#business overdraft loan

Explore tagged Tumblr posts

Text

Managing cash flow effectively can make or break an enterprise. Entrepreneurs, particularly small and medium-sized business owners, often face challenges in maintaining liquidity to meet short-term obligations. This is where a Business Overdraft Loan or a Dukandar Overdraft Facility becomes a valuable financial tool.

What is a Business Overdraft Loan?

A Business Overdraft Loan is a flexible credit facility provided by financial institutions to businesses. It allows account holders to withdraw funds exceeding their account balance, up to a pre-approved limit. This facility is particularly useful for managing working capital requirements, covering unexpected expenses, or bridging cash flow gaps without disrupting business operations.

The overdraft facility works like a revolving credit line—borrowers only pay interest on the amount utilized, not the entire sanctioned limit. It’s an ideal solution for businesses that experience fluctuating cash flow due to seasonal operations or delayed payments from clients.

What is the Dukandar Overdraft Facility?

The Dukandar Overdraft Facility is a specialized overdraft product designed to cater to small business owners, often referred to as "dukandars" in South Asia. This facility is typically offered by banks and non-banking financial institutions (NBFCs) to retail shop owners, wholesalers, and micro-enterprises who require short-term credit to manage their daily operations.

Key Features of the Dukandar Overdraft Facility:

Flexible Credit Limits:Credit limits are tailored based on the borrower’s business turnover, account history, and creditworthiness.

Interest on Usage Only:Interest is charged only on the utilized portion of the overdraft, not on the sanctioned limit.

Quick Approvals:With minimal documentation and simplified processes, approvals are faster compared to traditional loans.

Renewable Facility:Many overdraft facilities are renewable annually, subject to satisfactory performance.

Collateral Options:Depending on the lender, the facility may be secured (against assets like property or inventory) or unsecured.

Benefits of a Business Overdraft Loan

Improved Cash Flow Management:Businesses can handle unexpected expenses or delays in receivables without stress.

Cost-Effective Borrowing:Unlike fixed-term loans, interest is calculated only on the amount utilized, reducing the cost of borrowing.

Operational Continuity:With access to extra funds, businesses can ensure uninterrupted operations, even during lean periods.

Enhanced Creditworthiness:Timely repayments can improve the business’s credit score, making it easier to access future loans.

No Prepayment Penalties:Overdrafts allow borrowers to repay the borrowed amount anytime without incurring penalties.

Who Can Benefit from the Dukandar Overdraft Facility?

The Dukandar Overdraft Facility is ideal for:

Retail shop owners managing inventory and supplier payments.

Micro and small enterprises experiencing seasonal cash flow fluctuations.

Wholesalers and distributors dealing with large bulk orders.

Service providers needing working capital for operational expenses.

How to Apply for a Dukandar Overdraft Facility

Applying for a Dukandar Overdraft Facility is straightforward:

Choose a Lender:Research banks or NBFCs offering business overdraft products tailored for small businesses.

Gather Documentation:Commonly required documents include business registration certificates, GST returns, bank statements, and proof of identity and address.

Submit an Application:Fill out the application form and submit it along with the required documents.

Credit Assessment:The lender evaluates the applicant’s financial history and business performance.

Approval and Limit Sanctioning:Once approved, the overdraft limit is set, and the facility becomes available for use.

Conclusion

A Business Overdraft Loan or Business Overdraft Facility is a powerful tool that empowers small businesses to navigate financial challenges and seize growth opportunities. With its flexibility and cost-effective borrowing, it ensures that business owners have access to funds when they need them the most. For entrepreneurs looking to maintain liquidity and stabilize their operations, this facility can be a game-changer.

Whether you're a small shop owner or a growing enterprise, exploring overdraft options tailored to your needs can help you build a resilient and sustainable business.

0 notes

Text

Maintaining liquidity is essential for day-to-day operations. Cash flow gaps can arise unexpectedly, and having access to quick, flexible financing solutions can be crucial. One such solution is the Business Overdraft (OD) Loan, often referred to as the "Business Overdraft Facility" in local parlance. This financial product is tailored specifically for small business owners and traders (dukandars), providing them with a safety net to manage short-term cash flow needs. This article explores the features, benefits, and considerations of the Business Overdraft Loan, focusing on its relevance and application in the business world.

Understanding Business Overdraft (OD) Loan

A Business Overdraft Loan is a credit facility provided by banks and financial institutions that allows businesses to withdraw more money from their current account than they have deposited. Unlike traditional loans, which provide a lump sum amount upfront, an overdraft facility offers a revolving credit line up to a predetermined limit. This limit is often based on the borrower's creditworthiness, business turnover, and collateral offered.

Features of Business Overdraft (OD) Loans

Flexible Credit Limit: The overdraft limit is usually determined based on the business's financial health and credit profile. It can range from a few thousand dollars to several million, depending on the size and nature of the business.

Interest on Utilized Amount: Unlike a term loan, where interest is charged on the entire loan amount, an overdraft facility charges interest only on the amount utilized. This makes it a cost-effective option for managing short-term liquidity needs.

Revolving Credit Facility: The overdraft facility operates as a revolving credit line, allowing businesses to borrow, repay, and borrow again within the approved limit. This flexibility helps manage cash flow fluctuations without the need for repeated loan applications.

Secured and Unsecured Options: Depending on the borrower's credit profile, banks may offer secured or unsecured overdraft facilities. Secured overdrafts require collateral, such as property or inventory, while unsecured overdrafts are based on the business's creditworthiness.

Convenient Repayment: Repayment schedules for overdraft facilities are flexible, with businesses often required to make minimum monthly payments. Full repayment can be made at any time, reducing interest costs.

Benefits of Dukandar Overdraft Facility

Immediate Access to Funds: The primary advantage of a Business Overdraft Loan is the immediate access to funds it provides. This is particularly beneficial for small business owners who may face sudden expenses or delays in payments from customers.

Cost-Effective Solution: Since interest is only charged on the utilized amount, businesses can save on interest costs compared to a term loan where interest accrues on the entire borrowed sum.

No Prepayment Penalties: Businesses can repay the overdraft amount at any time without incurring prepayment penalties, offering flexibility in managing cash flows.

Enhances Business Credit Score: Regular use and timely repayment of an overdraft facility can help improve the business's credit score, making it easier to secure future financing.

Support for Seasonal Businesses: For businesses with seasonal revenue fluctuations, such as retail stores or traders, the overdraft facility provides a cushion to manage off-season expenses.

Considerations Before Opting for an Overdraft Facility

While the Business Overdraft Loan offers numerous benefits, there are several factors businesses should consider:

Interest Rates: Overdraft facilities often come with higher interest rates compared to traditional loans. It's essential to compare rates across different banks and financial institutions.

Overdraft Fees: Some banks charge fees for overdraft facilities, such as annual maintenance fees or penalties for exceeding the credit limit. Businesses should be aware of these charges and factor them into their cost calculations.

Collateral Requirements: For secured overdrafts, businesses need to provide collateral. The type and value of collateral required can vary, and in the event of default, the collateral may be seized.

Credit Limit Restrictions: The overdraft limit is typically lower than other forms of business financing. This may not be sufficient for businesses with larger financing needs.

Impact on Credit Score: While regular repayment can improve credit scores, excessive use of an overdraft facility or failure to repay can negatively impact the business's credit profile.

Conclusion

The Business Overdraft Loan, or Dukandar Overdraft Facility, is a versatile financial tool that offers small business owners and traders a flexible solution to manage cash flow needs. With its revolving credit structure, interest-on-utilized amount feature, and immediate access to funds, it is particularly suited for businesses facing short-term liquidity challenges. However, it's crucial for business owners to carefully assess their financial situation, compare options, and understand the associated costs and risks before opting for this facility. By doing so, they can leverage the benefits of the overdraft facility while ensuring sustainable financial health for their business.

0 notes

Text

The Business Overdraft (OD) Loan, often marketed as the Dukandar Overdraft Facility This facility is tailored to meet the unique needs of businesses, especially retail businesses (dukandars), providing them with a financial cushion to manage short-term liquidity challenges.

What is a Business Overdraft (OD) Loan?

A Business Overdraft Loan is a credit facility provided by banks and financial institutions that allows businesses to withdraw more money than what is available in their current account, up to a specified limit. This limit is determined based on the creditworthiness of the business and its financial health. The overdraft amount can be used for various business purposes, such as purchasing inventory, paying suppliers, managing operational expenses, or covering unforeseen expenses.

Features of a Business Overdraft Loan

Flexible Withdrawals: Businesses can withdraw funds as needed, up to the approved limit, and repay the amount as per their cash flow convenience.

Interest on Utilized Amount: Interest is charged only on the amount utilized, not on the entire overdraft limit. This makes it a cost-effective solution compared to traditional loans.

Revolving Credit: The overdraft facility acts as a revolving credit line, allowing businesses to borrow, repay, and borrow again within the approved limit without the need for a fresh loan application.

No Collateral Required: Many banks offer unsecured overdraft facilities to small businesses, though the terms may vary based on the business's credit profile.

Quick Approval and Disbursement: The application process for an overdraft facility is generally quicker than traditional loans, with minimal documentation required, enabling faster access to funds.

Dukandar Overdraft Facility: Tailored for Retailers

The Dukandar Overdraft Facility is specifically designed for retail businesses, acknowledging the unique cash flow challenges faced by retailers. Here’s how this facility benefits retail businesses:

Seasonal Cash Flow Management: Retailers often experience fluctuating cash flows due to seasonal demand. The overdraft facility helps manage these variations by providing easy access to funds during peak seasons and allowing repayment during off-peak periods.

Inventory Management: Retail businesses need to maintain adequate inventory to meet customer demand. The overdraft facility provides the necessary liquidity to purchase inventory without disrupting the cash flow.

Handling Operational Expenses: Daily operational expenses such as salaries, rent, and utilities can be managed efficiently with the overdraft facility, ensuring smooth business operations.

Meeting Unforeseen Expenses: Retailers can face unexpected expenses due to market changes, economic fluctuations, or emergencies. The overdraft facility acts as a financial safety net in such situations.

How to Apply for a Dukandar Overdraft Facility

Applying for a Dukandar Overdraft Facility typically involves the following steps:

Eligibility Check: Ensure your business meets the eligibility criteria set by the bank or financial institution. This may include factors like business vintage, annual turnover, and credit history.

Documentation: Prepare the necessary documents such as business registration certificates, bank statements, financial statements, and any other documents required by the lender.

Application Submission: Submit the application form along with the required documents to the bank or financial institution.

Credit Assessment: The lender will assess your business’s creditworthiness and financial health to determine the overdraft limit.

Approval and Agreement: Once approved, you will receive an overdraft agreement detailing the terms and conditions, including the interest rate, repayment terms, and overdraft limit.

Access to Funds: Upon signing the agreement, the overdraft limit will be activated, and you can start withdrawing funds as needed.

Conclusion

The Business OD Loan, particularly the Dukandar Overdraft Facility, is a vital financial tool for retail businesses, offering the flexibility and liquidity needed to manage cash flow effectively. Providing access to funds when needed enables retailers to maintain operations smoothly, manage inventory efficiently, and navigate through financial uncertainties with confidence. For any retail business looking to enhance its financial agility, the Dukandar Overdraft Facility is an excellent option.

#business overdraft#business od loan#business overdraft loan#dukandar overdraft#business overdraft facility

0 notes

Text

Introduction:

In the dynamic world of business finance, having access to flexible funding options is crucial for maintaining stability and fueling growth. One such option that often proves invaluable is the business overdraft. In this comprehensive guide, we'll delve into the intricacies of business overdrafts, exploring what they are, how they work, their advantages and disadvantages, and essential tips for utilizing them effectively.

Understanding Business Overdrafts:

At its core, a business overdraft loan is a form of revolving credit offered by banks or financial institutions to eligible businesses. Unlike traditional loans, where a fixed amount is borrowed upfront and repaid over a specified period, an overdraft provides businesses with a pre-approved credit limit that they can draw upon as needed. This flexibility makes overdrafts particularly appealing for managing short-term cash flow fluctuations and covering unexpected expenses.

How Business Overdrafts Work:

Business overdrafts operate on a revolving basis, meaning that once a repayment is made, the credit line becomes available again for future use. Typically, businesses are charged interest only on the amount they utilize from the overdraft facility, making it a cost-effective solution for short-term financing needs. However, it's essential to note that banks may also levy fees, such as overdraft arrangement fees or transaction charges, which can vary depending on the terms of the agreement.

Advantages of Business Overdrafts:

Flexibility: Business overdrafts offer unparalleled flexibility, allowing businesses to access funds on an as-needed basis without the constraints of a fixed repayment schedule.

Cash Flow Management: By bridging temporary cash flow gaps, overdrafts enable businesses to maintain operations smoothly, ensuring continuity even during lean periods.

Cost-Effective: Compared to alternative forms of financing, such as credit cards or short-term loans, overdrafts often come with lower interest rates, making them a cost-effective solution for managing liquidity.

Quick Access to Funds: With a pre-approved credit limit in place, businesses can access funds swiftly, providing them with the agility to seize opportunities or address urgent financial obligations.

Disadvantages of Business Overdrafts:

Interest Costs: While overdrafts offer flexibility, the interest charges associated with utilizing this credit facility can accumulate over time, potentially increasing the overall cost of borrowing.

Dependency Risk: Relying too heavily on overdrafts to cover ongoing expenses can indicate underlying financial instability and may lead to a cycle of debt if not managed prudently.

Credit Limitations: The approved overdraft limit is contingent upon factors such as the business's creditworthiness and financial performance, which means that businesses may not always secure the desired amount.

Repayment Obligations: Although overdrafts do not have a fixed repayment schedule, businesses are still required to repay the borrowed amount within the agreed-upon timeframe, failing which could result in penalties or adverse impacts on credit ratings.

Tips for Effective Utilization:

Assess Your Needs: Before applying for a business overdraft, conduct a thorough analysis of your cash flow requirements and determine the appropriate credit limit based on your short-term financing needs.

Negotiate Terms: Don't hesitate to negotiate with banks or financial institutions to secure favorable terms and conditions, including interest rates, fees, and repayment flexibility.

Monitor Usage Closely: Keep a close eye on your overdraft usage to avoid exceeding the approved limit or falling into a cycle of debt. Implement robust financial monitoring systems to track cash flow effectively.

Explore Alternatives: While business overdrafts offer flexibility, explore alternative financing options such as lines of credit, invoice financing, or asset-based lending to diversify your funding sources and mitigate risk.

Plan for Repayment: Develop a repayment strategy to gradually reduce your overdraft balance over time, thereby minimizing interest costs and strengthening your financial position.

Conclusion:

In conclusion, business overdraft serves as valuable financial tools for businesses of all sizes, providing them with the flexibility and liquidity needed to navigate the complexities of modern commerce. By understanding how overdrafts work, weighing their pros and cons, and implementing effective utilization strategies, businesses can harness the power of this versatile financing solution to drive growth and achieve long-term success.

0 notes

Text

Personal loan apply online in Noida

Unlock Financial Flexibility with Our Personal Loan Apply Online in Noida Dreaming of renovating your home or planning a grand celebration but tight on funds? Our Home loan balance transfer services in Noida. With our user-friendly online application, you can easily apply for a personal loan and access the funds you need without any hassle. Whether you're a salaried individual or self-employed, our flexible loan options cater to all. Applying is simple – just fill out our online form, submit the necessary documents, and receive quick approval. Get ready to bring your dreams to life with our Apply for Business loan in Noida. Apply Now: https://finaqo.in/

#Personal loan apply online in Noida#business loan against property apply in noida#personal loan balance transfer online in noida#pre approved personal loan apply online in noida#credit card balance transfer facility in noida#home loan in noida#apply personal loan overdraft facility in noida

2 notes

·

View notes

Text

ADVANCES IN FINANCE: UNLOCKING YOUR FINANCIAL POTENTIAL

Every business requires a substantial quantity of money. Which is vital for every company. It is not possible to vacillate a large amount of money, so he or she needs a source of money. So he has to find the appropriate financial institution or bank for the source of money. For the business owner, advance can be the source of finance which is mainly provided by the bank for companies.

Definition of advances in finance

The landing of money by a Lander or a loaned to be a quick one with a set quantity in interest. Formal contract between lender and a bank to offer a set amount of credit for a certain time period, also known as the advances in finance.

Usually the advance can be short term borrow. In this format they have less legal formalities. When the bank gives advances to clients via overdraft or loan account, this is known as credit by bankers.

What is advance rate

An advance rate is a percentage of the value Which is determined by the bank for the borrower. In different banks, the advance rate is different Which is dependent on borrowed value. The advance rate’s malfunction is the same as the loan value ratio. If a borrower has an advantage rate of 25% and the Present value is $100000 then the maximum advance the borrower can receive $ 25000.

Various types of bank advances

Commercial banks invest their funds in various profitable projects. Commercial bank usually granted which amount of advances is That Given below:

Loan: An advance granted by a bank by opening a loan account for a fixed term by pledging immovable property or debentures as collateral is called a loan. Borrowers can withdraw through such advance checks at one time or at various times as per requirement. The interest rate on such loans is high and interest starts accruing after transfer as loan. Present day long term and medium term loans are known as loans.

For loans of this kind, there is a charge for interest for the loan. Loans are repaid by current accounts. Interest rates for these loans are very high. Bank cost in providing such loans is relatively low. The interest rate on such days is lower as compared to other loans. People can easily collect such loans.

2. Cash : Commercial banks pledge the goods of traders and grant them advances called credit accounts. Borrowers can withdraw such amounts repeatedly up to a specified period. Banks usually don’t provide such loans to customers.

Generally only cash loans are given to clients who have integrity and trustworthiness Borrower can withdraw the sanctioned loan amount in lump sum or in part. By providing such loans, the income of the bank increases. Such loans are repaid in instalments or lump sum. By providing such loans, the good relationship of the bank is developed with the honest and trustworthy businessmen. Customer good behavior Play Bank can give loan to the customer up to a long time through the same.

3. Bank overdraft : As a bank depositor, if the bank gives an opportunity to withdraw the extra specified amount of money, then this principle is called a deposit loan against security. Interest has to be paid on it but only the money has to be paid in print. Businessmen prefer overdraft loans. This type of loan is provided against such security. In case of this type of loan, the bank gives the opportunity to withdraw the excess amount deposited in the current account, but the limit of the excess amount is fixed.

Businessmen have to raise short-term financing needs. Loans can be repaid conveniently. loans can be raised in lump sum or in part.

Conclusion

So ,advances in finance are very important for businessmen to spread their Business. On the other hand , advances in finance are also significant for banks. Because It is a golden opportunity for them to earn profit.

#finance#accounting#stock market#study motivation#studying#studyspo#sales#startup#school#success#advances in finance#loans#personal loans#business loan#financial planning#banking#Bank overdraft#Cash#Commercial bank#advances#financial institution

0 notes

Text

Guide to Understanding Small Business Loans

Australia's thriving entrepreneurial landscape demands accessible financing solutions to fuel business growth and innovation. Small business loans play a pivotal role in empowering local ventures, offering capital infusion to fund expansions, equipment purchases, and business optimisation. The most common reason for SMEs in Australia to look for small business loans is to buy equipment. Cash flow management, business expansions, inventory purchases, and invoice payments are other critical reasons why they need the funds. Loans for small businesses can help entrepreneurs manage exigencies and seize opportunities in the market. Let’s discuss everything you need to know about small business loans in Australia!

Purpose of additional finance SMEs, % Aug 2021 & 2022

WHAT ARE SMALL BUSINESS LOANS?

youtube

A small business loan is a financing option that allows business owners to get a lump sum amount from lenders to manage various business expenses. They are required to repay the loan at a fixed interest rate over a specified period. There are many types of small business loan products that suit a variety of enterprises. From start-up business loans to bad credit small business loans, there are numerous options to explore. Let’s break down the typical terms of small business finance products available in the market:

● Loan Amount: Small businesses can get loans in the range of $5000 to $1 million, depending on a multitude of factors. The average loan amount for small businesses in Australia is on the rise, growing by 15% between 2021 and 2022. Fuelled by post-pandemic recovery, many lenders are now lending more money to small businesses than ever before.

● Loan Term: In most cases, lenders provide small business loans for three months to three years.

● Interest Rate: Small business loan rates Lenders determine the interest rate based on factors like the firm’s financial strength, credit history, availability of collateral, industry prospects and more. A small business loan calculator can help you estimate your potential repayments based on the indicative interest rates typically charged by lenders.

● Repayment Frequency: Small businesses can make weekly, fortnightly, or monthly repayments according to their loan agreement with the lender. This flexibility makes it convenient for small-scale businesses to pay back these loans.

What Can You Do with a Small Business Loan?

A firm can use its small business loan to take care of various business expenses. Lenders usually do not place restrictions on how you can utilise the loan amount, provided it goes towards a legitimate business expenditure. Here are some of the ways of using a small business loan to maximise your firm's potential for success.

(Source: https://www.nbcbanking.com/business-banking/business-lending-guide/how-business-loans-work/)

● Working Capital Needs: Small loans for businesses can help these firms navigate their day-to-day expenses. Seasonal ventures with cash flow fluctuations often rely on small business loans to manage expenditures.

● Equipment Purchase: Many businesses rely on key pieces of equipment to provide their services and drive value for customers. They may need to purchase new equipment or machinery to scale their operations or replace an old asset. In such situations, they can borrow money from lenders to fund this essential business expense.

● Real Estate Investments: If you run a small business, you may want to purchase or lease new premises for your firm. You may want to expand and renovate your current premises or open new branches to grow your business. A small business loan can come in handy for all these purposes and help you take your venture to new heights.

● Buying Inventory: Lack of inventory can lead to the loss of sales and competitive advantage in the market. Hence, it is essential to maintain adequate inventory stocks to meet your demand forecasts. Many firms take out small business loans during festive seasons or other high-demand periods to buy more inventory to cater to the demand.

● Start-up Costs: Often, an entrepreneur may have an excellent business idea, but they may lack the funds to execute their plans. In such situations, small business loans can come to their rescue. They can borrow money to initiate their operations and lay the foundations for growth.

Small Business Loans: Options to Explore

If you want to explore loans for your small business, there are numerous options to explore. Let’s discuss the various types of small business loans available to firms:

● Unsecured Small Business Loans: Small businesses may lack the assets or time required to take out secured loans. In such situations, they can browse unsecured business loans to meet their needs. Lenders provide unsecured loans without any security or collateral. Since the risk for the lender is high, they tend to charge a slightly higher rate of interest to compensate for the same. Unsecured loans are a hassle-free source of funding because it takes very little time to process and approve these loans. A firm needs to submit only their bank statements for loans up to $250K. They can get a quick business loan within 24 hours for a term of 3-36 months if they opt for unsecured credit.

● Secured Small Business Loans: A secured business loan is a lump sum amount lent against some security or collateral. The borrower must offer a real estate property to the lender to secure this type of loan. Secured small business loans are excellent for start-ups that have no business activity or financial strength to show. They can pledge a residential or commercial property as collateral to cover the lender’s risk and get favourable terms on the loan. They can get small business start-up loans up to 80% of the value of their pledged asset. These loans are available for 3-18 months, allowing sufficient time for new firms to set up their operations.

● Small Business Line of Credit: A business overdraft is a flexible source of finance for small business owners. In this case, the lender approves a credit limit, and the firm can withdraw money according to their unique business requirements. They have to pay interest on the amount they withdraw and not the entire credit limit. Business lines of credit in Australia help firms navigate their working capital needs by providing an interest-free buffer.

● Bad Credit Loans: Lenders evaluate the credit score of applicants in detail before approving their loans. However, this does not mean that it is impossible to get a small business loan because of the applicant’s poor personal or business credit history. Bad credit small business loans are available to Australian firms with some stringent terms and conditions. These loans often carry higher rates of interest and have more rigorous lending criteria. Typically, bad credit business loans are available for a short-term period between three to twelve months.

● Short-term Loans: Short-term business loans are perfect for bridging capital needs. Firms can get short-term credit to meet urgent working capital requirements and tackle cash flow fluctuations. These loans require minimal documentation and are usually quick to be processed.

● Small Business Equipment Finance: 27% of SMEs borrow money to buy new equipment to streamline their operations. Hence, lenders frequently offer favourable terms to secure loans for this purpose. Firms can secure equipment loans against the value of the newly acquired asset and pay lower interest rates compared to unsecured loans. These loans can usually be taken for up to seven years, ensuring flexibility and convenience for the borrowers.

Eligibility Criteria to Get Small Business Loans in Australia

Borrowers have to meet the required criteria to be eligible for small business loans. They are as follows:

● Registration: The borrowing firm must have a valid and active Australian Business Number (ABN) to apply for business financing.

● Trading History: Many lenders prefer to advance small loans for business purposes to firms that have been in operation for six months or more. However, start-up businesses can also secure loans by pledging collateral to the lenders.

● Monthly Turnover: Small businesses need a monthly turnover of $5K or more to be eligible for most business loan products.

Advantages and Disadvantages of Taking a Small Business Loan

Small business loans can be a game-changer for business owners who want to grow their ventures or navigate challenging times. However, it is crucial to weigh the pros and cons of these loans before deciding to borrow. Here are the advantages you can expect with small business loans:

● Access to Capital: Small business loans provide a vital infusion of capital, enabling entrepreneurs to fund startup costs, expand operations, invest in equipment, or seize growth opportunities.

● Smooth Cash Flow: Small business loans can help address cash flow gaps, ensuring the continuity of operations and providing stability during lean periods or unexpected expenses.

● Flexibility in Use: Business loans offer flexibility in how the funds are utilised. Entrepreneurs have the freedom to allocate them as needed to drive their business forward.

● Building Credit: Responsible borrowing and timely repayments can help establish and improve your business credit profile. Increasing your credit score can potentially open doors to more favourable terms in the future.

● Quick and Hassle-Free Approvals: In most cases, lenders process small business loans very quickly. You can get unsecured loans in just 24-72 hours, while secured loans take about 3-7 days for unconditional approval and settlement. The experience of applying for small business loans is quite hassle-free, as businesses have to submit just a few documents to facilitate the process. Most small business loans are low-doc, requiring the applicants to submit their last six months’ bank statements and identification proofs to secure approval.

● Variety of Options: Small businesses can explore various loan products to find the options that suit them the best. They can compare small business loan rates and the terms offered by lenders to fit their unique business model. There are numerous small business loans available in the market, allowing business owners to compare the loans and opt for flexible sources of funding.

Now that you know the advantages of taking a small business loan, let’s discuss the potential disadvantages to help you make an informed decision:

● Small Amounts: Lenders often consider small businesses riskier than established firms because of their limitations in scale. As a result, they tend to approve lower amounts for small business loans to minimise their risks.

● Higher Rates of Interest: Small-scale businesses may have to pay a higher interest rate than larger firms with a demonstrated history of success. Lenders tend to charge higher interest rates to cover their risks in case the borrowers go bankrupt and fail to repay their loans. The higher interest rate can lead to high repayments, affecting the firm’s cash flow situation.

● No Guarantee of Business Growth: While small business loans are valuable tools for growing local ventures, they do not guarantee long-term business expansions. Success and growth depend on execution and not just the infusion of funds. A small business loan may not solve long-term business challenges. Hence, it is crucial to carefully weigh your requirements and business plans before taking out a loan.

You should carefully understand these advantages and disadvantages before applying for a loan. A detailed analysis will help you make an informed decision and avoid pitfalls in the future.

How to Apply for a Small Business Loan?

First-time borrowers may be daunted by the idea of applying for a small business loan. SMEs in Australia often struggle to figure out how to get a bank loan for small businesses, with many of them experiencing difficulties in finding a willing lender or an affordable loan. In such cases, firms can work with experienced finance brokers to connect with alternative lenders who offer flexible loan terms for small-scale ventures.

(Source: https://www.smefinanceforum.org/post/survey-finds-funding-gap-is-stifling-small-business-growth-in-australia)

If you are a small business owner looking for an affordable loan, following a structured approach can help you navigate the application process. Here are the steps you can take to simplify your loan application journey:

#1 Determine Your Funding Needs

Before applying for a small business loan, evaluate your funding requirements. Clearly define how much capital you need, what it will be used for, and the repayment terms you can comfortably manage. You can use a small business loan calculator to ascertain the potential repayments and assess if the amount fits your business budget.

#2 Research Loan Options and Eligibility Criteria

Thoroughly research different loan options and lenders to find the most suitable fit for your business. Understand the eligibility criteria for getting a small business loan to suit your requirements. At this stage, you can contact a financial broker to discuss your needs and explore the loan products that may be right for you. Compare the business loans and decide where you want to apply.

#3 Prepare Your Documents

Applicants must submit the required documents to facilitate the loan approval process. If you want a loan up to $250K, a low-doc application will suffice. You need the following documents for low-doc loan approval:

● A valid identification document.

● Bank statements from the past six months.

The lenders may require some more documents based on the nature of the loan you want. For example, if there is no ATO payments cited in the bank statement, the lender may ask for ATO statement. Your finance broker can guide you to prepare the necessary documents for a hassle-free application process.

If you want to apply for an unsecured loan over $250K, you have to submit the following documents in addition to the bank statements and identification proofs:

● Financial statements.

● ATO statements.

You can prepare your documents in advance before filling up your loan application.

#4 Submit the Application

Once you have gathered the required documents, submit your loan application. Ensure that all information provided is accurate and complete. Double-check the application for any mistakes or omissions that could potentially delay the approval process. You can submit your application online with all the required details. Your financial broker can go through your application and forward it to the most suitable lender to fast-track the process.

#5 Review and Accept the Loan Offer

After submitting your application, the lender will evaluate your eligibility and provide their loan offer. Carefully review the terms, including interest rates, repayment duration, and associated fees. Once you are satisfied, you can accept it by following the lender's instructions. If you have any queries, you can consult your financial broker for clarification. Once all requirements are met, the lender will finalise the loan and transfer the funds to your designated account. In some cases, you can receive the approval and the loan amount within just twenty-four hours.

How do Lenders Evaluate Applications for Small Business Loans?

Lenders evaluate the following factors to determine the status of a loan application:

● Industry and Market Factors: Lenders consider the industry in which the business operates, examining its growth potential, market conditions, and competitive landscape. They evaluate the risk associated with your industry's stability and your firm's position within the industry.

● Financial Position: Lenders assess the firm's financial strength to determine whether they can service the debt. Typically, a high monthly turnover is a positive indicator for lenders, leading them to approve higher amounts.

● Security: Lenders may require collateral to secure the loan. They assess the value and marketability of the offered collateral, such as real estate, inventory, or equipment, to mitigate the risk in case of default. If you take an unsecured small business loan, the lenders often prioritise applications where the firm or its directors are asset-backed.

● Credit Score: Lenders carefully assess your creditworthiness by reviewing your personal and business credit history. They consider factors such as your credit score, payment history, outstanding debts, and any past bankruptcies or defaults. The credit score is especially important for a new business, as it can minimise the lender’s risk and make them more likely to issue an approval.

● Trading History: Businesses operating for more than one year often get precedence when lenders evaluate loan applications. However, newer firms can also get start-up business loans from several alternative lenders.

Lenders analyse these factors to determine the loan amount, interest rate, and other terms they are willing to approve. Evaluating these aspects can give you more clarity about your loan prospects.

Tips to Simplify Your Small Business Loan Application Process

Applying for a business loan can be a complex process, but with the right approach, you can simplify it and increase your chances of success. By taking steps to streamline your loan application, you can save time, reduce stress, and present an excellent application to lenders. Here are some tips to simplify your application:

● Strengthen Your Credit Profile: You should prioritise improving your credit profile by paying bills on time, reducing outstanding debts, and correcting any errors on your credit report. A strong credit profile enhances your credibility and increases your chances of loan approval.

● Consult a Finance Broker: Once you identify your funding requirements, you can start exploring suitable options. Many SMEs in Australia struggle to find bank loans to fund their business operations. If you face this issue or do not know how to get a bank loan for your small business, it is better to partner with a finance broker. These brokers can connect you to a network of alternative lenders who provide tailored financing solutions for your firm. Moreover, their expertise can help you navigate the complexities and ensure your application is thorough and compelling. They can guide you about various aspects of the process and provide you with relevant information. From average loan amounts for small businesses to typical interest rates, they have in-depth knowledge about all facets of small business loans to help you.

● Explore Government Schemes: You can check government small business loans to find options that may fit your needs. The Australian government sometimes initiates loan assistance programmes to fuel the growth of SMEs. A knowledgeable finance broker can provide you with information about government small business loan schemes, enabling you to make the best decision for your firm.

● Prepare a Detailed Business Plan: Although lenders do not mandate the submission of a business plan, it is better to be prepared to demonstrate your growth trajectory. Craft a detailed and professional business plan that outlines your business objectives, strategies, financial projections, and market analysis. A well-prepared plan demonstrates your preparedness and increases the lender’s confidence.

If you want guidance and support to apply for various small business loans, you should contact Broc Finance today! Its team of financial brokers can help you apply for working capital loans and other credit options to help you achieve your business goals.

Source: https://www.brocfinance.com.au/blog/guide-to-understanding-small-business-loans/

#working capital loans#business overdraft#Business lines of credit in Australia#bad credit business loans#Short-term business loans#unsecured business loans#small business loan

0 notes

Text

5 Different Types Of Business Loans In India

Are you planning to finance your business to take it to the next level? Well, when it comes to business loans Indian financial institutions have multiple options under business loans. Check out these 5 different types of business loans available in India.

1. Startup Loans

In case you’re in the early stages of your business, then startup loans are one of the best options for you. With this loan you don’t have to worry about handling the expenses of starting a company, hiring employees, buying inventory, or marketing.

2. Business Loan For Women

For all the female entrepreneurs out there, several banks and NBFCs offer special financing to get you started with your small to medium businesses. Some of the advantages are low interest rates, quick loan disbursements, and flexible loan amounts.

3. Term Loans

Term loans are basically where lenders offer lump sum amounts that can be repaid over a particular period of time at a certain interest rate. These loans are great for long-term investments like growing operations, launching a new company, or acquiring a new property.

Also Read: 5 Best Banks And NBFCs For Business Loans In India

4. Business Overdraft

If you have a fixed deposits with your lending institution, then you can go for this type of business loan. With a business overdraft, you can borrow the amount you require and pay interest on only what is utilized.

5. Loan Against Property

A loan against property is exactly what it sounds like, you get a loan by pledging your property as collateral. Although, you need to make sure that the property is free of any active legal conflict. In case of default in repayment, there’s a risk of losing the collateral.

To Sum Up

As a business owner, you can choose any of these type of business loan. All you need to do is pick the financing option that best suits your company’s profile and needs.

0 notes

Link

A Letter of Credit

A letter of credit is a type of business loan, an important document that is a form of guaranteeing the buyer’s payment to the sellers. Generally, it is issued by the bank and ensures timely and full payment to the seller. In case the buyer defaults on the payment, then the bank covers the full or whichever remaining amount on behalf of the buyer.

A information about letter of credit is issued against a pledge of securities or cash. Banks typically collect a fee. For instance, percentage of the size or amount of the letter of credit.

Parties to a Letter of Credit

Importer, which means an applicant requests the bank to issue the Letter of credit.

Thereafter, an importer bank (issuing bank which issues the LC also known as the opening banker of LC).

Types of a Letter of Credit

There are several types of letters of credit that are categorized into the following categories:

Sight Credit: Under this type of LC, documents are payable at the sight/upon presentation of the correct documentation. A businessman can present a bill of exchange to a lender along with a sight letter of credit and take the necessary funds right away. A sight letter of credit is more immediate than other forms of letters of credit.

Usance Bill:

The Bills of Exchange which are drawn and payable after a period, are called usance bills. Under acceptance credit, these usance bills are accepted upon presentation and eventually honoured on their respective due dates.

Revocable and Irrevocable Credit: A revocable what is letter of credit is a credit, the terms and conditions of which can be cancelled by the importer/issuing bank. This cancellation can be done without prior notice to the beneficiaries. An irrevocable credit is a credit, the terms and conditions of which can neither be amended nor cancelled. Hence, the opening bank is bound by the commitments given in the LC.

#information about letter of credit#what is letter of credit#lc discounting#bank guarantee#bank overdraft#loan against property#business loan#financeseva

1 note

·

View note

Note

So I do have some good news for a change. One of the apartments we were wait listed at has given us five business days to come in and complete the move in packet for living there! I still have a bunch of big loan stuff to pay off, two payday loans coming out on the 10th and some overdraft issues, but we're getting closer! Could you share my post? It's up at https://www.tumblr.com/mousedetective/755314934535077888/please-help-the-only-help-ive-gotten-recently-is

Fingers crossed for you!

17 notes

·

View notes

Text

On April 30th 1728 The Royal Bank of Scotland invented the overdraft when William Hogg overdrew by £1,000 (over £66,000 at today’s money).

Merchant William Hog was having problems in balancing his books and was able to come to an agreement with the newly established bank that allowed him to withdraw money from his empty account to pay his debts before he received his payments. He was thus the first recipient of an official cash credit from a bank in the world.

Within decades, the advantages of this system, both for customers and banks, became apparent, and banks across the United Kingdom adopted this innovation.

With the onset of industrialisation, new businesses needed an easy form of credit to jump-start their activities, without having to take out loans on securities they didn’t necessarily have. The importance of this new financial innovation was recognised by the philosopher David Hume who described it in one of his essays as ‘one of the most ingenious ideas that has been executed in commerce’.

14 notes

·

View notes

Text

SVB bailouts for everyone - except affordable housing projects

For the apologists, the SVB bailout was merely prudent: a bunch of innocent bystanders stood in harm’s way — from the rank-and-file employees at startups to the scholarship kids at elite private schools that trusted their endowment to Silicon Valley Bank — and so the government made an exception, improvising measures that made everyone whole without costing the public a dime. What’s not to like?

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/15/socialism-for-the-rich/#rugged-individualism-for-the-poor

But that account doesn’t hold up to even the most cursory scrutiny. Everything about it is untrue. Take the idea that this wasn’t a “bailout” because it was the depositors who got rescued, not the shareholders. That’s just factually untrue: guess where the shareholders kept their money? That’s right, SVB. The shareholders of SVB will get billions in public money thanks to the bailout. Billions:

https://pluralistic.net/2023/03/18/2-billion-here-2-billion-there/#socialism-for-the-rich

But is it really public money? After all, the FDIC payouts come from a pool of funds raised from all of America’s banks. The billions the public put into SVB will be recouped through hikes on the premiums paid by every bank. Well, sure — but who do you think the banks are going to gouge to cover those additional expenses? Hint: it’s not going to be the millionaires who get white-glove treatment and below-cost loans. It’ll be the working people whom the banks steal billions from every year in overdraft fees — 78% of these are paid by 9.2% of customers, the very poorest, and they amortize to a 3,500% loan:

https://pluralistic.net/2021/04/22/ihor-kolomoisky/#usurers

As Adam Levitin put it on Credit Slips:

They will pass those premiums through to customers because the market for banking services is less competitive than the market for capital. In particular, the higher costs for increased insurance premiums are likely to flow to the least price-sensitive and most “sticky” customers: less wealthy individuals. So average Joes are going to be facing things like higher account fees or lower APYs, without gaining any benefit. Instead, the benefit of removing the cap would flow entirely to wealthy individuals and businesses. This is one massive, regressive cross-subsidy. It’s not determinative of whether raising the cap is the right policy move in the end, but this is something that should be considered.

https://www.creditslips.org/creditslips/2023/03/the-regressive-cross-subsidy-of-uncapping-deposit-insurance.html

The SVB apologists display the most curious and bizarre imaginative leaps…and imaginative failings. For them, imagining that regulators will just wing it to the tune of hundreds of billions in public money is simplicity itself. Meanwhile, imagining that those same regulators would say, “Not one penny unless every shareholder agrees to sign away their deposits” is literally impossible.

This bizarrely inconstant imagination carries over into all of the claims used to justify the SVB bailout — like, say, the claim that if SVB wasn’t bailed out, everyone would pile into too big to fail banks like Jpmorgan. This is undoubtably true — unless (and hear me out here!), regulators were to use this failure as a launchpad for public banks, and breakups of Jpmorgan, Wells Fargo, Citi, et al.

This is a very weird imaginative failure. America operated public banks. It had broken up too big to fail banks. These weren’t the deeds of a fallen civilization whose techniques were lost to the mists of time. There are literally people alive today who were around when America operated nationwide public banks — a practice that only ended in 1966! We’re not talking about recovering the lost praxis of the druids who built Stonehenge without power-tools, here.

The most telling imaginative failure of SVB apologists, though, is this: they think that people are angry that the government saved the janitors at startups and the scholarship kids at private schools, and can’t imagine that people are angry that America didn’t save anyone else. If you’re a low-income student at an elite private school, there’s billions on hand to save you — but not because the government gives a damn about you — saving you is a side effect of saving all the rich kids you go to school with.

Likewise, the startup janitors aren’t the target of the bailout — they’re overspill from the billions mobilized to rescue the personal fortunes of tech billionaires who supply VCs’ investment capital. If there was a way to bail out the startups without bailing out the janitors, that’s exactly what would happen.

How do I know this? Well, first of all, the “investors” who demanded — and received — a bailout are on record as hating workers and wanting to fire as many of them as possible. As one of the loudest voices for the bailout said of Twitter employees, in a private message to Elon Musk following the takeover: “Day zero: Sharpen your blades boys 🔪”:

https://pluralistic.net/2023/03/21/tech-workers/#sharpen-your-blades-boys

But there’s even better evidence that the bailout’s intended target was wealthy, powerful people, and every chance to carve out working people was seized upon. When regulators engineered the sale of SVB to First Citizens Bank, they did not require First Citizens to honor SVB’s community development obligations, killing thousands of affordable housing units that had been previously greenlit:

https://calreinvest.org/wp-content/uploads/2021/05/Community-Benefits-Plan-SVB-CRC-GLI.pdf

Tens of thousands of people wrote to regulators, urging them to transfer SVB’s Community Benefits Plan obligation to First Citizens:

https://www.dailykos.com/campaigns/petitions/sign-the-petition-save-affordable-housing-keep-the-promises-silicon-valley-bank-made

As did Rep Maxine Waters, the ranking member of the House Financial Services Committee:

https://democrats-financialservices.house.gov/uploadedfiles/318_cwm_ltr_fdic.pdf

But First Citizens — a bank whose slot in America’s top-20 banks was secured through a string of exceptions, exemptions and waivers — was not required to take on SVB’s obligations to carry out loans to build thousands of affordable housing units in the Bay Area and Boston, including a 112-unit building for people with disabilities planned for a plum spot across from San Francisco City Hall:

https://www.levernews.com/regulators-stiffed-low-income-communities-in-silicon-valley-bank-bailout/

All those people who wanted SVB’s community development obligations to carry forward vastly outnumbered the people calling for billionaires portfolio companies to be saved — but they merely spoke on behalf of people who sought the most basic of human rights — shelter. No one listened to them. Instead, it was the hyperventilating all-caps “investors” who spent SVB’s no-good weekend shouting on Twitter about the fall of civilization who got what they wanted, with a bow on top, and a glass of publicly funded warm milk before bed.

The US finance sector is reckless to the point of being criminally negligent. It constitutes an existential risk to the nation. And yet, every time it gets into trouble, regulators are able to imagine anything and everything to shift their risks to the public’s shoulders.

Meanwhile, everyday people are frozen out. School lunches? Unaffordable. Student debt cancellation? Inconceivable. Help for the hundreds of thousands of NYC schoolchildren whose schools are facing a $469m hack-and-slash attack? That’s clearly impossible:

https://council.nyc.gov/joseph-borelli/2022/09/06/nyc-council-calls-for-mayor-adams-doe-to-fully-restore-469m-in-school-funding/

When it comes to helping everyday people, American elites and their captured champions in the US government have minds that are so rigid and inflexible that it’s a wonder they can even dress themselves. But when the fortunes and wellbeing of the wealthy and powerful are on the line, their minds are so open that some of their brains actually leak out of their ears and nostrils:

https://pluralistic.net/2023/03/15/mon-dieu-les-guillotines/#ceci-nes-pas-une-bailout

Every bank merger is supposed to come with a “public interest analysis.” But these analyses are “perfunctory.” They needn’t be:

https://openyls.law.yale.edu/bitstream/handle/20.500.13051/8305/Kress_Article._Publication__1_.pdf

First Citizens got a hell of a bargain: it paid zero dollars for SVB’s assets, its deposits and its loans. Any losses it incurs from its commercial loans over the next five years will be paid by the FDIC, no questions asked. The inability of regulators to convince First Citizens to assume SVB’s community obligations along with those billions in public largesse speaks volumes.

Meanwhile, SVB’s shareholders continue to claim that their headquarters are a relatively unimportant office in Manhattan, and not their glittering, massive corporate offices in San Jose, as part of their bid to shift their bankruptcy proceeding to the Southern District of New York, where corporate criminals like the Sackler opioid family have found such a warm reception that they were able to escape “bankruptcy” with billions in the bank, while their victims were left in the cold:

https://pluralistic.net/2023/03/18/2-billion-here-2-billion-there/#socialism-for-the-rich

Contrary to what SVB’s apologists think, the case against them isn’t driven by spite — it’s driven by fury. America’s “socialism for the rich, rugged individualism for the poor” has been with us for generations, but rarely is it so plain as it is in this case.

There’s only two days left in the Kickstarter campaign for the audiobook of my next novel, a post-cyberpunk anti-finance finance thriller about Silicon Valley scams called Red Team Blues. Amazon’s Audible refuses to carry my audiobooks because they’re DRM free, but crowdfunding makes them possible.

[Image ID: A glass-and-steel, high-tech office building. Atop it is a cartoon figure of Humpty Dumpty, whose fall has been arrested by masses of top-hatted financiers, who hold fast to a rope that keeps him in place. At the foot of the office tower is heaped rubble. On top of the rubble is another Humpty Dumpty figure, this one shattered and dripping yolk. Protruding from the rubble are modest multi-family housing units.]

Image:

Lydia (modified) https://commons.wikimedia.org/wiki/File:Vicroft_Court_Starley_Housing_Co-operative_%282996695836%29.jpg

Oatsy40 (modified) https://www.flickr.com/photos/oatsy40/21647688003

Håkan Dahlström (modified) https://www.flickr.com/photos/93755244@N00/4140459965

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#housing crisis#svb#silicon valley bank#plutocracy#bailouts#affording housing#socialism for the rich#rugged individualism for the poor#regional banking#community development banks#housing

89 notes

·

View notes

Text

So, after getting off to an uncharacteristically good start at the beginning of the year, lately I haven’t been posting much at all. Partly because I haven’t been drawing much, but partly because I haven’t even been getting around to posting what I have been drawing. And I figured I may as well make a post explaining what’s going on.

The short answer is: I’ve kind of been under a lot of stress lately because of my finances. My income has been... rather lower than usual as of late, and I’ve been scraping by, but it hasn’t been easy. To pay my rent last month (and reinstate my medical insurance that had just been canceled due to nonpayment), I had to take out a title loan on my car. (The initial loan for which I’d only finally finished paying off a few months before.) My checking account got hit with overdraft fees twice in the last month (because of recurring payments I’d forgotten about, which I didn’t have enough in my account to cover). My phone was disconnected a few days ago, and—since I kind of need the phone connection to get work—I had to get it reconnected by making a payment despite not having the money in my checking account to cover it, counting on finding a way to get the money in there before the payment actually went through so I could avoid a third overdraft fee (I managed to do so, but it wasn’t easy). All of these things have made it kind of difficult to focus on creative work, as much as I’d like to.

The reason that I've been having financial troubles is because, well, I just haven’t been working much. (You might think less work equals more time for Tumblr, but less work also equals less money and that equals a lot more stress.) And the reason I haven’t been working much is because of the WGA strike. As I think I’ve mentioned before, I work in the film industry, specifically as a studio teacher. I work with child actors; whenever there’s a minor doing any sort of film or voice-recording-related job (with a few special exceptions), the production is legally required to have a certified studio teacher present. If it’s a schoolday I have to make sure the minor gets three hours of schoolwork; if it’s not a schoolday, a studio teacher is still required, but then my job is just to keep an eye on things and make sure production is following child labor laws and not having the minor do anything dangerous or inappropriate. Anyway, the WGA strike means there’s a lot less filming going on, which means a lot less work for anyone in the film businesses, including studio teachers.

All that being said, I don’t mean to imply that I don’t support the WGA strike. The writers have legitimate grievances, and the strike is fully justified. I don’t like the effect it’s having on my finances, but if anyone’s to blame for that it’s the producers, not the writers. As a matter of fact, while I’m not a member of the WGA, and thus wasn’t involved in voting to authorize the strike, I am a member of SAG-AFTRA, the actors’ union, and I did vote yes on the SAG-AFTRA strike authorization, even though if SAG-AFTRA also goes on strike it will, if anything, mean even less work for me as a studio teacher while the strikes are going on. I support the strike. But yeah, it’s making things difficult for me right now.

(For those unaware of the details of what’s going on, SAG-AFTRA’s contract with the AMPTP—the Alliance of Motion Picture and Television Producers—expires on June 30, and SAG-AFTRA and the AMPTP are currently engaged in contract negotiations. The strike authorization vote (in which 97.91% of the votes were in favor) doesn’t mean SAG-AFTRA definitely will strike; it just means that the members have given the go-ahead for the union leadership to call for a strike if warranted, i.e. if SAG-AFTRA and the AMPTP don’t come to an acceptable agreement by the 30th. Still, at the moment, a SAG-AFTRA strike seems significantly more likely than not. The AMPTP’s contract with the DGA, the Directors Guild of America, also expires on the 30th, but the AMPTP and the DGA have already come to a tentative agreement, which has been unanimously approved by the national board—though the DGA membership still has to vote to accept the agreement, the deadline for which vote is June 23rd. So it’s still theoretically possible that the DGA membership will reject the agreement and the DGA could also go on strike, but at this point that seems unlikely. But even without the Directors Guild involved, a simultaneous strike by the WGA and SAG-AFTRA will... have effects.)

Anyway, though, despite my current circumstances I really need to start getting things done, and I’ll try to start posting more frequently again. I still have a whole bunch of @sequentialartistsworkshop Friday Night Workshop comics from the last few months I haven’t posted. Also, I want to participate in Art Fight again this year, and I want to get more character references up for that. Plus I want to finally relaunch my long-dormant webcomic, Soup, in two months, and there’s a lot I need to do to make that happen. So... yeah, I’ve going through some difficult times lately, but I have a lot of work I want to get done, so I’m going to try to get back on the ball.

#apology#WGA#wga strike#writers strike#sag-aftra#sag-aftra strike#support the wga#i stand with the wga#studio teacher

26 notes

·

View notes

Text

How Does Bank of America Compare to Other Major Banks?

Bank of America is one of the largest banks in the U.S. They have a strong network of branches. You can find them in many places. This makes them very convenient. If you need to deposit cash or talk to someone, it’s easy. Many people like this. Other big banks like Chase and Wells Fargo also have many branches. But Bank of America stands out for its easy access. Their customer service is also good. However, some say they prefer smaller banks for a more personal touch.

Bank of America has many services. They offer checking, savings, and credit cards. You can also get loans and mortgages. Their mobile app is simple to use. It lets you check your balance, pay bills, and send money. Many users love this app. They say it makes banking easy. Other big banks also have apps. For example, Chase’s app is popular too. But Bank of America’s app has a strong reputation. It’s reliable and fast.

When it comes to fees, Bank of America is similar to other big banks. They have fees for overdrafts, monthly maintenance, and out-of-network ATMs. But you can avoid some fees. For example, by keeping a minimum balance. Some people find these fees high. They compare them to online banks like Ally, which have lower fees. Still, Bank of America offers good benefits. Their rewards programs on credit cards are popular. Overall, Bank of America is a solid choice. They compete well with other big banks.

Discover Seekiny: Your Comprehensive Source for USA Contact Information

For in-depth access to extensive USA contact details, explore the Seekiny directory. Offering a wide array of listings, this resource ensures you can find specific contacts across various industries and regions within the United States. Whether you're searching for business contacts, customer service numbers, or professional connections, Seekiny is a dependable platform to streamline your search. Utilize its user-friendly interface and vast database to access the most relevant and current contact information tailored to your needs. Efficiently uncover detailed American business contact information with the Seekiny directory today.

2 notes

·

View notes

Text

Pre-approved personal loan in Noida

Are you Looking for a pre-approved personal loan in Noida? You're at the right place! Our Noida-based business is committed to helping individuals like you achieve financial freedom and accomplish their goals. Our streamlined loan application process ensures a quick and hassle-free experience at finaqo. Let go of your worries and get ready to tackle life's challenges head-on with our exclusive loan offerings. Whether it's funding your child's education or upgrading your Noida home, our Personal loan apply online is designed to suit your needs. Experience our customer-oriented service and competitive interest rates. Apply for home loan in Noida. Visit our website link Apply now: https://finaqo.in/

#Pre approved personal loan in Noida#personal loan apply online in noida#Apply for overdraft facility in Noida#Apply for Credit Card Balance Transfer Loan in Noida#Home loan balance transfer services in Noida#Apply for business loan in noida#Apply for home loan in noida#loan against property in noida

2 notes

·

View notes

Text

GUIDE TO UNDERSTANDING UNSECURED BUSINESS LOANS

Small and medium enterprises (SMEs) in Australia play a crucial role in the national economy. They collectively provide over 65% of the private sector employment and contribute more than $700 billion to the country's GDP. However, despite their economic significance, many SMEs struggle to get loan approvals from traditional lenders like banks. In such situations, they can rely on alternative financing sources for business loans in Australia. SMEs can explore numerous loan products and choose the options that suit their requirements. Some of the most popular loan products fall in the category of unsecured loans. An unsecured business loan allows a firm to secure collateral-free funding, helping it manage urgent expenses and fuel critical expansion plans. Let’s discuss this funding option in detail and understand how to get the best unsecured business loans!

Unsecured Business Loans: An Overview

An unsecured business loan is a financing option that allows a firm to borrow money without providing any collateral. The collateral represents an asset offered as a security to the lender. A firm must submit collateral for secured business loans, allowing the lender to liquidate this asset if the borrower fails to repay the money. Since an unsecured loan does not involve this security, the lender issues it based on the firm’s performance, financial health, and creditworthiness.

Unsecured small business loans are perfect for firms that require quick funding or lack the assets to apply for secured loans. Lenders often charge slightly higher interest rates on unsecured loans to compensate for their risks. However, borrowers often prefer unsecured financing over secured loans when they have an urgent need for cash. Fast unsecured business loans can get approved within one to three days, providing businesses with a much-needed infusion of cash. Firms can get unsecured loans for various business purposes. They may utilise the amount for buying inventory, paying wages, financing renovations, or managing their working capital needs. While the proportion of unsecured loans may be low compared to other forms of SME financing, these options are highly advantageous for new businesses that require quick funding.

youtube

Unsecured business loan interest rates and other terms vary based on several factors. Lenders consider the borrower's requirements, the associated risks, and their internal policies while determining the loan terms. However, typically, the terms for unsecured business finance fall within the following range:

● Amount: Firms can borrow between $5,000 and $500,000 without providing any collateral.

● Interest Rate: Unsecured business loan rates start from 5.5% per annum.

● Loan Term: Firms can take an unsecured business loan for three months to three years.

● Frequency of Repayments: Borrowers can repay the loan on a daily, weekly, or fortnightly basis.

● Approval Time: The pre-approval process takes between two to four hours. Additionally, the unconditional approval and settlement procedures require one to three days.

Types of Unsecured Business Loans

SMEs have several options to get quick business loans without providing any security. The following are the three unsecured business loan types to consider depending on a firm's unique requirements:

● Small Business Loans

Unsecured small business loans allow SMEs to get a lump sum amount without tying up their assets. The application and approval processes are seamless and quick, allowing the borrower to secure funding within twenty-four hours.

● Business Line of Credit

A business line of credit in Australia is a flexible financing option. The lender approves a credit limit and the borrower withdraws the amount they need. The firm can borrow any sum under the limit and pay interest on the amount they utilise. An unsecured business overdraft facility can help seasonal businesses navigate cash flow fluctuations with minimum risk and hassle.

● Invoice Finance

The invoice finance facility allows a firm to take a loan against their unpaid invoices. The lender provides an advance based on the value of pending invoices. The firm can borrow large sums without submitting assets like equipment or property.

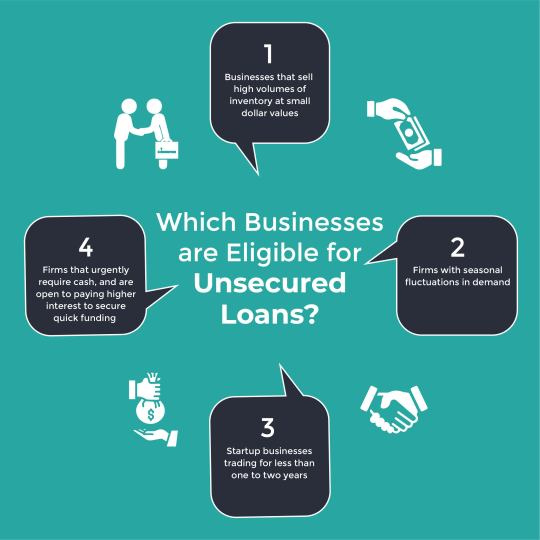

Which Businesses are Eligible for Unsecured Loans?

Firms must meet the eligibility criteria for getting unsecured loans.

The following are the minimum requirements to qualify for collateral-free small business loans:

● ABN: The firm must have an active Australian Business Number (ABN) to apply for collateral-free funding. In Australia, sole traders are not mandated to register for an ABN. However, if you apply for unsecured business loans for sole traders, having a registered ABN is required.

● Business History: The borrower must demonstrate that the firm has been operational for six months or longer to get a collateral-free working capital loan.

● Turnover: The firm must have a monthly turnover of at least $5000. This requirement ensures the business is financially stable enough to service repayments considering typical unsecured business loan rates.

A business owner must assess if they meet the eligibility criteria before applying for an unsecured loan. In addition, they should also consider if this form of funding is suitable for their business. Typically, the following types of businesses benefit the most from unsecured loans:

● Businesses that sell high volumes of inventory at small dollar values.

● Firms with seasonal fluctuations in demand.

● Startup businesses trading for less than one to two years.

● Firms that urgently require cash, and are open to paying higher interest to secure quick funding.

Pros and Cons of Taking an Unsecured Business Loan

A firm can leverage several benefits when they get an unsecured business loan. However, they must also consider certain downsides before deciding to go for collateral-free funding. The following are the top advantages of taking an unsecured loan:

● No Need for Collateral: Unsecured business loans allow business owners to get access to funds without putting up their assets as security. They can keep their property and other valuable assets safe no matter what happens in the business. Startup enterprises with little to no assets also benefit from unsecured business loans.

● Quick and Seamless Approval Process: Unsecured loans require minimal documentation as no collateral is involved. In most cases, firms can get low-doc approvals when they apply for unsecured business loans upto $500,000. The approval process takes less than a day for most applicants, and a borrower can get the money in their account within one to three days.

● Cash Flow Optimisation: Unsecured loans can help businesses manage their cash flow fluctuations more efficiently. The quick infusion of cash allows the borrower to optimise their cash flow and fulfil their working capital requirements. This aspect is especially beneficial for seasonal businesses that experience a lot of variations in their cash flow.

● Flexibility in Use of Funds: Unsecured loans offer flexibility in how you can utilise the money. Unlike certain forms of business lending like asset or trade finance, unsecured loans do not have hard and fast rules about the use of funds. Business owners can use it for inventory, expansion, hiring, or any other business purpose.

● Building a Good Credit History: Many alternative lenders provide collateral-free funding to businesses that do not have high credit scores. Your firm can get an unsecured business loan with a bad credit history and focus on timely repayments to improve the records. When you repay the loan diligently over time, it can help you build a strong credit history to get better loan terms in the future.

Businesses should consider both sides of the coin when they compare business loans and decide on the type of loan to choose. The following are some potential issues that borrowers must keep in mind while taking unsecured loans:

● Higher Interest Rates: An unsecured loan represents a high risk for the lender. If the borrower defaults on the repayments, the lender cannot fall back on any collateral to recoup their loss. That is why they charge a higher interest rate that reflects this risk. However, the interest rates vary depending on the unsecured business loan types and the creditworthiness of the borrowing firm.