#car loan balance transfer and top-up

Explore tagged Tumblr posts

Text

Maximize Savings with Car Loan Balance Transfer and Top-Up

Unlock the potential for significant savings and financial flexibility with our Car Loan Balance Transfer and Top-Up services. Tailored for those seeking to optimize their existing car loan conditions, this program allows you to transfer your current loan to a new lender offering lower interest rates, reduced EMI options, or better loan terms. Additionally, benefit from our Top-Up loan feature, providing you with extra cash for any immediate needs without the hassle of taking out a new loan.

0 notes

Note

Please explain how to write out a personal ledger like I’m 5 (my budget is getting tighter and I always pay my bills before any other spending but I’m tired of passively spending and wondering where 50 bucks went at the end of the month)

OK

I have a five year old and if I explained this to you like you were five it would not be useful to you in your mid twenties

I do mine on the computer, I have a file in Microsoft Excel because I have Excel, but any spreadsheet program would work I'm sure, you could probably use Google sheets or whatever it’s called

warning: if you follow this method you will know how you spend your money

So what I do is this

I have a sheet set up as follows:

Column A is "Date," which is the date I spent the money

Column B is "Date Posted," which is the date the transaction actually clears my bank

Column C is "Amount," or the amount spent/moved/deposited. This will be a positive or negative number depending on whether you are adding or subtracting money from the account

Column D is "Category," which is very important for making this data useful for a budget. Categories will probably be subjective but the ones that I mainly use are:

Bill - this is for a regular monthly expense necessary to live, like car insurance, electricity, the mortgage, phone, etc.

Debt - this is for money I flush down the toilet. I used to have a separate category for "Medical Debt" but now it's all just Debt. Credit card payments and student loans. And medical debt.

Gas - when I buy gasoline it gets its own category

Groceries - as the name implies this is when I buy food from a grocery store, as distinct from:

Takeout - this is when I eat out, have delivery, fast food, etc., unhealthy sodium-saturated food prepared by someone else for immediate consumption

Misc - this is the useless category in which all other spending is absorbed, including my irresponsible purchases.

I also have the following categories:

Deposit - for when money goes in

Transfer - for when money is moved to or from another account

Withdrawal - for when I remove cash

Obviously you could have other categories for expenses you want to track more closely. Clothing might warrant its own category, or books, or snacks, which are sort of between takeout and groceries, or whatever.

Column E is "Location," which is where I spent the money. I usually try to write this how it appears on my ledger, which is not always where I remember physically spending it. For example, my wife's Old Navy card shows up as Barclay Card on the ledger, which has been the object of much confusion, leading to

Column F is "Notes," where I elaborate when Column E doesn't make very much sense. What is Barclay Card? Oh, the Old Navy card.

One place in which Columns E and F work together most regularly is on paydays, when E gives the name of the employer and F gives whose payday it is.

Column G just says "Balance," which I leave in cell G1 permanently, and then Column H / cell H1 is a running balance, which you can see above I let Excel calculate using a simple formula that takes the sum of all additions and subtractions in column C

Now, these features might be exclusive to Excel but I'm sure you could find equivalents in other spreadsheet programs. I have Row 1 / Top Row "Frozen" so that I can always see the column names and the balance as I scroll down. I also have columns A through F set to "filter," which is why they have the little drop-down arrow on the right-hand side, and this, as the name implies, lets me filter. So if you want to look at a specific category, or specific place, or something. I most often use this to filter out all but the current month in Column A, and to keep my transactions in the right chronological order.

Once its set up, and this is the painful part, you need to keep track of every single penny you spend. You can do this in the old-school way by keeping receipts or if you have online banking and they're pretty on top of things you can look at your bank ledger at the end of the day and add the day's transactions then. But if you let it sit more than a day or two you will have unpleasantness and it will only get worse the longer it sits. This is where having a Date and Date Posted column comes into play. There are some bills I have that take several days to post. My mortgage for example, which is my largest single bill, takes about four days to clear. My wife's student loans, the second largest bill, take about a week to go through. So I put those on my ledger the day I submit the payment and then they show up in the bank ledger a few days later and I note that as well. PayPal transactions also tend to take several days to go through. The other reason having a Date and a Date Posted column is nice is when you have to self-audit because there's a discrepancy between your balance and the bank’s, you can use the sort/filter function to sort your transactions by the date posted which makes it easier to compare your ledger to your bank.

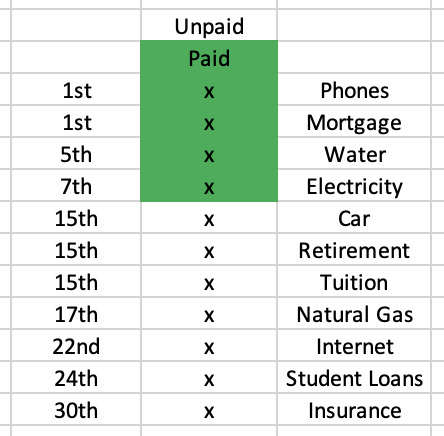

The other thing I do is I have a little portion of the spreadsheet off to the side where I keep all of my fixed bills and their due dates and keep track of when I pay them in a month. The Unpaid / Paid cells at the top are so I can copy and paste the format of those cells as the month goes on. As the months go on I have to cut and paste this to keep it close to the end of the ledger. You don't really need to have this but I do, it helps me decide which paycheck pays which bills and when every month.

The other thing is I have a different sheet for every year, because I don't want a spreadsheet with 10,000+ rows. You could have a different sheet for every month or whatever, I don't know. I did it by year.

If you keep on top of this you will know better than your bank how much money you have at all times.

30 notes

·

View notes

Text

Top 10 Money Management Tips for Financial Success

New Post has been published on https://sistamagazine.co.za/top-10-money-management-tips-for-financial-success/

Top 10 Money Management Tips for Financial Success

Managing money effectively is essential for achieving financial stability and security. Whether you’re just starting your financial journey or looking to improve your current situation, these top 10 money management tips can help you achieve your goals and build a solid foundation for your future financial success.

document.write('<a href="https://c.trackmytarget.com/?a=tff010&i=h0oxit" target="_blank" rel="nofollow"><img loading="lazy" decoding="async" src="https://i.trackmytarget.com/?a=tff010&i=h0oxit" width="970" height="250" border="0" />');

document.write('<a href="https://c.trackmytarget.com/?a=ij2cwj&i=h0oxit" target="_blank" rel="nofollow"><img loading="lazy" decoding="async" src="https://i.trackmytarget.com/?a=ij2cwj&i=h0oxit" width="970" height="250" border="0" />');

(adsbygoogle = window.adsbygoogle || []).push();

Create a Budget: Establishing a budget is the cornerstone of effective money management. Track your income and expenses to understand where your money is going each month. Allocate specific amounts for necessities like housing, groceries, utilities, and transportation, and set aside a portion for savings and discretionary spending.

Live Within Your Means: Avoid overspending by living within your means. Don’t rely on credit cards or loans to fund a lifestyle you can’t afford. Prioritize your needs over wants, and resist the temptation to make impulse purchases. Remember, living below your means allows you to save and invest for the future.

Build an Emergency Fund: Prepare for unexpected expenses by creating an emergency fund. Aim to save three to six months’ worth of living expenses in a separate account. This fund will provide a financial safety net in case of job loss, medical emergencies, or major car repairs, helping you avoid debt and financial stress.

Pay Yourself First: Make saving a priority by paying yourself first. Set up automatic transfers to your savings or investment accounts each time you receive income. Treat your savings like a non-negotiable expense, just like your rent or mortgage payment. Over time, these consistent contributions will grow your wealth and provide financial security.

Reduce Debt: Minimize high-interest debt to improve your financial situation. Focus on paying off credit card balances, personal loans, and other debts with the highest interest rates first. Consider debt consolidation or negotiating lower interest rates to accelerate your debt repayment process and save on interest charges.

Invest Wisely: Grow your wealth over the long term by investing wisely. Take advantage of retirement accounts like 401(k)s or IRAs to save for retirement. Diversify your investment portfolio across different asset classes, such as stocks, bonds, and real estate, to mitigate risk. Consider seeking professional advice from a financial advisor to develop a personalized investment strategy.

Track Your Spending: Monitor your spending habits regularly to identify areas where you can cut back and save more. Use budgeting apps or spreadsheets to track your expenses and identify patterns or trends. Being mindful of your spending can help you make informed decisions and stay on track with your financial goals.

Plan for Major Expenses: Anticipate major expenses, such as home repairs, vacations, or education costs, and plan for them in advance. Create sinking funds by setting aside small amounts of money each month to cover these expenses when they arise. Planning ahead will prevent you from dipping into your emergency fund or going into debt to cover unexpected costs.

Continuously Educate Yourself: Stay informed about personal finance topics and strategies to improve your financial literacy. Read books, listen to podcasts, or attend seminars to learn about investing, budgeting, and managing debt. The more you know, the better equipped you’ll be to make sound financial decisions and navigate complex financial situations.

Set SMART Goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals to keep yourself motivated and focused. Whether it’s saving for a down payment on a house, paying off student loans, or retiring early, having clear goals will help you stay disciplined and track your progress over time.

By implementing these top 10 money management tips into your financial routine, you can take control of your finances, reduce stress, and work towards achieving your long-term financial goals. Remember, financial success is not about how much money you make, but how effectively you manage and grow what you have.

0 notes

Text

Car Loan Balance Transfer Service in Varanasi

Experience seamless balance transfer and top-up » for your car loan with Bhumi Finance. Enjoy low-cost loans with high values, attractive interest rates, and flexible EMI options up to Rs. 20 lakh. Benefit from quicker processing, doorstep document collection, and pre-approved offers. Our premium services include car and life insurance, financial fitness reports, and GPS trackers. Requirements include one year of employment, minimum monthly income, and 11 months of repayment history. Self-employed individuals need a minimum ITR and repayment history. Simplify your car buying journey with our bank tie-up, offering discounts and streamlined loan processing directly at the dealership. Drive away hassle-free today!

0 notes

Text

Family Finance: American Hope Resources' Top Tips for Monthly Savings

Managing a family's finances can be both rewarding and challenging. Balancing income, expenses, and savings while ensuring your family's well-being requires careful planning and financial discipline. American Hope Resources (https://americanhoperesources.com/) recognizes the importance of family financial stability and offers valuable tips to help families save money on a monthly basis. In this blog, we'll explore some of American Hope Resources' top tips for monthly savings.

1. Create a Budget

The foundation of effective financial management is a well-crafted budget. American Hope Resources encourages families to create a monthly budget that outlines their income and expenses. By tracking where your money goes, you can identify areas where you can cut costs and increase savings.

2. Set Clear Financial Goals

Establishing clear financial goals is essential for motivating your family to save. American Hope Resources advises families to set both short-term and long-term goals, whether it's saving for a vacation, building an emergency fund, or planning for retirement. Having specific goals helps you stay focused and committed to saving.

3. Prioritize Essential Expenses

Identify your family's essential expenses, such as housing, utilities, groceries, and healthcare. American Hope Resources recommends prioritizing these expenses to ensure your family's basic needs are met. Look for ways to reduce costs, such as energy-efficient appliances or meal planning, to save on essential expenses.

4. Cut Unnecessary Costs

Evaluate your spending habits and identify non-essential expenses that can be reduced or eliminated. American Hope Resources suggests reviewing subscription services, dining out less frequently, and finding free or low-cost entertainment options. Redirect the money saved toward your savings goals.

5. Automate Savings

Automating your savings is a convenient way to ensure you consistently save a portion of your income. American Hope Resources recommends setting up automatic transfers to a savings account or retirement fund. This "pay yourself first" approach ensures that savings are a priority before discretionary spending.

6. Shop Smart and Compare Prices

Families can save significantly on everyday expenses by shopping smart. American Hope Resources advises comparing prices, using coupons, and taking advantage of discounts and cashback offers. Consider buying generic brands for groceries and household items to cut costs without sacrificing quality.

7. Reduce Debt

High-interest debt can be a major drain on your family's finances. American Hope Resources suggests developing a debt repayment plan to tackle outstanding loans and credit card balances. Paying down debt frees up more money for savings and reduces the financial stress on your family.

8. Build an Emergency Fund

Having an emergency fund is crucial for financial security. American Hope Resources recommends setting aside a portion of your income each month to build an emergency fund that can cover unexpected expenses, such as medical bills or car repairs. Having this safety net can prevent you from dipping into your savings or going into debt during emergencies.

9. Involve the Whole Family

Teaching children about money management from a young age can instill good financial habits. American Hope Resources encourages involving the whole family in financial discussions and decisions. This can include setting savings goals together, discussing the importance of budgeting, and finding ways for children to contribute to family savings.

10. Seek Professional Guidance

If your family's financial situation is complex or you're facing challenges, American Hope Resources advises seeking professional financial guidance. A certified financial planner or advisor can provide personalized strategies and solutions to help your family meet its financial goals.

Achieving monthly savings as a family is achievable with careful planning and commitment. American Hope Resources' top tips emphasize the importance of budgeting, setting clear goals, prioritizing essential expenses, and cutting unnecessary costs.

By adopting these strategies and involving the whole family in financial discussions, you can build a solid financial foundation and work toward your family's financial goals. Remember that achieving financial stability is a journey, and with the right tools and mindset, your family can enjoy greater financial security and peace of mind.

0 notes

Text

Why You Should Consider a Life Insurance Policy for Your Spouse

Introduction

Life insurance is a financial tool that provides a safety net for your loved ones in the event of your untimely demise. While many people recognize the importance of having a life insurance policy for themselves, they often overlook the significance of securing coverage for their spouses. In this article, we will explore the reasons why you should consider a life insurance policy for your spouse, highlighting the benefits it offers and the peace of mind it can provide.

Financial Protection for Your Family

One of the primary reasons to consider a life insurance policy for my spouse is to provide financial protection for your family. Losing a spouse can have significant financial implications, especially if they were a primary breadwinner or contributed significantly to the household income. A life insurance policy can help bridge the financial gap left by their absence, ensuring that your family's financial needs are met, such as mortgage payments, utility bills, and daily living expenses.

Covering Outstanding Debts

In addition to daily expenses, your spouse may have outstanding debts that need to be addressed upon their passing. These debts could include mortgages, car loans, student loans, or credit card balances. Without adequate life insurance coverage, you may find yourself responsible for paying off these debts, potentially putting your financial stability at risk. By securing a life insurance policy for your spouse, you can ensure that these obligations are taken care of, alleviating the burden on your shoulders.

Funeral and Burial Expenses

Funeral and burial expenses can be a significant financial burden for a grieving family. The cost of a funeral, casket, burial plot, and related services can add up quickly. Having a life insurance policy for your spouse can help cover these expenses, allowing you to give your loved one a proper send-off without depleting your savings or going into debt.

Providing for Children's Education

If you have children, their education is likely one of your top priorities. A life insurance policy for your spouse can ensure that there are funds available to support your children's educational needs, even if your spouse is no longer around to contribute financially. This can give you peace of mind knowing that your children's future is secure, and they can pursue their educational goals.

Maintaining Your Standard of Living

Losing a spouse can lead to a significant reduction in household income, which can affect your family's standard of living. With a life insurance policy in place, you can help maintain the lifestyle to which your family is accustomed. This means you won't have to make drastic cuts to your expenses or compromise on the quality of life for your family members.

Estate Planning and Inheritance

Life insurance can also play a crucial role in estate planning and inheritance. It allows you to designate your spouse as the beneficiary, ensuring that they receive a tax-free payout upon your passing. This can simplify the transfer of assets and wealth to your spouse, avoiding lengthy probate processes and potential estate taxes. It provides your spouse with a financial cushion and allows for a smoother transition of assets and property.

Peace of Mind and Emotional Support

While the financial benefits of a life insurance policy are evident, it's essential to recognize the emotional support it can provide. The grieving process is challenging, and worrying about financial matters during such a difficult time can add unnecessary stress. Knowing that your spouse is financially protected can offer peace of mind and allow you to focus on coping with your loss and supporting your family emotionally.

Long-Term Care and Medical Expenses

In some cases, a spouse may require long-term medical care or have ongoing medical expenses due to a chronic illness or disability. Life insurance can serve as a financial safety net to cover these costs, ensuring that your spouse receives the necessary care without depleting your savings or retirement funds. It provides a sense of security knowing that your spouse's medical needs will be met, even if you are no longer there to provide for them.

Conclusion

In conclusion, considering a life insurance policy for your spouse is a prudent financial decision that can provide numerous benefits and peace of mind. It offers financial protection for your family, covers outstanding debts, helps with funeral expenses, provides for your children's education, maintains your standard of living, simplifies estate planning, and offers emotional support during a difficult time. Additionally, it can cover long-term care and medical expenses, ensuring that your spouse's needs are met even in the face of illness or disability.

Securing a life insurance policy for your spouse demonstrates your commitment to their well-being and the financial security of your family. It is a proactive step towards safeguarding your family's future and ensuring that they can navigate the challenges that may arise in your absence. While the topic of life insurance may not be the most pleasant to discuss, it is a responsible and caring decision that can make a world of difference when it matters most. Ultimately, a life insurance policy for your spouse is an investment in your family's future and a lasting expression of love and protection.

0 notes

Text

10 Cash Advance Apps to Help You Stay Afloat Until Payday

In today's fast-paced world, unexpected expenses can leave you strapped for cash and in need of a quick solution. Whether it's a sudden car repair, medical emergency, or last-minute school expenses, you might find yourself in a tight spot with your finances. Thankfully, technology has made it easier for you to get the funds you need through cash advance apps. With lower fees than traditional payday loans and quick processing times, these apps can be a lifesaver when you're in a bind. In this article, we will explore the top 10 cash advance apps that can help cover you until payday.

CLICK HERE TO Get Cleo $250 FAST CASH ADVANCE

1. EarnIn: Best for Earnings-Based Borrowing

EarnIn is a unique cash advance app that allows you to access your money based on the number of hours you've worked. By tracking your work hours, the app enables you to borrow funds according to your earnings. In addition, EarnIn offers a notification feature that alerts you when your bank balance is low, ensuring that you stay on top of your finances.

Features

Amount: $100 to $750

Processing Time: One to two business days, with the option for instant access through EarnIn's Lightning Speed feature

Repayment: Due on your next payday

Fees: Voluntary tipping model, allowing you to choose a tip up to $14. Overdraft protection requires a recurring tip, but can be set to $0 if not needed.

Pros and Cons of EarnIn

Pros Cons Higher borrowing limit as you use the app more frequently Fees may apply for using Lightning Speed feature

2. Chime: Best for Overdraft Protection

Chime is a financial technology company that offers a checking account with SpotMe® overdraft protection. This feature allows eligible members to overdraw their accounts by up to $200 on debit card purchases without incurring fees. In addition to overdraft protection, Chime also provides a secured credit card and a savings account for users with a required checking account.

Features

Amount: Up to $200

Processing Time: Instantly

Repayment: Due on your next payday

Fees: None, with the option to tip

Pros and Cons of Chime

Pros Cons Overdraft protection up to $200 Only functions as overdraft protection Optional tipping Requires a Chime account with at least $200 in monthly direct deposits

3. Brigit: Best for Same-Day Loans

Brigit allows you to borrow up to $250 on the same day you apply, provided that your application is submitted before 10 a.m. ET. While the app requires a monthly fee to access its cash advance feature, Brigit also offers free access to financial experts who can help you manage your spending within your budget.

Features

Amount: Up to $250

Processing Time: Same-day approval if applied before 10 a.m. ET, or next business day for later applications. Instant cash may be available for users with a connected debit card.

Repayment: Scheduled according to your income, with the option to reschedule once after two on-time repayments

Fees: $9.99 per month for the Plus paid plan

Pros and Cons of Brigit

Pros Cons No late fees or penalties for delayed repayment $9.99 fee to access cash advances Option to reschedule payment Early cut-off time for same-day funding without a connected debit card Free access to financial experts No instant deposit options

4. MoneyLion: Best for Multiple Options

MoneyLion is more than just a cash advance app; it also offers financial tracking, investment accounts, and various other features to help you manage your finances. With a range of borrowing options, MoneyLion ensures that you have access to the funds you need when you need them most.

Features

Amount: $50 to $250, with larger loan amounts available for RoarMoney account holders or Credit Builder Plus members

Processing Time: 24 to 48 hours for RoarMoney account holders, three to five days for external account transfers, or instant access with a Turbo Fee

Repayment: Due on your next payday

Fees: Optional tipping, plus fees ranging from 49 cents to $5.99 for instant delivery to RoarMoney accounts and $1.99 to $8.99 for external accounts

Pros and Cons of MoneyLion

Pros Cons Access to larger loan amounts Up to eight weeks required to become eligible for maximum Instacash amount Variety of account features Fees required for same-day fund access

5. Current: Best for Checking and Spending

Although not a traditional cash advance app, Current offers Overdrive protection for users who overdraw their accounts by up to $200. This feature can provide a quick and easy solution when you're in need of a small cash infusion to tide you over until payday.

Features

Amount: $200

Processing Time: Instant

Repayment: Due on your next payday or deposit date

Fees: None

Pros and Cons of Current

Pros Cons No overdraft fees with Overdrive protection Requires minimum monthly direct deposits No monthly fees Not a true cash advance

6. Dave: Best for Highest Cash Advance

Dave offers the largest cash advance in the industry, providing up to $500 through its ExtraCash feature. New members also receive a Dave Spending Account, which allows for instant fund access with a small fee.

Features

Amount: Up to $500

Processing Time: One to three days, or instantly with an express fee

Repayment: Due on your next payday, with the option to edit the repayment date

Fees: $1 monthly subscription fee, optional tipping, and express fees ranging from $1.99 to $9.99 for Dave Spending Accounts and $2.99 to $13.99 for external transfers

Pros and Cons of Dave

Pros Cons Offers the largest cash advance in the industry Express fee required for instant fund access

7. Empower: Best for Quick Cash Advances

Empower provides cash advances of up to $250, along with an Empower Card that offers up to 10% cash back on purchases at select merchants. Additionally, the card provides free transactions at 37,000 ATMs nationwide, and Empower cardholders can receive their paychecks up to two days early

Features

Amount: Up to $250

Processing Time: Instant

Repayment: Due on your next payday

Fees: $8 subscription fee, but no interest or late fees

Pros and Cons of Empower

Pros Cons Interest-free borrowing up to $250 $8 subscription fee after a 14-day free trial

8. Payactiv: Best for Short-Term Loans

Payactiv is more than just a cash advance app; it also allows users to pay bills, access discounts on department store purchases and prescription drugs, and manage their finances all in one place. By offering a set percentage of your earnings as a cash advance, Payactiv ensures that you have access to the funds you need when you need them.

Features

Amount: A set percentage of your earnings

Processing Time: Instant access to Payactiv Card, 48 hours for other debit card transfers, or instant transfers with a $1.99 fee

Repayment: Not required, as you're accessing funds you've already earned

Fees: Free with direct deposit to Payactiv card, $1.99 fee without direct deposit, and $2.99 processing fee for cash pickup at Walmart or instant deposit to another card

Pros and Cons of Payactiv

Pros Cons Offers bill payment and product discounts Fees apply without a Payactiv card

9. Vola: Best for Same-Day Cash Advances of Up to $300

Vola is one of the few cash advance apps that offer same-day advances of up to $300 without a credit check, making it one of the easiest options for quick access to funds. With support for over 6,000 credit unions and banks, Vola provides a convenient and flexible solution for your cash advance needs.

Features

Amount: Up to $300

Processing Time: Within five hours

Repayment: Manually or automatically on the due date

Fees: Subscription fees ranging from $2.99 to $28.99

Pros and Cons of Vola

Pros Cons Same-day cash advances up to $300 Subscription fee applies No credit check required Five-day cool-off period between repayments and new advance requests

10. Albert: Best for No Late Fees

Albert is designed to simplify your financial life, offering instant cash advances and automatic repayment without any late fees. By providing a user-friendly and straightforward solution for cash advances, Albert ensures that you have access to the funds you need without any hidden costs or surprises.

Features

Amount: Up to $250

Processing Time: Instant access with a fee or two to three days for free

Repayment: Due on your next payday

Fees: No fees for instant cash advances to Albert Cash, but small fees apply for instant advances to external accounts

Pros and Cons of Albert

Pros Cons No late fees or penalties for delayed repayment 30-day free trial of Albert Genius required for Albert Instant access (can be canceled) Cash Advance Apps at a Glance

App Maximum Loan Amount Transaction Speed and Loan Fee EarnIn $750 1 to 3 days, $0.99 to $3.99 fee Chime $200 Instant, no loan fee Brigit $250 1 to 2 days, no loan fee; $9.99 subscription fee MoneyLion $250 12 to 48 hours, $0.49 to $8.99 fee Current $200 Instant, no loan fee Dave $200 Up to 3 days, $1.99 to $13.99 fee Empower $250 Instant, no loan fee; $8 subscription fee Payactiv A set percentage of earnings Instant to Payactiv Card or 48 hours for other debit card transfers, $1.99 to $2.99 fee Vola $300 Within 5 hours, no loan fee; subscription fee applies Albert $250 2 to 3 days, small fee for instant delivery Pros and Cons of Cash Advance Apps

Before choosing a cash advance app, it's important to weigh the pros and cons of each option to ensure that you select the best fit for your financial needs. While some apps may offer lower fees or larger loan amounts, others might provide additional features or faster processing times. By carefully evaluating the benefits and drawbacks of each app, you can make a more informed decision and avoid potential pitfalls.

Pros

Emergency fund access: Cash advance apps can provide a much-needed financial lifeline when unexpected expenses arise, such as car repairs, medical bills, or school costs.

Small loan convenience: For those in need of a small cash infusion to tide them over until payday, cash advance apps offer a simple and efficient solution without the hassle of traditional loans.

Cons

Fees can add up: Although many cash advance apps advertise low fees, these seemingly small costs can accumulate over time, especially if you frequently rely on the apps for financial assistance.

Potential debt cycle: With automatic repayment features and easy access to funds, it can be all too easy to fall into a cycle of borrowing and debt with cash advance apps.

FAQ

To help you make the best decision for your financial needs, we've answered some frequently asked questions about cash advance apps below.

What is the easiest app to get a cash advance? Vola allows you to borrow up to $300 without a credit check, making it one of the most accessible options. However, each app has its own eligibility criteria, so be sure to research and choose the one that best suits your situation.

What app offers the largest cash advance? Dave provides up to $500 through its ExtraCash feature, while EarnIn offers up to $750 based on hours worked.

Are cash advance apps payday lenders? No, cash advance apps are not the same as payday lenders. While both provide short-term loans, cash advance apps typically do not require credit checks and have lower fees than traditional payday loans.

What app provides a $50 cash advance? Most cash advance apps offer $50 loans if you meet their qualifications. Be sure to read the fine print and choose an app with favorable terms for your needs.

How can I borrow $300 on Cash App? The maximum borrowing limit on Cash App is $200. To access this feature, go to the "Banking" header and select "Borrow." Note that Cash App Borrow is only available to users who meet certain requirements.

In conclusion, cash advance apps can be a valuable resource for those in need of quick financial assistance. By carefully researching each app and considering your specific needs, you can find the best solution for your situation. Remember to always borrow responsibly and never take on more debt than you can afford to repay.

#cash advance#personal finance#short term loans#financial tips#emergency funds#borrowing money#payday loans#financial planning#debt management

1 note

·

View note

Text

Did you know that you could use your car to raise quick funds with Finflexi easy loan against car? Get an instant top-up on your existing car loan of up to 200% of its value. Loan on Car is the process of replacing your existing car loan with a new one or taking a fresh loan on an existing car. Loan against car can help you save money by securing a higher value on your current asset considering depreciation, convenient loan tenure options along with a competitive rate of interest to best suit the current requirement. As a result, you can decrease your monthly payments and free up cash for other financial obligations. Get Balance transfer car loan today !

1 note

·

View note

Text

Credit Counselling Services in Florida: The Best Ways to Improve Your Credit

These days, having good credit is critical to many aspects of your life, from getting approved for a car loan to qualifying for affordable apartment rentals. That’s why if you’re in Florida and want to start boosting your credit score, it’s important to understand credit counselling services inFlorida. In this guide, we cover everything from how to dispute inaccurate information on your credit report to how to obtain a copy of your report and what the three main credit reporting agencies are all about.

Understand credit bureaus

It may seem like credit bureaus are out of your control, but they’re not. The three major bureaus—Experian, Equifax, and TransUnion—are just data companies. They collect and then resell your personal information as part of their business model. To ensure you can get a loan, you must understand how these companies operate, as well as what might be hurting your score. Fortunately for consumers, there are free online tools that help illustrate potential issues. If there are credit counselling services in Florida you should take advantage of them before getting a loan.

Understand credit scoring models

While it might seem counterintuitive, staying on top of your credit score is one of the best ways to improve it. This process involves three key things:Make sure you are using your credit cards appropriately.

Don’t close any accounts, even those with high-interest rates.

Pay off your balances every month and avoid closing old accounts, which will lower your total available credit—even if that means transferring balances from a card with a higher interest rate to one with a lower rate so you can pay them off more quickly.

Make certain you are on track with your spending

It can be easy to get off track with spending. Before applying for a loan, you must have a good sense of your credit score. This can be achieved by paying close attention to monthly credit card statements and making adjustments accordingly. By working closely with a credit counselling service, individuals are on their way toward improving an existing score—which will make them more eligible for loans and other types of financing they might need. If you live in Florida, there are many credits counselling services available to help you through these processes.

Start applying for loans

If you’ve been looking for loans but haven’t received any offers, there are steps you can take to increase your credit score and get approved for a loan. One such way is through credit counselling services. A credit counsellor can help you consolidate bills, set up a payment plan, or even apply for a loan on your behalf. Regardless of what type of support they provide, they all work with an individual’s unique financial situation and help them find an alternative that works best. Credit counsellors also offer special repayment plans that may lower monthly payments and give consumers more time to pay off debt. If your plan doesn’t work out as expected, simply follow up with your lender and be sure to contact your credit-counselling service immediately if payments become delinquent.

Do not be afraid to visit retail shops and ask them if they report information to credit agencies

Credit counsellors agree that it’s critical for consumers to first know what their credit scores are, before attempting to improve them. One of many ways you can find out your credit score is by requesting a copy from one of three major credit bureaus: Experian, Equifax, and TransUnion. You can get all three reports for free. Many people also forget that most retail stores will report your payment history monthly. If a bill is not paid by its due date, then information about it will be sent out via credit agencies which could negatively affect your scores.

Don’t close accounts unless necessary

It can be tempting to close credit card accounts you don’t use often but resist that urge. Keeping your oldest accounts open and active is one of the easiest ways to improve your credit score quickly. It increases your length of credit history and lowers your average age of accounts. So, even if you don’t have any plans for those cards, don’t cancel them right away. If a card isn’t going to work for you anymore (e.g., because its rewards aren’t as valuable as its annual fee), do make sure it gets deactivated rather than cancelled—and then keep it that way for at least a year before finally closing it out completely.

Stop using cash wherever possible

The more you use credit cards, and not cash, for your purchases, the more positive points are added to your credit score. It might be best to start by switching all of your monthly bills (such as cable, internet, and insurance) over to auto-pay so that you don’t even have access to a bank card anymore. Once those are done it’s time for some damage control with your credit card usage habits. First things first: cut up all but one of your cards and shred them so that you can’t use them again until it is really necessary.

Correct any blunders as soon as you can

When your credit score is less than stellar, it can be tempting to spend months trying (and failing) to improve it. Resist that urges! Credit counselling services in Florida have discovered that fixing errors and delinquent accounts as soon as you’re made aware of them dramatically increases a person’s chances of a successful credit-score improvement. If your score is already on its way up, there’s no need for panic: Even small improvements can add up to a big difference over time. Follow these tips, and you’ll know exactly what works for you.

Contact Us :

Address - 66 W. Flagler Street, Ste. 900, Miami, FL 33130

Phone - (888) 383-8503

Email - [email protected]

Website - Credit Chix

Blog - Credit Counselling Services in Florida: The Best Ways to Improve Your Credit

0 notes

Text

Unlock financial flexibility with our car loan balance transfer and top-up services. Seamlessly transfer your existing car loan to us, enjoy competitive interest rates, and secure additional funds for your automotive needs. Experience the convenience of a hassle-free process and personalized solutions tailored to your financial goals. Drive forward with confidence – explore our car loan options today!

#car loan balance transfer and top-up#car loan balance transfer#car loan balance top-up#car loan balance

0 notes

Text

Quick Car loan with minimum documentation

The inflation rate stands much higher than a person's income growth rate, which causes trouble for many individuals who wish to own a car but cannot afford it. So, it is good to borrow money from banks and pay EMIs later on. Moreover, it also offers some tax benefits (if the car gets used for business purposes), saving your money the other way.

Why do you take a car loan?

For instance, let us assume you wish to own a car worth ten lakhs, and you start saving money for the same. By the time you accumulate the amount, it might get old. Even if you buy it then, you have already compromised your years in saving money.

But, What if you buy it the same day you thought to, and pay for it in upcoming years. That means you can drive the car while paying for it in EMIs.

How you can apply for a quick car loan?

Applying for a car loan is now hassle-free, easy, and paperless. Just make a few clicks, and you can submit the car loan application form online, from your home. Almost every bank today offers car loans at attractive interest rates.

From Where you can get the best car loan?

To help you get the lowest rate of interest for a car loan, We suggest you get one from Car galaxy.

Car Galaxy has been in the business for 20 long years. It has partnered with leading banks that have been rendering quality services for so long. Some of them are-

Axis Bank

IDFC First Bank

HDFC Bank

ICICI Bank

Bajaj finance ltd

AU small finance bank

Car galaxy offers the following plans to help you in arranging funds for your dream car-

Top-up plan -

You can borrow additional money over and above your existing car loan.

Used car loan -

You can get a loan for buying a used car at the least interest rates possible.

Vehicle refinancing -

It means applying for a new loan to pay off the old one. It results in a new interest rate, a new loan agreement, and a new loan term.

Balance transfer -

A balance transfer lets you transfer the balance from one credit card, where you may be paying interest, to another credit card. Transferring high-interest balances to a credit card that features a promotional offer or lower rate could save you money on interest repayments.

At Car galaxy, you can get correct guidance from their experienced staff who are specially appointed to guide you. So, you only need to select the model, give your details, and get your car home.

With Car galaxy, you get the most convenient and customer-friendly car loan to fulfill your dreams without facing any financial hurdles.

So do not wait for too long! Select and buy your favorite car with the financial assistance provided by car galaxy partnered banks, and pay for it later.

1 note

·

View note

Text

My Money Snapshot

[Inspired by Corporette]

Location: Ohio, small college town

Age: 29

Occupation: PhD candidate (English)/half-time instructor

Income: $16,000 before deductions

Net worth: $588 (I’m crying)

Current Debt: $12,844

Living situation: Renting with a roommate

Money Philosophy:

I grew up in the “working poor” category. My parents are divorced and my father never contributed much financially. Mom made around $21,000 per year at work and she cleaned houses “under the table” to supplement that. Somehow, we never went hungry, what we ate was relatively fresh and healthy, and she managed to put two of us through Catholic schools for a total of 14 years. I know now that mom is still paying some of those loans and credit card debts and that part of her strategy included not contributing more than the 3% that her employer matched in her 401k. Every time I complain about the financial stress I feel at my salary level, I have to remind myself how comparatively unstressful my financial life is.

I’ve always been poor and I always knew that graduate school/academia is not a lucrative career. I tell myself that if I can make things work at this pay grade, then I’m ready for just about anything. My main strategy is to have a budget, stay in the budget, and save every bit that I can.

Monthly budget

$1000-1100 for the necessities each month. Monthly spending on eating out, entertainment, shopping and other categories varies widely. I also won’t lie... dating someone who makes 4x more money than me helps... I’m fairly frugal on all of these fronts: I buy most of my clothes second hand and I tend to shop seasonally. Spikes in spending occur around the winter holidays when I’m buying gifts and when I am doing traveling. And I also have totally weak, impulsive moments - like the $3 soap sales at Bath & Body works, or that time I spent $110 on bras and underwear on a whim. Anyway:

Rent: $272.50/month

Other living expenses: $130-170/month (electric, internet, phone, renter’s insurance - lower in summer, higher in winter)

Transportation: $332/month (gas, insurance, car payment)

Healthcare: $162/month (health+dental insurance, no vision coverage)

Groceries: $120-150/month ($30/week)

Debt Picture

Student loan: $2000

Car loan: $10,488

I’m a career student & my motto for all the years I’ve been in school has been “follow the money.” I went to college on very hefty scholarships and I only had to take out the $2000 loan to cover housing costs during my first year. For the subsequent three years, I was an RA, so I never had to take loans again. I applied to graduate programs based on the research fit, and when I got my offers, money weighed heavily in the decision. I would have loved to live in Boston as a wee 22-year old, but I wasn’t about to take out loans for a year’s worth of tuition and the living expenses. And to get a PhD while living in Minneapolis, my very favorite city in the US? It would have been such a dream, but for the quite steep difference in stipends and the significant disparity in cost of living compared with Ohio. My only regret on this front is that I haven’t started paying back my tiny student loan. I’ve been able to defer it since I’m in graduate school, which was a great idea when I was a master’s student who didn’t know the first thing about budgeting. But if I had just paid $25/month from the start of grad school the balance would be $0 about the same time I graduate from this PhD program this August. Instead, I’ll be scrambling to pay off the whole balance before my 6 month grace period ends.

The car loan is less than a year old. I finally broke down and bought a new (by which I mean used) car last summer after really pushing it with the car my parents had bought me in high school. Repairing that car put me into credit card debt more than once and I was getting so stressed about it. It was time. I have a very good credit score, so I qualified for a nice loan rate with my credit union, and to get a better rate I got my mom to co-sign my loan. It’s a popular rental fleet model so there were tons of them on the market, but average miles were high - so when I saw one that was two years old with only a years worth of miles on it at $1000 less than the average price for that make, model, and year, I jumped on it. My payments are $231/month on the 5-year plan. Currently, I’m paying that minimum, but I plan to escalate my payments as my income goes up (I’m on the academic job market now, pray for me). I folded this car payment into my existing budget by giving up solo-living and finding a roommate. When I had my own apartment, very spacious with a huge kitchen and tons of windows/natural light, I was paying about $585 for monthly rent. I hate living with people, but I hated the idea of being trapped in this college town without a car even more - one of my other mantras is “you can do anything for a year.”

A note on credit cards: I love them. I’m one of those responsible people that charges everything and pays the balance like clockwork every month. This is the only way to make sure you’re actually taking advantage of the cash back/reward perks! Currently, I’m using Capital One’s Venture card and stockpiling airline miles for travel (it has a 40,000 mile sign-on bonus). If you’re good for it, I also recommend one card with a great balance transfer program. For me, when I get into an emergency situation, it makes me feel like I have options. It’s been about 4 years since I’ve had to use my balance transfer card to cover costs ($1400 in car repairs, summer 2015), but at my level, I can’t afford to not have back up plans.

Savings and Investments

$5,517 Cash

$7,861 Roth IRA + employer mandated retirement account

Retirement: The biggest financial mistake I've made in grad school is that I did not opt into the retirement account offered by the university when I started my M.A. in 2012. When they ask me that “what I wish I had known before I went to grad school” question, this is near the top of the list. I did, eventually, open a Roth IRA and slowly I started to build something. This year, when my graduate funding dried up and they made me a “half-time instructor” the retirement account for public school teachers was mandatory and the contributions are high: 14% of every pay check (annoying, yes, but on the flipside, there is an equally high employer match). While I’m contributing to this, I’ve paused my contributions to the IRA. I’ll roll this money over, either into the IRA or into another state/employer retirement fund when I move on from here.

Personal savings: I strive for a minimum of $100 per month and frequently do a little more, but each month is different and I consider it a win if I break even. Through most of grad school, I’ve taken on “second jobs” to bolster what I can save (and boost my resume). Both jobs have been through the university, so they limit me to five hours a week. When I max them out, this can be an extra $200-250 each month.

I took up a new savings challenge this academic year to build on my “play money” savings account (a high yield savings account which my bank labels a “goal setter” account). The challenge involves tallying the “total savings” printed on my receipts each month (i.e. when the grocery store is like “you saved $6″ because of sales and coupons). So, At the end of the month, I put that running total into my goal setter account. Sometimes the total savings are like $26, but others its as much as $171. It’s an interesting challenge because it encourages me to do tedious things, like scroll through all the digital coupons on the grocery store app; but at the same time, I know that the higher that number is usually coincides with a lot of shopping which encourages some self-regulation.

I initially set my goal at $2500 when I opened the goal setter account in 2014. When I had to dip into the account in April 2018 to pay $930 in car repairs, I finally set plans in motion to buy my car. Since I bought used, I only put 10% down on the car (just over $1200). When I sold my old car for $1000, I put that money right back into the account to start saving for new things...

What I’m saving for now:

travel: to celebrate finally finishing this PhD, I’m hoping to pull off a trip to Europe. Later this year, I’m also turning 30 around the same time that one of my regular professional conferences is meeting in Hawaii. If I can do one or both in the next year, that’d be grand. (As I mentioned, I'm saving up airline miles with my credit card program, too!)

a multicooker: think InstantPot...but more expensive because my dreams all revolve around small appliances that match my stand mixer.

What I do to be frugal...

I’ve been frugal my whole life, but a couple of major habits I’ve formed include:

Meal planning and home cooking (read my guide to meal prep here). The money part of that means planning what I eat around maximizing the ingredients I have to buy. I plan meals that use the same ingredients so I’m not spending on an entire bunch of celery and then throwing out 75% of it. Routinization also helps, so my grocery lists stay about the same week to week and the bill relatively predictable - for example, I eat avocado egg salad almost every day for lunch. I know, avocados are not cheap, but I also believe in spending on the things that nourish you––literally and “spiritually.” Roxane Gay once said that she never bought avocados or blueberries when she was a “poor grad student.” Once she started making money, she realized she would buy them because she could afford them, but she also threw them out all the time because she didn’t plan her meals right to actually eat them. The point is, buy the foods that you like/feel good about and build habits around them. It’s not wasted money. That said, I won’t pay more than $1.25 for an avocado!

Second hand clothes shopping, especially for my business casual (it’s amazing what people donate to the Goodwill, barely worn!)

31 notes

·

View notes

Text

Understanding Your Credit Score Is Easy

Good news! Understanding your credit score is pretty easy and you can use this knowledge to repair your guests and keep it healthy.

35 percent of your score is related to your payment history. If you have not yet had a consistent payment history, do not panic. Part of the repair process begins with reaching creditors and offices to remove inaccurate, misleading and obsolete information from your report forever. If your payments are not up to date, stay up to date and stay up to date. Creditors often work with you to create a payment plan to keep you up to date on payments. Punctual payments should be top priority. This is the easiest way to influence your credit rating. 30 percent of your score is your credit usage. Their credit utilization is extremely important and should be below 30 percent. What does that mean? Here is an example. You have three credit cards. Each card has a limit of $ 1,000. If you do not include any other open balance accounts, you have a $ 3,000 credit. $ 900 is equivalent to 30 percent of your $ 3,000 available balance. At a given time, you should not bill the three accounts together for more than $ 900. Add your balance accounts and then add how much you owe on these accounts. If it's over 30 percent, pay off the balance as soon as possible. You will notice an improvement in your creditworthiness. Bonus Tip: Do not let your credit card balance be transferred from month to month. If you can not afford to repay a balance within a month, you only spend the money if it is an absolute emergency. This will keep your credit utilization below 30 percent and immediately help your credit score. 15 percent of your score is the length of your credit rating. How long have you lent? If your credit rating is well known, you are less at risk than someone who has just started borrowing. You are more trustworthy if you can successfully prove that you can repay the borrowed money 10 percent of your score is taken into account through new accounts and loan requests. A newer credit account is a greater risk than an older credit account because you did not create a payment history. The same applies to a new loan request. If you apply for more credit, you must borrow more money for your monthly income - this tells creditors that you are spending more than you earn. 10 percent of your score is your credit mix. A good mix of loans is a great way to build good credit. A car loan, a mortgage and a credit card are a good credit mix. Read the full article

1 note

·

View note

Text

Maximize Savings: The Benefits of Car Loan Balance Transfer and Top-Up

Opting for a loan against your car has often proven to be the best way to finance the purchase of your dream car. However, circumstances can evolve, leading to a reconsideration of your existing car loan. You might come across another lender providing better terms, in such a case you can opt for a car loan balance transfer. With this option, you can shift your existing car loan to a different lender to enjoy the potential benefits of improved terms, interest rates and more convenience. In this blog, Car Kharido Becho 24 will take through the potential benefits of car loan balance transfer and top-up. So, hang tight and stick till the end:

For more Information about car loan balance transfer and top up click the link below: https://carkharidobecho24.com/maximize-savings-the-benefits-of-car-loan-balance-transfer-and-top-up/

0 notes

Text

How To Refinance A House Loan In Qatar

How To Refinance A House Loan In Qatar

In a bid to make your life simple, we have come up with this post. Our intention of this blog article is to provide you all the details about how to refinance a house loan in Qatar. All you need to do is read through and get the information that would serve you best.

Visit For More Info.

What is a Refinance Loan?

A refinance loan is a new loan taken out to replace an existing loan. The new loan may have different terms and conditions than the original loan, including a different interest rate, repayment schedule, or term length. borrowers typically refinance loans in order to get a lower interest rate, shorten the repayment period, or both.

When you refinance your mortgage, you are essentially taking out a new loan to pay off your existing mortgage. This new loan will typically have different terms than your original mortgage, including a different interest rate and/or repayment schedule.

What are the Benefits of Refinancing?

There are many benefits of refinancing a house loan in Qatar. Some of the most common reasons to refinance include:

-To save money on interest payments: When you refinance, you may be able to secure a lower interest rate than what you're currently paying. This can lead to significant savings on your monthly mortgage payments.

-To shorten the term of your loan: If you're looking to become mortgage-free sooner, refinancing can help. By refinancing into a shorter loan term, you'll pay off your mortgage faster and save on interest costs overall.

-To consolidate debt: If you have high-interest debt such as credit card debt, car loans, or personal loans, consolidating this debt into your mortgage can save you money in the long run. Not only will you benefit from a lower interest rate, but you'll also have just one monthly payment to make instead of multiple payments.

How to Pay Off Debt with a Personal Loan

If you're looking to pay off debt with a personal loan, there are a few things you'll need to consider. First, you'll need to find a personal loan that has a lower interest rate than the debt you're looking to pay off. This will help ensure that you save money in the long run.

You'll also need to make sure that you can afford the monthly payments on the personal loan. If you can't, you may want to consider another option, such as a balance transfer credit card or debt consolidation loan.

Once you've found a personal loan with favorable terms, it's time to apply. You can do this by visiting the lender's website or going through an online marketplace like Lending Tree.

If everything looks good, you'll be able to sign the loan agreement and get started with repayments right away. Just be sure to stay on top of your payments so that you can get out of debt as quickly as possible!

Conclusion

Refinancing your house loan in Qatar is a great way to save money on your monthly payments and reduce the overall cost of your loan. There are a few things to keep in mind when you're shopping for a new loan, but if you do your research and compare offers, you should be able to find a great deal. We hope our guide has helped you learn more about refinancing your house loan in Qatar and how to get started.

Champions Mortgage

Mortgage Broker Melbourne

Finance Mortgage Brokers Melbourne

Finance Brokers Melbourne

Finance Brokers in Melbourne

First Home Buyer Loans Melbourne

Home Loan Mortgage Broker

Home Loan Broker Melbourne

Mortgage Melbourne

Refinance Loan Melbourne

Investment Loans Melbourne

Commercial Loan Brokers Melbourne

Commercial Mortgage Melbourne

Personal Loans Melbourne

Car Loans Melbourne

Vehicle Finance Melbourne

First Home loan melbourne

home loan melbourne

0 notes

Text

Qube review

Qube review registration#

Your first instant transfer is free, and you’ll pay a 4% fee each time after that. If your bank is in Plaid’s network (most banks are), you can connect it directly to your Qube account to instantly transfer up to $250 at a time. You can fund your Qube account in several ways: There’s no minimum opening deposit requirement, so you can set up your account anytime and transfer money into it whenever you’re ready.

Qube review registration#

To sign up for Qube Money, add your details into its online registration form on the website or in the app. Quick Sign-Up With No Minimum Opening Deposit It then returns your card to the default $0 balance. When you swipe, tap, dip, or enter your card, the app records the transaction in your account and updates the balance in the corresponding qube. Qube also helps you keep track of the purchases you do follow through on. Qube simply creates a system that lets you see the ramifications of spending choices before you make them. You have complete control over how you use the money in your account. Don’t have enough in your “dining out” qube? You could pull from your “wedding savings” qube, or you could pass on dinner plans and stay in for the night. Unlocking a qube before you spend forces you to reckon with your budget in real time the way taking cash out of envelopes does. But its real benefit is its ability to curb overspending and balance your budget. That comes with a serious security benefit - your bank account balance is protected in case your card is stolen. When you want to make a purchase - either by typing your card info in for online checkout or by swiping your debit card - you have to unlock a qube in the app to instantly fund your card. Your debit card doesn’t carry a balance until you choose a qube to unlock from the app. The secret to changing your spending habits with Qube is that you have to make real-time spending choices. For online bill pay, the app draws from an assigned qube automatically based on customized rules that you set in the app. Before you spend, you must unlock a qube to let the app know which bucket of money to draw from for your purchase. Once you set dollar amounts for each qube, the app funds each category as you add money to your account through money transfers or paychecks. You can even dedicate qubes to paying off debt to make sure you set aside enough every month before you spend it elsewhere. Use goal-based qubes to help you save money for purchases like a vacation, wedding, or new car. You can also create qubes based on where you shop, like Amazon, Target, or Sephora. You can create qubes for spending categories, such as groceries, clothing and fashion, transportation, drinks and dining out, and entertainment. For example, you can create qubes for typical budget categories like rent, electricity bills, cable bills, cellphone payments, and car loan payments. Like an envelope-based budgeting system, you create a qube for anything you want to use your money for. It aims to help you create a proactive budget that encourages you to set aside money for expenses, debt payoff, and savings before you spend. The key to this app is the “qube,” a virtual envelope that designates each of your dollars for a specific job. “Qubes” for Budgeting, Saving, and Paying off Debt Qube’s premise is simple: It turns the envelope budgeting method digital and layers it on top of your bank account for seamless digital cash envelope budgeting. The fledgling banking-and-budgeting app lets you visualize and manage your budget, control spending, and automate saving through its signature “qubes.” To determine whether this is the solution for your banking and budgeting needs, get to know its features. Utah-based entrepreneurs Ryan Clark and Shane Walker founded Qube Money - or, simply, Qube - to address this need. Popularized by Dave Ramsey decades ago, the system assigns a job to every dollar you bring in - where to spend it, save it, or use it to pay down debt - by literally putting cash into envelopes for designated expenses.įew of us use actual cash for the bulk of our purchases anymore, however, so fintech has had to adapt to bring this useful budgeting system into the digital age. The cash envelope budgeting system solved this problem for a lot of people. Setting limits on spending feels restrictive and difficult to adhere to.

0 notes