#best cashback offers

Explore tagged Tumblr posts

Text

#coupons#promo codes#discounts deals#online shopping#savings#cashback offers#voucher codes#best deals#Black Friday sale

2 notes

·

View notes

Text

The Apple iPhone 16 Series: A Game-Changer for Buyers in India

Outline Introduction Overview of the iPhone 16 Series Significance of Buying Locally Price Breakdown in India Table of Prices for Each Model Effective Prices After Discounts and GST Price Comparison with Other Countries India vs. Singapore India vs. Dubai India vs. Canada India vs. USA Considerations for International Purchases Why Buying in India is a Smart Choice Warranty and…

#Best Apple reseller Mumbai#Import iPhone 16 to India#iPhone 16 duty-free limit India#iPhone 16 international prices#iPhone 16 Plus cashback offers#iPhone 16 Pro customs duty India#iPhone 16 Pro GST breakdown#iPhone 16 Pro Max best offers#iPhone 16 Pro Max discount deals#iPhone 16 Pro Max financing options#iPhone 16 Pro Max No-Cost EMI#iPhone 16 Pro Max price in USA#iPhone 16 Pro price comparison#iPhone 16 travel expenses#iZone Digital Andheri West

1 note

·

View note

Text

HitDeals - Best Deals For Ecommerce

Find unbeatable deals from all shopping platforms on hitdeals. Get the best prices on a wide range of products. Start saving today!

#amazon deals#cashback#coupons#discount#savings#online shops offer#shopping deals#shopping#best offers

0 notes

Text

Smart Steal Festival: Arista Vault's Smart Wallets, Bags & Combos

Arista Vault Smart Steal Festival is an exciting event that offers customers a fantastic opportunity to grab their favorite smart wallet models, including the Wallet Bot Finder and RFID wallet, at discounted prices.

In addition to smart wallets, this festival also features fantastic deals on various products such as the Fingerlock Bag, Croc Textured Bag, Pure Leather Fingerlock Laptop Bag, Techbag, and Laptop Backpacks. What's more, customers can enjoy unbeatable value with a selection of exciting combos at affordable prices. Be sure to mark this festival and visit Aristavault.com to avail yourself of some exciting offers now.

Smart wallets and smart bags have become essential accessories in modern life. They blend fashion with technology, offering convenience and security. With features like tracking and anti-theft protection, they simplify daily routines and provide peace of mind. "Experience Arista Vault's Mission: Travel with Peace of Mind, Choose Your Companion, We've Got Your Back!"

Smart Wallet by Arista Vault in Smart Steal Festival

Arista Vault's Smart Wallets redefine the concept of everyday accessories, seamlessly integrating cutting-edge technology. Beyond traditional card and cash storage, these wallets incorporate advanced features such as tracking and anti-theft mechanisms, ensuring the safety of your essentials.

At Arista Vault, we understand that style is a highly personal choice. That's why we offer a diverse selection of Smart Wallets, each with its own unique charm and appeal. Whether your taste leans towards a timeless and understated look or you prefer something more vibrant and attention-grabbing, we have the perfect Smart Wallet to match your preferences. Our Smart Wallets not only provide impeccable organization but also elevate your style game, proving that fashion and functionality can coexist seamlessly.

Explore our range of Smart Wallets, including the Wallet-bot Classic with an inbuilt power bank priced at just Rs. 5,999.00, and our RFID Wallets available in sleek Black and stylish Brown for Rs. 1,799.00. For those looking to stay connected, consider the Wallet-bot Finder, a trackable wallet priced at Rs. 4,999.00, or our��Ultra-Slim Wallet-Bot Classic in a sleek Black finish, also priced at Rs. 5,999.00. And that's just the beginning! Don't miss out on our Tru-Blu Duo smart wallet for Rs. 1,599.00 or the Traveller wallet with a 20-meter separation alarm and anti-theft features, available at Rs. 4,599.00.

Explore these and many more options of Smart Wallets at exciting prices during our Smart Steal Festival. Your perfect style companion awaits!

Incorporating Smart Technology In Arista Vault Smart Bag

Explore the seamless integration of cutting-edge technology within Arista Vault's bags.

Highlight the numerous benefits of utilizing tech-infused bags.

Fusion of Style and Functionality

Delve into the innovative design and practicality offered by smart bags.

Examine how these bags cater to the demands of modern lifestyles, providing a blend of fashion and functionality.

Arista Vault's collection of tech-enabled bags is a testament to their commitment to delivering advanced solutions. Among their offerings, the Arista Vault Croc-Textured Finger Lock Smart Laptop Bag stands out. Priced at Rs. 6,999.00 which is an exclusive limited-time offer in the smart steal festival sale, this croc-textured bag is available in a range of stylish colors including Blue, Black, Brown, and Royal Blue.

Get the newly launched Arista Vault Finger Lock Smart Laptop Bag Brown

at an exclusive price of just Rs. 6,999.00. This is a limited-time deal carrying the fusion of style and tech pure leather laptop bag with a fingerlock.

The Neo-Tech Smart Laptop Bag priced at Rs. 4,199.00, and the Arista Vault TechBag FingerLock Laptop Bag priced at Rs. 9,499.00, further exemplify Arista Vault's dedication to blending fashion with technology. Last but not least, the Arista Vault Smart-Pac Fingerlock Smart Backpacks, also priced at Rs. 9,499.00, offer an intelligent solution for those on the move. These products showcase Arista Vault's commitment to providing innovative and stylish options for tech-savvy individuals, be it laptop bags for men or women.

The above-mentioned prices of each product are subject to change as it is part of the ongoing smart steal festival sale and the prices may vary afterward because it is a limited-time deal. Hurry up and gift yourself or your loved ones a blend of fashion and technology. Upgrade your lifestyle by Switching to smart products like smart bags or smart wallets by Arista Vault.

Smart Steal Festival - Unbelievable Combos Await!

Discover the Magic of Festive Combos

Dive into the world of festive combos at this smart steal festival and unlock incredible savings.

Explore the exciting combo options designed to elevate your lifestyle.

Irresistible Combo Delights

Prepare to be amazed by our exclusive combos, carefully curated to deliver unmatched value.

Embrace the opportunity to upgrade your tech-savvy lifestyle with these unbeatable combos:

Genz Fingerlock Bag + BagTag Combo

Get the Genz Fingerlock bag and the BagTag for an incredible steal at just ₹7,999.00. Your essentials will thank you!BagTag + Smartpac Laptop Bag Combo

Elevate your on-the-go experience with the BagTag and Smartpac laptop bag combo, yours for only ₹9,999.00.Wallet Bot Finder Smart Wallet + Techbag Laptop Bag Combo

Secure your valuables with the Wallet Bot Finder smart wallet and pair it with the Techbag laptop bag featuring finger lock technology, all for an enticing ₹11,999.00.Wallet Bot Classic Smart Wallet + Smartpac Tech Bag Combo

Don't miss the chance to grab the Wallet Bot Classic smart wallet and the Smartpac tech-enhanced laptop bag for a jaw-dropping ₹12,999.00.

These combos are your ticket to an upgraded, tech-savvy lifestyle without breaking the bank. Join the Smart Steal Festival at Arista Vault, where incredible value meets unbeatable prices!

Perks of Joining the Arista Vault Smart Family

Peace of Mind

Arista Vault's products offer unmatched security, with features like RFID protection and GPS tracking ensuring your belongings are safe and sound.

Benefit from the peace of mind that comes with knowing your essentials are protected, even on the go.

Style and Innovation

Arista Vault's products seamlessly blend style and innovation, making a bold fashion statement while enhancing your tech-savvy lifestyle.

Elevate your daily routines with accessories that are not just functional but also set trends in the world of fashion and technology.

Visit Aristavault.com to avail offer prices and check out our products to get extra benefits.

Don't miss Arista Vault's Smart Steal Festival! Enjoy incredible offers on smart wallets, bags, and unbeatable combos. Elevate your style and security with tech-infused accessories. It's your chance to embrace innovation and savings. Join the festival now and experience the future of fashion and technology!

#Smart Steal Festival Sale#Smart wallet#Smart bag#Smart laptop bag#Arista vault festival season sale#arista vault offer#arista vault offers#arista vault sale#best deals#best deals today#black Friday deals#black friday offers#black friday 2023#cashback#coupon#coupon code#deals#Deepavali sale#discount#discount code#festival offer#festival sale#festival season#free coupon#offer price#offers#sale Diwali#Diwali sale

1 note

·

View note

Text

Smart Shopping: How to Save More and Buy BetterShopping is an essential part of life, but how often do we stop to think about whether we're making the smartest choices? Whether you’re shopping for groceries, clothes, gadgets, or home essentials, adopting a smart shopping strategy can save you time, money, and effort. In this blog, we’ll explore some essential tips and tricks to help you become a savvy shopper.1. Set a Budget and Stick to ItOne of the biggest mistakes shoppers make is overspending. Before heading out or browsing online, decide on a budget for your shopping trip. Use apps or simple lists to track your expenses and ensure you don’t exceed your limit.2. Plan Your PurchasesImpulse buying is a wallet-drainer. Make a shopping list and prioritize what you actually need. This is especially important for grocery shopping and big-ticket items like electronics. If it’s not on your list, reconsider whether you really need it.3. Take Advantage of Discounts and CouponsWho doesn’t love a good deal? Keep an eye out for sales, promotional discounts, and cashback offers. Many brands offer discount codes and coupons online, and loyalty programs can help you save even more over time.4. Compare Prices Before BuyingBefore making a purchase, compare prices from different stores or online platforms. Several price comparison tools and browser extensions can help you find the best deal, ensuring you never overpay for an item.5. Buy Quality Over QuantitySometimes, the cheapest option isn’t the best choice. Investing in high-quality products can save you money in the long run by reducing the need for frequent replacements. Always check reviews, warranties, and materials before buying.6. Shop at the Right TimeTiming your purchases can make a huge difference. Certain times of the year, like Black Friday, end-of-season sales, and holiday promotions, offer major discounts. If an item isn’t urgent, wait for a better deal.7. Utilize Cashback and Reward ProgramsMany credit cards, banks, and online platforms offer cashback and rewards for purchases. Consider signing up for these programs to get additional benefits while shopping.8. Be Mindful of Marketing TrapsRetailers use psychological tricks to make you spend more, from “limited time offers” to flashy displays. Be aware of these tactics and shop with a clear mind to avoid unnecessary purchases.9. Read Reviews and Research ProductsNever buy a product just because it looks good. Read customer reviews, watch unboxing videos, and research product specifications to ensure you’re making a wise decision.10. Consider Second-Hand or Refurbished OptionsFor certain products like electronics, furniture, and fashion, buying second-hand or refurbished items can be a great way to save money while still getting quality products. Many reputable sellers offer warranties on refurbished goods.Final ThoughtsSmart shopping isn’t just about saving money—it’s about making informed decisions, avoiding wasteful spending, and getting the best value for your hard-earned cash. By following these tips, you’ll develop better shopping habits and make more satisfying purchases every time.What are your favorite smart shopping strategies? Share them in the comments below! to more updates visit my page

2 notes

·

View notes

Text

Navigating the World of Crypto Betting with CryptoChipy

The world of crypto betting is growing at an incredible pace, offering players a unique and exciting way to place wagers using digital currencies. With so many platforms emerging, finding the right place to bet safely and profitably can be a challenge. This is where Crypto Chipy becomes an essential guide, helping both beginners and experienced bettors make informed decisions in the fast-evolving landscape of crypto gambling. Crypto Chipy provides valuable insights, expert reviews, and essential tips to ensure that every betting experience is secure, fair, and rewarding.

Crypto betting has changed the way people engage with online gambling, offering advantages like instant transactions, enhanced privacy, and provably fair gaming. However, with these benefits come risks, especially for players who are new to the world of cryptocurrency. Crypto Chipy helps users navigate these challenges by offering clear, well-researched information on the best crypto betting platforms available. By relying on Crypto Chipy, bettors can confidently choose platforms that are safe, reputable, and known for providing a top-tier gaming experience.

One of the main concerns for crypto bettors is security. Since cryptocurrencies operate in a decentralized environment, it is crucial to select platforms that implement advanced security measures to protect both funds and personal information. Crypto Chipy carefully reviews betting sites to ensure they use strong encryption, secure payment processing, and fair gaming algorithms. With Crypto Chipy, players can feel confident knowing they are betting on platforms that prioritize safety and transparency.

Another significant aspect of crypto betting is finding platforms that offer the best odds, bonuses, and promotions. Crypto Chipy constantly updates information on the most attractive betting offers, ensuring that players maximize their bankroll and get the most value from their wagers. Whether it’s free bets, deposit bonuses, or cashback offers, Crypto Chipy provides up-to-date recommendations on the best deals in the market. This allows players to enhance their gaming experience while increasing their chances of winning.

Understanding how to place bets using cryptocurrency can be overwhelming for newcomers. Crypto Chipy simplifies this process by providing step-by-step guides on how to deposit, withdraw, and manage digital assets on betting platforms. Whether it’s Bitcoin, Ethereum, or other popular cryptocurrencies, Crypto Chipy ensures that users have the necessary knowledge to make seamless transactions. This educational approach makes Crypto Chipy an essential resource for those looking to enter the world of crypto betting with confidence.

The crypto betting industry is constantly evolving, with new technologies, betting strategies, and regulations shaping the landscape. Staying ahead of these changes is essential for any serious bettor, and Crypto Chipy ensures that players are always informed about the latest trends. From new betting markets to blockchain innovations, Crypto Chipy keeps its audience updated with relevant news and expert insights, allowing them to make smarter betting decisions.

Crypto Chipy continues to be the ultimate guide for anyone looking to navigate the world of crypto betting with ease. By providing expert reviews, security insights, and valuable betting tips, Crypto Chipy ensures that every player can enjoy a safe, fair, and rewarding experience. Whether you're new to crypto betting or a seasoned gambler, Crypto Chipy is your trusted partner in making the most of your wagers.

2 notes

·

View notes

Text

How to Save Money on Beauty Products Online: A Complete Guide

Introduction:

Keeping up with the latest beauty trends in the modern world can occasionally feel like a financial burden. But do not worry! Saving money on your favorite beauty products has never been simpler, thanks to innovative shopping platforms like Redfynd. Whether you're shopping for skincare, haircare, cosmetics, or other basics for your beauty routine, this guide will take you through five easy steps to help you look amazing on a budget.

Identify what you need:

Understand Your Beauty Regimen Needs: Take some time to determine what you require before sinking into the world of online cosmetic shopping. Are you in need of a new serum, or are you almost out of your favorite lipstick? Determining exactly what you need will keep you concentrated and prevent you from making pointless purchases, ultimately resulting in financial savings.

Do a personal assessment. Assess your skin type, hair type, and any specific concerns you might have (like acne, fizziness, or pigmentation) to better understand your needs. For accurate advice and to ensure you choose products that offer effective results without side effects, consider consulting with a dermatologist, especially if you’re dealing with sensitive skin or serious beauty concerns.

Create an Inventory List: Develop the habit of maintaining an inventory list of your current beauty products. This not only prevents you from buying duplicates but also helps you avoid purchasing multiple products for the same purpose. Utilize apps or simple spreadsheets to track the usage and expiration dates of products you already own. Alongside your inventory, keep a wishlist of items you want to explore. Prioritize this list based on your most-needed items and include products that come highly recommended or have top-rated reviews.

Conduct thorough research by reviewing customer ratings:

After you have a clear idea of what you want, it's time to do a little homework online. Conduct Research the product and make sure it matches your concerns, skin type, and hair type. See online reviews to see if you are buying make-up and how it looks after application. Examine many online merchants to locate the greatest offers and compare prices. Keep an eye out for deals, discounts, and package deals that will enable you to spend less on cosmetics. Avoid impulsive buying.

Spend a little time reading feedback from others before making a purchase. This can help you prevent costly errors by providing insightful information on the efficacy and quality of a product. To be sure you're receiving the most value for your money, look for items with high ratings and reviews that are positive.

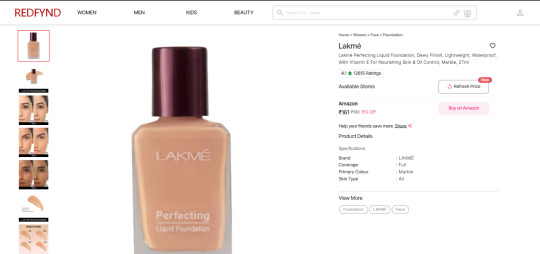

Use Comparison Sites like Redfynd to Compare Prices:

Comparison websites like Redfynd, in addition to cashback, may be very helpful resources for online shoppers looking to save money on beauty items. These websites make it simple to locate the greatest bargain without spending hours searching the internet by allowing you to compare prices from several stores all in one location.

Redfynd is the largest beauty comparison site with more than 1.5 million skincare and makeup products and 15+ beauty retailers, including Nykaa, Myntra, Tira, Ajio, Taacliq Palette, Sephora, etc.

Whenever you're looking for a new hair oil, shampoo, hair styling gel, or comparison website, they may assist you in finding the best deal. Additionally, a lot of comparison websites include thorough product evaluations and information to aid in your decision-making. You can purchase with confidence knowing that you're getting the greatest bargain possible on all your favorite beauty goods thanks to comparison sites' simplicity and savings.

Utilize Cashback Sites like Redfynd:

Platforms like Redfynd provide an easy-to-use but efficient means of getting money back on cosmetic purchases. All you must do is register, shop on their site, and watch as your savings increase with each transaction. It's like getting rewarded for shopping for your preferred face mask, face wash, or cleanser. To help you save more money, with Redfynd, you can find the best deals that are available in any online store in India. You can begin receiving cashback on all your cosmetic purchases with only a few clicks, and you can gradually see your savings grow.

Conclusion:

Shopping online for cosmetics doesn't have to be a difficult way to save money. You can buy more wisely and get more beauty for your money by following the above five easy steps: figuring out what you need, researching, using cashback and comparison websites, and checking user ratings. So, feel free to treat yourself to a wonderful mascara or to that lip gloss without breaking the bank!

#shopping#beauty#cashback#fashion#reward#makeup#beauty products#haircare products#bath and body products#skincare products

9 notes

·

View notes

Text

AskMeCoupons.com is a premier online platform dedicated to helping savvy shoppers save money effortlessly. Specializing in a vast array of discount codes, promo codes, and special offers.

#coupons#promo codes#discounts deals#online shopping#savings#cashback offers#voucher codes#best deals#Black Friday sale#coupon code

1 note

·

View note

Text

Unleashing Innovation: A Closer Look at the Realme 14 Pro 5G

The Realme 14 Pro 5G has arrived, setting new standards in smartphone performance, design, and features. This sleek powerhouse is designed to cater to tech enthusiasts, gamers, photographers, and anyone seeking a reliable, stylish, and feature-rich smartphone. In this detailed review, we’ll explore why the Realme 14 Pro 5G is making waves in the market and why it could be your next upgrade.

Realme 14 Pro 5G Features That Wow

Ultra-Fast and Power-Efficient Chipset

At its heart lies the Dimensity 7300 Energy 5G chipset, a marvel of engineering that ensures smooth and power-efficient performance. Built on a 4nm flagship process, it delivers exceptional speed and efficiency, making multitasking a breeze. Whether you’re streaming, gaming, or working on the go, the Realme 14 Pro 5G won’t let you down.

Boasting an AnTuTu benchmark score exceeding 750,000, this chipset ensures lag-free gaming, lightning-fast app launches, and unparalleled responsiveness. Gamers will appreciate the 120 FPS gaming capability, enhanced by GT Mode, which elevates the gaming experience to an e-sports level.

Capturing Moments Like Never Before

The Realme 14 Pro 5G is a photographer's dream. Equipped with a 50MP Sony IMX882 OIS camera, it offers clarity that rivals DSLRs. The large 1/1.95-inch sensor and F/1.8 aperture allow you to capture stunning photos, even in low light.

For selfie lovers, the 16MP front camera with AI Beauty Algorithm ensures picture-perfect shots every time. Features like AI Ultra Clarity 2.0, Dazzling Night Portraits, and AI Eraser 2.0 make it easy to enhance and edit your photos, preserving memories in stunning detail.

The underwater mode, paired with the phone’s IP69 waterproof rating, is perfect for capturing aquatic adventures, making the Realme 14 Pro 5G a versatile companion for travel and exploration.

Revolutionary Display Technology

The Realme 14 Pro 5G boasts a 120Hz Curved Vision Display that delivers an immersive viewing experience. The 6.77-inch screen, with a resolution of 2392x1080 and a contrast ratio of 5,000,000:1, ensures vibrant colors and sharp visuals.

Its AI Eye Protection algorithm adjusts the screen’s color temperature to reduce eye strain, ensuring comfortable viewing even during prolonged use. With a local peak brightness of 4500 nits and a True Color display supporting 1.07 billion colors, the Realme 14 Pro 5G stands out as a leader in display technology.

Design That Turns Heads

Unique Pearl Design

The Realme 14 Pro 5G is not just a phone; it’s a fashion statement. Available in Pearl White, Jaipur Pink, and Suede Grey, it features a unique texture co-designed with Valeur Designers.

The innovative cold-sensitive fusion fibers create a mesmerizing color-changing effect at lower temperatures, adding an element of surprise to the phone’s appearance. The pearlescent finish, combined with vegan suede leather, makes it a tactile delight while ensuring durability.

Slim Yet Sturdy

Despite housing a massive 6000mAh battery, the Realme 14 Pro 5G maintains a slim profile, making it the slimmest phone with such a high-capacity battery. Its Corning Gorilla Glass 7i and realme ArmorShell Protection ensure durability, while its IP69, IP68, and IP66 certifications guarantee resistance to water, dust, and shocks.

Battery and Charging: A Perfect Combo

The 6000mAh Titan Battery ensures extended usage, offering up to 29 days of standby time. Whether you’re watching videos for 25.3 hours, gaming for 10.2 hours, or listening to music for 90.1 hours, the Realme 14 Pro 5G has you covered.

With 45W SUPERVOOC charging, you can power up from 1% to 50% in just 36 minutes, ensuring you spend more time using your phone and less time waiting.

Realme 14 Pro 5G: Built for the Toughest Challenges

The Realme 14 Pro 5G is designed for adventurers. Its TÜV Rheinland Rugged Smartphone Certification and Military Grade Shock-Resistance ensure it can withstand extreme conditions. Whether you’re trekking in the mountains or exploring underwater worlds, this phone is your ultimate companion.

Realme 14 Pro 5G Offers and Availability

The Realme 14 Pro 5G is available online, offering incredible value for its feature set. With attractive launch offers and discounts, there’s never been a better time to buy Realme 14 Pro 5G. Visit authorized retailers or buy Realme 14 Pro online to secure your new smartphone.

Realme 14 Pro 5G Review: Why It Stands Out

The Realme 14 Pro 5G is more than just a phone; it’s a testament to cutting-edge technology and thoughtful design. From its ultra-clear cameras and power-efficient chipset to its stunning design and rugged build, it excels in every category.

Whether you’re a photography enthusiast, a gamer, or someone who needs a reliable phone for daily use, the Realme 14 Pro 5G is an excellent choice.

Final Thoughts

The Realme 14 Pro 5G redefines what a smartphone can be. Its blend of performance, design, and innovation makes it a top contender in its class. With features like the Dimensity 7300 Energy 5G chipset, a 50MP Sony OIS camera, a 6000mAh battery, and a 120Hz Curved Vision Display, it’s clear that the Realme 14 Pro 5G is a game-changer.

Don’t miss the opportunity to experience this technological marvel. Buy Realme 14 Pro 5G today and elevate your smartphone experience to new heights!

#best smartphones#best mobiles#mobiles#smartphone#deals#mobile offers#offers#new#trending#5g#realme#realme 14 pro#realme 14 pro plus#5g mobiles#new launch#newwiee#new launch alert#cashback#discounts#realme mobiles#realme mobile

0 notes

Text

Macy’s Cashback Promotion

👉 Visit Macys.com or your nearest Macy’s store to start saving now!

Macy’s, the iconic department store that has been your trusted shopping destination since 1858, is here to make your shopping experience even more rewarding! Introducing our exclusive cashback program, where every dollar spent earns you incredible savings.

Cashback Details

✔ 10% Cashback on all online purchases (Lancome included — see exclusions). ✔ 5% Cashback on furniture and mattresses. ✔ 3% Cashback on marketplace purchases.

Why Shop at Macy’s?

🌟 Heritage & Trust: Over 160 years of excellence, offering the best in fashion, beauty, home, and more. 🛍️ Unmatched Variety: Find everything you need, from luxury brands to everyday essentials. 🌐 Seamless Shopping: Enjoy a convenient online experience or visit any of our 740+ stores nationwide.

How to Earn Cashback

Shop Online or In-store: Browse our wide range of categories, including fashion, beauty, home essentials, and more.

Make a Purchase: Complete your purchase and watch the savings roll in!

Cashback Rewards: Automatically earn cashback based on your purchase type.

Terms & Conditions

Cashback rates apply to eligible purchases only.

Exclusions may apply, including certain items within the Lancome category.

Cashback is not applicable on select marketplace purchases.

Start Earning Today! Shop smarter and save more with Macy’s cashback promotion. Whether you’re refreshing your wardrobe, upgrading your home, or indulging in luxury beauty products, Macy’s is here to reward you!

👉 Visit Macys.com or your nearest Macy’s store to start saving now!

2 notes

·

View notes

Text

Discover the Best Rummy App to Play and Win Real Cash – Rummy Nabob

Rummy has long been a favorite card game among enthusiasts, combining strategy, memory, and a little luck for an engaging experience. With the rise of digital gaming, playing rummy on mobile apps has become popular, offering an easy way to enjoy the game and win real cash. In this article, we’ll explore Rummy Nabob, a top choice for playing rummy, and cover everything you need to know about Rummy Nabob APK download, the 51 bonus, and other ways to get the best experience from this real money rummy app.

Why Choose Rummy Nabob?

If you’re on the hunt for the best rummy app for real money, Rummy Nabob offers some of the most attractive features and bonuses. Designed with a user-friendly interface and backed by secure payment systems, Rummy Nabob provides a smooth gaming experience. Players can join different rummy variants, from Points Rummy to Pool Rummy, with options for beginners and seasoned players alike.

With the added bonus of winning cash, Rummy Nabob attracts users looking to sharpen their skills and compete for real rewards. New players are especially drawn to the Rummy Nabob 51 bonus, a welcome reward that gives an instant boost to start their gaming journey without an initial investment.

How to Download Rummy Nabob APK

If you’re ready to start playing, the Rummy Nabob APK download is a quick and simple process. Follow these steps to download and install the app on your Android device:

Search for the Rummy Nabob APK: Since some rummy apps may not be available on Google Play due to regional restrictions, you might need to visit the official Rummy Nabob website or a trusted APK download site.

Download the APK file: Once you locate the download link on the site, click on it to download the file. Ensure that you download it from a secure source.

Install the App: Once downloaded, open the APK file. You may need to enable the "Install from Unknown Sources" option in your device settings. Follow the prompts to complete the installation.

After installation, open the app and register for an account to claim the Rummy Nabob 51 bonus. This quick setup will have you ready to explore the exciting rummy games on offer.

Benefits of Playing on Rummy Nabob

Rummy Nabob isn’t just a platform to play rummy—it’s a complete gaming ecosystem with benefits for both beginners and experienced players. Here are some of the top features of this platform:

Cash Rewards: Rummy Nabob allows players to win real money in each game. Depending on the game format, you could win cash prizes that can be instantly withdrawn.

Bonus Offers: New players benefit from the Rummy Nabob 51 bonus, a free bonus on sign-up to help them start their rummy journey. Additional bonuses and rewards are available for regular players, which include deposit matches, cashback, and exclusive rewards on festivals and special events.

Secure Transactions: Rummy Nabob is committed to secure transactions, giving players peace of mind. The app integrates trusted payment gateways for easy deposit and withdrawal processes.

Diverse Game Formats: Whether you enjoy Points Rummy, Deals Rummy, or Pool Rummy, Rummy Nabob has it all. Players can choose their preferred variant and even participate in tournaments for higher rewards.

24/7 Customer Support: The app offers round-the-clock customer support to assist with any technical or account-related queries. This is a huge plus when playing for real cash, ensuring that any issues can be resolved promptly.

The Appeal of Real Money Rummy Apps

For rummy enthusiasts, the chance to play rummy and win cash has brought a fresh level of excitement to the game. Unlike playing for points or simply practicing, real money games come with higher stakes, making each round more thrilling. Rummy Nabob’s platform provides an ideal environment for this, with quick cashouts and reliable gameplay that makes it one of the best rummy apps for real money.

In addition to the cash benefits, these apps also provide a structured environment to improve rummy skills, learn from fellow players, and compete in exciting tournaments.

New Rummy Apps and the Growing Popularity of Rummy Nabob

The demand for rummy apps has led to a wave of new rummy apps, each offering different features and bonuses to attract players. However, Rummy Nabob stands out due to its user-focused features, rewards, and seamless experience.

For players who are new to online rummy, finding the best platform is essential for a positive experience. The Rummy Nabob app continues to draw users thanks to its user-friendly interface, great rewards, and ease of use.

How to Maximize Your Wins on Rummy Nabob

Once you’ve completed the Rummy Nabob APK download and claimed your Rummy Nabob 51 bonus, here are some strategies to enhance your gameplay and increase your chances of winning:

Practice Regularly: Playing regularly helps build your skill level. Most rummy apps have practice tables, where you can try out new strategies before entering cash games.

Start Small: If you’re new to cash games, start with smaller bets. This will help you get comfortable with the process and rules without risking too much of your balance.

Understand Game Variants: Each rummy variant requires different strategies. Try out different formats on Rummy Nabob to identify which suits you best and focus on that variant to improve your skill.

Claim Bonuses: Rummy Nabob regularly updates its bonus offers. Check the app frequently to maximize rewards and boosts to your balance.

Set Limits: To maintain a positive gaming experience, always play responsibly by setting time and cash limits for yourself.

Conclusion

Rummy Nabob offers a fantastic combination of competitive gameplay, exciting bonuses, and a secure platform to play rummy and win cash. The app is easy to download, and with the initial Rummy Nabob 51 bonus, it provides an excellent entry point for new users looking to dive into online rummy.

With plenty of new rummy apps on the market, Rummy Nabob remains a top choice for those seeking to play rummy for real money in a safe, rewarding environment. Whether you’re a casual player or a dedicated rummy enthusiast, this app offers something for everyone, and with the possibility of real cash wins, each game becomes an opportunity to put your skills to the test.

So, don’t wait! Download Rummy Nabob APK, claim your bonus, and get ready to enjoy one of the best rummy experiences available today.

#online money making app#rummy nabobz withdrawal#rummy nabob 51 bonus#rummy nabob apk download#play rummy win cash#best Rummy app for real money#new rummy app#real money rummy apk#rummy nabob online

2 notes

·

View notes

Text

You may like it : Best Electric Scooters in India

For the iQube equipped with a 2.2kWh battery, a cashback of Rs 17,300 is available, with certain bank cards offering an additional Rs 7,700 cashback. The 3.4kWh variant features a cashback of Rs 20,000, along with a Rs 10,000 discount for select cardholders. Additionally, TVS provides a complimentary extended warranty for the iQube S variant.

These incentives are expected to draw more consumers towards electric scooters as the trend of e-mobility continues to grow in India. The iQube presents an excellent option for those contemplating electric two-wheelers, as it combines affordability with environmental advantages.

you may like it : Best Scooter in India

In terms of performance, the TVS iQube demonstrates reliability. Testing indicates that it delivers sufficient power and range for everyday commuting. The 2.2kWh model offers a range of 75 km and a maximum speed of 75 km/h, while the 3.4kWh version provides a range of 100 km and a top speed of 80 km/h. Charging the smaller battery to 80% requires two hours, whereas the larger battery takes a bit longer.

The iQube is also equipped with contemporary technology, including a digital display that provides information on speed, battery status, and navigation. Riders can connect their smartphones to track their rides and utilize features from the TVS app.

Comfort and convenience are prioritized, featuring a roomy seat and under-seat storage. The suspension system ensures a smooth ride, while safety is enhanced by front and rear disc brakes, regenerative braking, and LED lights for improved visibility at night.

TVS is actively expanding its charging infrastructure to facilitate convenience for electric vehicle users, with plans for additional stations across urban areas. Home charging solutions are also being considered, enabling users to charge their scooters overnight.

You may like it : Royal Enfield Makes an Announcement

With the festive season in full swing, it is an opportune moment to purchase the TVS iQube. With its combination of cashback incentives, advanced features, and reliable performance, the iQube stands out as an ideal choice for environmentally conscious commuters seeking economical and sustainable transportation options.

2 notes

·

View notes

Text

To Manifest more money, get more specific.

Here are a FEW( there’s nearly infinite ways, don’t close yourself off!) ways one can receive money

Treat it like Pokémon and collect them all lol

1. Salary/wages: Regular income earned from employment self/employment.

2. Investment returns: Profits gained from investments such as stocks, bonds, or real estate.

3. Inheritance: Money or assets received from a relative or benefactor.

4. Grants: Funds awarded by organizations or institutions for specific purposes, such as research or education.

5. Loan repayment: Money received when someone pays back a loan that was previously provided.

6. Dividends: Payments made to shareholders from the profits of a corporation.

7. Royalties: Payments received by creators for the use of their intellectual property, such as books, music, or inventions.

8. Tips: Additional money given as appreciation for services rendered, typically in industries like hospitality or personal services.

9. Rebates: Refunds or discounts given after a purchase, often as an incentive or promotion.

10. Alimony/child support: Regular payments made to a former spouse or partner for financial support.

11. Found money: Money discovered unexpectedly, such as in lost or forgotten accounts, or on the ground.

12. Lottery winnings: Prizes won through games of chance like lotteries or scratch-off tickets.

13. Refunds: Money returned to a consumer after returning a product or canceling a service.

14. Sponsorship: Funds provided by companies or individuals to support a person or organization in exchange for advertising or promotion.

15. Crowdfunding: Money raised from a large number of people, typically through online platforms, to support a project, cause, or individual.

16. Cashback rewards: Money returned to a consumer as a percentage of their purchases, often offered by credit card companies or retailers.

17. Scholarships: Funds awarded to students to help cover the costs of education, typically based on academic achievement, financial need, or other criteria.

18. Patronage: Financial support given by individuals or organizations to artists, writers, or other creatives to fund their work or projects.

19. Rental income: Money earned from leasing or renting out property or assets, such as real estate, vehicles, or equipment.

20. Contest winnings: Prizes awarded for winning competitions or contests, which may include cash or other rewards.

21. Side hustle earnings: Additional income earned from part-time or freelance work outside of one's primary job.

22. Government benefits: Financial assistance provided by the government to eligible individuals or families, such as unemployment benefits, social security, or welfare.

23. Referral bonuses: Money received for referring new customers or clients to a business or service.

24. Stock options: Compensation provided to employees in the form of company stock, often as part of their overall compensation package.

25. Affiliate marketing commissions: Money earned through promoting and selling products or services for companies as an affiliate marketer.

26. Consulting fees: Payments received for providing expert advice or services to clients or businesses.

27. Trust distributions: Money distributed to beneficiaries from a trust fund, typically according to the terms outlined in the trust agreement.

28. Liquidation proceeds: Money received from selling off assets, such as stocks, bonds, or property.

29. Cash gifts: Money given by friends, family, or acquaintances as a gesture of goodwill, celebration, or support.

30. Insurance payouts: Money received from insurance companies to cover losses, damages, or expenses incurred due to accidents, disasters, or other covered events.

Focus on the ones that fits your self concept the best, for the best results.

5 notes

·

View notes

Text

Maximizing Credit Card Use for Financial Goals

Welcome back to our series on credit cards and personal finance! In the previous article, we explored the fundamentals of responsible credit card use and how to choose the right card for your needs. Now, we’re diving deeper into credit cards to help you leverage them for your financial goals. Whether you’re looking to build credit, earn rewards, or manage your expenses more effectively, this article is your guide to getting the most out of your plastic companion.

Have you ever wondered how to turn your credit card into a powerful tool for achieving financial success? The answer lies in strategic and responsible credit card usage. Let’s explore how you can leverage your card for various financial goals.

Building and Improving Credit with Credit Cards

Building and improving your credit score is like laying a strong foundation for your financial future. Your credit score influences the interest rates you’ll receive on loans and credit cards, affecting your ability to buy a home, finance a car, or even secure a job. Your credit card can be a key player in building and improving your credit score. By using it responsibly through making on-time payments and keeping balances low, you establish a positive credit history. If you’re new to credit or rebuilding your score, consider secured credit cards or credit builder loans to get started.

Here���s how to use your credit card to boost your creditworthiness:

Responsible Credit Card Use

The foundation of a good credit score is responsible credit card usage. Pay your credit card bills on time, every time. Timely payments contribute significantly to your payment history, one of the most crucial factors in your credit score. Set up automatic payments to ensure you never miss a due date.

Keep Balances Low

High credit card balances relative to your credit limit can negatively impact your credit score. Aim to keep your credit utilization ratio below 30%. For example, if your credit limit is $10,000, try to maintain a balance of $3,000 or less. This shows lenders that you’re responsible with credit.

Diversify Your Credit Mix

A mix of credit types can also work in your favor. In addition to credit cards, consider having installment loans (e.g., a car loan) in your credit history. A diverse mix demonstrates your ability to manage various types of credit.

Avoid Opening Too Many Accounts at Once

Each time you apply for credit, it results in a hard inquiry on your credit report, which can temporarily lower your score. Be selective when opening new credit card accounts and avoid a flurry of applications in a short period.

By mastering these credit-building strategies, you’ll not only elevate your credit score but also enhance your financial standing. A strong credit profile opens doors to better financial opportunities and lower borrowing costs.

Earning Rewards and Cashback with Credit Cards

One of the most enticing aspects of credit card ownership is the potential to earn rewards or cashback on your spending. Who doesn’t love the idea of being rewarded for their spending? To make the most of this, select a credit card that aligns with your spending habits. If you’re a frequent traveler, a travel rewards card might be the best option. For everyday expenses, cashback cards can put money back in your pocket. Additionally, keep an eye out for sign-up bonuses — these can provide a significant boost to your rewards balance. By leveraging your credit card for these purposes, you’re not only working towards your financial goals but also getting the most out of your credit card’s potential.

Credit cards offer an array of rewards, from cashback on everyday purchases to travel points that can whisk you away on exciting adventures. Let’s explore how to make the most of these perks:

Match Rewards to Your Lifestyle

The key to maximizing rewards is to match the right card to your lifestyle. If you’re a frequent traveler, consider a travel rewards card that offers bonus miles or hotel stays. For those who prefer simplicity, cashback cards provide straightforward rewards on everyday spending.

Sign-Up Bonuses

Don’t underestimate the power of sign-up bonuses. Many credit cards offer substantial bonuses when you meet a minimum spending requirement within the first few months. These bonuses can kickstart your rewards earnings.

Strategic Spending

Take a close look at your spending habits and leverage cards that offer the most rewards in your primary spending categories. For instance, if you spend heavily on groceries, choose a card with a high cashback rate in that category.

Supplementary Benefits

Beyond rewards, credit cards often come with supplementary benefits like purchase protection, extended warranties, rental car insurance, and airport lounge access. Familiarize yourself with these perks and use them to your advantage.

Remember, the key to successful rewards earning is to pay your credit card balance in full each month. Carrying a balance and incurring interest can quickly negate the value of your rewards.

Taking Advantage of Interest-Free Periods

Credit cards often come an interest-free period on purchases which is an enticing feature. During this period, you can make purchases without incurring any interest charges, provided you pay the balance in full by the due date. Here’s how to make the most of this perk:

Planned Purchases

If you have significant expenses on the horizon, such as home improvements or medical bills, consider using a credit card with a 0% APR introductory offer on purchases. This allows you to spread the cost over several months without accruing interest, making larger expenses more manageable.

Balance Transfers

Some credit cards also offer 0% APR introductory periods on balance transfers. If you have existing credit card debt with high-interest rates, transferring it to a card with a 0% APR can save you money on interest and help you pay down the debt faster.

Responsible Payment

While the interest-free period provides breathing room, remember that it’s crucial to pay off the balance before the promotional period ends. Missing this deadline can result in retroactive interest charges, which can be financially burdensome.

Automating Payments and Savings

Automation is a powerful ally in managing your credit card accounts and financial goals:

Auto-Pay Minimum

To avoid late fees and penalties, set up automatic payments to cover at least the minimum payment due each month. This ensures that you never miss a payment deadline.

Auto-Pay Full Balance

For optimal financial practice, consider setting up auto-pay to cover the full credit card balance each month. By doing so, you avoid interest charges altogether, and your credit score benefits from consistent, on-time payments.

Auto-Transfer to Savings

If your credit card rewards come in the form of cashback, consider automating transfers of your earnings into a savings account or towards specific financial goals. This effortless saving can gradually help you achieve your financial goals.

Maintaining a Low Credit Utilization Ratio

Your credit utilization ratio, which is the percentage of your available credit you’re using, plays a significant role in your credit score. Keeping this ratio low can positively impact your creditworthiness:

Pay Balances in Full

Aim to pay your credit card balances in full each month. By doing so, you not only avoid interest charges but also maintain a low credit utilization ratio.

Request Credit Limit Increases

If you’ve been a responsible credit card user, consider requesting a credit limit increase from your card issuer. A higher credit limit can automatically reduce your utilization ratio if you don’t increase your spending.

Monitor Credit Utilization

Regularly monitor your credit utilization ratio and make adjustments as needed. If you notice your ratio creeping up, consider reducing your credit card spending or making an extra payment mid-cycle to keep it in check.

By implementing these strategies, you’ll not only maximize the benefits of your credit cards but also strengthen your financial foundation. These practices promote responsible credit card use and financial discipline, essential elements of long-term financial success.

Conclusion

In this article, we’ve explored credit card strategies that can help you achieve your financial goals. From building and improving credit to earning rewards and leveraging interest-free periods, each strategy is a valuable tool in your financial toolkit. Remember that responsible credit card use is key to reaping the benefits while avoiding common pitfalls. In the next article, we will look into even more advanced credit card techniques and explore how to take your financial journey to the next level. Stay tuned for our continued exploration of credit card mastery and financial success!

Follow our Instagram account for your daily dose of fun and inspiration!!

Looking for a productivity tool that can help you achieve goals, set budget, and be more productive? Come learn about Illumtori!

#100 days of productivity#self improvement#goals#personal growth#productivity#personal development#inspiration#motivation#achieve your goals#finance

3 notes

·

View notes

Text

Looking For Home Or Personal Loan? Well Don't Look Any Further MortBuzz Is Here To Help YOU!

We Offer The Best Interest Rates In The Industry With Great Customer Support. Our Belief At MortBuzz Is transparent, accessible, and empowering Loan Services With Customer First Approach.

Our specialities Are -

Free Of Cost Stamp Duty UPTO 100% Cashback In 45 Days Free Notice of Intimation (NOI)

You Can Visit Our Site HERE : https://mortbuzz.in/

2 notes

·

View notes

Text

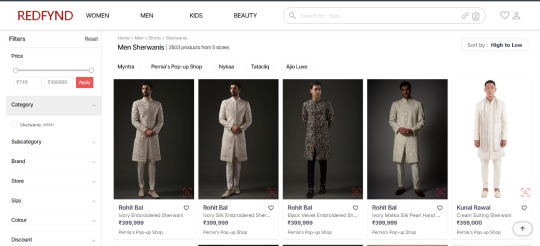

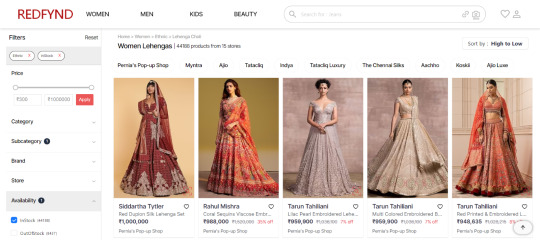

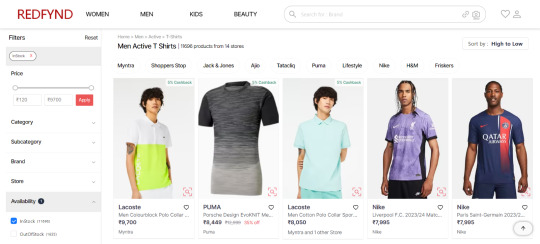

Redfynd: Stop and Shop.

The One-stop Shopping Solution for Fashion and Beauty Enthusiasts.

Shopping online can be difficult. We have so many websites and brands to choose from when we want to order or shop. It can also be difficult to find the right discounts or deals for the products we wish to buy. We have the best platform that will not only help you reduce your time and effort, but also make your shopping experience much easier if you are looking to buy something related to fashion and beauty. Redfynd is the one-stop solution.

Photo by Tamanna Rumee on Unsplash

Key to more than 100+ stores on a single platform.

Redfynd brings over 100+ stores related to e-commerce onto a single platform. It's like a buffet of your favorite brands on a table; you only need to pick your best deal and shop. Not only this, but it will also give you cash back in return. This signifies that a shopper can get a wide range of products in one place, making it easier for him or her to pick and order after comparing the prices and deals, which can help him/her save more money.

If a user is looking for a shirt, lehenga, shoes, watches, jeans, etc. for a special season or any beauty product or fashion-related products, Redfynd has your back

Comparing Prices and Cashbacks

What makes Redfynd different from other e-commerce shopping platforms is that it gives you the option to compare prices and provides cashback. With the listing of 100+ stores, Redfynd gives its users an option to explore and hunt down their favorite products, helping users save time, money, and the unnecessary hassle of switching tabs and adding products to every possible e-commerce Wishlist.

In addition to this, Redfynd also offers cashback on every verified purchase, giving you cherry-on-top experience. Users can get a certain percentage of cashback, which can be redeemed later with every verified purchase. This feature makes users happy and gives a soothing experience to shop more and save more.

1 Million Plus Happy Users

Since Redfynd was born it has served more than 1 million users, giving them a reason to stop and shop from Redfynd. The number of happy users is increasing day by day as well. With access to 2million+ products from over-the-top 100+ plus stores Redfynd carries something for everyone.

No matter whether users are looking for fashion, beauty or any special attire Redfynd is never back with anything.

AI-Powered Shopping Search Engine

Artificial intelligence Whenever we hear this word the first thing that comes to our mind is robot, algorithm, or smartness. Redfynd has worked on this only to make its website more and more efficient, giving its user an easy-to-shopping search engine experience. Redfynd uses AI to search millions of products online to find the exact product that a user is looking for in a fraction of a second. This feature helps users to save money, time, effort and in return gives cashback as well.

Product Customization

The customization option is another feature that separates it from other e-commerce platforms. Redfynd uses artificial intelligence to read a user experience on the platform and recommends products according to their budget and preference which will help them and also allow them to save money for every verified purchase. Users don't need to visit multiple websites looking for the same products, applying custom filters and comparing prices one after the other. All features of Redfynd sum up heaven for fashion and beauty enthusiasts.

A user-friendly interface with search and filtering capabilities

Redfynd friendly user interface helps a 12-year-old kid or a 60-year-old person to operate smoothly. It has so much sorted user interface which helps its users to look for their customized products. Filter features can help users narrow down their shopping lists by men/women, price, brands, colors, stores and many more. Redfynd filter feature helps its user to personalize their shopping experience.

Conclusion

Redfynd is a revolutionary shopping platform that is changing the whole game of shopping for all users across India. With access to 100+ stores and 2 million products and counting Redfynd is helping users to customize their shopping experience and giving them cashback on addition. So, what are you waiting for? Visit Redfynd ASAP and make you save money, time and effort on every purchase.

Google Redfynd Right now.

9 notes

·

View notes