#butte anaconda & pacific

Explore tagged Tumblr posts

Video

BA&P Butte, MT by larry zeutschel Via Flickr: One of their two GP38-2's leads a train of concentrated copper slurry off to the smelter in Anaconda.

Milwaukee Road's Alloy siding is in the foreground with the main to the left. By this time, there weren't many ties that hadn't felt a derailed wheel. Winter and frozen ground were the railroads salvation. The final year was a western 10 mph railroad for a reason.

5-20-78

19 notes

·

View notes

Video

Butte Anaconda & Pacific GE boxcab 57 by Craig Garver Via Flickr: Butte Anaconda & Pacific GE boxcab 57 at Rocker, Montana, September 14, 1965. Photographer: H N Proctor. Scanned from a 2 1/4 x 3 1/4 negative owned by Digital Rail Artist.

#Butte Anaconda & Pacific GE boxcab 57#H N Proctor#Rocker#Montana#BA&P#electric locomotive#General Electric#railfan#locomotive#train#railroad#railway#railphotography#trainspotting

6 notes

·

View notes

Photo

Berkeley Pit, Butte, Montana, 1969.

Earlier mining at Butte had been subsurface, but discovery of high quality ore accessible from an open pit by a University of California professor, hence Berkeley Pit, led to open pit mining beginning in 1955. The open pit mine closed in 1982 and slowly filled with a toxic soup which, among other things, flows into the Clark Fork of the Columbia River. It has been said that migrating birds landing on the slop die shortly afterwards. A mitigation facility is under construction but will not be fully active for several more years.

#mining#open pit#copper#pollution#anaconda#berkeley pit#butte#silver bow county#montana#1969#photographers on tumblr#pnw#pacific northwest

6 notes

·

View notes

Text

TIME: A CLOWN WITH GLAMOUR

May 26, 1952

TIME: The Weekly News Magazine ~ Lucille Ball: Prescription for TV; a clown with glamour. May 26, 1952.

On Monday evenings, more than 30 million Americans do the same thing at the same time: they tune in ‘I Love Lucy’ (9 p.m. E.D.T., CBS-TV), to get a look at a round-eyed, pink-haired comedienne named Lucille Ball.

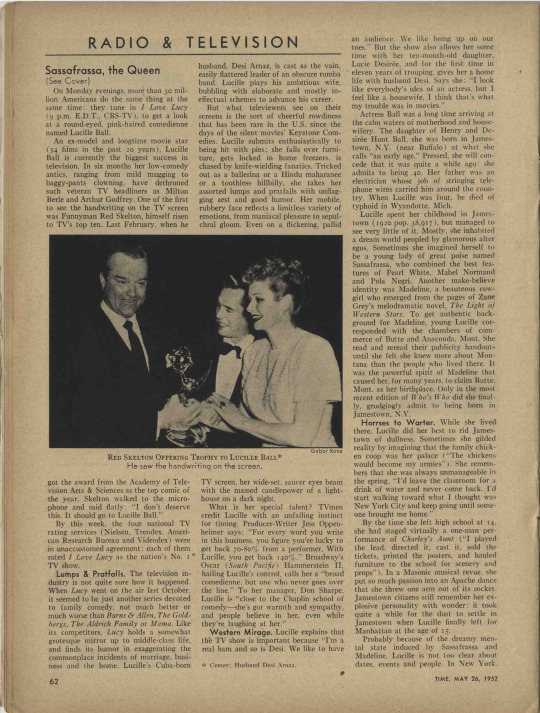

An ex-model and longtime movie star (54 films in the past 20 years), Lucille Ball is currently the biggest success in television. In six months her low-comedy antics, ranging from mild mugging to baggy-pants clowning, have dethroned such veteran TV headliners as Milton Berle and Arthur Godfrey. One of the first to see the handwriting on the TV screen was funnyman Red Skelton, himself risen to TV's top ten. Last February, when he got the award from the Academy of Television Arts and Sciences as the top comic of the year, Skelton walked to the microphone and said flatly: "I don't deserve this. It should go to Lucille Ball."

By this week, the four national TV rating services (Nielsen, Trendex, American Research Bureau and Videodex) were in unaccustomed agreement: each of them rated ‘I Love Lucy’ as the nation's No. 1 TV show.

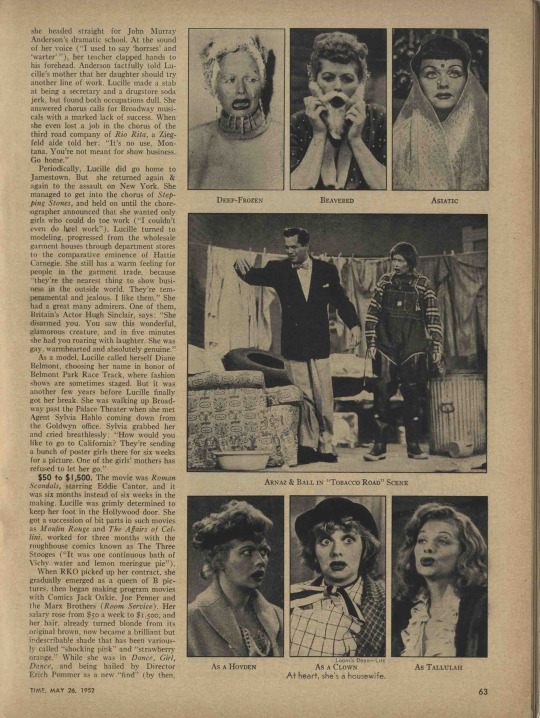

Lumps & Pratfalls. The television industry is not quite sure how it happened. When Lucy went on the air last October, it seemed to be just another series devoted to family comedy, not much better or much worse than ‘Burns and Allen’, ‘The Goldbergs’, ‘The Aldrich Family’ or ‘Mama’. Like its competitors, Lucy holds a somewhat grotesque mirror up to middle-class life, and finds its humor in exaggerating the commonplace incidents of marriage, business and the home. Lucille's Cuba-born husband, Desi Arnaz, is cast as the vain, easily flattered leader of an obscure rumba band. Lucille plays his ambitious wife, bubbling with elaborate and mostly ineffectual schemes to advance his career.

But what televiewers see on their screens is the sort of cheerful rowdiness that has been rare in the U.S. since the days of the silent movies' Keystone Comedies. Lucille submits enthusiastically to being hit with pies; she falls over furniture, gets locked in home freezers, is chased by knife-wielding fanatics. Tricked out as a ballerina or a Hindu maharanee or a toothless hillbilly, she takes her assorted lumps and pratfalls with unflagging zest and good humor. Her mobile, rubbery face reflects a limitless variety of emotions, from maniacal pleasure to sepulchral gloom. Even on a flickering, pallid TV screen, her wide-set saucer eyes beam with the massed candlepower of a lighthouse on a dark night.

What is her special talent? TV men credit Lucille with an unfailing instinct for timing. Producer-Writer Jess Oppenheimer says: "For every word you write in this business, you figure you're lucky to get back 70-80% from a performer. With Lucille, you get back 140%." Broadway's Oscar (’South Pacific’) Hammerstein II, hailing Lucille's control, calls her a "broad comedienne, but one who never goes over the line." To her manager, Don Sharpe, Lucille is "close to the Chaplin school of comedy—she's got warmth and sympathy, and people believe in her, even while they're laughing at her."

Western Mirage. Lucille explains that the TV show is important because "I'm a real ham and so is Desi. We like to have an audience. We like being up on our toes." But the show also allows her some time with her ten-month-old daughter, Lucie Desirée, and for the first time in eleven years of trouping, gives her a home life with husband Desi. Says she: "I look like everybody's idea of an actress, but I feel like a housewife. I think that's what my trouble was in movies."

Actress Ball was a long time arriving at the calm waters of motherhood and housewifery. The daughter of Henry and Desirée Hunt Ball, she was born in Jamestown, N.Y. (near Buffalo) at what she calls "an early age." Pressed, she will concede that it was quite a while ago: she admits to being 40. Her father was an electrician whose job of stringing telephone wires carried him around the country. When Lucille was four, he died of typhoid in Wyandotte, Mich.

Lucille spent her childhood in Jamestown (1920 pop. 38,917), but managed to see very little of it. Mostly, she inhabited a dream world peopled by glamorous alter egos. Sometimes she imagined herself to be a young lady of great poise named Sassafrassa, who combined the best features of Pearl White, Mabel Normand and Pola Negri. Another make-believe identity was Madeline, a beauteous cowgirl who emerged from the pages of Zane Grey's melodramatic novel, ‘The Light of Western Stars’. To get authentic background for Madeline, young Lucille corresponded with the chambers of commerce of Butte and Anaconda, Mont. She read and reread their publicity handouts until she felt she knew more about Montana than the people who lived there. It was the powerful spirit of Madeline that caused her for many years to claim Butte, Mont., as her birthplace. Only in the most recent edition of Who's Who did she finally, grudgingly admit to being born in Jamestown, N.Y.

Horrses to Warter. While she lived there, Lucille did her best to rid Jamestown of dullness. Sometimes she gilded reality by imagining that the family chicken coop was her palace ("The chickens would become my armies"). She remembers that she was always unmanageable in the spring. "I'd leave the classroom for a drink of water and never come back. I'd start walking toward what I thought was New York City and keep going until someone brought me home."

By the time she left high school at 14, she had staged virtually a one-man performance of ‘Charley's Aunt’ ("I played the lead, directed it, cast it, sold the tickets, printed the posters, and hauled furniture to the school for scenery and props"). In a Masonic musical revue, she put so much passion into an Apache dance that she threw one arm out of its socket. Jamestown citizens still remember her explosive personality with wonder: it took quite a while for the dust to settle in Jamestown when Lucille finally left for Manhattan at the age of 15.

Probably because of the dreamy mental state induced by Sassafrassa and Madeline, Lucille is not too clear about dates, events and people. In New York,

she headed straight for John Murray Anderson's dramatic school. At the sound of her voice ("I used to say 'horrses' and 'warter' "), her teacher clapped hands to his forehead. Anderson tactfully told Lucille's mother that her daughter should try another line of work. Lucille made a stab at being a secretary and a drugstore soda jerk, but found both occupations dull. She answered chorus calls for Broadway musicals with a marked lack of success. When she even lost a job in the chorus of the third road company of ‘Rio Rita’, a Ziegfeld aide told her: "It's no use, Montana. You're not meant for show business. Go home."

Periodically, Lucille did go home to Jamestown. But she returned again and again to the assault on New York. She managed to get into the chorus of ‘Stepping Stones’, and held on until the choreographer announced that she wanted only girls who could do toe work ("I couldn't even do heel work"). Lucille turned to modeling, progressed from the wholesale garment houses through department stores to the comparative eminence of Hattie Carnegie. She still has a warm feeling for people in the garment trade, because "they're the nearest thing to show business in the outside world. They're temperamental and jealous. I like them." She had a great many admirers. One of them, Britain's actor Hugh Sinclair, says: "She disarmed you. You saw this wonderful, glamorous creature, and in five minutes she had you roaring with laughter. She was gay, warmhearted and absolutely genuine."

As a model, Lucille called herself Diane Belmont, choosing her name in honor of Belmont Park Race Track, where fashion shows are sometimes staged. But it was another few years before Lucille finally got her break. She was walking up Broadway past the Palace Theater when she met agent Sylvia Hahlo coming down from the Goldwyn office. Sylvia grabbed her and cried breathlessly: "How would you like to go to California? They're sending a bunch of poster girls there for six weeks for a picture. One of the girls' mothers has refused to let her go."

$50 to $ 1,500. The movie was ‘Roman Scandals’, starring Eddie Cantor, and it was six months instead of six weeks in the making. Lucille was grimly determined to keep her foot in the Hollywood door. She got a succession of bit parts in such movies as ‘Moulin Rouge’ and ‘The Affairs of Cellini’, worked for three months with the roughhouse comics known as The Three Stooges ("It was one continuous bath of Vichy water and lemon meringue pie").

When RKO picked up her contract, she gradually emerged as a queen of B pictures, then began making program movies with comics Jack Oakie, Joe Penner and the Marx Brothers (’Room Service’). Her salary rose from $50 a week to $1,500 and her hair, already turned blonde from its original brown, now became a brilliant but indescribable shade that has been variously called ‘shocking pink' and 'strawberry orange.' While she was in ‘Dance, Girl, Dance’, and being hailed by Director Erich Pommer as a new 'find' (by then,

she had been playing in movies for six years), she met a brash, boyish young Cuban named Desi Arnaz.

Gold Initials. Desi had come to Hollywood to make the movie version of the Broadway hit, Too Many Girls. Taking one look at luscious (5 ft. 7 in., 130 Ibs.) Lucille, who was wearing a sweater and skirt, he cried: "Thass a honk o' woman!" and asked: "How would you like to learn the rumba, baby?" He took her for a ride in his blue convertible, with the gold initials on the door, and she shudderingly recalls that the only time the speedometer dipped below 100 m.p.h. was when he rounded a curve. On the way home, Desi hit a bump and, as Lucille tells it, a fender flew off. He simply flicked the ash from his Cuban cigarillo and sped on.

Lucille was as dazzled by his full name (Desiderio Alberto Arnaz y De Acha III) as by his history. The only child of a prosperous Cuban politician who had been mayor of Santiago and a member of the Cuban Senate, Desi had fled to Miami with his mother during the revolution of 1933. His father, a supporter of President Machado, was put in jail, and the Arnaz possessions disappeared in the revolution.

After six months, Desi's father was released from jail and rejoined his family in Miami, where he went into the export-import business. Desi, who was 16, enrolled in St. Patrick's High School (his closest friend was Al Capone's son Albert), and got a part-time job cleaning canary cages for a firm which sold birds to local drugstores. He soon found steadier work as a guitarist in a four-piece band incongruously called the Siboney Sextette. The critics agreed on Desi's meager musical gifts. "He was always off-beat," says theater owner Carlos Montalban. "But he's an awfully nice guy—a clean-cut Latin."

Conga Line. Whatever Desi had, it was something the public liked. He began beating a conga drum in Miami and soon nightclub audiences, from Florida to New York, were forming conga lines behind him. His good looks and unquenchable good humor interested producer George Abbott, who was searching for a Latin type to play a leading role in ‘Too Many Girls’. "Can you act?" asked Abbott. "Act?" answered Desi, expansively. "All my life, I act."

The courtship of Desi and Lucille was predictably stormy. Says a friend: "He's very jealous. She's very jealous—they're both very jealous." They were married in 1940, while Desi was leading his orchestra at the Roxy in New York and Lucille was between pictures in Hollywood. She flew in from the coast; they got up at 5 a.m. and drove to Connecticut, where they were married by a justice of the peace. Since they had no apartment, Desi compromised by carrying his bride across the threshold of his dressing room at the Roxy. Hollywood offered odds that the marriage would not last six weeks.

The marriage lasted better than six weeks, but after four years trouble blew. Desi kept moving about the country with his band, and Lucille, when not making pictures, mostly sat home alone. Their marriage was drifting on the rocks, and only World War II averted immediate shipwreck. Desi refused a commission in the Cuban army and was drafted into the U.S. infantry. He was moved on to Special Services, and spent much of the war shepherding USO troupes from one base to another.

In 1944, Lucille filed suit for divorce. She won an interlocutory decree but never got around to filing for her final papers. The reason: she and Desi were in the midst of a new reconciliation. But all the old difficulties remained. Lucille would sit night after night at the clubs where Desi's band was playing, but that resulted in rings under her eyes rather than a new intimacy. She tried cutting down on her movie work by starring in a CBS radio show called ‘My Favorite Husband’, and Desi also took a flyer at radio. They worked out a vaudeville act and toured U.S. theaters with their new routines.

Lucille credits Desi with being the one who was willing to take a chance on TV. "He's a Cuban," she says, "and all Cubans gamble. They'll bet you which way the tide is going and give you first pick." But it was a real gamble. Movie exhibitors do not look kindly upon movie stars who desert to the enemy. If the show flopped, Lucille would have no place to crawl back to. They told CBS that they would give television a try only if both of them could be on the same show. At first, they wanted to play themselves. They compromised by turning Desi into Ricky Ricardo, a struggling young bandleader, and letting Lucille fulfill her lifelong ambition of playing a housewife.

The decision to film the show also made CBS bigwigs uneasy. It would cost four times as much as a live show, and the only interested sponsor, Philip Morris, wasn't prepared to go that high. Again there was a compromise. Desi and Lucille agreed to take a smaller salary in return for producing the show and keeping title to the films.

Real Plumbing. Long years in the practical business of orchestra leading had given Desi considerable organizing ability and business sense. He set up Desilu Productions (Desi president, Lucille vice president), and leased a sound stage from an independent Los Angeles studio. Because Lucille was ‘dead' without an audience, a side wall of the studio was knocked out to make a street entrance, and seats installed for an audience of 300. When a show is ready for the cameras, the audience laughter is picked up on overhead microphones and used in the final print.

Though ‘I Love Lucy’ is filmed, it is more like a play than a movie. All of the lines and action are memorized and, whenever possible, the show is played straight through from beginning to end, and not shot in a number of unrelated scenes. The action takes place on four sets; two of them represent the Ricardos' Manhattan apartment, a third shows the nightclub where Ricky's band plays and the fourth is used for any other scenes called for by the script. Says Desi proudly: "We have real furniture, real plumbing, and a real kitchen where we serve real food. Even the plants are really growing; they're not phony."

Desilu Productions hired a pair of veteran troupers, William Frawley and Vivian Vance, to play the family next door and serve as foils and friends for Desi and Lucille. Academy Award-winning Karl (’The Good Earth’) Freund supervises the three cameras, and Director Marc Daniels (soon to be replaced by Bill Asher) gives Lucy its rattling pace. The writers—Jess Oppenheimer, Bill Carroll and Madalyn Pugh—turn out scripts that do not impose too much on the audience's credulity and are reasonably free of clichés. The writers are held in an esteem not common in TV. Lucille bombards Jess Oppenheimer with photographs flatteringly inscribed to "the Boss Man," and Desi has presented him with a statuette of a baseball player and a punning tribute, "To the man behind the ball."

"Wanta Play Cards?" Desi and Lucille live an unpretentious life on a five-acre ranch in the San Fernando Valley. The only Hollywood note is a kidney-shaped swimming pool, and the most recent addition to the house (a wing devoted to daughter Lucie and her nurse) cost $22,000—more than the house and land cost originally. Neither Desi nor Lucille has ever been socially ambitious, and their friends are the same ones they have known for years. Both Desi's mother (now divorced from Arnaz Sr., who still lives in Miami) and Lucille's Mom live nearby.

At home, Lucille, who collects stray cats and dogs, is an amateur painter ("I use oils because it's easier to correct mistakes than with water colors"), and generally considers herself a lazy, lounging homebody. She is fascinated by Desi's boundless energy.' He spends weekends fishing on his 34-foot cabin cruiser, Desilu; plays violent tennis; likes to cook elaborate dishes. Says Lucille: "Everything is fine with him all the time. Wanta play cards? Fine. Play games? Fine. go for a swim? Great." There's only one problem: "Desi is a great thermostat sneaker-upper and I'm a thermostat sneaker-downer. Cold is the one thing that isn't great with him."

Sex & Chic. Though life has grown noticeably more placid for Desi and Lucille, it promises more money than they ever made before. Desilu Productions has already branched out beyond ‘I Love Lucy’. It is filming TV commercials for Red Skelton, and is at work on a new TV series, ‘Our Miss Brooks’, starring Eve Arden. Three of the best 30-minute Lucy shows are being put together in a package and will be experimentally released to movie theaters in the U.S. and Latin America. This year, ‘I Love Lucy’ has grossed about $1,000,000, and sponsor Philip Morris has signed a contract for 39 more shows beginning this fall. All of the old Lucy films can be sold again as new TV stations go on the air (eventually there will be 2,053 TV transmitters in the U.S., compared to today's 108).

In reaching the TV top, Lucille's telegenic good looks may be almost as important as her talent for comedy. She is sultry-voiced, sexy, and wears chic clothes with all the aplomb of a trained model and showgirl. Letters from her feminine fans show as much interest in Lucille's fashions as in her slapstick. Most successful comediennes (e.g., Imogene Coca, Fanny Brice, Beatrice Lillie) have made comic capital out of their physical appearance. Lucille belongs to a rare comic aristocracy: the clown with glamour.

11 notes

·

View notes

Photo

bA & P BUTTE ANACONDA PACIFIC RAILWAY 1920′S

26 notes

·

View notes

Text

The Craziest Mining Story I've Ever Heard

Source: Matt Badiali for Streetwise Reports 08/06/2020

Independent financial analyst Matt Badiali tells a mind-bending tale about a gold project in Montana.

This story is the stuff of myth. It will be retold, inflated, and gilded

especially if there's a discovery.

It's a story about gold, a historical mining district, seizing opportunity and psychedelic mushrooms.

I heard about it from a good friend. It was so far-fetched, I reached out to Warwick Smith, CEO of American Pacific Mining Corp. (USGD:CSE; USGDF:OTC), a tiny, C$16 million Canadian junior, to get the truth.

You see, Warwick's company bought the Madison Project for just 20 million of its sharesworth roughly C$7.6 million today.

And the Madison Project is special.

With the acquisition, came a built in partner. Rio Tinto has a joint venture agreement on the project. It will spend $30 million to acquire 70% of the project. American Pacific gets a "carried interest." That means it doesn't have to pay another cent and it still owns 30% of whatever Rio Tinto finds.

And the potential at Madison is enormous.

This is a past producing mine in a historical mining district in Montana. Between 2005 and 2011, the mine produced 7,570 ounces of gold and 3 million pounds of copper from rocks that averaged half an ounce of gold and 25% copper per ton.

That's outrageous grade. And it justifies Rio Tinto's interest. But that isn't all. Madison is in the Butte Mining District in western Montana. It sits at the southern point of a triangle formed from the giant Anaconda mine and Barrick's Golden Sunlight mine.

This is a region steeped in mining history. The rocks here have a rich mineral endowment. Historical drilling results at Madison included 30 meters of rock that ran 24.5 grams per ton gold and another that hit 11 meters of core with 41.7 grams per ton gold.

That's the kind of grade and length that make me sit up and take notice. These aren't narrow little shoots of high grade. If Rio Tinto's geologists can repeat that success, this project has enormous potential.

But Madison's ownership tells another interesting story.

In 2019, Broadway Gold owned the Madison Project. The company had over 12 miles of drill core. All the data went into a Vulcan 3D model. The high grade gold and copper numbers pushed the market cap of the company over C$75 million.

Suddenly, Broadway made a radical change in direction. In April 2019, they brought in Rio Tinto as a partner.

And then in June 2019, Broadway Gold made a crazy announcement. It became Mind Medicine, a "neuro-pharmaceutical company" developing psychedelic medicines.

I couldn't make this story up

Mind Medicine spun out the Madison project and American Pacific snapped it up. In January 2020, American Pacific announced the signed agreement, which just closed in June 2020.

That's how we got here

with a tiny junior miner holding a 30% carried interest in a project that Rio Tinto is drilling right now.

Rio Tinto already spent $2 million in geophysics and drilling in 2019. And the drilling program is underway in 2020.

With the drills turning and metal prices soaring, the American Pacific Mining's Madison Project is one to watch.

Regards,

Matt Badiali

Reach Matt Badiali at www.mattbadiali.net.

Matt Badiali is a geologist and independent financial analyst. He spent fifteen years researching and writing about great investments inside the natural resources sectors. He can be reached at www.mattbadiali.net.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure: 1) Matt Badiali: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Pacific Mining, a company mentioned in this article.

( Companies Mentioned: USGD:CSE; USGDF:OTC, )

from https://www.streetwisereports.com/article/2020/08/05/the-craziest-mining-story-ive-ever-heard.html

0 notes

Text

The Craziest Mining Story I've Ever Heard

Source: Matt Badiali for Streetwise Reports 08/06/2020

Independent financial analyst Matt Badiali tells a mind-bending tale about a gold project in Montana.

This story is the stuff of myth. It will be retold, inflated, and gilded

especially if there's a discovery.

It's a story about gold, a historical mining district, seizing opportunity and psychedelic mushrooms.

I heard about it from a good friend. It was so far-fetched, I reached out to Warwick Smith, CEO of American Pacific Mining Corp. (USGD:CSE; USGDF:OTC), a tiny, C$16 million Canadian junior, to get the truth.

You see, Warwick's company bought the Madison Project for just 20 million of its sharesworth roughly C$7.6 million today.

And the Madison Project is special.

With the acquisition, came a built in partner. Rio Tinto has a joint venture agreement on the project. It will spend $30 million to acquire 70% of the project. American Pacific gets a "carried interest." That means it doesn't have to pay another cent and it still owns 30% of whatever Rio Tinto finds.

And the potential at Madison is enormous.

This is a past producing mine in a historical mining district in Montana. Between 2005 and 2011, the mine produced 7,570 ounces of gold and 3 million pounds of copper from rocks that averaged half an ounce of gold and 25% copper per ton.

That's outrageous grade. And it justifies Rio Tinto's interest. But that isn't all. Madison is in the Butte Mining District in western Montana. It sits at the southern point of a triangle formed from the giant Anaconda mine and Barrick's Golden Sunlight mine.

This is a region steeped in mining history. The rocks here have a rich mineral endowment. Historical drilling results at Madison included 30 meters of rock that ran 24.5 grams per ton gold and another that hit 11 meters of core with 41.7 grams per ton gold.

That's the kind of grade and length that make me sit up and take notice. These aren't narrow little shoots of high grade. If Rio Tinto's geologists can repeat that success, this project has enormous potential.

But Madison's ownership tells another interesting story.

In 2019, Broadway Gold owned the Madison Project. The company had over 12 miles of drill core. All the data went into a Vulcan 3D model. The high grade gold and copper numbers pushed the market cap of the company over C$75 million.

Suddenly, Broadway made a radical change in direction. In April 2019, they brought in Rio Tinto as a partner.

And then in June 2019, Broadway Gold made a crazy announcement. It became Mind Medicine, a "neuro-pharmaceutical company" developing psychedelic medicines.

I couldn't make this story up

Mind Medicine spun out the Madison project and American Pacific snapped it up. In January 2020, American Pacific announced the signed agreement, which just closed in June 2020.

That's how we got here

with a tiny junior miner holding a 30% carried interest in a project that Rio Tinto is drilling right now.

Rio Tinto already spent $2 million in geophysics and drilling in 2019. And the drilling program is underway in 2020.

With the drills turning and metal prices soaring, the American Pacific Mining's Madison Project is one to watch.

Regards,

Matt Badiali

Reach Matt Badiali at www.mattbadiali.net.

Matt Badiali is a geologist and independent financial analyst. He spent fifteen years researching and writing about great investments inside the natural resources sectors. He can be reached at www.mattbadiali.net.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure: 1) Matt Badiali: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Pacific Mining, a company mentioned in this article.

( Companies Mentioned: USGD:CSE; USGDF:OTC, )

from The Gold Report - Streetwise Exclusive Articles Full Text https://ift.tt/3gBPvPE

0 notes

Text

My blog title is Mountain Beach Mama, and I state over and over how much I love the beach, the ocean. Today I am going to talk about rivers. You may be familiar with a book, ‘A River Runs Through It’ by Norman MacLean. I live in the town that the river runs through. Growing up I thought everyone’s town had a river running through it.

The Clark Fork has its headwaters are in Silver Bow Creek near Anaconda Montana. It flows west through Missoula to Lake Pend Oreille. At Missoula the Blackfoot River joins the Clark Fork near Milltown and Bonner. The Bitterroot joins the Clark Fork and the Clark Fork makes it way to the Columbia. The Columbia ends up in the Pacific. I am setting the background, and I will get around to my point. Years ago I read ‘Indian Creek Chronicles: A Winter Alone in the Bitterroot Wilderness. Pete Fromm (the author of the book) spent 7 months in the Bitterroot Selway Wilderness guarding salmon eggs. Once those eggs hatched the salmon made their way to the Pacific.

Imagine if you could float along with those fish on their long swim. What would you see? Where all would you travel? I haven’t really read much about Lewis and Clark, but imagine their trip. They were the first white men to travel from the Mississippi to the Pacific.

Rivers are road ways. They were the first Interstate highways. They connect us in so many ways. Water is one of the essentials of life. My daughter posted a link to an article about Montana Craft Beers needing pure Montana water. The Butte mines and the Anaconda Smelter sent tons of toxic waste down the Clark Fork. At one time the nation’s largest Superfund sight was the Clark Fork River to the Milltown Dam. That dam was removed a couple of years ago, but before the dam could be removed they had to remove tons of toxic waste. That dam was the one thing protecting the rivers running west to the ocean from massive pollution. If you want to more know more about the removal project I will post a Wikipedia link to start you on your way. https://en.wikipedia.org/wiki/Milltown_Reservoir_Superfund_Site

We humans have not proven to be the best caretakers of our precious earth. I started out thinking about everything you would see floating down a river. The towns you would pass through, the scenery along the way. That morphed into how we care for our rivers.

Wildlife use those rivers both to drink the water and to travel along the banks. We have had several bears stop by town for a quick ‘feed’. They wander down the river, and we look like a good stopping place.

Rivers are a rich part of the earth. They are often called inland waterways. That is exactly what they are. Glacier Park has Triple Divide Pass. It is the world’s only triple divide point. Water that falls at the summit flows to the Atlantic, the Pacific and the Arctic (via the Hudson Bay). Another Wikipedia link

https://en.wikipedia.org/wiki/Triple_Divide_Peak_(Montana)

One think blogging does is open my mind to new avenues of thought. I hope you enjoy the ride. I will leave you with some river photos.

Rivers My blog title is Mountain Beach Mama, and I state over and over how much I love the beach, the ocean.

0 notes

Video

Butte Anaconda & Pacific GE boxcab 65 by Craig Garver Via Flickr: Butte Anaconda & Pacific GE boxcab 65 at Anaconda, Montana, July 5, 1973. Photographer: Bruce Black. Scanned from a 2 1/4 x 4 1/4 negative owned by Digital Rail Artist.

#Butte Anaconda & Pacific GE Boxcab 65#Anaconda#Montana#Bruce Black#trainspotting#train#railway#locomotive#General Electric#electric locomotive#railphotography

3 notes

·

View notes

Video

Butte Anaconda & Pacific GE 125 ton 201 by Craig Garver Via Flickr: Butte Anaconda & Pacific GE 125 ton 201 at Anaconda, Montana, July 5, 1973. Photographer: Bruce Black. Scanned from a 2 1/4 x 4 1/4 negative owned by Digital Rail Artist. GE built just two of these 125-ton units, both for the BA&P in 1957. They lasted just ten years before being retired in 1967. They were sold for parts to Canadian National in 1977 and scrapped. www.trainweb.org/rosters/BAP.html

#Butte Anaconda & Pacific GE 125 Ton 201#General Electric locomotive#Anaconda#Montana#Bruce Black#locomotive#railroad#railway#electric locomotive#General Electric#railfan#railphotography

2 notes

·

View notes

Video

Butte Anaconda & Pacific GE boxcab 65 by Craig Garver Via Flickr: Butte Anaconda & Pacific GE boxcab 65 at Anaconda, Montana, July 5, 1973. Photographer: Bruce Black. Scanned from a 2 1/4 x 4 1/4 negative owned by Digital Rail Artist.

1 note

·

View note

Video

Butte Anaconda & Pacific EMD GP7 102 by Craig Garver Via Flickr: Butte Anaconda & Pacific EMD GP7 102 at Rocker, Montana, July 5, 1973. Photographer: Bruce Black. Scanned from a 2 ¼ x 4 ¼ negative owned by Digital Rail Artist.

#Butte Anaconda & Pacific EMD GP7 102#Bruce Black#Rocker#Montana#BA&P#electro motive division#EMD GP7#emd#gp7#railphotography#railfan#railroad#railway#locomotive#butte anaconda and pacific

1 note

·

View note

Video

Butte Anaconda & Pacific EMD GP7 102 by Craig Garver Via Flickr: Butte Anaconda & Pacific EMD GP7 102 at Rocker, Montana, July 5, 1973. Photographer: Bruce Black. Scanned from a 2 1/4 x 4 1/4 negative owned by Digital Rail Artist.

0 notes

Text

The Craziest Mining Story I’ve Ever Heard

Source: Matt Badiali for Streetwise Reports 08/06/2020

Independent financial analyst Matt Badiali tells a mind-bending tale about a gold project in Montana.

This story is the stuff of myth. It will be retold, inflated, and gilded

especially if there’s a discovery.

It’s a story about gold, a historical mining district, seizing opportunity and psychedelic mushrooms.

I heard about it from a good friend. It was so far-fetched, I reached out to Warwick Smith, CEO of American Pacific Mining Corp. (USGD:CSE; USGDF:OTC), a tiny, C$16 million Canadian junior, to get the truth.

You see, Warwick’s company bought the Madison Project for just 20 million of its sharesworth roughly C$7.6 million today.

And the Madison Project is special.

With the acquisition, came a built in partner. Rio Tinto has a joint venture agreement on the project. It will spend $30 million to acquire 70% of the project. American Pacific gets a “carried interest.” That means it doesn’t have to pay another cent and it still owns 30% of whatever Rio Tinto finds.

And the potential at Madison is enormous.

This is a past producing mine in a historical mining district in Montana. Between 2005 and 2011, the mine produced 7,570 ounces of gold and 3 million pounds of copper from rocks that averaged half an ounce of gold and 25% copper per ton.

That’s outrageous grade. And it justifies Rio Tinto’s interest. But that isn’t all. Madison is in the Butte Mining District in western Montana. It sits at the southern point of a triangle formed from the giant Anaconda mine and Barrick’s Golden Sunlight mine.

This is a region steeped in mining history. The rocks here have a rich mineral endowment. Historical drilling results at Madison included 30 meters of rock that ran 24.5 grams per ton gold and another that hit 11 meters of core with 41.7 grams per ton gold.

That’s the kind of grade and length that make me sit up and take notice. These aren’t narrow little shoots of high grade. If Rio Tinto’s geologists can repeat that success, this project has enormous potential.

But Madison’s ownership tells another interesting story.

In 2019, Broadway Gold owned the Madison Project. The company had over 12 miles of drill core. All the data went into a Vulcan 3D model. The high grade gold and copper numbers pushed the market cap of the company over C$75 million.

Suddenly, Broadway made a radical change in direction. In April 2019, they brought in Rio Tinto as a partner.

And then in June 2019, Broadway Gold made a crazy announcement. It became Mind Medicine, a “neuro-pharmaceutical company” developing psychedelic medicines.

I couldn’t make this story up

Mind Medicine spun out the Madison project and American Pacific snapped it up. In January 2020, American Pacific announced the signed agreement, which just closed in June 2020.

That’s how we got here

with a tiny junior miner holding a 30% carried interest in a project that Rio Tinto is drilling right now.

Rio Tinto already spent $2 million in geophysics and drilling in 2019. And the drilling program is underway in 2020.

With the drills turning and metal prices soaring, the American Pacific Mining’s Madison Project is one to watch.

Regards,

Matt Badiali

Reach Matt Badiali at www.mattbadiali.net.

Matt Badiali is a geologist and independent financial analyst. He spent fifteen years researching and writing about great investments inside the natural resources sectors. He can be reached at www.mattbadiali.net.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure: 1) Matt Badiali: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Pacific Mining, a company mentioned in this article.

( Companies Mentioned: USGD:CSE; USGDF:OTC, )

from The Gold Report – Streetwise Exclusive Articles Full Text https://ift.tt/3gBPvPE

from WordPress https://ift.tt/2XEm0Fw

0 notes