#businessbroker

Explore tagged Tumblr posts

Photo

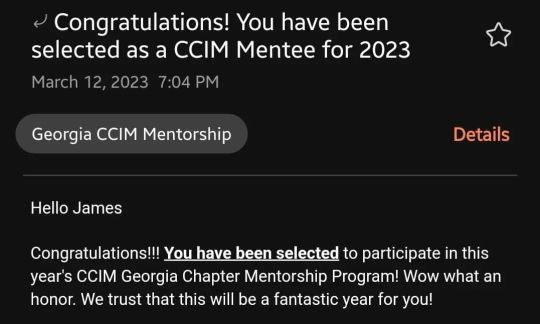

All Praises to the Most High. Im thankful to have been selected for the @georgiaccim @ccim mentorship program as a mentee. Let's Go!!! .. .. @AppLetstag #entrepreneur #entrepreneurship #leadershipdekalb2021 #rushmanmoorereg #MBE #DBE #lifestyle #leader #wehunting #faith #wealth #commercialrealestate #tenantrep #businessbroker #REAP #10x #mindset #milliondollarclub #branding #inspiration #marketing #commercial #realestate #broker #kingsofatlantabuilding #atlanta #decatur #downtown #buckhead (at Atlanta, Georgia) https://www.instagram.com/p/Cpu61SRACWW/?igshid=NGJjMDIxMWI=

#entrepreneur#entrepreneurship#leadershipdekalb2021#rushmanmoorereg#mbe#dbe#lifestyle#leader#wehunting#faith#wealth#commercialrealestate#tenantrep#businessbroker#reap#10x#mindset#milliondollarclub#branding#inspiration#marketing#commercial#realestate#broker#kingsofatlantabuilding#atlanta#decatur#downtown#buckhead

4 notes

·

View notes

Text

Top 5 Mistakes to Avoid When Choosing a Business Broker in Texas

Whether it is a sale or purchase, it is vital to consult a professional business broker for such an event. Choosing the wrong broker could lead to costly mistakes and loss of opportunity. Avoid these common mistakes below while choosing a business broker in Texas. Read more: https://adamnoble5.wordpress.com/2024/11/27/top-5-mistakes-to-avoid-when-choosing-a-business-broker-in-texas/

0 notes

Text

0 notes

Text

You can simultaneously exit your business & have a second $ bite of the apple - often for with less risk and more upside.

#GroundSwell℠#BusinessOwnershipPlatform℠#BusinessOwnership#BusinessPartner#SellingMyBusiness#BusinessTransition#ExitPlan#BusinessValuation#BusinessInvestors#PrivateEquity#BusinessBroker

0 notes

Text

Selling Your Business? 16 Things To Consider

Share Post:

LinkedIn

Twitter

Facebook

Reddit

Deciding whether to sell your business is a complex and significant undertaking that requires careful consideration of various factors. In this comprehensive guide, we’ll explore the key aspects of this crucial decision and provide you with 16 essential things to know if you’re contemplating selling your business.

1. Assess Your Motivation: Understanding the Why

Before delving into the logistics of selling, it’s crucial to understand your motivation. Are you looking for new opportunities, facing financial challenges, or planning for retirement? Knowing the “why” behind your decision will not only guide the entire process but also help you communicate effectively with potential buyers.

2. Financial Health Check: The Foundation of a Successful Sale

Conducting a thorough examination of your business’s financial health is a foundational step. Prospective buyers will scrutinize financial statements, so ensure your records are not only accurate but also showcase the profitability and potential for growth. Consider working with a financial advisor to present a clear and compelling financial picture.

3. Market Conditions: Timing Is Everything

When selling your business, consider the current market conditions and industry trends. Selling during a peak period may fetch a higher valuation. Stay informed about economic indicators, industry growth projections, and any external factors that may influence the market.

4. Valuation Expertise: Unlocking Your Business’s True Value

Engage professionals, such as business appraisers, to determine the true value of your business. Accurate valuation is critical for setting a realistic selling price and attracting serious buyers. A precise valuation also instills confidence in potential investors or buyers.

5. Legal and Regulatory Compliance: Mitigating Risks

Ensure your business complies with all legal and regulatory requirements. Addressing potential issues in advance will not only streamline the selling process but also enhance the attractiveness of your business to potential buyers. Consider conducting a legal audit to identify and resolve any compliance issues.

6. Customer and Employee Impact: Minimizing Disruptions

Anticipate the impact on customers and employees. Develop a communication plan to inform key stakeholders about the decision to sell. Transparent communication will help mitigate uncertainty and maintain goodwill, minimizing disruptions to your business operations.

7. Timing is Key: Strategic Planning for Optimal Results

Timing is crucial in the world of business sales. Plan strategically to capitalize on favorable market conditions. Keep in mind that the selling process can take time, so factor in a timeline that allows for thorough due diligence and negotiation.

8. Consider Your Industry: Industry Dynamics Matter

Different industries have unique dynamics. Understand how your industry influences the selling process and valuation. Research industry benchmarks and standards to gauge where your business stands in comparison to competitors.

9. Seek Professional Guidance: The Power of Expert Advice

Before selling your business, engage with experienced professionals, including business brokers, lawyers, and accountants, to guide you through the complexities of the sale. Their expertise can be invaluable in navigating legal processes, negotiating deals, and ensuring compliance with regulations.

10. Potential Buyers: Identifying Your Ideal Match

Identify potential buyers, whether they are competitors, investors, or individuals seeking business ownership. Tailor your marketing approach based on your target audience. Understanding the buyer’s perspective can help you tailor your sales strategy and enhance your business’s appeal.

11. Confidentiality Matters: Guarding Business Secrets

Maintain confidentiality throughout the selling process to prevent potential disruptions to your business. Leaks about a potential sale can lead to uncertainty among customers, employees, and suppliers. Implement confidentiality agreements and communicate discreetly with potential buyers.

12. Negotiation Strategies: Crafting Win-Win Solutions

Develop effective negotiation strategies. Be prepared to compromise while ensuring your fundamental interests are protected. Clearly define your objectives and priorities, and consider enlisting the expertise of a skilled negotiator to facilitate a smooth and mutually beneficial transaction.

13. Transition Plan: Ensuring a Smooth Handover

Create a comprehensive transition plan that includes handing over responsibilities, training the new owner, and ensuring a smooth shift in operations. A well-thought-out transition plan not only instills confidence in buyers but also contributes to the long-term success of the business post-sale.

14. Tax Implications: Navigating the Tax Landscape

Understand the tax implications of selling your business. Seek advice from tax professionals to optimize tax outcomes. Consider the potential tax liabilities associated with the sale and explore strategies to minimize tax obligations.

15. Emotional Preparedness: The Human Side of Business Sales

Selling a business is not just a financial transaction; it’s an emotional journey. Be mentally prepared for the transition and potential challenges. Recognize that emotions may play a significant role throughout the process, from the decision-making stage to negotiating terms and handing over the reins. Consider seeking support from mentors, advisors, or business support groups to navigate the emotional aspects of selling your business.

16. Post-Sale Involvement: Defining Your Role After the Handover

Consider your level of post-sale involvement. Are you willing to stay in an advisory capacity, or do you prefer a clean break? Clearly define your role and responsibilities after the sale to avoid any misunderstandings. This decision can impact the buyer’s perception of the transition and may influence their confidence in the ongoing success of the business. Discuss expectations openly with the buyer to ensure a seamless transition and a positive ongoing relationship. Your willingness to provide support post-sale can enhance the overall value proposition and contribute to the long-term success of the business under new ownership.

Summing Up

The decision to sell your business is multifaceted, requiring a blend of financial acumen, strategic planning, and emotional readiness. By considering these 15 essential aspects, you’ll be better equipped to navigate the complexities of selling your business and ensure a smooth transition for both you and the future owner. Thorough preparation, professional guidance, and strategic thinking are key to a successful business sale.

Also read: Selling your Business? These CEO Qualities drive Strong Private Equity Partnerships

#BusinessForSale#SellYourBusiness#Entrepreneurship#SmallBusinessSale#BusinessOpportunity#Investment#ExitStrategy#BusinessBroker#SellingBusiness#Acquisition#BusinessTransition#InvestInBusiness#BusinessOwners#SellMyCompany#BusinessExit#MergersAndAcquisitions

0 notes

Text

Preparing A Business To Sell: A Step-By-Step Guide

Selling a firm is a complex and time-consuming process that requires a lot of planning and preparation. Whether individuals are selling to retire, to pursue other opportunities, or for any other reason, it is crucial to be well-prepared to get the best possible price for their enterprise. Here is a step-by-step guide to help them prepare your business to sell.

Get Financials In Order:

The first step in preparing a business for sale is to get financials in order. Individuals need to have a clear understanding of their company's economic performance and be able to demonstrate this to potential buyers. Prep financial statements for the past three to five years and ensure they are accurate and up-to-date. It includes their balance sheet, income statement, and cash flow statement.

Make A Business Attractive To Buyers:

Making sure a company has a strong brand and a good reputation, a solid customer base, and a competitive advantage in an industry. Consider investing in marketing and advertising to attract more customers and increase the business's visibility.

Hire A Business Consultant:

If folks are not familiar with the process of marketing a firm, it is a good idea to hire a business selling expert to guide them through the process. A professional consultant can help them determine the value of their business, find potential buyers, and negotiate the terms of the sale. They can also assist in getting ready for sale by identifying areas that need improvement and making recommendations for changes.

Remember that selling a business takes time, so it is essential to start preparing as early as possible.

0 notes

Text

Professional Business Evaluation Consultants

We help you get the best possible price for your existing mid-market and main street business by valuing a business for sale. Drop a word!

0 notes

Text

issuu

Find a Professional Business Consultant

Our expert team is dedicated to helping you navigate complex transactions when looking to buy commercial business services. Contact us now!

0 notes

Text

Business Acquisition Services for Seamless Transitions

Navigate business acquisitions with ease. Our experts provide strategic advice and services to ensure successful transitions, whether you’re buying or selling a business. For more information visit our website: https://adamnoble.com/making-the-move-strategies-for-securing-a-business-acquisition-loan/

0 notes

Text

0 notes

Text

Analyzing the Company's Real Value

We offer an accurate business valuation to know your company's true worth and maximize its potential. Get in touch with us!

0 notes

Text

We facilitate and execute a plan to exit your business when and for how much you want.

#GroundSwell℠#BusinessOwnershipPlatform℠#BusinessOwnership#BusinessPartner#SellingMyBusiness#BusinessTransition#ExitPlan#BusinessValuation#BusinessInvestors#PrivateEquity#BusinessBroker

0 notes

Text

Estimate your Market Growth

Our business valuation consultants provide statistics about a company's assets, income, and competitors in the market.

0 notes

Text

Closing The Deal: The Ultimate Guide to Business Sales Services

As an existing business owner, closing deals is essential to driving revenue and achieving success. However, it can be complicated to steer the complex landscape of sales services and strategies. Discover the ultimate guide to business sales services, including key techniques, tools, and tactics to help individuals close more deals and attain fruitful transitions.

Understanding a Buyer's Needs

To effectively close deals, it's critical to comprehend one's customer's needs and pain points. Start by researching the target audience and identifying their specific challenges and goals. However, it will help existing company owners tailor their exchange approach and messaging to better resonate with their buyers.

One effective strategy is to use empathy in the sales process. Put themselves in their customer's shoes and acknowledge their perspective. It can assist them in establishing a connection and building trust, making it easier to close deals and drive long-term client relationships.

Effective Sales Techniques

Several sales tactics can support individuals in closing deals more effectively. One popular method is consultative selling, which involves asking questions and listening to their buyer's requirements rather than simply pushing their existing businesses.

Another approach is to create a sense of urgency by emphasizing the benefits of an offer and highlighting time-limited promotions or discounts. Additionally, social proof, such as customer testimonials or case studies, can help build credibility and persuade buyers to invest.

Always keep in mind to stay flexible and adapt to changing market conditions, and often prioritize the customer experience to build lasting relationships and drive long-term success.

0 notes

Text

Smoother Sales Process of your Business

Our business sales professionals conduct a thorough market pricing analysis to determine the valuation that would allow us to sell your business.

1 note

·

View note

Text

Exactly how does a broker help in selling your business?

A business broker plays a crucial role in helping you sell your business efficiently and at the best possible price. First, they assess your business's value and market position to determine an accurate selling price. Experienced Dallas business brokers and Texas business brokers have deep knowledge of the local market, allowing them to position your business effectively. Read more: https://qr.ae/p2wpOC

0 notes