#bonus calculation for government employees

Explore tagged Tumblr posts

Text

New Rules for GPF and Pension Payment: Ensuring Timely Payments for Retiring Government Employees

#pension rules#news for government employees#bonus calculation for government employees#bonus for government employees#nps for government employees#government employees news#government employees#pension payment#govt employees news#good news for government teachers and govt schools#good news for government teachers and govt#pension#employee pension scheme#hindi news for employees#govt employee pension rules#what is esi for employees#good news for government

0 notes

Text

Tips to Understand the Tax Code for Businesses

Navigating the tax code can be overwhelming for many business owners. The complexity of these regulations often leaves even seasoned entrepreneurs scratching their heads. However, understanding the tax code is essential to ensure compliance, optimize tax benefits, and avoid costly penalties. Here are tips to help business owners decode the intricacies of tax laws, along with insights into why some tax codes are particularly perplexing.

Why is the Business Tax Code So Complicated?

The complexity of the tax code is a result of multiple factors:

Diverse Business Structures Tax laws must address various business types—sole proprietorships, partnerships, LLCs, and corporations—each with unique tax obligations. These distinctions create layers of complexity.

Frequent Updates Governments often revise tax codes to reflect economic, social, or political changes. Staying updated can be challenging, particularly for small business owners.

Specialized Deductions and Credits Tax incentives like the Research & Development Tax Credit or Section 179 deductions provide significant benefits but come with intricate eligibility requirements.

State vs. Federal Tax Laws Businesses must comply with federal tax laws and those specific to their state, which may have conflicting regulations or additional complexities.

Tips for Understanding the Tax Code

1. Start with the Basics

Begin by understanding fundamental concepts like taxable income, deductions, credits, and tax brackets. Resources like IRS guides or online business tax courses can help build foundational knowledge.

2. Hire a Professional Accountant

A certified public accountant (CPA) can provide tailored advice and simplify tax filing. The best CPA firms, like More Than Numbers CPA, specialize in helping businesses navigate complex tax laws, ensuring compliance while maximizing benefits.

3. Use Accounting Software

Tools such as QuickBooks or Xero can automate calculations, categorize expenses, and generate reports. Many software options include tax-specific features that simplify tracking and compliance.

4. Stay Organized Throughout the Year

Keeping detailed records of income, expenses, payroll, and inventory helps streamline the tax preparation process and reduces the risk of errors.

5. Learn About Common Deductions

Research business-specific deductions, such as those for office supplies, travel expenses, and home offices. Ensure you understand eligibility criteria to avoid disallowed claims.

6. Take Advantage of Educational Resources

The IRS offers publications and workshops for small businesses, covering topics like estimated taxes, recordkeeping, and employment tax. Many local chambers of commerce also provide similar resources.

Most Confusing Tax Codes for Businesses

1. Section 179 Deductions

This tax code allows businesses to deduct the full purchase price of qualifying equipment or software in the year it is purchased. However, its limitations—such as caps on spending and specific eligible items—can be perplexing.

2. Qualified Business Income (QBI) Deduction

Introduced under the Tax Cuts and Jobs Act, the QBI deduction allows eligible businesses to deduct up to 20% of their qualified business income. The fine print, however, includes thresholds, phase-outs, and exclusions that confuse many business owners.

3. Depreciation Rules

Understanding how to depreciate assets over time, including choosing between straight-line and accelerated methods, can be daunting. Special rules, like bonus depreciation, add further complexity.

4. Payroll Taxes

Payroll tax regulations vary depending on the type of employees and independent contractors. Calculating withholding for Social Security, Medicare, and unemployment taxes can be time-consuming and error-prone.

5. International Tax Laws

Businesses operating internationally face additional challenges, such as understanding foreign tax credits, transfer pricing rules, and treaties that affect cross-border transactions.

Why Must Tax Codes Be So Difficult?

1. Fairness Across Businesses

The tax system aims to be equitable, considering the wide variety of industries, sizes, and structures. Unfortunately, ensuring fairness adds layers of complexity.

2. Revenue Generation and Incentives

Tax codes are designed not only to generate revenue but also to encourage behaviors beneficial to the economy, such as investing in clean energy or hiring veterans. This dual purpose results in complex incentive programs.

3. Economic and Political Influences

Tax laws often reflect broader economic policies and political compromises. For example, new tax credits might be introduced to stimulate economic growth, adding to the already intricate code.

4. Risk Mitigation

Detailed rules help prevent tax evasion and ensure compliance. However, the granularity required to address all potential scenarios increases the difficulty for non-experts.

Simplifying Your Tax Strategy

1. Outsource to Experts

Partnering with a reputable accounting firm like More Than Numbers CPA ensures your tax strategy is aligned with current laws. With expertise in various industries, they can demystify tax codes while safeguarding your business interests.

2. Automate Tax Tasks

Many accounting software platforms integrate directly with the IRS and state tax systems, making it easier to calculate and file taxes. Automation minimizes errors and improves efficiency.

3. Attend Industry-Specific Tax Seminars

Certain tax laws are more relevant to specific sectors. Attending niche workshops can provide valuable insights tailored to your business.

4. Plan Ahead

Meet with your accountant regularly to review your finances and develop a proactive tax strategy. This can help you take full advantage of deductions and credits while staying compliant.

Conclusion

Understanding the business tax code might seem like an impossible task, but breaking it into manageable steps can make a world of difference. Start by mastering the basics, leveraging professional advice, and using technology to stay organized. With the right approach, you can navigate even the most confusing tax codes with confidence and focus on growing your business.

For expert guidance, reach out to More Than Numbers CPA, the best CPA firm in Greater Toronto Area. Their team specializes in simplifying tax compliance and helping businesses unlock their full potential.

1 note

·

View note

Text

Payroll Compliance Services in India: Ensuring Compliance, Reducing Risks, and Enhancing Business Efficiency

In India’s complex regulatory environment, payroll compliance is critical for businesses of all sizes. From adhering to ever-evolving labour laws to ensuring proper tax withholdings, payroll compliance encompasses a wide range of statutory requirements that companies must meet to stay compliant and avoid penalties. Payroll compliance services have emerged as essential solutions for businesses looking to manage these obligations effectively. Here’s an in-depth look at what payroll compliance services entail, their benefits, and why they are crucial for Indian businesses today.

What is Payroll Compliance?

Payroll compliance in India involves adhering to various statutory regulations associated with employee wages, deductions, benefits, and taxes. It ensures that companies correctly process payroll while complying with key labour laws and tax rules. Some of the primary laws governing payroll compliance in India include:

The Payment of Wages Act, 1936

The Employees' Provident Fund and Miscellaneous Provisions Act, 1952

The Employees' State Insurance Act, 1948

The Payment of Bonus Act, 1965

The Payment of Gratuity Act, 1972

Income Tax Act, 1961

Failure to comply with these regulations can result in penalties, legal action, and reputational damage. Consequently, payroll compliance services have become essential for businesses to manage their obligations accurately and efficiently.

Key Components of Payroll Compliance Services in India

Statutory Deductions and Contributions Payroll compliance services ensure that all statutory deductions, such as Provident Fund (PF), Employee State Insurance (ESI), and Professional Tax, are accurately calculated and remitted on time. These deductions are crucial for employee welfare, and non-compliance can lead to hefty fines.

Income Tax Compliance In India, employers are required to deduct income tax at source (TDS) from employees' salaries. Payroll compliance services manage accurate tax calculations based on employees' income, investments, and tax-saving declarations, ensuring the correct amount is deducted and filed with the Income Tax Department. They also generate necessary documents such as Form 16 for employees to facilitate individual tax filings.

Gratuity and Bonus Compliance The Payment of Bonus Act and the Payment of Gratuity Act mandate employers to offer specific benefits to employees based on eligibility. Payroll compliance services calculate and manage these payments, ensuring that businesses meet these statutory obligations while enhancing employee satisfaction.

Labour Welfare Fund Contributions Certain states in India require contributions to a Labour Welfare Fund (LWF), which supports various employee welfare initiatives. Payroll compliance services ensure these contributions are accurately calculated and remitted to the appropriate authorities.

Maintenance of Statutory Records Businesses are required to maintain a range of records, including wage registers, attendance records, and TDS returns. Payroll compliance service providers help maintain these records in an organized, accessible format, ensuring they’re readily available for audits or inspections.

State-Specific Compliance Payroll laws in India often vary by state, making compliance especially challenging for businesses with a presence in multiple regions. Payroll compliance service providers ensure that all location-specific laws are adhered to, streamlining payroll processes for multi-state businesses.

Benefits of Payroll Compliance Services

Accuracy and Timeliness in Compliance Payroll compliance service providers have expertise in handling complex payroll processes. They ensure accurate calculations and timely submissions, reducing the risk of fines or penalties.

Cost and Time Efficiency Managing payroll compliance in-house can be resource-intensive, particularly for small and medium-sized businesses. Outsourcing payroll compliance saves time, reduces administrative burdens, and allows businesses to focus on core operations.

Risk Mitigation Payroll compliance service providers stay updated on regulatory changes and labor law updates, helping companies mitigate the risks of non-compliance. They monitor legislative changes to ensure that payroll practices remain aligned with current regulations.

Enhanced Employee Satisfaction Accurate payroll and timely disbursement of benefits contribute to employee satisfaction. Payroll compliance services help companies provide a transparent, error-free payroll experience, strengthening employee trust and engagement.

Comprehensive Reporting and Documentation Payroll compliance services offer comprehensive reporting and documentation, which is essential during audits. They maintain statutory records and furnish necessary reports, giving companies confidence and preparedness for any regulatory inspection.

Why Payroll Compliance Services are Essential for Indian Businesses

India’s regulatory landscape is dynamic, with frequent updates to labor laws and tax regulations. Keeping up with these changes can be daunting for businesses, especially those without a dedicated compliance team. Here’s why payroll compliance services are invaluable for companies operating in India:

Expertise in Regulatory Compliance: Payroll compliance service providers have a team of experts who specialize in labor law and tax compliance, ensuring that companies adhere to both central and state regulations.

Scalability: These services are designed to scale according to the needs of the business, making them suitable for startups, mid-sized companies, and large corporations.

Real-Time Adaptability: With constant monitoring of regulatory updates, payroll compliance providers help businesses adjust payroll practices in real time, minimizing disruptions.

By outsourcing payroll compliance, businesses can achieve greater operational efficiency, safeguard against legal risks, and provide a better payroll experience for their employees.

Choosing the Right Payroll Compliance Service Provider

When selecting a payroll compliance provider, consider the following:

Expertise and Track Record: Look for a provider with proven experience in managing payroll compliance for businesses similar to yours.

Comprehensive Service Offering: The provider should offer end-to-end compliance solutions, including tax filings, statutory deductions, and state-specific payroll compliance.

Data Security and Confidentiality: Payroll data is sensitive, and it’s essential that the provider follows best practices in data security to protect employee information.

Reporting Capabilities: Look for a provider that offers robust reporting tools, providing insights into payroll processes and enabling compliance tracking.

#PayrollCompliance#ComplianceServices#PayrollManagement#StatutoryCompliance#IndiaBusiness#LabourLaw#EmployeeBenefits#TaxCompliance#PayrollSolutions#BusinessCompliance#EmployeeSatisfaction#RiskManagement#PayrollOutsourcing#BusinessEfficiency#HRCompliance#WageCompliance#EmployeeWelfare

0 notes

Text

Are HR Payroll Courses Worth Pursuing for a Successful HR Career?

If you’re considering a career in Human Resources, you’ve probably heard a lot about HR payroll courses. But as a student or a professional looking to specialize, you might be wondering: Are HR payroll courses worth pursuing for a successful HR career? It’s a common question, especially since payroll is a specialized area within HR that requires specific expertise and knowledge. Let’s explore why these courses are gaining popularity and how they can impact your career path.

What Exactly Are HR Payroll Courses?

HR payroll courses are designed to provide comprehensive training on payroll management, taxation, employee benefits, and compliance with labor laws. They focus on both the technical and strategic aspects of payroll, helping you become proficient in managing salaries, deductions, bonuses, and other payroll-related processes. If you’re thinking of enrolling in an HR payroll course in Pune, for example, you’ll find that these programs often cover region-specific regulations and compliance standards, which are critical for handling payroll in Indian organizations.

For those aiming to make a mark in HR, choosing the best HR payroll course in Pune is essential. An effective payroll system is the backbone of any organization, and professionals who are well-versed in payroll management play a crucial role in ensuring employee satisfaction and regulatory compliance. Whether you’re a fresh graduate or a working professional, specialized training in payroll can make your profile more attractive to potential employers.

Why Choose HR Payroll as a Specialization?

The demand for payroll professionals is on the rise as organizations seek to optimize their HR functions. Payroll is not just a back-office operation; it directly impacts employee morale and trust in the organization. By enrolling in HR payroll courses, you gain a skill set that not many HR professionals possess. This specialization can be a strong addition to your resume, setting you apart from general HR candidates.

If you’re looking at options like an HR payroll course in Pune, consider factors such as the course content, faculty expertise, and placement support. The best HR payroll course in Pune will not only cover the basics but will also provide in-depth training on advanced payroll systems, digital tools, and compliance management. With a certification in HR payroll, you can pursue roles such as Payroll Analyst, Payroll Manager, and HR Payroll Consultant.

What Do HR Payroll Courses Typically Cover?

The content of HR payroll courses can vary depending on the institute and the level of expertise they aim to offer. Generally, you can expect to learn:

Payroll Processing and Management: Understanding the entire payroll cycle, from data collection to salary disbursement.

Taxation and Compliance: Learning how to calculate taxes, manage deductions, and ensure compliance with government regulations.

Employee Benefits and Compensation: Handling benefits like Provident Fund (PF), Gratuity, Leave Travel Allowance (LTA), and more.

Statutory Compliance: Covering key laws like the Employee State Insurance (ESI) Act, Minimum Wages Act, and Payment of Bonus Act.

HR Software Training: Gaining hands-on experience with popular payroll management software like SAP, Tally, or HRMS tools.

In a city like Pune, where educational opportunities are diverse, choosing the best HR payroll course in Pune will give you access to experienced faculty, industry-specific case studies, and practical workshops. This helps you apply what you learn in real-world scenarios, making you job-ready from day one.

Why Choose an HR Payroll Course in Pune?

Pune has become one of the most sought-after destinations for HR courses due to its growing IT and corporate sectors. If you’re considering an HR payroll course in Pune, you’re making a smart choice. The city offers a unique blend of quality education and professional opportunities. Institutes here focus on aligning their curriculum with industry standards, ensuring that you gain skills that are relevant and in demand.

Additionally, the best HR payroll course in Pune will often include placement assistance, helping you secure a job immediately after completing your certification. This is a crucial factor to consider, especially if you’re looking to make a quick transition into a specialized HR role.

Career Opportunities After HR Payroll Courses

One of the biggest advantages of completing HR payroll courses is the variety of career paths available. Payroll is a niche area, and professionals with expertise in this domain are often seen as indispensable to their organizations. Some of the roles you can explore include:

Payroll Specialist: Handling day-to-day payroll operations and ensuring accuracy in salary calculations.

HR Payroll Consultant: Advising companies on implementing and managing payroll systems.

Payroll Manager: Overseeing the entire payroll department and ensuring compliance.

HR Manager with Payroll Expertise: Combining general HR responsibilities with a focus on payroll and employee compensation.

If you’re taking an HR payroll course in Pune, make sure the institute offers opportunities for internships or live projects. This hands-on experience will not only enhance your learning but will also add weight to your resume, making you a strong contender for these roles.

How to Choose the Best HR Payroll Course in Pune?

Selecting the best HR payroll course in Pune can be challenging given the variety of options available. Here are some tips to help you make an informed choice:

Check the Course Curriculum: Ensure that the program covers all key areas of payroll management, compliance, and software training.

Look for Experienced Faculty: The trainers should have industry experience and in-depth knowledge of payroll processes.

Placement Support: Opt for a course that offers placement assistance or has tie-ups with reputed companies.

Student Reviews and Ratings: Look for reviews from previous students to gauge the quality of education and the kind of support you can expect.

By keeping these factors in mind, you can choose the best HR payroll course in Pune that aligns with your career goals.

Final Thoughts: Is an HR Payroll Course the Right Choice for You?

If you’re passionate about building a career in HR and want to specialize in an area that is both challenging and rewarding, then HR payroll courses are definitely worth considering. They equip you with a unique set of skills that are in high demand, making you an attractive candidate for various HR roles. Especially if you choose an HR payroll course in Pune, you’ll benefit from quality education, industry exposure, and strong job prospects.

The best HR payroll course in Pune will provide you with a comprehensive understanding of payroll management, along with practical training to help you stand out in the competitive HR landscape. So, if you’re still asking yourself whether an HR payroll course is the right fit for you, the answer is a resounding Yes—if you’re looking to build a niche skill set and advance your HR career

0 notes

Text

Understanding Termination Packages: What Every Employee Should Know

A termination package, also known as a severance package, is compensation that employers offer to employees when their employment is terminated. Whether the termination is due to layoffs, restructuring, or other reasons, understanding what constitutes a fair termination package is essential for both employers and employees. This guide will help you navigate the ins and outs of termination packages, ensuring you're informed of your rights and options.

What Is a Termination Package?

A termination package typically includes monetary compensation along with additional benefits that an employer offers to an employee whose job has been terminated. The specific components of the package can vary based on the employer, the length of employment, and the terms of the employment contract. While not every employee is entitled to severance, many companies provide termination packages as part of good business practice or as required by law.

Key Components of a Termination Package

Severance Pay Severance pay is the most significant component of a termination package. It's typically calculated based on the employee's length of service, salary, and, in some cases, position within the company. For example, an employee with many years of service may receive a larger severance pay package than someone with only a few months of employment. Severance is generally paid out in a lump sum or installments.

Continuation of Benefits Employers may offer to continue an employee’s benefits, such as health insurance, for a specified period after termination. This can be particularly valuable, as finding new employment often takes time, and maintaining health coverage is a priority for many individuals.

Accrued Vacation Pay Any unused vacation time is typically paid out as part of a termination package. Depending on your employment contract and the applicable labor laws, this may be mandatory.

Bonuses and Commissions If your compensation package includes bonuses or commissions, these may also be addressed in the termination package. Some employers choose to pay out bonuses that were earned but not yet paid, while others may offer prorated bonuses based on the time worked during the bonus period.

Outplacement Services Outplacement services are designed to help employees transition to new employment. These services may include career counseling, resume writing assistance, job search resources, and interview preparation. This is a valuable part of the termination package, as it supports employees in finding their next role.

Non-Compete and Non-Disclosure Agreements In some cases, a termination package will include legal agreements such as non-compete or non-disclosure agreements (NDAs). These contracts limit the employee's ability to work with competitors or share confidential company information. In exchange for signing these agreements, employers may offer additional compensation.

Release of Claims Many employers will include a release of claims in the termination package, which means the employee agrees not to sue the company for wrongful termination or other claims in exchange for the severance payment. It's important for employees to review this part carefully, as it can impact their legal rights.

Factors That Affect the Value of a Termination Package

Several factors determine the size and structure of a termination package:

Length of Employment: Employees with a long tenure are typically offered more generous packages.

Employment Contract: Some employees have contracts that specifically outline the severance terms, making it easier to determine what is owed upon termination.

Company Policy: Many organizations have policies in place that govern how termination packages are calculated.

Reason for Termination: If termination is due to restructuring, layoffs, or mergers, packages are often more generous than in cases of termination for cause, where severance may not be offered.

Legal Rights and Protections

In Canada, termination packages are regulated by both federal and provincial laws, such as the Employment Standards Act (ESA) in Ontario. Employers must adhere to minimum notice requirements, which are based on the employee’s length of service. The ESA outlines basic standards, including the minimum notice period and severance pay requirements for certain employees.

It's important to note that severance pay is separate from termination notice or pay in lieu of notice. While termination notice refers to the advance notice an employer must give before terminating an employee, severance pay is additional compensation provided to employees with long service records. Employees should be aware of their rights under the law and review the termination package to ensure compliance with provincial or federal regulations.

What to Do When Offered a Termination Package

Review the Terms Carefully Never rush to accept the first offer. Take the time to review all components of the termination package, ensuring you understand the financial compensation and any legal obligations you may be agreeing to, such as signing a non-compete agreement.

Consult an Employment Lawyer An employment lawyer can help you assess whether the severance package is fair and complies with local employment laws. They can also negotiate on your behalf if the offer falls short of what you're entitled to.

Understand Your Rights Know your rights under employment law. Certain entitlements, such as severance pay, may be guaranteed based on your years of service, job level, and the nature of your employment contract.

Negotiate If Necessary If the initial offer doesn't meet your expectations or legal entitlements, don’t be afraid to negotiate. Employers often leave room for negotiation, especially if the package offered is below market standards.

Final Thoughts

Understanding your termination package is critical in securing your financial stability after job loss. It’s essential to carefully review the package, consider legal advice, and ensure you receive what you're entitled to based on your employment contract and applicable laws. By being informed, you can navigate this difficult situation with confidence and ensure a smoother transition to the next chapter in your career.

0 notes

Text

Step-By-Step Guide To Apply For An Income Certificate

Income certificate is issued to the citizen by the Government, as evidence confirming their annual income. An income certificate is used as legal proof for availing various subsidies and schemes. An income certificate helps in securing scholarships provided by some organisations to help the underprivileged. Let’s understand what exactly an Income certificate is and how to apply for an income certificate online.

What Is An Income Certificate? An income certificate is a certificate issued by the government as proof of the annual income earned by a family. The main aim of the government is to manage all the citizens and provide govt schemes to those families who need them.

As the country has billions of citizens, it is often difficult for the government to keep account of everything. An income certificate makes it easier for the government to identify who is genuinely eligible and who is not. It provides free ration to underprivileged families, helps students get scholarships, etc.

Any financial gain obtained by individuals or families needs to be updated in the income certificate. This is so that the government can easily categorise all families to give various subsidies and rations to underprivileged families.

The income-earning members can be unmarried daughters, unmarried brothers and sisters, to calculate the family income. The earning people in the family can consist of:

Salary of members working in organisations

Various pensions

Daily/weekly wage of a labourer

Profits from business

Charges of consultancy

Commissions of agency work

Any kind of regular financial benefits received, such as

Employee bonus

Deposit interest

Dividends from share and stock markets

Property rent

Gains on the sale of assets

Gifts and inheritances

What Is The Purpose Of An Income Certificate? Income certificates make it easier for the government to find out the families who need help financially and help them get the help they need. It is also needed for the following reasons.

To avail of government welfare schemes and benefits.

To apply for scholarships and financial aid for education.

To apply for government jobs and reservations based on income criteria.

To avail of subsidies on essential commodities.

To apply for housing schemes and loans.

To avail of medical benefits and insurance schemes.

To apply for fee concessions in educational institutions.

To avail of tax exemptions and deductions.

To apply for loans and credit facilities from banks.

To prove eligibility for various government schemes and programs based on income criteria.

How To Apply For An Income Certificate Online? People who want to know how to apply for an income certificate online can follow these steps.

Visit the official website of your state or district that handles administrative services.

Create an account by registering with a unique username, password, and mobile number.

Search for the option to apply for an Income Certificate.

Fill in the online application with the required details.

Upload necessary documents such as Ration Card, Driving License, Voter ID, and Aadhaar Card.

Provide details about your religion, caste, and whether you belong to SC, ST, or OBC categories.

Attach proof of income, which can include your parent’s income certificate, Income Tax Return, Form 16 from your employer, or a salary certificate. Some documents may need to be attested by a government officer.

Upload utility bills like rent, electricity, or telephone bills as proof of address. These may also need to be attested.

Submit an affidavit confirming that all the details you provided are true.

Submit the application online or at the local district office.

The Income Certificate is normally issued within 10 to 15 days.

0 notes

Text

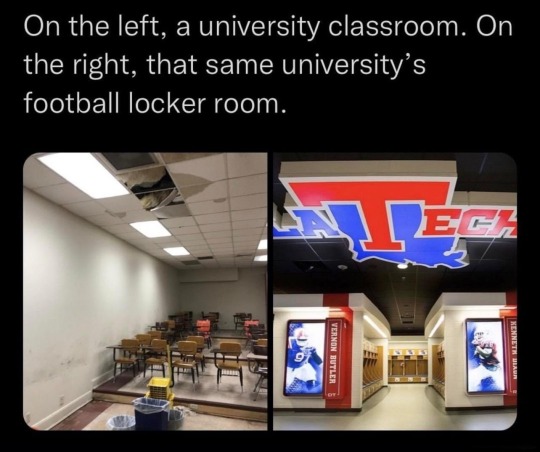

Semi-regular reminder that in most states, K-12 extracurricular athletics programs cannot be funded by school budget. This includes equipment and any facilities that are not part of the regular school day use. They are funded by student participation fees, ticket sales, sponsorships, and fundraising programs. The most popular sports (football, basketball, and baseball, sometimes soccer) often help pay for the other, smaller sports.

Other extracurricular activities like marching band, show choir, one act, FAA, debate, etc. are also not funded by school budget and have to have participation fees and fundraisers.

Funding for additional pay for teachers acting as coaches or club sponsors in addition to teaching varies by state. If a coach is an admin or athletic director (in charge of all athletics, regular school hour and extracurricular), then they get that pay plus coaching bonus, same as a classroom teacher would. In states where the extracurricular bonus pay is funded by taxes same as regular educator pay, the amount is based on the number of additional hours required, extra qualifications, and experience, same as any other pay. They may also receive additional bonuses from booster clubs (parent fundraising. Again applies to all extracurriculars as there can be general booster clubs or activity specific booster clubs, but all of that is up to parents, not the school or district.

Typically, the only things that are funded by school budget are teacher base pay, SpEd bonuses, and things required during regular school hours.

A teacher who works during school hours and doesn't sponsor any clubs or participate in any extracurricular activities won't get paid as much as one that does, which is fair based on student contact work hours (mandatory work hours and student contact hours are what are counted for calculating pay). A beginner coach won't have the same bonus as a coach with a decade of experience. That coach won't have the same bonus as a coach with a decade of experience and additional education certificates and a history of working with high achieving programs. That same thing can also be said of band directors, theater directors, and any other competition based program sponsor.

Regular school facilities and base teaching salaries being underfunded has nothing to do with extracurriculars of any kind and is entirely based on school funding being based on property taxes and local and state governments not allocating additional funding to cover the gaps.

A "car allowance" is either 1) not real or 2) a booster club or sponsored bonus. If a coaches school funded bonus is $30k+, and the school or other extracurriculars are underfunded, then there is a serious local government issue and potentially an illegal use of funds issue.

Universities are a different matter, though public universities typically follow the same model. Student tuitions pay for resources that are available to every student, while additional funding for sports teams and the like come from sponsorships, fundraising, ticket sales, etc. in the same way as K-12. Part of why college sports got into being televised and became a commercial thing was so that the teams could bring in more money for the schools without increasing tuitions. Unfortunately, obviously, since that wasn't codified and the salaries of employees of non-profits aren't restricted in any way, high ranking public university employees are grossly overpaid while the rest are underpaid, and athletics became a tool to keep boosting those salaries and the upper coaching staff became a part of that. Coaches' employment and salaries are still much more dependent on performance than other high paid university employees, but its still grossly disproportionate to other staff.

Even though it would benefit the school over all to regulate salaries of non-profit employees, they obviously arent going to do it themselves or support any legislature that would, and those individuals will fundraise for legislative candidates that allow them to keep making as much money as they can.

#tldr the problem is capitalism/money in government not sports#nerd hate-ons for athletics are a peeve of mine#like go to therapy and move past your middle school experience#jocks are just nerds but for moving instead of whatever else#though sometimes theyre nerds for moving and scifi or fantasy or science or history or allbof the above

19K notes

·

View notes

Text

Processing Class In SAP HR

Understanding Processing Classes in SAP HR: Key to Effective Payroll

In the heart of SAP’s Human Resources (HR) module lies a crucial concept governing how your company calculates employee salaries: Processing Classes. These classes are blueprints for how different wage types (salary elements such as basic pay, allowances, deductions, etc.) should be treated during the complex payroll process.

What Exactly Are Processing Classes?

Think of them as rulebooks. Each processing class has a set of specifications that dictate how a wage type is processed. These specifications determine things like:

Whether a wage type should be taxed,

How it should be cumulated (added up) with other wage types

The order in which it should be processed during payroll

Whether it carries forward to future payroll periods

Why They Matter

Accuracy: Correct processing classes free your payroll from errors, ensuring employees are paid precisely what they’re entitled to.

Compliance: They adhere to tax regulations and any specific company policies.

Customization: SAP offers standard processing classes, but you can create custom ones to tailor payroll to your organization’s unique needs.

Standard Processing Classes

SAP provides a range of pre-defined processing classes (numbered 1-89) to cover common payroll scenarios. Here are a few key ones:

Class 1: Adds a wage type to the gross amount.

Class 10: Subtracts a wage type from the gross to form a taxable base.

Class 20: Deducts a wage type from the gross amount.

Custom Processing Classes

When standard classes don’t fit, you can create custom processing classes (numbered 90-99). This is often required for handling unique bonuses, deductions, or complex calculations specific to your business.

How to Use Processing Classes

Maintain Processing Classes: Customize specifications or create custom classes using transaction code SM30 and table V_512W_D.

Create Processing Rules (PCRs): These rules, written in SAP’s payroll schema, tell the system how to apply a processing class’s specifications.

Assign to Wage Types: Carefully link each wage type to the appropriate processing class.

Example

Imagine a company that wants a “performance bonus” wage type to be taxed. Here’s how processing classes play a role:

A suitable processing class, perhaps class 1, would be assigned to the “performance bonus” wage type.

A processing rule would be written to add this wage type to the gross and, subsequently, the taxable base during payroll.

Tips

Understand the standard processing classes thoroughly before creating custom ones.

Collaborate closely with your HR functional experts when designing or defining custom processing classes.

Test any customization rigorously to prevent unexpected outcomes during payroll runs.

In Conclusion

Mastering processing classes is like unlocking a hidden toolkit within SAP HR. By using them strategically, you’ll guarantee a smooth, accurate, and compliant payroll process—a win-win for both your employees and your business.

youtube

You can find more information about SAP HR in this SAP HR Link

Conclusion:

Unogeeks is the No.1 IT Training Institute for SAP HR Training. Anyone Disagree? Please drop in a comment

You can check out our other latest blogs on SAP HR here – SAP HR Blogs

You can check out our Best In Class SAP HR Details here – SAP HR Training

———————————-

For Training inquiries:

Call/Whatsapp: +91 73960 33555

Mail us at: [email protected]

Our Website ➜ https://unogeeks.com

Follow us:

Instagram: https://www.instagram.com/unogeeks

Facebook: https://www.facebook.com/UnogeeksSoftwareTrainingInstitute

Twitter: https://twitter.com/unogeeks

1 note

·

View note

Text

Employee Compensation Basics: What Every Employer and Employee Must Know

This blog post spotlights the most common aspects HR pros and employees need to know about employee compensation in India.

Minimum Wages:

You should ensure that you not only give your employees minimum wages but also provide living wages so that they can experience a good quality of life. You should also understand that the government keeps revising the minimum wages based on the cost of living index. Even the new wage code will have an impact on the wages of employees. So, be aware of its provisions as well.

Working Hours & Overtime:

Your employees must be aware of their official working hours and the rules governing them. They should also be responsible enough to be productive during these hours. As the employer, you must also enlighten them about their eligibility for double wages when they have to work overtime.

Salary Components:

As per the law, there are some basic deductions to be made for PF, PT, ESI, bonus, etc. Therefore, it is critical to get these calculations right for making accurate salary payouts. Sometimes, some employees might request an increase in their take-home salary. In this case, you may have to make adjustments to the salary components for the benefit of the concerned employees. Yes, this has to be done without violating the law.

Leave Entitlement:

Leave is a mandatory benefit provided by all employers. Although it is non-monetary, it matters a lot for employees. Some companies offer additional types of leave as a gift. Birthday leave and marriage leave are just two examples. There are many more.

Employment Contract:

Both employers and employees must be aware of all the provisions of the applicable employment contracts. Since there are different types of contracts, like regular employment, fixed-term, part-time, consultancy, etc., it’s a good practice to enlighten the employees to avoid conflicts and legal issues. Even the salary structure and tax components are likely to be different in each category.

Do you want to hear it directly from the expert?

Read the greytHR blog and watch the webinar recording

Source Link

#hr#payroll#hrms#hrm#hr software#payroll software#hrms payroll#hr and payroll#hr and payroll software#greytHR

0 notes

Text

Method of Floatation of Securities in Primary Market

The process of issuing and offering new securities to the public in the primary market is known as the "floatation" or "issuance" of securities. Companies and governments use various methods to float securities in the primary market. Here are some common methods of floatation:

If you want to learn more about trading then joinInvestingdaddy.com.

Initial Public Offering (IPO):

An Initial Public Offering (IPO) is one of the most common methods of floatation. In an IPO, a private company offers its shares to the public for the first time. The company works with underwriters to determine the offering price and the number of shares to be issued. Once the IPO is complete, the company's shares are traded on a stock exchange.

Follow-on Public Offering (FPO):

A Follow-on Public Offering (FPO) occurs when a company that is already publicly listed issues additional shares to the public. This allows the company to raise more capital after its initial listing.

Rights Issue:

In a Rights Issue, existing shareholders are given the right to purchase additional shares at a discounted price. This method allows companies to raise capital from their current shareholder base.

Bonus Issue:

A Bonus Issue involves issuing additional shares to existing shareholders for free, without any cost. The new shares are distributed to shareholders in proportion to their existing holdings.

Private Placement:

Private Placement involves the direct sale of securities to a select group of institutional investors or high-net-worth individuals. This method is not open to the general public and is often used for debt instruments or equity shares.

Preferential Allotment:

Preferential Allotment is a method where companies issue shares to specific individuals or entities on a preferential basis. This is often done at a predetermined price, and it may involve issuing shares to promoters or strategic investors.

Employee Stock Option Plans (ESOPs):

ESOPs allow companies to issue shares to employees as part of their compensation. Employees typically have the option to purchase shares at a predetermined price.

Qualified Institutional Placement (QIP):

QIP is a method where listed companies can issue equity shares or other securities to qualified institutional buyers (QIBs) like mutual funds and insurance companies without a public offering.

Debenture Issue:

Companies can raise capital by issuing debentures, which are debt instruments. Investors who purchase debentures are essentially lending money to the company.

Convertible Securities:

Companies may issue convertible securities such as convertible bonds or preference shares. These securities can be converted into equity shares at a later date.

Initial Coin Offering (ICO):

In the context of cryptocurrencies, an Initial Coin Offering (ICO) is a method where companies raise funds by issuing new digital tokens or coins to investors. ICOs are common in the blockchain and cryptocurrency space.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in india.

You can also downloadLTP Calculator app by clicking on download button.

Each method of floatation has its advantages and considerations, and the choice depends on the issuer's objectives, market conditions, and regulatory requirements. The involvement of underwriters, regulatory compliance, and pricing strategies are crucial aspects of the floatation process in the primary market.

0 notes

Text

"Secretive Surprises Unveiled: Uncover the Mind-Blowing Deepavali Bonus for Public Sector Employees!"

PMK founder S. Ramadoss has called on the Tamil Nadu government to increase the Deepavali bonus for public sector employees from the usual 20% to 25% of their fixed salary ceiling. Dr. Ramadoss emphasized that the bonus for these employees is not calculated based on a percentage of their gross salary, but rather a predetermined pay ceiling, with 20% of the annual average being paid as bonus. He…

View On WordPress

0 notes

Text

"Secretive Surprises Unveiled: Uncover the Mind-Blowing Deepavali Bonus for Public Sector Employees!"

PMK founder S. Ramadoss has called on the Tamil Nadu government to increase the Deepavali bonus for public sector employees from the usual 20% to 25% of their fixed salary ceiling. Dr. Ramadoss emphasized that the bonus for these employees is not calculated based on a percentage of their gross salary, but rather a predetermined pay ceiling, with 20% of the annual average being paid as bonus. He…

View On WordPress

0 notes

Text

IELTS Is Your Ticket To The USA

There are various ways to enter the United States legally. However, some of these ways are time-consuming and complex.

For example, millions of people wait for the US Visa Process but don’t get it. Moreover, the US government’s regulations and process to give entry to foreigners are extremely strict. The wisest way to open the US opportunity gates is by scoring good IELTS.

So, let’s know more about IELTS and what is IELTS score.

What Is IELTS?

The most popular test in the world for people who want to study, work, or live in the US is IELTS. It is conducted to check candidates' English Language proficiency and eligibility. Along with the various US visa types, rely on your IELTS score to improve your chances of Visa approval.

Now, let’s understand how you can come closer to finding employment opportunities via IELTS.

IELTS For Employment:

It is not mandatory to perform an IELTS test for employment. However, IELTS adds bonus points to your US visa application.

You can opt for the IELTS General Training program for employment opportunities.

The test is associated with workplace settings. Also, the test comprises vocational training from renowned organizations.

You can request five test report forms from Embassies and Consulates.

Your scores will be calculated according to the 9-band scoring system. It evaluates your proficiency in understanding, writing, reading, and learning in English.

Employees should have at least a 4.0 score on the IELTS.

Remember these points and do take the IELTS test for employment. Now, let’s understand how IELTS is helping millions of students to study in the US.

Studying At A Prestigious University In The USA With IELTS

Today, more than 3,300 higher education programs and institutions in the United States accept international students based on IELTS scores. IELTS score determines students' English language proficiency and allows institutions to know whether they are fit.

The IELTS tests are prominent across significant institutions as they reflect students' English language abilities. So, educational institutions admit a student who knows to read, write, understand, and speak in English. IELTS permits you to enter into several recognized programs, such as:

Visiting programs

Fulbright scholarships

Degree programs

Masters

PhD

MBA

Masters of Philosophy

Over 25 top US universities trust IELTS. Additionally, all Ivy League colleges accept admission according to IELTS scores. Furthermore, the top renowned 50 US universities offer programs to international students.

So, IELTS numbers allow you to enter your dream university. With IELTS, students can even get a scholarship to study in the United States. So, let’s learn more about the scholarship offer via IELTS.

Scholarship To Study:

Universities and institutions provide scholarships to students depending on their IELTS scores. As a result, over $8.8 billion in financial aid is given to global students to study in the United States.

So, IELTS has become an essential aspect for students aspiring to study in the US as it’s a primary requirement to get admission to US universities. Your purpose of immigration, education, certification, and scholarship, is evaluated in the IELTS test for a scholarship. Now, the biggest concern for financially weak students is expenses.

No worries anymore because the British Council, Top Universities, and the US government permit IELTS scholarships to financially deprived foreign candidates. Now, let’s check the eligibility criteria for a scholarship via IELTS.

What Is IELTS Scholarship Eligibility?

Prominent in 9,000 organizations in 140 countries, you can get admission to universities in the UK, Canadian, Australia, and the US with an IELTS scholarship. Let’s understand its eligibility criteria.

The applicant should be an Indian Citizen.

Candidates should have a bachelor’s degree.

They must be interested in the subject that they want to study further.

Your English language proficiency will be tested through IELTS, PTE Academic, TOEFL-iBT, CAE, and CPE scores.

You have to attend the scholar’s networking events whenever required.

As we know the eligibility criteria for the IELTS scholarship, let’s understand the application details.

What Are The IELTS Scholarship Application Details?

First, candidates have to give an English Language proficiency exam. Once you receive the result, you apply for IELTS scholarships, especially for Indian Students. Now, you can use the GREAT Scholarship program if you have given the exam.

Let’s look at some of the critical application details:

Visit the university page and get all the information on the scholarship programs. For example, if you are visiting the webpage of Ivy colleges, know their application procedure and institute-related scholarship.

Keep yourself up-to-date with university deadlines.

Candidates selected for the scholarship program will be notified by the universities only.

Thus, universities only disburse the scholarship reward.

Note: The IELTS scholarship program is available for postgraduate aspirants.

Now that you know all the IELTS scholarship program details, let's get you through its application process.

How Can I Apply For An IELTS Scholarship?

The IELTS scholarship will be available to universities participating in IELTS programs. So, visit their webpage and directly download the application form. Then, please fill out the application form with relevant details and submit it on the portal. You can also download the IELTS preparation guidelines consisting of every minute detail of the scholarship.

Here's everything you will know in the IELTS preparation guide:

IELTS exam process

Eligibility criteria

Preparation methods

Procedure for the test

Exam pattern and schedule

Exam Syllabus

Registration process

Exam dates

Get a minimum of 6.0 score and a chance to enter the US with a visa USA.

0 notes

Text

Payroll Compliance Services: Guaranteeing Precise and Timely Payroll Administration

Payroll compliance services play a vital role for businesses in India, facilitating the management of employee salaries, mandatory deductions, and tax submissions in line with governmental regulations. Adhering to payroll laws is essential for companies to avoid fines and ensure a seamless, transparent payroll process for their workforce. As labor laws and tax regulations grow more intricate, many businesses are opting to outsource their payroll compliance management, regardless of their size.

Significance of Payroll Compliance Services:

In India, failing to comply with payroll regulations can result in substantial fines and legal repercussions. Effective payroll compliance management keeps businesses informed about the constantly evolving tax and labor laws, protecting them from penalties and fostering a positive rapport with their employees.

For expanding organizations, outsourcing payroll compliance services alleviates the administrative workload, enabling HR teams to concentrate on strategic initiatives rather than routine payroll processing and submissions.

As payroll regulations in India become more complex, it is crucial for businesses to adhere to various statutory obligations. Payroll compliance services provide accurate, timely, and efficient payroll management, assisting businesses in minimizing compliance risks while ensuring employee satisfaction.

Key Components of Payroll Compliance Services

Management of Statutory Deductions:

Ensuring compliance with statutory deductions, including the Employees' Provident Fund (EPF), Employees' State Insurance (ESI), Professional Tax, and Labour Welfare Fund (LWF), is vital for payroll management in India. Payroll compliance services facilitate the precise calculation, deduction, and timely remittance of these contributions to the appropriate authorities.

Income Tax and TDS Management:

Another essential role of payroll compliance services is the administration of income tax and TDS (Tax Deducted at Source) for employees. These services guarantee accurate TDS calculations based on employee salary structures, adherence to current tax slab rates, and timely filing of tax returns, including the issuance of Form 24Q and Form 16.

Accurate and Timely Payroll Processing:

By automating and optimizing payroll processes, payroll compliance services ensure that employees receive their salaries punctually while meeting statutory obligations. This encompasses managing attendance, leave encashment, overtime, and bonus distributions, all in accordance with labor regulations.

Audit Preparation and Reporting:

Payroll compliance services assist organizations in maintaining comprehensive and current records of payroll-related activities. This preparation is crucial for audits and inspections by government entities, thereby minimizing the risk of penalties for non-compliance.

Management of Employee Records:

Effective documentation and upkeep of employee records, such as salary slips, tax declarations, and leave information, are critical for compliance and efficient payroll operations. Payroll compliance services aid businesses in systematically managing this information, ensuring adherence to labor laws and regulatory standards.

Significance of Payroll Compliance Services:

In India, failure to comply with payroll regulations can result in substantial fines and legal repercussions.

0 notes

Text

Unlocking Opportunities with ICV Certification Services in the UAE

Introduction

In the dynamic landscape of the United Arab Emirates (UAE), the In-Country Value (ICV) certification program has emerged as a pivotal initiative. Spearheaded by the Abu Dhabi National Oil Company (ADNOC), this program has been in effect since April 1, 2018, and has reshaped the way suppliers of goods and services engage with the UAE's business ecosystem. This article explores the significance of the ICV certificate, its objectives, and why it has been implemented in the UAE. Additionally, we introduce Elevate as a trusted ICV service provider, offering comprehensive assistance in navigating this certification process.

The ICV Certification Program:

The ICV certification program is designed to enhance the UAE's economic landscape in several key ways:

Emiratization: By creating additional employment opportunities for Emiratis in the private sector, the program contributes to the nation's Emiratization goals.

GDP Diversification: The program supports UAE's GDP diversification efforts by encouraging the sourcing of goods and services within the country.

Strategic Considerations: Certain categories within the value chain are strategically critical. The program aims to localize these aspects to strengthen the UAE's economic resilience.

Unified ICV Certification Program

Since 2019, the ICV certification program has evolved to encompass a broader spectrum of sectors in Abu Dhabi and the UAE. This expansion includes collaboration with entities like the Department of Economic Development, Abu Dhabi Ports, and Aldar Properties. As more organizations join the ICV certification platform, it becomes increasingly important for businesses to understand and comply with its requirements.

Areas Considered for Unified ICV Calculations

The ICV score is calculated based on various factors, including:

(a) Goods Manufactured: Applicable to suppliers holding an industrial license.

(b) Third-Party Spend: Relevant for suppliers without an industrial license.

(c) Investment: Reflects the financial investments made within the UAE.

(d) Emiratization: Measures the employment of Emiratis in the private sector.

(e) Expatriate Contribution: Evaluates the contribution of expatriate employees.

(f) Bonus: Includes factors such as revenue from outside the UAE and Emirati headcount.

Who Requires a Unified ICV Certificate?

Companies engaged directly as suppliers or indirectly as sub-suppliers to various government and semi-government departments in Abu Dhabi need to obtain a unified ICV certificate. These include:

ADNOC Group Companies

Abu Dhabi Department of Economic Development

Aldar Properties

Abu Dhabi Ports

Environment Agency Abu Dhabi

All other Abu Dhabi government departments

Companies submitting tenders through Musanada (Abu Dhabi General Services Company)

Elevate: Your Trusted ICV Service Provider

Elevate Accounting & Auditing is your partner in navigating the ICV certification process in the UAE. Here's how we can assist:

Financial Audit: We audit and sign your financial statements, a critical component of the ICV certification process.

ICV Score Improvement: Our team guides you on understanding the ICV services and factors affecting your ICV score. We suggest ways to improve your score and provide an impact analysis report.

Template Drafting: We draft the ICV template based on your financial records for presentation to the ICV certifying body, ensuring compliance with the required ICV score.

Improvement Plans: We assist in drafting ICV improvement plans, a necessary component for tender submissions to ADNOC.

Conclusion The ICV certificate has become a critical element in doing business in the UAE. Elevate Accounting & Auditing stands ready to guide your company through this process, ensuring compliance and optimal ICV scores. Unlock the opportunities presented by ICV certification in the UAE with Elevate by your side.

0 notes

Text

Salary Payslip

When it comes to managing your personal finances, understanding your salary payslip is crucial. A salary payslip, also known as an income statement or paycheck stub, provides a detailed breakdown of your earnings, deductions, and other important financial information. This document serves as proof of your income and helps you keep track of your earnings and deductions throughout the year.

In this article GogPaySlip.com Login, we will delve into the intricacies of a salary payslip, exploring its various components, benefits, and importance. Whether you're an employee wanting to understand your income statement better or an employer seeking to provide clarity to your staff, this guide will equip you with the knowledge you need to navigate the world of salary payslips effectively.

1. What is a Salary Payslip?

A salary payslip is a document provided by an employer to an employee, usually on a monthly basis, which details the employee's earnings and deductions for a specific pay period. It serves as a record of an employee's financial transactions and provides transparency in terms of income and deductions.

2. Understanding Basic Salary

The basic salary, often referred to as the base salary or fixed salary, is the agreed-upon amount an employee receives before any deductions or additional payments. It forms the foundation of an employee's earnings and is usually stated as an annual amount in the employment contract.

3. Components of a Salary Payslip

A comprehensive salary payslip consists of various components that provide a breakdown of an employee's earnings and deductions. These components may vary depending on the country, company policies, and individual circumstances. However, some common components include:

Basic Salary

Allowances (Housing, Transport, etc.)

Overtime Pay

Bonus and Incentives

Deductions (Income Tax, Social Security, etc.)

4. Gross Salary: Breaking It Down

The gross salary represents the total amount an employee earns before any deductions are made. It includes the basic salary, allowances, overtime pay, and any additional earnings such as bonuses or incentives.

5. Net Salary: What You Take Home

The net salary, also known as the take-home pay, is the amount an employee receives after all the deductions have been subtracted from the gross salary. It represents the actual earnings an employee receives in their bank account.

6. Deductions: Unraveling the Mystery

Deductions are amounts subtracted from an employee's gross salary to account for various obligations and contributions. These deductions may include income tax, social security contributions, health insurance premiums, pension contributions, and other statutory obligations.

7. Income Tax: How It Affects Your Payslip

Income tax is a mandatory deduction imposed by the government on individuals' earnings. The amount of income tax deducted from an employee's salary depends on their income level, tax bracket, and other factors. It is crucial to understand the income tax regulations in your country to ensure accurate deductions on your payslip.

8. Statutory Deductions: Contributions and Obligations

Statutory deductions encompass contributions mandated by law, such as social security, health insurance, and pension schemes. These deductions aim to provide financial protection and security for employees during retirement, illness, or unemployment.

9. Voluntary Deductions: Employee Benefits

Voluntary deductions are deductions chosen by employees to avail themselves of additional benefits or services. These deductions may include contributions to retirement plans, health insurance premiums, life insurance premiums, or other employee benefit programs offered by the employer.

10. Overtime Pay: Compensating Extra Effort

Overtime pay refers to the additional compensation provided to employees for working beyond their regular working hours. It is usually calculated at a higher rate than the regular hourly wage or may be governed by specific labor laws.

1 note

·

View note