#bitmex tezos

Explore tagged Tumblr posts

Photo

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed on a blockchain without any possibility of downtime, censorship, fraud or third party interference. The project is developed by the Ethereum Foundation. The Ethereum currency is denominated by the currency code ETH and is commonly referred to as Ether. Further information about ETH and the Ethereum Project can be found here. BitMEX currently offers two types of ETH derivative products for traders. The first is in the form of an Ether / Bitcoin (ETH/XBT) Futures Contract and the second is in the form of an Ether / USD (ETH/USD) Perpetual Contract. Futures Contracts How Are ETHXBT Futures Quoted? Margin and Leverage Settlement ETHXBT Futures Contract Example Perpetual Contracts How Is The ETHUSD Perpetual Contract Quoted Margin and Leverage Settlement ETHUSD Perpetual Contract Example Trade Inception Trade Expiry Futures Contracts On BitMEX, the ETH Futures Contract allows traders to speculate on the future value of the Ether / Bitcoin (ETH/XBT) exchange rate. Traders need not have Ether to trade the futures contract as it only requires Bitcoin as margin. How Are ETHXBT Futures Quoted? The ETH futures’ underlying is the ETH/XBT exchange rate on Poloniex, Kraken and Binance as recorded in the .BETHXBT Index. The futures are quoted in Bitcoin and all margin and PNL calculations are denominated in Bitcoin. Contract Calculations Multiplier 1 XBT Contract Value Multiplier * Futures Price * 1 ETH USD Contract Value XBT Contract Value * XBTUSD PnL Calculation # Contracts * Multiplier * (Exit Price - Entry Price) Traders who think that the price of ETH will rise will buy the futures contract. Conversely, traders who believe the price will drop will sell the futures contract. Margin and Leverage All margin is posted in Bitcoin, that means traders can go long or short this contract using only Bitcoin. The ETH futures contracts feature a leverage of up to 50x. For example, to buy 50 Bitcoin worth of contracts, you will only require 1 Bitcoin of Initial Margin. Settlement The ETH futures contracts settle on the .BETHXBT30M Index Price. Settlement will occur on the last Friday of the Settlement Month. ETHXBT Futures Contract Example A trader wants to goes long 10 XBT of ETH futures contracts. ETHU18 (the ETH futures contract expiring in September 2018) trades at 0.0500 XBT. As the leverage is 50x, the trader only needs 0.2 XBT of margin for this trade. The trader must buy 200 contracts: 10 XBT / (0.0500 XBT * 1). A few days later, the price rises to 0.0550 XBT and the trader sells all their contracts. The trader’s profit will be: 200 * 1 * (0.0550 - 0.0500) = 1 XBT Perpetual Contracts Currently BitMEX only accepts Bitcoin as collateral. That that means margin, profit, and loss must be paid or received in Bitcoin. However, through the use of financial engineering, BitMEX can give users exposure to any underlying price using a derivative called a Quanto. A Bitcoin Quanto ETH/USD contract has a fixed Bitcoin multiplier regardless of the USD price of ETH. This allows the trader to go long or short the ETH/USD exchange rate without ever touching ETH or USD. The trader will post margin in Bitcoin, and make or lose Bitcoin as the ETH/USD exchange rate changes. How Is The ETHUSD Perpetual Contract Quoted Contract Calculations Bitcoin Multiplier per 1 USD 0.000001 XBT XBT Value ETHUSD Price * Bitcoin Multiplier USD Value XBT Value * .BXBT Spot Price ETH Value XBT Value / .ETHXBT Spot Price Bitcoin PNL Calculation (ETHUSD Exit Price - ETHUSD Entry Price) * Bitcoin Multiplier * # Contracts Margin and Leverage All margin is posted in Bitcoin, that means traders can go long or short this contract using only Bitcoin. The ETHUSD Perpetual Contract feature a leverage of up to 50x. For example, to buy 50 Bitcoin worth of contracts, you will only require 1 Bitcoin of Initial Margin. Settlement As the ETHUSD contract is perpetual, there is no settlement. Marking for Unrealised PNL and Liquidation purposes are done according to the Fair Price Marking system. Note also: since this product is a perpetual contract, funding occurs every 8 hours. Please see the Funding Section in the Perpetual Contracts Guide for information, and for the current rates please see Funding Calculation in the ETHUSD Contract Specifications. ETHUSD Perpetual Contract Example BitMEX Derivative: ETHUSD Perpetual Swap Contracts: 10,000 Bitcoin Multiplier per 1 USD: 0.000001 XBT .BXBT Spot Price: $10,000 ETHUSD Swap Price: $500 .ETHXBT Spot Price: 0.05 XBT Trade Inception Jaewon and Wang trade the ETHUSD Perpetual Swap against each other for 10,000 contracts. Jaewon goes long, and Wang goes short. For each 1 USD move, the contract pays out 0.000001 XBT; this is called the Bitcoin multiplier. They agree that each side can use 50x leverage, which means they post 2% initial margin to BitMEX to initiate the trade. To calculate the Bitcoin margin, they first calculate the Bitcoin value of their ETHUSD Quanto Swap. XBT Value = ETHUSD Price * Bitcoin Multiplier * # Contracts 5 XBT = $500 * 0.000001 XBT * 10,000 Initial Bitcoin Margin = 5 XBT * 2% = 0.1 XBT They both like to think in ETH terms at any given ETHUSD price. On the BitMEX Position Table, they are able to view the current value of their position in ETH terms. ETH Value = XBT Value / .ETHXBT Spot Price 100 ETH = 5 XBT / 0.05 XBT They notice that the ETH value can change either when the ETHUSD price changes, or when the .ETHXBT spot price changes. The only fixed number in a Quanto derivative is the multiplier. The ETH and USD value will change as the ETHUSD, .BXBT, and .ETHXBT prices change. Trade Expiry The ETHUSD swap price rises to $505, let’s compute Jaewon and Wang’s Bitcoin PNL. Bitcoin PNL = (ETHUSD Exit Price – ETHUSD Entry Price) * Bitcoin Multiplier * # Contracts Jaewon Bitcoin PNL = ($505 - $500) * 0.000001 XBT * +10,000 = 0.05 XBT Profit Wang Bitcoin PNL = ($505 - $500) * 0.000001 XBT * -10,000 = 0.05 XBT Loss Notice that the only variable that affects the PNL is the movement of the ETHUSD price. Neither the .BXBT, nor the .ETHXBT exchange rate affect either trader’s PNL.

#bitmex#bitmex app#bitmex api#bitmex tezos#bitmex testnet#bitmex margin chart#bitmex android app#bitmex com login#bitmex login#bitmex wiki#bitmex ticker#bitmex register#bitmex xbtusd#bitmex ethusd#bitmex anti#start trading now#leverage trading#p2p trading#exx#coinbene#coinbit#oex#bibox#okex#binance#huobi#bitforex#idax#upbit#bithumb

2 notes

·

View notes

Photo

✔Stellar is an open-source network for currencies and payments. Stellar makes it possible to create, send and trade digital representations of all forms of money—dollars, pesos, bitcoin, pretty much anything. It’s designed so all the world’s financial systems can work together on a single network. #cryptocurrency #crypto #cryptotrading #cryptocurrencies #cryptonews #cryptomemes #cryptomarket #cryptos #bitcoincharts #forexlifestyle #eth #bitcoin #ethereummining #bitcoinusa #bitcion #cryto #bitcoinhalving #bitmex #tezos #miningfarm #richardmore #stablecoin #btcnews #blockchainnews #blockchains #cryptocurrencynews #cryptoinvestor #decentralized #bitcoinasia #cryptopunk https://www.instagram.com/p/CaFmQO0teS0/?utm_medium=tumblr

#cryptocurrency#crypto#cryptotrading#cryptocurrencies#cryptonews#cryptomemes#cryptomarket#cryptos#bitcoincharts#forexlifestyle#eth#bitcoin#ethereummining#bitcoinusa#bitcion#cryto#bitcoinhalving#bitmex#tezos#miningfarm#richardmore#stablecoin#btcnews#blockchainnews#blockchains#cryptocurrencynews#cryptoinvestor#decentralized#bitcoinasia#cryptopunk

0 notes

Text

BitMEX Launches EOS, Chainlink, Tezos, and Cardano Futures

BitMEX Launches EOS, Chainlink, Tezos, and Cardano Futures

[ad_1]

The array of altcoin futures contracts in the crypto industry has just been expanded by BitMEX with new offerings for four of the top digital assets.

Advertisement

Crypto exchange BitMEX, which is well known in the industry for its highly leveraged trading options, has just added four more altcoins to its Quanto Futures products list.

Four More Futures Contracts

The official…

View On WordPress

0 notes

Text

BitMEX Plans to Add Futures Contracts for Chainlink and Tezos

BitMEX Plans to Add Futures Contracts for Chainlink and Tezos

Share this article

Leading crypto derivatives exchange, BitMEX announced that it would soon be launching four new “Quanto” futures contracts for Cardano (ADA), Chainlink (LINK), EOS (EOS), and Tezos (XTZ). The contracts will be paired with Tether’s USDT.

BitMEX Launches More Altcoin Futures

The Quanto feature of the altcoin contracts is exclusive to BitMEX. As a Bitcoin-only exchange,…

View On WordPress

0 notes

Text

How to use the Yandev RPC server for Nyzo

https://medium.com/@nyzoco/how-to-use-the-yandev-rpc-server-for-nyzo-56e616e0e6d0

#crypto#blockchain#binance#huobi global#huobi#bitmax#coinbase#bitmex#bittrex#exchange#bitcoin#ethereum#nyzo#litecoin#tezos (xtz)#tezos#cryptocurrency#investing

0 notes

Text

Beginner’s Guide to BitMEX(FS)

Founded by HDR Global Trading Limited (which in turn was founded by former bankers Arthur Hayes, Samuel Reed and Ben Delo) in 2014, BitMEX is a trading platform operating around the world and registered in the Seychelles.

Meaning Bitcoin Mercantile Exchange, BitMEX is one of the largest Bitcoin trading platforms currently operating, with a daily trading volume of over 35,000 BTC and over 540,000 accesses monthly and a trading history of over $34 billion worth of Bitcoin since its inception.

Unlike many other trading exchanges, BitMEX only accepts deposits through Bitcoin, which can then be used to purchase a variety of other cryptocurrencies. BitMEX specialises in sophisticated financial operations such as margin trading, which is trading with leverage. Like many of the exchanges that operate through cryptocurrencies, BitMEX is currently unregulated in any jurisdiction.

Visit BitMEX

How to Sign Up to BitMEX

In order to create an account on BitMEX, users first have to register with the website. Registration only requires an email address, the email address must be a genuine address as users will receive an email to confirm registration in order to verify the account. Once users are registered, there are no trading limits. Traders must be at least 18 years of age to sign up.

However, it should be noted that BitMEX does not accept any US-based traders and will use IP checks to verify that users are not in the US. While some US users have bypassed this with the use of a VPN, it is not recommended that US individuals sign up to the BitMEX service, especially given the fact that alternative exchanges are available to service US customers that function within the US legal framework. How to Use BitMEX

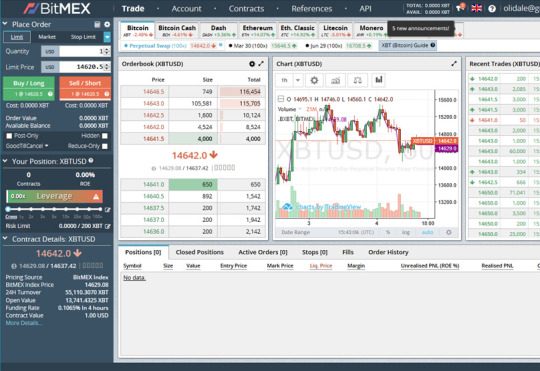

BitMEX allows users to trade cryptocurrencies against a number of fiat currencies, namely the US Dollar, the Japanese Yen and the Chinese Yuan. BitMEX allows users to trade a number of different cryptocurrencies, namely Bitcoin, Bitcoin Cash, Dash, Ethereum, Ethereum Classic, Litecoin, Monero, Ripple, Tezos and Zcash.

The trading platform on BitMEX is very intuitive and easy to use for those familiar with similar markets. However, it is not for the beginner. The interface does look a little dated when compared to newer exchanges like Binance and Kucoin’s.

Once users have signed up to the platform, they should click on Trade, and all the trading instruments will be displayed beneath.

Clicking on the particular instrument opens the orderbook, recent trades, and the order slip on the left. The order book shows three columns – the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long.

The widgets on the trading platform can be changed according to the user’s viewing preferences, allowing users to have full control on what is displayed. It also has a built in feature that provides for TradingView charting. This offers a wide range of charting tool and is considered to be an improvement on many of the offering available from many of its competitors.

Once trades are made, all orders can be easily viewed in the trading platform interface. There are tabs where users can select their Active Orders, see the Stops that are in place, check the Orders Filled (total or partially) and the trade history. On the Active Orders and Stops tabs, traders can cancel any order, by clicking the “Cancel” button. Users also see all currently open positions, with an analysis if it is in the black or red.

BitMEX uses a method called auto-deleveraging which BitMEX uses to ensure that liquidated positions are able to be closed even in a volatile market. Auto-deleveraging means that if a position bankrupts without available liquidity, the positive side of the position deleverages, in order of profitability and leverage, the highest leveraged position first in queue. Traders are always shown where they sit in the auto-deleveraging queue, if such is needed.

Although the BitMEX platform is optimized for mobile, it only has an Android app (which is not official). There is no iOS app available at present. However, it is recommended that users use it on the desktop if possible.

BitMEX offers a variety of order types for users:

Limit Order (the order is fulfilled if the given price is achieved);

Market Order (the order is executed at current market price);

Stop Limit Order (like a stop order, but allows users to set the price of the Order once the Stop Price is triggered);

Stop Market Order (this is a stop order that does not enter the order book, remain unseen until the market reaches the trigger);

Trailing Stop Order (it is similar to a Stop Market order, but here users set a trailing value that is used to place the market order);

Take Profit Limit Order (this can be used, similarly to a Stop Order, to set a target price on a position. In this case, it is in respect of making gains, rather than cutting losses);

Take Profit Market Order (same as the previous type, but in this case, the order triggered will be a market order, and not a limit one)

The exchange offers margin trading in all of the cryptocurrencies displayed on the website. It also offers to trade with futures and derivatives – swaps.

Futures and Swaps

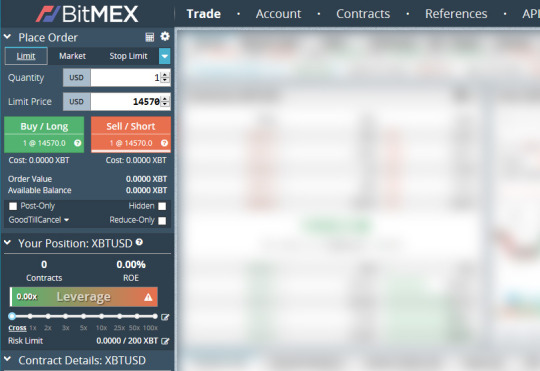

A futures contract is an agreement to buy or sell a given asset in the future at a predetermined price. On BitMEX, users can leverage up to 100x on certain contracts.

Perpetual swaps are similar to futures, except that there is no expiry date for them and no settlement. Additionally, they trade close to the underlying reference Index Price, unlike futures, which may diverge substantially from the Index Price.

BitMEX also offers Binary series contracts, which are prediction-based contracts which can only settle at either 0 or 100. In essence, the Binary series contracts are a more complicated way of making a bet on a given event.

The only Binary series betting instrument currently available is related to the next 1mb block on the Bitcoin blockchain. Binary series contracts are traded with no leverage, a 0% maker fee, a 0.25% taker fee and 0.25% settlement fee.

Bitmex Leverage

BitMEX allows its traders to leverage their position on the platform. Leverage is the ability to place orders that are bigger than the users’ existing balance. This could lead to a higher profit in comparison when placing an order with only the wallet balance. Trading in such conditions is called “Margin Trading.”

There are two types of Margin Trading: Isolated and Cross-Margin. The former allows the user to select the amount of money in their wallet that should be used to hold their position after an order is placed. However, the latter provides that all of the money in the users’ wallet can be used to hold their position, and therefore should be treated with extreme caution.

The BitMEX platform allows users to set their leverage level by using the leverage slider. A maximum leverage of 1:100 is available (on Bitcoin and Bitcoin Cash). This is quite a high level of leverage for cryptocurrencies, with the average offered by other exchanges rarely exceeding 1:20.

BitMEX Fees

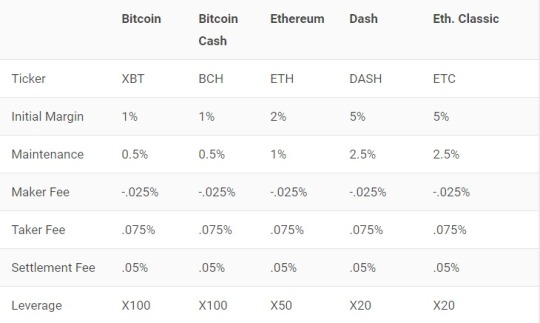

For traditional futures trading, BitMEX has a straightforward fee schedule. As noted, in terms of leverage offered, BitMEX offers up to 100% leverage, with the amount off leverage varying from product to product.

However, it should be noted that trading at the highest leverages is sophisticated and is intended for professional investors that are familiar with speculative trading. The fees and leverage are as follows:

However, there are additional fees for hidden / iceberg orders. A hidden order pays the taker fee until the entire hidden quantity is completely executed. Then, the order will become normal, and the user will receive the maker rebate for the non-hidden amount.

Deposits and Withdrawals

BitMEX does not charge fees on deposits or withdrawals. However, when withdrawing Bitcoin, the minimum Network fee is based on blockchain load. The only costs therefore are those of the banks or the cryptocurrency networks.

As noted previously, BitMEX only accepts deposits in Bitcoin and therefore Bitcoin serves as collateral on trading contracts, regardless of whether or not the trade involves Bitcoin.

The minimum deposit is 0.001 BTC. There are no limits on withdrawals, but withdrawals can also be in Bitcoin only. To make a withdrawal, all that users need to do is insert the amount to withdraw and the wallet address to complete the transfer.

Deposits can be made 24/7 but withdrawals are processed by hand at a recurring time once per day. The hand processed withdrawals are intended to increase the security levels of users’ funds by providing extra time (and email notice) to cancel any fraudulent withdrawal requests, as well as bypassing the use of automated systems & hot wallets which may be more prone to compromise.

Supported Currencies

BitMEX operates as a crypto to crypto exchange and makes use of a Bitcoin-in/Bitcoin-out structure. Therefore, platform users are currently unable to use fiat currencies for any payments or transfers, however, a plus side of this is that there are no limits for trading and the exchange incorporates trading pairs linked to the US Dollar (XBT), Japanese Yen (XBJ), and Chinese Yuan (XBC).

BitMEX supports the following cryptocurrencies:

Bitcoin (XBT)

Bitcoin Cash (BCH)

Ethereum (ETH)

Ethereum Classic (ETC)

Litecoin (LTC)

Ripple Token (XRP)

Monero (XMR)

Dash (DASH)

Zcash (ZEC)

Cardano (ADA)

Tron (TRX)

EOS Token (EOS)

BitMEX also offers leverage options on the following coins:

5x: Zcash (ZEC)

20x : Ripple (XRP),Bitcoin Cash (BCH), Cardano (ADA), EOS Token (EOS), Tron (TRX)

25x: Monero (XMR)

33x: Litecoin (LTC)

50x: Ethereum (ETH)

100x: Bitcoin (XBT), Bitcoin / Yen (XBJ), Bitcoin / Yuan (XBC)

Trading Technologies International Partnership

HDR Global Trading, the company which owns BitMEX, has recently announced a partnership with Trading Technologies International, Inc. (TT), a leading international high-performance trading software provider.

The TT platform is designed specifically for professional traders, brokers, and market-access providers, and incorporates a wide variety of trading tools and analytical indicators that allow even the most advanced traders to customize the software to suit their unique trading styles. The TT platform also provides traders with global market access and trade execution through its privately managed infrastructure and the partnership will see BitMEX users gaining access to the trading tools on all BitMEX products, including the popular XBT/USD Perpetual Swap pairing.

The BitMEX Insurance Fund

The ability to trade on leverage is one of the exchange’s main selling points and offering leverage and providing the opportunity for traders to trade against each other may result in a situation where the winners do not receive all of their expected profits. As a result of the amounts of leverage involved, it’s possible that the losers may not have enough margin in their positions to pay the winners.

Traditional exchanges like the Chicago Mercantile Exchange (CME) offset this problem by utilizing multiple layers of protection and cryptocurrency trading platforms offering leverage cannot currently match the levels of protection provided to winning traders.

In addition, cryptocurrency exchanges offering leveraged trades propose a capped downside and unlimited upside on a highly volatile asset with the caveat being that on occasion, there may not be enough funds in the system to pay out the winners.

To help solve this problem, BitMEX has developed an insurance fund system, and when a trader has an open leveraged position, their position is forcefully closed or liquidated when their maintenance margin is too low.

Here, a trader’s profit and loss does not reflect the actual price their position was closed on the market, and with BitMEX when a trader is liquidated, their equity associated with the position drops down to zero.

In the following example, the trader has taken a 100x long position. In the event that the mark price of Bitcoin falls to $3,980 (by 0.5%), then the position gets liquidated with the 100 Bitcoin position needing to be sold on the market.

This means that it does not matter what price this trade executes at, namely if it’s $3,995 or $3,000, as from the view of the liquidated trader, regardless of the price, they lose all the equity they had in their position, and lose the entire one Bitcoin.

Assuming there is a fully liquid market, the bid/ask spread should be tighter than the maintenance margin. Here, liquidations manifest as contributions to the insurance fund (e.g. if the maintenance margin is 50bps, but the market is 1bp wide), and the insurance fund should rise by close to the same amount as the maintenance margin when a position is liquidated. In this scenario, as long as healthy liquid markets persist, the insurance fund should continue its steady growth.

The following graphs further illustrate the example, and in the first chart, market conditions are healthy with a narrow bid/ask spread (just $2) at the time of liquidation. Here, the closing trade occurs at a higher price than the bankruptcy price (the price where the margin balance is zero) and the insurance fund benefits.

Illustrative example of an insurance contribution – Long 100x with 1 BTC collateral

(Note: The above illustration is based on opening a 100x long position at $4,000 per BTC and 1 Bitcoin of collateral. The illustration is an oversimplification and ignores factors such as fees and other adjustments.

The bid and offer prices represent the state of the order book at the time of liquidation. The closing trade price is $3,978, representing $1 of slippage compared to the $3,979 bid price at the time of liquidation.)

The second chart shows a wide bid/ask spread at the time of liquidation, here, the closing trade takes place at a lower price than the bankruptcy price, and the insurance fund is used to make sure that winning traders receive their expected profits.

This works to stabilize the potential for returns as there is no guarantee that healthy market conditions can continue, especially during periods of heightened price volatility. During these periods, it’s actually possible that the insurance fund can be used up than it is built up.

Illustrative example of an insurance depletion – Long 100x with 1 BTC collateral

(Notes: The above illustration is based on opening a 100x long position at $4,000 per BTC and 1 Bitcoin of collateral. The illustration is an oversimplification and ignores factors such as fees and other adjustments.

The bid and offer prices represent the state of the order book at the time of liquidation. The closing trade price is $3,800, representing $20 of slippage compared to the $3,820 bid price at the time of liquidation.)

The exchange declared in February 2019, that the BitMEX insurance fund retained close to 21,000 Bitcoin (around $70 million based on Bitcoin spot prices at the time).

This figure represents just 0.007% of BitMEX’s notional annual trading volume, which has been quoted as being approximately $1 trillion. This is higher than the insurance funds as a proportion of trading volume of the CME, and therefore, winning traders on BitMEX are exposed to much larger risks than CME traders as:

BitMEX does not have clearing members with large balance sheets and traders are directly exposed to each other.

BitMEX does not demand payments from traders with negative account balances.

The underlying instruments on BitMEX are more volatile than the more traditional instruments available on CME.

Therefore, with the insurance fund remaining capitalized, the system effectively with participants who get liquidated paying for liquidations, or a losers pay for losers mechanism.

This system may appear controversial as first, though some may argue that there is a degree of uniformity to it. It’s also worth noting that the exchange also makes use of Auto Deleveraging which means that on occasion, leveraged positions in profit can still be reduced during certain time periods if a liquidated order cannot be executed in the market.

More adventurous traders should note that while the insurance fund holds 21,000 Bitcoin, worth approximately 0.1% of the total Bitcoin supply, BitMEX still doesn’t offer the same level of guarantees to winning traders that are provided by more traditional leveraged trading platforms.

Given the inherent volatility of the cryptocurrency market, there remains some possibility that the fund gets drained down to zero despite its current size. This may result in more successful traders lacking confidence in the platform and choosing to limit their exposure in the event of BitMEX being unable to compensate winning traders.

How suitable is BitMEX for Beginners?

BitMEX generates high Bitcoin trading levels, and also attracts good levels of volume across other crypto-to-crypto transfers. This helps to maintain a buzz around the exchange, and BitMEX also employs relatively low trading fees, and is available round the world (except to US inhabitants).

This helps to attract the attention of people new to the process of trading on leverage and when getting started on the platform there are 5 main navigation Tabs to get used to:

Trade:The trading dashboard of BitMEX. This tab allows you to select your preferred trading instrument, and choose leverage, as well as place and cancel orders. You can also see your position information and view key information in the contract details.

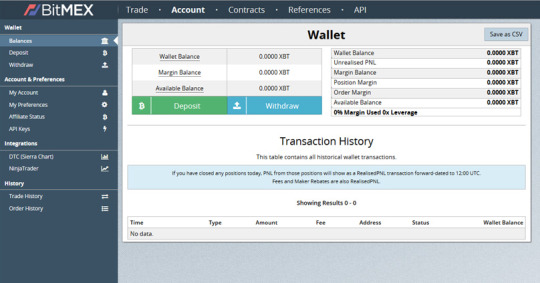

Account:Here, all your account information is displayed including available Bitcoin margin balances, deposits and withdrawals, and trade history.

Contracts:This tab covers further instrument information including funding history, contract sizes; leverage offered expiry, underlying reference Price Index data, and other key features.

References:This resource centre allows you to learn about futures, perpetual contracts, position marking, and liquidation.

API:From here you can set up an API connection with BitMEX, and utilize the REST API and WebSocket API.

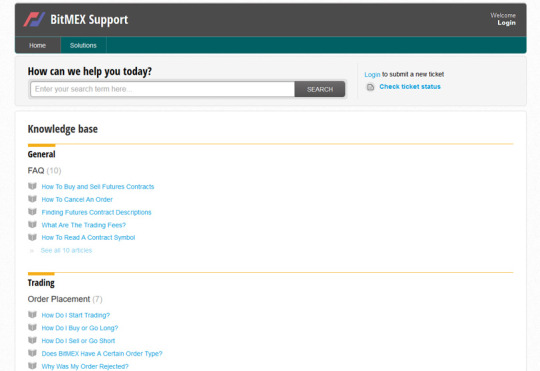

BitMEX also employs 24/7 customer support and the team can also be contacted on their Twitter and Reddit accounts.

In addition, BitMEX provides a variety of educational resources including an FAQ section, Futures guides, Perpetual Contracts guides, and further resources in the “References” account tab.

For users looking for more in depth analysis, the BitMEX blog produces high level descriptions of a number of subjects and has garnered a good reputation among the cryptocurrency community.

Most importantly, the exchange also maintains a testnet platform, built on top of testnet Bitcoin, which allows anyone to try out programs and strategies before moving on to the live exchange.

This is crucial as despite the wealth of resources available, BitMEX is not really suitable for beginners, and margin trading, futures contracts and swaps are best left to experienced, professional or institutional traders.

Margin trading and choosing to engage in leveraged activity are risky processes and even more advanced traders can describe the process as a high risk and high reward “game”. New entrants to the sector should spend a considerable amount of time learning about margin trading and testing out strategies before considering whether to open a live account.

Is BitMEX Safe?

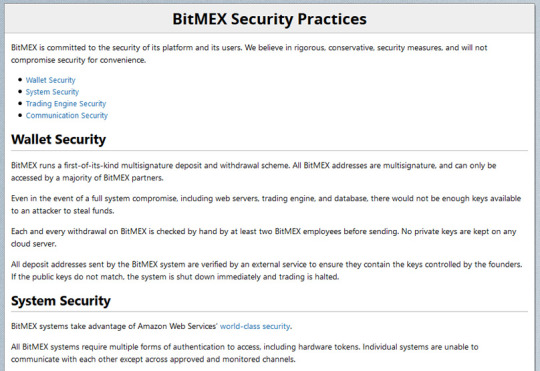

BitMEX is widely considered to have strong levels of security. The platform uses multi-signature deposits and withdrawal schemes which can only be used by BitMEX partners. BitMEX also utilises Amazon Web Services to protect the servers with text messages and two-factor authentication, as well as hardware tokens.

BitMEX also has a system for risk checks, which requires that the sum of all account holdings on the website must be zero. If it’s not, all trading is immediately halted. As noted previously, withdrawals are all individually hand-checked by employees, and private keys are never stored in the cloud. Deposit addresses are externally verified to make sure that they contain matching keys. If they do not, there is an immediate system shutdown.

In addition, the BitMEX trading platform is written in kdb+, a database and toolset popular amongst major banks in high frequency trading applications. The BitMEX engine appears to be faster and more reliable than some of its competitors, such as Poloniex and Bittrex.

They have email notifications, and PGP encryption is used for all communication.

The exchange hasn’t been hacked in the past.

How Secure is the platform?

As previously mentioned, BitMEX is considered to be a safe exchange and incorporates a number of security protocols that are becoming standard among the sector’s leading exchanges. In addition to making use of Amazon Web Services’ cloud security, all the exchange’s systems can only be accessed after passing through multiple forms of authentication, and individual systems are only able to communicate with each other across approved and monitored channels.

Communication is also further secured as the exchange provides optional PGP encryption for all automated emails, and users can insert their PGP public key into the form inside their accounts.

Once set up, BitMEX will encrypt and sign all the automated emails sent by you or to your account by the [email protected] email address. Users can also initiate secure conversations with the support team by using the email address and public key on the Technical Contact, and the team have made their automated system’s PGP key available for verification in their Security Section.

The platform’s trading engine is written in kdb+, a database and toolset used by leading financial institutions in high-frequency trading applications, and the speed and reliability of the engine is also used to perform a full risk check after every order placement, trade, settlement, deposit, and withdrawal.

All accounts in the system must consistently sum to zero, and if this does not happen then trading on the platform is immediately halted for all users.

With regards to wallet security, BitMEX makes use of a multisignature deposit and withdrawal scheme, and all exchange addresses are multisignature by default with all storage being kept offline. Private keys are not stored on any cloud servers and deep cold storage is used for the majority of funds.

Furthermore, all deposit addresses sent by the BitMEX system are verified by an external service that works to ensure that they contain the keys controlled by the founders, and in the event that the public keys differ, the system is immediately shut down and trading halted. The exchange’s security practices also see that every withdrawal is audited by hand by a minimum of two employees before being sent out.

BitMEX Customer Support

The trading platform has a 24/7 support on multiple channels, including email, ticket systems and social media. The typical response time from the customer support team is about one hour, and feedback on the customer support generally suggest that the customer service responses are helpful and are not restricted to automated responses.

The BitMEX also offers a knowledge base and FAQs which, although they are not necessarily always helpful, may assist and direct users towards the necessary channels to obtain assistance.

BitMEX also offers trading guides which can be accessed here

.

Conclusion

There would appear to be few complaints online about BitMEX, with most issues relating to technical matters or about the complexities of using the website. Older complaints also appeared to include issues relating to low liquidity, but this no longer appears to be an issue.

BitMEX is clearly not a platform that is not intended for the amateur investor. The interface is complex and therefore it can be very difficult for users to get used to the platform and to even navigate the website.

However, the platform does provide a wide range of tools and once users have experience of the platform they will appreciate the wide range of information that the platform provides.

Visit BitMEX

42 notes

·

View notes

Text

Bitcoin Tanks Under $7,000 After Rallying 100% From Bottom: What’s Next?

After days of consolidation after rallying 100% from the March bottom, Bitcoin tanked under $7,000 just minutes ago, reaching a local low of $6,920 as of the time of this article’s writing. With this downward move, the cryptocurrency is down 6% from Thursday’s peak and down nearly 8% from the highs at $7,470. Bitcoin’s drop comes after stocks have seen an extremely healthy week, with both the S&P 500 and the Dow Jones rallying hard as the coronavirus curve starts to flatten and despite record-level unemployment claims in the U.S. Related Reading: Crypto Tidbits: Bitcoin At $7,000, FATF Regulation, Coinbase Backs Ethereum DeFi The crypto market’s ongoing correction was somewhat to be expected. As reported by NewsBTC previously, the Tom Demark (TD) Sequential on Wednesday printing a sell “9” candle on the charts of Bitcoin, Ethereum, Ethereum Classic, Cardano, Binance Coin, Litecoin, Ontology, OmiseGo, Tron, Stellar, and Tezos. The so-called 9 candles, per the time-based indicator, are often seen at reversal points in markets. Case in point: 9 candles were seen at the $6,400 Bitcoin bottom in December 2019 and at the local $10,500 top in February of this very year. Furthermore, this outlet also observed that the Stochastic indicator, a trend/momentum-based indicator, recently printed a sign that Bitcoin was overbought. A top analyst observed that it has been accurate up to 86% for BTC. What’s Next for Bitcoin? Traders expect Bitcoin to breakdown further if it fails to maintain current levels. Tyler D. Coates, a technical analysis author and a popular Bitcoin trader, remarked that the recent price action has seen BTC “threaten to breakdown a bull trendline” that has held since March’s bottom. The breakdown, Coates wrote, could see the cryptocurrency return to the “mid $5ks.” Coates’ bearish sentiment was echoed by others, like a trader who suggested that Bitcoin’s recent price action is looking so much like the start of the 2018 bear market that it is “uncanny.” Despite the potentially harrowing short-term outlook, many remain optimistic about Bitcoin’s long-term prospects. In the latest edition of “Crypto Trader Digest,” Arthur Hayes of BitMEX remarked that while Bitcoin has the potential to retest $3,000 yet again if global markets roll over, his year-end price target “remains $20,000,” which is a 180% rally from the current price. As to why he thinks this is the case, he cited that the monetary and fiscal solutions that governments and central banks are enlisting to stave off precision: “Everyone knows the shift is upon us, that is why central bankers and politicians will throw all of their tools at this problem. And I will reiterate, that is inflationary because more fiat money will chase a flat to declining supply of real goods and labour. There are only two things to own during the transition to whatever the new system is and that is gold and bitcoin.” As of the time of this article’s writing, BTC is trading for $6,952 and seems poised to print the lowest one-hour candle since April 6th. Featured Image from Shutterstock from Cryptocracken WP https://ift.tt/2Vf8B4w via IFTTT

1 note

·

View note

Text

Bitcoin Tanks Under $7,000 After Rallying 100% From Bottom: What’s Next?

After days of consolidation after rallying 100% from the March bottom, Bitcoin tanked under $7,000 just minutes ago, reaching a local low of $6,920 as of the time of this article’s writing. With this downward move, the cryptocurrency is down 6% from Thursday’s peak and down nearly 8% from the highs at $7,470. Bitcoin’s drop comes after stocks have seen an extremely healthy week, with both the S&P 500 and the Dow Jones rallying hard as the coronavirus curve starts to flatten and despite record-level unemployment claims in the U.S. Related Reading: Crypto Tidbits: Bitcoin At $7,000, FATF Regulation, Coinbase Backs Ethereum DeFi The crypto market’s ongoing correction was somewhat to be expected. As reported by NewsBTC previously, the Tom Demark (TD) Sequential on Wednesday printing a sell “9” candle on the charts of Bitcoin, Ethereum, Ethereum Classic, Cardano, Binance Coin, Litecoin, Ontology, OmiseGo, Tron, Stellar, and Tezos. The so-called 9 candles, per the time-based indicator, are often seen at reversal points in markets. Case in point: 9 candles were seen at the $6,400 Bitcoin bottom in December 2019 and at the local $10,500 top in February of this very year. Furthermore, this outlet also observed that the Stochastic indicator, a trend/momentum-based indicator, recently printed a sign that Bitcoin was overbought. A top analyst observed that it has been accurate up to 86% for BTC. What’s Next for Bitcoin? Traders expect Bitcoin to breakdown further if it fails to maintain current levels. Tyler D. Coates, a technical analysis author and a popular Bitcoin trader, remarked that the recent price action has seen BTC “threaten to breakdown a bull trendline” that has held since March’s bottom. The breakdown, Coates wrote, could see the cryptocurrency return to the “mid $5ks.” Coates’ bearish sentiment was echoed by others, like a trader who suggested that Bitcoin’s recent price action is looking so much like the start of the 2018 bear market that it is “uncanny.” Despite the potentially harrowing short-term outlook, many remain optimistic about Bitcoin’s long-term prospects. In the latest edition of “Crypto Trader Digest,” Arthur Hayes of BitMEX remarked that while Bitcoin has the potential to retest $3,000 yet again if global markets roll over, his year-end price target “remains $20,000,” which is a 180% rally from the current price. As to why he thinks this is the case, he cited that the monetary and fiscal solutions that governments and central banks are enlisting to stave off precision: “Everyone knows the shift is upon us, that is why central bankers and politicians will throw all of their tools at this problem. And I will reiterate, that is inflationary because more fiat money will chase a flat to declining supply of real goods and labour. There are only two things to own during the transition to whatever the new system is and that is gold and bitcoin.” As of the time of this article’s writing, BTC is trading for $6,952 and seems poised to print the lowest one-hour candle since April 6th. Featured Image from Shutterstock from CryptoCracken SMFeed https://ift.tt/2Vf8B4w via IFTTT

1 note

·

View note

Photo

You can trade Bitcoin (XBT) on BitMEX through a new, innovative type of contract called a Perpetual Contract which is aimed at replicating the underlying spot market but with enhanced leverage. This product does not have an expiry date and is able to closely track the underlying reference Price Index through various mechanisms, the main of which is known as the Funding Rate. To view the current rates and calculations to determine the current Funding, please see the Funding Calculations in the XBTUSD Contract Specifications and more generally in the Perpetual Contracts Guide. The product suits traders who prefer to hold positions for a long time and do not want their positions to fluctuate in value due to large swings in basis. How is the XBTUSD Perpetual Contract Quoted? Margin and Leverage Price Index Marking and Settlement How is the XBTUSD Perpetual Contract Quoted? The XBTUSD contract’s underlying price is the BitMEX Index. It is an equally weighted index using the Bitstamp, Kraken, and GDAX USD XBT/USD prices. Both the underlying and the swap contract are quoted in USD. Margin and PNL are denominated in Bitcoin. Contract Calculations Multiplier 1 USD XBT Contract Value Multiplier / XBTUSD Price USD Contract Value 1 USD PnL Calculation # Contracts * Multiplier * (1/Entry Price - 1/Exit Price) Traders who want to profit from an increase in the Bitcoin / USD price, will buy the XBTUSD contract. Conversely, if they believe the price will go down they will sell the contract. Margin and Leverage All margin is posted in Bitcoin, which means traders can go long or short this contract using only Bitcoin. The XBTUSD contract features a high leverage of up to 100x. For example, to buy 100 Bitcoin worth of contracts, you will only require 1 Bitcoin of Initial Margin. Price Index The BitMEX .BXBT Index is currently being used for the XBTUSD Perpetual Contract and XBT Futures Contracts. The constituents are as below: Exchange Weight Bitstamp 50% GDAX 50% At this time, weightings are equal weighted. In the future, we may adjust this index. Any adjustments will be made with ample notification. Marking and Settlement As the XBTUSD contract is perpetual, there is no settlement. Marking for Unrealised PNL and Liquidation purposes are done according to the Fair Price Marking system. Note also: since this product is a perpetual contract, funding occurs every 8 hours. Please see the Funding Section in the Perpetual Contracts Guide for information, and for the current rates please see Funding Calculation in the XBTUSD Contract Specifications. XBTUSD Trade Example A trader goes long 100 XBT of XBTUSD at a price of 600 USD. He is long 100 XBT * 600 USD = 60,000 contracts. A few days later the price of the contract increases to 700 USD. The trader’s profit will be: 60,000 * 1 * (1/600 - 1/700) = 14.286 XBT If the price had in fact dropped to 500 USD, the trader’s loss would have been: 60,000 * 1 * (1/600 - 1/500) = -20 XBT. The loss is greater because of the inverse and non-linear nature of the contract. Conversely, if the trader was short then the trader’s profit would be greater if the price moved down than the loss if it moved up.

#bitmex#bitmex app#bitmex api#bitmex tezos#bitmex testnet#bitmex margin chart#bitmex android app#bitmex com login#bitmex login#bitmex wiki#bitmex ticker#bitmex register#bitmex xbtusd#bitmex ethusd#bitmex anti#start trading now#leverage trading#p2p trading#exx#coinbene#coinbit#oex#bibox#okex#binance#huobi#bitforex#idax#upbit#bithumb

2 notes

·

View notes

Text

Cardano (ADA) and Other Cryptocurrencies Now Available on BitMEX Exchange

Cardano (ADA) and Other Cryptocurrencies Now Available on BitMEX Exchange

Alex Dovbnya Cardano (ADA) is among the cryptocurrencies that were recently listed on the BitMEX exchange The BitMEX cryptocurrency exchange has announced that it now supports Cardano (ADA), Polkadot (DOT), and Tezos (XTZ). Users will be able to deposit and withdraw the aforementioned cryptocurrencies via their BitMEX wallet on top of Shiba Inu (SHIB), Chainlink (LINK), Tron (TRX), Solana…

View On WordPress

0 notes

Text

BitMEX to Launch EOS, LINK, XTZ, and ADA ‘Quanto’ Futures Contracts Soon

BitMEX to Launch EOS, LINK, XTZ, and ADA ‘Quanto’ Futures Contracts Soon

The popular Bitcoin and cryptocurrency derivatives exchange BitMEX announced the launch of ‘quanto futures’ for four crypto coins – EOS (EOS), Chainlink (LINK), Tezos (XTZ), and Cardano (ADA). This comes after BitMEX’s recent move that requires users to sign up for a mandatory ID verification procedure’.

BitMEX To Launch Quanto Futures Trading For LINK, XTZ, EOS, ADA

In an early morning blog anno…

View On WordPress

#AA News#ADABTC#adausd#Altcoins#BitMEX#cardano#chainlink#crypto news#cryptopotato#eos#EOSBTC#eosusd#LINKBTC#LINKUSD#tcr#TCRNews#Tezos#thecryptoreport#XTZBTC#XTZUSD

0 notes

Text

Cardano (ADA) and Other Cryptocurrencies Now Available on BitMEX Exchange

Cardano (ADA) and Other Cryptocurrencies Now Available on BitMEX Exchange

Alex Dovbnya Cardano (ADA) is among the cryptocurrencies that were recently listed on the BitMEX exchange The BitMEX cryptocurrency exchange has announced that it now supports Cardano (ADA), Polkadot (DOT), and Tezos (XTZ). Users will be able to deposit and withdraw the aforementioned cryptocurrencies via their BitMEX wallet on top of Shiba Inu (SHIB), Chainlink (LINK), Tron (TRX), Solana…

View On WordPress

0 notes

Text

Cardano (ADA) and Other Cryptocurrencies Now Available on BitMEX Exchange

Cardano (ADA) and Other Cryptocurrencies Now Available on BitMEX Exchange

Alex Dovbnya Cardano (ADA) is among the cryptocurrencies recently listed on the BitMEX exchange The BitMEX The cryptocurrency exchange has announced that it now supports Cardano (ADA), Polkadot (DOT) and Tezos (XTZ). Users will be able to deposit and withdraw the aforementioned cryptocurrencies via their BitMEX wallet in addition to Shiba Inu (SHIB), Chainlink (LINK), Tron (TRX), Solana (SOL),…

View On WordPress

0 notes

Photo

XRP 10,35% w górę, na rynku byka

sprzedaż bitkoinów, bitseven, wymiana monet, bitcoin, żeton, moneta, Krypto, wymiana bitcoinów

bitfinex, bitmex, bittrex, bithumb, bitonbay, cena bitcoin, bitcointalk, wykres bitcoina

Kurs XRP osiagnął poziom 0,51837$, o godzinie 06:08 (05:08 GMT), jak wykazuje Investing.com Index. Tym samym cena XRP wzrosła w trakcie dnia o 10,35%.

W związku ze wzrostem kursu XRP, zwiększyła się również kapitalizacja rynkowa kryptowaluty, osiągając poziom $20,58330B i notując wzrost o 9,62%.

Najwyższa kapitalizacja rynkowa XRP wciąż wynosi $79,53400B.

W ciagu ostatnich 24 godzin, cena kryptowaluty wahała się w przedziale od $0,50118 do $0,51838. Natomiast w ciągu ostatnich 7 dni XRP odnotowało zmianę wartości. Kurs monety zyskał 15,24% wartości.

W ciągu ostatnich 24 godzin, wolumen obrotu kryptowalutą wyniósł $728,04685M, czyli 5,50% całkowitego wolumentu obrotów na wszystkich kryptowalutach. W ciagu ostatnich 7 dni wolumen obrotu XRP wahał się w przedziale od $0,4382 do $0,5184.

Ze swoją obecna ceną, XRP wciąż znajduje się 84,24% od swojego historycznego maksimum, zanotowanego na poziomie $3,29 , osiagniętego w dniu: 4 Styczeń.

Notowania innych kryptowalut

Kurs kryptowaluty Bitcoin znajduje się na poziomie $6.452,7, jak wykazuje Investing.com Index, odnotowując tym samym spadek o 0,21%.

Kurs kryptowaluty Ethereum znajduje się na poziomie $209,97, jak wykazuje Investing.com Index, czyli notuje wzrost o 0,54%.

Kapitalizacja rynkowa kryptomonety Bitcoin wynosi $111,73739B, czyli 52,21% całkowitej kapitalizacji rynkowej kryptowalut, podczas gdy kapitalizacja rynkowa kryptomonety Ethereum wynosi $21,52419B, czyli 10,06% całkowitej kapitalizacji rynkowej kryptowalut.

sprzedaż bitkoinów, bitseven, wymiana monet, bitcoin, żeton, moneta, Krypto, wymiana bitcoinów

bitfinex, bitmex, bittrex, bithumb, bitonbay, cena bitcoin, bitcointalk, wykres bitcoina, bitcoin cash, bitcoin wiadomości, Bitconnect, bitcoin do dolara

CoinDesk, Coinbase, Ethereum, Ripple, Bitcoin Cash, EOS, Stellar Lumens, Litecoin, Cardano, IOTA, Tether, TRON, Monero, NEO, Dash, Alpari,

Ethereum Classic, NEM, VeChain, Binance Coin, Tezos, Omisego, Zcash, Qtum, 0x, Zilliqa, Bytecoin, Lisk, BitShares, Decred, Bitcoin Gold,

ICON, kryptowaluty, btc usd, eth usd, bch usd, btc, eth, xrp, bch, eos, xlm, ltc, usdt, trx, xmr, MIOTA, ada, trx, xmr, neo, dash, etc

https://www.bitseven.com/pl

Transakcje lewarowane Bitcoin, dźwignia max 100x, 100% zysku, jeśli cena wzrośnie o 1%

Zarabiaj niezależnie od tego, czy cena Bitcoina rośnie czy spada

TRANSAKCJE LEWAROWANE BITCOIN, KTÓRYM MOŻESZ ZAUFAĆ

sprzedaż bitkoinów, bitseven, wymiana monet, bitcoin, żeton, moneta, Krypto, wymiana bitcoinów

bitfinex, bitmex, bittrex, bithumb, bitonbay, cena bitcoin, bitcointalk, wykres bitcoina, bitcoin cash, bitcoin wiadomości, Bitconnect, bitcoin do dolara

CoinDesk, Coinbase, Ethereum, Ripple, Bitcoin Cash, EOS, Stellar Lumens, Litecoin, Cardano, IOTA, Tether, TRON, Monero, NEO, Dash, Alpari,

Ethereum Classic, NEM, VeChain, Binance Coin, Tezos, Omisego, Zcash, Qtum, 0x, Zilliqa, Bytecoin, Lisk, BitShares, Decred, Bitcoin Gold,

ICON, kryptowaluty, btc usd, eth usd, bch usd, btc, eth, xrp, bch, eos, xlm, ltc, usdt, trx, xmr, MIOTA, ada, trx, xmr, neo, dash, etc

1 note

·

View note

Text

giới crypto chỉ còn 2 con đường làm hoặc cò

COINS

ICOS

MINING

CRYPTOCURRENCIES

TOP 100

CRYPTONOMICS

TOKEN

Search for

Sidebar

Breaking News

Top news – ZyCov-D

Home

/

COINS

/ Crypto NewsCrypto News

Update the latest news of the cryptocurrency market.

Top news – Tezos price

15 hours ago

Top news – Tezos price

Top news – Kraken exchange

15 hours ago

Top news – Kraken exchange

Top news – Jack Ma

15 hours ago

Top news – Jack Ma

Top news – Warren Buffett

15 hours ago

Top news – Warren Buffett

Top news – Stable coin

15 hours ago

Top news – Stable coin

Top news – DeFi crypto

15 hours ago

Top news – DeFi crypto

Top news – Zcash

16 hours ago

Top news – Zcash

Top news – eToro

16 hours ago

Top news – eToro

Top news – Cryptocurrency

16 hours ago

Top news – Cryptocurrency

Top news – Success story

16 hours ago

Top news – Success story

Top news – BitMEX

16 hours ago

Top news – BitMEX

Top news – DAO crypto

16 hours ago

Top news – DAO crypto

Top news – Blockchain

16 hours ago

Top news – Blockchain

Top news – TRON Coin

16 hours ago

Top news – TRON Coin

Top news – OkEx

16 hours ago

Top news – OkEx

Top news – Coinbase

16 hours ago

Top news – Coinbase

Top news – Chainlink

16 hours ago

Top news – Chainlink

Top news – Stellar coin

16 hours ago

Top news – Stellar coin

Top news – IQoption

16 hours ago

Top news – IQoption

Top news – KuCoin

16 hours ago

Top news – KuCoin

«

first

2

3

»

ten

20

...

Last

Back to top button

Sitemap

English

0 notes

Text

What is Koinly

About Koinly

Cryptocurrency is quickly becoming a popular medium of undertaking transactions. This is due to several factors. The first being that cryptocurrency transactions are untraceable and completely anonymous. Another advantage is that it is simple and easy to complete crypto transactions. There are also multiple cryptocurrencies to select from, depending upon your preferences.

As with all monetary transactions, cryptocurrency transactions also come within the purview of taxation. The law requires you to pay taxes on the cryptocurrency earnings you have. This is where Koinly enters the sphere. Koinly is a business that aims to help cryptocurrency owners complete their taxation formalities easily and conveniently. It calculates your cryptocurrency taxes and helps you reduce them for the next year. It is a simple and reliable tool that works flawlessly. The tool is available in more than 20 countries and comes with several unique features.

Koinly is the perfect software for taxpayers looking to get an accurate crypto tax report. It is also suitable for businesses looking to track their inventory or accountants wishing to simplify their work. When you purchase Koinly, use the Koinly Promo Code and get fantastic discounts on your order.

Advantages of Koinly

Koinly is one of the best cryptocurrency management and tax calculation utilities that are available in the market. It will help you save time on downloading CSV files, formatting data, figuring out market prices, tax calculations, etc. Koinly also works with 350 exchanges and 11 services.

Koinly will help you import your ETH, BTC, Tezos and other transactions directly from the ledger, sync all your exchange trading history in a single click and get a ready-to-file tax report. You will be able to import all your trading transactions easily and simply. It enables you to add your exchange accounts via API or CSV files and connect your blockchain wallets using public addresses.

The utility supports DeFi, Margin trades, and Futures as well. It works with all the most popular platforms including Kraken, Nexo, BitMEX, etc. Koinly also supports Smart Transfer Matching and uses AI to detect transfers between your wallets. Additionally, you will also be able to keep track of your original cost. The software supports more than 300 cryptocurrency exchanges and wallets.

Another great feature is that you will be able to preview your capital gains. You will be able to get a glimpse of your profit/loss for any tax year, that too for free. It helps you track your portfolio, see your total holdings, Returns on Investments, and growth over time. You will also be able to view your profit/loss and capital gains as well as realized and unrealized capital gains.

Koinly will help you generate the right crypto tax reports for you, whether you file taxes manually or use software. For users in the USA, the utility can generate filled-in IRS tax forms. It will also generate comprehensive tax reports as well as a crypto tax report with your long/short term disposals. You will also be able to grab awesome offers by applying the Koinly Coupon Code on your purchase.

Conclusion

Koinly is the perfect utility to help you track your crypto assets and taxes. You will be able to view your total holdings and portfolio growth over time. It works perfectly with all your wallets and accounts. You will be able to view your actual ROI as well as invested fiat. It will help you see how much you have invested in your coins. You will easily be able to find and fix issues with your transactions. You will also be able to start for free and the pricing plans are very flexible and affordable. Using the Koinly Discount Code will ensure you get the greatest rewards as well.

The software provides an income overview as well as an overview of your mining, staking, lending, and other crypto income. Profit/Loss, as well as capital gains, are easily viewable and manageable. You will no longer need to shuffle forth and back between different accounts and wallets. Easily sync your data to Koinly and get a complete picture of all your trading activity. It has automated data import, works with over 17,000 cryptocurrencies, and 50 blockchains. The best part is that you get spectacular savings by using the Koinly Voucher Code on your purchase.

0 notes