#bill appelbaum

Photo

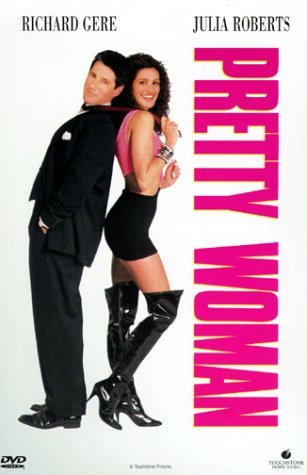

Movies I’ve Watched in 2022

Number 37

Pretty Woman

#movies2022#pretty woman#julia roberts#richard gere#garry mashall#ralph bellamy#jason alexander#laura san giacomo#alex hyde-white#amy yasbeck#elinor donahue#hector elizondo#judith baldwin#jason randal#bill appelbaum#tracy bjork#gary greene#billy gallo#hank azaria

2 notes

·

View notes

Text

A weapon of mass financial destruction

Some things are hard to understand because they're complicated.

Some things are complicated so they'll be hard to understand.

The harder you look at the finance industry, the more evident it becomes that the complexity is deliberate, a means of baffling with bullshit.

Private equity is one of those baffling and mysterious phenomena that only gets worse with scrutiny: how is it possible that a handful of companies are able to borrow vast sums to buy up and then destroy successful businesses? Can that really be their business-model?

Yup.

"Private Equity at Work," Eileen Appelbaum and Rosemary Batt's 2014 analysis of the social consequences of private equity takeovers. It identifies many destructive PE practices, but singles out one as especially deadly: "club deals."

https://www.russellsage.org/publications/private-equity-work

In a club deal, "two or more PE funds join together to acquire a huge enterprise, and share ownership." The presence of multiple marquee names on the deal (like the Toys R Us acquisition, with Bain, KKR, and Vornado in a single "club") puts billions on tap from lenders.

Club deals' easy access to credit made them hugely popular, constituting 40% of leveraged buyouts in 2004. But the uncritical fortunes showered on club LBOs emboldened a series of increasingly destructive grifts that caused club deals collapse in popularity.

The "save businesses, fuck workers" Trump stimulus sent trillions of Fed dollars sloshing into the finance world, fuelling multiple asset bubbles, from cryptos to single-family dwellings - even a violent trading-card frenzy.

https://www.nytimes.com/2021/05/14/business/pokemon-cards-target.html

To that list, we can now add Club Deals 2.0, with billions being marshalled by PE alliances who are bidding against one another to acquire Medline America's largest manufacturer/distributor of medical supplies, serving hospitals and doctor's offices.

https://www.bloomberg.com/news/articles/2021-05-06/top-buyout-firms-said-to-club-up-for-jumbo-lbo-of-medline

As Appelbaum writes for The American Prospect, this is cause for alarm. To the PE clubs, Medline is an asset, used to secure debt financing that can be handed out to fund managers and investors. To the rest of us, Medline is a matter of life or death.

https://prospect.org/economy/private-equity-club-deal-coming-to-a-pension-fund-near-you/

To remind us of the awesome destructive power of PE club deals, Appelbaum provides us with a rundown of their terrifying history:

The 2006 $5.4b Tishman Speyer/Blackrock deal to buy Stuyvesant/Cooper Village in order to undo its rent-control status, evict its tenants, and go condo. Tenants organized, and the fund went bankrupt in 2010, dodging the $200m it owed tenants for illegal rent overcharges. Though the fund managers made out fine on that deal, its investment partners weren't so lucky: "the Church of England, the government of Singapore, and three public-employee pension funds in Florida and California, lost a total of $850 million."

The 2007 $48b KKR/TPG/Goldman Sachs buyout of Texas energy giant TXU (AKA Energy Future Holdings). Bankrupt by 2012. PE extracted $538m from the deal, and millions more in "fees" to oversee the company's implosion. Investors lost 95 cents for every dollar they put in.

The 2004 Cerberus/Sun/Lubert-Adler/Klaff buyout of Mervyn's department stores: asset stripped, bankrupt by 2008, liquidated, destroying thousands of jobs and stiffing suppliers, kicking off a wave of knock-on bankruptcies.

The 2006 $30.7b Apollo/TPG buyout of Harrah's (now Caesar's): eliminated much of the 30,000 unionized employee workforce and cut the IPO offering from $17/share to $9 in 2010. Investors lost 40% of their cash.

The 2000 Caxton-Iseman/Sentinel acquisition of Buffets Holdings (Ryan's, Hometown Buffet, Old Country Buffet, Tahoe Joe's, etc). Bankrupt by 2008 after the PE extracted more than $250m. Thousands of jobs gone, forever.

PE firms claim that they are Good at Business in ways that the people who run profitable companies that employ people in good jobs that do things other people value simply are not.

With leveraged buyouts, PE firms borrow billions by putting up the companies they're targeting as collateral (like nonconsensually buying someone else's house by taking out a mortgage that puts their house up as security!).

Credulous lenders - your pension fund, your government, even your church - put up the money, accepting deals in which the key assets of the business are immediately liquidated to pay huge management and special dividend fees to the PE company.

PE rakes in hundreds of millions - even billions - and saddles the company with vast debts whose interest payments drain its profits. Meanwhile, the company is forced to lease back the capital assets the PE company sold off, exposing it to rent shocks and price hikes.

While the PE barons who devised this Excellent Business Strategy charge the company millions more in "management and consulting fees" in exchange for yet more of this species of commercial wisdom.

It's a (terrifying) sign of just how stupid big money has become that club deals are back. A leveraged buyout of Medline puts the whole medical system in jeopardy (raising a question: why didn't antitrust regulators prevent Medline from becoming a single point of failure?).

There is no credible case for PE making Medline a better company. As Appelbaum writes, "it's a highly successful company with no low-hanging fruit in the form of operational, marketing, or business strategy improvements requiring PE’s secret sauce."

Sticking Medline with $10b in leveraged buyout debts and saddling it with millions in payments for "management and consulting" will necessitate massive junk-bond raises and a spiral towards inevitable bankruptcy.

As Appelbaum writes, that doesn't mean that the funds bidding for the company (Advent/Bain/CVC, KKR/Clayton, Blackstone/Hellman) won't make out like (literal) bandits on the deal.

For decades, we've been sold the narrative that wealth is the reward for brilliance, in a concerted effort to overturn Balzac's maxim that "behind every great fortune there is a crime."

We've been told that we're not qualified to comment on finance matters because we don't understand its complexities, the underlying, unquestionable axioms that make it somehow necessary and valorous to destroy productive businesses in the name of capitalism.

We've been told that economic malaise is the result of workers demanding a living wage (especially through unions) and "burdensome regulations" that put the incomprehensible genius of billionaire saviors in shackles, to the detriment of us all.

Reality has finally come for that self-serving myth. At a time in which American union membership is at historic lows, support for unions is at historic highs, and our trust in big business has plummeted:

https://www.theguardian.com/commentisfree/2021/may/13/americans-are-more-pro-union-and-anti-big-business-than-at-any-time-in-decades

Starting in 2012, and for first time in half-century the history of the American National Election Studies, public sentiment moved for unions and against business (historically, trust for unions and business rise and fall together).

The latest ANES data shows the most intense divergence ever, with all age groups and political groups hold "record or near-record positive views favoring labor over big business." Republican support of unions, which has grown since 2012, is at an all-time high.

The PRO Act, a landmark pro-union bill, is currently before the Congress, with strong support from the Biden administration. It presents the possibility that public sentiment will turn into public policy, making lasting change to our politics:

https://pluralistic.net/2021/05/07/pro-act-class-war/#sectoral-balances

Billionaires have always been sterling exemplars of class solidarity. Even when their private equity funds result in wealthy investors losing hundreds of millions of dollars, they stick together and argue for preferential treatment for capital gains and finance deregulation.

Today, we see serious signs of class solidarity among the rest of us, the first in many decades. All it took was decades of hugely destructive financial engineering, a nation brought to the brink of collapse, and a planet on fire, all in the name of "efficiency."

58 notes

·

View notes

Link

The Senate voted 47-47 on a $1.8 trillion bill to shore up the economy during the COVID-19 coronavirus epidemic, far short of the 60 votes needed to advance the legislation. Senate Majority Leader Mitch McConnell (R-Ky.), who wrote the bill Saturday night, vowed Sunday night to bring it up for a vote again at 9:45 Monday morning, repeatedly daring Democrats to vote against it again as the stock market plummets further. Senate Minority Leader Chuck Schumer (D-N.Y.) said no. Negotiations continued overnight.

Republicans are "throwing caution to the wind for average workers and people on Main Street and going balls to the wall for people on Wall Street," Sen. Joe Manchin (D-W.Va.) said Sunday. Schumer laid out most of the Democratic concerns about the legislation, which The Washington Post calls "by far the largest financial rescue ever attempted by Congress," earning a three-word response from Sen. John Cornyn (R-Texas).> Blah blah blah https://t.co/zkJ1fsKMGc> > — Senator John Cornyn (@JohnCornyn) March 23, 2020But Democrats weren't the only ones concerned that the legislation gives too much to large corporations while demanding too little in return. "Any relief for big corporations must limit executive compensation, ban stock buybacks, and require companies to pay back loans w/ interest. Or I'm not voting for it," Sen. Josh Hawley (R-Mo.) tweeted. Democrats voiced special concern about the $500 billion available to large companies with little oversight, including $425 million to be doled out at the discretion of Treasury Secretary Steven Mnuchin, the recipients able to shield their identities for six months."We're not here to create a slush fund for Donald Trump and his family, or a slush fund for the Treasury Department to be able to hand out to their friends," Sen. Elizabeth Warren (D-Mass.) said Sunday. Democrats also want the funds contingent on companies retaining 90 percent of their workers, not just "to the extent practicable," as McConnell's legislation allows. New York Times economic columnist Binyamin Appelbaum found that point the most baffling.> The stock market is going to crash tomorrow morning and it's important to understand that the problem isn't the failure of this GOP bill.> > The problem is that the GOP failed to propose a bill that protects American workers from economic catastrophe.> > — Binyamin Appelbaum (@BCAppelbaum) March 23, 2020House Speaker Nancy Pelosi (D-Calif.) said "we're so far apart," the House will "be introducing our own bill and hopefully it will be compatible" with the Senate deal.

More stories from theweek.com Sen. Kyrsten Sinema calls Rand Paul's behavior prior to receiving coronavirus results 'irresponsible' Utah Sens. Romney, Lee self-quarantine after Rand Paul says he has coronavirus How bad will the coronavirus crash get?

VISIT WEBSITE

5 notes

·

View notes

Text

CEPR: U.S. Legislative and Economic Responses to COVID-19

What’s in Federal Legislation and What’s Not, but Still Needed:

This document is based on the two COVID-19 bills enacted by Congress to date—the Coronavirus Preparedness and Response Supplemental Appropriations Act(C1) and Families First Coronavirus Response Act (C2)—and our best understanding of the compromise bill passed by the Senate (C3). We will continue to refine and update this document as more information becomes available.

Legislation covered includes: Paid Family and Medical Leave; Paid Sick Time Leave; Unemployment Insurance; Additional Income Supplement; Housing; Health Care Capacity; Access to Testing, Treatment, and Prevention; Childcare; Worker Protection and Support; business Provisions; business Aid; Small Business and Nonprofits.

Centre for Economic Policy and Research, March 26, 2020: The U.S. Response to COVID-19: What’s in Federal Legislation and What’s Not, but Still Needed, by Shawn Fremstad and Eileen Appelbaum (6 pages, PDF)

Economics in the Time of COVID-19

“Joining the OECD’s dire growth forecast of 2 March 2020, the European Commission said on 4 March 2020 that both Italy and France are at risk of slipping into recession, and the IMF said it sees “more dire” possibilities ahead for the global economy. This book is an extraordinary effort for extraordinary times. On Thursday 27 February, we emailed a group of leading economists to see if they’d contribute to the effort. The authors responded and the eBook came together literally over the weekend (the deadline for contributions was Monday 2 March 2020).”

“The eBook is a testimony to the power of collaboration in a network that has the size, speed, flexibility, and talent of CEPR. The key economic questions addressed in the book are: How, and how far and fast, will the economic damage spread? How bad will it get? How long will the damage last? What are the mechanisms of economic contagion? And, above all, what can governments do about it?”

CEPR Press VoxEU.org eBook, March 6, 2020: Economics in the Time of COVID-19, edited by Richard Baldwin and Beatrice Weder di MauroA (123 pages, PDF)

The Power of the State Globally

“Big government is needed to fight the pandemic. What matters is how it shrinks back again afterward”

“In just a few weeks a virus a ten-thousandth of a millimetre in diameter has transformed Western democracies. States have shut down businesses and sealed people indoors. They have promised trillions of dollars to keep the economy on life support. If South Korea and Singapore are a guide, medical and electronic privacy are about to be cast aside. It is the most dramatic extension of state power since the second world war.”

The Economist, March 26, 2020: “The state in the time of covid-19″

2 notes

·

View notes

Text

Private Equity: The Perps Behind Destructive Hospital Surprise Billing

Digital Elixir

Private Equity: The Perps Behind Destructive Hospital Surprise Billing

I have to confess to having missed how private equity is a central bad actor in the “surprise billing” scam that is being targeted by Federal and state legislation. This abuse takes place when hospital patients, even when using a hospital that is in their insurer’s network, are hit with charges for “out of network” services that are billed at inflated rack rates. Even patients who have done everything they can to avoid being snared, like insisting their hospital use only in-network doctors for a surgery and even getting their identities in advance to assure compliance, get caught. The hospital is in charge of scheduling and can and will swap in out-of-network practitioners at the last minute.

Private equity maven and co-director of the Center for Economic and Policy Research Eileen Appelbaum explained in an editorial in The Hill in May how private equity firms have bought specialist physicians’ practices to exploit the opportunity to hit vulnerable patients with egregious charges:

Physicians’ groups, it turns out, can opt out of a contract with insurers even if the hospital has such a contract. The doctors are then free to charge patients, who desperately need care, however much they want.

This has made physicians’ practices in specialties such as emergency care, neonatal intensive care and anesthesiology attractive takeover targets for private equity firms….

Emergency rooms, neonatal intensive care units and anesthesiologists’ practices do not operate like an ordinary marketplace. Physicians’ practices in these specialties do not need to worry that they will lose patients because their prices are too high.

Patients can go to a hospital in their network, but if they have an emergency, have a baby in the neonatal intensive care unit or have surgery scheduled with an in-network surgeon, they are stuck with the out-of-network doctors the hospital has outsourced these services to….

It’s not only patients that are victimized by unscrupulous physicians’ groups. These doctors’ groups are able to coerce health insurance companies into agreeing to pay them very high fees in order to have them in their networks.

They do this by threatening to charge high out-of-network bills to the insurers’ covered patients if they don’t go along with these demands. High payments to these unethical doctors raise hospitals’ costs and everyone’s insurance premiums.

As an example, Appelbaum cites the work of Yale economists who examined what happened when hospitals outsourced their emergency room staffing to the two biggest players, EmCare, which has been traded among several private equity firms and is now owned by KKR and TeamHealth, held by Blackstone:

….after EmCare took over the management of emergency services at hospitals with previously low out-of-network rates, they raised out-of-network rates by over 81 percentage points. In addition, the firm raised its charges by 96 percent relative to the charges billed by the physician groups they succeeded.

The study also described how TeamHealth extorted insurers by threatening them with high out-of-network charges for “must have” services:

…in most instances, several months after going out-of-network, TeamHealth physicians rejoined the network and received in-network payment rates that were 68 percent higher than previous in-network rates.

We’d wondered why California legislation to combat surprise billing got yanked so quickly, with the opponents not even bothering to offer excuses. The official story was that hospitals objected, but the speed of the climbdown looks to have much more to do with the political clout of private equity donors.

The Financial Times yesterday made explicit how proposed Federal legislation would hit KKR’s EmCare and other private equity health care predators:

A push on Capitol Hill to stop US patients from being caught unaware by medical bills is weighing on the debt of KKR-backed Envision Healthcare, the target of one of the biggest leveraged buyouts last year…

Investors are concerned that a new so-called “surprise billing” law could crimp revenues at companies such as Envision, which employs emergency-room doctors and anaesthetists through its subsidiary EmCare….

“It is like a ransom negotiation: ‘I’ll hit your enrollees with giant bills unless you pay me enough money not to do that’,” said Loren Adler, associate director at USC-Brookings Schaeffer Initiative for Health Policy.

The debt that has gone wobbly. Recall that so-called credit funds, also managed by private equity firms, are big buyers of the leveraged loans that private equity firms use to finance their acquisitions. And public pension funds like CalPERS invest in these credit funds:

Envision’s $5.4bn loan due in 2025, sold in September when investor demand for leveraged loans was very strong, slid from almost 97 cents on the dollar at the start of May to just 87.8 cents on the dollar on Thursday, as more detail surrounding possible legislation has been released.

Leveraged loans for Blackstone’s TeamHealth and private-equity-owned air ambulance companies Air Methods and Air Medical have also taken hits.

The normally cool-headed, pro-business Financial Times readers were almost without exception appalled: “..highway robbers….smacks of fraud…sheer criminality….ambushing patients….criminals.” Welcome to health care, USA style.

Sadly, the article says that while both parties are eager to be seen to be Doing Something about health care costs, neither wants to give the other side a win, making new Federal legislation unlikely in the current session. But exposing private equity as the hidden hand behind this extortion may lead to more inquisitiveness about the degree to which private equity finding and exploiting economic choke-points has contributed to the suffering.

Private Equity: The Perps Behind Destructive Hospital Surprise Billing

from WordPress https://ift.tt/319PPNj

via IFTTT

1 note

·

View note

Link

Japan’s central bank will ease its support for the stock market. Here’s what you need to know: A recut of “Justice League” by Zack Snyder is among the films available on HBO Max as AT&T looks to build out its streaming service.Credit…Warner Bros. Pictures HBO Max is going global. The new streaming platform, currently only available to U.S. subscribers, will launch in 61 other markets starting in June. The company also plans to launch an advertising-driven streaming service in the United States at the same time. The announcements came Friday as part of a broader presentation outlining a set of goals for AT&T, which owns HBO. The company hopes to reach between 120 million and 150 million total customers for HBO Max and its traditional HBO TV channel by the end of 2025, a more ambitious target compared with its previous goal of 75 million to 90 million. The company also expects between 67 million and 70 million customers by the end of 2021. It had 61 million as of the end of December, but the number of people actually watching HBO Max is much smaller. About 41.5 million customers are in the United States, and of that group about 17.2 million have HBO Max accounts. That suggests that of the company’s new subscriber target, not all of them will necessarily be streaming HBO Max. The company has a complicated setup around HBO Max. People can sign up for the service directly, and those who already pay for the premium cable channel through their cable or satellite provider also have access, but not everyone has set up their streaming account. The service is also offered for free or at a reduced price to AT&T’s wireless customers. The jump into international markets shows how aggressively AT&T needs to expand its streaming enterprise. The addition of an advertising-based service means the company sees an opportunity to capture the ad dollars that have started to move away from traditional television. It’s unclear if the ad-supported version will be free or whether it will only be available at a reduced price from HBO Max’s current $15 per month cost. Jason Kilar, the chief executive of WarnerMedia, the unit that manages HBO, said the service is expected to start making money after 2025. It should generate about $15 billion in sales by that year, he added. HBO Max has become a key part of AT&T’s overall strategy to keep and grow mobile customers, so losing money is less of an immediate concern if it helps AT&T retain its core wireless subscribers. Mr. Kilar emphasized HBO Max’s value to the phone business, citing that 25 percent of HBO Max customers have come via AT&T. He ended his presentation with a cliché from the Warner Bros. film archives: “It’s the beginning of a beautiful friendship.” Video transcript Back transcript Microsoft Executive Says Tech Consolidation Threatens Journalism Brad Smith, Microsoft’s president, told Congress he supports the Journalism Competition and Protection Act, which empowers news publishers to collectively bargain with online platforms like Facebook and Google. I think that you all are on the right path. That’s why Microsoft is endorsing the Journalism Competition and Protection Act, the J.C.P.A., to give news organizations the ability to negotiate collectively, including with Microsoft, because as presently drafted, we will be subject to its terms. I hope that the subcommittee will continue its work to think more broadly about the fundamental lack of competition, especially in search and digital advertising, that are at the heart of not just the decline in journalism, but the decline and challenge in many sectors of the economy. What we’re finding is that the big publishers are not interested in negotiating collectively. The three largest news organizations in Australia are all negotiating separately. It is the small publishers that are negotiating collectively. If this bill is passed, that means that these news organizations would be able to negotiate collectively with us. I assume that they will negotiate effectively with us. It is far bigger than us. It is far bigger than technology. It is more important than any of the products that any of us produce today. And let’s hope that if a century from now people are not using iPhones or laptops or anything that we have today, journalism itself is still alive and well because our democracy depends on it. Brad Smith, Microsoft’s president, told Congress he supports the Journalism Competition and Protection Act, which empowers news publishers to collectively bargain with online platforms like Facebook and Google.CreditCredit…Kevin Lamarque/Reuters Lawmakers on Friday debated an antitrust bill that would give news publishers collective bargaining power with online platforms like Facebook and Google, putting the spotlight on a proposal aimed at chipping away at the power of Big Tech. At a hearing held by the House antitrust subcommittee, Microsoft’s president, Brad Smith, emerged as a leading industry voice in favor of the law. He took a divergent path from his tech counterparts, pointing to an imbalance in power between publishers and tech platforms. Newspaper ad revenue plummeted to $14.3 billion in 2018 from $49.4 billion in 2005, he said, while ad revenue at Google jumped to $116 billion from $6.1 billion. “Even though news helps fuel search engines, news organizations frequently are uncompensated or, at best, undercompensated for its use,” Mr. Smith said. “The problems that beset journalism today are caused in part by a fundamental lack of competition in the search and ad tech markets that are controlled by Google.” The hearing was the second in a series planned by the subcommittee to set the stage for the creation of stronger antitrust laws. In October, the subcommittee, led by Representative David Cicilline, Democrat of Rhode Island, released the results of a 16-month investigation into the power of Amazon, Apple, Facebook and Google. The report accused the companies of monopoly behavior. This week, the committee’s two top leaders, Mr. Cicilline and Representative Ken Buck, Republican of Colorado, introduced the Journalism and Competition Preservation Act. The bill aims to give smaller news publishers the ability to band together to bargain with online platforms for higher fees for distributing their content. The bill was also introduced in the Senate by Senator Amy Klobuchar, a Democrat of Minnesota and the chairwoman of that chamber’s antitrust subcommittee. Global concern is growing over the decline of local news organizations, which have become dependent on online platforms for distribution of their content. Australia recently proposed a law allowing news publishers to bargain with Google and Facebook, and lawmakers in Canada and Britain are considering similar steps. Mr. Cicilline said, “While I do not view this legislation as a substitute for more meaningful competition online — including structural remedies to address the underlying problems in the market — it is clear that we must do something in the short term to save trustworthy journalism before it is lost forever.” Google, though not a witness at the hearing, issued a statement in response to Mr. Smith’s planned testimony, defending its business practices and disparaging the motives of Microsoft, whose Bing search engine runs a very distant second place behind Google. “Unfortunately, as competition in these areas intensifies, they are reverting to their familiar playbook of attacking rivals and lobbying for regulations that benefit their own interests,” wrote Kent Walker, the senior vice president of policy for Google. Union members canvassing at the Amazon fulfillment center in Bessemer, Ala.Credit…Lynsey Weatherspoon for The New York Times Senator Marco Rubio of Florida became the most prominent Republican leader to weigh in on the unionization drive at the Amazon warehouse in Bessemer, Ala., with a surprising endorsement of the organizing effort on Friday. “The days of conservatives being taken for granted by the business community are over,” Mr. Rubio wrote in an opinion piece published in USA Today. “Here’s my standard: When the conflict is between working Americans and a company whose leadership has decided to wage culture war against working-class values, the choice is easy — I support the workers,” he continues. “And that’s why I stand with those at Amazon’s Bessemer warehouse today.” More than 5,800 workers at the Amazon warehouse, outside Birmingham, are voting by mail this month to decide whether to join the Retail, Wholesale and Department Store Union. Last week, President Biden posted a video message on Twitter referring to the vote in Alabama and espousing on the importance of unions in helping build the middle class, while excoriating employers who interfere in unionization efforts. He did not mention Amazon by name, but his remarks followed reports that the online retailer was engaged in aggressive anti-union tactics. “We welcome support from all quarters,” the union’s president, Stuart Appelbaum, said in a statement. “Senator Rubio’s support demonstrates that the best way for working people to achieve dignity and respect in the workplace is through unionization. This should not be a partisan issue.” The unionization drive has also continued to attract backing from Democrats. A spokesman for Speaker Nancy Pelosi said in an email on Friday that she supported the workers in their effort. Mr. Rubio, who recalls marching in a union picket line with his father, a hotel bartender, accused Amazon of expressing “woke” values, while bowing to Chinese censorship. And he warned the company not to expect Republicans to come to its rescue and condone its anti-union efforts. “Its workers are right to suspect that its management doesn’t have their best interests in mind,” Mr. Rubio wrote. “Wealthy woke C.E.O.s instead view them as a cog in a machine that consistently prioritizes global profit margins and stoking cheap culture wars. The company’s workers deserve better.” Simon Hu, the chief executive of Ant Group, at a conference in Shanghai in September. Mr. Hu asked to resign for personal reasons, the company said.Credit…Cheng Leng/Reuters The chief executive of Ant Group, the Chinese internet finance giant, has stepped down, the company said on Friday, a move that came in the middle of a business overhaul meant to address regulators’ concerns about its rapid growth. Ant said its chief executive, Simon Hu, had asked to resign for personal reasons. The company’s chairman, Eric Jing, was named as Mr. Hu’s replacement, effective immediately. Mr. Jing, who will remain Ant’s chairman, previously served as chief executive until December 2019, when Mr. Hu took over the post. Hundreds of millions of people in China use Ant’s Alipay app to make everyday payments, sock away savings and shop on credit. Ant, which was spun out of the e-commerce giant Alibaba, has faced rising scrutiny from China’s government, and officials scuttled the company’s plans last year to go public in Shanghai and Hong Kong. The company had been preparing to raise more than $34 billion by listing its shares in November, in what would have been the largest initial public offering on record. Instead, days before Ant’s shares were scheduled to begin trading, Chinese officials summoned company executives — namely, Mr. Hu, Mr. Jing and Jack Ma, Alibaba’s co-founder — to discuss regulation. The I.P.O. was halted soon after, and financial watchdogs said Ant had taken advantage of gaps in China’s regulatory system and ordered it to revamp its business. Mr. Hu joined Alibaba in 2005 and was president of its cloud division from 2014 to 2018. He joined Ant as president that year before becoming chief executive in 2019. Mr. Jing, also an Alibaba veteran, has been Ant’s executive chairman since April 2018. They are both members of the Alibaba Partnership, the company’s club of elite management partners. Ford Motor said two members of the Ford family have been nominated to join the automaker’s board of directors, replacing one family member who is retiring and an independent director who has chosen not to seek re-election. Alexandra Ford English, 33, daughter of Ford’s chairman, Bill Ford, and Henry Ford III, 40, son of Edsel B. Ford II, a current board member, are expected to be elected to the board by shareholders at the company’s annual meeting on May 13. Both are great-great-grandchildren of Henry Ford, who founded the company in 1903. Ms. English is a director in corporate strategy at the company. Henry Ford III is a director in investor relations. They will replace Edsel Ford II, 72, who is retiring after being on the board since 1988, and John C. Lechleiter, 67, who joined Ford’s board in 2013 and is a former president of Eli Lilly, the pharmaceutical company. Although the Ford family only owns a small portion of the company’s common stock, it retains effective control of the automaker though Class B shares with super-voting rights. A banner for the South Korean retailer Coupang hung in front of the New York Stock Exchange on Thursday, the day the company’s shares began trading.Credit…Courtney Crow/New York Stock Exchange, via Associated Press The stock of Coupang, a start-up in South Korea that is sometimes called the Amazon of South Korea, drifted after trading publicly for the first time in New York on Thursday. Coupang — the company’s name is a mix of the English word “coupon” and “pang,” the Korean sound for hitting the jackpot — was founded by a Harvard Business School dropout and has shaken up shopping in South Korea, an industry long dominated by huge, button-down conglomerates. The initial public offering raised $4.6 billion and valued Coupang at about $85 billion, the second-largest American tally for an Asian company after Alibaba Group of China in 2014. Coupang’s shares rose 6.6 percent on Friday as trading began but ended the day down 2 percent. Coupang is South Korea’s biggest e-commerce retailer, its status further cemented by people stuck at home during the pandemic and those in the country who crave faster delivery. In a country where people are obsessed with “ppalli ppalli,” or getting things done quickly, Coupang has become a household name by offering “next-day” and even “same-day” and “dawn” delivery of groceries and millions of other items at no extra charge. The electric Endurance pickup truck made by Lordstown Motors. An investment firm claimed the company had inflated the number of orders for its pickup trucks.Credit…Tony Dejak/Associated Press Shares of Lordstown Motors, an electric-vehicle start-up, fell more than 19 percent on Friday after an investment firm claimed the company had inflated the number of orders for its pickup trucks and overstated its technological and production capabilities. The revelations are the latest to call into question the promises made by an electric vehicle company that has gone public by merging with a shell company that has a stock market listing, cash and no operating business. Lordstown, which gained prominence by buying a former General Motors factory in Ohio to make electric trucks for commercial users, completed its merger with a shell company and started trading on the stock market in October 2020. In a lengthy post on its website, the investment firm, Hindenburg Research, said that Lordstown’s claim of having 100,000 “pre-orders” for its electric pickup truck included tens of thousands from small companies that do not operate fleets, and others who merely agreed to consider buying trucks but made no commitment to do so. Hindenburg said it had bet against Lordstown’s stock by selling its shares short, a maneuver used by some professional investors when they believe a stock is overvalued and poised to fall. “Our conversations with former employees, business partners and an extensive document review show that the company’s orders are largely fictitious and used as a prop to raise capital and confer legitimacy,” Hindenburg said. A Lordstown spokesman said, “We will be sharing a full and thorough statement in the coming days, and when we do we will absolutely be refuting the Hindenburg Research report.” One company that Lordstown said was prepared to buy 14,000 trucks, E Squared Energy, appears to be based in an apartment in Texas, have two employees and owns no vehicles. Hindenburg also unearthed a police report that showed a Lordstown prototype caught fire and burned to a shell during a test drive in January in Michigan. On Friday morning, Lordstown shares were trading at just over $14 a share, down from their close the previous day of $17.71. Former President Donald J. Trump hailed Lordstown in 2018 when it agreed to buy a plant in Lordstown, Ohio, that General Motors had closed, and former Vice President Mike Pence participated in an unveiling of the company’s truck in June. In September, Mr. Trump hosted Lordstown’s chief executive, Steve Burns, at the White House and praised the company’s technology. Hindenburg Research gained prominence last year when it released a report saying Nikola, an electric truck start-up, and its executive chairman, Trevor Milton, had mislead investors and exaggerated the capabilities of that company’s technology. The revelations resulted in Mr. Milton’s departure from Nikola, and prompted General Motors to scale back a partnership with the company. Nikola denied some of Hindenburg’s claims but recently acknowledged to the Securities and Exchange Commission that Mr. Milton had made statements that were “inaccurate in whole or in part.” Target will cease operations in the City Center building in downtown Minneapolis, relocating 3,500 employees.Credit…Lucy Nicholson/Reuters Target, a fixture in downtown Minneapolis, is giving up space in a large office building there, becoming the latest company to permanently allow its staff to spend more time working from home. The retailer told employees it would cease operations in the City Center building in downtown Minneapolis and that the 3,500 employees working there would relocate to other nearby offices, while also working from home part of the time. More than a quarter of Target’s corporate employees in the Minneapolis area work in the City Center building. “This change is driven by Target’s longer-term headquarters environment that will include a hybrid model of remote and on-site work, allowing for flexibility and collaboration and ultimately, requiring less space,” the company said Thursday. Office landlords across the country have been struggling to retain tenants as the pandemic drags on and companies realize their staff has been able to work effectively in a remote setting. Empty office buildings are putting a squeeze on city budgets, which are heavily reliant on property taxes. Salesforce, the software company based in San Francisco, adopted a flex model in which most of its employees would be able to come into the office one to three days a week. In a bet that more people would work from home after the pandemic ends, Salesforce acquired the workplace software company Slack in December. After the move, Target said it would still occupy about three million square feet of office space in the Minneapolis area. “It’s not easy to say goodbye to City Center, but the Twin Cities is still our home after all these years,’’ Target’s chief human resources officer, Melissa Kremer, said in an email to employees. Microsoft offices in Beijing. Microsoft owns LinkedIn, which has operated in China by conforming to the authoritarian government’s tight restrictions on the internet.Credit…Wu Hong/EPA, via Shutterstock LinkedIn has stopped allowing people in China to sign up for new member accounts while it works to ensure its service in the country remains in compliance with local law, the company said this week, without specifying what prompted the move. A company representative declined to comment further. Unlike other global internet mainstays such as Facebook and Google, LinkedIn offers a version of its service in China, which it is able to do by hewing closely to the authoritarian government’s tight controls on cyberspace. It censors its Chinese users in line with official mandates. It limits certain tools, such as the ability to create or join groups. It has given partial ownership of its Chinese operation to local investors. In 2017, the company blocked individuals, but not companies, from advertising job openings on its site in China after it fell afoul of government rules requiring it to verify the identities of the people who post job listings. The backdrop to the suspension of new user registrations is not clear. The government has previously blocked internet services that it believes to be breaking the law. In 2019, Microsoft’s Bing search engine was briefly inaccessible in China for unclear reasons. Microsoft also owns LinkedIn. By: Ella Koeze·Data delayed at least 15 minutes·Source: FactSet United States The S&P 500 inched further into record territory on Thursday, rising 0.1 percent. The index gained 2.6 percent this week, its best weekly performance since early February. The Nasdaq composite fell 0.6 percent, while the Dow Jones industrial average rose 0.9 percent. The yield on 10-year Treasury notes jumped as much as 10 basis points, or 0.1 percentage points, to 1.64 percent, its highest level in more than a year. Higher interest rates and tighter central bank policies are now considered to be the single biggest threat to so-called risk assets, mainly stocks, according to a Bank of America survey of fund managers. Investors have grown concerned that the stimulus bill and economic rebound will trigger inflation, prompting central banks to pull back on stimulus measures. Europe The Stoxx Europe 600 index dropped 0.3 percent, while the FTSE 100 index in Britain rose 0.4 percent. Data published on Friday showed that the British economy declined 2.9 percent in January as the country entered its third lockdown, shut schools and left the European Union single market and customs union. Separate data for the same month showed the largest monthly drop in trade since records began in 1997. Exports to the European Union dropped 40 percent and imports fell nearly 30 percent. Some of the fall is because of stockpiling at the end of last year, but many businesses struggled to keep trading as they dealt with new customs requirements. Shoppers wait in line at an outlet mall in Southaven, Miss. on Saturday. Many Americans are set to benefit from the new economic relief plan.Credit…Rory Doyle for The New York Times The economic relief plan that is headed to President Biden’s desk has been billed as the United States’ most ambitious antipoverty initiative in a generation. But inside the $1.9 trillion package, there are plenty of perks for the middle class, too. An analysis by the Tax Policy Center published this week estimated that middle-income families — those making $51,000 to $91,000 per year — would see their after-tax income rise by 5.5 percent as a result of the tax changes and stimulus payments in the legislation. This is about twice what that income group received as a result of the 2017 Tax Cuts and Jobs Act. Here are some of the ways the bill will help the middle class. Direct checks Americans will receive stimulus checks of up to $1,400 per person, including dependents. The size of the payments are scaled down for individuals making more than $75,000 and married couples earning more than $150,000. And they are cut off for individuals making $80,000 or more and couples earning more than $160,000. Those thresholds are lower than in the previous relief bills, but they will still be one of the biggest benefits enjoyed by those who are solidly in the middle class. Tax credits for parents The most significant change is to the child tax credit, which will be increased to up to $3,600 for each child under 6, from $2,000 per child. The credit, which is refundable for people with low tax bills, is $3,000 per child for children ages 6 to 17. The legislation also bolsters the tax credits that parents receive to subsidize the cost of child care this year. The current credit is worth 20 to 35 percent of eligible expenses, with a maximum value of $2,100 for two or more qualifying individuals. The stimulus bill increases that amount to $4,000 for one qualifying individual or $8,000 for two or more. Cheaper health insurance After four years of being on life support, the Affordable Care Act is expanding, a development that will largely reward middle-income individuals and families, since those on the lower end of the income spectrum generally qualify for Medicaid. Because the relief legislation expands the subsidies for buying health insurance, a 64-year-old earning $58,000 would see monthly payments decline to $412 from $1,075 under current law, according to the Congressional Budget Office. A rescue for pensioners One of the more contentious provisions in the legislation is the $86 billion allotted to fixing failing multiemployer pensions. The money is a taxpayer bailout for about 185 union pension plans that are so close to collapse that without the rescue, more than a million retired truck drivers, retail clerks, builders and others could be forced to forgo retirement income. The legislation gives the weakest plans enough money to pay hundreds of thousands of retirees their full pensions for the next 30 years. A drill ship contracted by ExxonMobil off the coast of Guayana in 2018. The temptation to produce more when prices rise has not disappeared completely, especially for countries like Guyana that want to pump as much oil as they can while oil is still valuable.Credit…Christopher Gregory for The New York Times Even as they are making more money thanks to the higher oil and gasoline prices, industry executives pledged at a recent energy conference that they would not expand production significantly. They also promised to pay down debt and hand out more of their profits to shareholders in the form of dividends. “I think the worst thing that could happen right now is U.S. producers start growing rapidly again,” Ryan Lance, chairman and chief executive of ConocoPhillips, said at the IHS CERAweek conference. Scott Sheffield, chief executive of Pioneer Natural Resources, a major Texas producer, predicted that American production would remain flat at 11 million barrels a day this year, compared with 12.8 million barrels immediately before the pandemic took hold. Even the Organization of the Petroleum Exporting Countries and allied producers like Russia surprised many analysts this month by keeping several million barrels of oil off the market, The New York Times’s Clifford Krauss reports. OPEC’s 13 members and nine partners are pumping roughly 780,000 barrels of oil a day less than at the beginning of the year even though prices have risen by 30 percent in recent months. Chevron said this week that it would spend $14 billion to $16 billion a year on capital projects and exploration through 2025. That is several billion dollars less than the company spent in the years before the pandemic, as the company focuses on producing the lowest-cost barrels. “So far, these guys are refusing to take the bait,” said Raoul LeBlanc, a vice president at IHS Markit, a research and consulting firm. But he added that the investment decisions of American executives could change if oil prices climb much higher. “It’s far, far too early to say that this discipline will last.” Shoppers in Southaven, Miss. Higher spending seems almost certain in the months ahead as vaccinations prompt Americans to get out and about, deploying savings.Credit…Rory Doyle for The New York Times While the Biden administration’s stimulus bill, which will funnel nearly $1.9 trillion to American households, made its way through Congress, some politicians and economists began to raise concerns that it would unshackle a long-vanquished monster: inflation. The worries reflect expectations of a rapid economic expansion as businesses reopen and the pandemic recedes. Millions are still unemployed, and layoffs remain high, The New York Times’s Nelson Schwartz and Jeanna Smialek report. But for workers with secure jobs, higher spending seems almost certain in the months ahead as vaccinations prompt Americans to get out and about, deploying savings built up over the last year. Healthy economies tend to have gentle price increases, which give businesses room to raise wages and leave the central bank with more room to cut interest rates during times of trouble. Over the long term, inflation can be a concern because it hurts the value of many financial assets, especially stocks and bonds. It makes everything from milk and bread to gasoline more expensive for consumers, leaving them unable to keep up if salaries stall. And once inflation becomes entrenched, it can be hard to subdue. Inflation is expected to increase in the coming months as prices are measured against weak readings from last year. Analysts surveyed by Bloomberg expect the Consumer Price Index to hit an annual rate of 2.9 percent from April through June, easing to 2.5 percent in the three months after that before easing gradually to year-over-year gains of 2.2 percent in 2022, based on the median projection. But those numbers are nothing like the staggering price increases of the 1970s, and evidence of renewed inflation is paltry so far. Load new posts The Bank of Japan said on Friday that it would scrap its annual minimum target for equity fund purchases, a decision that comes as Japan’s stock markets hit levels unseen since the collapse of the country’s economic bubble in the early 1990s. The decision was announced as part of a three-month policy review meant to give the central bank more flexibility to address the economic effects of the coronavirus pandemic. Under its previous policy, the bank aimed to invest around $55 billion annually in exchange-traded funds — baskets of equities that can be bought and sold on the stock market. That was part of a policy of monetary easing intended to stimulate inflation to combat sagging prices, which sap corporate profits. Since 2010, when the purchases began, the bank has become Japan’s single largest stockholder. Share prices are now at their highest point in over three decades. Friday’s decision will give the bank the flexibility to make future purchases at more favorable prices. It will also help to address concerns that the program has distorted Japanese stock markets. The bank will continue to invest in equities that track Japan’s Topix stock index “as necessary,” it said. It will maintain the upper limit of $110 billion in purchases per year that was set earlier in the pandemic, as part of emergency measures to stimulate the economy. The bank also said that it would maintain its current interest rate targets while allowing long-term rates slightly more room to breathe, increasing the band to 0.25 percent from 0.2 percent. Source link Orbem News #bank #Central #ease #Japans #market #stock #Support

0 notes

Photo

"The Coming Eviction Crisis: ‘It’s Hard to Pay the Bills on Nothing’" by BY BINYAMIN APPELBAUM via NYT Opinion https://ift.tt/2XHCqN8

0 notes

Text

The Coming Eviction Crisis: ‘It’s Hard to Pay the Bills on Nothing’

By BY BINYAMIN APPELBAUM

If the federal government repeats the mistakes of the last recession, millions of Americans will lose their apartments and homes.

Published: August 9, 2020 at 08:00PM

from NYT Opinion https://ift.tt/2XHCqN8

via

0 notes

Text

How Private-Equity Firms Squeeze Hospital Patients for Profits

Sheelah Kolhatkar on the role of private-equity firms in surprise medical billing, and how the economists Eileen Appelbaum and Rosemary Batt helped bring the practice to the light of day, spurring Congress to almost take action.

from Humor, Satire, and Cartoons https://ift.tt/2yKLw21

from Blogger https://ift.tt/34mzjfI

0 notes

Text

The Legacy of Paul Volcker

(Want this by email? Sign up here.)

Remembering Paul Volcker, the Fed chair “willing to be unpopular”

Paul A. Volcker, who died Sunday in New York at the age of 92, was remembered for helping shape American economic policy for more than six decades, particularly as the Fed chair who tamed inflation in the 1970s and ‘80s. Mr. Volcker arrived in Washington as America’s postwar economic dominance was beginning to crumble and devoted his professional life to wrestling with the consequences, write the NYT’s Binyamin Appelbaum and Robert D. Hershey Jr. As a Treasury Department official under Democratic and Republican presidents, Mr. Volcker waged a long, losing struggle to preserve the post-World War II international monetary system. In his last official position, as chairman of President Barack Obama’s Economic Recovery Advisory Board, he persuaded lawmakers to impose new restrictions on big banks — a controversial measure known as the Volcker Rule. His defining achievement, however, was his success in ending an extended period of high inflation after President Jimmy Carter chose him to be the Fed chair in 1979. He delivered shock therapy, pushing interest rates as high as 20 percent, the WSJ writes, driving the economy into a deep recession but making him one of the most successful central bankers in history. “Volcker’s mantra, one he told me again and again through 2008-9, was that in a crisis the only asset you have is your credibility,” Austan Goolsbee, an economist at the University of Chicago’s Booth School and a former chairman of the Council of Economic Advisers, tweeted. That quality is one of the best reasons to mourn the loss of Mr. Volcker, writes the WaPo Opinion section: “Unlike so many other public officials, he was unusually — perhaps uniquely — willing to be unpopular.” Mr. Volcker was not sanguine about the future when he talked to Andrew last year. “I’m not good,” he said as Andrew walked into his Manhattan apartment, and he wasn’t referring only to his health. “We’re in a hell of a mess in every direction,” he said. “Respect for government, respect for the Supreme Court, respect for the president, it’s all gone.”

Boeing whistle-blower says production was riddled with problems

Ahead of his testimony before a congressional committee tomorrow, a former senior manager at Boeing is speaking about the concerns he had with the production of the 737 Max airplane. Four months before the first of two deadly crashes of a 737 Max, the manager, Ed Pierson, approached an executive at the company, saying he was worried that the plane was riddled with production problems and potentially unsafe, David Gelles of the NYT reports. The Max has been grounded since March, shortly after the second crash. Employees at the Renton, Wash., factory where the 737 Max is produced were overworked, exhausted and making mistakes, Mr. Pierson told Mr. Gelles. Damaged parts, missing tools and incomplete instructions were preventing planes from being built on time. Executives were pressuring workers to complete planes despite staff shortages and a chaotic factory floor. “Frankly right now all my internal warning bells are going off,” Mr. Pierson said in an email to the head of the 737 program last year that was reviewed by The NYT. “And for the first time in my life, I’m sorry to say that I’m hesitant about putting my family on a Boeing airplane.” Mr. Pierson called on Boeing to shut down the Max production line last year. But the company kept producing planes and did not make major changes in response to his complaints. During the time when Mr. Pierson said the Renton facility was in disarray, it built the two planes that crashed and killed 346 people. “The suggestion by Mr. Pierson of a link between his concerns and the recent Max accidents is completely unfounded,” a Boeing spokesman, Gordon Johndroe, said in a statement.

Amazon accuses Trump of “improper pressure” in cloud contract

Amazon has gone to court to accuse President Trump of using “improper pressure” on the Pentagon to harm Amazon’s chief executive, Jeff Bezos — whom it calls the president’s “perceived political enemy,” writes the NYT’s Kate Conger. That pressure was intended to divert a multibillion-dollar cloud computing contract to its rival, Microsoft, Amazon said in a legal complaint unsealed yesterday in U.S. Court of Federal Claims in Washington. Amazon, which has the country’s largest cloud computing provider, Amazon Web Services, had been considered the front-runner for the Joint Enterprise Defense Infrastructure project, known as JEDI. But the Defense Department reviewed outdated submissions from the company and overlooked key technical capabilities, Amazon claimed. Those errors tipped the scales in favor of Microsoft, which won the contract in October, Amazon said. In its complaint, Amazon said the president “launched repeated public and behind-the-scenes attacks” on the contract and the company, the WSJ reports. It would be improper for a president to intervene in the awarding of a contract, according to experts on federal contracting.

Demand grows for educated factory workers

As American factories shift toward automation, jobs are requiring more advanced skills, and workers can no longer get by without higher education, writes the WSJ’s Austen Hufford. Manufacturers are on track to employ more college graduates in the next three years than workers with less education, according to an analysis of federal data. “U.S. manufacturers have added more than a million jobs since the recession, with the growth going to men and women with degrees,” Mr. Hufford writes. “Over the same time, manufacturers employed fewer people with at most a high-school diploma.” • Manufacturing jobs that require the most complex problem-solving skills grew 10 percent between 2012 and 2018. But jobs requiring the least declined 3 percent in that same period. “Investments in automation will continue to expand factory production with relatively fewer employees,” Mr. Hufford writes. “Jobs that remain are expected to be increasingly filled by workers from colleges and technical schools, leaving high-school graduates and dropouts with fewer opportunities.”

The argument for why capitalism’s revival depends on taxation

Capitalism is in a state of crisis, thanks to a lack of revenue, and it can be resolved only by a substantial increase in taxation, Joseph Stiglitz, Todd Tucker, and Gabriel Zucman write in Foreign Affairs. “No successful market can survive without the underpinnings of a strong, functioning state,” they write. Total tax revenue in the U.S. shrank over the last two decades, to approximately 28 percent of national income today from about 32 percent in 1999. This has led to “crumbling infrastructure, a slowing pace of innovation, a diminishing rate of growth, booming inequality, shorter life expectancy, and a sense of despair among large parts of the population.“ Opponents of tax increases claim that corporate investment is the engine of growth, the authors write. “In the real world, however, there is no observable correlation between capital taxation and capital accumulation.” The authors propose “a bold new regime of domestic and international taxes”: • “Only a far more progressive tax code will provide the necessary level of revenue.” • “Eliminate special provisions that exempt dividends, capital gains, carried interest, real estate, and other forms of wealth from taxation.” • “A wealth tax, such as the one recently proposed by Elizabeth Warren, the Democratic U.S. senator from Massachusetts who is currently running for president.” • “To curb the evasion of income and wealth taxes, countries will have to cooperate much more with one another.” • “A global minimum tax should be instituted to set a floor on how low would-be tax havens could drop their rates.”

Former DealBook reporter raises $8 million for start-up

Yumi, a baby-food delivery start-up, announced today that it has raised $8 million in a fund-raising round. Investors in the round include the founders of Allbirds, Casper, Harry’s, SoulCycle, Sweetgreen, Uber and Warby Parker, and the C.E.O. of Blue Bottle Coffee. Yumi delivers meals that are high in nutrients and low on fructose and are tailored to a child’s age and developmental stage. The company will use the capital to expand nationwide and develop proprietary software, which would allow the company to create personalized meal plans and educational content. The round brings the company’s total funding to $12.1 million, Yumi said; other investors include August Capital, Brand Foundry and Day One Ventures. • Yumi was founded in 2017 by Angela Sutherland and Evelyn Rusli, a former New York Times and DealBook reporter, with a focus on the importance of what children eat in their first 1,000 days.

Revolving door

As part of a major overhaul at HSBC, Samir Assaf, the global banking and markets chief, will become the bank’s chairman of corporate and institutional banking. Georges Elhedery and Greg Guyett will take over as co-heads of the unit. Morgan Stanley is cutting around 1,500 jobs worldwide. Away, an online luggage seller, said its C.E.O., Steph Korey, was stepping down. Fox News said Bill Hemmer, one of the network’s longest-serving news anchors, would replace Shepard Smith as host of its afternoon news hour.

The speed read

Deals

• NortonLifeLock, the $16 billion consumer-software company, has attracted deal interest from a handful of companies including a rival, McAfee. (WSJ) • Tiger Global Management, one of Juul’s earliest boosters, slashed its valuation of the e-cigarette start-up to $19 billion, another sign investors are re-evaluating one-time Silicon Valley darlings. (WSJ) • SoftBank’s Vision Fund has agreed to sell its stake in Wag Labs back to the struggling dog-walking start-up. (NYT) • Goldman Sachs is arranging a $1.75 billion line of credit for WeWork, the first step in SoftBank’s plan to bail out the office-sharing company. (Bloomberg) • Merck and Sanofi, two of the world’s biggest drugmakers, struck multibillion-dollar deals aimed at bolstering their lineups in the fiercely competitive cancer drug market. (WSJ) • A federal judge told lawyers fighting over T-Mobile’s bid to acquire Sprint to skip their customary opening arguments so they could start questioning witnesses, a sign he is seeking a speedy trial. (WSJ) • Pentagon officials have stepped up talks with Japan to choose a U.S. fighter jet over one from BAE Systems, a British rival. (FT) Politics and policy • Records from hundreds of interviews with people who were directly involved in the war in Afghanistan reveal they could not shake their doubts about the strategy and mission. (WaPo) • A long-awaited report by the Justice Department’s inspector general criticized aspects of the early stages of the F.B.I.’s Russia investigation but essentially exonerated former bureau leaders of President Trump’s accusations that they engaged in a politicized conspiracy to sabotage him. (NYT) • Mayor Pete Buttigieg will disclose his management consulting clients, open his fund-raisers to reporters and reveal the names of people raising money for his presidential campaign. (NYT) Impeachment • House Democrats are said to have narrowed the articles of impeachment against President Trump, which are expected to be unveiled today, to abuse of power and obstruction of Congress. (NYT) Trade • Congress is taking aim at China in a defense-policy bill at the same time that the Trump administration is seeking to negotiate a trade pact with Beijing. (WSJ) • The agriculture secretary, Sonny Perdue, said that the U.S. was unlikely to impose new tariffs on Chinese goods on Dec. 15. (Bloomberg) • Democratic lawmakers are close to an agreement with the White House on revisions to the United States-Mexico-Canada Agreement; an announcement could come today. (NYT) Tech • New York is becoming more of a global technology hub, as industry giants tap into the work force of a region long known as a banking and media stronghold. And Democrats who torpedoed Amazon’s plans to set up a second headquarters in the city are finding their stance could come back to bite them. (Bloomberg, Politico) • Comcast plans to spend $2 billion on its Peacock streaming service in the platform’s first two years. (Bloomberg) • The E.U. has approved a 3.2 billion euro ($3.55 billion) fund to promote the research and development of batteries. (FT) • Major nonprofits and other organizations critical of Big Tech are pledging millions to groups that are taking on corporate giants. (NYT) Best of the rest • Blackstone’s Jon Gray and his wife are giving $10 million to the University of Pennsylvania to support 10 low-income students from New York City annually. (Bloomberg) • A look at Citigroup’s sweeping renovation of its Manhattan headquarters. (Bloomberg) • Big brands and online start-ups are finding that consumers generally prefer buying household staples in a single shopping trip over enrolling in subscription services. (WSJ) • The first mission to remove space junk from Earth’s orbit is expected to launch in 2025 as part of an initiative to clean up more than 3,000 defunct satellites. (Bloomberg) Thanks for reading! We’ll see you tomorrow. We’d love your feedback. Please email thoughts and suggestions to [email protected].

Source link

Read the full article

0 notes

Text

#5yrsago GCHQ's black bag of dirty hacking tricks revealed

The dirty tricks used by JTRIG -- the toolsmiths of the UK spy agency GCHQ -- have been published, with details on how the agency manipulates public opinion, censors Youtube, games pageview statistics, spy on Ebay use, conduct DDoS attacks, and connect two unsuspecting parties with one another by phone.

The JTRIG Manual (JTRIG stands for Joint Threat Research Intelligence Group) is similar to the NSA Tailored Access Operations catalog, which Jacob Appelbaum presented last year.

As Glenn Greenwald points out in his story on the JTRIG doc in The Intercept, the underhanded, unethical nature of JTRIG's tools give important context to #DRIP, the surveillance bill that the major party leadership are attempting to ram through Parliament without any debate.

https://boingboing.net/2014/07/14/gchqs-black-bag-of-dirty-hac.html

7 notes

·

View notes

Text

Economistas a dar com pau…

Binyamin Appelbaum, autor de “Hora dos Economistas” [The Economists’ Hour: How the False Prophets of Free Markets Fractured Our Society], publicado em 2019, afirma: os economistas são um grupo diversificado. Qualquer lista razoável inclui Milton Friedman e Karl Marx, ou seja, a associação de economistas não pode ser definida em termos de apoio a nenhum conjunto específico de políticas. Ao descrever a influência dos economistas nas políticas públicas, Binyamin Appelbaum, autor do livro “A Hora dos Economistas”, está ciente de alguns economistas se opor, vigorosamente, a cada uma das mudanças descritas neste livro. De fato, é bem provável poucos economistas terem apoiado todas as mudanças descritas neste livro.

Ainda Appelbaum acha possível falar de economistas, particularmente nos Estados Unidos na segunda metade do século XX, como uma comunidade homogênea. A maioria dos economistas americanos – e em particular aqueles participantes midiáticos influentes nos debates sobre políticas públicas – ocupavam uma parte estreita do espectro ideológico.

Ora, lá como cá… Economistas midiáticos são conservadores – e “chapa-branca”. Louvam em todos seus artigos O Mercado. Aguardam, em consequência, convites para palestras e consultorias muito bem remuneradas por empresas.

Os economistas americanos às vezes são divididos em dois campos, um dos quais com sede em Chicago e favorecendo os mercados em tudo, enquanto o outro com sede em Cambridge, Massachusetts, e favorecendo a mão pesada do governo. Esses campos são algumas vezes referidos como “água doce” e “água salgada”.

Muito é feito com essas distinções primárias. Os principais membros de ambos os grupos favoreceram as principais mudanças descritas neste livro de Appelbaum. Embora a natureza tenda à entropia, eles compartilhavam a confiança de as economias de mercado tenderem ao equilíbrio. Eles concordaram sobre o objetivo principal da política econômica ser o aumento do valor em dólar da produção econômica do país. Eles tinham pouca paciência com os esforços para combater a desigualdade.

As diferenças entre os economistas norte-americanos liberais e neoliberais eram questões de grau. Embora essas diferenças sejam consequenciais – e sejam descritas nas páginas deste livro resenhado aqui – o grau de consenso também é consequencial.

Críticas ao capitalismo, o ponto principal do debate na Europa, raramente eram ouvidas nos Estados Unidos. A diferença é bem resumida pelo cientista político Jonathan Schlefer: “Cambridge, Inglaterra, via o capitalismo como inerentemente perturbado; Cambridge, Massachusetts, passou a ver o capitalismo apenas como questão de ‘ajuste fino’.”

Com o tempo, o consenso americano mudou também as fronteiras do debate em outros países. Por exemplo, os economistas tupiniquins se submetem, voluntariamente, à lavagem cerebral no centro do Império. Acham a rede de relacionamentos com editores de revistas ranqueadas no Qualis ser benéfica para suas carreiras profissionais.

Portanto, “esqueçam o escrito antes, viva o Primeiro Mundo! O que é bom para os Estados Unidos é bom para o Brasil!”. Aliás, este discurso de servidão voluntária não é muito diferente do proferido pela casta dos militares, formados na ideologia da Guerra Fria… Insistem, de forma anacrônica, em “lamber as botas” dos de lá… Para ascenderem socialmente, embora sejam esnobados por tal submissão, não têm vergonha. I love you!

As diferenças reais entre liberais e conservadores em questões de política econômica tenderam a obscurecer até que ponto o Partido Democrata e os principais partidos de esquerda de outros países desenvolvidos apoiaram a priorização da eficiência econômica. Os conservadores costumam ser os reformadores mais eficazes no “modo conservador”. Os democratas progressistas se inibem – ou não sabem escolher seus melhores quadros porque abominam a meritocracia.

Mas, nas últimas décadas, à medida que a reforma neoliberal avançava em uma direção conservadora, os liberais da esquerda norte-americana frequentemente lideravam a marcha em direção a objetivos impossíveis de os conservadores alcançarem por conta própria. Nos Estados Unidos, a redução da tributação começou sob Kennedy e a redução da regulamentação começou com Carter. Na Grã-Bretanha, o primeiro-ministro trabalhista James Callaghan declarou mortas as ideias keynesianas em 1976. Na França, o presidente François Mitterrand, socialista, impôs austeridade fiscal para preparar o país para a união monetária com a Alemanha. Snif, snif… é de chorar essa “socialdemocracia” reformista adotar bandeiras da direita e abandonar a esquerda…

O colapso da União Soviética solidificou esse consenso político. A divisão do mundo entre sociedades comunistas e capitalistas foi uma das grandes experiências naturais da história, e os resultados pareciam claros. “A Guerra Fria acabou e a Universidade de Chicago venceu”, exultou o colunista conservador George Will em 1991.

Os líderes dos partidos de esquerda reformista chegaram ao poder na década de 1990, como Bill Clinton nos Estados Unidos e Tony Blair, no Reino Unido, [e FHC em terra tupiniquim] continuou, em grande parte, as políticas econômicas de seus antecessores conservadores. O capitalismo tornou-se um monopolista satisfeito no mercado de ideias, com consequências previsíveis: na ausência de alternativas, era difícil reunir a vontade de lidar com suas deficiências evidentes.

Nos últimos anos do século XX e na primeira década do século atual, a revolução da confiança em O Mercado atingiu seu apogeu. As restrições políticas e sociais sobre o papel de O Mercado foram deixadas de lado. Os governos recuaram dos esforços para regular o mercado, investir na prosperidade futura ou limitar a desigualdade. A importância do crescimento econômico tornou-se a coisa mais próxima de um espírito americano: como o presidente George W. Bush disse à nação após os ataques de 11 de setembro: “Devemos resistir ao terror voltando ao trabalho”. Ueba, lula-lá!

O triunfo da economia de livre mercado é às vezes ilustrado por uma imagem de satélite da península coreana à noite, a metade sul iluminada por eletricidade, a metade norte preta como o oceano circundante. É uma imagem poderosa, mas seu significado sempre foi deturpado. A Coréia do Sul, como outras nações ricas, alcançou a prosperidade ao dirigir cuidadosamente sua economia. Esta é a história de planejamento, em economia de mercado. Ela não aconteceu quando as nações decidiram “tirar as duas mãos do volante”…

Economistas a dar com pau… publicado primeiro em https://fernandonogueiracosta.wordpress.com

0 notes

Text

Elizabeth Warren Seeks to Cut Private Equity Down to Size

Digital Elixir

Elizabeth Warren Seeks to Cut Private Equity Down to Size

Elizabeth Warren’s Stop Wall Street Looting Act, which is co-sponsored by Tammy Baldwin, Sherrod Brown, Mark Pocan and Pramila Jayapal, seeks to fundamentally alter the way private equity firms operate. While the likely impetus for Warren’s bill was the spate of private-equity-induced retail bankruptcies, with Toys ‘R’ Us particularly prominent, the bill addresses all the areas targeted by critics of private equity: how it hurts workers and investors and short-changes the tax man, thus burdening taxpayers generally.

Not only would Warren’s legislation prohibit some of the most destructive private equity activities, but it would end their ability to act as traditional asset managers, taking fees and incurring close to no risk if their investments go belly up. The bill takes the explicit and radical view that:

Private funds should have a stake in the outcome of their investments, enjoying returns if those investments are successful but ab-1sorbing losses if those investments fail.

Needless to say, this upends the traditional private equity model of “head’s I win, tails you lose.”

Warren’s bill owes a considerable debt to the work of Eileen Appelbaum and Rosemary Batt, who have been investigating the private equity industry for many years. Appelbaum also provided detailed testimony which provided additional backup for the provisions of Warren’s bill.

Critics will say that Warren’s bill has no chance of passing, which is currently true but misses the point. When Bernie Sanders talked about universal health care and other progressive policies in 2016, the media either ignored it or treated it as crazypants leftie. Those ideas are now part of the discourse, as elite Dems are wont to say. Warren is taking on the “value creator” myth of private equity and seeking to end or restrict their asset-stripping. Her bill isn’t just a step in the process of exposing the falsehoods that have kept the industry from being held to account. By (hopefully) putting private equity titans on the back foot, it should also help impede their efforts to allow mom and pop retail investors to partake of private equity’s egregious fee structure (which would be larded up even more to cut in retail fund management firms).

Because the bill itself has sections that amend the bankruptcy and Internal Revenue Code (meaning mere mortals can’t readily parse them), we’ll rely on Compliance Week’s summary of its main provisions as far as private equity is concerned:

…firms would share responsibility for the liabilities of companies under their control, including debt, legal judgments, and pension obligations to “better align the incentives of private equity firms and the companies they own.” The bill, if enacted, would end the tax subsidy for excessive leverage and closes the carried interest loophole.

The bill also seeks to ban dividends to investors for two years after a firm is acquired. Worker pay would be prioritized in the bankruptcy process, with guidelines intended to ensure affected employees are more likely to receive severance pay and pensions. It would also clarify gift cards are consumer deposits, ensuring their priority in bankruptcy proceedings. If enacted, private equity managers will be required to disclose fees, returns, and political expenditures.

This is a bold set of proposals that targets abuses that hurt workers and investors. Most readers may not appreciate the significance of the two-year restriction on dividends. One return-goosing strategy that often leaves companies crippled or bankrupt in its wake is the “dividend recap” in which the acquired company takes on yet more debt for the purpose of paying a special dividend to its investors. Another strategy that Appelbaum and Batt have discussed at length is the “op co/prop co.” Here the new owners take real estate owned by the company, sell it to a new entity with the former owner leasing it. The leases are typically set high so as to allow for the “prop co” to be sold at a richer price. This strategy is often a direct contributor to the death of businesses, since ones that own their real estate usually do so because they are in cyclical industries, and not having lease payments enables the to ride out bad times. The proceeds of sale of the real estate is usually dividended out to the investors, hence the dividend restriction would also pour cold water on this approach.

The bill also seeks to help workers by making the private equity firms liable for pension looting, and for giving unpaid wages and other employee consideration much higher status in bankruptcy.

I don’t mean to sound like a nay-sayer about ending the tax bennies of highly-leveraged deals, since it’s an appealing and sensible restriction. However, the Reagan Administration floated a proposal to limit the tax deductions for highly leveraged transactions. The Brady Commission report found that that was one of the two triggers for the 1987 crash. So it might need to be phased in.

Last but the opposite of least, one pro-worker measure would constitute a major change in shareholder rights and duties. the bill’s imposition of what is known as “joint and several liability” for portfolio company debts onto both the private equity fund that made the investment, as well as onto the fund’s individual investors themselves, breaks significant new ground.