#cma part 1

Explore tagged Tumblr posts

Text

#cma course#Certified Management Accountant#cma#cma part 1#finance courses#HPA#High Performance Academy

0 notes

Text

Want to Boost Your Career with the US CMA Certification? Learn More with FINAIM! 🚀

Did you know that the US CMA certification was created in the 1970s to meet the growing demand for strategic financial experts, not just number crunchers? 📊 This globally recognized certification is designed for professionals who want to take their career in finance to the next level. 🌍

At FINAIM, we specialize in helping you achieve your US CMA certification with top-notch training, guidance, and resources. Whether you're aiming to transition into management accounting or seeking to advance your financial expertise, FINAIM offers a robust learning experience. 🎓

Why Choose FINAIM for Your US CMA Journey? 🤔

Comprehensive US CMA Coaching: Learn from experts with years of experience. 💼 Global Recognition: The CMA designation is recognized worldwide, enhancing your career opportunities. 🌎 Flexible Learning: Access online resources and personalized coaching that fit your schedule. 🖥️ Join the thousands of successful professionals who have trusted FINAIM to help them pass the US CMA exams and transform their careers. Don’t wait – take the first step toward securing your future today! 💪

Start your US CMA journey with FINAIM and open doors to opportunities in management accounting, financial analysis, and strategic business planning. 💼

VISIT: https://finaim.in/cma-course-in-delhi/

FINAIM ADDRESS: First Floor, Tewari House, 102 - B, Pusa Rd, Block 11, Old Rajinder Nagar, Rajinder Nagar, New Delhi, Delhi, 110005 PHONE NO: 087009 24049

#finaim#us cma#us cma coaching in delhi#us cma eligibility#us cma course duration#us cma part 1 and part2 offline classes#us cma fees in india#us cma certification#us cma exam

0 notes

Text

Is the CMA Exam Hard? Discover Tips to Pass with Ease

Is the CMA exam tough, or is it manageable with the right preparation? This guide breaks down the CMA exam structure, prerequisites, curriculum, and cognitive skills required to pass. Discover key study tips, time management strategies, and the role of a good CMA review course. With a strong study routine and expert guidance, you can overcome the challenges and achieve CMA certification. Learn how to approach Parts 1 and 2 with confidence, avoid common pitfalls, and boost your chances of success Read More: https://cfonext.co.in/is-cma-tough/

#Is the CMA exam hard#Tips to pass CMA exam#CMA exam pass rate#CMA Part 1 and 2 tips#How to prepare for CMA

0 notes

Text

youtube

US CMA Course Syllabus

Mastering strategic financial management and decision-making is a rewarding adventure that begins with the US CMA (Certified Management Accountant) course syllabus. The program, which covers subjects like financial planning, analysis, control, and professional ethics, gives applicants the tools they need to succeed in fast-paced work settings. The CMA syllabus serves as a road map for financial professionals looking to gain competence in promoting organizational success, covering topics like risk and performance management. The American CMA course guarantees that candidates are adequately equipped to tackle the demands of contemporary management accounting by emphasizing practical applications. Take your career to new heights by utilizing the US CMA syllabus to embark on a transformative learning experience.

#cma us syllabus#cma usa part 1 syllabus#cma part 1 syllabus#us cma part 1 syllabus#cma usa course syllabus#Youtube

0 notes

Text

CMA Exam Study Plan for Retaking

Now that you know the CMA exam retake policy, it’s time to start preparing for your retake. The first thing you should do is to analyze your performance on your previous attempt. Identify the areas where you struggled the most and focus on improving your knowledge and skills in those areas.

#cma course passing percentage#score to pass cma exam#cma exam score scale#cma part 1 passing score#highest score on cma exam#passing marks for cma usa#cma result passing percentage

0 notes

Text

Un professore s2 moodboard, parte 4 (3, 2, 1):

1 CMA Italia // 2, 4, 6 D. Buzzati, Un amore // 5 J. H. Füssli, L'incubo // 9 B. Zannoni, i miei stupidi intenti // 10 Rkomi, Il ritmo delle cose

12 notes

·

View notes

Text

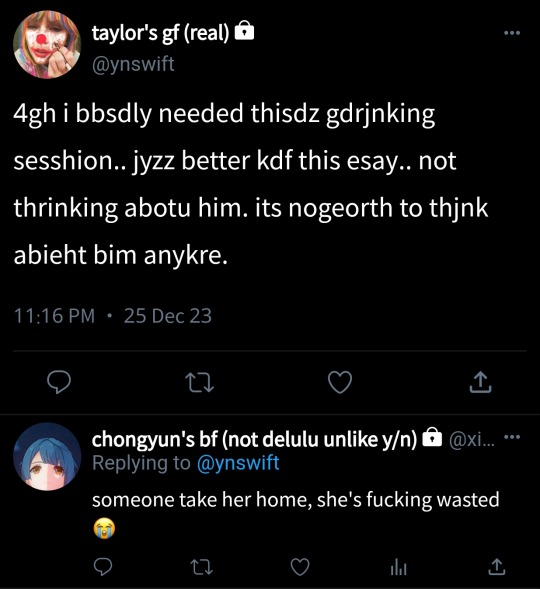

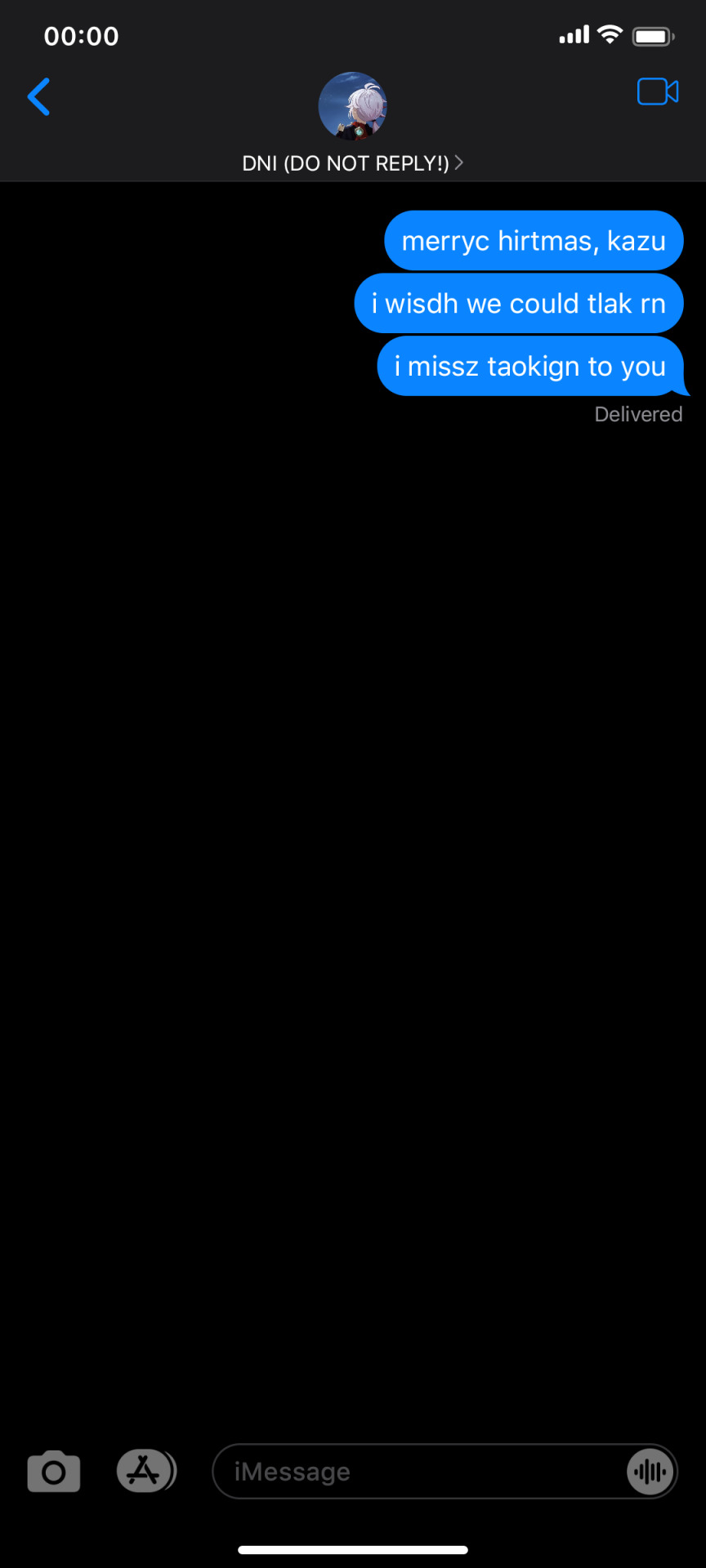

⸻ christmas wish 🎄

pov: drinking on Christmas eve is not so bad not until you drunk texted your ex, kazuha, who you miss so dearly (you may or may not read "you're losing me" before reading this one but is recommended :))

k.kazuha x fem!reader | mini/short smau; exes to ???; some crack/humor; lowkey angst with fluff haehehhe; xingyun; drinking; time stamps don't matter except for the text time separators; everything's a mess (including the parts cut off and layout cause me got lazy to fix)

you're losing me | part 1 | part 2 | part 3 (final)

> disappears > comes back with a sequel for the kazuha mini smau 🤣 this was honestly not planned and i only got a burst of excitement when i saw people on twitter getting greeted by their exes merry cmas 👍 initially, the smau mini series ended by the part 4 of youre losing me but err yeah whatever! taglist is open for whoever wants to be tagged/remove just send an ask or reply!

hopefully you guys enjoy and get the ending you deserve. will update quickly (real no lies please dont bash) have a very very merry christmas even tho it's late. i love u guys so much

taglist @loveroftheoldestdream @danhenglovebot @wonderland-fan @sunnyskiesv2 @m3rryy @kkazuyass @otomegame-oneshots

#genshin x reader#genshin smau#genshin impact smau#genshin imagines#genshin x y/n#genshin x female reader#genshin x you#kazuha smau#kaedehara kazuha x reader#kazuha x y/n#kazuha x reader#kazuha x you#kaedehara kazuha x you#kaedehara kazuha smau#✍ー rein writes

74 notes

·

View notes

Note

What are your thoughts on the three years Taylor had disappeared for before her reputation comeback? Was she also professionally cancelled, as in lost a lot of brand deals and the like?

PS: I like your tea posts a lot! How long have you been doing that now? Do you buy more tea for your collection?

PSS: How do you think your anon-answering records look like this year?

hi!

i am a rep era kaylor. i started paying attention to things with reputation, so i was not really paying attention closely during this period of time you’re asking about. so, my below thoughts are just based on me taking a second to google and check my chronological understanding of how things went based on how i’ve researched in the past.

**people who were there at the time please add on**

in actuality taylor only “disappeared” for about a year. maybe you are getting the 3 year number from the period of time between 1989 and rep release years? but taylor’s instagram reset only happened several months before reputation’s release. after releasing 1989 she of course went on tour with the 1989 tour and that went until december 2015. snapchatgate didn’t happen until july 2016. after that she had appearances at Formula 1 in Austin in october, the 2016 CMAs, and she release i don’t want to live forever with zayn in december 2016 with the music video released in january 2017 and had a pre super bowl concert in february. she erased everything from her instagram in august 2017, reputation was announced that august, and then her next public appearance was SNL on in november 2017.

i don’t get the sense she was professionally cancelled. one example, she signed her multi year promo deal with at&t in october 2016, which would have been after snapchatgate. that’s a huge deal. her deal with keds shoes did end with 2016 but i think part of that is likely aligned with taylor’s desire at the time to evolve her image. keds as very red era and it worked with 1989 era but, i think 2016 was a logical stopping point.

i think the reason why it felt like she disappeared is that she was active on social media so much in the years before snapchatgate, but then she really dropped a bunch of that so it felt like it was drastically less so suddenly. but taylor has really pared down her social media presence in recent years as well so, im not sure if she was similarly quiet these days if people would even notice.

re: ps: it’s been around 900 days since i started! yes i buy more teabags every once in a while to replenish. i have a lot of loose tea leaves though too.

re: pss: not sure i can judge the quality of my own anon answers! i think i only answer about 25% of the anons i get. if i don’t answer back it’s usually nothing personal 😆 sometimes i draft an answer to something when im halfway done and then forget its in the draft.. i often dont post stuff that is personal or questions that are difficult to respond to. sometimes the timing of a response has been lost and i don’t get back around to it. sometimes i won’t answer if the anon is unrelated to my blog or if its something being send around everywhere looking for someone to bite. etc etc. it’s not a perfect science but all and all, i don’t answer the majority of what i get, for sure. taking a page from taylor’s book: dear reader you don’t have to answer just cause they asked you…

14 notes

·

View notes

Text

Malone first teased the song on Instagram a couple weeks ago, and earlier this month, he and Shelton played it twice in one night during CMA Fest in Nashville: First, they delivered a full-band version at Nissan Stadium, then they shared a stripped-back acoustic rendition at Shelton’s Ole Red Bar during the Spotify House takeover. (The Nissan Stadium performance will air as part of the CMA Fest special on ABC, June 25.)

17 notes

·

View notes

Text

testing my knowledge with this vidoe of "the craziest drugs you've never heard of"

1st we have: Salvinorin B Methoxymethyl Ether

now i have not heard of this but lets make some infrences and see if i was right. 1, im guessing its similar to Salvinorin A Methoxymethyl Ether spefically, which I also haven't heard of that specific thing, and am simply assuming it's real. my guess is it's also a hallucinogen, because Salvinorin A (which i have heard of) is the part of the Saliva (aka the magic mint) that makes you trip. also salivinorin a is super duper cool cause it has... NO NITROGEN ATOMS which is super fucking weird

okay now video guy says: yes it is related to salvia!! apparently its insanely strong, and lasts SUPER long, and only one guy has ever done it. (can i be the second?) also apparently it has crazy time dilation and hes describing it like time dilation is so bad... i've always loved it cause im like "wow im gonna listen to a 3 minute song" and then i'm like "wow.... 20 mins went by... sad..." and i'm halfway through the song AND NOW HE LIED!!! AND THERES ACTUALLY 2 PEOPLE WHO HAVE DONE IT??? but apparently it might not be factual so.... whatever

2nd we have: 4-cma

shit idk man... theres 4 of something in it??

video guy says: it was a research drug in the 1960s!! that was supposed to be astimulant but turned out to just be a mild anti depressant and also will kill your brain

3rd we have: pyros

super addictive. i forget the name of the whole thing it stands for. it's what "bath salts" are. it's super fucking bad im being so serious never do pyros. do meth do crack snort fucking gasoline i do not care please im begging you never do pyros!!!!!!!!!! im being 100% serious theyre the worst thing ever please trust me

video guy says: yes you're right gold star

4th we have: 5-MEO DMT

ITS THE FUCKING TOAD VENOM!!!!!!!

video guy says: ITS THE FUCKING TOAD VENOM!!!!!!!!!!!!!!

5th we have: air duster

uhhhh fuck i forget what it is but it kills your brain cells or somehting

video guy says: it's a refrigerant that replaces the oxegyen in your brain and will suffocate you without you noticing, bad bad bad bad and super addictive but they sell it at walmart and also i spilled nail polish on my school computer

finial asher drug rating: 2 1/2 out of 5 :3

3 notes

·

View notes

Text

FP Markets Review ☑️ Top Forex Brokers Review (2025)

Welcome to our in-depth FP Markets Review, where we explore everything you need to know about this well-established forex and CFD broker. Whether you're a seasoned trader or just starting your trading journey, this review will provide valuable insights into FP Markets' services, features, and its position in the competitive forex market of 2025. As part of our analysis, we’ll also touch on the broader forex market landscape and how FP Markets compares to its competitors. This review is brought to you by Top Forex Brokers Review, your trusted source for unbiased and detailed broker evaluations.

FP Markets Overview

Company Background

FP Markets, founded in 2005, is an Australian-based broker with a strong reputation for reliability and transparency. Over the years, it has grown into a global brand, offering a wide range of trading instruments and services. Headquartered in Sydney, FP Markets has achieved several milestones, including expanding its regulatory footprint and introducing advanced trading platforms to cater to a diverse clientele.

Regulation and Security

FP Markets is regulated by multiple top-tier authorities, including:

Australian Securities and Investments Commission (ASIC)

Cyprus Securities and Exchange Commission (CySEC)

Capital Markets Authority of Kenya (CMA)

Financial Sector Conduct Authority in South Africa (FSCA).

This robust regulatory framework ensures that FP Markets adheres to strict financial standards, providing a secure trading environment. Additionally, the broker segregates client funds from its operational capital, further enhancing safety and trustworthiness.

Services and Features

Trading Platforms

FP Markets offers a variety of trading platforms to suit different trading styles and preferences:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These industry-standard platforms are known for their advanced charting tools, automated trading capabilities, and user-friendly interfaces. They are available on desktop, web, and mobile devices.

cTrader: This platform is ideal for traders who value the depth of market visibility and advanced order capabilities. It also supports algorithmic trading through cAlgo.

IRESS Platform: Designed for trading equities, indices, and futures CFDs, IRESS offers a high level of customization and transparency in market pricing.

TradingView Integration: FP Markets integrates with TradingView, a popular platform for technical analysis and social networking among traders.

Account Types

FP Markets provides several account types to cater to different trading needs:

Standard Account: Aimed at beginners, this account requires a minimum deposit of AUD 100 and offers spreads starting at 1.0 pips with no commissions.

Raw Account: Designed for experienced traders, it also requires an AUD 100 minimum deposit but offers spreads from 0.0 pips with a commission of $3.50 per lot per trade.

IRESS Accounts: These include Standard, Platinum, and Premier accounts, each with varying minimum deposits and brokerage fees. They are tailored for active traders and offer Direct Market Access (DMA).

Islamic Accounts: Swap-free accounts adhering to Sharia law are available for both MetaTrader and IRESS platforms.

Range of Tradable Instruments

FP Markets boasts an impressive range of over 10,000 tradable instruments, including:

Forex: Over 70 currency pairs, covering both major and exotic pairs.

Shares: Access to more than 13,000 global shares.

Indices, Commodities, and Cryptocurrencies: A wide selection of indices, commodities like gold and oil, and cryptocurrency CFDs 9.

Leverage and Spreads

FP Markets offers competitive leverage options, with forex leverage up to 500:1. The Raw ECN account provides spreads starting from 0.0 pips, making it an attractive choice for cost-conscious traders

Additional Services

FP Markets goes beyond trading by offering:

Educational Resources: Webinars, trading guides, and video tutorials to help traders improve their skills.

Market Analysis: Daily market updates and insights to keep traders informed.

Customer Support: 24/7 multilingual support via live chat, email, and phone.

User Reviews and Feedback Customer Satisfaction

FP Markets generally receives positive feedback from users, particularly for its:

Competitive Pricing: Low spreads and transparent fee structures are frequently praised.

Platform Variety: The availability of multiple platforms like MetaTrader, cTrader, and IRESS is well-received.

Customer Support: The broker's 24/7 multilingual support is highly rated.

Common Criticisms

Some users have noted areas for improvement, such as:

Limited features in the proprietary mobile app compared to industry leaders.

Higher spreads on the Standard account, which may not be ideal for traders seeking commission-free options.

Forex Market Landscape in 2025

Geopolitical and Economic Factors

The forex market in 2025 is shaped by several key trends:

Geopolitical Tensions: Ongoing conflicts and rising tensions between major powers like the US and China are driving market volatility.

US Political Climate: The return of Donald Trump to the White House is expected to influence the US dollar through policies like tariffs and increased spending.

Central Bank Policies: Interest rate adjustments by central banks like the Federal Reserve and the European Central Bank are pivotal in shaping currency values.

Technological and Regulatory Developments

AI in Forex Trading: The integration of AI tools is democratizing market analysis, enabling traders to make more informed decisions.

Regulatory Changes: Enhanced oversight in forex trading is improving transparency but may increase operational costs.

Implications for FP Markets

FP Markets is well-positioned to thrive in this dynamic landscape by leveraging its advanced trading platforms and robust regulatory compliance. Its focus on emerging markets and technological innovation further strengthens its competitive edge

Competitive Analysis

Top Competitors

FP Markets faces competition from brokers like IC Markets, Pepperstone, and XM. While these brokers also offer competitive pricing and advanced platforms, FP Markets stands out for its extensive range of tradable instruments and strong regulatory framework

Strengths and Weaknesses

Strengths: Regulatory compliance, competitive pricing, and platform variety.

Weaknesses: Limited mobile app features and higher spreads on Standard accounts

Conclusion

FP Markets is a reliable and well-regulated broker that offers a comprehensive range of services and features. Its competitive pricing, extensive platform offerings, and robust regulatory framework make it a strong choice for traders in 2025. While there are areas for improvement, such as mobile app features and Standard account spreads, the overall user feedback is positive. For traders seeking a secure and versatile trading environment, FP Markets is undoubtedly worth considering.

2 notes

·

View notes

Text

CMA Course Part 1 [Certified Management Accountant] is the advanced professional certification specifically designed to measure the accounting and financ…

1 note

·

View note

Text

🌟 Invest in Your Growth Today! 🌟 Hey future finance leaders! Did you know the best investments aren’t just in stocks but also in your mind? 🌱 Whether you’re chasing the CFA charter, aiming to conquer the FRM exams, or mastering US CMA, your efforts now will pay dividends FOREVER! 💸

🚀 Finaim is here to make your journey seamless! From cracking CFA Level 1 to decoding the FRM course duration and fees, we’ve got the best guidance for every step. Want to ace your dream investment banking job or understand the CMA course details? Let’s make it happen!

✨ Why wait? Transform your career with our expert-led courses and build a future where your returns compound like never before. Explore bank nifty investing, join top investment banking companies, and dominate the finance world like a pro. For more details VISIT: https://finaim.in/ FINAIM ADDRESS: First Floor, Tewari House, 102 - B, Pusa Rd, Block 11, Old Rajinder Nagar, Rajinder Nagar, New Delhi, Delhi, 110005 PHONE NO: 087009 24049

#cfa#frm#us cma#investment banking#investing#finance goals#investors#online and offline classes#CFA level1#CFA level2#CFA level3#FRM part 1 and part 2#best coaching center in delhi

0 notes

Text

When the Houthis attacked the Israeli-linked merchant vessel Galaxy Leader on Nov. 19, it was clear that shipping had entered a new and dangerous phase. Not only did the militia, which rules parts of Yemen, successfully take over a large tanker sailing in the Red Sea: It also filmed the undertaking, which garnered massive global attention. Since then, the attacks have accelerated at such an extraordinary rate that the world’s largest shipping companies will no longer sail through the Red Sea.

That means reduced traffic through the Suez Canal and the Red Sea—and harm to Egypt’s economy. The collision between Middle Eastern acrimony and global shipping means that you’ll have to wait longer for some of your favorite consumer goods.

One must grant the Houthis this: The video they released after seizing the Galaxy Leader and taking its crew hostage was slick. That, of course, was the point. The Houthis were eager to tell the world that they could target any ship they liked. Indeed, the Iran-linked force declared that any Israeli ship might encounter the same fate as the Galaxy Leader. That was no consolation for ships not owned by Israeli firms: The Houthis would define what constituted an Israeli-linked ship.

And since then, the attacks have accelerated fast. All manner of ships traversing the Red Sea have been targeted with missiles, drones, or attempted seizures. On Dec. 12, for example, Houthi fighters fired a missile on the Norwegian-owned tanker Strinda, claiming that it was headed for Israel when it was in fact en route to Italy. Two days later, a tanker owned by Danish shipping line A.P. Moller Maersk was targeted in the Bab el-Mandeb Strait, which connects the Red Sea and the Gulf of Aden, and the day after that, a Hapag-Lloyd-owned container ship was hit. On Dec. 18, another three ships were hit in the Red Sea, including the Cayman Islands-flagged chemical tanker Swan Atlantic.

Western naval vessels are trying to help their merchant-navy colleagues. On Dec. 16, the U.K. Royal Navy’s HMS Diamond shot down a Houthi missile fired against a tanker. The French Navy’s FS Languedoc has downed a drone. Within one morning, USS Carney downed 14 drones heading toward merchant vessels.

But even such help hasn’t calmed the rapidly growing alarm among global shipping lines. On Dec. 15, Maersk and Hapag-Lloyd announced that they were diverting their ships away from the Red Sea. Two days later, CMA CGM of France, the Swiss giant MSC, and China’s Yang Ming joined the exodus from the storied strip of water that connects the Suez Canal (and thus the Mediterranean) with the Bab el-Mandeb Strait (and thus the Indian Ocean). Maersk, MSC, and Hapag-Lloyd represent around 40 percent of ocean shipping.

Their departure is likely to cause a dramatic plunge in traffic through the Suez Canal, which accounts for 12 percent of global trade and an astonishing 30 percent of container shipping. On an average day, 50 ships travel through the canal, transporting $3 billion to $9 billion worth of cargo. The Red Sea, which has nearly the same amount of traffic (and which also serves many local ports, including Jeddah, Djibouti, the Port of Sudan, Egypt’s Safaga, and Aden), stands to lose in equal measure. Western navies are trying their best, but it’s no surprise that the shipping lines are diverting their ships.

“The change in dynamic here is that it isn’t shipping caught up in the crossfire of conflict, such as the war in Ukraine, but shipping being directly targeted,” said Simon Lockwood, an executive in charge of shipping at the global insurance broker Willis Towers Watson. War insurance premiums for vessels traversing the Red Sea have already risen to headline rates of at least 0.7 percent of the value of a ship’s cargo. Only Russia’s and Ukraine’s ports have significantly higher war risk headline rates, of around 1 percent.

At a 0.7 percent rate, a ship carrying $1 million worth of cargo through the Red Sea pays $70,000 in war risk insurance alone. And the ship’s owners will pass that cost on. “The first thing that happens when the risks to ships increase is that the premiums rise; that’s how war insurance works,” said Svein Ringbakken, the managing director of the Oslo-based maritime war risk underwriter Den Norske Krigsforsikring for Skib. “And long-established mechanisms help shipping companies pass on these costs to their customers,” he added.

The Houthis’ campaign is, in fact, already wreaking havoc on global shipping. “The East-West container trade relies on the Red Sea and the Suez Canal,” Lockwood noted. “With the major lines diverting to other routes, there will be significant delays and increased cost. And there will be knock-on effects on international trade.”

Ringbakken added: “Now large shipping companies are including in their contracts the option of going around the Cape of Good Hope. That means an additional 10-12 days, or longer in case of tankers that don’t travel very fast. That means that transportation costs will also rise significantly.” The suddenly much longer routes also mean logistical disruption in global supply chains. “We’re entering the same territory as during COVID and after Ever Given,” Ringbakken said. “It’s not good news for the globalized economy. People will have to wait longer for their goods.”

On Dec. 17, the chairman of the Suez Canal Authority (SCA), Osama Rabea, said that since the attack on the Galaxy Leader, 55 vessels had opted to instead travel via the Cape of Good Hope. That’s a small number compared to the 2,128 ships that traversed the canal during that period, but with the major shipping lines just having announced their diversions from the Red Sea, it’s likely to rise sharply.

Even Operation Prosperity Guardian, the aptly named mission to protect Red Sea shipping announced by the U.S. Defense Department, won’t be able to fully restore calm to the choppy waters. The operation’s participating naval vessels will have to act with restraint lest they accidentally trigger a conflict with the Houthis and, by extension, Iran. And if they do use force against the Houthis, for example by firing retaliatory missiles, it still leaves merchant vessels exposed to whatever violence the Houthis decide to visit on them.

Indeed, shipping has become the new front line of geopolitics. As I have documented in Foreign Policy and elsewhere, Iran and Israel have for years been engaged in a proxy war involving shipping, and more recently, China has stepped up its harassment of Philippine vessels to frighten the global shipping industry—and as a result, manufacturers—away from the Philippines.

There is, of course, very little that shipping lines can do to deter such determined attackers, and no navy is large enough to provide escort to all the merchant vessels that might need it.

Even 10 years ago, the necessary technology was so expensive and inaccessible that not even the most ambitious Houthi commander could have pulled off a drone attack on a merchant vessel. But it’s not just that military-style technology has become affordable: The Houthis have identified a gap in global shipping, which can mostly protect itself against piracy and has contingency plans for war.

Until late November, though, shipping lines hadn’t reckoned with sophisticated attacks by statelike militias. The Houthis’ successful campaign in the Red Sea is, in fact, likely to inspire other proxy forces to seek fame and power through attacks on merchant vessels.

In addition to the shipping lines and their customers, there’s one clear loser from the unfolding tanker war: Egypt. The SCA provides one of the country’s most significant and most stable incomes. Between June 2022 and June this year, the SCA saw its revenues reach a record high of $9.4 billion. During that time, 25,887 ships passed through the canal, up from 23,800 during the previous fiscal year. It’s hardly surprising that Rabea, the SCA chairman, has been at pains to reassure shipowners that the risks facing ships in the Suez Canal are manageable.

The question, though, is how Cairo will respond to the predicament posed by the tanker conflict and the harm that it’s causing Egypt. Could it decide to try to punish Iran and the Houthis? That, of course, brings the risk of the tanker war exploding into a more wide-ranging and deadlier one.

Forces keen on disruption have decided that shipping is an extremely attractive target, and it’s even more attractive because some of the world’s most convenient shipping lanes are in geopolitically choppy Middle Eastern waters. Get ready for delayed goods and more expensive consumer products. I hope you bought your Christmas presents long ago. Happy Holidays!

3 notes

·

View notes

Text

Thursday, December 14, 2023 Canadian TV Listings (Times Eastern)

WHERE CAN I FIND THOSE PREMIERES?: CHRISTMAS RESCUE (BET +) CMA COUNTRY CHRISTMAS (CTV) 8:00pm HEAVEN DOWN HERE (W Network) 8:00pm

WHAT IS NOT PREMIERING IN CANADA TONIGHT: THAT CLIP SHOW: HOLIDAY EDITION (NBC Feed) THE REAL HOUSEWIVES ULTIMATE GIRLS TRIP (Premiering on December 15 on Slice at 9:00pm) AN ICE PALACE ROMANCE (Premiering on December 22 on Lifetime Canada at 8:00pm) DRAGONS: THE NINE REALMS (TBD - YTV)

NEW TO AMAZON PRIME CANADA/CBC GEM/CRAVE TV/DISNEY + STAR/NETFLIX CANADA:

CBC GEM SOMETHING UNDONE

NETFLIX CANADA AS THE CROW FLIES (TR) (Season 2) THE CROWN (GB) (Season 6 Part 2) THE DEVIL’S ADVOCATE YU YU HAKUSHO (JP)

GRAND SLAM OF CURLING (SN) 1:00pm: Masters - Draw 10 (SNEast/SNWest/SNPacific) 5:00pm: Masters - Draw 11 (SN360) 10:00pm: Masters - Draw 12

NHL HOCKEY (SNOntario) 7:00pm: Blue Jackets vs. Leafs (TSN5) 8:00pm: Sens vs. Blues (SNWest) 8:00pm: Flames vs. Wild (SN1/SNEast) 9:00pm: Lightning vs. Oilers (SNPacific) 9:00pm: Panthers vs. Canucks

NBA BASKETBALL (SN Now) 7:30pm: Bulls vs. Heat (TSN2) 8:30pm: Timberwolves vs. Mavericks

THE HURON CAROLE 2023 (APTN) 7:30pm: Celebrated actor and singer Tom Jackson and friends mark the Christmas holidays in Halifax with the beloved concert, The Huron Carole, that this year will generate funds for the Canadian Red Cross.

THE POLAR EXPRESS (CBC) 8:00pm: The conductor (Tom Hanks) of a train to the North Pole guides a boy who questions the existence of Santa Claus.

CHRISTMAS ON CANDY CANE LANE (Super Channel Heart & Home) 8:00pm: Ivy Donaldson struggles with her mom's shadow, Muriel, the Christmas darling of Icicle Falls. She is now separated from her husband Rob and tries her best with her daughter.

NFL FOOTBALL (TSN/TSN3) 8:15pm: Chargers vs. Raiders

AUSSIE GOLD HUNTERS (Discovery Canada) 9:00pm

CANADA'S DRAG RACE (Crave) 9:00pm

OUTBACK OPAL HUNTERS (Discovery Canada) 10:00pm: A massive lightning storm forces the Young Guns to work on a series of flooded dirt roads; the Bushmen risk it all in a dangerous area vandalized by opal thieves; the Blacklighters take their chances with night mining.

WHAT HAPPENED TO VALENTINO DIXON? (Investigation Discovery) 10:00pm: The shooting of a young man in his prime, witnessed by scores, turns a seemingly open-and-shut case into a web of mystery.

CANADIAN REFLECTIONS (CBC) 11:30pm: The Fall; Escape to Eternity; Ataraxia

#cdntv#cancon#canadian tv#canadian tv listings#aussie gold hunters#canada's drag race#outback opal hunters#canadian reflections#curling#nhl hockey#nba basketball#nfl football

2 notes

·

View notes

Text

What is a CMA course?

The Certified Management Accountant (CMA) course is a professional certification designed for individuals seeking expertise in management accounting and financial management. Administered by the Institute of Management Accountants (IMA), the CMA designation is globally recognized, signifying a high level of proficiency in financial planning, analysis, control, decision support, and professional ethics.

The CMA program is structured to equip candidates with a comprehensive skill set, covering areas such as financial planning, performance, and control. The course consists of two parts, each focusing on specific competencies. Part 1 delves into financial reporting, planning, performance, and control, while Part 2 focuses on financial decision-making. Candidates are required to pass both parts to attain the CMA designation.

One distinctive feature of the CMA course is its emphasis on real-world business applications. It goes beyond traditional accounting practices, incorporating strategic financial management and business analysis. This makes CMAs invaluable assets in corporate settings, where their insights contribute to effective decision-making and organizational success.

Moreover, the CMA designation is highly respected in the business and finance sectors, opening doors to diverse career opportunities globally. Professionals with a CMA designation often pursue roles in management accounting, financial analysis, strategic planning, and corporate finance. The CMA course thus serves as a pathway for individuals aspiring to excel in management accounting and make a meaningful impact in today's dynamic business environment.

#US CMA course in India#CMA review#CMA training#CMA training institute#CMA classes#CMA courses#CMA exam#US CMA eligibility#certified management accountant

2 notes

·

View notes