#bank valuation

Explore tagged Tumblr posts

Text

Investment Strategies Based on Bank Valuation

Introduction

Bank valuation plays a crucial role in investment decision-making, particularly in the financial sector. Investors who understand how banks are valued can develop effective strategies to maximize returns while mitigating risks. Unlike traditional companies, banks have unique balance sheets, regulatory requirements, and risk profiles, making their valuation complex but essential for strategic investments. This article explores investment strategies based on bank valuation, focusing on various methodologies, key valuation metrics, and actionable investment approaches.

Understanding Bank Valuation

Unique Aspects of Bank Valuation

Banks differ from regular corporations due to their business models. Instead of producing goods or traditional services, banks generate revenue from interest income, fees, and financial instruments. Key factors influencing bank valuation include:

Regulatory environment: Compliance with capital adequacy requirements impacts profitability.

Asset composition: Loans, securities, and cash holdings dictate financial stability.

Interest rate sensitivity: Affects net interest margin and profitability.

Risk exposure: Credit, market, and operational risks influence valuation.

Key Valuation Metrics

Several financial metrics help in assessing the valuation of banks, including:

Price-to-Earnings (P/E) Ratio – Measures profitability and investor confidence.

Price-to-Book (P/B) Ratio – Evaluates market value relative to book value.

Return on Equity (ROE) – Indicates profitability in relation to shareholder equity.

Net Interest Margin (NIM) – Reflects the bank’s ability to manage interest rate spreads.

Capital Adequacy Ratio (CAR) – Assesses financial strength and risk-bearing capacity.

Non-Performing Loans (NPL) Ratio – Measures asset quality and credit risk exposure.

Investment Strategies Bank Valuation

1. Value Investing in Undervalued Banks

Value investors seek banks trading below their intrinsic value using fundamental analysis. Key strategies include:

Identifying undervalued banks based on low P/B and P/E ratios.

Analyzing financial health, focusing on asset quality and capital adequacy.

Comparing historical valuation multiples to industry benchmarks.

Considering regulatory and economic conditions affecting banking operations.

2. Growth Investing in High-Performing Banks

Growth investors focus on banks with strong earnings growth potential. Characteristics of attractive banks include:

Consistently high ROE and ROA (Return on Assets).

Expanding loan and deposit base.

Strong digital banking transformation and innovation.

Low cost-to-income ratio, indicating operational efficiency.

3. Dividend Investing in Stable Banks

Investors seeking passive income favor banks with consistent dividend payments. Key factors include:

High dividend yield relative to peers.

Sustainable dividend payout ratios.

Stable cash flow generation.

Regulatory compliance ensuring consistent distributions.

4. Cyclical Investing Based on Economic Trends

Bank valuations fluctuate with economic cycles. Investors can time their investments based on:

Economic expansion: Favor banks with strong loan growth and interest income.

Recessionary periods: Prefer defensive banks with low NPL ratios and strong capital buffers.

Interest rate trends: Higher rates benefit banks with asset-sensitive portfolios, while lower rates favor liability-sensitive banks.

5. Contrarian Investing in Distressed Banks

Contrarian investors take positions in struggling banks with recovery potential. Strategies include:

Assessing turnaround potential based on management restructuring and risk mitigation efforts.

Evaluating asset quality improvements.

Identifying regulatory interventions that can stabilize operations.

6. Mergers and Acquisitions (M&A) Driven Investing

Investors can capitalize on M&A activity in the banking sector by:

Identifying acquisition targets with undervalued assets.

Investing in banks with strong M&A synergy potential.

Analyzing market reactions to announced mergers and restructuring plans.

Risk Considerations in Bank Investments

Regulatory Risks

Stringent financial regulations, such as Basel III requirements, can impact capital adequacy and profitability.

Credit Risk Exposure

High levels of non-performing loans (NPLs) indicate poor asset quality and potential write-offs.

Interest Rate Risks

Banks with significant exposure to interest rate fluctuations may experience volatile earnings.

Market Volatility

Macroeconomic conditions and financial crises can lead to sharp valuation declines in banking stocks.

Conclusion

Understanding investment strategies based on bank valuation allows investors to make informed decisions in the banking sector. Whether pursuing value, growth, dividend, cyclical, contrarian, or M&A-driven investments, analyzing key valuation metrics and economic trends is essential. Investors should also consider regulatory risks, credit exposure, and market volatility when structuring their portfolios. By applying these strategies effectively, investors can optimize returns while managing risk in banking investments.

0 notes

Text

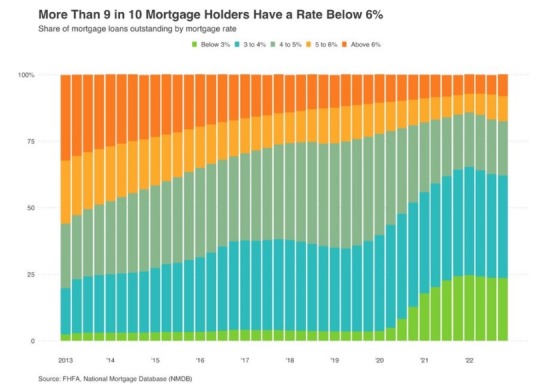

Potentially painful process of #realestate value normalization over next years?

Data from @Redfin show roughly 4 in 5 homeowners with mortgages have an interest rate below 5%; nearly 1 in 5 have rate below 3% … 80% of likely home sellers say they would feel more urgency to sell if rates were to drop to 3% or lower

#cmbs #RealEstate #cpi #fed #inflation #philadelphia #Philly #phl #rental #realtors #housing #mbs #investments #privatedebt #credit

2 notes

·

View notes

Text

IBGrid: The Best Investment Banking Company

IBGrid, a subsidiary of IndiaBizForSale, is redefining investment banking services for businesses across industries. In today’s competitive business environment, having the right investment banking company by your side is crucial for success.

Whether you are looking for expert M&A services, strategic fundraising solutions, or a fair business valuation report, IBGrid offers industry-leading investment banking solutions tailored to your needs. Specializing in transactions ranging from INR 10 Cr to 200+ Cr, IBGrid ensures businesses connect with the right investors and funding opportunities to drive growth.

Why IBGrid Stands Out as a Top Investment Banking Firm

IBGrid is not just another investment banking company—it is a trusted partner for business owners, investors, and entrepreneurs. With a strong reputation in investment banking solutions, IBGrid helps businesses navigate complex financial transactions with ease. Here’s what makes IBGrid the best investment banking firm:

End-to-End Investment Banking Solutions: From deal structuring to final negotiations, IBGrid handles everything with precision.

Expert-Led Valuation Reports: Get a comprehensive business valuation report in just 21 days, enabling quick and informed decision-making.

M&A Services with Maximum Value: IBGrid ensures businesses secure the best deals by connecting them with the right buyers and sellers.

Fundraising Solutions to Scale Faster: IBGrid helps businesses secure the right mix of debt and equity funding to fuel growth.

Industry-Specific Expertise: Whether you operate in manufacturing, healthcare, technology, or retail, IBGrid provides customized investment banking solutions.

Business Valuation Services: A Key to Smart Financial Decisions

Knowing your company’s true value is essential for making informed financial and strategic decisions. IBGrid’s business valuation services provide deep insights that help business owners, investors, and stakeholders understand the real worth of their assets.

Comprehensive Valuation Services by IBGrid

Detailed Business Valuation Report: IBGrid’s valuation experts analyze financial performance, industry trends, and market positioning to provide a reliable business valuation report.

Company Valuation Services for M&A and Fundraising: A precise valuation strengthens negotiation power in M&A deals and fundraising rounds.

Valuation Expert Consultation: IBGrid’s valuation experts with 25+ years of experience guide businesses through complex valuation methodologies, ensuring accuracy and clarity.

Regulatory Compliance and Financial Due Diligence: IBGrid ensures valuation reports meet regulatory standards and are suitable for legal and financial documentation.

M&A and Fundraising Solutions That Drive Growth

IBGrid’s M&A services and fundraising solutions have helped numerous businesses achieve successful transactions. Whether you are a startup seeking investors or an established company looking for acquisition opportunities, IBGrid simplifies the process.

M&A Deal Advisory: From target identification to post-merger integration, IBGrid’s experts guide businesses at every step.

Investor and Buyer Network: With access to a vast network of investors, IBGrid connects businesses with the right funding partners.

Fundraising Strategy Development: IBGrid helps businesses craft compelling investor pitches and structure deals to attract the best funding opportunities.

Exit Planning & Succession Advisory: Business owners looking for an exit strategy benefit from IBGrid’s expertise in maximizing company valuation before a sale.

Why Businesses Trust IBGrid?

Fast & Reliable Reports: Business valuation reports delivered in 21 days.

Expert Investment Bankers: Decades of experience in M&A services and fundraising solutions.

Tailored Solutions: Customized investment banking solutions based on industry and business needs.

Trusted by Entrepreneurs & Corporates: Proven track record with successful deals across various sectors.

Final Thoughts

When choosing the best investment banking firm, IBGrid is the trusted partner for valuation services, M&A transactions, and fundraising solutions. Whether you need a valuation expert to assess your company’s worth or strategic advisory for mergers and acquisitions, IBGrid delivers results that drive business success.

Contact IBGrid today to explore how our investment banking company can help you achieve your financial and business goals.

#investment banking#investment banking company#business valuation services#fundraising solutions#m&a solutions

0 notes

Text

I slept in and just woke up, so here's what I've been able to figure out while sipping coffee:

Twitter has officially rebranded to X just a day or two after the move was announced.

The official branding is that a tweet is now called "an X", for which there are too many jokes to make.

The official account is still @twitter because someone else owns @X and they didn't reclaim the username first.

The logo is 𝕏 which is the Unicode character Unicode U+1D54F so the logo cannot be copyrighted and it is highly likely that it cannot be protected as a trademark.

Outside the visual logo, the trademark for the use of the name "X" in social media is held by Meta/Facebook, while the trademark for "X" in finance/commerce is owned by Microsoft.

The rebranding has been stopped in Japan as the term "X Japan" is trademarked by the band X JAPAN.

Elon had workers taking down the "Twitter" name from the side of the building. He did not have any permits to do this. The building owner called the cops who stopped the crew midway through so the sign just says "er".

He still plans to call his streaming and media hosting branch of the company as "Xvideo". Nobody tell him.

This man wants you to give him control over all of your financial information.

Edit to add further developments:

Yes, this is all real. Check the notes and people have pictures. I understand the skepticism because it feels like a joke, but to the best of my knowledge, everything in the above is accurate.

Microsoft also owns the trademark on X for chatting and gaming because, y'know, X-box.

The logo came from a random podcaster who tweeted it at Musk.

The act of sending a tweet is now known as "Xeet". They even added a guide for how to Xeet.

The branding change is inconsistent. Some icons have changed, some have not, and the words "tweet" and "Twitter" are still all over the place on the site.

TweetDeck is currently unaffected and I hope it's because they forgot that it exists again. The complete negligence toward that tool and just leaving it the hell alone is the only thing that makes the site usable (and some of us are stuck on there for work).

This is likely because Musk was forced out of PayPal due to a failed credit line project and because he wanted to rename the site to "X-Paypal" and eventually just to "X".

This became a big deal behind the scenes as Musk paid over $1 million for the domain X.com and wanted to rebrand the company that already had the brand awareness people were using it as a verb to "pay online" (as in "I'll paypal you the money")

X.com is not currently owned by Musk. It is held by a domain registrar (I believe GoDaddy but I'm not entirely sure). Meaning as long as he's hung onto this idea of making X Corp a thing, he couldn't be arsed to pay the $15/year domain renewal.

Bloomberg estimates the rebranding wiped between $4 to $20 billion from the valuation of Twitter due to the loss of brand awareness.

The company was already worth less than half of the $44 billion Musk paid for it in the first place, meaning this may end up a worse deal than when Yahoo bought Tumblr.

One estimation (though this is with a grain of salt) said that Twitter is three months from defaulting on its loans taken out to buy the site. Those loans were secured with Tesla stock. Meaning the bank will seize that stock and, since it won't be enough to pay the debt (since it's worth around 50-75% of what it was at the time of the loan), they can start seizing personal assets of Elon Musk including the Twitter company itself and his interest in SpaceX.

Sesame Street's official accounts mocked the rebranding.

158K notes

·

View notes

Text

Valuation Methodologies in Investment Banking: A Comprehensive Overview

Valuation is at the heart of every investment banking transaction. Whether it’s mergers and acquisitions (M&A), initial public offerings (IPOs), or private equity deals, knowing how to value a company accurately is essential. But with so many methodologies out there, it can be overwhelming for professionals, especially those new to the field. In this article, we’ll break down the most common valuation methodologies used in investment banking and how each one plays a crucial role in deal-making. We'll also point you to some fantastic resources to dive deeper into these methods.

What is Company Valuation?

Company valuation is the process of determining the economic value of a business or asset. In investment banking, this is key to advising clients on the price to pay, sell, or merge a company. Valuations are typically conducted by using different models, each with its strengths and weaknesses depending on the situation. But before we dive into specific methods, let’s quickly highlight why valuation is such an important skill for investment bankers.

Why Does Valuation Matter in Investment Banking?

In investment banking, valuation is necessary for:

Acquisitions and Mergers: When a company is buying or merging with another, valuing the target company helps determine the right price.

IPO: For a company going public, proper valuation helps set an initial offering price that reflects its market potential.

Financial Advisory: Investment bankers help clients decide whether a deal is worth pursuing based on valuation estimates.

Private Equity & Venture Capital: Accurate valuations ensure investors know what stake they’re buying or selling, and at what price.

5 Key Valuation Methodologies in Investment Banking

Now, let’s take a deeper look at the five main types of valuation methodologies used by investment bankers. Each method has a unique approach, and the context of the deal will determine which is the best to use.

1. Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method is one of the most thorough ways of valuing a company. It involves projecting a company's future free cash flows and then discounting them to present value using the company’s cost of capital (WACC). The formula behind DCF might seem complex, but essentially, you are determining what a future cash flow is worth today based on its expected growth and risk.

When to use it: DCF is ideal when the company has predictable cash flows and the ability to maintain stability over the long term. It works best for mature companies with a clear path for future growth.

2. Comparable Company Analysis (Comps)

Comparable company analysis, also known as "Comps," involves evaluating a company’s value by comparing it to other similar companies in the same industry. This method relies on multiples such as Price-to-Earnings (P/E), Enterprise Value to EBITDA (EV/EBITDA), and others. By applying these multiples to the target company’s financial metrics, you can estimate its value.

When to use it: Comps are most useful when there’s a robust peer group and market data to draw from. This method is commonly used for industries where companies are similar in nature, like technology or consumer goods.

3. Precedent Transactions Analysis

Precedent Transactions, also known as "M&A Comps," works by looking at past transactions in the market. This involves analyzing past deals involving similar companies, whether it be mergers, acquisitions, or buyouts. By examining the pricing and multiples from these transactions, investment bankers can estimate the target company’s value.

When to use it: This method is valuable when market conditions are stable and there’s a relevant set of comparable transactions to analyze. It’s commonly used in M&A advisory.

4. Asset-Based Valuation

Asset-based valuation focuses on determining the value of a company based on its assets and liabilities. This method can be particularly useful for companies in distress or those that have substantial tangible assets, such as real estate or machinery. The valuation is based on adjusting the company’s book value of assets and liabilities.

When to use it: Asset-based valuation works best for companies with significant physical assets or those undergoing liquidation.

5. Market Capitalization

Market capitalization is the simplest of the valuation methods, as it’s calculated by multiplying the company’s stock price by its total number of shares outstanding. This is essentially the market’s view of the company’s value based on the current stock price.

When to use it: This is most appropriate for publicly traded companies, but it does not provide the same level of insight as other methods since market prices can fluctuate based on factors unrelated to the company’s true value.

Which Valuation Method Should You Choose?

The right method depends largely on the nature of the company and the transaction at hand. Often, investment bankers will use a combination of these methodologies to ensure a comprehensive view of a company’s value.

If you’re looking for a more in-depth exploration of valuation methodologies, check out this detailed guide on valuation methodologies. It’ll help you understand not just the different methods but also how to apply them in real-world scenarios.

Conclusion

Valuation is more than just numbers and formulas—it’s about making informed decisions based on analysis and insights. Whether you’re valuing a company for an IPO, a merger, or an acquisition, understanding the different valuation methodologies will give you the tools you need to perform at your best. Each methodology has its unique advantages, and choosing the right one for the situation can make all the difference.

In investment banking, mastering these methodologies will help you guide your clients and make the right recommendations, ensuring your deal-making strategies lead to success. For a deeper dive into valuation methodologies and how they impact your work, don’t forget to check out the valuation guide linked above!

#valuation#valuationintelligentsystem#Valuation Methodologies Investment Banking#Valuation Methodologies in Investment Banking

0 notes

Text

The Secret Weapon of Investment Bankers : Skills that will Skyrocket your Career in Corporate Finance

In the competitive world of corporate finance, investment bankers are often seen as the elite players. Their success is not merely due to their environment but largely attributed to their specialized skills. One of the most valuable assets in their toolkit is expertise in financial modeling and valuation. Enrolling in a financial modelling and valuation course can be the secret weapon that propels your career to new heights.

Understanding Financial Modeling and Valuation

Financial modeling is the process of creating a quantitative representation of a company's financial performance. It includes forecasting future earnings, expenses, and capital needs, providing a framework for decision-making. Valuation, on the other hand, is the determination of a company's worth based on its financial data, market trends, and potential for growth. Together, these skills enable finance professionals to analyze investment opportunities and assess company performance accurately.

A financial modelling and valuation course equips you with the knowledge and practical skills necessary to master these techniques, making you a more attractive candidate in the corporate finance landscape.

Why Financial Modeling and Valuation Skills Matter

Here are some compelling reasons why mastering financial modeling and valuation is essential for your career:

Foundational Knowledge: These skills provide a strong foundation for understanding how businesses operate financially. A solid grasp of financial modeling and valuation helps you make informed decisions and recommendations.

High Demand in the Industry: Investment banks and corporate finance firms actively seek professionals who can create detailed financial models and conduct valuations. Proficiency in these areas sets you apart in a crowded job market.

Critical for Deal-Making: In corporate finance, the ability to evaluate potential mergers, acquisitions, and other investment opportunities hinges on strong financial modeling and valuation skills. These competencies are crucial in making high-stakes deals.

Enhanced Analytical Skills: Mastering financial modeling sharpens your analytical skills, enabling you to assess complex financial situations, identify trends, and present data-driven insights to stakeholders.

Career Advancement: Professionals skilled in financial modeling and valuation are often seen as leaders within their organizations, positioning themselves for promotions and increased responsibilities.

Versatility Across Roles: These skills are not limited to investment banking; they are also highly applicable in private equity, corporate finance, and even consulting roles. This versatility enhances your career options.

Benefits of Taking a Financial Modelling and Valuation Course

Investing in a financial modelling and valuation course comes with numerous benefits:

Comprehensive Curriculum: A structured course covers everything from basic financial principles to advanced modeling techniques, ensuring you gain a well-rounded education.

Hands-On Experience: Many courses emphasize practical applications, allowing you to work on real-world projects that reinforce your learning and build your portfolio.

Networking Opportunities: Joining a course provides access to a community of peers and industry professionals, facilitating valuable networking opportunities that can enhance your career prospects.

Credibility and Recognition: Completing a recognized course adds credibility to your resume, demonstrating your commitment to professional development and enhancing your marketability.

Skill Development: Beyond financial modeling and valuation, you’ll also develop complementary skills, such as advanced Excel techniques and presentation abilities, further boosting your professional toolkit.

Steps to Enroll in a Financial Modelling and Valuation Course

If you’re ready to elevate your career in corporate finance, consider these steps to enroll in a financial modelling and valuation course:

Research Programs: Look for reputable courses that offer a comprehensive curriculum. Consider factors like duration, delivery format, and industry recognition.

Evaluate Your Goals: Determine what you hope to achieve from the course. Are you looking to switch careers, enhance your skills, or prepare for a specific role? Clarifying your goals will guide your decision.

Enroll and Engage: Once you’ve selected a course, enroll and fully engage with the materials. Dedicate time each week to study and participate in discussions.

Practice Regularly: Apply what you learn by building financial models and conducting valuations. The more you practice, the more proficient you will become.

Network Actively: Take advantage of networking opportunities within the course. Building relationships with fellow students and instructors can lead to valuable connections in the industry.

Stay Informed: After completing the course, continue learning and stay updated on industry trends and best practices. This ongoing education will keep your skills sharp and relevant.

Conclusion

In conclusion, mastering financial modeling and valuation is a secret weapon that can significantly elevate your career in corporate finance. A financial modelling and valuation course not only provides you with essential skills but also enhances your credibility and marketability in a competitive landscape.

As the finance industry evolves, the need for skilled professionals who can analyze and interpret complex financial data will only grow. By investing in your skills today, you can position yourself for success in the future. Elevate your career and unlock new opportunities by enrolling in a financial modelling and valuation course—your gateway to becoming a standout professional in corporate finance!

#financial modelling#financial modeling certification#financial modelling course#financial modelling and valuation course#financial valuation course#FINANCE#Banking#FINANCIAL ANALYST#Investment Banking course#investment banking certification

0 notes

Text

Musk has stock valued at $400 billion. The value is based on multiples of earnings or eventual earnings.

Americans earn paychecks. People have bank accounts or use cash.

Average workers don't have wealth based on multiples of their earnings.

Don't confuse stock valuations with hard work.

Elon has the benefit of the stock market valuations and multiples to crush your earned social security and medicare.

Stop adoring this psychopath.

2K notes

·

View notes

Text

Theory Alone Does Not Pay Bills

Theory Alone Does Not Pay Bills What is it really worth? Mr Market doesn’t care what I think. There is reason that the Silicon Valley Bank saga was important, it shed light on the fact that banks have a lot of assets (commercial real estate), which, in theory, are worth $xxx. They are allowed to value these assets using theory. Based on ‘theory,’ they are able to lend 10-11x of $xxx to Jae’s Rib…

View On WordPress

0 notes

Text

'𝐕𝐢𝐝𝐚𝐫𝐛𝐡𝐚 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐞𝐬' nears resolution. 𝐋𝐞𝐧𝐝𝐞𝐫𝐬 𝐏𝐢𝐜𝐤 𝐂𝐅𝐌 𝐚𝐬 𝐀𝐧𝐜𝐡𝐨𝐫 𝐁𝐢𝐝𝐝𝐞𝐫𝐬'.

Valuation of this Power Plant was previously conducted by 𝐑.𝐊 𝐀𝐬𝐬𝐨𝐜𝐢𝐚𝐭𝐞𝐬 𝐨𝐧 𝐛𝐞𝐡𝐚𝐥𝐟 𝐨𝐟 𝐋𝐞𝐧𝐝𝐞𝐫𝐬.

𝐕𝐢𝐝𝐚𝐫𝐛𝐡𝐚 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐞𝐬 𝐏𝐨𝐰𝐞𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 which is a Coal-fired sub-critical thermal power plant primarily comprising of 𝟐 𝐮𝐧𝐢𝐭𝐬 𝐨𝐟 𝟑𝟎𝟎 𝐌𝐖 each situated at Butibori, MIDC Industrial Area, Nagpur District of Maharashtra, India. The plant was having 100% PPA with the electricity distribution business of R-Infra. Later Adani Electricity Mumbai Ltd. after the acquisition of the R-infra Power distribution business terminated the PPA. This has deteriorated the company's financial position.

The Loans of 𝐕𝐢𝐝𝐚𝐫𝐛𝐡𝐚 𝐏𝐨𝐰𝐞𝐫 were a distressed asset for the lenders. We are delighted that the lenders have picked CFM ARC as Anchor Bidder for the Calls for counteroffers in the Swiss Auction to conclude the deal of the troubled Vidarbha Power’s Loans.

More Info:

Website: https://www.rkassociates.org/

Facebook: https://www.facebook.com/rkavaluers

Instagram: https://www.instagram.com/rka_valuers/

Linkedin: https://www.linkedin.com/company/rkassociatesvaluers/

Twitter: https://twitter.com/rkavaluers

#valuationservices#valuations#axis bank#idbi bank#hdfc bank#icici bank#sbibank#bank of india#bank of baroda#union bank of india

0 notes

Text

11th Accountancy - Conceptual Framework of Accounting Chapter 2

I. Multiple Choice Questions : Choose the Correct Answer Question 1: The business is liable to the proprietor of the business in respect of capital introduced by the person according to ……………… (a) Money measurement concept (b) Cost concept (c) Business entity concept (d) Dual aspect concept Answer: (c) Business entity concept Question 2: The concept which assumes that a business will…

View On WordPress

#Accounting period#Accounting standard#Bad debt#Depreciation#FYI#Institute of Chartered Accountants of India#Medium of exchange#Money measurement concept#Reserve Bank of India#Revenue recognition#Stock valuation#Supreme Court of India

0 notes

Text

https://procurve.in/bank-valuation-methods-metrics-key-considerations/

The valuation for banks is crucial for investors, regulators, and stakeholders who need to make informed decisions. Whether assessing a bank for an acquisition, investment, or regulatory compliance, having an accurate valuation is essential. However, various challenges, such as fluctuating interest rates, credit risks, and regulatory requirements, can complicate the process.

1 note

·

View note

Text

Residential sales

O'Toole Real Estate is a leading real estate agency that specializes in residential sales across the country. O'Toole Real Estate had a highly successful year in residential sales, achieving a significant increase in sales volume compared to the previous year.

The company's success can be attributed to its highly experienced and dedicated team of agents who are committed to providing top-notch services to clients. O'Toole Real Estate has also invested heavily in technology and marketing, which has helped it reach a wider audience and attract more potential buyers.

The company's portfolio comprises a diverse range of properties, including apartments, townhouses, and houses, to meet the varying needs and preferences of clients. O'Toole Real Estate's agents work closely with clients to understand their unique requirements and help them find properties that match their needs.

Furthermore, the company has an excellent track record of negotiating and closing sales deals quickly and efficiently. Its agents are highly skilled negotiators who work tirelessly to ensure clients get the best possible price for their properties.

Overall, O'Toole Real Estate's success in residential sales is a testament to its commitment to providing exceptional services and its ability to adapt to the ever-changing real estate market.

Source URL:

0 notes

Text

IBGrid is the leading investment banking firm specializing in facilitating M&A, fund-raising, and strategic partnerships, with ticket sizes ranging from INR 10 Cr to INR 200+ Cr.

With over 25 years of experience, our expert team at IBGrid delivers tailored solutions for SMEs and large enterprises. Whether you need fair business valuation reports within 21 days or investment banking solutions—including capital raising and M&A advisory—executed within 120 - 180 days, we ensure fast, efficient, and strategic results.

We’ve helped over 250 businesses guiding them through complex financial decisions and growth opportunities.

Whether it's understanding your business’s value, raising capital, seeking exit, or structuring strategic deals, our team is here to support you every step of the way.

Contact our 25+ years of experience team at [email protected]

Click here: https://ibgrid.com/

0 notes

Text

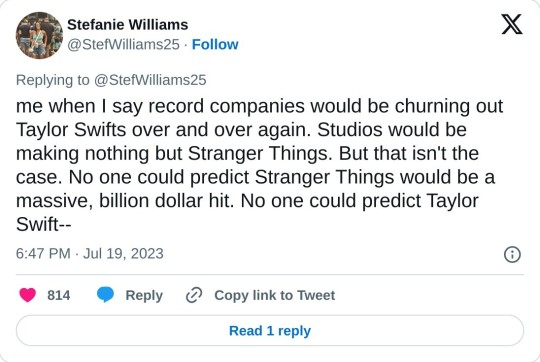

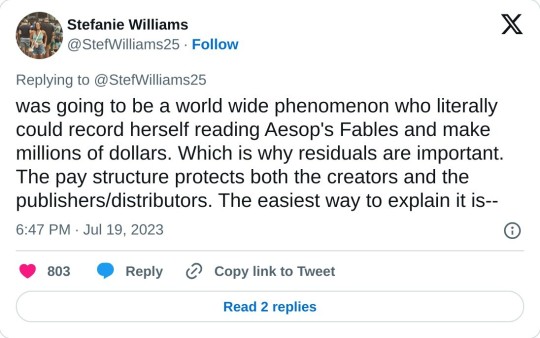

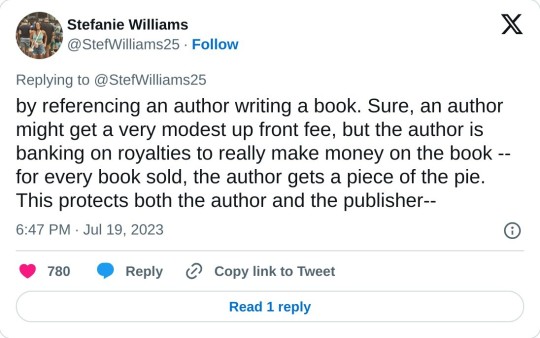

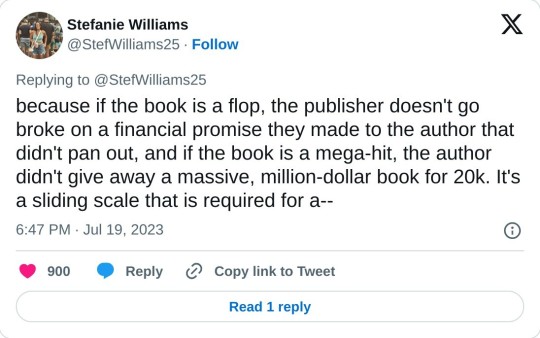

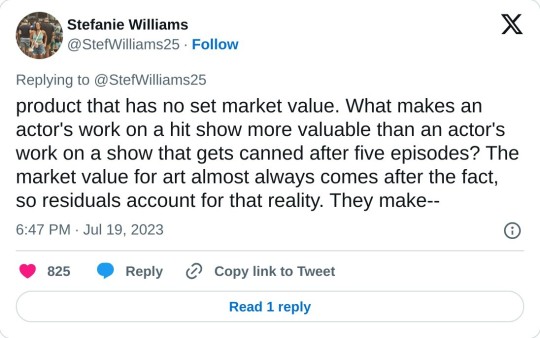

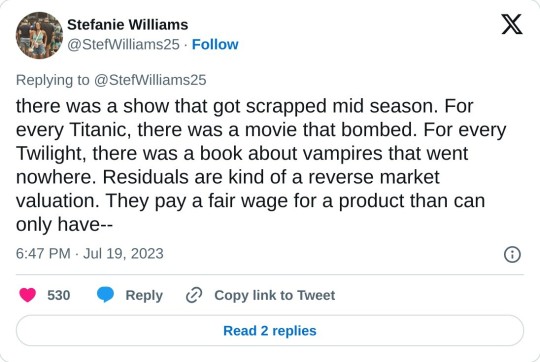

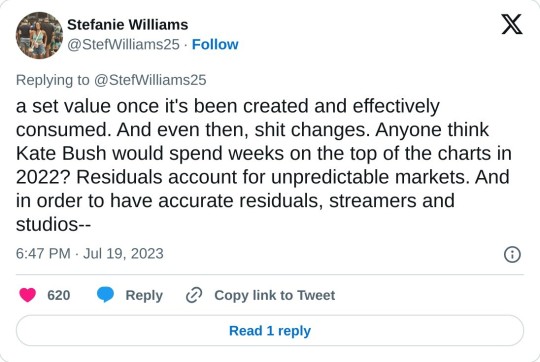

'Why creatives are seeking residuals' - thread by Stefanie Williams

[Tweet thread by Stefanie Williams @/StefWilliams25

TRANSCRIPT:

Why creatives are seeking residuals vs. "do you pay the mattress maker every time you sleep on a mattress?" A thread. I keep hearing over and over again that writers/actors/creatives don't deserve residuals for the work they create. "If I build a bathroom in a house, I don't get paid every time someone uses the toilet."

TRUE! However, your bathroom build has a set market value. Art does not. No one knows what makes one TV show an overnight success, and another a flop. No one knows what makes one song a hit, and the other a dud. If they did, trust me when I say record companies would be churning out Taylor Swifts over and over again. Studios would be making nothing but Stranger Things.

But that isn't the case. No one could predict Stranger Things would be a massive, billion dollar hit. No one could predict Taylor Swift was going to be a world wide phenomenon who literally could record herself reading Aesop's Fables and make millions of dollars. Which is why residuals are important. The pay structure protects both the creators and the publishers/distributors.

The easiest way to explain it is by referencing an author writing a book. Sure, an author might get a very modest up front fee, but the author is banking on royalties to really make money on the book — for every book sold, the author gets a piece of the pie. This protects both the author and the publisher—because if the book is a flop, the publisher doesn't go broke on a financial promise they made to the author that didn't pan out, and if the book is a mega-hit, the author didn't give away a massive, million-dollar book for 20k.

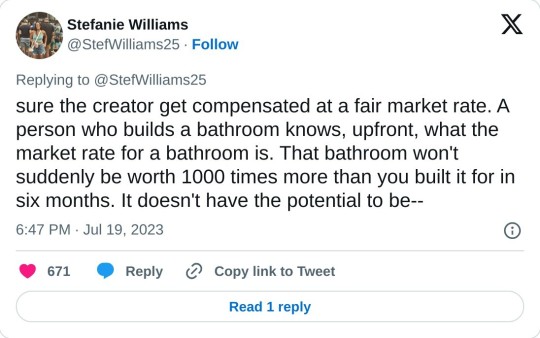

It's a sliding scale that is required for a product that has no set market value. What makes an actor's work on a hit show more valuable than an actor's work on a show that gets canned after five episodes? The market value for art almost always comes after the fact, so residuals account for that reality. They make sure the creator get compensated at a fair market rate. A person who builds a bathroom knows, upfront, what the market rate for a bathroom is. That bathroom won't suddenly be worth 1000 times more than you built it for in six months. It doesn't have the potential to be built for 20k and generate 20 million.

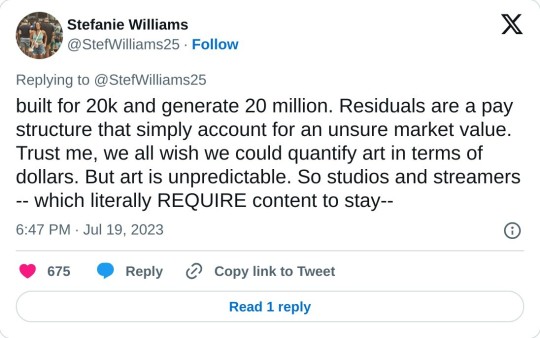

Residuals are a pay structure that simply account for an unsure market value. Trust me, we all wish we could quantify art in terms of dollars. But art is unpredictable. So studios and streamers -- which literally REQUIRE content to stay viable -- have to account for that unpredictability. And for studios (or record labels, or book publishers) it's always trial and error. The only way to get a hit, is to go through a few flops.

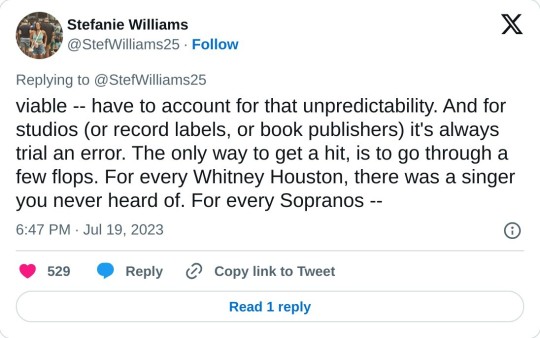

For every Whitney Houston, there was a singer you never heard of. For every Sopranos, there was a show that got scrapped mid season. For every Titanic, there was a movie that bombed. For every Twilight, there was a book about vampires that went nowhere. Residuals are kind of a reverse market valuation. They pay a fair wage for a product than can only have a set value once it's been created and effectively consumed.

And even then, shit changes. Anyone think Kate Bush would spend weeks on the top of the charts in 2022? Residuals account for unpredictable markets. And in order to have accurate residuals, streamers and studios need to be transparent and open about their data, which is one of the MANY things the WGA and SAG are both fighting for.

#sag-aftra strike#sag strike#actors strike#union solidarity#support unions#fans4wga#described#wga strike#writers strike

3K notes

·

View notes

Text

This is it. Generative AI, as a commercial tech phenomenon, has reached its apex. The hype is evaporating. The tech is too unreliable, too often. The vibes are terrible. The air is escaping from the bubble. To me, the question is more about whether the air will rush out all at once, sending the tech sector careening downward like a balloon that someone blew up, failed to tie off properly, and let go—or more slowly, shrinking down to size in gradual sputters, while emitting embarrassing fart sounds, like a balloon being deliberately pinched around the opening by a smirking teenager. But come on. The jig is up. The technology that was at this time last year being somberly touted as so powerful that it posed an existential threat to humanity is now worrying investors because it is apparently incapable of generating passable marketing emails reliably enough. We’ve had at least a year of companies shelling out for business-grade generative AI, and the results—painted as shinily as possible from a banking and investment sector that would love nothing more than a new technology that can automate office work and creative labor—are one big “meh.” As a Bloomberg story put it last week, “Big Tech Fails to Convince Wall Street That AI Is Paying Off.” From the piece: Amazon.com Inc., Microsoft Corp. and Alphabet Inc. had one job heading into this earnings season: show that the billions of dollars they’ve each sunk into the infrastructure propelling the artificial intelligence boom is translating into real sales. In the eyes of Wall Street, they disappointed. Shares in Google owner Alphabet have fallen 7.4% since it reported last week. Microsoft’s stock price has declined in the three days since the company’s own results. Shares of Amazon — the latest to drop its earnings on Thursday — plunged by the most since October 2022 on Friday. Silicon Valley hailed 2024 as the year that companies would begin to deploy generative AI, the type of technology that can create text, images and videos from simple prompts. This mass adoption is meant to finally bring about meaningful profits from the likes of Google’s Gemini and Microsoft’s Copilot. The fact that those returns have yet to meaningfully materialize is stoking broader concerns about how worthwhile AI will really prove to be. Meanwhile, Nvidia, the AI chipmaker that soared to an absurd $3 trillion valuation, is losing that value with every passing day—26% over the last month or so, and some analysts believe that’s just the beginning. These declines are the result of less-than-stellar early results from corporations who’ve embraced enterprise-tier generative AI, the distinct lack of killer commercial products 18 months into the AI boom, and scathing financial analyses from Goldman Sachs, Sequoia Capital, and Elliot Management, each of whom concluded that there was “too much spend, too little benefit” from generative AI, in the words of Goldman, and that it was “overhyped” and a “bubble” per Elliot. As CNN put it in its report on growing fears of an AI bubble, Some investors had even anticipated that this would be the quarter that tech giants would start to signal that they were backing off their AI infrastructure investments since “AI is not delivering the returns that they were expecting,” D.A. Davidson analyst Gil Luria told CNN. The opposite happened — Google, Microsoft and Meta all signaled that they plan to spend even more as they lay the groundwork for what they hope is an AI future. This can, perhaps, explain some of the investor revolt. The tech giants have responded to mounting concerns by doubling, even tripling down, and planning on spending tens of billions of dollars on researching, developing, and deploying generative AI for the foreseeable future. All this as high profile clients are canceling their contracts. As surveys show that overwhelming majorities of workers say generative AI makes them less productive. As MIT economist and automation scholar Daron Acemoglu warns, “Don’t believe the AI hype.”

6 August 2024

#ai#artificial intelligence#generative ai#silicon valley#Enterprise AI#OpenAI#ChatGPT#like to charge reblog to cast

182 notes

·

View notes

Text

Take away every consequential activity through which AI harms people, and all you’ve got left is low-margin activities like writing SEO garbage, lengthy reminisces about “the first time I ate an egg” that help an omelette recipe float to the top of a search result. Sure, you can put 95 percent of the commercial illustrators on the breadline, but their total wages don’t rise to one percent of the valuation of the big AI companies.

For those sky-high valuations to remain intact until the investors can cash out, we need to think about AI as a powerful, transformative technology, not as a better autocomplete.

We literally just sat through this movie, and it sucked. Remember when blockchain was going to be worth trillions, and anyone who didn’t get in on the ground floor could “have fun being poor?”

At the time, we were told that the answer to the problems of blockchain were exotic, new forms of regulation that accommodated the “innovation” of crypto. Under no circumstances should we attempt to staunch the rampant fraud and theft by applying boring old securities and commodities and money-laundering regulations. To do that would be to recognize that “fin-tech” is just a synonym for “unlicensed bank.”

The pitchmen who made out like bandits on crypto — leaving mom-and-pop investors holding the bag — are precisely the same people who are beating the drum for AI today.

-Ayyyyyy Eyeeeee: The lie that raced around the world before the truth got its boots on

2K notes

·

View notes