#cigna healthcare providers

Explore tagged Tumblr posts

Text

Fun fact! As well as all of this, United Healthcare is ALSO one of the largest contributors towards anti-abortion lobby organizations, including ones that impacted the Dobbs decision to allow states to fully ban abortion rights. They're using that money that they stole from taxpayers to directly fuck people over even more! 🥰

Here's an article!

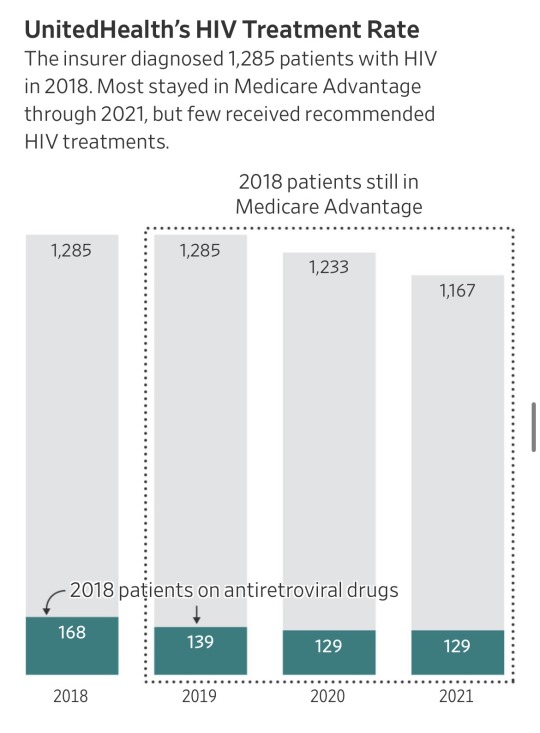

“It seems like almost all of those people don’t have HIV,” said Jennifer Kates, HIV policy director at KFF, a health-research nonprofit. “If they did, that would be substandard care at a pretty severe level,” she said.

Ya’ll. United Health just got accused of $17 billion in medicare fraud.

Basically they made up diagnosis which are improbable or impossible, “forgot” to remove ones which had been cured, and overall allegedly stole billions from taxpayers.

The government pays insurers a base rate for each Medicare Advantage member. The insurers are entitled to extra money when their patients are diagnosed with certain conditions that are costly to treat.

… About 18,000 Medicare Advantage recipients had insurer-driven diagnoses of HIV, the virus that causes AIDS, but weren’t receiving treatment for the virus from doctors, between 2018 and 2021, the data showed. Each HIV diagnosis generates about $3,000 a year in added payments to insurers.

… He said internal company data for 2022 showed a treatment rate for patients UnitedHealth diagnosed with HIV of more than triple what the Journal found. He said the pandemic disrupted care, lowering treatment rates during the period analyzed by the Journal, and that the analysis failed to account for patients who started treatments in future years.

The Medicare data, however, show UnitedHealth’s patients with insurer-driven HIV diagnoses were on the antiretrovirals at low rates even before the pandemic, and hardly any started the drugs in the years after UnitedHealth diagnosed them.

Source: https://www.wsj.com/health/healthcare/medicare-health-insurance-diagnosis-payments-b4d99a5d

I bet United Health really wishes it was a different week right now.

#This was discovered by my coworkers at a certain large reproductive healthcare organization#when about 2 years ago our employer switched our insurance provider from Cigna to United#They never gave a reason why they decided to financially support an organization that directly impacted our patients' access to abortion#which we were providing EVERY DAY!!#I'm still so pissed at them for that#But even MORE SO at UHC#FUCK THEM for real#abortion#united healthcare

18K notes

·

View notes

Text

Cigna’s nopeinator

I'm touring my new, nationally bestselling novel The Bezzle! Catch me THURSDAY (May 2) in WINNIPEG, then Calgary (May 3), Vancouver (May 4), Tartu, Estonia, and beyond!

Cigna – like all private health insurers – has two contradictory imperatives:

To keep its customers healthy; and

To make as much money for its shareholders as is possible.

Now, there's a hypothetical way to resolve these contradictions, a story much beloved by advocates of America's wasteful, cruel, inefficient private health industry: "If health is a "market," then a health insurer that fails to keep its customers healthy will lose those customers and thus make less for its shareholders." In this thought-experiment, Cigna will "find an equilibrium" between spending money to keep its customers healthy, thus retaining their business, and also "seeking efficiencies" to create a standard of care that's cost-effective.

But health care isn't a market. Most of us get our health-care through our employers, who offer small handful of options that nevertheless manage to be so complex in their particulars that they're impossible to directly compare, and somehow all end up not covering the things we need them for. Oh, and you can only change insurers once or twice per year, and doing so incurs savage switching costs, like losing access to your family doctor and specialists providers.

Cigna – like other health insurers – is "too big to care." It doesn't have to worry about losing your business, so it grows progressively less interested in even pretending to keep you healthy.

The most important way for an insurer to protect its profits at the expense of your health is to deny care that your doctor believes you need. Cigna has transformed itself into a care-denying assembly line.

Dr Debby Day is a Cigna whistleblower. Dr Day was a Cigna medical director, charged with reviewing denied cases, a job she held for 20 years. In 2022, she was forced out by Cigna. Writing for Propublica and The Capitol Forum, Patrick Rucker and David Armstrong tell her story, revealing the true "equilibrium" that Cigna has found:

https://www.propublica.org/article/cigna-medical-director-doctor-patient-preapproval-denials-insurance

Dr Day took her job seriously. Early in her career, she discovered a pattern of claims from doctors for an expensive therapy called intravenous immunoglobulin in cases where this made no medical sense. Dr Day reviewed the scientific literature on IVIG and developed a Cigna-wide policy for its use that saved the company millions of dollars.

This is how it's supposed to work: insurers (whether private or public) should permit all the medically necessary interventions and deny interventions that aren't supported by evidence, and they should determine the difference through internal reviewers who are treated as independent experts.

But as the competitive landscape for US healthcare dwindled – and as Cigna bought out more parts of its supply chain and merged with more of its major rivals – the company became uniquely focused on denying claims, irrespective of their medical merit.

In Dr Day's story, the turning point came when Cinga outsourced pre-approvals to registered nurses in the Philippines. Legally, a nurse can approve a claim, but only an MD can deny a claim. So Dr Day and her colleagues would have to sign off when a nurse deemed a procedure, therapy or drug to be medically unnecessary.

This is a complex determination to make, even under ideal circumstances, but Cigna's Filipino outsource partners were far from ideal. Dr Day found that nurses were "sloppy" – they'd confuse a mother with her newborn baby and deny care on that grounds, or confuse an injured hip with an injured neck and deny permission for an ultrasound. Dr Day reviewed a claim for a test that was denied because STI tests weren't "medically necessary" – but the patient's doctor had applied for a test to diagnose a toenail fungus, not an STI.

Even if the nurses' evaluations had been careful, Dr Day wanted to conduct her own, thorough investigation before overriding another doctor's judgment about the care that doctor's patient warranted. When a nurse recommended denying care "for a cancer patient or a sick baby," Dr Day would research medical guidelines, read studies and review the patient's record before signing off on the recommendation.

This was how the claims denial process is said to work, but it's not how it was supposed to work. Dr Day was markedly slower than her peers, who would "click and close" claims by pasting the nurses' own rationale for denying the claim into the relevant form, acting as a rubber-stamp rather than a skilled reviewer.

Dr Day knew she was slower than her peers. Cigna made sure of that, producing a "productivity dashboard" that scored doctors based on "handle time," which Cigna describes as the average time its doctors spend on different kinds of claims. But Dr Day and other Cigna sources say that this was a maximum, not an average – a way of disciplining doctors.

These were not long times. If a doctor asked Cigna not to discharge their patient from hospital care and a nurse denied that claim, the doctor reviewing that claim was supposed to spend not more than 4.5 minutes on their review. Other timelines were even more aggressive: many denials of prescription drugs were meant to be resolved in fewer than two minutes.

Cigna told Propublica and The Capitol Forum that its productivity scores weren't based on a simple calculation about whether its MD reviewers were hitting these brutal processing time targets, describing the scores as a proprietary mix of factors that reflected a nuanced view of care. But when Propublica and The Capitol Forum created a crude algorithm to generate scores by comparing a doctor's performance relative to the company's targets, they found the results fit very neatly into the actual scores that Cigna assigned to its docs:

The newsrooms’ formula accurately reproduced the scores of 87% of the Cigna doctors listed; the scores of all but one of the rest fell within 1 to 2 percentage points of the number generated by this formula. When asked about this formula, Cigna said it may be inaccurate but didn’t elaborate.

As Dr Day slipped lower on the productivity chart, her bosses pressured her bring her score up (Day recorded her phone calls and saved her emails, and the reporters verified them). Among other things, Dr Day's boss made it clear that her annual bonus and stock options were contingent on her making quota.

Cigna denies all of this. They smeared Dr Day as a "disgruntled former employee" (as though that has any bearing on the truthfulness of her account), and declined to explain the discrepancies between Dr Day's accusations and Cigna's bland denials.

This isn't new for Cigna. Last year, Propublica and Capitol Forum revealed the existence of an algorithmic claims denial system that allowed its doctors to bulk-deny claims in as little as 1.2 seconds:

https://www.propublica.org/article/cigna-pxdx-medical-health-insurance-rejection-claims

Cigna insisted that this was a mischaracterization, saying the system existed to speed up the approval of claims, despite the first-hand accounts of Cigna's own doctors and the doctors whose care recommendations were blocked by the system. One Cigna doctor used this system to "review" and deny 60,000 claims in one month.

Beyond serving as an indictment of the US for-profit health industry, and of Cigna's business practices, this is also a cautionary tale about the idea that critical AI applications can be resolved with "humans in the loop."

AI pitchmen claim that even unreliable AI can be fixed by adding a "human in the loop" that reviews the AI's judgments:

https://pluralistic.net/2024/04/23/maximal-plausibility/#reverse-centaurs

In this world, the AI is an assistant to the human. For example, a radiologist might have an AI double-check their assessments of chest X-rays, and revisit those X-rays where the AI's assessment didn't match their own. This robot-assisted-human configuration is called a "centaur."

In reality, "human in the loop" is almost always a reverse-centaur. If the hospital buys an AI, fires half its radiologists and orders the remainder to review the AI's superhuman assessments of chest X-rays, that's not an AI assisted radiologist, that's a radiologist-assisted AI. Accuracy goes down, but so do costs. That's the bet that AI investors are making.

Many AI applications turn out not to even be "AI" – they're just low-waged workers in an overseas call-center pretending to be an algorithm (some Indian techies joke that AI stands for "absent Indians"). That was the case with Amazon's Grab and Go stores where, supposedly, AI-enabled cameras counted up all the things you put in your shopping basket and automatically billed you for them. In reality, the cameras were connected to Indian call-centers where low-waged workers made those assessments:

https://pluralistic.net/2024/01/29/pay-no-attention/#to-the-little-man-behind-the-curtain

This Potemkin AI represents an intermediate step between outsourcing and AI. Over the past three decades, the growth of cheap telecommunications and logistics systems let corporations outsource customer service to low-waged offshore workers. The corporations used the excuse that these subcontractors were far from the firm and its customers to deny them any agency, giving them rigid scripts and procedures to follow.

This was a very usefully dysfunctional system. As a customer with a complaint, you would call the customer service line, wait for a long time on hold, spend an interminable time working through a proscribed claims-handling process with a rep who was prohibited from diverging from that process. That process nearly always ended with you being told that nothing could be done.

At that point, a large number of customers would have given up on getting a refund, exchange or credit. The money paid out to the few customers who were stubborn or angry enough to karen their way to a supervisor and get something out of the company amounted to pennies, relative to the sums the company reaped by ripping off the rest.

The Amazon Grab and Go workers were humans in robot suits, but these customer service reps were robots in human suits. The software told them what to say, and they said it, and all they were allowed to say was what appeared on their screens. They were reverse centaurs, serving as the human faces of the intransigent robots programmed by monopolists that were too big to care.

AI is the final stage of this progression: robots without the human suits. The AI turns its "human in the loop" into a "moral crumple zone," which Madeleine Clare Elish describes as "a component that bears the brunt of the moral and legal responsibilities when the overall system malfunctions":

https://estsjournal.org/index.php/ests/article/view/260

The Filipino nurses in the Cigna system are an avoidable expense. As Cigna's own dabbling in algorithmic claim-denial shows, they can be jettisoned in favor of a system that uses productivity dashboards and other bossware to push doctors to robosign hundreds or thousands of denials per day, on the pretense that these denials were "reviewed" by a licensed physician.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/29/what-part-of-no/#dont-you-understand

#pluralistic#cigna#computer says no#bossware#moral crumple zones#medicare for all#m4a#whistleblowers#dr debby day#Madeleine Clare Elish#automation#ai#outsourcing#human in the loop#humans in the loop

242 notes

·

View notes

Text

Repealing the Affordable Care Act (ObamaCare) - What Does It Mean for Me?

Trump has made it clear that one of his first acts as president will be repealing Obamacare or the Affordable Care Act (ACA). He has also made it very clear that he does not have a plan to replace the ACA. Most people understand that the ACA allows individuals and families to purchase Marketplace health insurance coverage. Marketplace health insurance is the best option for many self-employed individuals, as the US mostly depends on employer provided health insurance plans that are cost prohibitive to small businesses.

With the announcement that Trump won the election, I was reminded that many of you did not live through or were not aware of what healthcare was like prior to the ACA (enacted in 2010). I wanted to get on my soapbox a bit to explain what the ACA did to help individuals and what the repercussions of losing these protections could mean.

Pre-existing conditions – Prior to the ACA, health insurance companies could deny coverage or charge more for anyone with a pre-existing condition. If you experienced a lapse in coverage for any reason (even a single day!), health insurance companies could deny coverage for any pre-existing health condition as well as any complication that arose from that condition. Pre-existing conditions were not limited to severe health issues, it was any health condition that you were diagnosed with (ex: eczema, asthma, migraines, cancer, diabetes).

If you had high blood pressure and switched jobs, there is typically a 90-day probationary period before your new employer health plan kicks in. During those 90 days, you would need to obtain COBRA insurance to ensure that your new employer plan would continue to cover your high blood pressure. COBRA plans can easily cost between $600-$1800/month, so you could spend $1800-$5200 during those 3 months to prevent a lapse in coverage. If you cannot afford to pay for COBRA, your insurance lapses and your new employer plan does not have to cover your high blood pressure. If you end up with complications later down the road such as kidney failure or a heart attack and the insurance company decides that this is related to your high blood pressure, they don’t have to cover the cost of those complications either.

Lifetime Caps – prior to the ACA, each health insurance would list a lifetime cap on their policy. This was generally somewhere between $1-2 million dollars. This was the maximum amount of healthcare charges that they would insure you for, and once reached, you would become uninsurable for that healthcare plan.

A $2 million dollar lifetime cap sounds big right? The average person will not be eligible for medicare until they are 65, so that’s 65 years of healthcare costs that need to be under that cap. We have 2 major health insurers (Anthem and United Healthcare) with some minor plans in play as well (Cigna, Aetna, Humana, and a few others). Prior to the ACA, I have watched parents switch jobs from one job that provided Anthem insurance to another job that provided another type of insurance just to make sure they didn’t reach their lifetime cap. These were individuals that didn’t want a new job, they had to find a new job and the next year, when their new employer changed their insurance plan to what the previous employer had, they had to find a new job again. Each time, they had to pay for COBRA to ensure that their families didn’t have a lapse in coverage, otherwise their pre-existing conditions wouldn’t be covered.

Healthcare is expensive in this country. If you have diabetes, cancer, a heart condition, or any chronic disease, you will have no problem reaching a $2 million lifetime cap in a few years.

Once a lifetime cap is reached, that insurance will not provide you with any insurance coverage. You are uninsurable by that company. If you reach that cap at age 30, you have 35 years until you get Medicare, and that’s 35 years of scrounging around for other jobs that don’t have that type of insurance.

There were annual limits as well, and the same applied. In this case, once you reached the annual limit, they just wouldn’t pay any more healthcare charges, and you were liable for 100% of the costs after that limit was reached.

Disability - If you are deemed disabled by the Social Security Administration, it takes an additional 2 years before you are eligible for Medicare. In the interim, if you can no longer purchase a Marketplace plan, your only option is a state-funded Medicaid plan. In order to qualify for Medicaid, there are income limits. Remember you just got approved for disability and depending on your previous work experience, the average disability check is for $1542/monthly, but could range up to $3822/month. Do you have a little bit of a savings? To qualify for most state Medicaid plans when you are disabled, your income needs to be <$1255/month and you can have a maximum of $2000 in assets (savings, stocks/bonds). The average disability payment makes you ineligible for Medicaid, and if the ACA is repealed, you will not have an option for health insurance unless your spouse carries you on their employer provided insurance.

Preventative Services – the ACA requires plans to provide preventative healthcare services at little to no cost. This includes well baby checks, vaccines, annual physicals, annual gynecological exams, annual lab work, mammograms, and colonoscopies. Before the ACA, we paid for these services, and many people just didn’t seek preventative care because they could not afford the cost, even when insurance covered a portion of the charges.

Emergency Care – the ACA requires emergency room care to be considered in-network. Prior to the ACA, if you were out of state and experienced an emergency that required an emergency room visit, you were charged out-of-network charges. Many plans wouldn’t cover out-of-network providers, so you were liable for the entire cost of the ER visit. A rough estimate for the average ER visit is around $2600 but could be significantly higher depending on the reason for the visit.

Protections from Cancellation – the ACA made it illegal for your insurance to cancel you for costing them to much money. Before the ACA, similar to homeowners or car insurance, if you had too many claims, they just cancelled your coverage.

Birth Control and Contraceptives – prior to the ACA, birth control pills, IUDs, and other contraceptives were generally excluded from coverage and you had to pay for these out of your pocket.

The ACA did much more than just offer Marketplace plans for individuals to purchase. It’s easy to take these protections for granted now that we are almost 15 years out from when they were enacted, but do not doubt that healthcare in the US is a business. Every day, insurance plans deny coverage for treatments because it’s too expensive, and doctors are continually frustrated by the red tape required by insurance to get patients what they need. Insurance plans will not hesitate to go back to the way healthcare was prior to the ACA, as it’s more profitable for them to do so. They do not care that patients will suffer, that people will die, and people will be financially crippled in the process.

#affordable care act#fuck trump#fuck around and find out#healthcare#health insurance#us elections#election 2024#health information#health inequality

15 notes

·

View notes

Text

Long Boring Health Insurance Rant: Provider Edition

A few years ago, United Healthcare decided to give medical providers no choice about how they were paid. Incrementally, everyone was migrated to EBT payments, unless they went through the process of getting payments sent by Direct Deposit, which was made intentionally byzantine, and the physician I worked for didn't want to do it because it was a small office and they didn't have a big fancy records system that could perform complex functions like integrating directly with their banking. The problem with EBT payments, though, is that they must be processed like a credit payment, and when the card isn't present, an even larger transaction fee is taken out of the payment. There is no card in this case, just a number, so you're losing 3.5% + 15 cents or whatever of a $17.00 payment (Yes! Someone's copay can be $50 and United would be paying $17.00-30.00 and there's nothing a doctor can do about the contracted rate except not take the insurance at all and lose patients.) Of course United didn't make these payments in batches, which was customary, so someone in a doctor's office has to sit and process $17 payment after $17 payment over and over and over again.

I think they did this because they were paying out more money during the pandemic and they were trying to find money saving measures that wouldn't get them bad press. So suddenly, they were saving money on paper by not having to mail anything. Doctors had to go online to retrieve the EBT and the remittance forms, WHICH, by the way ARE NOT ASSOCIATED WITH ONE ANOTHER. Which patient's claim is this payment for? Who knows!? See if you can make a match from a check number! If there was information missing, there was no one to call about it who would do anything. Things would not get reconciled. Small offices need a physical remittance form to facilitate workflow with bookkeeping, so those needed to be printed, therefore shifting the printing expense onto the provider's back. What I also think they were doing with this change in procedure was making it both difficult for admin to tell what they were looking at, to spend unreasonable amounts of time doing forensics to match payments to remittance forms with patient names and dates of service on them, and then, if a claim was erroneously denied, to push the idea of appealing the denial into the territory of unsustainable money loss. To have a staff member spend ANY time appealing $17 ($16.25) in a confusing process that may or may not actually lead to the claim being paid, you're spending at least double the amount of money you're fighting over. They make it hard for providers on purpose. They deny things up front on PURPOSE because there's a good chance the provider will accept the loss because they really can't, not even being selfish, afford to fight it. It's unbelievably petty. And it really works.

This is true for many insurance companies, though Cigna and Aetna seem to be pretty decent comparatively, but United and Blue Cross really are the worst. Something people may not also know is that both Blue Cross and United have lowered their contracted rate of payment to doctors EVERY YEAR for as long as I've been watching, and not just a little. A visit that used to be covered at $89.06 ten years ago is now $56.00. Was it $156 in 2012? Now it's $103.11. That sort of shit. It almost never goes up. Why? Inflation doesn't deflate. They do it because they can and doctors have no recourse.

I think this is also why you see Medicare/Medicaid fraud sometimes, and it's not always because someone is greedy. Providers really might be trying to break even due to being paid BELOW COST for services by several other insurance companies (United definitely being one of them), and Medicare/Medicaid is the only insurer whose claims process is automated and not actively playing Keep Away with payments. I almost cried (I probably did cry) the first time I put a claim through to Medicaid... because it was just paid. Right then. Result visible on the website immediately. Not a lot of money by any means, but enough.

There's no shock value here at all compared to what patients experience (I've seen things that I can't even begin to forget). And I'm not trying to say "woe is the physician". I just know the full scale of the bullshit being conducted by these useless middlemen, who do nothing but sit around coming up with increasingly dystopian ideas, isn't necessarily known to the average person who doesn't deal with medical billing.

I mean, WHY is it okay, and not a DEEEEP conflict of interest, for an insurance company to start a medical clinic franchise and push you hard to use it if you have their insurance? THAT EXISTS.

Anyway.

That's all I have to say about that.

#united healthcare#blue cross blue shield#u.s. health insurance#scam#cut out the middleman however necessary

10 notes

·

View notes

Text

From the GLMA website:

We at GLMA take great pride in the impact we’ve made over our 40+ year history—with the support of our members, our supporters, and the community at-large—toward greater equality in healthcare. GLMA– Health Professionals Advancing LGBTQ+ Equality partnered with the Tegan and Sara Foundation, to launch the brand-new LGBTQ+ Healthcare Directory with key support and collaboration from global health service company, Cigna. The LGBTQ+ Healthcare Directory is now open for provider registration and patient use.

If you are a healthcare professional that would like to be added to the directory, read through research conducted by the GLMA, or look into educational courses they provide, check the main website!

#healthcare#us healthcare#us politics#queer activism#LGBTQIA#queer health#health advocacy#survival#LGBTQ+ Healthcare Directory#lgbtq community#resistance#gender affirming care#mental health#lgbtq mental health

3 notes

·

View notes

Text

Are we in the French Revolution Season of America? Well, we should have been decades ago.

I have a migraine and can't sleep so let me yap about insurance for a bit.

Everyone's heard the UHC CEO was shot dead in NYC. And I'm sure most people are like "yeah, and?" Indeed. I have a unique perspective on this because I work in healthcare, specifically healthcare admin and my actual specialty is fighting claim denials on behalf of my company. I am unusually qualified to have opinions on this. I know quite a bit more about it than the average joe.

United Health Group is a notorious ghoul in the healthcare world, specifically behavioral health (mental health). It surprises me how many people don't understand what I mean when I say "behavioral health". We're talking psych. UHC's vendor for behavioral health is called Optum. Not many people know this but you can have Blue Cross and Blue Shield insurance, but your behavioral health benefits can be taken care of by Optum. This is called a "carve out". Insurance companies do this for... God knows why (cost? savings? something to do with saving a buck I'm sure) but it surprises patients time and time again. It doesn't happen super often but it does happen. And what that means is that you have to find providers that take Optum/UHC even though your main insurance is BCBS/Cigna/Aetna/Whatever. Behavioral Health is it's own little special world in the insurance marketplace and it's... sometimes very poorly run and very mismanaged. I work in psych and this isn't my first job working in psychology - so I have a LOT of experience here. When I tell you that Optum is one of the WORST and most predatory behavioral health payors I've ever encountered, I kid you not. The only other tragic fucking mess I've seen that rivals UHC is Cigna's BH group called Evernorth. Oh my god, don't ever try to get any answers at Evernorth - no one there knows how a fucking thing works.

So anyway, what UHC likes to do with patients that get therapy is they will see that a patient is costing them a lot of money - you know, actually using the benefits they pay premiums for. They'll then decide that this can't continue and they'll stop paying for services until the provider that is doing them undergoes a "Medical Records Review". What that means politely is that they think you're over-using their benefit and they don't want to pay for this service, so you now have to prove that you need it. This is usually a taske the provider must do. Our providers must write an appeal and submit the patient's records for review to UHC. You might think "so what? submit the paperwork". Not so fast. The process is not cut and dry. You have to write the review, which is time the provider isn't being paid for. They must then give it to someone (me) or fax the paperwork themselves, while also compiling their medical records which usually means months worth of notes. This means in our practice that we must have a medical records person submit the documents to our boss, who then signs off on them after proofing them - this is so the records meet requirements medically. Then we have to compile, sort and fax the paperwork and then we get to track it. Meanwhile, the payments for the service stop. UHC does not continue to pay for services while a review is in process. You just have to assume it will work out. Our success rate with these reviews is low, something like 40%... so our providers often just opt not to do them. When I tell you it doesn't matter what the provider writes in the review or who does it, I mean it. We have a Harvard trained Psychologist who sees patients for talk therapy and knows all the specifics. She wrote one of these for a patient, gave it to me, I sent it, tracked it, etc. It was magically approved (one of the only successes I've personally seen) and then 6 months later they did it AGAIN and this time our Psych was like "I'm not doing this anymore, we've proven she needs the therapy, her situation hasn't magically changed in 6 months!" The patient had complex issues that definitely required therapy and pharmacological intervention. I also get calls from Optum, about 1-2 a month wherein a doctor will call us and say they're from Optum and they're stopping services because X, Y, Z. They'll say that the diagnosis doesn't require the amount of visits that the patient has had and I can't argue with them - I just note it and relay the message. Every single Psychologist in our practice hates UHC. Whenever the email I write contains the word "Optum" or "Denial" the providers tell me they don't even want to read them LOL I do not get the same kind of denials from any other insurer, JUST Optum. That tells you something. There is no insurance company I like, to be frank, but if you asked me who I hated the most it's Optum. And the funny thing is that our healthcare through my job is UHC (but I can't afford it). The benefits are outrageously expensive and have high deductibles. Count me out.

That was a lot of words to say that their processes are in place to make things hard on providers and on patients. They want it to be difficult, confusing and nearly impossible to navigate. They bank on you not knowing anything - so the best thing to do is know AS MUCH as you possibly can. What I described here is the main reason why I can not work for an insurance company or become a broker, I do not like or want to sell anyone any of it. I hate insurance and I think it's all a huge scam.

An insurance company's first priority is to keep profit margins high. It is not to help provide excellent care. It's not patient satisfaction. You give them money and they aim to keep it. That's it. So, a CEO is most definitely in charge of helping to keep that company profitable. Insurance companies make BILLIONS - yes, BILLIONS of dollars - a year. They're not "just scraping by".

My number one concern has ALWAYS been single payer healthcare in the US and I have never quite figured out why people are so against the idea. I know why greedy companies don't want it to happen and all I can assume is that the lobbying against it and spreading of misinformation and fear mongering is the reason it's gotten in to so many people's heads that it's "bad". Look around you, does it seem like anything is working well the way it is?

5 notes

·

View notes

Text

The North Star of communications policy should be to make services faster, better, and cheaper for all. Yet, next year, about 50 million Americans could find that their access to the core communications service of our time—broadband—has become slower, worse, and more expensive, with many even likely to be disconnected. That shift would constitute the biggest step any country has ever taken to widen, rather than close, its digital divide.

The reason for the potential debacle? The Affordable Connectivity Program (ACP), which provides a $30 per month subsidy for broadband to over 16 million households (with the number continuing to grow) will run out of funds.

Congress established the ACP in the Infrastructure Investment and Jobs Act (IIJA) of 2021. That law correctly observed that “a broadband connection and digital literacy are increasingly critical to how individuals participate in the society, economy, and civic institutions of the United States; and access health care and essential services, obtain education, and build careers.”

To assure that all were connected, the law appropriated $65 billion to broadband. Congress devoted most of the funds to network deployments in unserved and underserved areas, but there was another $14.25 billion allocated to the ACP to assure that broadband would be affordable to all. The program is projected exhaust all its funds sometime in the first half of 2024.

The end of the program would be a disaster for families who generally have little savings or discretionary income and will suddenly face monthly broadband charges of $30 or more. It would also rob the broader economy of an opportunity to grow faster due to universal connectivity. As demonstrated by a 2021 study on the employment effects of subsidized broadband for low-income Americans, such programs increase employment rates and earnings of eligible individuals due to greater labor force participation and decreased probability of unemployment, with a benefit of $2,200 annually for low-income households.

Ending the program would also limit the enormous potential for savings in critical services that broadband can deliver. For example, in health care, data from Cigna Healthcare shows that patients save an average of $93 when using non-urgent virtual care instead of an in-person visit. Similarly, patients save an average of $120 when the virtual visit involves a specialist, and $141 with a virtual urgent-care clinic over an in-person one. Given that the Medicaid-eligible population and the ACP-eligible population overlap significantly, the savings for the government in assuring all can afford telehealth likely pays for itself. In addition, as Brookings Metro has previously noted, widespread broadband access also leads to improved outcomes in education, jobs, and social services, which would be lost if the ACP elapses.

The ACP’s expiration will also create problems for the Broadband Equity, Access, and Deployment (BEAD) Program—the $42.5 billion network deployment program Congress created in the IIJA. A study reviewing the ACP’s impact on BEAD concluded that it reduces the subsidy needed to incentivize providers to build in rural areas by 25% per household, writing: “The existence of ACP, which subsidizes subscriber service fees up to $360 per year, reduces the per-household subsidy required to incentivize ISP investment by $500, generating benefit for the government and increasing the market attractiveness for new entrants and incumbent providers.” As the National Urban League has observed, that study demonstrates that “if Congress fails to reauthorize ACP, the federal government likely will end up overpaying for broadband deployments. As a result, the federal dollars will end up funding deployments to significantly fewer unserved and underserved homes and businesses.”

The obvious solution is for Congress to continue funding the program. That is possible, as it enjoys bipartisan support. For example, former Republican FCC Commissioner Michael O’Rielly penned an op-ed titled “A Conservative Case for the Affordable Connectivity Program.” EducationSuperhighway, a national nonprofit with the mission of closing the digital divide, identified 28 governors who have prioritized implementing the ACP, including those from deep-red states such as Alabama, Idaho, and Mississippi. And polling suggests the program is widely popular among the public, with a January poll showing a “strong bipartisan majority of voters (78 percent) support continuing the ACP, including 64 percent of Republicans, 70 percent of Independents, and 95 percent of Democrats.”

But despite the ACP’s importance and popularity, it is questionable whether the Republican-controlled House will continue funding it, given the party’s attacks on other social safety net programs.

Should ACP funding be discontinued, there are alternatives—but all come with their own concerns. The FCC could fund the program itself, through the mechanism by which it funds universal service programs. That framework, however, is already under stress from legal challenges to its constitutionality and a shrinking revenue base, which has declined by 63% in the last two decades. States could design their own programs, such as New York did by requiring providers to offer a $15 broadband service to low-income residents. But in 2021, a judge ruled that the program violates federal law. Moreover, it is questionable whether the country’s universal service ambitions are best served by a fragmented set of state programs.

The National Urban League proposed a promising alternative in its Lewis Latimer Plan for Digital Equity and Inclusion. (Disclosure: The author of this piece assisted the National Urban League in its development of the Latimer Plan and its analysis of the implications of the ACP on the BEAD program.) Noting the cost savings demonstrated through telehealth, the plan proposed allowing Medicaid to enable states to provide broadband vouchers, like what the ACP offers, to eligible persons. This is similar to the way health insurance providers offer non-medical benefits that, over time, reduce the cost of health coverage. Of course, such a plan would require an administrative process to determine if and how to proceed. But it offers an alternative that would provide a sustainable source of funding.

The ACP, like any new program, could use some incremental fixes. As a Government Accountability Office review of the program noted, the FCC could improve performance goals and measures, consumer outreach, and fraud risk management. The FCC is working to do so.

But those reforms should not take our eyes off the crisis close at hand. Two years ago, the government came together in an unusually bipartisan way to assure that all could afford the broadband service they need in their homes to fully participate in the economy and society. Since then, the importance of broadband for accessing essential services has only grown. We should make the years ahead be the ones when we finally close the digital divide—not allow it to grow even more.

2 notes

·

View notes

Text

Oh. OH.

This isn't really about breaking up United Healthcare as a company. This is about Pharmacy Benefit Managers.

Pharmacy Benefit Managers are scum of the earth middle men who are supposed to "negotiate" drug prices between pharmacies, insurance companies, and drug makers. This would be fine (maybe) if you didn't have groups like United Healthcare or Cigna or CVS who provide insurance AND run pharmacies AND have their own PBMs who negotiate prices for those pharmacies and insurers. So the people who are setting the prices of the drugs you are buying, deciding the insurance coverage for the drugs, and negotiating the prices from drug manufacturers are all the same person.

You can see how this would be ripe for abuse, right?

So this bill would force insurers and PBMs to divest from their pharmacies. This is Senator Elizabeth Warren doing what she does best - protecting American consumers from corporate greed.

75K notes

·

View notes

Text

Can’t bring myself to be upset or outraged about a healthcare CEO being shot dead like. Keep squeezing people and trap them in the psychological nightmare that is navigating health insurance in this country and eventually people are going to go insane. My father-in-law was once driving to an imaging appointment when he got a call from Cigna that they had just decided not to cover that specific provider and he now needed to drive to a new location that was TWO HOURS AWAY. A friend of ours had a massive blood clot in her leg and she spent 3 months fighting with insurance to cover the removal procedure while the thing just grew and grew, making the eventual procedure more complicated and extending the recovery time (they also denied coverage for pain meds in the meantime, saying Tylenol should be fine!) One time a neighbor was denied coverage for a routine skincare screening and the agent told him, “Yeah, we literally just had a meeting where they announced this new policy.” Like that’s the thing, health insurance isn’t just cruel, it’s capricious and opaque. A deadly combination.

#I acknowledge this might not be what motivated the shooter#like it could be some guy that he owed money to or something who knows

1 note

·

View note

Text

For no related reason at all to the recent shooting of a healthcare company CEO, here was the letter I wrote to Cigna last year after they threatened the literal livelihood of my fiancé and I over his medically necessary orthognathic surgery <3

First of all, if there are any minimum wage employees reading this that probably had no other choice but to take a shitty job at Cigna to pay your bills and feed your family, I'm sorry, this isn't about you. This is directed at the people in charge of this scam "insurance company".

Dear shitbags,

I find it devastatingly ironic how you can make social media and newsletter posts about "avoiding insurance scams" and "healthcare fraud" when you yourselves are plainly and provenly running the biggest healthcare scam of all. It's the foundation and unspoken motto upon which your bullshit corporation operates. In 2022 you were literally sued by the US government for artificially inflating the payments you needed to receive for providing insurance coverage to your Medicare Advantage plan members. Then you paid $172,294,350 to "resolve those allegations". It's bad enough you expect anyone to believe you have a shred of integrity after that. Now you are being hit with class-action lawsuits because of the way you systematically deny patient claims. All because you want to save your precious pennies (have to get that million dollar salary somehow!) and not fund the care that your patients pay for and trust you to cover. You simultaneously gaslight patients into accepting that the care they need isn't "medically necessary", while also pretending your patients are sicker than they are in the face of the goverment so that you may obtain more funds from them. You break down patient claims for surgeries into the most granualar of operations so that you can decide that two out of three of them are "medically necessary", but just on a technicality is that third one "purely cosmetic". You want to talk about cosmetic? How about all that Botox you Cigna execs inject yourselves with to look less like the lizards you are? The best part is, you do all this hoping the patient will roll over and submit to you lest they be saddled with thousands in medical debt and an impossible appeal process (or just fucking die so you don't have to deal with them anymore). How precious is that?

You sick fucks are truly deranged and I hope you go as bankrupt financially as you are morally. You are hideous, inside and out. Cheers, cuntbags <3 have a wonderful next few months of ruining people's lives through the holidays. Fuck you.

1 note

·

View note

Text

What is Health Insurance? A Beginner's Guide

The global health insurance market size was USD 3.30 Trillion in 2022 and is expected to register a rapid revenue CAGR of 5.6% during the forecast period. Increasing Gross Domestic Product (GDP) and healthcare expenditure and elderly population and rising prevalence of chronic illness, cost of medical care, and government's initiatives for development of surgical reimbursement policies are key factors driving market revenue growth.

The report on Global Health Insurance Market added by Emergen Research offers a comprehensive analysis of the recent advancements in the Health Insurance industry and trends driving the growth of the market. It is an investigative study covering analysis of market drivers, restraints, challenges, threats, and growth prospects in the global Health Insurance market. The global Health Insurance market report is a methodical research of the Health Insurance market done by extensive primary and secondary research. The fundamental purpose of the Health Insurance market report is to offer an accurate and strategic analysis of the Health Insurance business sphere.

Get Download Pdf Sample Copy of this Report@ https://www.emergenresearch.com/request-sample/2422

Competitive Terrain:

The global Health Insurance industry is highly consolidated owing to the presence of renowned companies operating across several international and local segments of the market. These players dominate the industry in terms of their strong geographical reach and a large number of production facilities. The companies are intensely competitive against one another and excel in their individual technological capabilities, as well as product development, innovation, and product pricing strategies.

The leading market contenders listed in the report are:

Allianz, Elevance Health, Inc., Centene Corporation, Aetna Inc., Kaiser Foundation Health Plan, Inc., Cigna Healthcare, Highmark Health, United Health Group, Jubilee Holdings, and Ottonova

Key market aspects studied in the report:

Market Scope: The report explains the scope of various commercial possibilities in the global Health Insurance market over the upcoming years. The estimated revenue build-up over the forecast years has been included in the report. The report analyzes the key market segments and sub-segments and provides deep insights into the market to assist readers with the formulation of lucrative strategies for business expansion.

Competitive Outlook: The leading companies operating in the Health Insurance market have been enumerated in this report. This section of the report lays emphasis on the geographical reach and production facilities of these companies. To get ahead of their rivals, the leading players are focusing more on offering products at competitive prices, according to our analysts.

Report Objective: The primary objective of this report is to provide the manufacturers, distributors, suppliers, and buyers engaged in this sector with access to a deeper and improved understanding of the global Health Insurance market.

Emergen Research is Offering Limited Time Discount (Grab a Copy at Discounted Price Now)@ https://www.emergenresearch.com/request-discount/2422

Market Segmentations of the Health Insurance Market

This market is segmented based on Types, Applications, and Regions. The growth of each segment provides accurate forecasts related to production and sales by Types and Applications, in terms of volume and value for the period between 2022 and 2030. This analysis can help readers looking to expand their business by targeting emerging and niche markets. Market share data is given on both global and regional levels. Regions covered in the report are North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Research analysts assess the market positions of the leading competitors and provide competitive analysis for each company. For this study, this report segments the global Health Insurance market on the basis of product, application, and region:

Segments Covered in this report are:

Insurance Type Outlook (Revenue, USD Billion; 2019-2032)

Hospitalization

Income Protection

Critical Illness

Medical Insurance

Service Provider Outlook (Revenue, USD Billion; 2019-2032)

Public

Private

Insured Type Outlook (Revenue, USD Billion; 2019-2032)

Senior Citizens

Adults

Minors

Browse Full Report Description + Research Methodology + Table of Content + Infographics@ https://www.emergenresearch.com/industry-report/health-insurance-market

Major Geographies Analyzed in the Report:

North America (U.S., Canada)

Europe (U.K., Italy, Germany, France, Rest of EU)

Asia Pacific (India, Japan, China, South Korea, Australia, Rest of APAC)

Latin America (Chile, Brazil, Argentina, Rest of Latin America)

Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of MEA)

ToC of the report:

Chapter 1: Market overview and scope

Chapter 2: Market outlook

Chapter 3: Impact analysis of COVID-19 pandemic

Chapter 4: Competitive Landscape

Chapter 5: Drivers, Constraints, Opportunities, Limitations

Chapter 6: Key manufacturers of the industry

Chapter 7: Regional analysis

Chapter 8: Market segmentation based on type applications

Chapter 9: Current and Future Trends

Request Customization as per your specific requirement@ https://www.emergenresearch.com/request-for-customization/2422

About Us:

Emergen Research is a market research and consulting company that provides syndicated research reports, customized research reports, and consulting services. Our solutions purely focus on your purpose to locate, target, and analyse consumer behavior shifts across demographics, across industries, and help clients make smarter business decisions. We offer market intelligence studies ensuring relevant and fact-based research across multiple industries, including Healthcare, Touch Points, Chemicals, Types, and Energy. We consistently update our research offerings to ensure our clients are aware of the latest trends existent in the market. Emergen Research has a strong base of experienced analysts from varied areas of expertise. Our industry experience and ability to develop a concrete solution to any research problems provides our clients with the ability to secure an edge over their respective competitors.

Contact Us:

Eric Lee

Corporate Sales Specialist

Emergen Research | Web: www.emergenresearch.com

Direct Line: +1 (604) 757-9756

E-mail: [email protected]

Visit for More Insights: https://www.emergenresearch.com/insights

Explore Our Custom Intelligence services | Growth Consulting Services

Trending Titles: Geocell Market | Pancreatic Cancer Treatment Market

Latest Report: Ceramic Tiles Market | Life Science Analytics Market

0 notes

Text

As someone who works for the hospital’s billing ☝️☝️everything this person said is correct! Peer to peer reviews are a great way to get your claims accepted. I once came across a claim where an insurance denied because the person didn’t bleed enough internally to meet an inpatient stay. Can’t remember the insurance carrier, but I would bet my bottom dollar it’s either UHC or CIGNA.

Hey did you know this is happening with Cigna too?

AI isn’t coming for your healthcare.

It’s already here.

UnitedHealthcare, the largest health insurance company in the US, is allegedly using a deeply flawed AI algorithm to override doctors' judgments and wrongfully deny critical health coverage to elderly patients. This has resulted in patients being kicked out of rehabilitation programs and care facilities far too early, forcing them to drain their life savings to obtain needed care that should be covered under their government-funded Medicare Advantage Plan.

It's not just flawed, it's flawed in UnitedHealthcare's favor.

That's not a flaw... that's fraud.

52K notes

·

View notes

Text

Sinus Dilation Devices Market Analysis: Applications, Technologies & Growth 2023 - 2030

The global sinus dilation devices market size is estimated to reach USD 5.69 billion by 2030, registering a CAGR of 9.6%, according to a new report by Grand View Research, Inc. Changes in lifestyle, increasing cases of obesity, and a resultant rise in the incidence of sinus-related conditions are the major factors contributing to the market growth. The introduction of technologically advanced devices is also one of the key factors boosting market growth. Major market players are focusing on R&D activities to introduce minimally invasive procedures creating a positive impact on the adoption of MIS procedures.

Some of the inventions in the market related to endoscopic approaches include a nasal endoscope, rhinoscopes, and balloon sinus dilation devices. An increase in medical reimbursements across major markets is likely to fuel the market growth. Rising adoption of health insurance and growing per capita expenditure coupled in developed as well as developing countries is predicted to augment the market growth.

Gather more insights about the market drivers, restrains and growth of the Sinus Dilation Devices Market

In November 2017, Entellus Medical, Inc. announced that Anthem, Inc., an American health insurance company, provided insurance coverage for Balloon Sinus Dilation (BSD) used in the treatment of recurrent acute sinusitis and chronic sinusitis. Anthem, Inc. is a member of the Blue Cross Blue Shield Association, the second-largest health benefits plan provider that covers around 40 million people in the U.S. Other major health insurance companies providing coverage for standalone BSD are Medicare, Aetna, Cigna, TRICARE, Humana, Health Net, Kaiser, and United Healthcare.

Browse through Grand View Research's Medical Devices Industry Research Reports.

The global nasal packing devices market sizewas valued at USD 205.2 million in 2024 and is projected to grow at a CAGR of 5.1% from 2025 to 2030.

The global ligation devices market sizewas estimated at USD 1.2 billion in 2024 and is expected to grow at a CAGR of 7.0% from 2025 to 2030.

Sinus Dilation Devices Market Segmentation

Grand View Research has segmented the global sinus dilation device market on the basis of product, Type, procedure, application, end-use, and region:

Sinus Dilation Devices Product Outlook (Revenue in USD Million, 2018 - 2030)

Ballon Sinus Dilation Devices

Endoscopes

Sinus Stents/Implants

Functional Endoscopic Sinus Surgery (FESS) Instruments Set

Others

Sinus Dilation Devices Type Outlook (Revenue in USD Million, 2018 - 2030)

Sinuscopes

Rhinoscopes

Sinus Dilation Devices Procedure Outlook (Revenue in USD Million, 2018 - 2030)

Standalone

Hybrid

Sinus Dilation Devices Application Outlook (Revenue in USD Million, 2018 - 2030)

Adult

Pediatric

Sinus Dilation Devices End-use Outlook (Revenue in USD Million, 2018 - 2030)

Hospitals

Ambulatory Surgical Centers

ENT Clinics/In Office

Sinus Dilation Devices Regional Outlook (Revenue in USD Million, 2018 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

Australia

Thailand

South Korea

Latin America

Brazil

Mexico

Argentina

Middle East and Africa

South Africa

Saudi Arabia

UAE

Kuwait

Key Companies profiled:

Medtronic

Smith+Nephew

Stryker

Intersect ENT, Inc

Olympus Corporation

SinuSys Corporation

Johnson & Johnson Services, Inc.

TE Connectivity

InnAccel Technologies Pvt Ltd

Order a free sample PDF of the Sinus Dilation Devices Market Intelligence Study, published by Grand View Research.

0 notes

Text

youtube

"It is important to note that CVS got big through a series of acquisitions and not due to its quality of service."

It is also important to note that CVS owns Aetna health insurance AND it owns Caremark (a Prescription Benefits Manager, which determines which drugs will be accessible to customers and where) AND it owns multiple chains of doctors offices. TALK ABOUT CONFLICTS OF INTEREST. CVS is being investigated by the DOJ for violating antitrust law and suspected Medicare overcharging.

And CVS/Aetna isn't the only megaprovider threatening the safety of its patients. UnitedHealth Group owns United Healthcare, OptumRx (PBM), Optum Health (doctors offices), and has a deal with Walgreens through their Medicare Advantage plan. UHG is also being investigated by the DOJ for violating antitrust regulations and Medicare billing practices on suspicion of doctors mischaracterizing patients illnesses to increase payments from the government.

And Cigna owns PBM and prescription mailing service Express Scripts. They do not own any doctors offices or brick and mortar pharmacies. Cigna is not being investigated by the DOJ at the moment, but they are trying to buy Humana (a Medicare advantage provider), which shows their vested interest in becoming like the other two megaproviders.

All 3 companies' respective Prescription Benefits Managers are suing the FTC for trying to stop them from overcharging for insulin.

#american healthcare#health insurance#prescription drug coverage#medicare part d#Youtube#More Perfect Union#pharmacies#CVS#Walgreens#Express Scripts#Medicare

0 notes

Text

🌟 Hello, Tumblr! 🌟

We’re so excited to introduce In Network Providers, your new go-to platform for finding healthcare providers that accept your insurance.

Whether you’re with Medicare, Aetna, Cigna, or another insurance plan, we make it simple to connect with doctors, clinics, and hospitals near you. No more guessing, no more surprise bills—just reliable, in-network care at your fingertips.

👉 Visit us at innetworkproviders.net to start your search today. Your health, your network, your choice! 💙

Follow us for tips on navigating healthcare, saving on medical expenses, and making the most of your insurance. Let’s make healthcare easier together!

#InNetworkProviders#HealthcareMadeSimple#HealthInsurance#FindYourProvider#AffordableCare#InNetworkCare

0 notes

Text

Cosmetic Dentistry: Have You Had It? Is It Worth It? (Veneers in Particular)

A beautiful smile can significantly boost your self-confidence in today's image-conscious society. Cosmetic dentistry offers a range of procedures to enhance your smile, with veneers being a popular choice. But is it worth the investment? Let's delve into the world of veneers and explore the benefits and considerations.

What are Veneers?

Veneers are thin, custom-made shells bonded to your teeth' front surface. They can be used to correct a variety of cosmetic dental issues, including:

Discolored Teeth: Veneers can mask stubborn stains that don't respond to whitening treatments.

Chipped or Cracked Teeth: They can repair damaged teeth and restore their natural appearance.

Gaps Between Teeth: Veneers can close gaps and create a more uniform smile.

Misaligned Teeth: In some cases, veneers can subtly correct minor misalignments.

Unevenly Shaped Teeth: They can reshape teeth that are too long, short, or irregularly shaped.

The Benefits of Veneers

Enhanced Appearance: Veneers can dramatically improve the appearance of your smile, making it more attractive and youthful.

Boosted Confidence: A beautiful smile can boost your self-esteem and make you feel more confident in social and professional settings.

Durability: Well-maintained veneers can last many years, providing a long-term solution to cosmetic dental problems.

Minimal Tooth Preparation: Compared to other cosmetic procedures, veneers require minimal tooth preparation, preserving more of your natural tooth structure.

Is It Worth It?

The decision to get veneers is a personal one. While they can offer significant benefits, weighing it's essential to weigh the costs and potential drawbacks. Veneers are a considerable investment, and the procedure is irreversible. It's crucial to consult with an experienced cosmetic dentist to determine if veneers are the right choice for you.

Considering Veneers? Consult with the Experts at Metropolitan Dental Arts

At Metropolitan Dental Arts, our skilled dentists can assess your needs and recommend the best treatment options. We prioritize patient comfort and satisfaction, ensuring a positive and transformative experience.

Schedule a consultation today if you're considering cosmetic dentistry, including veneers. We'll help you achieve the smile you've always dreamed of.

We offer Aetna, Ameritas , Argus, Assurant, Careington , Cigna, Connection Dental / GEHA, CSEA, Delta Dental, Dental Health Alliance, Emblem Health, Empire Blue Cross Blue Shield, Guardian, Humana, Local 3, Metlife , Principal, United Concordia, and United Healthcare.

#cosmetic dentistry#veneers in brooklyn#brooklyn dentist#metlife dentist brooklyn#cigna dentist brooklyn#principal dentist brooklyn

0 notes