#business loans rate

Explore tagged Tumblr posts

Text

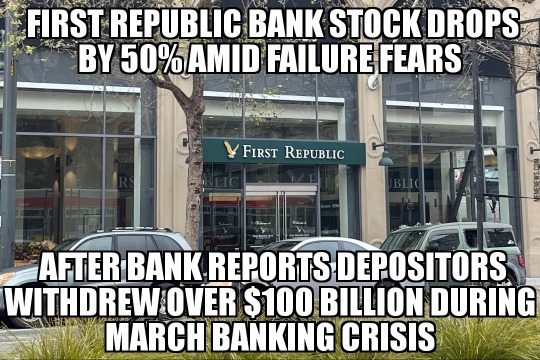

First Republic Bank stock drops

View On WordPress

#America#bank#banking#business#economy#first republic#first republic bank#interest rate#loans#meme#memes#money#news#recession#united states

45 notes

·

View notes

Text

#Business Loan Interest Rates#Business Loans For Business#Interest Rate in Business Loan#Business Loan calculator#Personal and Business Loans#Small Business Loan Rates#Quick Business Funding#Best Small Business Loan#Low Interest Business Loans#Best bank For Business Loans#Business Loans UK#Loan For Small Business UK#Loan Business UK#Business lending UK#Company Loans UK#Best Business Loan Rates UK#Business Loans Interest Rates UK#Business Loans For New Business UK#Short term Business Loans UK#Low Rate Business Loans UK#aFFordable Business Loans#Business Borrowing#Business Loan Funding#Business Loans For Same Day Funding#Cash Flow Loans#Eligibility Criteria For Business Loan#Fast and Affordable Business Loan#Flexible and Affordable Business Loan#Flexible Business Loan Criteria#Hassle Free Business Loans

3 notes

·

View notes

Text

Sunlite Mortgage: Your Licensed Mortgage Experts in Ontario

Sunlite Mortgage is a trusted name mortgage license in Ontario. Our qualified professionals offer expert advice and assistance in navigating the mortgage landscape. Whether you're buying a home or refinancing, count on Sunlite Mortgage for reliable and compliant mortgage services in Ontario. For more information visit our website.

#business loans alberta#small business loans alberta#small business startup loans#mortgage brokers in mississauga#mortgage brokers ottawa rates

2 notes

·

View notes

Text

any time I see people tying minor world events to economics I’m like. that’s not how economics works. I know you want it to be how it works so you can blame someone. but that’s not how it works in any country or global economy.

#it’s like saying gravity only exists on Tuesdays#this is directly looking at two things:#one: saying the FFR (federal funds rate) is why ‘start up’s’ in the gig economy are failing#and two: someone saying we should cause a bank run (multiple bank runs) when we’re still in pre-recession waters#per point one: the FFR is for banks and credit unions and determines what rate at which lending happens#it effects things like housing; car loans; savings accounts; etc because it sets a floor at which interest rates have to be#it does not affect how much money VCs pour into companies they think are going to be worth billions#which VCs pour money into them so they get a % of the company as stock#so they’re incentivized for the company to do well and make them a profit when they go public#not to say these companies might not have traditional bank loans but it’s very unlikely for the amount they’re spending#additionally as we all should have learned from the Glass-Stegel act and the 08 crash#banks need to keep their commercial investments and consumer investments separate#so yes these companies are failing…. but for other reasons like increased regulation; changing preferences in the consumer and economy;#but MOSTLY they were unsustainable businesses at the onset; they didn’t need to be profitable; just go public and make billions on stock#now for point two this one is simple: IF YOU CAUSE MULTIPLE BANK RUNS#THEY BECOME A SELF FULFILLING PROPHECY#AND THEN MORE BANKS FAIL AND WE GET A RECESSION#all caps were necessary here#if you look at the Great Depression (a great example of a banking panic)#not all of the banks were initially failing#but by people panicking about their money (and a lack of the FDIC at the time)#but because people panicked and pulled their money out the banks failed anyway and caused the worst recession in US history#so yes feel free to cause a banking run and tank the economy#it’s likely Europe will enter a recession in the next 6 months so please exacerbate the situation#(which because global economy will push us further into possible recession)#I’m sure people will have plenty of time to feel smug and superior while sitting on a mattress of cash and looking for jobs#ugh anyway bad economics bothers me#just cause you watched a dude rant about it on YouTube (when he doesn’t know what a Phillips curve is) doesn’t mean you know economics#thoughts? thoughts#or: wHy DoNt YoU jUsT bAlAnCe ThE eCoNoMy LiKe My ChEcKbOoK

1 note

·

View note

Text

I believe this is what they call: ''having a bank account''

Whenever you visit the dragon’s lair, you give some treasure instead of taking some. People think you are crazy for doing this.

#writing prompts#I would read the fuck out of a fantasy story in which dragons are just like. Mega banks.#Instead of destroying towns and kidnapping princesses. They just like embezzle money and bribe local rulers#The story is about a protagonist who has been financially ruined by a bank because of crippling loans with unfairly high interest rates#And now seeks to take them down by exposing their scandals and shady business practices

4K notes

·

View notes

Text

"Why Buy Property? Top Reasons and Tips for Making a Smart Real Estate Investment"

"Thinking about buying property? Discover the top benefits of property ownership, essential tips for first-time buyers, and insights on choosing the best location for a solid real estate investment. Read our guide on why buying property can be your smartest financial move."

Are you considering buying property but not sure where to start? Purchasing real estate is one of the most significant financial decisions you can make, and it offers benefits that go beyond just owning a home. This article dives into the advantages of property ownership, from building equity and creating a stable investment to diversifying your portfolio. Learn how location, timing, and financing play crucial roles in your buying process. Whether you're a first-time buyer or a seasoned investor, our guide provides insights to help you make the best choices and maximize your returns. Discover why now might be the perfect time to buy property and how to navigate the journey with confidence.

#property#propertyforsale#propertyinvestment#realestate#realtor#business loan#loans#home loan#rates#real estate investing#investors#investment

0 notes

Text

MSME Business Loans Interest Rate to Empower Small and Medium Businesses

Need funding for your MSME? Discover the current msme business loan interest rate and find a solution that meets your financial requirements for growth and success.

0 notes

Text

In the dynamic world of entrepreneurship, access to capital is crucial for driving growth and innovation. For many business owners, securing the right financing can be the key to unlocking new opportunities. One effective solution is obtaining loans specifically designed for business needs. These financial products provide the necessary funds to cover various expenses, from purchasing equipment and inventory to expanding operations and managing cash flow.

Business loans offer flexibility, allowing entrepreneurs to choose the amount and repayment terms that best suit their financial situation. Whether you are a startup looking to establish your presence or an established company aiming to scale, tailored financing can help you achieve your goals. With competitive interest rates and diverse options available, business owners can find a loan that aligns with their unique requirements.

Moreover, the application process has become more streamlined, with many lenders offering quick approvals and minimal documentation. This accessibility empowers entrepreneurs to act swiftly on growth opportunities. By leveraging business loans effectively, companies can invest in their future, enhance operational efficiency, and ultimately drive success in an increasingly competitive market. Embracing the right financial solutions is essential for any business looking to thrive and expand.

0 notes

Text

Smart Business Financing: How a Business Loan Calculator Helps You Plan

Finding funding for your business expansion is not a walk in the park. A loan is often a prerequisite for pursuing new ventures, increasing operations, or enhancing systems. On the contrary, incurring debt may turn out to be a bad idea if one does not have a plan in place for it. If there is no plan, a business loan becomes a financial straitjacket than a means of growth. This is where a business loan calculator comes in handy. This effective instrument allows you to estimate how much you will repay the loan, how much it will interest you, and check several poses of financing options before you take the loan.

A business loan calculator is a device that ranks as one of the most budgets in every smart business planning. Its importance in cost accounting and in making any decisions regarding the finances of your entity is most prominent.

What is a Business Loan Calculator?

A business loan calculator is a specific type of online device that is available to business owners with the aim of estimating loan repayments in relation to some major factors such as the loan amount and application period as well as interest rate. In other words, after determining these parameters, you will as clearly as possible see what your monthly or weekly payment will look like. It helps to plan finances as it is possible to assess several alternatives for loans taken or for repayment terms, thus helping one to opt for the best financial solution possible for the company.

How Does a Business Loan Calculator Work?

A business loan calculator employs the technique of computation in determining the total amount spread in the entire loan term together with the interest. This is the information that one usually needs to put into the calculator:

Loan amount: The sum total of the money that you are required to borrow.

Interest rate: The cost charged on the borrowed amount lent by a financial institution.

Repayment period: Duration in which the loan will be settled.

After these values have been provided, the other function of the loan calculator is very useful in estimating how much the borrower has to pay on a weekly or monthly basis. This gives a point of reference on the possible impact of various loan arrangements on the borrower’s cash flow and even their overall financial situation in the future.

Benefits of Using a Business Loan Calculator

There are plenty of benefits to using a business loan calculator, especially while budgeting. Let’s examine some of these merits:

Accurate Repayment Estimates

Accurate Repayment Estimation and Funding Plans are two factors that are attractive to a borrower with the knowledge of a loan calculator. This knowledge enables the individual to prudently draw a budget for the relevant period. That is because one knows how much he or she has to save every month in repayment of the loan.

For example, if you’re looking to borrow $50,000 at an interest rate of 5% over five years, a loan calculator can show you that your monthly repayments would be approximately $943. Using this information, you can assess whether this amount fits within your business’s budget and cash flow.

Better Financial Planning

By utilizing a device known as a business loan calculator, one can investigate the effects of varying loan amounts and repayment tenures on one’s finances. This process presents the impact of varying the loan amount or repayment duration on the overall cost hence enhancing decision-making.

In particular, one might end up paying higher monthly obligations if the loan repayment period is grieved but the total interest paid is lower. However, when an individual opts to repay the loan over a longer period, the monthly obligations are reduced, but the cost of interest rises. Being able to visualize these portraits in advance helps in selecting the most appropriate loan terms conducive to the borrowing strategy of the business.

Transparency in Loan Costs

By computing how much a loan will cost aside from the sum amount borrowed and the interest, mortgage loan calculators allow for clear pricing. Several small-scale business owners ignore the impacts that their interest rates shall have on the overall cost of the loan. However, the use of a loan calculator provides a good range of knowing how much one shall have paid by the closing of the loan.

This degree of clarity is very important when it's time to make choices regarding what sort of financing to pursue. Allowing you to see the complete picture from the beginning saves you the ore of being presented with hidden costs later on.

Compare Loan Options

Analyzing various loan options cannot be achieved without business loan calculators. You can change the interest rate and repayment term while keeping the loan amount the same to see which lender has the better offer. This will help you in getting the most suitable loan for your business.

For instance, if two companies are offering similar cash loans, one at 10% and another at 12%, loan computations will help you see the paybacks with each offer. This is pertinent as regards information best suited to determine which kind of loan one should take in relation to their financial position and business objectives.

Saves Time and Effort

It may take a long time and countless engagements in mental acrobatics to reach a loan repayment sum. A business loan calculator simply helps one perform this operation with ease and in a very short while.

In this way, there is no need to spend time calculating the numbers as estimates can be gotten very fast enabling you to handle other business activities.

Steps to Use a Business Loan Calculator

Using a business loan calculator is very easy. Below is the following procedure:

Gather Loan Information

Prior to employing the calculator, all pertinent loan information such as the requested amount, interest rate, and duration of the loan should be gathered. It might be necessary also to find out if the loan is at a fixed rate of interest or a variable one since this will affect repayment figures.

Input the Data

Do not forget to insert the required information as well, such as the loan value, interest percentage, and term of repayment into the fields of the loan calculator. Additionally, a few of the calculators will require other figures such as the loan repayment of how many weeks or months.

Review the Results

As soon as all the data you have provided has been processed, the calculator will provide you with an approximate figure of how much you will have to repay. Analyze the output results in detail to make sure they fit your capabilities and the requirements of the business.

Adjust the Variables

If the figures for the repayment amounts appear way too high or low, change the loan figures, the rate of interest, or the repayment duration. For instance, cutting down the monthly payment as a result of the outstanding loan amount or extension of the time taken to repay the loan can lead to a rise in the loan amount or reduce in the loan term.

Use the Information to Make Informed Decisions

After testing the calculator with different loan scenarios, assess the loans offered and come up with an appropriate alternative for your business. At this point, you should appreciate the levels of financial involvement expected and prepare yourself to apply for the loan.

Frequently Asked Questions (FAQs)

Q: What is a business loan calculator?

This business loan calculator is a free self-help service available on certain websites that assists in calculating the expected amounts payable on loans for various businesses after considering certain aspects such as the amount of loan, interest charged, and time duration of payment. When you feel you are ready to borrow money, it helps you to understand the expected costs and risks.

Q: How can a business loan calculator benefit me?

It grants you the ability to prepare your budget by predicting the exact monthly payments less the risk of searching for the best loan, in the case there are different loans with various interest rates and costs, in the risk of the total cost of the loan, in so making the choice.

Q: Is using a business loan calculator difficult?

No, it’s convenient. Enter the particulars of the loan such as the amount of the loan, the interest rate, as well as the term and you will obtain repayment schedules instantly.

Q: Can a business loan calculator help me save money?

Yes, as it informs you of several options including the costs of the options available, and encourages you to pick the cheapest one.

Q: Where can I find a business loan calculator?

Most of them, for instance, NZ Mortgages, contain a business loan calculator for your use free of charge. They are easy to find on the internet and are useful to your financial planning.

Conclusion

One of the key financial resources in the hands of every debt-contemplating business owner is a business loan calculator. The tool facilitates the computation of the possible repayment amounts, estimates the interest cost and rate, and evaluates various loan products— all of which are very important in making sound financial decisions. It doesn’t matter if you plan on increasing your infrastructure, purchasing more assets, or handling working capital – simulating the effect of a business loan gives room for more efficient financial management and less unpleasantness in the future.

At NZ Mortgages, a platform for NZ business loans, we understand the importance of financial forecasting and we provide our clients with a business loan calculator. We have qualified advisors who will assist you in any loan request. Contact us today and find out what else we can do for your business and begin the process of obtaining good business funding services for us.

0 notes

Text

What is working capital and when should I apply for cash flow loans?

Surely a business loan is a business loan, whatever you're using it for? When it comes to applying for small business loans, what difference does it make whether it's for business growth funding or working capital, what exactly are cash flow loans, and when should you apply for them?

What are working capital loans?

To understand working capital loans, let's just establish what we mean by working capital. Working capital, by anyone's standards, is the money that a company or organisation uses for its day-to-day operations, from paying your staff to buying stock and keeping the electricity on. It's the difference between your business's current assets and current liabilities. Therefore, as you might think, working capital loans or cash flow loans, are designed specifically to serve the needs of day-to-day working capital requirements.

Read Full Blog - https://www.riversfunding.com/news/what-is-working-capital-and-when-should-I-apply-for-cash-flow-loans?searchQuery=&pageNo=1&limit=25

#Business Loans#cash flow loans#affordable business loans#best bank for business loans#best business loan rates uk#business loans for new business uk#business lending uk#best small business loan#business borrowing#business loan funding#business loans for same day funding

0 notes

Text

business loan interest rate:- Explore unsecured business loans interest rates at Arka Fincap. Get the financial support your business needs with flexible repayment options and quick approval process.

0 notes

Text

Unlock Your Property’s Potential: Get a Loan Against Property with CSL Finance

Unlock the value of your property with CSL Finance’s loan against property service. Whether you need funds for personal or business expenses, our competitive interest rates and flexible repayment options make it easy to access the cash you need. With a straightforward application process and quick approvals, you can turn your property into a valuable financial asset. Our experienced team is dedicated to guiding you through every step, ensuring you receive the best possible service tailored to your needs. Don’t let your property sit idle—leverage its value today with CSL Finance!

Contact Us

CSL Finance Phone: 9773896801 Email: [email protected] Website: Loan Against Property Address: 410-412, 18/12, 4th Floor, W.E.A. Arya Samaj Road , Karol Bagh, New Delhi -110005

For inquiries or to schedule a consultation, please reach out to us through any of the contact methods above. Our dedicated team is here to assist you with your loan against property needs. Let us help you unlock the potential of your property today!

#loan#loans#personal loans#home loan#business loan#markets#financial#retail loan#nbfc#finance#interest rates

0 notes

Text

business loan interest rate:- Explore unsecured business loans interest rates at Arka Fincap. Get the financial support your business needs with flexible repayment options and quick approval process.

0 notes

Text

Personal Loan for Low CIBIL Score: A Comprehensive Guide

A low CIBIL score can feel like a significant obstacle when applying for a personal loan, but the reality is that it doesn’t have to stand in the way of your financial goals. Even if you have a less-than-ideal credit history, options are still available to secure a personal loan in India. In this comprehensive guide, we’ll explore how a low CIBIL score impacts personal loan applications, the steps you can take to improve your chances of approval, and how Kreditbazar can assist you in accessing funds, even with a low credit score.

What is a CIBIL Score and Why Does It Matter?

Your CIBIL score is a three-digit number ranging from 300 to 900, generated by the Credit Information Bureau (India) Limited (CIBIL), which reflects your creditworthiness. It is based on your financial history, borrowing behaviour, repayment patterns, and outstanding debts. A higher score indicates that you are a low-risk borrower, while a lower score suggests a higher risk, which can make lenders cautious about approving your loan applications.

Here’s a quick breakdown of CIBIL score ranges and what they indicate:

750 – 900: Excellent credit score, low risk, high chances of loan approval with favourable terms.

650 – 749: Good credit score, moderate risk, fairly good chance of approval.

550 – 649: Average credit score, higher risk, chances of approval reduced significantly.

300 – 549: Poor credit score, high risk, very limited loan options, if any.

For most banks and financial institutions in India, a score of 750 and above is ideal for quick and easy personal loan approvals. However, if your score falls below this, especially below 650, your loan application may either get rejected or be subject to higher interest rates and stricter terms.

But a low CIBIL score doesn’t mean you're out of options. Many alternative lenders, including Kreditbazar, offer personal loans to individuals with lower credit scores, though certain factors may influence your loan approval.

Can You Get a Personal Loan with a Low CIBIL Score?

The short answer is yes, but there are some trade-offs. Lenders may view you as a higher risk if you have a low CIBIL score, but they can still offer loans under specific circumstances. These could include charging higher interest rates, reducing the loan amount, or requiring additional guarantees like collateral or a guarantor. Some lenders, particularly NBFCs (Non-Banking Financial Companies), are more flexible with their credit requirements compared to traditional banks.

At Kreditbazar, we understand that not everyone has a perfect credit history. This is why we work with a network of lending partners, including NBFCs, to offer personal loans for low CIBIL score borrowers. While the terms may vary, our goal is to ensure that those in need of financial assistance have access to it, regardless of their credit background.

Factors That Lenders Consider Besides CIBIL Score

When evaluating a personal loan application from someone with a low CIBIL score, lenders consider several factors to assess the borrower’s repayment capacity. These include:

1. Income Stability

Lenders often look at your monthly income and job stability. If you have a steady and reliable source of income, especially from a reputed employer, this can offset the risk posed by a low CIBIL score. A higher income gives lenders the confidence that you will be able to meet your repayment obligations, even if your credit history isn’t stellar.

2. Loan Amount

Requesting a smaller loan amount may increase your chances of approval. A lower loan amount reduces the risk for the lender, making it easier for them to accommodate borrowers with low credit scores. If you don’t need a large sum immediately, opting for a smaller loan can be a smart move.

3. Existing Debt

Lenders will check your current debt load. If you are already overburdened with other loans and credit card balances, they may hesitate to extend another loan. However, if you have a manageable debt load and can demonstrate a consistent repayment history for existing obligations, it can help improve your case.

4. Collateral or Guarantor

Some lenders may ask for collateral or a guarantor if your CIBIL score is low. This provides them with extra security and reduces their risk. Offering assets like property or a fixed deposit as collateral can increase the likelihood of approval, as can having a co-applicant or guarantor with a strong credit score.

5. Relationship with the Lender

If you have an existing relationship with a lender—such as a savings account, credit card, or another financial product—they may be more willing to approve your loan despite a low CIBIL score. Having a history of responsible financial behaviour with the same lender works in your favour.

Steps to Get a Personal Loan with a Low CIBIL Score

If your CIBIL score is below the preferred threshold, here are some steps you can take to improve your chances of getting a personal loan:

1. Look for Lenders that Cater to Low CIBIL Scores

Not all lenders are focused on offering loans to high-credit-score borrowers. Some specialize in providing loans to individuals with lower scores. At Kreditbazar, we work with lending partners who understand that a low CIBIL score doesn’t necessarily reflect your current financial standing. We help connect you with loan options that match your needs, even if your credit score is less than ideal.

2. Improve Your CIBIL Score

If your loan isn’t an immediate necessity, taking a few months to improve your credit score can greatly enhance your loan prospects. Here’s how:

Timely repayments: Ensure that all your current loans, EMIs, and credit card payments are made on time.

Reduce credit utilization: Try to keep your credit utilization below 30% of your total credit limit.

Avoid applying for multiple loans/credit cards: Each application results in a hard inquiry, which can further lower your score.

Check your credit report for errors: Dispute any inaccuracies that may be negatively affecting your score.

3. Opt for a Co-Applicant or Guarantor

Adding a co-applicant or guarantor with a high CIBIL score can boost your chances of loan approval. This provides the lender with added assurance, as they have another individual to fall back on in case of default.

4. Apply for a Secured Loan

If you have assets like property, gold, or fixed deposits, consider applying for a secured loan. Secured loans often come with lower interest rates and are easier to obtain for borrowers with low CIBIL scores, as the lender has collateral to fall back on if you default.

5. Demonstrate Income Stability

Highlight your steady income and job stability in your loan application. If you have a good track record with your current employer or a strong business background (if self-employed), lenders may be more lenient regarding your low CIBIL score.

Understanding the Drawbacks: Higher Interest Rates for Low CIBIL Scores

One of the most significant drawbacks of securing a personal loan with a low CIBIL score is the higher interest rate. Lenders compensate for the increased risk by charging higher rates than they would for borrowers with good credit. This means that although you can get a loan, you may end up paying more in interest over time.

For instance, a borrower with a high CIBIL score may get a personal loan with interest rates as low as 10% to 12%, while a borrower with a low CIBIL score might be offered rates ranging from 14% to 20% or higher. It's essential to factor this into your decision and ensure that the repayment terms are manageable.

How Kreditbazar Can Help

At Kreditbazar, we understand the challenges that come with a low CIBIL score. Our mission is to ensure that financial setbacks don’t stand in the way of your future. We’ve partnered with leading NBFCs to provide personal loans for low CIBIL score borrowers, offering tailored solutions that meet your needs without adding unnecessary complexity to the process.

By applying for a personal loan through Kreditbazar, you can expect:

Quick and easy online application

Minimal documentation requirements

Personalized loan offers

Fast approvals and disbursements

Whether you're facing an emergency, planning for personal expenses, or consolidating existing debt, Kreditbazar can help you find the right loan option—even if your CIBIL score isn’t perfect.

Conclusion: Don’t Let a Low CIBIL Score Hold You Back

Having a low CIBIL score may make it more challenging to secure a personal loan, but it doesn’t mean you’re out of options. By exploring alternative lenders, improving your credit profile, and applying for manageable loan amounts, you can still access the funds you need.

Ready to apply for a personal loan despite your low CIBIL score? Explore your options with Kreditbazar today, and take the first step towards financial freedom.

#low interest personal loans#personal loans#same day loans online#loans for small business#small business funding#small business#small business loans#loans for small industry business#personal loans without car title#student loans#low cibil score#cibil score#low credit score#credit score#Low credit Score Loans#loans#lowest interest rates business loans#interest rates

0 notes

Text

youtube

#sr consultancy#trending#trending video#trend#trending videos#youtube#trendingnow#business#trends#viral trends#tamilnadu#branding#viral video#loan#loan services#personal loans#home loan#business loan#student loans#mortgage#investor#credit cards#loans#rates#Youtube

0 notes

Text

Expert Financial Assistance in Delhi NCR

Loanswalah is a trusted financial assistance provider in Delhi NCR, offering expert solutions tailored to individual and business needs. The company's client-centric approach ensures that financial requirements vary from person to person, offering a wide range of services including personal loans, home loans, business loans, and vehicle loans.Loanswalah has gained a solid reputation in the region by consistently delivering transparent, reliable financial solutions. They work with a network of financial institutions to secure the best loan products for their clients, ensuring competitive interest rates and easy approval processes. Their team of experts guides clients through each step, simplifying complex financial jargon and making the entire loan process smooth and stress-free.

One key reason behind Loanswalah's success is their personalized service, which takes the time to understand each client's financial situation and goals before recommending loan options. This personalized attention ensures that customers receive terms that suit their financial health and future plans.

In an age where time is of the essence, Loanswalah ensures a swift loan approval process, with minimal paperwork and quick turnaround times. This focus on efficiency is particularly beneficial for small business owners who need immediate capital for expansion or operations.

For anyone seeking expert financial assistance in Delhi NCR, Loanswalah is a top choice due to their range of services, commitment to transparency, and customer-first approach. They can help navigate the complexities of securing the right loan, making the process hassle-free. Contact Loanswalah today to explore financial solutions that fit your needs and let their team of experts guide you to the best loan options available in Delhi NCR.

#Home Loans#Loans Against Property#Business Loans#Auto Loans#Personal Loans#Competitive Rates and Expertise

1 note

·

View note