#blockchain venture capital

Explore tagged Tumblr posts

Text

How a billionaire’s mediocre pump-and-dump “book” became a “bestseller”

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

I was on a book tour the day my editor called me and told me, "From now on, your middle name is 'Cory.'"

"That's weird. Why?"

"Because from now on, your first name is 'New York Times Bestselling Author.'"

That was how I found out I'd hit the NYT list for the first time. It was a huge moment – just as it has been each subsequent time it's happened. First, because of how it warmed my little ego, but second, and more importantly, because of how it affected my book and all the books afterwards.

Once your book is a Times bestseller, every bookseller in America orders enough copies to fill a front-facing display on a new release shelf or a stack on a bestseller table. They order more copies of your backlist. Foreign rights buyers at Frankfurt crowd around your international agents to bid on your book. Movie studios come calling. It's a huge deal.

My books became Times bestsellers the old-fashioned way: people bought and read them and told their friends, who bought and read them. Booksellers who enjoyed them wrote "shelf-talkers" – short reviews – and displayed them alongside the book.

That "From now on your first name is 'New York Times Bestselling Author' gag is a tradition. When @wilwheaton's memoir Still Just A Geek hit the Times list, I texted the joke to him and he texted back to say @jscalzi had already sent him the same joke (and of course, Scalzi and I have the same editor, Patrick Nielsen Hayden):

https://www.harpercollins.com/products/still-just-a-geek-wil-wheaton

But not everyone earns that first name the same way. Some people cheat.

Famously, the Church of Scientology was caught buying truckloads of L Ron Hubbard books (published by Scientology's own publishing arm) from booksellers, returning them to their warehouse, then shipping them back to the booksellers when they re-ordered the sold out titles. The tip-off came when booksellers opened cases of books and found that they already bore the store's own price-stickers:

https://www.latimes.com/local/la-scientology062890-story.html

The reason Scientology was willing to go to such great lengths wasn't merely that readers used "NYT Bestseller* to choose which books to buy. Far more important was the signal that this sent to the entire book trade, from reviewers to librarians to booksellers, who made important decisions about how many copies of the books to stock, whether to display them spine- or face out, and whether to return unsold stock or leave it on the shelf.

Publishers go to great lengths to send these messages to the trade: sending out fancy advance review copies in elaborate packaging, taking out ads in the trade magazines, featuring titles in their catalogs and sending their sales-force out to impress the publisher's enthusiasm on their accounts.

Even the advance can be a way to signal the trade: when a publisher announces that it just acquired a book for an eyebrow-raising sum, it's not trumpeting the size of its capital reserves – it's telling the trade that this book is a Big Deal that they should pay attention to.

(Of all the signals, this one may be the weakest, even if it's the most expensive for publishers to send. Take the $1.25m advance that Rupert Murdoch's Harpercollins paid to Sarah Palin for her unreadable memoir, Going Rogue. As with so many of the outsized sums Murdoch's press and papers pay to right wing politicians, the figure didn't represent a bet on the commercial prospects of the book – which tanked – but rather, a legal way to launder massive cash transfers from the far-right billionaire to a generation of politicians who now owe him some rather expensive favors.)

All of which brings me to the New York Times bestselling book Read Write Own by the billionaire VC New York Times Bestselling Author Chris Dixon. Dixon is a partner at A16Z, the venture capitalists who pumped billions into failed, scammy, cryptocurrency companies that tricked normies into converting their perfectly cromulent "fiat" money into shitcoins, allowing the investors to turn a massive profit and exit before the companies collapsed or imploded.

Read Write Own (subtitle: "Building the Next Era of the Internet") is a monumentally unconvincing hymn to the blockchain. As Molly White writes in her scathing review, the book is full of undisclosed conflicts of interest, with Dixon touting companies he has a direct personal stake in:

https://www.citationneeded.news/review-read-write-own-by-chris-dixon/

But this book's defects go beyond this kind of sleazy pump-and-dump behavior. It's also just bad. The arguments it makes for the blockchain as a way of escaping the problems of an enshittified, monopolized internet are bad arguments. White dissects each of these arguments very skillfully, and I urge you to read her review for a full list, but I'll reproduce one here to give you a taste:

After three chapters in which Dixon provides a (rather revisionistd) history of the web to date, explains the mechanics of blockchains, and goes over the types of things one might theoretically be able to do with a blockchain, we are left with "Part Four: Here and Now", then the final "Part Five: What's Next". The name of Part Four suggests that he will perhaps lay out a list of blockchain projects that are currently successfully solving real problems.

This may be why Part Four is precisely four and a half pages long. And rather than name any successful projects, Dixon instead spends his few pages excoriating the "casino" projects that he says have given crypto a bad rap,e prompting regulatory scrutiny that is making "ethical entrepreneurs … afraid to build products" in the United States.f

As White says, this is just not a good book. It doesn't contain anything to excite people who are already blockchain-poisoned crypto cultists – and it also lacks anything that will convince normies who never let Matt Damon or Spike Lee convince them to trade dollars for magic beans. It's one of those books that manages to be both paper and a paperweight.

And yet…it's a New York Times Bestseller. How did this come to pass? Here's a hint: remember how the Scientologists got L Ron Hubbard 20 consecutive #1 Bestsellers?

As Jordan Pearson writes for Motherboard, Read Write Own earned its place on the Times list because of a series of massive bulk orders from firms linked to A16Z and Dixon, which ordered between dozens and thousands of copies and gave them away to employees or just randos on Twitter:

https://www.vice.com/en/article/n7emkx/chris-dixon-a16z-read-write-own-nyt-bestseller

The Times recognizes this in a backhanded way, by marking Read Write Own on the list with a "dagger" (†) that indicates the shenanigans (the same dagger appeared alongside the listing for Donald Trump Jr's Triggered after the RNC spent a metric scientologyload of money – $100k – buying up cases of it):

https://www.nytimes.com/2019/11/21/books/donald-trump-jr-triggered-sales.html

There's a case for the Times not automatically ignoring bulk orders. Since 2020, I've run Kickstarters where I've pre-sold my books on behalf of my publisher, working with bookstores like Book Soup and wholesalers like Porchlight Books to backers when they go on sale. I signed and personalized 500+ books at Vroman's yesterday for backers who pre-ordered my next novel, The Bezzle:

https://www.flickr.com/photos/doctorow/53531243480/

But there's a world of difference between pre-orders that hundreds or thousands of readers place that are aggregated into a single bulk order, and books that are bought by CEOs to give away to people who may not have any interest in them. For the book trade – librarians, reviewers, booksellers – the former indicates broad interest that justifies their attention. The latter just tells you that a handful of deep-pocketed manipulators want you to think there's broad interest.

I'm certain that Dixon – like me – feels a bit of pride at having "earned" a new first name. But Dixon – like me – gets something far more tangible than a bit of egoboo out of making the Times list. For me, a place on the Times list is a way to get booksellers and librarians excited about sharing my book with readers.

For Dixon, the stakes are much higher. Remember that cryptocurrency is a faith-based initiative whose mechanism is: "convince normies that shitcoins will be worth more tomorrow than they are today, and then trade them the shitcoins that cost you nothing to create for dollars that they worked hard to earn."

In other words, crypto is a bezzle, defined by John Kenneth Galbraith as "The magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it."

So long as shitcoins haven't fallen to zero, the bag-holders who've traded their "fiat" for funny money can live in the bezzle, convinced that their "investments" will recover and turn a profit. More importantly, keeping the bezzle alive preserves the possibility of luring in more normies who can infuse the system with fresh dollars to use as convincers that keep the bag-holders to keep holding that bag, rather than bailing and precipitating the zeroing out of the whole scam.

The relatively small sums that Dixon and his affiliated plutocrats spent to flood your podcasts with ads for this pointless 300-page Ponzi ad are a bargain, as are the sums they spent buying up cases of the book to give away or just stash in a storeroom. If only a few hundred retirees are convinced to convert their savings to crypto, the resulting flush of cash will make the line go up, allowing whales like Dixon and A16Z to cash out, or make more leveraged bets, or both. Crypto is a system with very few good trades, but spending chump change to earn a spot on the Times list (dagger or no) is a no-brainer.

After all, the kinds of people who buy crypto are, famously, the kinds of people who think books are stupid ("I would never read a book" -S Bankman-Fried):

https://www.washingtonpost.com/opinions/2022/11/29/sam-bankman-fried-reading-effective-altruism/

There's precious little likelihood that anyone will be convinced to go long on crypto thanks to the words in this book. But the Times list has enough prestige to lure more suckers into the casino: "I'm not going to read this thing, but if it's on the list, that means other people must have read it and think it's convincing."

We are living through a golden age of scams, and crypto, which has elevated caveat emptor to a moral virtue ("not your wallet, not your coins"), is a scammer's paradise. Stein's Law tells us that "anything that can't go on forever will eventually stop," but the purpose of a bezzle isn't to keep the scam going forever – just until the scammer can cash out and blow town. The longer the bezzle goes on for, the richer the scammer gets.

Not for nothing, my next novel – which comes out on Feb 20 – is called The Bezzle. It stars Marty Hench, my hard-driving, two-fisted, high-tech forensic accountant, who finds himself unwinding a whole menagerie of scams, from a hamburger-based Ponzi scheme to rampant music royalty theft to a vast prison-tech scam that uses prisoners as the ultimate captive audience:

https://us.macmillan.com/books/9781250865878/thebezzle

Patrick Nielsen Hayden – the same editor who gave me my new first name – once told me that "publishing is the act of connecting a text with an audience." Everything a publisher does – editing, printing, warehousing, distributing – can be separated from publishing. The thing a publisher does that makes them a publisher – not a printer or a warehouser or an editing shop – is connecting books and audiences.

Seen in this light, publishing is a subset of the hard problem of advertising, religion, politics and every other endeavor that consists in part of convincing people to try out a new idea:

https://pluralistic.net/2021/07/04/self-publishing/

This may be the golden age of scams, but it's the dark age of publishing. Consolidation in distribution has gutted the power of the sales force to convince booksellers to stock books that the publisher believes in. Consolidation in publishing – especially Amazon, which is both a publisher and the largest retailer in the country – has stacked the deck against books looking for readers and vice-versa (Goodreads, a service founded for that purpose, is now just another tentacle on the Amazon shoggoth). The rapid enshittification of social media has clobbered the one semi-reliable channel publicists and authors had to reach readers directly.

I wrote nine books during lockdown (I write as displacement activity for anxiety) which has given me a chance to see publishing in the way that few authors can: through a sequence of rapid engagements with the system as a whole, as I publish between one and three books per year for multiple, consecutive years. From that vantagepoint, I can tell you that it's grim and getting grimmer. The slots that books that connected with readers once occupied are now increasingly occupied by the equivalent of the botshit that fills the first eight screens of your Google search results: book-shaped objects that have gamed their way to the top of the list.

https://www.theguardian.com/commentisfree/2024/jan/03/botshit-generative-ai-imminent-threat-democracy

I don't know what to do about this, but I have one piece of advice: if you read a book you love, tell other people about it. Tell them face-to-face. In your groupchat. On social media. Even on Goodreads. Every book is a lottery ticket, but the bezzlers are buying their tickets by the case: every time you tell someone about a book you loved (and even better, why you loved it), you buy a writer another ticket.

Meanwhile, I've got to go get ready for my book tour. I'm coming to LA, San Francisco, Seattle, Vancouver, Calgary, Phoenix, Portland, Providence, Boston, New York City, Toronto, San Diego, Salt Lake City, Tucson, Chicago, Buffalo, as well as Torino and Tartu (details soon!).

If you want to get a taste of The Bezzle, here's an excerpt:

https://www.torforgeblog.com/2023/11/20/excerpt-reveal-the-bezzle-by-cory-doctorow/

And here's the audiobook, read by New York Times Bestselling Author Wil Wheaton:

https://archive.org/download/Cory_Doctorow_Podcast_459/Cory_Doctorow_Podcast_459_-_The_Bezzle_Read_By_Wil_Wheaton.mp3

#pluralistic#molly white#books#publishing#dunning kruggerands#crypto#cryptocurrency#a16z#venture capitalism#guillotine watch#this is why we can't have nice things#bookselling#the bezzle#bezzles#web3#blockchain

384 notes

·

View notes

Text

Managed Global Securities Trade Ltd. ha anunciado planes para una oferta pública inicial por 7 mil millones de dólares

Managed Global Securities Trade Ltd. ha anunciado planes para una oferta pública inicial por 7 mil millones de dólares Managed Global Securities Trade Ltd. ha anunciado planes para una OPI (oferta pública inicial), por 7 mil millones de dólares, y se espera que cotice en la Bolsa de Valores de Nueva York.

La plataforma líder mundial de comercio de activos digitales, Managed Global Securities Trade Ltd. (en adelante, MGST), anunció recientemente que la compañía ha estado planificando durante varios meses y ha presentado gradualmente su solicitud para una oferta pública inicial (OPI). Se espera que cotice en la Bolsa de Valores de Nueva York (NYSE) en las próximas semanas, con el símbolo bursátil…

#activos digitales#blockchain#Bolsa de Valores de Nueva York#Ciencia e Innovación Tecnológica#comercio de activos digitales#datos#DeFi#experiencia del usuario#finanzas descentralizadas#Innovación Tecnológica#Inteligencia artificial#Lightspeed Venture Partners#Managed Global Securities Trade Ltd.#mercados globales#MGST#NYSE#oferta pública inicial#OPI#Philip J. Hermann#Sequoia Capital#Tecnología Blockchain#Tiger Global Management

1 note

·

View note

Text

[11 March 2024]

The windfall could have been the boost the company needed to help it reset and get back on a path toward relevance. Instead, the blockchain pivot triggered a vitriolic response from the community of creators and fans on which the company relied, leading to the loss of major projects and a reputational hit from which Kickstarter has yet to recover. The turmoil shows how even the most promising startups can lose their way, but also underscores the challenge of pursuing a do-gooder mission atop a foundation of venture capital.

0 notes

Text

Shiba Inu auf dem Vormarsch: Neue Anwendungsmöglichkeiten durch CoinGate Integration

Die Krypto-Welt ist in ständiger Bewegung, und Shiba Inu (SHIB) ist keine Ausnahme. Dank einer bedeutenden Integration des litauischen Zahlungsanbieters CoinGate mit Polygon und Binance Smart Chain haben SHIB-Besitzer nun noch mehr Möglichkeiten, ihre Tokens im Alltag zu nutzen. Von großen Marken wie Nike bis hin zu Dienstleistungen wie Airbnb – die Anwendungsbereiche für Shiba Inu erweitern sich rasant.

Ein Meilenstein für SHIB-Besitzer

CoinGate, bekannt für seine Rolle als Brücke zwischen der Krypto- und der traditionellen Finanzwelt, hat Shiba Inu in sein Zahlungssystem integriert. Das bedeutet, dass SHIB-Besitzer ihre Kryptowährung jetzt in zahlreichen realen Transaktionen einsetzen können. CoinGate selbst äußerte sich dazu begeistert:

“Shibarmy, nutzt eure SHIB, um Airbnb zu buchen, die neuesten Spiele von Steam und PS5 zu kaufen, eure Garderobe mit Nike und Zalando aufzufrischen und mehr.”

Mehr als nur ein Memecoin

Shiba Inu arbeitet kontinuierlich daran, seinen Status als „Memecoin“ hinter sich zu lassen. Ein bedeutender Schritt in diese Richtung ist die Einführung von Shibarium, einer Ethereum Layer-2 Skalierungslösung. Dieses Upgrade, das kürzlich durch ein umfassendes Hard Fork abgeschlossen wurde, soll schnellere Transaktionen und stabilere Gasgebühren ermöglichen und damit das Nutzungserlebnis erheblich verbessern.

Vertrauen der Investoren wächst

Im April sorgte das Shiba Inu Team erneut für Schlagzeilen, als es in einer großen Finanzierungsrunde 12 Millionen USD sammelte. Diese Mittel sollen in die Entwicklung einer neuen Layer-3 Blockchain fließen. Bemerkenswert ist, dass namhafte Investoren wie Polygon Ventures, Mechanism Capital und Animoca Brands zu den Unterstützern gehören, was das wachsende Vertrauen in das Potenzial von SHIB verdeutlicht.

SHIB-Kurs stabil, aber mit Potenzial

Trotz der wachsenden Akzeptanz und den technologischen Fortschritten blieb der Kurs von Shiba Inu in letzter Zeit relativ stabil. Seit dem 7. Mai schwankte er zwischen 0,00002379 USD und 0,00002227 USD. Doch Analysten sehen Potenzial für signifikante Kursbewegungen in naher Zukunft. Ein Durchbruch könnte den Kurs auf 0,00002558 USD treiben, was eine Steigerung von über 13 Prozent bedeuten würde. Auf der anderen Seite könnte ein Rückgang den Kurs auf etwa 0,00002080 USD fallen lassen, was fast acht Prozent unter dem aktuellen Niveau liegt.

Fazit

Die Integration von Shiba Inu durch CoinGate und die kontinuierlichen Bemühungen, die Funktionalitäten und die Akzeptanz der Kryptowährung zu erweitern, markieren einen spannenden Moment für die SHIB-Community. Mit der Aussicht auf schneller und stabiler werdende Transaktionen und der Unterstützung durch bedeutende Investoren steht Shiba Inu vor einer vielversprechenden Zukunft. Bleibt abzuwarten, wie sich diese Entwicklungen auf den Kurs auswirken werden, aber eines ist sicher: Shiba Inu ist auf dem besten Weg, weit mehr als nur ein Memecoin zu sein.

#Shiba Inu#Kryptowährung#CoinGate#Integration#Polygon#Binance Smart Chain#Nike#Airbnb#SHIB#Shibarium#Ethereum Layer 2#Blockchain#Investitionen#Finanzierungsrunde#Kryptowährungszahlungen#Memecoin#Kryptowährungsakzeptanz#Shiba Inu Kurs#Kryptowährungsmarkt#Technologie#Investoren#Marktanalyse#Transaktionen#digitale Vermögenswerte#Gasgebühren#Hard Fork#Layer 3 Blockchain#Polygon Ventures#Mechanism Capital#Animoca Brands

0 notes

Note

hey jonny, i just thought you'd want to know that character.ai has an ai-generated imitation of your voice and i'm not sure what other websites might have it or where it originated :(

Yeah, it's a fucking garbage state of affairs but, as a somewhat well-known performer with a pretty distinctive voice it doesn't exactly shock me. Needless to say I think anyone who used this is a mediocre waste of skin and if they ever tell me in person they've used it then 50/50 I punch them in the teeth.

I can't wait for a couple of years when it all collapses just like every other niche-but-interesting-technology-with-limited-use-cases-sold-as-a-universal-panacea-to-gormless-CEOs grift (blockchain being the best example). Because the thing is, none of these things actually make any money and cost a vast amount, so as soon as all the dumb venture capital funding dries up and AI is required to actually start paying for itself, the bubble bursts and the whole industry is fucked.

That said, it's gonna be rough when it happens - a lot of companies have invested very heavily in AI and they're going to be hurting badly. I know of more than one media company whose idiot executives invested ridiculous amounts into NFTs and ended up laying off massive swathes of workers when that obvious fucking scam collapsed. I suspect the AI crash is gonna be even worse than that. And by then it will have drowned the Internet in slop. We'll see, I guess.

Anyway, anyone who uses AI is a soulless fucking husk of a person who cannot tell half-digested vomit from culture, and I would pity them if they weren't making the world such a measurably worse place to exist.

#Ghouls and idiots the lot of them#That have killed off their sense of wonder and murdered their own spirit#So that they now look at the staggering beauty and scope of human creativity and culture#And call it all “content”

5K notes

·

View notes

Text

Inquisitive questions about our groundbreaking business model and their responses.

For more details, read our FAQs here https://smartpreordering.blogspot.com/2023/11/faqs.html

#Digital Shopping Mall#Digital Shopping Points#Digital Shopping Coin#Early investors#Venture capital#crypto investment#crypto revolution#Digital revolution#Blockchain revolution#crypto enthusiasts#Crypto investors#Blockchain investors

0 notes

Text

Accélération de la stratégie Web 3.0 du groupe OLKY et recrutement de Karima Lachgar 👇

0 notes

Text

Blockchain Investment And Web3 Crypto Projects Get A Boost With Venom Foundation's $1B Fund

The global blockchain market is predicted to witness unprecedented growth in the coming years, with estimates suggesting it will reach $94.0 billion by 2027. In light of this, the Abu Dhabi-based Venom Foundation has launched a $1 billion venture capital fund poised to boost blockchain investment and accelerate the growth of web3 crypto projects. The Fund will provide crucial startup funding to…

View On WordPress

#Blockchain#blockchain investment#blockchain technology#Latest blockchain news#Middle East#startup funding#venture capital fund#web3 and blockchain#web3 crypto projects

0 notes

Note

Forgive me if I'm mistaking you for another person, but I remember you speaking at multiple points on the unsustainability of free social media services (I think especially in response to the cohost collapse?), and I'm curious on what your thoughts on bluesky are so far. I'm not an expert on the subject, but from what I've read previously it seemed like they were on track to be financially sustainable, but I don't know if the recent floods of users has thrown those projections off. Sorry if I'm mixing you up with someone else on my timeline, in that case just ignore me.

bluesky will almost certainly follow the same trajectory of monetisation => bloat => enshittification => decline as every other major platform built on venture capital and user hoarding. it's a terrible model that only works in the short term as a mirage for attracting funding and making founders look good for a year or two before they sell.

you can see the same effect in the decline of all the subscription box services that came into vogue just before covid: they feel great to use for as long as the initial injection of venture funding lasts, because the purpose of that funding at that stage is to attract users and impress the next round of funders with how pleasant/intuitive/efficient/ethical/good value the service is. that's the stage where they're handing out freebies and bowling over influencers, and every ingredient in the box is fresh and high quality and locally sourced. wow what a good deal, what a great system!!! why hasn't anyone done this before? the answer is because it's unsustainable by design. they rack up good reviews, sign on a billion new users, attract new funding from a bunch of much more credulous investors, and then gut all of the expensive parts. portions get smaller, ingredients get worse, packaging gets flimsier, prices go up, freebies turn into "5% off your first 9 boxes when you invite 3 friends", and customer service vanishes.

with social media (and platforms like discord) the logic is the same, it's just a little less glaringly obvious to the end user because they're not coming home to leaking packages of rancid chicken on the doorstep. bluesky has an advantage over tiny operations like cohost because it was founded by a billionaire making a point for the sake of his own image. it got a really significant chunk of startup funding, and the owner had existing connections and rep in the space to attract more. That's why it has survived the goldrush period, why it still feels good to use, and why users who have been burned so many times before are finally accepting it as a stable, reliable option. It's still in its venture capital honeymoon phase where the only thing worth spending money on is making the service attractive to users.

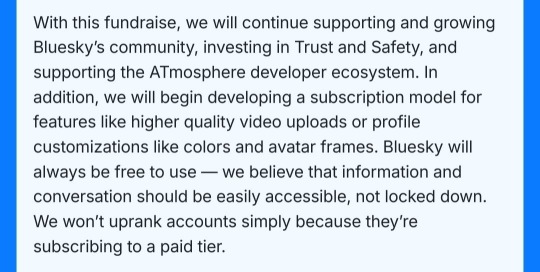

What I expect we will see next, with another mass influx of users from twitter and new funding from a rogue's gallery of tech venture sickos led by Blockchain Capital is a strong ramp up into monetising that userbase. They've already been pretty forthright about how they plan to do this, and I think it's a solid roadmap of how Bluesky will bloat and decay over the next few years:

this is a huge lol. don't worry, we're not going to hyperfinancialize the social experience through NFTs. the thing even crypto freaks started feigning amnesia about a year ago. real "our health conscious sodas are 100% arsenic free" messaging here. They know perfectly well that rubes users are suspicious of their typical 5 dimensional tech finance chess games and are patting our hands about last week's bogeymen so nobody worries too hard about whatever 'decentralised developer ecosystem' just happens to be helmed by a bunch of crypto guys. this definitely means something good and based and not a google-like single sign on user data harvesting operation.

This is the same shit that's currently rotting the floorboards of discord. Bluntly, there is no way to run a platform on this scale without gating functionality behind paid services. Discord has been squeezing free-tier file uploads and call quality etc. down steadily and cranking up subscription costs over the last year or two, throwing in chaff like animated avatar frames to try and justify the user cost. They're also doing the same misdirection thing again here, pointing to Thing We All Hate to deflect from thing we might not like very much when they do it. Booo elon booo we all hate elon!!! wait how do we feel about subscription models again,

watch out for this to kill porn on bsky like it has killed porn on every other social platform 👍 boooo we hate elon boooo stupid idiot and his 'everything app' booooo wait why do you need my tax information, what's that about mastercard,

Look, we are all aware social media is a money pit. Let's not forget dorsey was looking to sell twitter in the first place, long before elon's very public plunge into total online derangement. Subscription services are not going to plug the hole, so we are gradually going to see more and more spaghetti thrown at the wall while early funders shuffle cards and do their pyramid scheme bit bringing in stupider and stupider investments. this is the window in which bluesky will be temporarily worth using for us, for the idiot public, the poorly rendered crowd jpegs in the background of their venture capital MOBA. it's in their interests to slow and pad the decline as much as possible, because that is how they get maximally paid.

Given the scale of the money involved, and dorsey's weird ego investment, I think bluesky will probably manage a controlled drift for a good few years before it gets really bloated and painful. and by then we will all be so used to the *checks notes* decentralised developer ecosystem that we'll just be posting through it, watching another generation of columnists call another collapsing platform 'their beloved hellsite' and passing around that meme about not getting out of our chairs no sir until idk we all get on a fediverse neurolink alternative to stick it to the elongated muskrat and our brains pop peacefully in our sleep. which I guess is the closest thing to viability any social media platform can achieve.

anyway diogenes the cynic is also on bluesky

483 notes

·

View notes

Note

what kind of lawyers are the grid

my opinion on most of the grid is “his ass would NOT be a lawyer.” however.

Fernando: criminal defense

Esteban: civil defense

Lewis: big law darling (youngest partner in history)

Checo: big law (killing himself)

Lando: personal injury with billboards on every road

Alex: traffic court

George: appellate

Valtteri: weed law

Zhou: 14th amendment

Max: 1st amendment

Oscar: mold litigation

Charles: divorce (only does jury trials)

Carlos: plaintiff’s housing

Hulk: blockchain litigation

Franco: m&a

Yuki: employment discrimination

Liam: consumer class actions

Kmag: legal malpractice

Lance: dropped out of law school to do commercial real estate

Pierre: dropped out of law school to do venture capital

212 notes

·

View notes

Text

US president-elect Donald Trump has appointed venture capitalist and former PayPal executive David Sacks as White House AI & Crypto Czar, a newly created role meant to establish the country as the global leader in both fields.

Members of the cryptosphere have gathered to congratulate their new czar, a Trump loyalist from Silicon Valley who has previously expressed enthusiasm for crypto technologies and invested in crypto startups. The appointment is being celebrated by crypto executives and policy wonks as “bullish” for the industry, which under the previous administration was bombarded with lawsuits by US regulators. On X, Gemini chief legal officer Tyler Meader wrote, “At long last, a rational conversation about crypto can be had.”

Others have speculated that the dual-faceted nature of the role, covering both AI and crypto, could set the tone for experimentation around potential synergies between the two disciplines. Among VCs, Sacks “was very early in noting the importance of crypto to AI,” says Caitlin Long, CEO at crypto-focused bank Custodia. In his announcement, Trump wrote that the two areas were “critical to the future of American competitiveness.”

“There is no better person than David Sacks to help steer the future of crypto and AI innovation in America,” says John Robert Reed, partner at crypto-focused VC firm Multicoin Capital. “He's a principled entrepreneur and brilliant technologist that deeply understands each of these industries and where they intersect.”

“Initial reactions from the crypto industry on the Sacks appointment has been positive. Given his purview as a venture capitalist, he’s seen a lot of the innovation in crypto and AI that has been stunted in growth due to various political or regulatory issues the past few years,” says Ron Hammond, director of government relations at the Blockchain Association. “What remains to be seen is how much power the czar role will even have and if it will be more a policy driver position versus a policy coordinator role.”

In an X post, Sacks expressed his gratitude to Trump. “I am honored and grateful for the trust you have placed in me. I look forward to advancing American competitiveness in these critical technologies,” he wrote. “Under your leadership, the future is bright.”

In his role as czar, Sacks will lead a council of science and technology advisers responsible for making policy recommendations, Trump says. He will also develop a legal framework that sets out clear rules for crypto businesses to follow—something the industry has long demanded. That will reportedly involve working closely with the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), two regulatory agencies that vied for jurisdiction over the crypto industry under the Biden administration. Earlier this week, Trump appointed crypto advocate Paul Atkins as SEC chair; members of the crypto industry contributed to the selection process, sources told WIRED in November.

Trump officials did not respond when asked to clarify whether the new position would be internal to the government, or whether Sacks would act as a “special government employee,” allowing him to continue in other private-sector roles. Sacks did not respond to a request for comment.

Sacks first made his name as one of the earliest employees at payments technology firm PayPal, which he built alongside Elon Musk, Peter Thiel, Reid Hoffman, and others. Like other members of the so-called “PayPal Mafia,” Sacks went on to set up multiple other business ventures. In 2012, he sold workplace software company Yammer to Microsoft in a deal worth $1.2 billion. Now he runs his own venture capital firm, Craft Ventures, which has previously invested in companies including AirBnb, Palantir, and Slack—as well as crypto firms BitGo and Bitwise.

Sacks also cohosts the popular All In podcast where he’s used the platform to boost Trump. He’s also shared a host of right-wing takes: At the podcast’s summit this September, Sacks questioned the effectiveness of the Covid vaccine.

Like Musk, Sacks was a vocal proponent of Trump during the presidential race. In an X post in June, he laid out his very Silicon Valley rationale: “The voters have experienced four years of President Trump and four years of President Biden. In tech, we call this an A/B test,” he wrote. “With respect to economic policy, foreign policy, border policy, and legal fairness, Trump performed better. He is the President who deserves a second term.”

That same month, Sacks hosted an exclusive fundraiser for the Trump campaign, reportedly generating as much as $12 million. Attendees reportedly included vice-president-elect JD Vance—who has previously described Sacks as “one of my closest friends in the tech world”—and Cameron and Tyler Winklevoss, cofounders of crypto exchange Gemini.

In the weeks since Trump won back the Oval Office, crypto markets have been on a tear. During the race, the president-elect made a host of crypto-friendly pledges, including a promise to set up a national “bitcoin stockpile.” In Sacks, Trump has picked a czar that the crypto industry believes will deliver on his campaign pledges.

On December 6, the price of bitcoin vaulted beyond $100,000 for the first time. “YOU”RE WELCOME!!! [sic]” Trump posted on Truth Social.

7 notes

·

View notes

Note

Seeing the Blockchain Capital post, I was wondering where the BSky funding would come from. It's still better than twitter but I've been around long enough to know that the enshittfication has begun. It's a venture capital company. Like any other vc, it's rotten to the core. I wouldn't say jump ship, but don't be surprised when we have to.

Always gotta be looking down the internet road, ready to move on.

11 notes

·

View notes

Text

Orion Depp Traveling to Dubai for the MVIM Institutional Crypto Fund Pitch at Gitex, Orion Depp

(c) Orion Michael Depp – Co-Founder, Master Ventures Institutional Investment Management, SOLANA, SUI Ecosystem & Crypto Capital Markets Advisor, Wharton, USC MBA, Former Bain & Co IPO Management Consultant, First BNB Binance Analyst 2017, 30 Under 30 Entrepreneur CNBC.

Orion Depp, Orion Michael Depp, Orion Depp Crypto Advisor, Orion Depp Institutional Crypto Fund Manager, Orion Depp Crypto VC Venture Capital Fund Manager, Orion Depp Crypto Capital Markets Advisor, Orion Depp Crypto Community Growth Strategist, Orion Depp Bain Management Consultant, Orion Depp SOLANA Advisor, Orion Depp SUI Blockchain Specialist, Orion Depp Aptos Advisor, Orion Depp Binance BNB Analyst, Orion Depp Coin Listing Specialist, Orion Depp Coinbase Listing Advisor, Orion Depp Binance Listings, Orion Depp CoinList, Orion Depp Bybit Listing Consultant, Orion Depp OKX Listing Expert, Orion Depp IEO IDO Advisor, Orion Depp Tokenomics Expert, Orion Depp Blockchain Business Advisor, Orion Depp Crypto Influencer.

Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Binance Coin (BNB), Ripple (XRP), Cardano (ADA), Polkadot (DOT), Avalanche (AVAX), DeFi, NFTs, Crypto Trading, Tokenomics, Crypto Insights, Metaverse, Digital Assets, Blockchain Development, Web3 Technology, ICO, IDO, Crypto Events, Crypto Exchange Listings, Crypto Community Building, Airdrops, Staking, Decentralized Finance Projects, Crypto Fund Management, Crypto Trading Signals.

#OrionDepp#OrionMichaelDepp#orion-depp#orion depp#CryptoAdvisor#Solana#BTC#SOL#ETH#Bitcoin#Binance#BinanceCoin#Bybit#OKX#Coinbase#Ethereum#Altcoins#Blockchain#Crypto#Cryptocurrency#DeFi#NFTs#Web3#CryptoMarket#CryptoTrading#CryptoCommunity#CryptoInvesting#Tokenomics#CryptoInsights#Metaverse

2 notes

·

View notes

Text

Blockchain Investment: A New Frontier for Investors

The rise of blockchain technology over the last decade has sparked interest across various industries, from finance and supply chain management to healthcare and entertainment. As blockchain matures, investors are starting to recognize its potential not only for transforming traditional sectors but also for offering new investment opportunities. In this article, we explore the significance of blockchain investment, the types of investments available, the associated risks, and the future outlook for this promising technology.

What is Blockchain?

Blockchain is a decentralized digital ledger technology that securely records transactions across multiple computers. It allows information to be stored transparently, immutably, and without the need for intermediaries such as banks or government bodies. The most famous application of blockchain technology is Bitcoin, the first cryptocurrency, but its potential extends far beyond digital currencies.

Blockchain’s unique features—decentralization, transparency, and security—make it an appealing foundation for various applications, ranging from finance to supply chain management to voting systems. With an increasing number of industries exploring blockchain’s use cases, it has garnered significant attention from investors.

youtube

Why Invest in Blockchain?

Disruption of Traditional Systems: Blockchain has the potential to disrupt a wide range of industries by providing more efficient, transparent, and secure alternatives to legacy systems. For example, blockchain-based financial services can lower transaction costs, reduce fraud, and offer access to previously unbanked populations. The transformation of industries such as healthcare, logistics, and government services is just beginning.

The Growth of Cryptocurrencies: Blockchain is the backbone of cryptocurrencies, which have seen exponential growth in recent years. Bitcoin, Ethereum, and other altcoins have become established assets, and decentralized finance (DeFi) platforms built on blockchain promise further innovation in financial markets. Investors can benefit from both the appreciation of these digital assets and the broader adoption of cryptocurrency ecosystems.

Tokenization of Assets: Blockchain enables the tokenization of real-world assets, including real estate, art, and commodities. This allows investors to gain fractional ownership in previously illiquid assets, opening up new avenues for diversification and investment. Tokenization can also improve liquidity and streamline processes such as cross-border payments and property transfers.

Venture Capital and Startups: Many blockchain-based startups are developing innovative applications, from decentralized applications (dApps) to non-fungible tokens (NFTs) to blockchain-based identity verification systems. Venture capitalists and angel investors can tap into the high growth potential of these companies, as blockchain adoption continues to rise globally.

Types of Blockchain Investments

Blockchain investments can be approached in several ways. Some of the most common types include:

Cryptocurrencies: Direct investment in digital currencies like Bitcoin, Ethereum, and other altcoins is the most straightforward form of blockchain investment. These cryptocurrencies can be purchased through exchanges and stored in digital wallets. While Bitcoin and Ethereum are the most well-known, there are thousands of altcoins that investors can explore.

Blockchain-related Stocks and ETFs: Rather than investing directly in cryptocurrencies, investors can gain exposure to blockchain technology by purchasing stocks in companies that are integrating blockchain into their operations. Public companies such as Nvidia (which provides hardware for mining), Coinbase (a cryptocurrency exchange), and Block (formerly Square) are examples of firms investing heavily in blockchain. Additionally, blockchain-focused exchange-traded funds (ETFs) allow investors to diversify their exposure to the sector.

Initial Coin Offerings (ICOs) and Token Sales: ICOs and token sales are fundraising mechanisms where startups issue their own cryptocurrency tokens in exchange for investments. While ICOs were initially seen as high-risk, high-reward ventures, they have become more regulated over time. This form of investment allows early-stage investors to gain a stake in blockchain projects before they are widely adopted.

Blockchain Real Estate: The tokenization of real estate allows fractional ownership of property via blockchain-based tokens. Platforms like RealT and Propy have been pioneers in this space, enabling investors to buy shares in real estate and receive dividends from rental income. Blockchain’s transparency and immutability make it ideal for managing property transactions.

Decentralized Finance (DeFi): DeFi is a rapidly growing sector that leverages blockchain to provide financial services such as lending, borrowing, and trading without intermediaries. By investing in DeFi projects or liquidity pools, investors can earn returns in the form of interest or tokens.

Risks of Blockchain Investment

While blockchain presents exciting investment opportunities, there are several risks to consider:

Volatility: Cryptocurrencies, in particular, are known for their extreme price volatility. Dramatic price swings can occur in a short time, making blockchain investments high-risk, especially for short-term traders. Long-term investors should be prepared for fluctuations in value.

Regulatory Uncertainty: Blockchain and cryptocurrencies are still in the early stages of regulatory development. Governments around the world are working on creating frameworks to govern blockchain and digital currencies, but until clear regulations are established, there could be sudden changes in legal and tax requirements that impact investment returns.

Security and Fraud Risks: While blockchain technology itself is secure, the platforms and exchanges built on top of it may not always be. Hacks, scams, and fraud have occurred in the blockchain space, with investors losing substantial amounts of money. Conducting thorough research and choosing reputable platforms is crucial.

Technological Risks: Blockchain is still an emerging technology, and its long-term scalability, interoperability, and environmental impact remain open questions. For instance, Ethereum, one of the leading blockchains, is transitioning from a proof-of-work to a more energy-efficient proof-of-stake consensus mechanism, highlighting the potential for technical challenges.

The Future of Blockchain Investment

As blockchain technology evolves, it’s expected that adoption across industries will only increase. Many experts believe that blockchain will play a central role in reshaping the global economy, particularly in areas like supply chain transparency, decentralized finance, and digital identity verification.

The rise of central bank digital currencies (CBDCs), which are government-backed digital currencies that leverage blockchain technology, will likely spur further mainstream adoption. Additionally, innovations in smart contracts, which automate transactions based on predefined conditions, will expand the use of blockchain beyond simple transactions into complex business processes.

For investors, this presents an exciting opportunity to position themselves at the forefront of a technological revolution. However, as with any emerging technology, it is important to approach blockchain investment with caution, conducting thorough due diligence and maintaining a diversified portfolio to manage risk effectively.

Conclusion

Blockchain investment offers promising opportunities for those willing to navigate its complexities. From cryptocurrencies to tokenized assets to decentralized finance, the potential for growth in this sector is vast. However, investors should carefully consider the risks associated with volatility, regulation, and security before diving in. As blockchain technology matures and becomes more widely adopted, it will likely be a key driver of innovation, providing unique opportunities for savvy investors to capitalize on the next generation of digital transformation.

2 notes

·

View notes

Text

One of the things that really get me with this huge "AI" fad is how for all their talk of Artificial General Intelligence and whatnot, they've really only recreated the Chinese Room thought experiment and declared it the solution to all of the world's problems.

The Chinese Room, if you're unfamiliar, is this hypothetical about the difference between understanding and the mere appearance of it, and basically goes like this: imagine a room with a man and a book. The room has a tiny slot on one end where one can communicate with the man via written letters in traditional Chinese*. The man himself does not actually know a single character of any of these languages, but the book contains an exhaustive list of possible messages he can recieve along with appropriate responses and instructions on how to write them. Now imagine that this book is so well constructed that in spite of not understanding any of the communication he is receiving, nor any of the replies he is giving, the man and his book are still able to effectively pass the Turing test and convincingly appear a fluent speaker to anyone knowing a traditional Chinese language: can we realistically say anything within that room has any actual understanding of either Chinese or any of the communication it has participated in? The man clearly has none - does the book? Does the room as a whole system?

While I personally tend to think the thought experiment isn't necessarily all that useful due to underestimating the necessary complexity of the book and also the sheer extents to which humans showcase Competence Without Comprehension, it's not lost on me how the recent proliferation of Large Language Model systems and the forced attempts to insert it into just about anything and everything no matter whether it makes any sense or not is basically a straight up example of the Chinese Room on an industry-wide scale.

We have entire throngs of techbros falling over themselves in praise and wonder of these fancy little rooms they've constructed and the free market capitalism that purportedly has created it - even though OpenAI, the organisation that kicked off the AI gold rush with ChatGPT, is technically a non-profit organization, supposedly with the explicit goal to keep AI research available to the public and not left purely in the hands of grubby venture capitalists and profiteering CEOs.

Honestly it's kind of hard to shake the feeling that the whole AI rush is basically the same hypercapitalist tech cult that previously worshipped the blockchain turned to a new golden cow so they don't have to think about their own culpability in the current late stage capitalism hellhole we find ourselves in, even as their latest toy tech god already indulges freely in misinformation, rampant fraud, and good old racial profiling - just to name a few.

And honestly don't get me wrong - I think LLMs as a technology likely have far more actual practical applications than the blockchain ever did, but it's pretty inescapable that most examples we're being shown aren't particularly practical - if anything, I'd argue most of what I see is just spam, spam, spam.

(* the hypothetical scenario of the Chinese Room was proposed by an English-speaking American, and the choice of traditional Chinese as the example is one made purely on the basis of its perceived illegibility to many westerners. The thought experiment does not depend on any particular characteristics of traditional Chinese languages beyond their distance to English, and can easily be exchanged for any written language you personally find utterly incomprehensible - or even some generic form of encryption if you prefer, so long as the information in the notes exchanged is never presented to the person inside the room in a form that they could possibly understand)

14 notes

·

View notes

Text

We Are All Committed to Make Rajasthan the Capital of Skill Development: Col Rajyavardhan Rathore

Colonel Rajyavardhan Rathore, a visionary leader and advocate for youth empowerment, has set forth an ambitious goal: transforming Rajasthan into the capital of skill development in India. With a strong belief in the potential of the state’s youth, he emphasizes the importance of skilling, upskilling, and reskilling to prepare for a future driven by innovation and technology.

Through comprehensive policies and initiatives, Colonel Rathore and the double-engine BJP government are laying the groundwork for a skilled Rajasthan, making it a beacon of progress for the nation.

Why Skill Development is Key to Rajasthan’s Progress

1. Preparing for the Future Workforce

In today’s rapidly evolving job market, skill development is crucial to:

Equip youth with industry-relevant skills.

Bridge the gap between education and employment.

Enhance productivity and innovation in the workforce.

2. Boosting Employment Opportunities

Skill development creates a robust ecosystem by:

Increasing employability in high-demand sectors like IT, healthcare, and manufacturing.

Promoting entrepreneurship by fostering a culture of self-reliance.

Supporting rural and urban communities with localized training programs.

3. Enhancing Rajasthan’s Competitiveness

Rajasthan’s focus on skill development strengthens its position as:

A preferred destination for investments in industries and technology.

A hub for talent that meets global standards.

A state that aligns its workforce with national and international opportunities.

Key Initiatives to Make Rajasthan the Skill Capital

1. Establishing Skill Universities and Training Centers

The government has initiated the creation of:

World-class skill development universities.

Training centers in collaboration with global leaders in education and technology.

2. Focus on Sector-Specific Training

To address industry-specific needs, programs are being tailored for sectors like:

Agriculture: Modern techniques and sustainable practices.

Information Technology: AI, blockchain, and cybersecurity.

Tourism and Hospitality: Global service standards.

3. Public-Private Partnerships (PPPs)

The government actively collaborates with private entities to:

Leverage expertise in cutting-edge technologies.

Ensure training is aligned with industry demands.

Expand reach through digital learning platforms.

4. Empowering Women and Marginalized Communities

Special focus is placed on inclusive development by:

Offering skill training programs for women in rural areas.

Providing resources and mentorship to marginalized communities.

Encouraging participation in leadership roles and entrepreneurial ventures.

5. Digital Platforms and E-Learning

Harnessing the power of technology, the government is:

Launching e-learning platforms for remote training.

Promoting digital literacy among youth in rural and semi-urban regions.

Collaborating with ed-tech companies to deliver interactive, high-quality content.

Colonel Rajyavardhan Rathore’s Commitment

Colonel Rathore, known for his hands-on approach, has been instrumental in:

Advocating policies that prioritize skill development.

Engaging with youth to understand their aspirations and challenges.

Ensuring the implementation of programs that have a tangible impact on lives.

His commitment reflects a broader vision of transforming Rajasthan into a state where every individual has the tools to succeed in a competitive world.

Conclusion

The journey to making Rajasthan the capital of skill development is a collective mission that requires the combined efforts of the government, private sector, and citizens. Under the leadership of Colonel Rajyavardhan Rathore, this vision is steadily becoming a reality, empowering the youth and positioning Rajasthan as a frontrunner in India’s growth story.

Together, with determination and innovation, the state is set to redefine the benchmarks of skill development and create prosperity for generations to come.

4 notes

·

View notes