#bookkeeping services in India

Explore tagged Tumblr posts

Text

Why Accounting Firms Are Essential for Growing Businesses

In today’s fast-paced and competitive business environment, financial management is more important than ever. Whether you're starting a small business or managing an expanding enterprise, having a solid financial foundation is crucial. But why are Accounting Firms In Mumbai and other professional services so essential for growing businesses? In this blog, we'll explore the reasons why accounting firms are key to sustainable business growth.

Streamlining Financial Operations

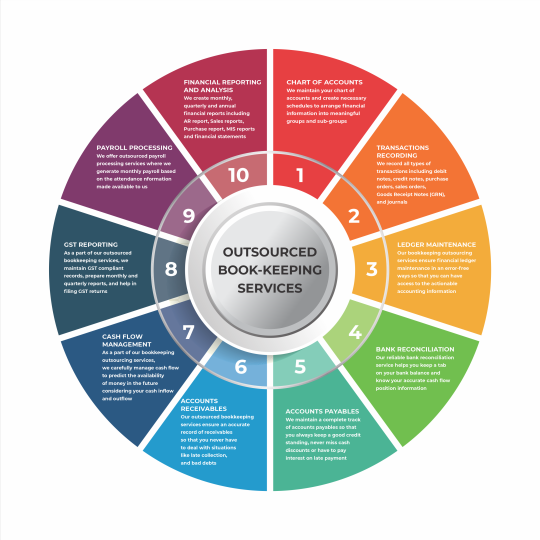

One of the main reasons businesses turn to professional accounting services is to streamline financial operations. Proper bookkeeping and financial management are necessary to ensure smooth business operations. For any growing business, handling these tasks in-house can quickly become overwhelming. Professional firms that offer Bookkeeping Services In India help businesses maintain precise and organized records of all financial transactions. This accurate bookkeeping enables business owners to track their income, expenses, and overall financial health, ensuring that they can make informed decisions for the future.

Expert Taxation and Compliance Support

Tax regulations and compliance are among the most complex aspects of managing a business. Many businesses, especially growing ones, struggle to keep up with constantly changing tax laws. This is where Accounting Firms In Mumbai come in. These firms provide expert guidance on local and national tax regulations, ensuring that businesses stay compliant and avoid costly penalties. Additionally, by outsourcing tasks like bookkeeping, businesses can reduce the burden of tax-related paperwork. This also allows owners to focus more on growing their business rather than worrying about legal and financial regulations.

Time and Cost Efficiency

For growing businesses, time is one of the most valuable resources. Handling bookkeeping and accounting internally requires significant time and effort that could otherwise be used to focus on core business functions. By choosing outsourced bookkeeping, businesses can save time and ensure that their financial tasks are in the hands of experts. Outsourcing these services reduces the need to hire a full-time in-house accounting team, cutting down on costs related to salaries, benefits, and training.

Valuable Financial Insights for Growth

Beyond maintaining records and filing taxes, professional accounting firms provide valuable financial insights that can drive business growth. Accounting Firms In Mumbai and other areas use advanced tools to analyze financial data, offering actionable insights that help businesses identify growth opportunities, monitor cash flow, and optimize spending. By understanding the financial aspects of their business, owners can make strategic decisions to enhance profitability and drive long-term success.

Scalability and Flexibility

As your business grows, your financial needs will evolve. Whether you're scaling your operations, expanding into new markets, or dealing with more complex financial transactions, accounting firms offer the flexibility to scale services as needed. Professional services like outsourced bookkeeping can be easily adjusted to accommodate the changing needs of a growing business. Accounting firms specialize in tailoring their services to fit businesses of all sizes, making it easier for owners to scale their financial operations without the hassle of managing the growing workload internally.

Reducing Financial Risks

Errors in financial reporting, tax filings, or bookkeeping can lead to significant risks, including penalties, audits, and even legal issues. For a growing business, these risks can be detrimental to long-term success. By partnering with experienced professionals who offer Bookkeeping Services In India, businesses can reduce the chances of costly errors. Accounting firms implement best practices to ensure accuracy and transparency in financial records, providing business owners with peace of mind.

Conclusion

For growing businesses, reliable financial management is essential for success. Professional accounting services help streamline operations, reduce risks, and provide valuable insights that drive business growth. By working with Accounting Firms In Mumbai or opting for outsourced bookkeeping, businesses can focus on what they do best—growing and thriving—while leaving the complexities of financial management to the experts.

Infinzi offers expert financial services tailored to the needs of growing businesses. With a focus on precision and efficiency, Infinzi helps businesses achieve financial clarity and growth with ease.

0 notes

Text

Tax audits can be daunting for businesses, regardless of their size or industry. Accurate financial management and compliance are essential to navigating these challenges effectively. Virtual CFO services are crucial in ensuring businesses are audit-ready by offering expert financial guidance, strategic planning, and a streamlined approach to managing financial operations.

#virtual cfo services#outsourced cfo services#cfo#cfo services#bookkeeping services#bookkeeping services in india#fundraising services#fund raising for business

0 notes

Text

The Future of Bookkeeping in India: Trends to Watch in 2024

In 2024, StartupFino highlights key trends transforming bookkeeping in India. Embracing cloud-based solutions, AI and automation, and data analytics will streamline processes and enhance efficiency. Blockchain and cybersecurity will further safeguard financial data. Stay ahead with expert CA, CS, and Legal Services. Read more

0 notes

Text

How to Choose the Right Bookkeeping Service for Your Startup

Choosing the right bookkeeping service is crucial for the smooth operation and financial health of your startup. With the abundance of options available, including accounting and bookkeeping services, bookkeeping services in India, and outsourced bookkeeping services, making the right choice can be overwhelming. This guide will help you navigate through the selection process and find a service that best suits your needs.

1. Understanding Your Startup’s Needs

Before selecting a bookkeeping service, it’s essential to assess your startup’s specific requirements. Consider the scale of your business, the complexity of your financial transactions, and any industry-specific needs. Determine whether you need remote bookkeeping services in India, or if virtual bookkeeping in India would be more suitable. Identifying your needs will help you choose a service that aligns with your startup’s requirements and ensures efficient financial management.

2. Evaluating Service Options

Explore the various accounting and bookkeeping services available. Options include traditional bookkeeping services in India, outsourced bookkeeping services, and modern virtual bookkeeping solutions. Compare these services based on their features, pricing, and the level of support they offer. For instance, if you prefer flexibility and cost-effectiveness, remote bookkeeping services in India might be ideal. Alternatively, if you need more personalized attention, you might opt for a service where you hire bookkeepers from India directly.

3. Assessing Expertise and Credentials

The expertise and credentials of the bookkeeping service provider are crucial factors in your decision-making process. Look for services that offer professional bookkeeping services with proven experience in handling startups. Check their certifications, client reviews, and case studies to ensure they have the necessary skills and knowledge to manage your financial records accurately. For example, outsourced bookkeeping services in India often come with extensive expertise in managing diverse financial needs.

4. Considering Cost and Value

Cost is a significant consideration when choosing a bookkeeping service. Compare the pricing models of different providers to understand what fits your budget. While cost is important, also evaluate the value offered by the service. A higher cost might come with added benefits, such as comprehensive support and advanced features. Evaluate if the service provides good value for money and if it aligns with your budget and expectations.

Conclusion

Choosing the right bookkeeping service for your startup involves evaluating your needs, understanding the options available, assessing expertise, and considering cost. By focusing on these factors and considering keywords such as accounting and bookkeeping services, bookkeeping services in India, and remote bookkeeping services in India, you can make an informed decision that supports your startup’s financial health and growth.

#bookkeeping services in india#hire bookkeepers from india#remote bookkeeping services india#virtual bookkeeping in india

0 notes

Text

Reasons Why Bookkeeping is Important for Your Business

Bookkeeping is more than just a regular, mundane administrative task; it is the backbone of your financial infrastructure. Proper bookkeeping involves recording every financial transaction your business undertakes, from sales and purchases to receipts and payments. This process ensures you have a clear and accurate picture of your business’s economic health. Without proper bookkeeping, managing your business finances can become chaotic and lead to serious issues such as cash flow problems, compliance issues, and inaccurate financial reporting. Let’s delve into the specific reasons why bookkeeping is so crucial for your business.

1. Financial Clarity and Accuracy

One of the primary reasons bookkeeping is vital is that it provides financial clarity and accuracy. By meticulously recording all financial transactions, you gain a clear and detailed view of your income and expenses. This accurate financial information is crucial for making informed business decisions.

With precise records, you can easily track where your money is coming from and where it is going. This helps identify profitable areas of your business and areas that may need cost-cutting or other adjustments. Financial clarity also enables you to set realistic budgets and forecasts, ensuring your business stays on track financially.

2. Regulatory Compliance

Businesses are specifically required to comply with various financial regulations and tax laws. Proper bookkeeping ensures that the financial records are the most accurate and up to date, making it easier to meet regulatory requirements. This includes filing taxes accurately and on time, which helps avoid penalties and legal issues.

Accurate bookkeeping records are also essential during audits. If your business is audited by tax authorities or other regulatory bodies, well-maintained financial records make the audit process smoother and less stressful. Providing detailed and accurate records demonstrates your commitment to compliance and can protect your business from potential fines and sanctions. Partnering with companies providing bookkeeping services in India help you remain fully compliant from end to end.

3. Better Cash Flow Management

Effective cash flow management is of the essence to maintain the sustainability and growth of any business. Bookkeeping helps you monitor and manage your cash flow by keeping track of all incoming and outgoing payments. This enables you to predict cash flow shortages and surpluses, allowing you to plan accordingly.

By clearly understanding your cash flow, you can make strategic decisions to ensure that your business has enough cash on hand to cover expenses, invest in growth opportunities, and handle uncertain and unexpected financial challenges. Good cash flow management, supported by accurate bookkeeping, can help prevent cash shortages and ensure the smooth operation of your business.

4. Informed Business Decisions

Accurate financial records are significant for making informed business decisions. Bookkeeping provides the financial data needed to evaluate your business's performance and make strategic decisions. These include decisions about pricing, inventory management, hiring, and investment opportunities.

With detailed financial reports, you can analyze trends, measure performance against goals while also identifying the areas for improvement. This data-driven approach provides you with an opportunity to make better decisions based on facts rather than assumptions, increasing the likelihood of achieving your business objectives.

5. Easier Financial Reporting

Financial reporting is of the essence when it is about running a business. Investors, stakeholders, and financial institutions often require detailed financial reports to assess the health and overall performance of your business. Proper bookkeeping ensures you can generate accurate, precise and timely financial reports, like income statements, cash flow statements, and balance sheets.

These reports provide a proper snapshot of your business’s financial status and are critical for securing funding, attracting investors, and making strategic business decisions. Well-maintained financial records make it easier to prepare these reports, ensuring they are comprehensive and reliable.

6. Improved Financial Analysis and Planning

Bookkeeping lays the groundwork for financial analysis and planning. By keeping detailed, compliant and accurate records, you can conduct various types of economic analysis, such as ratio analysis, trend analysis, and variance analysis. These analyses provide insights into your business’s financial performance and help identify strengths, weaknesses, opportunities, and threats.

With this information, you can develop strategic financial plans that align with your business goals. Accurate financial data is essential for creating effective strategies and achieving long-term success, whether you are planning for expansion, looking to cut costs, or exploring new markets.

7. Enhanced Operational Efficiency

Lastly, proper bookkeeping enhances overall operational efficiency. You can streamline various business processes when your financial records are organized and up to date. For example, accurate financial data can help manage invoicing, payroll, and inventory more efficiently.

Operational efficiency reduces the likelihood of errors and discrepancies, saving your business time and money. It also allows you to focus on other core business activities, customer service and product development, rather than being bogged down by financial paperwork.

Bookkeeping is an inevitable aspect of running a successful business. It provides financial clarity, ensures regulatory compliance, and enhances cash flow management. Accurate bookkeeping enables informed decision-making, simplifies financial reporting, and supports comprehensive financial analysis and planning.

Outsourced bookkeeping improves operational efficiency, allowing you to focus on growing your business. By recognizing the importance of bookkeeping and investing in proper financial record-keeping, you can lay a solid foundation for your business’s long-term success.

If you want to partner with Mumbai accounting firms, contact Infinzi. As one of the best accounting firms offering bookkeeping services in India, Infinzi assures fully compliant services that add value to your business. Get in touch with Infinzi and rest assured of highly efficient, effective, and compliant outsourced bookkeeping services in India.

0 notes

Text

#Accounting Services in India#Bookkeeping Services in India#Accounting & Bookkeeping Services in India#Taxation Services in India#AKM Global

0 notes

Text

The Advantages of Outsourcing Bookkeeping Services to India

In today's competitive business world, streamlining operations is crucial for success. One way to achieve this is by outsourcing bookkeeping services to India. This blog post will explore the benefits of outsourcing bookkeeping, how to choose the right partner, and why AKM Global is the perfect solution for your needs.

Benefits of Outsourcing Bookkeeping to India

Increased Efficiency and Accuracy: Indian bookkeeping providers are known for their efficiency and accuracy. They leverage cutting-edge accounting software and proven methodologies to ensure your financial records are meticulously maintained and up-to-date.

Reduced Costs: Outsourcing bookkeeping to India can lead to significant cost savings. You can avoid the overhead expenses of hiring and training an in-house bookkeeper, while benefiting from the economies of scale offered by Indian bookkeeping companies.

Freed Up Time and Resources: By outsourcing bookkeeping, you can free up valuable time and resources for your core business activities. Your team can focus on strategic initiatives that drive growth and profitability.

Access to a Wider Talent Pool: India boasts a vast pool of highly skilled and experienced bookkeepers. Outsourcing allows you to tap into this talent pool and secure the expertise you need, regardless of your business size.

Improved Scalability: As your business grows, your bookkeeping needs will evolve as well. A reliable outsourcing partner in India can seamlessly scale their services to accommodate your growing requirements.

Choosing the Right Outsourcing Bookkeeping Partner

Selecting the ideal outsourcing bookkeeping partner requires careful consideration of several factors:

Experience and Qualifications: Ensure the provider has a team of experienced and qualified bookkeepers with a proven track record of success.

Security Measures: Financial data security is paramount. Choose a partner that implements robust security measures to safeguard your sensitive information.

Communication and Time Zone Compatibility: Effective communication is essential. Select a partner with a clear communication style and consider time zone differences to ensure smooth collaboration.

Cost: Obtain quotes from several providers and compare their pricing structures to find a solution that aligns with your budget.

Why AKM Global is Your Ideal Outsourcing Bookkeeping Partner

AKM Global stands out as a leading provider of outsourcing bookkeeping services to India. We offer a multitude of advantages:

Experienced and Qualified Team: Our team comprises highly skilled and experienced bookkeepers who are proficient in handling all your bookkeeping requirements.

Cutting-Edge Technology: We leverage the latest accounting software and technologies to ensure the accuracy and efficiency of your financial records.

Unwavering Security: We prioritize the security of your financial data and implement industry-best security practices to protect your information.

Clear Communication: We maintain a clear and concise communication style, keeping you informed throughout the process. We are always available to address your questions and concerns.

Scalable Solutions: Our bookkeeping services are designed to scale with your business. We can seamlessly adjust our services to accommodate your evolving needs.

Conclusion

Outsourcing bookkeeping services to India offers a compelling solution for businesses seeking to streamline operations, reduce costs, and gain access to a wider talent pool. By partnering with a reputable provider like AKM Global, you can ensure the accuracy and efficiency of your financial records while freeing up valuable time and resources to focus on core business activities.

#Outsourcing Bookkeeping Services in India#Bookkeeping Services in India#AKM Global#Taxation Services

1 note

·

View note

Text

AKM Global: Precision Bookkeeping Solutions in India Tailored for USA Businesses

Elevate your financial strategy with AKM Global's premier bookkeeping services in India, crafted for the USA market. Rely on our expertise for precise, compliant, and tailored solutions. Choose AKM Global to optimize your business accounts – your trusted partner for bookkeeping excellence in India, serving the USA clients.

0 notes

Text

Trends in Finance and Accounting Outsourcing for 2023

Outsourcing accounting and finance functions has evolved significantly in recent years, shaping the way businesses manage their financial operations. As we step into 2023, several trends continue to redefine this landscape, influencing how organizations approach outsourcing. Let's delve into some prevailing trends that are anticipated to shape finance and accounting outsourcing in India this year.

1. Embrace of Advanced Technologies:

The integration of AI, machine learning, and automation in finance and accounting outsourcing in India has revolutionized operations. AI-driven analysis enhances accuracy, while machine learning refines predictive analytics and risk assessments. Automation streamlines tasks, freeing resources for strategic initiatives. This tech evolution cements India's status as a hub for innovative financial services outsourcing.

2. Focus on Data Security and Compliance:

Outsourcing partners in India prioritize stringent security protocols and compliance standards to combat rising cyber threats. Employing encryption, multi-factor authentication, and compliance audits, they fortify data protection. Regular assessments, employee training, and client collaboration ensure a proactive defense against cyber risks, fostering client trust.

3. Scalable Solutions for Small Businesses:

Accounting Outsourcing in India has evolved, providing small and medium-sized enterprises (SMEs) with customizable solutions. These offerings, specifically designed for SMEs, offer scalability, granting access to specialized expertise. SMEs can optimize resources, focusing on strategic growth while swiftly adapting to market changes, fostering financial resilience and competitive edge in a dynamic landscape.

4. Remote Work Dynamics and Virtual Teams:

In the wake of the pandemic, remote work practices persist, driving a paradigm shift in outsourcing dynamics. Providers adeptly transition to virtual work environments, enabling streamlined collaboration and uninterrupted service delivery. Embracing virtual teams, they ensure seamless operations, leveraging technology to sustain effective client partnerships amidst evolving workplace outlooks.

5. Customized Service Offerings:

Accounting Outsourcing companies in India are pivoting towards bespoke service models, acknowledging the limitations of standardized solutions. They craft tailored approaches addressing unique business needs, ensuring better alignment with client requirements.

This customization drives increased value delivery, allowing providers to deeply integrate with client workflows, offer specialized expertise, and facilitate seamless adaptation to diverse industry nuances, ultimately enhancing client satisfaction and outcomes.

6. Strategic Focus on Analytics and Insights:

Businesses are increasingly prioritizing accounting outsourcing partners in India proficient in advanced analytics. The emphasis on data-driven insights aids in informed decision-making and proactive strategies for long-term expansion. Outsourcing firms harness analytics to offer predictive modeling, trend analysis, and actionable insights, empowering clients to make strategic choices, anticipate market shifts, and steer their businesses toward sustained growth and competitive advantage.

7. Green Accounting and Sustainability:

There's a rising trend in integrating sustainability into financial practices within outsourcing. Providers are partnering with businesses dedicated to eco-conscious accounting. They assist in implementing eco-friendly practices, like carbon accounting and sustainability reporting, aligning financial decisions with environmental responsibility. This alignment fosters transparency, aiding businesses in meeting sustainability goals and addressing stakeholder concerns.

Explore More Such Trends in Accounting Outsourcing in India

The trends outlined above demonstrate the dynamic nature of finance and accounting outsourcing in 2023. To harness the full potential of outsourcing, businesses must strategically align with partners who not only adapt to these trends but also offer innovative solutions aligned with their unique objectives and values.

As the accounting outsourcing services in India evolve, businesses should proactively assess these trends and leverage them to drive efficiencies, enhance financial performance, and achieve strategic objectives in the ever-evolving global marketplace.

#accounting outsourcing in India#accountants in India#outsourced accountants in India#bookkeeping services in India#payroll services in India#accounts#financial freedom#financial analysis#accounting outsourcing services in India#accounting and sustainability reporting#outsourcing partners in India

1 note

·

View note

Text

#outsource bookkeeping services#bookkeeping services in india#bookkeeping services#online bookkeeping services#bookkeeping services India#accounting bookkeeping services#professional bookkeeping services#outsourcing bookkeeping

0 notes

Text

Accounting outsourcing services in India

We provide the best Accounting outsourcing services in India and MAS is the top outsourcing and Bookkeeping service Companies in India Accounting Outsourcing Services in India | Accounting Services in India | Bookkeeping | Outsourcing Company

#accounting & bookkeeping services in india#businessregistration#audit#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

7 notes

·

View notes

Text

Outsource Bookkeeping Services to India: A Smart Business Move

In today’s competitive business environment, companies are constantly looking for ways to streamline operations and reduce costs. One effective strategy is to outsource bookkeeping services to India. This approach not only provides access to skilled professionals but also offers significant cost savings. Let's explore why outsourcing bookkeeping services to India can be a game-changer for your business.

Why Outsource Bookkeeping Services?

1. Cost-Effectiveness

Delegating your bookkeeping tasks to an external provider can result in significant financial savings. By choosing to outsource bookkeeping services to India, businesses can reduce overhead expenses associated with hiring in-house staff, such as salaries, benefits, and training costs. Indian firms offer competitive pricing due to lower labor costs, providing high-quality services at a fraction of the cost.

2. Access to Expertise

India is known for its vast pool of highly skilled and qualified professionals. When you outsource bookkeeping services, you gain access to experts who are proficient in international accounting standards and practices. These professionals are equipped with the latest tools and technologies to ensure accurate and efficient bookkeeping.

3. Focus on Core Business Activities

By outsourcing bookkeeping services, companies can focus more on their core business activities. This allows management and staff to dedicate their time and resources to areas that directly impact growth and profitability, such as sales, marketing, and product development.

Benefits of Outsourcing Bookkeeping Services in India

1. High-Quality Services

Indian bookkeeping firms are known for their commitment to quality. They employ stringent quality control measures and adhere to international accounting standards. This ensures that the financial records are accurate, reliable, and compliant with regulatory requirements.

2. Scalability

Outsourcing bookkeeping services in India offers flexibility and scalability. Whether you are a small business or a large corporation, Indian service providers can scale their services to meet your specific needs. This flexibility is particularly beneficial during periods of growth or seasonal fluctuations in business activity.

3. Time Zone Advantage

The time zone difference between India and Western countries can be leveraged to your advantage. By outsourcing bookkeeping services to India, you can benefit from round-the-clock operations. Work can be completed overnight, providing you with updated financial information by the start of your business day.

How to Choose the Right Bookkeeping Service Provider

1. Experience and Expertise

When outsourcing bookkeeping services, it’s crucial to choose a provider with extensive experience and expertise in the field. Seek out companies that have a history of success and favorable reviews from their clients. Ensure they have experience in your specific industry and are familiar with relevant regulations.

2. Technology and Security

Ensure the service provider uses the latest accounting software and technologies. Data security is paramount, so choose a provider that implements robust security measures to protect your financial information from unauthorized access and cyber threats.

3. Transparent Pricing

Opt for a service provider with a transparent pricing model. Avoid firms with hidden fees and unclear contracts. A clear understanding of the costs involved will help you make an informed decision and avoid any unexpected expenses.

4. Communication and Support

Effective communication is essential when outsourcing bookkeeping services. Choose a provider that offers reliable customer support and maintains clear and consistent communication channels. This guarantees that any problems or questions will be handled quickly and efficiently.

Conclusion

Outsourcing bookkeeping services to India is a strategic decision that can offer numerous benefits, including cost savings, access to expertise, and improved focus on core business activities. By carefully selecting the right service provider, businesses can enjoy high-quality, scalable, and secure bookkeeping services. Embrace this opportunity to enhance your business efficiency and drive growth.

In summary, outsourcing bookkeeping services to India is not just a cost-saving measure; it is a smart business strategy that can lead to improved operational efficiency and long-term success.

#Outsource bookkeeping services to India#outsourcing bookkeeping services in India#outsource bookkeeping services#outsourcing bookkeeping services#offshore bookkeeping services#CPA outsourcing services#outsourced accounting firms#finance#accounting#bookkeeping

2 notes

·

View notes

Text

The Role of Accounting and Bookkeeping in Tax Industry

Accounting and bookkeeping are tedious and arduous but are necessary for the company to gain an advantage over competitors and to make decisions. Bookkeeping is the recording of financial details of the company in an orderly manner over some time. Bookkeepers are people who maintain the accounts. Ileadtax LLC is one of the best tax preparation and planning companies based in New York, India, and California. It offers accounting and bookkeeping services and are adviser for many companies. This article discloses the importance of accounting and bookkeeping in the tax industry and how it is useful to a company.

Accounting and bookkeeping are dependent on each other. Bookkeeping is a sub-branch of accounting that organizes and summarizes financial data and it has accurate financial data. Bookkeepers have access to all financial data of the company and can track their transactions. They ensure the data is up to date and is complete. Bookkeeping helps the company with decisions related to investing and operations. IleadTax LLC is a global company that consists of tax accounting experts in India, New York, and California. They provide their tax experts for all companies which are in need. The accounting and bookkeeping services provided contain detailed records of past transactions.

The first step in achieving flawless tax preparation is keeping accurate financial records. The foundation of this process is accounting and bookkeeping. These tasks entail the meticulous documentation of financial transactions, which results in an accurate depiction of earnings, outlays, assets, and liabilities. Having structured financial records is essential for tax season. Identification of deductible expenses is made possible for people and organizations through accounting and bookkeeping. Taxpayers can properly minimize their taxable income by accurately categorizing their costs and keeping track of the necessary supporting records. This may lead to significant cost savings and a better tax situation.

Beyond tax time, accounting and bookkeeping are important. They serve as the cornerstone for budgeting, investments, and future tax planning, enabling both individuals and corporations to make well-informed choices. It's advantageous to obtain professional advice when dealing with the complicated realm of tax preparation. CPAs (Certified Public Accountants) and seasoned bookkeepers may provide priceless insights, ensuring that you successfully navigate tax season.

A thorough and accurate bookkeeping procedure gives businesses a reliable way to assess their success. It also serves as a benchmark for its income and revenue targets and information for general strategic decision-making. A trustworthy source for businesses to gauge their financial performance is bookkeeping. Accounting and bookkeeping are more than simply administrative duties; they are also effective instruments that can lessen the strain of tax season and enhance your financial security. A sound accounting and bookkeeping system can result in significant savings, compliance, and financial peace of mind whether you're a business owner or an individual taxpayer. So, as tax season draws near, keep in mind that having a solid financial foundation is the key to success. ILeadTax LLC attempts to deliver results that meet the expectations of the client.

#Accounting and bookkeeping#tax preparation#tax accounting experts in India#accounting and bookkeeping services

5 notes

·

View notes

Text

#accounting services for small business#accounting services#accounting bookkeeping service#online accounting services#accounting and bookkeeping services#bookkeeping services in india#bookkeeping services#startupfino

0 notes

Text

Outsource Payroll Services | Easy Payroll Solutions

Let us manage your payroll with Collab Accounting AU's reliable Outsourced Payroll Services. We handle payroll processing, tax compliance, and employee payments with accuracy and efficiency. Save time and avoid mistakes while focusing on your business. Visit us at 3 Hanley St, Stanhope Gardens, NSW 2768, Australia, or call +61 2 8005 8155 for professional payroll solutions from Collab Accounting AU!

#Outsource Payroll Services#bookkeeping service provider#offshore bookkeeping services#affordable accounting outsourcing india

0 notes

Text

Reasons Why Bookkeeping is Important for Your Business

Bookkeeping is more than just a regular, mundane administrative task; it is the backbone of your financial infrastructure. Proper bookkeeping involves recording every financial transaction your business undertakes, from sales and purchases to receipts and payments. This process ensures you have a clear and accurate picture of your business’s economic health. Without proper bookkeeping, managing your business finances can become chaotic and lead to serious issues such as cash flow problems, compliance issues, and inaccurate financial reporting. Let’s delve into the specific reasons why bookkeeping is so crucial for your business.

1. Financial Clarity and Accuracy

One of the primary reasons bookkeeping is vital is that it provides financial clarity and accuracy. By meticulously recording all financial transactions, you gain a clear and detailed view of your income and expenses. This accurate financial information is crucial for making informed business decisions.

With precise records, you can easily track where your money is coming from and where it is going. This helps identify profitable areas of your business and areas that may need cost-cutting or other adjustments. Financial clarity also enables you to set realistic budgets and forecasts, ensuring your business stays on track financially.

2. Regulatory Compliance

Businesses are specifically required to comply with various financial regulations and tax laws. Proper bookkeeping ensures that the financial records are the most accurate and up to date, making it easier to meet regulatory requirements. This includes filing taxes accurately and on time, which helps avoid penalties and legal issues.

Accurate bookkeeping records are also essential during audits. If your business is audited by tax authorities or other regulatory bodies, well-maintained financial records make the audit process smoother and less stressful. Providing detailed and accurate records demonstrates your commitment to compliance and can protect your business from potential fines and sanctions. Partnering with companies providing bookkeeping services in India help you remain fully compliant from end to end.

3. Better Cash Flow Management

Effective cash flow management is of the essence to maintain the sustainability and growth of any business. Bookkeeping helps you monitor and manage your cash flow by keeping track of all incoming and outgoing payments. This enables you to predict cash flow shortages and surpluses, allowing you to plan accordingly.

By clearly understanding your cash flow, you can make strategic decisions to ensure that your business has enough cash on hand to cover expenses, invest in growth opportunities, and handle uncertain and unexpected financial challenges. Good cash flow management, supported by accurate bookkeeping, can help prevent cash shortages and ensure the smooth operation of your business.

4. Informed Business Decisions

Accurate financial records are significant for making informed business decisions. Bookkeeping provides the financial data needed to evaluate your business's performance and make strategic decisions. These include decisions about pricing, inventory management, hiring, and investment opportunities.

With detailed financial reports, you can analyze trends, measure performance against goals while also identifying the areas for improvement. This data-driven approach provides you with an opportunity to make better decisions based on facts rather than assumptions, increasing the likelihood of achieving your business objectives.

5. Easier Financial Reporting

Financial reporting is of the essence when it is about running a business. Investors, stakeholders, and financial institutions often require detailed financial reports to assess the health and overall performance of your business. Proper bookkeeping ensures you can generate accurate, precise and timely financial reports, like income statements, cash flow statements, and balance sheets.

These reports provide a proper snapshot of your business’s financial status and are critical for securing funding, attracting investors, and making strategic business decisions. Well-maintained financial records make it easier to prepare these reports, ensuring they are comprehensive and reliable.

6. Improved Financial Analysis and Planning

Bookkeeping lays the groundwork for financial analysis and planning. By keeping detailed, compliant and accurate records, you can conduct various types of economic analysis, such as ratio analysis, trend analysis, and variance analysis. These analyses provide insights into your business’s financial performance and help identify strengths, weaknesses, opportunities, and threats.

With this information, you can develop strategic financial plans that align with your business goals. Accurate financial data is essential for creating effective strategies and achieving long-term success, whether you are planning for expansion, looking to cut costs, or exploring new markets.

7. Enhanced Operational Efficiency

Lastly, proper bookkeeping enhances overall operational efficiency. You can streamline various business processes when your financial records are organized and up to date. For example, accurate financial data can help manage invoicing, payroll, and inventory more efficiently.

Operational efficiency reduces the likelihood of errors and discrepancies, saving your business time and money. It also allows you to focus on other core business activities, customer service and product development, rather than being bogged down by financial paperwork.

Bookkeeping is an inevitable aspect of running a successful business. It provides financial clarity, ensures regulatory compliance, and enhances cash flow management. Accurate bookkeeping enables informed decision-making, simplifies financial reporting, and supports comprehensive financial analysis and planning.

Outsourced bookkeeping improves operational efficiency, allowing you to focus on growing your business. By recognizing the importance of bookkeeping and investing in proper financial record-keeping, you can lay a solid foundation for your business’s long-term success.

If you want to partner with Mumbai accounting firms, contact Infinzi. As one of the best accounting firms offering bookkeeping services in India, Infinzi assures fully compliant services that add value to your business. Get in touch with Infinzi and rest assured of highly efficient, effective, and compliant outsourced bookkeeping services in India.

Bookkeeping is more than just a regular, mundane administrative task; it is the backbone of your financial infrastructure. Proper bookkeeping involves recording every financial transaction your business undertakes, from sales and purchases to receipts and payments. This process ensures you have a clear and accurate picture of your business’s economic health. Without proper bookkeeping, managing your business finances can become chaotic and lead to serious issues such as cash flow problems, compliance issues, and inaccurate financial reporting. Let’s delve into the specific reasons why bookkeeping is so crucial for your business.

1. Financial Clarity and Accuracy

One of the primary reasons bookkeeping is vital is that it provides financial clarity and accuracy. By meticulously recording all financial transactions, you gain a clear and detailed view of your income and expenses. This accurate financial information is crucial for making informed business decisions.

With precise records, you can easily track where your money is coming from and where it is going. This helps identify profitable areas of your business and areas that may need cost-cutting or other adjustments. Financial clarity also enables you to set realistic budgets and forecasts, ensuring your business stays on track financially.

2. Regulatory Compliance

Businesses are specifically required to comply with various financial regulations and tax laws. Proper bookkeeping ensures that the financial records are the most accurate and up to date, making it easier to meet regulatory requirements. This includes filing taxes accurately and on time, which helps avoid penalties and legal issues.

Accurate bookkeeping records are also essential during audits. If your business is audited by tax authorities or other regulatory bodies, well-maintained financial records make the audit process smoother and less stressful. Providing detailed and accurate records demonstrates your commitment to compliance and can protect your business from potential fines and sanctions. Partnering with companies providing bookkeeping services in India help you remain fully compliant from end to end.

3. Better Cash Flow Management

Effective cash flow management is of the essence to maintain the sustainability and growth of any business. Bookkeeping helps you monitor and manage your cash flow by keeping track of all incoming and outgoing payments. This enables you to predict cash flow shortages and surpluses, allowing you to plan accordingly.

By clearly understanding your cash flow, you can make strategic decisions to ensure that your business has enough cash on hand to cover expenses, invest in growth opportunities, and handle uncertain and unexpected financial challenges. Good cash flow management, supported by accurate bookkeeping, can help prevent cash shortages and ensure the smooth operation of your business.

4. Informed Business Decisions

Accurate financial records are significant for making informed business decisions. Bookkeeping provides the financial data needed to evaluate your business's performance and make strategic decisions. These include decisions about pricing, inventory management, hiring, and investment opportunities.

With detailed financial reports, you can analyze trends, measure performance against goals while also identifying the areas for improvement. This data-driven approach provides you with an opportunity to make better decisions based on facts rather than assumptions, increasing the likelihood of achieving your business objectives.

5. Easier Financial Reporting

Financial reporting is of the essence when it is about running a business. Investors, stakeholders, and financial institutions often require detailed financial reports to assess the health and overall performance of your business. Proper bookkeeping ensures you can generate accurate, precise and timely financial reports, like income statements, cash flow statements, and balance sheets.

These reports provide a proper snapshot of your business’s financial status and are critical for securing funding, attracting investors, and making strategic business decisions. Well-maintained financial records make it easier to prepare these reports, ensuring they are comprehensive and reliable.

6. Improved Financial Analysis and Planning

Bookkeeping lays the groundwork for financial analysis and planning. By keeping detailed, compliant and accurate records, you can conduct various types of economic analysis, such as ratio analysis, trend analysis, and variance analysis. These analyses provide insights into your business’s financial performance and help identify strengths, weaknesses, opportunities, and threats.

With this information, you can develop strategic financial plans that align with your business goals. Accurate financial data is essential for creating effective strategies and achieving long-term success, whether you are planning for expansion, looking to cut costs, or exploring new markets.

7. Enhanced Operational Efficiency

Lastly, proper bookkeeping enhances overall operational efficiency. You can streamline various business processes when your financial records are organized and up to date. For example, accurate financial data can help manage invoicing, payroll, and inventory more efficiently.

Operational efficiency reduces the likelihood of errors and discrepancies, saving your business time and money. It also allows you to focus on other core business activities, customer service and product development, rather than being bogged down by financial paperwork.

Bookkeeping is an inevitable aspect of running a successful business. It provides financial clarity, ensures regulatory compliance, and enhances cash flow management. Accurate bookkeeping enables informed decision-making, simplifies financial reporting, and supports comprehensive financial analysis and planning.

Outsourced bookkeeping improves operational efficiency, allowing you to focus on growing your business. By recognizing the importance of bookkeeping and investing in proper financial record-keeping, you can lay a solid foundation for your business’s long-term success.

If you want to partner with Mumbai accounting firms, contact Infinzi. As one of the best accounting firms offering bookkeeping services in India, Infinzi assures fully compliant services that add value to your business. Get in touch with Infinzi and rest assured of highly efficient, effective, and compliant outsourced bookkeeping services in India.

0 notes