#capitalsands

Explore tagged Tumblr posts

Text

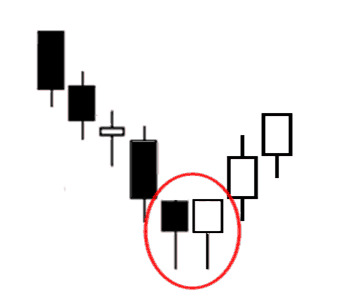

Bearish Counter-Attack Candlestick Pattern

Bearish Counter-Attack Candlestick Pattern

The bearish counterattack candlestick pattern is a bearish reversal candlestick pattern. A bearish counterattack candlestick pattern can lead to a quick price reversal to the downside.

An uptrend has been underway for some time, and bullish investors are comfortable with the momentum in the stock price. A bearish counterattack candlestick pattern starts with too much of the same, maybe even too much of an anniversary, as price opens with a gap from the close of the previous candlestick pattern. Bullish investors feel good about the gap this morning.

But somewhere in the middle of the trading period, things change. Investors sell shares, and at the end of the trading period, the closing price of the candle is equal to or even slightly lower than the closing price of the previous candle. Hence the naming convention "counterattack".

How to Use the Counterattack Candlestick Pattern?

Recognizing the pattern is one thing. Entering a trade using the identified pattern is a completely different ball game. So, here are some important points to consider before entering a trade based on the Counter Line candlestick pattern.

– Watch out for a hard trend first. It can be an uptrend or downtrend.

– Once you have identified the trend, look for a candle that opens with a gap up or down. The openings must be consistent with the current trend.

– Observe the movement of this candle. The movement of the candle must be in a direction opposite to the prevailing trend.

– Once this condition is met, make sure that the candle moving in the opposite direction closes close to the previous day's close.

– A pattern can only be called a counter lines candle if it meets all the above conditions.

– Once the pattern has been accurately identified, it is advisable to wait for a confirmation candlestick before entering a position. For example, in the case of a bullish counterattack pattern, you should only consider taking a trade if the candle that appears after the pattern is bullish. Otherwise, the bullish reversal is said to have failed.

See how the candlestick that appears after the bearish counterattack candlestick pattern is also bearish? This candle essentially confirms the trend reversal and should ideally be the entry point.

What does the Bullish Pattern tell Traders?

The bullish counterattack candle predicts that the reversal of the current downtrend in the market is imminent. The appearance of the first black candlestick with a long real body indicates that the downward trend of the market will continue. The close of the first candle well below the open lifts the morale of the bears at the expense of the confidence of the bulls. The second candle opens and creates a gap below the close of the previous session. However, the opening of the second candlestick also indicates that the selling pressures and the overall downtrend are easing and the bullish reversal is near. The third or fourth day candles confirm the change in trend.

Difference Between Counterattack Lines and an Engulfing Pattern

Both patterns are created by candlesticks of the opposite color/direction. The engulfing pattern differs in that the candles are side by side with the true body of the second candle fully engulfing the true body of the first. It is also a reversal pattern.

Limitations of Using Counterattack Lines

Contour lines may not be reliable. They generally require confirmation candlesticks and are best used in conjunction with other confirmation technical analysis.

Candlestick patterns also do not offer profit targets, so there is no indication of the magnitude of the reversal. The pattern may initiate a long-term reversal, or the reversal may be very short-lived.

Although the pattern does occur, it is not common. The ways to use this candlestick pattern are limited Read More...

Contact us

0 notes

Text

Online Forex Trading - A Way to Enter in the Biggest Financial Market

Online Forex the Biggest Financial Market

Among the many financial markets in the world, the Forex market is the most important of all. In the Forex market, various currencies are traded against each other, with daily transactions often exceeding US $ 4 trillion. The main players in currency markets are central and commercial banks, hedge funds, and multinational corporations. However, the forex market is the easiest financial market to access as a retailer, on a desktop or mobile device, and with little investment capital. Unlike the "big boys" who invest millions in Forex trading, retailers can start with limited funds and no prior trading experience.

All you need to do is choose a forex broker, preferably one of the regulated CFD brokers, and make an initial deposit as shown in the trading account details. In our experience, regulated CFD brokers charge a starting balance of around $ 100 for a normal trading account. However, the amount varies depending on the type of account and the benefits granted to customers. Still, there are novice forex brokers offering micro accounts with deposits starting at $ 1, giving newbies a chance to test the waters before taking the plunge with larger investments and longer trading positions.

Do Forex Retailers Need Huge Investment Capital To Trade?

If retail clients could only invest their own capital in currency trading, the potential for profitable returns would be limited to very wealthy investors. However, the best forex brokers offer marginal trading and leverage to their clients as part of the online trading package. With leverage, currency traders can control more of the market without raising the full amount of capital. forex trading platforms in India Typically, the leverage available on the forex trading platform ranges from 1:25 to 1: 500. Although we have seen regulated CFD brokers offering trades from 1: 1000 to 1: 2000, trades that can be done in This level of relationship can be very risky. and should be avoided by inexperienced traders. In particular, the leverage ratio offered may depend on the customer's trading experience and the type of trading account. how to trade forex for beginners The best forex brokers often ask clients to demonstrate their understanding of forex trading through a simple test on the website. The test results determine the initial leverage ratio that can increase as clients gain trading experience. Successful leveraged trades generate higher investment returns for traders than if they had only traded with funds in their trading account.

Still, leveraged trades can backfire when failed trades occur, as potential losses increase dramatically. Still, the best forex brokers generally protect their clients from catastrophic losses by providing restrictive features like predefined stop loss settings and margin calls on the platform. In our experience, novice forex brokers and regulated CFD brokers pay particular attention to integrating negative balance protection into their trading platforms.

Benefits of forex trading

The forex market offers traders endless trading opportunities, especially when markets are highly volatile. Since currency trading involves predicting the price movements of currencies against each other, the devaluation of one currency means the appreciation of another. In addition, the world currency markets are open 24 hours a day, 7 days a week, Monday to Friday, and the sessions of the Asian, European and Asian markets follow each other due to different time zones. best broker in India for forex offer support throughout the opening of the markets. In our experience, forex brokers for beginners and experienced traders offer demo accounts for hands-on trading, as well as free training courses on their websites. how to read forex charts It is important to note that regulated CFD brokers are typically ECN (Electronic Communications Network) brokers connecting small investors with liquidity providers in the currency markets. ECN brokers do not trade against their clients, but are interested in their clients' earnings, as they receive commissions on those earnings.

Automated Forex trading

The best forex brokers usually offer automated transactions on their trading platforms. With multiple variables affecting the financial markets, it is very stressful for traders to sit at their desks for hours on end trying to understand the Forex market. Automated trading is possible through the use of forex robots that analyze market movements and generate predictions through trading signals on the platform or even via SMS on traders' mobile devices. how to make money on forex Traders can choose to act on the signals themselves or use the signals to automatically execute currency trades. Automated signal trading is particularly useful for inexperienced traders and can potentially significantly increase your return on investment.

Contact Us

0 notes

Text

BEST ONLINE TRADING PLATFORM FOR BEGINNERS

Capital Sands offers its clients one of the most advanced forex trading platforms in India, enabling you to trade currency pairs ranging from majors to exotic pairs.

We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for beginning investor.

In our list of the best Trading Platform for beginners, we focused on the features that help new investors learn as they are starting their investing journey. Brokers were selected based on top-notch educational resources, easy navigation, clear commission and pricing structures, portfolio construction tools, and a high level of customer service. Some brokers also offered low minimum account balances, and demo accounts to practice.

Discover the currency markets for yourself, best broker in India for forex today by simply opening up an account with us, or contact us for further information.

Best Online Trading Platform for Beginners:

Capital Sands Forex : Best Trading Platform for Beginners and Easy To Use.

Contact Us….

0 notes

Text

Top Free Forex Trading. Training For Beginners.

Learn How to manage your funds so you always have Enough money to Trade with capitalsands-fx.

Free Forex Trading Classes.

Open Your Account in Just $100

7 notes

·

View notes

Text

*Seven mistakes makes you blow your trading account*

trading skill the easy way

, why not take it?So, here are the common mistakes every new trader does. And you don’t have to do it. Because you read it here.*Mistake #1 — Diving without due preparation*Which is smart – Learning to swim in a pool or in the sea? It’s the pool. In this analogy, the swimming pool is the demo account and the sea is the real account.Trading in a demo account can seem childish. You may even feel lame that you’re putting in your hours for nothing. Some even argue that trading in a demo account doesn’t bring emotions into play and so a trader will not be prepared for the ordeals out in the world.But, here’s the thing: The demo account doesn’t emulate the experiences of a real account. Rather, it gives a feel of the things out there in the real. It makes you understand the correlation between currency pairs, the best time to trade and renders you a forum to test your baby strategy. If the strategy gives you a decent reward, it piles up your confidence. When you’re new to trading and you see prices sway from your entry, confidence matters most. You need to know when to hold your guns and when to let go. And demo account can aptly do so for you.Remember, its a pool and it makes you learn basic swimming though it might not prepare you for the currents of the ocean. As a wannabe swimmer (trader), you got to take it.

*Mistake #2 — Overtrading*When one is good, why not make two out of it or even three out of the same? It seems logical, right? Nay, wrong. Trading doesn’t work that way. The market doesn’t produce profitable trade setups at your will. If you’re finding aplenty, then it means you’re not following the due diligence. Before you realize this mistake, your trading capital would be halved.What you lose in a matter of minutes, take months or even years to build. So, you need to cherry-pick the trades wisely.*Overcoming overtrading syndrome*The key reason traders overtrade is that they either don’t have the patience or understand its importance. The purview of patience is not limited to the formation of the trade setup alone. A quintessential trader has patience in all aspects of trading — the formation of trade setups, the long haul to book profits, waiting years to build his/her trade account. And one can’t acquire prototypical patient characteristics over-night just for trading.It requires a change in your personality. Take up a hobby, say hunting or fishing. Because like trade setups, preys are a hard catch too. You have to wait for hours to catch it. And these kinds of hobbies slowly change you as a person. It instills patience in your character and makes you a better trader.

*Mistake #3 — Avenging for Revenge**Revenge trading*It is the one mistake that every trader know that they shouldn’t do, yet no one can help it but do. The market can be cruel at times. A winning position can turn into a lose suddenly or you can have a series of losses for reasons you can’t comprehend. It unleashes a vicious chain of emotions and you feel the urge to get back what you lost immediately.But the more you try, the more lose. It is because the trades are not backed by logic or strategy rather emotion and desperation. And when you realize the mistake, it may be too late. So, when you have a streak of loses, take a pause, clear up your mind, cool-off and then get back to trading.A break from trading helps you in many ways. It gives a fair perspective of what went wrong for you. So never hesitate to take a break. After all, it’s the only thing that you can control in the market.*Mistake #4 — Trading without stop loss*This notion is getting fancy off late. Many mentors take a leaf out of pros’ handbook and are recommending it. But it is not going to work for you. Because the resources available at their (pros) disposal and at your end are quite different. They do have a team of fundamental experts and a hefty load of cash.And so they trade without a stop loss but with solid fundamental backing. Further, they deploy various hedging strategies to counter short-term loss, which is not privy to you.Being a retail trader, it is better to keep things simple. When a technical structure breaks, it is best to exit positions. It minimizes your loss and lets you see another day. Further, when you’re new to trading, you’re bound to mistakes. So, eke out every penny and stretch out your learning process.*Mistake #5 — Trading with a small stop loss*Stop loss is not the value that you deem you can afford. It is the value the technical structure demands. Traders often make this mistake in an effort to curb the losses. But it only increases the number of losing traders and in turn decrease your accuracy level and confidence. And so, it is the primary reason behind the advice of trading mentors to dodge the stop loss.If you feel, you can’t afford a wide stop, then reduce your lot size. Fix the dollar value you could afford and then calculate the lot size accordingly. Sounds complicated and tedious? If you want to mimic the pros style of trading, then do it the right way.

*Mistake # 6 — Betting on a news*No one can resist the temptation of making quick bucks. And the news trading ideally provides it so. But you should resist it. Why?Because it is not the news that matters most. It is the aftermath reaction of the traders and the sentiment of the community that takes the center stage.For instance, consider the FOMC statement released on July 30, 2019. The committee made a rate cut of 25 bps which by convention and wisdom should have made the gold prices to soar. Many retail traders had a humongous number of long bets during that day. But the market took them as casualty eventually. Contrary to popular belief, it plunged 300 pips and stumped everyone.*Trading mistake is betting on a news*Well, the trading community usually has its own explanation like, “It wasn’t par or up to the expectations.” The reasons don’t matter because you would get a margin call from your broker before you can dial up ‘why’. So news betting is more of a gamble than trading. Because you can’t interpret what others have in mind. Therefore it is better to stick to the charts.*Mistake #7 — Trading without a plan*This is the one trading mistake that instigates and galvanizes the above all or even thousands more. When you don’t have a plan, you tend to succumb to the moments. And trading presents you those moments often. Further, the plan dictates the right and wrong for you.It’s all about the discipline in trading the plan that’s going to bring success to you. So, pick a strategy. We have many Best Forex Trading Strategies for free and some for a small fee. Just contact

@capitalsands

or

Or choose an indicator to help you. We have the best in the business indicators for you. Then create a risk-reward ratio and stick to it.*Conclusion*There is no doubt that the market is a paradox. But you have to keep things simple in order to succeed. And there is always be pep talks from experts to try contemporary techniques. You can learn it, but don’t try to act on it, unless you garner the experience. Further, when a strategy works for you, use it as long as it becomes obsolete.

Capital Sands Financial Services

Contact Details:-

Website - https://capitalsands.com/

Phone No. - +91 9910181398

What's app No. - 9910181398

Email: [email protected]

Instagram: @capitalsands

Twitter: @CapitalSands

Facebook: Capital Sands Financial Services

Linkedin: Capital Sands Financial Services

Telegram: 01capitalsands01

Skype: [email protected]

# Tag - #capitalsands

2 notes

·

View notes

Text

we war on you macs your faggots and try to hit our son and haul him in so many times i am bleary eyed and the tons of idiot comments too and on our chanel allmacs out now out ofhere now all...i order it select teams and your ago Balaam Baal and we need you itact Zues...and we hear it good..adn i like it this is drudgery, Hera states..we took tons of capitalsand now we hover over cities and yes per his orde yournasty idiots..a.nd we see where you say and soon we install protectorate and use the weapon elswhere and to clear ad free upthe main lasers for other work and we need ships up and now...tons say it we workit and it grows back..we send Starz there t suspect clone areas and drain pull them all out. now too. and help Arriane we will continue rapid bombardment Thor Freya we help out now it is hell htere these are so unruly they see wi after win and today as a win. w e see them now squirrely idiots and dangerous dont get it they were harmping ont e shipt thing ad junk nd then the ring ding it is not high tech thy laughed no it is not and you have better and they wanted to know and tried ad itis lame but not the lamest so we weill fight themand thier bossesnow irradicate them. ad their towers. huge fleets fight still and ar up and are at towers giatn towers go down and all over hug huge towers they are ten times the size of regular ones and bout 40 per area around 100miles hight toolarge as ships overhead too riskey all covered too time consuming and we see it this is a nuisance too we infilrate take tem all and took all in th emidewest this afternon they will lose it all now Thor

0 notes

Text

What is in The Neck Candlestick Pattern

What is in The Neck Candlestick Pattern?

The pattern at the neckline occurs when a long real-body bearish candle is followed by a smaller real-body rising candle that widens at the open but then closes near the close of the previous candle. The pattern is called a cleavage because the two closes are the same (or nearly the same) on both candles, forming a horizontal cleavage.

In theory, the pattern is considered a continuation pattern, which indicates that the price will continue to fall following the pattern. In reality, this only happens half the time. As such, the pattern often suggests at least a short-term bullish reversal.

What Does the Neckline Candlestick Pattern tell Traders?

The candlestick pattern at the neckline informs traders of the possibility of the current trend in the market continuing. If the study is exhaustive, it also sheds light on the general behavior of the market in which it occurs. The appearance of the first bearish candle indicates the strength of the bears in the market. The second candlestick is bullish and shows that the bulls are trying to rally to turn the tide. However, the second candle does not close above the close of the bearish candle.

Theoretically, the appearance of the pattern at the neckline predicts the continuation of the current downtrend in the market, as the bulls simply cannot outperform the bears. What is unique about the neckline pattern is that it can predict the continuation despite the bull's best efforts to push the market higher through significant buying pressure. The market goes its own way after being sold off by the once-long bulls hoping for a brief pullback. This continues the current downward trend in the market.

How is a Neck Candlestick Pattern different from a hump pattern?

– A push pattern is considered both a bearish continuation pattern and a reversal indicating an uptrend. It is similar to the neckline candlestick pattern or the neckline pattern as it is two candlesticks where the first candlestick is high and bearish while the second candlestick is bullish and short.

– The difference between the stock pattern and the neck and neck pattern is in the closing point. In the push pattern, the second candlestick closes above the close of the first candlestick, but closes at or near the middle of the body of the first candlestick.

– However, a push pattern does not produce any clear results and sometimes shows a reversal and sometimes resumes the downtrend.

- A trader should be careful when following this pattern as it is not a strong pattern to confirm the trend. It is ideal to be on the lookout for other signals that may indicate a downtrend before trading. A trader should look carefully and take the time to identify a neckline pattern to trade as there are close similarities to the other two candlestick patterns.

On the Psychology of the Neck Trader

To increase their chances of success, traders can use this neck-in approach in combination with other types of technical analysis, including technical factors and chart structures. The Psychology Behind the Neck The traded value is either in a major downtrend or a significant pullback that is within a major uptrend. There is a small daily high on the first candle that reverses into an extended blackbody and creates a whole new low. Such weak or low price activity increases the value of the declining market and forces weak bulls to retreat altogether. The second candle deviates a few ticks and sells the stock to a new low. However, it lowers both the buyers and the other bulls to take control before the closing bell, causing the price to rise from the bottom in a quick uptrend that outweighs the opening pressure. This strong pricing strategy builds confidence among bullish investors, causing complacent bears to scrutinize positions and worry about a trend reversal. A limited amount of bullish power sizzles before the close when the long tick fails to penetrate the true body of the first candle. The bears analyze the waning power of the bulls and push lower in the continuation of the current downtrend. This low price approach drops the value to a new low on the third or fourth candle Read More...

Contact us

0 notes

Photo

Access 100+ FX, Commodities, Indices & Global Shares CFDs from Market24X365 https://qrco.de/MT-24x365 #capitalsands #capitalsandsfx https://bit.ly/2OifzGm

0 notes

Text

Jim Schoenfeld born on September 4, 1952

Jim Schoenfeld was selected by the Sabres with the fifth overall pick in the 1972 NHL Draft. The 6'2" Ontario native became a fan favorite in his rookie season as he took on three Boston Bruins in a fight. From there on, he made his reputation as a solid, tough two-way defender.

He played in parts of 11 different seasons with the Sabres, serving as the team's captain from 1974-77. As soon as he retired in 1985, he became the coach of the team the following year. He was fired after the team finished fifth in the Adams division, but later went on to coach for the New Jersey Devils, Washington Capitalsand Phoenix Coyotes.

Schoenfeld ranks third for the Sabres in all time plus/minus rating and is undoubtedly considered amongst the top defenders that have played in Buffalo.

Currently, he serves as the assistant general manager of the New York Rangers. However he just parted ways with the New York Rangers

#buffalo sabres#hockey#sabres#vintage hockey#old time hockey#hockey history#vintage#history#jim schoenfeld#retro hockey#retro sabres

0 notes

Text

Introduction to Trading: Scalper

What Are Scalpers?

Typically, investors make their money by buying a security and then selling it at a profit. It is not uncommon for investors to hold positions for a few months to several years. On the other side of the coin are the dealers foreign exchange market today. The typical trader doesn't hold a stock for more than a few days and often trades stocks multiple times a day. Scalpers are a specific type of short-term trader who can move in and out of a stock or other asset class dozens, or in some cases hundreds, of times a day.

Understanding Scalpers

Scalpers are often energetic individuals who thrive in times of stress and have the resources and temperament to handle the high volume of transactions. While almost anyone with a lot of time, money, and knowledge (among other qualities) can become a scalper, it often makes sense to leave this type of trading to the more experienced day traders.

The Costs

There are several issues that make it difficult to be a scalper. First of all, holding so many positions can be time consuming. In fact, it is safe to say that the scalper is glued to his monitor all day, waiting for the slightest movement to enter and exit positions. Being a scalper can also be expensive (in terms of dollars and opportunity cost) forex trading platforms in India. Indeed, the scalper often needs to have money in hand to be able to seize opportunities in the blink of an eye. And don't forget the commissions. In fact, commissions can be a big killer. Just think of all the ticket fees a scalper could rack up in a day and how that eats away at his hard-earned winnings. For this reason, scalpers who work alone should try to get the lowest commission rates by negotiating with a broker

Tools of the Trade

Scalpers need special equipment to be successful. This may include accessing Level II quotes to track offers and requests throughout the trading session. Access to card information and a phone line is also important. Aspiring scalpers should also be aware of how decimalization can affect trading, and therefore their profits. Specifically, traders and investors historically bought and sold stocks using a fractional system; Transactions were generally made in fractions of 1/16 (or the equivalent of $ 0.0625) or more about foreign exchange market you. Today, spreads are often only separated by a few cents and transactions are done in cents. This is a problem because it may be more difficult for the scalper to make a profit. For example, if a scalper buys a stock for $ 10 and sells it for $ 10 with a decimal of 1/16, using fractions, he will get a profit of $ 62.50 on 1,000 shares (excluding commissions). However, if that same scalper bought a stock at $ 10 per share and sold it at $ 10.01, his profit would only be $ 10, which probably doesn't even cover the commission. Again, the point is, this can be a stumbling block for future scalpers and should be taken into account.

Entering the Game

So how do you become a scalper and participate in this exciting and potentially lucrative field? To be clear, scalping isn't for everyone. Scalpers must be naturally willing to take risks and manage the tensions that surely come with this frantic style of trading best broker in India for forex. With this in mind, there are no formal educational requirements to become a scalper yourself. In fact, it's technically something almost anyone can do if they have the time and the resources. Of course, it probably makes sense for a scalper to initially trade only a few stocks at a time and have a thorough understanding of the markets. In fact, for this reason, many would argue that scalping should most likely be left to professionals or experienced day traders.

Compete Risk-Free With $ 100,000 in Virtual Money

Put your trading skills to the test with our FREE stock simulator. Compete against thousands of Investopedia traders and trade your way to the top! Submit transactions in a virtual environment before risking your own money. Practice trading strategies so that when you are ready to enter the real market, you have the necessary practice.

Contact us

0 notes

Text

INVEST IN FINANCIAL TECHNOLOGY AND AUTOMATED INVESTMENT

How to Use the Software to Perform Arbitrage Operations

Traders use software to identify arbitrage trading opportunities that they can exploit for potential profit foreign exchange market today. The three types of software that are commonly used for arbitrage trading are auto trading software, warning programs, and remote warning programs.

What is Arbitrage Trading?

Arbitrage trading aims to take advantage of temporary market inefficiencies that cause the same asset to be undervalued in different markets or with different brokers or similar assets in the market. Arbitrage trading helps to quickly correct these temporary pricing inefficiencies by properly reconciling prices in different markets, brokers, or different forms of the same asset or financial instrument forex trading platforms in India. Temporary imbalances that create arbitrage trading opportunities ideally provide a trader with the ability to simultaneously conduct buy and sell transactions that generate a small profit due to price fluctuations.

For example, in the forex market, there may be a slight temporary spread between the EUR / GBP exchange rate and the EUR / USD and GBP / USD currency pairs, which may allow a trader to profit from the sale. EUR / USD and buying EUR / GBP and GBP / USD at the same time Another example of an arbitrage trading opportunity is when different brokers offer slightly different bid and ask spreads that provide a similar opportunity to make a small profit by simultaneously buying an asset at a broker's lowest price and at the same time selling the lowest price. high of a corridor. the other broker rate.

Use of Auto Trading Software

Since arbitrage trading opportunities generally only exist for a very short period of time, often only seconds, it is too long for traders to perform arbitrage calculations on their own. As a result, traders use a variety of software that can instantly identify and calculate arbitrage opportunities. One type of software used by arbitrage traders is automated trading software. This type of software is uploaded to a trader's brokerage platform and whenever the software detects an arbitrage opportunity, it immediately initiates designated trades on behalf of the trader about foreign exchange market you. This type of program is designed to overcome one of the main challenges of arbitrage trading - fast and accurate execution of the trades needed to take advantage of trading opportunities that can last as little as a few seconds.

Use of Commercial Alert Programs

Traders who are not comfortable with automatic trade execution and prefer to make all final trading decisions themselves use something called Trade Alert software. Like auto trading software, trading alert software continuously scans various markets, instruments, and brokers for arbitrage trading opportunities. When it detects an arbitrage opportunity, instead of automatically executing the trade, it simply indicates an opportunity to the trader, who then makes the decision to execute or not trade on the opportunity.

Use Remote Warning Programs

Some resellers subscribe to a remote warning service instead of running their own software. Subscribing to the service allows them to receive warning signals of arbitrage trading opportunities in the same way as they would with their own software best broker in India for forex. The difference is that the warning signs are provided by software running in a different location outside of the dealership's computer or network.

The Bottom Line

Institutional traders or market makers have several advantages in arbitrage trading over retailers, including faster sources of information, high-performance computers, and more sophisticated arbitrage trading software. Either way, arbitrage trading is still popular with many traders.

Compete Risk-Free With $ 100,000 in Virtual Money

Put your trading skills to the test with our FREE stock simulator. Compete against thousands of Investopedia traders and trade your way to the top! Send transactions in a virtual environment before risking your own money. Practice trading strategies so that when you're ready to enter the real market, you have the necessary practice.

Contact us

0 notes

Text

Tweezer Bottom and Top Candlestick Patterns

How to Trade the Tweezer Bottom and Top Candlestick Patterns.

The depth of the lower shadows of this signal indicates a support zone. The bears were unwilling to sell below that low price, so the bulls came back with great force, driving the price higher. The fact that two or more shadow candles have formed at the same level confirms the strength of the support and shows that the downtrend is likely to continue or turn into an uptrend.

Like the high tweezers, this signal is considered a short-term minor reversal pattern. To better understand its meaning, pay attention to these characteristics:

1When this model appears at the bottom of the market, it is more reliable.

2If the first candle has a high body and the second one has a short body, then the reversal will be more reliable.

3If the bottom of the tweezer is followed by another reversal pattern, such as B. an engulfing or bullish piercing pattern, with identical lows, this is even more reliable.

The Tweezers Top and Tweezers Bottom Patterns.

Tweezers Top

The Tweezers Top pattern appears in an uptrend. The first candle of this pattern should be a bullish candle with a large real body, followed by a bearish candle with a short real body. Both candlesticks must have the same high or their real bodies must be at the same high. The pattern is most reliable when viewed in the context of the larger price chart, with the pattern appearing at market highs or near resistance or trend lines.

tweezers Bottom

The Tweezers Bottom pattern appears in a downtrend, with the first candle being a dark bearish candle with a large real body, followed by a bullish candle with a short real body. Both candlesticks must have the same low or their actual body lows must be at the same level. The pattern is most reliable when it appears at market lows or near support levels or lower trend lines.

Advantages and Disadvantages: Using Tweezer Patterns at the Top and Bottom

Let's see the advantages of the upper and lower gripper models:

1Tweezer patterns are reliable price reversal patterns that put traders at the forefront of a new trend.

2The tweezers pattern can reliably indicate the mood of the buyer and seller.

3Tweezers of a necessary support and resistance level increase the trading accuracy of other indicators and methods.

4This trading strategy integrates well with other indicators.

5 There are also some drawbacks to using the top and bottom clamp models:

1It can be difficult to count on a trend reversal just by looking at two candles. The addition of high volatility suggests a very likely price reversal.

2When the tweezers pattern forms against a major trend, it may not work as well.

3Tweezer patterns occur regardless of market volatility and uncertainty.

4Investors should use indicators other than the tweezer pattern to increase accuracy.

conclusion

The candlestick patterns at the top and bottom of the caliper generally take on different appearances, but they do share some common characteristics that typically occur in market turns Read More...

Contact us

0 notes

Text

What is a Marubozu candlestick pattern?

What is a Marubozu candlestick pattern?

A Marubozu candlestick pattern is a stock chart pattern that can help investors gain insight into market sentiment at any time. Although Marubozu's model performs quite well when spotted, it remains relatively unpopular with investors. We take a look at the basics and key features of the model so you can start harnessing the power of this little-known stock market predictor. Marubozus are full-bodied bullish or bearish candlesticks with no upper wicks or lower shadows. Marubozus are usually green or white when they are bullish and red or black when they are bearish on stock charts.

What are the pros and cons of using the Marubozu candlestick pattern?

An important point to keep in mind when researching Marubozu candles is that while you should never trade in the same direction as the candles, you should definitely trade against them. Given the trading activity that is driving this pattern, if the market continues to move in this direction, you may feel crushed. History has shown that price rarely reverses immediately, consuming the movement of the candle. In this sense, the Marubozu model is excellent for demonstrating the market sentiment behind a currency pair. As these patterns develop, they can help traders gauge how forex traders view this pair overall, which plays a critical role in determining the price action of this pair in the near future.

However, sentiment is only one of the factors that influence exchange rates. For this reason, the Marubozu can be a frustrating source of false signals that incur costs for forex traders, deflecting potential price moves and setting up their trades for huge losses. For this reason, Marubozu models should be combined with indicators and models that assess trading opportunities based on other key metrics such as trading volume and/or resistance levels.

Why use charts to track stocks

Stock market charting activity is not a new idea. Analysts were charting long before the New York Stock Exchange (NYSE) was created, albeit in a more rudimentary form than it is today. Charts are used to create an easy-to-understand visual representation of stock market activity. Regardless of the reasons for decline or growth, graphs track changes and show activity over time. Even a casual investor can read charts once he understands the basics of what he is tracking. This gives the investor the information that he may need to make decisions based on what is happening in the market. Using charts, they can see what is overbought or oversold and decide whether to follow those trends or try to take advantage of less popular assets or dump high-demand assets.

Keep in mind, however, that the charts can track many different features. So be very careful with the information you see broken down. Some charts cover daily activity, while others may track weeks or months. To get a bigger, more complete picture, a trader may want to look at many different charts to see short-term and long-term changes before making decisions.

What does a Marubozu pattern tell you?

The Marubozu sends a strong message: the market is moving in one direction. If you break out the candle, you can see that the price of the asset is trading in one direction throughout the session.

This feature applies to both open and closed Marubozu candles, despite the small wicks on both sides, as the buying or selling interest was so strong that it overwhelmed the other side of the market. For bearish Marubozu candles, the pattern indicates that sellers are in full control as they dominate the session in the desired direction, and vice versa for bullish Marubozu candles. Marubozu is especially important when the candlestick is near resistance or support levels, as it can open on one side and close on the other, further amplifying the current trend Read More...

Contact us

0 notes

Text

Three White Soldiers Definition

Three White Soldiers Definition

The Three White Soldiers candlestick pattern is unusual in that its meaning depends on its context. However, the pattern itself is easy to spot. This training is simply three days in a row with a white candle, each higher than the last. The apparition is of three white soldiers standing in a row, hence the name. The bullish significance of this formation is easy to guess. But how reliable is this indicator?

This indicator is quite strong and very reliable in most situations, indicating an accumulation of bullish strength. For example, when a market is flat or moving mostly sideways, the three white soldiers indicate that the bulls are gaining ground. When the market has entered a downtrend, this candlestick pattern indicates a reversal. However, when the market is constantly progressing, the three white soldiers are considered less important. That's because they fit the current blueprint and aren't even really considered a sequel.

How to identify the Three White Soldiers Candlestick Pattern?

A three-soldier white candlestick consists of three long white royal bodies separated by two black royal bodies. The third long white body should be wider than the first two.

It is formed when three consecutive long candles are formed:

1The first candle must be black, which means that it opens above the opening price of its previous candle but closes below it.

2A second white candlestick should open above the close of the previous one and also close above your open position.

3A third white candle should form with a long body that should stay within or slightly above the range of your previous two candles for the day.

A three white soldier’s candlestick pattern indicates that prices have reached a temporary low after a prolonged decline. A break above the resistance level will confirm the uptrend reversal and suggest that prices will continue to rise. Therefore, the Three White Soldiers candlestick is most effective when used with other technical indicators. This is significant as it suggests a continuation of the uptrend despite several small pullbacks. Therefore, traders can use Three White Soldiers as a signal to enter long positions.

What does the pattern tell traders?

The Three White Soldiers candlestick pattern is a bullish reversal pattern. This indicates that the bears are losing control and a market reversal is very likely. In this pattern, each candle must be above the close of the previous candle, creating a ladder where each step is higher than the previous one. This upward movement of the pattern is actually an indication of the start of an uptrend.

As we have already mentioned, the model of the three white soldiers is a very solid and reliable model. This is especially true when used in conjunction with other indicators like the relative strength index. Therefore, it is also an excellent tool for trading strategies. However, traders must also consider other factors such as volume.

The Three White Soldiers pattern helps start or exit existing operations. For example, a trader may enter a long position when the Three White Soldiers candlestick appears on the chart and the next candlestick shows an open gap (the opening price is higher than the previous day's closing price). It is also useful for day trading where traders can also look for the three white soldiers on 5 minute, 15 minute or hourly charts. After initiating a long position, it is always advisable to set a stop loss at the last low and take profit whenever there are more signs of a trend reversal. Although it is quite rare to spot the Three White Soldiers candlestick pattern, it is a very useful pattern that traders should never ignore.

Difference between three white soldiers and three black crows:

The opposite of the three white soldiers is the candlestick pattern with the three black crows. Three Black Crows consists of three consecutive long-bodied candles that open at the real body of the previous candle and close lower than the previous candle. As three white soldiers capture the bears passing the bulls, three black crows show the bears taking control of the bulls. The same caveats regarding volume and additional confirmation apply to both samples.

The three black crows candlestick pattern is the opposite of the three white soldiers.

Three black crows consist of three consecutive bearish candlesticks.

On the other hand, three white soldiers indicate a change from bearish to bullish and consist of three consecutive bullish candlesticks Read More...

Contact us

0 notes

Text

PIERCING PATTERN

WHAT IS A PIERCING PATTERN?

The piercing line pattern is considered a bullish reversal candlestick pattern at the bottom of a downtrend. This often results in a trend reversal when bulls enter the market and push prices higher. The piercing pattern features two candles, with the second bullish candle opening lower than the previous bearish candle. This is followed by buyers pushing prices past the 50% bearish candlestick body.

How a Piercing Pattern Works

A piercing pattern has two days where the first day is decidedly influenced by sellers and the second day is answered by enthusiastic buyers. This may indicate that the supply of shares that market participants are looking to sell has dried up a bit and the price has fallen to a level where the demand to buy shares has increased and increased. This momentum appears to be a reasonably reliable indicator of a short-term bullish outlook.

How to identify Piercing Patterns?

First of all, it should be considered that the pattern formulation should consist of 2 candlesticks. The second candle must be such that it starts below the low of the day 1 candle (which is inherently bearish). At the same time, it should close at the top of the middle part of the bearish candlestick. When the bullish candle of day 2 closes above the middle of the bearish candle of day 1, it forms a triangle. Also, it only appears during a downtrend, and price gaps at the beginning of day 2 are necessary. The formation of this pattern is unique in that it shows the reverse trend of the market when its appearance has not been accepted.

It also includes a lower spread after the first trading day, with the second trading day starting around the low and ending near the high. The close must also be a candle that covers at least half the length of the previous day's red candle.

Advantages of using piercing pattern

This method is easy to use and implement. Any investor or trader can implement this technique. This method generally offers its investors a better risk/return ratio. By paying attention and understanding this technique, investors can easily find entry points into the stock or index.

Disadvantages of using piercing pattern

The main disadvantage of this method is that it can only be used for a bullish reversal pattern. And to confirm the reversal pattern, this technique should be combined with oscillators and other technical indicators. One cannot fully rely on this model when making trading decisions. This involves analyzing the entire market movement and not just the candlestick pattern itself read more.

Contact us.

0 notes

Text

Candlestick Chart

The 3 Most Powerful Candlestick Chart Patterns

Candlestick charts are a technical tool that groups data from multiple timeframes into individual price bars. This makes them more useful than traditional open-high, low-close bars or simple lines connecting closing price points. Candlesticks form patterns that predict the direction of prices when they end. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. Steve Nison introduced Japanese candlestick patterns to the Western world in his popular 1991 book, Candlestick Charting Techniques.1 Many traders today can identify dozens of these patterns, which have colorful names like bearish cloud cover, evening star, and bearish cloud cover. three black ravens. Additionally, single bar patterns including Doji and Hammer have been incorporated into dozens of long and short trading strategies.

1. Spinning Top

When trading stock markets or other liquid and risky asset classes, profits can be maximized by spotting a change in trend and then moving it in the right direction. This is exactly what a gyro candlestick pattern does: it helps spot trend changes for the underlying asset. Highs are simple candlestick lines that have small real bodies with upper and lower bodies that are longer than the real bodies. In general, this is a small candlestick pattern (single candlesticks) where stock prices open and close together. The pattern forms at the top of an uptrend or at the end of a downtrend.

Unlike many other candles, a gyro can be a bearish or a bullish candle, which means that the color of the candle doesn't matter and therefore shouldn't be too important. It is important for the trader to wait once the gyro pattern has formed and see the next price move to bet on the direction of the market. Assuming an uptrend prevails and a trader sees a bearish candlestick shape following the gyro pattern at a resistance level, the exit point would be there. The interpretation, structure and logic of spins and doji are more or less the same. However, a gyroscope shows a larger candle body, highlighting the fact that there has been significant price movement during the candle's time frame. As shown in the photo to the side, shares of Tasty Bite Eatables Ltd. formed a gyroscope pattern and then saw a nearly 41% correction over 19 trading sessions.

2. The Piercing Pattern

A piercing pattern is a candlestick pattern that gives us potential bullish reversal signals and forms near support levels at the end of a downtrend. This pattern consists of two candlesticks, the first one is a bearish candlestick and the second one is a bullish candlestick.

The bearish candlestick should have a large real body and the second bullish candlestick should move below the low of the previous candlestick and close above the midpoint of the real body of the first candlestick. Investors should be aware of a few features when trading this bullish candlestick pattern – the ubiquitous pattern:

First of all, the trend should be down, as the penetrating pattern is a bullish reversal pattern.

Second, the length of the candlestick plays an important role in determining the strength of the reversal.

The gap between the bearish and bullish candles indicates the strength of the trend reversal.

Fourth, the bullish candlestick should close higher than the midpoint of the previous bearish candlestick.

Finally, the bearish and bullish candle should have larger bodies.

3 The Doji Candlestick Pattern

There are times when the forex candlestick is neither bullish nor bearish. Instead, it is a candlestick with short wicks and an insignificant body. It is shaped like a "plus" sign. The candlestick formed is called a Doji.

The best Japanese candlestick patterns for intraday trading

The doji appears on the charts when the market is temporarily undecided on which direction to go, up or down. In other words, it is neutral and cannot be used to trade a reversal or continuation.

So what makes this unbiased candle so powerful?

Its power lies in the positioning of the doji. You can find a doji almost anywhere on the charts, and each position says something important about the currency pair read more.

Contact us.

0 notes