#blockchain race

Explore tagged Tumblr posts

Text

Project Dragon was a game that was in development for 3 years only to be canceled weeks from its announcement and its entire art and development team laid off. The game (which would have been called 'Everhaven' upon release) was intended to be a multiplayer sandbox rpg taking inspiration from both Minecraft and The Legend of Zelda, with an art style similar to that of the Spyro Reignited Trilogy, which some of the team members also worked on along with Crash Bandicoot 4.

According to character design/illustrator Nicholas Kole "Our cancelled project of the last 3 years is officially, truly dead as of today (internal attempts to save it failed), and the embargo on the whole body of portfolio work has been lifted". This means that the only way the game has a chance of resuming development is by raising awareness and spreading the word of it's development. More info from Nicholas Kole and #BringBackProjectDragon Even if you're not interested in the game itself, you can find the concept art, animations, 3D models, music and all other completed pieces of work for the game being shared by the team at either of these links, and I think are worth checking out. Some mounts and NPCs

4 of the 5 playable starter races (5th being human of course)

Edit: the decision to cancel the game was made by Forte, a blockchain company that acquired Phoenix Labs last year, who later decided to cancel all other projects so that the studio could focus on Dauntless and Fae Farm, Phoenix Labs' other already established games, rather than take the risk with this new IP.

I advise against sending any sort of hate towards Forte or Phoenix Labs and instead recommend continuing to share love for Everhaven and what it could have been until they realize their mistake.

Also thanks for 10k notes.

#BringBackProjectDragon#Project Dragon#spyro#crash bandicoot#minecraft#furry#concept art#art#not my art#dragons#rpg#phoenix labs#dauntless#fae farm#forte#blockchain#nft#10k

14K notes

·

View notes

Text

Take away every consequential activity through which AI harms people, and all you’ve got left is low-margin activities like writing SEO garbage, lengthy reminisces about “the first time I ate an egg” that help an omelette recipe float to the top of a search result. Sure, you can put 95 percent of the commercial illustrators on the breadline, but their total wages don’t rise to one percent of the valuation of the big AI companies.

For those sky-high valuations to remain intact until the investors can cash out, we need to think about AI as a powerful, transformative technology, not as a better autocomplete.

We literally just sat through this movie, and it sucked. Remember when blockchain was going to be worth trillions, and anyone who didn’t get in on the ground floor could “have fun being poor?”

At the time, we were told that the answer to the problems of blockchain were exotic, new forms of regulation that accommodated the “innovation” of crypto. Under no circumstances should we attempt to staunch the rampant fraud and theft by applying boring old securities and commodities and money-laundering regulations. To do that would be to recognize that “fin-tech” is just a synonym for “unlicensed bank.”

The pitchmen who made out like bandits on crypto — leaving mom-and-pop investors holding the bag — are precisely the same people who are beating the drum for AI today.

-Ayyyyyy Eyeeeee: The lie that raced around the world before the truth got its boots on

2K notes

·

View notes

Text

What is Everhaven (codenamed Project Dragon)?

Everhaven was a sandbox survival crafting multiplayer RPG game that was being developed by Phoenix Labs. It had fantasy characters and quests inspired by Minecraft and The Legend of Zelda: Breath of the Wild. We first hear about Everhaven through the former development team of the game, including the character artist @nicholaskole on his Twitter/X where he explains what the game was about and how far along it was in development.

The game had been in development since 2021, 3 years. It was to be announced in June 2024 and released later in Early Access in September. The player would've started with 5 playable races: Humans, mountain-dwelling Fauns, plantlike Valekins, draconic Wyvarrs, and the feline Purrans.

Players would also collect creatures and have them as pets or ride them as mounts. Many regions were planned, and a starter region was to be used for launch, the Inner Lands - "a cosy pastoral paradise of rolling fields, lush forests, and alpine slopes". Like Minecraft, players would be able to build houses and customize their land, and grow crops and gardens.

Fully voiced NPCs would've given the world of Everhaven life, expanding the lore surrounding the 5 playable species and a story for players to follow. Enemies would also fill the regions of Everhaven as you explore the land, embark on quests and gather materials.

Each NPC was designed with unique art, gameplay traits, quests, and quirks. They each had a profession, a culture, a backstory. Some had friends and rivals and possible love interests. Aside from their personal quests, they had no linear story. Instead, by playing the game, players would discover their own developing narratives. Narrative designer Bethany Higa stated that the world of Everhaven would be procedurally generated each time, and everyone's experience with the characters would be different. When you met them, and how, and where in your journey, would all be unique. Phoenix Labs wanted to give players the freedom to choose how to build their own story using the NPCs.

The story of the characters would've been told through cinematics driven by the aesthetics and motifs of their cultures.

youtube

youtube

According to Nicholas Kole, Phoenix Labs was entering the final 3 months stretch with Everhaven: the character customization was working, music soundtrack and character voiceover was mostly done and still being recorded, cinematics were close to completion. After the Early Access period, Phoenix Labs would've went on with a full plan from there.

The game received excellent feedback and mock reviews, as it was preparing for its upcoming release.

Unfortunately...

A blockchain company named Forte quietly bought Phoenix Labs in 2023 and later decided to cancel all projects that were in development, including Project Unicorn and Everhaven. The team members assigned to the projects were also laid off. This decision was done to focus fully on the other existing games at Phoenix Labs, Dauntless and Fae Farm. There were internal attempts made to save Everhaven but they were unsuccessful.

Phoenix Labs wasn't the first company Forte had purchased. They had also bought Rumble Entertainment, the developer of the mobile game Towers and Titans, and decided to shut down the studio this year in July 2024 in, what a former Rumble dev member calls it, "a ruthless pursuit of profit". This reveals that Forte buys game studios and would casually shut them down if they choose. A gaming news article with anonymous former employees later revealed that Forte would close down studios they acquired and cancel their game projects if they can’t find ways to implement their blockchain tech into the games.

On July 12, 2024, the embargo for Everhaven was lifted, allowing the former team members to post their contributions of the project on social media and on their personal portfolios.

After seeing the content made for Everhaven, a movement was formed by fans; this campaign was called #BringBackProjectDragon, at the hopes of getting Forte's attention and convince them to revive Everhaven and at least sell the game to another publisher. Word spread, and a few cozy game influencers covered Everhaven and its cancellation.

A petition was even created that has reached over 9,000 signatures as a way to show Forte that there is a fanbase that cares for Everhaven.

youtube

To try and get Forte's attention, please spread the word about Everhaven to your friends and on social media (Twitter/X, Facebook, here on Tumblr, Bluesky, etc.), sign the petition, send Forte passive messages about wanting Everhaven back!

For Everhaven fans, there is a Facebook Fan Group, a Bluesky fan account, one for Twitter/X, a subreddit, and a discord server.

#BringBackProjectDragon!

36 notes

·

View notes

Text

Tires cost a fortune. You can buy a car for $200, or at least you used to be able to, and easily spend double that on a set of rock-hard ditch-finders from the local tire shop. When I asked a tire company executive about it, they weasel-worded some mouth grease about tires being “expensive to ship.” Obviously, the only way I was going to get through this was to open a tire factory of my own.

This isn’t unusual. Tire factories used to dot this proud nation in a time before AliExpress and Amazon Secondus. Folks just like you and I would go to work and eke out a reasonable, middle-class existence – with a pension – putting high-quality tires under our neighbours’ cars, for cheap. Eventually, some spreadsheet said this was no longer cost-effective, and now we have to order our tires from another country.

I’m sure they have lots of good reasons for this. Tires are a lot better since the sixties and seventies: for instance, when it starts to snow, not everyone within a 50 mile radius of your car is instantly killed. You can brake harder into corners and also take them at greater speed, without them getting all greasy and knobbly as they heat up. You would expect this improved technology to cost more money, which means that the big tire executives needed to outsource it in order to make the final price more affordable.

Of course, this is patented bullshit. If you’re not interested in profit, you can make inexpensive, good tires all day long. Switch Tire Company, being technically a subsidiary of Switch Investment Corporation, is run entirely at a loss. We simply bet against ourselves every day, shorting our stock on the open market. People take the other side of it, maybe because we keep renaming our company to things like “Switch Blockchain Expressions” or “Switch Artificially Intelligent Hookerbots,” the sort of names that make the casual Wall Street Tier 1 investment bank think that we’re up-and-comers. Then we pour the money we made off their backs into running off a new set of race tires.

Sure, I could have used this kind of business acumen to do something other than lose money making tires for shit-box cars. How else was I going to be able to find 13-inch tires that are 10 inches wide?

207 notes

·

View notes

Text

Tezos Goes Big

I really didn’t want to write this, I swear. I have real work to do, podcasts to edit and my daughter is home sick; but, it’s like holding in a sneeze, when I have something to say it’s best to get it out.

This is not about the @tezos event at Art Basel Miami. It may be what is driving the conversation but this is not really about the displays in a lobby of a hotel.

This is the culmination of years of disrespect to a driving force of adoption and endemic of the crypto space (and society) at large.

Art rejuvenating dead space is not a novel concept. In fact, in Miami, there’s an entire area that could have been used as a template by all blockchains. It’s called Wynnewood, look it up and you’ll get the New York Times article I reference all the time.

What was once an industrial park became a hub for restaurants, music and entertainment: culture.

Why? Because some graffiti artists began painting on the cold gray walls of a concrete jungle.

Did those artists share any of the financial gain brought to the neighborhood? No, but think of the exposure!

Web3 was not built by nor built for creatives like us (yea, I’m putting myself in that group, shut up about it). It was built by boys and men that look, talk and act like me (white, male, presumable douchey based on appearance) but lack a moral and emotional foundation.

They use the right words, have picked up key phrases and platitudes, but at the core it’s not about the things many of us value. It’s not about art.

It’s not about a reorganization of institutions that were built to keep specific classes, races and sexes subservient.

It is not building a utopian-Marxist future where the moral and decent are rewarded financially for their collective effort.

Look at the state of streaming services: Netflix, Hulu, Paramount, Peacock, Max. What was once meant to disrupt the cable industry has now become Cable Networks 2.0.

The same is true in crypto. What started as a revolution has become a hype parade led by influencers masquerading as cultural relevance.

Remember the @TezosFoundation Permanent Collection drama? In a Twitter space shortly after things began to spiral downward, one of the leads made a comment on the criticisms, “if this is the response maybe we won’t do this again.”

We all knew it then.

But many of us came here to create something better. So we, many of them my friends, gave second chances, put a positive spin on it and took their opportunity when it was offered.

I was jealous.

Because I would have done the same.

UNDRGRND is just me: a stay at home dad, taking care of a toddler who disrupts the means of production constantly. I know how hard it is to put together something and share it with an audience.

But so does every artist I write about.

So when we watch people with large budgets, people who are able to make a living on crypto already, getting paid to present the work of others and the result is done with the level of care it takes to hang a Missing Cat poster on a telephone pole, it’s infuriating.

Many of the artists I’ve gotten to know over these past three years were creative directors in their web2 lives. Do you know what they could have done with a fraction the amount of money @tezos has in its war chest?

It’s disrespectful.

It always has been.

I’m going to push post on this in a few minutes and the anxiety is rising. I know others are going to criticize what I’m launching in the coming months.

I’m in a glass house throwing rocks.

The difference is I’m not deluded enough to think I have all the answers or have an ego like I’ve done anything yet.

I’m just a guy writing about the things I like while my four-year-old sleeps on me.

This was never about the display.

It was about the devaluation of creatives for years and the continuation of a broken social contract that promised an idealistic future.

So heed the lesson because we’re tired of this shit.

And I’m fucking coming…

- Founder of UNDRGRND, @NFTjoe

#undrgrnd#tezos (xtz)#nftmagazine#nftcommunity#nftgallery#nftcollection#cryptoart#crypto#nft#nft4art#miami#digital art#artwork#art#artists on tumblr#gif art#art basel#miami beach#art week#art miami#louis vuitton

21 notes

·

View notes

Text

A potential bidding war to buy TikTok has begun, less than a month after President Joe Biden signed legislation that would force the app’s Chinese parent company ByteDance to divest, or face a ban in the United States within a year.

The latest suitor to emerge is the real estate billionaire Frank McCourt, who announced this week he’s assembling a group of investors to acquire TikTok and has brought on financial advisers from Guggenheim Securities and the law firm Kirkland & Ellis to help. The app could be worth $100 billion, according to some estimates, though McCourt said it’s too early to discuss potential valuations.

What exactly McCourt would do with TikTok remains unclear, but in an interview with Time Magazine, he said that “the user experience wouldn’t change much.” He was not deterred by the prospect of the Chinese government preventing him from buying TikTok’s core algorithm, which is responsible for determining what content users see on the app.

“Of course, TikTok isn't worth as much without the algorithm. I get that. That’s pretty plain,” McCourt said. “But we’re talking about a different design, which requires people to move on from the mindset and the paradigm we’re in now.”

McCourt, who was previously the owner of the Los Angeles Dodgers, says he has already poured $500 million into an existing social media and technology initiative called Project Liberty, which aims to reduce the power that Silicon Valley giants like Meta and Google have over the internet. One of its main focuses has been building and deploying a blockchain-based protocol that Project Liberty claims will give people more control over their data online.

McCourt also previously invested in another social network called MeWe, a privacy-focused platform that became popular with far-right users after Facebook and Twitter deactivated many of their accounts in the wake of the US Capitol riot on January 6. In 2022, MeWe announced it was migrating its entire platform over to Project Liberty’s decentralized social networking protocol, and it’s possible McCourt could do the same thing with TikTok.

Anna Feagan, a spokesperson for Project Liberty, says McCourt and his team are currently focused on putting together their bid for TikTok, but are committed to finding the right technological solutions for the platform. She adds that so far, they have not been in contact with ByteDance.

New York University professor Jonathan Haidt, a leading voice of the movement arguing that smartphones and social media are causing grave harm to children, says he supports McCourt’s plan for TikTok. “What a creative approach to changing social media: Assemble a consortium to buy TikTok and make it better, on an architecture that respects users' rights,” he said in a post on X.

TikTok, however, has made it clear that it does not want to sell its US operations, and is fighting the legality of the new divest-or-ban law in court. TikTok did not respond to a request for comment about the acquisition plans announced by McCourt and other investors.

This has done little to deter a growing list of other business moguls who have also expressed interest in acquiring the app, which has been under government scrutiny in the US for four years over alleged national security concerns stemming from its Chinese ownership. One of them is former Treasury secretary Steven Mnuchin, who said earlier this week he too was assembling a group of investors to make a bid for TikTok. He first hinted about the plan in March before the divestiture bill passed into law.

Mnuchin told Bloomberg he understands that the Chinese government is unlikely to allow ByteDance to sell TikTok’s algorithm, but he planned to “rebuild the technology.” That would be quite a lofty endeavor, especially given that TikTok competitors like YouTube and Meta have been trying to copy its product for years with only mixed success.

There’s at least one existing business connection between Mnuchin and TikTok: They are both backed by Japan’s SoftBank, which has stakes in ByteDance and in Liberty Strategic Capital, the private equity firm Mnuchin set up after he left office. A representative from Liberty Strategic Capital did not immediately return a request for comment about Mnuchin’s TikTok acquisition strategy.

Former Activision CEO Bobby Kotick has reportedly considered buying TikTok as well. He even floated the idea to Zhang Yiming, the former CEO of ByteDance who retains a roughly 20 percent stake in the company, the Wall Street Journal reported in March. Around the same time, Canadian businessman and Shark Tank judge Kevin O'Leary told Fox News that the app is “not going to get banned, ’cause I’m gonna buy it.”

O’Leary did not immediately return a request for comment about whether he was seriously interested in TikTok. Kotick could not be reached for comment.

All of TikTok’s potential suitors would be facing an uphill battle to close a deal. The first challenge will be raising enough money. Only a small number of the world’s largest companies likely have enough cash on hand to acquire the app outright, and so far, they haven’t publicly voiced an interest in the platform. That’s a big change from four years ago when then-president Donald Trump first tried to force ByteDance to sell TikTok. At the time, Microsoft, Oracle, and Walmart were among the most promising buyers for the app.

But the even bigger problem that investors face is the fact that TikTok doesn’t seem to think a sale would even be possible, let alone desirable. In a lawsuit it filed against the US government last week, TikTok argued the divestiture bill violated the First Amendment and claimed severing its American operations from ByteDance was “not commercially, technologically, or legally feasible.”

TikTok noted that the Chinese government has “made clear” that it would not permit the company to sell its recommendation algorithm to a foreign buyer, citing regulations that Beijing introduced after Trump first targeted TikTok in 2020. The measures put limits on the export of certain technologies such as “personal interactive data algorithms.”

Even if a sale were politically possible, TikTok argued the move would “disconnect Americans from the rest of the global community” on the platform, in possibly the same way that the Chinese version of the app is restricted only to people in China. TikTok added that it would take a team of new engineers years to sift through its source code and “gain sufficient familiarity” with it to run the app effectively.

A group of TikTok creators filed a separate lawsuit against the federal government earlier this week arguing that the divest bill violated their free speech rights. (TikTok is paying their legal fees.) Separating TikTok from ByteDance, they said, “is infeasible, as the company has stated and as the publicly available record confirms.”

9 notes

·

View notes

Text

Transaction Security and Management of Blockchain-Based Smart Contracts in E-Banking-Employing Micro-segmentation and Yellow Saddle Goatfish

Authored by:- Wid Alaa Jebbar and Mishall AL-Zubaidie

for full-length paper press here.

Abstract:-

Our research attempts to improve the system in which banks deal with the security of financial transactions. This research leverages the idea of micro-segmenting the entire system into designated zones to concentrate on security, where each zone has its own rules and limitations. These rules are managed by a smart contract, which decides whether they have been observed to verify the legitimacy of the customer. First, the two-phase commit algorithm (2PC) was used to specify the type of e-banking request. After this, the micro-segmentation principle was applied to isolate each type of e-transaction process alone in a separate segment. Then, the yellow saddle goatfish algorithm (YSGA) was used to determine whether the smart contract conditions were optimized. Finally, if the customer is authorized, then the entire transaction process is saved in the blockchain's main ledger and secured by a unique hash. The blockchain application makes our system capable of dealing with large numbers of users in a decentralized manner.

Facts:-

Our system has been examined against several recent well-known assaults/attacks, such as falsification, advanced persistent threat, bribery, spoofing, double spending, chosen text, race, and transaction replay attacks, and has proven to overcome them. In terms of the performance evaluation, we obtained an execution time of approximately 0.0056 nanoseconds, 3.75% complexity, and 1500 KB of memory and disk drive, which is considered low compared to that of state-of-the-art research. Thus, our proposed system is highly acceptable for banking sector applications.

our main contribution

Our contributions are as follows:

The level of security can be increased by using the micro-segmentation principle for the first time with financial systems to isolate each process alone in a separate segment, where if one segment is affected by an assault, then the other segments will remain isolated and safe. To the best of our knowledge, this contribution has not been previously studied.

Two phases of authentication are applied: first, smart contract condition detection, and second, hashing and ID detection in BCT. This procedure will make the authentication process more powerful. There will be no entrance to the system from any assaulter unless he/she is verified in both phases.

The increase in the time consumption and execution time of the specified e-banking process depended on the properties of the YSGA, which is considered one of the fastest search algorithms. To the best of our knowledge, this approach has not been previously applied in e-bank systems.

How does the system work:-

The proposed system's hierarchy. Initially, the proposed system determines the type of CR request based on the decision of the 2PC algorithm and then creates a separate segment for each type of e-banking process after the transaction processes are combined alone in a separate segment. The detection phase of the SC's conditions will start based on the fast detection of the YSGA result.

RESULTS:-

Our proposed module has the following characteristics and advantages.

Fast: Because of the use of modern, easy, and accurate algorithms such as the YSGA and the 2PC, our proposed system guarantees that the e-banking procedure will be performed in real-time.Safe and authentic: The proposed module is controlled by the SC conditions in which both the CR and the SR agree on and do not agree, the e-transaction procedure cannot be performed, and our proposed module can be considered safe and secure.

Additionally, because of the usage of the principle of isolation for each process alone in a separate segment, the danger that threatens a specific segment will remain bounded by that segment, and the other segments will work normally.Integrating: The final layer of our proposed module is the hashing and creating blocks for each procedure. Each block has complete information about the whole transaction process plus the number of previous blocks. This approach provided our proposed module with an advantage in terms of integrity.

Speed: Our proposed system is fast due to the speed of the algorithms used. Additionally, after the full analysis shown above, the time required to complete a full transaction is not more than 0.0056 nanoseconds, which is considered fast compared to other similar methods.

#blockchain

6 notes

·

View notes

Text

Casino Big Wins: Triumphs and Tales of Fortunes Won

Introduction

Casino Big Wins: What sets hearts racing, palms sweating, and adrenaline pumping more than the thrill of hitting it big at a casino? In this article, we delve deep into the realm of Casino Big Wins, exploring the excitement, strategies, and stories behind these monumental moments.

Factors Contributing to Big Wins

Luck vs. Skill: What Matters Most? Casino games often walk the tightrope between chance and skill. While luck undoubtedly plays a significant role in securing big wins, strategic gameplay can tilt the odds in your favor. We'll explore the delicate balance between luck and skill in pursuit of Casino Big Wins.

Strategies for Maximizing Wins From mastering the art of bluffing in poker to employing progressive betting systems in blackjack, various strategies can enhance your chances of scoring big at the casino. We'll uncover these strategies and provide insights into their effectiveness.

Popular Games for Big Wins

Slot Machines: The Allure of Jackpots With their flashing lights and enticing sound effects, slot machines beckon players with the promise of life-changing jackpots. We'll delve into the world of slots, examining the mechanics behind jackpot payouts and sharing tips for spinning your way to success.

Table Games: High Stakes, High Rewards For those seeking a more strategic challenge, table games offer ample opportunities for big wins. Whether it's the thrill of roulette, the strategic depth of blackjack, or the anticipation of a winning hand in poker, table games provide a diverse landscape for pursuing Casino Big Wins.

Real-Life Big Win Stories

Tales of Fortune: Memorable Wins Behind every big win lies a captivating story. From hitting the jackpot on a progressive slot to outplaying opponents in a high-stakes poker tournament, we'll showcase real-life tales of casino triumph that will leave you inspired and awestruck.

Overcoming Odds: Inspirational Stories In the face of adversity, some players defy the odds to achieve remarkable victories. We'll share stories of perseverance, resilience, and sheer determination, highlighting the human spirit's triumph in the pursuit of Casino Big Wins.

Tips for Increasing Win Potential

Bankroll Management: Playing it Smart Effective bankroll management is crucial for sustaining success in the casino world. We'll offer practical tips for managing your funds wisely, ensuring that you can weather both winning streaks and losing spells without derailing your gameplay.

Capitalizing on Bonuses and Promotions Casinos often entice players with enticing bonuses and promotions, ranging from welcome offers to loyalty rewards. We'll reveal insider tips for leveraging these bonuses to maximize your win potential while minimizing risk.

Responsible Gambling Practices

Knowing When to Stop: Setting Limits While the allure of big wins can be irresistible, responsible gambling entails knowing when to step away from the table. We'll discuss the importance of setting limits, recognizing signs of problem gambling, and seeking help when needed.

Seeking Support: Resources for Problem Gambling For those struggling with compulsive gambling behaviors, support is available. We'll provide a comprehensive list of resources, including helplines, support groups, and counseling services, to assist individuals in overcoming gambling addiction and reclaiming control of their lives.

The Future of Big Wins in Casinos

Technological Advancements and Their Impact As technology continues to advance, the landscape of casino gaming is undergoing rapid transformation. We'll explore emerging trends such as virtual reality casinos, blockchain-powered gaming platforms, and AI-driven predictive analytics, offering a glimpse into the future of Casino Big Wins.

Evolving Trends: What's Next in Casino Big Wins? From the rise of skill-based gaming to the integration of cryptocurrency payments, the casino industry is evolving to meet the changing preferences of players. We'll forecast upcoming trends and innovations that are poised to shape the future of Casino Big Wins.

Conclusion

In conclusion, Casino Big Wins embody the essence of excitement, anticipation, and triumph that define the allure of casino gaming. Whether through strategic gameplay, sheer luck, or sheer determination, these monumental moments capture the imagination and inspire players worldwide. As we navigate the ever-changing landscape of the casino industry, one thing remains certain: the thrill of chasing that elusive big win will continue to captivate hearts and minds for generations to come.

10 notes

·

View notes

Text

Red Team Blues

A very novel novel, reviewed

tl;dr - it's a good book and if detective stories or thrillers are of interest to you, I would recommend checking it out.

Warning: possible minor spoilers below. If you want to go in blind, stop reading.

A mixture of a noir detective story and a cyber dystopian alternate reality nearly indistinguishable from our own, Red Team Blues is a roller coaster ride. The story follows our hero, Martin "Marty" Hench, a 67-year-old bachelor forensic accountant for hire on his last job before retirement. A prodigious sleuth at finding assets that some people would rather stay hidden, he has had a long and storied career stretching back to the beginnings of Silicon Valley. When Marty's old friend Danny Lazer calls in a favor to discreetly retrieve some stolen cryptographic keys that allow for control over Danny's revolutionary new blockchain system, Marty diligently works to find the keys. Fortunately, Marty is good at his job. He returns the keys and receives his payment for finding the assets: a cool 300 million dollars. Unfortunately, he also happens to find some dead bodies along with said assets. Consequently, he finds himself in a race against time to solve the mystery of what really happened and to clear his name before either the family of the dead or the people they double-crossed take him out.

The story is not just a gumshoe thriller taken on the road, but also a commentary about Silicon Valley, the impacts that technology has on our world and the people in it, and the differences between the haves and have-nots. It touches on the difficulties of playing defense (the blue team), the ease of playing the offense (the red team), and the benefits of playing to your strengths.

The characters are well written and feel like real, actualized people. They have their own lives, their own experiences, and their own voices. And Marty has to rely on them. He can't keep himself safe without the help of friends and strangers, and he does what he can to help keep them safe in return.

Ultimately, it's a masterfully written book (and well narrated by Wil Wheaton) that is hard to put down. I listened to the audiobook nearly non-stop. When it was done, I had to fight the urge from starting it back from the beginning. I'm truly excited that this is the beginning of a series, and especially one that has the interesting twist where it is, chronologically, the end of the story. As stated previously, Red Team Blues is a good book and if detective stories or thrillers are of interest to you, I would highly recommend checking it out.

You can get a copy of the ebook or audiobook directly from the author here. You can also buy the audiobook from libro.fm or get a physical copy from bookshop.org

#red team blues#Cory Doctorow#book review#beaches' speeches#noir detective#mystery novels#recommendations#book#book recommendations

24 notes

·

View notes

Text

Escape the Matrix: Create Your Own Crypto and Memecoins to Break Free from the Rat Race

In today’s fast-paced world, many people feel trapped in the proverbial “matrix” of conventional work life — a never-ending grind where the promises of financial freedom and personal fulfillment seem elusive. If you find yourself yearning for a way out, creating your own cryptocurrency or memecoin tokens might be the key to escaping the rat race and paving the way to a brighter, more prosperous future. This blog will explore how you can break free from traditional financial constraints and take control of your financial destiny by delving into the world of crypto and memecoins.

Understanding the Matrix and the Rat Race

Before we dive into how you can create your own crypto and memecoin tokens, it’s important to understand the matrix and the rat race. The matrix represents a system of control and conformity that often dictates our daily lives, while the rat race is the relentless pursuit of success and wealth through conventional means, often leading to burnout and dissatisfaction.

Breaking free from this cycle involves adopting new ways of thinking and exploring alternative financial opportunities. The cryptocurrency revolution offers a pathway to redefine your financial future, allowing you to step out of the traditional financial system and into a world of digital innovation.

The Rise of Cryptocurrencies and Memecoins

1. The Cryptocurrency Revolution

Cryptocurrencies have transformed the financial landscape by offering decentralized alternatives to traditional financial systems. Bitcoin, the first and most well-known cryptocurrency, introduced the concept of blockchain technology — a decentralized ledger that ensures transparency, security, and immutability.

Since Bitcoin’s inception, thousands of cryptocurrencies have emerged, each with unique features and use cases. Ethereum introduced smart contracts, enabling the creation of decentralized applications (dApps) and new tokens. The rise of cryptocurrencies has paved the way for individuals to create their own digital assets, offering opportunities for innovation and financial empowerment.

2. The Memecoin Phenomenon

Memecoins, on the other hand, represent a more playful and community-driven aspect of the cryptocurrency world. Born from internet memes and viral trends, memecoins often gain popularity through social media and online communities. Despite their origins as jokes or experiments, some memecoins have experienced significant price surges and garnered substantial attention.

Notable examples include Dogecoin, which started as a meme but has become a widely recognized cryptocurrency with a strong community backing. The success of memecoins highlights the power of community engagement and the potential for digital assets to capture public interest.

Creating Your Own Cryptocurrency

Creating your own cryptocurrency involves several key steps. Here’s a roadmap to help you get started:

1. Define Your Purpose and Goals

Before diving into the technical aspects, it’s essential to define the purpose and goals of your cryptocurrency. Consider the following questions:

What problem does your cryptocurrency aim to solve?

Who is your target audience?

How will your cryptocurrency differentiate itself from existing options?

Having a clear vision will guide the development process and help you create a compelling value proposition for your digital asset.

2. Choose the Right Blockchain Platform

Selecting the appropriate blockchain platform is crucial for the development of your cryptocurrency. Popular platforms include:

Ethereum: Known for its robust smart contract capabilities, Ethereum is a popular choice for creating custom tokens. Ethereum’s ERC-20 and ERC-721 standards provide a foundation for creating fungible and non-fungible tokens, respectively.

Binance Smart Chain (BSC): BSC offers low transaction fees and compatibility with Ethereum’s tools and infrastructure, making it an attractive option for new projects.

Solana: Renowned for its high throughput and low transaction costs, Solana is suitable for projects requiring scalability and speed.

Evaluate the features and benefits of each platform to determine which best aligns with your project’s needs.

3. Develop Your Cryptocurrency

Once you’ve chosen a blockchain platform, you can begin the development process. This involves creating the token’s smart contract, which defines its properties, such as total supply, distribution, and functionality.

For Ethereum-based tokens, you can use tools like Solidity (a programming language for smart contracts) and development environments like Remix or Truffle. If you’re using BSC or Solana, familiarize yourself with their respective development tools and languages.

4. Test and Deploy

Testing is a critical phase to ensure that your cryptocurrency functions as intended. Conduct thorough testing on testnets (blockchain networks used for testing purposes) to identify and resolve any issues before deploying your token on the mainnet.

Once testing is complete, you can deploy your cryptocurrency on the chosen blockchain platform. Ensure that all smart contract code is secure and has been audited to prevent vulnerabilities.

5. Market and Promote

Creating a cryptocurrency is only the beginning. Effective marketing and promotion are essential for gaining traction and attracting users. Develop a marketing strategy that includes:

Building a website and social media presence

Engaging with online communities and forums

Creating informative content and promotional materials

Leverage the power of social media and influencer partnerships to spread the word about your cryptocurrency and build a supportive community.

Creating Your Own Memecoin

Creating a memecoin follows a similar process to developing a standard cryptocurrency, with an emphasis on community engagement and viral potential. Here’s how to get started:

1. Embrace the Meme Culture

Memecoins thrive on internet culture and humor. To create a successful memecoin, embrace popular memes and viral trends. Consider how your memecoin can tap into existing online communities and trends to generate excitement.

2. Develop a Unique Concept

While memecoins often start as jokes, a unique concept or theme can help your token stand out. Create a compelling narrative or branding that resonates with your target audience and aligns with current meme trends.

3. Build a Community

Community is crucial for the success of a memecoin. Engage with potential users through social media platforms, online forums, and meme communities. Foster a sense of belonging and enthusiasm around your memecoin to drive interest and participation.

4. Launch and Promote

After developing and testing your memecoin, launch it on a blockchain platform and begin promoting it to your target audience. Utilize social media, memes, and viral marketing tactics to generate buzz and attract attention.

The Path to Financial Empowerment

Creating your own cryptocurrency or memecoin offers a unique opportunity to escape the rat race and take control of your financial future. By embracing the world of digital assets, you can potentially unlock new revenue streams, build innovative solutions, and connect with like-minded individuals.

However, it’s important to approach this venture with a clear vision, thorough planning, and a willingness to adapt to the dynamic nature of the cryptocurrency market. Success in the crypto world requires dedication, creativity, and a strategic mindset.

Conclusion

The journey to escaping the matrix and breaking free from the rat race can be transformative and empowering. By creating your own cryptocurrency or memecoin tokens, you can tap into the potential of digital assets and explore new avenues for financial growth and innovation.

And If you are new to solana, Memecoins, what is token and all? Not to worry about this, we founf this amazing platform for you, Visit Solana launcher & Deployment token, Here you can launch your own memecoins token in just less than three seconds without any extesive programming knowledge. And start young and watch your wealth grow!!!

Whether you’re driven by a desire for financial independence or a passion for technology and innovation, the world of cryptocurrencies offers a pathway to redefine your future. Embrace the opportunities, stay informed, and embark on your journey to a brighter and more prosperous tomorrow.

3 notes

·

View notes

Text

Eighty-eight corporate leaders endorse Harris in new letter, including CEOs of Yelp, Box

Eighty-eight corporate leaders signed a new letter Friday endorsing Vice President Kamala Harris for president.

Signers include former 21st Century Fox CEO James Murdoch, Snap Chairman Michael Lynton, Yelp boss Jeremy Stoppelman and Ripple co-founder Chris Larsen.

If the Democratic nominee wins the White House, they contend, “the business community can be confident that it will have a president who wants American industries to thrive.”

WASHINGTON — Eighty-eight current and former top executives from across corporate America have endorsed Vice President Kamala Harris for president in a new letter shared exclusively with CNBC.

Among the signers are several high-profile CEOs of public companies, including Aaron Levie of Box, Jeremy Stoppelman of Yelp and Michael Lynton, chairman of Snap

.

Other signers appear to be issuing their first public endorsements of Harris since she became the de facto Democratic nominee in July.

They include James Murdoch, former CEO of 21st Century Fox and an heir to the Murdoch family media empire, and crypto executive Chris Larsen, co-founder of the Ripple blockchain platform.

Other notable signers are philanthropist Lynn Forester de Rothschild, private equity billionaire José Feliciano, Twilio co-founder Jeff Lawson, and D.C. sports magnate Ted Leonsis, owner of the NBA’s Washington Wizards, WNBA’s Mystics and the NHL’s Washington Capitals.

The three-page list also includes a slate of longtime Democratic political donors, like Kleiner Perkins’ John Doerr, Insight partners Deven Parekh, and Jeffrey Katzenberg, founder and managing partner of Wndr and former chairman of Walt Disney Studios.

Another subset of names are people who have supported Harris in particular since her political campaigns in California, like the philanthropist Laurene Powell Jobs, Facebook co-founder Dustin Moskovitz, and NBA Hall of Famer and billionaire businessman Magic Johnson.

More than a dozen of the signers made their fortunes on Wall Street: Tony James, former president and COO of Blackstone and founder of Jefferson River Capital; Bruce Heyman, former managing director of private wealth at Goldman Sachs; Peter Orszag, CEO of Lazard; and Steve Westly managing director of the Westly Group and a former Tesla

board member.

Still more are prominent in Silicon Valley, including the venture capitalist Ron Conway, entrepreneur Mark Cuban and former LinkedIn CEO Reid Hoffman.

***Cuban just said her plans would destroy the stock market.. Oh well... WOW

2 notes

·

View notes

Text

quotes from crash.net's interview with Razlan Razali about the future of the RNF team. CryptoData was the title sponsor of the Austrian GP before they became an Aprilia sponsor. Dorna stepped in to partner them with RNF when the team was coming under financial problems. CryptoData is now rumored to not have paid the full fee for sponsoring the Austrian events, which is likely why Dorna is cutting them. it looks like Trackhouse Racing will indeed become the next independent Aprilia sponsor.

to clear up some minor misinformation: CryptoData is not a cryptocurrency company. they are a security firm that offers messaging encryption and cybersecurity. they do have a product that monitors the cryptocurrency market, but they do not make blockchain technology. that is not their game. they're still scammers, just a different scheme.

8 notes

·

View notes

Text

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days. ‘ They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

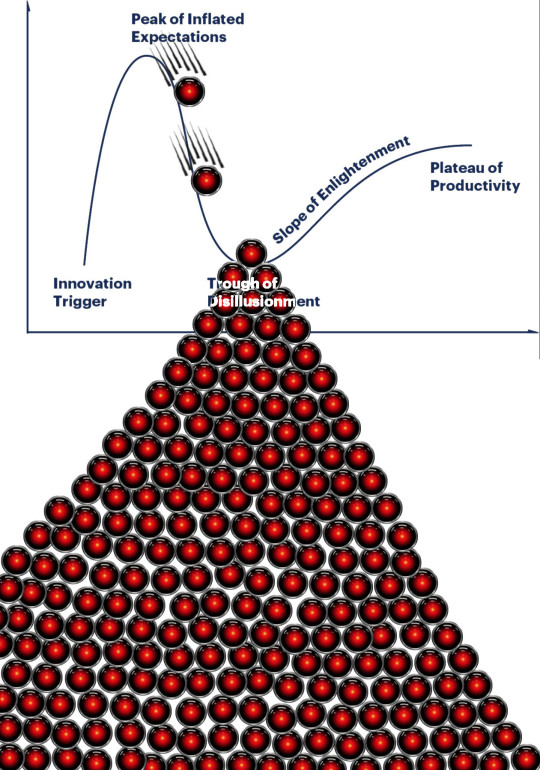

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Text

Like Everhaven, Project Unicorn was a WIP game at Phoenix Labs, but was cancelled by the company’s new owner, Forte, a blockchain company. Unicorn was set as a racing multiplayer where you bond with collectible mounted creatures in a magical world.

The following game artwork is by Anneliese Mak, Kimberly Parker, Khoa Viet, Hien Le and Justin Chan

Apart from bonding with your collectible creatures, they would’ve had different color schemes based on elements.

Like Everhaven, Project Unicorn had been in development since 2021 and was cancelled back in early 2024. This passion project was scrapped because Forte didn’t see it useful in implementing their blockchain tech into the game; a fate shared by Everhaven and other projects that were cancelled at Phoenix Labs.

8 notes

·

View notes

Text

Get your Quick Turn NFTs and claim your cars at the #Prebetavr!

Dear community of racing game enthusiasts and NFT collectors.

We are pleased to announce an exciting partnership between Fast Lap and Token Mithradir. As part of this collaboration, we have created an exclusive NFT collection that will allow you to claim your race cars at the upcoming #Prebetavr event.

What are Fast Lap NFTs? Fast Lap NFTs (non-fungible tokens) are unique digital pieces that represent in-game race cars. Each NFT is backed by blockchain technology, which guarantees its authenticity and exclusive ownership. When you purchase a Fast Turn NFT, you not only get a piece of digital artwork, but also the ability to unlock and use the corresponding car in-game.

How does it work?

Purchase your NFTs: Browse the collection on Mithradir's platform and purchase the Fast Turn NFTs you like the most. Each NFT represents a specific car model.

Claim your car at the #Prebetavr: During the #Prebetavr event, you will be able to exchange your NFTs for the corresponding cars in the game. Get ready to compete in exciting races and prove your driving skills!

Collect and share: In addition to using the cars in races, you can collect them and display them on your profile - show your passion for Fast Lap and Mithradir, share your achievements with the community!

Why should you buy Fast Lap NFTs?

Exclusivity: Each NFT is unique and limited in quantity. No more copies will be available once this collection is sold out.

Participation in the game: NFTs are not only collectibles, but also an active part of the game. Use them to compete and enhance your Fast Lap experience.

Potential investment: NFTs have proven to be an interesting form of investment. While we cannot guarantee returns, the growing demand and passionate community support their long-term value.

Join the Fast Turn community and be part of this exciting adventure! Purchase your NFTs at Mithradir and get ready for speed.

For press inquiries and interviews, contact us www.vueltarapida.com.

See you at the track!

Sincerely. The Vuelta Rápida Game and Token Mithradir team.

#Token MITHR#Token Mithrandir#NFT#Vuelta rápida Game#Vuelta Rápida#Formula 1#F1#Cardano#NFTs#nftcommunity#digitalcurrency

2 notes

·

View notes

Text

The Future of Finance: How Fintech Is Winning the Cybersecurity Race

In the cyber age, the financial world has been reshaped by fintech's relentless innovation. Mobile banking apps grant us access to our financial lives at our fingertips, and online investment platforms have revolutionised wealth management. Yet, beneath this veneer of convenience and accessibility lies an ominous spectre — the looming threat of cyberattacks on the financial sector. The number of cyberattacks is expected to increase by 50% in 2023. The global fintech market is expected to reach $324 billion by 2028, growing at a CAGR of 25.2% from 2023 to 2028. This growth of the fintech market makes it even more prone to cyber-attacks. To prevent this there are certain measures and innovations let's find out more about them

Cybersecurity Measures in Fintech

To mitigate the ever-present threat of cyberattacks, fintech companies employ a multifaceted approach to cybersecurity problems and solutions. Here are some key measures:

1. Encryption

Encrypting data at rest and in transit is fundamental to protecting sensitive information. Strong encryption algorithms ensure that even if a hacker gains access to data, it remains unreadable without the decryption keys.

2. Multi-Factor Authentication (MFA)

MFA adds an extra layer of security by requiring users to provide multiple forms of verification (e.g., passwords, fingerprints, or security tokens) before gaining access to their accounts.

3. Continuous Monitoring

Fintech companies employ advanced monitoring systems that constantly assess network traffic for suspicious activities. This allows for real-time threat detection and rapid response.

4. Penetration Testing

Regular penetration testing, performed by ethical hackers, helps identify vulnerabilities in systems and applications before malicious actors can exploit them.

5. Employee Training

Human error is a significant factor in cybersecurity breaches. Companies invest in cybersecurity training programs to educate employees about best practices and the risks associated with cyber threats.

6. Incident Response Plans

Having a well-defined incident response plan in place ensures that, in the event of a breach, the company can respond swiftly and effectively to mitigate the damage.

Emerging Technologies in Fintech Cybersecurity

As cyber threats continue to evolve, so do cybersecurity technologies in fintech. Here are some emerging technologies that are making a significant impact:

1. Artificial Intelligence (AI)

AI and machine learning algorithms are used to analyse vast amounts of data and identify patterns indicative of cyber threats. This allows for proactive threat detection and quicker response times.

2. Blockchain

Blockchain technology is employed to enhance the security and transparency of financial transactions. It ensures that transaction records are immutable and cannot be altered by malicious actors.

3. Biometrics

Fintech companies are increasingly adopting biometric authentication methods, such as facial recognition and fingerprint scanning, to provide a higher level of security than traditional passwords.

4. Quantum-Safe Encryption

With the advent of quantum computing, which poses a threat to current encryption methods, fintech companies are exploring quantum-safe encryption techniques to future-proof their security measures.

Conclusion

In the realm of fintech, where trust and security are paramount, the importance of cybersecurity cannot be overstated. Fintech companies must remain vigilant, employing a combination of advanced digital transformation solutions, employee training, and robust incident response plans to protect sensitive financial data from cyber threats. As the industry continues to evolve, staying one step ahead of cybercriminals will be an ongoing challenge, but one that fintech firms must embrace to ensure their continued success and the safety of their customers' financial well-being.

3 notes

·

View notes