#boycott nickelodeon & paramount

Explore tagged Tumblr posts

Text

guilty pleasure and childhood show

#fanboy and chum chum#fanboy#chum chum#kyle bloodworth#sal arts#kyle the conjurer#fbncc#fankyle#nostalgic cartoons#emptying out the drafts tag#boycott nickelodeon & paramount#fanboy and chum chum fanart#fanart#artists of color#artist#2010s nostalgia#2010 cartoons#you guys don't get it. southeast asian fanboy and latino chum chum is my everything.

121 notes

·

View notes

Text

I apologize for coming across hostile, but like what the fuck? Why are y'all so surprised that the bitch with a blog dedicated to Henry Danger still plans on watching the show/movie?

The amount of random ppl unprovoked in my DM's is wild. Why are y'all shitting on me because of this post?

I made this to spread awareness, and I called for a boycott. I'm not watching it legally. Clearly, I'm not supporting Dan Schneider, Nickelodeon, or Paramount.

Not that it fucking matters, nor should I have to defend myself to you guys. But I was molested and abused as a kid, too.

Hyperfixations are a coping mechanism, I'm sorry if it's hard for some of you to understand.

I used nickelodeon for escapism to ignore the situation happening to me at the time. My attachment to it came from a dark place just like it's creation.

Perhaps that's why I identified with the show so much, but I can't change that. It'll always be my comfort show, I can't go back and relive my childhood to pick a new one.

Comparing me to a literal pedophile for enjoying the show that brought me comfort for my entire childhood is disgusting and takes attention from the intended awareness of my post.

All the stuff uncovered about nickelodeon these last few days through the "Quiet on Set" has been so devastating. Nickelodeon failed their cast, and they failed their audiences.

But something not a lot of ppl have acknowledged is that Dan Schneider is still working.

He was never truly released by nickelodeon. It was a publicity ploy to appease the public. Once Paramount bought nickelodeon, he was immediately hired back on.

Like, right now, he's listed as one of the lead writers and producers of the Henry Danger movie.

At first, I was really excited for a movie, but in this mess, I plan on and encourage all of you to watch your favorite nickelodeon shows/movie (if you still can) through pirating. They don't deserve to profit off the children they abused anymore.

#trigger warnings#topics of sa#henry danger#dangerverse#nickelodeon#paramount plus#boycott paramount#boycott nickelodeon#leave me the fuck alone#quiet on set

2K notes

·

View notes

Text

since it's now confirmed that melissa barrera was fired from the scream franchise for supporting palestine, i'd like to remind everyone that paramount (who produces the movies) donated $1 million dollars to israel and is matching all employee donations

so yeah, fuck paramount. if you want to boycott them here's their newest and upcoming releases:

killers of the flower moon

under the boardwalk

mean girls

bob marley: one love

IF

a quiet place: one day

transformers one

smile 2

gladiator 2

sonic the hedgehog 3

oh, and don't forget they also own nickelodeon:

#i will not be supporting anything they fucking put out especially not scream vii#fuck you 🖕🖕#free palestine#paramount#nickelodeon#fuck paramount#melissa barrera#scream#scream vii#scream 7

20 notes

·

View notes

Text

If you're British you may have seen that there's a lot of ROTTMNT merch around lately, specifically the stampers. However, I'm not entirely sure if these are boycott compliant??? They're really old, like from 2020, so I'm unsure if Nickelodeon still gets profit from them as I doubt they'd be putting out Rise stuff again now, but ive been seeing them at too many places for it to just be old excess stock that they didnt know what to do with, even if they are on clearance. If they do still get the profits then please don't buy them!!! If you're really that desperate for them then purchase them through a third party source where Nick or Paramount won't receive any of the profits, I've seen them a lot on ebay recently!!! As long as it's not an ebay account for a big business then you're all good!!!! Always check the account name before purchasing!!! It may be more expensive but I hope most people wouldn't mind spending a couple extra pounds if it meant not supporting Nickelodeon or Paramount.

Genuinely as much as I love Rise I promise you Rise merch is NOT worth supporting Nick and Paramount!!!! Even if it is a rarity, people don't deserve to lose their lives because of silly turtles!!! Supporting Palestine is way more important than supporting zionist companies.

Also remember to pirate TOTTMNT when it releases along with ROTTMNT itself!!!!

(Please add on to this if you know more about this sort of stuff than I do!!! Would be very much appreciated.)

4 notes

·

View notes

Note

why are people even hyped for the sonic movies? tbh they're kinda awful, and the only reason people even give a shit about them is that they feel vindicated about successfully cyberbullying paramount into redesigning sonic.

the characters don't even feel in character. robotnik is literally just 90s jim carrey. sonic has a weird backstory about an owl. knuckles doesn't even SOUND like knuckles. about the only redeeming factor is tails

and now learning paramount is pro-israel it's time to make sonic 3 bomb hard. there's plenty of other, better sonic media

Okay, now that I'm off work I can finally answer this properly.

Firstly - i'm just gonna let you sit on that first question for a minute and see if you understand that you just asked me why people are hyped for a movie series about a massively popular videogame franchise that has been around for literally 30+ years. Sonic is older than I fucking am.

Secondly - anon. I adore Shadow the Hedgehog, and he is my favorite character in the Sonic franchise and I will probably continue to post about him and share reblogs if his design is revealed, but I personally am not planning on going and spending money to see this movie after finding out about Paramount's support for Israel. I don't really post about it on my blog, but I have been participating in boycotts of multiple brands. Paramount, and by extension Nickelodeon, is now one of them. Please do not mistake my posting of Shadow hype for me saying that I'm okay with Paramount. I just like Shadow and think he looks cool.

Thirdly - i completely disagree with your take on the Sonic movies. The Sonic franchise was dragged through SHIT through the 2010s. NONE of the characters were acting like themselves. Look up videos of people criticizing Sonic Forces. Tails is horrendously written in that game, but the others are not much better. The Sonic Movies -Sonic Movie 2, especially, have absolutely helped to repair the massive damage done to the brand thanks to Sega being way too strict. Knuckles was more in character in Sonic Movie 2 than he has been in YEARS in any of the other media. The amount of fans I saw saying that Knuckles finally felt like Knuckles again was insane. I remember the older games, back when he was still taken seriously and wasn't just "big dumb musclehead" stereotype. And then Sonic himself is acting more like the older tv shows' versions of him. Like in Sonic Underground and parts of Sonic X. He's fun, he's childish, that's who they chose to make Sonic this time. His personality has been so all over the place that I'm really not too picky, as long as he isn't completely stupid. These movies feel like they were made by someone who LOVES Sonic. You can tell the writers and the director actually give a shit about this franchise. They got kind of fucked over in the first movie, but were given more freedom in the second.

Fourthly(?) - To be fair, people have a solid reason to feel vindicated for bullying Paramount into changing Sonic's design. That's literally never fucking happened before. Studios typically DO NOT LISTEN to what fans complain about. They scoff and say "Well we know better than you, so shut up."

5 notes

·

View notes

Text

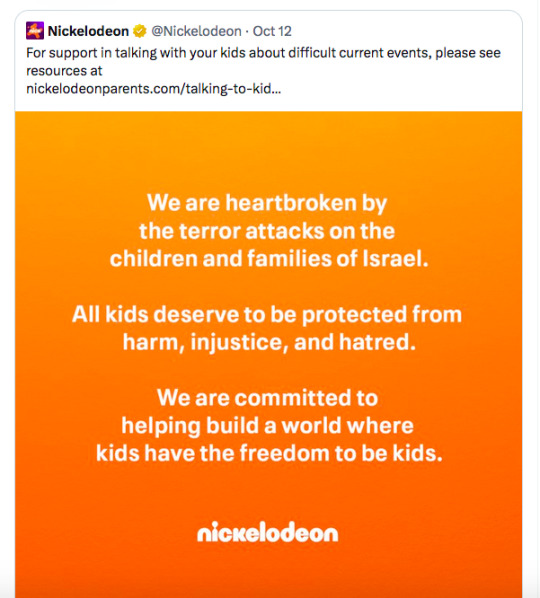

i know it's outrageous to say "this isn't news to me" to companies supporting the bombing and maiming of civilians, including infants and children, but after seeing the nickelodeon twitter account put on blast for doing the exact same thing...

...it IMMEDIATELY became clear to me, alongside the fact that they still operate in the colony, that ALL of paramount global/viacom supports israel.

granted, they own... quite a lotta shit, but we oughta put the most focus on the main ones: paramount and nickelodeon. if people can also try to boycott any subsidiaries, like mtv, that'll also go a long way.

if you know who and what to boycott, BOYCOTT. i've told y'all this much now, and the lives of MILLIONS of palestinians depend on it, so you don't have an excuse not to.

remember: as with all corporations, their wallets are where it'll hurt them the most. piracy is always free and will always be morally correct in this case. and ofc you don't have to throw away anything you already have. that'd be heartbreaking and wasteful. just don't give them your money ANYMORE and you'll be fine.

feel like this is a good time for a reminder that paramount supports israel

happy for the knuckles series, pirate it

#jxnisreblogging#paramount#nickelodeon#free palestine#from the river to the sea palestine will be free

15K notes

·

View notes

Text

Jobs on the Line; Peloton’s Doing Fine

Jobs on the Line; Peloton’s Doing Fine:

Wall Street’s Breaking Bad

This must be Thursday. I never could get the hang of Thursdays.

— Arthur Dent, The Hitchhiker’s Guide to the Galaxy.

Indeed, it is Thursday, dear reader. And you know what that means … weekly unemployment claims and a market rally. (More optimistically, it’s also Reader Feedback day! Read on…)

The Labor Department reported 3.2 million new unemployment claims for last week. The seven-week rolling total now sits at a staggering 33 million. In case you wondered, that’s bad.

However, Wall Street managed to delude itself into finding a silver lining once again. Investors are keying off the fact that claims have fallen steadily for the past five weeks.

In other words, the labor market is bad and getting worse. But … at least it’s not getting progressively bad… (Or the amount of bad is not as bad as the amount of bad that we had two weeks ago.) Something like that.

So, either Wall Street has broken “bad,” or investors are so far into doublespeak that they can’t tell the difference anymore. Personally, I like Jim Cramer’s commentary on the situation: “At the end of the day, this action makes little sense.”

Cramer also went on to tell CNBC: “When we get Friday’s employment report it is going to be so bad that we’re going to be debating whether we’re in a serious recession or a depression.”

I don’t have Cramer’s confidence on this one. I believe Wall Street will shrug off tomorrow’s official jobs data from the Labor Department. Why wouldn’t it?

The market has shrugged at every other piece of apocalyptic economic data in the past two months. Why should tomorrow’s nonfarm payrolls report be any different?

The Takeaway:

Let’s shift gears here and turn to a reemerging trend that could have a more direct impact on our trading habits over the next several weeks to months.

I’m talking about the return on the trade war cycle.

Buried under the weekly unemployment claims headlines was this gem from MarketWatch: “Global Equities Rise on Trade Talk Hopes as More Jobs Vanish in the U.S.” (Well, that was the headline before MarketWatch changed it.)

Yes, trade talk hopes.

On May 1, President Trump said that he is considering putting the kibosh on the phase 1 U.S.-China trade deal in retaliation for China’s handling of COVID-19.

Trump doubled down on the China threat at a town hall meeting over the weekend. “Now they have to buy,” Trump said. “And if they don’t buy, we’ll terminate the deal, very simple.”

Today, news broke that Washington and Beijing have scheduled talks on the matter next week. This will be the first time that the two sides have discussed the trade deal since signing it in January.

And so, we find ourselves once again moving the needle on the Great Stuff Trade War Cycle chart:

If you followed this pattern last year, you probably made quite a bit of cash. I had more than a few Great Stuff readers tell me they made bank by following this pattern.

That said, things are a bit different this time around. We’re not in a bull market. We face a mountain of bad economic data. And we’re desperately dealing with a global pandemic. Given those external pressures, this may be a short-lived trade war cycle.

Regardless, Trump’s tilt toward China brings more volatility to an already volatile market. But you can use this volatility instead to your advantage instead of making decisions out of panic.

Hectic times beg for simple trading strategies, and we found what just might be the simplest strategy to follow: the 10X Switch.

Adam O’Dell is about to show you how you can use it to easily play both sides of the market swings — without buying or selling a single stock, option or bond.

The best part? You can reserve your spot to hear more for free. Simply click here.

(See, we told you Great Stuff gets you past the velvet ropes.)

Good: Viable Viacom

ViacomCBS Inc. (Nasdaq: VIAC) is the dark horse in the race for streaming-video dominance. The unholy union between Viacom and CBS holds a collection of content that includes Pluto TV, CBS, Nickelodeon, BET, MTV, Comedy Central, Paramount Pictures and Showtime.

That dark horse status isn’t holding back ViacomCBS at all. The company blew past Wall Street’s earnings expectations this morning by $0.18 per share. Revenue, meanwhile, beat analysts’ targets by $100 million.

That’s not to say there weren’t problems. ViacomCBS’s ad revenue fell 19% year over year, and so did both earnings and revenue. However, digital-streaming revenue soared 51%, and film revenue jumped 11% on home-licensing deals (read: streaming deals).

The point is, if ViacomCBS wasn’t already on your shortlist for streaming video investment ideas, it should be. The real question is, if you read Great Stuff, why isn’t VIAC already on your radar? (I mean, we told you about ViacomCBS back in February.)

Better: Getting Down at P-Town

It’s official. I was wrong on Peloton Interactive Inc. (Nasdaq: PTON).

Well, sort of — I didn’t count on a global pandemic to force people to work and work out from home.

The company proffering stationary bikes with video subscriptions is making bank during the U.S. pandemic lockdown. This morning, Peloton said that first-quarter revenue spiked 66% to $524.6 million.

Earnings were still poor, arriving at a loss of $0.20 per share and missing the Street’s estimate by $0.02. But, for an expanding startup, that’s to be expected.

The real juicy news is that subscription revenue skyrocketed 92%, as the company’s “connected fitness” subscribers jumped 94% to 886,0000. Paid digital subs rose 64% on the quarter.

Peloton also raised its full-year revenue and subscriber count outlooks above Wall Street’s target.

What’s more, this trend may be stickier than most stay-at-home trends in the market right now. Imagine going to the gym while COVID-19 still floats around out there with no cure. No thanks.

So, do I still think Peloton sells overpriced bikes with the equivalent of a Netflix subscription? Yes.

Is that model going to work in the current and post-pandemic market? Yes, yes it will.

The fear-driven sentiment surrounding local gyms and going outside to work out could linger for months to a year or more. That fear will provide a heavy tailwind for PTON stock and the company’s bottom line.

Editor’s Note: Looking for a way to play earnings season? Just wait until you hear from earnings expert Chad Shoop… (Click here.)

Best: Testing, One, Two … Three?

We’re still months away from a viable vaccine for COVID-19, but Moderna Inc. (Nasdaq: MRNA) has put the world one step closer to that goal.

Today, the U.S. Food and Drug Administration cleared Moderna’s coronavirus vaccine for phase 2 trials. The company plans to begin those trials with 600 patients very shortly. Furthermore, it’s already finalizing plans for phase 3 trials as early as this summer.

“We are accelerating manufacturing scale-up and our partnership with Lonza puts us in a position to make and distribute as many vaccine doses of mRNA-1273 as possible, should it prove to be safe and effective,” CEO Stephane Bancel said in a statement.

I’ll be honest: This is the best news I’ve heard on the COIVD-19 front since this whole thing began.

Now, you’re probably wondering if you should invest in MRNA shares. I’m going to give that a great big “that depends.”

Way to be noncommittal there, Mr. Great Stuff.

Well … it does. Are you in or nearing retirement? Then stay away from speculative biotechs. Moderna itself said that it will “incur significant expenses this year” due to vaccine development. It should get most of that money back from grants and awards, but it’s still a risk.

If you’re younger in your investment journey, and your risk tolerance is high enough, you might give MRNA a shot. (Ha-ha … shot … I’ll see myself out.)

That said, for those of you into taking risks, wait for MRNA to pull back from today’s surge before you jump in. There will be some follow-through profit-taking from those who got in early. You’ll get a better entry price if you don’t chase today’s surge.

You yelled “Marco!” and it’s my turn to play polo — or something along those lines. It’s time for this week’s edition of Reader Feedback!

Boy, this week has everyone writing in … and it’s not just the “DO YOU HAVE MESOTHELIOMA???” ads that usually come through.

Nay, this week, Great Stuff readers are right on the pulse with all things China and trade wars. Seriously, I haven’t seen this many “anti-this” and “anti-that” email chains since the early 2000s… (Boycott the world — no, no, reopen the world! Go underground! Eat more broccoli!)

Keep it coming, dear readers! Write to us anytime at [email protected]. Now let’s dive in…

Imperfect Circle

Some cities are exposing their inner dictators by some of their actions. The federal government has been overly generous in helping the states deal with the enormous challenges created by this virus. Has it been perfect? Of course not. It’s government. I just hope and pray voters remember who did what in November.

— Andrew W.

Hey Andrew! Quick counter point, just for funsies: At many levels, the federal government’s inability to stay self-consistent is one of the enormous challenges that states are facing. Reopen now, reopen never — it doesn’t matter what the plan is if mixed messages and misinformation botch it either way.

That said, I am envious of the hope you hold for your fellow voters this November.

Warren Dumps

Just one question — who did Buffet sell all his airline shares to?

All the airlines he sold have similar charts, but selling a position the size he had any time in the last month should have caused an even bigger move, unless someone with VERY DEEP pockets was buying those shares.

— Gordon F.

Deep pockets, you say? JPow, it’s Buff Buff. My, what unlimited stimulus you have … maybe you’d be down with a little personal bailout…

I hate to break it to anyone wanting a juicy story. There’s no boogey man here. There’s no conspiracy. I know, the X-Files lied to me too.

Many people, new to the markets or otherwise, want to find something — anything — amiss whenever the Big Money is concerned. Warren Buffett didn’t go prowling the streets of Omaha looking for a back-alley airline stock deal, as fanciful an image as that might be.

Let’s break this down.

Big-time investors like Buffett’s Berkshire don’t just dump $4 billion in stock all at once. They do it carefully, bits at a time over a period … to market makers, other big investors, retail investors and banks. And Berkshire and its subsidiaries started last month.

I’m not privy to the exact methods, but Big-Money investors do this for exactly the reason you mentioned: to not tank the market all at once … and to not hurt the prices that they get for that sold stock.

Is Buffett willing to get a bad deal on hundreds of millions of airline shares? When a single-penny difference means losing billions? And risk even more portfolio upheaval at a time like this? I say nay nay.

(A shill! A shill! They got to him!)

Sure.

Ooh, I’ve Been Dirt, and I Don’t Care

I read lots, but put my money in dirt (real estate). I know where it is and how much it will make me. — Tim P.

You know how much it’ll make you?! Tim, your crystal ball — give it here!

I joke, but there is one serious leg-up that real estate has over equities right now.

Yes, home showings will slow and/or stop. And going through the buying process is a pain in non-pandemic times. (Though, I’ve seen quite a few rental listings using the “See it solo!” method, which gets my industry-disruption Spidey senses tingling.)

But here’s the difference: With stocks, you can check Robinhood every second of the trading day and watch the dizzying price changes.

You can … but it’ll drive you bat-flu crazy. Well, most of the market is glued to the screen anyway. And as investors’ positions whipsaw, so do their reactions, and the vicious cycle grows through rally, bust and boom again — often within mere hours.

Irrationality breeds irrationality, and the equity markets are filled to the brim with it right now. Real estate? Not to the same neck-breaking extent. Just imagine if your house had a ticker on it and you could see it make 500-point moves like the Dow every day.

If you wrote in and I didn’t get to your email, it may be because you cursed too $%^*@#$ much. I still appreciate your email, even if we can’t share it publicly.

Got more on your mind? So do I, so let’s get writing. Send us an email at [email protected].

That’s a wrap for today, but if you still crave more Great Stuff, check us out on social media: Facebook and Twitter.

Until next time, be Great!

Regards,

Joseph Hargett

Editor, Great Stuff

0 notes

Link

Wall Street’s Breaking Bad

This must be Thursday. I never could get the hang of Thursdays.

— Arthur Dent, The Hitchhiker’s Guide to the Galaxy.

Indeed, it is Thursday, dear reader. And you know what that means … weekly unemployment claims and a market rally. (More optimistically, it’s also Reader Feedback day! Read on…)

The Labor Department reported 3.2 million new unemployment claims for last week. The seven-week rolling total now sits at a staggering 33 million. In case you wondered, that’s bad.

However, Wall Street managed to delude itself into finding a silver lining once again. Investors are keying off the fact that claims have fallen steadily for the past five weeks.

In other words, the labor market is bad and getting worse. But … at least it’s not getting progressively bad… (Or the amount of bad is not as bad as the amount of bad that we had two weeks ago.) Something like that.

So, either Wall Street has broken “bad,” or investors are so far into doublespeak that they can’t tell the difference anymore. Personally, I like Jim Cramer’s commentary on the situation: “At the end of the day, this action makes little sense.”

Cramer also went on to tell CNBC: “When we get Friday’s employment report it is going to be so bad that we’re going to be debating whether we’re in a serious recession or a depression.”

I don’t have Cramer’s confidence on this one. I believe Wall Street will shrug off tomorrow’s official jobs data from the Labor Department. Why wouldn’t it?

The market has shrugged at every other piece of apocalyptic economic data in the past two months. Why should tomorrow’s nonfarm payrolls report be any different?

The Takeaway:

Let’s shift gears here and turn to a reemerging trend that could have a more direct impact on our trading habits over the next several weeks to months.

I’m talking about the return on the trade war cycle.

Buried under the weekly unemployment claims headlines was this gem from MarketWatch: “Global Equities Rise on Trade Talk Hopes as More Jobs Vanish in the U.S.” (Well, that was the headline before MarketWatch changed it.)

Yes, trade talk hopes.

On May 1, President Trump said that he is considering putting the kibosh on the phase 1 U.S.-China trade deal in retaliation for China’s handling of COVID-19.

Trump doubled down on the China threat at a town hall meeting over the weekend. “Now they have to buy,” Trump said. “And if they don’t buy, we’ll terminate the deal, very simple.”

Today, news broke that Washington and Beijing have scheduled talks on the matter next week. This will be the first time that the two sides have discussed the trade deal since signing it in January.

And so, we find ourselves once again moving the needle on the Great Stuff Trade War Cycle chart:

If you followed this pattern last year, you probably made quite a bit of cash. I had more than a few Great Stuff readers tell me they made bank by following this pattern.

That said, things are a bit different this time around. We’re not in a bull market. We face a mountain of bad economic data. And we’re desperately dealing with a global pandemic. Given those external pressures, this may be a short-lived trade war cycle.

Regardless, Trump’s tilt toward China brings more volatility to an already volatile market. But you can use this volatility instead to your advantage instead of making decisions out of panic.

Hectic times beg for simple trading strategies, and we found what just might be the simplest strategy to follow: the 10X Switch.

Adam O’Dell is about to show you how you can use it to easily play both sides of the market swings — without buying or selling a single stock, option or bond.

The best part? You can reserve your spot to hear more for free. Simply click here.

(See, we told you Great Stuff gets you past the velvet ropes.)

Good: Viable Viacom

ViacomCBS Inc. (Nasdaq: VIAC) is the dark horse in the race for streaming-video dominance. The unholy union between Viacom and CBS holds a collection of content that includes Pluto TV, CBS, Nickelodeon, BET, MTV, Comedy Central, Paramount Pictures and Showtime.

That dark horse status isn’t holding back ViacomCBS at all. The company blew past Wall Street’s earnings expectations this morning by $0.18 per share. Revenue, meanwhile, beat analysts’ targets by $100 million.

That’s not to say there weren’t problems. ViacomCBS’s ad revenue fell 19% year over year, and so did both earnings and revenue. However, digital-streaming revenue soared 51%, and film revenue jumped 11% on home-licensing deals (read: streaming deals).

The point is, if ViacomCBS wasn’t already on your shortlist for streaming video investment ideas, it should be. The real question is, if you read Great Stuff, why isn’t VIAC already on your radar? (I mean, we told you about ViacomCBS back in February.)

Better: Getting Down at P-Town

It’s official. I was wrong on Peloton Interactive Inc. (Nasdaq: PTON).

Well, sort of — I didn’t count on a global pandemic to force people to work and work out from home.

The company proffering stationary bikes with video subscriptions is making bank during the U.S. pandemic lockdown. This morning, Peloton said that first-quarter revenue spiked 66% to $524.6 million.

Earnings were still poor, arriving at a loss of $0.20 per share and missing the Street’s estimate by $0.02. But, for an expanding startup, that’s to be expected.

The real juicy news is that subscription revenue skyrocketed 92%, as the company’s “connected fitness” subscribers jumped 94% to 886,0000. Paid digital subs rose 64% on the quarter.

Peloton also raised its full-year revenue and subscriber count outlooks above Wall Street’s target.

What’s more, this trend may be stickier than most stay-at-home trends in the market right now. Imagine going to the gym while COVID-19 still floats around out there with no cure. No thanks.

So, do I still think Peloton sells overpriced bikes with the equivalent of a Netflix subscription? Yes.

Is that model going to work in the current and post-pandemic market? Yes, yes it will.

The fear-driven sentiment surrounding local gyms and going outside to work out could linger for months to a year or more. That fear will provide a heavy tailwind for PTON stock and the company’s bottom line.

Editor’s Note: Looking for a way to play earnings season? Just wait until you hear from earnings expert Chad Shoop… (Click here.)

Best: Testing, One, Two … Three?

We’re still months away from a viable vaccine for COVID-19, but Moderna Inc. (Nasdaq: MRNA) has put the world one step closer to that goal.

Today, the U.S. Food and Drug Administration cleared Moderna’s coronavirus vaccine for phase 2 trials. The company plans to begin those trials with 600 patients very shortly. Furthermore, it’s already finalizing plans for phase 3 trials as early as this summer.

“We are accelerating manufacturing scale-up and our partnership with Lonza puts us in a position to make and distribute as many vaccine doses of mRNA-1273 as possible, should it prove to be safe and effective,” CEO Stephane Bancel said in a statement.

I’ll be honest: This is the best news I’ve heard on the COIVD-19 front since this whole thing began.

Now, you’re probably wondering if you should invest in MRNA shares. I’m going to give that a great big “that depends.”

Way to be noncommittal there, Mr. Great Stuff.

Well … it does. Are you in or nearing retirement? Then stay away from speculative biotechs. Moderna itself said that it will “incur significant expenses this year” due to vaccine development. It should get most of that money back from grants and awards, but it’s still a risk.

If you’re younger in your investment journey, and your risk tolerance is high enough, you might give MRNA a shot. (Ha-ha … shot … I’ll see myself out.)

That said, for those of you into taking risks, wait for MRNA to pull back from today’s surge before you jump in. There will be some follow-through profit-taking from those who got in early. You’ll get a better entry price if you don’t chase today’s surge.

You yelled “Marco!” and it’s my turn to play polo — or something along those lines. It’s time for this week’s edition of Reader Feedback!

Boy, this week has everyone writing in … and it’s not just the “DO YOU HAVE MESOTHELIOMA???” ads that usually come through.

Nay, this week, Great Stuff readers are right on the pulse with all things China and trade wars. Seriously, I haven’t seen this many “anti-this” and “anti-that” email chains since the early 2000s… (Boycott the world — no, no, reopen the world! Go underground! Eat more broccoli!)

Keep it coming, dear readers! Write to us anytime at [email protected]. Now let’s dive in…

Imperfect Circle

Some cities are exposing their inner dictators by some of their actions. The federal government has been overly generous in helping the states deal with the enormous challenges created by this virus. Has it been perfect? Of course not. It’s government. I just hope and pray voters remember who did what in November.

— Andrew W.

Hey Andrew! Quick counter point, just for funsies: At many levels, the federal government’s inability to stay self-consistent is one of the enormous challenges that states are facing. Reopen now, reopen never — it doesn’t matter what the plan is if mixed messages and misinformation botch it either way.

That said, I am envious of the hope you hold for your fellow voters this November.

Warren Dumps

Just one question — who did Buffet sell all his airline shares to?

All the airlines he sold have similar charts, but selling a position the size he had any time in the last month should have caused an even bigger move, unless someone with VERY DEEP pockets was buying those shares.

— Gordon F.

Deep pockets, you say? JPow, it’s Buff Buff. My, what unlimited stimulus you have … maybe you’d be down with a little personal bailout…

I hate to break it to anyone wanting a juicy story. There’s no boogey man here. There’s no conspiracy. I know, the X-Files lied to me too.

Many people, new to the markets or otherwise, want to find something — anything — amiss whenever the Big Money is concerned. Warren Buffett didn’t go prowling the streets of Omaha looking for a back-alley airline stock deal, as fanciful an image as that might be.

Let’s break this down.

Big-time investors like Buffett’s Berkshire don’t just dump $4 billion in stock all at once. They do it carefully, bits at a time over a period … to market makers, other big investors, retail investors and banks. And Berkshire and its subsidiaries started last month.

I’m not privy to the exact methods, but Big-Money investors do this for exactly the reason you mentioned: to not tank the market all at once … and to not hurt the prices that they get for that sold stock.

Is Buffett willing to get a bad deal on hundreds of millions of airline shares? When a single-penny difference means losing billions? And risk even more portfolio upheaval at a time like this? I say nay nay.

(A shill! A shill! They got to him!)

Sure.

Ooh, I’ve Been Dirt, and I Don’t Care

I read lots, but put my money in dirt (real estate). I know where it is and how much it will make me. — Tim P.

You know how much it’ll make you?! Tim, your crystal ball — give it here!

I joke, but there is one serious leg-up that real estate has over equities right now.

Yes, home showings will slow and/or stop. And going through the buying process is a pain in non-pandemic times. (Though, I’ve seen quite a few rental listings using the “See it solo!” method, which gets my industry-disruption Spidey senses tingling.)

But here’s the difference: With stocks, you can check Robinhood every second of the trading day and watch the dizzying price changes.

You can … but it’ll drive you bat-flu crazy. Well, most of the market is glued to the screen anyway. And as investors’ positions whipsaw, so do their reactions, and the vicious cycle grows through rally, bust and boom again — often within mere hours.

Irrationality breeds irrationality, and the equity markets are filled to the brim with it right now. Real estate? Not to the same neck-breaking extent. Just imagine if your house had a ticker on it and you could see it make 500-point moves like the Dow every day.

If you wrote in and I didn’t get to your email, it may be because you cursed too $%^*@#$ much. I still appreciate your email, even if we can’t share it publicly.

Got more on your mind? So do I, so let’s get writing. Send us an email at [email protected].

That’s a wrap for today, but if you still crave more Great Stuff, check us out on social media: Facebook and Twitter.

Until next time, be Great!

Regards,

Joseph Hargett

Editor, Great Stuff

0 notes

Text

I'm going to mention that I meant the word strike when saying 'Global Boycott'.

Granted, everyone is free to criticize me for even stating their could be an end to the boycotts & strikes.

There are plenty of reasons to stop purchasing from big name companies aways:

- Paramount & Nickelodeon allowing children to be sexually assaulted by show creators like Dan Schneider

- Mavel's 'Isreali' 'Superhero' Sabra

- DreamWorks laying off animators

- Hollywood deciding to utilize AI

- Google, Apple, Samsung, & etc forcing children in Congo to mine Cobalt that makes the electronics we use on a daily basis

I supposed I was referring to the people who are addicted or need these products.

(Looking at you Disney Adults)

There are recipes for potato chips (or crisps if you live in the UK),

There are plenty of indie shows in production for us to find and support

Eventually, the US Empire will fall,

Whether it be this year or another.

Perhaps a more natural country will exist in its place made by the Natives who lived in this land before.

One day, those independent animators & small businesses will take over the economy whilst Mickey Mouse gets lost with the sea of brand new faces.

I can't say for certain what the future holds, but we all have to tell the people around us that...

We don't need Disney for entertainment...

We don't need McDonald's for food (Especially since they're so expensive right now).

But the people of the United States of America are stuck in a Captialist Surveillance Colonial Settlement that was built on top of Native land and advertises itself as a democracy...

Parents of previous generations (not all of them of course) are brainwashed by the government, their parents, & the education system to ensure that no one makes a difference.

But it is very easy for us to stop buying products from major corporations so that they can fear the people that give them money.

Tell people outside social media.

It will be a hard and long process, but we've our countries fear the people before.

We can free everyone from the hands of Capitalism.

Keep Fighting & Spreading the message as much as you can.

As the Global Boycott for Palestine is ending, we should not stop talking about the Genocide.

Continue Amplifying Palestinian Voices such as MoTaz & Bisan.

Continue Boycotting McDonald's, Starbucks, KFC, Pizza Hut, Papa Johns, Marvel, etc...

The People of Palestine need your voice and support for a CEASEFIRE, An end to the Occupation, & To Rebuild.

And do not forget that Hawai'i, Congo, Sudan, Tigray, and more need their voices heard too.

1K notes

·

View notes

Text

Community Post: 15 Invaluable Life Lessons We Learned From '90s Pop Culture

New Post has been published on https://kidsviral.info/community-post-15-invaluable-life-lessons-we-learned-from-90s-pop-culture/

Community Post: 15 Invaluable Life Lessons We Learned From '90s Pop Culture

I’m so…scared.

1. Bug Juice taught us that if you break the rules, there will be consequences.

View this image ›

Disney / Via youtube.com

The mystery of what Eve did to get kicked out of Camp Waziyatah still lingers. Cigarettes? Drugs? Caffeine pills?

2. Clueless gave us important dating advice to use even today.

View this image ›

Paramount Pictures / Via pixgood.com

Also, only trust Polaroids.

3. The Secret World of Alex Mack made us suspicious of chemicals and secret government agencies.

View this image ›

Nickelodeon / Via tumblr.com

4. Real men are in touch with their feelings, like Dawson from Dawson’s Creek.

View this image ›

Warner Bros / Via replygif.net

Let it out, Dawson, you hopeless romantic.

5. Full House reminded us it’s normal to have moments of self-doubt.

View this image ›

ABC / Via pixshark.com

6. Legends of the Hidden Temple showed us LIFE ISN’T FAIR.

View this image ›

Nickelodeon / Via pinterest.com

There are infinitely more wrong turns than right ones.

7. Homeward Bound: The Incredible Journey taught us that sometimes the hardest thing is knowing when to let go.

View this image ›

Disney / Via dogster.com

Shadow, you wonderful wise sage. We’re still crying!

8. Man of the House gave us fun pranks to try on our mom’s boyfriends before we ultimately accept them.

View this image ›

Disney / Via fuckyesjtt.tumblr.com

And JTT showed us what human perfection looks like.

9. 3 Ninjas showed us the power of physical fitness, which extra handy in case you ever had to take on some kidnappers.

View this image ›

Touchstone Pictures / Via youtube.com

*Signs up for karate class*

10. Two words: GIRL. POWER.

View this image ›

Virgin Records/EMI / Via continuumissues.wordpress.com

They taught us well.

11. We knew to boycott Sea World early on thanks to Free Willy.

View this image ›

Warner Bros / Via gifsoup.com

The OG Blackfish.

12. The Secret of Nimh showed us that fear is real and occasionally justified.

View this image ›

United Artists / Via aaronbouchard.com

Even the GIF is terrifying.

13. Fashion, bedroom goals, and life advice was provided in abundance by Clarissa Explains It All.

View this image ›

Nickelodeon / Via mentalfloss.com

14. Your sleepover party game was on point because of Mary-Kate and Ashley’s inspirational You’re Invited series.

View this image ›

Dualstar / Via coub.com

P-I-Z-Z-A

15. And of course, you know to never — I repeat: NEVER — go near caffeine pills.

View this image ›

NBC / Via crushable.com

Don’t even look at them.

Read more: http://www.buzzfeed.com/katecroley/15-life-lessons-the-90s-taught-us-early-on-18v70

#15 Invaluable Life Lessons We Learned From 90s Pop Culture#free willy#Mary Kate and Ashey#pop culture#saved by the bell#Spice Girls

0 notes

Note

not sure why the self-censor, but i'm assuming the asker is referring to the support that nickelodeon/paramount global has given israel. if anyone is looking to boycott companies in support of palestine, they should check the BDS Movement website/social media accounts for guidance and information:

nickelodean and paramount global are not currently listed as targeted consumer boycotts. if, as an individual, you feel uncomfortable with the fact that a company not on the BDS list has given money to israel and supported genocide, you need to make your own personal decision about what to do. i would start by reading the BDS Movement's statement and information and go from there.

nothing is "safe." i think it's important to understand what a boycott is here if you are feeling uncomfortable (understandably) about giving money to a company that supports israel. the BDS Movement is an organized, political action, meaning organizers want specific companies targeted because at a large scale, it will lose those companies money and pressure them into cutting ties with israel. if you are personally boycotting a company, you aren't making an impact on their profits, meaning, it's not going to make that company change what it's doing. that doesn't mean you shouldn't boycott a company on your lonesome, it just means the impact the boycott has is personal and individual. you don't have to buy shit if it makes you feel uncomfortable.

listen to the BDS Movement if you want to participate in a consumer boycott. again, nothing is "safe" anyways, don't look for things to be "safe," it's not productive for anyone, including yourself. you gotta examine your relationship to things beyond if it's "safe."

if this isn't about israel, then hey, fuck israel anyways, don't censor yourself because how is anyone supposed to know what you're talking about, and free palestine.

This is an odd question but I'm curious to know. Given who Nickelodeon and their Parent Company is currently supporting in the you know what I was wondering how much they make off of the TMNT Comics? I try to boycott what I can but if the comics are safe I'd love to know.

Oh shit what are they supporting?? I haven't heard anything! O_o

49 notes

·

View notes

Text

^ What they said,

Honestly, I've been pirating my shows for a long while now, I started because was the only way I could watch all of a show without having to go to multiple platforms, but after I realized Dan Schneider was still working, I just completely pirate everything he was even remotely involved in.

It sucks that the cast had to go through things like that, and so young too, Its horrible, and sure he made stuff that people adored to this day, but people need to realize no matter what he's still a bad person, And the more you watch the shows, the more profit he gets the more he'll continue with his horrid actions.

All the stuff uncovered about nickelodeon these last few days through the "Quiet on Set" has been so devastating. Nickelodeon failed their cast, and they failed their audiences.

But something not a lot of ppl have acknowledged is that Dan Schneider is still working.

He was never truly released by nickelodeon. It was a publicity ploy to appease the public. Once Paramount bought nickelodeon, he was immediately hired back on.

Like, right now, he's listed as one of the lead writers and producers of the Henry Danger movie.

At first, I was really excited for a movie, but in this mess, I plan on and encourage all of you to watch your favorite nickelodeon shows/movie (if you still can) through pirating. They don't deserve to profit off the children they abused anymore.

2K notes

·

View notes