#ca intermediate courses

Text

CA Inter Classes Online

Choosing online classes for CA Inter from Lecturewala is a strategic investment in your CA Inter success. The platform's commitment to flexibility, accessibility, expert faculty, and comprehensive study material makes it a reliable ally on your path to becoming a chartered accountant. Elevate your CA Inter preparation with Lecturewala's online classes and set yourself on the path to success. Enroll now for a transformative learning experience.

#ca inter classes#ca inter class#inter classes#ca inter courses#ca intermediate course#ca intermediate classes#ca intermediate courses

0 notes

Text

CA Intermediate Study Plan:

The CA Intermediate exam is one of the most crucial stages in the journey to becoming a Chartered Accountant. The syllabus, set by the Institute of Chartered Accountants of India (ICAI), covers a wide array of topics across two groups, making thorough preparation essential. Whether you're sitting for the May 2024 or November 2024 exams, following a structured study plan will significantly improve your chances of success.

In this blog, we will outline a comprehensive CA Intermediate study plan, designed to help you cover the entire syllabus efficiently and master the material in time for the exam.

Overview of the CA Intermediate Exam

The CA Intermediate exam is divided into two groups with a total of eight papers:

Group I:

Accounting

Corporate and Other Laws

Cost and Management Accounting

Taxation

Group II:

Advanced Accounting

Auditing and Assurance

Enterprise Information Systems & Strategic Management

Financial Management & Economics for Finance

Each paper requires a mix of practical problem-solving and conceptual knowledge. Students need to dedicate substantial time to each subject and balance their preparation between both theory and practical subjects.

CA Intermediate Study Plan May 2024

To ensure success, you should aim to study for 6-8 hours daily and complete the syllabus within four to five months, leaving the remaining time for revision and mock tests. Below is a detailed month-by-month study plan.

Type of Questions

Name of Subjects

Time to be Invested

30% MCQ

70% Subjective

Corporate & Other Laws

108 Hrs

30% MCQ

70% Subjective

Taxation

140 Hrs

Practical

Advanced Accounting

118 Hrs

Practical

Cost and Management Accounting

103 Hrs

30% MCQ

70% Subjective

Auditing & Ethics

86 Hrs

30% MCQ

70% Subjective

Financial Management and Strategic Management

89 Hrs

35 Hrs

First Month: Building a Strong Foundation

In the first month, focus on building a solid understanding of the core concepts for each subject. This phase is all about laying the groundwork.

Accounting: Spend 2 hours daily understanding basic principles and accounting standards.

Corporate and Other Laws: Focus on the Companies Act, making detailed notes of important sections and provisions.

Cost and Management Accounting: Start with costing techniques like Marginal Costing and Standard Costing.

Taxation: Learn the basic concepts of Income Tax and GST. Dedicate 1.5 hours daily to building a strong foundation in direct taxes.

Second Month: In-Depth Study

In the second month, deepen your understanding of each subject. It’s important to consistently revise while moving forward with new topics.

Advanced Accounting: Tackle complex topics like Consolidation of Financial Statements and Amalgamation.

Cost and Management Accounting: Continue with process costing, contract costing, and other advanced topics.

Taxation: Dedicate 2 hours daily to practicing numerical problems on Income Tax and GST.

Third Month: Practice and Reinforcement

The third month is where you start practicing practical problems and past exam papers to reinforce your knowledge.

Accounting: Start solving ICAI’s past exam papers. Dedicate 3 hours daily to practicing numerical problems.

Corporate and Other Laws: Revise all provisions and practice writing detailed answers for case studies.

Taxation: Focus on GST compliance and more complex direct tax scenarios.

Fourth Month: Focus on Mock Tests and Timed Practice

In this month, it’s essential to take mock tests and time yourself to get used to the exam conditions.

Group I: Take a full-length mock test every week and review your answers in detail.

Group II: Dedicate time to solving case-based questions in subjects like Financial Management and Strategic Management.

Fifth and Sixth Months: Full Revision

The final months should be dedicated entirely to revision. Spend your time revising key topics and concepts. Revise difficult chapters first, then move on to easier subjects to build confidence.

Full Study Plan for CA Intermediate Exams May 2024 in steps

Step 1: Understand the Exam Structure

Go through the CA exam notification and understand the structure, syllabus, and eligibility criteria.

Look at past years' papers to get familiar with the type of questions that are asked.

Step 2: Build Strong Basics

Review foundation-level materials to strengthen your basics in subjects like Accounting and Law.

Go through ICAI’s standard study materials and make detailed handwritten notes.

Step 3: Practice Answer Writing

Once you’ve studied a topic, immediately begin answering related questions.

Writing out answers will help you retain more information and improve your answer-writing speed for the exam.

Step 4: Mock Tests and Review

Three months before the exam, switch to a mock test-based approach.

Take full-length tests under timed conditions to simulate the exam environment.

Step 5: Revise and Practice

Dedicate your last month to revision. Review your notes, take more mock tests, and practice exam scenarios to boost confidence.

Books for CA Intermediate Exam Preparation:

1. CA Intermediate Study Material by ICAI

Why It's Essential: This is the official study material provided by ICAI and covers the syllabus comprehensively for both groups. It’s highly recommended for students to follow the ICAI modules as they are aligned with the exam pattern.

Best for: All subjects, with a focus on conceptual clarity.

2. Advanced Accounting by MP Vijay Kumar

Why It's Essential: This book is excellent for understanding Advanced Accounting concepts. It breaks down complicated topics like consolidation and amalgamation into simple, easy-to-understand language.

Best for: Students who need extra support in Group II - Advanced Accounting.

3. Taxation (Income Tax & GST) by T.N. Manoharan

Why It's Essential: A popular choice among CA students, this book provides in-depth coverage of Taxation, with practical problems and case studies. It also focuses on GST and Income Tax, making it essential for the Taxation paper.

Best for: Both beginners and students revising key concepts in Taxation.

4. Cost and Management Accounting by P.C. Tulsian

Why It's Essential: This book simplifies complicated topics in Costing and Management Accounting with a practical approach. The numerous problems and solutions included in this book help students to practice extensively.

Best for: Conceptual clarity in Cost and Management Accounting and practicing numerical problems.

5. Auditing and Assurance by Surbhi Bansal

Why It's Essential: This book provides a detailed understanding of Auditing standards and assurance practices. Known for its concise notes and question bank, it helps students grasp the subject quickly.

Best for: Students preparing for the Auditing & Assurance paper in Group II.

Why Choose iProledge Academy?

At iProledge Academy, we provide a structured approach to help you ace your CA Intermediate exams:

Comprehensive Study Material: Our materials are designed to cover both theory and practical problems comprehensively.

Mock Tests and Feedback: We provide regular mock tests with detailed feedback to ensure continuous improvement.

Experienced Faculty: Our faculty members are industry experts who guide you through each subject, ensuring clarity in complex topics.

Personalized Attention: We focus on one-on-one mentoring to address each student’s weak areas.

Conclusion: Your Path to Success in the CA Intermediate Exam

With a well-organized study plan and expert guidance from iProledge Academy, you’ll be fully prepared to ace your CA Intermediate exam. Start early, remain consistent, and follow a structured revision and practice routine to ensure success.

Enroll at iProledge Academy today and take your first step toward becoming a Chartered Accountant!

FAQs on CA Intermediate Study Plan

How many hours should I study for CA Intermediate?

It’s recommended to study for 6-8 hours daily, depending on your understanding and comfort with the subjects.

What is the ideal time to complete the syllabus for CA Intermediate?

The syllabus should be completed 4-5 months before the exam, leaving time for revision and mock tests.

How important are mock tests for CA Intermediate preparation?

Mock tests are crucial as they help in time management, identifying weak areas, and reducing exam anxiety.

Can I clear CA Intermediate in the first attempt?

With a structured study plan, regular revision, and guidance from iProledge Academy, clearing the exam on the first attempt is achievable.

0 notes

Text

Upcoming Trends in CA Intermediate Education in Coimbatore for 2024

As we step into 2024, the landscape of CA Intermediate Course in Coimbatore is poised for transformative changes, driven by technological advancements, evolving educational methodologies, and a deeper focus on holistic development. Rachith Academy, a pioneering institution in CA coaching, is at the forefront of these trends, ensuring students are well-prepared for the future.

One of the most significant trends in CA Intermediate Course in Coimbatore is the integration of technology into the learning process. With the proliferation of digital tools and resources, traditional classroom teaching is being supplemented by online platforms, enabling students to access high-quality content anytime, anywhere. Rachith Academy has embraced this trend by offering a hybrid model of learning, combining the best of both worlds. This approach not only caters to the diverse learning preferences of students but also ensures that they can continue their studies uninterrupted in any situation.

The use of Artificial Intelligence (AI) and Machine Learning (ML) in education is another trend gaining momentum. These technologies are being utilized to personalize learning experiences, offering tailored study plans and practice tests that adapt to the individual needs of each student. Rachith Academy is leveraging AI-powered analytics to track student performance, identify areas of improvement, and provide targeted interventions. This data-driven approach enhances the learning experience, ensuring students achieve their full potential.

Gamification is emerging as a powerful tool to make learning more engaging and enjoyable. By incorporating game-like elements such as quizzes, leaderboards, and rewards into the curriculum, educators can motivate students and foster a competitive spirit. Rachith Academy has introduced interactive learning modules and gamified assessments to keep students motivated and invested in their studies. This innovative approach not only makes learning fun but also improves retention and understanding of complex concepts.

In addition to technological advancements, there is a growing emphasis on soft skills development. The modern CA professional is expected to possess strong communication, leadership, and problem-solving skills, in addition to technical expertise. Rachith Academy is incorporating soft skills training into its CA Intermediate Course in Coimbatore program, providing students with workshops and seminars on topics such as public speaking, teamwork, and time management. This holistic approach ensures that graduates are well-rounded individuals, ready to excel in their professional careers.

Collaborative learning is another trend reshaping CA Intermediate Course in Coimbatore education. Study groups, peer-to-peer learning, and group projects are becoming integral parts of the curriculum. Rachith Academy encourages collaboration among students through interactive sessions and group activities, fostering a sense of community and collective growth. This collaborative environment not only enhances learning outcomes but also prepares students for the collaborative nature of the professional world.

Sustainability and ethical practices are also gaining importance in the curriculum. As future financial professionals, CA students need to be aware of the ethical implications of their decisions and the impact of their actions on society and the environment. Rachith Academy is integrating topics such as corporate social responsibility, sustainable finance, and ethical accounting practices into its syllabus, preparing students to be responsible and conscientious professionals.

Lastly, continuous professional development is becoming a cornerstone of CA education. The dynamic nature of the accounting profession demands that individuals stay updated with the latest developments and trends. Rachith Academy offers ongoing training and upskilling opportunities for its alumni, ensuring they remain competitive in the ever-evolving job market.

In conclusion, the CA Intermediate Course in Coimbatore is evolving rapidly, driven by technological innovations, a focus on holistic development, and the need for continuous learning. Rachith Academy is leading the way in embracing these trends, providing students with a comprehensive and future-ready education. As we move forward into 2024, these trends will shape the future of CA education, ensuring that students are well-equipped to meet the challenges of the professional world.

To Know More https://rachithacademy.com/upcoming-trends-in-ca-intermediate-education-in-coimbatore-for-2024/

0 notes

Text

Unlocking Success: A Comprehensive Guide to Preparing for the CA Inter Exam

Are you gearing up for the CA Inter Exam? This pivotal moment in your academic and professional journey demands meticulous preparation and a strategic approach. Whether you’re a first-time taker or aiming for a top rank, mastering the art of preparation is key. Here’s a comprehensive guide to help you unlock success in the CA Inter Exam.

Understanding the CA Inter Exam: The CA Inter Exam, conducted by the Institute of Chartered Accountants of India (ICAI), is a stepping stone towards becoming a Chartered Accountant. It consists of eight papers divided into two groups, covering topics such as Accounting, Corporate and Other Laws, Cost and Management Accounting, Taxation, and more.

Creating a Study Plan: Effective time management is crucial for exam preparation. Create a study plan that allocates sufficient time to cover each subject thoroughly. Break down your study sessions into manageable segments, focusing on understanding concepts, practicing problems, and revising regularly.

Utilizing Study Material: ICAI provides study material and practice manuals for each subject. These resources are invaluable for exam preparation, as they are curated by experts and align with the exam syllabus. Make sure to supplement your studies with additional reference books and online resources for a holistic understanding of the topics.

Mock Tests and Previous Years’ Papers: Practice makes perfect, and this holds true for the CA Inter Exam as well. Solve mock tests and previous years’ papers to familiarize yourself with the exam pattern, time management, and question types. Analyze your performance to identify weak areas and work on improving them.

Seeking Guidance: Don’t hesitate to seek guidance from experienced professionals, teachers, or mentors. Joining a coaching institute or online classes can provide structured guidance and help clarify doubts. Engage in group study sessions to gain different perspectives and enhance your learning experience.

Maintaining a Healthy Lifestyle: A healthy body supports a healthy mind. Ensure you get enough rest, eat nutritious meals, and exercise regularly. Avoid stress and burnout by taking breaks and indulging in hobbies or activities that relax you.

Staying Positive and Motivated: The journey to becoming a Chartered Accountant is challenging, but maintaining a positive attitude and staying motivated is key to success. Visualize your goals, stay focused, and believe in your abilities.

Conclusion: The CA Inter Exam is not just a test of knowledge but also a test of determination and perseverance. By following this comprehensive guide, you can prepare effectively and increase your chances of acing the exam. Stay committed to your goals, and success will be yours. Best of luck!

Original Source: CA Intermediate Course

#ca inter exam#ca inter#ca intermediate#ca intermediate course#ca inter subjects#ca inter syllabus#ca intermediate syllabus#ca inter group 1 subjects#ca inter group 2 subjects#ca inter accounts

0 notes

Text

CA Online Course By DG Sharma | CA Classes | CA Intermediate & Foundation

CA D.G. Sharma is an eminent and most admired faculty in the student fraternity. He is the epitome of knowledge helping students to realize their own potential and achieve newer heights. Academically he is a rare gem he has qualified the most prestigious exams CA, CS and ICWA.

He believes that the profession of Chartered Accountancy is rewarding and responsible. He opines that CA’s have to be an expert in Accounting and to gain command students should acquire knowledge. He imbibes confidence in students by giving conceptual clarity. His success mantra is, “Do not memorize everything try to understand everything”.

CA D.G. Sharma is the Founder and Managing Director of DG Sharma‘s CAPS, a premier commerce coaching institute in central India. He has penned more than 10 books in accountancy published by renowned publishing houses.

#ca classes#ca online classes#ca intermediate classes#ca foundation classes#ca online course#ca course online classes#ca best online classes#best ca online classes#online ca foundation classes#chartered accountant online classes#chartered accountant online course#best online coaching for ca foundation#ca intermediate online classes#ca final classes online#online ca course#ca online coaching classes#ca foundation coaching#ca foundation online classes

0 notes

Text

An Overview CA Intermediate Exam as Per New Syllabus 2024

With its hard coursework and exams, the Chartered Accountancy (CA) Intermediate level is a critical step on the path to becoming a chartered accountant. To guarantee that prospective chartered accountants (CAs) possess the most recent information and abilities, the Institute of Chartered Accountants of India (ICAI) has unveiled a revised curriculum for the CA Intermediate course. We'll go over the main ideas of the CA Intermediate New Syllabus in this blog, giving candidates an idea of what to expect and how to get through this demanding yet rewarding stage of their career.

Updated Structure and Pattern: The CA Intermediate exam's structure and pattern have been updated in light of the new syllabus. Six papers total are split into two groups, Group I and Group II, each of which has three papers. The framework attempts to offer a comprehensive grasp of many aspects of business, finance, and accounting.

Papers for Group I:

Advanced Accounting: This section of the CA Intermediate New Syllabus 2024 focuses on producing financial statements using Indian Accounting Standards, which are comparable to IFRS, and applying accounting standards to actual business scenarios. It also addresses the financial statement preparation framework and IFRS convergence or adoption.

Corporate and Other Laws: This essay covers business law, other corporate laws, ethics, and legal and regulatory topics. Candidates must understand the laws that control corporations and corporate governance.

Taxation: Both direct and indirect taxes are covered in this paper. To prepare applicants for the complexities of the taxation landscape. It has 2 sections.

Income Tax Laws(IT)

Goods and Service Tax(GST)

Papers for Group II:

a. Cost and Management Accounting: With an emphasis on budgeting, performance analysis, and costing techniques, this paper gives candidates the tools they need to control costs and make decisions in companies.

b. Auditing and Ethics: Understanding the foundational ideas of auditing and becoming acquainted with the well-recognized auditing methods, approaches, and competencies are the main goals. Students will also acquire the skills necessary to successfully apply this information in audit and attestation assignments.

c. Financial Management and Strategic Management: The main goal of financial management is to optimize the value of an organization's finances.

Conversely, strategic management focuses on the broad picture, explaining how to create and carry out plans that will support a business in achieving its objectives in the long run.

FM and SM are two sides of the same coin, not distinct topics. Implementing effective strategy requires strong financial management, and making wise financial decisions requires a solid understanding of the business environment. Through acquiring both FM and SM, students enrolled in CA Inter gain a comprehensive viewpoint.

Strategies for Preparation:

Considering the new syllabus's comprehensive nature, candidates need to implement efficient preparation techniques. This entails making a study schedule that allows enough time for each paper, getting practice with previous exams and practice questions, and consulting mentors or knowledgeable instructors for advice. Furthermore, candidates must stay informed about any modifications or updates issued by ICAI to guarantee that they are adequately prepared for the exams.

In summary, the CA Intermediate New Syllabus represents a major advancement in bringing the CA curriculum into compliance with the needs of the contemporary business world. This stage should be approached by aspiring chartered accountants with a dedication to comprehending both the theoretical and real-world applications of the concepts. Candidates can pass the exams and become well-rounded professionals prepared to make valuable contributions to the finance and accounting industries by assiduously studying the new syllabus and planning ahead.

Start your journey with CA online classes at SPC:

#ca online classes#ca inter online classes#ca intermediate#ca inter classes in pune#ca course#ca classes in pune#ca coaching classes#ca final classes in pune

0 notes

Text

All About CA Course: CA foundation, CA Intermediate and CA Final Syllabus

For those interested in pursuing a career in Commerce or any other stream, chartered accountancy is one of the best career option.

It is a very good job option for individuals who are interested in the field of taxation and accounting. The road to become a chartered accountant is arduous and difficult and hence paid a great amount after completion.

If you want to read more click here

0 notes

Text

1 note

·

View note

Note

As a native Spanish speaker and an English teacher myself, let me say, she does have some control of the language in terms of vocabulary, and her pronunciation is not terrible. However, she makes mistakes in the tenses of the verbs and she clearly has no fluency, she memorised most of this little “speech” and that’s why it sounds unnatural.

She has no detectable “Argentinian” accent, she sounds more like LA Spanish to me. Again, not terrible, but more basic/intermediate than advanced.

To be honest, she’s better than I thought she was. She’s clearly a well educated woman, sadly, we all dislike her for her actions, and we assume every word out of her mouth is a lie. In this particular case I dare say she wasn’t lying about speaking Spanish, she’s got the basics down. She’s probably been rehearsing her speech, it’s not hard to find Spanish speakers to practice with in California.

🤷🏽♀️

I agree. She sounds like me when I try to speak Spanish on vacation - I had 6 years of Spanish in school so I have a passing familiarity with the language but I’m so rusty that I have to re-teach myself phrases, vocabulary, and pronunciation when I travel to be able to speak it and it does sound more like rote memorization than fluent conversation (which I could do 17 years ago!).

So to my untrained (and deaf, so please be kind to me if I’m missing something) ear, Meghan sounds like someone who once had a Spanish education but lost the skills from non-use and has recently had a crash course in it.

But that isn’t the same as claiming to be conversationally fluent in Spanish after all this time, and that’s not what she demonstrated this weekend; she can make a speech in Spanish (which anyone can do if they practice long enough because honestly it’s just mimicking sounds and pronunciation when you don’t know the words), but she can’t hold or follow a conversation in Spanish - which we know because she needed headphones for that one conference and all of her answers were in English.

And there’s a lot of speculation, from Sussex Squad and the rest of us, that because Meghan has claimed to be conversational in Spanish, she speaks to her household staff in Spanish - which started after a rumor that Meghan’s household staff is largely Hispanic because of assumptions that the domestic workforce in CA is largely Hispanic - that’s why I made the post I did suggesting that because she didn’t sound conversationally fluent (to me) and she needed translator services all weekend, we can probably debunk those claims that she speaks specifically in Spanish to her staff.

(For some reason I can still read Spanish pretty well but being able to read Spanish doesn’t help when you’re asking for directions!)

21 notes

·

View notes

Text

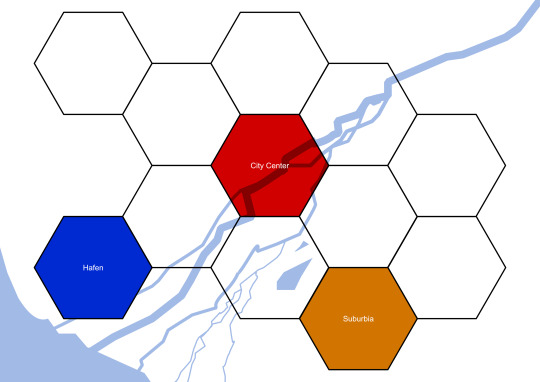

I'm about to go to bed and I don't particularly feel like translating these wip graphics into english but I wanna scream (affectionate) about the project anyways, so here goes:

I'm building a cyberpunk city for a shadowrun ttrpg campaign :D

... or not, if it no longer strikes my fancy.

Anywah, I thought long and hard about how best to do this and came to the conclusion that to simulate the experience of a city that you can actually get to know as a player without getting lost in making huge-ass, mostly empty maps is instead making a few large-ish maps that represent a part of a city.

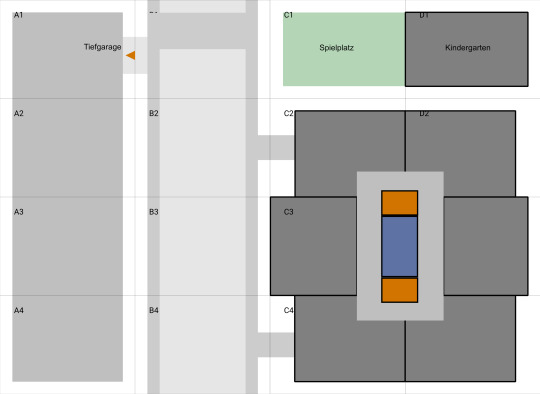

Above you see a symbolic representation of the 12 city parts, currently named after their function more than their history. For each of these maps I'll make a large-ish maps which has a unique feel and represents that city part, e.g. this one, the "worker neighborhood":

It features, left to right: a supermarket with a parking garage under it, a main street with a bridge over it, a playground (green) with a kindergarten next to it and (below) an apartment complex (orange are lifts, blue are staircase).

Now you might wonder: hey chicken, why are there rectangles and numbers/letters on there?

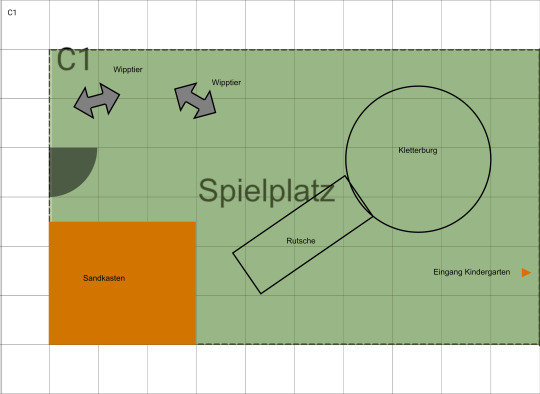

I'm glad you asked! it's because this is only an intermediate-sized map which is supposed to give an overview. The tiles are named A1 to D4 and each of them in its final form can become a battle map if needed, see here:

This is the C1 tile, which is the playground, except zoomed-in. (It features rocking animals, sandbox, climbing tower and slide). As you can see, each map once again has square tiles and I picked a size that has a somewhat generous amount of space for minis.

Each map-tile prints easily on a din-a4 page, so you can either use the intermediate map-size to give an overview of an area ooooor you can print out every single map tile individually and assemble them together into an Din A0 map which should hopefully fit on your kitchen table (ca. 80 cm x 120 cm = ca. 2' 9" x 3' 11")

Of course you could always build upon this by pretending that a mission you thought up yourself or bought takes place in one of the city parts but doesn't connect directly to one of the large-ish maps, oooor you can keep drawing the maps bigger, if you prefer.

One way or the other, you can establish places and come back to them because these maps are big enough and have enough going on in them that they can easily become recurring places (e.g. someone's contact lives in the apartment but also the supermarket becomes relevant in a mission. Also. ALSO... gang territories! The possibilities!!)

I'm so looking forward to filling these out!

9 notes

·

View notes

Text

(In reference to this post)

@andromacheflints those are his titles!

GCH - AKC Grand Champion

CH - AKC Champion

CA - Coursing Ability

DCAT - he's fast. I'll admit FCAT titles confuse me some.

CGCA - Canine Good Citizen Advanced

CGCU - Canine Good Citizen Urban

TKI - Trick Dog Intermediate

ATT - AKC Temperament Title

He also recently got his FDC (Farm Dog Certified) title!

8 notes

·

View notes

Text

The journey to becoming a Chartered Accountant (CA) in India is a rigorous and rewarding one, requiring candidates to clear the CA Foundation, CA Intermediate, and CA Final exams. In addition to investing time and effort in preparing for these exams, candidates must also consider the associated financial costs. In this blog, we will explore the CA course fees for 2023, as well as introduce you to Lecturewala, a trusted resource for CA aspirants.

CA Foundation Course Fees

The CA Foundation course is the first step on the path to becoming a CA. The registration fee for the CA Foundation course in 2023 is approximately INR 9,000. This fee includes the cost of study materials and online registration. Please note that this fee is subject to change, so it’s essential to check the official website of the Institute of Chartered Accountants of India (ICAI) for the most up-to-date information.

CA Intermediate Course Fees

Once you clear the CA Foundation exam, you can move on to the CA Intermediate level. The registration fee for the CA Intermediate course in 2023 is approximately INR 18,000. This fee includes both groups, and the study materials are provided at no additional cost. However, it’s worth noting that the fee can vary based on the route you choose (i.e., direct entry or after completing the CA Foundation course). To get the exact fee structure for your situation, consult the ICAI’s official website.

CA Final Course Fees

The final leg of the journey is the CA Final course, which prepares you for the last and most challenging set of exams. The registration fee for the CA Final course in 2023 is approximately INR 22,000. Similar to the CA Intermediate course, this fee is for both groups, and study materials are included in the cost. Again, the fee may vary depending on your entry route and other factors, so it’s crucial to consult the official ICAI website for precise information.

Lecturewala: A Valuable Resource for CA Aspirants

One of the key elements of preparing for CA exams is access to quality study material and guidance. This is where Lecturewala, a trusted name in the field of CA education, comes into the picture. Lecturewala offers a wide range of courses, including video lectures and study materials for CA Foundation, CA Intermediate, and CA Final exams. They understand the needs of CA aspirants and provide comprehensive and up-to-date resources to help students succeed.

Key Features of Lecturewala:

Expert Faculty: Lecturewala boasts a team of experienced and knowledgeable faculty members who are well-versed in the CA exam syllabus.

High-Quality Video Lectures: Their video lectures are known for their clarity and depth, making complex topics easier to understand.

Comprehensive Study Materials: Lecturewala provides study materials that are aligned with the latest syllabus and examination patterns, ensuring that students are well-prepared.

Mock Tests and Practice Papers: To help candidates assess their progress, Lecturewala offers mock tests and practice papers, allowing them to gauge their readiness for the actual exams.

Cost-Effective: Lecturewala’s courses are reasonably priced, making them accessible to a wide range of CA aspirants.

Conclusion

Becoming a Chartered Accountant is a noble and rewarding pursuit, but it comes with its share of financial commitments. Understanding the CA course fees for 2023 is essential for planning your journey. Additionally, resources like Lecturewala can play a pivotal role in helping you achieve your CA aspirations by providing you with high-quality study material and expert guidance. So, if you’re embarking on your CA journey in 2023, be sure to stay informed about the latest fees and explore resources like Lecturewala to enhance your preparation and increase your chances of success. Good luck with your CA journey!

0 notes

Text

Tips for Choosing the Right CA Intermediate Course

Are you aspiring to become a Chartered Accountant and looking for the best CA Intermediate course in Coimbatore? Choosing the right institute can make a significant difference in your career path. Embarking on the journey to become a Chartered Accountant (CA) is a significant step, and selecting the right Best CA Intermediate Course in Coimbatore is crucial to your success. Here are some essential tips to guide you in making the best choice:

Accreditation and Recognition

Ensure that the course provider is accredited by the relevant professional bodies. A recognized institution ensures a high standard of education and better career prospects.

Experienced Faculty

Research the qualifications and experience of the faculty members. Experienced instructors can provide valuable insights, practical knowledge, and effective teaching methods.

Comprehensive Curriculum

The course should cover all essential topics and comply with the latest syllabus prescribed by the Institute of Chartered Accountants of India (ICAI). A thorough curriculum ensures you are well-prepared for the exams.

Study Materials and Resources

Check if the course offers high-quality study materials, including textbooks, online resources, and practice papers. These materials should be updated regularly to reflect the latest exam patterns and content.

Flexible Learning Options

Look for courses that offer flexibility in terms of class schedules, online or offline modes, and self-paced learning. Flexibility is crucial for balancing your studies with other commitments.

Success Rate and Reviews

Investigate the success rate of previous students and read reviews or testimonials. High pass rates and positive feedback from alumni can indicate the effectiveness of the course.

Support Services

Consider the availability of additional support services such as doubt-clearing sessions, mentorship programs, and career guidance. These services can provide extra assistance and motivation throughout your study period.

Affordability

Compare the fees of various courses and ensure that the one you choose offers good value for money. Sometimes, investing a bit more in a reputed institution can yield better results in the long run.

By considering these tips, you can choose a Best CA Intermediate Course in Coimbatore that aligns with your learning style, goals, and financial considerations, paving the way for a successful career in chartered accountancy.

Choosing the best CA Intermediate course in Coimbatore is a crucial step towards achieving your career goals in chartered accountancy. By considering these factors and conducting thorough research, you can make an informed decision that aligns with your aspirations and sets you on the path to success.

To Know More: https://rachithacademy.com/tips-for-choosing-the-right-ca-intermediate-course/

0 notes

Text

The Chartered Accountancy (CA) Course: A Comprehensive Guide

The Chartered Accountancy (CA) course is one of the most prestigious and challenging professional courses in India and around the world. It is regulated by the Institute of Chartered Accountants of India (ICAI), which was established in 1949. Becoming a Chartered Accountant opens up a world of opportunities in various sectors such as finance, taxation, audit, and consultancy. In this article, we will explore the various aspects of the CA course, including its eligibility criteria, exam structure, and career prospects.

Eligibility Criteria: To pursue the CA course, a candidate must have completed 10+2 or its equivalent from a recognized board. Candidates can register for the CA Foundation course after passing the 10th examination, but they can appear for the exam only after passing the 10+2 examination. Additionally, candidates must fulfill certain criteria related to age and educational qualifications as specified by the ICAI.

Course Structure: The CA course is divided into three levels: Foundation, Intermediate, and Final. Each level has a set of papers that candidates need to clear to move to the next level. The course also includes practical training and a series of examinations conducted by the ICAI.

Foundation Course: The Foundation course consists of four papers covering topics such as Accounting, Business Laws, Business Correspondence and Reporting, and Business Mathematics and Logical Reasoning & Statistics.

Intermediate Course: The Intermediate course is further divided into two groups, each consisting of four papers. The subjects covered include Accounting, Corporate Laws and Other Laws, Cost and Management Accounting, Taxation, Advanced Accounting, Auditing and Assurance, Enterprise Information Systems & Strategic Management, and Financial Management & Economics for Finance.

Final Course: The Final course is also divided into two groups, each consisting of four papers. The subjects covered include Advanced Auditing and Professional Ethics, Corporate and Economic Laws, Strategic Cost Management and Performance Evaluation, Financial Reporting and Strategic Financial Management, and Direct Tax Laws and International Taxation.

Articleship and Training: Apart from clearing the examinations, candidates are required to undergo three years of practical training called articleship. During this period, candidates work under the guidance of a practicing Chartered Accountant and gain practical experience in areas such as accounting, auditing, taxation, and financial management.

Career Prospects: Becoming a Chartered Accountant opens up a wide range of career opportunities in both the public and private sectors. Chartered Accountants are in high demand in areas such as auditing, taxation, financial reporting, and consultancy. They can also work in roles such as Chief Financial Officer (CFO), Finance Manager, Tax Consultant, and Auditor. Many Chartered Accountants also choose to start their own practice and provide services to clients.

In conclusion, the CA course is a challenging yet rewarding journey that offers immense opportunities for professional growth and development. It requires dedication, hard work, and perseverance, but the rewards are well worth it. If you have a passion for accounting and finance, and are willing to put in the effort, the CA course could be the perfect choice for you.

#ca course#ca course details#ca course fees#ca course subjects#ca course duration#ca foundation course#ca intermediate course#ca course details after 12th

0 notes

Text

Understanding the New 42-Month CA Course Structure: What Has Changed?

It is well acknowledged that the Chartered Accountancy (CA) programme is among the most difficult professional programmes offered in India. The most recent change to the course's 42-month duration signifies a substantial change in the way prospective CAs will approach their studies because the Institute of Chartered Accountants of India (ICAI) updates it on a regular basis to meet the changing needs of the industry. This new structure affects not only the length but also the curriculum, training, and methods of assessment. Let's examine the changes and what they signify for those aspiring to become CAs.

1. The Shift to a 42-Months Duration

The move to a 42-months timetable is the most noticeable modification to the new CA course structure. The CA program used to take at least 48 months to complete, including a three-year articleship (practical training). Many students are happy about the shorter duration because it will enable them to finish the course more quickly and start working in the workforce sooner.

However, the shortened time frame also means that students must study with greater efficiency and intensity. The course's rigor and content will not be diminished by the shorter duration. Instead, it calls for a more efficient and cohesive method of instruction, where theoretical understanding is more closely matched with hands-on training. To navigate this demanding schedule successfully, students must also focus on the right study materials, particularly CA Entrance Exam Books, which play a crucial role in building a strong foundation early in the course.

2. Revised Curriculum

Revisions to the curriculum are among the major adjustments that come with the new structure. In order to keep the syllabus contemporary and applicable to the current business and economic climate, the ICAI has taken action to modernize it. This covers the addition of fresh topics as well as the update of current ones to match modern methods.

As an example, the curriculum now gives more weight to data analytics, sustainability reporting, and digital finance—areas that are becoming more and more important in today's business environment. Furthermore, there is an increased emphasis on honing analytical and problem-solving abilities, which are critical for success in the accounting and financial industries. To assist students in navigating these changes, Scanner CA Intermediate Books have become a valuable resource, offering an organized approach to covering both new and updated topics efficiently.

3. Integrated Training and Education

There is also a more integrated approach to training and education with the new 42-month structure. The updated framework more successfully integrates theoretical knowledge and practical experience, reflecting the ICAI's recognition of the value of doing so.

During their articleship, students will have more chances under the new approach to apply what they have learned in the classroom to actual situations. Utilizing resources like the CA Intermediate Scanner can further enhance this learning by providing a focused review of important topics and questions. By bridging the gap between theory and practice, this integration helps students graduate from the course more industry-ready.

4. Streamlined Assessment Process

The assessment procedure has been modified, which is another noteworthy alteration. Exams for the CA degree are famously challenging and demanding, and this has historically been a big obstacle for students. The ICAI made modifications to the new structure that should make the assessment process less stressful and more ongoing.

During the articleship, this includes introducing more frequent internal assessments and project-based evaluations. These adjustments are meant to ease the stress associated with final exams and promote a more regular and stable study schedule. The goal of the ICAI's ongoing assessment program is to make sure that students are learning and implementing their material during the course, as opposed to only studying for tests.

5. Increased Flexibility

The new CA course structure offers students more flexibility, allowing them to tailor their learning routes to align with their career goals. The Institute of Chartered Accountants of India (ICAI) has introduced a broader selection of elective courses, enabling students to focus on areas of interest such as forensic accounting, international taxes, and financial services. This expanded choice in Study Material For CA allows students to specialize in their preferred fields, making the course more appealing to a wider range of students. Moreover, this flexibility ensures that students are better prepared to tackle the unique challenges they will encounter in their chosen career pathways.

Conclusion

The way chartered accountancy is taught and acquired in India has undergone a substantial change with the introduction of the 42-month CA course framework. The ICAI has streamlined examinations, shortened the time, updated the curriculum, integrated training and education, provided greater flexibility, and improved the course's alignment with industry and student needs. Alongside these changes, the importance of selecting the right books for the CA Exam has become even more critical for students aiming to excel in their studies.

Although the changes present new challenges, they also offer students exciting chances to acquire the information and skills needed to succeed in the rapidly changing finance and accounting industries. The new framework provides prospective CAs with a more effective, pertinent, and adaptable route to reaching their career objectives.

#scanner ca foundation books#scanner ca intermediate books#study material for ca#ca intermediate scanner#ca entrance exam books#books for ca exam

0 notes

Text

Ace your CA Intermediate Costing with CA Parag Gupta Sir’s expert course. Limited time offer: use the 12k coupon code for a discount.

0 notes