#chipmaker

Explore tagged Tumblr posts

Text

Broadcom Stock Surges as Chipmaker Touts AI Revenue Growth

Key Takeaways The S&P 500 added 0.6% on Friday, March 7, after the February jobs report showed a slight recovery in hiring from the previous month. Broadcom shares soared after the chipmaker topped quarterly estimates, highlighting strong AI-driven growth. Shares of Hewlett Packard Enterprise dropped after the IT services provider issued soft profit guidance and announced cost-cutting…

0 notes

Text

Hackers Exposed Android Chips

0 notes

Text

📈 Intel's Shares Surge as the Chipmaker Explores Strategic Options

In an encouraging turn for investors, Intel’s shares rose over 3% on Friday following a report that the struggling chipmaker is exploring strategic options, including a potential merger or split. The news comes after one of the steepest declines in the stock’s history, sparking renewed investor interest. 💡

Why This Matters for Intel and the Tech Industry

Intel is reportedly considering separating its flagship product business from its loss-making manufacturing unit, a move that could significantly reshape the company's future. As Intel grapples with the capital-intensive task of expanding chip production and transitioning into a contract manufacturer for other firms, these strategic options offer a potential path to recovery in the highly competitive chip market.

🎯 Key Benefits for Stakeholders...Get the full story here

#Intel#Chipmaker#TechNews#AI#Nvidia#AMDRivalry#MarketUpdate#InvestmentStrategies#TechInnovation#SMMSoftwareLTD

0 notes

Link

#AI#AMD#AMDVersal#Arm#artificialintelligence#Blackberry#chipmaker#Cognata#ECARX#EmbeddedWorld#Futurride#Hesai#LiDAR#lidarreferencedesign#Luxoft#QNX#Qt#RoboSense#SEYOND#SonySemiconductorSolutions#Subaru#SubaruEyeSight#sustainablemobility#Tanway#VersalAIEdgeSeriesGen2#VersalPrimeSeriesGen2#Visteon#XYLON

0 notes

Text

Micron Technology Surpasses Expectations, Sparks Stock Surge in Tech Sector #advancedmemorysolutions #analysts #CEO #chipmaker #cloudandenterprisesectors #digitaltransformation #earningsreport #globaleconomicuncertainties #investors #laptops #marketgrowth #memorychips #MicronTechnology #netincome #pricetargets #revenue #SanjayMehrotra #servers #Smartphones #stock #technologysector #WallStreetexpectations

#Business#advancedmemorysolutions#analysts#CEO#chipmaker#cloudandenterprisesectors#digitaltransformation#earningsreport#globaleconomicuncertainties#investors#laptops#marketgrowth#memorychips#MicronTechnology#netincome#pricetargets#revenue#SanjayMehrotra#servers#Smartphones#stock#technologysector#WallStreetexpectations

0 notes

Text

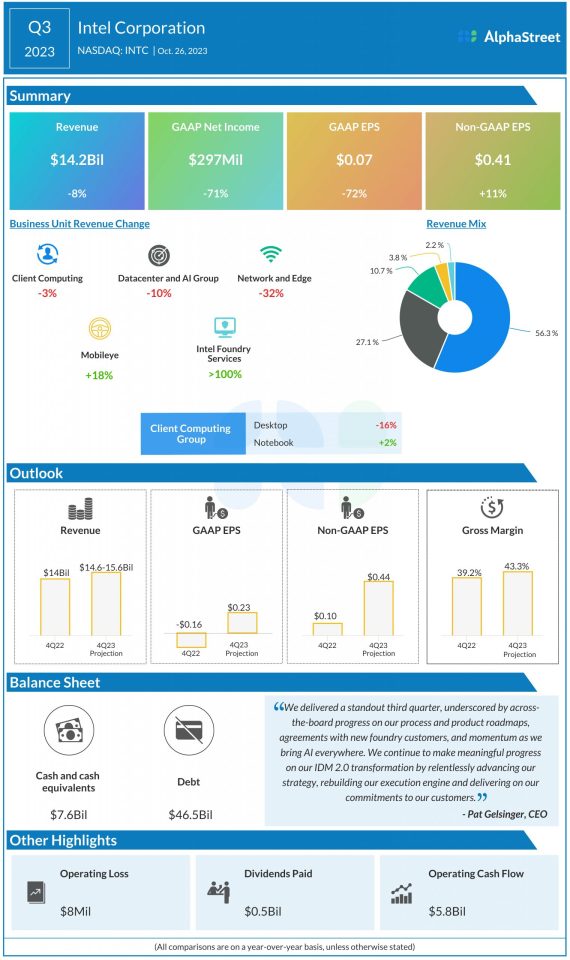

Intel (INTC) all set to report Q4 2023 results. Here is what to look for

Intel Corporation (NASDAQ: INTC) is preparing to report fourth-quarter results on Thursday after the bell, amid expectations for a positive outcome. The company reported revenues above the high end of its guidance in the most recent quarter when earnings also benefited from expense discipline. The value of Intel’s stock nearly doubled in the past twelve months, but it is still far below the 2021…

View On WordPress

0 notes

Link

Price lower than competitors Intel has finally released its Arc A580 graphics card. It was originally announced along with older models more than a year ago, but for some reason, Intel decided to delay the release of the card. Be that as it may, today we have an official re-announcement, all the parameters, and even reviews, which we will read in the next news. [caption id="attachment_64943" align="aligncenter" width="780"] Intel[/caption] The most important thing for a new product is the price. It is set at just $180. It's quite cheap. This is cheaper than the GeForce RTX 3050 and Radeon RX 6600, with which the new product was released to compete. The latest ones in the US start at $210. Intel released a video card for $180 with a 256-bit bus and 8 GB of memory. [caption id="attachment_64944" align="aligncenter" width="780"] Intel[/caption] Let's remember that the Arc A580 is based on the same GPU as the older A700 models, but has 24 Xe cores (or 3072 ALU units). There is also 8 GB of memory, a 256-bit bus, which is no longer found in new cards in this segment, and the TDP is 185 W. At the moment, the Arc A580 will be available on the market only in the form of three models ASRock, Sperkle, and Gunnir.

#Chipmaker#Intel#Intel_achievements.#Intel_advancements#Intel_Corporation#Intel_developments#Intel_hardware#Intel_innovations#Intel_news#Intel_processors#Intel_products#Intel_software#Intel_technology#semiconductor_company#technology_company

0 notes

Text

India renews call for chipmakers as Anil Agarwal’s efforts drag

Due to the slow progress of projects already announced, such as billionaire Anil Agarwal’s $19 billion proposal, India is redoubling its efforts to attract potential chipmakers to the nation. According to those who know about the situation, New Delhi intends to restart the application process for the $10 billion in incentives and assistance intended to promote domestic chip making.

They noted the elimination of a previous 45-day deadline for submission as another benefit of keeping the process open-ended; they wished to remain anonymous because the discussions are private. That comes after a first effort launched last year only managed to attract three applicants, all of whom have made just minimal advancement thus far. For more reads : Latest business news

0 notes

Text

The Microchip: Powering the AI Revolution and Fueling Geopolitical Tensions

(Images created with the assistance of AI image generation tools) The explosive growth of artificial intelligence (AI) is the result of a confluence of factors, most notably the surge in available data and remarkable advancements in computing power. While the abundance of data has been pivotal in training sophisticated models, this post highlights the central role of microchips in the…

0 notes

Text

#ChipMaking#EUVLithography#ASMLInnovation#TSMCDominance#ChineseChipAdvances#RareEarthsHold#QuantumComputingRace#GlobalTechCompetition#USChinaTechWar#SemiconductorSupplyChain#AITechnologyRise#DefenseIntelligenceChips#StemEducationInnovation

0 notes

Text

#Semiconductor_Manufacturing_Equipment is the backbone of modern technology, enabling the production of advanced microchips for electronics, AI, and automation. Precision, innovation, and efficiency drive the future of chipmaking.

#SemiconductorManufacturing#ChipMaking#TechInnovation#Semiconductors#AdvancedManufacturing#NanoTechnology#Electronics#Automation#FutureOfTech#Microchips#AI#SmartTechnology#Engineering#Industry40

0 notes

Text

Semiconductor Stocks Surge on NVIDIA’s Stellar Performance

In a remarkable show of strength, semiconductor stocks experienced notable gains, driven by NVIDIA Corporation's (NASDAQ) impressive 8.1% rally—the company's best performance in over six weeks. This surge has had a ripple effect across the sector, boosting several key suppliers and broader chipmaking stocks.

Leading the charge, NVIDIA’s suppliers saw significant advances. Taiwan Semiconductor Manufacturing Company (TSMC) (TW:2330) and SK Hynix Inc (KS:000660) rose between 4% and 8%, while Hon Hai Precision Industry (Foxconn) (TW:2317) and Advantest Corp. (TYO:6857) also enjoyed substantial gains. This uptick reflects strong market confidence in the semiconductor industry’s prospects.

In addition to NVIDIA’s direct suppliers, other chipmaking giants also saw improvements. Japan’s Tokyo Electron Ltd. (TYO:8035) increased by 3.3%, and Renesas Electronics Corp (TYO:6723) climbed by 1.5%. SoftBank Group Corp. (TYO:9984), with its stake in chipmaking through its Arm subsidiary, saw a notable 7.4% rise.

Samsung Electronics Co Ltd (KS:005930), a major player in the memory chip sector, rose 1.4% following reports that the company is considering global job cuts of up to 30% in some divisions. Meanwhile, China’s largest chipmaker, Semiconductor Manufacturing International Corp (HK:0981), increased by 0.4%.

The tech sector's broader gains were also evident in internet giants. Alibaba Group (NYSE) (HK:9988), Baidu Inc (HK:9888) (NASDAQ), and Tencent Holdings Ltd (HK:0700) experienced rises between 1% and 3%, reflecting a positive sentiment across tech stocks.

This surge in semiconductor stocks highlights a strong market reaction to NVIDIA’s performance and an optimistic outlook for the tech industry, underlining its resilience and growth potential.

#Semiconductors#NVIDIA#TechStocks#Chipmakers#TSMC#SKHynix#Foxconn#Advantest#TokyoElectron#SamsungElectronics#SoftBank#SMIC#Alibaba#Baidu

0 notes

Text

Chipmaker Broadcom Faces Revenue Slowdown, Explores New Opportunities for Growth #Broadcom #chipmaker #costcuttingmeasures #diversificationefforts #ethernetswitches #futuregrowth. #industryexperts #Innovation #netincome #networkingbusiness #researchanddevelopment #Revenuegrowth #routers #semiconductorindustry #sharebuybackprogram #smartphoneprocessors #strategicacquisitions #taxrate #tradetensions #USandChina #wirelesscommunicationbusiness

#Business#Broadcom#chipmaker#costcuttingmeasures#diversificationefforts#ethernetswitches#futuregrowth.#industryexperts#Innovation#netincome#networkingbusiness#researchanddevelopment#Revenuegrowth#routers#semiconductorindustry#sharebuybackprogram#smartphoneprocessors#strategicacquisitions#taxrate#tradetensions#USandChina#wirelesscommunicationbusiness

0 notes