#commodity trading training courses

Explore tagged Tumblr posts

Text

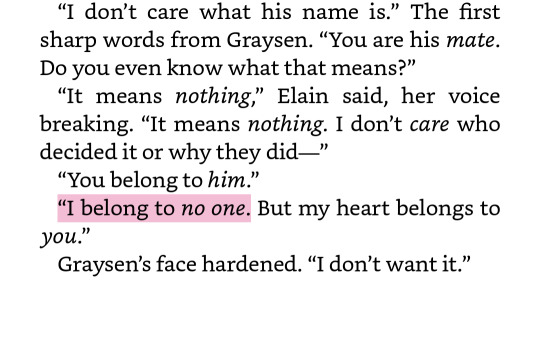

On Disrupting the Status Quo: The Archeron Sisters

First of all, I want to thank everyone so much for the love on my previous post! I genuinely thought I was sending a Vassien Hero's Journey dissertation out into the void and not a soul alive would read it. I am thrilled and delighted to have been met with such welcome in this space!

I'll keep this next one short and sweet, (retcon- I did not keep it short and sweet) but one of my additional favorite topics to break down regarding the structure of the Archeron sister's and their journey's is a disruption of the status quo to the world at large. Through their stories of healing, love, and coming into their power, both Feyre and Nesta have tackled a system of patriarchy within Prythian/Illirya and improved conditions for females in a way no one has been able to do before the arrival of the Made Sisters. I truly hope Elain gets her chance to do the same!

Feyre at the beginning of her Hero's Journey: There are no High Ladies. Only males have the power to oversee a court. Feyre, not only through her relationship with Rhys but through her own healing journey and establishing her power, takes his side as an equal. She is High Lady. Feyre showed that females can be more. They do not simply have to sit by the side with no titles or agency and let males fight over who gets to keep them as Lady of their court. They can be equal in power. Even Tarquin, who has his own plans to disrupt power imbalances, was surprised.

And of course, my hope is we got some foreshadowing for more High Ladies to step up with Viviane. She single handedly held the Winter Court together during those harrowing years Under the Mountain, both as a warrior and a leader.

Moving on to Nesta, her Hero's Journey led her to solve a problem that her mate and the High Lord of the Night Court hadn't been able to solve for HUNDREDS of years- getting females training.

More than that, she and Gwyn and Emerie became not only the first females to ever participate in the Blood Rite, but they also won.

By coming into her power and going down her path to accept her life as Fae and heal, The Valkyrie's have been restored and females of any heritage now have a safe space to train without the leering contempt of Devlon and the Illyrians. I certainly hope Illyria continues to progress, but this is a huge start. And it is all because of Nesta and her choice to lean into who she would be in this new life now that she had chosen to face it.

Aaaaand I'm crying. Please hold.

Now we move onto Elain. And this is my question- if Elain is *not* going to disrupt the status quo by challenging the mating bond, by pushing against the expectations of her court to satisfy political conflicts and taking away her agency in who she wants to love, then who is going to do it? And what is going to be done for the females of Prythian who are unhappily mated? What is going to be done for Lady Autumn, for females like Rhy's mother, for all who *tried* to make it work because females have little to no choice in who they are paired with?

*Someone* is going to tell this story. And in doing so, they will not only be making the best choice for themselves, but they are going to challenge the very foundation of another way females are kept in submission like Feyre and Nesta did. They are going to demand that no one else goes through what Feyre did-giving Tamlin the right to wage a war simply by putting a ring on her finger then deciding not to go through with the wedding and leaving him by choice. Someone is going to ask why anyone had the right to sell Lady Autumn into a lifetime of abuse. Why Morrigan was allowed to be sold as a commodity. Someone is going to remember what it felt like to lose their fiancé because the mating bond meant they "belonged" to someone they didn't even know.

Someone is going to say no more. No more of females being political pawns, being objects to be sold and traded, to having their choices stripped and lives controlled over a system that is widely accepted as deeply flawed and not entirely understood.

This story will be told. And if it is not told by Elain Archeron, then I simply ask, who will?

The Archeron sisters are not maintaners.

They are disruptors.

#elriel#pro elain archeron#pro elain#pro elriel#azriel x elain#elriel supremacy#elriel endgame#elain archeron

116 notes

·

View notes

Note

Tenya watches as his parents discuss assets and boons. Tenya who sees them looking at Harry and Teddy (who are his and whom he loves so much) and knows that the people who should love him yet left him behind don’t see two amazing people. Tenya who stands up and seriously tells them that no, Harry and Teddy won’t be paraded about by the media. No he won’t request they ‘show off’ Teddy’s ‘early Quirk’.

Harry fighting for his soulmate and his friends, fierce and deadly because he can’t lose anyone else. Who screams at Stain that he’s ’nothing more than another villain with empty promises who wants pain’. Their first kiss (Tenya and Harry) being in a hospital as baby Teddy cries because ‘Pap’ is hurt. (His first word was dada and it was Harry. Pap, papa, his second, is for Tenya and oh lord does it make them sob).

Izuku and Ginny trading letters and stories. Ginny coming to UA to finish her schooling because her mark is black and everyone knows. Luna following, Hermione and Ron a step behind. Luna who smiles at the dual haired teen whose mark shines like hers. George coming to, tired, tired, tired. But he slowly smiles again. Molly and Arthur, Percy, Bill, Charlie (all tired and seeing that little is changing. That no one wants to do more then get rid of the laws Voldemort put up. Who see Kingsley frown in anger and can’t do anything) all packing up to move.

They burned and got nothing. Screw England.

(Percy’s mark shines around a man with scars who glares and sneers but who also left his family behind once. Percy isn’t the same as him but he understands feeling as if his family has let him down over and over again.

It’s funny in a way how many marks shine in Japan. As if Fate knew.)

Screaming sobbing barking howling

Tenya who has always allowed himself to be treated like a tool, like a commodity by his parents knowing that was the best he would ever get from them, but refusing to let them do the same to Harry and Teddy. Harry who would have let them use him at least (not Teddy never Teddy) because every moment from the one he received his letter has been honing him I to a tool to be wielded. Harry looking at Tenya with wide, confused eyes when he snaps at his parents and pulls Harry and Teddy from the house because he doesn’t understand. (No one ever stood up for him like that. Not when he was The Chosen One. It takes him far longer than he would care to admit to wrap his mind around it.)

Harry who bares his teeth and fights dirty. Fights like only one person will walk away from the fight and he is fully planning on being the one to do so. Fights like the weapon he was raised to be rather than the heroes those closest to him are. Harry who refuses to lose anyone else so he meets the villains on their level and comes out with more faces and names to haunt his nightmares but alive. With his family alive. He will bear the burden. He has always done so. Ever since his first kill at eleven.

And he comes back to Tenya and Teddy who ground him. Who remind him that he so still human. That he has people to live for and not four ghosts leading him to his death. (He cries after Tenya and Teddy fall asleep in the hospital. Cries so hard he forgets how to breathe. Cries for how close he got to losing this and the man he will have to become to make sure that doesn’t happen. One more fight. One more war. And then he can truly retire. He promises himself. Promises the two sleeping figures in the bed.)

Ginny and Izuku becoming fast friends and even faster allies. Swearing to each other (and eventually to Ochako who joins their little group after Training Camp when her mark only started to shine after a girl with a cruel knife and crueler smile had her pinned to the ground promising to make her red red red) that they would not bow to fates design for them. That they would choose what made them happy rather than the agony they had been saddled with. And of course, comforting each other when the grief of what ifs and shattered bonds become too much to bear on their own.

Luna and Shoto trading theories and conspiracies in a language that almost seems to be entirely their own. Shoto who sees the scars left over from the months Luna spent as a captive in the Malfoy estate and decides he needs both halves of his power to make sure it never happens again. Luna whose eyes go startlingly sharp the first time she sees Endeavor and refuses to let him anywhere near Shoto no matter how much he roars and rages. She puts out his fire with a wave of her hand when he tries to move her and sends him flying into the far wall with barely a thought when he tries to lift a hand to her. Shoto has never been more in love.

Percy who comes early enough to lure Touya away from a path that would only lead to the ruin of both him and his family. Who offers a better way to get his revenge. One that would disgrace his father instead of turning him into a martyr. One that would spare the innocents caught in the middle. And if all else fails he promises to make it look like an accident then leak the damning evidence anyway because really how many fire quirks does Touya really think exist in Japan magic is so much cleaner. Touya who sees that darkness and anger in Percy that he kept hidden even from his own family until it grew fangs and lashed out at them rather than the ones that truly deserved it and understands why this man is his.

George who stopped looking at the name on his arm after Fred died. He has already lost half of his soul he doesn’t need a mark to tell him that there is someone better than his brother. What other relationship could compare? What fate decided romance could possibly make up for the loss of his heart? The loss of Fred is like the loss of a limb and who could possibly replace that? And then he meets Tensei who has a brother he loves just as much as George loves his who doesn’t want to replace Fred but wants to make a life with George anyway if he would allow it. Who honors George’s brothers, dead and alive, just as much as he honors Tenya. And it doesn’t fix it. Doesn’t magically make Fred’s loss okay, but slowly it starts to hurt less to smile, to laugh. He can’t look in a mirror most days, but Tensei doesn’t seem to mind tugging him down to fix his hair or straighten his tie.

Everyone coming in twos and threes until they are all out from under the Ministry’s grasp and finally able to live rather than just survive. To thrive.

#the elf talks#mha#bnha#harry potter#afo: you’re a hero. you won’t kill me. your honor won’t allow it#Harry: a weapon has no honor

26 notes

·

View notes

Text

So I've been training my woodcutting skill in Runescape. I've saved up like 1200 yew logs, and I've also been selling a couple hundred in the in-game stock market as well.

The woodcutting experience is great, but over the past few days, the price of yew logs has taken a sharp downturn:

When I was burning them for firemaking experience, prices began to get up above 300 coins per log. But as you can see, the price is in freefall right now - rapidly approaching 250 coins per log. And it's a straight shot to the bottom; it's not curving back upwards and it doesn't look like it's gonna stop any time soon.

That being said, this is the stock price over the course of one month. Let's see how the price graph looks over a six month timeframe:

Huh. The price almost bottomed out in early June at 200 coins a log, and it bounced back to a 300+ coin high by the start of July.

Basically, yew logs aren't a stable commodity. They're cheap now, they'll be expensive later on. It's fine - I'll hold onto the logs until I can get a big return or unless I decide to do something with them. Making yew longbows involves a lot of downtime for not a super great reward, and they don't shift as often as the actual logs do. I could also use the logs to further my firemaking experience, of which I still need a lot of XP.

But just for fun, I decided to look back over the market history of yew logs on the Grand Exchange, since the start of 2022 and 2020 respectively:

And that's really interesting. Yew logs appear to have historically had a pretty depressed market price, at least through 2022. We're talking sub-200 prices at one point. And yet in 2020 and 2021, the price spiked just as high as the peaks of 2023's log sales. There's evidence of low market engagement, but there's also historical precedent to suggest that yew logs were a popular trading item before the low prices, leading into a resurgence in the market come 2023.

I hope the prices bounce back soon. I mostly just want a solid cash injection with little to no additional work from me.

21 notes

·

View notes

Text

Improvisor Operative (Operative Alternate Class Feature)

(photograph and prop weapon by NuclearSnailStudios on DeviantArt)

Whether it’s MacGyver, Kevin McCallister, or any number of heroes with a genius level understanding of how objects work together, there’s something we all love about the gadgeteer hero that can rig a weapon or working device from whatever happens to be on hand.

Such is the inspiration behind today’s operatives, for while one might associate mechanics with jury rigging and creating objects from seeming trash, the spy or agent that can make anything they need is also a fun version of the trope.

As we’ll soon see, these operatives can form a solution to any problem as long as they have time and materials on hand.

With a few moments of time, these sneaks can turn an object into an improvised weapon, adjusting it to also be thrown and usable with their operative training. Typically, these weapons deal bludgeoning, slashing, or piercing, but I could make an argument for them dealing other damage types if the right components are used. A bit of resolve can even be used to cobble together the weapon in the same fluid motion as them picking it up or drawing it.

What’s more, they can rig junk into various technological devices, which typically only have enough power to be used once, but a bit of resolve can be used to bolster that duration.

This ability replaces the operative’s edge, but with the ability to replicate technological devices on the fly, I’d say it’s pretty fairly balanced. That being said, I feel like a few other operative abilities might have been traded out to make this ability more flexible.

This archetype has elements of the junker gadgeteer, but also of the specialist agent, able to procure and improvise technology in an almost Metal Gear sort of way. As such, the reason for their skill set can vary a lot depending on the character, and I think that’s worth exploring.

Sometimes you come across a story on the infosphere that seems too amazing to be plausible. For example, stories of a stranded spacer converting their entire cargo of children’s toys into simple distress beacons, weapons, and the like seems too incredible, but it is very real. Some wonder if there is more than an engineering degree at work here.

Most loquan prefer to live in a realm of magic beneath the mists of their homeworld. However, a few do choose to venture out among the starts. They often have to learn very quickly the technological solutions to problems they’d normally solve with magic, and some have an exceptional knack for it.

When you choose to give up the nomadic subsistence life of the haan, one must learn to survive alone and with others. As such, many paramilitary groups try to recruit them as premier survivalists as they leave their homeworld. Of course, many a savvy haan recognize this for what it is, and chafe over being treated as a commodity.

6 notes

·

View notes

Text

NZDCHF & The Rounding Bottom: The Hidden Gem Setup Most Traders Ignore The Secret Weapon Hiding in Plain Sight Ever feel like trading Forex is a lot like dating? You spend weeks analyzing charts, looking for the perfect setup, only to watch it ghost you at the last second. But every once in a while, you stumble upon a setup so powerful, so reliable, that it feels like you just discovered the ultimate cheat code. Enter the rounding bottom pattern—a formation so underrated, it’s practically the introvert of technical analysis. Now, let’s talk about how this pattern is setting up beautifully on NZDCHF, a pair that rarely makes headlines but often delivers high-reward opportunities when you know what to look for. Why Most Traders Get It Wrong (And How You Can Avoid It) Let’s be honest—most traders are obsessed with head and shoulders, double tops, or whatever pattern gets hyped up in trading forums. But here’s the kicker: the rounding bottom is a stealthy powerhouse, catching big moves before they happen. This pattern forms when a currency pair slowly transitions from a downtrend into an uptrend, forming a bowl-shaped curve. The problem? Impatient traders give up too soon, expecting instant gratification like a toddler waiting for a microwave to finish. Common Mistakes That Cost Traders Money - Impatience: Traders abandon the trade because it takes time to develop. - Poor Confirmation: Jumping in before a proper breakout. - Misreading Volume: Ignoring the increasing volume that confirms institutional interest. - Ignoring Fundamentals: Not checking economic trends that align with the technical setup. But here’s the twist—NZDCHF is showing all the right signs that this pattern is about to pay off big time. NZDCHF’s Rounding Bottom: A Setup You Can’t Ignore 1. The Technical Case: What the Charts Are Screaming - Gradual Downtrend Exhaustion: NZDCHF has been sliding downward for months, but the pace is slowing. - Rounded Support Base: Price is forming a steady bottom, curving upwards like a shallow bowl. - Breakout Zone: The key breakout level is 0.5550, which, if broken with strong volume, could send the pair skyrocketing. - Rising Volume: Smart money is accumulating. When retail traders finally notice, it’ll be too late. 2. The Fundamental Case: Why This Trade Makes Sense - Interest Rate Divergence: The Reserve Bank of New Zealand (RBNZ) has hinted at potential rate hikes, while the Swiss National Bank (SNB) remains dovish. - Risk Sentiment Shift: If market sentiment tilts toward risk-taking, the NZD benefits at the expense of the CHF. - Commodity Correlation: With dairy and commodity prices stabilizing, NZD has fundamental tailwinds. How to Trade the NZDCHF Rounding Bottom Like a Pro 1. Entry Strategy: Timing It Right ✅ Ideal Entry: Wait for a daily close above 0.5550 with strong volume. ✅ Alternative Entry: If price retests 0.5500 as support, that’s your secondary buy signal. 2. Risk Management: Playing It Smart 🚨 Stop-Loss: Below 0.5480, just under the rounding base. 🎯 Target 1: 0.5700 (nearest resistance zone) 🎯 Target 2: 0.5900 (long-term breakout move) 3. Bonus Ninja Trick: Using Smart Money Insights Most traders ignore commitment of traders (COT) data, but it’s a goldmine. Look for a shift where big institutions reduce CHF longs while increasing NZD longs—it’s the ultimate confirmation that the big players are positioning before the breakout. Final Thoughts: Are You Ready to Catch This Move? The rounding bottom pattern on NZDCHF is shaping up to be one of those high-reward, low-risk setups that only seasoned traders recognize. Most retail traders won’t see it coming, but by the time they do, the train will have left the station. If you want to stay ahead of the curve with exclusive trade ideas, expert analysis, and real-time alerts, check out: 🔹 Latest Forex News & Indicators 🔹 Free Advanced Forex Courses 🔹 Live Trading Community 🔹 Smart Trading Tools & Journals Trade smart, stay ahead, and never chase a trade—let the trade come to you. 🚀 —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Why Enrolling in a Derivatives Trading Course Is the Best Investment!

Introduction to Derivatives Trading

In the fast-paced world of financial markets, staying ahead of the curve is crucial. One of the most dynamic and lucrative segments is derivatives trading. Whether you're a budding investor or a seasoned professional, understanding the intricacies of derivatives can open doors to new financial opportunities. This is where enrolling in a Derivatives Trading Course becomes a game-changer.

What is a Derivative?

A derivative is a financial contract whose value is derived from an underlying asset like stocks, commodities, currencies, or indices. Common types of derivatives include futures, options, swaps, and forwards. These instruments are essential for hedging risks, speculating on price movements, and optimizing investment strategies.

Why is a Derivatives Trading Course Essential?

1. Master the Fundamentals

Understanding derivatives requires more than just surface-level knowledge. A Derivatives Trading Course provides in-depth training, covering everything from basic terminologies to advanced trading strategies.

2. Learn Risk Management

Derivatives trading involves significant risk. A structured course teaches you how to manage these risks effectively, ensuring you make informed decisions that safeguard your investments.

3. Stay Ahead with Practical Insights

Theory alone won't cut it in the real world. A quality Derivatives Trading Course includes practical sessions, case studies, and market simulations, helping you apply concepts in real-time trading scenarios.

4. Enhance Career Prospects

With specialized skills in derivatives trading, you become an asset to financial institutions, investment firms, and brokerage houses. Certification from a reputable course can significantly boost your resume.

Why Choose ICFM for Your Derivatives Trading Course?

The Institute of Career in Financial Market (ICFM) stands out as a premier institute offering comprehensive and industry-relevant courses in financial markets. Here’s why ICFM should be your top choice:

Expert-Led Training

ICFM's courses are designed and delivered by industry veterans with years of experience in financial markets. Their insights ensure you receive both theoretical knowledge and practical expertise.

State-of-the-Art Curriculum

The Derivatives Trading Course at ICFM is continually updated to reflect the latest market trends and regulatory changes. You'll learn the most current strategies and tools used by professional traders.

Hands-On Experience

ICFM emphasizes practical learning. The course includes live trading sessions, workshops, and simulations that give you real-world exposure.

Career Support and Networking

Graduating from ICFM doesn't just earn you a certificate—it opens doors. The institute offers career guidance, placement assistance, and networking opportunities with industry experts.

What You'll Learn in ICFM’s Derivatives Trading Course

Introduction to Derivatives Markets

Understanding the types of derivatives

Market participants and their roles

Regulatory frameworks and compliance

Trading Strategies and Techniques

Futures and options strategies

Hedging, arbitrage, and speculation tactics

Technical and fundamental analysis methods

Risk Management and Mitigation

Identifying potential risks in trading

Tools and techniques for risk mitigation

Practical exercises for risk assessment

Live Market Exposure

Simulated trading environments

Analysis of current market trends

Real-time strategy implementation

Who Should Enroll?

Aspiring traders looking to build a solid foundation

Financial professionals aiming to upskill

Students interested in capital markets

Investors seeking to diversify their portfolios

How to Enroll in ICFM’s Derivatives Trading Course?

Getting started is simple. Visit the ICFM website, explore the course details, and complete your registration. You can also reach out to their career advisors for personalized guidance.

Conclusion

In a world where financial acumen dictates success, equipping yourself with specialized knowledge in derivatives trading is invaluable. The Derivatives Trading Course at ICFM doesn't just teach you the basics; it empowers you to navigate complex markets confidently.

Don't just watch others succeed in the financial markets—become a skilled trader and carve out your own path to financial freedom. Enroll in ICFM's Derivatives Trading Course today and take the first step towards mastering the art of derivatives trading!

Read More blogs: Derivatives Trading Course

#Derivatives trading course#Derivatives trading course in india#Derivatives trading course online#Derivatives trading course free#options#futures and other derivatives course#Best Derivatives course in India#Advanced derivatives course#Derivatives courses

0 notes

Text

7 Point Something

The train rattled along the endless tracks, its rhythmic clatter the only thing tying together a group of students too tired to pretend they liked each other. It was the first stop of their study tour, and tensions, like the humidity in the air, had begun to cling to their skin.

Professor R, a last-minute addition to the tour, sat stiffly in his seat, watching over them like a disinterested warden. He didn’t know any of them. Perhaps that should have made him impartial, but somehow, he had already found his favorites. The boys.

It wasn’t obvious at first. A nod here, a chuckle there, a casual “Good job, boys” after every task. The girls noticed. Of course, they did.

But the real storm arrived on the second day.

A few girls, tired of the exhausting schedule and the mindless lectures, asked for permission to go home by flight. Professor R shrugged them off, telling them to ask the dean. The dean, as expected, was noncommittal. That should have been the end of it.

Except, that very morning, whispers floated through the air—one of the guys had gotten permission. And not because of an emergency. No, he had lied, spun a story, and walked away with a green signal.

“You know what?” One of the girls muttered. “If we don’t get permission, I’m telling them about his little fairytale excuse.”

Someone—because there was always someone—overheard and carried the words to their rightful owner. The boy.

Minutes later, chaos erupted. He stormed in, furious, his voice cutting through the tense silence. And before anyone could react, he lunged.

That was the moment the lines were drawn.

The girls, fed up, were no longer just angry at the attack. They were furious at the snitching, the backstabbing, the constant surveillance of their every word. And as the night unraveled, so did every buried insult, every whispered rumor, every falsehood that had been traded between the boys like a cheap commodity.

One of the girls confronted a boy about a particularly nasty rumor he had started. He denied it. Until proof landed in front of him, leaving him speechless. The shame turned to rage. He chased after her, had to be physically held back.

The people working at the institute saw. They reported.

The professor arrived, face dark with frustration.

“What happened?”

Silence.

A table crashed to the floor.

“I SAID, WHAT HAPPENED?”

The students mumbled a version of the story—a diluted, edited, censored version. The girls, foolishly believing they were playing peacemakers, didn’t expose the boys for what they had done. They thought it would end there.

It didn’t.

The boys had learned the game well. By the next day, they had begun working on the professor, spinning a new tale where they were the victims, the girls the aggressors. A few girls—eager for favor—joined them, helping paint the others as troublemakers.

The professor, slowly but surely, started believing it.

Seeing this, the girls retreated into silence, isolating themselves. They had no idea that this would be interpreted as disrespect. No idea that this was the beginning of their downfall.

By the time the tour ended and they returned home, the verdict was already written.

The results came out.

The boys: 9-point-something.

The girls: 7-point-something.

Fairness was a myth. Justice was a joke. And as they stared at their marksheets, they realized—sometimes, you don’t need to fail to be punished. Sometimes, a seven-point-something was all it took to remind them where they stood.

0 notes

Text

Learn Logistics and Supply Chain Management in Kerala | Blitz Academy

The logistics and supply chain management sector is more vital than ever in the current, fast-paced global economy. In order for firms to remain competitive, it guarantees that things are created, delivered, and received in an efficient and timely manner. Blitz Academy in Kerala provides extensive courses that are intended to give you the fundamental knowledge and real-world experience required to succeed in logistics and supply chain management if you want to establish a prosperous career in this fast-paced industry.

Logistics and supply chain management: what are they?

The process of managing the flow of products and services, including the movement of raw materials, completed goods, and even information across a business’s operations and distribution network, is known as logistics and supply chain management, or SCM. Procurement, production, storage, transportation, and distribution are some of the procedures involved. Cost reduction, increased customer happiness, and improved business efficiency all depend on these operations being managed well.

Logistics and supply chain management is a broad field that includes aspects of customer service, technological integration, operational execution, and strategic planning. Professionals in this industry are crucial to the seamless flow of commodities across international boundaries and via local markets as businesses continue to grow internationally.

Why Choose Supply Chain Management and Logistics Courses?

Globalization, technology breakthroughs, and the growing need for quicker, more effective delivery methods are all contributing factors to the logistics and supply chain industry’s explosive growth. Businesses require highly qualified individuals who can successfully manage resources, streamline supply chains, and address issues including shifting regulatory frameworks, varying demand, and transportation delays.

You will benefit from studying supply chain management and logistics in the following ways: 1. business Relevance: Almost every business, including manufacturing, retail, and healthcare, depends heavily on logistics. The need for supply chain experts is increasing rapidly due to the growth of e-commerce and worldwide trade. 2. A Wide Range of Career possibilities: Jobs in logistics and supply chain management include positions as distribution managers, supply chain analysts, procurement managers, logistics coordinators, and inventory control specialists. These professions cover many industries, allowing for a diverse career path. 3. Practical Instruction: The focus on real-world experience is one of the main benefits of taking a logistics and supply chain management course at Blitz Academy. Instead of merely sitting in a classroom, you will be participating in real-world settings that mimic the opportunities and difficulties encountered by industry experts. 4. Lucrative payment: Logistics and supply chain management positions frequently provide high salaries as a result of the growing need for qualified workers. Your earning potential may increase significantly as you acquire expertise and focus on particular fields.

Your Pathway to a Successful Career in Supply Chain Management and Logistics with Blitz Academy

Situated in the center of Kerala, Blitz Academy provides specialized supply chain management and logistics courses that are designed to satisfy the expanding demands of the sector. Through innovative training techniques, the school ensures that you are well-prepared for the challenges of the logistics industry by imparting both academic knowledge and practical skills.

What Is Unique About Blitz Academy?

1. Knowledgeable Faculty: The academy employs seasoned teachers who infuse the classroom with a multitude of industry expertise. They make sure you get the most current and pertinent information by fusing academic rigor with practical insights. 2. Extensive Curriculum: Blitz Academy’s courses address a variety of subjects, such as risk management, distribution, inventory control, supply chain strategy, procurement management, and transportation management. Additionally, you will learn about new developments like AI-powered logistics, digital supply chains, and sustainable practices. 3. Practical Training: Blitz Academy is a firm believer in experiential learning. Participating in case studies, internships, field trips, and simulations will provide you the chance to learn more about the real-world applications of supply chain management. 4. Industry Collaboration: Students can network, attend workshops, and potentially land internships or job placements with leading firms thanks to Blitz Academy’s excellent relationships with logistics companies and industry leaders. 5. State-of-the-Art Facilities: To enhance your educational experience, the academy has state-of-the-art classrooms, a well-stocked library, and the newest technology. You will be able to work with the technologies that are influencing supply chain management and logistics in the future if you have access to industry-standard software and tools.

Course Offerings

A range of courses are available at Blitz Academy to accommodate varying skill levels and professional objectives. There is a curriculum for everyone, regardless of whether you are just starting out in your profession, want to advance your skills, or are moving into logistics. * Diploma in Logistics and Supply Chain Management: This extensive curriculum covers the fundamentals of procurement, logistics, and supply chain management. Ideal for anyone who want to have a solid foundation in the field. * Advanced Certificate in Supply Chain and Logistics: This more specialized course is intended for individuals with some logistics experience who want to learn more and become more knowledgeable in the field. * Corporate Training Programs: Blitz Academy also provides tailored training programs for businesses that want to improve employee skills and stay up to date with supply chain management and logistics trends.

Why Kerala?

Kerala is becoming into a center for supply chain and logistics operations due to its advantageous location and booming port infrastructure. The state is ideally situated for firms to set up logistics and distribution operations because of its robust transportation network, which includes air, rail, and road connections, as well as its close proximity to important shipping lanes. Studying in Kerala will give you firsthand knowledge of this thriving sector as well as access to a wide range of local businesses and professionals.

Join Blitz Academy Right Now!

Blitz Academy in Kerala is the place to go if you’re prepared to advance in your profession in supply chain management and logistics. With knowledgeable instructors, hands-on training, and a curriculum tailored to the demands of the contemporary supply chain, you’ll be ready to succeed in this expanding industry. Don’t pass up the chance to acquire the knowledge and expertise required to succeed. Start your path to a fulfilling career in supply chain management and logistics by enrolling today!

0 notes

Text

Best stock market training institute in Thane

Best Stock Market Training Institute in Thane | Learn Trading from Experts at Tradeshiksha

Are you looking for the best stock market training institute in Thane to kick-start your trading career? Tradeshiksha is one of the leading stock market training institutes offering high-quality courses to help you become a confident and successful trader. With a proven track record of excellence, we provide expert-led training tailored to both beginners and advanced traders.

Why Tradeshiksha is the Best Stock Market Training Institute in Thane?

Tradeshiksha has earned its reputation as Thane's best stock market training institute by offering well-structured courses, practical learning experiences, and expert guidance. Our aim is to provide comprehensive knowledge of the stock market and trading strategies that can be applied in real-time.

Key Reasons to Choose Tradeshiksha:

Experienced Trainers: Learn from seasoned traders with years of experience in the stock market.

Comprehensive Curriculum: Our courses cover everything from stock market basics to advanced trading strategies, ensuring a holistic learning experience.

Practical Exposure: Gain hands-on experience with live market analysis, real-time trading, and case studies to apply theoretical concepts.

Interactive Classes: Engage in interactive sessions, one-on-one guidance, and doubt-solving with our experts.

Affordable Training: High-quality education doesn’t have to be expensive. Tradeshiksha offers affordable courses with flexible payment options.

Proven Track Record: Hundreds of students have successfully launched their trading careers with Tradeshiksha’s training programs.

What We Offer at Tradeshiksha, the Best Stock Market Training Institute in Thane:

Stock Market Basics: Learn about the stock market, types of financial instruments, and how trading works.

Technical Analysis: Master chart reading, trends, candlesticks, and key technical indicators like RSI, MACD, and Moving Averages.

Fundamental Analysis: Understand how to evaluate companies using financial statements, ratios, and economic indicators.

Trading Strategies: Learn various strategies such as intraday trading, swing trading, long-term investing, and options trading.

Risk Management: Learn how to manage risks and protect your capital using tools like stop-loss orders, position sizing, and portfolio management.

Live Trading Sessions: Participate in live market sessions, where you can observe real-time analysis and trading strategies in action.

Psychology of Trading: Understand the psychological factors that affect traders’ decisions and learn how to maintain discipline in volatile markets.

Benefits of Choosing Tradeshiksha for Stock Market Training in Thane:

Personalized Attention: With small batch sizes, you get personalized attention from instructors to clear your doubts and improve your trading skills.

Expert Mentorship: Receive guidance from industry experts who have hands-on experience in equity, commodity, and forex trading.

Comprehensive Resources: Get access to a wide range of learning materials, including study guides, recorded sessions, market research, and trading tools.

Flexible Learning Options: Whether you prefer classroom training or online learning, we offer flexible options to suit your schedule.

Job Assistance: Tradeshiksha offers career guidance and job assistance to help you pursue a career in trading or investment analysis.

Who Can Join Our Stock Market Training Institute in Thane?

Beginners: If you're new to the stock market, our beginner-level courses will help you understand the basics and build a strong foundation.

Intermediate Traders: For those with some experience, our advanced training programs will enhance your skills and teach more complex trading strategies.

Working Professionals: Our flexible online courses allow working professionals to learn at their own pace without affecting their schedules.

Investors: If you want to learn how to invest in the stock market effectively, our courses are designed to help you manage your portfolio and maximize returns.

How to Enroll at the Best Stock Market Training Institute in Thane?

Getting started with Tradeshiksha’s stock market courses is easy:

Visit Our Website: Browse through our various courses and pick the one that fits your goals and learning needs.

Contact Us for Details: Get in touch for more information about course content, schedule, and pricing.

Register Online: Complete the registration process and get started with your trading education today!

Get Started with Tradeshiksha and Build a Successful Trading Career!

Tradeshiksha is the best stock market training institute in Thane for those who want to take their trading skills to the next level. Whether you aim to trade full-time or part-time, we provide you with the tools, knowledge, and confidence to succeed.

Contact Us

Office 201, 2nd floor, Akshay Co- operative Society , JS Road Bhandar Ali, Near Thane Railway Station, Thane, Maharashtra 400601

+8779971358

0 notes

Text

Options Trading Course for Beginners

The world of stock markets is complex, and many people are unaware of all the financial instruments traded within it. If you’re new to the stock market, you may come across instruments like shares, currency, commodities, futures, and options trading. It can seem overwhelming at first, but don’t worry—Taking Forward Institute is here to simplify the learning process and help you get started on your stock market journey.

Our Options Trading Course for Beginners is specifically designed to provide you with the knowledge and skills you need to navigate the world of options trading with confidence. Let us guide you every step of the way!

What is Options Trading?

The big question to any beginner is should you start your stock market journey by trading options first or is there any clear roadmap which can help you in deeper learning of not only options but also almost all financial instruments?

So there are 2 paths which can be followed –

Path 1. If you can give a minimum 1/1.30 hours during market hours (9.15 am to 3.30 pm) on a daily basis, start with Intraday Equity trading. Intraday equity trading is very difficult to master but it’s like “shoot for the moon you may reach the stars”, the outcomes of going through this rigorous training can be seen in a relatively easy understanding of swing/positional and delivery trades. Also you will build a command of risk management, position sizing and most important – entries and exits.

Then try to master trend analysis, you will find that there are many saying about trend in stock market like “Trend is your best friend, never go against the trend”, studying trend is more like learning an art of chart reading where every chart wants to say something to you it’s up to you how you decipher the meaning.

Once you can get the directions using trend analysis comes the role of technical tools like candles indicators and oscillators to improve your probability.

Finally you are ready to start learning the basics of options.

Options trading is a type of trading that gives you the right, but not the obligation, to buy or sell an underlying asset (like stocks) at a predetermined price before a certain date. In simpler terms, options are contracts that allow traders to benefit from the future price movement of stocks or other underlying assets.

There are two main types of options:

Call Options: A call option gives the holder the right to buy a stock at a set price before a specific date.

Put Options: A put option gives the holder the right to sell a stock at a set price before a specific date.

Options trading offers a way for traders to benefit from the movement of stock prices without owning the actual stock. It’s a powerful strategy that allows for flexibility, but it also comes with its complexities. That’s where a structured course can help!

We will discuss the alternate way in our upcoming blogs.

Why Take an Options Trading Course?

While the idea of trading options might sound exciting, it’s important to understand that without the proper knowledge, it can also be risky. Many beginners dive into options trading without fully grasping the concepts, leading to unnecessary losses. That’s why it’s crucial to get trained before jumping in.

Here’s why you should consider an options trading course for beginners:

Learn the Basics: The course will cover all the essential terms and concepts such as calls, puts, strike prices, expiration dates, and more.

Risk Management: One of the main advantages of options trading is that it allows you to hedge against risks in your portfolio. However, without the right understanding, you could end up taking on too much risk. A proper training course will teach you how to manage risk effectively.

Structured Learning: Instead of spending time searching for random tips and tricks online, a structured course at Taking Forward Institute will provide you with a clear path from basic to advanced options trading strategies.

Hands-On Experience: Many options trading courses, including those at Taking Forward, provide live market sessions and simulated trading environments where you can practice your skills in real-time. This practical approach will make you feel confident and ready to trade on your own.

Expert Guidance: Learning from seasoned professionals who have years of experience in options trading is invaluable. At Taking Forward Institute, you’ll have access to knowledgeable instructors who can break down complex topics in a way that’s easy to understand.

What Will You Learn in an Options Trading Course at Taking Forward?

When you sign up for the Options Trading Course for Beginners at Taking Forward, you’ll go through a well-rounded curriculum that covers everything from the basics to advanced techniques. Here’s what you’ll explore in the course:

1. Understanding the Basics of Options

What are options?

Difference between stocks and options.

Key terms: Call options, put options, strike price, expiration date, premium, etc.

The benefits and risks of trading options.

2. How to Evaluate Options

How to choose the right option based on market conditions.

Learning the Greeks: Delta, Gamma, Theta, Vega, and Rho, which help traders understand how options prices change based on market factors.

3. Basic Options Trading Strategies

Covered Calls: A basic strategy for income generation in stable markets.

Protective Puts: A strategy to protect your portfolio from potential losses.

Long Call/Put: Simple strategies to benefit from price movements.

Understanding how to use these strategies in various market conditions.

4. Advanced Trading Strategies (for later stages)

Spreads: Vertical, horizontal, and diagonal spreads for hedging and maximizing returns.

Iron Condors and Straddles: Advanced strategies for stable or volatile markets.

When and how to use these strategies in various market conditions.

5. Managing Risk in Options Trading

How to set stop-loss orders and take-profit targets.

How to diversify using options and minimize losses.

Managing your position size and balancing your portfolio.

Adjustments

6. Practical Application Through Live Sessions

At Taking Forward, we believe that practice is essential for mastering options trading. That’s why our course includes live market sessions where you can see strategies being applied in real time. You’ll also have access to simulated trading accounts, allowing you to practice without any financial risk.

Why Choose Taking Forward Institute?

There are many options for options trading courses out there, but here’s why Taking Forward stands out as the best choice:

Experienced Trainers:

Our trainers have years of hands-on experience in the stock market, and they are passionate about teaching. They simplify complex concepts, making them accessible to beginners. You’ll feel supported throughout your learning journey.

Comprehensive Curriculum:

Our course takes you from the fundamentals to expert-level strategies, ensuring you’re ready to trade with confidence. You’ll not only understand the theory behind options trading but also learn how to apply it in real-life trading scenarios.

Personalized Attention:

We believe in small class sizes to provide personalized attention. If you have any doubts or questions, our trainers are always there to assist you, ensuring that you fully understand each concept.

Practical Learning:

We emphasize hands-on learning with live market analysis and trading simulations. This practical approach helps you build confidence before you start trading with real money.

Supportive Community:

At Taking Forward, you’ll be part of a learning community. You can interact with fellow students, share your insights, and learn from others. This collaborative environment enhances your learning experience.

Getting Started: How to Join the Course

Getting started with Taking Forward’s Options Trading Course is simple:

Register for the Course:

Visit our website and sign up for the options trading course.

Start Learning:

Once enrolled, you’ll get access to basic free course, online lessons, and live sessions. Begin your learning journey with our comprehensive modules.

Practice and Build Confidence:

Use our simulated trading platform to practice the strategies you learn in class. Take your time to build confidence before you begin real trading.

Start Trading:

Once you feel ready, you can start trading options in real-time with your newly acquired skills.

Conclusion

Start Your Options Trading Journey Today

Options trading is actually difficult as it requires knowledge, practice, and the right guidance. At Taking Forward Institute, we make learning options trading easy and accessible for beginners. Our course will give you the skills and confidence you need to navigate the world of options trading and make informed decisions.

If you’re ready to take control of your decisions in the stock market, start learning the ins and outs of options trading, enroll in our Options Trading Course for Beginners today. Your journey toward becoming a skilled options trader starts here.

Also Read This Blog: Learn Options Trading: Beginner’s Course & Stock Market Classes in Bhopal

Instagram

Facebook

Q1: What is options trading, and why learn it?

Options trading lets you invest without buying stocks directly. It helps you profit from market movements, manage risks, and diversify your portfolio.

Q2: Is this course for beginners?

Yes, Taking Forward’s course starts with basics and builds up to advanced strategies, perfect for those with no prior experience. However as a beginner we recommend you to start with equity trading first and learn technical analysis and develop your mindset towards trading before entering into the complex world of options trading.

Q3: What will I learn?

You’ll learn call and put options, risk management, strategies like covered calls, and how to apply them in real market situations.

Q4: How does Taking Forward simplify learning?

We provide live sessions, demo accounts, and expert guidance. Complex topics are explained in simple, beginner-friendly language.

Q5: How do I join?

Just visit our website www.takingforward.com, register, and start learning through online lessons, live sessions, and hands-on practice. For assistance, call us at 82250 22022.

0 notes

Text

Why Education Matters Before You Start Trading

Trading can be an exciting way to earn money, but it’s not as simple as it seems. Many beginners dive in without the necessary knowledge, thinking they can learn as they go. However, without the right education, trading can lead to more losses than gains. Here’s why learning before trading is so important, and how Crypstox Trading Academy can help.

Understanding the Market

Before you start trading, you need to know how the market works. There are various markets like stocks, forex, crypto, and commodities, and each one behaves differently. Without understanding these differences, you might find yourself making trades based on guesswork rather than solid analysis. Crypstox Trading Academy offers courses that break down these markets, helping you grasp the basics and decide which market might suit you best.

The Importance of Risk Management

One of the key aspects of trading is managing your risk. Many beginners focus solely on profits and overlook the importance of protecting their investments. Knowing how to set stop-losses, how much of your capital to risk on each trade, and how to avoid emotional decision-making can make a significant difference in how well you do in the long run. With Crypstox, you’ll get the tools and knowledge to manage risks carefully, keeping you in the game longer.

Mastering Technical and Fundamental Analysis

When you trade, you don’t want to rely on luck. Successful traders use technical analysis (studying price patterns, charts, and indicators) and fundamental analysis (looking at news, economic data, and company performance). Learning both types of analysis will help you make smarter decisions. Crypstox teaches both methods, helping you develop a balanced approach to the markets.

Building a Strong Trading Mindset

Trading isn’t just about strategy; it’s also about how you think. Emotions like fear and greed can lead to impulsive decisions. It’s easy to get carried away, especially when you experience your first big win (or loss). Having the right mindset and sticking to a plan is critical, and Crypstox emphasizes the importance of mental discipline. By learning how to approach trading calmly and strategically, you’ll be better prepared for the ups and downs of the market.

Hands-On Learning with Real Market Practice

You can read all the books and watch all the videos you want, but there’s no substitute for practical experience. That’s why Crypstox offers live market sessions and simulated trading environments, so you can practice without risking real money at first. Getting real-world exposure can help you understand how the markets move and how to react in different situations.

Why Crypstox Trading Academy?

Crypstox Trading Academy provides a comprehensive approach to learning trading. Rather than just focusing on theory, they offer practical, hands-on training, including:

Courses on various markets (Stock, Forex, Crypto, Commodities).

Personalized mentorship to guide you at your own pace.

Live market sessions to see how trading works in real-time.

They focus on giving you a strong foundation in trading so you can approach the markets confidently and responsibly.

Taking the First Step

Trading isn’t a get-rich-quick opportunity; it’s a skill that takes time and dedication to master. By investing time in education and gaining practical experience, you give yourself a better chance of success in the long run. If you’re looking to start your trading journey with the right foundation, consider checking out Crypstox Trading Academy and see how their approach can help you grow as a trader. Read more…

1 note

·

View note

Text

The Secret Sauce to Algorithmic Trading & The RBA: How to Decode Market Moves Like a Pro The Algorithmic Edge: Why Traders are Turning to Bots Imagine this: You wake up, stretch, and check your phone, only to see your trading bot made more money overnight than you did in your last full-time job. Sounds like a dream, right? Well, welcome to the world of algorithmic trading—where automation meets intelligence, and human emotion takes a back seat. But before you start shopping for yachts, let’s talk about a critical factor influencing algorithmic trading: the Reserve Bank of Australia (RBA). If you think central banks are just bureaucratic snooze-fests, think again. The RBA’s decisions can make or break even the most sophisticated trading algorithms. Why the RBA Matters in Algorithmic Trading The RBA Reserve Bank of Australia isn’t just another economic player—it’s a puppet master pulling the strings of the Australian dollar (AUD), which algorithmic traders love to sink their teeth into. Here’s why: - Interest Rate Decisions – The RBA sets the cash rate, influencing the AUD’s value. Algorithmic traders anticipate these changes to make lightning-fast trades before humans can even blink. - Economic Outlooks – From employment numbers to inflation reports, the RBA releases data that algorithms use to predict future market behavior. - Policy Statements – The wording of RBA announcements can cause instant market shifts, and sophisticated AI-driven bots analyze the text for sentiment shifts. Ninja Tactics: How to Stay Ahead of the RBA Moves Want to outsmart the market? Here’s how algorithmic traders gain the upper hand when trading AUD: 1. AI-Powered Sentiment Analysis Most traders react to the RBA’s statements after they’re made. Smart traders? Their bots are already analyzing tone shifts, keyword frequencies, and sentiment scores in RBA speeches to predict upcoming moves. 2. High-Frequency Trading (HFT) for RBA Surprises The first five minutes after an RBA decision are chaos. High-frequency trading (HFT) algorithms capitalize on this by making thousands of micro-trades in milliseconds. The result? Profits before manual traders even click “buy.” 3. The Hidden Pattern in RBA’s Rate Decisions Believe it or not, the RBA has a historical bias toward steady policy adjustments. By backtesting decades of data, smart algorithms can predict the probability of rate hikes before they happen. The Dark Side of Algorithmic Trading & RBA Shocks Of course, it’s not all smooth sailing. Even the best trading algorithms can get wrecked if they don’t account for black swan events—like a surprise rate decision or unexpected global shock. How to protect yourself? - Use circuit breakers to halt trades when volatility exceeds a set threshold. - Incorporate hedging strategies that offset potential losses. - Monitor global economic shifts, since Australia’s economy is heavily tied to commodities and China’s demand. Elite Strategies for Algorithmic Traders To truly dominate algorithmic trading with the RBA in mind, implement these strategies: 1. The “Whisper Rate” Trick Financial analysts often release unofficial “whisper rates” (predicted cash rate changes) ahead of RBA meetings. Use machine learning models trained on these whispers to make preemptive trades. 2. The Carry Trade Loophole Australia traditionally offers higher interest rates compared to other economies. Algorithmic traders exploit this through carry trades—borrowing in low-interest currencies like the JPY and investing in high-yield AUD assets. 3. Liquidity Spike Detection Instead of reacting to price movements, use liquidity algorithms to detect when large institutions are placing hidden orders. This allows you to ride the wave before retail traders even notice the shift. Your Next Move: Automate Smarter, Trade Wiser Algorithmic trading is here to stay, and the RBA’s influence on the AUD makes it a prime target for strategic automation. But blindly following bots isn’t enough—you need elite-level insights, cutting-edge tech, and real-time updates to stay ahead. Want real-time economic indicators, expert analysis, and secret strategies? Get exclusive access at: - Latest Forex News: https://www.starseedfx.com/forex-news-today/ - Advanced Forex Education: https://www.starseedfx.com/free-forex-courses - Elite Trading Community: https://www.starseedfx.com/community - Smart Trading Tools: https://www.starseedfx.com/smart-trading-tool/ —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Essential Basic Knowledge of Trading for Beginners

Introduction to Trading

In today's fast-paced financial world, understanding the basic knowledge of trading is crucial for anyone looking to invest and grow their wealth. Trading is the act of buying and selling financial instruments like stocks, bonds, commodities, and currencies with the goal of making a profit. Whether you're a beginner or an aspiring investor, having a solid grasp of trading basics can be your first step toward financial success.

Why is Basic Knowledge of Trading Important?

Trading is not merely about buying low and selling high; it's about understanding market trends, analyzing data, and making informed decisions. Without a foundational understanding, the risk of losses significantly increases. Learning the basic knowledge of trading helps in:

Understanding Market Dynamics: Knowing what influences price movements.

Risk Management: Learning how to minimize losses and maximize profits.

Informed Decision-Making: Using data and analysis to make strategic trades.

Types of Trading

1. Stock Trading

This involves buying and selling shares of companies. It’s the most popular form of trading and offers high liquidity.

2. Forex Trading

Forex, or foreign exchange trading, is about trading currencies. It's one of the largest financial markets in the world.

3. Commodity Trading

This type of trading involves commodities like gold, oil, and agricultural products.

4. Cryptocurrency Trading

A modern form of trading involving digital assets like Bitcoin, Ethereum, and other altcoins.

Essential Concepts in Trading

1. Market Orders vs. Limit Orders

Market Order: Buying or selling immediately at the current market price.

Limit Order: Setting a specific price at which you want to buy or sell.

2. Bull Market vs. Bear Market

Bull Market: A period where prices are rising.

Bear Market: A period where prices are falling.

3. Technical Analysis vs. Fundamental Analysis

Technical Analysis: Using charts and data to predict future price movements.

Fundamental Analysis: Evaluating a company's financial health and market conditions.

Steps to Start Trading

1. Educate Yourself

Understanding the basic knowledge of trading is the foundation. Online courses, books, and workshops can be invaluable.

2. Choose the Right Broker

Selecting a reliable trading platform with low fees and good customer service is essential.

3. Develop a Trading Strategy

Whether it's day trading, swing trading, or long-term investing, having a clear plan is crucial.

4. Practice with a Demo Account

Before risking real money, practice trading on demo platforms to understand how markets work.

5. Start Small

Begin with small investments and gradually increase as you gain confidence and experience.

Common Mistakes to Avoid

Ignoring Risk Management: Always set stop-loss orders to limit potential losses.

Overtrading: Don't trade too frequently; quality over quantity.

Emotional Trading: Avoid making impulsive decisions based on emotions rather than data.

How ICFM Helps You Gain Basic Knowledge of Trading

The Institute of Career in Financial Market (ICFM) is a premier institute dedicated to providing essential education in trading and financial markets. Here’s how ICFM can help you master the basic knowledge of trading:

Comprehensive Courses: Tailored to cover all trading aspects from beginner to advanced levels.

Experienced Trainers: Learn from seasoned market experts.

Practical Training: Gain hands-on experience through live trading sessions and simulations.

Certification: Receive recognized certification upon course completion, adding value to your financial career.

Conclusion

Grasping the basic knowledge of trading is the first step towards becoming a successful trader. By understanding the market dynamics, learning various strategies, and avoiding common mistakes, you set the foundation for long-term financial growth. Institutions like ICFM can guide you through this journey, ensuring you gain both theoretical and practical knowledge.

So, are you ready to embark on your trading journey and unlock the potential of the financial markets? Start today and take control of your financial future!

Read More Blogs: Basic knowledge of trading

#Basic knowledge of trading#Basic knowledge of trading in india#Basic knowledge of trading for beginners#How to start trading as a student#What is trading#Day trading for beginners#Types of trading

0 notes

Text

Trading Courses in Sri Ganganagar: Unlocking Financial Potential with Starbenchmark Investments By Deepanshu Gupta

In today’s fast-paced world, trading has emerged as one of the most lucrative ways to generate wealth, whether through the stock market, forex, commodities, or other financial instruments. However, successful trading requires more than just basic knowledge—it requires proper education, guidance, and a clear understanding of market strategies. For individuals in Sri Ganganagar looking to dive into the world of trading, Trading Courses in Sri Ganganagar can provide the foundation needed to succeed.

One of the most renowned names offering such courses is Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar. Known for its in-depth curriculum and practical training, Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar is committed to helping aspiring traders understand the intricacies of financial markets and develop the skills necessary to make informed trading decisions.

The Growing Need for Trading Courses in Sri Ganganagar

As interest in trading grows, so does the demand for quality trading courses in Sri Ganganagar. While there are countless resources available online, a local, hands-on approach can be more beneficial, especially for those who prefer in-person instruction and personalized guidance. With the right training, individuals can learn the fundamentals of market analysis, risk management, and strategy development, which are key components of a successful trading career.

Many beginners may find the complexity of trading intimidating, but with the right education, they can gain the confidence and knowledge needed to navigate the markets effectively. This is where Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar excels. The institute provides a range of trading courses that cater to different levels, from beginners to advanced traders.

Why Choose Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar?

When it comes to Trading Courses in Sri Ganganagar, Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar stands out for several reasons. Here’s why you should consider enrolling in their courses:

1. Expert Guidance from Deepanshu Gupta

Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar is led by Deepanshu Gupta, a seasoned professional with extensive experience in financial markets. With years of expertise, Gupta has crafted a comprehensive trading curriculum that covers all aspects of trading. His hands-on approach ensures that students gain real-world insights and strategies that go beyond theoretical knowledge.

2. Comprehensive Course Structure

One of the key advantages of Trading Courses in Sri Ganganagar offered by Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar is the well-structured curriculum. Whether you’re a beginner or an advanced trader, the courses are designed to accommodate all skill levels. Topics covered include fundamental and technical analysis, trading psychology, risk management, and understanding market trends. The courses also incorporate practical training, giving students the opportunity to trade in real-time, which enhances their learning experience.

3. Personalized Training

Unlike many online courses, Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar offers a personalized approach. Students receive individual attention, allowing them to address their specific challenges and goals. This tailored approach ensures that each student understands the material at their own pace and can apply the concepts directly to their trading activities.

4. Hands-On Experience and Live Trading

Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar goes beyond theoretical teaching by providing hands-on training. Students have the opportunity to participate in live trading sessions, allowing them to apply their knowledge in real-world scenarios. This live exposure helps build confidence and a deeper understanding of how markets operate, preparing students for actual trading.

5. Post-Course Support

Learning doesn’t stop after the course ends. Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar offers continuous support even after students complete their training. They provide ongoing guidance and mentorship, helping students stay updated on market trends and refine their trading strategies. This post-course support ensures that students remain engaged and motivated in their trading journey.

The Benefits of Enrolling in Trading Courses in Sri Ganganagar

Taking a Trading Course in Sri Ganganagar offers several benefits, especially for individuals looking to gain practical knowledge and skills in a professional setting. Some of the key advantages include:

1. Expert Market Insights

Trading Courses in Sri Ganganagar, particularly those offered by Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar, provide valuable market insights that can only come from years of experience. Learning from someone who has traded and succeeded in the markets can give students the edge they need to make informed decisions.

2. Risk Management Skills

One of the most important aspects of trading is managing risk. Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar places a strong emphasis on teaching students how to manage risk effectively, ensuring that they do not make impulsive decisions that can lead to significant financial losses. Proper risk management is crucial for long-term success in trading.

3. Confidence in Trading

Trading can be daunting, especially for beginners. By completing a comprehensive trading course in Sri Ganganagar, students gain the knowledge and confidence to make smarter decisions in the market. With a clear understanding of strategies and market analysis, they’re better equipped to navigate the volatility of financial markets.

4. Networking Opportunities

Joining a trading course provides the chance to network with like-minded individuals who share an interest in trading. This network can offer support, share insights, and collaborate on strategies, creating a learning environment that extends beyond the classroom.

Conclusion: Choose Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar for Your Trading Education

If you’re serious about learning how to trade and want to start your journey on the right foot, enrolling in Trading Courses in Sri Ganganagar is a great way to begin. With Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar, you get access to expert-led training, a structured curriculum, and ongoing support that helps you succeed in the fast-paced world of trading. Whether you’re new to trading or looking to refine your skills, Starbenchmark Investments By Deepanshu Gupta in Sri Ganganagar offers the resources and guidance you need to achieve your financial goals.

#stock market courses near me#trading courses in sri ganganagar#stock market classes in ganganagar#best trading classes in ganganagar#best stock market trader in ganganagar#trading courses near me#best stock market classes in ganganagar#Best Share Marketing Training in Sri Ganganagar#Stock Marketing Training in Ganganagar#stock market trading courses#stock market online course#online trading course#stock market trading courses in Sri Ganganagar

0 notes

Text

Top Forex Trading Courses/Classes in Indore, M.P

Indore city in India is filled with traders and those eager to learn trading, but many people are now showing interest in Forex trading because it offers higher and quicker profits. That's why Street Investment has introduced Forex trading courses and classes for beginners in Indore, MP.

In this article, you will learn what Forex trading is, how it is taught at Street Investment, and the pricing of the courses.

Enroll for free

What is Forex Trading?

Forex trading, or foreign exchange trading, involves buying and selling currencies to make a profit. To understand this in the context of the Indian market, let’s use a relatable example:

Example:

Imagine you are planning a trip to the U.S. You go to a currency exchange and buy $1 for ₹83. A few days later, the exchange rate changes, and now $1 equals ₹85. If you exchange your $1 back to rupees, you’ll get ₹85, making a profit of ₹2.

In Forex trading, this concept is applied on a larger scale, where traders buy and sell currencies based on market movements.

Why do currency prices fluctuate?

Currency prices depend on various factors, such as:

Demand and Supply: If more people want U.S. dollars, its price increases compared to the Indian rupee.

Economic News: A strong GDP report or a positive policy announcement can boost a currency’s value.

Interest Rates: Countries with higher interest rates attract more foreign investment, strengthening their currency.

In Forex trading, traders analyze these factors using tools and strategies to predict price movements and make profitable trades.

By learning Forex trading at Street Investment, beginners get hands-on guidance on these strategies, practical examples, and a deep understanding of the market.

Forex Trading Courses and Classes in Indore

In Indore, Street Investment offers Forex trading courses and classes, where every aspect of Forex trading is explained in detail.

Comprehensive Forex Trading Course by Street Investment

Are you ready to master the art of Forex trading and unlock consistent profits? Street Investment presents an exclusive Forex Trading Course designed for beginners and aspiring traders who want to dominate the financial markets. With our structured approach and in-depth training, you'll gain the skills to trade confidently and profitably in any market.

What Makes Our Course Unique?

Our Forex trading course focuses on teaching proven strategies and practical skills. Here's what you'll learn:

1. Introduction to Forex Trading

Understanding the Forex market

How currency pairs work

Key factors affecting currency prices

2. Mastering the Smart Money Concept (SMC)

The Smart Money Concept is the foundation of professional trading. You'll discover:

How big institutions move the market

Identifying entry and exit points using SMC

Reading price action like a pro

3. Technical Analysis for Any Market

This course goes beyond Forex! You'll learn:

How to analyze charts effectively

Key technical indicators and tools

Trading strategies applicable to stocks, commodities, and indices

4. Trap Trading for High Profits

Our unique trap trading strategy will show you how to achieve an incredible 1:5 risk-reward ratio. This section includes:

Spotting false breakouts and traps

Using market psychology to your advantage

Maximizing gains with minimal risk

Why Choose Street Investment?

Expert Guidance: Learn from experienced traders who simplify complex concepts.

Live Market Sessions: Practice strategies in real-time with guidance from our mentors.

Comprehensive Materials: Get access to premium resources, including e-books, videos, and trading tools.

Community Support: Join a network of traders to share insights and grow together.

Who Should Enroll?

Beginners looking to start their trading journey

Intermediate traders aiming to refine their strategies

Anyone interested in achieving financial freedom through trading

Course Fees and Duration

Duration: 4 weeks (online and offline options available)

Fees: Affordable and value-packed pricing (contact us for details)

enroll now

Seats are limited, and demand is high! Take the first step toward becoming a successful trader today. Contact us at:

Phone: +91 89890 00006

Email: [email protected]

Visit Us: 213, Sapphire Heights, AB Rd, opposite C21 Mall, Opposite C-21 Mall, Vijay Nagar, Scheme No 54, Indore, Madhya Pradesh 452001

Don’t miss this opportunity to transform your trading journey. Join Street Investment’s Forex Trading Course and unlock your potential to achieve consistent profits in the financial markets!

#Forex Trading Indore#Forex Trading Beginners#Forex Trading Institute#Forex Trading Courses Classes in Indore#Forex trading courses and classes for beginners in Indore#Forex Trading Course by Street Investment

0 notes

Text

Gann Indicator for Trading | Gann.academy

Unlock the Secrets of Financial Markets with GannAcademy: Master the Art of Trading with W.D. Gann's Timeless Techniques

At GannAcademy, we are dedicated to teaching you the powerful methods developed by the legendary trader W.D. Gann, one of the most influential figures in the history of financial markets. Whether you're a novice trader or an experienced market professional, GannAcademy offers in-depth, practical training that helps you understand and apply Gann's strategies for consistent success in the market.

Who Was W.D. Gann?

W.D. Gann was an American financial trader and market theorist who gained fame for his ability to predict market trends with remarkable accuracy. Over his career, Gann developed a set of trading methods that integrated astrology, geometry, and cycles of time. He authored numerous books and created a legacy that continues to influence traders worldwide. His key concept was the idea that market movements are not random but are governed by predictable patterns that can be analyzed and utilized to forecast future price movements.

Why Choose GannAcademy?

GannAcademy provides an opportunity to learn from the original work of W.D. Gann, with structured courses designed for all levels of traders. Our courses focus on core principles that have stood the test of time, offering you a unique approach to market analysis and trading that incorporates: