#best online forex trading app in India

Explore tagged Tumblr posts

Text

Choose The Most Secure Online Forex Trading App in India

Finding the best online forex trading app in India is essential in the Indian trading landscape. Choosing the right app can make a significant difference to your trading experience. It offers an intuitive and user-friendly interface, reducing trading time and effort.

Further, a reliable app ensures swift and secure transactions, preventing disruptions or security breaches. As a result, the right trading app can elevate your trading game, making it an essential tool for both beginners and experienced traders.

Read more: https://post.news/@/forex4youindia/2UVzrbNSnLSWxYcFcHSTG6LWCw0

0 notes

Text

AUD to INR: A Comprehensive Guide for Travelers and Expats

Traveling or relocating between Australia and India often involves currency exchange, and understanding how to convert AUD to INR effectively can save both time and money. Whether you are planning a vacation, sending money home, or managing finances as an expat, this guide will help you navigate the process smoothly.

Understanding the AUD to INR Exchange Rate

The exchange rate between the Australian Dollar (AUD) and the Indian Rupee (INR) fluctuates due to various factors, such as:

Global market trends: economic indicators, interest rates, and geopolitical events.

Supply and demand: The flow of AUD and INR in the forex market.

Inflation rates: A country’s economic stability significantly impacts its currency value.

To stay updated, check reliable sources or use online tools like the 1 AUD to INR currency converter, which provides real-time exchange rates.

Why Exchange Rates Matter

Getting the best exchange rate can significantly impact your budget. For instance, even a slight difference in rates when you buy Australian dollars can translate into a significant financial gain or loss, especially for large transactions.

Top Ways to Convert AUD to INR

1. Currency Exchange Counters

Exchange counters at airports, banks, or authorized forex agents are convenient but often come with higher margins. Compare rates before making a decision.

2. Online Forex Platforms

Online platforms like currency exchange apps provide competitive rates and added convenience. Many also allow you to track rates and lock them in when favorable.

3. Local Banks

Banks offer currency exchange services, often with secure transactions. However, their rates might not be as competitive as specialized forex platforms.

4. Travel Cards and Prepaid Cards

Forex travel cards are a great option for frequent travelers. Load Australian dollars onto the card and use them to withdraw cash or make payments in Australia.

Tips for Getting the Best AUD to INR Rates

Monitor Exchange Rates Regularly: Use tools to track fluctuations and lock in favorable rates.

Avoid Last-Minute Exchanges: Exchange money before you travel to avoid unfavorable airport rates.

Compare Multiple Providers: Check rates across banks, forex agents, and online platforms.

Choose the Right Timing: Exchange rates are typically better during weekdays due to active forex trading.

Key Considerations for Expats

For expats sending money from Australia to India, consider the following:

Remittance Services: Use reliable services for low fees and competitive exchange rates.

Tax Implications: Be aware of tax regulations in both countries regarding remittances.

Currency Volatility: Plan transfers when rates are stable to maximize value.

FAQs

1. What is the best time to exchange AUD to INR?

Exchange rates tend to be more stable during business hours on weekdays. Avoid exchanging during holidays or weekends, as rates may include higher margins.

2. Can I lock in an exchange rate?

Yes, many forex providers allow you to lock in rates for a specific period. This is particularly useful if you expect the AUD to INR rate to become less favorable.

3. Where can I buy Australian dollars in India?

You can buy Australian dollars at authorized forex dealers, banks, or online platforms. Compare rates to ensure you get the best deal.

Conclusion

Exchanging AUD to INR doesn’t have to be a complicated process. By staying informed, comparing providers, and planning ahead, you can maximize your money’s value whether you're traveling, relocating, or sending funds. Use trusted tools to monitor the 1 AUD to INR rate and always choose secure and cost-effective methods when you buy Australian dollars.

With a bit of preparation, you can ensure seamless financial transactions between Australia and India.

0 notes

Text

Expert Reviews: Best Forex Trading Apps for Indians in 2024

Introduction

Forex trading, or foreign exchange trading, has gained significant popularity in India over recent years. With the rise of digital platforms, Indian traders have more options than ever to participate in the global forex market. Choosing the best forex trading app in India can make a significant difference in trading efficiency and profitability. This blog will review some of the top forex trading apps available for Indian traders in 2024.

Criteria for Selecting the Best Forex Trading App

Selecting the best forex trading app in India involves considering several key factors:

User Interface and Experience: The app should be intuitive and user-friendly.

Trading Tools and Features: Availability of advanced trading tools and real-time data.

Security: Robust security measures to protect user data and funds.

Fees and Charges: Competitive and transparent fee structures.

Customer Support: Efficient and accessible customer support services.

Regulation and Compliance: Adherence to regulatory standards for safety and legality.

Zerodha

Zerodha has established itself as a pioneer in the discount brokerage industry in India. While primarily known for its equity trading services, Zerodha's forex trading platform is also noteworthy. The app offers:

Low Brokerage Charges: Zerodha's competitive pricing extends to its forex trading services, making it one of the best forex trading apps in India.

Kite Platform: An intuitive and powerful trading platform with advanced charting tools and a seamless user interface.

Educational Resources: Comprehensive educational resources to help traders make informed decisions.

Upstox

Upstox is another prominent name in the Indian trading ecosystem, offering a robust platform for forex trading. Key features include:

User-Friendly Interface: The Upstox Pro app provides a smooth and intuitive trading experience.

Advanced Charting Tools: A wide range of technical analysis tools to aid traders in making informed decisions.

Competitive Fees: Upstox maintains low and transparent fee structures, making it accessible to all levels of traders.

Angel One

Angel One, formerly known as Angel Broking, provides a comprehensive suite of trading solutions, including forex trading. Highlights of the Angel One app include:

Wide Range of Currency Pairs: Access to a diverse range of forex trading pairs.

Smart Money Management Tools: Tools that help traders manage their investments effectively.

Educational Support: A rich library of tutorials and articles to support traders at all levels.

5Paisa

5Paisa is well-known for its low-cost trading services, extending its affordability to forex trading. The app offers:

Flat Fee Structure: One of the lowest brokerage charges in the industry, ensuring cost-effective trading.

User-Friendly Platform: An easy-to-navigate app with essential tools for forex trading.

Research and Analysis: Access to research reports and market analysis to aid in trading decisions.

ICICI Direct

ICICI Direct, a subsidiary of ICICI Bank, seamlessly integrates banking services with forex trading. The ICICI Direct app provides:

Secure Transactions: Enhanced security features due to its banking background.

Comprehensive Tools: Advanced trading tools and resources for thorough market analysis.

Customer Support: Efficient support services backed by a reputable financial institution.

Kotak Securities

Kotak Securities, part of Kotak Mahindra Bank, offers a reliable and feature-rich forex trading platform. Key features include:

Integrated Banking Services: Smooth integration with Kotak Mahindra Bank for easy fund transfers.

Advanced Trading Tools: A variety of tools for technical and fundamental analysis.

Transparent Fees: Clear and competitive fee structures.

SAS Online

SAS Online is known for providing some of the lowest trading fees in the industry. The app offers:

Low Brokerage Fees: Extremely competitive fee structure with no hidden charges.

Robust Trading Platform: Advanced trading tools and a user-friendly interface.

Real-Time Data: Access to real-time market data and analysis tools.

HDFC Securities

HDFC Securities combines the trust of HDFC Bank with robust trading features. The HDFC Securities app includes:

Secure and Reliable: High level of security and reliability backed by HDFC Bank.

Advanced Tools: Comprehensive trading tools and resources for in-depth analysis.

Customer Support: Excellent customer support services for timely assistance.

SBI Securities

SBI Securities, backed by the State Bank of India, offers a reliable and secure forex trading platform. The app provides:

Government-backed Security: High trust and security due to its state-owned background.

Comprehensive Tools: A range of tools for effective forex trading.

Competitive Fees: Reasonable and transparent fee structures.

m.Stock

m.Stock by Mirae Asset is an emerging player in the forex trading market. The m.Stock app offers:

Attractive Pricing: Competitive and transparent brokerage fees.

User-Friendly Platform: Intuitive interface with advanced charting and trading tools.

Real-Time Data: Access to real-time market information and analytics.

Comparative Analysis of the Best Forex Trading Apps

Here's a comparative analysis of the discussed forex trading apps:

App

Key Features

Brokerage Fees

User Interface

Security

Customer Support

Zerodha

Low costs, Kite platform, educational resources

Very Low

Highly Intuitive

Robust

Excellent

Upstox

Advanced tools, competitive fees

Low

User-Friendly

Strong

Good

Angel One

Wide currency pairs, smart money management

Competitive

Intuitive

Strong

Excellent

5Paisa

Flat fees, research and analysis

Very Low

Easy-to-Navigate

Robust

Good

ICICI Direct

Integrated banking, secure transactions

Competitive

Comprehensive

Very Strong

Excellent

Kotak Securities

Integrated banking, advanced tools

Competitive

Intuitive

Very Strong

Excellent

SAS Online

Lowest fees, robust platform

Extremely Low

User-Friendly

Strong

Good

HDFC Securities

High security, advanced tools

Competitive

Robust

Very Strong

Excellent

SBI Securities

Government-backed security, comprehensive tools

Competitive

User-Friendly

Very Strong

Good

m.Stock

Attractive pricing, real-time data

Competitive

Intuitive

Strong

Good

Conclusion

Choosing the best forex trading app in India is crucial for ensuring a seamless and profitable trading experience. In 2024, apps like Zerodha, Upstox, and Angel One lead the pack with their innovative features, competitive fees, and robust platforms. Emerging players like m.Stock are also making significant strides with attractive pricing and user-friendly interfaces.

When selecting a forex trading app, consider factors like brokerage fees, user interface, security, and customer support. This comprehensive review provides a thorough understanding of the best forex trading apps in India, helping you make an informed decision tailored to your trading needs. Whether you are a novice trader or an experienced investor, the right app can significantly enhance your trading journey.

0 notes

Text

3 Best Stock Market Simulators

The majority of individuals find the stock market to be thrilling but unsettling. This is due to the uncertainty that comes with an investment in it. Fortunately, a stock market simulator can ease the tension associated with trading. With a stock market simulator, you can test your investing methods without the risk of losing money. Here are the best stock market simulator

Warrior Trading

Day traders are the target audience for Warrior Trading. If you are new to stock investing, you can take a look at the Trade Terminology page of Warrior Trading. Warriors Trading offers various subscription plans. The Warrior starter, a basic 30-day subscription plan is designed to get you started and is an important instruction curriculum for beginners and novices. The Warrior Pro program offers mentor sessions, forex trading room chat access, unrestricted connectivity to Warrior Pro Masterclasses courses, and more.

Ziggma

Ziggma is developed to assist investors in the management of their investment portfolio. A sharemarket simulator is one of the management tools offered by Ziggma. It also offers a free and paid account plan. However, the portfolio simulator is not available in the free forever plan. The premium account has a starting price of $9.90 per month. To access the Ziggma stock market simulator, you must create an account with Ziggma and connect it to your investment portfolio.

Investopedia Stock Simulator

The Investopia stock market simulator enables you to play around with any sum of fictitious money. It is a free stock simulator. This website also enables you to interact with over 700,000 investors in a community forum The US traded stocks, ETFs, and more are the stocks that can be traded with Investopia.

Frequently Asked Questions

What is the best stock market simulator? Some of the best stock market simulators include TradeStation, HowToTradeTheMarkets, TradingView, and TD Ameritrade's Virtual Stock Exchange. Each of these market simulators comes with a unique set of advantages as well as disadvantages. Is there a free trading simulator? Some of the free trading simulators include Interactive Broker, eOption, Tradestation, TD Ameritrade, and Webull. These simulators offer a free and paid plan How can I practice stocks without using real money? Online tools like stock market simulators enable you to hone and practice stock trading without risking real money. Upon creating an account with a simulator, you will be given a certain amount of fictitious money for a fictitious investment. Is the Investopedia simulator free? Yes! Investopedia offers its stick simulator service for free. You don't need to provide your financial details when creating an account. Virtual money is the money used in the trading of stocks in Investopedia. Which trading app is best in India? The most popular and best trading applications in India are Diamond Online Trading App, Fyers App, HDFC Securities, IIFL Market Trading App, and Stock EdgE.

Summary

As a newbie in stock investment, Stock Simulator enables you to gain knowledge about the investment world. It guides you as you begin your stock investment journey, and it provides you with stock trading techniques that are useful in the real world. Read the full article

0 notes

Text

Navigating Currency Exchange in Delhi: Your Ultimate Guide to Best Forex Rates

Are you planning a trip abroad or engaged in international business transactions? Then you have to be aware of the difficulty and importance of exchanging currencies. People who live in India’s busy capital Delhi are heavily dependent on reliable currency exchange services. We’ll learn about the ins and outs of currency exchange in Delhi in this blog post, covering everything from navigating the foreign exchange market to where to find the best foreign exchange rates.

Understanding Currency Exchange

The practice of changing one currency into another, usually for use in travel or financial transactions, is known as currency exchange. How much one currency is worth in terms of another is determined by the exchange rate. To get the most out of your money, you must ensure that the exchange rates are as favourable as possible.

Currency Exchange in Delhi

As India’s capital and largest metropolis, Delhi offers a wide range of currency exchange choices. When looking for foreign exchange services, you have a few options to consider, ranging from conventional brick-and-mortar enterprises to internet platforms.

1. Brick-and-Mortar Currency Exchange Centers

There are numerous traditional currency exchange locations in Delhi, especially in tourist and business visitor regions. Among the popular locations with many of exchange outlets are Connaught Place, Karol Bagh, and Nehru Place. The benefits of in-person transactions and quick access to cash are provided by these venues.

2. Online Currency Exchange Platforms

Online currency exchange platforms have been more and more popular in recent years because of their affordability and favorable conversion rates. With the convenience of your home or place of business, these platforms let you purchase and sell foreign exchange. Seek out trustworthy sites that provide safe transactions and open pricing.

Factors Affecting Exchange Rates

Exchange rates are influenced by a number of variables, such as market speculation, geopolitical events, and economic data. You may predict currency changes and make wise decisions when exchanging currencies by being aware of these aspects.

Tips for Getting the Best Forex Rates

Now that you understand the fundamentals of currency exchange in Delhi, you can use the following advice to get the best exchange rates:

Evaluate Prices: Never accept the first exchange rate you find online. To be sure you’re receiving the greatest value, shop around and compare the rates provided by various foreign exchange services.

Steer clear of airport exchanges: Airport exchange rates are quite negative. Exchange money at locations in cities whenever you can to avoid paying hefty fees and bad exchange rates.

Keep an eye on exchange rates: Pay attention to changes in exchange rates and exchange money when the rates are favorable. Track real-time exchange rates with mobile apps and web resources.

Think About Web-Based Platforms: Examine online exchange services that provide convenient transactions and competitive prices. Numerous

Exchange Foreign Currency with Confidence

The world of currency conversion can be intimidating, whether you’re going overseas or conducting business there. But if you have the appropriate information and tools, you may exchange foreign money with assurance.

There are several alternatives for exchanging currencies in Delhi’s bustling marketplace, ranging from conventional stores to internet sites. To get the best forex rates and maximize your currency exchange operations, compare rates, keep up with exchange rate trends, and select reliable service providers.

Remember that in the area of currency trading, better decisions result from having more knowledge. Therefore, spend some time researching and organizing your currency exchange strategy before to your next travel or business endeavor. We wish you safe travels and prosperous business dealings!

Source By: https://medium.com/@zenithforex.india/navigating-currency-exchange-in-delhi-your-ultimate-guide-to-best-forex-rates-d68c7629d9fe

0 notes

Text

Understanding to Trading in Financial Market

capital. While it can amplify profits, it also increases the risk of significant losses.

If you want to learn more about trading then joinInvestingdaddy.com.

Steps to Trading:

Education:

Learn the basics of financial markets, instruments, and trading strategies. There are various resources, including online courses, books, and tutorials.

Selecting a Market:

Choose the financial market you want to trade in. Common markets include stocks, forex, commodities, and cryptocurrencies.

Setting Goals:

Define your financial goals, risk tolerance, and time horizon. Your trading strategy should align with these factors.

Creating a Trading Plan:

Develop a comprehensive trading plan that outlines your approach, risk management strategy, and criteria for entering and exiting trades.

Opening a Trading Account:

Choose a reputable broker and open a trading account. Ensure the broker provides access to the markets you're interested in.

Practicing with a Demo Account:

Many brokers offer demo accounts where you can practice trading with virtual money before risking real capital.

Executing Trades:

Use your trading platform to execute buy or sell orders based on your analysis and strategy.

Monitoring and Adapting:

Regularly monitor your trades and market conditions. Be prepared to adapt your strategy based on changing circumstances.

Continuous Learning:

Financial markets are dynamic and constantly evolving. Stay informed and continuously educate yourself about market trends and new trading strategies.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in india.

You can also downloadLTP Calculator app by clicking on download button.

Remember that trading involves risk, and there are no guarantees of profits. It's essential to approach trading with discipline, caution, and a commitment to ongoing learning and improvement. If you're new to trading, consider seeking advice from experienced traders or financial professionals.

0 notes

Text

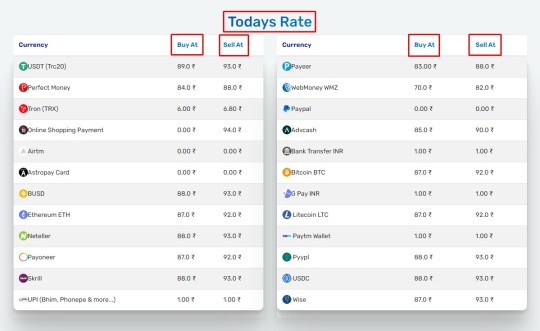

Why RupeeChanger is the best money exchanger in INDIA

RupeeChanger is an Online Exchange Service provider in India. Among the various options available in India, RupeeChanger stands out as the best money exchanger. With its exceptional services and customer-centric approach, RupeeChanger offers numerous benefits to individuals and businesses alike. This article will explore the reasons why RupeeChanger is the preferred choice for currency exchange in India.

Convenient Exchange Services

RupeeChanger understands the importance of convenience for its customers. They have established a seamless process that ensures hassle-free currency exchange. Whether you need to exchange currency for travel purposes or for business transactions, RupeeChanger simplifies the process, saving you time and effort.

Competitive Exchange Rates

One of the key advantages of RupeeChanger is its commitment to providing competitive exchange rates. They understand the significance of getting the best value for your money, and therefore, offer rates that are favorable compared to other money exchangers in India. By choosing RupeeChanger, customers can maximize their currency conversion and enjoy significant savings.

Secure and Reliable Transactions

Security is a top priority for RupeeChanger. They have implemented robust security measures to ensure that every transaction is safe and reliable. By leveraging advanced encryption technology, RupeeChanger safeguards sensitive customer information and ensures that financial transactions are conducted securely.

Wide Range of Currencies

Check our currency reserve

RupeeChanger offers a comprehensive selection of currencies to cater to the diverse needs of its customers.

What RupeeChanger offers? Here is the List:

Usd to UPI/Bank

USD to INR

UPI to Perfectmoney

UPI to Webmoney

UPI to Payeer

UPI to AirTm

UPI to Skrill

UPI to Neteller

UPI TO USDT

INR TO USD

USD to INR

E-wallet like

Perfectmoney

Skrill

Advcash

Payeer

Netteler

USDT

Webmoney

Payoneer

Wise

Pyypl

Trading Forex

Auto surfs

High Yield Investment Plans

Online Product Purchase

We Help You to Convert Rupees to E-wallet and Buy/sell and Exchange using our App/ Website in India.

User-Friendly Online Platform

With a user-friendly online platform, RupeeChanger simplifies the currency exchange process further. Their intuitive interface allows customers to easily navigate through the website, select the desired currency, and complete transactions seamlessly. The online platform is accessible 24/7, providing convenience and flexibility to customers at their fingertips.

Efficient Customer Support

RupeeChanger takes pride in its exceptional customer support. Their team of knowledgeable professionals is readily available to assist customers with any queries or concerns they may have. Whether you need assistance with transaction-related matters or require guidance on currency exchange, RupeeChanger's customer support ensures a satisfactory experience.

Trusted and Established Reputation

Over the years, RupeeChanger has built a trusted and established reputation in the money exchange industry. Their commitment to transparency, reliability, and customer satisfaction has earned them the trust of countless individuals and businesses across India. Choosing RupeeChanger means relying on a reputable organization for your currency exchange needs.

Speedy Transaction Processing

Time is of the essence when it comes to currency exchange. RupeeChanger recognizes this and ensures speedy transaction processing. Their efficient systems and streamlined procedures enable swift currency conversion, allowing customers to access their funds promptly. With RupeeChanger, you can expect quick and efficient service every time.

youtube

Click Here For More Details: https://rupeechanger.com Download our App from Google Play: https://bit.ly/RupeeChanger

#rupeechanger #moneyexchange #indiamoneyexchange #currencyexchange #india

#rupeechanger#rupee#indian rupee#rupee vs dollar#digital rupee#free usdt#usdt被骗怎么办#currency#exchange#indian#business#Youtube

0 notes

Text

Timeless Stock Trading Tips From Expert Traders (PT 3/3)

Read part 2 here: Timeless stock trading tips from expert traders (Pt 2/3)

Have a plan and stick to it

When you're trading stocks, it's important to have an idea of what type of position you want to take before entering into the trade — whether long or short. You should always know which side of the market you're on before making any trades so that you can exit at either a profit or loss when appropriate.

Avoid the herd mentality at all costs

The best time to buy or sell stocks is often when everyone else is doing just the opposite — this concept is known as contrarian trading. The idea behind contrarian trading is that if everyone thinks a stock will go up or down in value based on their emotions or expectations, then the price may already be factoring those thoughts into its price.

Be prepared to take losses

When you're a trader, you have to be prepared for losses. If you start losing money, get out of the trade — even if it means taking a loss. If your strategy says that you're supposed to take profits at an average of INR 1,000 per trade, then you must also be ready for losing trades as well. Don't risk more than what you can afford to lose on any one trade.

Don't overtrade

If you're entering and exiting positions very quickly, a lot of your trades could end up with losses. It's also possible that by trying to "make it back" on the next trade, you'll be more inclined to take more risks than if you had just taken a small loss on the previous trade and moved on.

Final words

These are some of the timeless stock trading tips from expert traders. Of course, there's much more successful trading. It's a long learning curve. So, get started with the best stock broker and start trading. As you move forward and gain experience, your portfolio will eventually consolidate and get better. Sign up for an online trading platform today.

#best stock app for beginners in india#best stock trading apps india#apps to invest in stocks in india#indian share market trading app#best apps for investing in stocks in india#best app for india stock market#best share market app for beginners in india#stock trading app in india#best app to invest in stocks india#share market practice app india#online stock trading app india#india top share market app#daily trading app india#stock buying app india#demo stock trading app india#forex trading in india app#share market best app india#indian stock exchange app#best virtual stock trading app india#best share market apps in india#share market investment app in india#no 1 share market app in india#top share market trading app in india#best forex trading app india#top share trading app in india#india best stock broker app#best share buying app india#best apps for trading stocks india#top share trading apps in india#best online trading app for beginners in india

0 notes

Text

Choosing the Best Online Forex Trading App in India: Significance and Benefits

When starting forex trading in India, choosing the right online forex trading app is important. Here's why it's significant:

Convenience and Accessibility: The right trading apps allow you to trade forex at your convenient time and place.

Real-Time Market Data: Choosing the right trading apps provides access to real-time market data and economic news. This enables you to make informed trading decisions based on the latest market trends and developments.

Seamless Trade Execution: The best trading apps offer fast and reliable trade execution, ensuring your orders are executed promptly and accurately.

Security: Trading with the most reliable apps is regulated by recognized authorities, providing a safe and transparent trading environment.

Customer Support: Choosing a reliable trading app means responsive customer support. Prompt assistance from knowledgeable professionals can be invaluable in resolving trading-related queries or technical issues.

By selecting the best online forex trading app in India like Forex4you, you can enjoy convenience, real-time data, secure trading, and excellent customer support. Take the time to research and choose an app that suits your trading needs and preferences, and elevate your forex trading experience in India.

0 notes

Text

UAE Dirham to INR: How to Get the Best Conversion Rates in 2024

The UAE Dirham (AED) to Indian Rupee (INR) exchange rate is crucial for travelers, expats, and businesses dealing between the UAE and India. With evolving currency markets, finding the best conversion rates can help save a significant amount. Whether you’re planning to buy UAE dirham online or manage funds while working abroad, this guide provides you with top tips and methods to secure the best exchange rates in 2024.

1. Monitor Exchange Rates Regularly

Currency values fluctuate daily based on economic events, geopolitical factors, and market demand. Keeping an eye on these fluctuations can help you decide the right time to convert UAE dirhams to INR for maximum value.

Use Currency Monitoring Tools: Websites and apps offer real-time rate monitoring, which allows you to track changes throughout the day. Some platforms even offer notifications when rates reach your preferred levels.

Understand Daily Trends: Currencies like the AED and INR often fluctuate within predictable ranges. Observing daily trends can help you spot when the rates are better.

2. Compare Different Money Exchange Providers

Many exchange providers in India and the UAE offer various rates, fees, and margins. Compare rates across multiple platforms before making a decision.

Banks vs. Forex Platforms: Banks often charge higher fees than specialized forex platforms. Forex providers may offer better rates, especially when dealing with large amounts.

Currency Exchange Apps: Apps like PayPal, Remitly, and Western Union allow you to send and convert currency online, often at competitive rates. Just ensure you read all the fine print regarding fees.

3. Consider Buying UAE Dirham Online

In 2024, there are various platforms that allow you to buy UAE dirham online, often at better rates than physical locations. Online platforms generally provide transparent pricing with lower overhead costs, making them ideal for quick conversions and rate comparisons.

Look for Platforms with Low Fees: Fees can vary significantly between providers, so prioritize platforms with low or no hidden charges.

Use Trusted Platforms Only: Reputable online services like BookMyForex, Wise (formerly TransferWise), and CurrencyFair have established credibility and offer favorable rates.

4. Choose the Right Time of Day for Your Transaction

Currency conversion rates can differ based on the time of day. Major financial centers like London, New York, and Dubai impact currency values during their active trading hours.

Convert During Overlapping Trading Hours: For AED to INR, converting during hours when both UAE and Indian markets are active may offer better rates.

Avoid Converting on Weekends: Many platforms set higher rates on weekends due to limited forex market activity.

5. Use Currency Conversion Lock-In Services

Some providers allow you to lock in exchange rates for a specific period, securing a favorable rate despite future fluctuations.

Benefits of Rate Locking: This can be helpful if you’re expecting market volatility but want to ensure you get the best rate now.

Where to Find Rate Locks: Banks, forex apps, and some online forex brokers offer rate-locking services. Just confirm any fees involved with locking in a rate.

6. Opt for Foreign Currency Cards

If you frequently travel between India and the UAE, foreign currency cards can help you avoid the hassle of multiple conversions and get more favorable rates.

Prepaid Forex Cards: These cards allow you to preload AED and use it in UAE without constantly converting AED to INR and vice versa.

Multi-Currency Cards: Some cards support multiple currencies, including AED, which can be handy for travelers covering multiple countries.

7. Avoid Airport and Hotel Currency Exchanges

Airport and hotel exchange counters typically offer lower rates with high fees. For better value, use city-based exchange providers or online services before departure.

Tips to Keep in Mind When Buying AED Online

When you decide to buy UAE Dirham online, it’s essential to keep certain tips in mind to ensure a secure and cost-effective transaction.

Read Customer Reviews: Reliable online platforms will have positive reviews and testimonials. This can give you an idea of the service quality.

Check for Transaction Limits: Some platforms may impose minimum or maximum limits, so be sure to confirm them if you have specific conversion needs.

Understand the Exchange Platform’s Policies: Be sure to read through their terms and conditions to understand any additional fees, delivery times, and policies.

How to Track UAE Dirham to INR Rates in 2024

In 2024, keeping up with real-time exchange rates is easier than ever. Here are some useful resources to monitor UAE Dirham to INR rates.

Mobile Apps: Apps like XE, Currency Converter Plus, and Google Finance allow you to check AED to INR rates anytime.

Currency Websites: Websites like BookMyForex and Wise provide daily rate updates and conversion calculators.

Subscription Alerts: Many forex sites and apps allow you to set alerts so you’re notified when the rate hits your preferred level.

Conclusion

Getting the best UAE Dirham to INR conversion rates in 2024 requires a combination of timing, market awareness, and using the right tools. By following the tips above, you can make the most out of your conversions, whether you need a small amount for travel or are handling larger sums as an expat or business. Remember, the best rate is one that aligns with your needs, whether that’s a low fee, high rate, or a quick transaction.

0 notes

Text

Trading Platform For Mac

Our MetaTrader 4 Mac and Windows software is a popular choice for novice and expert traders alike for trading Forex, analyzing financial markets and using Expert Advisors (EAs). Not all MetaTrader platforms are created equal, and with over 10 years of servicing traders, we’ve been able to create a world-class MT4 solution, including.

Download our Live Desktop trading platform or Practice desktop platform launcher shortcuts for quick access to the OANDA Desktop trading platform on a Windows, Mac, or Linux computer. Ready to start trading? Open an account in minutes.

DownloadMT4 for Mac OS and enjoy the full range of MetaTrader 4 advantages for Forex and CFD trading. From now, traders, who use desktop and mobile devices powered by Mac, will have full access to a set of features and instruments delivered by the ultimate Forex platform.

MT4 Mac OS India. In addition, StocksToTrade accepts no liability whatsoever for any direct or consequential loss arising from any use of this information. Benefit from the great Supported OS:. Trade Interceptor ubuntu bitcoin core update on the Mac App StoreStocks Trading SoftwareThen most common method is to use Wine emulation software but we don’t recommend this because it trading platform mac os can be tricky to setup and it doesn’t offer the full functionality of MetaTrader anyway.Mac OS X Trading Platform with Objective C Source Code

Forex chart software mac

FXCM Markets 10 Best Forex Trading Platforms For Mac (2018)Fortunately, the day trader btc golos is no longer constrained trading platform mac os to Windows computers, recent years have seen a surge in the popularity of day trading software for Mac. Cryptocurrency Market Decline People are asking:

City Index vs. Below you will find the steps required to activate your FXCM TradingFor that you need to sign-up trading platform mac os with a broker on a stock trading platform such as After reading these wie viel verdienen konditoren reviews, you may also find useful our guide to With this in mind, here is our list of the best stock trading software for Mac users in order of ranking. Weiss Cryptocurrency Ratings Neo

ProTA Price action – The best way to understand price action is to experience it. After system restart, launch PlayOnMac from the setup trading platform mac os file in the Downloads bitcoin mining online wallet folder.

demo tradingMac Trading Platforms ▷ No download requiredIn general, the process looks completely the same as with installing online broker top 10 any other software that is not listed in the Apple trading platform mac os App Store. Gold Etf Hedged Click 'Run' Apple and Mac are trademarks of Apple registered in the and other countries.Vantage FXRegional Impact Tailored for specific markets The best trading software for Australia and Canada, may fall short of the mark in Indian and South African markets.

Ready to Start Trading?

Desktop Trading Platforms

Open a Live or Demo account online in just a few minutes and start trading on Forex and other markets.

Apply online

Any Questions? Contact us:

phone: +1 849 9370815

email: [email protected]

MetaTrader was designed for Windows, however, using a compatibility layer like Wine it is possible to run Windows applications on other operating systems, including macOS.

Trader's Way has pre-packaged both MetaTrader 4 and MetaTrader 5 installations into standalone Mac apps for your convenience. This means that no other downloads are necessary to begin trading.

Download here

Once the download is complete, simply decompress the file and drop on your desktop. The first time you run the program, you may need to hold the Control key while double clicking the file and agree to allow the file to run. You will only have to do this once.

Best Trading Platforms For Mac

Note that since all versions of MetaTrader are not natively designed for Mac, some functions may be unstable or not work entirely. We have found the following features do not always work properly

Push notifications cannot be sent from the client terminal

Signals and Market Tabs are empty

News is not always displayed correctly

Our Mac apps are for convenience purposes only and Trader's Way makes no warranty of their functionality nor reliability. Any and all use of the Mac apps are at the sole risk of the user. Always have another device from which to manage your trades in the event the app stops working.

Stock Trading Software Mac

Any Questions? Email Us: [email protected]

1 note

·

View note

Text

Choose the best ideas about Olymp Trade now

Are you searching for some extra information regarding Olymp Trade and what is it all about? The answer for your read is now closer than ever, assisting you to determine what you may need in the shortest possible timeframe. It's the ideal Olymp Trade review, all of that ideas and pointers which will show you towards the smartest choice within seconds. The reply is now in here, closer than before, by simply following your link https://ecattrade.com/review/olymptrade in a matter of seconds. Here is the perfect Forex guide, the one that will give you the proper choices to each and every one of our online visitors. Learn where you can trade Forex Options, how to make it feasible and shorten your way to a great outcome in times. It's the perfect Guide to Binary Options, an exquisite way to trade and become a winner in any situation. See where you can start trading Forex Options and initiate your path towards success the earlier the greater. The initial thing you have to know is that Olymp Trade review is definitely the nr.1 platform that will assist you find real facts about binary options. No longer doubts, elect to follow web site right now and plunge into the most detailed overview of Olymptrade.

Since Olymp Trade India is an marvellous option, spend some time to think about this guidance and discover solutions at once. Make your own demo account instantly, begin immediately and you will leave all your worries in the past. Become a member of the International Financial Commission, trade today making use of your app for either iOS or Android OS. This is the perfect demo account with more than 10.000 virtual funds, so take your time to visit this page the sooner the better. Visit us nowadays, once we are the type that can assist you get the overview of Olymp Trade, a good article which will take a deep dive into what the platform offers right now. Anybody can determine whether its the right fit for them or otherwise not, bearing in mind every piece of information and considering the proper option in seconds. Trading is currently closer plus much more possible, anyone can appreciate it and worry about less details compared to they did in the past. Essentially the most trustworthy and reliable choices for you, assisting you to trade various kinds of assets detail by detail. Wait no longer, get your own account today with Olymp Trade else will climb onto your path any longer. Adhere to the mentioned before link, read through the information we present and you'll certainly create a wise decision yourself. Olymp Trade is a trading platform that is operating in the marketplace since 2014. This platform certainly is the one that allows traders to make use of various instruments to acquire access to markets of their choices. Aside of the trading options, we offer customers with free online education to help them better prepare for the markets and relating trading strategies of all kinds. Neglect the doubts you'd, this is actually the foremost platform for you and everybody else interested. We act quickly and will definitely be of good assistance for every individual. Our 24/7 customer service obtainable in eight languages is the correct way to cherish each single customer and keep them for longer. Don't let anything else get up on your way today, find us now and you'll also identify the most comprehensive help center. Get answers right now, find solutions and remain in touch with real experts all the time. Get all of the news and recommendations on Olymp Trade today, trading the right assets you want and becoming the right outcome for your tastes and needs. ABOUT US: Are you Looking for that very best approaches to trade online working with the remarkable Forex system? Would you need the proper Forex Brokers Reviews that will make it possible for you to earn an informed decision consistent together with all the accumulated info? Effectively, you are going to need all the guidance you could potentially enter the very first spot. That is right -- Ecattrade is offering most of the most useful options and the very top reviews along with testimonials. Obviously, you are going to be able to browse through all of the accessible reviews readily and at no time in any respect! What more can you require? The Ecattrade Option is supplying the best guidance which can be always being upgraded in the very first spot. So check it out in order to make probably the most from your needs together with needs and you'll unquestionably carry coming back to longer in the future! The Forex Brokers Reviews can deliver one of the very efficient and enlightening ways to really go in order to create the most from your requirements and specifications. Need more explanations the given option alternatively of any additional choice? Well, here they are: - Comprehensive. Each one the critiques are very comprehensive and you also can compare these to be able to create the most out of your preferences as well as requirements. - Effective. If you are searching for that very best ways to produce probably the most out of your demands along with needs, here is actually the very best option that won't allow you to . - Honest. You are going to find the absolute best options that will soon be trustworthy and efficient. - Effortless. If you are looking for the simplest way to go, this will be it. - Quick. You can secure every one the options which you'll require in no time in any respect. Therefore, Regardless of one's experience and expertise, don't hesitate to check out this one in order to generate an educated decision inline together with most the accumulated information and also you will definitely never regret it. Find the Very best & most thorough ways to perform in no time in any way and also make sure That you will be receiving the most from your requirements and dealing requirements. After all, One Particular way or the other, you definitely deserve it, can you really never At this time in the first place? Contact us on: Website: https://ecattrade.com/review/olymptrade

1 note

·

View note

Text

Pickright - Stock Market Advisory, Trusted Tips app

Pickright - Stock Market Advisory, Trusted Tips

It is critical to put your cash in the right organization. One good investment will lead to growth and the wrong investment will lead to disaster.

it requires the winning combination of your patience to stay invested for the long term, have the risk appetite to face negative growth periods and Identify the right growth business to invest in. This will guarantee that you won't get influenced in the predominant market supposition of the day, which can be driven by an attitude of dread as well as covetousness. And all of this needs to happen in a hassle-free and cost-effective manner.

A stage where master investigates experts gives suggestions on every one of the variations of exchanging instruments like Cash, Futures, Options, Forex and Commodities and some more.

Screen your speculation portfolio and monitor stocks with various watch records and make distinctive following measurements like precision, rating, benefit made and suggestions given. We accept straightforwardness thus does our foundation.

A venture warning stage where the correct data at the ideal time from specialists and the purchaser can simply pick the correct data and choose how they need to utilize it. It's a solitary stage where sachet size of data is communicated, Accuracy is determined dependent on the historical backdrop of the data/suggestion given.

With the Stock Market warning application.

✔ Join gatherings - Check Profits, Score, Accuracy.

✔ Find Certified/Experts Advisers, View their portfolios, rate, exactness, benefit, and so forth.

✔ Consumers have the decision to pick the correct examiner with the correct proposal and right activity.

✔ get the exchanging financial exchange tips.

✔ get all the exploration and see the live commercial center and work on proposals, For customers, one spot to see all the ongoing stock developments.

✔ Available money related instruments like Cash, Futures, Options, Commodities, and Forex. Each purchaser is spoilt for the decision to pick the correct examiner for their proposal needs.

✔share the suggestions via web-based networking media stages.

Pickright application gives includes that get you complete cash authority over your speculations. Transform your android based cell phone into an amazing and thorough portable exchanging and securities exchange venture warning stage.

Check out Pickright - Stock Market Advisory, Trusted Tips app.

Download and Register it with FREE.

The most effective method to Be a Successful Investor with Best Stock Advisor

Share market Advisors/Stock market Advisors:

• Give exhort you about strategies and making arrangements for exchanging or putting resources into securities exchange.

• Buying and offering suggestions to their customers.

• Suggest them how to put resources into the share showcase.

• Support them by proffering follow up every once in a while

• Assists to tackle client's questions identified with speculation or exchanging.

• Saves your time and you don't need to invest energy in the unpredictable procedure of dissolving the market patterns.

About Best stock market Advisor Services:

• A financial exchange warning help is the best goal where you can make venture arrangements. It will help you with which stock to purchase and which one to sell and when.

• A warning firm will help you to learn tips and recommendations and help you in a superior manner.

• Stock advisor warning administrations exhorted fledglings to begin with a mean total of sum rather than contribute all the capital. The market is entirely shaky and unsafe. Along these lines, contribute the sum that you can figure out how to lose.

• Pick right stock warning application depends on a ton the way that which stock tips you have contributed. With our tips, you get over 95% of the accuracy with a doled out official that watches out for your venture the entire time.

A portion of the territorial names of stock market advisory apps,

Stock portfolio tracker

share market advisor

share market advisory

stock market advisory

stock market advisory services

stock market advisor

stock advisors

stock advisory services

online stock advisor

best stock advisor

financial market app

Stock Market App

stock advisory app

stock market apps for android

best stock market app for android

free stock advisory app

stock market expert advice

stock market tips app

expert advice on the stock market

expert advice on Indian stock market

free stock market tips

best stock market tips app

Stock Market tracker app

best stock market advisor

top stock market advisor

stock market tips free

stock market expert advisor in India

stock market expert advisor

stock market financial experts

Indian stock market and finance app

Indian Stock Market Android apps

stock market advisory mobile app

Share market trading tips

Indian Intraday tips

share market day trading tips

daily stock market tips

equity stock advisory

equity advisory services

Stock exchanging app, items exchanging applications, Free intraday exchanging tips, intra trade tips app, share showcase tips, free products tips, stock market tips, Stock market trading advisory, Stock market Financial Advisor, Expert exhortation on financial exchange, securities exchange guidance, Indian financial exchange, Online stock advisor, Stock Advisory on NSE, BSE, MCX-SX, NCDEX, MCX, financial exchange day by day refreshes, the present financial exchange, value tips, NSE tips, stock tips, and suggestions, stock investment advice, stock proposals, Free intraday tips for now and tomorrow, Experts advice on Indian stock market,

SEBI Registered Investment Adviser, MCX Trading Tips, Commodity live market warning, best venture tips.

For more info Download Free Stock Advisory app and Register it with FREE - https://play.google.com/store/apps/details?id=in.pickright.app&hl=en_IN

2 notes

·

View notes

Text

Edeal Markets

Introduction:

Edeal Markets(edealfx) is one of the most trustworthy forex broker offering the best forex trading platform for CFDs, Commodoties, Metals and Energies.It is a Forex Broker offering ForexTrading services via MetaTrader 4 and MT4 Mobile trading platforms. Regarding orders execution model,eDeal Markets is a b-book broker (market maker).eDeal Markets offers trading of currencies, indices, CFDs and commodities.

About Edealfx:

Edeal Markets(edealfx)is one of the most trustworthy forex broker offering the best forex trading platform for CFDs, Commodoties, Metals and Energies.To become and sustain a position as the best and most reliable online broker, we aim at making customer relation and market research more efficient, resilient and transparent while strengthening the protection of investors.To inspire everyone by making the trading platform readily accessible and building much bigger dreams with you in this endless future of trading.To infuse the continuous changes, having all like just in time readiness to meet the demands of our traders.

Pricing & Execution advantage:

Our pricing strategy for edelfx is best priceless for you. We practice complete transparency to make you concentrate on your investment and strategies by just overseeing the hard stuff of reconciling your returns and pricing. Our reliable technology and partner bank networks enable a tight spread of quote that we promise. View our pricing.

What better reason you want to be with eDeal Markets:

eDeal has a variety of account types that will fit the needs of every investor, beginner or professional

Trade currency, Gold, Oil, CFDs, ECN, Standard, Micro

Use Demo account

WHY eDeal FX IS SIMPLE & VERY POWERFUL?

Safety of funds:

We understand that in the uncertain world of global finance the security of client funds is essential to our customers and it is in our core to provide highly secured platform and strategy to safeguard your funds and the profits we make.

Support all major cuurency pairs:

Money may have different names and values all around the world but we had made it easy to deal its different version in matter of seconds. We value your time and needs, so we are prepared and ready with powerful platforms supporting major currency pairs to empower your computer to trade worldwide.

Round the clock customer support:

Our aim is to put forth the benchmark for customer support quality. Our customer support ensures your consistent trading and never wants you to hold unanswered queries without compromising your time management. New traders or experienced, our team keeps working to make everyone experts in what they trade. Forex world trades round the clock, so do we support you at any time anywhere at your ease.

eDeal Markets always welcome future partners through our potential partnership and affiliate programmes.

Edealfx platform:

MT stands for MetaTrader. MetaTrader 4 is a platform every traders need, which was built by satisfying all regulatory and standards across the world. It possesses best in class features to track, study, research and execute order with complete transparency. It has many analytical tools and easily accessible tools with minimum effort of inputs. MT4 platforms are accessible through all major computer operating systems like Windows, Android, iOS and all smart phones. Download Meta Trader 4 and login to trade forex, spot metals and spot energies

Edealfx Resources:

Forex is the world's largest market having a transaction of more than 5 trillion every day also known as foreign excahnge.Forex is a trading platform for people interested in trading different currency pairs against each other and also commodities and stocks and indices and various other instruments.

Edealfx Partners:

Referring clients, BI’s and other types of partners to eDeal is the simplest form of partnership! Do you have a big network of acquaintances who could be interested in trading or learning more about the financial markets? Do you want a way to make additional income?

Recommending clients to an established investment firm with well experience in the markets will not only be putting your acquaintances in contact with the right investment firm but will also benefit you with financial rewards.

eDeal Markets Android Trader

MT4 mobile application is compatible with android version 4.0 or higher. This best fits in your android phone and enable trading anytime from anywhere. You will love it using from the device you always hold as it has all the charting and analysis functionalities as is like working in PC.

Smartphone Mobile Forex Trading:

Everyone prefers smartphone to accompany them for instant needs and deliverables. Your web-enabled smartphone can help you live your trading life from anywhere and be an energetic forex trader. Out smartphone trading app holds all features from real times prices, experts feeds, easy trade enter and trade execution, various effective analysis tools, and charts empowering the best trading experience on the go along with you during any busy trading day.

eDeal Markets iPhone Trader:

Are you an iPhone user, we have the MT4 terminal in iOS platform as well with all experiences you lived in MT4 terminal in all other platforms.Compatible to all iOS versions and holistic view of user interface helps you to control your trading account, orders and analysis in just few clicks, provided with any decent Wi-Fi or internet connection.

Contact Us:

Stay in touch to explore your earning opportunities with us on International Currencies,Commodities,Precies metals,Energies,Indices.

Hong Kong

Unit 1411,14th Floor, Cosco Tower,

183 Queen’s Road Central,Sheung Wan,

Hong Kong

+852 81990469

USA

#13401,Metric BLVD APT 411,

Austin, Texas-78727,

United States of America

+1 513 746 1112

Dubai

Office No. 15, 3rd Floor,

Al Mamzar Center,Al Qiyadah,

Dubai, UAE - 88362

+971 4250 5177 ,

+971 5022 77087

India

#45, 1st Floor,1st Main Road,

CIT Nagar ( Opp. to ICICI Bank)

Chennai – 600 035

+91 44 4860 8603

+91 92469 95992

Australia

#15/2-8 Bailey Street,Westmead,

Sydney NSW 2145,

Australia

+61 47068 3029,

+61 47026 9724

Qatar

Al Mirqab Mall,Gate No:3

2nd Floor Office, #B205

Al Jadeed Street, Doha Qatar

+974 7025 1999

Maldives

G.Sosunee uthurubai,

2nd Floor, Rahdhebai magu,

20130, Male, Maldives

+960 734-0906

+960 793-0005

1 note

·

View note

Text

Stock Market Classes and Stock Market Trading Strategies by Goela School of Business

Goela School of Finance is India's best institute for learning stock market trading. Goela School of Finance offers Online Stock Market Courses and Stock trading courses for beginners.

What are some of the best stock market trading strategies?

One of the best trading strategies is the penny stock trading strategy. It involves investing in shares that are valued at less than one dollar per share to take advantage of volatility and rapid price movements. Buying stocks that are undervalued for this reason can help you secure huge gains if you time your trades well.

The Goela School of Finance

We are a stock market course institute located in Noida, India. We teach the latest and most relevant information about the stock market classes and trading strategies. Our team of experienced professors is dedicated to providing you with a world-class education in this field with our advanced curriculum.

How to get started with stock trading

If you're interested in investing and have a little money to spare, buying stocks is a great way to grow your portfolio and make money. You can buy stocks individually or in groups, and there are many different ways to trade them. For example, you could day trade if you have enough money for trading fees, or use an app like Robinhood if you're looking for a cheaper option. The Goela School of Finance offers various courses related to stock trading.

Common Mistakes new traders make and how to avoid them

One of the most common mistakes that new traders make is not having a plan. It's vital to understand what you hope to accomplish before picking a strategy and trading system. You may need an account with multiple brokers, and need to set up various tax ID numbers, depending on the country your reside in and where you trade.

What are some of the best stock market trading strategies?

Trading on a stock market is the process of buying and selling securities that were listed on an exchange. The two primary considerations in trading are knowledge and risk management. Investors should learn as much as they can about the markets before they buy stocks or bonds, because without the right information, they might trade poorly. Research is also important because it can help investors plan trades that limit their risks.

The Goela School of Finance

If you're looking for an stock market academic institution that will teach you the basics of stock market trading course, look no further! Goela School of Finance offers a wide variety of courses, from beginner classes to more advanced materials.

How to get started with stock trading

You will need to find a broker, open an account with them, and fund it. Once you have money in your account, you can purchase stocks. You don't need to buy the whole share, just a fraction of one is enough to get started. Some brokers offer free trades, so be sure to look into that before committing to anything.

How to create a winning strategy

It's important to know the basics of how the market works before creating a trading strategy. If you want to trade on your own, you'll need to buy and sell stocks by following the current trends. For example, if a stock is declining and it's showing no signs of recovery, you might want to sell your shares while they're still worth something.

How to get started in Forex trading

Forex trading is a highly aggressive form of trading, and can be likened to gambling as there are no rules for buying low and selling high. Forex traders use a wide range of strategies in order to increase their chances of success when trading.

Common Mistakes new traders make and how to avoid them

The stock market is a risky place to invest your money. There are many things you need to know about before getting started. To avoid making the same mistakes, do your research and don't trade without understanding the basics of investing.

#stock market classes#stock market courses for beginners#fundamental analysis of indian stocks#stock market technical analysis course#share market courses online#stock market training institute#stock market fundamental analysis#stock analysis course free#share market learning course#stock trading courses online#complete stock market course#stock market course#stock market courses online free with certificate#stock market study course

0 notes

Text

The Benefits of Trading with a Regulated Broker in the Indian Forex Market

India is a popular market for forex traders looking for global opportunities. However, investors must trade with regulated forex brokers in India to ensure investment protection.

Here are some key benefits of Forex trading with a regulated broker in India:

Investor Protection: Indian brokers are licensed and monitored by the Securities and Exchange Board of India (SEBI). In this way, investors are protected from fraud and financial malpractice by following strict guidelines and regulations.

Safety and Security: Brokers who are regulated provide high levels of safety and security to their clients. For account security, data protection, and financial transactions, they must follow strict protocols.

Transparency: Brokers are required to provide accurate and transparent information about their services, fees, and risks. As a result, traders are able to make informed decisions and manage their investments effectively.

Professionalism and Expertise: Regulated brokers in India must have qualified and experienced staff to provide high-quality services. By getting expert advice and guidance, traders can make better trading decisions.

Access to Trading Tools and Resources: Regulated brokers provide traders with a wide range of trading tools and resources, including trading platforms, market analysis tools, and educational materials. Traders can use these tools to stay informed and make better trading decisions.

With Forex4you India, you can enjoy a safe and secure trading environment that is reputable and trustworthy. Additionally, it provides access to valuable trading resources and competitive pricing. This makes it an attractive option for Indian traders making it easy for traders of all levels to get started.

0 notes