#cad adds an addendum

Explore tagged Tumblr posts

Note

I woke up, saw this post and then immediately started trawling through my music likes on a Mission and by Jove I have a Suggestion for @docgoldman87

Tunguska by Ashbury Heights

I’m just going to quote from two parts of the song because damn I’ve liked this song since it came out three months ago but if I look at it again to me it actually fits Soult scarily well

I'm doing all the things that are expected / I'm working overtime and paying taxes / And still / I'm dying on this hill / I'm looking for the usual plans and assets / I'm stretching them to cover up my past dents / Until / There's nothing left to feel

And they would always call me trash / And all I ate would taste like ash / I've been lost on countless ships / I've been through against the cliffs / I've been staring at the sea / I'm in love with broken dreams / And I've been breaking at the seams / Cause I just can't make my peace

Look at it! the grind of duty and plugging away at something for little or no reward, Soult’s reputation as a strategist in “looking for the usual plans and assets”, the rumours and mockery directed at him, even his fascination with ships!

Also unrelated but as a dabbler in linguistics I’m just absolutely feral for the line “It's really hard for me to play pragmatic / When all of the veneer is just semantics”

Also it’s dancey electronic pop because I like dancey electronic pop

Notable other suggestions I have which I would probably just all chuck on a Soult playlist

Good Shot Good Soldier by Everything Everything (You're a grown man, you're a good leader / Don't everybody know / What's the right thing, what's the right thing to do?) - more kinda a satirical song for general military/duty bound characters

Spring / Sun / Winter / Dread by Everything Everything (The hands loom heavy with only an hour to go / I hold my breath but the seekers will find me / Priest and pauper, the leper, can't change his spots / The king knows and I know, and everybody knows) - vibes for the slander and accusations around the “Roi Nicolas” stuff

South by Sleeping At Last (Some truths are gentle, forgiving and kind / Some truths are hard to define / Some truths are crooked, with rough edges too / But some truths wear like comfortable shoes) - a quieter song, I really like the line “if truth is north / then I am due south / I can’t figure it out” for an embittered and doubting Soult

And also East by Sleeping At Last from the same series of songs is 10000% a Napoleon song (Now I bear little resemblance to the king I once was / I bear little resemblance to the king I could become / Maybe paper is paper, maybe kids will be kids / Lord, I want to remember how to feel like I did) so that’s a nice parallel

I should probably stop typing and go to work but yeah! And @josefavomjaaga don’t be too hard on yourself for not being that into music!

hallo!

if you were to choose a song/music that would essentially be Marshal Soult's "theme song," what would it be?

Hi! Thank you for the Ask! And ... 🤔

It's an interesting question. It's just that I fear I'm the person least suited to give an answer.

Embarrasing confessions time: a) I'm fifty years old. b) I never listen to music these days (literally) and I barely did so when I was younger. I have no clue what music people listen to these days.

So, I'm sorry. And stupid.

But if it's okay for you, maybe I could hand over that question to other people? Maybe somebody else has an idea? - The topic would probably be something about duty and responsibilities, discipline and self-abnegation. And I'm not sure if these things are very popular at all, let alone in music.

So sorry I can't help you any better. 😥 Please somebody come to the rescue!

#cadmus rambles#cad adds an addendum#cad uses the opportunity to share his music taste unprovoked#jean de dieu soult#napoleon’s marshals#napoleonic era#trying to stop myself from adding regret by everything everything because everything everything can’t stop making bangers

13 notes

·

View notes

Text

How I ditched streaming services and learned to love Linux: A step-by-step guide to building your very own personal media streaming server (V2.0: REVISED AND EXPANDED EDITION)

This is a revised, corrected and expanded version of my tutorial on setting up a personal media server that previously appeared on my old blog (donjuan-auxenfers). I expect that that post is still making the rounds (hopefully with my addendum on modifying group share permissions in Ubuntu to circumvent 0x8007003B "Unexpected Network Error" messages in Windows 10/11 when transferring files) but I have no way of checking. Anyway this new revised version of the tutorial corrects one or two small errors I discovered when rereading what I wrote, adds links to all products mentioned and is just more polished generally. I also expanded it a bit, pointing more adventurous users toward programs such as Sonarr/Radarr/Lidarr and Overseerr which can be used for automating user requests and media collection.

So then, what is this tutorial? This is a tutorial on how to build and set up your own personal media server using Ubuntu as an operating system and Plex (or Jellyfin) to not only manage your media, but to also stream that media to your devices both at home and abroad anywhere in the world where you have an internet connection. This is a tutorial about how building a personal media server and stuffing it full of films, television shows and music that you acquired through indiscriminate and voracious media piracy legal methods such as ripping your own physical media to disk, you’ll be free to completely ditch paid streaming services. No more will you have to pay for Disney+, Netflix, HBOMAX, Hulu, Amazon Prime, Peacock, CBS All Access, Paramount+, Crave or any other streaming service that is not named the Criterion Channel (which is actually good). If you want to watch your favourite films and television shows, you’ll have your own custom service that only features things that you want to see, and where you have control over your own files and how they’re delivered to you. And for music fans out there, both Jellyfin and Plex support music streaming, meaning you can even ditch music streaming services. Goodbye Spotify, Youtube Music, Tidal and Apple Music, welcome back unreasonably large MP3 (or FLAC) collections.

On the hardware front, I’m going to offer a few options catered towards various budgets and media library sizes. The cost of getting a media server up and running using this guide will cost you anywhere from $450 CAD/$325 USD at the entry level to $1500 CAD/$1100 USD at the high end. My own server was priced closer to the higher figure, with much of that cost being storage. If that seems excessive, consider for a moment, maybe you have a roommate, a close friend, or a family member who would be willing to chip in a few bucks towards your little project provided they get a share of the bounty. This is how my server was funded. It might also be worth thinking about cost over time, how much you spend yearly on subscriptions vs. a one time cost of setting up a server. Additionally there's just the joy of being able to scream "fuck you" at all those show cancelling, movie deleting, hedge fund vampire CEOs who run the studios through denying them your money. Drive a stake through David Zaslav's heart.

On the software side I will walk you step-by-step through installing Ubuntu as your server's operating system, configuring your storage as a RAIDz array with ZFS, sharing your zpool to Windows with Samba, running a remote connection between your server and your Windows PC, and then a little about started with Plex/Jellyfin. Every terminal command you will need to input will be provided, and I even share a custom #bash script that will make used vs. available drive space on your server display correctly in Windows.

If you have a different preferred flavour of Linux (Arch, Manjaro, Redhat, Fedora, Mint, OpenSUSE, CentOS, Slackware etc. et. al.) and are aching to tell me off for being basic and using Ubuntu, this tutorial is not for you. The sort of person with a preferred Linux distro is the sort of person who can do this sort of thing in their sleep. Also I don't care. This tutorial is intended for the average home computer user. This is also why we’re not using a more exotic home server solution like running everything through Docker Containers and managing it through a dashboard like Homarr or Heimdall. While such solutions are fantastic and can be very easy to maintain once you have it all set up, wrapping your brain around Docker is a whole thing in and of itself. If you do follow this tutorial and had fun putting everything together, then I would encourage you to return in a year’s time, do your research and set up everything with Docker Containers.

Lastly, this is a tutorial aimed at Windows users. Although I was a daily user of OS X for many years (roughly 2008-2023) and I've dabbled quite a bit with various Linux distributions (mostly Ubuntu and Manjaro), my primary OS these days is Windows 11. Many things in this tutorial will still be applicable to Mac users, but others (e.g. setting up shares) you will have to look up for yourself. I doubt it would be difficult to do so.

Nothing in this tutorial will require feats of computing expertise. All you will need is a basic computer literacy (i.e. an understanding of what a filesystem and directory are, and a degree of comfort in the settings menu) and a willingness to learn a thing or two. While this guide may look overwhelming at first glance, it is only because I want to be as thorough as possible. I want you to understand exactly what it is you're doing, I don't want you to just blindly follow steps. If you half-way know what you’re doing, you will be much better prepared if you ever need to troubleshoot.

Honestly, once you have all the hardware ready it shouldn't take more than an afternoon or two to get everything up and running.

(This tutorial is just shy of seven thousand words long so the rest is under the cut.)

Step One: Choosing Your Hardware

Linux is a light weight operating system, depending on the distribution there's close to no bloat. There are recent distributions available at this very moment that will run perfectly fine on a fourteen year old i3 with 4GB of RAM. Moreover, running Plex or Jellyfin isn’t resource intensive in 90% of use cases. All this is to say, we don’t require an expensive or powerful computer. This means that there are several options available: 1) use an old computer you already have sitting around but aren't using 2) buy a used workstation from eBay, or what I believe to be the best option, 3) order an N100 Mini-PC from AliExpress or Amazon.

Note: If you already have an old PC sitting around that you’ve decided to use, fantastic, move on to the next step.

When weighing your options, keep a few things in mind: the number of people you expect to be streaming simultaneously at any one time, the resolution and bitrate of your media library (4k video takes a lot more processing power than 1080p) and most importantly, how many of those clients are going to be transcoding at any one time. Transcoding is what happens when the playback device does not natively support direct playback of the source file. This can happen for a number of reasons, such as the playback device's native resolution being lower than the file's internal resolution, or because the source file was encoded in a video codec unsupported by the playback device.

Ideally we want any transcoding to be performed by hardware. This means we should be looking for a computer with an Intel processor with Quick Sync. Quick Sync is a dedicated core on the CPU die designed specifically for video encoding and decoding. This specialized hardware makes for highly efficient transcoding both in terms of processing overhead and power draw. Without these Quick Sync cores, transcoding must be brute forced through software. This takes up much more of a CPU’s processing power and requires much more energy. But not all Quick Sync cores are created equal and you need to keep this in mind if you've decided either to use an old computer or to shop for a used workstation on eBay

Any Intel processor from second generation Core (Sandy Bridge circa 2011) onward has Quick Sync cores. It's not until 6th gen (Skylake), however, that the cores support the H.265 HEVC codec. Intel’s 10th gen (Comet Lake) processors introduce support for 10bit HEVC and HDR tone mapping. And the recent 12th gen (Alder Lake) processors brought with them hardware AV1 decoding. As an example, while an 8th gen (Kaby Lake) i5-8500 will be able to hardware transcode a H.265 encoded file, it will fall back to software transcoding if given a 10bit H.265 file. If you’ve decided to use that old PC or to look on eBay for an old Dell Optiplex keep this in mind.

Note 1: The price of old workstations varies wildly and fluctuates frequently. If you get lucky and go shopping shortly after a workplace has liquidated a large number of their workstations you can find deals for as low as $100 on a barebones system, but generally an i5-8500 workstation with 16gb RAM will cost you somewhere in the area of $260 CAD/$200 USD.

Note 2: The AMD equivalent to Quick Sync is called Video Core Next, and while it's fine, it's not as efficient and not as mature a technology. It was only introduced with the first generation Ryzen CPUs and it only got decent with their newest CPUs, we want something cheap.

Alternatively you could forgo having to keep track of what generation of CPU is equipped with Quick Sync cores that feature support for which codecs, and just buy an N100 mini-PC. For around the same price or less of a used workstation you can pick up a mini-PC with an Intel N100 processor. The N100 is a four-core processor based on the 12th gen Alder Lake architecture and comes equipped with the latest revision of the Quick Sync cores. These little processors offer astounding hardware transcoding capabilities for their size and power draw. Otherwise they perform equivalent to an i5-6500, which isn't a terrible CPU. A friend of mine uses an N100 machine as a dedicated retro emulation gaming system and it does everything up to 6th generation consoles just fine. The N100 is also a remarkably efficient chip, it sips power. In fact, the difference between running one of these and an old workstation could work out to hundreds of dollars a year in energy bills depending on where you live.

You can find these Mini-PCs all over Amazon or for a little cheaper on AliExpress. They range in price from $170 CAD/$125 USD for a no name N100 with 8GB RAM to $280 CAD/$200 USD for a Beelink S12 Pro with 16GB RAM. The brand doesn't really matter, they're all coming from the same three factories in Shenzen, go for whichever one fits your budget or has features you want. 8GB RAM should be enough, Linux is lightweight and Plex only calls for 2GB RAM. 16GB RAM might result in a slightly snappier experience, especially with ZFS. A 256GB SSD is more than enough for what we need as a boot drive, but going for a bigger drive might allow you to get away with things like creating preview thumbnails for Plex, but it’s up to you and your budget.

The Mini-PC I wound up buying was a Firebat AK2 Plus with 8GB RAM and a 256GB SSD. It looks like this:

Note: Be forewarned that if you decide to order a Mini-PC from AliExpress, note the type of power adapter it ships with. The mini-PC I bought came with an EU power adapter and I had to supply my own North American power supply. Thankfully this is a minor issue as a barrel plug 30W/12V/2.5A power adapters are plentiful and can be had for $10.

Step Two: Choosing Your Storage

Storage is the most important part of our build. It is also the most expensive. Thankfully it’s also the most easily upgrade-able down the line.

For people with a smaller media collection (4TB to 8TB), a more limited budget, or who will only ever have two simultaneous streams running, I would say that the most economical course of action would be to buy a USB 3.0 8TB external HDD. Something like this one from Western Digital or this one from Seagate. One of these external drives will cost you in the area of $200 CAD/$140 USD. Down the line you could add a second external drive or replace it with a multi-drive RAIDz set up such as detailed below.

If a single external drive the path for you, move on to step three.

For people with larger media libraries (12TB+), who prefer media in 4k, or care who about data redundancy, the answer is a RAID array featuring multiple HDDs in an enclosure.

Note: If you are using an old PC or used workstatiom as your server and have the room for at least three 3.5" drives, and as many open SATA ports on your mother board you won't need an enclosure, just install the drives into the case. If your old computer is a laptop or doesn’t have room for more internal drives, then I would suggest an enclosure.

The minimum number of drives needed to run a RAIDz array is three, and seeing as RAIDz is what we will be using, you should be looking for an enclosure with three to five bays. I think that four disks makes for a good compromise for a home server. Regardless of whether you go for a three, four, or five bay enclosure, do be aware that in a RAIDz array the space equivalent of one of the drives will be dedicated to parity at a ratio expressed by the equation 1 − 1/n i.e. in a four bay enclosure equipped with four 12TB drives, if we configured our drives in a RAIDz1 array we would be left with a total of 36TB of usable space (48TB raw size). The reason for why we might sacrifice storage space in such a manner will be explained in the next section.

A four bay enclosure will cost somewhere in the area of $200 CDN/$140 USD. You don't need anything fancy, we don't need anything with hardware RAID controls (RAIDz is done entirely in software) or even USB-C. An enclosure with USB 3.0 will perform perfectly fine. Don’t worry too much about USB speed bottlenecks. A mechanical HDD will be limited by the speed of its mechanism long before before it will be limited by the speed of a USB connection. I've seen decent looking enclosures from TerraMaster, Yottamaster, Mediasonic and Sabrent.

When it comes to selecting the drives, as of this writing, the best value (dollar per gigabyte) are those in the range of 12TB to 20TB. I settled on 12TB drives myself. If 12TB to 20TB drives are out of your budget, go with what you can afford, or look into refurbished drives. I'm not sold on the idea of refurbished drives but many people swear by them.

When shopping for harddrives, search for drives designed specifically for NAS use. Drives designed for NAS use typically have better vibration dampening and are designed to be active 24/7. They will also often make use of CMR (conventional magnetic recording) as opposed to SMR (shingled magnetic recording). This nets them a sizable read/write performance bump over typical desktop drives. Seagate Ironwolf and Toshiba NAS are both well regarded brands when it comes to NAS drives. I would avoid Western Digital Red drives at this time. WD Reds were a go to recommendation up until earlier this year when it was revealed that they feature firmware that will throw up false SMART warnings telling you to replace the drive at the three year mark quite often when there is nothing at all wrong with that drive. It will likely even be good for another six, seven, or more years.

Step Three: Installing Linux

For this step you will need a USB thumbdrive of at least 6GB in capacity, an .ISO of Ubuntu, and a way to make that thumbdrive bootable media.

First download a copy of Ubuntu desktop (for best performance we could download the Server release, but for new Linux users I would recommend against the server release. The server release is strictly command line interface only, and having a GUI is very helpful for most people. Not many people are wholly comfortable doing everything through the command line, I'm certainly not one of them, and I grew up with DOS 6.0. 22.04.3 Jammy Jellyfish is the current Long Term Service release, this is the one to get.

Download the .ISO and then download and install balenaEtcher on your Windows PC. BalenaEtcher is an easy to use program for creating bootable media, you simply insert your thumbdrive, select the .ISO you just downloaded, and it will create a bootable installation media for you.

Once you've made a bootable media and you've got your Mini-PC (or you old PC/used workstation) in front of you, hook it directly into your router with an ethernet cable, and then plug in the HDD enclosure, a monitor, a mouse and a keyboard. Now turn that sucker on and hit whatever key gets you into the BIOS (typically ESC, DEL or F2). If you’re using a Mini-PC check to make sure that the P1 and P2 power limits are set correctly, my N100's P1 limit was set at 10W, a full 20W under the chip's power limit. Also make sure that the RAM is running at the advertised speed. My Mini-PC’s RAM was set at 2333Mhz out of the box when it should have been 3200Mhz. Once you’ve done that, key over to the boot order and place the USB drive first in the boot order. Then save the BIOS settings and restart.

After you restart you’ll be greeted by Ubuntu's installation screen. Installing Ubuntu is really straight forward, select the "minimal" installation option, as we won't need anything on this computer except for a browser (Ubuntu comes preinstalled with Firefox) and Plex Media Server/Jellyfin Media Server. Also remember to delete and reformat that Windows partition! We don't need it.

Step Four: Installing ZFS and Setting Up the RAIDz Array

Note: If you opted for just a single external HDD skip this step and move onto setting up a Samba share.

Once Ubuntu is installed it's time to configure our storage by installing ZFS to build our RAIDz array. ZFS is a "next-gen" file system that is both massively flexible and massively complex. It's capable of snapshot backup, self healing error correction, ZFS pools can be configured with drives operating in a supplemental manner alongside the storage vdev (e.g. fast cache, dedicated secondary intent log, hot swap spares etc.). It's also a file system very amenable to fine tuning. Block and sector size are adjustable to use case and you're afforded the option of different methods of inline compression. If you'd like a very detailed overview and explanation of its various features and tips on tuning a ZFS array check out these articles from Ars Technica. For now we're going to ignore all these features and keep it simple, we're going to pull our drives together into a single vdev running in RAIDz which will be the entirety of our zpool, no fancy cache drive or SLOG.

Open up the terminal and type the following commands:

sudo apt update

then

sudo apt install zfsutils-linux

This will install the ZFS utility. Verify that it's installed with the following command:

zfs --version

Now, it's time to check that the HDDs we have in the enclosure are healthy, running, and recognized. We also want to find out their device IDs and take note of them:

sudo fdisk -1

Note: You might be wondering why some of these commands require "sudo" in front of them while others don't. "Sudo" is short for "super user do”. When and where "sudo" is used has to do with the way permissions are set up in Linux. Only the "root" user has the access level to perform certain tasks in Linux. As a matter of security and safety regular user accounts are kept separate from the "root" user. It's not advised (or even possible) to boot into Linux as "root" with most modern distributions. Instead by using "sudo" our regular user account is temporarily given the power to do otherwise forbidden things. Don't worry about it too much at this stage, but if you want to know more check out this introduction.

If everything is working you should get a list of the various drives detected along with their device IDs which will look like this: /dev/sdc. You can also check the device IDs of the drives by opening the disk utility app. Jot these IDs down as we'll need them for our next step, creating our RAIDz array.

RAIDz is similar to RAID-5 in that instead of striping your data over multiple disks, exchanging redundancy for speed and available space (RAID-0), or mirroring your data writing by two copies of every piece (RAID-1), it instead writes parity blocks across the disks in addition to striping, this provides a balance of speed, redundancy and available space. If a single drive fails, the parity blocks on the working drives can be used to reconstruct the entire array as soon as a replacement drive is added.

Additionally, RAIDz improves over some of the common RAID-5 flaws. It's more resilient and capable of self healing, as it is capable of automatically checking for errors against a checksum. It's more forgiving in this way, and it's likely that you'll be able to detect when a drive is dying well before it fails. A RAIDz array can survive the loss of any one drive.

Note: While RAIDz is indeed resilient, if a second drive fails during the rebuild, you're fucked. Always keep backups of things you can't afford to lose. This tutorial, however, is not about proper data safety.

To create the pool, use the following command:

sudo zpool create "zpoolnamehere" raidz "device IDs of drives we're putting in the pool"

For example, let's creatively name our zpool "mypool". This poil will consist of four drives which have the device IDs: sdb, sdc, sdd, and sde. The resulting command will look like this:

sudo zpool create mypool raidz /dev/sdb /dev/sdc /dev/sdd /dev/sde

If as an example you bought five HDDs and decided you wanted more redundancy dedicating two drive to this purpose, we would modify the command to "raidz2" and the command would look something like the following:

sudo zpool create mypool raidz2 /dev/sdb /dev/sdc /dev/sdd /dev/sde /dev/sdf

An array configured like this is known as RAIDz2 and is able to survive two disk failures.

Once the zpool has been created, we can check its status with the command:

zpool status

Or more concisely with:

zpool list

The nice thing about ZFS as a file system is that a pool is ready to go immediately after creation. If we were to set up a traditional RAID-5 array using mbam, we'd have to sit through a potentially hours long process of reformatting and partitioning the drives. Instead we're ready to go right out the gates.

The zpool should be automatically mounted to the filesystem after creation, check on that with the following:

df -hT | grep zfs

Note: If your computer ever loses power suddenly, say in event of a power outage, you may have to re-import your pool. In most cases, ZFS will automatically import and mount your pool, but if it doesn’t and you can't see your array, simply open the terminal and type sudo zpool import -a.

By default a zpool is mounted at /"zpoolname". The pool should be under our ownership but let's make sure with the following command:

sudo chown -R "yourlinuxusername" /"zpoolname"

Note: Changing file and folder ownership with "chown" and file and folder permissions with "chmod" are essential commands for much of the admin work in Linux, but we won't be dealing with them extensively in this guide. If you'd like a deeper tutorial and explanation you can check out these two guides: chown and chmod.

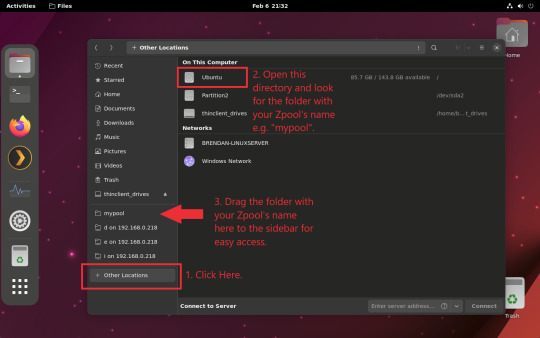

You can access the zpool file system through the GUI by opening the file manager (the Ubuntu default file manager is called Nautilus) and clicking on "Other Locations" on the sidebar, then entering the Ubuntu file system and looking for a folder with your pool's name. Bookmark the folder on the sidebar for easy access.

Your storage pool is now ready to go. Assuming that we already have some files on our Windows PC we want to copy to over, we're going to need to install and configure Samba to make the pool accessible in Windows.

Step Five: Setting Up Samba/Sharing

Samba is what's going to let us share the zpool with Windows and allow us to write to it from our Windows machine. First let's install Samba with the following commands:

sudo apt-get update

then

sudo apt-get install samba

Next create a password for Samba.

sudo smbpswd -a "yourlinuxusername"

It will then prompt you to create a password. Just reuse your Ubuntu user password for simplicity's sake.

Note: if you're using just a single external drive replace the zpool location in the following commands with wherever it is your external drive is mounted, for more information see this guide on mounting an external drive in Ubuntu.

After you've created a password we're going to create a shareable folder in our pool with this command

mkdir /"zpoolname"/"foldername"

Now we're going to open the smb.conf file and make that folder shareable. Enter the following command.

sudo nano /etc/samba/smb.conf

This will open the .conf file in nano, the terminal text editor program. Now at the end of smb.conf add the following entry:

["foldername"]

path = /"zpoolname"/"foldername"

available = yes

valid users = "yourlinuxusername"

read only = no

writable = yes

browseable = yes

guest ok = no

Ensure that there are no line breaks between the lines and that there's a space on both sides of the equals sign. Our next step is to allow Samba traffic through the firewall:

sudo ufw allow samba

Finally restart the Samba service:

sudo systemctl restart smbd

At this point we'll be able to access to the pool, browse its contents, and read and write to it from Windows. But there's one more thing left to do, Windows doesn't natively support the ZFS file systems and will read the used/available/total space in the pool incorrectly. Windows will read available space as total drive space, and all used space as null. This leads to Windows only displaying a dwindling amount of "available" space as the drives are filled. We can fix this! Functionally this doesn't actually matter, we can still write and read to and from the disk, it just makes it difficult to tell at a glance the proportion of used/available space, so this is an optional step but one I recommend (this step is also unnecessary if you're just using a single external drive). What we're going to do is write a little shell script in #bash. Open nano with the terminal with the command:

nano

Now insert the following code:

#!/bin/bash CUR_PATH=`pwd` ZFS_CHECK_OUTPUT=$(zfs get type $CUR_PATH 2>&1 > /dev/null) > /dev/null if [[ $ZFS_CHECK_OUTPUT == *not\ a\ ZFS* ]] then IS_ZFS=false else IS_ZFS=true fi if [[ $IS_ZFS = false ]] then df $CUR_PATH | tail -1 | awk '{print $2" "$4}' else USED=$((`zfs get -o value -Hp used $CUR_PATH` / 1024)) > /dev/null AVAIL=$((`zfs get -o value -Hp available $CUR_PATH` / 1024)) > /dev/null TOTAL=$(($USED+$AVAIL)) > /dev/null echo $TOTAL $AVAIL fi

Save the script as "dfree.sh" to /home/"yourlinuxusername" then change the ownership of the file to make it executable with this command:

sudo chmod 774 dfree.sh

Now open smb.conf with sudo again:

sudo nano /etc/samba/smb.conf

Now add this entry to the top of the configuration file to direct Samba to use the results of our script when Windows asks for a reading on the pool's used/available/total drive space:

[global]

dfree command = home/"yourlinuxusername"/dfree.sh

Save the changes to smb.conf and then restart Samba again with the terminal:

sudo systemctl restart smbd

Now there’s one more thing we need to do to fully set up the Samba share, and that’s to modify a hidden group permission. In the terminal window type the following command:

usermod -a -G sambashare “yourlinuxusername”

Then restart samba again:

sudo systemctl restart smbd

If we don’t do this last step, everything will appear to work fine, and you will even be able to see and map the drive from Windows and even begin transferring files, but you'd soon run into a lot of frustration. As every ten minutes or so a file would fail to transfer and you would get a window announcing “0x8007003B Unexpected Network Error”. This window would require your manual input to continue the transfer with the file next in the queue. And at the end it would reattempt to transfer whichever files failed the first time around. 99% of the time they’ll go through that second try, but this is still all a major pain in the ass. Especially if you’ve got a lot of data to transfer or you want to step away from the computer for a while.

It turns out samba can act a little weirdly with the higher read/write speeds of RAIDz arrays and transfers from Windows, and will intermittently crash and restart itself if this group option isn’t changed. Inputting the above command will prevent you from ever seeing that window.

The last thing we're going to do before switching over to our Windows PC is grab the IP address of our Linux machine. Enter the following command:

hostname -I

This will spit out this computer's IP address on the local network (it will look something like 192.168.0.x), write it down. It might be a good idea once you're done here to go into your router settings and reserving that IP for your Linux system in the DHCP settings. Check the manual for your specific model router on how to access its settings, typically it can be accessed by opening a browser and typing http:\\192.168.0.1 in the address bar, but your router may be different.

Okay we’re done with our Linux computer for now. Get on over to your Windows PC, open File Explorer, right click on Network and click "Map network drive". Select Z: as the drive letter (you don't want to map the network drive to a letter you could conceivably be using for other purposes) and enter the IP of your Linux machine and location of the share like so: \\"LINUXCOMPUTERLOCALIPADDRESSGOESHERE"\"zpoolnamegoeshere"\. Windows will then ask you for your username and password, enter the ones you set earlier in Samba and you're good. If you've done everything right it should look something like this:

You can now start moving media over from Windows to the share folder. It's a good idea to have a hard line running to all machines. Moving files over Wi-Fi is going to be tortuously slow, the only thing that’s going to make the transfer time tolerable (hours instead of days) is a solid wired connection between both machines and your router.

Step Six: Setting Up Remote Desktop Access to Your Server

After the server is up and going, you’ll want to be able to access it remotely from Windows. Barring serious maintenance/updates, this is how you'll access it most of the time. On your Linux system open the terminal and enter:

sudo apt install xrdp

Then:

sudo systemctl enable xrdp

Once it's finished installing, open “Settings” on the sidebar and turn off "automatic login" in the User category. Then log out of your account. Attempting to remotely connect to your Linux computer while you’re logged in will result in a black screen!

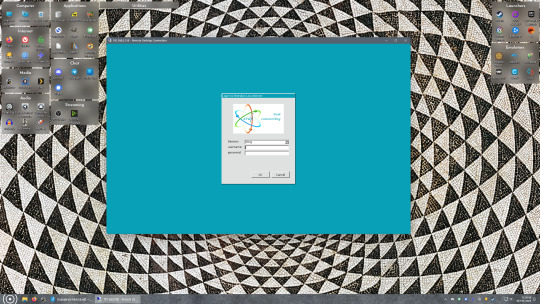

Now get back on your Windows PC, open search and look for "RDP". A program called "Remote Desktop Connection" should pop up, open this program as an administrator by right-clicking and selecting “run as an administrator”. You’ll be greeted with a window. In the field marked “Computer” type in the IP address of your Linux computer. Press connect and you'll be greeted with a new window and prompt asking for your username and password. Enter your Ubuntu username and password here.

If everything went right, you’ll be logged into your Linux computer. If the performance is sluggish, adjust the display options. Lowering the resolution and colour depth do a lot to make the interface feel snappier.

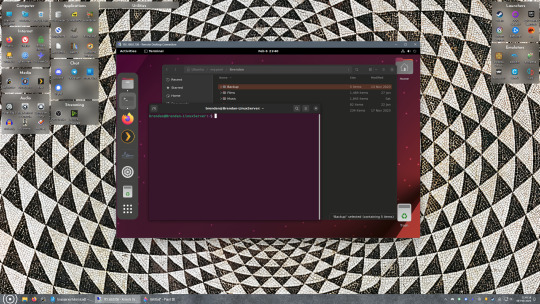

Remote access is how we're going to be using our Linux system from now, barring edge cases like needing to get into the BIOS or upgrading to a new version of Ubuntu. Everything else from performing maintenance like a monthly zpool scrub to checking zpool status and updating software can all be done remotely.

This is how my server lives its life now, happily humming and chirping away on the floor next to the couch in a corner of the living room.

Step Seven: Plex Media Server/Jellyfin

Okay we’ve got all the ground work finished and our server is almost up and running. We’ve got Ubuntu up and running, our storage array is primed, we’ve set up remote connections and sharing, and maybe we’ve moved over some of favourite movies and TV shows.

Now we need to decide on the media server software to use which will stream our media to us and organize our library. For most people I’d recommend Plex. It just works 99% of the time. That said, Jellyfin has a lot to recommend it by too, even if it is rougher around the edges. Some people run both simultaneously, it’s not that big of an extra strain. I do recommend doing a little bit of your own research into the features each platform offers, but as a quick run down, consider some of the following points:

Plex is closed source and is funded through PlexPass purchases while Jellyfin is open source and entirely user driven. This means a number of things: for one, Plex requires you to purchase a “PlexPass” (purchased as a one time lifetime fee $159.99 CDN/$120 USD or paid for on a monthly or yearly subscription basis) in order to access to certain features, like hardware transcoding (and we want hardware transcoding) or automated intro/credits detection and skipping. jellyfish features for free. On the other hand, Plex supports a lot more devices than Jellyfin and updates more frequently. That said Jellyfin's Android/iOS apps are completely free, while the Plex Android/iOS apps must be activated for a one time cost of $6 CDN/$5 USD. But that $6 fee gets you a mobile app that is much more functional and features a unified UI across Android and iOS platforms, the Plex mobile apps are simply a more polished experience. The Jellyfin apps are a bit of a mess and the iOS and Android versions are very different from each other.

Jellyfin’s actual media player itself is more fully featured than Plex's, but on the other hand Jellyfin's UI, library customization and automatic media tagging really pale in comparison to Plex. Streaming your music library is free through both Jellyfin and Plex, but Plex offers the PlexAmp app for dedicated music streaming which boasts a number of fantastic features, unfortunately some of those fantastic features require a PlexPass. If your internet is down, Jellyfin can still do local streaming, while Plex can fail to play files. Jellyfin has a slew of neat niche features like support for Comic Book libraries with the .cbz/.cbt file types, but then Plex offers some free ad-supported TV and films, they even have a free channel that plays nothing but Classic Doctor Who.

Ultimately it's up to you, I settled on Plex because although some features are pay-walled, it just works. It's more reliable and easier to use, and a one-time fee is much easier to swallow than a subscription. I do also need to mention that Jellyfin does take a little extra bit of tinkering to get going in Ubuntu, you’ll have to set up process permissions, so if you're more tolerant to tinkering, Jellyfin might be up your alley and I’ll trust that you can follow their installation and configuration guide. For everyone else, I recommend Plex.

So pick your poison: Plex or Jellyfin.

Note: The easiest way to download and install either of these packages in Ubuntu is through Snap Store.

After you've installed one (or both), opening either app will launch a browser window into the browser version of the app allowing you to set all the options server side.

The process of adding creating media libraries is essentially the same in both Plex and Jellyfin. You create a separate libraries for Television, Movies, and Music and add the folders which contain the respective types of media to their respective libraries. The only difficult or time consuming aspect is ensuring that your files and folders follow the appropriate naming conventions:

Plex naming guide for Movies

Plex naming guide for Television

Jellyfin follows the same naming rules but I find their media scanner to be a lot less accurate and forgiving than Plex. Once you've selected the folders to be scanned the service will scan your files, tagging everything and adding metadata. Although I find do find Plex more accurate, it can still erroneously tag some things and you might have to manually clean up some tags in a large library. (When I initially created my library it tagged the 1963-1989 Doctor Who as some Korean soap opera and I needed to manually select the correct match after which everything was tagged normally.) It can also be a bit testy with anime (especially OVAs) be sure to check TVDB to ensure that you have your files and folders structured and named correctly. If something is not showing up at all, double check the name.

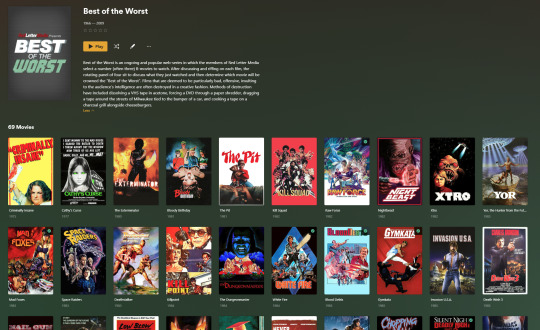

Once that's done, organizing and customizing your library is easy. You can set up collections, grouping items together to fit a theme or collect together all the entries in a franchise. You can make playlists, and add custom artwork to entries. It's fun setting up collections with posters to match, there are even several websites dedicated to help you do this like PosterDB. As an example, below are two collections in my library, one collecting all the entries in a franchise, the other follows a theme.

My Star Trek collection, featuring all eleven television series, and thirteen films.

My Best of the Worst collection, featuring sixty-nine films previously showcased on RedLetterMedia’s Best of the Worst. They’re all absolutely terrible and I love them.

As for settings, ensure you've got Remote Access going, it should work automatically and be sure to set your upload speed after running a speed test. In the library settings set the database cache to 2000MB to ensure a snappier and more responsive browsing experience, and then check that playback quality is set to original/maximum. If you’re severely bandwidth limited on your upload and have remote users, you might want to limit the remote stream bitrate to something more reasonable, just as a note of comparison Netflix’s 1080p bitrate is approximately 5Mbps, although almost anyone watching through a chromium based browser is streaming at 720p and 3mbps. Other than that you should be good to go. For actually playing your files, there's a Plex app for just about every platform imaginable. I mostly watch television and films on my laptop using the Windows Plex app, but I also use the Android app which can broadcast to the chromecast connected to the TV. Both are fully functional and easy to navigate, and I can also attest to the OS X version being equally functional.

Part Eight: Finding Media

Now, this is not really a piracy tutorial, there are plenty of those out there. But if you’re unaware, BitTorrent is free and pretty easy to use, just pick a client (qBittorrent is the best) and go find some public trackers to peruse. Just know now that all the best trackers are private and invite only, and that they can be exceptionally difficult to get into. I’m already on a few, and even then, some of the best ones are wholly out of my reach.

If you decide to take the left hand path and turn to Usenet you’ll have to pay. First you’ll need to sign up with a provider like Newshosting or EasyNews for access to Usenet itself, and then to actually find anything you’re going to need to sign up with an indexer like NZBGeek or NZBFinder. There are dozens of indexers, and many people cross post between them, but for more obscure media it’s worth checking multiple. You’ll also need a binary downloader like SABnzbd. That caveat aside, Usenet is faster, bigger, older, less traceable than BitTorrent, and altogether slicker. I honestly prefer it, and I'm kicking myself for taking this long to start using it because I was scared off by the price. I’ve found so many things on Usenet that I had sought in vain elsewhere for years, like a 2010 Italian film about a massacre perpetrated by the SS that played the festival circuit but never received a home media release; some absolute hero uploaded a rip of a festival screener DVD to Usenet, that sort of thing. Anyway, figure out the rest of this shit on your own and remember to use protection, get yourself behind a VPN, use a SOCKS5 proxy with your BitTorrent client, etc.

On the legal side of things, if you’re around my age, you (or your family) probably have a big pile of DVDs and Blu-Rays sitting around unwatched and half forgotten. Why not do a bit of amateur media preservation, rip them and upload them to your server for easier access? (Your tools for this are going to be Handbrake to do the ripping and AnyDVD to break any encryption.) I went to the trouble of ripping all my SCTV DVDs (five box sets worth) because none of it is on streaming nor could it be found on any pirate source I tried. I’m glad I did, forty years on it’s still one of the funniest shows to ever be on TV.

Part Nine/Epilogue: Sonarr/Radarr/Lidarr and Overseerr

There are a lot of ways to automate your server for better functionality or to add features you and other users might find useful. Sonarr, Radarr, and Lidarr are a part of a suite of “Servarr” services (there’s also Readarr for books and Whisparr for adult content) that allow you to automate the collection of new episodes of TV shows (Sonarr), new movie releases (Radarr) and music releases (Lidarr). They hook in to your BitTorrent client or Usenet binary newsgroup downloader and crawl your preferred Torrent trackers and Usenet indexers, alerting you to new releases and automatically grabbing them. You can also use these services to manually search for new media, and even replace/upgrade your existing media with better quality uploads. They’re really a little tricky to set up on a bare metal Ubuntu install (ideally you should be running them in Docker Containers), and I won’t be providing a step by step on installing and running them, I’m simply making you aware of their existence.

The other bit of kit I want to make you aware of is Overseerr which is a program that scans your Plex media library and will serve recommendations based on what you like. It also allows you and your users to request specific media. It can even be integrated with Sonarr/Radarr/Lidarr so that fulfilling those requests is fully automated.

And you're done. It really wasn't all that hard. Enjoy your media. Enjoy the control you have over that media. And be safe in the knowledge that no hedgefund CEO motherfucker who hates the movies but who is somehow in control of a major studio will be able to disappear anything in your library as a tax write-off.

1K notes

·

View notes

Text

The (En)Bridge-T Jones Baby

New Post has been published on http://affordablewebhostingsearch.com/the-enbridge-t-jones-baby/

The (En)Bridge-T Jones Baby

We have covered the Enbridge Corporation (ENB) saga previously. Briefly, our take on this was that ENB is undervalued and a highly underrated future dividend aristocrat. We covered the Federal Energy Regulatory Commission (FERC) decision when it came out mid March and believed that ENB had several alternatives to ensure that Enbridge Energy Partners (EEP) and by extension Enbridge Energy management LLC (EEQ) would not suffer as a consequence of the decision. One of the six suggestions was that ENB would simplify the corporate structure by absorbing all its babies into the fold. That is exactly the path ENB decided to go. A few days ago the offer for Spectra Energy Partners (SEP) was boosted by 9.8%. We now examine what is likely to happen next with EEP & EEQ.

What has changed since the original FERC decision

FERC clarified mid June on its initial ruling with a key component being that the accumulated deferred income tax (ADIT) would not have to refunded to customers.

Although the final rule maintains the requirement to file the FERC 501-G, the final rule makes adjustments to the proposed form, including automatically eliminating the accumulated deferred income tax from a pipeline’s cost of service when the form enters a federal and state income tax of zero for pipelines that are non-tax paying entities. This adjustment is consistent with the Order on Rehearing of the Revised Policy Statement in Docket PL17-1-001 issued concurrently with the final rule. The final rule also encourages pipelines to file an addendum to the FERC 501-G to reflect their individual financial situation.

This has an impact of removing uncertainty about any potential refunds for past service overcollection on the tax front. It also increases the net equity invested by the MLPs and hence increases the return on equity threshold in our opinion. For those unaware, this is the threshold that FERC has deemed “fair” and would not allow MLPs to earn less than this return via reducing their rates. We believe this was a key component in ENB increasing SEP’s offer by 9.8%. ENB already owns 83% of SEP and hence the boost was a rather marginal hit to ENB.

Impact to EEP & EEQ

During the second quarter conference call ENB made the preliminary assessment that mid June FERC announcement would be marginally positive for EEP & EEQ.

With respect to the impact of the FERC policy change on EEP, our early assessment is that, in isolation, the ability to eliminate ADIT from the forecast cost of service and to add it to rate base would generate incremental DCF of approximately CAD 30 million per year. However, this would only partially offset the negative impact of U.S. tax reform and the elimination of the tax allowance for MLPs, which we previously estimated at approximately CAD 120 million per year.

Previously ENB had guided that EEP would produce a DCF coverage of 1.0X and this will likely boost DCF coverage to the range of 1.04-1.07X. While not the biggest boost, it is significant for better interest coverage and funds for Line 3 replacement.

What is fair value for EEP/EEQ?

That is what it all comes down to. Before we show you what we think we ask that you keep an open mind about our numbers. To start with let’s look at ENB’s debt to EBITDA.

Currently hovering near the 5.5X mark, it should hit 5.0X at year end after some asset sales.

Source: ENB Q2-2018 slides

Here is where EEP & EEQ stand.

Now this number is an annual number and will trend higher as the reduction from FERC hits but will be under 5.0X at year end 2018.

EEP & EEQ currently distribute $1.40/share a 1.04-1.07X coverage gets to a DCF of $1.50/share. ENB has guided for about $3.30 (this is USD) in DCF per share and the shares are thus trading close to 10.3X DCF.

Based on the acquisition share exchange proposed EEP would be sold for $10.80 and EEQ at $10.10. Obviously both are trading higher than that, perhaps pricing in a better offer. But even at today’s prices EEP is trading at 7X DCF. The question therefore is, why would you sell an asset to ENB at 7X DCF while being paid at 10X DCF currency? Now if the exchange was made when ENB itself was trading at the same multiple, it might make sense.

There are two other considerations, debt to EBITDA and growth profile. The first metric is similar for both and likely better for EEP/EEQ as shown above. ENB does have a superior growth profile but a big part of its growth is the line 3 replacement with EEP/EEQ. So the minimum fair value for us would be where EEP/EEQ gets the same DCF multiple as ENB.

Now obviously as ENB increases the price for EEP/EEQ, its stock is likely to fall. Based on that the absolute minimum that shareholders should accept is a 9X multiple for both EEP/EEQ, which would put shares at $13.50.

Reasons to reject regardless

There is substantial room for EEP/EEQ to improve their metrics from here. The first is simply through documenting the full impact of the FERC rule. We think ENB is likely being conservative on the $30 million estimate. The second is through corporate conversion. Post conversion, EEP/EEQ would have a big tax shield and DCF should approach close to the $1.70 mark. For a boring utility like business with a virtual monopoly we would be hard pressed to value this under 10X DCF or $17/share. By rejecting the offer investors would force ENB to either pay the full amount or simply convert EEP/EEQ to corporate status. Unlike in the case of SEP, EEP/EEQ shareholders do have substantially more leverage.

The proposed merger transaction will be subject to the approval of holders of a majority of the outstanding SEP common units.

The proposed EEP merger transaction is subject to the approval of holders of 66⅔% of the outstanding EEP units. The proposed EEQ merger transaction is subject to the approval of holders of a majority of the outstanding EEQ listed shares, other than Enbridge and its affiliates.

Clearly a blockade here is possible with retail holding a lot of EEQ shares.

Source: ENB presentation

One interesting aspect of this corporate conversion would be that EEP/EEQ would reduce Enbridge Income Fund Holdings Inc revenues (OTC:EBGUF) as the total revenues on the mainline are fixed and currently the FERC decision is essentially enriching EBGUF at the expense of EEP/EEQ.

Trades

Currently EEP holds a premium to EEQ. There are reluctant shareholders in the EEP shareholder group who are working hard at avoiding the taxes that come with the sale. We think however that a sale to ENB or a corporate conversion is inevitable. Selling EEP and buying EEQ would be the best way to get the votes to block ENB’s acquisition attempt as EEQ is held far more by non-institutions. It would also get the potential further upside if ENB is ultimately forced to recognize EEP and EEQ shares as equals (which they actually are based on the 10-K). The same additional upside would also be realized on corporate conversion by EEP itself. Hence trading your shares now seems a good way to capture an additional 4% with no downside.

On ENB itself, we were very bullish in mid March but we got defensive as the stock hit $36. We covered our cash secured puts,

as well as sold calls against our long position. The rationale was that higher bids were coming for SEP (which happened) and EEP/EEQ and those would pressure ENB lower in the shorter term. We were happy capturing 3% extra yield for 2.5 months.

Conclusion

We get all advantages associated with the roll-up and we think ENB is undervalued here. But we just don’t see the rationale of throwing away great assets at a ridiculously low price just because ENB thinks it is fair. If ENB wants EEP/EEQ, it has to explain why a corporate conversion fails to give us the same advantages as rolling into the behemoth ENB. At the minimum we would like an estimate of what the 5 year DCF profile would be post a stand alone corporate conversion and what kind of dividends could be paid while funding Line 3. In the absence of that if ENB wants EEP & EEQ…

For more analysis such as this, along with recommendations for binge watching on Netflix, please consider subscribing to our marketplace service Wheel of Fortune.

Disclaimer: Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Seeking Alpha has changed its policies. Previously “following” someone required a ritualistic commitment and an offering of not less than 4 oxen or 3 breeding horses. Now, all it takes is one click! If you enjoyed this article, please scroll up and click on the “Follow” button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the “Follow” button next to my name to not miss my future articles.

Disclosure: I am/we are long ENB, EEQ.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

The (En)Bridge-T Jones Baby

New Post has been published on http://affordablewebhostingsearch.com/the-enbridge-t-jones-baby/

The (En)Bridge-T Jones Baby

We have covered the Enbridge Corporation (ENB) saga previously. Briefly, our take on this was that ENB is undervalued and a highly underrated future dividend aristocrat. We covered the Federal Energy Regulatory Commission (FERC) decision when it came out mid March and believed that ENB had several alternatives to ensure that Enbridge Energy Partners (EEP) and by extension Enbridge Energy management LLC (EEQ) would not suffer as a consequence of the decision. One of the six suggestions was that ENB would simplify the corporate structure by absorbing all its babies into the fold. That is exactly the path ENB decided to go. A few days ago the offer for Spectra Energy Partners (SEP) was boosted by 9.8%. We now examine what is likely to happen next with EEP & EEQ.

What has changed since the original FERC decision

FERC clarified mid June on its initial ruling with a key component being that the accumulated deferred income tax (ADIT) would not have to refunded to customers.

Although the final rule maintains the requirement to file the FERC 501-G, the final rule makes adjustments to the proposed form, including automatically eliminating the accumulated deferred income tax from a pipeline’s cost of service when the form enters a federal and state income tax of zero for pipelines that are non-tax paying entities. This adjustment is consistent with the Order on Rehearing of the Revised Policy Statement in Docket PL17-1-001 issued concurrently with the final rule. The final rule also encourages pipelines to file an addendum to the FERC 501-G to reflect their individual financial situation.

This has an impact of removing uncertainty about any potential refunds for past service overcollection on the tax front. It also increases the net equity invested by the MLPs and hence increases the return on equity threshold in our opinion. For those unaware, this is the threshold that FERC has deemed “fair” and would not allow MLPs to earn less than this return via reducing their rates. We believe this was a key component in ENB increasing SEP’s offer by 9.8%. ENB already owns 83% of SEP and hence the boost was a rather marginal hit to ENB.

Impact to EEP & EEQ

During the second quarter conference call ENB made the preliminary assessment that mid June FERC announcement would be marginally positive for EEP & EEQ.

With respect to the impact of the FERC policy change on EEP, our early assessment is that, in isolation, the ability to eliminate ADIT from the forecast cost of service and to add it to rate base would generate incremental DCF of approximately CAD 30 million per year. However, this would only partially offset the negative impact of U.S. tax reform and the elimination of the tax allowance for MLPs, which we previously estimated at approximately CAD 120 million per year.

Previously ENB had guided that EEP would produce a DCF coverage of 1.0X and this will likely boost DCF coverage to the range of 1.04-1.07X. While not the biggest boost, it is significant for better interest coverage and funds for Line 3 replacement.

What is fair value for EEP/EEQ?

That is what it all comes down to. Before we show you what we think we ask that you keep an open mind about our numbers. To start with let’s look at ENB’s debt to EBITDA.

Currently hovering near the 5.5X mark, it should hit 5.0X at year end after some asset sales.

Source: ENB Q2-2018 slides

Here is where EEP & EEQ stand.

Now this number is an annual number and will trend higher as the reduction from FERC hits but will be under 5.0X at year end 2018.

EEP & EEQ currently distribute $1.40/share a 1.04-1.07X coverage gets to a DCF of $1.50/share. ENB has guided for about $3.30 (this is USD) in DCF per share and the shares are thus trading close to 10.3X DCF.

Based on the acquisition share exchange proposed EEP would be sold for $10.80 and EEQ at $10.10. Obviously both are trading higher than that, perhaps pricing in a better offer. But even at today’s prices EEP is trading at 7X DCF. The question therefore is, why would you sell an asset to ENB at 7X DCF while being paid at 10X DCF currency? Now if the exchange was made when ENB itself was trading at the same multiple, it might make sense.

There are two other considerations, debt to EBITDA and growth profile. The first metric is similar for both and likely better for EEP/EEQ as shown above. ENB does have a superior growth profile but a big part of its growth is the line 3 replacement with EEP/EEQ. So the minimum fair value for us would be where EEP/EEQ gets the same DCF multiple as ENB.

Now obviously as ENB increases the price for EEP/EEQ, its stock is likely to fall. Based on that the absolute minimum that shareholders should accept is a 9X multiple for both EEP/EEQ, which would put shares at $13.50.

Reasons to reject regardless

There is substantial room for EEP/EEQ to improve their metrics from here. The first is simply through documenting the full impact of the FERC rule. We think ENB is likely being conservative on the $30 million estimate. The second is through corporate conversion. Post conversion, EEP/EEQ would have a big tax shield and DCF should approach close to the $1.70 mark. For a boring utility like business with a virtual monopoly we would be hard pressed to value this under 10X DCF or $17/share. By rejecting the offer investors would force ENB to either pay the full amount or simply convert EEP/EEQ to corporate status. Unlike in the case of SEP, EEP/EEQ shareholders do have substantially more leverage.

The proposed merger transaction will be subject to the approval of holders of a majority of the outstanding SEP common units.

The proposed EEP merger transaction is subject to the approval of holders of 66⅔% of the outstanding EEP units. The proposed EEQ merger transaction is subject to the approval of holders of a majority of the outstanding EEQ listed shares, other than Enbridge and its affiliates.

Clearly a blockade here is possible with retail holding a lot of EEQ shares.

Source: ENB presentation

One interesting aspect of this corporate conversion would be that EEP/EEQ would reduce Enbridge Income Fund Holdings Inc revenues (OTC:EBGUF) as the total revenues on the mainline are fixed and currently the FERC decision is essentially enriching EBGUF at the expense of EEP/EEQ.

Trades

Currently EEP holds a premium to EEQ. There are reluctant shareholders in the EEP shareholder group who are working hard at avoiding the taxes that come with the sale. We think however that a sale to ENB or a corporate conversion is inevitable. Selling EEP and buying EEQ would be the best way to get the votes to block ENB’s acquisition attempt as EEQ is held far more by non-institutions. It would also get the potential further upside if ENB is ultimately forced to recognize EEP and EEQ shares as equals (which they actually are based on the 10-K). The same additional upside would also be realized on corporate conversion by EEP itself. Hence trading your shares now seems a good way to capture an additional 4% with no downside.

On ENB itself, we were very bullish in mid March but we got defensive as the stock hit $36. We covered our cash secured puts,

as well as sold calls against our long position. The rationale was that higher bids were coming for SEP (which happened) and EEP/EEQ and those would pressure ENB lower in the shorter term. We were happy capturing 3% extra yield for 2.5 months.

Conclusion

We get all advantages associated with the roll-up and we think ENB is undervalued here. But we just don’t see the rationale of throwing away great assets at a ridiculously low price just because ENB thinks it is fair. If ENB wants EEP/EEQ, it has to explain why a corporate conversion fails to give us the same advantages as rolling into the behemoth ENB. At the minimum we would like an estimate of what the 5 year DCF profile would be post a stand alone corporate conversion and what kind of dividends could be paid while funding Line 3. In the absence of that if ENB wants EEP & EEQ…

For more analysis such as this, along with recommendations for binge watching on Netflix, please consider subscribing to our marketplace service Wheel of Fortune.

Disclaimer: Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Seeking Alpha has changed its policies. Previously “following” someone required a ritualistic commitment and an offering of not less than 4 oxen or 3 breeding horses. Now, all it takes is one click! If you enjoyed this article, please scroll up and click on the “Follow” button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the “Follow” button next to my name to not miss my future articles.

Disclosure: I am/we are long ENB, EEQ.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

The (En)Bridge-T Jones Baby

New Post has been published on http://affordablewebhostingsearch.com/the-enbridge-t-jones-baby/

The (En)Bridge-T Jones Baby

We have covered the Enbridge Corporation (ENB) saga previously. Briefly, our take on this was that ENB is undervalued and a highly underrated future dividend aristocrat. We covered the Federal Energy Regulatory Commission (FERC) decision when it came out mid March and believed that ENB had several alternatives to ensure that Enbridge Energy Partners (EEP) and by extension Enbridge Energy management LLC (EEQ) would not suffer as a consequence of the decision. One of the six suggestions was that ENB would simplify the corporate structure by absorbing all its babies into the fold. That is exactly the path ENB decided to go. A few days ago the offer for Spectra Energy Partners (SEP) was boosted by 9.8%. We now examine what is likely to happen next with EEP & EEQ.

What has changed since the original FERC decision

FERC clarified mid June on its initial ruling with a key component being that the accumulated deferred income tax (ADIT) would not have to refunded to customers.

Although the final rule maintains the requirement to file the FERC 501-G, the final rule makes adjustments to the proposed form, including automatically eliminating the accumulated deferred income tax from a pipeline’s cost of service when the form enters a federal and state income tax of zero for pipelines that are non-tax paying entities. This adjustment is consistent with the Order on Rehearing of the Revised Policy Statement in Docket PL17-1-001 issued concurrently with the final rule. The final rule also encourages pipelines to file an addendum to the FERC 501-G to reflect their individual financial situation.

This has an impact of removing uncertainty about any potential refunds for past service overcollection on the tax front. It also increases the net equity invested by the MLPs and hence increases the return on equity threshold in our opinion. For those unaware, this is the threshold that FERC has deemed “fair” and would not allow MLPs to earn less than this return via reducing their rates. We believe this was a key component in ENB increasing SEP’s offer by 9.8%. ENB already owns 83% of SEP and hence the boost was a rather marginal hit to ENB.

Impact to EEP & EEQ

During the second quarter conference call ENB made the preliminary assessment that mid June FERC announcement would be marginally positive for EEP & EEQ.

With respect to the impact of the FERC policy change on EEP, our early assessment is that, in isolation, the ability to eliminate ADIT from the forecast cost of service and to add it to rate base would generate incremental DCF of approximately CAD 30 million per year. However, this would only partially offset the negative impact of U.S. tax reform and the elimination of the tax allowance for MLPs, which we previously estimated at approximately CAD 120 million per year.

Previously ENB had guided that EEP would produce a DCF coverage of 1.0X and this will likely boost DCF coverage to the range of 1.04-1.07X. While not the biggest boost, it is significant for better interest coverage and funds for Line 3 replacement.

What is fair value for EEP/EEQ?

That is what it all comes down to. Before we show you what we think we ask that you keep an open mind about our numbers. To start with let’s look at ENB’s debt to EBITDA.

Currently hovering near the 5.5X mark, it should hit 5.0X at year end after some asset sales.

Source: ENB Q2-2018 slides

Here is where EEP & EEQ stand.

Now this number is an annual number and will trend higher as the reduction from FERC hits but will be under 5.0X at year end 2018.

EEP & EEQ currently distribute $1.40/share a 1.04-1.07X coverage gets to a DCF of $1.50/share. ENB has guided for about $3.30 (this is USD) in DCF per share and the shares are thus trading close to 10.3X DCF.

Based on the acquisition share exchange proposed EEP would be sold for $10.80 and EEQ at $10.10. Obviously both are trading higher than that, perhaps pricing in a better offer. But even at today’s prices EEP is trading at 7X DCF. The question therefore is, why would you sell an asset to ENB at 7X DCF while being paid at 10X DCF currency? Now if the exchange was made when ENB itself was trading at the same multiple, it might make sense.

There are two other considerations, debt to EBITDA and growth profile. The first metric is similar for both and likely better for EEP/EEQ as shown above. ENB does have a superior growth profile but a big part of its growth is the line 3 replacement with EEP/EEQ. So the minimum fair value for us would be where EEP/EEQ gets the same DCF multiple as ENB.

Now obviously as ENB increases the price for EEP/EEQ, its stock is likely to fall. Based on that the absolute minimum that shareholders should accept is a 9X multiple for both EEP/EEQ, which would put shares at $13.50.

Reasons to reject regardless

There is substantial room for EEP/EEQ to improve their metrics from here. The first is simply through documenting the full impact of the FERC rule. We think ENB is likely being conservative on the $30 million estimate. The second is through corporate conversion. Post conversion, EEP/EEQ would have a big tax shield and DCF should approach close to the $1.70 mark. For a boring utility like business with a virtual monopoly we would be hard pressed to value this under 10X DCF or $17/share. By rejecting the offer investors would force ENB to either pay the full amount or simply convert EEP/EEQ to corporate status. Unlike in the case of SEP, EEP/EEQ shareholders do have substantially more leverage.

The proposed merger transaction will be subject to the approval of holders of a majority of the outstanding SEP common units.

The proposed EEP merger transaction is subject to the approval of holders of 66⅔% of the outstanding EEP units. The proposed EEQ merger transaction is subject to the approval of holders of a majority of the outstanding EEQ listed shares, other than Enbridge and its affiliates.

Clearly a blockade here is possible with retail holding a lot of EEQ shares.

Source: ENB presentation

One interesting aspect of this corporate conversion would be that EEP/EEQ would reduce Enbridge Income Fund Holdings Inc revenues (OTC:EBGUF) as the total revenues on the mainline are fixed and currently the FERC decision is essentially enriching EBGUF at the expense of EEP/EEQ.

Trades

Currently EEP holds a premium to EEQ. There are reluctant shareholders in the EEP shareholder group who are working hard at avoiding the taxes that come with the sale. We think however that a sale to ENB or a corporate conversion is inevitable. Selling EEP and buying EEQ would be the best way to get the votes to block ENB’s acquisition attempt as EEQ is held far more by non-institutions. It would also get the potential further upside if ENB is ultimately forced to recognize EEP and EEQ shares as equals (which they actually are based on the 10-K). The same additional upside would also be realized on corporate conversion by EEP itself. Hence trading your shares now seems a good way to capture an additional 4% with no downside.

On ENB itself, we were very bullish in mid March but we got defensive as the stock hit $36. We covered our cash secured puts,

as well as sold calls against our long position. The rationale was that higher bids were coming for SEP (which happened) and EEP/EEQ and those would pressure ENB lower in the shorter term. We were happy capturing 3% extra yield for 2.5 months.

Conclusion

We get all advantages associated with the roll-up and we think ENB is undervalued here. But we just don’t see the rationale of throwing away great assets at a ridiculously low price just because ENB thinks it is fair. If ENB wants EEP/EEQ, it has to explain why a corporate conversion fails to give us the same advantages as rolling into the behemoth ENB. At the minimum we would like an estimate of what the 5 year DCF profile would be post a stand alone corporate conversion and what kind of dividends could be paid while funding Line 3. In the absence of that if ENB wants EEP & EEQ…

For more analysis such as this, along with recommendations for binge watching on Netflix, please consider subscribing to our marketplace service Wheel of Fortune.

Disclaimer: Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Seeking Alpha has changed its policies. Previously “following” someone required a ritualistic commitment and an offering of not less than 4 oxen or 3 breeding horses. Now, all it takes is one click! If you enjoyed this article, please scroll up and click on the “Follow” button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the “Follow” button next to my name to not miss my future articles.

Disclosure: I am/we are long ENB, EEQ.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

The (En)Bridge-T Jones Baby

New Post has been published on http://brummy80.com/the-enbridge-t-jones-baby/

The (En)Bridge-T Jones Baby

We have covered the Enbridge Corporation (ENB) saga previously. Briefly, our take on this was that ENB is undervalued and a highly underrated future dividend aristocrat. We covered the Federal Energy Regulatory Commission (FERC) decision when it came out mid March and believed that ENB had several alternatives to ensure that Enbridge Energy Partners (EEP) and by extension Enbridge Energy management LLC (EEQ) would not suffer as a consequence of the decision. One of the six suggestions was that ENB would simplify the corporate structure by absorbing all its babies into the fold. That is exactly the path ENB decided to go. A few days ago the offer for Spectra Energy Partners (SEP) was boosted by 9.8%. We now examine what is likely to happen next with EEP & EEQ.

What has changed since the original FERC decision

FERC clarified mid June on its initial ruling with a key component being that the accumulated deferred income tax (ADIT) would not have to refunded to customers.

Although the final rule maintains the requirement to file the FERC 501-G, the final rule makes adjustments to the proposed form, including automatically eliminating the accumulated deferred income tax from a pipeline’s cost of service when the form enters a federal and state income tax of zero for pipelines that are non-tax paying entities. This adjustment is consistent with the Order on Rehearing of the Revised Policy Statement in Docket PL17-1-001 issued concurrently with the final rule. The final rule also encourages pipelines to file an addendum to the FERC 501-G to reflect their individual financial situation.

This has an impact of removing uncertainty about any potential refunds for past service overcollection on the tax front. It also increases the net equity invested by the MLPs and hence increases the return on equity threshold in our opinion. For those unaware, this is the threshold that FERC has deemed “fair” and would not allow MLPs to earn less than this return via reducing their rates. We believe this was a key component in ENB increasing SEP’s offer by 9.8%. ENB already owns 83% of SEP and hence the boost was a rather marginal hit to ENB.

Impact to EEP & EEQ

During the second quarter conference call ENB made the preliminary assessment that mid June FERC announcement would be marginally positive for EEP & EEQ.

With respect to the impact of the FERC policy change on EEP, our early assessment is that, in isolation, the ability to eliminate ADIT from the forecast cost of service and to add it to rate base would generate incremental DCF of approximately CAD 30 million per year. However, this would only partially offset the negative impact of U.S. tax reform and the elimination of the tax allowance for MLPs, which we previously estimated at approximately CAD 120 million per year.

Previously ENB had guided that EEP would produce a DCF coverage of 1.0X and this will likely boost DCF coverage to the range of 1.04-1.07X. While not the biggest boost, it is significant for better interest coverage and funds for Line 3 replacement.

What is fair value for EEP/EEQ?

That is what it all comes down to. Before we show you what we think we ask that you keep an open mind about our numbers. To start with let’s look at ENB’s debt to EBITDA.