#broke my like 40 streak for that. for science

Text

btw did a couple runs of hades today after a few days break just to max rank all the keepsakes and it just wasnt feeling Right and i realise now i basically had zag kill himself via minotaur

#i was just really curious as to what the consequences of not making it through an area in time with that condition activated#ok i did kill asterius with like two minutes left on the timer and the Whim overtook me#and so zag spent two minutes ducking behind pillars from theseus' spear just to see what would happen#broke my like 40 streak for that. for science#You Die btw. its like -5 health for each second you pass the time limit. so you die slowly#first time since literally before my first successful escape that i died anywhere other than hades#gemitus#im not Entirely fussed about the last two achievements anymore 45/47 is pretty good#i think the impetus for this burnout is that i purposefully got hit in erebus bc i needed one more red onion#for the next part of the codex entry and then it said i needed Ten more#you want me to fail on purpose Ten more times. come on man#hades

0 notes

Text

the more you say (the less I know)

By @hailxhydra for @iwritedumbshit

via @friendly-neighborhood-exchange

Rating: Gen

Relationships: Tony Stark & Peter Parker, Steve Rogers & Peter Parker

Characters: Peter Parker, Tony Stark, Steve Rogers

Summary:

TONY STARK IS DEAD.

The words were plastered on the front page of every newspaper across the world. Tony Stark, the resident genius, billionaire, playboy, and philanthropist, was dead. Completely, irrevocably, unchangeably, dead.

Or was he?

OR

After the events of Endgame, Peter Parker decides he has to go back in time to save his mentor’s life, finds out that Tony wasn’t everything Peter thought he was, and chaos ensues.

“You sure about this, kid?” Steve asked Peter, coming up from behind him to clasp his hand on his shoulder. Looking out into the crystal clear lake and the surrounding forest, Peter gulped, trying to get rid of that unsettling feeling at the bottom of his stomach bubbling up until it overflowed, and he broke down right in front of everyone.

“What?” he said, swallowing the lump at the back of his mouth. Turning to face Steve, he shook off the hand on his shoulder, which immediately went straight into the pockets of his black pants. He glared at Steve, though obviously not in a malicious way. He was met back with a blank stare. The impassiveness of it was relieving; Peter didn’t need any more emotion from anyone, let alone the person who had abandoned his mentor for years, without a goodbye, nor some contact information. The bleak, vacant gaze held a sort of comfort for him, being something steady, something that he could hold on to while all around him, there was chaos. It was a lifeboat.

“Look, we’ve all been there. Believe me, I know what it feels like. I was in ice for seventy years. I lost everyone. But I had people to help me through it. You do, too. You don’t have to do this.”

“What’re you trying to get at?” he blatantly asked, rolling his eyes and turning back to the lake, the calm lake, the lake that had absolutely no problems, the lake that was steadfast and balanced, the lake that was everything that Peter wanted to be. “Are you implying that I might do something? I can’t change what happened either way, what with the implications, plus, the Grandfather Paradox is a bunch of bullshit, it just creates an alternate timeline, like with blue robot lady one and two, and anyway, how would that work without any local quantum interference? It’s crazy, I mean like-”

“I’m not talking about the science behind it. I can’t know what you think, but, looking from the outside, it is pretty clear what you want to do. Now, I don’t know if anyone else realizes it, and maybe it’s just because we’re so similar that I would have taken the same line of action, but you have family here. People who care about you. Just, spend a few minutes mulling over your decision. You have to be completely sure before you do anything drastic,” Steve said, starting to walk away after he was done.

“You’re really big on monologues, aren’t you? It’s a very 40s vibe you give off!” Peter called after him, a smile gracing his face in this tough moment. Steve just made a peace sign in return, his back still facing him, and continued his conversation with Sam. He looked around, taking in the serenity of the lake house. Tony had bought it during the Blip, so Peter had never gotten around to seeing it with him. He quietly stepped inside, making sure not to make any noise as to give away his position. He wanted solitude, without anyone barging in every few minutes to check in on him, or to offer him some juice, or to whack his head with a newspaper (although that last one was mainly Sam and Bucky, and he didn’t know from where they even got the endless supply of newspapers).

The inside was nice. A change of scenery from the dark outfits everyone wore outside. Built almost entirely of walnut wood, the lake house served as a reminder that he would never get those five years back. The five years, in which everything had changed. He wondered if May had gotten dusted, too. If she had gotten married again, or had a kid. They didn’t have much time before the funeral to catch up, always being whisked away to talk to one person or another. He led his fingers across the panels of wood, taking in the peacefulness inside. Feeling a presence creeping up behind him, he swiveled around to punch the person in the gut. He widened his eyes when he realized who it was.

Bucky Barnes, aka the Winter Soldier, aka the White Wolf, aka the most dangerous man on Earth, was keeling over, hands on his midsection, looking like he was about to puke.

“OhmygoshI’msosorry,” Peter rushed, hands outstretched, but stopping in mid-air, as if he was rethinking his decision to help him up.

“Come on, kid. Why do you have to do that to a hundred-year-old man? Ever heard of ‘respect your elders’?” he groaned, stabilizing himself by putting his hands on Peter’s shoulders and lifting himself up.

Peter felt his cheeks heat up and turn scarlet before muttering a small, “I said I’m sorry.”

“What I came here to say was before you so rudely knocked me over, was that I think Bruce is firing up the machine. He wants you to suit up and get ready. It’ll be ready any time now,” Bucky said, giving a Chesire cat-like grin before turning away to talk to someone Peter didn’t know.

Peter laughed and shouted, “That wasn’t a good pun at all!”

Bucky looked back at him, gave him the middle finger, and yelled back, “I’m a hundred-year-old assassin, give me a break!”

Peter shook his head and turned to look at the suit in his hands. The suit itself was grey, with streaks of red running down it (the Avengers were very fashionable, to say the least). It had a leathery texture, but not quite leather; it was comfortable, yet effective at the same time. Most importantly, it would protect him from the quantum energy and radiation that came with time travel.

Looking at it, Peter felt unworthy, but, wearing it, he felt like he could do anything that he ever wanted. He felt like he was an Avenger. It wasn’t like anything else in the world. It was special. It was distinctly his, not anyone else’s; his.

“My wittle spidey is all gwown up now!” May exclaimed, smiling at Peter in his new time-traveling suit.

“May, I’m not a baby!” he pouted, stomping his feet on the ground, purposely acting immaturely. “I’m not your ‘wittle spidey’! I’m a grown-up kid!”

“Whatever, it’s fine. Just come with me. They’re all ready for your big superhero entrance.”

Getting there was a long hike. For some absurd reason, Bruce had decided to put the time travel machine smack in the middle of a dense forest, and it took quite a while, even in his super suit, to reach the destination.

“Peter? You ready?” Bruce (Professor Hulk) asked. He put his big green hand on his shoulder, and Peter felt something break there.

He suppressed a cry and said weakly, “Yeah.”

“You sure about that? One of us could do it.”

“Yeah, I’m sure.”

Bruce gave a soft smile and led Peter over to the launching pad.

“So what do I have to do again?” he asked.

“Just stand there. Make sure you’re holding the stones and the hammer. You need to return those things at the exact time they were taken. If you don’t, it’ll-”

“Create another timeline, I know. That’s all I have to do. Just return the stones. To the right time. Okay, let’s do this.”

He stretched out his hands and legs and went to go and stand at the pad. Surveying the crowd, he caught a certain someone’s eye. Steve took off his hat, bowed down, and smiled at him. He gave a small thumbs up to Peter, reassuring him that this was the right decision. Peter cleared his throat, nodded a few times, and gave Bruce the signal.

“Five… four… three… two… one.”

“How long will it take?” Sam asked. “I need a break.”

Bruce looked at his monitor in confusion. Typing something into it, he showed Sam the calculations. Sam just raised his eyebrows.

“I’m not some science genius. You’re going to have to explain it to me.”

“He was supposed to come back in two seconds. He should’ve been back by now.”

“What?” he asked, although there wasn’t anything he could do, and he knew that. Steve smiled a bit and turned around to face the wilderness. Unfortunately, this action did not go unnoticed by Bucky. He lunged towards him and pulled him up by the collar. He raised his eyebrows to his hairline and gave Bucky a bewildered look.

“What did you do?” he threatened. Steve gave a smirk and raised his hands, surrendering. He shrugged (which was really hard, given Bucky was still holding onto his collar), and slowly took Bucky’s hands off of him. Once they were completely off (and into his jacket’s pockets), Steve huffed.

“I did nothing, Buck. It was his decision, not mine.”

“Will you tell us where he is?” Sam asked, coming up from behind them. Steve simpered, looking Sam straight in the eye.

“No, I’d rather not.”

“I know you did something you little piece of-”

December 16, 1990 || New York City

The streets of New York City were bustling with people trying to do last-minute Christmas shopping, the shops illuminated with strings of Christmas lights. Although the rain dampened the mood (in more ways than one), the crowd hurried from store to store, trying to acquire the perfect gift for their friends and family, brightening the otherwise bleak scene.

The women, clad in their voguish outfits of pantsuits and tinted oval sunglasses, directed their tired husbands to different toy stores, presumably to buy a set of some knick knacks and trinkets for their children. The little boys and girls dragged their mothers and fathers to various windows, pointing at the numerous playthings propped up in the front.

The teenagers, dressed in baggy sweatpants and flannel jackets and too many chains to look good, looked bored as hell, and were smoking in some neglected corner in the adjacent alleyway. They laughed, sending puffs of smoke billowing into the atmosphere, seeming so carefree in that small moment.

Muffled conversations could be heard throughout the streets, though no one was paying much attention to the stifled voices, choosing to focus on the more fortunate aspects of life. A man, speaking into his phone in hushed whispers, hugged his briefcase tight to his chest and sent out panicked glances if anyone came in close proximity to him. A woman, an unlit cigar hanging from her mouth, clutched her handbag, a small purse dog whining in it, and grinned at any unsuspecting young man that came near her. A young couple, looking like they were physically connected to each other, walked along the jam-packed street, sneaking in kisses as if they weren’t allowed to be seen in public with one another. There were, in total, at least a few hundred people in that small street, all trying to get away from the stress of day-to-day life.

Although it was a lighthearted scene down on the streets below the towering skyscrapers, the rain poured down onto the throng of people, the immense clouds covering the full moon, giving the place an eerie aura.

In an alleyway off to the side of the square, Peter dazedly woke up, scratching his eyes, just recovering from the gripping experience of time traveling. He had returned the infinity stones to their particular places and time periods. The soul stone to Vormir in 2014, the Tesseract to that old SHIELD laboratory in 1970, the time stone to the Sanctum and the Ancient One in 2012, the power stone to Morag, the Aether to Asgard in 2013, and the mind stone to the oblivious Hydra agents at the Avengers Tower in 2012. So, as you can see, it had been a really long day for Peter.

He groaned and raised his hands, only to find them covered in dirt and some wet, slimy substance he couldn’t remember the name of. It wasn’t just his hands; the whole alleyway was covered in this substance.

“Ew,” he groaned, making sure not to be loud, so that the horde of people wouldn’t see him. That would cause multiple complications in Peter’s plan, probably resulting in him being sent to an orphanage because they couldn’t find his parents. It could also be more drastic and he could end up in some government facility because his name wasn’t on any of their rosters. He might also have been classified as an alien, and that would definitely thwart his mission.

The pitter patter of the rain woke Peter up from his delusional fantasy, and, putting his palms on the damp, muddy ground, he stood up. Tip toeing out of the alley, he surveyed his surroundings in order to make sure no one was watching him, and wandered out onto the street. People shouldered their way through the crowd, always looking behind their back to see if someone was following them. Peter did the same, though for different reasons than them.

He walked along the street for a while, getting whisked away by the crowd. There wasn't really a place to go for him right now, so he just wandered around, window shopping (though he had absolutely no money), trying not to think about the past Christmas he spent with Tony, eating food until they threw up, and opening the presents they gifted each other, Rhodey, Pepper, and Aunt May.

There were a lot of… characters on the road. Some of them smiled at him very creepily, staring at him as though he were something enjoyable to eat for supper, and others were confused as to why a child, dressed up in a weird suit without his parents, was solemnly walking along the boulevard - Halloween had passed two months ago, and it was now Christmastime. One couple was kind enough (or evil enough) to hand him a Hershey’s chocolate bar. Not those bite-sized little ones that Peter used to get from Delmar’s or that one grocery shop in Queens. This one was king-sized. It could’ve lasted Peter at least a month if he were back in Queens in his apartment.

A sense of dread overtook him. The mission. He couldn’t fail it. No, he had to prove to himself that he was ready.

But what if he wasn’t?

He pushed his way through the mob of people. They stared back at him, eyes wide in shock. He didn’t care. He sprinted all the way across the road to the other side of it, shoving away the people who got in the way. He reached the empty wall, feeling the bile rise in his throat.

He puked onto the wall. The people moved away from him. His heart pounded in his chest. Blood throbbed in his ear. Holding onto the wall, he sobbed. The world seemed to turn fuzzy, and everything he saw was distorted, as if he were in a VR game that was malfunctioning. The wall in front of him turned wobbly. Instead of a straight wall, it was now a curved structure. The ground underneath him seemed to give out. He was falling. He was falling to his death. He couldn’t speak. He couldn’t call for help. No one wanted to help him. Another round of bile seemed to erupt from him, and he puked even more of his lunch onto the wall. The world was ending. The world was ending, and he couldn’t do anything about it.

He couldn’t save people from dusting. It was his responsibility to save them. People were counting on him, and he let them all down. He let Mary and Richard down. He let Ben down. He let Aunt May down. He let Mr. Stark down.

He could hear people in the distance, calling for help. He also heard an indistinct sound of laughter. A familiar sound. This sound, unlike the multiple other people screaming, he knew. He knew this sound.

“Mr Stark?” he mumbled from force of habit, pausing to throw up for the third time. All the sound ceased. The tears didn’t, though. They continued flowing in wet, fiery streaks down his cheeks. He could see the crowd make a partition, though his vision was seriously warped. A teenager, probably around his age, walked through the space. He could hear the crowd whispering and pointing at him, although the other man paid no attention. He had to squint his eyes to see him, choking back a sob. He couldn't embarrass himself more than he already did. He cried violently, and the man crouched down and cocked his head to the side. Almost, but not quite, as if he was observing him. As if he was some experiment in a glass cage.

He sobbed harder, and he retched, wishing something would come out so the man would move away from him. The man just tilted his head to the other side and squinted his eyes. He looked at all the other people and shooed them away, and they obliged. Peter and the man were left in solitude, a small sort of bubble forming around them, giving them some peace and quiet.

“How do you know me?” he asked in a low, menacing voice that made Peter cry even more.

“I don’t know!” he bawled. “I’m sorry!”

The man picked Peter up by the arm and looked him straight in the eye. He couldn’t see well through the tears in his eyes, but the man looked truly scary. He heard some shouts in the background, cheering the man on. He grunted and threw Peter onto the ground, walking away to his group of friends.

Peter tried to pull himself up, but, through his severe panting and sobbing, he could not sit upright. He then resorted to lying on the murky ground (on which there were some questionable substances). Gasping for air, Peter tried to calm down.

Key word: tried.

The tears never stopped flowing. The memories didn’t, either.

Memories of Mary and Richard. Of how his last words to them were, “I hate you!”’ before they boarded that damn plane.

Memories of Ben. Of how he died in his arms, bleeding out from the gunshot wound, while he couldn’t do anything to save him.

Memories of how he left Mr. Stark for five years. Five freaking years. And, just as he came back from the dead, Mr. Stark had to go and sacrifice himself for the universe.

Lying there, on the ground, the crowd walking around him to avoid stepping on the child, he fell into a deep sleep, unbothered by the disgusted looks thrown at him by the supposedly “posh” people of New York City.

#this is just chapter one#i'm going to add more at some point#i hope this is what you wanted!#ahhh i'm so excited#i hope you like it#peter parker#tony stark#time travel#steve rogers#bucky barnes#sam wilson#ben parker#may parker#irondad#spiderson#endgame#avengers#avengers: endgame#i tried basing the sort of panic attack on ones i've had

24 notes

·

View notes

Text

laws of attraction | spencer reid x reader | chapter 3

Description: "The law of attraction is the attractive, magnetic power of the Universe that manifests through everyone and through everything. It is part of the creative power of the Universe. Even the law of gravity is part of the law of attraction. This law attracts thoughts, ideas, people, situations, circumstances, and the things you think about." She was cynical about love. She didn't believe in soulmates, or fate, or that the universe brought you together. She believed in science, facts, and statistics. Her experience had taught her that love didn't exist, so she wasn't hell bent on finding it. She was just the broken girl with a tragic backstory she wouldn't let anyone see. But when she gets bumped up to a job working for BAU as a personal forensics analyst at Quantico, she meets someone that might just make her believe in love again. He might have too. {SET AFTER SEASON 13 OF CRIMINAL MINDS}. Warnings: adult language, some adult themes, blood, gore. Couple: Spencer Reid x Female Reader. Read new chapters ahead of time here on Wattpad ————————————————————

Chapter One Chapter Two Chapter 3

first case

⊱⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⊰

The pictures flashing on the board were gruesome, truly. There was blood absolutely everywhere, so much that the walls almost looked like they were painted with it. It made your stomach churn because of the damage done to the bodies, but otherwise you seemed unfazed.

"Last week, the Anderson's were all brutally murdered in their home in Orlando, Florida. The children were both beaten with their father's golf clubs and then strangled with their mother's pearl necklaces. The parents were then stabbed repeatedly and left to bleed out in front of their dead children." As you looked at he pictures up close in the virtual case file, your eyebrows furrowed. Pictures of the children's faces flooded your vision, their faces caked in blood with streaks visible from tear tracks. Their eyes seemed to stare vacantly and blindly, glazed over while their mouths lay open and breathless. Their necks had a ring of sickly purple dots, pearls laying in their hair and on their bodies. Their clothes were bloody and torn in places, and bruises adorned the otherwise pristine white skin. Your eyes went vacant as you then looked at the parents, red pools of blood spread around them like a bedsheet. The mothers hair was caked in blood, the blonde strands now dip dyed a hideous red. The father's beard was stained with it, his white button up torn to shreds. You swiped again and a new family popped up on the screen, every picture more gruesome than the last.

"Y/n?" Prentiss' voice snapped you out of your daze, hands shaking a bit as you closed the tablet. You'd never seen anything like this where you worked before, and you didn't think there'd be a shortage here. You noticed the room was empty except for Penelope, who was still standing at the front of the room.

"We're heading out. Got your bags?" You felt around for your messenger bag you'd packed full of essentials the night before.

"Yeah, I got it." You offered a weak smile before standing up, following her as she walked to the door at the end of the room. Penelope stopped you as you walked.

"It gets easier after a while, trust me." She gave you a comforting smile in an effort to reassure you. You sent a meek one back.

"I hope so."

—————————————————

The jet ride seemed agonizingly long, especially since those crime scene photos were engrained in your mind. It was like time was slowing down as you stared at the clouds outside your window, legs pulled to your chest as your hands picked nervously at the fabric of your pants.

"You okay?" You were startled a little bit by a voice, looked up into the aisle to see a concerned looking Spencer with his hands in his pockets. You just shrugged. He sat down across from you, almost waiting for you to say something. "You aren't used to this, are you?" You shook your head.

"Hell no. I worked for a lame ass police department who could barely afford proper lab equipment before this. My whole day was spent trying to figure out what drug was on a person's t-shirt."

"That big of a jump?"

"Yeah. I mean, I expected to jump into things right away but...not this. Not this brutal. And not this young." There was a moment of silence between the two of you, your eyes and mind drifting off to a place hidden deep in your mind that you didn't want to go again. Finally, your mouth opened and you spoke what you were thinking aloud. "How many cases with kids do you guys have?"

"I'm pretty sure we've all lost count by now." Another silence.

"See, I took this job to get away from the boring. It was like every day was planned out for me, and when I got this job opportunity it was like life would finally be exciting. This is not what I meant by exciting." The two of you let out a small laugh before Prentiss asked everyone to come together to look over everything one more time before the jet landed.

"Okay, so, let's look over this again before we land. Garcia, did you find any connection between both families?" Garcia's face popped up on the screens of the jet.

"Nothing I can see. The Anderson's were easy going people, father was a lawyer, mother stayed at home, went to church every Sunday. The Kirkland's were similar except the kids were teenagers, the mother worked at a bank and the father was a mechanic at a local garage."

"The unsub has to be using some type of ruse to get into the house. Social worker, sales rep, cleaning service." Alvez spoke with certainty and confidence; you felt like you didn't fit in with everyone since they were so experienced at this and you got shaken up over some dead kids.

"It's also possible both families knew the unsub. Maybe a teacher or a church goer."

"Wouldn't be anything associated with church or school, neither of the families attended the same ones." The team talked in amongst themselves and threw out theories before Garcia spoke again. "Uh, guys? A third family was just found this morning. The Davidson's. Mom, Eleanor, was 38, father James was 40, daughter Carol who was 16, and son Adam who was 12." You decided not to look at any of the pictures, knowing full well you'd just have to go anyway. They continued talking for a moment before Emily started giving out assignments.

"-and Reid, you'll go with Y/N to the crime scene." He gave you a small smile and you smiled back, staring out the window again as the plane approached its landing.

—————————————————

"So you've never been out in the field before?" Spencer asked you the question out of curiosity as you two stepped out of the large black sedan.

"A few times, but nothing as brutal as this. Mainly just shootings and overdoses." You wrung your hands nervously as you approached the sealed off house. The looming police tape gave you a sense of dread that hung over you like a dark cloud.

"So how'd you end up getting into the bureau?"

"My boss sent in an application for me a few years ago since I was 'outstanding in my field' as he put it. Basically I could analyze almost 100 pieces of evidence a day as opposed to my coworker's 60, and successfully reconstructed over 50 crime scenes." You opened the door to the house, noticing the bloody footprints leading into the house from the door. You bent down to look at it, evidence markers next to each one. "First glance I'd have to say it's a size 8 work boot, most likely rubber soles." You walked further into the room, Spencer trailing behind. He looked over the scene.

"There was some sort of struggle. Picture frames are knocked over and the lamp is broken." You walked over to the center of the living room, looking at the four bodies laying on the ground. The sight repulsed you, and you momentarily looked away. You shook yourself out, remembering you had a job to do.

"The mother and father were positioned here, and the children across from them. He made them sit across from each other and bound their hands with barbed wire it looks like, based off the puncture wounds. It would make it impossible for them to struggle with hurting themselves further in the process."

"He grabbed the statuette from the table next to the couch." Reid walked over to the table, looking at the empty space. "He beat the children with it almost to death, before strangling them with the father's neckties." You crouched over the two children's bodies, lifting up their clothes in spots.

"He knew exactly where to hit them to inflict maximum pain but prolong the death until the exact moment he wanted to kill them. He avoided hitting the head so they wouldn't be knocked unconscious, but he broke almost all their joints. No doubt it was so the parents would hear their screams." Spencer walked to the parents, leaning over their bodies as you stood across from him.

"Then he cut the parents, avoiding every major artery so they wouldn't bleed out as fast. The unsub has to have extensive medical knowledge or experience to know this much about how to prolong his victim's torture." You took a moment to collect yourself from the gruesome scene, looking at the trail of bloody footprints. You followed it, stopping at a chair that sat in a corner in the foyer. You noticed a smooth bloody glove print on the side of the chair. Your eyes trailed to scuff marks on the floor, sliding the chair to the end of them.

The chair landed right in the middle of the hallway, looking directly at the family.

"He watched them as they died."

#books#crime fiction#crime#criminal minds#criminals#davidrossi#derekmorgan#emilyprentiss#fanfiction#forensics#jennifer jareau#luke alvez#matthew gray gubler#matt simmons#mgg#murder#mystery#spencer reid reader insert#spencer reid x reader#spencer reid fanfiction#spencer reid fanfic#spencer reid#tara lewis#tv seires#television shows

4 notes

·

View notes

Text

I am in a medical trial for a supplement to make people more perceptive. Unfortunately, it works.

[check tags for cws]

“Question thirteen,” I was mid-beer-sip when the announcer, a cheerful man who I knew only by the name of “Trivia Guy”, read out the next question. “In a human body, bacterial cells outnumber actual human cells by a ratio of three to one, ten to one, or six to one?”

“It’s ten to one,” Jack said. He sounded pretty confident about it, too.

“That’s a common misconception,” Lis responded, her eyes shining with the unmistakable joy of someone who is about to tell someone else they’re wrong. “It’s actually a lot closer to three to one. I was reading this article about gut microbiomes and fecal transplants the other day, and --”

“Jesus,” I looked at the plate of nachos shared between the four of us. The pile of chili on top didn’t look as appealing as it had moments before. “Can we not?”

She grabbed a chip herself, then, in classic Lis fashion, continued to talk through her full mouth.

“Alright, fine, but I’m telling you, it’s three to one.”

Jack grunted, writing something down on the answer sheet. Seeing as Lis was a bio major and Jack was in CompSci with me, I hoped he took her answer.

“Question fourteen,” Trivia Guy pulled no punches. “According to a poll from Cosmopolitan magazine, the worst vacation fashion trend was speedos, socks and sandals, or Hawaiian shirts?”

“Socks and sandals.” Sadie spoke up first. She didn’t even wait for anyone else to comment before she snatched the answer sheet from Jack and began to write it down.

“Oh, definitely,” I agreed, a few moments too late for it to matter. But hey -- Sadie was the reason our trivia team was ever anything besides dead last (not to mention the only one of the four of us who’d ever cracked open a copy of Cosmo). I took another sip of the beer and cringed slightly. Corona is not what I’d normally go for, but that night, the price point meant a lot more to me than the quality.

The night continued on in a haze of shitty beer and nachos that went cold far too fast. We didn’t place this week, but we were all slightly buzzed, so we got over it. As Trivia Guy made his final remarks, the waitress came and gave us our bills. My total for the night was $40, and that was before adding a tip. I could cover it, but just barely. Sadie watched me as I pulled out the cash and put it down on the table, completely emptying my wallet of change.

I stood up. My head spun for a moment, but it wasn’t too bad.

“I think I’m gonna have to skip next week.” I didn’t know why I felt the need to announce it to everyone. Probably the vodka that had come before the Corona. I regretted it the moment I said it -- way to look like a broke loser in front of everyone. Great one, Brent.

We shuffled out of the bar in a sea of other beer-sticky, stumbling students. Lucky for us, it wasn’t a long walk; All four of us lived on campus. There were probably cheaper places to get drunk on a Thursday, but there weren’t more conveniently located ones, and certainly none with trivia.

We said goodbye to Jack first, then Lis. I had a vague awareness of the May air being frigid, but it didn’t register with me on a physical level. The alcohol had taken off the edge of a Canadian spring that still thinks it’s winter. A coat would have been a more responsible way to handle it, but hey. Whatever works.

“You’re broke.” The words weren’t stated, but slurred. I watched Sadie as she swayed side to side. In the bar, it hadn’t been clear just how drunk she was. A delayed reaction, she clasped her hands over her mouth, then said something that was probably “I’m sorry!” into the palms of her hands. I just laughed.

“Yeah, I’m broke. What gave it away? The fact that I have no money?” Not my cleverest comeback. Not technically true, either -- I didn’t have money to throw around, but it’s not like I’d starve. I still had my meal plan and two parents who tolerated me, so I wasn’t exactly in dire straits.

“I’ve got an idea.” She grabbed my arm, her nails poking me through my hoodie, and I recoiled. Sharper than they looked. “No, really!”

“Alright, what is it then?” I half expected her to try and sell me on the essential oil bullshit I knew her sister was into, but then again, Sadie was always the brighter of the two.

“Dr. Davidson asked us to try and get him some subjects for some experiment he’s running.” She grinned. I had no idea who he was -- being in CompSci myself, I wasn’t familiar with any of the professors over in the psych department. I thought she’d said the name before, but I was never good with names -- especially the names of people I had no reason to care about.

“Okay, and?” I’d gone into experiments at Sadie’s behest before and never really gained that much from the experience. In one of them I got two marshmallows, which I appreciated. Most of them just involved watching videos of shapes dancing about on a screen and then writing a story about whether you thought the triangle and the square were friends or enemies. Neither of those were going to help me buy another night of beers.

“He’s paying participants $100 for being a part of it.” I froze in my tracks. $100 wasn’t life-changing - not for me, anyway - but it was more than enough to solve the problem of not having the spare cash to get wasted. “I wanted to do it myself, but he says we’re not allowed to if we’re in his class. He doesn’t want to ‘inadvertently prime’ us or anything.”

“Hell yeah,” I nodded, though Sadie hadn’t asked a question. “Yeah, I’ll do it. That sounds great. Do you think there’ll be any marshmallows?”

Before long, we were at our dorm complex. I helped Sadie to her room, and in return she promised me that she’d text me the details in the morning.

I made my way back to my own dorm. I unlocked the door and sighed. I hated the room. It was small -- scarcely room for a single nightstand between Tareq’s bed and my own. He was asleep already, a flat cardboard box that smelled of pepperoni flipped open on the nightstand. He was a good enough guy, but God, the number of pizza boxes that room had seen must rival all of Italy.

I was asleep by the time my head hit the pillow. I awoke what felt like five minutes later to the blaring of my alarm. The morning began like any other -- with me blindly grasping for my phone. Alarm turned off, I noticed a text from Sadie. She’d kept her word (as she always did) and sent me the details on where and when I could find Dr. Davidson.

Lucky for me, I had no classes that Friday. I’d done my damndest to cram everything else into the other four days of the work week to extend my weekend. When I finally rolled out of bed around 11:30, there were only two things on my mind: breakfast and Davidson.

After pancakes and coffee -- thank God for meal plans -- I took another look at the text. Davidson’s office was, to my surprise, in the science complex. Most of Sadie’s classes were in the McPherson building - an ancient brick monolith crawling with ivy - and that was where all the studies I’d been a part of before had taken place. I’d assumed that’s where I’d find Davidson, but apparently not.

Davidson’s office hours weren’t until three, so I headed back to my room to get showered. I didn’t know exactly what kind of test subject he was hoping for, but I figured being halfway presentable would probably be a good start. I nearly tripped over Tareq’s iPad in the process. He had a habit of leaving it unlocked on the bathroom floor, for reasons I tried not to learn.

Stone-cold sober, I made the decision to wear an actual jacket as I headed off to the science complex. The building had a name other than “science complex”, but I could never remember it since no one called it that. It was the newest building on campus, one of those angular glass monstrosities that makes any fan of classical architecture cry and bemoan the decline of society. I liked it well enough, but I was in the minority.

I got lost finding my way to Davidson’s office -- it was in the basement, and none of the elevators seemed to go down there. It was only after talking to a group of tense zoology students that I managed to get conclusive directions.

As far as basements went, the science complex’s was pretty damn classy. Since they couldn’t exactly carry on the whole glass-walls theme underground, they’d gone with a smooth black faux-marble. Comparing it to the basement where one of my small-group sessions took place -- where the black on the walls was almost certainly mold -- I felt a surge of jealousy.

Davidson’s office was not as classy as the surrounding corridors. Papers lay scattered around an oak desk clearly much older than the building itself, a man even older still seated behind it. His hair was dark, but streaked with grey that he made no attempt to cover, and his face was softly wrinkled. Looking at him, I had no idea how old the man was, but presumably old enough that he should have done a better job cleaning the place. I knocked on the open door and he looked up. His brows knit together and he squinted, the face of someone trying to figure out if they’re supposed to know you or not.

“Dr. Davidson?” I asked. His name had been on the door, but it didn’t hurt to confirm. He tilted his head like an inquisitive puppy, and I winced as his neck cracked. He didn’t seem to notice.

“Yes?” His voice caught me off guard - it was smoother than I would have assumed from his appearance. He waited patiently, big brown eyes staring expectantly in my direction.

“I’m here about the, uh, study.” It would have helped had I known what he was researching, but Davidson beamed up at me. Clearly he knew what I was talking about, even if I didn’t.

“You’re interested in participating?”

“Yeah. A friend of mine, Sadie, she’s in one of your classes,” I watched him process the name, trying to figure out who Sadie might be. “She said you were doing a study with compensation.” I winced after saying it -- way to look desperate.

“Yes,” He smiled, shaking his head, bemused. “A hundred as soon as you’re approved, and a hundred at the conclusion.” My eyes bulged. Sadie had said there was $100 compensation total -- I guess she’d finally been mistaken about something. All the better for me.

Davidson rifled through the papers on his desk, licking his thumb to help him separate a set of sheets. “We’ll need to make sure you’re fit first, of course.” He held two pages out, and I finally left his doorway to approach the desk. “Both of these can be done at the clinic on Stonemason Ave.”

I frowned as I took the papers. This I wasn’t expecting. One was a letter requesting an EKG, and the second a blood test. “You’ll need to put your info at the top of those there, but once you’ve filled them out you can get tested. They fax the results straight to me, same day.”

For a moment, I wondered what kind of psychology experiment needed an EKG and blood test, but the doctor continued. “Once I’ve got the documents, you come back and we can fill out your consent form. And,” he paused, grinning, “get you the first payment.”

Despite my moment of apprehension, I was grinning back at him. I took one more look at the papers, and gave him a nod. “Awesome.”

Davidson let me know my deadline for the testing, but he didn’t need to -- the second I was out of the science complex, I was on my way to the clinic. When both tests were through, it was dinner time. My parents were coming to visit on Saturday and Davidson had no office hours Sunday, so I resolved to visit him right at three on Monday.

The weekend flew by. It always did when my parents came. It was their mission to cram as much family time as possible into every visit. They lived just an hour away from the campus, but I was an only child. I didn’t really know what it was like for them, but I must have made the house feel different for me to not be around. Dad was always saying how empty it felt, while my mom told me how happy she was that I was pursuing my passion. Mixed messages, maybe, but think they just missed me. I missed them too. We always were close.

I woke up at 7:45am on Monday. I was one of the few who liked morning classes; I thought it was more practical to get class done early in the day so I had the afternoon to do whatever I wanted. This meant by the time three rolled around, I was finished class for the day and ready to pay Davidson another visit.

His office was tidier than it had been the last time. Papers were still scattered around the room, but they had coalesced into semi-defined piles. He seemed excited to see me.

“Wonderful news!” was how he began the conversation. The blood test and EKG had come through normal, which meant that it was time for me to sign my consent form -- and receive my first payment.

I skimmed the document. I didn’t understand a lot of it, but I also didn’t care. Much to my surprise, this wasn’t going to be another marshmallow or shape storytelling study. This was a full-on medical trial. Or, well...something like that. I was fuzzy on the details. Myself, and the other subjects, were going to be given some sort of supplements. I wasn’t on any medications they could interfere with, and I didn’t have any heart conditions that they could aggravate. Animal trials had indicated that, in mice, the supplements boosted reaction times and functioning in tests of reasoning. The most notable finding was that the rodents were more “generally perceptive”, whatever that meant.

The last sheet of the document included a list of seven other names. Below that were two lines for me to sign - one confirming that I consented to take part in the study, and the other confirming I did not know any of the seven listed people. I scrawled Brent Haywood twice*,* wrote my phone number and email below, and a few minutes later I was walking out of the room with $100 cash. I was giddy. $100 wasn’t much, but at least I wasn’t going to miss trivia after all.

I didn’t see Davidson again until Thursday. He’d emailed asking me to meet him and the other participants in the science complex. This time we didn’t meet in the basement, but in a small aboveground lab. I thought I was prompt, getting there right at three -- but when I walked in, there were already nine people present.

Davidson stood at the front of the room, a tray of bottles behind him. He flipped through some papers, whispering to the woman standing next to him. The other seven, clearly students, were in chairs organized into a rough semi-circle. One seat remained right on the end, next to a girl who looked to be a year or two my senior. Her brown eyes were warm and inviting, and I’d be lying if I said I wasn’t interested. She smiled as I sat down. I opened my mouth to greet her, but Davidson cleared his throat to gather our attention, cutting off any attempts at flirting.

“Hello!” He smiled and waved, and I couldn’t help but smile back. In the light of the lab, not crammed behind a desk, he looked a bit better off. He had an energy about him, that kind that radiates from anyone who has a genuine passion for what they do.

“You all know me, but I’d like to introduce you to Ms. Gill. She’s a fantastic woman and she’ll be assisting me throughout the duration of this study. Ms. Gill and I have worked together for the last few years, and she has even taken the lead on some of our most recent animal studies.” Davidson beamed like a proud parent. The faintest pink blush graced her cheeks as she smiled.

“Nice to meet all of you. I’ve got all of your consent forms here, but I would like to ask one more time before we begin: do any of you know each other?”

I looked down the line of chairs. Counting me, there were four men and four women. It struck me as an awfully small group, but this wasn’t my field. I didn’t know any of them. One man looked familiar -- I’d definitely seen him before. I was about 90% sure he worked at the Subway on campus. That hardly counted as knowing him, though. I looked back to Gill and shook my head. There were some murmurs of no from my cohorts.

“Excellent. Now, it is absolutely critical to the integrity of this study that at no point do you attempt to contact any of these fine folks outside of the context of the study. As we want to measure your individual responses to the supplement, we don’t want to muddy the waters by having you discuss your experiences with each other outside of the lab.”

I shot the girl next to me an exaggerated frown. She stifled a laugh, and turned her eyes back to Gill.

Gill went on to explain the process. She would be giving us each a bottle of the supplement. We were to take one pill each morning at eight o’clock. Failures to take it on time would need to be reported immediately. Every weekday, we’d report back to the lab at an assigned time and complete some basic reasoning tasks to assess any impact the supplement had on our abilities over time. For me, that meant I’d need to haul my ass out to the science complex at seven o’clock in the evening for the foreseeable future. I scowled - that was going to be annoying. The good news was that we had no need to show up on weekends.

The next morning, I woke up at 7:45 with a mild hangover. Trivia had been the night before. I’d thanked Sadie again for the lead, and she’d admitted she was surprised about the fact that there were only eight people there.

“I’d expected more,” she told me, sipping on her cider. “Assuming half of you are actually taking the supplement, the rest a placebo, that’s only four people in each group!”

“Who cares?” I asked, holding up my own. No discounted Corona this week. “Cheers to Davidson!”

It didn’t take long to make my hair look tolerable and pull on some clothes. A second alarm went off at eight, reminding me that it was time for me to take my first dose of the supplement. Tareq, not a morning person, growled into his pillow.

I didn’t give the pill itself much thought - it looked like a multivitamin, and it tasted like something that’d fallen to the back of an oven and continued to burn there for over a year before someone realized and pulled it out. I nearly gagged, but it was nothing half a bottle of Sprite couldn’t help with.

Nothing felt that out of the ordinary throughout the day, but I wasn’t really sure what I’d expected. It sure as hell wasn’t the pill from Limitless. The only difference I really noticed in my own behaviour was that I was overanalyzing everything I did and trying to figure out if it was the pill’s fault. Was I slightly jumpier today? Was I thinking about the pill too much because of the pill?

No. None of that. Obviously.

At six, I grabbed a quick dinner with Lis, Jack and Sadie. When I was done, I headed off to the lab and arrived just before seven. Subway guy was leaving as I went in. We gave each other a nod of recognition as we crossed paths.

Inside the lab, Gill and Davidson were seated at one of the black lab countertops. In front of them were some sheets of paper and some red and white tiles. I recognized them from when I was younger. In grade four I’d had to do some sort of test with those tiles where they showed me a picture of a completed pattern and I had to assemble it myself. I hadn’t expected to see them again at twenty-two.

Davidson seemed happy to see me, and gestured for me to come sit. The next twenty minutes were spent on a variety of tasks - not just reasoning, but memory as well. In one of them, they’d read me a series of numbers, and then I’d have to recite them backwards. I didn’t do particularly well on that task. I was more confident with the tiles, at least. Time flew by.

Gill was the one who actually administered the tests, while Davidson took notes, grinning the whole time. I wondered what he was so excited about; It couldn’t have been my test results. Finally, they took my blood pressure and sent me on my way.

As I went to leave, the brown-eyed girl from the first day was coming in. She smiled at me, and before I knew it I was smiling back. I just barely managed to choke back a hi before we’d walked past each other and I was back out in the hallway, alone.

In the empty hallway my heart was racing, and I couldn’t tell you why. I felt sweat instantly start to build on the back of my neck. I’d almost said hi to her when I wasn’t meant to. Davidson wouldn’t have been happy -- was that it? Or was it the simple fact that she was hot and I wanted to talk to her? Whatever it was, it felt stronger than it should have -- but -- goddammit, I was just overthinking things again.

Days passed, following the same pattern -- I’d get up, I’d take the pill at eight, and I’d spend the rest of the day overanalyzing everything I did. Each day it worsened, because I had another twenty-four hours of evidence that I was overthinking. My heart was getting one hell of a workout, though Davidson and Gill never commented when my blood pressure was taken.

A feedback loop sparked to life deep inside my chest. I’d hear my heart hammering away and I would feel anxiety make my hairs stand on end -- then I would think about what I was experiencing and the panic would grow deeper. I couldn’t talk myself down from it. Every time I tried, my body would fight against me, digging in its heels, turning up my nerves.

By Monday, I was on edge in a way I'd never experienced. In the past, I hadn’t been a leg-shake. Now, crammed into my lecture theatre seat, laptop balanced on the tiny desk, my right leg was positively vibrating. I nearly leapt out of my seat when Jack asked me if I could double-check a piece of code he had written.

“Jesus, dude,” He looked me up and down. “Are you alright?”

I nodded, but speech hadn’t come back to me just yet. I closed my eyes, breathing deeply and rhythmically in an effort to calm myself down. After a few moments passed, I was able to speak. “Yeah, it’s just...the study I’m doing. I think it’s getting to me, man.”

Jack shook his head, incredulous. “Yeah, no shit.” He turned, and as he did his arm clipped the edge of his laptop.

Something in my chest exploded, and my vision completely greyed out. When it came back, my hand had Jack’s laptop in a death-grip. It was still sitting on the desk, but it was clear it had nearly fallen. Jack, mouth slightly ajar, stared at me.

I swallowed hard, gently nudging the laptop into a more secure position on the table. As I pulled my hand back, it was quivering.

“What the fuck, Brent?”

A few moments passed, the instructor droning on in the distance.

“It was going to fall,” I finally answered, my voice weak. My heart was still throbbing, and the beginnings of nausea tickled at my stomach. It was too much. I closed my laptop, slipped it into my bag, and walked out.

The instructor paused to stare as I walked to the doors. I managed to choke out the word “sick” before I was out of the room. In the corridor, I broke into a run. I needed to go home.

I needed to lie down.

I spent the bulk of the day as a heap in my dorm room. I wasn’t an anxious person by nature, so it had to be the supplement’s doing. What a fucking shame. I feel like I’m going to die but I don’t feel any smarter.

Thankfully, I had my laptop and Netflix. I stuck to watching comedies for the rest of the day. Eventually my heart rate slowed to the point where it wasn’t dominating my every thought. By the time seven rolled around, I was in a state you might almost mistake for normal. A benefit, since I needed to haul my ass down to Davidson and Gill.

I didn’t see Subway guy leaving the lab this time. I wondered if he’d left early -- or maybe last time he’d left late. Oh well.

It was much the same as Friday -- little puzzling questions, tests of memory, rearranging tiles. If anything, I thought I did worse than I had on the first day. As it continued, anxiety began to rise in me again, building in my chest, setting my nerve endings on fire. I managed to keep it together until the very end.

As I finished up the last of the tile activities, my thoughts were consumed by the fact that there was someone behind me turn around now they’re behind you --

I nearly snapped my neck spinning around to look behind me. There was no one there -- at first. A second later later, the brown-eyed girl walked through the open door. Our eyes instantly met, and for the first time I saw her frown. It was probably off putting to walk into a room and find someone staring directly at you. I turned, gingerly rubbing my neck, back towards the researchers.

Neither was facing me. Instead, they were looking at each other. Davidson’s grin was wider than ever, and a smile was playing at Gill’s lips. Whatever that shared look said, I was deaf to it. Davidson turned, and offered me words that gave little clarity in the moment.

“Brent, you’re becoming an awfully perceptive person.”

Before I could respond, Gill stood up and gestured for me to leave. As I walked past the girl, she refused to look at me.

That evening, I received an email from Davidson. There was going to be a slight change to our regimen -- I was now to come in at 7:10pm. The message said that a greater effort should be taken to “space out” the subjects.

I was feeling pretty spaced out myself. By the time I was back in my dorm, all I could think about was going to sleep. But it did not come easily. No matter how long I lay in the bed, tossing and turning, I never felt at ease. Eventually, with the help of a meditation app my mother had emailed me months ago but I’d never bothered trying, I calmed myself to a point of stillness. That was when things got worse.

I am not sure if you have ever experienced sleep paralysis, but if not, consider yourself blessed. Instead of drifting to sleep, I felt a tingling sensation crawl across my limbs. I went to shake them out, and found I was frozen in place. I couldn’t see a damn thing -- my eyes may as well have been glued shut. There were no dreams, no hallucinations to break up the blackness. As I lay still as a corpse, the tingling gave way to numbness. Before long the only sensation I could experience was one of impending doom. I couldn’t move, I couldn’t feel.Unable to form rational thoughts in this dark void, I was absolutely certain I was going to die.

I don’t know how long it was I lay there in that worse-than-nightmare state, but eventually it ended. I woke up groggy, no memory of any dreams.

I don’t know why I kept taking the supplements. Maybe it was morbid curiosity. Perhaps it was the manifestation of some deep-seated self-loathing I’d never bothered to unearth, some sort of pill-popping l'appel du vide. It doesn’t matter why, it just matters that I did. I skipped classes over the next few days, only leaving to get food and to visit Davidson and Gill for the next round of my testing. The researchers would watch my actions and smile at me, but I have no idea if I improved. Davidson seemed thrilled, but he wouldn’t tell me why.

“What’s your problem?” Tareq had asked me on Thursday. I shrugged, my duvet pulled tight around my body. I was acutely aware of the dark shadows that hung below eyes -- sleep was getting harder. Every night, the pins and needles, the numbness, the sensation that Death Himself was in the room with me seemed to take up a greater percentage of my sleep cycle. I was anything but well rested.

My phone vibrated on the bed next to me, and I was angry. I shouted a string of expletives at the phone for daring to disturb me, at whoever was on the other end of it for having the gall to try and contact me, before tossing the damn thing to my bedroom floor.

“You’ve fucking lost it, dude.”

My skin prickled as he picked up a slice of pizza from the newest box he’d added to his hoard. I watched as he lifted the greasy, floppy triangle up to his mouth. When I realized he was going to drop it, I buried my head in my blanket. I didn’t want to watch. I didn’t want to be right. I didn’t want to be perceptive.

Through the blanket, I heard a muffled “fuck”. I screamed into the fabric.

“Fuck’s sake Brent, it’s just pizza.”

I didn’t respond. My hands shook, and I held the blanket tighter. I gripped it so intensely I feared my nails might tear through the fabric.

“Hey, it’s almost seven. Shouldn’t you be leaving?” Tareq spoke, clearly not out of a genuine interest for what I was supposed to be doing but because he had found a great way to get rid of me. Motives aside, he was right. I leapt off the bed, dropping the blanket on the floor as I went to pick up my phone from where it had landed.

Moving helped, terrifying though it was. Walking across the campus managed to lessen the feelings, or at the very least, distract me from them.

I broke down crying during the testing. Davidson lacked his usual grin, replacing it with a look of concern which, as far as I could tell, was genuine. He stopped the last test early. In what was clearly a breach of some sort of ethics code, he reached out to give me a pat on the arm.

I recoiled before his fingers could touch me, the hairs on my arm standing on end like I’d stepped out into a hailstorm without so much as a jacket. I stared at him, rubbing my face with my other arm to try and get rid of the tears. Finally, he spoke.

“I don’t understand.” He said it quietly. At first I thought he was talking to me, but he wasn’t facing my direction. He was looking down at the sheet where he’d been taking notes. Then he said it again, more forcefully. “I don’t understand.” He turned to Gill. She shrugged.

“What don’t you understand?” I asked. There was a tickle on my arm where Davidson had nearly touched me. Just a faint sensation, like a tiny spider had found its way onto my skin when I wasn’t looking. I tried to brush it off, but it wouldn’t go.

He didn’t respond. He spoke again, but to Gill rather than me.

“We need to stop this.”

“What don’t you understand?” I meant to just ask, but somehow I was shouting. Somehow I was standing, scratching my arm as I shouted.

“You were our most promising candidate, Brent.” His voice was quiet, and he refused to make eye contact. “Your scores have gone up every day, by a significant margin. You’ve become so much more perceptive, but -- “

There it was again. That word -- perceptive. I supposed it was accurate, too. I noticed people, sounds, things about to happen. I paid more attention to the world than I ever had before. I obsessed over it, whether I wanted to or not.

“But?”

“Maybe...too perceptive?” Gill whispered. As she looked up at me, I could see pity in her eyes.

She was right. As I stood in front of the two, I felt everything. I felt the fabric of my hoodie rubbing up against my chest, and the pressure of my jeans tight around my legs. I felt the crawling sensation growing across my skin, moving from one arm up to my neck, to my face.

For the final time, I ran from the lab back to my dorm room. Outside, the gentle wind hit my face, stabbing into my skin like icicles. My phone vibrated in my pocket and I screamed as it buzzed up against my leg. I pulled it out, glancing at the message from Sadie -- “you coming to trivia?” -- and I threw it as hard as I could against the pavement. I did not stop to look and see if it cracked. I left it behind and kept running.

Back in my dorm room, the first thing I did was tear the sweater off. It was too much to bear. The rubbing of fabric against my body was nauseating, and the sensation of unseen spiders creeping across my skin had reached an apex. No matter how much I scratched, I couldn’t stop it. In my absence Tareq had left, so I had free reign of the dorm. I headed for the bathroom, hoping to scrub away whatever plagued me.

It worked, to some degree. The itching lessened, but did not dissipate entirely. When I stepped out of the shower, I took a look at the mirror. I could see nothing there but my own face, the same as it had always been. There were no bugs visibly crawling across my skin, but I could feel them. Less than before, but still undeniably present.

I towelled off, then sat on my bed attempting to comprehend what was happening. This wasn’t imagination -- not according to Davidson, anyway. This was not simply hallucination brought on by lack of sleep. No, he’d said that I had become more perceptive. So what the Hell was I perceiving? As I sat scratching my arms, the explanation came to me.

When people say “the answer was inside you all along”, I don’t think this is what they mean.

It started with a tickle in my throat, the kind that lets you know you’ve got the beginnings of a cold. I coughed, an attempt to make the sensation go away, but it failed. If anything, it made my throat itchier. I stood to grab a glass of water, and my legs shook beneath me. Something was deeply wrong. The itching, the crawling, had sunk far deeper down into my throat than any cold ever reaches.

Once the awareness was there, I could not return to ignorance: There were things moving within me, and I would never be rid of them. Deep inside of me, there were billions of things squirming and twitching and pressing up against my internal organs, and I could feel every one of them. Now that I had become perceptive enough to feel them, there was simply no way to stop.

I tried to scream. I felt the movement of my throat and stopped because it was agonizing. I tried to stand, but the billions of living things inside of me crawled and shuddered as I moved. Innumerable flagella smacked against the walls of my intestines as I shifted, miniature whips cutting into me. I wanted to destroy each and every one of these legions of invaders who I had never asked for but who I would die without. I wanted to lacerate my abdomen, pry myself open and scrape them all out until only I remained, just me.

I tried to stand, but I hated it. I despised them writhing and scratching inside of me. Unable to take the sensation, I fell to my knees. The carpet burned like I had fallen into a lit campfire. Everything was too much and there was no escape because it was on me and within me. I started to sob and the tears seared my flesh like acid. I don’t know how long I was there on hands and knees, gasping as everything within me twitched and moved and boiled.

There was nothing I could do to quell the sensations, crashed there in the middle of my dorm room, but I knew how to make it stop once and for all. And so I began my mission of dragging myself to the bathroom. I pulled myself there on my hands, and my knees dragged. They turned red and raw and they felt like they had been shredded to the bone. The things in my guts wriggled and whipped and the things on my skin itched and crawled.

It was an agonizingly slow process. Eventually, my desperate, reaching palms were met with the cold tile of the bathroom floor. It was like passing from a volcano to a glacier, but I forced myself onward. My hand grasped for the latch on the cabinet under the sink.

I sit here with a bottle of drain cleaner in one hand, the other pressed to the floor as I try to hold myself up. Every second that passes, I still feel them, on me and in me. I’m not an idiot, you know, but there’s only one way out of this. The good news is that I’m going to take every one of those little fuckers down with me.

There’s one thing, though, that I can’t help thinking about as I sit here, trying to overcome the sensations long enough to do what needs to be done.

For my family’s sake, I hope I wasn’t in the control group.

#horror stories#writers on tumblr#original fiction#creepypasta#i mean not really but maybe people will click#self harm / implied suicide cw#original post

1 note

·

View note

Text

Monthly Review Of DivGro: March 2019

New Post has been published on http://unchainedmusic.com/monthly-review-of-divgro-march-2019/

Monthly Review Of DivGro: March 2019

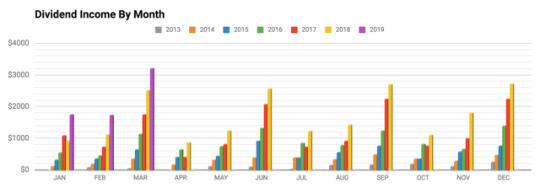

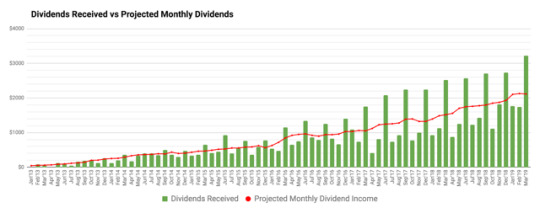

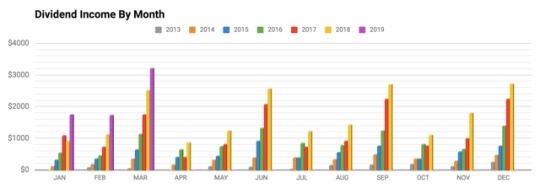

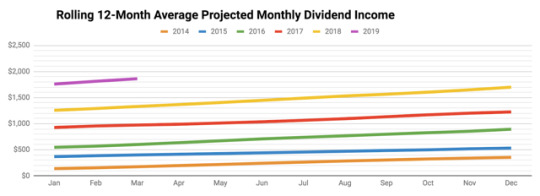

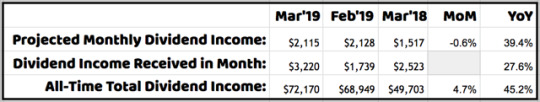

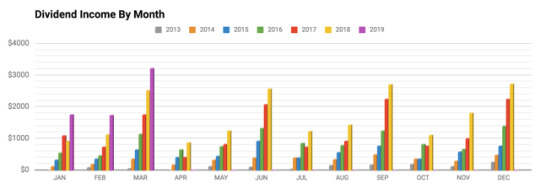

Welcome to the March review of DivGro, my portfolio of dividend growth stocks. Quarter-ending months are exciting, as many of the stocks I own pay dividends in these months and I usually set a new record for monthly dividend income in quarter-ending months.

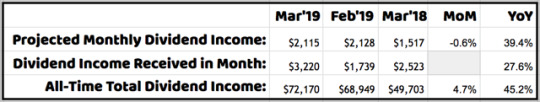

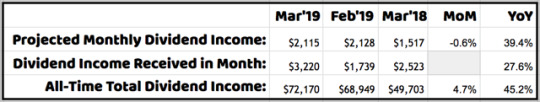

March did not disappoint. I received dividends totaling $3,220 from 43 stocks in my portfolio, a new record for monthly dividend income! Year over year, DivGro’s dividend income increased by 28%. So far in 2019, I’ve collected $6,724 in dividends or about 27% of my 2019 goal of $25,200.

Looking at how the month’s activities impacted DivGro’s projected annual dividend income (PADI), I note that five DivGro stocks announced dividend increases in March. Additionally, I opened one new position and added shares to five existing positions. On the other hand, I closed out one high-yielding position. Unfortunately, the net result of these changes is that projected annual dividend income (PADI) decreased by about 0.6% in March. Year over year, PADI increased by 39%.

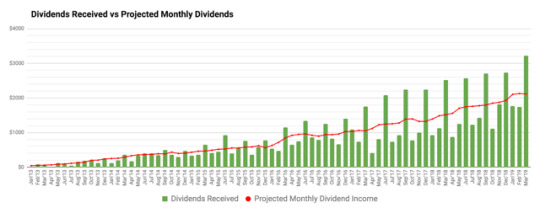

DivGro’s PADI now stands at $25,376, which means I can expect to receive $2,115 in dividend income per month, on average, in perpetuity, assuming the status quo is maintained. Of course, I expect the companies I’ve invested in not only to continue to pay dividends but to also increase them over time. Also, until I retire, I hope to continue reinvesting all dividends, so DivGro’s PADI should continue to grow through dividend growth and through compounding.

Dividend Income

In March, I received a total of $3,220 in dividend income from 43 different stocks:

Following is a list of the dividends I collected in March:

Aflac (AFL) — income of $27.00

Amgen (AMGN) — income of $36.25

Broadcom (AVGO) — income of $53.00

Boeing (BA) — income of $41.10

BlackRock (BLK) — income of $115.50

Cummins (CMI) — income of $57.00

Chevron (CVX) — income of $28.56

Dominion Energy (D) — income of $91.75

Digital Realty Trust (DLR) — income of $48.60

EPR Properties (EPR) — income of $18.75

Eversource Energy (ES) — income of $53.50

Extra Space Storage (EXR) — income of $47.30

Ford Motor (F) — income of $300.00

Gilead Sciences (GILD) — income of $126.00

Home Depot (HD) — income of $81.60

Honeywell International (HON) — income of $41.00

International Business Machines (IBM) — income of $47.10

Intel (INTC) — income of $163.81

International Paper (IP) — income of $50.00

Johnson & Johnson (JNJ) — income of $111.60

Lockheed Martin (LMT) — income of $30.80

Main Street Capital (MAIN) — income of $146.26

McDonald’s (MCD) — income of $31.32

3M (MMM) — income of $36.00

Microsoft (MSFT) — income of $46.00

NextEra Energy (NEE) — income of $31.25

AllianzGI Equity & Convertible Income Fund (NIE) — income of $380.00

Realty Income (O) — income of $56.38

PepsiCo (PEP) — income of $18.55

Pfizer (PFE) — income of $72.00

Public Storage (PSA) — income of $60.00

Ross Stores (ROST) — income of $25.50

Stanley Black & Decker (SWK) — income of $33.00

TJX (TJX) — income of $39.00

T. Rowe Price (TROW) — income of $152.00

Travelers (TRV) — income of $77.00

UnitedHealth (UNH) — income of $36.00

Union Pacific (UNP) — income of $35.20

United Parcel Service (UPS) — income of $33.60

Visa (V) — income of $4.25

Valero Energy (VLO) — income of $166.50

Walgreens Boots Alliance (WBA) — income of $88.00

Exxon Mobil (XOM) — income of $82.00

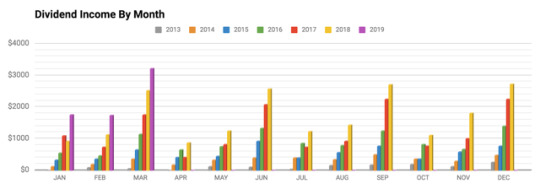

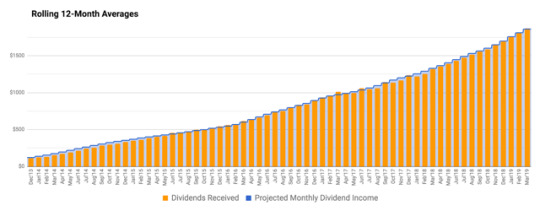

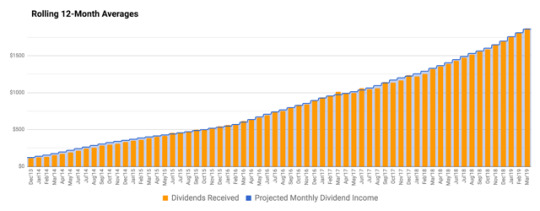

The following chart shows DivGro’s monthly dividends plotted against PMDI. Quarter-ending months are huge outliers:

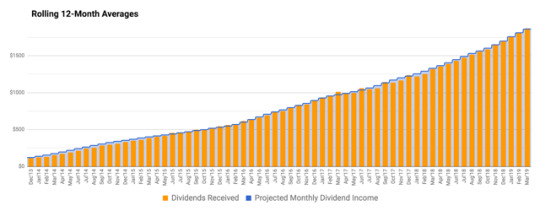

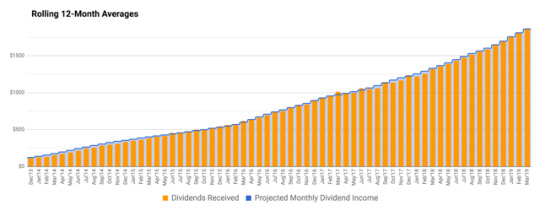

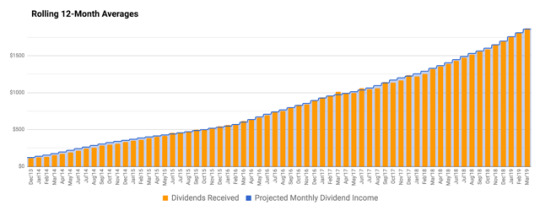

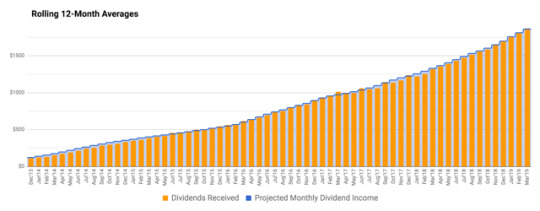

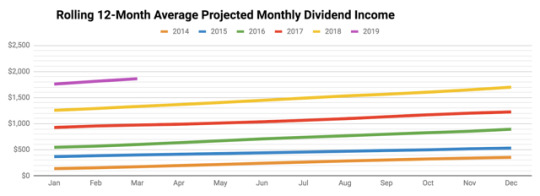

This is one reason that I now create a rolling 12-month average of dividends received (the orange bars) plotted against a rolling 12-month average of PMDI (the blue, staggered line):

While it would be nicer if dividends were distributed more evenly, it is not something that would drive my investment decisions.

Dividend Changes

In March, the following stocks announced dividend increases:

General Dynamics (GD) — an increase of 9.68%

Realty Income — an increase of 0.22%

Ross Stores — an increase of 13.33%

Raytheon (RTN) — an increase of 8.65%

W.P. Carey (WPC) — an increase of 0.19%

These changes will increase DivGro’s PADI by about $39.

I like seeing dividend increases above 7% and three of the five increases top my expectations. As for the REITs O and WPC, they announce dividend increases multiple times per year. O’s year-over-year increase is 2.96%, whereas WPC’s year-over-year increase is 1.67%.

Transactions

Here is a summary of my transactions in March:

Merck (MRK) — new position of 30 shares

After opening a small position in Chevron (CVX) in December 2018, MRK was the highest ranked stock in the top 50 holdings of dividend ETFs not in my DivGro portfolio. MRK ranked higher on an aggregate score than several of my Health Care sector holdings and, according to Simply Safe Dividends, MRK has a Very Safe dividend safety score of 98.

I opened a relatively small position of 30 shares at $80.52 per share, as MRK is not trading at my preferred discount to fair value of at least 10%. With this opening position, I’ll be able to track MRK more closely and look for opportunities to add shares at a better valuation.

Omega Healthcare Investors (OHI) — sold 250 shares and closed position

I decided to close my position in OHI on concerns about the declining fundamentals of OHI’s skilled nursing tenants. OHI has a Borderline Safe dividend safety score of 47, yet the REIT’s yield of 7%+ provides some compensation for the increased risk. Unfortunately, OHI broke a streak of 21 consecutive quarters of dividend increases when it froze its dividend last April, and unless OHI declares another dividend increase in 2019, it will be removed from the CCC list of dividend growth stocks.

It turns out my closing trade was about two weeks premature, as OHI closed at a 30-day high of $38.31 on 28 March. Nevertheless, my closing price of $35.90 secured a net gain of 29% or about 18% annualized.

To (somewhat) make up for the $660 in annual dividends I gave up by closing my OHI position, I added shares to several existing positions trading at favorable comparative yields.

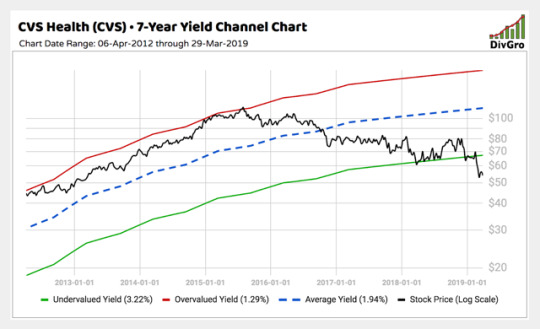

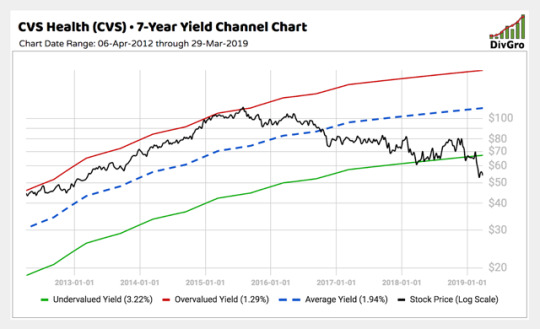

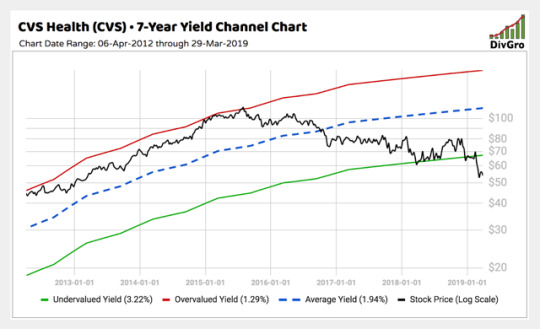

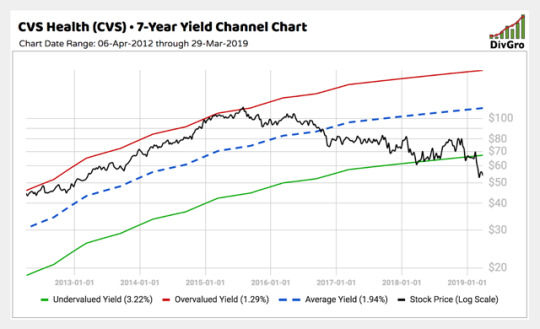

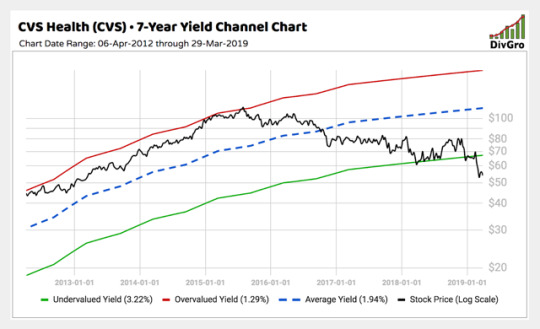

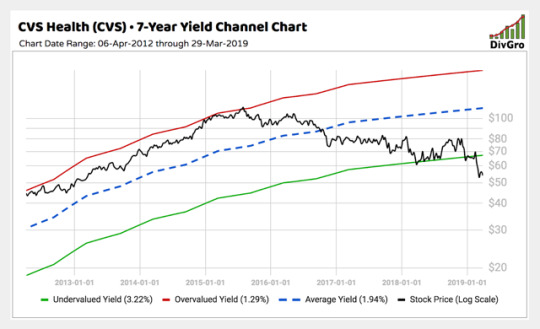

CVS Health (CVS) — added 50 shares and increased position to 200 shares

CVS continues to struggle and now is trading about 34% below its 52-week high. I paid $53.49 per share and lowered my average cost basis to $65.16. CVS froze its dividend after buying Aetna, though Simply Safe Dividends still considers the dividend Safe with a dividend safety score of 75.

I believe CVS will be fine in the long term, so the current yield is just too compelling to pass up, as illustrated in this 7-year yield channel chart:

Home Depot — added 10 shares and increased position to 60 shares

Honeywell International — added 10 shares and increased position to 60 shares

Iron Mountain (NYSE:IRM) — added 50 shares and increased position to 200 shares

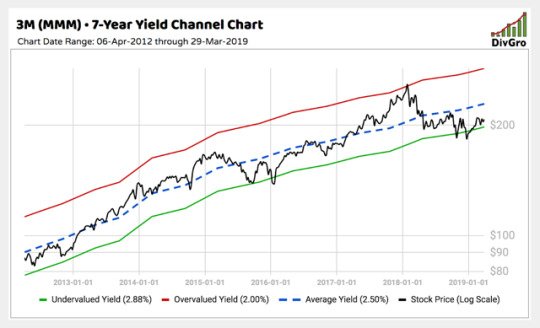

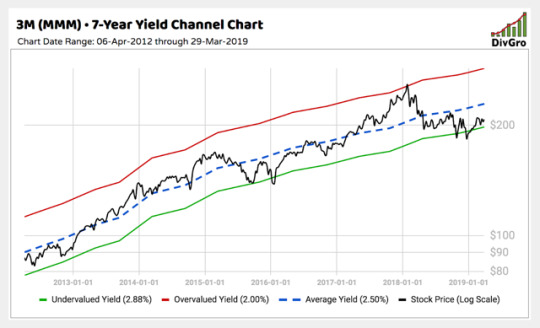

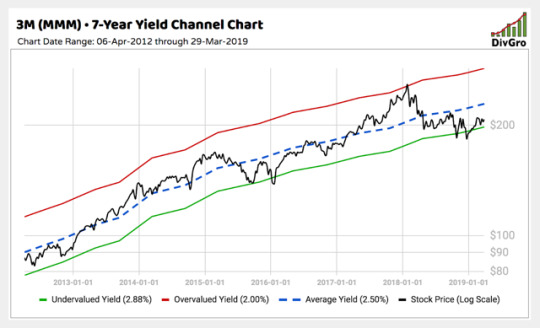

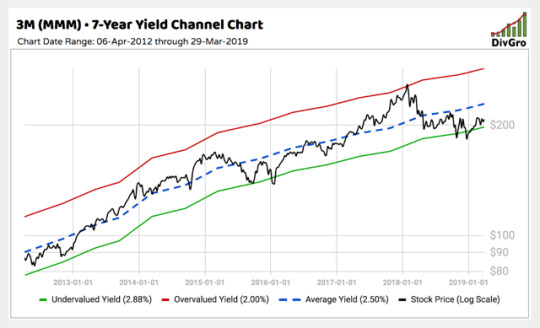

3M — added 15 shares and increased position to 40 shares

HD‘s dividend safety score is 90 (Very Safe) while the stock’s current dividend yield of 2.71% is 29% above its 5-year average of 2.11%, according to Simply Safe Dividends. I paid $182.11 per share, slightly lowering my average cost basis in the process. The stock’s dividend growth is stellar, with 5-year and 20-year dividend growth rates of 22%.

I also added 10 shares to my HON position, which is deemed a Very Safe dividend growth stock with a dividend safety score of 98. HON is trading at about fair value. Honeywell reported solid Q4’18 results and the management team increased their guidance for fiscal 2019. I think the stock is a great long term hold, though it is vulnerable to market cyclicality.

IRM‘s dividend yield of 6.8% is about 11% above its 5-year average dividend yield of 6.13%. While the REIT’s dividend safety score is on the low end at 52 (Borderline Safe), I think the 6.8% yield compensates me sufficiently for the somewhat higher risk. I paid $34.86 per share and I notice the stock is now trading above $36 per share, so my timing seemed to be good.

Finally, it is not often that one can buy MMM at a discount to fair value. I missed an even better opportunity in December 2018, but I’m happy that I grabbed 15 shares at $206.08 in March. The stock now trades at $216 per share. MMM has a Very Safe dividend safety score of 86 and boasts a 5-year dividend growth rate of 16%.

The net effect of my March transactions is that DivGro’s PADI decreased by about $198. However, I believe my portfolio’s risk profile has improved in the process and I’m happy that I replaced the somewhat riskier OHI with safer alternatives.

Markets

Here is a summary of various market indicators, showing the changes over the last month:

In March, the DOW 30 increased slightly, the S&P 500 increased by 1.79%, and the NASDAQ increased by 2.61%. The yield on the benchmark 10-year Treasury note fell to 2.414%, while CBOE’s measure of market volatility, the VIX, decreased to 13.71.

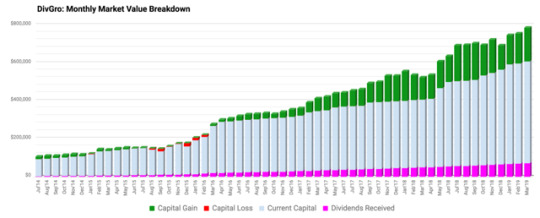

Portfolio Statistics

Based on the total capital invested and the portfolio’s current market value, DivGro has delivered a simple return of about 47% since inception. In comparison, DivGro’s IRR (internal rate of return) is 14.5%. (IRR takes into account the timing and size of deposits since inception, so it is a better measure of portfolio performance).

I track the yield on cost (YoC) for individual stocks, as well as an average YoC for my portfolio. DivGro’s average YoC decreased from 3.98% last month to 3.92% this month.

On the other hand, DivGro’s projected annual yield is 4.73%. This is down from last month’s value of 4.84%. I calculate the projected annual yield by dividing PADI ($25,376) by the total amount invested.

Percentage payback relates dividend income to the amount of capital invested. DivGro’s average percentage payback is 13.5%, up from last month’s 13.1%.

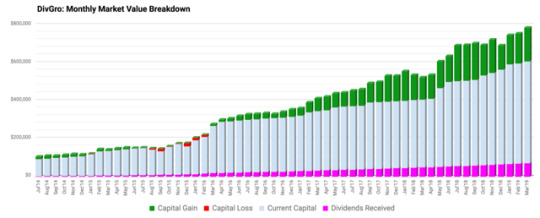

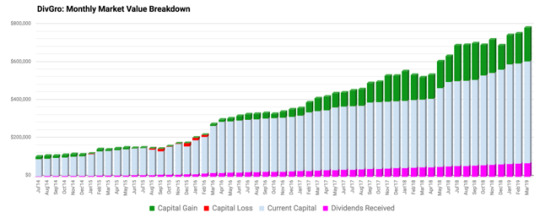

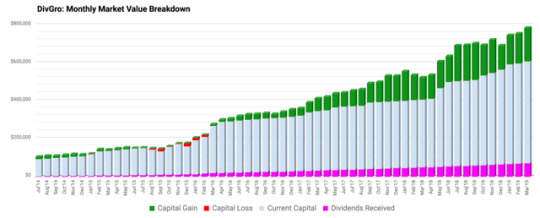

Here’s a chart showing DivGro’s market value breakdown. Dividends are plotted at the base of the chart so we can see them grow over time:

Looking Ahead

I’ve been working on creating a database of weekly dividend yields covering a period of 12 years. For now, the database covers dividend-paying stocks in my portfolio. In time, I’d like to add high-quality dividend growth stocks I don’t yet own.

Maintaining the database will allow me to create yield channel charts at any time to help guide investment decisions. Furthermore, I’ll be able to do a quick fair value estimate for stocks in the database by comparing the current dividend yield with the historical average dividend yield over a period of, say, five years.

I’m hoping to get back to writing monthly DivGro Pulse articles and share yield channel charts of stocks trading at or near extreme historical yields.

Please see my Performance page for various visuals summarizing DivGro’s performance.

Thanks for reading and take care, everybody!

Disclosure: I am/we are long AAPL, ABBV, ADM, AFL, AMGN, APD, AVGO, BA, BLK, CB, CMCSA, CMI, CSCO, CVS, CVX, D, DGX, DIS, DLR, EPR, ES, EXR, FDX, FRT, GD, HD, HON, HRL, IBM, INTC, IP, IRM, ITW, JNJ, JPM, KO, LMT, LOW, MAIN, MCD, MDT, MMM, MO, MRK, MSFT, NEE, NNN, O, PEP, PFE, PG, PM, ROST, RTN, SBUX, SKT, SPG, SWK, T, TJX, TROW, TRV, TXN, UNH, UNP, UPS, V, VLO, VZ, WBA, WEC, WPC, XOM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

Monthly Review Of DivGro: March 2019

New Post has been published on http://unchainedmusic.com/monthly-review-of-divgro-march-2019/

Monthly Review Of DivGro: March 2019

Welcome to the March review of DivGro, my portfolio of dividend growth stocks. Quarter-ending months are exciting, as many of the stocks I own pay dividends in these months and I usually set a new record for monthly dividend income in quarter-ending months.

March did not disappoint. I received dividends totaling $3,220 from 43 stocks in my portfolio, a new record for monthly dividend income! Year over year, DivGro’s dividend income increased by 28%. So far in 2019, I’ve collected $6,724 in dividends or about 27% of my 2019 goal of $25,200.

Looking at how the month’s activities impacted DivGro’s projected annual dividend income (PADI), I note that five DivGro stocks announced dividend increases in March. Additionally, I opened one new position and added shares to five existing positions. On the other hand, I closed out one high-yielding position. Unfortunately, the net result of these changes is that projected annual dividend income (PADI) decreased by about 0.6% in March. Year over year, PADI increased by 39%.

DivGro’s PADI now stands at $25,376, which means I can expect to receive $2,115 in dividend income per month, on average, in perpetuity, assuming the status quo is maintained. Of course, I expect the companies I’ve invested in not only to continue to pay dividends but to also increase them over time. Also, until I retire, I hope to continue reinvesting all dividends, so DivGro’s PADI should continue to grow through dividend growth and through compounding.

Dividend Income