enhance quality, and introduce new features. Some key innovations include:

3D Printing: Manufacturers use 3D printing technology to create prototypes and streamline the design process, reducing production time and costs.

Smart Shoes: The integration of technology into shoes, such as fitness tracking or self-lacing features, is becoming popular among athletic and casual footwear brands.

Sustainable Materials: The use of biodegradable and recycled materials is an emerging trend in shoe manufacturing, catering to environmentally conscious consumers.

Customization and Design Trends in the Indian Shoes Industry

Customization is a significant trend in the footwear industry today. Many consumers and businesses are looking for shoes that reflect their personal style or brand identity. Indian manufacturers, including Carbon Footwear, offer custom shoe manufacturing services, enabling businesses to create unique, branded footwear that stands out in the marketplace.

Sustainability in Shoe Manufacturing

As consumers become more environmentally conscious, sustainability has become a significant focus for shoes manufacturers in India. Sustainable practices include the use of eco-friendly materials, waste reduction techniques, and energy-efficient production processes.

Carbon Footwear has made strides toward sustainability by adopting green practices and sourcing eco-friendly materials for their shoe production.

The Indian footwear industry continues to grow at a remarkable pace, fueled by a combination of skilled craftsmanship, technological innovation, and sustainability efforts. As a leading name among shoe manufacturers in India, Carbon Footwear stands out for its commitment to quality, customization, and customer satisfaction.

Whether you are looking for leather shoes, athletic footwear, or specialized safety shoes, Carbon Footwear offers top-notch products that meet the needs of both domestic and international markets.

FAQs

Why are Indian shoes manufacturers preferred globally?Indian manufacturers offer high-quality shoes at competitive prices, with a focus on craftsmanship, innovation, and sustainability.

What types of shoes does Carbon Footwear manufacture?Carbon Footwear manufactures a wide range of footwear, including leather shoes, casual shoes, sports shoes, and customized designs.

How does Carbon Footwear ensure product quality?Carbon Footwear follows strict quality control measures throughout the production process, from material selection to final inspection, ensuring every pair of shoes meets high standards.

0 notes

Text

The 10 Biggest Construction Vehicles in the World

A comprehensive list of the world’s largest construction vehicles.

Here is a complete list of the 10 largest construction vehicles in the world, from the D8–774 mining dump truck to Komatsu’s D575A-3SD and Liebherr’s LTM11200 mobile crane.

D8–774 is the world’s largest dump truck.

The D8–774 Mining Truck, introduced by Slovenian business ETF Mining Equipment in May 2018, is the world’s largest dump truck, with a payload capacity of 774 tonnes.

The vehicle has an 810-tonne gross operational weight. It has a loading height of 6.3 meters and a width of 7.6 meters. The truck’s entire length varies between 12.5 and 29 meters.

The D8–774 Mining Truck is completely electric (no diesel engines), and it harvests braking energy. The machine emits no carbon dioxide and produces very little noise.

2. The Komatsu D575A-3SD is the world’s largest bulldozer.

With an operational weight of 152 tonnes, a blade capacity of 69 m3, and a ground pressure of 159 kilopascals, the Komatsu D575A-3SD is the world’s largest bulldozer (kPa).

The machine has a 3.6m tall and 7.3m broad ‘Super Dozer’ blade that can move up to 127.5 tonnes of material in a single pass.

The Komatsu D575A-3SD has a 12-cylinder diesel engine that produces roughly 1,150bhp and weighs 114.5 tonnes.

3. ACCO Grader is the world’s largest motor grader.

The ACCO Grader, built by the Italian business Umberto in 1980, is the world’s largest grader. It was built for a Libyan client, but because of trade constraints, it never left Italy.

The 181-tonne grader, which had a 9-meter blade and a 7.3-meter length, featured two engines: one at one end that produced 1,000bhp and the other at the other end that produced 7,00bhp.

There were a total of 12 tires on the ACCO Grader. It was disassembled for scrap metal after that.

Caterpillar’s 24H, which debuted in the United States in 1996, is the only living holder of the title. The Cat 24H is around 15 meters long and weighs 62 tons.

4. Liebherr LTM11200 is the world’s largest mobile crane.

The LTM11200, manufactured by the German company Liebherr, is the world’s largest mobile crane, capable of lifting up to 1,200 tonnes.

The telescoping boom of the machine, which extends from 18.3 to 100 meters, is the longest ever installed on a mobile hydraulic crane.

The LTM11200 is driven by an 8-cylinder, water-cooled diesel engine with a maximum output of 500kW and a fuel tank capacity of 602 liters. The crane has nine axles and can travel at a top speed of 75 kilometers per hour.

5. The JCB 4CX-15 SUPER is the world’s largest backhoe.

The four-wheel steer 4CX-15 SUPER is not just JCB’s largest backhoe; it’s also the largest backhoe in the world.

It weighs 8.6 tonnes and has a top speed of 41.8 km/h, thanks to a JCB EcoMAX 109hp diesel engine.

The bucket on the 4CX-15 SUPER is 2.35m wide and produces 516NM of torque.

The 4CX-15 SUPER, like other JCB backhoes, comes with a 2-year/2,000-hour bucket-to-bucket transferrable warranty.

#heavyequipment #equipment #constructionequipment #construction #machine #machineries #machines #constructionequipment #whobuysyourequipment #whobuyswheelloaders #whobuysbackhoes #whobuysexcavators #ihaveequipmenttosell #whobuyscompactors #whobuyscranes #whobuysdozers #whobuysbulldozers #whobuystruckhoes #whobuysminingequipment #whobuysskidsteers #motorgrader #whobuysforklifts #whobuyscaterpillarequipment #caterpillar #whobuysjohndeereequipment #johndeere #whobuysbobcat #bobcat #whobuyscaseequipment #case #whobuysingersollrand #whobuysequipmentnearme #machinerytrader #whobuysequipment #whobuysconstructionequipment #ihaveconstructionequipmenttosell #ihaveequipmenttosell #whobuysheavymachinery #whobuysheavyequipment #wheretosellheavyequipment #sellmyconstructionequipment #sellmyheavyequipment #whobuysoilfieldequipment #whobuyusedconstructionequipment #whobuysconstructionequipment #whobuyheavyequipment #whobuysoilfilledequipment #whobuysloaders #Whobuysheavyequipmentmachinery #sellheavyequipment #whobuysusedheavyequipment #constructionequipmentdealer #equipmentdealer #heavyequipmentdealer #heavyequipmenttrader #webuyheavyandmediumequipment #Whobuysequipment #Whobuysheavyequipment #Whobuysconstructionequipment #Ihaveapieceofequipmenttosell #Whobuystruck #whobuystrucks #whobuysaicompressor #whobuysaircompressors #whobuysbackhoe #whobuysbackhoes #whobuysdozer #whobuysdozers #whobuysforklift #whobuysforklifts #whobuyscompactor #whobuyscompactors #whobuysdumptruck #whobuysdumptrucks #whobuysexcavator #whobuysexcavators #whobuysmotorgrader #whobuysmotorgraders #whobuysscrapers #whobuysscraper #whobuysskidsteer #whobuysskidsteers #whobuyswheelloader #whobuyswheelloaders #whobuyscrane #whobuyscranes #whobuyslighttower #whobuyslighttowers #whobuystelehandler #whobuystelehandlers #whobuysconcreteequipment #whobuysasphaltequipment #whobuysaerialequipment #whobuysforestryequipment #whobuysairman #whobuysatlas #Equipment Dealer in Dallas #Equipment for sale in Dallas #Forklifts for sale #Used forklifts for sale #Used forklift trucks for sale #Equipment dealer #Equipment for sale #Selling Equipment #Selling Used Equipment #Used Equipment for sale #Heavy Equipment #Construction Equipment Dealer #Sell Construction Equipment #Tractors for sale #Sell Used Equipment #Sell Equipment Near Me #Sell Used Equipment Near Me #Caterpillar #John Deere #Hitachi #Bobcat #Kobota #Dozer #Excavator #Loader #Backhoe #Roller #Compactor #Telehandler

0 notes

Text

An Insider’s Guide to Exporting Limestone from India | High-Quality Lime Solutions

India is one of the world’s largest producers of limestone, offering abundant reserves of high-quality material. Exporting limestone from India has become a lucrative opportunity, thanks to its growing demand in industries such as construction, steel, and environmental remediation. If you’re considering venturing into the export business, this guide will provide all the essential insights to help you succeed.

Whether you’re targeting markets that need high-quality lime for asphalt or are supplying materials for lime for industrial flotation Rajasthan, understanding the nuances of exporting limestone is critical. Let’s explore the key aspects of this process.

1. Why Export Limestone from India?

India’s limestone reserves are renowned for their purity, consistency, and quality. Industries across the globe rely on Indian limestone for applications such as:

Asphalt production

Industrial flotation processes

Cement manufacturing

Soil stabilization

Suppliers from regions like Rajasthan, in particular, are highly sought after for their expertise in producing lime for industrial flotation Rajasthan and other specialized applications.

Advantages of Indian Limestone:

High calcium carbonate (CaCO3) content

Minimal impurities like silica and magnesium

Competitive pricing

Well-established mining and processing infrastructure

2. Key Steps in Exporting Limestone

a. Identify Target Markets

The first step in exporting limestone is to identify demand in international markets. Countries in Southeast Asia, the Middle East, and Europe are major importers of lime in flotation process India and other specialized limestone products.

b. Comply with Export Regulations

Exporting limestone from India requires adherence to government regulations, including:

Obtaining an Import-Export Code (IEC)

Meeting customs documentation requirements

Ensuring compliance with environmental and mining laws

c. Partner with Reputable Suppliers

Collaborate with trusted suppliers who provide consistent quality. For instance, companies producing high-quality lime for asphalt often have robust quality assurance practices to meet international standards.

d. Arrange for Logistics

Efficient logistics are essential for successful exports. This includes:

Selecting the right shipping method (bulk or containerized)

Coordinating with freight forwarders

Ensuring proper packaging and labeling

3. Quality Assurance: A Key to Success

Quality assurance is paramount in the limestone export business. International buyers expect consistent quality, especially for specialized uses such as lime for industrial flotation Rajasthan or lime in flotation process India.

Tips for Maintaining Quality:

Conduct regular chemical and physical testing.

Use advanced processing techniques to ensure uniformity.

Provide detailed specifications to buyers, including calcium carbonate content and particle size.

4. Marketing Strategies for Limestone Exports

a. Build a Strong Online Presence

Create a professional website highlighting your products, certifications, and case studies. Optimize your site with keywords like high-quality lime for asphalt and lime in flotation process India to attract potential buyers.

b. Leverage Trade Platforms

Participate in trade shows, online marketplaces, and industry-specific forums to connect with global buyers. Platforms like Alibaba and IndiaMART can help showcase your offerings to a broader audience.

c. Develop Long-term Relationships

Establish trust with your clients by delivering consistent quality and excellent customer service. Repeat customers are crucial for sustainable growth in the export business.

5. Benefits of Sourcing Limestone from Rajasthan

Rajasthan is India’s leading limestone-producing state, known for its high-quality deposits. Suppliers from this region cater to diverse industries with products like lime for industrial flotation Rajasthan and high-quality lime for asphalt.

Key Advantages:

Rich natural reserves with consistent quality

Advanced processing facilities

Expertise in tailoring products for specific applications

Proximity to ports for easy export logistics

6. Challenges in Limestone Export and How to Overcome Them

a. Regulatory Hurdles

Exporting limestone involves navigating complex regulations. Work with experienced compliance officers and customs agents to streamline this process.

b. Quality Control

Maintaining quality across large shipments can be challenging. Invest in advanced testing facilities and implement strict quality assurance protocols.

c. Competition

The global limestone market is highly competitive. Differentiate yourself by offering superior quality, competitive pricing, and exceptional customer service.

7. Applications of Limestone in International Markets

Understanding the end-use of your product is crucial for targeting the right customers. Common applications include:

a. High-Quality Lime for Asphalt

Limestone is a key ingredient in asphalt production, improving its durability and stability. Buyers in infrastructure-focused regions often prioritize high-quality lime for asphalt.

b. Lime for Industrial Flotation Rajasthan

This specialized product is used in mining processes to separate valuable minerals. Indian suppliers are known for producing lime in flotation process India, meeting stringent international standards.

c. Cement and Concrete Production

Limestone is a primary raw material in cement manufacturing, making it a staple for construction industries worldwide.

8. Future Opportunities in Limestone Exports

The demand for limestone is expected to grow due to increasing infrastructure projects, environmental initiatives, and industrial development. Areas of opportunity include:

Supplying high-quality lime for asphalt for road construction projects

Expanding into emerging markets requiring lime in flotation process India

Developing value-added products like hydrated lime

9. How to Choose the Right Buyers

a. Conduct Market Research

Identify buyers in industries such as construction, steel, and mining who require products like lime for industrial flotation Rajasthan.

b. Evaluate Buyer Credibility

Verify potential buyers through references, trade directories, and credit checks to ensure reliability.

c. Establish Clear Contracts

Negotiate terms that cover product specifications, delivery timelines, and payment conditions to avoid disputes.

Conclusion

An Insider’s Guide to Exporting Limestone from India provides essential knowledge for navigating this lucrative industry. By focusing on quality assurance, compliance, and effective marketing, you can establish a strong foothold in the global market. Leveraging India’s reputation for producing high-quality lime for asphalt, lime for industrial flotation Rajasthan, and lime in flotation process India, exporters can tap into growing demand and build a sustainable business.

Rajasthan’s rich limestone reserves and experienced suppliers make it the perfect starting point for your export journey. With careful planning and execution, exporting limestone from India can become a profitable and rewarding venture

#High-quality lime for asphalt#Lime for industrial flotation Rajasthan#Lime in flotation process India

0 notes

Text

Molded Plastic Market: Segmentation, Growth Trends, and Key Insights

The global molded plastic market is poised for significant growth, with a projected valuation of USD 1218.39 billion by 2033, up from USD 715.07 billion in 2024. This growth, driven by rising demand across various industries, including automotive, packaging, and electronics, underscores the importance of molded plastics as a critical component in modern manufacturing and consumer goods production.

Market Definition and Latest Trends

Molded plastics refer to plastic products manufactured using molding techniques such as injection molding, blow molding, and extrusion. These products are lightweight, durable, and cost-effective, making them ideal for various applications, including automotive parts, consumer goods, packaging materials, and electrical components. The molded plastic market includes various product types such as polyethylene, polypropylene, polystyrene, and polyethylene terephthalate, among others.

The latest trends in the molded plastic market reflect the ongoing shift toward sustainability, technological advancements, and the increasing demand for high-performance plastics in emerging applications. Notable trends include:

Sustainability Focus: As the world becomes more environmentally conscious, manufacturers are turning to bio-based and recyclable plastics, especially in packaging and automotive applications. The push toward circular economy models is expected to accelerate innovation in sustainable molded plastics.

Smart Plastics: The growing adoption of smart technologies in industries such as electronics and automotive is creating a demand for molded plastics with integrated functions like sensors, lighting, and communication capabilities. These advanced molded plastics are contributing to the development of the Internet of Things (IoT) and autonomous vehicles.

Technological Advancements: Newer, more efficient molding technologies, including 3D printing and multi-component injection molding, are enabling manufacturers to produce more complex and customized plastic components at a lower cost.

Growing Automotive Sector: The automotive industry remains a major consumer of molded plastics, especially with the rise in electric vehicles (EVs) and lightweight materials to improve fuel efficiency and reduce carbon emissions.

Get Free Request Sample Report @ https://straitsresearch.com/report/molded-plastic-market/request-sample

Growth Factors in the Molded Plastic Market

The molded plastic market is expected to experience strong growth due to several key factors:

Rapid Industrialization: As industries such as automotive, packaging, and construction continue to grow globally, the demand for molded plastic products is expanding. Manufacturers are increasingly turning to plastics to replace traditional materials like metals and glass due to the lightweight, cost-effective, and versatile properties of molded plastics.

Demand for Packaging Materials: The global packaging industry is one of the largest end-users of molded plastics. The rise in e-commerce and retail, especially in the food and beverage sector, has increased the need for plastic packaging solutions. The convenience, durability, and flexibility of molded plastics make them ideal for use in bottles, containers, and protective packaging.

Technological Advancements in Molding Techniques: The advancement of molding technologies such as injection molding and blow molding has improved the production efficiency, precision, and scalability of molded plastics, enabling manufacturers to meet increasing demand across multiple sectors.

Urbanization and Infrastructure Development: The growing urbanization and infrastructure development in emerging economies are fueling demand for plastic pipes, sheets, and other molded plastic products used in construction, plumbing, and electrical systems.

Opportunities in the Molded Plastic Market

The molded plastic market offers substantial opportunities for growth and innovation:

Sustainable Plastics: There is a growing demand for environmentally friendly plastics, including biodegradable, recyclable, and renewable materials. Companies that invest in developing sustainable molded plastics will have a competitive advantage as consumers and regulatory bodies continue to push for eco-friendly alternatives.

Emerging Applications: The growing adoption of electric vehicles (EVs), renewable energy systems, and medical devices provides ample opportunities for the molded plastic market. Lightweight, durable, and cost-effective plastic components are essential in EVs, solar panels, wind turbines, and medical equipment.

Expansion into Emerging Markets: Emerging economies in Asia-Pacific, Latin America, and the Middle East are seeing an increase in industrialization and consumer spending, driving demand for molded plastic products. Companies that expand their presence in these regions can benefit from the growing demand across various industries.

Buy Now @ https://straitsresearch.com/buy-now/molded-plastic-market

Key Players in the Molded Plastic Market

The molded plastic market is competitive, with several leading companies dominating the global landscape. These key players include:

LyondellBasell (Netherlands)

SABIC (Saudi Arabia)

INEOS (Switzerland)

DuPont (US)

ExxonMobil (US)

Sinopec (China)

Dow Inc (US)

BASF SE (Germany)

Eastman Chemical Company (US)

Chevron Corporation (US)

Formosa Plastics Corporation (Taiwan)

Solvay (Belgium)

China Plastics Extrusion Ltd. (China)

Lanxess AG (Germany)

Versalis (Italy)

LG Chem (South Korea)

Reliance Industries (India)

These companies are investing in research and development, focusing on innovations in molding technologies, sustainability, and expanding their global reach to maintain leadership in the market.

Market Segmentation of the Molded Plastic Market

The molded plastic market can be segmented based on product type, technology, and application.

By Product Type:

Polyvinyl Chloride (PVC)

Polypropylene (PP)

Polystyrene (PS)

Polyethylene (PE)

Polyurethane (PU)

Polyethylene Terephthalate (PET)

Others

By Technology:

Injection Molding

Blow Molding

Extrusion

Others

By Applications:

Packaging

Film

Automotive Parts

Corrugated Sheets

Bags and Pouches

Battery Cases

Bottles and Vials

Pipes

Containers

Filament Yarn

Wires and Cables

Others