#ca inter online classes

Explore tagged Tumblr posts

Text

CA Foundation Business Laws: Complete Guide to Prepare for May 2025

Business Laws is a critical subject in the CA Foundation syllabus and often sets the tone for a student's confidence in law-related papers throughout the CA journey. For the May 2025 attempt, cracking Business Laws isn't just about reading bare acts—it's about understanding the logic behind legal provisions and applying them effectively in exams. With the right study strategy and resources like UltimateCA’s expert-led CA coaching classes, even beginners can master this subject with clarity and confidence.

Understanding the Business Laws Paper

The Business Laws paper tests your conceptual clarity, understanding of key acts, and ability to apply law to practical scenarios. The syllabus includes the Indian Contract Act, Sale of Goods Act, Partnership Act, LLP Act, and Companies Act—each carrying significant weightage. While some students find legal language overwhelming, with the right guidance from CA Foundation Classes and a smart revision approach, these laws can become easy to grasp.

Importance of Conceptual Clarity

The foundation of success in business law is conceptual clarity. Instead of rote learning, try to understand the "why" behind each legal provision. For instance, rather than just memorizing what makes a contract valid, understand why mutual consent, lawful object, and consideration matter in real-world contracts. That’s where CA Online Classes from UltimateCA stand out—they explain every clause in a practical and relatable way that ensures long-term retention.

Smart Study Plan for Effective Preparation

A smart study plan involves daily study sessions, active recall, and consistent revision. Start by dividing your syllabus into logical segments—one Act at a time. Dedicate time to reading the theory, followed by solving MCQs and writing case-based answers. Make short notes during your first reading and revisit them during revision days. UltimateCA’s CA Foundation Classes provide concise yet comprehensive coverage with law charts, summaries, and previous year questions that are highly effective for last-minute review.

Regular Practice of MCQs and Case Studies

The objective nature of the Business Laws paper means multiple-choice questions play a vital role in your final score. Practice at least 30-40 MCQs every day from each chapter. Understand the reasoning behind the right response rather than merely speculating.Case-based MCQs are also becoming more common, testing your understanding of legal applications. The CA Inter Online Classes offered by UltimateCA include MCQ practice sessions that mirror the ICAI exam pattern, ensuring students are well-prepared.

Revise Using Summary Charts & Mind Maps

Law is a subject that needs multiple revisions. Summary charts, flashcards, and mind maps are excellent tools to revise large portions of the syllabus quickly. UltimateCA’s CA coaching classes offer digital mind maps and law flowcharts that help in quick memory recall and improve your writing in the exam. Keep these resources handy while revising so you can recall key sections and case laws faster.

Time Management in Exam Hall

One of the most common mistakes students make is spending too much time on theory questions and rushing through MCQs. During your mock tests, practice completing the paper within the time limit. Set up specific time slots, such as two hours for the descriptive portion and forty minutes for multiple-choice. This habit will train your brain to perform under pressure. CA Online Classes from UltimateCA provide timed test series and evaluated answer sheets to help students improve speed and accuracy.

Stay Updated with ICAI Notifications

ICAI may update the syllabus, introduce amendments, or issue guidelines close to the exam. Stay connected with your coaching platform and regularly check the official ICAI website. UltimateCA makes it easier by providing instant updates within the course platform, so students don't miss anything crucial.

How UltimateCA Helps You Stay Ahead

UltimateCA’s CA Foundation Classes are specifically designed keeping exam orientation and student needs in mind. Whether you're attending live sessions or watching recorded lectures, the teaching style focuses on conceptual clarity, consistent revision, and problem-solving skills. The platform also provides 24/7 doubt resolution, weekly mentorship sessions, and topic-wise MCQ practice to strengthen every student’s foundation.

The goal of UltimateCA is to train your mind to think like a chartered accountant, not only to impart knowledge. From foundational subjects to CA Inter Online Classes, each course is built to prepare students for ICAI’s evolving exam patterns and real-world application.

Final Thoughts

Business Laws doesn’t have to be intimidating. With a clear approach, the correct materials, and coaching from experienced faculty members, you can surely pass the CA Foundation May 2025 examinations. Start early, stay consistent, and make your preparation smarter, not harder. And if you're looking for the best platform to guide you through it, UltimateCA’s CA coaching classes are your go-to solution.

#Business Laws#UltimateCA’s#CA coaching classes#CA Inter Online Classes#CA Foundation Classes#Business Laws Paper

0 notes

Text

Breaking the Geographical Barriers: Accessing Top CA Classes From Anywhere in India

In the rapidly evolving digital world, geography is no longer a barrier to education. Aspiring Chartered Accountants (CAs) from remote towns, bustling cities, and everything in between can now access top-notch CA classes from anywhere in India. The rise of Online CA courses in India has transformed how students prepare for their CA Foundation, Intermediate, and Final exams, enabling equal access to quality education.

Why Breaking Geographical Barriers Matters

The journey to becoming a Chartered Accountant is demanding, requiring students to have the best guidance and resources. Traditionally, students often needed to relocate to metro cities to access premier CA coaching classes, which added financial and emotional strain. Today, the digital transformation of education ensures that every student, regardless of location, has access to top CA classes in India from the comfort of their homes.

The Power of Online CA Courses in India

Online learning platforms have revolutionized the CA preparation landscape. Here’s how:

Expert Faculty: Students now have access to the best mentors and educators, like those at Swapnil Patni Classes, known for their stellar track record in CA coaching.

Live & Recorded Classes: Flexible learning options through live sessions and recorded lectures allow students to learn at their own pace.

Comprehensive Study Materials: Top-tier CA inter classes and CA foundation classes provide exhaustive study materials, mock tests, and doubt-solving sessions.

Cost-Effectiveness: Students save on relocation and accommodation costs while getting high-quality education at affordable rates.

CA Foundation Classes: Building the Right Base

The CA Foundation course is the stepping stone in a CA’s journey, covering subjects like Principles of Accounting, Business Laws, and Quantitative Aptitude. Online CA Foundation classes ensure students across India can access top-notch training, exam-focused study plans, and personalized guidance to ace the exam on their first attempt.

CA Inter Classes: Bridging the Gap to Success

The CA Intermediate level is crucial, as it tests deeper conceptual knowledge and practical application. Through interactive online CA Inter classes, students can participate in group discussions, solve doubts in real-time, and master key subjects such as Accounting, Taxation, and Auditing—all without stepping out of their homes.

Why Choose Swapnil Patni Classes?

Swapnil Patni Classes is a name synonymous with success in CA coaching. With a blend of expert faculty, innovative teaching methods, and result-oriented approaches, SPC bridges the gap between students and their dreams. The online CA courses in India offered by SPC ensure that every student, whether in a metro city or a rural town, gets the same level of mentorship and resources.

Key features of SPC’s online programs include:

Live and recorded lectures for flexibility

Regular tests and performance analysis

Dedicated doubt-solving sessions

Access to comprehensive study materials and mock exams

Conclusion

The availability of top CA coaching classes through online platforms like Swapnil Patni Classes has truly democratized CA education. Students no longer need to uproot their lives or face additional challenges to access quality education. By leveraging the power of technology and enrolling in CA Foundation classes, CA Inter classes, or advanced-level courses, students across India can now confidently prepare for their exams and achieve their CA dreams, no matter where they are located.

To explore more about SPC's online CA courses and start your journey, visit www.swapnilpatni.com.

#CA Classes In India#CA Inter Classes#CA Foundation Classes#Online CA Course In India#CA Coaching Classes#CA Live Classes#CA inter online classes#Best Ca Online Classes

0 notes

Text

#CA Intermediate Classes#Best CA Inter Coaching#CA Inter Coaching in Laxmi Nagar#CA Inter Online Classes#CA Inter Face-to-Face Classes#CA Intermediate Preparation#CA Inter Mock Tests#CA Inter Taxation Classes

0 notes

Text

CA Inter online classes offer flexible learning at your own pace, guided by expert instructors. Enjoy interactive tools, cost-effective education, and access to comprehensive resources anytime, anywhere, ensuring a well-rounded preparation for your exams.

0 notes

Text

Koncept Education, with its futuristic approach, has emerged as a leader in providing top-notch CA Inter online classes, revolutionizing the way CA aspirants prepare for this reputable examination.

0 notes

Text

An Overview CA Intermediate Exam as Per New Syllabus 2024

With its hard coursework and exams, the Chartered Accountancy (CA) Intermediate level is a critical step on the path to becoming a chartered accountant. To guarantee that prospective chartered accountants (CAs) possess the most recent information and abilities, the Institute of Chartered Accountants of India (ICAI) has unveiled a revised curriculum for the CA Intermediate course. We'll go over the main ideas of the CA Intermediate New Syllabus in this blog, giving candidates an idea of what to expect and how to get through this demanding yet rewarding stage of their career.

Updated Structure and Pattern: The CA Intermediate exam's structure and pattern have been updated in light of the new syllabus. Six papers total are split into two groups, Group I and Group II, each of which has three papers. The framework attempts to offer a comprehensive grasp of many aspects of business, finance, and accounting.

Papers for Group I:

Advanced Accounting: This section of the CA Intermediate New Syllabus 2024 focuses on producing financial statements using Indian Accounting Standards, which are comparable to IFRS, and applying accounting standards to actual business scenarios. It also addresses the financial statement preparation framework and IFRS convergence or adoption.

Corporate and Other Laws: This essay covers business law, other corporate laws, ethics, and legal and regulatory topics. Candidates must understand the laws that control corporations and corporate governance.

Taxation: Both direct and indirect taxes are covered in this paper. To prepare applicants for the complexities of the taxation landscape. It has 2 sections.

Income Tax Laws(IT)

Goods and Service Tax(GST)

Papers for Group II:

a. Cost and Management Accounting: With an emphasis on budgeting, performance analysis, and costing techniques, this paper gives candidates the tools they need to control costs and make decisions in companies.

b. Auditing and Ethics: Understanding the foundational ideas of auditing and becoming acquainted with the well-recognized auditing methods, approaches, and competencies are the main goals. Students will also acquire the skills necessary to successfully apply this information in audit and attestation assignments.

c. Financial Management and Strategic Management: The main goal of financial management is to optimize the value of an organization's finances.

Conversely, strategic management focuses on the broad picture, explaining how to create and carry out plans that will support a business in achieving its objectives in the long run.

FM and SM are two sides of the same coin, not distinct topics. Implementing effective strategy requires strong financial management, and making wise financial decisions requires a solid understanding of the business environment. Through acquiring both FM and SM, students enrolled in CA Inter gain a comprehensive viewpoint.

Strategies for Preparation:

Considering the new syllabus's comprehensive nature, candidates need to implement efficient preparation techniques. This entails making a study schedule that allows enough time for each paper, getting practice with previous exams and practice questions, and consulting mentors or knowledgeable instructors for advice. Furthermore, candidates must stay informed about any modifications or updates issued by ICAI to guarantee that they are adequately prepared for the exams.

In summary, the CA Intermediate New Syllabus represents a major advancement in bringing the CA curriculum into compliance with the needs of the contemporary business world. This stage should be approached by aspiring chartered accountants with a dedication to comprehending both the theoretical and real-world applications of the concepts. Candidates can pass the exams and become well-rounded professionals prepared to make valuable contributions to the finance and accounting industries by assiduously studying the new syllabus and planning ahead.

Start your journey with CA online classes at SPC:

#ca online classes#ca inter online classes#ca intermediate#ca inter classes in pune#ca course#ca classes in pune#ca coaching classes#ca final classes in pune

0 notes

Text

All About CA Industrial Training - Process, Eligibility & Duration

Industrial Training refers to the practical training in a company or an industrial environment that helps the students in developing the required skills which will help them in becoming a professional of the future.

ICAI industrial Training aims to equip the candidates who wish to pursue a career in the industry with the required practical exposure and appreciation about the functioning of the finance department in an industrial environment. It develops a problem-solving attitude amongst future chartered accountants and prepares them for work later on.

In this article, we will be discussing all the important aspects of Industrial training in the Chartered Accountancy course.

Eligibility Criteria for Industrial Training

A candidate desirous of pursuing Industrial Training must fulfill the below-mentioned eligibility criteria:

As per the Chartered Accountant Regulations, A candidate who has passed the ca intermediate or CA IPCC Examination (both groups) is eligible to serve as an industrial trainee in any of the financial, commercial, industrial undertakings as may be specified by the council or such other institution or organization as may be approved by the council from time to time.

An article assistant can serve as an Industrial Trainee only during the last year of his/ her prescribed period of Practical Training/ Articleship.

The article assistant has to intimate to his/ her principal about the intention to take such industrial training at least three months before the date on which such training is to commence.

Procedure for Industrial Training

Candidates who wish to serve in a company as an industrial trainee must register themselves with the ICAI in Form No. 104 electronically on ICAI’s website.

How to fill Form No. 104?

You can fill form no. 104 by following the below steps:

Go to ICAI Self Service Portal (SSP) Log in using your User Id and Password Go to Articleship Cycle Click on the Articleship/ Auditship tab available on the left side of the portal Click on the articleship menu Go to Industrial Training (Form No. 104) option Submit all the required details and click on submit Now your form has been submitted and will be sent to the Principal (under whom industrial training will be done) for approval. Once your application has been approved, go to the “Submitted/ Pending Actions” (in the articleship tab of the articleship cycle option of the SSP Portal) tab, download the PDF of the form, get it signed by the Principal and upload the scanned copy along with the deed in order to complete the registration process.

Duration of Industrial Training

The period of industrial training may range between a minimum of nine months and a maximum of twelve months during the last year of the prescribed period of practical training.

The period of industrial training is treated as service under articles for all purposes of the Chartered Accountant Regulations.

Is it mandatory to pursue Industrial Training during the CA course?

It is not mandatory to pursue Industrial Training. It is entirely up to the discretion of the candidate whether he/she wants to pursue Industrial training or complete 3 years of articleship under his/her existing Principal.

Advantages of Industrial Training

However, it is not mandatory for the candidates to pursue Industrial Training but it definitely provides an edge over the candidates who don’t. Some of the advantages are listed below:

It gives a new learning experience You get to interact with the members of other disciplines Fixed office timings Only five working days a week High Stipend amount Good contacts for future opportunities A Brand Name gets added to your profile Increased opportunities of getting placed in larger organizations (outside of Audit Firms)

Which Companies provide Industrial Training

Only the companies which are approved by the Institute of Chartered Accountants of India can provide Industrial Training.

There is a complete region-wise list of companies offering Industrial Training to CA students on the Institute’s official website which can be accessed by clicking on the given link:

https://www.icai.org/post.html?post_id=823

Some of the Companies are HSBC, Citi Bank, Wipro, HDFC, Kotak, etc.

How to apply for Industrial Training and Selection Process

You can directly apply in the ‘careers’ section of the company’s website where you wish to pursue Industrial training in case there is a vacancy.

You can also enroll yourself on the icai ca inter Articleship and Industrial Training Portal to get an opportunity of pursuing articleship in the companies registered on the portal.

You can also register on various job portals to find an Industrial Training opportunity that best suits you.

Selection Process: The selection process for Industrial Training generally includes a telephonic interview by the company or an online written test or sometimes both.

Working Hours and Days of Industrial Training

Normally, the timings for Industrial Training in most of the companies is 10 am to 6 pm (approximately 8 hours)

And generally, there are five working days during a week during Industrial Training.

Stipend in Industrial Training

The amount of stipend offered varies from Industry to industry, company to company. But generally, it is seen that companies give a handsome amount of stipend to their Industrial Trainees which ranges from Rs.15,000 to Rs.40,000 a month.

Under whom an article can pursue Industrial Training

The industrial training shall be received under a member of the Institute working in the company where you register as an Industrial Trainee.

As per the ICAI guidelines, An Associate who has been a member for a continuous period of at least three years shall be entitled to train one industrial trainee at a time and a fellow shall be entitled to train two industrial trainees at a time, whether such trainees be articled, clerks or audit clerks.

After successful completion of the Industrial Training, a Certificate of service will be issued by the member under whom industrial training was received in Form No. 105.

Exam Leaves allowed during Industrial Training

Every company has a different policy regarding exam leaves to be given to the Industrial Trainees for CA Final Exams. But normally a study leave of 2- 3 months is allowed by the companies.

How to create better chances of selection in companies for Industrial Training

To create better selection opportunities for yourself in Industrial Training you must understand the subject effectively and practically in which you want to join Industrial Training. (e.g, If you wish to pursue your Industrial Training in the field of finance, focusing more on subjects like Financial Management, Risk Management will be of great help)

Article Source: All About CA Industrial Training – Process, Eligibility & Duration

#ca inter#ca intermediate#ca intermediate course#icai intermediate#icai ca inter#ca inter costing#ca inter financial management#icai inter#Ca inter online classes

0 notes

Text

Are CA Foundation Online Classes Enough to Pass on the First Attempt?

Becoming a Chartered Accountant (CA) is a dream for many students in India. The journey starts with the CA Foundation exam, a stepping stone that tests your basics in accounting, law, economics, and mathematics. With the rise of digital learning, more students are turning to CA Foundation Online Classes to prepare. But the big question remains: Are these online classes enough to help you pass the exam on your first attempt? Let’s dive into this topic with a clear mind, exploring the realities, challenges, and possibilities based on insights from academic experts and real-world experiences.

The CA Foundation exam, conducted by the Institute of Chartered Accountants of India (ICAI), is no walk in the park. It demands dedication, a solid understanding of concepts, and consistent practice. Traditionally, students relied on face-to-face coaching from the best CA coaching institutes in India. However, online classes have changed the game, offering flexibility and access to quality education from anywhere. To answer whether CA Foundation online classes are sufficient, we need to look at various factors—how they work, their strengths, their limitations, and what it takes to succeed.

Understanding CA Foundation Online Classes

CA Foundation online classes are digital courses designed to cover the entire syllabus—Principles and Practices of Accounting, Business Laws and Correspondence, Business Mathematics and Logical Reasoning, and Business Economics. These classes are offered by various platforms, including some of the best CA coaching institutes in India, and come in different formats: live sessions, pre-recorded lectures, or a mix of both. They often include study materials, mock tests, doubt-solving sessions, and revision notes.

The appeal of online classes lies in their convenience. You can learn at your own pace, rewind tricky topics, and study from the comfort of home. For students in remote areas or those juggling other commitments, this is a huge advantage. Plus, many platforms bring in experienced faculty who break down complex topics into simple, digestible lessons. But does this flexibility and accessibility translate into passing the exam on the first try? That depends on more than just the classes themselves.

Strengths of CA Foundation Online Classes

One of the biggest strengths of CA Foundation online classes is the quality of teaching you can access. Many top institutes, recognized as the Best CA Coaching Institute in India, have shifted their expertise online. Their faculty members—often CAs themselves—know the exam inside out and can guide you on what matters most. These classes often come with structured schedules, ensuring you cover the syllabus on time.

Another advantage is the availability of resources. Online platforms provide video lectures, PDFs, practice questions, and past papers—all at your fingertips. If you miss something in a live session, you can revisit it later, unlike traditional classes where you might miss out entirely. Mock tests, a critical part of preparation, are also a staple in most CA Foundation online classes. These tests mimic the real exam, helping you gauge your progress and build confidence.

Time management is a key factor in passing any exam, and online classes give you control over your schedule. You can study early in the morning or late at night—whatever suits you. This is especially helpful for students who need to balance school, college, or even a part-time job. With discipline, this flexibility can be a game-changer.

Challenges You Might Face

While CA Foundation online classes sound promising, they’re not without challenges. The biggest hurdle is self-discipline. In a physical classroom, the teacher’s presence and a fixed timetable keep you accountable. Online, it’s easy to procrastinate—skipping a lecture here, delaying practice there. Without a strong routine, even the best resources won’t help you pass.

Another issue is the lack of personal interaction. In traditional setups, you can ask questions on the spot, discuss doubts with peers, and get immediate feedback. Online, doubt-solving might happen through chats or forums, which can feel less engaging. For subjects like Business Mathematics or Accounting, where concepts build on each other, unresolved doubts can pile up and hurt your preparation.

Technical challenges also play a role. A slow internet connection, power cuts, or device issues can disrupt your learning. If you’re not tech-savvy, navigating online platforms might feel overwhelming at first. These hurdles don’t mean online classes are ineffective—they just require you to be proactive and resourceful.

What Experts Say About Online Learning for CA Foundation

Academic experts and CA professionals agree that CA Foundation online classes can be enough to pass—if you use them right. According to educators, success depends less on the mode of learning (online or offline) and more on how you approach it. The syllabus is the same, the exam pattern is the same, and the passing criteria—40% per subject and 50% overall—don’t change. What matters is your grasp of the material and your ability to apply it.

Experts highlight that online classes often use modern teaching methods, like visual aids and real-life examples, which can make learning easier. For instance, a tricky accounting concept might stick better when explained through a video demonstration rather than a textbook alone. However, they caution that online learners need to simulate exam conditions regularly. Practicing with a timer and solving full-length papers is non-negotiable, no matter how good the classes are.

Data backs this up. ICAI pass percentages for CA Foundation hover around 20-30% each attempt, whether students study online or offline. This suggests that the medium isn’t the deciding factor—your effort is. Students who treat online classes as a complete solution, without supplementing them with practice, often struggle. Those who pair them with a smart strategy tend to succeed.

Bridging the Gaps: How to Make Online Classes Work

So, are CA Foundation online classes enough on their own? Not quite. They’re a powerful tool, but passing on the first attempt requires you to fill in the gaps. Here’s how you can make them work for you.

First, create a study plan. Break the syllabus into manageable chunks and set daily or weekly goals. Stick to the schedule as if you’re attending a physical class. For example, dedicate mornings to Accounting and evenings to Economics, with regular breaks to stay fresh. Consistency beats cramming every time.

Second, practice actively. Don’t just watch lectures—solve problems. The ICAI study material, available for free on their website, is your best friend. Pair it with the mock tests from your online classes and solve past papers. This builds speed and accuracy, two things you’ll need in the exam.

Third, tackle doubts immediately. If your platform offers live Q&A sessions, use them. If not, join online study groups or forums where students and mentors discuss CA Foundation topics. Even a quick search can clarify small doubts before they snowball.

Finally, stay motivated. Online learning can feel lonely, so remind yourself why you started. Set small milestones—like mastering a chapter—and reward yourself when you hit them. A positive mindset keeps you going when the material gets tough.

Online vs. Offline: A Fair Comparison

It’s tempting to compare CA Foundation online classes with traditional coaching from the best CA coaching institutes in India. Both have their merits. Offline classes offer structure, direct interaction, and a competitive vibe that pushes you to keep up. Online classes offer flexibility, affordability, and access to top faculty without travel. Neither is inherently “better”—it’s about what suits your learning style.

If you thrive in a classroom, online classes might feel isolating. But if you’re self-driven and comfortable with technology, they can be just as effective. The key difference is accountability. Offline setups enforce it; online setups demand you create it. Either way, passing on the first attempt isn’t guaranteed—it’s earned.

Conclusion

Let’s circle back to the question: Are CA Foundation online classes enough to pass on the first attempt? Yes, they can be—but it’s not automatic. They give you the tools: expert guidance, comprehensive resources, and flexibility. But tools are useless without effort. You need discipline, practice, and a proactive attitude to turn potential into results.

The best CA coaching institutes in India, whether online or offline, can’t take the exam for you. CA Foundation online classes are a solid foundation, but passing on the first try depends on how you build on them. If you’re ready to commit, they’re more than enough. If not, no amount of classes—online or otherwise—will carry you through.

In the end, it’s not about the medium; it’s about the mindset. Equip yourself with a plan, use the resources wisely, and trust in your ability to succeed. The CA journey is tough, but with the right approach, your first attempt could be your victory lap.

#CA Foundation online classes#CA Foundation exam#CA Foundation Coaching#CA Intermediate Online Classes#CA Inter Classes#CA Final Online Classes#CA Final Coaching#Best CA Foundation Coaching Classes in UP

0 notes

Text

At 100xCommerce, we Our platform offers realistic test series with instant performance analysis to identify strengths and improve weak areas.help CA, CS, and CMA aspirants succeed.

98% With 100xCommerce's mock tests, your success rate will soar to new heights.

Over 24,000 students have trusted us to boost their exam readiness. https://100xcommerce.com/

#ca final test series#ca online classes#bangalore#ca coaching classes#ca foundation classes#ca inter classes#finance

0 notes

Text

Crack the CA Exam with Kerala’s Leading CA Coaching Centre – Xylem Learning

Becoming a Chartered Accountant (CA) is a dream for many commerce students, but the journey to success requires dedication, hard work, and the right guidance. With its challenging syllabus and rigorous exams, the CA course demands expert coaching and structured preparation. If you're looking for the best CA coaching center in Kerala, look no further than Xylem Learning.

Why Choose Xylem Learning for CA Coaching?

Xylem Learning has established itself as a trusted name in CA coaching by consistently delivering top results and providing students with the best resources. Here’s why Xylem Learning is the ideal choice for your CA preparation:

1. Expert Faculty with Industry Experience

At Xylem Learning, experienced CA professionals and subject experts guide students through the complex concepts of the CA syllabus. Their real-world expertise ensures that students grasp both theoretical knowledge and practical applications.

2. Comprehensive Study Materials

Success in the CA exams depends on quality study materials. Xylem Learning provides well-structured notes, practice questions, and revision guides that simplify even the most difficult topics, ensuring students are well-prepared.

3. Structured Coaching for All CA Levels

Whether you're preparing for CA Foundation, CA Intermediate, or CA Final, Xylem Learning offers customized coaching programs to meet the unique needs of students at every stage.

4. Regular Mock Tests and Assessments

Consistent practice is key to cracking the CA exams. Xylem Learning conducts frequent mock tests and assessments to help students evaluate their performance, identify weak areas, and build confidence for the final exam.

5. Personalized mentoring and Doubt-Solving Sessions

One-on-one mentorship ensures that students receive individual attention to clarify doubts and strengthen their understanding. The faculty at Xylem Learning is dedicated to providing personalized guidance to every student.

6. Flexible Learning Options

Xylem Learning offers both online and offline coaching, making it accessible to students across Kerala. With interactive online classes and recorded lectures, students can learn at their convenience.

7. Proven Track Record of Success

The institute has a history of producing top CA rank holders and achieving high pass percentages. The success stories of Xylem Learning students are a testament to the institute’s commitment to excellence.

Join Xylem Learning and Start Your CA Journey Today!

If you are determined to crack the CA exam and build a successful career in accounting and finance, Xylem Learning is your ultimate coaching partner. With expert faculty, structured study plans, and result-oriented training, Xylem Learning ensures that you are well-prepared to excel in your exams.

Enroll today and take the first step towards becoming a Chartered Accountant!

For more details, visit Xylem Learning or contact us for course inquiries.

0 notes

Text

Happy Hanuman Janmotsav From Ultimateca

Celebrate the divine strength and wisdom of Lord Hanuman with a special 10% OFF on all courses at Ultimate CA! 💪📚

🎁 Use Code: HANUMAN

📅 Valid only on 12th April

🖱️ Enroll now at https://www.ultimateca.com/

#Hanuman Janmotsav#Ultimate CA#CA Online Classes#CA Foundation Classes#CA Inter Online Classes#CAInter Classes#CA coaching classes#Specia lDiscount#HanumanJ ayanti Offer#10 Percent Off#Enroll Now#Study With UltimateCA#CA Students India

0 notes

Text

How to Use Online Platforms to Clear Doubts Instantly During CA Preparation

The journey to becoming a Chartered Accountant (CA) is demanding, requiring immense dedication and a clear understanding of concepts. With advancements in technology, online platforms have become a crucial tool for CA aspirants to address doubts instantly and enhance their preparation. Whether you're pursuing CA Foundation classes, CA Inter classes, or an online CA course in India, leveraging these platforms effectively can make a significant difference in your success.

Why Instant Doubt Resolution Matters

Clearing doubts as soon as they arise is essential for effective learning. Prolonging unresolved queries can create gaps in understanding, especially when preparing for CA exams, where every concept builds on the previous one. Instant doubt resolution ensures you stay on track, reduces stress, and boosts confidence in tackling challenging topics.

Top Ways to Use Online Platforms for Doubt Resolution

1. Join Live Online Classes

Online CA courses in India have transformed learning by offering interactive live sessions. Platforms like Swapnil Patni Classes provide real-time interaction with faculty, enabling students to ask questions during lectures. This ensures clarity and immediate resolution of doubts, making learning more effective.

2. Participate in Discussion Forums

Discussion forums dedicated to CA coaching classes are excellent platforms to engage with peers and mentors. Websites and apps often have forums where students can post doubts and receive detailed explanations from experienced professionals or fellow aspirants.

3. Leverage Doubt-Solving Apps

Many online CA course providers, including Swapnil Patni Classes, offer doubt-solving apps or dedicated sections on their websites. These tools allow students to upload questions, receive step-by-step solutions, or watch recorded answers, ensuring a seamless learning experience.

4. Utilize Social Media Groups

Social media platforms like Facebook, Telegram, and WhatsApp host groups specifically for CA Foundation and CA Inter classes. These groups facilitate quick doubt resolution by connecting students with tutors and experienced peers. However, it's essential to join reputable groups to ensure accurate information.

5. Schedule One-on-One Sessions

Several online CA courses in India offer personalized doubt-clearing sessions. These one-on-one interactions with faculty members enable students to gain in-depth clarity on complex topics. Scheduling these sessions can be especially helpful for tackling subjects like Accounting and Taxation.

6. Access Recorded Lectures

Revisiting recorded lectures is another effective way to clear doubts. Many CA coaching classes provide access to recorded sessions, allowing students to revisit specific topics and strengthen their understanding.

7. Engage in Online Test Series and Feedback

Participating in online test series is a great way to identify weak areas and seek immediate clarification. Platforms offering CA Inter classes and CA Foundation classes often provide detailed feedback on tests, guiding students on where they need improvement.

Benefits of Using Online Platforms for Doubt Resolution

Convenience and Accessibility: Clear doubts anytime, anywhere without disrupting your schedule.

Expert Guidance: Get insights from top CA experts across India.

Time Efficiency: Save time by resolving queries instantly rather than waiting for physical classes.

Collaborative Learning: Learn from peers and exchange ideas on online platforms.

Why Choose Swapnil Patni Classes?

At Swapnil Patni Classes, we understand the importance of doubt resolution in CA preparation. Our CA coaching classes integrate interactive live sessions, dedicated doubt-solving apps, and expert faculty support to ensure a comprehensive learning experience. Whether you're preparing for CA Foundation or CA Inter, our online CA courses in India are designed to provide the right guidance and resources to help you succeed.

Final Thoughts

In today’s digital age, online platforms are a game-changer for CA aspirants. By utilizing live classes, doubt-solving apps, and social media groups effectively, you can overcome challenges and stay ahead in your preparation. For a structured and supportive learning environment, explore Swapnil Patni Classes and take the first step towards your CA journey.

Visit www.swapnilpatni.com to learn more about our CA Foundation and CA Inter classes. Start your preparation with India’s leading CA coaching institute today!

#ca classes in india#ca coaching classes#online ca course in india#ca foundation classes#ca inter classes#swapnilpatniclasses#ca inter online classes#ca live classes#spcgurukul#best ca online classes

0 notes

Text

Best Faculty for CA Inter Cost and Management Accounting: Top Experts for Exam Success

Selecting the right faculty for Cost and Management Accounting (CMA) in CA Intermediate is crucial for mastering the subject and excelling in exams. In this blog, we provide a detailed look at the top faculty members for CA Inter CMA, their key strengths, teaching styles, and why they are highly recommended by students.

Why Is Faculty Selection Crucial for CA Inter CMA?

The Cost and Management Accounting (CMA) subject in CA Intermediate is known for its complexity. It covers a wide range of topics that include cost analysis, decision-making, and strategic management, which are critical for future CA professionals. A strong foundation in CMA not only helps with exams but also provides valuable insights into practical financial management.

With the right faculty, students can grasp complex concepts more easily, develop practical problem-solving skills, and approach their exams with confidence.

Factors to Consider When Choosing a CA Inter CMA Faculty

Before selecting your faculty, here are a few key factors you should consider:

Teaching Experience: How experienced is the teacher in handling CA Intermediate subjects?

Student Reviews: What do other students have to say about their teaching methods and style?

Conceptual Clarity: Does the teacher simplify complex topics or make them easier to understand?

Focus on Practical Application: How well does the teacher integrate real-world examples and problem-solving techniques?

Study Material Provided: Is the study material comprehensive and aligned with the exam syllabus?

Best Faculty for CA Inter Cost and Management Accounting

Faculty Name

Key Strength

Teaching Style

Link to Course

CA Ashish Kalra

Dynamic teaching

Engaging, real-life examples

CA Inter CMA by CA Ashish Kalra

CA CS Anshul Agarwal

Strategic clarity

Concept-driven, practical

CA Inter CMA by CA Anshul Agarwal

CA Darshan Chandaliya

Practical application

Interactive, exam-focused

CA Inter CMA by CA Darshan Chandaliya

CA Harshad Jaju

In-depth subject knowledge

Interactive, engaging

CA Inter CMA by CA Harshad Jaju

CA Manoj Sharma

In-depth subject knowledge

Real-world application

CA Inter CMA by CA Manoj Sharma

CA Namit Arora

Conceptual clarity

Simplified, practical

CA Inter CMA by CA Namit Arora

CA Navneet Mundhra

Conceptual clarity

Case-based, interactive

CA Inter CMA by CA Navneet Mundhra

CA Nikhil Gokhru

Conceptual clarity

Engaging, simplified

CA Inter CMA by CA Nikhil Gokhru

CA Nitin Guru

Conceptual clarity

Practical, application-based

CA Inter CMA by CA Nitin Guru

CA Parag Gupta

Strategic problem-solving

Step-by-step, engaging

CA Inter CMA by CA Parag Gupta

CA Pranav Popat

Exam-oriented approach

Simplified, engaging

CA Inter CMA by CA Pranav Popat

CA Praveen Khatod

Financial expertise

Detailed, concept-driven

CA Inter CMA by CA Praveen Khatod

CA Purushottam Aggarwal

Conceptual clarity

Practical, exam-focused

CA Inter CMA by CA Purushottam Aggarwal

CA Rakesh Agrawal

Detailed problem-solving

Engaging, concept-driven

CA Inter CMA by CA Rakesh Agrawal

CA Ranjan Periwal

Conceptual depth

Case-based, exam-focused

CA Inter CMA by CA Ranjan Periwal

CA Ravi Sonkhiya

Financial expertise

Detailed, engaging

CA Inter CMA by CA Ravi Sonkhiya

CA RK Mehta

Strategic clarity

Easy-to-follow, interactive

CA Inter CMA by CA RK Mehta

CA Sankalp Kanstiya

Strategic problem-solving

Fast-paced, simplified

CA Inter CMA by CA Sankalp Kanstiya

CA Satish Jalan

Strategic clarity

Engaging, practical

CA Inter CMA by CA Satish Jalan

CA Vinod Reddy

Practical insights

Real-world examples

CA Inter CMA by CA Vinod Reddy

CMA CS Rohan Nimbalkar

Strategic insights

Application-based, simplified

CA Inter CMA by CMA Rohan Nimbalkar

CMA Sumit Rastogi

Conceptual depth

Simplified, interactive

CA Inter CMA by CMA Sumit Rastogi

CIMA Siddhanth Sonthalia

Financial management expertise

Engaging, practical examples

CA Inter CMA by CIMA Siddhanth Sonthalia

CA Aman Agarwal

Strategic clarity

Fast-paced, interactive

CA Inter CMA by CA Aman Agarwal

CA Amit Sharma

Problem-solving skills

Engaging, real-life examples

CA Inter CMA by CA Amit Sharma

CA Anuj Jalota

Strategic clarity

Detailed, step-by-step

CA Inter CMA by CA Anuj Jalota

CA Amit Manek

Conceptual depth

Exam-focused, practical

CA Inter CMA by CA Amit Manek

CA Rakesh Rathi

Strategic insights

Simplified, interactive

CA Inter CMA by CA Rakesh Rathi

CA Vaibhav Jalan

Conceptual clarity

Simplified, exam-focused

CA Inter CMA by CA Vaibhav Jalan

CA Divyank Gyanchandani

Financial insights

Practical, real-world examples

CA Inter CMA by CA Divyank Gyanchandani

CA Saurav Jindal

Strategic clarity

Simplified, exam-oriented

CA Inter CMA by CA Saurav Jindal

CA Abhishek Zaware

Dynamic teaching

Engaging, real-life examples

CA Inter CMA by CA Abhishek Zaware

CA Dhawal Purohit

Strategic insights

Application-based, simplified

CA Inter CMA by CA Dhawal Purohit

Why You Should Learn from Multiple Faculty Members

Learning from multiple faculty members can give you different perspectives and approaches to understanding difficult concepts. While one teacher may help you develop a solid theoretical foundation, another might focus on practical problem-solving and exam-oriented strategies. For example, you could choose CA Sankalp Kanstiya for mastering problem-solving skills and opt for CA Praveen Khatod to build strong conceptual clarity.

Common Mistakes to Avoid in CA Inter CMA

Overlooking Practical Applications: CMA is not just about theory. Many students struggle because they fail to connect theoretical concepts with practical applications.

Ignoring Numerical Questions: Numerical problems form a significant part of the CMA exam. Ignoring these could cost you valuable marks.

Lack of Time Management: Proper time management during the exam is essential. Faculty like CA Satish Jalan and CA Praveen Khatod focus heavily on this aspect.

FAQs

1. Which faculty is best for CA Inter CMA?

It depends on your learning style. CA Sankalp Kanstiya and CA Harshad Jaju are known for their fast-paced and engaging methods, while CA Purushottam Aggarwal and CA Praveen Khatod focus on strong conceptual clarity and exam techniques.

2. Can I study CA Inter CMA with one teacher?

While it's possible, students often benefit from learning from multiple faculty members to get varied perspectives on complex topics.

3. Is practical learning important in CA Inter CMA?

Yes, practical application of concepts is critical in CMA. Most top faculties, like CA Ashish Kalra and CA Satish Jalan, emphasize real-world examples to help students understand practical implications.

If you are looking for CA Inter Cost & Management Account faculties then you purchase it from Smart Learning Destination.

0 notes

Text

Choosing the Best CA Firm for Your Articleship in Pune

Choosing the right Chartered Accountancy (CA) firm for your articleship is a crucial decision for any aspiring CA in Pune. The articleship is a vital part of your CA journey, providing you with practical exposure and experience in the field. Pune, known for its educational institutions and growing business sector, offers a plethora of options for articleship positions. In this blog, we'll explore how to identify and select the best CA firm for your articleship in Pune.

Key tips to select the right CA firm for your Articleship:

Reputation and recognition

One of the first things to consider when choosing a CA firm for your articleship is its reputation and recognition. Look for firms that are well-established and have a good track record of producing successful CAs. Reputed firms often have a strong network, which can be beneficial for your future career.

Work Exposure and Specializations

Different CA firms may specialize in various fields of accounting and finance. Before making a choice, assess the areas of specialization of the firm and consider whether they align with your career goals. Exposure to diverse fields can be an advantage, but if you have a specific interest, look for a firm that specializes in that area.

Mentorship and guidance

Mentorship is a critical aspect of your articleship experience. Investigate whether the CA firm offers a structured mentorship program. A good mentor can provide valuable guidance, answer your queries, and help you develop your skills as an aspiring CA.

Work Environment

The work environment at a CA firm plays a significant role in your overall experience. Consider factors like the office culture, workload, and work-life balance. A positive work environment can make your articleship more enjoyable and rewarding.

Location

Pune is a sprawling city, and commuting can be time-consuming. Choose a CA firm that is conveniently located to minimize your travel time and expenses. Proximity to public transportation can also be a crucial factor to consider.

Remuneration and benefits

While an articleship is primarily about gaining knowledge and experience, you should also consider the remuneration and benefits offered by the CA firm. Evaluate whether they provide a fair stipend and additional perks such as study leave, exam support, or financial incentives for good performance.

CA Final Pass Percentage

Find out the pass percentage of the CA Final exams for candidates who completed their articleship at the firm. A high pass rate indicates that the firm provides quality training and support for the CA exams.

Alumni Success Stories

Seek out alumni who have completed their articleship at the firm and gone on to become successful CAs. Their experiences and achievements can offer insights into the quality of training and mentorship provided by the firm.

Conclusion

Choosing the best CA firm for your articleship in Pune is a significant decision that can shape your future career as a Chartered Accountant. Consider factors like reputation, specialization, mentorship, work environment, location, remuneration, and success rates when making your choice. Conduct thorough research, visit the firms, and have conversations with current and former trainees to gain a better understanding of what each firm offers. By carefully selecting the right CA firm for your articleship, you can set the stage for a successful and fulfilling career in the field of accounting and finance.

For more info about SPC Classes contact +91– 8668772717, www.swapnilpatni.com

#ca foundation classes in pune#ca final classes in pune#pendrive lectures for fm-sm#ca foundation online classes#ca classes in pune#ca inter online classes#ca pendrive classes#ca final online classes#ca inter classes in pune#CA articleship in pune

0 notes

Text

i don't feel like studying any of the subjects from The Plan rn but everything else is so boring that i also don't want to waste time on like watching content or something and i would rather switch subjects then give up on studying for the day and by old me standards ive already done enough but new me i still feel like i can do more but i don't know what ughhhhh this is torture

#okay so The Plan is#i mean not that anyone would care or understand but i like writing on tumblr like a diary#The Plan is to finish law in one month so i can give the online test and this js non negotiable because there's two#online tests and i have to do ATLEAST one before this year ends or it will be too much#and then to finish my backlog of direct tax till like 10th so i can give that test and be caught up with the rest of the class#and there's about 35 more 2 hr lectures to go (rip me)#oh also i haven't touched audit in ages and backlog is getting to the i can't breathe under this burden levels and classes resume on like#10th 11th something and i want to rejoin with them#the plan is to have all this done by november so in December#i can focus on catching the fuck up with fr and afm because like ive attented SOME classes like sparingly#and i know it but very upar upar se so i have to do it properly once or ill die#yeah that's it that's The Plan#it's doable i think i calculated hours days wise and everything#but like. theory subjects are fucking hard to do constantly because either they're boring asf (like law and audit)#or they're complicated and make me cry from frustration (like direct tax)#mann.#now that im actually studying#i feel so irrationally scared for how chill and like. blaise attitude i had towards inter exam#i had absolutely no idea everyone else was studying so deeply like tax syllabus first half is the exact same as inter#just a little advanced and sir keeps saying ye toh aapne inter mein padha hi tha and im like hain??? bhai itna sab tha????? i had no clue😭#like how tf did i pass my dad says not to tell anyone that i didn't really study for it cause ppl will think#aise hi farzi ca finalist ban gayi but like tunblr so wtvr#but yeah how tf??? could i pass???????#like i actually start to panic when i think about how less i had studied which makes no sense since it's not like they can#take away the result or reverse it or anything it doesn't matter now#but like just woah. like i can't even explain#i remember for tax all i watchef was marathon and usme bhi i got bored (THE DAY BEFORE EXAM!!!) so i skipped#the main topics that had crazy weightage and just did a number of tiny topics and studied only enough#to get passing#dt irl is VAST i can't believe these people learn such specific things that if iss date se iss date mein hai toh section 54 ka exemption

1 note

·

View note

Text

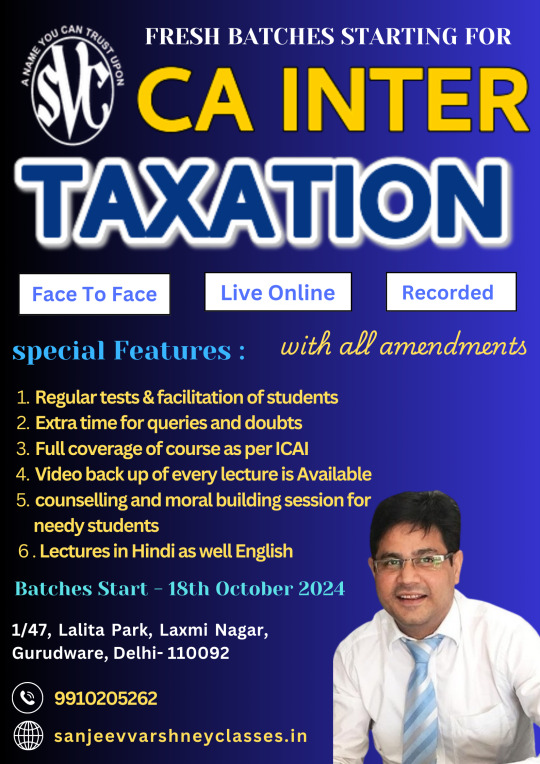

CA INTER TAXATION ONLINE CLASSES

The subject of CA Inter Taxation is one of the big basics in the Chartered Accountancy (CA) Intermediate course, and it requires a deep grasp of the Tax laws which is a kind of complex code as well as their applications. The India's premier teacher CA Inter Taxation online classes are only available at Sanjeev Varshney Classes for aspirants. The subjects range from both Direct as well as Indirect Taxes like Income Tax and Goods and Services Tax (GST) etc. The entire course is devotee to the taxation law which is a must for the candidates who want to gain CA Inter Certificate and then to thrive in the accounting and the financial world.

The fact is that Sanjeev Varshney shares his expertise in tax and his ability to break down complex issues has made him a favorite amongst the CA Inter students. The early modules are geared to clear the foundation followed by the others which are to be completed before each exam. The practice tests and the quick clearance of doubts are the learning methods that the students can do.

Sanjeev Varshney Classes offer the students the flexibility to attend both online and physical classes in a way that does not disturb their other activities and studies. The school sells such great reading materials, as textbooks, practice guides, and revision notes, in order that the work be made easy for the teachers.

#CA Inter Taxation#CA Inter Tax Classes#CA Intermediate Taxation#CA Inter Direct Tax#CA Inter Indirect Tax#CA Inter Tax Preparation#Best CA Inter Taxation Classes#CA Inter Tax Coaching#CA Inter Taxation Lectures#CA Inter Tax Online Classes

0 notes