#best online trading in commodities

Explore tagged Tumblr posts

Text

Trade Gold To Oil With Online Trading In Commodities.

“Explore the lucrative world with Way2forex in online trading in Commodities. Utilize real-time market data, a diverse array of commodities, and effective risk management tools to make informed decisions. Whether you’re new to trading or experienced, online platforms offer accessibility and convenience for optimizing your investment in commodities.”

0 notes

Text

Litecoin trading platform

Actamarkets offers a cutting-edge Litecoin trading platform, designed for traders seeking fast execution, advanced tools, and seamless experience. Join Actamarkets to maximize your Litecoin trading potential.

Visit Us : - https://actamarkets.com/account-types/

#uk#Litecoin trading platform#international brokerage company#Commodity Trading Companies#Currency Exchange Foreign Forex Trading#Low Spreads Forex Trading#Best Forex Trading Platforms#Trade Currency Online With Forex#Foreign Exchange Investment Fx#forex trading investment company#Best Platform For Forex Trading#best commodities trading#MOBUIS TRADER 7 app#best ACTA MARKETS APPS#ACTA MARKETS MT7#best MetaTrader platform#best forex trading with CFDs#BUY or SELL forex CFDs#best cryptocurrency trading platform#litecoin trading platform#best Ethereum with CFDs

0 notes

Text

Discover Top Trading Solutions with WinproFX: Guide to the Best Platforms

WinproFX, located in Mumbai, is committed to providing top-tier trading solutions that cater to diverse trading needs. Our platforms are designed to offer unparalleled access and tools for trading commodities, crude oil, stocks, gold, and silver. Explore our offerings and see why we are the preferred choice for traders.

Best Commodity Trading Platform

WinproFX is renowned for offering theBest commodity trading platform. Our platform supports a wide range of commodities, including agricultural products, energy resources, and metals. With real-time market data, advanced charting tools, and efficient trade execution, you can make informed decisions and capitalize on market opportunities. Our user-friendly interface ensures a seamless trading experience for both novice and experienced traders.

Best Crude Oil Prices Platform

WinproFX provides the Best crude oil prices platform. Our platform offers comprehensive access to global crude oil markets, delivering up-to-date pricing, high liquidity, and competitive spreads. With detailed market analysis and robust trading features, you can navigate the complexities of crude oil trading with confidence and precision.

Top-Rated Online Brokers For Stock Trading

WinproFX is proud to be associated with Top-rated online brokers for stock trading. Our brokers are selected based on their excellence in providing reliable trading services, advanced tools, and exceptional customer support. Whether you’re trading major indices or individual stocks, our brokers offer the expertise and resources needed to enhance your trading experience.

Compare Brokers Offering Automated Trading Solutions

WinproFX, you can Compare brokers offering automated trading solutions to find the best fit for your needs. Our platform provides insights into various brokers' automated trading features, helping you choose the one that aligns with your trading goals and preferences.

Best Gold and Silver Trading Platform

WinproFX excels as the Best gold and silver trading platform. Our platform supports trading in precious metals with competitive pricing, real-time data, and advanced analytical tools. Whether you are trading gold, silver, or both, our platform offers a secure and efficient environment to manage your investments and capitalize on market trends.

WinproFX, we are dedicated to offering the best trading platforms and solutions to help you achieve your financial goals. Join us today and experience top-notch trading services. Visit https://winprofx.com for more information and to start your trading journey.

#winprofx#best#Best Commodity Trading Platform#Best Crude Oil Prices Platform#Top-Rated Online Brokers For Stock Trading

0 notes

Text

Who is a Reliable Online stock Broker in Kolkata For a Beginner Investor?

INV Rajat Finserv is a reliable online stock broker in Kolkata for beginner investors who offers user-friendly platforms, educational resources, and responsive customer support. We will help you ensure a smooth start in the stock market. For more information, visit https://www.invrajatfinserve.com/stock-trading-companies-in-kolkata.php

#best brokerage accounts in Kolkata#online stock broker in Kolkata#stock market broker in Kolkata#stock trading companies in Kolkata#best commodity trading broker in Kolkata#derivatives trading broker in Kolkata

0 notes

Text

Who Provides the Best Commodity Market Services in Alwar?

When it comes to investing in commodities, the residents of Alwar have a gem in their midst. Our financial services firm, which has been a guiding light for many investors, stands out as the go-to place for commodity market services in Alwar.

Understanding Commodity Markets

Before we dive into the services, let’s understand what commodity markets are. Simply put, they are places where you can buy or sell things like wheat, cotton, and even gold. It’s like a big shop where instead of clothes or toys, people trade in goods that come from the earth or are made in large quantities.

Why choose us?

We have been around for a while, and they know the ins and outs of the commodity market like the back of their hand. They offer advice that’s easy to understand and act on, making sure you’re not left scratching your head wondering what to do next.

Gold Trading Expertise

Gold is a big deal in Alwar, and we have got some of the best gold trading experts in Alwar. We can help you understand when to buy gold, when to sell, and how to keep your investments diversified and safe from market volatility. It’s like having a friend who knows all about gold and is always there to give you the best advice.

Personal Touch

What makes us special is the personal touch they bring to their services. They will sit down with you, listen to your aspirations, requirements, and plans, and then help you make the right decisions. Because it’s not just about making money; it’s about making your money work for you.

Community Trust

The people of Alwar trust us because they’ve seen the results. Neighbors, friends, and family members have all worked with us and come away happier and more confident about their investments.

Conclusion

In a city like Alwar, finding someone who understands your financial needs and can offer solid advice on commodity markets is priceless. We have proven time and again that we are the leaders in this field. Whether you’re looking to invest in gold or other commodities, we can be your partner you need.

This article is a brief overview of why we are considered the best provider of commodity market services, especially for those interested in gold trading. For more detailed information and personalized advice, visiting their website or contacting them directly would be the best course of action.

#mutual fund company in alwar#mutual fund sip experts in alwar#mutual fund expert in alwar#mutual fund investment advisor in alwar#mutual funds advisor in alwar#mutual funds sip advisor in alwar#best insurance company in alwar#mutual fund sip services in alwar#online investment in mutual funds in alwar#equity savings funds advisor in Alwar#top equity mutual fund experts in Alwar#equity fund investment advisor in alwar#equity fund experts in alwar#investing in equity mutual funds#equity based mutual funds services in Alwar#commodity market services in Alwar#commodity market news in Alwar#gold trading experts in Alwar#oil trading advisors in Alwar#commodity trading advisor in Alwar#share trading in bhiwadi#f and o trading advisor in bhiwadi#bonds investment platforms in bhiwadi

0 notes

Text

Trade Gold Smartly With Way2forex Online Commodities Trading.

Engage in the dynamic world of online commodities trading. Seize opportunities to trade precious metals, energy resources, agricultural products, and more. Access real-time market data, diversify your portfolio, and harness the potential of commodity markets—all with the convenience of online commodities trading platforms.

0 notes

Text

Which Platform is Good for Commodity Trading?

Commodity trading has grown in popularity as investors seek to diversify their portfolios beyond traditional stocks and bonds. With the rise of online trading platforms, choosing the right platform for commodity trading can make a significant difference in your trading experience and profitability.

Top 10 Platforms for Commodity Trading:

Finding the best commodity trading platform is crucial for beginners looking to trade commodities such as gold, silver, and crude oil. Whether you need a mini futures broker or a comprehensive trading app, the right platform can enhance your trading experience. Here’s a quick overview of the top platforms to help you get started:

1. AvaTrade

Pros: User-friendly, offers both CFDs and futures, extensive educational resources, regulated globally.

Cons: Higher spreads, limited advanced features.

2. Eightcap

Pros: Low fees, ideal for beginners, mobile app available, offers a 20% deposit bonus.

Cons: Limited contract trading tools, fewer educational resources.

3. IG

Pros: Wide market selection, in-depth research reports, user-friendly.

Cons: Higher commissions, complex for beginners.

4. Interactive Brokers

Pros: Access to global exchanges, competitive fees, strong market insights.

Cons: High minimum deposit, steep learning curve.

5. Exness

Pros: Low fees, good educational content, mobile trading available.

Cons: Limited niche market access, complex platform for new traders.

6. CMC Markets

Pros: Low spreads, advanced charting tools, extensive educational content.

Cons: Complex for beginners, limited support for mini futures.

7. E*TRADE Futures

Pros: Low commissions, fast execution, strong research tools.

Cons: Limited educational content, restricted customer support hours.

8. NinjaTrader

Pros: Low-cost futures trading, real-time data, advanced tools for professionals.

Cons: Steep learning curve, limited customer support.

9. TradeStation Futures

Pros: Comprehensive tools for experienced traders, wide market access, strong risk management features.

Cons: High commissions for small traders, not beginner-friendly.

10. Webull Futures

Pros: Commission-free trading, mobile-friendly, real-time data access.

Cons: Limited selection of commodities, minimal educational content.

Each platform offers unique advantages tailored to different trading styles. Beginners should consider factors such as fees, ease of use, available educational resources, and market access before making a choice.

3 notes

·

View notes

Text

FxPro Review: Unveiling the World's Leading Online Forex Broker

In the dynamic realm of financial trading, the significance of efficient and reliable online forex brokers cannot be overstated. Among the myriad options available, FxPro stands out as a beacon of excellence, earning its reputation as the world’s number one online forex (FX) broker. This detailed FxPro review aims to explore the unique features, offerings, and overall experience that have established this broker as a preferred choice for traders globally.

youtube

Discovering FxPro: A Legacy of Trust and Innovation

Founded in 2006, FxPro has carved a niche for itself in the competitive forex market, showcasing a steadfast commitment to providing an exceptional trading experience. As a Top Forex Brokers review, FxPro has successfully built a reputation for transparency, reliability, and innovation, making it a trusted partner for thousands of traders around the world. With a user-centric approach, the broker continuously evolves to meet the needs of its clients, ensuring they have the tools and resources necessary to thrive in the fast-paced world of forex trading.

The FxPro Trading Platforms: A Gateway to Success

Central to FxPro's appeal is its diverse array of trading platforms, designed to cater to the varied preferences of both novice and experienced traders. Each platform boasts unique features that facilitate seamless trading, empowering users to make informed decisions in real-time.

MetaTrader 4 (MT4): The Industry Standard

The MetaTrader 4 (MT4) platform is a cornerstone of the forex trading experience, and FxPro offers an optimized version that enhances its functionality. Known for its user-friendly interface, MT4 provides traders with powerful charting capabilities, a plethora of technical indicators, and automated trading options through Expert Advisors (EAs). This platform is particularly favored by those who appreciate a straightforward yet effective trading environment.

MetaTrader 5 (MT5): The Next Generation

For traders seeking a more advanced experience, FxPro also provides access to the MetaTrader 5 (MT5) platform. MT5 is a comprehensive trading environment that includes advanced order management, a greater array of analytical tools, and an integrated economic calendar. Its multi-asset capabilities extend beyond forex, allowing traders to delve into commodities, stocks, and futures, making it an excellent choice for those looking to diversify their trading portfolio.

cTrader: Innovative and Intuitive

In addition to MT4 and MT5, FxPro offers the cTrader platform, which is designed for traders who prefer a more innovative and user-friendly experience. cTrader features a clean interface, advanced charting tools, and customizable workspaces, catering to both manual traders and algorithmic trading enthusiasts. The platform also includes a community-driven marketplace where traders can share and access trading tools, fostering collaboration and innovation.

Competitive Spreads and Pricing Structure

When it comes to trading costs, FxPro excels in providing competitive spreads and transparent pricing. The broker’s commitment to low trading costs is evident across its various account types, allowing traders to choose an option that best fits their trading style and budget.

FxPro offers several account types—each tailored to different trading needs—ensuring that clients can find a suitable option. For instance, the FxPro MT4 account is popular for its tight spreads and no commission trading, while the FxPro cTrader account provides a commission-based structure with slightly tighter spreads. This flexibility allows traders to optimize their trading strategies while minimizing costs.

Moreover, the broker’s commitment to transparency ensures that traders are always aware of the costs associated with their trades, allowing for effective financial planning and decision-making.

A Diverse Selection of Trading Instruments

One of the standout features of FxPro is its extensive range of trading instruments. While the broker is predominantly known for its forex offerings, it also provides access to a wide array of asset classes, including commodities, indices, and cryptocurrencies.

Forex Trading

FxPro covers a vast selection of currency pairs, encompassing major, minor, and exotic pairs. This diversity enables traders to capitalize on global economic trends and currency fluctuations, providing ample trading opportunities.

Commodity Trading

For those interested in commodities, FxPro offers trading in popular assets such as gold, silver, oil, and agricultural products. This allows traders to hedge against inflation or geopolitical risks while diversifying their investment portfolios.

Indices and Cryptocurrencies

In addition to traditional forex and commodities, FxPro provides access to global indices and a selection of cryptocurrencies. Traders can engage with major indices like the S&P 500 and FTSE 100, or explore the burgeoning cryptocurrency market, including popular coins such as Bitcoin and Ethereum. This extensive range of instruments empowers traders to explore various market dynamics and seize opportunities across different sectors.

Robust Security and Regulatory Oversight

In an industry where security is paramount, FxPro stands out for its commitment to safeguarding client funds and personal information. The broker is regulated by multiple reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. This multi-tiered regulatory framework offers clients peace of mind, knowing that their investments are protected by stringent regulations.

FxPro also employs advanced security measures to ensure the safety of its clients’ funds. These measures include SSL encryption for data protection and two-factor authentication for account security. The broker’s proactive approach to security and regulatory compliance underscores its dedication to maintaining a trustworthy trading environment.

Enhanced Customer Support

Exceptional customer support is a hallmark of a reputable broker, and FxPro does not disappoint in this regard. The broker offers a robust support system designed to assist traders at any stage of their trading journey.

FxPro’s customer support team is available 24/7, providing multilingual assistance to cater to its diverse global clientele. Whether you require help with account management, technical inquiries, or trading strategies, the knowledgeable support staff is always ready to assist.

Additionally, FxPro offers a wealth of educational resources, including webinars, trading tutorials, and market analysis, empowering clients to enhance their trading skills and knowledge. This commitment to client education is a testament to FxPro’s dedication to fostering a supportive trading community.

Educational Resources and Trading Tools

FxPro goes beyond offering trading platforms and customer support by providing a comprehensive suite of educational resources and trading tools. The broker recognizes that informed traders are successful traders, and it strives to equip its clients with the knowledge they need to navigate the complexities of the forex market.

Webinars and Tutorials

FxPro hosts regular webinars led by industry experts, covering a variety of topics ranging from trading strategies to market analysis. These interactive sessions provide valuable insights and allow traders to ask questions in real time, fostering a collaborative learning environment. Additionally, the broker offers a library of tutorials and articles, catering to traders of all experience levels.

Market Analysis

To help traders make informed decisions, FxPro provides daily market analysis and insights. This analysis includes technical and fundamental reports, helping traders understand market trends and identify potential trading opportunities. By staying informed about market developments, traders can enhance their strategies and improve their overall performance.

Trading Tools

FxPro also offers a range of trading tools to enhance the trading experience. These tools include economic calendars, calculators, and trading signals, all designed to assist traders in making informed and timely decisions. Such resources are invaluable for both novice and experienced traders, facilitating a more strategic approach to trading.

Conclusion: The Ultimate Choice for Forex Traders

In this comprehensive FxPro review, we have explored the myriad features and advantages that make this broker a top choice for forex traders worldwide. From its cutting-edge trading platforms and competitive pricing structure to its diverse selection of trading instruments and robust security measures, FxPro has established itself as a leader in the online forex brokerage space.

Through its unwavering commitment to customer support and education, FxPro empowers traders to hone their skills and navigate the complexities of the financial markets with confidence. Whether you are a seasoned trader or just starting your journey in forex trading, FxPro offers the tools, resources, and support to help you succeed.

In conclusion, FxPro stands as a testament to what a premier forex broker should aspire to be. With its extensive offerings and client-focused approach, FxPro is not just a broker; it is a partner in your trading journey, ready to elevate your forex trading experience to new heights.

2 notes

·

View notes

Text

Advanced Tips and Tricks for Global Market Trading

Trading in the global market can be both exciting and profitable if you employ the right strategies. Whether you're dealing with Forex, commodities, or other investments, these advanced tips will set you up for success.

Master Technical Analysis: Technical analysis is crucial for predicting market movements. Learn to read charts and use indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These tools help you identify trends and make informed trading decisions.

Choose the Best Trading Platform: Selecting the right trading platform is essential. Look for platforms that offer real-time data, analytical tools, and a user-friendly interface. Good platforms also provide educational resources and excellent customer support.

Diversify Your Investments: Diversification reduces risk. Spread your investments across different asset classes like Forex, commodities, and stocks. This approach ensures that your portfolio is protected from market volatility.

Stay Updated with Market News: Keeping up with global news, economic events, and market trends is vital. Regularly read financial news and reports. Use economic calendars to track important events that might impact your trades.

Implement Risk Management Strategies: Effective risk management is key to long-term success. Use stop-loss orders to limit potential losses and ensure no single trade can hurt your portfolio too much. This way, you can trade with confidence.

Follow Expert Insights: Industry experts and analysts provide valuable insights. Platforms like TradingView and social media channels can offer advanced strategies and techniques. Learning from these experts can enhance your trading approach.

Use Automated Trading Systems: Automated trading systems can execute trades based on pre-set criteria, helping you take advantage of market opportunities without constant monitoring. Understand the algorithms and monitor their performance regularly.

Focus on Continuous Learning: The trading world is always changing. Participate in webinars, attend workshops, and take online courses to stay updated with the latest strategies and trends. Continuous learning helps you stay ahead.

Monitor Your Performance: Regularly review your trades and performance. Keep a trading journal to track your decisions, outcomes, and lessons learned. This practice helps you improve your strategies and avoid repeating mistakes.

Partner with Reliable Brokers: Choosing a reliable broker is crucial. Look for brokers with competitive spreads, low fees, and robust security measures. A good broker provides the tools and support you need for successful trading.

Trust APM for more expert insights and trading solutions.

5 notes

·

View notes

Text

Online Trading In Commodities With Way2forex.

Online trading in commodities involves buying and selling goods like gold, oil, or agricultural products through digital platforms. Traders can access real-time market data, execute transactions, and manage their portfolios online, offering convenience and flexibility. This form of trading provides opportunities for profit by capitalizing on price fluctuations in commodity markets.

0 notes

Text

Online currency trading platforms

Actamarkets: Your gateway to online currency trading platforms. We offer cutting-edge tools for forex success. Our user-friendly interface makes navigating online currency trading platforms a breeze. Join thousands of traders who trust Actamarkets for their forex needs.

Visit Us : - https://actamarkets.com/trading-flatforms/

#uk#Online currency trading platforms#foreign exchange trading platforms#online forex trading platforms#forex trading download app#platforms for trading forex#popular forex trading platforms#online currency trading platforms#Actamarkets trading#actamarkets online trading#actamarkets online trading platform#actamarkets trading company#international brokerage company#Commodity Trading Companies#Currency Exchange Foreign Forex Trading#Low Spreads Forex Trading#Best Forex Trading Platforms#Trade Currency Online With Forex#Foreign Exchange Investment Fx#forex trading investment company#Best Platform For Forex Trading#best commodities trading#MOBUIS TRADER 7 app#best ACTA MARKETS APPS#ACTA MARKETS MT7#best MetaTrader platform#best forex trading with CFDs#BUY or SELL forex CFDs#best cryptocurrency trading platform#litecoin trading platform

0 notes

Text

10 Best Practices and Disciplines When Trading in the Global Market

Trading in the global market can be both exciting and profitable, but it requires a solid approach and disciplined strategies. Whether you're new to trading or looking to refine your skills, these best practices can help you navigate the complexities of the market. Here are ten essential tips to help you become a successful trader.

1. Choose the Best Trading Platform

Your trading platform is your primary tool. Make sure you choose the best trading platform that offers real-time data, user-friendly interfaces, and robust analytical tools. Look for platforms that provide educational resources and responsive customer support to help you on your trading journey. The right platform can make a significant difference in your trading experience by providing reliable and fast execution of trades, which is crucial for seizing opportunities in volatile markets.

2. Master Forex Trading

Forex trading can be highly profitable if you know what you're doing. Start by learning the basics, such as understanding currency pairs, market hours, and the factors that influence currency prices. Then delve into advanced strategies like technical analysis and risk management. Stay updated with the latest trends and use reliable sources to get your information. Always aim to be the best Forex trading expert by continuously improving your skills. Practice with a demo account before committing real money to refine your strategies without financial risk.

3. Diversify Your Investments

Don’t put all your eggs in one basket. Spread your investments across different asset classes such as stocks, commodities, and Forex. Diversification helps mitigate risks and can lead to more stable returns over time. By investing in a variety of assets, you reduce the impact of a poor-performing investment on your overall portfolio. This strategy helps balance the risk and rewards, providing a more consistent growth trajectory.

4. Keep Up with Market News

Staying informed is crucial. Regularly read financial news, follow economic reports, and pay attention to global events that could impact the markets. This knowledge will help you make informed decisions and anticipate market movements. Utilize reliable news sources and economic calendars to stay ahead of market trends. Understanding the broader economic context can help you predict how markets will react to news and events, giving you an edge in your trading decisions.

5. Practice Risk Management

Effective risk management is key to long-term success. Set stop-loss orders to limit potential losses and avoid over-leveraging your trades. Determine how much of your capital you are willing to risk on each trade and stick to that limit. This practice helps you manage your trades more effectively and protects your portfolio from significant losses. Always remember that protecting your capital is more important than chasing profits.

6. Develop a Trading Plan

Having a well-defined trading plan is essential. Outline your trading goals, risk tolerance, and strategies. A solid plan keeps you focused and helps prevent emotional trading decisions that can lead to losses. Your trading plan should include criteria for entering and exiting trades, risk management techniques, and a schedule for reviewing and adjusting your strategy. Regularly updating your plan based on performance and market conditions can help you stay on track toward your trading goals.

7. Continuously Educate Yourself

The trading world is always evolving. Take advantage of online courses, webinars, and workshops to stay updated on the latest strategies and tools. Continuous learning is crucial to adapting to new market conditions and improving your trading skills. Stay curious and proactive in seeking out new knowledge. Join trading communities and forums to exchange ideas and learn from experienced traders. This ongoing education helps you stay competitive and informed.

8. Use Technical Analysis

Technical analysis involves studying price charts and using indicators to predict future market movements. Learn to use tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands to identify trading opportunities and make more informed decisions. By analyzing past price movements, you can identify patterns and trends that may indicate future price directions. This analytical approach provides a data-driven basis for your trading decisions, increasing your chances of success.

9. Maintain Discipline

Discipline is one of the most important traits of a successful trader. Stick to your trading plan, avoid impulsive decisions, and manage your emotions. Consistent discipline helps you stay focused and reduces the likelihood of costly mistakes. It's essential to stay patient and avoid the temptation to deviate from your plan based on short-term market movements. Keeping a cool head and following your strategy will help you achieve long-term success.

10. Evaluate Your Performance

Regularly review your trades to understand what worked and what didn’t. Keep a trading journal to track your performance, analyze your mistakes, and refine your strategies. Continuous evaluation and adjustment are key to long-term success in trading. By systematically reviewing your trades, you can identify patterns and areas for improvement, helping you become a more effective and successful trader.

Conclusion

By following these best practices and disciplines, you can improve your chances of success in the global market. Remember, choosing the best trading platform and becoming proficient in best Forex trading are just the starting points. Stay informed, manage your risks, and continuously educate yourself to stay ahead in the trading game. Happy trading!

2 notes

·

View notes

Text

What is Derivatives Trading: Who is the Best Derivatives Trading Broker in Kolkata?

Investing can be a great way to grow your money over time. If you’ve been exploring the world of investments, you might have heard about something called derivatives trading. But what exactly is derivatives trading, and how can it benefit you? Let’s dive into this topic and see why we might be the best choice for you if you’re looking for a derivatives trading broker in Kolkata.

Understanding Derivatives Trading

Derivatives are financial contracts whose value is derived from the performance of an underlying asset. This asset could be stocks, bonds, commodities, currencies, interest rates, or market indexes. The main types of derivatives include futures, options, forwards, and swaps.

Futures Contracts: These are agreements to buy or sell an asset at a future date for a price that is agreed upon today.

Options Contracts: These give the buyer the right, but not the obligation, to buy or sell an asset at a set price before a certain date.

Forwards Contracts: These are similar to futures but are not traded on an exchange and are usually customized between parties.

Swaps: These involve exchanging cash flows or other financial instruments between parties.

Why Trade Derivatives?

Derivatives trading can be used for various purposes, including hedging (protecting against price movements), speculation (betting on price movements), and arbitrage (taking advantage of price differences between markets).

For example, a farmer might use derivatives to lock in a price for their crops, protecting against the risk of price drops. On the other hand, a speculator might trade derivatives hoping to profit from the changes in the price of the underlying asset.

Choosing the Best Derivatives Trading Broker

When it comes to choosing a broker for derivatives trading, there are several factors to consider. These include the broker’s reputation, fees, ease of use of their trading platform, customer service, and the range of products they offer.

Why Choose Us?

Our company has earned a solid reputation in Kolkata for being a reliable and trustworthy financial services provider. Here’s why they stand out as the best commodity trading broker in Kolkata and a top choice for derivatives trading:

Experience and Expertise: With years of experience in the financial market, we understand the nuances of derivatives trading. Their team of experts can guide you through the process, making it easier for both beginners and experienced traders.

User-Friendly Platform: Their trading platform is designed to be intuitive and easy to use. This is especially important for new traders who might find complex trading platforms intimidating.

Comprehensive Support: We offer excellent customer support to help you navigate any challenges you might face. Their dedicated support team is available to answer your questions and provide assistance when needed.

Competitive Fees: Cost is always a crucial factor in trading. We offer competitive fees, ensuring that you get the best value for your money.

Multiple offerings: If you want to invest in futures, options, or other derivatives, we can provide you with resources to do so.

Final Thoughts

To Trade derivatives, then it’s important to choose the right broker to help you navigate this complex market. If you are looking for a good broker with expertise, a good platform to invest, constant support, and product offerings, we can help you.

If you’re ready to start your journey in derivatives trading, consider reaching out to us today. They can provide the guidance and support you need to succeed in the exciting world of derivatives trading. Visit our website for more information.

#best brokerage accounts in Kolkata#online stock broker in Kolkata#stock market broker in Kolkata#stock trading companies in Kolkata#best commodity trading broker in Kolkata#derivatives trading broker in Kolkata

0 notes

Text

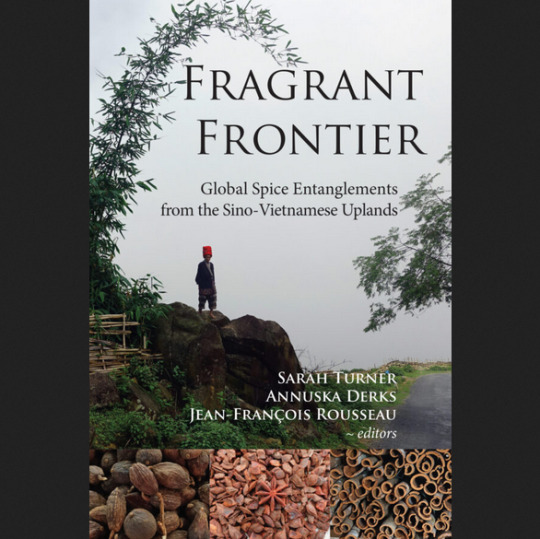

Fragrant Frontier: Global Spice Entanglements from the Sino-Vietnamese Uplands. Edited by Sarah Turner, Annuska Derks, and Jean-Fracois Rousseau. Published in 2022 by Nordic Institute of Asian Studies Press. Part of the series NIAS Studies in Asian Topics.

Open access e-book available. (All blurbs, quotes, and reviews in this post are excerpted from: niaspress.dk/book/fragrant-frontier)

Publisher’s “about the book” blurb:

“Since its inception over two millennia ago, the spice trade has connected and transformed the environments, politics, cultures, and cuisines of vastly different societies around the world. The ‘magical’ qualities of spices mean they offer more than a mere food flavoring, often evoking memories of childhood events or specific festivals. Although spices are frequently found in our kitchen cupboards, how they get there has something of a mythical allure. In this ethnographically rich and insightful study, the authors embark on a journey of demystification that starts in the Sino-Vietnamese uplands with three spices – star anise, black cardamom, and cassia (cinnamon) – and ends on dining tables across the globe. This book foregrounds the experiences of ethnic minority farmers cultivating these spices, highlighting nuanced entanglements among livelihoods, environment, ethnic identity, and external pressures, as well as other factors at play. It then investigates the complex commodity chains that move and transform these spices from upland smallholdings and forests in this frontier to global markets, mapping the flows of spices, identifying the numerous actors involved, and teasing out critical power imbalances. Finally, it focuses on value-creation and the commoditization of these spices across a spectrum of people and places. This rich and carefully integrated volume offers new insights into upland frontier livelihoods and the ongoing implications of the contemporary agrarian transition. Moreover, it bridges the gap in our knowledge regarding how these specific spices, cultivated for centuries in the mountainous Sino-Vietnamese uplands, become everyday ingredients in Global North food, cosmetics, and medicines. Links to online resources, including story maps, provide further insights and visual highlights.”

---

NIAS Press also provides “about the author” blurbs:

“Sarah Turner is Professor of Geography at McGill University. She is a development geographer specializing in ethnic minority livelihoods, agrarian change, and everyday resistance in upland northern Vietnam and southwest China. She also works with street vendors and other members of the mobile informal economy [...] in urban Southeast Asia. [...] [S]he is also an editor of the journals Geoforum and Journal of Vietnamese Studies. Annuska Derks is an [...] is a social anthropologist interested in social transformation processes in Southeast Asia, in particular in Vietnam, Cambodia, and Thailand. Also widely published, her research focuses on migration, labor, gender, as well as the social lives of things [...]. Jean-François Rousseau [...] is a development geographer with research focusing on the relationships between agrarian change, infrastructure development – especially hydropower dams and sand-mining – and ethnic minority livelihood [...].”

---

NIAS Press quotes a couple of book reviews. From Janet Sturgeon of Simon Fraser University:

“This compelling study – one of the best integrated volumes I have read – traces the precarious livelihoods of ethnic minority farmers producing spices under two related processes. The first is global commodity chains, which the chapters follow from node to node along long-standing relations of trust. The second is misguided state-driven interventions to limit farmers’ land and get them to produce monocrops. These combined processes threaten farmers in the borderlands between Vietnam and China, while international traders of these lucrative spices become rich.”

---

Available to read, for free, at NIAS Press.

20 notes

·

View notes

Text

Comparing the Top Online Trading Apps: Which One Is Right for You?

The online stock trading app industry has experienced a tremendous surge since the onset of the pandemic in 2020. Thanks to improved internet speeds and the growing interest in financial literacy, mobile-based stock trading has undergone a significant transformation. Each day, more Indians are experiencing the seamless shift towards incredibly smooth and flexible trading options, all available at the touch of a button.

As these apps continue to gain widespread adoption, even beginners can enter the world of trading with ease. These applications not only enable the buying and selling of financial assets but also offer a range of other valuable services. The only requirement is a reliable internet connection to ensure these trading apps operate smoothly.

This article has listed some of the best online trading apps so that you can choose any one of them.

Top Three Online Trading Apps

The list of the best online trading app is as follows.

1. Zerodha Kite

Zerodha boasts over 100 million active clients, contributing significantly to India's retail trading volumes, making up about 15% of the total. This app is highly recommended for both beginners and experienced traders and investors, thanks to its robust technological platform.

Zerodha's flagship mobile trading software, Kite, is developed in-house. The current Kite 3.0 web platform offers a wide array of features, including market watch, advanced charting with over 100 indicators, and advanced order types such as cover orders and good till triggered (GTT) orders, ensuring swift order placements.

Furthermore, users can also utilise Zerodha Kite as a Chrome extension, enabling features like order placement and stock tracking for added convenience.

2. Kotak Securities

Opening a trading account at Kotak Securities comes with the advantage of zero account opening fees. Additionally, there are discounted rates for investors below 30 years of age, making it a cost-effective option. The account setup process is streamlined, with minimal steps involved.

Kotak Securities enables users to engage in a wide range of financial activities, including trading in stocks, IPOs, derivatives, mutual funds, currency, and commodities. Furthermore, it offers opportunities for global investments through its trading app. This app is thoughtfully designed, featuring a user-friendly interface accessible on iOS, Android, and Windows platforms. It also provides valuable extras like margin funding, real-time portfolio tracking, and live stock quotes with charting options.

3. Upstox

Upstox PRO, supported by Tiger Global and endorsed by prominent investors like Indian tycoon Ratan Tata and Tiger Global Management, is a well-known discount broker app. It offers a range of trading and investment opportunities, encompassing stocks, currencies, commodities, and mutual funds. For experienced and seasoned investors, it is an ideal choice, featuring advanced tools such as TradingView and ChartsIQ libraries.

Online trading apps offer a diverse array of financial products and services, consolidating your investment and financial management in one convenient platform. You can engage in activities such as trading equities, participating in IPOs, trading derivatives, investing in mutual funds, placing fixed deposits, dealing in commodities, and trading currency.

2 notes

·

View notes

Text

youtube

UC Berkeley Doctor Studied 1700 NDE Cases & WHAT He Discovered Gave Him CHILLS!! | Jeffrey Mishlove

Welcome to today's episode, where we dive deep into a fascinating conversation with the renowned Dr. Jeffrey Mishlove. 🌟 Best-selling author, licensed clinical psychologist, and a prominent figure in the realm of consciousness studies, Dr. Mishlove's credentials and contributions are nothing short of awe-inspiring.

Graduating from the University of California, Berkeley, in 1980, Dr. Mishlove holds the unique distinction of possessing the only doctoral diploma in parapsychology awarded by an accredited American university. Not only has he been a registered Commodity Trading Advisor, but he also has rich experience as a licensed psychologist in California.

From 1987 to 2002, Dr. Mishlove graced the screens of many as the host of the national public television series, 'Thinking Allowed.' For those familiar with CNBC’s 2007 Million Dollar Portfolio Challenge, you might recognize him as the author of the Handbook for Contestants. Furthermore, his work, "The Roots of Consciousness," serves as an expansive volume on consciousness studies, reinforcing his authority in the field.

One of the most eloquent voices on television, Dr. Mishlove's interviewing skills are unparalleled. And if you've been seeking stimulating content online, you must check out 'New Thinking Allowed.' This ongoing YouTube series sees him delve into riveting topics and discussions, ensuring that the flame of 'Thinking Allowed' continues to burn bright.

Beyond his media endeavors, Dr. Mishlove has significantly impacted the psychology community. He's been at the helm of the Association for Humanistic Psychology and led the Intuition Network as its President.

His exploration into the mysterious realms of the mind extends to his books. A notable mention is "Psi Development Systems," a revision of his doctoral dissertation, which critically evaluates methods claimed to train psychic abilities. And for those intrigued by the supernatural, his book, 'The PK Man,' is a must-read.

Dive into our enlightening conversation now! And don’t forget to LIKE, SHARE, and SUBSCRIBE for more thought-provoking episodes. Your support keeps the flame alive! 🔥 Enjoy!

#life after death#survival of consciousness#post mortem#post mortem survival#Robert Bigelow#jeffrey mishlove#nde#near death experience#after death communications#instrumental trans communication#William James#parapsychology#paranormal#paranormal investigation

2 notes

·

View notes