#compliances for Pvt ltd company

Explore tagged Tumblr posts

Text

Navigating Annual Compliance: A Guide for Pvt Ltd Companies

Annual compliance is not just a legal requirement; it's a cornerstone of good corporate governance and transparency. For private limited (Pvt Ltd) companies in India, adhering to annual compliance regulations is essential to maintain legal standing, uphold accountability, and ensure smooth operations. In this blog, we'll explore the key aspects of annual compliance for Pvt Ltd companies and why it matters.

Understanding Annual Compliance

Annual compliance for Pvt Ltd companies entails fulfilling various legal and regulatory obligations mandated by the Companies Act and other relevant statutes. These obligations include holding annual general meetings (AGMs), filing financial statements, maintaining statutory registers, and complying with tax laws. These tasks are designed to promote transparency, protect stakeholders' interests, and uphold the integrity of the corporate sector.

The Importance of AGMs

AGMs are pivotal events in the annual compliance calendar for Pvt Ltd companies. During these meetings, shareholders gather to discuss and approve financial statements, appoint auditors, declare dividends, and address any other matters concerning the company's affairs. AGMs serve as a platform for shareholders to exercise their rights, engage with company management, and assess the company's performance and governance practices.

Filing Financial Statements

Filing accurate and timely financial statements with the Registrar of Companies (RoC) is a crucial aspect of annual compliance. These statements, including the balance sheet, profit and loss account, and cash flow statement, provide insights into the company's financial health and performance. Compliance with filing requirements ensures transparency, facilitates investor confidence, and mitigates the risk of regulatory penalties.

Maintaining Statutory Registers

Pvt Ltd companies are required to maintain various statutory registers, including registers of members, directors, and charges. These registers contain vital information about the company's ownership, management structure, and financial obligations. Keeping these registers updated and accurate is essential for regulatory compliance, facilitating due diligence processes, and demonstrating good corporate governance practices.

Tax Compliance Obligations

Annual compliance for Pvt Ltd companies also extends to tax-related obligations. This includes filing annual tax returns, such as income tax returns and Goods and Services Tax (GST) returns, and paying applicable taxes within the prescribed deadlines. Compliance with tax laws is critical to avoid penalties, maintain financial integrity, and uphold the company's reputation.

Conclusion:

Annual compliance is a non-negotiable responsibility for Pvt Ltd companies in India. By fulfilling their legal and regulatory obligations, these companies demonstrate their commitment to transparency, accountability, and sound corporate governance. However, navigating the complexities of annual compliance can be challenging, requiring careful planning, attention to detail, and expertise in regulatory matters. Seeking professional assistance from legal and financial advisors can help Pvt Ltd companies stay on top of their compliance obligations and ensure continued success in the dynamic business landscape.

0 notes

Text

Easy Steps To Llp Register In India: Procedure, Price, And Advantages

Limited liability, legal flexibility, and the absence of a minimum capital requirement make it simple to register an LLP Registration in India .We provide best guidance to registration. Learn about the costs, necessary paperwork, and deadlines for a smooth registration process with our expert guidance. Get in touch for more details!

#LLP Registration in India#tax#company registration in mumbai#llp#business consulting#private limited company compliances#tax advisory services#buy and sell business#compliance for pvt ltd company

0 notes

Text

Ensuring Compliance: Key ROC Requirements for Private Limited Companies

Private limited company is the most popular choice of entrepreneurs who want to establish their business due to its numerous benefits. But along with benefits here come the responsibilities like ROC compliances. It can be complex to navigate the ROC compliances for Private Limited Company.

ROC Compliances For Private Limited Company

Board Meetings: Private limited companies must have conducted at 4 board meetings and the first meeting should be held within 30 days of incorporation. The maximum gap between two boards meetings should be 120 days.

AGM (Annual General Meeting): First AGM should be conducted within 9 months from the closing of the first financial year. Thereafter, the AGM should be held within 6 months of the end of the financial year.

Auditor Appointment: Companies must have to appoint their first auditor within 30 days of incorporation for the five years. Auditor appointment will be done by using form ADT-1.

Director Disclosure: Directors of the company must have to file the form MBP-1 to disclose their interests in any other company. This disclosure should be made every year at the first board meeting.

Statutory Audits: Every private limited company must have a statutory auditor to prepare/ verify the annual report & financial statements and to audit the financial report.

Filing of Form MGT 7: Company must have to file the form MGT 7 within 60 days from the date of AGM.

Filing of Form AOC 4: Company must have to file its financial statement including balance sheet, statement of Profit & Loss Account and director’s report within 30 days of holding AGM.

Filing DIR-3 KYC: Directors of the company must have to file their KYC using form DIR-3 by 30th September of each year, providing their DIN that was allotted by Mach 31 of that year and the status is approved.

Filing Form DPT-3: Companied have to report the details of deposits and other non-deposit receipts annually before June 30 by using form DPT-3.

Maintaining Statutory Registers: Companies must have to maintain their statutory registers, minutes of board meetings, AGMs, creditors meetings, and debenture holder meetings.

Conclusion

ROC Compliances for Private Limited Company are very important for the smooth functioning and legal compliance of Companies. Companies can maintain the transparency, accountability, and trust among stakeholders by fulfilling these requirements. Directors & management of the company should stay updated with the evolving regulatory landscape.

#compliances for private limited company#Roc Compliance#Roc Of Company#Roc Compliance For Pvt Company#Pvt Company Compliances#Company Compliance#Compliance For Pvt Ltd Company#compliance for pvt ltd company#roc compliance for private limited company#annual compliances for private limited company

0 notes

Text

How to Obtain a Well-Known Trademark

In India, over 350,000 trademark applications were filed in the year 2019, and this number is predicted to grow rapidly. By 2025, over 600,000 trademark applications are projected to be submitted annually. The Trade Mark Rules 2017 introduced a new procedure for announcing a trademark as "well-known."

To acquire this status, trademark owners can submit an application (TM-M form) to the Registrar. A well-known trademark receives special protection against violation and passing off. Recognition as a well-known trademark is based on reputation, both domestically and internationally, and across borders.

What is a Well-Known Trademark

According to the Trademarks Act of 1999, a well-known trademark is a mark that has earned recognition among a substantial portion of the public who use the goods or services associated with the mark.

This recognition is so strong that the use of the mark in relation to other goods or services is likely to be sensed as a connection between those goods or services and the person who uses the mark in relation to the first-mentioned goods or services.

The criteria used to determine whether a trademark is well-known

While choosing whether a trademark is a well-known trademark, the Registrar shall consider all facts that he thinks relevant for determining a trademark as a well-known trademark, including the following factors:

The level of recognition of the trademark among the general public in India.

The number of individuals involved in the distribution channels of goods or services related to the trademark.

The number of existing or potential buyers of the goods or services associated with the trademark.

The duration, extent, and geographical scope of the trademark's use.

The business community deals with the goods or services related to the trademark.

The trademark's enforcement record, precisely the extent to which it has been recognized as a well-known mark by any court or Registrar.

The Trademark Rules 2017. (Rule 124)

The latest set of rules for trademark registration in India is the Trademark Rules of 2017. Under these rules, trademark owners can request that their mark be recognized as "well-known" by approaching the Trademark Registry. A separate application process is established, which outlines the standards for determining well-known trademarks.

Those desiring to have their trademark designated as well-known can file an application in the TM-M form, along with the requisite fee (paid online). Rule 124 empowers the registrar to grant a trademark the status of "well-known" based on the application proposal.

Read more to know about Well-Known Trademark

#Well known trademark#legal advisers#legal consultation#llp registration#pvt ltd company registration#startup registration#opc registration#annual compliance of private limited company#annual compliance of llp#trademark registration#itr filing#tds return filing#private limited company registration#gst registration

0 notes

Text

Unlocking Business Potential: How Benchmark Professional Solutions Private Limited Revolutionizes Finance Solutions

Comprehensive finance and legal solutions with Benchmark Professional Solutions Private Limited

Benchmark Professional Solutions Private Limited stands as a beacon of reliability in the realm of business and finance. As a certified partner of Tally Solutions, this company is committed to providing comprehensive solutions that cater to various financial needs, ensuring businesses can operate smoothly and efficiently.

At the heart of Benchmark's offerings is its core service of Digital Signature Certificates (DSC) and token services, which include EMUDHRA, PANTASIGN, CAPRICORN, TRUST, ID SIGN, XTRA TRUST, and HYP TOKEN. These services are essential for ensuring secure and legally recognized digital transactions, allowing businesses to comply with regulatory requirements effortlessly.

In addition to DSC services, Benchmark excels in traditional financial services such as accounts management, auditing, trademark registration, and ROC compliance. The company understands the complexities involved in starting and maintaining a business, which is why it also offers comprehensive license and registration services. This ensures that all legal formalities are met, allowing clients to focus on their core operations without the burden of regulatory concerns.

Benchmark also provides invaluable support in managing tax obligations, including income tax and GST compliance. With a team of experienced consultants, they offer tailored solutions that help businesses navigate the intricacies of tax laws, ensuring they remain compliant while optimizing their financial outcomes.

Consultancy and outsourcing services further enhance Benchmark’s value proposition. Their expert advice can help organizations make informed decisions, while outsourcing specific functions can lead to significant cost savings and increased operational efficiency. Additionally, their civil and criminal law services offer clients peace of mind, knowing that legal matters are handled by professionals who understand the nuances of the law.

Choosing Benchmark Professional Solutions Pvt. Ltd. means opting for a partner dedicated to your success. Their extensive experience, combined with a diverse range of services, positions them as a one-stop solution for all business and finance needs. With a commitment to excellence and client satisfaction, Benchmark not only simplifies complex processes but also empowers businesses to thrive in today’s competitive landscape.

In a world where reliable financial partners are crucial, Benchmark Professional Solutions stands out as a trusted ally, making them the ideal choice for businesses seeking to enhance their operations and achieve sustainable growth.

3 notes

·

View notes

Text

Common Problems Solved by Emulsion Breakers in Crude Oil Processing

Crude oil processing is a complex and challenging task, fraught with numerous obstacles that can hinder efficiency and productivity. One of the most persistent issues faced by the oil industry is the formation of emulsions. Emulsions, which are mixtures of water and crude oil, can cause significant operational problems. This is where emulsion breakers come into play. These specialized chemicals are designed to separate emulsions into their constituent parts, allowing for smoother and more efficient processing.

Imperial Oilfield Chemicals Pvt. Ltd., a leading emulsion breaker manufacturer in Vadodara, has been at the forefront of providing solutions to these common problems. As a prominent emulsion breaker manufacturer in India and an oil chemical exporter in Vadodara, the company has extensive expertise in addressing the challenges posed by emulsions in crude oil processing.

Understanding Emulsions in Crude Oil

Emulsions in crude oil are formed when water droplets are finely dispersed within the oil. These emulsions can be stable or unstable, with stable emulsions being particularly problematic due to their persistence and resistance to separation. Factors such as the presence of natural surfactants, mechanical agitation during extraction, and the composition of the crude oil itself contribute to the formation and stability of these emulsions.

Common Problems Caused by Emulsions

1. Reduced Oil Quality

Emulsions can significantly degrade the quality of crude oil. The presence of water in the oil reduces its purity, which in turn affects the value and marketability of the final product. High water content in crude oil can also lead to increased corrosion in pipelines and storage tanks, further compromising the quality and integrity of the oil.

2. Increased Processing Costs

The presence of emulsions complicates the refining process, leading to higher operational costs. Additional treatments and processing steps are required to separate the water from the oil, consuming more energy and resources. This not only increases the cost of production but also reduces overall efficiency.

3. Equipment Corrosion and Damage

Water and other contaminants in emulsions can cause significant corrosion and damage to processing equipment. This leads to increased maintenance costs and downtime, negatively impacting productivity. Over time, the wear and tear on equipment can result in the need for costly replacements and repairs.

4. Environmental and Regulatory Concerns

Improper handling of emulsions can lead to environmental contamination and regulatory non-compliance. Discharging emulsified water into the environment can cause pollution and harm to aquatic ecosystems. Regulatory bodies impose strict guidelines on the disposal of emulsified water, and failure to comply can result in hefty fines and legal repercussions.

How Emulsion Breakers Address These Problems

Emulsion breakers, also known as demulsifiers, are chemical agents specifically designed to separate emulsions into oil and water. As a leading emulsion breaker exporter in India, Imperial Oilfield Chemicals Pvt. Ltd. provides high-quality solutions that effectively address the common problems caused by emulsions in crude oil processing.

1. Improving Oil Quality

Emulsion breakers work by breaking the bonds between water and oil molecules, allowing for the separation of water from the crude oil. This results in higher purity oil with reduced water content, improving its quality and marketability. The use of emulsion breakers ensures that the final product meets industry standards and fetches a higher market price.

2. Reducing Processing Costs

By facilitating the efficient separation of water from oil, emulsion breakers streamline the refining process. This reduces the need for additional treatment steps, conserving energy and resources. Consequently, the overall cost of production decreases, enhancing the profitability of crude oil processing operations.

3. Preventing Equipment Corrosion and Damage

The removal of water and contaminants from crude oil minimizes the risk of corrosion and damage to processing equipment. This extends the lifespan of the equipment, reduces maintenance costs, and minimizes downtime. Emulsion breakers thus play a crucial role in maintaining the operational integrity of oil processing facilities.

4. Ensuring Environmental Compliance

Effective emulsion breaking and water separation allow for the proper handling and disposal of water, ensuring compliance with environmental regulations. By preventing the discharge of emulsified water into the environment, companies can avoid fines and legal issues, while also contributing to environmental sustainability.

Why Choose Imperial Oilfield Chemicals Pvt. Ltd.?

As a top-tier emulsion breaker manufacturer in Vadodara and a leading oil chemical exporter in Vadodara, Imperial Oilfield Chemicals Pvt. Ltd. stands out for several reasons:

Expertise and Innovation

Imperial Oilfield Chemicals Pvt. Ltd. has a team of experts dedicated to researching and developing innovative solutions for the oil industry. Their in-depth knowledge and experience ensure that they produce highly effective emulsion breakers tailored to the specific needs of their clients.

Quality and Reliability

The company is committed to delivering high-quality products that meet stringent industry standards. Their emulsion breakers are known for their reliability and effectiveness, ensuring consistent performance in crude oil processing operations.

Global Reach

As a prominent emulsion breaker exporter in India, Imperial Oilfield Chemicals Pvt. Ltd. serves clients worldwide. Their extensive distribution network ensures timely delivery and support, regardless of the client’s location.

Customer-Centric Approach

The company prides itself on its customer-centric approach, offering personalized solutions and support to meet the unique needs of each client. Their commitment to customer satisfaction has earned them a reputation as a trusted partner in the oil industry.

Conclusion

The challenges posed by emulsions in crude oil processing are significant, but they can be effectively addressed with the right solutions. Emulsion breakers play a crucial role in separating water from crude oil, improving oil quality, reducing processing costs, preventing equipment damage, and ensuring environmental compliance.

Imperial Oilfield Chemicals Pvt. Ltd., a leading emulsion breaker manufacturer in Vadodara and a top oil chemical exporter in Vadodara, offers high-quality emulsion breakers that solve these common problems. Their expertise, innovation, and commitment to quality make them a trusted partner for oil companies worldwide.

By leveraging the solutions provided by Imperial Oilfield Chemicals Pvt. Ltd., businesses in the oil industry can enhance their operational efficiency, reduce costs, and ensure the production of high-quality crude oil. In an industry where efficiency and quality are paramount, the right emulsion breakers can make all the difference, helping companies build a stronger and more profitable future.

#Best chemical company in Vadodara#Drag reducing agent manufacturer in India#DRA systems manufactured by ICPL#Oil chemical exporter in Vadodara#Emulsion breaker manufacturer in India#Emulsion breaker manufacturer in Vadodara#Emulsion breaker exporter in India#Oilfield chemicals manufacturer and exporter in India#Turbine cleaner manufacturer in India#Turbine cleaners manufactured by ICPL#Best oilfield chemicals company in Gujarat#Scale inhibitor manufacturer in India#Scale inhibitor manufacturer in Vadodara#scale inhibitors manufactured by ICPL

4 notes

·

View notes

Text

The Vital Role of Dust Collector Manufacturers in Keeping Our Air Clean

Dust may seem like an insignificant nuisance, but it's anything but. Microscopic particles can wreak havoc on our health, environment, and industrial processes. Fortunately, unsung heroes stand sentinel against this silent threat: dust collector manufacturers. These companies play a crucial role in safeguarding our air quality, and Intech Bulk Handling Systems Pvt. Ltd., a leading chain conveyor manufacturers in India, stands out as a prime example.

Invisible Hazards, Tangible Impact:

Dust exposure poses significant health risks, triggering respiratory problems like asthma and allergies. In industrial settings, it can also compromise product quality, damage equipment, and even escalate fire hazards. Dust collectors combat these issues by capturing and filtering dust particles, ensuring cleaner air for workplaces and communities.

How Dust Collectors Work:

These unsung heroes come in various configurations, each suited to specific applications. Common mechanisms include:

Cyclones: Utilizing centrifugal force, they separate heavier dust particles from air.

Bag filters: Air passes through fabric bags, trapping dust while clean air exits.

Cartridge filters: Similar to bag filters, but with pleated cartridges offering higher efficiency.

Wet scrubbers: Water sprays capture dust, often ideal for sticky or hazardous materials.

Intech's Contribution to Cleaner Air:

Intech Bulk Handling Systems, while specializing in chain conveyors, also recognizes the importance of dust control. They offer a range of dust collection systems tailored to various industries, including:

Cement: High-efficiency bag filters capture fine dust particles, protecting workers and the environment.

Pharmaceuticals: Dust-free environments are crucial for product purity. Intech's systems ensure compliance with strict regulations.

Food processing: Preventing dust contamination safeguards product quality and consumer health. Intech provides solutions for both dry and wet ingredients.

Beyond Individual Companies:

The efforts of dust collector manufacturers reach far and wide. They contribute to:

Improved public health: By reducing dust exposure, they help prevent respiratory illnesses and promote overall well-being.

Environmental protection: Dust collectors control air pollution, contributing to cleaner air and mitigating climate change effects.

Enhanced industrial efficiency: Cleaner work environments and protected equipment lead to improved productivity and reduced maintenance costs.

Conclusion:

Dust collector manufacturers may not grab the headlines, but their work is essential for our health, environment, and industrial well-being. Companies like Intech Bulk Handling Systems, with their commitment to innovative solutions, exemplify the critical role this industry plays in keeping our air clean. As we strive for a healthier and more sustainable future, appreciating and supporting these silent guardians of clean air becomes ever more important.

#dust collector manufacturers#clean air#Intech Bulk Handling#dust emissions control#CleanAir#DustControl#IndustrialSafety#HealthAndSafety#EnvironmentalProtection#AirQuality#DustCollection#Manufacturing#PublicHealth#CleanerEnvironment#Sustainability#WorkplaceSafety#IntechBulkHandling#ChainConveyors#India

3 notes

·

View notes

Text

Why Custom Software Solutions are Vital for Your Business?

read more... https://aequitasindia.com/why-custom-software-solutions-are-vital-for-your-business/

Tailored to Your Needs

Enhanced Efficiency

Competitive Advantage

Sacalability

#Data_Security

Integration

#Cost_Efficiency

Compliances

#Support and #Maintenance

#User_Experience

#Ownership and #Control

#Innovation

Long-Term Investment

#Customer_Satisfaction

Powered by : #Aequitas_Infotech Pvt. Ltd.

Our website: https://aequitasindia.com/

Follow us on...

LinkedIn: https://www.linkedin.com/company/aequitas-infotech-private-limited/

Twitter (X): https://twitter.com/AequitasInfotec

Facebook: https://www.facebook.com/profile.php?id=61550565488254

Instagram: https://www.instagram.com/aequitas_infotech/

#software company#technology#digitalmarketing#seo services#software development#customer satisfaction#innovation

2 notes

·

View notes

Text

The Features and Benefits of Services ERP

ERP systems are used across industries, from manufacturing to retail. They have different features and benefits depending on the size of their users' organizations (and whether they make cars or suits).

Investing in enterprise software is a big decision. While the monetary cost and your team's time investment can seem overwhelming, implementing the right ERP system will go a long way toward helping you compete with other companies in your industry. We’ve listed 10 key benefits of upgrading to an ERP system, so you can make a business case for how it can help your organization thrive in our hyper-paced, ever-changing world.

A successful ERP implementation hinges on a number of factors, including careful planning and goal setting. Once deployed, however, an ERP system will provide tremendous benefits to any business that implements it well.

Shanti Technology ranks among the top ERP software companies in Mumbai, Pune, Bhopal, Surat, Rajkot. STERP Software Pvt. Ltd. (Previously Known as Shanti Technology), is a Leader in Engineering and manufacturing ERP software in India, with headquarter in Vadodara, Gujarat. STERP Software Pvt. Ltd. has branch offices located in various cities across India such as Ahmedabad, Rajkot, and Surat in Gujarat, Mumbai and Pune in Maharashtra, as well as Bhopal in Madhya Pradesh.

What is Enterprise Resource Planning (ERP)?

Enterprise Resource Planning (ERP) is a type of software that organizations use to manage and automate various business functions, such as finance, procurement, human resources, and supply chain management. The purpose of ERP is to provide a centralized, integrated view of an organization's operations and data, enabling real-time decision-making and improved efficiency. ERP systems typically include modules for various business functions and provide a common database, user interface, and set of business processes. By integrating data and processes across departments, ERP helps organizations streamline operations, reduce costs, and improve overall performance.

Shanti Technology ranks among the best ERP software companies in India. STERP Software Pvt. Ltd. (Previously Known as Shanti Technology), is a Leader in Engineering and manufacturing ERP software in India, with headquarter in Vadodara, Gujarat. STERP Software Pvt. Ltd. has branch offices located in various cities across India such as Ahmedabad, Rajkot, and Surat in Gujarat, Mumbai and Pune in Maharashtra, as well as Bhopal in Madhya Pradesh.

What benefits can I expect for my business when adopting an ERP?

Improved data accuracy and consistency: ERP helps ensure that data is entered correctly and consistently across all departments, reducing errors and improving decision-making.

Increased efficiency: ERP automates many manual processes, freeing up employees to focus on higher-level tasks and increasing overall efficiency.

Better visibility into business operations: ERP provides real-time access to business data, enabling organizations to make informed decisions based on accurate, up-to-date information.

Enhanced customer satisfaction: ERP helps organizations provide more accurate and timely information to customers, improving customer satisfaction.

Improved supply chain management: ERP provides real-time visibility into inventory levels, delivery schedules, and supplier performance, enabling organizations to manage their supply chain more efficiently.

Better financial management: ERP provides real-time financial information, enabling organizations to better plan and control their finances.

Compliance: ERP helps organizations comply with regulatory requirements by providing a centralized repository of data and automated processes.

Better project management: ERP provides project management tools that help organizations plan, track, and execute projects more efficiently.

Scalability: ERP systems can be easily scaled to accommodate business growth.

Improved collaboration: ERP systems provide a centralized platform for collaboration, enabling employees from different departments to work together more effectively.

Solutions offered by ERP software companies in India are one-of-a-kind and specially designed ERP software for engineering companies that follow the fashion in which people work today. It focuses on strategic IT Initiatives. These solutions maximize the availability of the systems or processes and reduce the risks as well.

Benefits of ERP systems

Integration: ERP systems integrate all business functions into a single system, reducing data redundancy and increasing efficiency.

Improved decision-making: ERP provides real-time access to data and analytics, enabling better decision-making.

Increased productivity: ERP automates many manual processes, freeing up employees to focus on higher-level tasks.

Enhanced customer satisfaction: ERP helps companies provide more accurate and timely information to customers.

Better supply chain management: ERP helps companies manage their supply chain more efficiently by providing real-time visibility into inventory levels, delivery schedules, and supplier performance.

Improved financial management: ERP provides real-time financial information, enabling better financial planning and control.

Compliance: ERP helps companies comply with regulatory requirements by providing a centralized repository of data and automated processes.

Better project management: ERP provides project management tools that help companies plan, track, and execute projects more efficiently.

Scalability: ERP systems can be easily scaled to accommodate business growth.

Mobile accessibility: Many ERP systems provide mobile apps that allow employees to access business data and complete tasks from anywhere.

Shanti Technology is one of the most popular ERP software for engineering companies. Solutions offered by Shanti technology are one-of-a-kind and specially designed ERP software for engineering companies that follow the fashion in which people work today. It focuses on strategic IT Initiatives. These solutions maximize the availability of the systems or processes and reduce the risks as well.

The cumulative benefit of an ERP system is the competitive advantage it delivers.

Yes, that's correct. By streamlining operations, improving data accuracy, and providing real-time visibility into business operations, ERP can give organizations a competitive advantage by enabling them to make more informed decisions, respond more quickly to market changes, and increase efficiency. Additionally, ERP can help organizations improve customer satisfaction, manage their supply chain more effectively, and comply with regulatory requirements, all of which can contribute to a competitive advantage.

#ERP software for engineering company#ERP Software Companies in Mumbai | Pune | Bhopal | Surat | Rajkot - STERP#ERP software Companies in India#ERP software

7 notes

·

View notes

Text

ICV Assessments Pvt. Ltd. provided ISO certification which builds more trust for the people and improves the quality of your company. We offer- ✅ ISO 9001:2015 ✅ ISO 14001:2015 ✅ ISO 45001:2018 ✅ ISO 22000:2018 ✅ ISO 27001:2013 Contact to our team 👇 ☎️: +91 8826777664 🌐: www.icvassessments.com . #icvcertified #RepublicDay #iso #isocertification #certification #training #certificationbody #business #ISO9001 #innovation #improvement #assessment #qualitymanagement #assessor #neverstopimproving #isocertificationbody #isoquotes #haccp #quality #productivitytips #isocertified #ISO2200 #ISO_GMP_Approved #ISO45001 #ISO14001 #isoaudit #ISO27001 #compliance #foodmansgement #qualityassurance

#icvcertified#RepublicDay#iso#isocertification#certification#training#certificationbody#business#ISO9001#innovation#improvement#assessment#qualitymanagement#assessor#neverstopimproving#isocertificationbody#isoquotes#haccp#quality#productivitytips#isocertified#ISO2200#ISO_GMP_Approved#ISO45001#ISO14001#isoaudit#ISO27001#compliance#foodmansgement#qualityassurance

2 notes

·

View notes

Text

All-in-One Business Solutions: An Introduction to YesToBoss

Starting a business is a monumental task, filled with legal, administrative, and financial hurdles. That’s where YesToBoss comes in. Offering all-in-one business solutions, YesToBoss is dedicated to simplifying business incorporation and ongoing management. From company registration to compliance services, accounting, and IT solutions, they handle it all, ensuring a smooth start for your business.

Key Services Offered by YesToBoss

Company Registration and Incorporation Setting up a business can be complex, but YesToBoss streamlines the process for you. Whether you’re setting up a Limited Liability Partnership (LLP) or a Private Limited Company (Pvt Ltd), YesToBoss ensures a quick and efficient registration process. They manage all the legal paperwork, filings, and government requirements to get your business officially recognized.

Compliance and Legal Support Staying compliant with government regulations is critical to any business’s success. YesToBoss offers a full range of legal and compliance services, including annual filings, statutory compliance management, and legal document management. With their expertise, you can rest assured that your business stays in line with all necessary regulations, avoiding any potential legal issues.

Accounting and Auditing Financial health is the backbone of any business, and YesToBoss provides professional accounting and auditing services to keep your books in order. From bookkeeping and tax filing to financial auditing, their experts ensure your business maintains transparency and stays compliant with all financial regulations. Their detailed reports help you make informed decisions, so your business stays on track financially.

Licensing and Documentation To legally operate, many businesses need specific licenses or permits. YesToBoss helps you navigate the often complex world of business licensing. Whether it’s industry-specific certifications or general operating licenses, YesToBoss ensures that you acquire the necessary permits and handle the accompanying documentation seamlessly.

IT and Web Solutions In the modern world, having a robust digital presence is essential for success. YesToBoss offers web development, software solutions, and IT support that cater to your business needs. Whether you need a professional website, custom software, or ongoing IT maintenance, YesToBoss ensures that your tech infrastructure is solid and optimized for growth.

Why Choose YesToBoss?

YesToBoss offers comprehensive business solutions designed to make your entrepreneurial journey as seamless as possible. With their paperless processes, secure document handling, and expert guidance, they take care of all the administrative burdens. Their services are not only affordable but also flexible, ensuring that businesses of all sizes — whether startups or established companies — receive the support they need.

By choosing YesToBoss, you’re partnering with a team that’s committed to your success. They offer a hassle-free approach, giving you the peace of mind to focus on what matters most: growing your business.

0 notes

Photo

(via ROC Compliances for Private Limited Companies in India)

#ROC Compliances for Private Limited Companies#Roc Compliance#Roc Of Company#Roc Compliance For Pvt Company#Pvt Company Compliances#Company Compliance#Compliance For Pvt Ltd Company#Roc Compliance For Llp

0 notes

Text

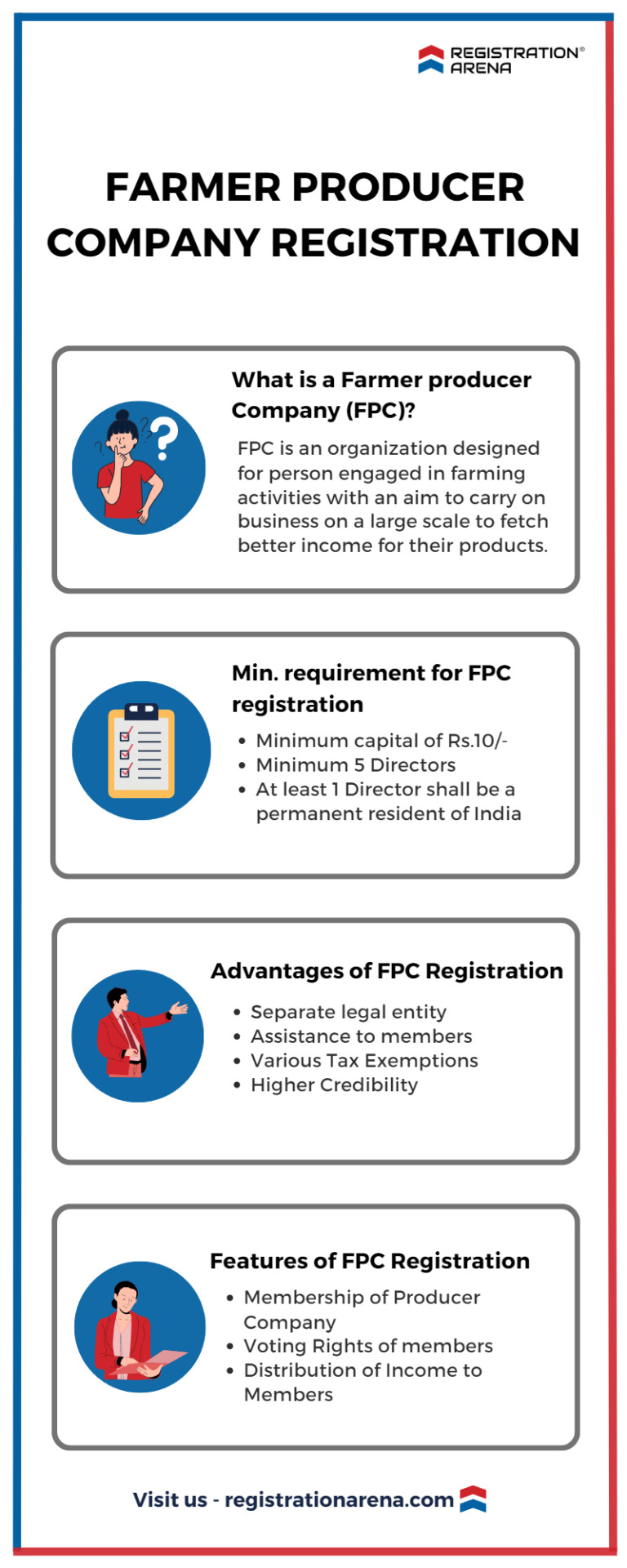

Farmer Producer Company (FPC) or Farmer Producer Organisation (FPO) is an organization that has been developed taking into consideration the requirements of farmers, agriculturists, fishermen, weavers, milk producers, and persons engaged in farming activities, collectively known as ‘Producers’.

#legal advisers#legal services#legal consultation#private limited company#gst registration#llp registration#OPC Registration#trademark registration#farmer producer company registration#Annual compliances of llp#Annual compliances of Pvt Ltd Company#itr filing#tds return

0 notes

Text

Your Ultimate Ally for Navigating Business and Finance Challenges : Benchmark Professional Solutions Private Limited

Comprehensive finance and legal solutions with Benchmark Professional Solutions Private Limited

In today’s fast-paced business environment, having a reliable partner for your financial and operational needs is essential. Benchmark Professional Solutions Private Limited stands out as a certified partner of Tally Solutions, providing comprehensive business and finance services tailored to meet the diverse needs of its clients. Their core services encompass everything from digital signatures to financial consultancy, ensuring that businesses can operate efficiently and remain compliant with regulatory requirements.

Benchmark Professional Solutions offers a wide range of Digital Signature Certificate (DSC) and token services, including EMUDHRA, PANTASIGN, CAPRICORN, TRUST, ID SIGN, XTRA TRUST, and HYP TOKEN. These services are crucial for businesses that need to secure their online transactions and adhere to legal compliance, especially in the digital landscape.

In addition to DSC services, Benchmark excels in traditional financial services such as accounting, auditing, and trademark registration. Their expertise in ROC (Registrar of Companies) compliance, along with license and registration services, ensures that businesses can navigate the complexities of corporate governance without hassle. They also provide professional assistance in income tax and GST compliance, helping clients minimize liabilities while maximizing savings through strategic planning.

Consultancy and outsourcing services are integral to Benchmark’s offering, allowing businesses to focus on their core activities while leaving administrative and compliance tasks in the hands of experts. Whether it’s legal assistance from their civil and criminal lawyers or expert advice on business strategy, Benchmark is equipped to handle various aspects of business operations.

Why choose Benchmark Professional Solutions Pvt. Ltd.?

The answer lies in their commitment to delivering personalized solutions that cater to the unique needs of each client. Their partnership with Tally Solutions enhances their credibility, enabling them to offer advanced software solutions that streamline financial management. With a team of experienced professionals dedicated to excellence, Benchmark ensures that every client receives the highest level of service.

In a world where financial landscapes are constantly evolving, Benchmark Professional Solutions Pvt. Ltd. remains a steadfast partner for businesses seeking growth, compliance, and peace of mind. With their comprehensive suite of services and a client-centered approach, they are well-positioned to support businesses in achieving their financial goals while navigating the complexities of the business world.

3 notes

·

View notes

Text

Best Business Structures for Small Tea Startups - Basketleaf

Selecting the right business structure is crucial for your tea startup, as it affects everything from taxation to personal liability and scalability. Here’s a look at the best business structures for small tea startups and how to choose the right one for your needs. Best business under 1lakh

1. Sole Proprietorship

A sole proprietorship is one of the simplest and most common structures for small businesses, especially for startups operating on a small budget.

Pros: Easy to set up, minimal paperwork, and full control over business decisions. You also benefit from simplified tax filing, as business income is reported on your personal tax return.

Cons: Personal liability is a major drawback, as you are personally responsible for any debts or legal actions against the business.

Best For: Solo tea vendors, small tea kiosks, or online tea shops selling directly to customers.

A sole proprietorship is ideal if you’re starting small and want a low-cost structure to get your business off the ground.

2. Partnership

If you plan to start your tea business with one or more partners, a partnership structure might be suitable. Partnerships come in two types: General Partnership (GP) and Limited Partnership (LP).

Pros: Low startup costs, shared financial responsibility, and pooled resources. Partnerships also allow each partner to bring in unique skills to the business.

Cons: In a general partnership, all partners share liability, which could impact personal finances. Limited partners have less control but are not personally liable.

Best For: Tea cart businesses, pop-ups, or tea cafes where two or more people are working together to share the costs and workload.

A partnership is an affordable way to start a tea business with multiple owners, but it requires trust and good communication between partners.

3. Limited Liability Partnership (LLP)

An LLP provides the benefits of a partnership but with limited liability protection, making it a popular choice for small businesses in India.

Pros: Limited liability protection for each partner, while still allowing flexibility in management. Each partner’s liability is limited to their investment in the business.

Cons: Higher setup costs than a sole proprietorship or general partnership, and LLPs are subject to more regulatory requirements.

Best For: Small tea businesses looking to expand in the future or attract investors, as an LLP offers credibility and limited liability.

An LLP combines flexibility and liability protection, making it a secure structure for small tea startups with multiple partners.

4. Private Limited Company (Pvt. Ltd.)

A private limited company offers substantial liability protection and is ideal if you have ambitions to scale your tea business significantly.

Pros: Limited liability for shareholders, separate legal identity, and a more professional structure, which is attractive to investors. Pvt. Ltd. companies also offer tax benefits and easier access to funding.

Cons: Higher registration and compliance costs, including auditing and mandatory filings with the Ministry of Corporate Affairs.

Best For: Tea brands that plan to scale nationally or internationally, open multiple outlets, or expand their product line to premium markets.

While it requires more paperwork and investment, a private limited company structure is advantageous for tea startups aiming for rapid growth and attracting investors.

5. One Person Company (OPC)

A One Person Company (OPC) is a relatively new business structure in India that combines the benefits of a sole proprietorship and a private limited company, specifically designed for solo entrepreneurs.

Pros: Offers limited liability while giving full control to a single owner. OPCs also enjoy some tax benefits and can raise funds by bringing on shareholders without losing ownership.

Cons: Limited to one shareholder, and if the turnover exceeds ₹2 crores, it must convert into a private limited company. OPCs also have higher compliance requirements than a sole proprietorship.

Best For: Solo tea entrepreneurs with a strong vision for growth, especially those planning to introduce unique or niche products.

An OPC is ideal if you want the benefits of a private limited company without bringing on additional shareholders initially.

6. Limited Liability Company (LLC)

Though more common in Western countries, an LLC structure is similar to an LLP in India. It offers flexibility in management, limited liability, and tax benefits.

Pros: Limited liability for owners and fewer compliance requirements than a private limited company. Profits are taxed at the owner level, avoiding double taxation.

Cons: Not as common in India, so some banks and investors may view it less favorably than other structures. There are also state-specific requirements.

Best For: Small tea businesses, especially those involved in imports and exports or seeking international expansion.

An LLC structure is best for tea startups focused on flexibility and international trade, though it’s less common in India.

7. Franchise Model

If you want to start a tea business with established brand support, consider becoming a franchisee. This model offers the security of a proven business model, training, and marketing support from the franchisor.

Pros: Benefit from an established brand name, ready-made marketing materials, and business training. Franchisees receive ongoing support, reducing the risks associated with startups.

Cons: Initial franchise fees can be high, and franchisees have limited control over the business model and brand image.

Best For: Entrepreneurs with some capital who want to avoid the risk of starting from scratch and prefer the security of a proven tea brand.

Franchising is a good option if you’re willing to invest in a brand with strong market potential and established customer loyalty.

Choosing the Right Business Structure

To determine the best structure for your tea startup, consider the following factors:

Budget and Startup Costs: Sole proprietorships, partnerships, and LLPs are cost-effective for startups with budgets under ₹1 lakh.

Personal Liability: If you want to limit personal liability, an LLP, Pvt. Ltd., or OPC structure may be more suitable.

Business Goals: For solo ventures, a sole proprietorship or OPC is practical, while partnerships, LLPs, or private limited companies are better for businesses aiming to grow and attract investors.

Scalability: Choose a structure that supports growth. Pvt. Ltd. and LLPs offer more potential for expansion and investment.

Compliance Requirements: Sole proprietorships have minimal compliance requirements, whereas Pvt. Ltd. companies and LLPs require regular filings and audits.

Frequently Asked Questions (FAQs)

Q1: Can I change my business structure later?Yes, you can convert your business to a different structure as it grows. For instance, many businesses start as a sole proprietorship and later convert to an LLP or Pvt. Ltd. company.

Q2: What’s the best business structure if I want to attract investors?A Private Limited Company (Pvt. Ltd.) is generally preferred by investors due to its limited liability and separate legal identity.

Q3: Are there tax differences between these structures?Yes, tax rates and benefits vary by structure. For instance, sole proprietorship income is taxed as personal income, while Pvt. Ltd. companies have corporate tax rates. Consult a tax advisor for details.

Conclusion

Best business under 1lakh Choosing the right business structure for your tea startup is essential for both legal protection and long-term success. Consider your budget, business goals, and liability tolerance when deciding. Whether you’re launching a small tea kiosk or planning to build an online tea brand, there’s a business structure that fits your needs and future aspirations

0 notes

Text

Sanolet Lifecare Pvt. Ltd., a WHO-GMP certified company, is holding a walk-in interview for various roles in Engineering, Production, Quality Assurance (QA), and Autoclave operations. Located on the Bavla-Changodar Highway in Ahmedabad, Sanolet offers a rewarding career in a state-of-the-art pharmaceutical manufacturing environment, where quality and efficiency are key. The walk-in interviews will be held on November 9th and 10th, 2024, from 10:00 AM to 4:00 PM. About Sanolet Lifecare Pvt. Ltd. Sanolet Lifecare is dedicated to advancing healthcare solutions through high-quality pharmaceutical manufacturing processes. Known for its commitment to compliance and quality, Sanolet offers a dynamic work environment with opportunities for career development. Employees benefit from working in a facility that adheres to the highest global standards, including WHO-GMP certifications. Job Openings and Requirements Engineering Department Position: Officer Experience Required: 3-4 years Responsibilities: Responsible for managing mechanical and electrical breakdowns to ensure smooth daily maintenance and production operations. The role requires expertise in HVAC, water systems, and boiler operations to support uninterrupted facility functioning. Production Department Position: Officer Experience Required: 1-3 years Responsibilities: Focus on aseptic practices and essential production documentation. Proficiency with MS Office and basic aseptic techniques is necessary for maintaining cleanliness and efficiency. Position: Operator (Vial Washing and Filling Machine) Experience Required: 3-5 years Responsibilities: Operate vial washing and filling machines, ensuring compliance with production standards. Experience with dry powder injection is essential. Quality Assurance (QA) Department Position: Officer (QMS, Validation, and Qualification) Experience Required: 3-5 years Responsibilities: Handle Quality Management Systems (QMS), validations, and qualifications independently. The role requires expertise in CAPA, OOS, and OOT processes, along with the ability to prepare protocols and SOPs autonomously. Position: Officer (In-Process Quality Assurance - IPQA) Experience Required: 3-4 years Responsibilities: Perform in-process activities such as line clearance and documentation for quality checks in manufacturing and packaging, ensuring consistency and compliance. Autoclave Operations Position: Operator Experience Required: 1-3 years Responsibilities: Operate autoclave equipment, maintain machine parts, and handle necessary documentation. Expertise in autoclave procedures and documentation is essential for this role. Note: Dry powder injection experience is a must for relevant roles. Transportation is provided from Gota and CTM Ahmedabad for employee convenience. [caption id="attachment_78620" align="aligncenter" width="930"] Sanolet Lifecare pvt ltd Recruitment - Job vacancies[/caption] Walk-In Interview Details Date and Time: November 9th & 10th, 2024 10:00 AM to 4:00 PM Location: Sanolet Lifecare Pvt. Ltd. (A WHO-GMP Certified Company) Plot No. 10, Survey No. 151, Inside Varmora Plastech P.O. Vasna Chancharwadi, Bavla-Changodar Highway Ahmedabad-382213, Gujarat, India Application Process applications can be sent via email to [email protected] Required Documents: Updated CV Educational Certificates Proof of Experience

0 notes