#car insurance Alberta

Explore tagged Tumblr posts

Text

Don't Fall For These Liability Insurance Myths: For Small Business Owners

Liability insurance is no laughing matter when it comes to running a successful business. It can protect your business from financial loss and legal trouble, but unfortunately, there are plenty of myths surrounding this crucial coverage. In this article, we'll debunk some of the most common liability insuranceAlberta myths for small businesses.

Myth #1: Only High-Risk Businesses Need Liability Insurance

Some people think Alberta liability insurance is only necessary for businesses in high-risk industries like skydiving. But in reality, any business can face liability claims. For example, even if you're running a daycare center for children, a child could still get hurt on your property, leading to a lawsuit. So don't let the myth fool you - all businesses need liability insurance.

Myth #2: Liability Insurance is Too Expensive for Small Businesses

While we all love a good bargain, skimping on liability insurance isn't the place to do it. It's true that the cost of insurance can vary depending on the coverage you need, but there are affordable options available. Plus, think of the cost of a liability claim - it could be enough to put your business in the red. So if you want to keep your business's finances in the black, liability insurance is worth the investment.

Myth #3: General Liability Insurance Covers Everything

Some business owners think that general liability insurance covers all kinds of liability claims, from angry customers to natural disasters. But like that one-size-fits-all hat you bought online, it's not quite as versatile as you thought. General liability insurance typically covers bodily injury, property damage, and personal injury claims. But other types of claims, like product liability or cyber liability, may not be covered. So, make sure you know the limits of your coverage and consider additional policies if necessary.

Myth #4: Liability Insurance is Only Necessary if You Have Employees

You might think that without employees, there's no one to get hurt on the job, so you don't need liability insurance. But what about customers or clients who visit your business? They could still get hurt on your property or blame you for something that goes wrong. Liability insurance can help protect your business and your bank account from legal trouble.

About Schwartz Coaldale:

Schwartz Coaldale is a reliable insurance brokerage business that offers a range of services including car insurance Alberta and liability insurance. With a team of experienced brokers, they work to provide the best coverage options for their clients.

To know more about their services, visit https://schwartzcoaldale.com/

Original source: https://bit.ly/47OtQyE

0 notes

Text

Essential Reasons to Choose Personal Property Insurance

Personal property insurance is important for protecting your belongings from unexpected events. Many people don’t think loss will happen to them, but unexpected incidents can occur anytime. It’s very important to choose an insurance plan. Often, people don’t realize how much their things are worth until something goes wrong. Personal property insurance offers peace of mind, knowing your valuable assets are safe. It offers essential support, helping to cover the costs of unexpected incidents. Choosing home insurance quotes Alberta opens the door to a range of valuable benefits.

Protection from Financial Loss

Personal property insurance shields you from big financial hits. If unexpected events damage your belongings, insurance can help cover many costs, saving you from high expenses. Without this help, paying out-of-pocket could create financial strain, which may be hard to recover quickly. Insurance acts as a safety net during tough times, like after unexpected incidents, so you can get back on track without big setbacks that disrupt your financial plans. This support helps you recover faster, maintain stability, and continue your daily life with fewer disruptions during uncertain times.

Peace of Mind

Personal property insurance provides peace of mind. Knowing that your assets are protected reduces worry about potential problems, so you can focus on everyday life. It gives comfort, knowing help is there if things go wrong, whether due to accidents or unexpected damages, which can happen suddenly. This layer of protection allows you to plan your life with greater security, making daily routines feel safer and more assured. Being prepared in this way makes it easier to stay calm and enjoy the present, handling life’s challenges with less stress and anxiety. This peace of mind is priceless for many, allowing them to live with greater confidence and freedom.

Flexibility in Coverage

Personal property insurance offers flexible coverage that adjusts to your needs. You can choose the right plan according to your needs, like house and car insurance Alberta. This flexibility ensures that your important things are protected, even with life’s ups and downs. With different coverage levels, you can pick what fits your budget and needs, staying prepared as life changes.

About Claresholm Agencies:

Claresholm Agencies specializes in personal property insurance designed to meet individual needs. This includes coverage for commercial vehicle insurance Alberta, ensuring clients have the protection they require.

For more details about their services, visit https://www.claresholmagencies.com/

Original Source: https://bit.ly/4gk89u5

0 notes

Text

This is so bc i cant

#please note ''boojiebevs''#we think we're california but we also think we're british#and then a portion of us want to move to alberta and already pay car insurance there

0 notes

Text

Using a tracking app for car insurance discounts?

Alberta drivers, there's a recent change you NEED to know about!

Do read our blog on how it could impact your rates #UBI

0 notes

Text

Connecting With The Best Car Insurance Companies in Alberta via Surex

#Automotive#Information#Alberta#Car Insurance#Car Insurance Companies#Insurance#Insurance Services#Surex

1 note

·

View note

Text

Car Repair Loans Canada

Need a car repair loan in Canada? LoanSpot offers fast, easy loans for vehicle repairs with flexible terms. Apply now and get back on the road quickly!

Car Repair Loans Canada

About Company:-Loanspot.ca emerges as a valuable platform for those seeking funds in Canada. With a commitment to simplifying the lending process, Loanspot.ca was established in 2020 and is located in Calgary, Alberta, Canada. Loanspot.ca connects borrowers with a network of lenders, increasing the chances of finding a suitable loan solution. The platform offers access to a variety of financial products, including personal loans, business loans, credit cards, mortgages, insurance, banking services, and credit reports.

Click Here For More Info:- https://www.loanspot.ca/vehicle-repair-loans/

0 notes

Text

Will Alberta's radical changes to car insurance fix major mess? | masr356.com

Breadcrumb Trail Links News Politics Opinion Columnists Depending on your politics, that either sounds exciting to you or it leaves you wondering why Alberta simply didn’t go with what appears to be working in B.C., Saskatchewan and Manitoba Published Nov 22, 2024 • Last updated Nov 22, 2024 • 4 minute read You can save this article by registering for free here. Or sign-in if you have an…

0 notes

Text

The Importance of Alberta Credit Score Improvement for Your Financial Health

Your credit score might be one of the most important items in your financial life. You want to buy a house, you want to take out a car loan, or maybe you just want to rent an apartment. Whichever the case, often times your credit score is what makes this all possible, or not so much. Now, here's the good news: improving your credit score in Alberta can unlock long-term financial stability and open new opportunities.

Better Access Loan Opportunities A good credit score opens the doors to more loan options. Lenders prefer lending to borrowers with high credit scores since they are perceived to carry lesser risk than others. Focusing on Alberta Credit Score Improvement can significantly enhance your chances of securing loans. Whether you're applying for a personal loan or a car loan, your credit score plays a major role in the approval process, increasing your likelihood of getting the required amount with minimal hurdles and rejections.

Lower Loan and Credit Card Interest Rates Interest rates are directly related to your credit score. Borrowers with a high credit score get to have lower interest rates, meaning you will pay less over time on loans or credit cards. An example is when a few percent differences in interest rates on a mortgage might save you tens of thousands of dollars over the life of the loan. Improving your credit score in Alberta can significantly reduce borrowing costs, leaving more money in your pocket for other priorities.

Enhanced Credit Card Benefits People who are also high in credit score normally get preference for high-end credit cards. These cards make available to their holders more benefits than the ordinary cards, including more excellent credit lines, cashback rewards, great traveling gifts, and relatively small fees. Increasing your credit score enables you to benefit from these features, saving cash and accumulating rewards on purchases you usually undertake.

Easy Approval to rent homes Lenders mostly use credit scores to rate credit applicants in Alberta's competitive rental market. A good credit score shows that the tenant is financially responsible, and hence getting a rental house is easy. On the other hand, having a low credit score might make you more susceptible to rejection or require higher security deposits. With an improved credit score, your chances of approval for the housing unit you want are going to skyrocket.

Job Opportunities Increase While not all employers in Alberta verify credit scores, those within specific sectors like finance, government, and management do. A good credit score reflects responsible financial behavior; employers consider such behavior in applicants to sensitive positions. Improving your credit score can make you a more attractive candidate, which will improve your job prospects and career growth opportunities.

Better Financial Reputation Your credit score is a form of report card of your financial habits. A high score means you take care of credit responsibly, pay bills in time, and control debt levels. Such a good reputation benefits you not only at the hands of lenders and landlords but also with utility companies, insurers, or even business partners.

No Security Deposits Utility companies and service providers always ask for credit deposits from customers with poor credit scores. Such upfront costs can be overwhelming, especially when one needs to start or relocate. Eradicating such deposits is possible through improving your credit score so that you can spend that money on something important.

More Bargaining Power Over Credit Providers Having a good credit score is also a competitive advantage in negotiating terms with lenders. Whether it's in the form of lower interest rates, lower fees, or more flexible repayment options, lenders will find borrowers with excellent credit more accommodating than others. This negotiating power can easily save you money and perhaps even optimize the borrowing process to favor your needs.

Easier Access to Business Loans For entrepreneurs in Alberta, a good credit score can be an essential factor in getting a loan to start or expand a business. Lenders want to see that you are financially reliable. When you have a good credit score, it showcases your ability to manage finances responsibly and helps you get easier access to funding for the growth of your business.

Preparation for Financial Emergencies Unforeseen medical bills, car repairs, and more can strike anyone. A good credit score lets you have credit in times of need. Whether it is a personal loan or just an increased credit limit, having the financial flexibility necessary to ensure emergencies don't become financial setbacks and can give you a sense of security and calmness during those hard times.

Achieving Long-Term Financial Goals Improving your credit score in Alberta would enable significant financial milestones such as buying a house, saving up for retirement, or having more investment in your future. A good credit score opens opportunities for further financing options and can lay the foundation for wealth accumulation over time.

Conclusion Improving your credit score in Alberta isn’t just about getting better interest rates; it’s about creating a secure and stable financial future. A strong credit score opens the door to numerous opportunities, from securing loans and renting homes to enjoying lower costs and greater financial flexibility. By taking proactive steps to boost your credit, you can reduce stress, save money, and achieve your long-term financial goals. Whether you’re starting fresh or recovering from financial setbacks, focusing on Alberta credit score improvement is a powerful way to take control of your finances and pave the way for a brighter future.

0 notes

Text

Factors That Will Influence the Home Insurance Rates for You

Life without insurance coverage appears to be a bit challenging. In the absence of suitable insurance, you might end up in a financially complicated situation. It may affect your budget adversely. Therefore, you need life, health, house and car insurance Alberta.

Among all these, you might have to think about home insurance a bit more. You might be paying a unique amount for home insurance. It may lead you to a few questions. For instance, you might wonder why am I paying this amount. The home insurance amount depends on a few factors. Here are a few of them.

Location:

Insurers will always consider the location of your home while setting an insurance amount. You may have to pay higher rates if you live near a disaster-prone area. For instance, if a water body is around your house that often leads to floods, you might have to pay higher premiums and the total insurance amount. Similarly, the location & available facilities around your home will help insurers determine the amount.

Property Type:

The next factor that will play a crucial role in deciding the home insurance amount is property type. The size, shape, construction type, and elements of your home will contribute to the insurance amount.

Also, insurers will consider if you are living in an apartment, dwelling, or an owned house. All these factors will influence the insurance amount. Insurers try their best to provide fairly priced insurance to the customers.

Other Factors:

Insurance companies are here to serve you. But they will check everything that can impact the insurance. For instance, they will evaluate the building's condition, systems, pets, pools, liabilities, renovation requirements, etc. After this, they can help you with the home insurance quotes Alberta.

Home insurance is not easy to pick like other insurance coverage’s. You need an expert's assistance to find the best option among the available insurance products. You can always consult insurance brokers and find out the right options. Brokers can help you make the right choice. Therefore, consulting them is the smartest way to deal with this.

About Claresholm Agencies:

Buying insurance coverage for your home is now easier with Claresholm Agencies. The company offers complete insurance-related assistance to its customers. Whether you need commercial vehicle insurance Alberta, farm insurance, or any other, you can trust the experts from this firm. They will assist you and deliver the finest services needed.

Check out more at https://www.claresholmagencies.com/

Original Source: https://bit.ly/3V3zW9s

0 notes

Text

Drive Safe with Calgary’s Trusted Safety Inspection Experts!

Your car’s safety always comes first. It is crucial in Calgary, where traffic is relatively heavy. When buying a car for the first time or getting it serviced, a basic requirement should be to ensure it is safe to use. It is where inspection experts help you with your car maintenance needs in Calgary, vehicle inspection Alberta, and preventive tips to keep you safe from all causes of car accidents.

Why Vehicle Inspections Matter

There are several reasons why regular inspections of your vehicle are critical. Firstly, they prevent serious issues from occurring by identifying potential problems early. Furthermore, it is often necessary to pass an inspection before being able to register or get insurance to drive.

What Happens If Your Vehicle Fails Inspection

You will get a detailed report of problems and potential repairs when your car is rejected after inspection. This report will list all these demerits, including minor faults and serious safety issues.

Ensure these issues are repaired to match Alberta safety standards. When you fix these issues you need to request an inspection. The second examination checks whether all the problems have been addressed and your car conforms to local standards.

Benefits of Choosing Professional Car Inspection Experts

Expert Help: Expert techs furnish your vehicle, provide superior care, and counsel to remain safe while performing optimally.

Honest Checkups: Inspection experts never force you to get other services you do not need during the inspection, thus offering you a true state of your car.

All-in-One Service: Here are some aspects covered, which entail taking care of your car and ensuring it is well-maintained for use in Calgary and Alberta.

Services Provided by Professional Car Inspection Experts

Vehicle Inspections: Alberta safety inspection also includes out-of-province and pre-purchase inspections.

Routine Maintenance: Some general auto repairs include oil changes and checking the brake system, and the tires to ensure they are in good condition.

Safety Inspections: Thorough inspections focus on meeting safety requirements to get on the road.

Insurance Inspections: Some of the evaluation services, which you need to take to meet your insurance and cover your investment in the car.

About InspectaCAR:

InspectaCAR offers the best vehicle inspection services for pre-purchase and newly purchased vehicles. These include out-of-province and safety inspections, auto insurance, and car maintenance Calgary services to provide you with that assurance.

If you need professional recommendations and a convenient car shopping experience, visit https://inspectacar.ca/

Original Source: https://bit.ly/4hegfVX

0 notes

Text

Alberta Drivers!

Hit the Brakes on Rising Insurance Costs!

The new "𝗔𝗹𝗯𝗲𝗿𝘁𝗮 𝗥𝗲𝘄𝗮𝗿𝗱𝘀 𝗦𝗮𝗳𝗲 𝗗𝗿𝗶𝘃𝗲𝗿𝘀 𝘄𝗶𝘁𝗵 𝗥𝗮𝘁𝗲 𝗖𝗮𝗽" program could save YOU money!

0 notes

Text

0 notes

Text

How a Calgary Personal Injury Lawyer Can Maximize Your Compensation

When you're injured in an accident, the road to recovery can be overwhelming, not just physically but emotionally and financially as well. Whether you've been in a car accident, suffered a slip-and-fall injury, or experienced any form of personal injury, one of the most important steps in your recovery is obtaining fair compensation for your damages. However, navigating the legal system can be complex and daunting, especially when dealing with insurance companies that often aim to minimize payouts.

This is where hiring a personal injury lawyer in Calgary can make a significant difference. A qualified personal injury lawyer can ensure that your rights are protected, guide you through the legal process, and maximize the compensation you deserve. In this comprehensive guide, we will explore the various ways in which a Calgary personal injury lawyer can help you secure the highest possible settlement for your case.

Understanding Personal Injury Law in Calgary

What Is Personal Injury Law?

Personal injury law, also known as tort law, is a legal framework designed to protect individuals who have been harmed by the negligent actions of others. If someone else’s carelessness, recklessness, or intentional misconduct leads to your injury, you are entitled to seek compensation for the damages you have suffered. This compensation is meant to cover medical expenses, lost wages, pain and suffering, and other losses that have resulted from the injury.

The Legal Framework in Alberta

In Alberta, personal injury claims are governed by the Alberta Tort Law and the Insurance Act. These laws lay out the rights of individuals to recover damages from the party responsible for their injuries. The legal process in Alberta can be complex, and personal injury cases can vary widely depending on the specifics of the accident, the severity of the injuries, and the insurance policies involved. Working with a Calgary-based personal injury lawyer who understands the local legal landscape can make a significant difference in your case.

Why You Need a Personal Injury Lawyer in Calgary

While some individuals may be tempted to handle their injury claim on their own, the reality is that dealing with insurance companies and the legal system can be challenging. Insurance companies often use tactics to minimize their liability and reduce the amount they have to pay. A personal injury lawyer has the experience and knowledge to fight these tactics and ensure that you receive a fair settlement.

The Role of a Personal Injury Lawyer in Maximizing Compensation

1. Investigating Your Case Thoroughly

One of the first ways a personal injury lawyer can help maximize your compensation is by conducting a thorough investigation into your case. The lawyer will gather all relevant evidence to support your claim, including:

Police reports

Medical records

Eyewitness testimonies

Surveillance footage

Photographs of the accident scene, and injuries

By building a strong case with clear evidence, a lawyer can demonstrate the extent of your injuries and the liability of the party responsible. This evidence is crucial when negotiating with insurance companies or presenting your case in court.

2. Calculating the Full Extent of Your Damages

One of the most common mistakes made by individuals handling their personal injury claims is underestimating the value of their damages. A personal injury lawyer in Calgary will ensure that all of your losses are accounted for, including:

Medical Expenses: This includes not only immediate medical bills but also the cost of ongoing treatment, rehabilitation, surgeries, and any future medical needs.

Lost Wages: If your injuries have prevented you from working, you may be entitled to compensation for the income you have lost. This includes both past and future lost wages.

Pain and Suffering: Non-economic damages, such as pain and suffering, emotional distress, and loss of enjoyment of life, are also factored into the compensation amount.

Property Damage: If your personal property, such as a vehicle, was damaged in the accident, the costs of repair or replacement will be included.

Future Care Costs: For severe injuries that require long-term care, the lawyer will work with medical experts to estimate the costs of future care and ensure that this is included in your claim.

3. Negotiating with Insurance Companies

Insurance companies are often focused on minimizing their payouts to protect their bottom line. Without legal representation, you may be offered a settlement that is far below what you are entitled to. A personal injury lawyer will use their expertise in negotiation to push back against lowball offers and ensure that you receive fair compensation.

4. Utilizing Expert Witnesses

In some personal injury cases, it may be necessary to bring in expert witnesses to strengthen your claim. These experts may include:

Medical experts: To provide testimony on the severity of your injuries and the long-term impact on your health.

Accident reconstruction specialists: To demonstrate how the accident occurred and establish liability.

Economic experts: To calculate the financial impact of your injuries, including future earnings loss and long-term care needs.

A personal injury lawyer will have access to a network of reputable experts who can provide the testimony needed to support your case and maximize your compensation.

5. Preparing Your Case for Trial

While many personal injury claims are settled outside of court, there are instances where the case may need to go to trial. If negotiations with the insurance company fail to result in a fair settlement, your lawyer will be prepared to take your case to court. A personal injury lawyer will:

Prepare all legal documents

Present evidence to the court

Cross-examine witnesses

Argue your case before a judge or jury

By being prepared to go to trial, your lawyer sends a strong message to the insurance company that they are serious about securing the compensation you deserve.

Types of Compensation You May Be Entitled To

1. Economic Damages

Economic damages are quantifiable financial losses that you have suffered as a result of the injury. These include:

Medical Expenses: This covers all medical costs related to your injury, including hospital bills, surgeries, medications, rehabilitation, and future medical expenses.

Lost Income: If your injury has resulted in time away from work, you are entitled to compensation for both past and future lost wages.

Property Damage: If your personal property was damaged in the accident, such as your vehicle, you can recover the cost of repairs or replacement.

Out-of-pocket Expenses: This includes any other expenses you have incurred as a direct result of your injury, such as transportation to medical appointments or hiring help for household tasks.

2. Non-Economic Damages

Non-economic damages are more subjective and refer to the emotional and psychological impact of the injury. These can include:

Pain and Suffering: This compensates you for the physical pain and emotional distress caused by the injury.

Loss of Enjoyment of Life: If your injury has resulted in a diminished ability to participate in activities you once enjoyed, you may be entitled to compensation for this loss.

Emotional Distress: Injuries can lead to psychological effects, such as anxiety, depression, or post-traumatic stress disorder (PTSD), which may be compensated.

3. Punitive Damages

In some cases, punitive damages may be awarded in addition to economic and non-economic damages. Punitive damages are intended to punish the defendant for particularly egregious or reckless behavior and to deter similar conduct in the future. While not common in all personal injury cases, they may be pursued if the at-fault party’s actions were particularly negligent or malicious.

Common Types of Personal Injury Cases in Calgary

1. Motor Vehicle Accidents

Motor vehicle accidents are one of the most common types of personal injury cases in Calgary. Whether you were injured in a car, motorcycle, or truck accident, a personal injury lawyer can help you navigate the legal process and ensure that you receive fair compensation for your injuries.

2. Slip and Fall Accidents

Slip and fall accidents can occur due to unsafe conditions on someone else's property, such as wet floors, uneven surfaces, or inadequate lighting. Property owners have a responsibility to maintain safe premises, and if they fail to do so, they may be held liable for any injuries that occur.

3. Medical Malpractice

Medical malpractice occurs when a healthcare provider fails to meet the standard of care, resulting in harm to the patient. A personal injury lawyer can help you hold the responsible parties accountable and seek compensation for medical expenses, lost income, and pain and suffering.

4. Workplace Injuries

If you have been injured on the job, you may be entitled to workers' compensation benefits. However, in some cases, you may also be able to pursue a personal injury claim if a third party (such as a contractor or equipment manufacturer) is responsible for your injury.

5. Product Liability

When a defective or dangerous product causes injury, the manufacturer, distributor, or retailer may be held liable. Product liability cases can involve anything from faulty machinery to defective medical devices, and a personal injury lawyer can help you pursue compensation for your injuries.

Key Steps to Take After an Injury to Protect Your Claim

1. Seek Medical Attention Immediately

The first and most important step after any injury is to seek medical attention. Even if you believe your injuries are minor, it is crucial to have a medical professional evaluate your condition. Not only does this ensure that you receive the care you need, but it also provides documentation of your injuries, which will be important for your claim.

2. Document the Incident

If possible, document the scene of the accident by taking photographs and gathering contact information from any witnesses. This evidence can be valuable when building your case and proving liability.

3. Report the Accident

Depending on the type of accident, you may need to report it to the appropriate authorities. For example, car accidents should be reported to the police, while workplace injuries should be reported to your employer. Having an official record of the incident can strengthen your claim.

4. Avoid Talking to Insurance Adjusters Without Legal Counsel

After an accident, you may be contacted by insurance adjusters who will try to obtain statements from you or offer a quick settlement. It is important not to speak with them or sign any documents without consulting a personal injury lawyer first. Insurance adjusters often aim to settle claims for as little as possible, and any statements you make could be used against you.

5. Contact a Personal Injury Lawyer

The sooner you consult with a personal injury lawyer, the better your chances of maximizing your compensation. A lawyer can help you navigate the legal process, negotiate with insurance companies, and build a strong case to ensure you receive the compensation you deserve.

The Importance of Hiring a Calgary Personal Injury Lawyer

Suffering a personal injury can be a life-altering experience, but you don't have to go through it alone. A Calgary personal injury lawyer can be a powerful advocate in your corner, fighting to ensure that your rights are protected and that you receive the compensation you deserve. By thoroughly investigating your case, calculating the full extent of your damages, negotiating with insurance companies, and preparing for trial if necessary, a personal injury lawyer can maximize your settlement and help you move forward after your injury.

If you've been injured in Calgary due to someone else’s negligence, don’t hesitate to seek legal assistance. With the right lawyer by your side, you can focus on your recovery while they handle the legal complexities and ensure that you are compensated for your losses.

#personal injury lawyer calgary#personal injury attorney calgary#personal injury attorney in Calgary#personal injury lawyer in calgary#accident attorney Calgary#accident lawyer calgary

1 note

·

View note

Text

Hello,

My name is Krit.

Last year, my husband was hit in the head by a forklift at work.

He has since been seen by many doctors and specialists and received treatment. This treatment did not improve his brain injury symptoms. He just finished an 8-week program for brain injury in Edmonton. We haven't seen many improvements. We've actually seen a decline in his health.

He does not receive a lot from Workers Comp. I haven't been able to work much, as I have to attend most of his appointments because his memory is completely gone.

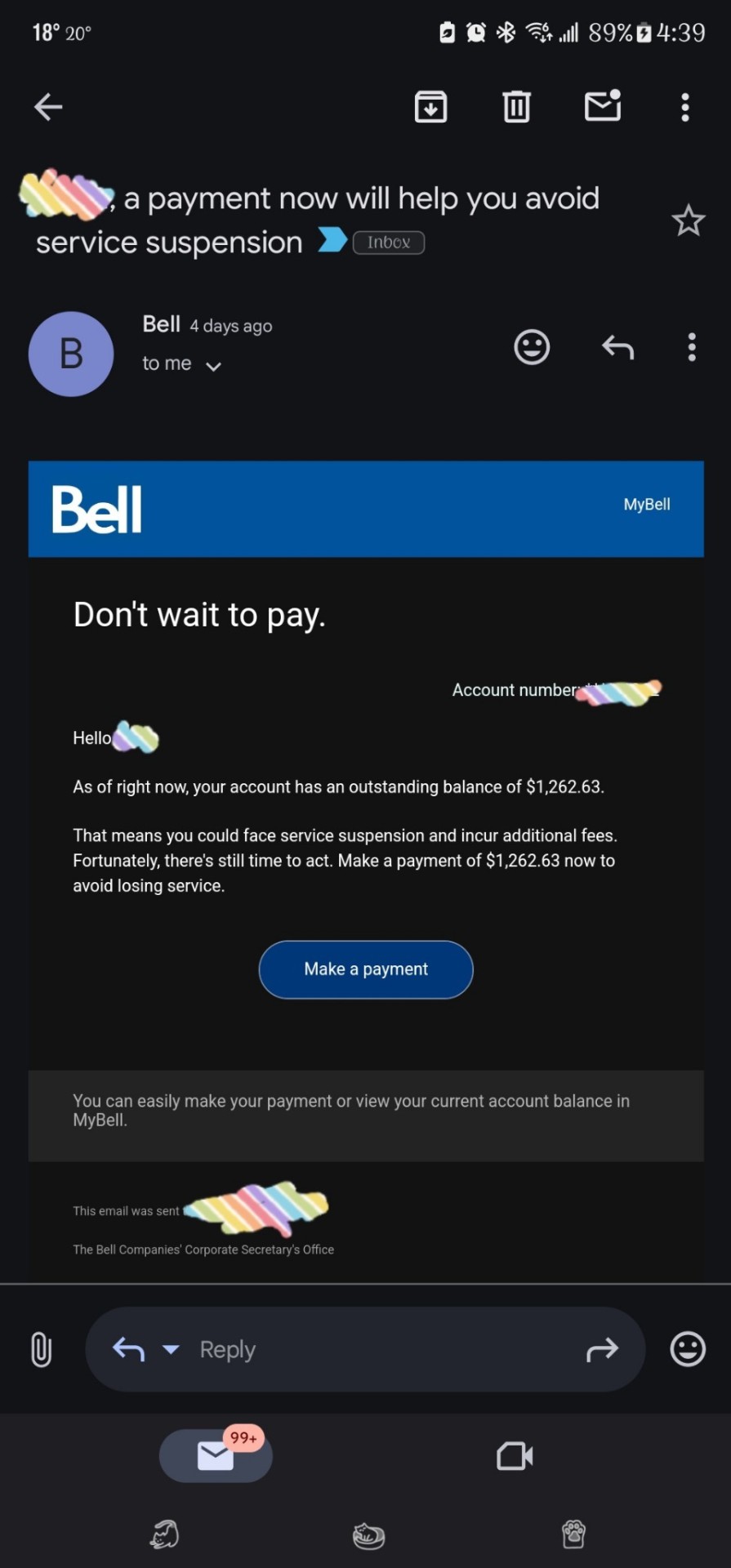

We have struggled to make it by, but we are at a point where we are very far behind on our bills. I've had our utility companies threaten us many times to cut us off. Rent is the only thing I've been able to consistently pay, as we don't have anywhere else to go.

I myself was hit by an SUV last year July as a pedestrian and have been dealing with the fallout from that. I was still at this point in grieving from my father passing in April.

Our combined medications and treatments equal to a lot. I personally haven't been to my physiotherapist in almost two and a half months, which has essentially led to many painful days and nights, and I have regressed in all my progress from those treatments. The woman's insurance, the one who hit me with her SUV, has been refusing to pay for my treatments, as he believes I should just be all better now. He wants to send me to his own privately funded doctor to say I'm all better, and he can officially cut off all support. I have gotten my lawyer involved.

We've also had other set backs, in February, my SUV needed a new engine, which took 2 months before it was installed due to financial issues.

I drive for work. There's a lot of money that goes into gas and maintenance. Driving also exasperates my injuries, but we have no options right now. I've been with my job for 8+ years and haven't received any follow-up from the hundreds and hundreds of jobs I've applied to within the whole province of Alberta.

I am really at a place where I can't ask people in my life for help anymore, as I've asked for help many times over the last year to help pay off minimums for our utilities, my car payments and rent.

Both my husband and I are dealing with a lot. Our whole lives were changed when he sustained his brain injury. This last year and a half has not been very good to us. If you could help us out, it would be greatly appreciated.

Thank you.

****Update****

My vehicle has now started to make a noise that I suspect is my timing chain. In the new engine I just had replaced THIS YEAR.

I drive for my job, all over Alberta. I really need a working vehicle, my little car needs a new transmission, it drives, but will stop working randomly. When it stops running, I have to go in the shoulder and restart the car. I can't do that with client in the car, I would lose my job for not having a reliable vehicle.

The sounds my vehicle was making:

https://youtube.com/shorts/4hSvpdehhlY?si=FsaNVh31ArEcjUss

https://youtu.be/nNArKhOAbcc?si=tCmWcvVw_7cuCSaA

***UPDATE as of September 16/2024**

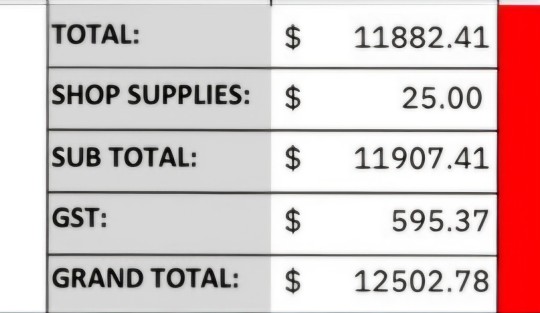

I have added many pictures of bills owed and the final total of my vehicles repairs, that have already been done to fix my vehicle.

**Update: Sept. 29, 2024**

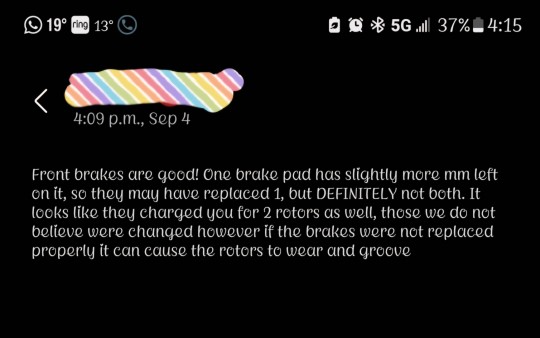

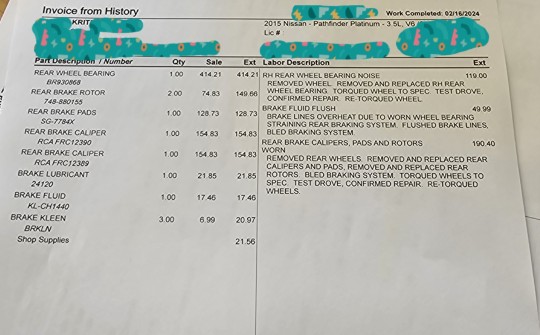

There were issues with the brake also, the brakes I also had replaced ***this year in February***. I guess I didn't explain it well on the past post, but my bearing on my back passenger tire seized. So I went in for repairs and they claimed I needed, new brakes completely. Brake pads, drums and rotors. Just all on both sides. So I said okay, go ahead. I have posted the invoice previously. However. According to the Nissan Dealership, this doesn't appear to be the case, unless these brakes were installed so horribly, that they have put on 5 years of wear in five months. Which isn't possible.

My husband's condition is worsening, he is unable to remember within minutes now. He'll be talking about something and forget what it is he is talking about mid sentence and then ask me what he was talking about. He is having a hard time with noise and light. My mom bought him noise cancelling headphones and polarized sunglasses that fit over his eyes. We don't know what to do from here, the doctor has prescribed some new medications, that I don't believe I can mention here, but they are also expensive for small amounts. We are working on pain management now solely. The meds they kept prescribing him for headaches were mainly ones used for other things like depression or epilepsy. They caused very abrupt and obvious changes in his moods, his tiredness throughout the day and many other after effects.

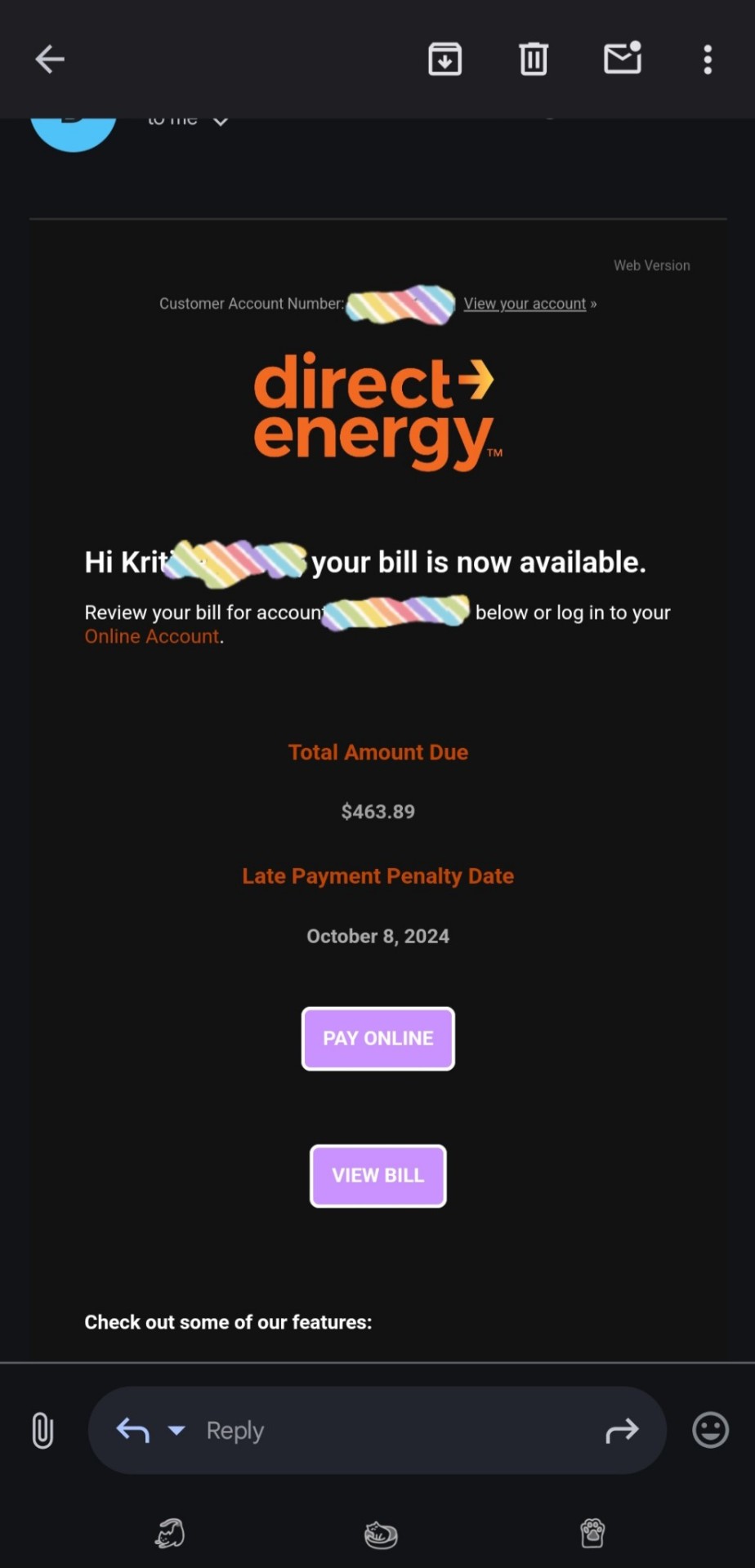

I also am not able to pay rent for the first time in a long time, due to my paycheque being very small, directly because my vehicle was in the shop for so long this September. Direct energy has sent a letter now that they will cut off my services on Oct. 2nd. The city called about my water bill this previous week, she said they will start the disconnection process at the end of September.

I'm really in a bad place and I hope someone out there can help me.

My GoFundMe Link:

https://gofund.me/9d4e74ee

0 notes

Text

Chelan Summer

Portland, Oregon, my hometown by birth but at present not my current home. Stuck I am in Spokane, Washington, not the worst place to be stuck by any stretch of imagination, but a far cry from Portland. It wasn’t so much that I was stuck here, it was just for the summer break from Eastern Washington University. Nothing like spending the summer sleeping on a friends couch while trying to find something at least partially resembling a part time job. If anything it sure as hell beat hanging around Cheney for the summer, anything was better than that.

After two weeks sleeping on my friend Mike’s couch and doing little more than chain drinking Rainier beer I knew I needed a change, this is not at all what I had in mind for my summer vacation. It was the middle of my third week off from classes that the phone call came in from my friend Marie who was spending her summer as she always did, working at her families diner in Chelan. I hadn’t been to Chelan since I was a wee lad, and the only thing I remembered was staying in a tiny cabin with my parents. It was one of the few vacations I could think back at with fond memories and now with the passing of my parents that made me feel far more sad than I would have liked to admit.

Marie was calling wondering if I would at all be interested in coming out to Chelan for a portion of the summer to both do a little work at the diner, what with her brother being off doing basic training for the National Guard, but also if anything to not be spending the whole summer stuck in Spokane. I didn’t mind Spokane anywhere near as much as she did, but still, spending a good deal of the summer hanging out at Lake Chelan sure sounded better than than being bored. I packed my clothing , laptop and a decent selection of books into the trunk of my 1963 Ford Falcon and headed West, escape from the horrific heat that was already setting in on Spokane was a welcome change, it was already pushing 100 and it was only the second week of June. I was not used to this sort of heat, mild Portland summers had spoiled me as a kid and this was going to take some serious getting used to. I knew Chelan wasn’t going to be cold by any stretch of the imagination but it was not going to be anywhere near as warm as Spokane and that was all I was asking for. The Falcon had a decent speed and traffic was light. Well it was a Tuesday I figured I would stop for lunch in Moses Lake and make it into Chelan by late afternoon, by then it would give Marie time to figure out exactly what I would be doing at the diner, but also to figure out if the little guest cabin she said I could stay in was in any condition for me to actually stay in tonight. To say I was getting tired of sleeping on couches would be an understatement to say the least. I was longing for sleeping on a dorm bed and those things were god awful. The Falcon was my second car in less than a year. It was a replacement for the Plymouth Arrow that met an untimely demise after it was t-boned by a Ford Explorer in the first ice storm of the season. The minimum amount of insurance money didn’t afford me enough to get anything terribly fancy but the Falcon made due. I always did like vintage cars from a young age. Something about cars actually having some personality unlike the bulk of cars produced since the late 1970’s.

Lunch in Moses Lake was decent, nothing special, just a burger and fries from a little cafe out by the airport. It had been ages since I had last been though Moses Lake, probably at least 10 years, and seeing as how I was only 19, for me that was quite a while. I really didn’t remember much about my last visit other than it was rather warm as my parents and I were coming back from Banff, Alberta, Canada, via Spokane. I hadn’t been back to Alberta since then either, which made me sad. The Canadian Rockies had to be one of the most beautiful places I had ever been. I was hoping on making it up this summer but with the lack of cash flow in my life, I had ruled it out. Now with some money coming in the door, a late summer trip could easily be in the works I felt.

I didn’t know how much money I would actually have before classes started back up, but if there was somehow enough to make a short trip to the Rockies I felt it would be worth it. Dealing with only my own thoughts for a few days would be worth it I felt. I really hadn’t had a chance to spend any time on my own since my parents passed right before classes started. It was nice however to have the people around in the dorm that wanted to make sure I was alright and that I had someone around if and or when I ever needed to talk about anything which was very much appreciated, sometimes though I really just wanted some time on my own and I really hoped that here in Chelan I just might finally be able to find some time on my own.

I pulled into Chelan a bit after 4:00 p.m. which was right around when I thought I would. The skies were blue and there was enough of a breeze that even with the temperature hanging in the 80’s it was not bad out at all. I made it to the diner, Lakeside Pies, it was quite busy, the parking lot as well as the street out front was packed with cars and a small like of folks out the front door. At least the place was busy and popular I thought to myself. Nothing worse I felt than working someplace that was never busy.

I made my way through the group of people at the front door and started looking for Marie. I knew she had to be around somewhere. I saw her a couple minutes later coming out of the kitchen with a tray piled high with plates. In Cheney she had worked at Watermans, the bar and grill across from campus, which is where I first met her. Later on I ended up having a class with her and ended up getting to know her far better than I did from just having out far too much at Watermans. I wasn’t expecting her to offer me to come out to Chelan, but now that I was here I could see why, the place was packed and they needed the staff. Not that I had any experience at all in food service but now was as good of a time as any to learn and she knew I was a reliable person from the multiple group projects we had needed to complete in our class together.

Once she finished running the mountain of food to the table she came over and gave me a massive bear hug, which was not at all what I was expecting. She had never been much for hugging and such, well at least not that I had noticed. I wasn’t about to complain though. Marie was older than me, not by much though, a couple of years or so perhaps, not that it mattered all that much, just something that popped into my head. I had never thought about her in any sort of romantic way, never had any reason to in my mind. I had always presumed that she was romantically tied up with James who was the late night bartender at Watermans. I knew now wasn’t the best time to sort things out my employment because it was so busy, but I felt I should do something to help during the rush. Marie insisted though for me not to worry and gave me the key for the cabin that would be my home for the enxt couple months. I headed down the road back from the lake to find the cabin. It was nothing special to say the least, a one room box with a tiny loft in the back with an old mattress. Nothing special by any stretch, but I was clearly liking the solitude that was soon to be in my future. I headed out to my car to unload my very limited amount of belongings, tossed the clothes in the tiny closet and the books on the built in shelf next to the fridge. The fridge wasn’t on. I had to search for the breaker box and finally found it, of all places, in the bathroom, and finally got power up and going to the whole cabin. It wasn’t the best lit place in the world but I was sure I could manage to make due with it at least for the summer. I was however worried that it would get warmer than I wanted in July. I knew I was going to have to invest in at least one fan in order to make sure I didn’t roast to death. By the time I was unpacked and had the fridge at a decent temperature and ran to the store to get a few things, namely coffee, it was close to 11:00 p.m. and there was a knock at the cabin door. I walked over and opened it up and there was Marie with a to-go box and a case of Rainier beer. She came over and had a seat on the couch and handed me a beer, of course after she already opened one for herself.

She apologized for the state of the place, the idea for me to come out and stay there was just hatched this morning, not really allotting much time to prep the cabin for any sort of long term lodging. She went outside, beer in hand to make sure that the water had been turned on at a decent enough pressure that I would be able to take a shower with enough pressure to actually get clean. She headed over to the built in dining table and bench and took the seat off and pulled out a typewriter and some dishes and the like. I had always enjoyed working on a typewriter. There was just something soothing about the gattling gun sound made by the keys striking the paper. No chance for going back and editing, just one idea after another hitting the page. I loved to write, I was going to school to be involved in journalism, after this last school year though I really had no idea what I wanted to do with my life. The shock of my parents dying after hitting a moose with their car a day after dropping me off at Eastern Washington put me in a daze, a state of shock. It was a blessing that I was essentially able to take my first semester off in order to try my best to cope with the whole situation, but not having any real time by myself made that rather difficult to say the least. I did feel lucky to be able to make some very good friends that went out of their way to make sure that I was alright though the whole situation perhaps now I would have a chance, even though it was almost nine months ago since it all happened. It is important to grieve and better late than never I guess.

Marie asked me how I was feeling about the whole sudden relocation to Chelan. Clearly it was a surprise and not at all something I was planning going into the summer but I was indeed quite pleased to be here and actually be working. As well it was time away from Cheney and Eastern.

Marie agreed that I needed some real time away from both Eastern but also from the large amount of people that I had come to know there. Not that they were bad people or anything along those lines, more that they were people I was just thrown into a social circle of sorts with, almost like a support group of sorts after the incident with my parents. Ideal it was not, at all. I felt that I knew the people, well at least I kind of knew them. I really didn’t know if I could actually trust or count on any of them besides a couple who I had actually had a couple of classes with. Generally the people in the dorms left a lot to be desired. Thank god I had a single room for the whole year, made things a whole lot easier for me. Was able to have time on my own if I felt I needed it.

There was something magic about Chelan, or at least I felt that there was. I loved the lake, the peace and quiet. I was finally able to be alone with my thoughts, and that was something I desperately needed and had wanted for months. The cabin was a step up from my dorm room, but that wasn’t really saying too much. The dorm left a great deal to be desired. It was a bit drafty in the cabin even for it being summer. I had a feeling it was not going to exactly be the warmest of nights. I searched the couple of small closets in the cabin in hopes that I would find a extra blanket or something. I remembered I had my emergency sleeping bag that I always kept in the trunk of my car which I could always use if I really needed to. I felt there had to be some sort of extra bedding somewhere in the cabin though, or that Marie would have some in the main house. I made a note to ask her about that when she came back. She stepped out a few minutes earlier saying she was going to figure out what happened to all of the plates and other dishes that were supposed to be in the cabin’s kitchen.

I was still trying to get a grasp on what all was going on. I still felt like a complete and total wreck, I truthfully had no idea how all how to react to the death of my parents, even eight months later I still felt like I had no idea how to judge or process the while series of events. Their death hit me, obviously, even though I was not exactly the closest with them, or had the best relationship with them. That made my reaction their death hard to read from an outsiders point of view. As parents it was not as though they were bad, more that they were rather absorbed in their own lives and I was so often on my own or in the company of other family members. I never really felt all that close to them. I however did not know exactly how much of it I could honestly blame on them, after my father lost his job with the merger mania of banks in the early 1990’s he went back to do what he always wanted to do, teach, and got a position teaching accounting at the school of business at Lewis and Clark College in Portland and within a couple of years had been named chair of the department. My mother worked as a nurse at Oregon Health Sciences University. Often with off the wall schedules and being perpetually on call, it was not unheard of for me to only see my parents for any real length of time on the weekends, and even then my mother would have to dart off to the hospital more often than she ever would have liked.

My going off to Eastern however had prompted the both of them to look into retirement. They weren’t terribly old, both in their late 50’s but financially they were well enough off that they could at least consider the prospects of an early retirement. For my father it was much easier to scale back the work flow. He scheduled himself to only teach two senior level classes at Lewis and Clark, and he was no longer the department chair, having served two consecutive three year terms. This course load allowed him to only be on campus two days a week, save the occasional department meeting or an office hours appointment with a student. He was embracing his newfound free time and began to start running again which was something he had not seriously done since his college days at the University of Washington. For my mother however it was not as easy. She loved her job, always had, she loved caring for people, it was her nature, it was her mother’s nature as well, she wouldn’t admit it but that is why she wen into nursing in the first place.

She managed to use a good stock of her accumulated vacation time to coincide with helping me move to Cheney and it still bring summer break for my father, to see see if she was really ready for retirement. Financially they were a-ok. Owned two houses, one in Portland and another on the Oregon Coast in Yachats. The beach house was used in the summer primarily, at one point my father headed out there for two months to work on a research article with relative peace and quiet, it ended up getting published in some prestigious journal and helped his career dramatically. I hadn’t been to the beach house in at least a couple years. I knew my parents had let my aunt and uncle borrow it for a good length of time the prior summer. They had both already retired, well, more my uncle retired as he had worked for Burlington Northern for a considerable time, nearly 35 years, he was on the receiving end of a healthy retirement package even after their merger with Santa Fe.

Everything my parents owned had been left to me, in a trust that I wouldn’t have access to until I hit the age of 35. I didn’t have an issue with that in the least. Finances were to be made available to pay for my education and housing and I would be allowed to either live in or rent out my parents former home in Portland, but I would not have the ability to sell the home until I was 35. It seemed like that was a condition put in to make sure I didn’t do anything stupid with the money at a young age. I was only 19 after all. Not that I Was noted for doing anything too stupid mind you, but it prevented me from making any spur of the moment decisions to sell, and also would reduce pressure from others in the family or elsewhere to try and sell the homes as well. I had no idea what to do about the house at the coast.

I was also given a small monthly stipend for expenses, it was not a large sum by any stretch of the imagination but it was enough to keep me from really worrying about having to find some low level crappy job to make ends meet while I went to school. I was grateful for that. I was able to focus full time on school, although for my first semester it was mainly me focusing on not losing my damned mind, which proved to be far more difficult than I had ever imagined. Even though I was not exactly all that close with my parents, it still ht me, and hit me hard, far harder than I had honestly expected when I first got the news. I felt incredibly lucky that I had family in the area, just outside of Spokane, which I became closer with almost overnight. The situation there was a bit odd, and a little stressful, but we all made it work.

Getting out for the summer however I hoped would prove to be a good decision, if anything I felt it really couldn’t make things any worse. Marie came back into the cabin with a large box in her arms. Inside was a ton of stuff that I hoped would prove to be some used to me. A French press, dishes and coffee mugs, as well as a blanket and a new pillow. I was happy to see all of the things, as well as the can of coffee that was hiding under the blanket. The thought of having to function in the mornings without coffee was not a happy prospect. I had learned to love the stuff over the last year, even though I couldn’t stand it in the least earlier in my life. Getting used to using a French press instead of a normal drip coffee maker was going to take some time though I thought.

Marie looked exhausted, it was close to 11:30 p.m. and her day began at 6:20 a.m. when she arrived at work to begin baking bread and biscuits for the day. She asked if there was anything else I could think of that I might need. I told her that I couldn’t think of anything else that I needed, well at least not tonight. I asked her what time she wanted me to show up to work in the morning. She said she really wasn’t all that sure. The cafe opened at 7:30 a.m. so she figured I should at least show up by 7:15 a.m. I told her I would set the alarm clock on the kitchen counter. With it being far enough from the bed, located in the loft it would force me to get out of bed to shut the damned thing off. Marie said she was going to head to the house to get some sleep, and that if I determined that I needed anything that I should let her know in the morning. I told her I would as she headed out the door. I knew I needed to get some sleep too, it had been a long day, and tomorrow was going to be just as long, if not longer, but I really didn’t feel all that tired. I grabbed an old paperback off the shelf by the door, “Hitchhikers guide to the galaxy” and headed up to the bed with it in hand. The wind was whipping through the trees that surrounded the cabin, not something I was used to, and of course I didn’t have a fan or anything around to help drown out the sounds. The only radio had dead batteries. I had a sinking feeling I was going to have a rough time getting to sleep. Thankfully that ended up not being the case.I awoke with a jolt, the alarm was going off. The bedside light was still on, the book next to me, I had no idea where I was. This wasn’t the first time I had woken up somewhere in a panic with no clue as to where I was or how I got there, and I was sure it wouldn’t be the last either. Still it was not the ideal way to start ones morning.

I finally managed to remember where I was and that I was going to need to hurry and take a shower and get ready to go into my first day of work at the cafe, I had no idea what I was getting myself into. I was hoping for it to be peaceful at Chelan, I should have known better. Calm summers in Chelan were ancient history, it was a vacation spot through and through and had been for years. Winters were the only calm time, and from what I had heard from Marie, they were almost too calm. A summer someplace that was lively and active was going to be a far cry from what I would have been in store for if I stayed in Cheney. For being a college town, it nearly rolled up the sidewalks in the summer. The summer class offerings were minimal at best and mostly all of the student population headed home, or to Spokane for the summer where there were actually jobs to be had. Not that Cheney was a ghost town mind you, but unless you worked at the University or at one of the few small businesses , in the summer there was next to nothing to do, save get drunk all the time, which most did year round anyways.

I took a quick shower partially out of necessity, but also because there only seemed to be about five minutes of hot water. That was not ideal, I needed to ask Mary about that. Not knowing what to wear for work, better yet not even knowing what I would be doing when I got there, I figured jeans and a Eastern Washington t-shirt would be ok, as the dress seemed to be rather casual when I showed up last night. I made sure I had the keys to the cabin and headed out the door on foot to Lakeside Pies. Marie was already there when I arrived, we appeared to be the only ones however. I really hoped I wasn’t going to be in the kitchen, my cooking skills left a lot to be desired, especially if it comes to cooking things quickly. I was hoping that there was already some coffee made. I hadn’t though to make any before my shower and I desperately needed a cup. If anything not just to wake up but also to warm my hands, it wasn’t particularly warm outside, hovering in the 40’s, a wee bit cooler than I was used to in Spokane to say the least. Marie told me there was indeed coffee, but I had to make it. I set up the brewers to make four large air pots of coffee in preparation for opening. I had a feeling that between the two of us we would be able to put at least one out of its misery on our own. Moments after I started the coffee, in walked Keith, one of the cooks. He was also one of the few who was born and raised there in Chelan. He was an older gentleman, I was guessing at first look that he might be in his early 60’s I was shocked to find out later that he was 77 and came back to Chelan to work here after nearly 20 years working in various diners in Seattle. You could tell by looking at him that he enjoyed working in a kitchen. Several minutes later the kitchen started filling with people coming in through the back door. Marie and I went from being the only people in the place to only a small fraction of the staff. There were nearly a dozen people in the kitchen, one whole section was set up specifically for baking the house specialty, pies. The last 45 minutes before opening was hectic, especially for me since I had no idea what I was actually supposed to be doing. Marie finally told me what I was going to be doing, and I was relived I wouldn’t be working in the kitchen,

I was relegated to serving, bussing tables and seating people. The trifecta of things I hoped I wouldn’t fuck up too bad. My biggest worry had to be dropping food on the way to the tables. Graceful I was not. I downed another cup of coffee before making my way over to the cash register, which looked to be at least 50 years old, to see if I could figure out how to use it. All in all I was thankful that it was an older register it made it far easier to use as far as I was concerned, no worries about some software having issues. As long as I could read everyones handwriting I would be golden. I knew my handwriting was far from the best but I would have to make it look a bit more readable. I felt lucky that the menu was rather limited in its offerings. Far less for me to need to try and memorize.

We could see people starting to arrive in the parking lot in advance of the doors opening. Not what I was expecting for the middle of the week, but then it was Chelan, nothing had to make sense in a vacation town like this. People were either coming in before they had to go to work, or people out here on vacation. Working here was a far cry from what I was hoping I would be doing over the summer. My plan during the spring was going to include a summer trip on Amtrak to Chicago and Milwaukee. That obviously didn’t end up happening.

1 note

·

View note

Text

Comprehensive Car Starter Installation and Engine Repair Services in Alberta

When it comes to maintaining and repairing your vehicle, having a reliable service provider is crucial. In Alberta, residents seeking top-notch car starter installation in Calgary and expert engine repair services have plenty of options. This article will explore why choosing the right service is essential and highlight the benefits of working with qualified professionals.

Importance of Professional Car Starter Installation in Calgary

A well-functioning car starter is vital for your vehicle's performance. In Calgary, car starter installation services are designed to ensure that your car starts smoothly every time. Proper installation by skilled technicians not only enhances reliability but also prevents potential issues down the line. Whether you're dealing with a faulty starter or upgrading to a more advanced model, professional installation ensures optimal performance and longevity of your vehicle's starting system.

Engine Repair Services Across Alberta

Engine problems can be daunting, but with the right Engine repair in alberta, you can get back on the road with confidence. From minor fixes to major overhauls, skilled mechanics can diagnose and address a wide range of issues. Regular maintenance and prompt repairs can significantly extend the life of your engine, improve fuel efficiency, and enhance overall vehicle performance.

Why Choose Experienced Technicians?

Both car starter installation in Calgary and engine repair services require expertise and precision. Experienced technicians have the skills and knowledge to handle complex repairs and installations efficiently. They use advanced diagnostic tools and high-quality parts to ensure that every job is done right the first time. Choosing a reputable service provider means you can trust that your vehicle is in capable hands.

Benefits of Timely Repairs and Upgrades

Addressing car starter issues and engine problems promptly can save you time and money in the long run. Ignoring these problems may lead to more severe damage and costly repairs. By opting for timely car starter installation in Calgary and regular engine repair services in Alberta, you ensure your vehicle remains reliable and safe. Regular maintenance also helps in identifying potential issues before they become major problems.

To learn more about us, visit our site.

Engine repair in alberta

OOP Insurance Inspection

0 notes