#component depreciation

Explore tagged Tumblr posts

Text

Backed by IRS Cost Segregation study, O’Connor & Associates has been preparing preliminary analysis & cost segregation reports for 25 years. https://www.costsegregationirs.com/irs-expectations-cost-segregation/

#Cost segregation study#component depreciation#free cost segregation calculator#cost segregation specialists#cost segregation company

0 notes

Text

the number of people hurblurrring about win7 is doing my fuggen head in. There's missing the point, then there's missing the point while trying to hammer home your own urrblurr in peak dunning kruger and then getting personally insulting and bitchy when your misguided idiocy isn't entertained.

yeah yeah I know, welcome to the internet. You can still miss me with that bullshit.

But anyway for those of you wanting clarification: Here is a scenario for you.

There is a game called Children of the Nile. It was released in 2004. It's not supported any more, it's completely depreciated, there's no online features, just a standalone worldbuilder (my favourite kind of nip) This game is sold on steam. This game actually predates steam as a third party reseller, so it definitely doesn't require any steam integration to run. It wasn't even a consideration when the game was being developed. However, steam deliberately integrated their client into the bootwrapper so the game will not run without steam. now pay verrry careful attention because this is where Certain People seem to be losing their goddamn mental faculties: -- Steam deliberately writes in a dependency not required in any way, shape or form to run the game. -- Steam then deliberately disables this dependency based on the dictates of yet another software company whose components (chromium) they utilise for their client webstore. -- End result: A win7 user cannot use a program developed for winXP despite massively exceeding any minimum requirements for the software and having full compatibility because steam broke it.

This is what is bullshit. Steam put in dependencies that the game didn't need and now they're saying they can't support those dependencies that didn't need to be added so you, the end user must run an entirely different operating environment because their business needs dictate it.

They deliberately hobbled the software, then absconded on the obligation that action inferred to any reasonable mind.

This isn't "hurr hurr security concerns" or "hurr blurrr why support old OS" the game already supported the OS (well, technically the OS was compatible with the game). That game isn't updating. The last expansion was in 2008 (which predates the release of win7). That game is a dead, mothballed creature. There aren't any patches coming. No new releases. This isn't about software comparability in the fucking slightest - the game already had that. This is about the fact they took that away in a deliberate act. Don't get it? lemme get the megaphone and make it reaaaal simplified:

YOU SHOULD NOT HAVE TO RUN WINDOWS 10 TO PLAY A GAME RELEASED IN 2004

Likewise you shouldn't need an internet connection to run software with no internet integration and you certainly shouldn't need to support the latest chromium to run steam to play a game that was released as a done creature before either of these fucking companies existed.

This entire scenario is not the natural depreciation of support. It's entirely artificially created by steam, and they can shove it up their arses.

277 notes

·

View notes

Photo

Jay Treaty

The Jay Treaty, formally known as the Treaty of Amity, Commerce, and Navigation, Between His Britannic Majesty and the United States of America, was a controversial treaty signed by representatives of the United States and Great Britain in November 1794. It sought to resolve issues left over from the American Revolution (1765-1789) and establish trade between the two nations.

At the time of the treaty's signing, the United States appeared to be on the brink of war with Great Britain. Believing the United States to be reneging on agreements made in the Treaty of Paris, Britain refused to evacuate its troops from forts in the Northwest Territory and attacked American shipping in the French West Indies, seizing over 250 American merchant vessels and impressing their crews into service in the Royal Navy. Although many Americans clamored for war, President George Washington (served 1789-1797) believed the young republic was not strong enough to withstand another war with Britain. Instead, he dispatched John Jay, Chief Justice of the United States, to negotiate a treaty that would, hopefully, avert an armed conflict.

Jay succeeded in avoiding war, and even managed to strengthen commercial ties with Britain; the US was granted 'most favored nation' status at British ports, and American merchants were given limited trade rights in the British West Indies. However, the treaty came up short in many respects, as it significantly did not protect American sailors from future impressment. But the most controversial aspect was that the treaty created stronger political and economic ties between the United States and Britain, something that many Americans feared would lead to a re-emergence of aristocracy in the US. Riots broke out in many cities, and Jay was often burned in effigy. Even President Washington was abused in the press. A new political faction, the Democratic-Republican Party, emerged to combat the growing power of the pro-British Federalist Party. Revolutionary France, meanwhile, interpreted the Jay Treaty as an Anglo-American alliance and also began attacking American shipping, eventually resulting in the brief Quasi-War (1798-1800).

Background: The Threat of War

The Treaty of Paris of 1783 ended the American Revolutionary War, creating a state of fragile and uneasy peace between the fledgling United States and its former mother country, Great Britain. The treaty was generally regarded as favorable to the Americans: it more than doubled the size of the United States, whose borders now stretched as far west as the Mississippi River, and the British promised to evacuate their soldiers from these boundaries. In return for these concessions, Britain expected that all prewar debts owed by American borrowers to British lenders would still be paid and that state governments would stop confiscating the properties of Loyalists (Americans who had remained loyal to the British Crown during the Revolution). These were among the main components of the ten articles of the treaty, signed by American and British commissioners on 3 September 1783.

The ink on the treaty was barely dry, however, when troubles began to sprout. For much of its short existence, the United States had been plagued with economic difficulties; indeed, its recent attempt at a national currency, the Continental Currency, had failed after depreciating to the point of near worthlessness. State governments were imposing high taxes to begin paying off their own hefty war debts while Congress – under the terms of the Articles of Confederation – could not raise any taxes at all. Burdened by high taxes and inflation, many American debtors were unable to pay back their British creditors in a timely fashion. Additionally, many state governments were loath to take any pity on Loyalists, who were regarded as traitors; few were compensated for the properties that had been confiscated during the Revolution, with some states even continuing to seize Loyalist estates. Britain pointed to these two examples as evidence that the United States was not holding up its end of the bargain. In retaliation, the British maintained garrisons of troops in a series of forts in the Great Lakes region, which had been ceded to the US in the treaty. When the US complained, Britain promised that it would indeed evacuate these troops as promised – but only once the Americans had paid off all their debts.

Tensions between the two nations continued to simmer for the next decade. Then, in February 1793, Britain declared war on Revolutionary France. By this point, the French Revolution was in full swing; a French Republic had been proclaimed, King Louis XVI of France had lost his head, and hundreds of thousands of French citizen-soldiers were pouring into Europe to deliver liberty, equality, and fraternity at the points of their bayonets. Many Americans were quick to express their support for Revolutionary France, donning tricolor cockades, singing revolutionary songs, and opening political clubs called Democratic-Republican societies, in which they toasted the French Republic and denounced aristocracy. President George Washington, however, was more hesitant to offer support to the revolutionaries; such an act would certainly bring the US into conflict with Britain, a conflict that Washington knew they were not ready for. Instead, he issued a Proclamation of Neutrality on 22 April 1793, in which he promised to keep the United States out of the French Revolutionary Wars.

It did not take long for Britain to disregard this neutrality. Without offering so much as a warning, British ships began seizing American merchant vessels in the French West Indies, considering any ship carrying French cargo to be a valid prize. Over the course of the next year, around 250 American ships were captured and their crews were impressed into service with the Royal Navy.

Impressment of American Sailors into the British Navy

Howard Pyle (Public Domain)

At the same time, the British used their forts in the Great Lakes region to offer support to the Northwest Confederacy, a loose coalition of Native American nations currently at war with the United States. These were blatant acts of aggression that could not be ignored; many Americans, particularly those associated with the Democratic-Republican societies, began to demand war. Other Americans were not so hasty. The Federalist Party, a nationalist political faction led by Alexander Hamilton, was horrified by the chaos and bloodshed of the French Revolution and did not want the US to fall under the influence of Revolutionary France. On the contrary, the Federalists viewed Britain as the natural ally of the United States; they believed stronger ties with the former mother country were vital for the survival of the US. Influenced by these Federalists, and still desirous to avoid war, President Washington agreed to send an envoy to London to hopefully reach an agreement and pull the quarreling countries away from the brink.

Continue reading...

26 notes

·

View notes

Text

everything else ties. EVERYTHING else ties. the workpapers all tie to the K-1s & basis schedules, my partner capital accounts on their workpapers are perfectly in line with what they should be (not even a dollar off). and the totals also tie between the tax return and my workpapers.

except. for. my trial balance. the equity section on the trial balance (literally THEEEEE core component of my work) does not fucking tie. to anything!!!! my §754 adjustment accounts and my partner capital accounts on the general ledger are totally befuckened!!! absolutely nothing is anywhere near where it should be, the net variance is nothing I've ever seen... it's possible this is just a timing difference (or the net of a couple of them), but from fucking WHERE??? i tied everything else out! my balance sheet balances! my M-1 and M-2 are correct! my depreciation schedules are fine!

when the client asks how i got these numbers... i guess i'm gonna, what, fart into a harmonica??? and run away whilst slapping my own ass???? right now it's as good an answer as anything else i can come up with!!! fuck!!!

#dal is a tax#the actual buyout of this partner was very simple. the other partners gave him some money and then he went away.#but because of reasons. it is a nightmare.

6 notes

·

View notes

Text

BLACK AND WHITE

Akito Shinonome x Reader

Sometimes, when the very thing that was your escape starts feeling like a chore, you have to find new outlets to jumpstart your creativity. Akito finds his in an unconventional form of art.

Reader is gender neutral.

Contains: graffiti art, vandalism (if you don’t vibe with that), mentions of scars (can be translated as from Ena, but may not canonically make sense in terms of the timeline), brief self-depreciating thoughts, can be romantic if you squint, reader is Akito’s graffiti mentor, they both wear face masks cuz breathing in VOC fumes is dangerous as fuck.

“Nasty scars you got there.”

Akito felt his pointer press down harder on the spray can’s nozzle. “Don’t want to talk about it.”

“Didn’t ask,” you replied with no sort of menace, shaking up your own can to mix its components together. Then, sparing a quick glance at Akito’s handiwork, you added, “let up on the pressure. Short bursts, remember?”

A curse slipped out from under the ginger’s breath when he realized his “i” was running from too much propellant buildup. Immediately, he relieved the nozzle from further abuse of his finger, staring disapprovingly at his semi-ruined tag. “Right,” he mumbled. A rookie mistake.

As if sensing his thoughts, you let out a breathy chuckle. “Don’t worry. Finding the balance between enough coverage and heavy-handiness is hard.” A short pchit from your can interluded your words. “You’ll get used to it. Just takes practice.”

He felt his furrowed brows relax a bit. Ah, that’s right… he’s still new to this. Considering that only a few weeks ago was the first time he even touched a spray can for the very first time, it was a ridiculous expectation to be a natural at this. Practice, he echoed in his brain. Just takes practice. That’s all.

And not the kind of practice that makes his voice hoarse and limbs feel like led.

Admittedly, he never thought he would be doing something like this. Sure, he always found himself admiring the graffiti in alleyways and old venues, but his father made it clear to him that this was no form of art. He recalls being a young primary schooler in the local art and supply store, his father ranting to himself about the spray cans being on full display and on sale. “Just making it easier for talentless fools to vandalize everything.”

Welp… god only knows what his old man would think about what he’s doing now.

“Saw that you updated your old tag in Vivid Street,” Akito commented, shaking up his can to start on a new letter. “I like the new style.”

You didn’t provide an immediate response, instead opting to scan over your progress as you adjusted your face mask. “Did it just last night. Not sure how I feel about the colors.”

“I think they’re fine.” The ginger finished his “r” much faster than he anticipated, pleased that there was less dripping than his previous letter. It was a bit wonky, but he found a bit of charm in the way it turned out. “A gradient was a good choice. Shows off your skill real well.”

“I’m just worried people are gonna laugh at the irony of KURO being colorful,” you chortled.

He thought about it for a moment, then let out an amused hum. Yeah, it was a bit ironic, but he found the technical aspect of the graffiti overriding that detail. Besides, it was a big improvement from the simple thin black letters that barely popped out from the wall. The color made it more than just a normal meaningless piece of vandalism; it was now art.

Now on the “o,” he offered a shrug. “I don’t think it matters that much. Still looked cool.” After grimacing at the weird overlap his circle had, he stepped back and observed the final product. It was an obviously amateur tag: the coverage was blotchy, a few of his letters dripped from over-spraying, and the block letters had inconsistent thicknesses. A friend tugged at his lips as he studied every glaring imperfection in his work.

Compared to yours…

“Hey, that looks good.”

His head snapped in your direction at breakneck speed. “Hah?”

“I said it looks good,” you repeated. You had just finished outlining your own “o,” a can of orange now being shook in your hand to assumingely begin a gradient. “Considering it’s only your third tag, and your first trying out block letters, I’m super impressed.”

All he could do was dumbly blink at you for a few seconds. You were… impressed? At his hotchpotch of a graffiti? Surely, you had to just be saying that to make him feel better. There’s no way a pro like you thought it looked anything above subpar. Hell, it barely even looked like he took it seriously, half-assing it like some punk who only wants to spray paint a train just to look like a cool kid. Nothing about his tag resembled anything close to art.

“I could definitely do better,” he huffed, looking back at his finished product with distaste.

You hummed. “Yeah. You definitely could.” Before he could even begin to wonder if that was supposed to be a snide remark or not, you continued. “But so can I. There’s a lot of stuff about my own graffiti works that I wish I could improve on.” You shook up the orange, your eyes trained on the your work. “S’why I go back and update my old tags. Like the one I did in Vivid Street. It was one of my first.”

He tried his best to remember the details of the old KURO in Vivid Street. The letters had a unique style, but were too thin to be easily readable. He had initially mistaken the “r” for a “b” for how runny it was. Looking back, he probably shouldn’t of been surprised that it was your first tag, especially compared to what you can do now. Throwing you a curious glance, he stuffed his freehand in his pocket. “Do you update all of your old tags like that?”

“Nah.” You didn’t elaborate for a couple of seconds, your can hissing as you began filling in the negative space of your letters. “Only the ones that get passed by a lot. Wanna have my art look presentable to people, y’know?”

He thought about your response. It made sense; any artist would want their most seen work to reflect their best work. Plus, there was the added bonus of making the environment feel more lively. Before the style update, the KURO in Vivid Street admittedly looked boring, and even distasteful. Just any other graffiti you would barely even spare a glance towards as you go on your merry way. After you went back to do a much-needed revamp, however, he found himself admiring every detail for a solid 10 minutes. The blue to pink was very eye-catching, white highlights boldly contrasting the black outline. Bubble letters replaced simple stick characters. He felt himself becoming inspired the more he took in every meticulous detail. It was amazing how one graffiti update could completely change the vibe of an alleyway.

Shifting his weight from one leg to the other, he fiddled with the nozzle of the spray can in his grip. “So, what about the tags you don’t redo?”

“I leave them like that.”

“How come?”

A fond shimmer sparked in your eyes. It held a sense of nostalgia to it; the kind that comes with reflecting on good times. “Tells my story as an artist. Might not be an exclusive interview or anything, and KURO’s sure as hell not famous outside of the local street art space but those who see my novice KURO tags get to see a journey.” You reached down to grab a can of yellow. “Besides, I like to go back and look at them, so I can see how far I’ve come.”

Huh… Akito wasn’t expecting that response. Sure, he was a fellow artist (admittedly, he was too much of a rookie graffiti artist to consider himself as such, but he was still a performing artist), but he never thought that way about his own art. The whole point of wanting to improve was, not only to one day make an event bigger than RAD WEEKEND, but to also distance himself from his old shitty skill level. He wanted nothing to do with his old singing and dancing, and just looking at recordings of his old performances made him feel sick. They only serve as a reminder to get better, or else he’ll be stuck in the same box for the rest of his life as an artist.

But… when you put it like that…

“So,” he awkwardly began, trying to dispel his thoughts about Vivid BAD SQUAD. “You ever gonna come back and update this one?”

There wasn’t an immediate answer. You seemed to engrossed in probably blending the orange and yellow to even think of one, so he patiently waited. This gave him a perfect opportunity to examine your technique, watching how you angled your extremely light sprays upwards to mingle the colors together (huh, he’ll have to keep that in mind). It was at this point that he took notice of the paint fumes, but rather than finding it disgusting like he initially did, there was an odd sense of comfort that came with it this time… of course, it probably helped that he came prepared with a face mask. During his initial chance encounter with you, you had warned him to stand a good distance away as to not breathe in the toxic VOC fumes.

The clacking noise of your spray can snapped him out of his thoughts, your eyes still staring intently at the still wet tag. You still had the “r” and the “o” to finish blending, but he knew it wouldn’t take long for you to do. Instead of continuing to work, however, you straightened your up posture, turning to fully face him. “You kidding me? Definitely am.”

… Huh—?

Your declarative delivery threw him for a loop. Were you not satisfied with the way this KURO turned out? His brows furrowed at the thought, eyes studying every detail of the tag. It looked amazing; and while he’s definitely no stranger to the concept of being your own worst critic, this felt ridiculous. Especially when it’s side by side with his own frumpier work. It reminded him too much of the growing gap between him and his fellow Vivid BAD SQUAD members, the familiar weight of self-doubt and envy pressing against his chest… ah, yeah… of course he had to be reminded of his own shortcomings every day. Such is the life of a talentless, worthless—

Your voice cut through his spiraling thoughts. “After all, you gotta come back later and update your very first box-letter tag, right?”

… Oh.

Suddenly, all of those self-deprecating mantras fell upon deaf ears. His chest felt lighter than before, and he couldn’t fight the radiant warmth that filled his heart. Something about your implied promise of progress was… oddly freeing. It recognized his current novice status, but again, this was only his first time doing box letters. As long as he kept practicing, he could only get better. Along with that, your promise also held a deeper meaning; that you two would be working alongside each other for a while longer. Though he was too stubborn to say it out loud, your presence was calming, and he appreciated how he didn’t have to be hard on himself when it came to graffiti.

By pure chance, you helped him discover a new outlet.

He was grateful for the mask, because trying to keep the big smile off his face was damn near impossible. He tried to play it off cool by offering a humorous huff and shaking his head. “Sounds like a plan. If you think you can stand me for that long, anyway.”

“Well, you’re not the worst person out there,” you mused, getting to work on your last two letters. “Now pick up the black paint, will you?”

Quirking a brow, he couldn’t help but skeptically posing, “what for?”

Your answer came after a good shake to your can. “Gonna teach you how to properly outline. The white pops on a darker surface like this, but in most alleyways, white tags get a bit lost on the brick. Plus, it can look pretty bland.”

Ah, a lesson. He could definitely use those. Sure, he’s picked up a lot of good tips from you over the past few weeks, but if he ever wants to get better at this, he’s always down to learn some more. Graffiti took his life by storm, activating his creativity in ways he didn’t even imagine before, and the thought of being able to create it with his own hands gave him the same high that events did.

He looked at your KURO, and then his SHIRO.

Yeah, there may have been an obvious gap in skill, but with your guiding advice, this is one he was sure he could catch up on.

51 notes

·

View notes

Text

A feminist Searcher who reads definitions of fetishism in psychiatric encyclopedias and "studies" will find ejaculations of bias and self-contradictions everywhere. The authors of the entry on fetishism in the Encyclopedia of Aberrations and Psychiatric Handbook, for example, begin by discussing this as "a form of sexual deviation in which the person's sexual aim becomes attached to something that symbolizes that person's love-object" [emphases mine]. These sages go on to explain that the "something" may be an article of clothing or a nongenital (!) part of the body. It is only later in the article that we find their admission that the fetishistic "person" is male and the "love-object" female, when we read that: " . . . the fetishist is attempting to escape from women. When he cannot do so he compromises by depreciating them. . . . he can then consider [his mate] superfluous."

It would be a mistake for women searching for clues about fetishism to stop reading the article at this point, for we would be left with the knowledge that fetishists are male but might still assume that these constitute a perverted minority of males. Moving further into the maze of this analysis we come upon their admission that fetishism is so widespread in its implications that it includes acoustic stimulation, such as the pleasure obtained by listening to sexual stories. Immediately the processions of professional Peeping/Listening Toms appear before the feminist mind's eye, as we recall the parade of priestly, psychiatric, and ob/gyn Toms, whose main interests and concerns are sexual stories. By now we are ready to handle the concluding sentence of the article:

Fetishism is quite often a normal and necessary component of the sexual lives of all individuals [emphases mine].

A-mazing, we see not only that "individuals" means males, but that the "sexual deviation" described at the beginning of the article is considered "normal and necessary" for all males.

-Mary Daly, Gyn/Ecology

18 notes

·

View notes

Text

Physical Verification of Fixed Assets: Why Your Business Needs It

Introduction In the world of business, fixed assets—like machinery, buildings, and equipment—are fundamental to operations and profitability. However, without proper management and regular verification, businesses can lose track of these valuable resources. Physical verification of fixed assets is a critical process to ensure that a company’s assets are accurately recorded and maintained. In this article, we’ll delve into why physical verification of fixed assets is essential and how MAS LLP offers a streamlined approach to safeguarding these vital resources.

What is Physical Verification of Fixed Assets? Physical verification of fixed assets is a systematic process of counting and verifying a company's tangible assets to confirm their presence, condition, and alignment with accounting records. This process helps ensure assets are accounted for, thereby minimizing risks of asset misappropriation, losses, or unexpected depreciation.

Key Components of Physical Verification Inventory Count: Ensuring that all assets, big or small, are physically located and accounted for. Condition Assessment: Reviewing the status and usability of assets to determine if they need maintenance, repair, or replacement. Compliance Check: Ensuring that the asset register aligns with financial statements and legal regulations. Tagging & Labeling: Using asset tags or barcodes for easy tracking and future verification. Why Physical Verification is Essential for Businesses

Improved Financial Accuracy An accurate inventory of fixed assets ensures that the company's financial statements reflect true value. By confirming asset existence and condition, physical verification helps in producing precise data for depreciation, amortization, and insurance claims.

Asset Utilization Optimization Physical verification helps identify underutilized or idle assets, providing opportunities to redeploy them where needed. This leads to optimized resource allocation, potentially saving costs by maximizing the productivity of existing assets.

Enhanced Security and Fraud Prevention Unauthorized use, theft, or misappropriation of assets can have significant financial consequences. Regular verification protects businesses by preventing fraudulent practices and ensuring that each asset is appropriately safeguarded.

Accurate Tax Reporting Fixed assets have tax implications, especially in terms of depreciation. Accurate records enable businesses to file correct depreciation values, avoid tax penalties, and ensure compliance with local tax laws.

Supporting Business Valuation For businesses seeking investments or mergers, a well-documented and verified list of fixed assets enhances business valuation. A clean asset register is a positive indicator for potential investors, showing operational control and value transparency.

Physical Verification with MAS LLP At MAS LLP, we provide comprehensive physical verification of fixed assets services, tailored to meet your company’s unique requirements. Our process is designed to deliver accuracy, transparency, and peace of mind. Here’s how we can help:

Detailed Asset Inventory Creation Our team conducts an in-depth assessment to create an exhaustive inventory list that aligns with your company’s financial records. We account for every asset to ensure you have a clear picture of your holdings.

Customized Verification Plans MAS LLP works with clients to develop verification schedules suited to the size and nature of the business. Whether it’s annual, semi-annual, or periodic checks, we customize our approach to your operational needs.

State-of-the-Art Tracking Technology We leverage advanced tracking solutions, such as barcode tagging and RFID, to simplify the asset verification process and minimize errors. This enhances the traceability and management of assets, especially for larger organizations.

Condition and Compliance Reporting Our experts assess the physical state of assets and generate detailed reports on their condition. We also ensure compliance with relevant regulations, maintaining an accurate record of all assets in your register.

Seamless Integration with Financial Statements Once verification is complete, we update the asset register and integrate findings with your financial statements. This ensures consistency across your asset records, accounting books, and tax documents, giving you a precise and compliant asset overview.

Why Choose MAS LLP? When it comes to managing your fixed assets, MAS LLP’s expertise in physical verification of fixed assets helps you minimize risk and maximize control. With a team of seasoned professionals, we have the resources, technology, and industry knowledge to provide you with a comprehensive asset verification solution.

Benefits of Working with MAS LLP Unmatched Accuracy: Our rigorous processes ensure asset records are accurate and up-to-date. Cost-Efficiency: We help you avoid over-investment by identifying and redistributing idle assets. Compliance Assurance: Stay compliant with regulatory requirements through verified asset data. Transparent Reporting: Receive detailed, actionable reports for informed decision-making. Conclusion The physical verification of fixed assets is an indispensable aspect of asset management that safeguards your company’s resources, supports financial accuracy, and boosts compliance. With MAS LLP, businesses can gain confidence in the integrity of their asset records and optimize asset utilization for long-term success. Reach out to MAS LLP today to learn more about how we can assist you in managing your fixed assets effectively.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

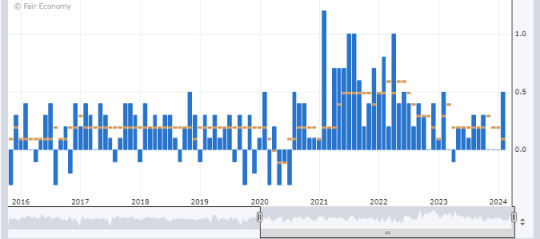

Understanding the Core PPI and Its Impact on Currency and Gold Markets!

The Producer Price Index (PPI) serves as a vital economic indicator, shedding light on changes in the prices of finished goods and services sold by producers. However, when analyzing PPI data, one must pay close attention to the Core PPI, which excludes the volatile components of food and energy prices. This exclusion is significant because food and energy prices often exhibit erratic fluctuations that can skew the overall PPI reading.

A noteworthy shift occurred in February 2014 when the calculation formula for the Core PPI underwent a modification. This alteration aimed to provide a more accurate representation of underlying inflation trends by eliminating the influence of volatile food and energy prices.

It's crucial to recognize that food and energy prices typically constitute around 40% of the overall PPI. Consequently, when analyzing the Core PPI, which excludes these volatile components, one may find a more stable and reliable measure of inflationary pressures.

Now, let's delve into the implications of Core PPI releases on currency and gold markets.

When the Core PPI data release exceeds market expectations, it signals that inflationary pressures are building up in the economy. This can lead to an appreciation of the dollar as investors anticipate potential interest rate hikes by the central bank to curb inflation. A stronger dollar makes gold, which is priced in dollars, relatively more expensive for investors holding other currencies. As a result, the price of gold may decline in response to a stronger dollar.

Conversely, if the Core PPI data release falls below expectations, it suggests subdued inflationary pressures. In such a scenario, the dollar may weaken as investors adjust their expectations regarding future monetary policy actions. A weaker dollar tends to make gold more attractive as a hedge against currency depreciation, leading to an increase in its price.

For instance, let's consider a hypothetical scenario where the Core PPI data release indicates a higher-than-expected increase in producer prices. This prompts investors to anticipate tighter monetary policy by the Federal Reserve, causing the dollar to strengthen. Consequently, the price of gold, denominated in dollars, declines as it becomes less appealing to investors.

On the other hand, if the Core PPI data release comes in below expectations, signaling subdued inflation, investors may interpret this as a dovish signal from the central bank. In response, the dollar weakens, leading to an increase in the price of gold as investors seek refuge in the precious metal amid currency uncertainty.

In conclusion, the Core PPI serves as a crucial economic indicator that can influence both currency and gold markets. By understanding its significance and the factors driving its movements, traders and investors can make informed decisions to navigate the ever-changing landscape of financial markets.

2 notes

·

View notes

Video

youtube

Best Gold Investment Organizations To Consider

Gold is becoming one of the most sought after investments because of its properties giving a place of refuge to your reserve funds in a non-monetary cordial market climate. Gold likewise gives adequate confirmation to the future since it is viewed as a steady investment by market experts and financial specialists. Gold is one of the more appealing investments in the valuable metals classification. Gold is viewed as one of the more essential investments in valuable metals for its oxidation resistant properties and warming safeguard. Many investing learn more organizations permit you to buy common finances that exclusively incorporate gold. Whether you are thinking about buying bars, coins, ETFs, ETNs, gold stock or one more kind of investment, here are the absolute best gold investment organizations to consider while choosing whether the gleaming component ought to enhance your portfolio.

1. Blanchard - one of the most regarded gold investment organizations in the US, Blanchard furnishes clients with the investing apparatuses needed in the valuable metal commercial center. Blanchard is an innovator in valuable metals news, counseling for bullion coins, rarities and pattern examination as well as a demonstrated record of giving investors magnificent gold investments that convey beneficial and monetarily sound returns.

2. Tocqueville - one of the gold investment organizations with a goal and an enthusiasm for long haul capital appreciation, Tocqueville accepts its gold asset in any portfolio will forestall and balance gambles with that might happen. With more than 80% of its resources in gold, the Tocqueville Gold Asset, known as TGLDX, makes an extraordinary retirement fund during unfavorable economic situations and safeguards portfolios against a hurricane of expansion and money depreciation.

3. First Hawk - a forerunner in quite a while, this investment organization gives one of the most mind-blowing gold investment reserves known as SGGDX, zeroing in its resolved to gold explicitly. Holding significant measures of bullion inside, the Primary Falcon Gold Asset is intended for the gold investors and is one of the immense qualities of this investment organization. First Hawk's only liability is to guarantee that the gold inside the common assets is of high worth, as they search out gold in the bear stage.

4. Gamco - having some expertise in various assets, Gamco is headed to broaden the investor's portfolio with their gold asset, which offers remarkable benefit over the long haul. In the beyond 15 years, the Gamco gold asset has consistently kept a consistent yearly return of 9.31%. With the Gamco gold asset, expansion is the great key to productivity and excellent portfolio detailing.

5. Franklin Templeton - offering a tremendous measure of common assets, including the Franklin Gold and Valuable Metals Asset, Franklin Templeton accepts clients will acquire from their reputation, counseling expertise and interesting organization viewpoint. The Franklin Gold and Valuable Metals Asset places its solidarity in 80% of gold and valuable metals working organizations and companies. A non-enhanced reserve, the Franklin Gold and Valuable Metals Asset, frequently will invest in organizations notwithstanding market capitalization.

10 notes

·

View notes

Text

Top 10 ERP Software for Engineering Industry

In the contemporary and dynamic commercial environment, the engineering sector in India is confronted with a diverse range of obstacles, including intense competition, increasing client expectations, intricate project administration, and resource allocation optimisation. In the contemporary era of technology, the utilisation of Enterprise Resource Planning (ERP) software has become an essential and irreplaceable instrument for engineering firms aiming to optimise their operational processes, improve productivity, and foster long-term and sustainable expansion. Boost your engineering company's efficiency with cutting-edge ERP software – STERP software offered by STERP (Shanti Technology) – one of the most trusted firms offering ERP software for engineering companies in Mumbai. Take the first step towards success today with STERP!

This blog article offers a comprehensive examination of the ten leading enterprise resource planning (ERP) software packages specifically designed to cater to the distinct requirements of the engineering sector in India. The aim is to assist organisations in making well-informed choices that will contribute to their future success.

· STERP Software:

STERP Software is a cutting-edge ERP solution offering an array of features to streamline business operations. It excels in location tracking, task management, and mobile user visit reports. Additionally, it enables seamless tracking of finished goods progress and efficient document management. ISO audit reports and vendor ratings ensure compliance and supplier assessment. The dynamic dashboard provides real-time insights, while multi-currency support facilitates global transactions.

The export documents feature simplifies international trade, and auto-email & SMS integration enhances communication. Quotation lost analysis ratio aids in optimizing sales strategies. Depreciation calculation and auto JV streamline accounting. Moreover, it's Android & iOS mobile app enables easy on-the-go access, including component process tracking.

· Tally.ERP 9:

Tally.ERP 9 is a highly renowned and extensively utilised enterprise resource planning (ERP) software in India, serving a diverse range of businesses, including engineering enterprises, irrespective of their scale or magnitude. Tally.ERP 9 offers comprehensive financial management, inventory control, and taxation modules that enable engineering organisations to adhere to Indian accounting rules and effectively handle financial data management.

· Oracle NetSuite:

Oracle NetSuite is a cloud-based enterprise resource planning (ERP) software that offers a cohesive platform, encompassing ERP, customer relationship management (CRM), and electronic commerce (eCommerce) capabilities. The software's adaptability and capacity to accommodate the needs of engineering businesses of varying sizes in India allow for the optimisation of operations and the acquisition of significant knowledge regarding their business procedures.

· Microsoft Dynamics 365 ERP:

Microsoft Dynamics 365 is a multifaceted enterprise resource planning (ERP) solution that encompasses several functionalities like financial management, supply chain operations, and project accounting. By incorporating localization capabilities specifically designed for India, the software enables engineering organisations to effectively streamline their processes, adhere to regulatory standards, and improve overall client satisfaction.

· Ramco ERP:

The Ramco ERP system has been specifically developed to cater to the distinct needs and demands of the engineering sector within the Indian market. The inclusion of modules pertaining to project management, asset management, and production planning facilitates the attainment of operational excellence and the stimulation of growth within engineering enterprises.

Empower your engineering firm with advanced ERP tools offered by STERP – one of the renowned ERP solution providers in Mumbai. Get a free consultation to discover how!

· EPPS ERP:

The EPPS ERP is a software solution originating from India that has been specifically designed to cater to the needs of the engineering industry. The EPPS ERP system offers a comprehensive range of modules that encompass several aspects of project management, including project planning, procurement, and quality control. By leveraging these modules, firms can effectively streamline their project management processes while upholding stringent quality standards.

· Marg ERP 9+:

Marg ERP 9+ is widely favoured among small and medium-sized engineering enterprises in India. The programme provides a wide range of capabilities, encompassing inventory management, order processing, and adherence to GST legislation, so facilitating operational efficiency and ensuring compliance with local legal requirements for enterprises.

· Infor CloudSuite Industrial (SyteLine):

Infor CloudSuite Industrial, previously recognised as SyteLine, is a comprehensive enterprise resource planning (ERP) solution that specifically caters to the needs of process manufacturing and job shop industries. Its suitability for engineering firms in India lies in its ability to effectively manage different production requirements.

· Focus i:

Focus i is an ERP software that has been designed in India specifically to address the distinct requirements of the engineering industry in the country. Focus i is a software solution that offers several functionalities, including project management, production planning, and HR management. This comprehensive suite of tools enables engineering organisations to enhance their operational efficiency and financial performance.

Optimize your engineering projects and increase profitability. Get ERP solutions offered by top ERP for manufacturing company in Mumbai – STERP (Shanti Technology).

· Reach ERP:

Reach ERP is a nascent participant in the Indian enterprise resource planning (ERP) industry, specifically tailored to cater to the needs of small and medium-sized engineering enterprises. The cloud-based design of this system, in conjunction with its various capabilities such as inventory control, order management, and financial accounting, facilitates efficient operational administration for organisations.

Final Thoughts:

The pursuit of efficiency, innovation, and sustainable growth holds significant importance in India's engineering business. The adoption of digital transformation within the industry has led to the recognition of ERP software as a crucial facilitator. This software plays a significant role in assisting engineering companies in optimising their operations, enhancing the efficient allocation of resources, and ultimately improving customer satisfaction. The aforementioned list comprises the top 10 enterprise resource planning (ERP) software systems that are tailored to address the unique requirements of the engineering sector in India. These software solutions offer a wide range of comprehensive features and functionalities, specifically designed to effectively address the many difficulties and opportunities prevalent in the market.

When making a decision on the choice of an Enterprise Resource Planning (ERP) system, engineering businesses should take into account many variables like scalability, localization capabilities, simplicity of integration, and vendor support. Gain a competitive edge in Mumbai's engineering sector - Implement effective ERP solution offered by STERP (Shanti Technology) – one of the distinct ERP software providers in Mumbai! The use of Enterprise Resource Planning (ERP) technology represents a strategic decision that holds the potential to bring about dramatic changes within the engineering industry in India.

#ERP software for engineering companies in Mumbai#ERP solution providers in Mumbai#ERP for manufacturing company in Mumbai#ERP software providers in Mumbai#ERP software#technology#ERP system#cloud ERP#ERP solutions#manufacturer#engineering#business process#management software#business analytics#engineering industry

5 notes

·

View notes

Text

Cost segregation IRS audit technique of calculating depreciation is more accurate for real estate. To find out, click here https://www.whatiscostsegregation.com/irs-position-cost-segregation/

#what is cost segregation#component depreciation#free cost segregation calculator#cost segregation specialists#cost segregation company

0 notes

Text

Exploring the Benefits and Considerations of Used Lasers for Sale

In the realm of technology, lasers are now a crucial component of many different sectors, from manufacturing and healthcare to research and entertainment. However, buying brand-new laser equipment may be expensive, particularly for smaller companies or those on a tight budget. Fortunately, there is a substitute on the market: Used laser for sale. In this article, we'll explore the advantages of buying used lasers as well as the crucial factors to take into account for a profitable purchase.

Cost-Effectiveness Cost-effectiveness is among the most important benefits of buying secondhand lasers. New laser equipment might be extremely expensive, making it impossible for many firms and researchers to buy them. On the other hand, used lasers are less expensive while still providing equivalent performance. Businesses may save a substantial sum of money without sacrificing quality by choosing a secondhand laser.

Reliable Performance New versions might not have the performance history of used lasers. Since these systems have been used in practical settings, there is some assurance in their dependability and effectiveness. Buyers can determine the caliber of the secondhand equipment they're contemplating by looking into the laser's performance history and maintenance records.

More rapid implementation Due to production and shipping processes, there may be a waiting period when buying a new laser. Contrarily, purchasing a used diode laser for sale enables speedier deployment because the tools are easily accessible. Business activities may be sped up, productivity increased, and returns on investment can start to be seen sooner.

Access to More Expensive Models Purchasing old lasers may give access to expensive versions that would otherwise be beyond a company's price range. This gives companies the chance to invest in cutting-edge technology that will increase their skills, raise the quality of their output, and help them remain ahead of the competition.

Depreciation was lessened Lasers are one piece of new equipment that can depreciate quickly over time. Used IPL machine for sale often retain their worth better than new ones since they have already been through some initial depreciation. Businesses that might need to update or sell the equipment in the future would particularly benefit from this.

For More information visit: https://laser-tech.com/services-repair/

2 notes

·

View notes

Text

Corporate Tax Strategies for Maximizing Profitability

In an increasingly competitive business environment, companies must look beyond revenue generation and focus on optimizing internal strategies to maintain profitability. One of the most effective ways to do this is through smart corporate tax planning. Leveraging tax strategies not only reduces the financial burden but also frees up resources for innovation, expansion, and reinvestment. Many companies, especially smaller enterprises, turn to experts offering small business tax planning services in Fort Worth, TX to design personalized plans that align with their financial goals and business structure.

Structuring the Business for Tax Efficiency

The foundation of an effective tax strategy often begins with choosing the right business structure. Whether a company operates as a corporation, S corporation, LLC, or partnership, the tax implications vary significantly. A well-structured entity can reduce exposure to double taxation, enable pass-through income benefits, and offer more flexible compensation arrangements for owners and employees.

For example, S corporations allow profits and losses to pass directly to shareholders, potentially reducing self-employment taxes. Meanwhile, C corporations might be suitable for businesses seeking to reinvest profits back into the company due to favorable corporate tax rates. Reviewing and adjusting the business structure as the company evolves is a crucial part of long-term tax efficiency.

Leveraging Deductions and Credits

Maximizing deductions and tax credits is another essential component of a profitable tax strategy. Ordinary and necessary business expenses—such as rent, utilities, employee wages, insurance, and advertising—can be deducted to lower taxable income. Additionally, there are numerous federal and state tax credits available for specific activities such as research and development, energy efficiency, or hiring from targeted groups.

Keeping detailed records and understanding which deductions apply can significantly impact a company’s tax bill. Moreover, year-end tax planning can include strategies like accelerating expenses or deferring income, depending on projected earnings and tax rates. These timing tactics help businesses manage cash flow and control when taxes are paid.

Managing Depreciation and Capital Investments

Depreciation is a powerful tool for businesses investing in equipment, machinery, or property. By spreading out the cost of these assets over time, companies can reduce taxable income each year. The IRS also offers bonus depreciation and Section 179 expensing options, which allow for larger upfront deductions in the year assets are placed in service.

By aligning capital investment decisions with tax planning, businesses can make smarter purchasing decisions that offer long-term financial and operational benefits. Consulting professionals ensure compliance with current tax laws and help optimize the timing and method of depreciation.

Planning for the Future

Long-term tax strategies are just as important as immediate savings. Succession planning, mergers and acquisitions, and exit strategies all carry tax implications that can affect profitability. Proactively planning for these events ensures a smooth transition and minimizes tax exposure during significant business changes.

In summary, corporate tax strategies are essential tools for maximizing profitability. They help businesses reduce liabilities, improve cash flow, and position themselves for sustainable growth. By working with experts offering small business tax planning services, companies can craft tailored strategies that not only ensure compliance but also drive financial success.

0 notes

Text

Affordable PC on Rent in Kolkata | Latest Models Available

In today’s digital-first world, access to high-performance computing is no longer a luxury—it’s a necessity. Whether for professional tasks, online learning, gaming, or content creation, the demand for reliable and up-to-date desktops is ever-increasing. For individuals and businesses alike, investing in brand-new systems may not always be feasible. That’s where the option of getting a PC on Rent in Kolkata becomes a game-changer.

Why Renting a PC Makes Sense

The rental economy has expanded its reach across multiple domains, and technology is no exception. Opting for a computer on rent provides not just convenience but also unmatched flexibility. Users can select configurations tailored to specific needs, ranging from basic systems for documentation and browsing to high-end machines equipped with the latest processors, GPUs, and RAM for demanding applications.

Businesses setting up temporary workstations, startups looking to reduce initial capital expenditure, or students in need of short-term access to a device can all benefit significantly from this cost-effective approach.

Access to the Latest Technology

Technology evolves at breakneck speed. A device bought today may become obsolete in just a couple of years. Renting eliminates this obsolescence trap. Providers offering PC on Rent in Kolkata consistently upgrade their inventory to keep pace with industry standards. From Intel Core i7 and AMD Ryzen series processors to SSD storage, full-HD monitors, and advanced peripherals—rental systems now come fully equipped with the latest components.

This allows renters to experience top-tier performance without bearing the cost of outright purchase or worrying about future depreciation.

Flexible Rental Plans for Every Need

Whether it’s a daily rental for a training session, a monthly package for freelance work, or a long-term lease for an office setup, service providers offer dynamic plans suited to diverse requirements. Options for short- and long-term rentals, bundled maintenance, and even upgrade opportunities make the proposition even more attractive.

For instance, professionals involved in video editing, 3D rendering, or game development can rent high-spec computers for intensive tasks without committing to ownership. At the same time, educational institutions and coaching centers can deploy multiple systems for temporary classrooms.

Seamless Service and Technical Support

Most companies offering computer on rent include value-added services such as installation, configuration, and on-call technical assistance. This ensures smooth operation and minimal downtime. Many providers also offer doorstep delivery and pickup, saving precious time and logistical hassle.

In addition, backup systems and on-site replacements are often part of the service-level agreements—especially crucial for businesses where uptime is non-negotiable.

Ideal for Remote Work and Hybrid Models

As remote work and hybrid office models continue to gain traction, demand for plug-and-play tech solutions is skyrocketing. A rented PC serves as a fast, economical solution for equipping employees without the overhead of permanent infrastructure.

Freelancers, consultants, and gig workers can also benefit immensely from the ability to rent electronics like desktops without being tied to long-term commitments. It’s the perfect fusion of utility, mobility, and affordability.

Cost-Efficient Solutions for Every Segment

Affordability remains the linchpin of the rental model. Compared to purchasing a new desktop, renting can reduce costs by up to 70%, depending on the duration and specifications required. These savings can be channelled into other critical areas, such as software subscriptions, employee training, or marketing strategies.

Furthermore, many providers offer bundled deals where customers can rent electronics in bulk, including PCs, printers, monitors, and networking devices—all under one rental agreement. This simplifies budgeting and enhances procurement efficiency.

Environmentally Responsible Choice

Renting technology contributes to sustainability by promoting reuse and reducing e-waste. Every time a PC on Rent in Kolkata is reused, it extends the life cycle of the device and curbs unnecessary manufacturing. For eco-conscious users and companies, this offers a dual benefit: economic and environmental.

Conclusion

Choosing a PC on Rent in Kolkata is more than just a financial decision—it’s a strategic one. It empowers users with the latest computing power, operational flexibility, and unparalleled support—all without the burden of ownership. Whether you're a student, a startup, or a corporate entity, embracing computer on rent services can be the key to staying ahead in a fast-paced digital landscape. And with the option to rent electronics of all types under one roof, the process becomes not only efficient but also incredibly streamlined.

0 notes

Text

Planning to Sell Your NJ Business? Here’s the Role Private Capital Markets Play in Your Valuation

When you're planning to sell your New Jersey-based business, the process can be both exciting and daunting. The idea of moving on from something you’ve built often comes with a mix of emotions, but it also presents an opportunity for financial success if handled properly. One of the most critical components of the sale process is understanding your business’s value, which will directly impact the sale price. This is where private capital markets play an important role in shaping your business valuation.

Private capital markets consist of financial institutions, investors, and funds that deal with the buying and selling of private equity, debt, and other financial instruments outside of the public markets. For small and mid-market businesses, like many in New Jersey, private capital markets provide the infrastructure and support for both raising capital and determining business valuations during a sale. Understanding how these markets influence your company’s value can ensure that you make informed decisions throughout the process.

What is Private Capital and How Does it Relate to Your Business?

Private capital refers to the investment of capital in a business or project that is not listed on the public stock exchange. In the context of a business sale, private capital markets typically involve private equity firms, venture capitalists, family offices, and institutional investors who are seeking to acquire or invest in businesses. These investors play a pivotal role in determining the value of your company when you decide to sell.

Unlike public markets, where companies' valuations are determined by stock prices and market forces, private markets involve more nuanced assessments. Investors in the private capital market are often more focused on the company’s fundamentals—such as revenue, profit margins, growth potential, and market position—than on short-term price fluctuations. This allows for a deeper and often more stable valuation process, but it also introduces complexities in how these values are determined.

Valuation Metrics in Private Capital Markets

Private capital investors use a range of metrics and methodologies to assess the value of your business. These methods differ significantly from public market valuations because private businesses don’t have easily accessible financial data, such as stock prices or public disclosures. Here are some common approaches to valuation in the private capital markets:

1. EBITDA Multiples

One of the most widely used valuation methods in private markets is the application of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiples. Investors look at your company’s earnings potential by assessing its operating performance without considering tax structures or financing costs. The EBITDA multiple is a ratio derived from comparing the company’s historical or projected EBITDA with the sale price. In the New Jersey market, businesses in certain industries—like healthcare, tech, and manufacturing—can command higher multiples due to their growth potential.

2. Comparable Company Analysis (Comps)

This method involves comparing your business to similar companies that have been sold recently or are publicly traded. The comparable company analysis helps establish a fair market range for the sale price by looking at metrics like revenue, EBITDA, and industry benchmarks. Investors in private capital markets will often use comps to determine how your company stacks up against others in the same industry, size, and geographical region. This is particularly helpful in New Jersey, where the local market dynamics can significantly influence a company’s worth.

3. Discounted Cash Flow (DCF)

The discounted cash flow (DCF) method estimates the value of a business based on its future cash flows. In simple terms, it determines what your business will be worth in the future, taking into account projected revenues, operating costs, and expected profits. A discount rate is then applied to account for the time value of money. The DCF method is often used by investors who are focused on long-term growth potential, and it can be particularly useful when selling a business that has predictable cash flows or is in a growth phase.

4. Asset-Based Valuation

For some businesses, especially those that are asset-heavy or operate in industries such as real estate, manufacturing, or construction, an asset-based valuation may be used. This method determines a company’s value by assessing the worth of its tangible and intangible assets, including real estate, equipment, intellectual property, and goodwill. This approach can be beneficial if your business has significant assets but may not be generating large profits yet.

The Impact of Private Capital Markets on Your Sale Price

The role of private capital markets in your sale is not just about determining the right valuation; these markets can also help you find the right buyers who will pay the price your business is worth. Here are a few key ways private capital markets influence the final sale price:

1. Investor Appetite

The current appetite for investment in certain sectors or industries can drive up valuations in private capital markets. For instance, New Jersey has a thriving healthcare and life sciences sector, and if your business operates within these areas, private capital investors may be willing to offer higher multiples due to the perceived growth potential. Similarly, industries such as technology, clean energy, and logistics are also attracting attention from private equity firms and venture capitalists. A favorable market for your industry can push your valuation higher.

2. Competitive Bidding

Private capital markets are often structured around competitive bidding, where multiple investors or firms vie for ownership of your business. This competition can drive up the price of the business, as potential buyers are motivated to outbid each other. A competitive auction-style sale often results in higher valuations than those found through direct negotiations with a single buyer. A well-structured sale process leveraging private capital markets can create this competitive dynamic.

3. Deal Structures and Terms

Private capital investors may also influence the structure of the deal itself. For example, private equity firms might offer you a mix of cash upfront and equity in the buying company, allowing for a higher overall sale price. In such cases, the long-term potential of your business within the new ownership structure could increase the perceived value. Additionally, private capital markets provide liquidity options that can make a business more attractive to potential buyers, further enhancing the sale price.

4. Market Trends and Timing

The overall conditions in the private capital markets at the time of your sale can also affect your valuation. If the market is experiencing a liquidity boom, such as during periods of economic expansion or low-interest rates, private equity firms may be more inclined to offer higher prices to secure investments. Conversely, during periods of market uncertainty, valuations may contract. Timing the sale of your business with favorable market conditions can make a significant difference in the ultimate price.

How to Leverage Private Capital Markets for Your Sale

Selling a business is a complicated process, and you’ll want to work with professionals who understand both your industry and the intricacies of private capital markets. Here are a few ways to leverage these markets when planning your business sale:

1. Work with an M&A Advisor or Investment Banker

To navigate the private capital markets effectively, you should consider engaging with an M&A (mergers and acquisitions) advisor or investment banker who specializes in your industry. These professionals can help you understand the nuances of valuation, identify potential buyers, and run a competitive bidding process to maximize your sale price.

2. Prepare Thorough Financials

Private capital investors rely heavily on financial data to assess your company’s value. Having well-prepared financial statements, a solid business plan, and projected cash flows will make your business more attractive to buyers in private capital markets. The more transparent and organized your business is, the easier it will be for investors to determine its worth.

3. Understand Industry-Specific Trends

Private capital markets are influenced by trends within specific industries. Make sure you understand how these trends impact the valuation of your business. For example, if you’re in the tech space, understand how market demand, innovation, and competition might affect your company’s potential for growth. Keep up with market developments and adjust your expectations accordingly.

Conclusion

The role of private capital markets in your New Jersey business sale is immense. From determining the right valuation to finding the right buyers, these markets provide the necessary tools, infrastructure, and financial backing to ensure a successful transaction. By understanding the factors that influence your company’s value, leveraging investor appetite, and working with professionals who specialize in private capital markets, you can maximize your business’s sale price and ensure a smooth transition to the next phase of your life or business venture.

0 notes

Text

Cost Segregation Real Estate Strategies That Unlock Hidden Value

Every real estate investor looks for ways to maximize returns. One strategy that often goes underutilized is cost segregation real estate planning. When implemented properly, it allows property owners to accelerate depreciation, improve cash flow, and uncover tax savings hidden within their buildings. This article explores how a real estate cost segregation strategy works and how it can unlock significant financial benefits.

What Is Cost Segregation in Real Estate?

Cost segregation real estate is a tax-saving method that allows property owners to break down their building components into different depreciation categories. Instead of depreciating the entire property over the standard 27.5 or 39 years, certain parts—like flooring, lighting, cabinetry, and even landscaping—can be depreciated over a shorter life span (typically 5, 7, or 15 years).

The IRS permits this accelerated depreciation if the building undergoes a qualified cost segregation analysis that real estate experts can perform. By classifying assets correctly, investors gain access to upfront tax deductions that improve short-term profitability without affecting long-term asset value.

The Benefits of a Real Estate Cost Segregation Study

Conducting a real estate cost segregation study has several notable benefits:

1. Increased Cash Flow

Accelerated depreciation reduces taxable income, which can lead to substantial tax savings. These funds can then be reinvested into new properties, renovations, or debt reduction.

2. Time-Value of Money Advantage

Receiving deductions sooner enhances money's time value. When money is saved earlier, it can be used more effectively within your investment cycle.

3. Property Acquisition & Renovation Incentives

Cost segregation isn't just for newly acquired properties. Even renovations or improvements can qualify. A cost segregation study of real estate investors' commission post-renovation can reveal hidden deductions, increasing ROI without waiting decades for the tax benefit to materialize.

4. Compatibility with 1031 Exchanges & Bonus Depreciation

A strategic real estate cost segregation plan works in tandem with other tax-saving tools like 1031 exchanges or bonus depreciation. When structured properly, this synergy can lead to massive reductions in current-year tax liability.

When Should You Consider a Cost Segregation Analysis?

Not every property may benefit equally from this strategy, but it’s especially valuable in the following scenarios:

You’ve purchased or built a property with a cost basis of $500,000 or more.

You’ve recently completed major renovations.

You own commercial, industrial, or multi-family residential real estate.

You plan to hold the property for several years, ensuring the depreciation benefit offsets any potential recapture later.

Before initiating a study, always assess your long-term investment goals, property type, and cash flow needs. Consulting with a tax advisor or cost segregation analysis real estate professional can help determine the right time to act.

What Does a Cost Segregation Study Include?

A cost segregation study real estate professionals conduct is a detailed engineering-based analysis. It usually involves:

A site inspection to evaluate the physical components of the building.

Review of blueprints, construction budgets, and financial records.

Categorization of property components into shorter depreciation classes.

A finalized report with IRS-compliant documentation to support deductions.

This meticulous process ensures the IRS will recognize your deductions if audited.

Real-World Example: Unlocking Hidden Value

Let’s say you purchased a commercial office building for $1 million. Without cost segregation, you’d depreciate it over 39 years—just over $25,000 per year. But with cost segregation real estate planning, you might be able to reclassify $300,000 of the structure into 5, 7, or 15-year property. This could result in first-year depreciation deductions exceeding $100,000—freeing up vital cash for new opportunities.

Choosing the Right Partner

The success of your real estate cost segregation study depends on the expertise of the firm conducting it. Experience, engineering know-how, and compliance with IRS standards are crucial. A reliable partner will not only help you uncover savings but also ensure long-term protection during audits or tax reviews.

A well-planned cost segregation real estate strategy can completely shift the financial landscape of your property investments. It turns deferred tax benefits into immediate cash flow and supports broader real estate goals with enhanced liquidity and return potential.

For those seeking expert guidance, firms like Capstan specialize in tailored, engineering-based cost segregation studies that meet IRS standards and deliver measurable results. With a strategic approach to depreciation, unlock your property’s full potential today.

0 notes