#beware of the pipeline! /j

Text

most teenagers start off with percy jackson, then they decide to see if owl house has any kick. it does.

1 note

·

View note

Text

so this take is controversial w the system. i need tumblr's opinion

1 note

·

View note

Text

Might make bigger and re-sketch

Peppermint x Sorbet Shark (Cookie from Cookie Run)

Luca x Alberto (Luca by Pixar )

Siren x Kappa (Castle Swimmer)

Beware the pipeline /j

Im going to resketch but I loved this concept way too much

#castle swimmer#luca pixar#luca x alberto#kappa x siren#siren x kappa#peppermint x sorbet shark#sorbet shark x peppermint#cookie run

11 notes

·

View notes

Text

beware of the pipeline

harold → herold → Mary ridonculous race → tommy february6 /j

3 notes

·

View notes

Note

beware of the pipeline blimbo... first it's silly little cats... then it's silly little slugcats.... /j

I'm in danger

10 notes

·

View notes

Note

your ruggie and gender ideas have consumed my thoughts 🤧 it’s becoming a problem

AWW THANK YOU!!!!!!! ^_^

I’m really glad my propaganda has affected you /j

Ruggie Bucchi is soooo gender to me it’s insane- they just don’t do it like ruggie Bucchi- he’s so HEHEHEEHEHRGEHEHJWSJNFNSHSVDDBH

This is me assuming you’re talking about the ruggie beware the pipeline meme thing- but like I’ve been meaning to talk about them more??? Like at first they were just a silly thing I made..bc like “haha ruggie is so gender” but then they started becoming actual headcanons of mine??? Like idk 😔😔😔😔

Anyways stan ruggie Bucchi and his gender

#I studied at yappington academy and majored in blabberology sorryyyy ☹️☹️☹️#I talk a lot 😁😁😁😁😁#💛! asks

1 note

·

View note

Text

beware the

cool idea -> oc -> para -> headmate -> frequent fronter

pipeline

/j

16 notes

·

View notes

Text

January 2020

Dear Friends,

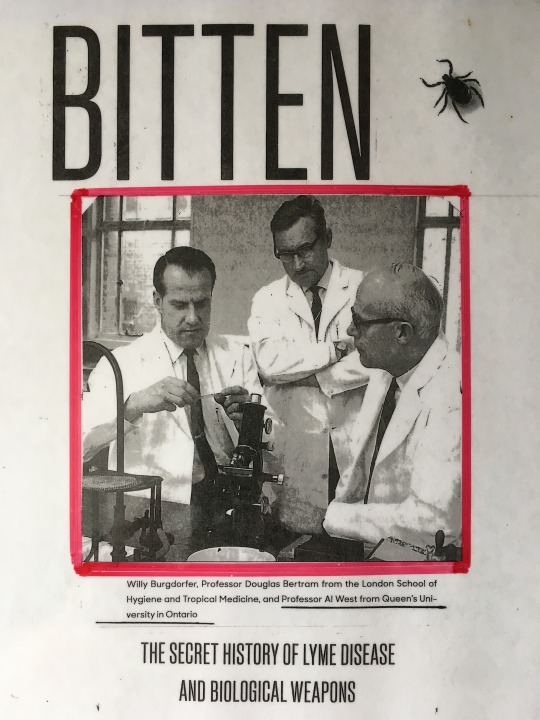

This mysterious poster has been appearing on lampposts in downtown Kingston since last fall. It has prompted a rather personal examination of fake news. Read the fine print under the photo and note that the scientist on the right is The West Letter editor’s father, Allen (Al) West. He died at age 86 in 1996.

Bitten is the title of a book that appeared last year. Written by a science writer in California, Kris Newby, it argues with great conviction that the scourge of tick-borne Lyme disease can be traced to US biological weapons research “gone wrong” post World War II. The author, a recovered Lyme disease patient herself, builds a case that experimental work at Plum Island NY, led to the pathogen “escaping” into the deer population in Connecticut in the ‘70s, and from there to humans.

In plain English, Bitten is a conspiracy theory, that commits the classic error of equating correlation with causation. Newby conveniently skirts the ample evidence that Lyme disease has been with us at least since the 1890s, and possibly for centuries, preferring to make a case out of two coincident but unrelated facts: one, US military tick-borne disease research in progress on Plum Island NY post WW II; and two, the first identification of Lyme disease in Old Lyme (from whence the name), Connecticut in 1977. The “ah hah” factor, if you are inclined to the conspiracy, is that Plum Island is but a short hop, as the crow flies, from Connecticut.

The amateur poster maker too has indulged -- egregiously so -- in the same lack of critical thinking. Looking at the poster, you might assume that Al West and Queen’s University “in Ontario” were central to the conspiracy theory story. You would be wrong. The cover of the book does not feature this photograph. Nor in the entire text of Bitten is there any reference to Al West or Queen’s University, other than in the photo and caption. The main character from beginning to end of Bitten is the man on left, Willy Burgdorfer, the discoverer of the bacterium that causes Lyme Disease. The purpose of the photo was to help bring him to life for the reader. The guys in the lab coats to his left were completely unrelated to the conspiracy tale.

I’m guessing that the poster maker is a Lyme disease sufferer in Kingston who buys the conspiracy angle of Bitten. He or she has seized on the three amigos in lab coats photo, and its caption, as “evidence” (guilt by association) that Al West and Queen’s University must have had a hand, along with Burgdorfer, in releasing the plague of Lyme disease upon humans. Sic transit the compounding of fake news.

§

FAKE INVESTING NEWS

Beware the market soothsayers

Canadian economist David Rosenberg is a genuine heavy hitter. After years opining and advising on Wall Street he returned to Canada to do the same for the Toronto-based money manager Gluskin Sheff. Rosenberg’s “Breakfast with Dave” subscription service has a devoted following, as do his frequent interviews and articles in publications such as the Wall Street Journal, the Globe and Mail and the Financial Post.

Last November Rosenberg left Gluskin Sheff to hang out his own shingle. The name may be changing, but the schtick has not and will not. Rosenberg is best known as a “perma-bear”, someone who almost always forecasts bad news ahead in the markets. Famously, while Chief Economist at Merrill Lynch, he correctly called the impending real estate crash in the US before the Great Recession in 2008. That made his reputation. Unfortunately, with rare exceptions, he has been calling for more bad news ever since.

Rosenberg is one of those economists of whom it can fairly be said: “He called 39 of the last 9 recessions.” Put another way, even a broken clock is right twice every 24 hours.

Beware the market soothsayers. If you listened to the naysayers a year ago (including Rosenberg), you missed out on the best market performance in the past decade. In investing it pays to stick to the knowable: is this stock over or under priced; are the board and management demonstrably competent and on the shareholders’ side; can the balance sheet withstand the inevitable storms? The rest is guessing, which has no place in long term successful investing.

§

THEME FOR A NEW DECADE

Hop on board the shortage in rental housing!

To quote from an editorial in the January 3rd edition of Globe and Mail:

“Canada has recently been the fastest growing country in the Group of Seven, with a population rising at double the pace of the United States and United Kingdom, and four times that of France and Germany.

According to Statistics Canada projections, our country could have 48.8 million people by 2050. And that’s the agency’s medium growth projection; under a high-growth scenario,there could soon be 56 million Canadians.

Nearly all of these future residents are going to live in this country’s handful of big cities. That means millions of new urban dwellers ....”

At a recent baby boomers dinner party, the talk turned to empty nesters making steps to downsize. The hosts, it turned out, were preparing to put their house on the market, and had been apartment hunting. However, they were discouraged. “How long do you think the waiting lists are to get into a good building in Kingston?” they asked.

No one knew. They answered their own question: “Two hundred. Three hundred. Even five freaking hundred!!!”

Of course that’s just anecdotal. But the Stats Can projections bear out the argument. In large part due to immigration policy, but also taking natural increase into account, there is a widely acknowledged shortage in rental housing stock in Canada’s cities. This bodes well for the the cash flows and growth rates of well-run operators like Minto Apartment Real Estate Income Trust (REIT) of Ottawa. The founding Greenberg family is still running the business and they are best of breed, as is their portfolio of properties.

§

CLASS OF 2020 FIRST TERM REPORT CARD

Solid start, Info Tech shines

At the half-way mark in the 2020 academic year (July 1st to December 31st, 2019) the Class was up a respectable 7.3% vs. 4.2% for the TSX; 9.5% for the S&P 500; and 7.3% for the Dow.

For the calendar year (January 1st to December 31st, 2019) the Class advanced a sparkling 22.1% vs. 19.1% for the TSX; 28.9% for the S&P 500; and 22.3% for the Dow.

The Headmaster is reasonably pleased and offers the following first-term commentary:

“We dodged a bullet in the energy sector with Enbridge making a nice recovery -- there should be more to come -- and the addition of Algonquin’s green energy portfolio to the Class. The pair were up 12.4%.”

“Our Info Tech players -- Apple, Microsoft, Visa and Open Text -- once again led the pack with a sterling average return of 20%. Are they expensive? Arguably, yes. Could their run have exhausted itself? Quite possibly, in the short term. Am I considering replacing these Class leaders with new prospects? Absolutely not.”

“Financials, represented by BlackRock, RBC, ScotiaBank and TD, held their ground, eking out a 1.4% average return. On the plus side, their valuations are quite attractive, a quality that is increasingly difficult to find in many parts of the market. That bodes well for future gains. As noted previously, BlackRock’s co-founder and CEO Larry Fink is an impressive guy, quite visionary and worth keeping an eye on. In his just published annual letter he is committing to exiting positions in environmentally unsustainable businesses. He is encouraging others to do the same. Coming from the head of the largest asset manager in the world ($7 trillion USD), that’s a meaningful nudge.”

“Retail Class veterans Metro and Alimentation Couche Tard clocked a respectable 4.5%. While fully priced for now, they continue to benefit from wise acquisitions. There will be more to come. In particular, I’m following Couche Tard’s mating dance with Caltex, a fuel distributor and convenience store chain in Australia. If the deal goes through, it will be the largest in Couche Tard’s history and transformational for the company. If not, another deal will come along. Couche are patient buyers.”

“Global fertilizers champ Nutrien was beaten up somewhat this past term, dragging the return for Resources down 11.2%. By comparison with key competitors like Mosaic, however, Nutrien is smelling like a rose, given the weak market conditions. All the while, wisely managed Nutrien continues to throw off cash and use it to buy back shares and pay a growing, nicely yielding dividend. With some cooperation in potash and nitrogen prices, I can see this Class member in positive territory by the end of the school year.”

“Brookfield Infrastructure pulled up the Class average with a tidy 15.5% Infrastructure gain. What did the market like? Among other things, canny purchases of cell phone towers and a gas pipeline network in India. And data centres. This classmate is a master at recycling capital to deliver shareholder value. Translation: selling high; buying low.”

“CNR, John Deere and CCL held the fort, almost, for Industrials, with an average return of - 4.1%. Each had to contend with headwinds of one form or another. For CNR, there was the strike; for Deere, the fallout from the US/China trade war in agriculture; for packager CCL, global trade would be a factor, but I also have nagging concerns about purely operational factors. More recent acquisitions have been slow to bear fruit. Let’s hope some of these issues will be resolved by next June.”

“Healthcare desk-mates Amgen and Johnson & Johnson didn’t break a sweat over the past six months, registering an average gain of 17.8%. Do not be deterred by the multitude of talcum powder and opioid litigations J&J is facing. These are par for the course in the pharma world, and are already fully reflected in J&J’s still below par share price. Keep your eye on the business fundamentals. They are doing just fine.”

“Telus, our lone but dependable Class member in Telecom, logged a 3.8% gain. Factor in the dividend yielding 4.6% and what’s not to like?”

“Disney waves the Class flag for Entertainment, and what a flap it has created with the keenly awaited launch of its streaming service Disney +. Since its September debut, subscriptions have breached the 50 million mark and show no signs of slowing down (Netflix watch out). It’s enough to make a Headmaster proud. The stock is up an underwhelming 3.6% for the term. But put that in perspective: over the past 12 months, the House of Mouse has had a run-up of 31.9%. As is so often the case, the market anticipated the good news. Fear not; there should be more to come in the months and years ahead.”

If you would like further information on any of the investing ideas raised in this issue, or a complimentary consultation, please call or email.

CW

0 notes