#claim a tax rebate

Text

How To Claim a Tax Rebate in UK?

New Post has been published on https://www.fastaccountant.co.uk/how-to-claim-a-tax-rebate-in-uk/

How To Claim a Tax Rebate in UK?

Are you a UK taxpayer, wondering how to claim a tax rebate? Look no further! In this article, we’ll provide you with a step-by-step guide to help you through the process. Whether you’re claiming for overpaid taxes, work expenses, or any other eligible refunds, we’ve got you covered. So grab your pen and paper, because by the end of this article, you’ll be well equipped to claim your tax rebate in the UK.

Understanding Tax Rebates in the UK

What is a tax rebate?

A tax rebate, also known as a tax refund, is the return of excess taxes that you have paid to the government. It occurs when the amount of tax withheld from your income exceeds the actual amount of tax you owe. This can happen if you have overpaid taxes, qualify for certain tax allowances or reliefs, or have had expenses that are eligible for tax deductions.

Who is eligible for tax rebates in the UK?

In the UK, tax rebates are available to individuals who have overpaid taxes or are eligible for certain tax allowances and reliefs. Some common situations where you may be eligible for a tax rebate include:

Overpaying taxes due to being placed in the wrong tax code.

Working for only part of the tax year.

Leaving the UK and no longer being subject to UK tax.

Being self-employed and having eligible business expenses.

Having a job where you pay expenses out of your own pocket.

These are just a few examples, and there may be other circumstances where you could claim a tax rebate. It’s always best to consult with a tax professional or review the HM Revenue and Customs (HMRC) guidelines to determine your eligibility.

Why claim a tax rebate?

Claiming a tax rebate is important because it allows you to recover any excess taxes you have paid throughout the tax year. By doing so, you ensure that you are only paying the correct amount of tax that you owe, based on your income and individual circumstances. It can also help you gain a better understanding of your tax situation and potentially provide a financial boost by receiving a refund.

Gather Necessary Documents and Information

Gather your personal information

Before starting the process of claiming a tax rebate, it’s important to gather all the necessary personal information. This includes your full name, National Insurance number, and current address. Having these details readily available will make it easier and faster to complete the tax form accurately.

Obtain your P45 and P60 forms

The P45 and P60 forms are important documents that provide details of your income and tax contributions. The P45 is given by your previous employer when you leave a job, and it outlines your earnings and taxes paid during your employment. The P60, on the other hand, is provided by your current employer at the end of each tax year and summarizes your total income and taxes paid.

If you have changed jobs or worked for multiple employers during the tax year, ensure you have all your P45s and P60s for accurate income and tax calculations.

Collect relevant receipts and documents

If you believe you have eligible tax deductions or expenses, it’s essential to gather all relevant receipts and supporting documents. This might include expenses related to your job, such as uniform purchases, professional memberships, tools, or travel costs.

By having all these receipts and documents organized and easily accessible, you will be able to accurately calculate your potential rebate amount and provide evidence to support your claim, if required.

Calculate Your Rebate Amount

Understand taxable income and tax paid

To calculate your potential rebate amount accurately, it’s important to understand how taxable income and tax paid are determined. Taxable income is the amount of income you are liable to pay tax on, after accounting for any tax reliefs or allowances you may be eligible for. Tax paid refers to the amount of tax that has been deducted from your income throughout the tax year.

By analysing your taxable income and tax paid, you can identify any discrepancies or potential overpayments that may lead to a tax rebate.

Determine applicable tax allowances and reliefs

Tax allowances and reliefs are deductions that can reduce your taxable income, resulting in a lower tax liability. Common tax allowances and reliefs in the UK include the personal allowance, which is the amount of income you can earn tax-free, and specific reliefs for things like pension contributions or charitable donations.

By determining which tax allowances and reliefs apply to you, you can accurately calculate your rebate amount by subtracting them from your taxable income.

Calculate your potential rebate amount

Once you have gathered all the necessary information and understood how taxable income, tax paid, and tax allowances and reliefs work, you can calculate your potential tax rebate amount. This can be done manually using HMRC guidelines or by using an online tax rebate calculator that takes into account all the relevant factors.

Calculating your potential rebate amount will give you an estimate of how much money you may be entitled to receive back from the government.

Ensure Accuracy of Tax Records

Check for errors in tax coding

Tax coding determines how much tax is deducted from your income. It’s essential to review your tax coding to ensure there are no errors or discrepancies that could result in overpayment or underpayment of taxes. You can find your tax coding on your payslip or by contacting HMRC.

If you identify any errors, it’s important to update your tax coding to ensure it accurately reflects your income and tax situation.

Review employment details and expenses

Reviewing your employment details and expenses is crucial to ensure they are correctly reflected in your tax records. Check that your job title, income, and other employment-related information match your actual circumstances. Similarly, review any expenses you have claimed for accuracy and eligibility.

By reviewing these details, you can identify any discrepancies or errors that may impact your tax rebate claim.

Verify tax deductions and allowances

Double-checking your tax deductions and allowances is essential to ensure you have claimed all the eligible tax reliefs and deductions you are entitled to. This includes reviewing any specific deductions for things such as pension contributions, charitable donations, or student loan repayments.

Verifying your tax deductions and allowances will ensure you are maximizing your potential tax rebate.

Find the Appropriate Tax Form

Choose the right tax form for your situation

When claiming a tax rebate, it’s important to select the appropriate tax form that matches your individual circumstances. There are different forms available, such as the P85 for leaving the UK, the P87 for claiming employment expenses, or the Self Assessment tax return if you are employed and self-employed in the same tax year.

By choosing the correct form, you can provide the necessary information and documentation specific to your situation, ensuring a smooth and accurate process.

Download forms from HM Revenue and Customs (HMRC) website

Once you have determined the correct tax form for your circumstances, you can download it directly from the HMRC website. The website provides access to various tax forms and guidance, making it easy to find and download the forms you need.

Ensure you download the most up-to-date form and carefully read any guidance or instructions provided to accurately complete the form.

Contact HMRC if you are unsure about the form

If you are unsure which tax form to use or have questions about the form-filling process, it’s best to contact HMRC directly. They have dedicated helplines and online resources to assist individuals with their tax-related queries.

By reaching out to HMRC, you can ensure that you have the correct information and guidance to complete the tax form correctly.

Fill Out the Tax Form Correctly

Provide accurate personal details

When filling out the tax form, it’s crucial to provide accurate personal details, including your full name, address, and National Insurance number. These details are essential for HMRC to identify and process your claim correctly. Double-check all personal information to avoid any delays or issues with your tax rebate claim.

Include relevant income and tax information

Include all relevant income and tax information accurately on the tax form. This involves entering details from your P45s and P60s, as well as any additional income sources, such as rental earnings or dividends. Ensure that all income and tax figures are entered correctly to avoid any discrepancies or potential delays in processing your tax rebate claim.

Submit the Completed Tax Form

Double-check all entered information

Before submitting your completed tax form, double-check all the information you have entered. Make sure all personal details, income figures, and supporting documentation have been included accurately. Verify any calculations made to determine the rebate amount. By thoroughly reviewing the form, you minimize the risk of errors or missing information that could lead to delays in processing your tax rebate claim.

Send the form to the appropriate HMRC address

Once you are confident that the form to claim a tax rebate is complete and accurate, send it to the appropriate HMRC address. The address to which you should send the form will be specified in the instructions or guidance provided with the form. Ensure that the form is securely packaged and that you retain a copy for your records.

Consider using recorded delivery for proof of submission

To have proof of submission, it can be beneficial to use recorded delivery when sending HMRC your form to claim a tax rebate. This ensures that you have a tracking number and a receipt of delivery, which can be helpful if any issues arise or if you need to provide evidence of submission.

Wait for HMRC Assessment

Allow time for HMRC to review your claim

After submitting your tax rebate claim, it’s important to allow sufficient time for HMRC to review and process it. The time it takes for your claim to be assessed can vary, but it’s generally advisable to wait at least a few weeks.

Check your online tax account for updates

To stay informed about the progress of your claim for tax rebate, regularly check your online tax account. HMRC provides an online platform where you can access and manage your tax-related information, including updates on the status of your claim.

By checking your online tax account, you can track the progress of your claim and stay informed about any additional information or actions required.

Respond promptly to any requests for additional information

During the assessment process, HMRC may request additional information or supporting documents to verify your claim for a tax rebate. It’s essential to respond promptly to any such requests to ensure the smooth processing of your claim.

By providing the requested information in a timely manner, you help expedite the assessment process and increase the chances of a successful claim for tax rebate.

Receive the Rebate Payment

Receive a cheque or bank transfer

Once your claim for a tax rebate has been approved and processed, you can expect to receive the rebate payment. This payment can be made via cheque, which will be sent to your registered address, or through a bank transfer to your nominated bank account.

Ensure that the payment details provided on your form to claim a tax rebate are accurate to avoid any delays or issues with receiving your rebate payment.

Understand the timeframe for receiving the payment

The timeframe for receiving your tax rebate payment can vary depending on HMRC’s processing times and other factors. While the exact duration cannot be guaranteed, many individuals receive their rebate payments within a few weeks to a few months of their claiming a tax rebate being approved.

If you haven’t received your payment within a reasonable time, it’s advisable to contact HMRC to inquire about the status of your payment.

Contact HMRC if there are any delays or issues with your claim for a tax rebate

If you encounter any delays or issues with your rebate payment, it’s important to contact HMRC for assistance. They have dedicated helplines and support services to address any concerns or queries you may have.

By reaching out to HMRC, you can resolve any payment-related issues and ensure that you receive your tax rebate in a timely manner.

Common Mistakes to Avoid

Incomplete or inaccurate forms

One common mistake when claiming a tax rebate is submitting an incomplete or inaccurate form. It’s important to take the time to carefully review and complete all sections of the form accurately. Double-check that all relevant information and supporting documents have been included.

By avoiding incomplete or inaccurate forms, you minimize the risk of delays or potential rejections of your tax rebate claim.

Missing supporting documentation

Another mistake to avoid is not providing the necessary supporting documentation for your claim. Ensure that you have included all relevant receipts and documents that support your claimed deductions or expenses if it is required. This will help validate your claim and increase the likelihood of a successful tax rebate.

Failure to follow up with HMRC

Lastly, failing to follow up with HMRC can lead to delays or missed opportunities regarding your claim for tax rebate. Stay proactive in checking your online tax account for updates and responding promptly to any requests for additional information.

By actively engaging with HMRC, you ensure that your claim is being processed and provide any necessary information to support your case.

In conclusion, claiming a tax rebate in the UK requires thorough understanding, careful documentation, and accurate form completion. By following the step-by-step guide outlined above, you can navigate the process with confidence and increase your chances of a successful tax rebate claim. Remember to gather all necessary documents, calculate your potential rebate accurately, fill out the correct form, and submit it to HMRC. From there, patiently await the assessment and, once approved, enjoy the financial benefit of your tax rebate payment.

0 notes

Text

How To Claim a Tax Rebate in UK?

Are you a UK taxpayer, wondering how to claim a tax rebate? Look no further! In this article, we’ll provide you with a step-by-step guide to help you through the process. Whether you’re claiming for overpaid taxes, work expenses, or any other eligible refunds, we’ve got you covered. So grab your pen and paper, because by the end of this article, you’ll be well equipped to claim your tax rebate in…

View On WordPress

0 notes

Text

Claim Income Tax Rebate u/s 87A for FY 2024 – 25 (AY 2025 – 26)

Claim Income Tax Rebate u/s 87A for FY 2024 – 25 (AY 2025 – 26) With Excel Based Automatic Income Tax Calculator All in One for the Non-Govt Employees for the F.Y.2024-25 as per Budget 2024

Introduction

Navigating the world of income tax rebates can be tricky, but it’s essential for maximizing your tax savings. One significant provision in the Indian tax system is Section 87A, which offers a…

View On WordPress

#87A#Automatic Income Tax Calculator in Excel#Claim#Income#Income Tax#Income Tax Arrears Relief Calculator U/s 89(1)#Income Tax Form 10E#Income Tax Form 16#Income Tax Form 16 Part B#Income Tax Preparation software in Excel#Rebate#Tax

0 notes

Text

Claim Income Tax Rebate u/s 87A for FY 2024 – 25 (AY 2025 – 26)

Claim Income Tax Rebate u/s 87A for FY 2024 – 25 (AY 2025 – 26) With Excel Based Automatic Income Tax Calculator All in One for the Non-Govt Employees for the F.Y.2024-25 as per Budget 2024

Introduction

Navigating the world of income tax rebates can be tricky, but it’s essential for maximizing your tax savings. One significant provision in the Indian tax system is Section 87A, which offers a…

View On WordPress

#87A#Automatic Income Tax Calculator in Excel#Claim#Income#Income Tax#Income Tax Arrears Relief Calculator U/s 89(1)#Income Tax Form 10E#Income Tax Form 16#Income Tax Form 16 Part B#Income Tax Preparation software in Excel#Rebate#Tax

0 notes

Text

vimeo

In this video, we'll break down everything you need to know about tax relief and how it can benefit your retirement savings. So, let's dive right in!

#online income tax calculator#hmrc tax refund calculator#claim your tax rebate online#cis tax return online#income tax calculator#pay simple self assessment tax#Vimeo

0 notes

Text

R&D Tax Credits — An ultimate guide

Uplifting Innovation: Maximising success and financial stability of businesses through Research and Development (R&D) tax relief, ultimately driving the economic growth of the UK.

What are R&D tax credits?

The R&D tax credits serve as governmental incentives formulated to foster and facilitate R&D activities carried out by businesses operating within the UK. This opens the window for businesses to stretch the scope of their R&D endeavours and enhance operations to fuel growth, all while alleviating concerns about R&D expenditures.

How do R&D tax credits work?

You can apply for R&D tax credits to claim cash refunds from HMRC or enjoy corporation tax reductions on qualifying R&D expenditures if your business is engaged in:

The development of new or improved products, processes, services or even the advancement of existing ones

Overcoming technical challenges or uncertainties to achieve scientific advancements

Systematic investigation or experimentation throughout the process

The dynamics of these activities may vary based on the industries considering the broad horizons of R&D.

What are the qualifying R&D expenditures?

Carrying out R&D activities is evidently associated with expenses also known as Qualified Research Expenses (QREs) that companies incur in order to achieve innovations. Most of these costs fall under the category of R&D expenditures, which include staff PAYE costs/pension contributions, subcontractors’ costs, consumables, software purchases, travel costs, and utility bills.

Use our free R&D tax credit calculator to determine your estimated claim amount.

What costs don’t qualify for R&D tax relief?

R&D tax credits are specifically intended to assist companies engaged in trial and error for innovations and advancements. This implies that expenses related to the production, distribution, or creation of goods and services resulting from R&D work cannot be claimed. Additionally, expenses such as rent, land, and patent creation are also ineligible for claiming.

Who can claim R&D tax credits?

The legislation governing R&D tax credits has intentionally cast a wide net, encompassing diverse sectors such as Information Technology (IT), construction, manufacturing, renewable energy, engineering, and more. Its spectrum is broad, ensuring that innovation across various industries can qualify for these credits. In order to be eligible for the R&D tax credits, you must:

Be a limited company in the UK that is subject to Corporation Tax

Have carried out qualifying R&D activities

Have spent money on these projects in the UK

It’s important to note that even unfinished or abandoned projects that meet the criteria can still be eligible for claiming R&D tax credits.

Don’t let them go to waste — they could still be the source of your financial stability and future prospects of growth.

Who qualifies for R&D tax credits?

R&D is fueling innovation and growth in almost all industries: Information Technology (IT) drives advancements in emerging technologies, manufacturing focuses on cost-effective operations, construction adopts advanced safety measures, renewable energy seeks sustainability, engineering delivers reengineered solutions and so on, making it applicable to these sectors plus many more.

What counts as R&D?

The qualifying activities for R&D vary across industries, considering the broad scope of possibilities in their respective field. In order to ascertain eligibility for R&D tax credits, companies need to follow a four-criteria model, commonly referred to as the four-part test. This model offers a more precise perspective and helps determine whether a company qualifies for R&D tax credits.

The four criteria for R&D tax credits

The four criteria also known as the four-part test evaluate activities related to the company’s business operations in terms of R&D. To qualify for R&D tax relief, the activities must be conducted in accordance with the following criteria:

Permitted Purpose delineates the R&D activities conducted with the aim of enhancing the performance, reliability, quality and functionality of a product or software.

Technological Uncertainty refers to the unpredictable results that may arise during the development of a product or software, including the associated processes.

The process of Experimentation indicates the need for a trial-and-error phase with the intention to overcome technological uncertainties.

Technological in Nature means that the R&D activities must fall within the domains of engineering, physical sciences, biological sciences, or computer science.

Simply put, if your business is involved in developing new or improved products, processes, services, or advancements, overcoming technical challenges, and conducting systematic investigation or experimentation within technological fields, you may be eligible to apply for R&D tax credits.

Which R&D tax credit scheme is right for me?

The initiative covers two R&D schemes for claiming R&D tax credits: the SME Scheme and the RDEC Scheme. The SME Scheme is designed for companies with less than 500 staff, a turnover under £100m, and a balance sheet under £86m. Eligible SMEs can deduct an additional 130% of their qualifying R&D expenditure from their taxable profit or claim up to 14.5% of the surrenderable loss as a cash injection for loss-making businesses.

On the other hand, the RDEC Scheme is used by larger companies or SMEs that have received grants or subcontracted R&D from a non-SME. Companies qualifying for the RDEC Scheme can expect to claim up to 9.72% of their eligible expenditure provided they have a staff headcount over 500, a turnover of £100m or more, and at least £86m or more in gross assets. These schemes offer different opportunities for businesses to benefit from R&D tax credits based on their size and specific circumstances.

Contact our R&D tax credit specialists to find out the suitable scheme for you or hop into our Knowledge Library to learn more about the schemes.

What are the rates of R&D tax credits?

The rates of R&D tax credits heavily depend on the specific R&D scheme and the context of your company. Here are the rates according to the scheme:

SME Scheme:

Profitable SMEs can benefit from an enhanced deduction of 130% on qualifying R&D expenditure, in addition to the standard 100% deduction. This means a total deduction of 230%.

Loss-making SMEs can claim a tax credit worth up to 14.5% of the surrenderable loss, which can be used to offset against other taxes or received as a cash payment.

RDEC Scheme:

Eligible companies can receive a tax credit of 13% on their qualifying R&D expenditure under the RDEC scheme.

Note: These rates are subject to change based on the ever-evolving legislation by the Government, so it’s advisable to consult with R&D tax credit specialists for the most up-to-date information on R&D tax credit rates.

How to calculate R&D tax credits?

Find out an estimation of your eligible cost that can be claimed back from HMRC with our precise R&D tax calculator.

Start your claim or contact us for more information about your estimated cost.

How far back can you claim R&D tax credits?

You can reclaim your research tax credits for a period of up to two years after the end of your accounting period. It is highly recommended that you include all eligible qualified research expenses (QREs) that were incurred within the period you are claiming prior to the conclusion of the two-year window.

What are the benefits of R&D tax credits?

R&D tax credits in the UK offer significant financial benefits to businesses. The initiative provides a valuable source of funding to support the R&D initiatives for small and medium-sized enterprises (SMEs). SMEs can potentially claim a higher tax relief rate than larger companies. Essentially, R&D tax credits fuel companies’ financial resources, encouraging increased R&D activities across industries and ultimately contributing to the growth of the UK economy.

How can Alexander Clifford maximise your R&D tax credits claim?

Our team of experienced R&D tax credit specialists is well-versed in the ever-evolving governmental regulations, grants, tax incentives, and funding opportunities available to companies across various industries within the UK. And to ensure you’re always informed and well compensated for your claims, Alexander Clifford is here to provide the support and guidance you need to stay ahead and succeed. We are well-versed in the R&D claim process, boasting a 100% success rate with HMRC. With our best-in-class expertise, we can help you accurately and precisely claim R&D tax credits based on the latest guidelines.

Having second thoughts? Check out our 5-star reviews and personal recommendations, book a free consultation for tailored advice or start your R&D claim process with confidence to maximise your potential benefit.

0 notes

Text

How Much Can You Claim for Work-Related Clothing Laundry Expenses?

If you are required to wear a uniform to work or you have to purchase and laundry special clothing for work, you may be able to claim a deduction for these expenses. Here’s what you need to know about claiming laundry expenses related to clothing you wear for work.

You may be wondering how much you can claim for work-related clothing laundry allowance. The amount you can claim depends on a few different things, such as the type of clothing and how often you have to wash it. In this blog post, we’ll break down everything you need to know about claiming laundry expenses for work-related clothing.

The ATO states that you can claim a deduction for the cost of laundering your uniform if it is:

-A compulsory uniform, and

-You are required to wear it at work, and

-It is not suitable for everyday wear.

Compulsory uniforms must be recognizable as being work uniforms. They might include items with your company logo or a unique style of dress. If your employer does not require you to wear a specific uniform, but you still need to purchase and launder special clothing for work, you can only claim a deduction if:

-Your occupation has a recognizable uniform, and

-You are required to wear it as part of your position, and

-It is not suitable for everyday wear.

What Can Be Claimed?

The types of clothing that can be claimed are those that are not suitable for everyday wear and would incur a cost for laundering. For example, if you are required to wear a uniform or protective clothing for your job, you may be able to claim laundry expenses.

How Much Can Be Claimed?

The amount that can be claimed depends on how often the clothing needs to be laundered. If the clothing needs to be laundered weekly, you can claim up to $1 per week. If the clothing needs to be laundered more than once a week, you can claim up to $4 per week. The ATO has a Laundry Claims Calculator which can help you estimate your costs.

Who Can Claim?

Anyone who is required to wear specialised clothing or uniforms for their job may be able to claim laundry expenses. This includes items such as overalls, aprons, and protective clothing. If you are required to launder your own clothes, you may be able to claim a deduction for the cost of doing so.

Conclusion:

You may be able to claim deductions for the cost of purchasing and laundering certain items of clothing if they are required as part of your job. To be eligible for a deduction, the clothing must be a compulsory uniform, or recognizable as being unique to your occupation. You can only claim the costs incurred in laundering the clothing, not the cost of purchasing it. Remember to keep records of your expenses in case the ATO asks for proof of your claims.

By following moneyhelpr, you can find out if you can claim for work–related clothing and laundry expenses, as well as the amount you can claim. Moneyhelpr.com provides easy–to–understand explanations and answers to any questions you may have on the subject. Additionally, Moneyhelpr.com provides helpful resources such as tax tips, newsletters, and articles related to money management.

Website : https://moneyhelpr.com/how-much-can-you-claim-for-work-related-clothing-laundry-expenses/

#moneyhelpr.com#claim tax for washing uniform#mutual fund#claim for washing uniform#claim uniform tax#nhs uniform rebate

0 notes

Text

For all anyone knows, this might be as good as it gets for Jagmeet Singh's NDP. But would that be so bad?

The NDP is certainly in a celebratory mood. On Wednesday, the day after the federal budget, the party's MPs staged a mini-pep rally for the television cameras to celebrate their influence on the document. Singh announced an eight-city "post-budget tour" to "talk to Canadians about how the NDP delivered results that put money back in their pockets."

Some of the victories New Democrats are claiming for themselves are at least open to debate. Left to its own devices, the Liberal government might have ended up boosting the GST credit last fall anyway — and might have done so again in this year's budget. (Still, the decision to now promote the extra payment as a "grocery rebate" feels like a nod to the complaints New Democrats have focused on major grocers).

The Liberals also might not have needed the NDP's help to decide to apply labour standards to the new round of investment tax credits for clean tech.

But a new dental care program for low-income Canadians is an indisputable NDP win. While it's a Liberal government that will actually implement the program — Prime Minister Justin Trudeau was in New Brunswick on Friday to tout "affordable dental care" — dental care was not a feature of the Liberal platform in either the 2019 or 2021 federal elections. [...]

Continue Reading.

Tagging: @politicsofcanada

76 notes

·

View notes

Quote

Donald Trump has for months denigrated electric vehicles, arguing their supporters should “rot in hell” and that assisting the nascent industry is “lunacy”. He now appears to have somewhat shifted his view thanks to the support of Elon Musk, the world’s richest person.

“I’m for electric cars, I have to be because Elon endorsed me very strongly,” Trump, the Republican nominee for US president, told supporters at a rally in Atlanta, Georgia, on Saturday.

The transactional nature of this relationship with Musk was made clear by the former president and convicted business fraudster, however. “So I have no choice,” said Trump, who then went on to say that electric vehicles were suitable for a “small slice” of the population and that “you want every type of car imaginable” to be available.

[...]Trump also claimed that $9tn would be needed to build a network of electric car chargers, which is not a figure that has been cited by the industry or White House. Joe Biden’s administration has vowed to build 500,000 chargers, far fewer than the approximately 28m needed, and secured several billion dollars for this, although progress on this buildout has been painfully slow.

[...]A new Trump administration will “immediately terminate Joe Biden’s insane electric vehicle mandate”, Trump has said. There is no such mandate, although Biden has overseen a tightening of vehicle pollution rules that should help make EVs more attractive and has signed legislation providing a tax rebate for new EV buyers.

Trump says he has ‘no choice’ but to back EVs after Musk endorsement | US elections 2024 | The Guardian

2 notes

·

View notes

Text

Account // Edgar Kunz

Because I was the one to end it,

and so soon, I offered to reimburse her

what I owed. She had covered

most of the wedding, the move,

our rent. I was living on the grace

of a friend, sleeping

in his sunroom on Folsom.

Every morning I opened my account

to see how little I had left.

It wasn’t looking good

until she wrote to say we could forget it

if I would let her claim me

on her taxes. I guessed there was

a rebate for this kind of thing.

I could hear my friend knocking

around in the kitchen, making coffee,

frying eggs. I couldn’t believe my luck.

I let myself be claimed.

#poetry#Edgar Kunz#American poetry#breakup#divorce#taxes#brokenhearted#love#marriage#breakfast#wedding#money#broke

2 notes

·

View notes

Text

do you know how to drive. do you know how to unblock a drain. do you know how to claim a tax rebate. do you know how to see the world in a grain of sand, and heaven in a wildflower. do you know how to hold infinity in the palm of your hand, an eternity in an hour

3 notes

·

View notes

Text

Guide To Self Employed Tax Rebate

Being self-employed offers a world of freedom, flexibility, and entrepreneurial spirit. However, along with the independence comes the responsibility of managing your own finances and taxes. The good news is that as a self-employed individual, you have the potential to unlock a range of tax-saving opportunities.

Claiming a tax rebate is one of the most effective ways for self-employed individuals…

View On WordPress

#Claiming tax rebate#Eligibility for tax rebates#Self-employed tax rebate#Self-employment tax refund#Tax rebates for self-employed"

0 notes

Text

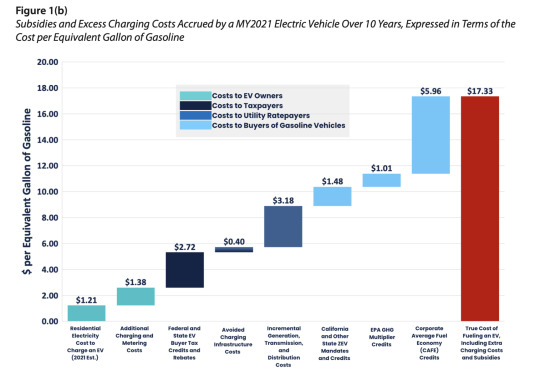

Study: Cost of ‘fueling’ an electric vehicle is equivalent to $17.33 per gallon

By Kenneth Schrupp | The Center Square

(The Center Square) – The complete costs of "fueling" an electric vehicle for 10 years are $17.33 per equivalent gallon of gasoline, a new analysis from the Texas Public Policy Foundation says.

The study authors say the $1.21 cost-per-gallon equivalent of charging a car cited by EV advocates excludes the real costs born by taxpayers for subsidies, utility ratepayers for energy investments, and non-electric vehicle owners for mandate-and-environmental-credit-driven higher vehicle costs, which they say total $48,698 per EV. Those costs must be included when comparing fueling costs of EVs and traditional gas-powered vehicles, TPPF maintains.

“The market would be driving towards hybrids if not for this market manipulation from the federal government. We’d be reducing emissions and improving fuel economy at the same time on a much greater scale,” study author Jason Isaac told The Center Square in an interview. He then cited Toyota estimates that the batteries from one EV can power 90 hybrids and reduce emissions 37 times more than that one EV.

The study adds up the costs of direct subsidies to buyers of the car and chargers; indirect subsidies in the form of avoided fuel taxes and fees, as well as electric grid generation, transmission, distribution, and overhead costs for utilities; and regulatory mandates that include fuel economy standards, EPA greenhouse gas credits, and zero-emission mandates.

Image courtesy of the Texas Public Policy CenterTexas Public Policy Center

The study also assumes EVs will be driven for 10 years and 120,000 miles, which the authors claim is a generous estimate. According to J.D. Power, EVs lose 2.3% of their range each year due to battery degradation, in part driving EVs to lose value faster than internal combustion cars.

With Ford losing an estimated $70,000 per EV and subsidies reaching $50,000 per EV, Isaac says the real cost of a vehicle such as a Ford Lightning is over $150,000, and those costs are carried by everyone, including non-EV owners and even Americans without cars.

“The real cost of a Ford Lightning is closer to $172,00 and no one would buy them at that. I know their sales have tanked. The [electric] Silverado sold 18 electric trucks last quarter,” Isaac said. “Buying a car is more expensive today and people don’t understand why that is. I’m trying to help them understand if they buy a gas or diesel car they’re paying for an electric vehicle for a wealthy EV owner.”

To reach the $17.73 per gallon equivalent figure, the authors created categories for costs borne by EV owners, taxpayers, utility ratepayers, and buyers of electric vehicles. For reference, the cost per gallon equivalent is computed by dividing the number of miles over a car’s ten year lifetime by the average new vehicle's fuel efficiency of 36 miles per gallon equivalent, and using that number to divide the total cost presented.

EV owners only pay $1.21 for the cost of residential electricity and $1.38 for charging and metering costs per equivalent gallon, which makes charging still cheaper than gasoline in terms of costs paid by EV owners. However, taxpayers pay $2.72 per gallon in federal and state EV buyer tax credits and rebates ($8,984 over a vehicle lifetime), a cost of $0.40 per gallon ($1,318 over a vehicle lifetime) in avoided charging infrastructure costs split between taxpayers and utility ratepayers. Utility ratepayers then pay $3.18 per gallon ($10,515 over a vehicle lifetime) in increased costs to enable the grid to charge electric vehicles at mass scale through increased power generation, transmission and distribution. Lastly, buyers of non-electric vehicles face increased vehicle costs equating to $1.48 per gallon equivalent ($4,881 over a vehicle lifetime) due to requirements in many states that manufacturers sell a certain number of often money-losing EVs to continue selling other cars, $1.01 per gallon equivalent ($3,322 over a vehicle lifetime) due to EPA GHG emissions standards, while Corporate Average Fuel Economy Credits add a whopping $5.96 per gallon equivalent ($19,678 over a vehicle lifetime).

CAFE standards are the single largest externalized cost of EVs, a cost that researchers attribute to the fact that automakers whose fleets do not meet the necessary average fuel economy must purchase credits from automakers with excess credits, with these credit markets worth billions of dollars per year and contributing $1.78 billion to Tesla’s bottom line in 2022. The average fuel economy of an average EV with a 300 mile range in 2021 was estimated to be 113 miles per gallon equivalent, making automakers strongly incentivized to build these often money-losing cars to meet CAFE goals. To increase the adoption of cars that don’t use diesel or gasoline, the federal government created a 667% multiplier in MPGe for vehicles that use alternative power. With a fleetwide CAFE standard of 37 MPG for 2021 and a 2021 EV rated at 113 MPGE, an EV is worth 507 MPG worth of credits, or more than what Ford loses directly on its EVs.

2 notes

·

View notes

Text

Policymakers seeking to spur persistently faster economic growth sometimes make claims about the long-term benefits of fundamental tax reform, which economic theory often suggests can be a potent force over many years. However, the more tractable and plausible tax reforms that become law have historically offered weaker impacts on economic growth. After the fact, the evidence is that these politically feasible tax reforms and tax legislation that have already been enacted uniformly fail to spark even moderate expansions in the long-term size of the economy.

In broad strokes, tax reform has the potential to have long-term effects on the economy through three principal channels: (1) changing the amount of tax revenue collected by the federal government, (2) altering incentives to improve economic efficiency or better align behavior with societal goals, and (3) redistributing income. All three types of effects can affect—positively or negatively—long-term gross domestic product (GDP). Nonetheless, the major tax reforms enacted in recent decades historically have had extremely small effects on long-term aggregate output.

And yet the estimated effect on aggregate output often receives more attention than the significant effects on revenues, behavior, and income distribution. In our view, this is a mistake. During the forthcoming policy debate necessitated by the sunsets in the Tax Cuts and Jobs Act (TCJA), we believe that scrutiny of the inevitable estimates of GDP impacts should take a backseat to these other effects.

In this essay we intentionally center on the long-term impacts of tax reform rather than on the short-term effects that may come from tax policy shifts designed to stimulate the economy. When policymakers enact tax changes that take effect quickly, such as an immediate cut in tax rates, aggregate demand typically responds and can lead to short-term boosts to GDP. For example, during recent downturns, Congress legislated household tax rebates that boosted consumption and, subsequently, near-term growth. We are setting near-term effects aside, and instead we focus on estimates of how enacted tax reforms have affected the productive capacity of the economy over the longer term.

Over the past four decades, Congress has substantially reformed the tax code eight times, most recently in 2017 with the TCJA. Our review of major tax reforms since 1986 shows that the most comprehensively estimated impacts of those reforms have ranged between a 0.5 percent increase to a 0.5 percent decrease in the long-term level of output. Although these estimates are highly uncertain, we walk through some practical reasons why the effect of tax reform on aggregate output is relatively small.

We argue that, when tax reform is projected to have a minor impact on aggregate output in the long run, considerations of those effects should be secondary relative to effects on federal tax revenues, changes in behavior to further broader societal goals, and distribution of income. It is particularly shortsighted if a focus on small negative aggregate economic effects precludes the passage of well-designed tax policy that would achieve other priorities.

2 notes

·

View notes

Text

Claim your tax rebate online with Mysimply Tax

If you're looking for a hassle-free way to claim your tax rebate, look no further than Mysimplytax. With their user-friendly platform and expert services, you can rest assured that your rebate will be claimed accurately and quickly. Mysimplytax is a user-friendly online platform that helps you claim your tax rebate in just a few simple steps.

0 notes

Text

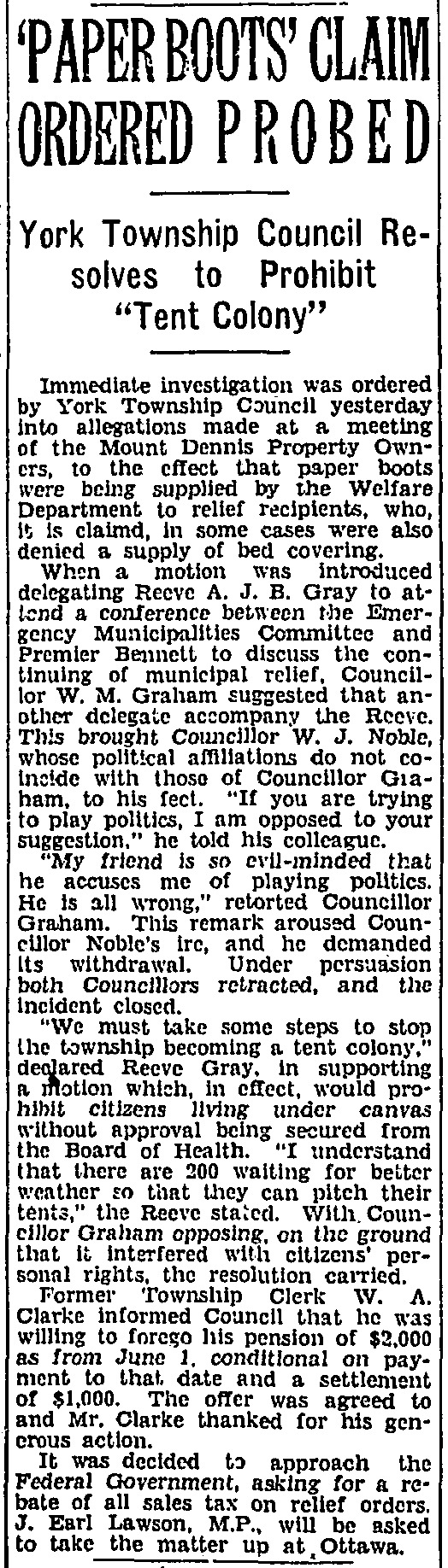

"PAPER BOOTS CLAIM ORDERED PROBED," Toronto Globe. April 19, 1933. Page 9.

----

York Township Council Resolves to Prohibit "Tent Colony"

----

Immediate investigation was ordered by York Township Council yesterday into allegations made at a meeting of the Mount Dennis Property Owners, to the effect that paper boots" were being supplied by the Welfare Department to relief recipients, who, it is claimed, in some cases were also denied a supply of bed covering.

When a motion was introduced delegating Reeve A. J. B. Gray to at- lend a conference between the Emergency Municipalities Committee and Premier Bennett to discuss the continuing of municipal relief, Councillor W. M. Graham suggested that an- other delegate accompany the Reeve. This brought Councillor W. J. Noble, whose political affiliations do not coincide with those of Councillor Graham, to his fect. "If you are trying to play politics, I am opposed to your suggestion," he told his colleague.

"My friend is so evil-minded that he accuses me of playing politics. He is all wrong," retorted Councillor Graham. This remark aroused Councillor Noble's ire, and he demanded its withdrawal. Under persuasion both Councillors retracted, and the incident closed.

"We must take some steps to stop the township becoming a tent colony," declared Reeve Gray, in supporting a motion which, in effect, would prohibit citizens living under canvas without approval being secured from the Board of Health. "I understand that there are 200 waiting for better weather so that they can pitch their tenta," the Reeve stated. With Councillor Graham opposing, on the ground that it interfered with citizens' personal rights, the resolution carried.

Former Township Clerk W. A. Clarke informed Council that he was willing to forego his pension of $2,000 as from June 1, conditional on payment to that date and a settlement of $1,000. The offer was agreed to and Mr. Clarke thanked for his generous action.

It was decided to approach the Federal Government, asking for a rebate of all sales tax on relief orders. J. Earl Lawson, M.P., will be asked to take the matter up at, Ottawa.

#york township#tent city#unemployed#unemployment#sleeping in tents#homelessness#homeless#evictions#fighting evictions#tenants#great depression in canada#working class struggle#punishing the poor#middle class ideology#when freedom was lost

1 note

·

View note