#capm

Explore tagged Tumblr posts

Text

CAPM試験対策2025!再始動!

Nick/野村です。CAPM試験対策の新バージョンを制作中です。今日はマイルストーンを達成したので報告です。これまでもCAPMの試験対策をプロトタイピング的に提供してきましたが、そろそろプロダクトとしてリリースしていこうと思います。 CAPMの位置付け CAPMは、PMIが認定する、認定資格です。PMPよりも下位に位置づけられています。大学生や新卒の人が受験すべきもの、と、思います。ちょっとChatGPTに説明してもらいましょう。 CAPM(Certified Associate in Project Management)は、プロジェクトマネジメントの入門資格として、これからプロジェクトに関わる人に向けて設計されています。国際的に著名なPMI(Project Management…

0 notes

Text

How to Get Entry Level Project Management Job? No Experience Needed | PMPwithRay

youtube

If you’re trying to start a career in project management but don’t know where to begin, this video is for you. I’ll show you five simple and practical steps to help you get an entry-level project management job, even if you have no experience. You’ll learn how to build basic knowledge, choose the right certifications, find beginner job roles, prepare for interviews, and apply the right way. Whether you’re a student, a fresher, or someone changing careers, this video will give you the right direction to start your journey as a project manager.

#howtogetajob#projectmanagementtips#jobinterviewprep#careerbeginners#startyourcareer#projectsupport#pmcareers#projectmanagementcertification#capm#prince2#scrummaster#jobhunting#newcareerpath#jobapplicationtips#pmroles#career2025#Youtube

0 notes

Text

Gain foundational project skills by pursuing the CAPM Certification designed for emerging professionals or those transitioning into project management. Offered by PRINCE2 Training, this PMI-endorsed programme covers essential concepts including project lifecycle, planning, scope, and stakeholder management. Learners receive guidance aligned with the PMBOK Guide, preparing them for exam success and practical application. The course suits coordinators, assistants, and team members seeking formal credentials. With structured learning and expert instruction, it builds confidence to manage small projects or support larger initiatives. It also serves as a stepping stone to the more advanced PMP certification.

0 notes

Text

CAPM Exam Prep Training Course - https://tinyurl.com/CAPMExamPrepforMe

0 notes

Text

Como medir financeiramente um projeto de investimento imobiliário?

Existem muitas formas de se fazer isso, mas o investidor imobiliário costuma utilizar as formas mais tradicionais de verificação de qualidade econômico-financeira de projetos: Taxa Interna de Retorno (TIR) e Valor Presente Líquido (VPL), ainda que estejam cientes de suas limitações. Em parte, isso acontece por haver referenciais setoriais consolidados para esses dois indicadores. Vamos demonstrar…

View On WordPress

#análise#avaliação#beta#capital de terceiros#capital próprio#CAPM#como é calculado#como calcular#como calcular a taxa#como calcular taxa de desconto#como fazer#comparativo#custo de capital#custo de capital de terceiros#custo de capital próprio#de onde vem a taxa#de onde vem o CAPM#de onde vem taxa de desconto#de onde vem WACC#definição#definição de TIR#definição de VPL#DFC#DRE#economia#estudo de viabilidade#evef#exemplo#exemplo numérico#exemplos

0 notes

Text

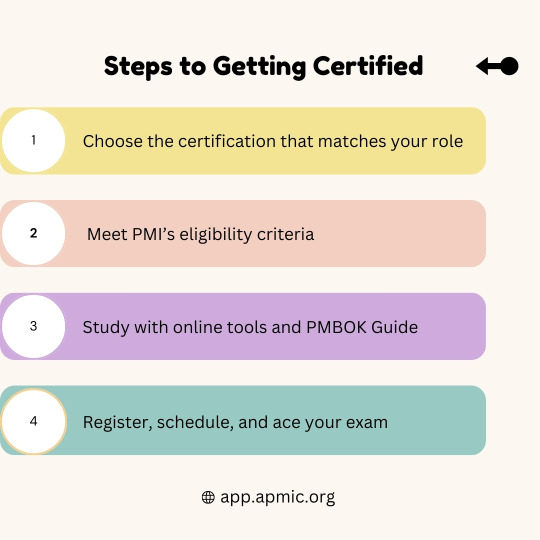

📖 PMBOK Guide: Your Key to Project Management Success! 🚀

The PMBOK Guide by PMI is the global gold standard for project management. It transforms theory into action with best practices, tools, and techniques. Mastering it is essential for PMI certifications like PMP and CAPM!

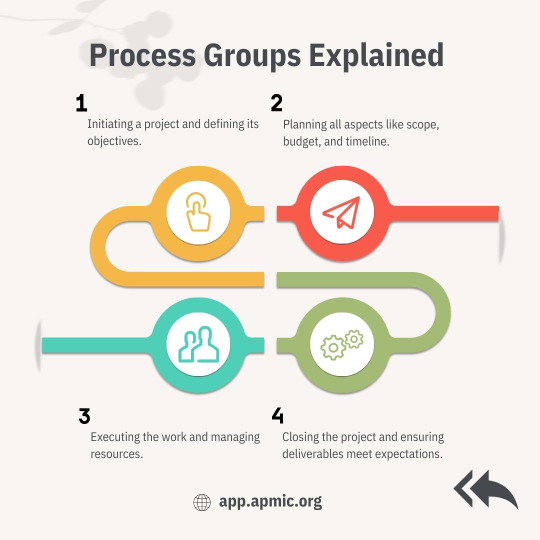

🔑 Key Knowledge Areas: ✔️ Scope, Time, Cost & Risk Management ✔️ Process Groups: Initiation, Planning, Execution, Monitoring, & Closing ✔️ The 7th Edition focuses on Agile, Collaboration & Value Delivery

💡 Why Learn the PMBOK Guide? ✅ Align with global project management standards ✅ Improve project efficiency & success rates ✅ Ace PMI certification exams with confidence

🌐 Visit: app.apmic.org

📚 Ready to master project management? Follow @apmicorg for expert insights! 🎯

---

#projectmanagement#PMBOK#PMP#CAPM#AgilePM#PMO#projectmanager#training#riskmanagement#scopemanagement#PMBestPractices#pmicertifications#leadership#stakeholdermanagement#projectexecution#knowledge#agileleadership#workbreakdownstructure#processimprovement#valuedelivery#community#projectsuccess#teamcollaboration#APMIC#studytips

0 notes

Text

The Business Analyst, Project Manager, A New Partnership for Managing Complexity and Uncertainty

Table of Contents The Business Analyst and Project Manager: A New Partnership for Managing Complexity and Uncertainty The Evolving Roles of Business Analysts and Project Managers Benefits of a Collaborative Partnership Case Studies: Successful BA and PM Collaborations Statistics Supporting the BA and PM Partnership Conclusion: A Strategic Alliance for Success The Business Analyst and Project…

0 notes

Text

Modelul CAPM (Capital Asset Pricing Model) - Episod 104 (FINANȚE)

Videoclipul de astăzi este despre Modelul de evaluare a activelor financiare. În engleză se cheamă Capital asset pricing model si are prescurtarea CAPM. William F. Sharpe a dezvoltat prima versiune a modelului CAPM în 1964, pentru care a primit Premiul Nobel.John Virgil Lintner Jr. și Jan Mossin au contribuit independent la dezvoltarea și rafinarea modelului CAPM în 1965, respectiv 1966,…

youtube

View On WordPress

#Acțiuni#administrare capital#brokeri#Capital asset pricing model#CAPM#Catalin Daniel Iamandi#clasele de active#Cătălin D. Iamandi#dezvoltare personala#dividende#domeniu financiar#educatie financiara#ETF#Financial Education#Financial Success#finante personale#Fonduri mutuale#independență financiară#investiții#investiții în acțiuni#investiții în ETF#Investing#investitor#motivatie#R-type Evolution#risc-randament#România#română#subtirare#surse suplimentare venit

1 note

·

View note

Text

🤝Hand holding support is available with 100% passing assurance🎯 📣Please let me know if you or any of your contacts need any certificate📣 📝or training to get better job opportunities or promotion in current job📝 📲𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝗨𝘀 : Interested people can whatsapp me directly ✅WhatsApp :- https://wa.link/82ce5u 💯Proxy available with 100% passing guarantee.📌 🎀 FIRST PASS AND THAN PAY 🎀 ISC2 : CISSP & CCSP Cisco- CCNA, CCNP, Specialty ITILv4 CompTIA - All exams Google-Google Cloud Associate & Google Cloud Professional People Cert- ITILv4 PMI-PMP, PMI-ACP, PMI-PBA, PMI-CAPM, PMI-RMP, etc. EC Counsil-CEH,CHFI AWS- Associate, Professional, Specialty Juniper- Associate, Professional, Specialty Oracle - All exams Microsoft - All exams SAFe- All exams Scrum- All Exams Azure & many more… 📲𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝗨𝘀 : Interested people can whatsapp me directly ✅WhatsApp :- https://wa.link/82ce5u

0 notes

Text

The Project Management Institute (PMI) is a globally recognized organization known for its leadership in setting standards for project management. Whether you’re an experienced project manager or someone looking to break into the field, PMI offers a range of certifications and tools that can help launch your career forward. This cheat sheet provides a quick overview of PMI’s most important certifications, frameworks, and key principles.

#PMI#ProjectManagement#PMP#CAPM#Agile#Scrum#Kanban#Lean#PMBOK#PgMP#PfMP#ProjectManager#PMICertification#PMICheatSheet#AgilePractitioner#ProjectLeadership#RiskManagement#StakeholderManagement#PortfolioManagement#ProgramManagement#PMIACP#PMIStandards#TalentTriangle#PMIResources

0 notes

Text

CA Final AFM | Portfolio Management | SSEI

In this CA Final Portfolio Management class with Sanjay Saraf Sir, we tackle some of the most complex and powerful questions that could appear in the 2024 exam.

#CAFinal2024#PortfolioManagement#CAPM#CPPPI#RiskFreeRate#SanjaySaraf#CAFinalPrep#FinanceExam#WeightedBeta#CAFinalTips

0 notes

Text

PMP certification alternatives | Is PMP overrated?

youtube

Thinking about getting PMP certified? Before you spend your time and money, watch this video! I’m breaking down 4 powerful alternatives to the PMP certification that could be a smarter choice for your career, depending on your industry, goals, and experience level. From beginner-friendly options to Agile-focused and process improvement paths, this video will help you make the right decision. Don’t miss the last one—it’s a hidden gem most people overlook!

#pmpalternative#projectmanagementcertifications#capm#prince2#scrummaster#pmiacp#sixsigma#careerchange#projectmanager#agilecertification#certificationguide#Youtube

0 notes

Text

How to Get CAPM Certification Training Online ?

The Certified Associate in Project Management (CAPM) certification is an excellent starting point for those new to project management or looking to enhance their skills. As an entry-level credential from the Project Management Institute (PMI), it demonstrates your understanding of fundamental project management concepts and practices. If you're considering obtaining CAPM certification, here's a user-friendly guide on how to get CAPM certification training online.

Why Pursue CAPM Certification?

CAPM certification is valuable for those seeking to enter the field of project management or advance their careers. It provides a solid foundation in project management principles, including the Project Management Body of Knowledge (PMBOK) guide, which is essential for effective project execution. Earning this certification can help you stand out to employers, increase your job prospects, and set the stage for further professional growth.

Steps to Get CAPM Certification Training Online

1. Understand the CAPM Requirements

Before enrolling in training, it's crucial to understand the requirements for CAPM certification. To qualify, you need to have either:

- A secondary degree (high school diploma or equivalent) and 1,500 hours of project management experience.

- completed 23 hours of project management coursework prior to the test

Online CAPM training programs typically meet the education requirement and often provide resources to help you gain the necessary project management experience.

2. Choose a Reputable Online Training Provider

Selecting the right online training provider is key to your success. Look for accredited and reputable organizations that offer CAPM training. Ensure the course is PMI-approved and provides comprehensive coverage of the PMBOK guide. Consider these factors:

- Course Content: Ensure the training covers all areas of the CAPM exam, including project management processes, knowledge areas, and techniques.

- Instructor Expertise: Check the qualifications of the instructors. Experienced professionals with practical knowledge can provide valuable insights and real-world examples.

- Reviews and Testimonials: Look for feedback from past students to gauge the quality of the training.

3. Enroll in an Online CAPM Training Course

Once you’ve selected a provider, enroll in their online CAPM training course. Most courses offer flexible scheduling, allowing you to study at your own pace. Online training typically includes:

Video Lectures: Pre-recorded or live sessions covering key topics.

Interactive Modules: Engaging activities and quizzes to reinforce learning.

Study Materials: Access to ebooks, practice exams, and other resources.

4. Prepare for the CAPM Exam

In addition to the training, dedicate time to studying the PMBOK guide and other recommended resources. Practice exams are crucial for understanding the format and types of questions you’ll encounter. Here are some tips for effective preparation:

- Create a Study Plan: Set aside regular study times and break down the material into manageable sections.

- Join Study Groups: Online forums or study groups can provide support and additional resources.

- Use Practice Tests: Familiarize yourself with the exam structure and identify areas where you need improvement.

5. Schedule and Take the CAPM Exam

After completing your training and preparation, schedule your CAPM exam through PMI’s official website. The exam is administered online, offering flexibility in terms of timing and location. Ensure you are well-rested and prepared on exam day.

6. Maintain Your Certification

After earning your CAPM certification, it’s important to maintain it by continuing your education and staying updated with project management practices. CAPM certification is valid for five years, after which you’ll need to renew it by earning Professional Development Units (PDUs).

Benefits of Online CAPM Training

Online CAPM training offers several advantages:

Flexibility: Study at your own pace and on your own schedule, fitting training into your busy life.

Accessibility: Get access to top-notch training resources from any location with an internet connection.

Cost-Effective: Online courses often cost less than in-person classes and eliminate travel expenses.

Conclusion

Getting CAPM certification training online is a convenient and effective way to start your journey in project management. By understanding the requirements, choosing a reputable provider, and committing to thorough preparation, you can successfully earn your CAPM certification and enhance your career prospects. Embrace the flexibility and resources of online learning to achieve your professional goals and make a strong start in the field of project management.

#CAPM#certificationtraining#ProjectManagement#pmicertification#pmi#CAPMTraining#ProjectManagementCertification

0 notes

Text

Upbuild Academy CAPM Course Overview: Outcomes and Approach

By obtaining the Certified Associate in Project Management certification, individuals are able to demonstrate their foundational knowledge of project management principles and practices regard it as an important credential. In accordance with the above, our Upbuild Academy CAPM course aims at equipping aspiring project managers with the proper skills and knowledge to set them on their way to success.

Course Outcomes

Our CAPM course at UpBuild Academy is structured around some of the key program outputs, including:

Full Knowledge Base: The participants get knowledge pertaining to project management terminology, processes, and best practices for doing their projects right per PMI's Project Management Body of Knowledge.

Exam Preparation: This course enables every aspirant to confidently take the CAPM certification exam. Subject matter covered includes all exam domains of project management processes, integration, scope, schedule, cost, quantity, quality, resource, communication, risk, procurement, and stakeholder management.

Skill Development: Participants learn practical skills in Initiating, Planning, Executing, Monitoring, Control, and Closure of projects that help them contribute towards project teams.

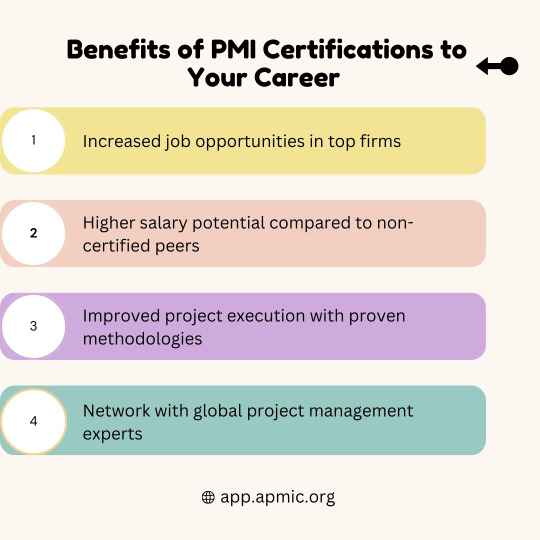

Career Growth: The CAPM certification reflects dedication to professional growth and is very much supportive of career growth aspirations in the area of project management across multiple industries.

Learning Strategy

We adopt a well-structured approach at Upbuild Academy, through which you get to experience an effective course in CAPM.

Trained by Industrial Experts: Participants herein are trained by highly talented instructors who are certified PMPs and have industry experience ensuing rich expertise. Interactive Sessions: The course will use a combination of lectures, discussions, case studies, and hands-on exercises to enhance learning and practical individual application of concepts of project management. Exam oriented: Our course is tailored to the CAPM Exam Blueprint to ensure that all knowledge areas are entirely covered alongside the domains tested. Supportive Environment: We Create a supportable learning environment that helps participants to ask questions, engage in conceptual and meaningful discussions, collaborate with peers and support each other for better understanding and retention of course material.

Why Upbuild Academy?

Upbuild Academy stands out with its high-quality concept of education and professional development:

Proven Track Record: Our CAPM course has a high pass percentage; most of the participants could reach their certification goals.

Flexible Learning Options: Offer weekend, weekday, and online class options to suit the needs and preferences of learners.

Career Guidance: We do not stop at certification; rather, we have post-class career guidance and assistance to make participants really push their careers by possessing a CAPM credential.

The Upbuild Academy designs the course, CAPM, to help each attendant develop the skills, knowledge, and confidence necessary for success in project management roles and attainment of Certification of Associate in Project Management. If you're getting started in your career or formalizing your skills with a recognized credential, our course provides a structured pathway toward the accomplishment of professional goals. Join today at Upbuild Academy; enhance your project management career with confidence.

0 notes

Text

Quanto um investimento deve render?

Hoje iniciamos aqui uma nova série de textos, dessa vez sobre temas econômico-financeiros de aplicabilidade à arquitetura e engenharia: estudo de viabilidade econômico-financeira (EVEF) de empreendimentos, avaliação econômica de empreendimentos pela capitalização da renda, modelagem econômico-financeira (MEF) de projetos de desenvolvimento de infraestrutura, e assim por diante. Abordar esse tema…

View On WordPress

#avaliação econômica#benefício fiscal#capital de terceiros#CAPM#cálculo#como calcular#concessões#concessionária#CSLL#custo de capital#custo de capital capital próprio#custo de oportunidade#custo de oportunidade do capital#custo do capital#D#dívida#dívidas#debt#definição#definição benefício fiscal#definição resumida#definição simples#e#empreendimento#empreendimento imobiliário#equity#explicação#fácil#fácil de entender#imóveis

0 notes

Text

Unlock Career Success with PMI Certifications! 🚀

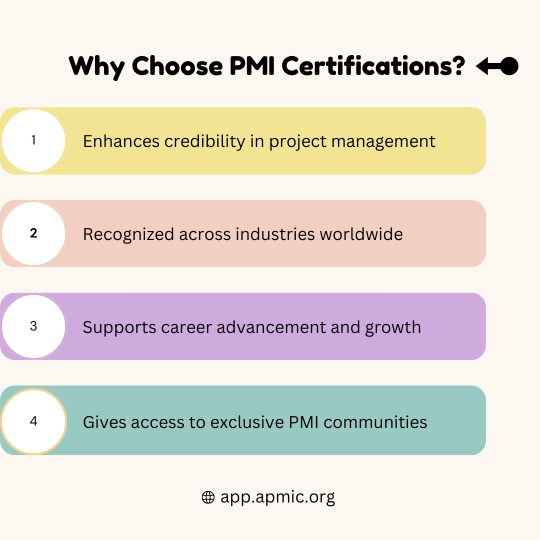

PMI (Project Management Institute) offers globally recognized certifications that can skyrocket your career. Whether you're aiming for leadership roles or new job opportunities, PMI certifications give you the credibility and skills you need!

📈 Top Certifications: - PMP® (Project Management Professional) - CAPM® (Certified Associate in Project Management) - PMI-ACP® (Agile Certified Practitioner) - PMI-PBA® (Professional in Business Analysis)

💡 Benefits: - Higher salary potential - Access to exclusive PMI communities - Boosted job prospects

With over 1 million PMP-certified professionals globally, it's time for you to level up!

💥 Start your certification today. Transform your career!

🌐 Visit: app.apmic.org

👉 Follow @apmicorg for expert tips!

#PMI#projectmanagement#pmpcertification#careersuccess#certifiedprojectmanager#AgilePM#businessanalysis#PMIACP#CAPM#pmicertification#leadership#projectmanager#careergrowth#pmicommunity#success#PMO#PMBestPractices#globalcertification#projectmanagementinstitute#PMPExam#pmiresources#pmbokguide#training#projectmanagementtips#StudyWithPMI#jobopportunities

0 notes