#tradetensions

Explore tagged Tumblr posts

Text

Central Bank of Nigeria Injects $197.71 Million into Forex Market to Stabilize Naira as Global Trade Tensions Rise over Trump’s New Tariffs http://dlvr.it/TJzQdJ Follow, Like & Share

0 notes

Text

Canada wants to be "close friends" with France due to conflicts with the US.... http://dlvr.it/TJZmjf

0 notes

Text

#TradeTensions#TrumpTariffs#MarketVolatility#TechIndustryWoes#RetirementWealthGrowth#BirdFluOutbreak#GlobalTradeImpacts#EconomicUncertainty#AIInnovation#SocialSecurityDebate#AgricultureChallenges#ConsumerSpending

0 notes

Text

Tariff Troubles: Can Trump and Starmer Strike a Deal?

Trade tensions between the USA and UK have heightened recently. With figures like former President Donald Trump and current UK Labour leader Sir Keir Starmer involved, the question arises: can they strike a deal or will it lead to a trade war brewing with increased tariffs? In this article, we’ll explore the current tariff troubles and what they could mean for each country. Understanding Trade Tensions Trade tensions refer to the ongoing conflicts between two countries over tariffs, regulations, and political disagreements. These tensions can impact national economies significantly, leading to increased costs for consumers and businesses alike. According to recent reports, the USA and the UK have faced several economic confrontations since Brexit. Both countries could see bad outcomes if issues remain unresolved. Who Are the Key Players? - Donald Trump: Former President and a major advocate for “America First” policies. - Keir Starmer: Labour Leader keen to strengthen UK’s relationship with other countries. Both men hold distinct views on trade that can either exacerbate tensions or promote collaboration. Trump’s Trade Policies During his presidency, Trump engaged in various trade wars, particularly with China. He imposed several tariffs, with the aim of protecting American jobs but it also resulted in higher prices for consumers. Importantly, many economic analysts pointed out that tariffs can often backfire, hurting the very industries they were intended to help. Additionally, Trump often expressed frustration with the EU and the UK's trade agreements. A strong advocate for changing international trade rules, he has indicated a desire to ensure any trade deal primarily benefits the USA. Starmer's Approach to Trade Keir Starmer's leadership has focused on rebuilding the UK's international standing post-Brexit. He aims to create new favorable trade agreements while ensuring the UK's economy remains strong. Starmer believes constructive dialogue with the USA is essential. He is less inclined towards confrontational tactics and more about achieving common ground. His vision emphasizes collaboration over conflict. The Potential for a Deal Could these two diverse leaders find a middle ground to address their tariff troubles? Many experts suggest there is a chance for cooperation. If they can discuss shared interests, it may work in favor of both countries. What a deal could include: - Extended cooperation on security and defense. - Agreements to lower specific tariffs which would benefit industries on both sides. - Environmental standards to enhance sustainability within trade. Could this lead to an overall reduction of trade tensions? Possibly—if both sides refuse to be too hard-headed. The Stakes of Tariff Troubles The stakes couldn’t be higher. Studies show that unnecessary tariffs could lead to a significant loss in GDP for both the USA and the UK. For instance, economic analysts from the Peterson Institute for International Economics predict that persistent tariffs could cost the American economy around $30 billion per year. While the USA continues to balance trade deficits, the UK seeks to rediscover its footing. Resolving tariff troubles is crucial for maintaining at least moderate economic growth rates. Public Sentiment Interestingly, public opinion toward these leaders can shift as trade negotiations progress. If Trump adopts a more conciliatory stance, it could improve his position among moderates. Meanwhile, Starmer's potential pitfalls might come if consumer prices rise significantly due to tariffs. As Andrew Bailey, Governor of the Bank of England, and many other economic leaders suggest, “Awareness and adaptation to trade circumstances are key.” It highlights the necessity of keeping the public informed about the cost implications of ongoing tariffs.

UK USA Trade Deal Possible Challenges in Negotiations Despite a broad focus on cooperation, challenges prevail. Trump’s past unpredictability could hold negotiations back. Also, Starmer has to contend with domestic pressures within his party where some call for a more robust stance against US economic policies. Several analysts point out that Trump remains beholden to his base, which may complicate any relations he seeks to establish. Trade conflicts could impede both politicians’ aims for compromise. The Consequence of a No Deal If no deal emerges, we could see a setback across industries. Rising tariffs might lead to retaliatory measures, deepening a trade war that harms both economies. Permitting tensions to grow unchecked could escalate into long-term economic strife. For example, increased consumer prices could lead to inflation, affecting everything from food to manufacturing costs. Additionally, neutral perspectives warn that rules-based international order is hanging in the balance with potential implications for global trade cooperation. Conclusion: Finding Common Ground? Trade tensions show no signs of waning, leaving both Trump and Starmer in a fascinating political landscape. Can they strike a deal or risk fostering a deeper trade war? As much as they are different in style and perspective, mutual interests could open the door for agreements that limit tariffs and promote trade. Both leaders stand at a crossroads, where resolving tariff troubles could shine a light on hope amidst instability. A meeting of minds could reveal that a cooperative approach is essential for navigating the complex relationships forming between the USA and UK. Let’s watch out for what comes next. Will it be deal or no deal, and how will it affect trade tensions moving forward? References - Peterson Institute for International Economics - Bank of England Economic Reports - Various economic analysis articles and reports Read the full article

0 notes

Text

Canada Prepares for Tariff Standoff with the US: “Nothing is Off the Table”

As the United States considers imposing 25% tariffs on Canadian goods, Canadian leaders have pledged a unified response, with Prime Minister Justin Trudeau affirming, “Nothing is off the table.”

The potential tariffs, expected to be implemented under the administration of President-elect Donald Trump, aim to pressure Canada to address concerns about illegal immigration and drug smuggling into the US. With 75% of Canadian exports relying on the US market, the proposed measures could have devastating economic effects.

In a high-level meeting with provincial and territorial premiers, Trudeau emphasized Canada’s commitment to standing up for its economy and citizens. "We will protect Canadians and ensure the burden is shared across the country," he said. Support for sectors affected by the tariffs was also promised.

Energy Exports at the Forefront Energy policy has become a focal point in Canada’s response strategy. Alberta Premier Danielle Smith, whose province plays a critical role in energy exports to the US, refused to sign a joint statement supporting possible retaliatory energy tariffs. She vowed to protect Albertans’ livelihoods from what she called “destructive federal policies.”

Meanwhile, other leaders, including the premiers of Ontario, Quebec, and Newfoundland, have signaled openness to using energy exports as leverage. Newfoundland and Labrador Premier Andrew Furey likened energy to Canada’s “queen” in a game of chess, suggesting it could be a decisive bargaining chip.

Canada supplies a significant portion of the US’s crude oil, natural gas, and electricity, with 40% of crude in US refineries originating from Canada. Energy-related countermeasures could therefore have a profound impact on both nations.

Economic Impact and Strategic Challenges Economic analyses predict Canada’s GDP could shrink by up to 5.6% if blanket tariffs are imposed, while the US could see a GDP reduction of up to 1.6%. The Canadian auto industry, heavily concentrated in Ontario, could lose up to 500,000 jobs, with Alberta potentially losing 50,000 jobs in its energy sector.

Experts caution that responding strategically to an unpredictable US administration will be a challenge. "We need to be smarter in how we respond, and that’s tricky," said Drew Fagan, a professor at the University of Toronto.

Domestic and Political Tensions The looming trade conflict comes as Canada grapples with domestic political challenges. Trudeau has announced he will step down in March, with his Liberal Party set to choose a new leader ahead of an anticipated spring election.

Despite fractures in the Canadian leadership’s approach, Trudeau reaffirmed a commitment to a robust response, saying, “We’re all united in recognizing the need to act decisively.”

With the deadline for US tariffs approaching, Canada’s next steps could shape the future of its economic and political relationship with its largest trading partner.

0 notes

Text

Trump's Trade Adviser Cautions Against Currency Manipulation Amid China's Consideration of a Weaker Yuan

#CurrencyManipulation#TradeAdviser#WeakerYuan#ChinaTradePolicy#GlobalEconomy#TradeTensions#TrumpAdministration#CurrencyWar#YuanDevaluation#USChinaRelations

1 note

·

View note

Text

🌍 China Strikes Back: Gallium and Germanium Export Ban Escalates Global Tensions 🚨

China has banned exports of gallium, germanium, and tightened controls on antimony to the U.S., intensifying the ongoing tech trade war. These materials are essential for semiconductors, solar panels, and defense technologies, putting pressure on global supply chains.

Key Impacts of the Ban

1️⃣ Semiconductors: Gallium and germanium are critical for advanced chips used in AI and telecommunications. 2️⃣ Defense Industry: Antimony controls could disrupt production of night-vision systems and military hardware. 3️⃣ Renewable Energy: Solar panels relying on gallium may face rising costs and delays.

Experts warn this move highlights the fragility of global supply chains and the high stakes of the U.S.-China tech rivalry.

📖 Read more about how this ban could reshape global trade and innovation

0 notes

Text

Europe's Recovery: Investing in a Resilient Economy with Potential Risks #Europerecovery #EuropeanCentralBankstimulus #eurozoneresilience #investinginEurope #investmentlandscape #longtermperspective #potentialrisks #tradetensions

#Business#Europerecovery#EuropeanCentralBankstimulus#eurozoneresilience#investinginEurope#investmentlandscape#longtermperspective#potentialrisks#tradetensions

0 notes

Text

US-China Relations: Navigating Challenges for Stability #HongKongprotests #securitychallenges #technologydisputes #tradetensions #USChinarelations

0 notes

Text

The U.S. Debt Ceiling and Its Global Implications

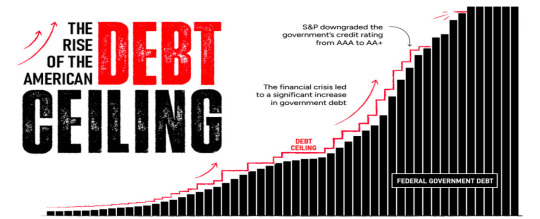

Every country’s financial structure houses various integral concepts that dictate its economic narrative. One such pivotal yet complex concept is the ‘debt ceiling.’ Frequently appearing in U.S. financial news, the term ‘debt ceiling’ refers to the maximum limit set by Congress on the amount of national debt that the U.S. government can accrue to meet its financial obligations. The term ‘ceiling’ signifies a limit beyond which the national debt cannot extend.

What is the Debt Ceiling

The debt ceiling functions as a regulatory limit on the amount of national debt the U.S. Treasury can accrue to pay for the expenditures that Congress has already approved. It acts as a checkpoint to monitor and control government spending.

Over the past century, the debt ceiling has been raised or suspended multiple times, each change reflecting the evolving realities and necessities of government spending and borrowing. It’s an interesting dance between policy, spending, and repayment, and an essential cog in the wheel of U.S. financial mechanisms.

Why is the U.S. in Debt and Unable to Repay It?

Over the years, the U.S. has built up a colossal national debt, a daunting figure that’s largely the outcome of varied factors such as heavy government spending, enduring economic crises like the 2008 financial meltdown, the COVID-19 pandemic, and certain tax policies that have influenced the debt scenario.

The complex challenge of repaying this debt is deeply intertwined with the global economic structure’s complexities. While it’s easy to assume that the trade deficit, characterized by a higher import volume than export, contributes to the debt, it doesn’t directly add to the national debt. However, it does play a role in influencing the overall economic health of the nation and indirectly impacts the debt situation.

But, what are the reasons that the U.S. has hit the debt ceiling and is not able to overcome it?

Government Spending: The U.S. government spends substantially on various programs such as defence, healthcare, social security, and interest payments on the national debt. This spending often exceeds the government’s revenues, resulting in a deficit that adds to the national debt.

Economic Crises: Economic downturns often necessitate increased government spending to stimulate the economy and provide relief.

Tax Policies: Tax policies also play a role in the debt scenario. Tax cuts, while potentially stimulating economic growth, can decrease government revenue, thus increasing the deficit if not accompanied by corresponding reductions in government spending.

Interest Payments: As the national debt grows, so does the interest the government must pay on that debt. These interest payments can become a significant part of the budget, leaving less room for other spending priorities and creating a cycle that can cause the debt to grow even further.

Managing and repaying the U.S. debt is a complex issue that involves a careful balance of government spending and revenue, fiscal policy decisions, and managing the country’s economy in the context of a global economic system.

The Size and Scope of U.S. Debt

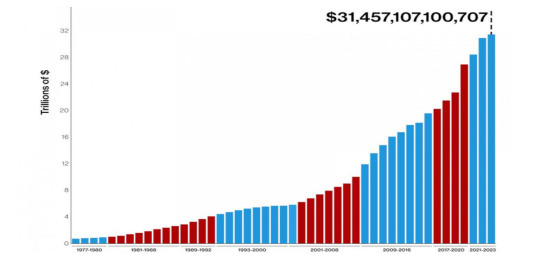

As of 2023, the U.S. national debt stands at a staggering $31.4 trillion, earning the country the status of being the world’s largest debtor.

Where Does the U.S. Borrow From?

The United States acquires debt by issuing Treasury securities like Treasury bonds, notes, and bills. These financial instruments are bought by a wide array of investors, including individuals, corporations, and foreign governments.

Who Are Its Biggest Lenders?

The U.S.’s most substantial debt holders on the international front are Japan and China. Other countries, including the United Kingdom, Brazil, and Ireland, also hold significant portions of U.S. debt. The United States owes Japan approximately $1.28 trillion, while China holds around $1.06 trillion of U.S. debt. The amounts owed to other lenders vary, typically falling into the range of billions of dollars.

Consequences of Hitting the Debt Ceiling

The U.S. hitting its debt ceiling can have significant global implications due to the interconnectedness of today’s global economy.

Here are some potential global consequences:

Impact on Global Markets: The U.S. Treasury market is the largest and most liquid bond market in the world. If the U.S. defaults on its debt obligations, it could cause widespread volatility in global markets. Investors, both domestic and foreign, might start doubting the creditworthiness of the U.S., causing a sell-off of U.S. Treasury securities that could disrupt financial markets worldwide.

Currency Fluctuations: The U.S. dollar is the world’s primary reserve currency, meaning many countries hold it in large quantities to carry out international trade. A U.S. debt default could weaken the dollar, leading to currency fluctuations and economic instability globally.

Global Economic Slowdown: The U.S. economy plays a vital role in driving global growth. Any economic disruption in the U.S., like a recession triggered by a debt default, could have a domino effect on the world economy, potentially leading to a global economic slowdown or recession.

Impact on Foreign Debt Holders: Countries like China and Japan, which hold significant amounts of U.S. debt, could face losses if the U.S. were to default. This could impact their economic stability.

Reduced Confidence in Global Financial System: The U.S. is seen as a global economic leader, and its debt is considered one of the safest investments. A debt default could shake confidence in the global financial system, leading to economic uncertainty and reduced investment.

Potential for Increased Borrowing Costs: If a U.S. default leads to a downgrade in its credit rating, borrowing costs for the U.S. could increase, which could then impact borrowing costs globally. This could make it more expensive for governments, businesses, and individuals worldwide to borrow money.

Here are some potential individual consequences:

In short, the U.S. hitting its debt ceiling and potentially defaulting on its debt repayments could have serious, far-reaching consequences for the global economy. It highlights the need for prudent fiscal policy not only for the U.S. but for economies around the globe. But, what will the citizens of the U.S. face because of hitting its debt ceiling?

The wrangling over the debt ceiling can create economic uncertainty, negatively impacting consumer and business confidence. This can lead to reduced business investments, job cuts, and slower economic growth.

The government might have to make tough choices about which bills to pay. This could put programs like Social Security, Medicare, and military pensions at risk, directly affecting the citizens dependent on these programs.

The uncertainty and the potential for increased government borrowing costs can trickle down to the public in the form of higher interest rates for mortgages, auto loans, student loans, and credit cards.

The debate and uncertainty surrounding the debt ceiling often lead to stock market volatility. This can affect the retirement savings and investment portfolios of everyday Americans.

The Domino Effect: Recession and Layoffs

The repercussions of the U.S. hitting its debt ceiling can go far beyond its own borders, owing to the country’s significant role in the global economy. A notable concern is the potential for a worldwide economic recession and the dreaded consequence – mass layoffs.

As the keystone of global markets, the U.S. economy’s health directly influences financial currents worldwide.

Imagine this: the U.S., unable to lift its debt ceiling, defaults on its debt. This scenario would unsettle financial markets and could seriously undermine investors’ confidence. The ensuing decline in investments can ripple through economies, leading businesses to scale back or shut down, manifesting the dire reality of layoffs.

A U.S. default could also send shockwaves through economies heavily reliant on exporting to the U.S. A debt default could trigger a contraction in the U.S. economy, causing a slump in demand for imports. As a result, these export-dependent economies may see their growth slow down, potentially leading to job cuts in various sectors.

A U.S. debt default could create a ripple effect in global interest rates. As investors’ confidence shakes, they may demand higher returns to compensate for the increased risk, causing a surge in global interest rates. This increase in borrowing costs can hurt businesses and households, leading to a decline in spending, further slowing economic growth, and potentially driving more layoffs.

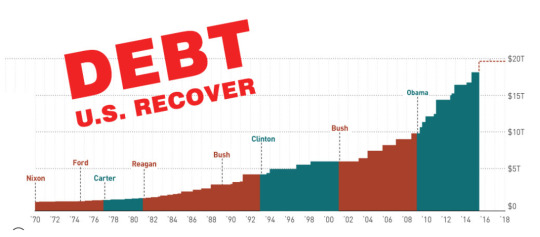

How Will the U.S. Recover from This Debt?

Recovering from such an overwhelming amount of debt is a long-term and complex process. It requires the implementation of severe cost-cutting measures, comprehensive tax reforms, and strategies to stimulate economic growth.

An integral part of this process is maintaining fiscal discipline to prevent uncontrolled debt accumulation. However, these measures must be carefully balanced to ensure that they don’t hinder economic growth or place an unfair burden on the nation’s citizens.

Read more at: https://dsb.edu.in/the-us-debt-ceiling-and-its-global-implications/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=tumblr+us+debt

#USDebtCeiling#GlobalImplications#EconomicImpact#FinancialMarkets#USFiscalPolicy#DebtCrisis#EconomicOutlook#FinancialStability#GovernmentShutdown#GlobalEconomy#USDollar#TradeTensions#MonetaryPolicy#BudgetDeficit#EconomicForecast#india#fintech#jobs#banking#education#google#ai#blockchain

0 notes

Text

youtube

The EU has launched antitrust actions under the Digital Markets Act against Google and Apple for anti-competitive practices. Google is accused of favoring its services, while Apple must improve interoperability. Non-compliance could mean fines up to 10% of global revenue.

New Scientists Awards

Nomination Link: https://newscientists.net/award-nomination/?ecategory=Awards&rcategory=Awardee

Web Visitors: https://newscientists.net/

For Enquiry: [email protected]

#sciencefather #scientificexcellence #scientist #excellence #researcher #scientificexcellence #EUAntitrust #DigitalMarketsAct #TechRegulation #Google #Apple #TrumpTariffs #USTech #EURegulation #TradeTensions

Get Connected Here:

=================

Twitter: https://x.com/awards67811

Instagram: https://www.instagram.com/afreen202564/

blogger: https://www.blogger.com/blog/posts/8014336030053733629?hl=en&tab=jj

Pinterest: https://in.pinterest.com/scienceawards/

0 notes

Text

French President Emmanuel Macron Calls for Suspension of Investments in the U.S. Amid Tariff Dispute http://dlvr.it/TJxh3Y Follow, Like & Share

0 notes

Text

"Alibaba Group Posts Strong Financial Results for December Quarter 2022 - A Testament to Its Resilience and Diversified Business Model!"

“Alibaba Group Posts Strong Financial Results for December Quarter 2022 – A Testament to Its Resilience and Diversified Business Model!” #AlibabaGroup #FinancialResults #DecemberQuarter2022 #EarningsReport #RobustGrowth #CoreCommerceBusiness #CloudComputing #DigitalMedia #Resilience #DiversifiedBusinessModel #ChinaMarket #TradeTensions #GlobalEconomy #InvestmentOpportunities The article reports…

View On WordPress

0 notes

Text

What you don’t see about the Canadian dollar and what nobody will tell you!

Summary

The US dollar index is in a bounce mode to the upside; I expect another 3% appreciation in the US dollar index before it falls by at least around 7%. This should help to buy an underpriced Canadian dollar (short the USDCAD pair). We are not there yet.

Long term, I am bullish in the Canadian dollar (bearish in the USDCAD pair); however, in the short term, the USDCAD pair may close at 1.33. Right now, it is trading at 1.2970.

I expect the USDCAD pair will trade between 1.25 and 1.33 for a long time. However, in the future, once the 1.25 is broken to the downside, I see 1.17 as the next floor.

While it is always good to know about the news that impacts the Canadian dollar, such as changes in the NAFTA, the recent weakness in oil, the low Canadian central bank interest rates, or the likely overvaluation of Canadian real estate, it should only be used as a reference, but not acted upon. By the time you read the news, it will already be old news for the “smart money”.

The truth is that it is better to pay attention to upcoming events instead of reading the news. The fx rate always reflects the latest news. We are heading into next week’s Bank of Canada interest rate announcement on May 30th, followed by the first-quarter Gross Domestic Product figures on Thursday, May 31st. Mark these types of events in your calendar, because they are more worthy of your consideration, given the likely surprises, instead of the old news that is already reflected in the fx rate.

Technical Analysis approach: focus on price

If I had to pick one approach to analyze what can happen to the Canadian dollar in the short and long term, I would pick technical analysis because it allows me to create good risk reward trade setups with a long term perspective. Additionally, it allows for the use of a classical and simple chart with only price and price levels with neither indicators nor oscillators.

The forex market is bigger than the bond or equity market, so it makes more sense to assume that fundamentals quickly catch up with price in fx markets. This may be why there are smart value investors that do well managing equity portfolios by only using fundamentals, but it is not that simple with fx. For starters, fx doesn’t move like stocks from a risk reward perspective; fx is better traded in a mean reversion style that uses longer time frame charts and a momentum or trend style for shorter time frames.

Having said that, here are the monthly and weekly charts of the loonie.

Monthly chart

In this monthly chart, you see the Fibonacci levels drawn from a high in 2002 to a low in 2008. Pay attention to the 0.618 and 0.382 Fibonacci levels, which are around 1.33 and 1.17. This means that the USDCAD can get stuck between the two levels for a long time. For this monthly chart, once we have a breakout above 1.33 or a breakout below 1.17 that is driven by fundamentals or global events, we will be able to see the loonie going to different levels. However, until then, we are stuck between 1.17 - 1.33. Also, remember that the longer we stay within these levels, the larger the potential breakout. Additionally, if we break outside of these levels soon, it might not last and it might come back to the same range as a failed breakout, which normally has the opposite effect. For the near term (next few days/weeks), I am planning to swing trade on the short side of the USDCAD only if we are in the yellow area of the chart above. However, I would not touch the USDCAD if we are in the red area of the chart above. In general, the green area can be a profit taking area or opening for new short trades in case we are below the declining resistance. It all depends on the timing of when we are in those areas and the magnitude of the news and market sentiment.

The 1.25 level is an important level as well, which should be used as a pivot point. Apart from 1.25 level, the psychological level of 1.30 is also important (we are only 25 pips below!). Of course as you can see in the chart above, the 1.30 is an approximate level because there is a declining resistance as of this month at around 1.31, which means the longer we stay below 1.30, the lower the declining resistance. So, this might be a topping pattern, but once the declining resistance is broken to the upside, there is a risk of the resistance breaking out of 1.33ish (0.618 Fibonacci level). If this happens, all the fundamental excuses in the media will also take place, such as the FED further tightening their monetary policy, or the Bank of Canada keeping lighter monetary policies for a longer time. However, remember that Fibonacci levels (with support and resistance coincidences) are inflection points; traders expect some type of price action, either a break or a rejection.

Weekly chart

In the weekly chart, we don't use Fibonacci (I did not find that the Fibonacci levels coincided with the support and resistance levels). However, we do see a beautiful pattern that started in 2015 and ended in September 2017. Yes, it was a head and shoulder pattern, which even though is completed, as of today, is showing lower highs and lower lows. This means that the loonie can get stronger in the long term (USDCAD would go lower), which aligns with my bullish long term view of commodities. The weekly chart above shows that there is likely a “bear flag” in the USDCAD pair - the bear flag is the red area in the chart above (bullish in the Canadian dollar)!

Mean reversion and trend following trading of the loonie

In addition to the monthly and weekly charts, it is important to recognize changes in trends and to go with the trend before opening a trade, which means being a momentum trader in shorter time frame charts and having the big picture of mean reversion for longer time frame charts. These setups are the best risk reward trades. Never solely rely on mean reversion trading, because you can get burnt if you use it for all of the time frames. I.e. don't be a hero and go against the trend, especially in shorter time frames. However, for longer time frames, it is good to go against the herd with mean reversion strategies.

It is important to wait for an event like a Bank of Canada policy interest rate announcement and wait for the right set up...but how? See the daily chart below and use the lines drawn as inflection points (Fibonacci and pivots).

Again, just to clarify, technical analysis for the loonie, or for any other fx pair, is the best way to go because everything (fundamentals, opinions, and hidden large trades) is reflected in the price. The chart above is what I am mostly going to use over the following few days or weeks to swing trade the loonie.

Canadian dollar and intermarket analysis

By looking at the US dollar index in the following monthly chart, we see that it would be a bit risky to go against the US dollar or against the USDCAD as of now. So, be careful to be bullish in the loonie if the US dollar index is getting strong. I will explain why. The US dollar index has recently been moving with strength to the upside and we just ended the week at 94.25, within a range of around 90 and 102. This range is clearly seen using two important Fibonacci levels for the US dollar index (0.618 = 101ish and 0.382 = 89ish). This is why intermarket analysis is important, and it would be perfect to have the USDCAD close to 1.33 and the US dollar index close to 102 to go long in the loonie, that would be the perfect scenario.

Monthly chart of the US dollar index

By having a closer look at the US dollar index again and by redrawing Fibonacci levels from different points, the monthly chart of the US dollar index below showed the end of a Fibonacci extension of 1.618 on January 2017, which had a price around 103ish. This means that we might have a strong ceiling around the 1.382 Fibonacci level, representing a price between 96 and 97. Additionally, there might be another 3% appreciation to the upside in the US dollar index. In conclusion, I would take my chances to have a bearish view of the US dollar once the expected appreciation of 3% takes place (but not yet).

Taking the 2008 lows (70ish) and 2009 highs (close to 90) as Fibonacci extensions allows for the perfect long term set up to go bearish in the US dollar index at around 96–97 (1.382 Fibonacci) and to have a first target price of 90 (the old high in 2009). I expect that USDCAD can go lower (strong loonie) with the latest bullish leg of commodities that I think will continue over the following months, no matter where and when the FED continues to push its US rate.

Monthly chart of the US dollar index with Fibonacci extensions

The price of crude also has some influence on the loonie. Oil WTI has completed the Fibonacci extension to 1.618, getting close to US$ 73, and it is now going to at least US$ 66ish in the form of a healthy correction, as shown in the chart below.

Weekly chart of OIL WTI

We might have a period of consolidation in crude WTI between 66ish and 73ish, with a worst case scenario of it going to 60ish. This can help my view of having the extra 3% of weakness in the loonie.

Why is Fibonacci important? Please read the following Investopedia link about Fibonacci. Are you not convinced? Are those just a bunch of numbers? Well, I thought the same thing many years ago, but I like to use Fibonacci only when I see it coincide with real support and resistance levels after I draw a Fibonacci retracement or projection. It doesn’t have to be exact, but when they coincide, I am certain that it is important to use Fibonacci. And, guess what? I have found many fx pairs that coincide with Fibonacci in both long and short time frames, which doesn’t really happen that often with stocks. In my opinion, Fibonacci levels work the best for fx. You also can read about the statistical importance of Fibonacci (within technical analysis) in the following IFTA article (page 4–9).

Remember that, for long term trading, if simplicity is used well, it is better than trying to understand macroeconomic complexity. We don’t need to embrace complexity in order to find the best timing to buy or sell fx rates. Isaac Newton once said:

“Truth is ever to be found in the simplicity, and not in the multiplicity and confusion of things.”

If you are a Canadian exporter, the risk of receiving US dollars in the future is that you might have to receive less Canadian dollars if the loonie appreciates along with commodities, which I believe will happen after the US dollar ends its recent bounce to the upside.

0 notes

Text

Discover the Exciting Growth of Chinese Stocks: NIO, Pinduoduo, JD.com, and More! #Chinarenewableenergy #digitalpayments #ecommercegiantJD.com #electricvehiclemakerNIO #electricvehicles #governmentpolicies #growthopportunities #highqualitycompanies. #investinginChinesestocks #onlineretailplatformPinduoduo #onlineshopping #regulatoryuncertainties #tradetensions #USlistedChinesestocks

#Business#Chinarenewableenergy#digitalpayments#ecommercegiantJD.com#electricvehiclemakerNIO#electricvehicles#governmentpolicies#growthopportunities#highqualitycompanies.#investinginChinesestocks#onlineretailplatformPinduoduo#onlineshopping#regulatoryuncertainties#tradetensions#USlistedChinesestocks

0 notes

Text

Joe Biden and Xi Jinping Meet to Improve U.S.-China Relations: What You Need to Know #climatechange #humanrights #JoeBiden #NorthKoreanuclearprogram #southchinasea #taiwan #technologycompetition #tradetensions #U.S.Chinarelationship #XiJinping

#Politics#climatechange#humanrights#JoeBiden#NorthKoreanuclearprogram#southchinasea#taiwan#technologycompetition#tradetensions#U.S.Chinarelationship#XiJinping

0 notes