#commodity online crude oil

Explore tagged Tumblr posts

Text

Discover Top Trading Solutions with WinproFX: Guide to the Best Platforms

WinproFX, located in Mumbai, is committed to providing top-tier trading solutions that cater to diverse trading needs. Our platforms are designed to offer unparalleled access and tools for trading commodities, crude oil, stocks, gold, and silver. Explore our offerings and see why we are the preferred choice for traders.

Best Commodity Trading Platform

WinproFX is renowned for offering theBest commodity trading platform. Our platform supports a wide range of commodities, including agricultural products, energy resources, and metals. With real-time market data, advanced charting tools, and efficient trade execution, you can make informed decisions and capitalize on market opportunities. Our user-friendly interface ensures a seamless trading experience for both novice and experienced traders.

Best Crude Oil Prices Platform

WinproFX provides the Best crude oil prices platform. Our platform offers comprehensive access to global crude oil markets, delivering up-to-date pricing, high liquidity, and competitive spreads. With detailed market analysis and robust trading features, you can navigate the complexities of crude oil trading with confidence and precision.

Top-Rated Online Brokers For Stock Trading

WinproFX is proud to be associated with Top-rated online brokers for stock trading. Our brokers are selected based on their excellence in providing reliable trading services, advanced tools, and exceptional customer support. Whether you’re trading major indices or individual stocks, our brokers offer the expertise and resources needed to enhance your trading experience.

Compare Brokers Offering Automated Trading Solutions

WinproFX, you can Compare brokers offering automated trading solutions to find the best fit for your needs. Our platform provides insights into various brokers' automated trading features, helping you choose the one that aligns with your trading goals and preferences.

Best Gold and Silver Trading Platform

WinproFX excels as the Best gold and silver trading platform. Our platform supports trading in precious metals with competitive pricing, real-time data, and advanced analytical tools. Whether you are trading gold, silver, or both, our platform offers a secure and efficient environment to manage your investments and capitalize on market trends.

WinproFX, we are dedicated to offering the best trading platforms and solutions to help you achieve your financial goals. Join us today and experience top-notch trading services. Visit https://winprofx.com for more information and to start your trading journey.

#winprofx#best#Best Commodity Trading Platform#Best Crude Oil Prices Platform#Top-Rated Online Brokers For Stock Trading

0 notes

Text

Gas Station Stream of Consciousness Post

Gas Stations as Liminal Spaces

I've had quite a few hyperfixations in my day - ATMs, laundry detergents, credit cards - so my current one pertaining to gas stations is fitting considering my affinity for liminal spaces and the dedication of this blog to them. Liminal spaces are transitory in nature, hence their portrayal in online circles through photos of carpeted hallways, illuminated stairwells, dark roads, and backrooms, among other transitional points.

Gas stations are posted online as well; images of their fuel pumps or neon signage photographed through a rainy car window communicate their liminality and the universal experiences they provide to all of society. Perhaps they are the ultimate specimen of a liminal space. The machines they are created for, automobiles and tractor trailers alike, themselves are tools for motion, vestibules that enable travel and shipment across long distances at high speeds. Cars and roads are liminal spaces, albeit in different formats, and gas stations serve as their lighthouses. Vehicles at filling stations, therefore, are in a sense liminal spaces within liminal spaces within liminal spaces.

The uniqueness of a gas station as a liminal space, however, is its intersection with the economics and aesthetics of capitalism. Gasoline (and diesel fuel) is a commodity, downstream from crude oil, merely differentiated by octane ratings. Some argue that minute distinctions between agents, detergents, and additives make some brands better than others. Indeed, fuels that are approved by the Top Tier program, sponsored by automakers, have been shown to improve engine cleanliness and performance, but this classification does not prefer specific refiners over others; it is simply a standard. To a consumer, Top Tier fuels are themselves still interchangeable commodities within the wider gasoline commodity market.

The Economics of Gas Stations

The market that gas stations serve is characterized by inelastic demand, with customers who reckon with prices that fluctuate day in and day out. This is not to say that consumer behavior does not change with fuel prices. It has been observed that as prices rise, consumers are more eager to find the cheapest gas, but when prices fall, drivers are less selective with where they pump and are just happy to fill up at a lower price than last week. In response, gas stations lower their prices at a slower rate than when increasing prices, allowing for higher profit margins when wholesale prices fall. This has been dubbed the "rockets and feathers" phenomenon.

When portrayed as liminal spaces, gas stations are most often depicted at night, places of solitude where one may also enter the adjacent convenience store and encounter a fellow individual who isn't asleep, the modern day lightkeeper. The mart that resides at the backcourt of a gas station is known to sell goods at higher prices than a supermarket, simultaneously taking advantage of a captive customer, convenient location, and making up for the inefficiencies of a smaller operation. It may come as no surprise, then, that gas stations barely make any money from fuel sales and earn their bulk through C-store sales. This is a gripe I have with our economic system. Business is gamified, and in many cases the trade of certain goods and services, called loss leaders, is not an independent operation and is subsidized by the success of another division of a business, a strategy inherently more feasible for larger companies that have greater scale to execute it.

Nevertheless, most gas station owners, whether they have just one or hundreds of sites, find this method fruitful. Even though most gas stations in the US sell one of a handful of national brands, they operate on a branded reseller, or dealer, model, with oil companies themselves generally not taking part in the operations of stations that sell their fuels. The giants do still often have the most leverage and margin in the business, with the ability to set the wholesale price for the distributor, which sells at a markup to the station owner, which in turn will normally make the least profit in the chain when selling to the end customer at the pump. This kind of horizontal integration that involves many parties lacks the synergies and efficiencies of vertical integration that are so applauded by capitalists, but ends up being the most profitable for firms like ExxonMobil, who only extract and refine oil, and on the other end of the chain merely license their recognizable brands to the resellers through purchasing agreements. Furthermore, in recent years, independent dealers have sold their businesses to larger branded resellers, in many cases the ones from whom they had been buying their fuel.

A Word on ExxonMobil's Branding Potential

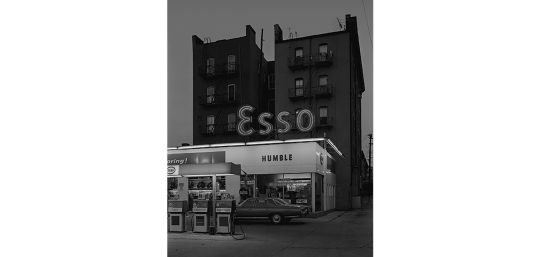

The largest publicly traded oil company in the world is Exxon Mobil Corporation. It is a direct descendent of the Rockefeller monopoly, Standard Oil, which was broken up in 1911 into 34 companies, the largest of which was Jersey Standard, which became Exxon in 1973. This title was generated by a computer as the most appealing replacement name to be used nationwide to unify the Humble, Enco, and Esso brands, decades before AI was spoken of. The latter brand is still used outside of the United States for marketing, arising from the phonetic pronunciation of the initials of Standard Oil. In 1999, Exxon and Mobil merged, and the combined company to this day markets under separate brands. Exxon is more narrowly used, to brand fuel in the United States, while Mobil has remained a motor oil and industrial lubricant brand, as well as a fuel brand in multiple countries.

Mobil originated in 1866 as the Vacuum Oil Company, which first used the current brand name for Mobiloil, and later Mobilgas and Mobilubricant products, with the prefix simply short for "automobile". Over time, Mobil became the corporation's primary identity, with its official name change to Mobil Oil Corporation taking place in 1966. Its updated wordmark with a signature red O was designed by the agency Chermayeff & Geismar, and the company's image for service stations was conceived by architect Eliot Noyes. New gas stations featured distinctive circular canopies over the pumps, and the company's recognizable pegasus logo was prominently on display for motorists.

I take issue with the deyassification of the brand's image over time. As costs were cut and uniformity took over, rectangular canopies were constructed in place of the special ones designed by Noyes that resembled large mushrooms. The pegasus remained a prominent brand icon, but the Mobil wordmark took precedence, which I personally believe to be an error in judgement. This disregard for the pegasus paved the way for its complete erasure in 2016 with the introduction of ExxonMobil's "Synergy" brand for its fuel. The mythical creature is now much smaller and appears only at the top right corner of pumps at Mobil gas stations, if at all.

Even into the 90s and the 21st century the Pegasus had its place in Mobil's marketing. In 1997, the company introduced its Speedpass keytag, which was revolutionary for its time and used RFID technology, akin to mobile payments today, to allow drivers to get gas without entering the store or swiping a card. When a Speedpass would be successfully processed, the pegasus on the gas pump would light up red.

When Exxon and Mobil merged in 1999, the former adopted the payment method too, with Exxon's less iconic tiger in place of the pegasus.

The program was discontinued in 2019 in favor of ExxonMobil's app, which is more secure since it processes payments through the internet rather than at the pump.

What Shell has done with its brand identity is what Mobil should've done for itself. The European company's logo was designed in 1969 by Raymond Loewy, and is a worth contender for the "And Yet a Trace of the True Self Exists in the False Self" meme. In recent years, Shell went all in on its graphic, while Mobil's pegasus flew away. I choose to believe that the company chose to rebrand its stations in order to prevent the malfunction in the above image from happening.

ExxonMobil should have also discontinued the use of the less storied Exxon brand altogether, and simplifying its consumer-facing identity to just the global Mobil mark. Whatever, neither of the names are actual words. As a bonus, here is a Google map I put together of all 62 gas stations in Springfield, MA. This is my idea of fun. Thanks for reading to the end!

#exxonmobil#exxon#mobil#gas station#gas stations#liminal space#liminal spaces#liminal#liminalcore#liminal aesthetic#justice for pegasus#shell#corporations#capitalism#branding#marketing#standard oil#economics#gas#gasoline#fuel#oil companies

108 notes

·

View notes

Text

First thing I will like y'all to take a look at before going through my blog is the company I work for👍

I know most of y'all must have heard or might not heard about Bluepeak-global company. So if you're seeing this, it's an opportunity for you to grab but we will never force you to join us but at least try to give at least a look and make your research before you judge 👨⚖️

Okay, Blue peak Global company is a big investment company based in US but they have branches across the globe 🌎. Bluepeak global is the investors Gateway to the World’s Markets. We’re the core in Natural Resources(Diamond, Gold,crude oil) Real Estate, Stocks,Etfs and Bonds,indices, commodities. Our transparent, low commissions and financing rates, support for best price, stock yield enhancement program which help minimize costs to maximize your returns.

About bluepeak global

bluepeak global is an investment company, whose team is working on making money from the volatility of cryptocurrencies and offer great returns to our clients.

No matter their income level, social class, or anything else, it is the fundamental responsibility of bluepeak global to provide everyone with acceptable housing that is affordable. Our daily efforts are focused on exceeding expectations by keeping our word, building up our land bank, growing our clientele, and providing premium services and reasonably priced home options. Our range of series are created on suitable lands using recurrent development methods. They provide excellent value and a well-known product since they are standardized in terms of design, layout, and specification. Making the unbelievable accessible is our aim.

Below is a link to Bluepeak-global website 👇

You might not trust me to teach you or tell you more about the company and that's why there's a company video there on our website which has every information you need and the company ONLINE SUPPORT are always online too to attend to your messages and guide you. Do take your time and do your findings too. It's a global company and have marketing agents everywhere too which am one of it representing from Colombia🇨🇴. But there's only one Bluepeak-global head office which is located at👇

108 woodland way Greenwood, south Carolina (SC) USA 🇺🇸

Oh the picture ☝ that's me back there on my glasses👓 in the picture of our last meeting at the office😹 Am the smallest 🤦🏻♂️

3 notes

·

View notes

Text

2025 starts on cautious footing, USD hits 2-year high

US stocks ended weaker on Thursday, after a volatile first session of 2025, starting the new year on a cautious note after a subdued December performance tarnished the strong gains seen overall in 2024.

The main Wall Street indices slipped back again amid concerns over a slower pace of interest rate cuts by the Federal Reserve and uncertainty over the impact of incoming US President Donald Trump’s policy.

Investors fear that Trump’s policies could keep inflation elevated in the long-term, leading to fewer interest rate cuts by the Fed. The central bank recently flagged a slower pace of rate cuts in 2025, citing concerns over sticky inflation and a robust labor market.

Ahead of next week’s monthly official jobs report, the latest weekly jobless claims dropped by 9,000 to a seasonally adjusted 211,000 for the week ended December 28, the lowest level since April and below forecasts for 222,000 claims.

Meanwhile, the S&P Global manufacturing purchasing managers index (PMI) for December saw a smaller than expected contraction to a reading of 49.4, down from 49.7 in November but above forecasts for a fall to 48.3. A reading above 50 points towards expansion in the sector, while a reading below 50 signals contraction.

The Atlanta Fed GDPNow model has revised its growth estimate for the fourth quarter of 2024. The model now predicts a seasonally adjusted annual growth rate of 2.6%, down from the previous 3.1% forecast made on December 24.

On foreign exchanges, the dollar jumped to a two-year high, adding around 1.0% versus both the pound and the euro, building on the strong gains from the prior year as expectations remained intact that growth in the US economy will still outpace that of its peers.

DXY H4 (1)

DXY H4 (2)

At the stock market close in New York, the blue-chip Dow Jones Industrials Average was down 0.4% at 42,392, while the broader S&P 500 index fell 0.2% at 5,868, and the tech-laden Nasdaq Composite shed 0.2% at 19,280.

The main focus was on electric vehicles maker Tesla, which fell 6.1% after its fourth quarter deliveries came in at 495,570, a record level, but below the consensus estimate for 512,277. Meanwhile, Tesla’s overall deliveries for 2024 fell for the first time in more than a decade.

Elsewhere, Apple lost 2.6% on reports it is offering discounts on its latest iPhone models in China, a rare move that points to rising competition from domestic rivals in the world's largest smartphone market.

And personal finance app SoFi Technologies shed 8.3% after analysts at KBW downgraded the stock to ‘underperform’ on concerns over its lofty valuation and ambitious financial target.

But Nvidia gained 3.0% as Bank of America reiterated the AI chipmaker as its top pick ahead of the Consumer Electronics Show next week, with CEO Jensen Huang set to deliver a keynote speech during the event.

And Unity Software jumped 9.1% higher following a cryptic social media post from well-followed meme stock trader Keith Gill, known online as Roaring Kitty. Also boosting Unity was a block-trade of 1.32 million shares at a market value of $29.7 million earlier this week.

Among commodities, crude prices pushed higher, as traders eyed hopes for an economic recovery in China, the largest global oil importer.

The private-sector Caixin/S&P Global survey indicated that China's factory activity grew in December, albeit at a slower than expected pace. The report echoed Tuesday’s official manufacturing survey, and suggested policy stimulus is gradually trickling into the second largest economy in the world.

USOILRoll H1

US WTI crude climbed 1.9% to $73.09 a barrel, while UK Brent was up 1.7% to $75.90 a barrel.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Crude Takes a Breather, Gold Finds its Groove, and Copper Eyes China The Ripple Effect: Digging Beneath the Surface of Today's Market Trends Picture this: you're ready to score a sweet Forex deal—like finally finding that perfect-sized pair of shoes on sale���only to have the market pull the rug out from under you. Crude prices dipped just a bit today, showing a "meh" response to OPEC+'s rollercoaster updates. Imagine it like the market on a caffeine crash—just waiting for a burst of excitement that might come with U.S. jobs numbers. Traders are still glued to their newsfeeds for any geopolitical drama that might breathe some life back into the action. Now, if you've been eyeing the shiny stuff (that's gold, for the uninitiated), you may have noticed it's nudging higher today. Spot gold's hanging out in the USD 2,613-2,645 range, teasing its way just above yesterday's dip, like an old friend that's finally ready to be on good terms again. It's wedged between the 50-day and 100-day moving averages, trying to decide if it wants to make a real run for it or just coast along—the classic "to commit or not to commit" dance. Gold's upward bias feels like it could be a foreshadowing of something a little shinier, but then again, we don't have a crystal ball (at least not a reliable one). Copper: The Smooth Operator Ah, copper—the quiet, steady operator of the commodities market. While everyone's shouting about oil and gold, copper's over here just doing its thing, inching up ahead of the U.S. jobs report. Traders are also keenly watching the upcoming Chinese Central Economic Work Conference. Here's the scoop: if China talks about boosting domestic demand, copper could be the star. It's like copper has its own internal PR agent working overtime. Add in the possibility of China tossing some love towards the property market, and this could be the boost copper's been waiting for—like getting picked first in a dodgeball game for once. Oil Markets: The Tightrope Act Continues Oil's story has been a bit like a Netflix drama with way too many plot twists—OPEC+, production cuts, Morgan Stanley throwing a curveball. Speaking of Morgan Stanley, they've taken a look at their magic 8-ball and nudged their forecast for H2 2025 Brent prices up to USD 70/bbl from the previous USD 66-68. Why? Because OPEC+ decided to tighten production, narrowing the margin between supply and demand. Think of it like trying to keep your favorite restaurant reservation list tight: not too many guests, just enough to keep it exclusive but still happening. Still, MS thinks we’ll see a surplus—just a bit smaller than the one we had in mind. Oh, and by the way, the Czech Republic is back in the game. Oil supplies via Druzbha have resumed today—as per Orlen CEO. It's like your favorite pizza delivery chain going back online after a hiccup. Everyone's pretty pleased, especially those who were anxiously waiting with their fingers crossed. Why It All Matters for You Now, you might be asking, "How does any of this noise help me hit a home run in my trading strategy?" Here's where the hidden gems come in. With Morgan Stanley's revised Brent forecast, we're looking at smaller supply gluts in the near future. What does that mean for you? Watch out for smaller-than-expected dips in oil-related currencies and commodities. The market is telling you something—you just need to know how to listen. Gold's position between key moving averages is also a signal. The savvy trader watches for a breakout—the classic "if it goes up, I buy, if it goes down, I also buy but smarter." And copper? Consider it your early bird signal for any surprise announcements out of China next week. When the rest of the market catches up, you'll already have your stakes down. Bottom Line: Opportunity is Hiding in Plain Sight Remember, every market move tells a story, and the real opportunity lies in reading between the lines. Today’s seemingly lackluster moves in crude, gold, and copper are all subtly whispering clues about tomorrow’s actions. So, let’s grab those nuggets of truth, give them a good polish, and trade smart. Ready to learn more? Check out our services to keep your edge: - Latest Economic Indicators and Forex News: StarseedFX News - Expand your Forex expertise with our free courses: Forex Education - Want to hang out with the best? Join our community: StarseedFX Membership Let’s keep digging beneath the surface—there are always hidden treasures waiting for those willing to look. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Asia-Pacific Markets Stock markets in Asia remained mostly subdued. South Korea's KOSPI index underperformed amid political and economic instability. Disappointing GDP data and underperformance in real estate, financials, and defensive sectors weighed down the ASX 200 in Australia. In China, mixed PMI data and trade frictions stemming from restrictions on key materials exports to the US created an uncertain market environment. European markets European markets started the day mostly in positive territory and continued to climb higher as the session progressed. Final PMI data across Europe presented mixed results but had little impact on market sentiment. Autos, retail, and technology sectors emerged as top performers, benefiting from the prevailing risk-on mood in European equities. Meanwhile, healthcare stocks lagged, primarily due to AstraZeneca's decline after HSBC cut its price target. Positive sentiment from European bourses also lifted US equity futures, with the Nasdaq marginally outperforming other indices. In corporate news, ASM International reported that the latest US export controls were broadly consistent with previous assumptions, easing concerns about regulatory impacts. Additionally, the EU announced plans to impose stricter regulations on Asian online retailers like Shein and Temu, aiming to curb tax evasion and the distribution of unsafe goods. FX markets The US dollar (USD) showed broad strength across currency markets, performing particularly well against the Japanese yen (JPY) and antipodean currencies like the Australian dollar (AUD). The AUD was the weakest major currency, pressured by softer-than-expected Australian Q3 GDP data, which led markets to fully price in a rate cut by the Reserve Bank of Australia for April 2025. The British pound (GBP) also faced downward pressure following dovish comments from Bank of England Governor Andrew Bailey, who indicated the possibility of four 25 basis point rate cuts in 2025. This marked a shift from market expectations, which had priced in three rate cuts next year. The euro (EUR) traded slightly lower against the USD ahead of the French no-confidence vote scheduled later in the day, with ECB President Christine Lagarde’s upcoming comments unlikely to provide significant new guidance. Fixed income markets Fed official Waller's comments sparked a bear-steepening trend in fixed income markets, which followed an earlier bull-steepening trend. Market participants awaited key US economic data, including ADP employment numbers and the ISM Services PMI, alongside remarks from Federal Reserve Chair Jerome Powell later in the session. In Europe, Bunds and OATs traded lower, with the market focused on the no-confidence vote in French Prime Minister Barnier's government. Gilts also saw some upward momentum, though they remained softer overall, after Bailey's dovish comments spurred brief gains. Commodity markets Commodity markets remained relatively subdued. Crude oil prices held a slight upward bias, supported by reports in the Wall Street Journal that Saudi Arabia intends to prioritize higher oil prices over increasing market share. This policy stance fueled minor gains in the oil market but failed to sustain significant upward momentum. Brent crude traded within a narrow range. A stronger dollar constrained precious metals like gold, while base metals also traded within tight ranges amid a mildly firmer risk tone. Economic Updates - Private Payrolls Growth SlowsNovember private payrolls grew by 146,000, below the 163,000 estimate. Gains in education, health services, and construction offset manufacturing job losses. - Eurozone PMI DeclinesEurozone business activity contracted sharply in November, with PMI falling to 48.3. The Services PMI fell below 50 for the first time since January, indicating a decline in demand. - OECD Forecasts Stable GrowthThe OECD projects stable global growth of 3.3% in 2025 and 2026, citing easing inflation and interest rate cuts. However, rising protectionism remains a concern. - Australian Economy Misses ExpectationsAustralia’s economy grew by 0.3% in Q3, slightly below the 0.4% estimate. Core inflation remains above the Reserve Bank's target at 3.5%. World News and Politics - South Korean Political CrisisPresident Yoon Suk Yeol faced backlash after briefly declaring martial law, leading to impeachment proceedings. The political instability could affect South Korea’s economic outlook. - French Government at RiskFrance's PM Barnier faces a no-confidence vote, risking a government collapse and potential delays to the 2025 budget. - Airline Executives to TestifyU.S. airline executives from major carriers will testify before a Senate panel regarding the billions earned from seat selection fees. Geopolitical developments Globally, geopolitical developments added uncertainty. The French no-confidence vote loomed large, with Prime Minister Barnier expected to lose, potentially destabilizing the government. In South Korea, political turmoil continued after President Yoon Suk Yeol’s controversial martial law declaration, leading to calls for his resignation and opposition-led impeachment efforts. Labor unrest is growing, with unions threatening strikes unless Yoon steps down. Meanwhile, Middle Eastern tensions persisted, with reports of Israeli forces firing on Lebanese army personnel and further military maneuvers in Syria. Notable corporate news - Eli Lilly's Zepbound Outperforms WegovyEli Lilly's (LLY) weight-loss drug Zepbound demonstrated superior results compared to Novo Nordisk's (NVO) Wegovy in a direct trial. Over 72 weeks, Zepbound users lost an average of 20.2% of body weight compared to Wegovy's 13.7%. This strengthens Lilly’s market position in the growing weight-loss drug sector. - Amazon Faces Discrimination LawsuitThe D.C. Attorney General sued Amazon (AMZN) for allegedly excluding two predominantly Black ZIP codes from Prime’s expedited delivery services, despite charging full membership fees. This lawsuit could influence regulatory scrutiny on e-commerce practices. - General Motors Restructures in ChinaGeneral Motors (GM) announced a $5 billion charge in Q4 due to a major restructuring of its Chinese operations. Amid declining sales and stiff competition from local EV makers, GM's market share in China has dropped significantly, highlighting challenges for foreign automakers in the region. - Volkswagen CEO Warns of Further CutsVolkswagen (VWAGY) CEO Oliver Blume criticized current union cost-cutting proposals, deeming them inadequate to address the automaker's declining competitiveness. He called for tougher measures to secure the company's future amidst market challenges. - Hyundai Faces Potential StrikeHyundai Motor (HYMTF) union workers plan partial strikes on December 7–8 and a full strike on December 11, with demands including the resignation of South Korean President Yoon Suk Yeol. This reflects growing labor unrest in South Korea. - Intel Shares Drop on CEO ExitIntel (INTC) shares plunged 6% following the resignation of CEO Pat Gelsinger. The company faces challenges including declining PC demand, AI struggles, and losses in its foundry business. Analysts expressed pessimism about short-term recovery. - Constellation Brands RestructuresConstellation Brands (STZ) will sell its Svedka vodka brand to Sazerac. This move aims to address challenges in its wine and spirits segment, which saw a 12% drop in Q2 net sales. - Donald Trump Jr. Joins PublicSquarePublicSquare (PSQ) surged 270% after Donald Trump Jr. joined its board. The company markets itself as a "cancel-proof," economy-focused platform. - SpaceX Tender OfferSpaceX is reportedly conducting a tender offer for insider shares, raising its valuation to $350 billion, up sharply from $210 billion earlier this year. The growth underscores the company's significant gains in space exploration and satellite internet ventures. - Frontier Airlines Adds First ClassFrontier Airlines (ULCC) plans to introduce first-class seating and enhance loyalty perks. It projects these changes will contribute $250 million in revenue by 2026 and $500 million by 2028. - Banks Raise FeesSynchrony (SYF) and Bread Financial (BFH) increased credit card APRs by 3-5 points and introduced monthly fees of $1.99–$2.99, anticipating a potential CFPB rule capping late fees at $8. These changes could impact consumers significantly. Earnings Highlights - Salesforce (CRM) - Q3 Performance: Revenue rose 8% YoY to $9.44 billion, beating estimates by $104 million. Net income increased by 25% to $1.5 billion. - Guidance: Q4 revenue guidance exceeded expectations at $9.9–$10.1 billion. FY25 revenue guidance was raised slightly to $37.8–$38 billion. Shares surged 9%. - UnitedHealth (UNH) - 2025 Outlook: Higher-than-expected medical cost ratio (86%-87% vs. 84.77%) could pressure profitability. Adjusted profit guidance met expectations. - Foot Locker (FL) - Q3 Results: The company reported a $33 million loss, a decrease from a $28 million profit in the previous year. Revenue fell to $1.96 billion, missing estimates. Shares plummeted 15%. - Okta (OKTA) - Q3 Performance: Revenue grew 14% YoY to $665 million, beating expectations. Adjusted EPS of $0.67 marked a $16 million profit. Shares surged 18%. - Lululemon (LULU) - Challenges: Anticipates just 7% YoY growth in Q3 revenue, down from 19% last year. The stock has fallen 33% YTD due to competition and North American market fatigue. - Rio Tinto (RIO) - Guidance: Increased 2025 capex to $11 billion. Copper production forecast for 2025 is 780,000–850,000 tons, targeting 1 million tons annually by 2030. Upcoming Events and IPOs - Key Economic Events - December 5: ISM Services PMI, Factory Orders (MoM), and Fed Chair Powell's Speech. - December 6: Non-Farm Payrolls and Unemployment Rate. - IPO Highlights - December 5: Jinxin Technology (NAMI), a Chinese digital education company. - December 6: zSpace (ZSPC), an AR/VR educational tech provider. Looking ahead Looking ahead, the focus shifts to upcoming US data releases, including ADP employment, ISM Services PMI, and factory orders. We eagerly await Fed Chair Powell's speech, the French no-confidence vote, and the remarks of ECB President Lagarde. The OPEC+ meeting scheduled for tomorrow is also a key event for energy markets. Market participants remain cautious amid geopolitical risks, evolving economic data, and central bank communications. Read the full article

0 notes

Text

Golden Brokers Review 2024

This review will discuss the Malaysian-based forex broker, Golden Brokers Ltd. We explore its features with information on the trading platform, available markets, fees, regulation, pros, cons and more. Find out whether to open a live account with Golden Brokers.

Headlines

Golden Brokers Limited was founded in 2018. It is regulated by the Malaysian financial regulator Labuan FSC and its headquarters is based in Kuala Lumpur, Malaysia. It is not quite a global broker as many major geographical locations such as France, Germany and Switzerland are restricted, which other brokers for forex and all manner of trading cater to.

Trading Platforms

MetaTrader 5

MT5 is a world-leading platform with many tools and instruments that can be customised to help each user carry out thorough technical analysis and manage their positions. MT5 is a further development of the MetaTrader 4 platform, offering greater functionality, faster processes and a more intuitive layout. This platform is available on your web browser and downloadable on Windows and Mac.

MT5 platform features include:

Copy trading

21 timeframes

One-click trading

Integrated signals

Automated trading

Hedging and netting

38 built-in indicators

6 pending order types

Markets

Forex – Over 60 major, minor and exotic currency pairs

Commodities – 15 commodities, including precious metals and crude oil

Stock CFDs – Large multinational companies such as Apple, Google and Volkswagen

Indices – 14 global equity indices, such as the Dow Jones & FTSE

Trading Fees

Golden Brokers offers quite large spreads, with typical rates around 3-4 pips for major currency pairs like GBP/USD and EUR/GBP. Spreads for indices range from 2 to 50 pips, while commodities sit between 0.07 and 14 pips.

No commissions are charged, though there are overnight swap fees on CFD positions, which sit at a 0.5% charge, with a minimum fee of USD 20. Additionally, there is a dormancy charge of USD 100 for accounts that remain inactive for an entire year.

Mobile Apps

Golden Brokers clients can access mobile trading through the MetaTrader 5 application. This can be downloaded for both Apple (iOS) and Android (APK) devices from the relevant stores, boasting much of the functionality of the desktop versions. The app offers all supported order types, account management systems and asset classes, with 24 analysis tools and 30 indicators.

The broker’s website also links to a proprietary application on the Apple App Store and Google Play Store. However, there is no mention of the functionality of the application, except for the fact that 24/5 customer support is integrated. From the images provided, the application seems sleek, with at least line, area and candlestick chart support.

Payment Methods

Users can make deposits to and withdrawals from their Golden Brokers accounts using bank wire transfers, credit cards, debit cards and online payment services like Neteller. Deposits can be made in any currency, though they will be converted to USD. A minimum deposit limit of USD 100 is imposed.

Leverage

Golden Brokers clients can access leverage for forex pairs, though not for any other assets offered by the broker. All currency pairs have a maximum rate of 1:100, though this is flexible.

Account Types

To open an account with Golden Brokers you will need to provide personal information like your home address and date of birth, as well as income information like annual income and total net worth. Additionally, you must provide documentation showing proof of identity and residence. It is important to note that the broker will only accept transfers of funds from bank accounts listed on the application forms.

Demo Account

Golden Brokers have provided users with the opportunity to practise making trades on their platform and explore the various markets offered with a free demo account. Each account is given USD 100,000 of digital funds to execute forex, commodities, indices and CFD trades in a simulated environment.

Live Accounts

There is a standard live account on the Golden Brokers platform that provides access to the MetaTrader 5 platform and the many financial instruments. There is also the option for an Islamic account, with which users are entitled to 20 calendar days per year that are swap-free.

Regulation

Golden Brokers is regulated by the Labuan Financial Services Authority in Malaysia with License number MB/19/0030.

This means that the company is authorised to conduct its business and must maintain certain industry standards, such as protection of funds, for example. Client funds are kept safe through account segregation with tier-1 banking institutions, meaning that money can be returned if the broker collapses.

0 notes

Text

The Aviation Fuel Market is projected to grow from USD 249,812.34 million in 2023 to an estimated USD 721,085.21 million by 2032, with a compound annual growth rate (CAGR) of 12.50% from 2024 to 2032. The aviation fuel market plays a crucial role in the global economy, powering commercial airliners, cargo planes, and military aircraft. With air travel demand steadily increasing, the market for aviation fuel is expanding and evolving. This growth brings unique challenges and opportunities, including sustainability, fluctuating fuel prices, and shifts in global supply chains. Below, we explore the drivers of the aviation fuel market, current trends, and projections for its future.

Browse the full report https://www.credenceresearch.com/report/aviation-fuel-market

Overview of the Aviation Fuel Market

Aviation fuel, primarily in the form of jet fuel, kerosene, and aviation gasoline, is vital for maintaining air transport operations. It contributes significantly to operating costs, representing approximately 30-40% of airlines' total expenses. The aviation fuel market has been growing in parallel with the demand for air travel, which has been rising at an annual rate of about 4-5% over the past two decades.

However, fuel prices are heavily influenced by global oil markets, geopolitical events, and natural disasters. These factors impact not only the cost of jet fuel but also the airline industry’s financial stability. The market is also seeing a push towards biofuels and sustainable aviation fuels (SAF) as the industry seeks to align with global carbon reduction commitments.

Key Growth Drivers

1. Rising Demand for Air Travel: Increasing globalization, urbanization, and the growth of low-cost carriers (LCCs) have led to a surge in both passenger and cargo air traffic. Economic development in regions like Asia-Pacific, the Middle East, and Latin America has further contributed to this demand, as more people travel for business, tourism, and family connections.

2. Expansion of Military Aviation: Military aviation is another significant factor driving the demand for aviation fuel. Governments worldwide are investing in advanced military aircraft, which require reliable fuel supplies. Rising geopolitical tensions have led to increased military budgets in various countries, which in turn bolsters the aviation fuel market.

3. Growth in E-commerce: The rise of e-commerce has significantly impacted the aviation fuel market. Online retail giants like Amazon, Alibaba, and others are investing in efficient cargo air fleets to meet fast delivery expectations. Air freight is preferred over other transport modes due to its speed, increasing the demand for aviation fuel in the cargo segment.

4. Innovation in Fuel Efficiency: Technological advancements in aircraft design and engine efficiency are reducing the fuel consumption per mile flown. However, despite these efficiencies, overall demand for fuel is growing due to increased flight volume.

Major Market Trends

1. Sustainable Aviation Fuel (SAF) Development: One of the biggest shifts in the aviation fuel market is the move toward sustainable aviation fuel (SAF). Made from renewable sources like algae, used cooking oil, and municipal solid waste, SAF produces significantly fewer carbon emissions than conventional jet fuel. The International Air Transport Association (IATA) and major airlines aim to increase SAF use to meet long-term decarbonization goals, targeting carbon neutrality by 2050.

2. Fluctuating Fuel Prices: As a commodity, aviation fuel is subject to price fluctuations that are often beyond the control of airlines. The price of crude oil, geopolitical tensions, and disruptions in production or supply chains can all impact fuel prices. In response, airlines are employing fuel hedging strategies to stabilize costs, even though this sometimes leads to higher short-term expenses.

3. Adoption of Hybrid and Electric Aircraft: Research into hybrid-electric and fully electric aircraft is underway as part of broader efforts to reduce carbon emissions. Although electric aircraft are not yet commercially viable for long-haul flights, shorter, regional flights could be electrified in the near future, reducing fuel demand in these segments.

4. Regional Growth in Emerging Markets: Emerging markets in Asia-Pacific, the Middle East, and Africa are experiencing rapid aviation sector expansion due to economic growth and infrastructure development. This trend is creating increased demand for aviation fuel in these regions, with new airports, expanded routes, and larger airline fleets.

Challenges in the Aviation Fuel Market

1.Environmental Regulations: As global pressure mounts to reduce greenhouse gas emissions, the aviation sector is under increased scrutiny to limit its carbon footprint. Governments and regulatory bodies are enacting stricter environmental laws, such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), which requires airlines to offset their emissions.

2. Supply Chain Disruptions: Political instability, natural disasters, and pandemics can disrupt the global supply chain, affecting the availability and price of aviation fuel. The COVID-19 pandemic, for instance, significantly reduced aviation demand, and fuel suppliers faced unprecedented challenges in balancing supply with fluctuating demand.

3. Cost of SAF Production: Currently, SAF is significantly more expensive than conventional jet fuel, which limits its adoption. However, increased investment in production facilities and government incentives could bring down costs over time, making SAF a viable alternative for more airlines.

Future Outlook

The aviation fuel market is expected to grow in the coming years, with a compound annual growth rate (CAGR) of approximately 5% between 2023 and 2030. Emerging markets, SAF adoption, and advancements in aircraft technology will be key factors shaping the industry. Although conventional jet fuel will continue to dominate the market in the short term, SAF and alternative fuel sources are anticipated to make a greater impact as costs decrease and adoption scales up.

The future of the aviation fuel market will likely be defined by a balance between sustainability and profitability. Airlines, fuel suppliers, and governments will need to work together to support SAF development, promote efficiency, and manage emissions, all while meeting the growing demand for air travel.

Key players

Vitol

Exxon Mobil

Chevron Corporation

Shell Plc

Indian Oil Corporation Limited

TotalEnergies SE

BP Plc

Rosneft Deutschland GmbH

Valero Energy Corporation

Marathon Petroleum Corporation

World Fuel Services Corporation

Essar Oil (UK) Limited

Bharat Petroleum Corporation Limited

Segments

Based on Type

Jet Fuel

Aviation Gas (Avgas)

Bio Jet Fuel

Based on End User

Commercial

Private

Military

Based on Region

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

Browse the full report https://www.credenceresearch.com/report/aviation-fuel-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

Website: www.credenceresearch.com

0 notes

Text

Golden Brokers Review 2024

This review will discuss the Malaysian-based forex broker, Golden Brokers Ltd. We explore its features with information on the trading platform, available markets, fees, regulation, pros, cons and more. Find out whether to open a live account with Golden Brokers.

Headlines

Golden Brokers Limited was founded in 2018. It is regulated by the Malaysian financial regulator Labuan FSC and its headquarters is based in Kuala Lumpur, Malaysia. It is not quite a global broker as many major geographical locations such as France, Germany and Switzerland are restricted, which other brokers for forex and all manner of trading cater to.

Trading Platforms

MetaTrader 5

MT5 is a world-leading platform with many tools and instruments that can be customised to help each user carry out thorough technical analysis and manage their positions. MT5 is a further development of the MetaTrader 4 platform, offering greater functionality, faster processes and a more intuitive layout. This platform is available on your web browser and downloadable on Windows and Mac.

MT5 platform features include:

Copy trading

21 timeframes

One-click trading

Integrated signals

Automated trading

Hedging and netting

38 built-in indicators

6 pending order types

Markets

Forex – Over 60 major, minor and exotic currency pairs

Commodities – 15 commodities, including precious metals and crude oil

Stock CFDs – Large multinational companies such as Apple, Google and Volkswagen

Indices – 14 global equity indices, such as the Dow Jones & FTSE

Trading Fees

Golden Brokers offers quite large spreads, with typical rates around 3-4 pips for major currency pairs like GBP/USD and EUR/GBP. Spreads for indices range from 2 to 50 pips, while commodities sit between 0.07 and 14 pips.

No commissions are charged, though there are overnight swap fees on CFD positions, which sit at a 0.5% charge, with a minimum fee of USD 20. Additionally, there is a dormancy charge of USD 100 for accounts that remain inactive for an entire year.

Mobile Apps

Golden Brokers clients can access mobile trading through the MetaTrader 5 application. This can be downloaded for both Apple (iOS) and Android (APK) devices from the relevant stores, boasting much of the functionality of the desktop versions. The app offers all supported order types, account management systems and asset classes, with 24 analysis tools and 30 indicators.

The broker’s website also links to a proprietary application on the Apple App Store and Google Play Store. However, there is no mention of the functionality of the application, except for the fact that 24/5 customer support is integrated. From the images provided, the application seems sleek, with at least line, area and candlestick chart support.

Payment Methods

Users can make deposits to and withdrawals from their Golden Brokers accounts using bank wire transfers, credit cards, debit cards and online payment services like Neteller. Deposits can be made in any currency, though they will be converted to USD. A minimum deposit limit of USD 100 is imposed.

Leverage

Golden Brokers clients can access leverage for forex pairs, though not for any other assets offered by the broker. All currency pairs have a maximum rate of 1:100, though this is flexible.

Account Types

To open an account with Golden Brokers you will need to provide personal information like your home address and date of birth, as well as income information like annual income and total net worth. Additionally, you must provide documentation showing proof of identity and residence. It is important to note that the broker will only accept transfers of funds from bank accounts listed on the application forms.

Demo Account

Golden Brokers have provided users with the opportunity to practise making trades on their platform and explore the various markets offered with a free demo account. Each account is given USD 100,000 of digital funds to execute forex, commodities, indices and CFD trades in a simulated environment.

Live Accounts

There is a standard live account on the Golden Brokers platform that provides access to the MetaTrader 5 platform and the many financial instruments. There is also the option for an Islamic account, with which users are entitled to 20 calendar days per year that are swap-free.

Regulation

Golden Brokers is regulated by the Labuan Financial Services Authority in Malaysia with License number MB/19/0030.

This means that the company is authorised to conduct its business and must maintain certain industry standards, such as protection of funds, for example. Client funds are kept safe through account segregation with tier-1 banking institutions, meaning that money can be returned if the broker collapses.

0 notes

Text

Efficient Crude Oil Trading with AvaTrade Platform

Crude oil remains one of the most traded commodities globally, as it plays a vital role in the global economy. The volatility and liquidity of crude oil markets offer traders significant opportunities to profit. To effectively capitalize on these opportunities, traders need access to robust crude oil trading platforms. AvaTrade, a leading online trading platform, provides traders with an efficient way to engage in various markets, including crude oil.

Understanding Crude Oil Trading Platforms

A crude oil trading platform is a digital interface that allows traders to buy and sell crude oil contracts, typically in the form of futures or options. These platforms offer real-time market data, analytics, and a wide array of tools for executing trades. The main advantage of using a dedicated crude oil trading platform is its ability to provide insights into price movements, geopolitical factors affecting supply and demand, and technical analysis tools that guide traders in making informed decisions.

Traders using crude oil platforms can take advantage of price swings caused by geopolitical tensions, OPEC decisions, and global economic shifts. With advanced order types, risk management tools, and charting features, crude oil trading platforms are essential for traders looking to succeed in this highly volatile market.

AvaTrade Trading Platform Online

AvaTrade is a well-established online trading platform that caters to a wide variety of traders, including those interested in crude oil. The platform offers seamless access to crude oil markets through Contracts for Difference (CFDs), allowing traders to speculate on the price of crude oil without needing to own the physical commodity. This offers significant flexibility, as traders can profit from both rising and falling markets.

The Avatrade Trading Platform Online is known for its user-friendly interface, advanced charting tools, and multiple trading instruments. It offers comprehensive educational resources for novice and experienced traders alike, helping users develop strategies and improve their trading skills. Moreover, AvaTrade provides mobile access, ensuring that traders can monitor the markets and execute trades from anywhere, anytime.

Benefits of Trading Crude Oil on AvaTrade

Leveraged Trading: AvaTrade allows traders to use leverage, increasing potential returns.

Risk Management Tools: Features like stop-loss orders and trailing stops help manage risk effectively.

Real-Time Data: Traders benefit from real-time market data, enabling faster decision-making.

Conclusion

In the ever-dynamic crude oil market, choosing the right trading platform is critical for success. AvaTrade’s online platform offers a reliable, feature-rich environment for traders to navigate the complexities of crude oil trading with confidence. GFT Trading stands as a key player in helping traders access top-tier trading platforms like AvaTrade, empowering them to explore lucrative opportunities in crude oil markets with advanced tools, educational resources, and personalized support.

0 notes

Text

Singapore’s Oil Party Spoiled by Falling Prices and China Gloom - Journal Global Internet https://www.merchant-business.com/singapores-oil-party-spoiled-by-falling-prices-and-china-gloom/?feed_id=192798&_unique_id=66dd54d9dec28 #GLOBAL - BLOGGER BLOGGER The oil party isn’t over yet — but for top merchants and executives gathering for talks and rooftop cocktails in Singapore this week, the exuberance that came with the outsized profits of recent years is quickly fading.Author of the article:Bloomberg NewsSerene CheongPublished Sep 07, 2024 • 4 minute readhlqz3bs]is7vs[bn(s9q9)mf_media_dl_1.png Bloomberg(Bloomberg) — The oil party isn’t over yet — but for top merchants and executives gathering for talks and rooftop cocktails in Singapore this week, the exuberance that came with the outsized profits of recent years is quickly fading.China’s economic slowdown, structural shifts in the global energy mix and the prospect of additional crude supply are all weighing on refiners and producers. Processing margins have tumbled. Traders will be no less glum, as the turbulence of the pandemic and of the months that followed Russia’s invasion of Ukraine — once-in-a-generation events — have been replaced by low volatility.THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLYSubscribe now to read the latest news in your city and across Canada.Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.SUBSCRIBE TO UNLOCK MORE ARTICLESSubscribe now to read the latest news in your city and across Canada.Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.REGISTER / SIGN IN TO UNLOCK MORE ARTICLESCreate an account or sign in to continue with your reading experience.Access articles from across Canada with one account.Share your thoughts and join the conversation in the comments.Enjoy additional articles per month.Get email updates from your favourite authors.Merchant Sign In or Create an AccountorArticle contentThe thousands of oil executives, hedge funds and investors gathering for the Asia Pacific Petroleum Conference (APPEC) will be facing up to the grim reality that is already forcing Wall Street analysts to revise down price and demand forecasts. In recent weeks, global oil prices have erased all gains for this year. OPEC and allied nations have found themselves compelled to postpone a supply hike that could have tipped the market into surplus.Sentiment is unquestionably bearish, said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore, absent a return to the geopolitical uncertainty and trading frenzy of the years when Donald Trump was in the White House. “It would take something like Trump coming back in to shake things up again to add that kind of excitement and turbulence back into the market.”Of all the gloomy topics at Asia’s biggest oil gathering of the year, the toughest to avoid will be China — and the question of whether cooling consumption is masking a more permanent decline in fossil fuel use as clean energy takes hold. Beijing’s economic troubles run deep, and indicators have repeatedly sounded warnings on demand in the world’s largest crude importer, until recently a key source of growth for global crude. In August, factory

activity contracted for a fourth straight month, while loan data has been uninspiring and the job market dour. Economists are now forecasting China will fall short of delivering its growth target of around 5% this year.By signing up you consent to receive the above newsletter from Postmedia Network Inc.Article contentArticle contentTraders who anticipated a stimulus-led recovery have repeatedly been forced to revise their forecasts, initially pushing the revival back to early this year and now into 2025. Even then, China will likely face a new normal when it comes to energy. Commodities trader Trafigura is among those who have suggested the nation’s gasoline demand may have already peaked due to rapid growth in electric vehicles, while high-speed rail travel and trucks fueled by liquefied natural gas are crimping appetite for jet fuel and diesel. These, combined with a slump in consumer confidence, have already contributed to a year-on-year dip in crude imports from January-July — a phenomenon previously seen only during the depths of Covid-19.The other cloud hanging over the Singapore gathering is Organization of the Petroleum Exporting Countries and allies and what comes next — even after the cartel brushed off Libyan outages and pushed back additional supply for two months — a move that still wasn’t enough to roll back steep price losses. Since OPEC+ began output cuts in 2020, some of the group’s traditional suppliers have been losing ground in China, where refiners cranked up imports of restricted crude, using networks that the US cannot reach. India has turned to lesser-known entities to broker deals. Article contentWhile Saudi Arabia has invested more in Chinese refiners, locking in some downstream demand, it’s unclear if that’s enough to stem a decline. A slump in margins is capping processors’ ability to pay for imports, leading operating rates at China’s private refining sector to hover at close to 50% or lower in the past weeks. State-owned processors, meanwhile, are considering trimming volumes in a counter-seasonal move. The one irrefutable winner next week will be the city-state of Singapore. From its skyscrapers, oil executives will spot the queue of hundreds of vessels waiting off the coast for their chance to refuel, a reminder that this is one of the world’s busiest bunkering hubs, as well as a key financing center.Since attacks from Houthi rebels in the Red Sea began last year, the port of Singapore has seen a surge in bunker fuel sales and trans-shipment activity as vessels ranging from container carriers to oil supertankers make the detour around the African continent, skipping spots such as Fujairah in favor of Southeast Asia. The trading community that has thrived along with the port is still expanding. Even Dubai’s emergence as an attractive alternative for many companies — a financial center where firms handling Iranian and Russian trades can easily be set up and dissolved — has yet to dent the appeal of the island nation.What may be up for uncomfortable discussion, among cocktails and presentations, is whether China’s slowdown could.Article contentSource of this programme “My grandma says this plugin is interesting!”“The oil party isn’t over yet — but for top merchants and executives gathering for talks and rooftop cocktails in Singapore this week, the exuberance that came with the outsized…”Source: Read MoreSource Link: https://financialpost.com/pmn/business-pmn/singapores-oil-party-spoiled-by-falling-prices-and-china-gloom#Merchant – BLOGGER – Merchant http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/09/g5ba0636b01eb30bb0c24b8c39023f687899a69bf52b3d916156b628866ec299a69ed0e802518cb5b9f79006e483f7637207.jpeg The oil party isn’t over yet — but for top merchants and executives gathering for talks and rooftop cocktails in Singapore this week, the exuberance that came with the outsized profits of recent years is quickly fading. Author of the article: Bloomberg News Serene Cheong Published Sep 07, 2024 • 4 minute read hlqz3bs]is7vs[bn(s9q9)mf_media_dl_1.

png Bloomberg … Read More

0 notes

Text

WTI Crude Rises, Gold Dips: Hidden Market Patterns Revealed Gold’s Red Flare? Or Just a Midweek Tantrum? Before we get to the juice of today’s trading shenanigans, let's set the record straight. Not all news is made equal, and in a market this fickle, some news simply doesn't move the needle—just like when you realize those “huge” Black Friday discounts were only on the leftovers nobody wanted anyway. But hidden amidst the noise, there are often tiny patterns that drive the market—you just need to know where to look. So, let’s uncover some hidden gems in today's updates. WTI & Brent Crude Oil: Putin, Trump, and A Market That Couldn’t Care Less In today’s intriguing-but-didn't-quite-matter section, we heard that President Putin is apparently open to discussing a ceasefire with President-elect Trump. Sounds like a big headline, right? Except, for the markets, this was a snooze-fest. WTI and Brent climbed early in European trade, but quickly shrugged and edged back—kind of like when you put effort into a workout but end up ordering pizza right after. Here's where the advanced insight comes in. When geopolitical news hits the scene, the traders in the know understand that it’s often the follow-up, not the initial announcement, that carries market weight. If you're positioning yourself based on these headlines, it's a matter of patience. Today's jump? That’s nothing more than a reflex. The real movement—if it’s coming—will emerge when concrete actions back up those political niceties. For now, just keep your eyes peeled on inventory data (more on that later). Gold Dips but Still Shines Bright Gold’s taking a tiny dive today, but it’s still comfortably above Tuesday’s USD 2610/oz base. Let’s put it this way: it’s like realizing you’ve still got a decent amount in your account after an expensive weekend—a dip, sure, but not a disaster. It's a classic case of gold doing what gold does best—providing that comfort level where, even on a “down” day, things aren't all that bad. From an advanced trading perspective, it’s moments like these where traders are in a sweet spot for laddering in buys if they’re eyeing longer-term stability. Most traders overreact when they see red, but gold’s dip is well within its usual pattern. A savvy trader sees opportunity—not panic—when the floor is well above previous critical levels. Copper and the Risk Sentiment Rollercoaster Copper's up too, but let’s not throw a party just yet—it's a modest gain, mainly fueled by a broader rebound in risk sentiment. Think of copper as the thermometer for market optimism; today, it's saying, "Hey, things could be worse." It's bobbing within a USD 9.12-9.17k band, which means traders are still waiting for a solid signal to move with conviction. Now, here’s a nugget for the smarter trader: copper's resilience might be an early whisper that industrial activity is on an uptick, albeit not dramatically. This often sets the stage for positioning yourself well ahead of the herd in other correlated commodities. Remember, those who read between the lines get in ahead of the headlines. Gas Storage Charges: A Tiny Shockwave Coming Your Way Trading Hub Europe casually dropped the news that the gas storage neutrality charge from January 2025 will be EUR 2.99/MWh. Sounds boring? Maybe, but here’s why it matters. Storage charges directly affect supply-side decisions, and small shifts can snowball into larger implications for natural gas prices, particularly in the colder months. Hidden opportunity: watch how forward contracts adjust over the next few weeks. Charges might seem inconsequential now, but experienced traders know these set the stage for winter volatility. It’s all about getting in while the getting’s lukewarm. Equinor's Sverdrup Oilfield: Steady and Smooth, But Watch for the Next Jolt Equinor's Johan Sverdrup oilfield is back online after a power outage. It’s pumping 775k barrels per day—which is about the same as your daily caffeine intake if you’re a news junkie keeping up with everything. The takeaway here? Stability. No significant ripples today, but keep an eye out for reports on whether production stays smooth. These subtle markers can predict when WTI might go volatile if outages become a pattern. Private Inventory Data: When Too Much Oil Isn’t Always a Good Thing Today’s private inventory data surprised a bit: crude was up a whopping +4.8 million barrels against expectations of a meager +0.1 million. Meanwhile, gasoline inventories fell significantly by -2.5 million barrels, which might explain why your gas pump visits have felt even more like mini mortgages recently. Distillates also showed a draw, but nothing major. For the advanced trader, this is where the contrarian play might make sense. Too much crude and too little gasoline is an odd imbalance that can create interesting arbitrage opportunities in refining stocks or related energy derivatives. Classic misalignments like these are often where fortunes are made by those sharp enough to connect the dots. How to Ride Today’s Market Moves Like a Pro Okay, so we’ve got geopolitical news that isn’t quite living up to the hype, metals that are playing it coy, and some significant inventory swings. What's the takeaway? Simple: - Be Patient: Not every headline will be a game-changer, but some are precursors. Learn to see the sequence. - Read Between the Lines: Commodities are about relationships—between supply, demand, sentiment, and seasonality. Today’s gas storage charge may just be a number, but it’s what that number will mean for winter that matters. - Look for Misalignments: Crude and gasoline numbers are off-balance, creating a potential opportunity for refined products. Traders miss these details, and that’s where your edge lies. And remember, no trading blunder is worse than diving in without a plan. If you’re tired of getting blindsided, maybe it’s time to check out StarseedFX's free trading plan or trading journal—because smart trading is planned trading. To keep you on top of the market game, don’t forget to join our community for exclusive insights and next-level tactics you simply won’t find elsewhere. Because, let’s face it, the edge you need is often buried under a mountain of headline clutter, and it’s all about knowing where to dig. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Singapore’s Oil Party Spoiled by Falling Prices and China Gloom - Journal Global Internet - BLOGGER https://www.merchant-business.com/singapores-oil-party-spoiled-by-falling-prices-and-china-gloom/?feed_id=192793&_unique_id=66dd53b096e6e The oil party isn’t over yet — but for top merchants and executives gathering for talks and rooftop cocktails in Singapore this week, the exuberance that came with the outsized profits of recent years is quickly fading.Author of the article:Bloomberg NewsSerene CheongPublished Sep 07, 2024 • 4 minute readhlqz3bs]is7vs[bn(s9q9)mf_media_dl_1.png Bloomberg(Bloomberg) — The oil party isn’t over yet — but for top merchants and executives gathering for talks and rooftop cocktails in Singapore this week, the exuberance that came with the outsized profits of recent years is quickly fading.China’s economic slowdown, structural shifts in the global energy mix and the prospect of additional crude supply are all weighing on refiners and producers. Processing margins have tumbled. Traders will be no less glum, as the turbulence of the pandemic and of the months that followed Russia’s invasion of Ukraine — once-in-a-generation events — have been replaced by low volatility.THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLYSubscribe now to read the latest news in your city and across Canada.Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.SUBSCRIBE TO UNLOCK MORE ARTICLESSubscribe now to read the latest news in your city and across Canada.Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.REGISTER / SIGN IN TO UNLOCK MORE ARTICLESCreate an account or sign in to continue with your reading experience.Access articles from across Canada with one account.Share your thoughts and join the conversation in the comments.Enjoy additional articles per month.Get email updates from your favourite authors.Merchant Sign In or Create an AccountorArticle contentThe thousands of oil executives, hedge funds and investors gathering for the Asia Pacific Petroleum Conference (APPEC) will be facing up to the grim reality that is already forcing Wall Street analysts to revise down price and demand forecasts. In recent weeks, global oil prices have erased all gains for this year. OPEC and allied nations have found themselves compelled to postpone a supply hike that could have tipped the market into surplus.Sentiment is unquestionably bearish, said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore, absent a return to the geopolitical uncertainty and trading frenzy of the years when Donald Trump was in the White House. “It would take something like Trump coming back in to shake things up again to add that kind of excitement and turbulence back into the market.”Of all the gloomy topics at Asia’s biggest oil gathering of the year, the toughest to avoid will be China — and the question of whether cooling consumption is masking a more permanent decline in fossil fuel use as clean energy takes hold. Beijing’s economic troubles run deep, and indicators have repeatedly sounded warnings on demand in the world’s largest crude importer, until recently a key source of growth for global crude. In August, factory activity contracted for a fourth straight month, while loan data has been uninspiring and the job market dour.

Economists are now forecasting China will fall short of delivering its growth target of around 5% this year.By signing up you consent to receive the above newsletter from Postmedia Network Inc.Article contentArticle contentTraders who anticipated a stimulus-led recovery have repeatedly been forced to revise their forecasts, initially pushing the revival back to early this year and now into 2025. Even then, China will likely face a new normal when it comes to energy. Commodities trader Trafigura is among those who have suggested the nation’s gasoline demand may have already peaked due to rapid growth in electric vehicles, while high-speed rail travel and trucks fueled by liquefied natural gas are crimping appetite for jet fuel and diesel. These, combined with a slump in consumer confidence, have already contributed to a year-on-year dip in crude imports from January-July — a phenomenon previously seen only during the depths of Covid-19.The other cloud hanging over the Singapore gathering is Organization of the Petroleum Exporting Countries and allies and what comes next — even after the cartel brushed off Libyan outages and pushed back additional supply for two months — a move that still wasn’t enough to roll back steep price losses. Since OPEC+ began output cuts in 2020, some of the group’s traditional suppliers have been losing ground in China, where refiners cranked up imports of restricted crude, using networks that the US cannot reach. India has turned to lesser-known entities to broker deals. Article contentWhile Saudi Arabia has invested more in Chinese refiners, locking in some downstream demand, it’s unclear if that’s enough to stem a decline. A slump in margins is capping processors’ ability to pay for imports, leading operating rates at China’s private refining sector to hover at close to 50% or lower in the past weeks. State-owned processors, meanwhile, are considering trimming volumes in a counter-seasonal move. The one irrefutable winner next week will be the city-state of Singapore. From its skyscrapers, oil executives will spot the queue of hundreds of vessels waiting off the coast for their chance to refuel, a reminder that this is one of the world’s busiest bunkering hubs, as well as a key financing center.Since attacks from Houthi rebels in the Red Sea began last year, the port of Singapore has seen a surge in bunker fuel sales and trans-shipment activity as vessels ranging from container carriers to oil supertankers make the detour around the African continent, skipping spots such as Fujairah in favor of Southeast Asia. The trading community that has thrived along with the port is still expanding. Even Dubai’s emergence as an attractive alternative for many companies — a financial center where firms handling Iranian and Russian trades can easily be set up and dissolved — has yet to dent the appeal of the island nation.What may be up for uncomfortable discussion, among cocktails and presentations, is whether China’s slowdown could.Article contentSource of this programme “My grandma says this plugin is interesting!”“The oil party isn’t over yet — but for top merchants and executives gathering for talks and rooftop cocktails in Singapore this week, the exuberance that came with the outsized…”Source: Read MoreSource Link: https://financialpost.com/pmn/business-pmn/singapores-oil-party-spoiled-by-falling-prices-and-china-gloom#Merchant – BLOGGER – Merchant http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/09/g5ba0636b01eb30bb0c24b8c39023f687899a69bf52b3d916156b628866ec299a69ed0e802518cb5b9f79006e483f7637207.jpeg Singapore’s Oil Party Spoiled by Falling Prices and China Gloom - Journal Global Internet - #GLOBAL BLOGGER - #GLOBAL

0 notes

Text

Dangote refinery designed to process Nigerian crude – CEO