#backtest

Explore tagged Tumblr posts

Text

Bullish Backtest -- Update

On Tuesday we discussed how stocks retraced to backtest their breakout from the election. We watching for a swing low and close back above the 10 day MA. Which is what happened. Stocks are currently in a daily uptrend. Closing back above the 10 day MA indicates a continuation of their daily uptrend and signals a cycle band buy signal. A break above the day 5 high of 6017.31 will assure us of…

View On WordPress

0 notes

Text

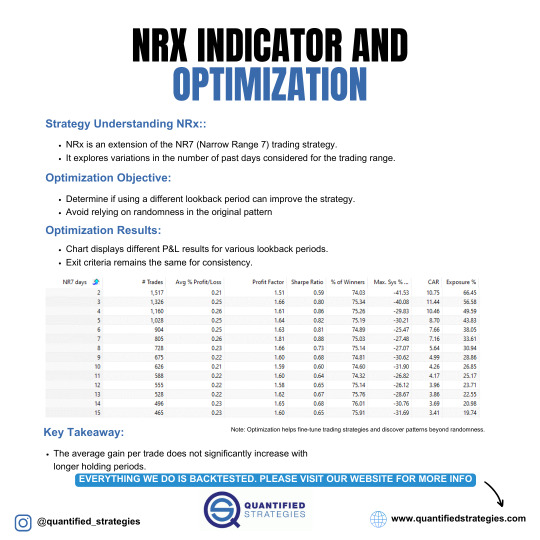

NRX INDICATOR AND OPTIMIZATION

The NRX Indicator extends the NR7 trading strategy by varying the lookback period for identifying narrow range days. The goal of optimization is to determine if altering the lookback period improves performance while avoiding randomness. Results show minimal improvement in the average profit with longer lookback periods, indicating diminishing returns. The strategy maintains consistent exit criteria, with higher profit factors and Sharpe ratios around the 3-7 day range.

#TradingStrategy#NR7#NRXIndicator#Optimization#Backtest#TradingPerformance#SharpeRatio#ProfitFactor#MarketAnalysis

1 note

·

View note

Text

NDIV11: O Primeiro ETF Brasileiro que Paga Dividendos Mensais

Recentemente, foi lançado o NDIV11, o primeiro ETF brasileiro que distribui dividendos mensalmente. Essa novidade chamou a atenção dos investidores, e neste artigo, vamos analisar os principais aspectos desse ETF e avaliar se vale a pena incluí-lo em sua carteira de investimentos. O que é o NDIV11? O NDIV11 é um ETF (Exchange-Traded Fund) que busca replicar o desempenho do índice Bovespa Smart…

View On WordPress

#backtest#bitributação#Bovespa Smart Dividendos#carteira de investimentos#consultor financeiro#desempenho passado#dividendos#dividendos mensais#ETF brasileiro#imposto de renda#investimento direto em ações#investimentos#NDIV11#Nubank#renda regular#taxa de administração#tributação

0 notes

Text

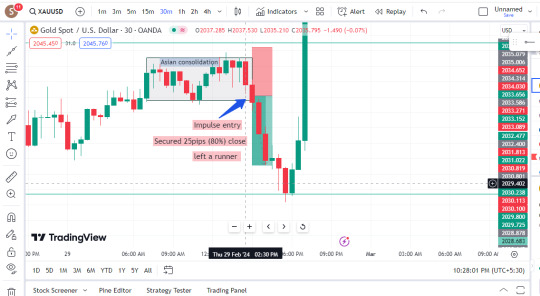

Gold! Remember to backtest and journal your trades. Simplify your charts for clearer opportunities. Keep it straightforward, folks! Clean charts enhance opportunity visibility.

2 notes

·

View notes

Text

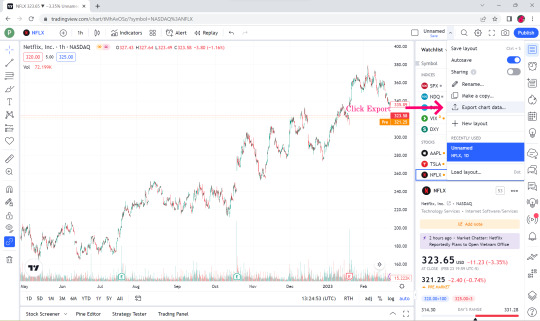

How to Import Candle Charts from TradingView websites?

youtube

💥S#.Data provides functionality that supports automatic downloading of historical market data from many data sources. But sometimes websites do not provide an API to make the process automatically. Fortunately, in addition to downloading you can import market data from CSV files directly.

💥TradingView is a charting platform and social network used by many traders and investors worldwide to spot opportunities across global markets. The major feature of the website - various historical dataset - that you can download as a csv file for further usage (e.g. - backtesting, analyzing).

💥For the TradingView website, you need a premium subscription to be able to export candles. Let’s look at this process step-by-step to understand how we can import this market data into S#.Data.

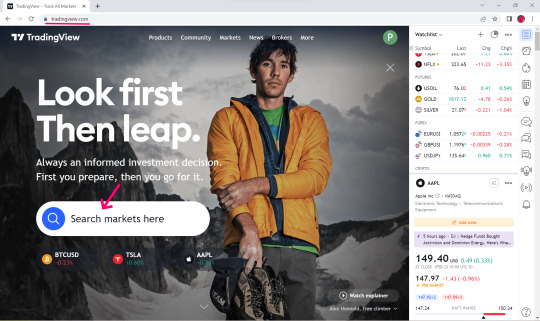

👉Visit TradingView Website.

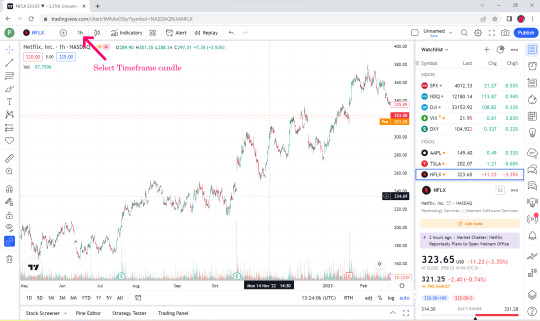

👉Select Search Market for example NFLX. 👉Click Launch Chart for view.

👉Select Time Flame Candle for example 1 hr.

👉Select Export Chart Data.

👉In the Time format box, select ISO time.

👉Click Export.

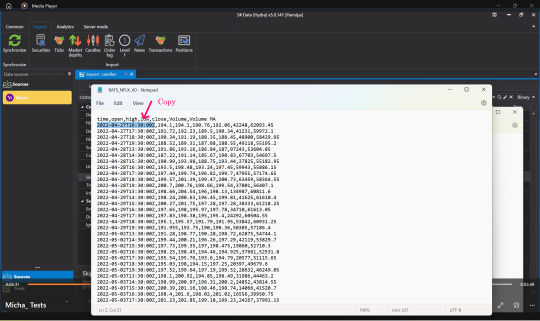

👉Open the downloaded Market data file. You can see that the top bar is date and time, open price, low price, close price, volume and volume MA.

👉S#.Data supports only the first 6 data, the last one volume MA we will not take.

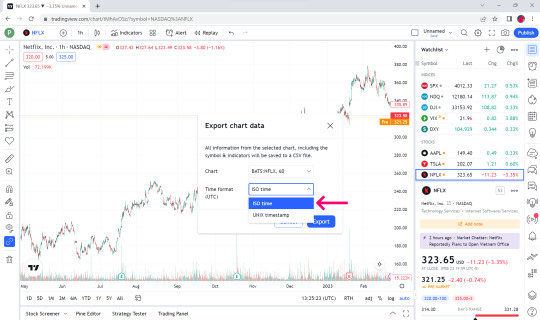

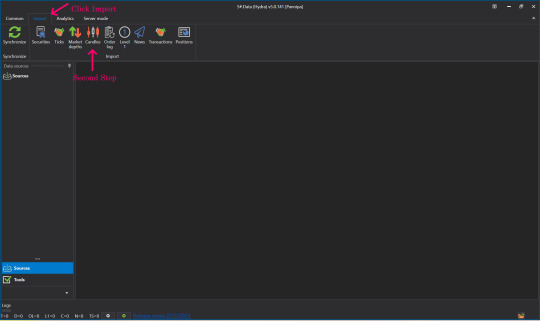

👉Open up your S#.Data Application.

👉Visit our instruction if you doesn't have S#.Data application.

👉How I can get S#.Data

👉Go to S#.Data application, click select import and Click candle.

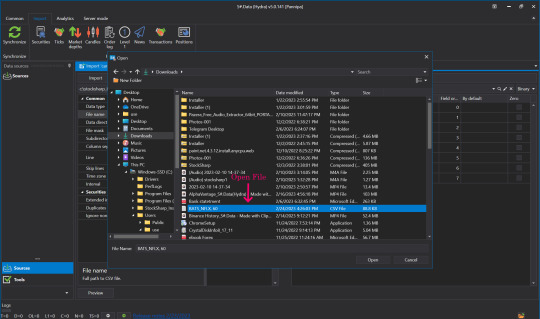

👉Find the name of the file we just downloaded (btw, you can import by directories as well).

👉Click to select the file that we downloaded, click open.

👉Click to select the time frame to match the timeframe we selected in the file we downloaded initially in the data type field.

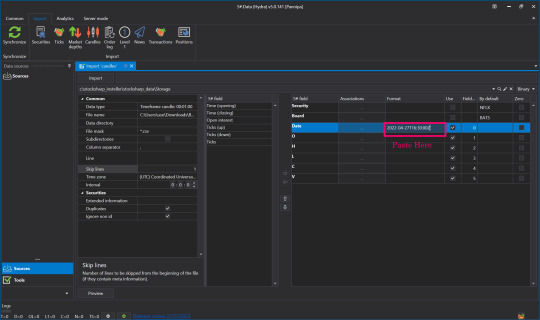

👉Setting S#.filed from the Security and Board fields.

👉By default put the Instruments Code that we downloaded. For example NFLX in the Security slot in the instrument board e.g. BATS by default.

👉Enter numbers 0-5 in the date box and so on. Remember - numeration started from 0, not from 1.

👉Skip lines Row 1 cause it contains data columns description.

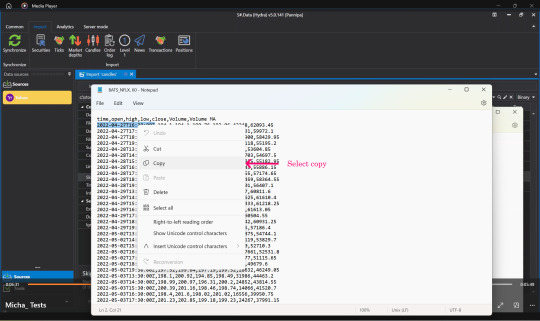

👉Open the file that we downloaded again, select Copy, time, date that we started downloading Market Data.

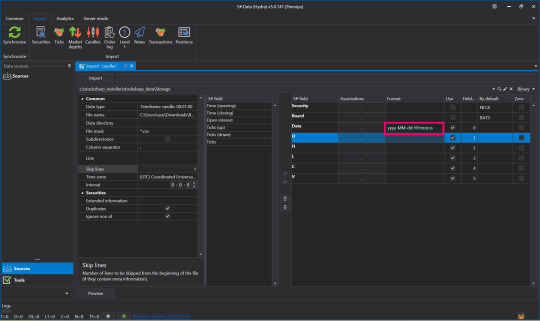

👉Press Paste in the Date Format field.

👉Change Numbers to Code Letters By yyyy-MM-dd HH:mm:ss You can read more about format on Microsoft website

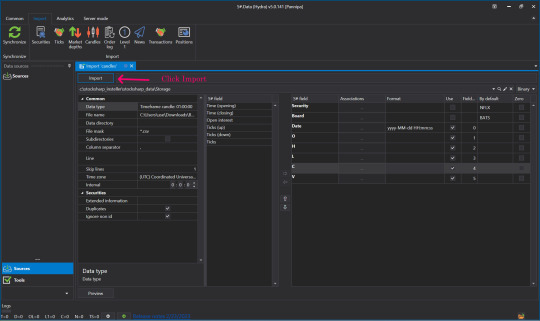

👉Once everything is entered correctly, click Preview to double check before importing.

👉When the screen shows this page, there is no problem.

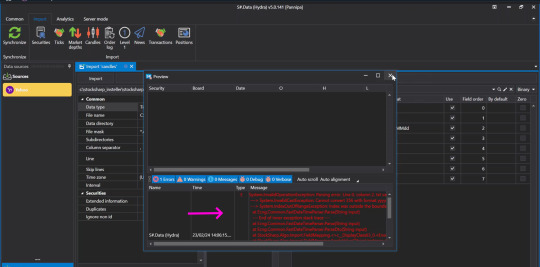

👉But if you press Preview and the screen appears like this, check the details that you have entered again to see if there is any mistake, correct it and press Preview again.

👉Once it's verified and there are no problems, press Import.

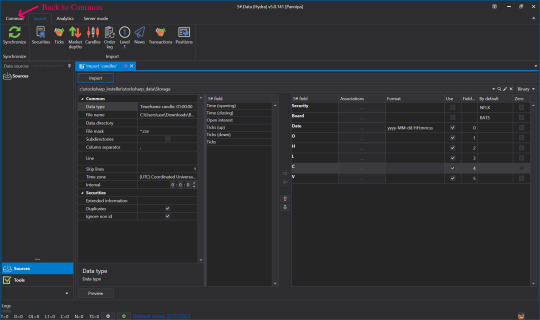

👉When done, click Back to go to Common.

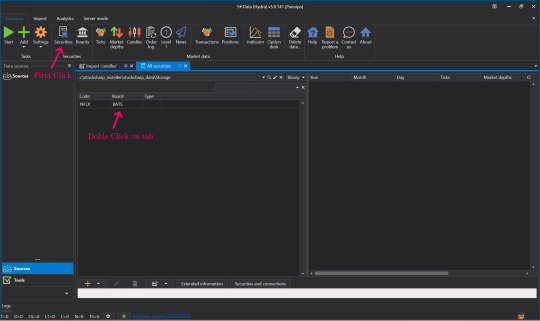

👉Click on our Security.

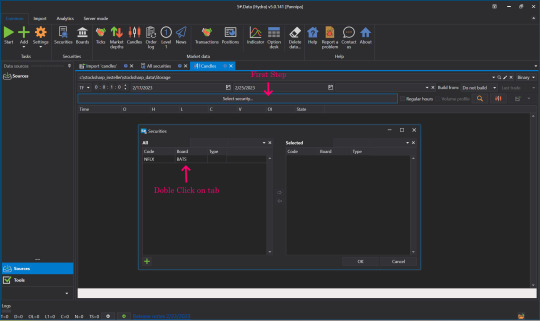

👉Click on Instrument Tab to view market Data.

👉Now let's see what data was imported. Click Candles.

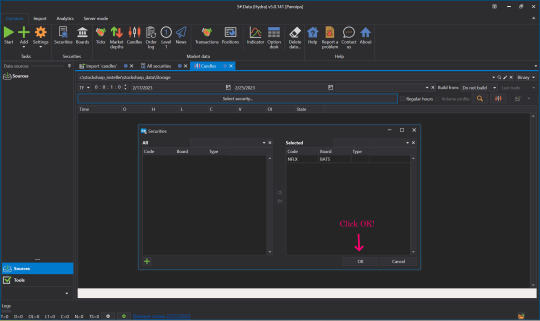

👉Select Security, select the Instrument to view by double-clicking the Instrument Tab, move it to the right side and click OK.

👉Select date and time frame.

👉Click View Market data.

👉Click View Candle Chart to see our candles as a chart.

👉This is a Candle Chart comparison between the Chart that was in TradingView website before it was downloaded and the downloaded Chart rendered in S#.Data application.

💥💥Now you know how to import from a CSV file. To make this process you no need to use only limited websites like TradingView. S#.Data supports any format of CSV files that you can download from a variety of sources and websites.

💥Hope this blog is interesting for you. Please comment us what you interesting to know more about S#.Data. We will try to write our next posts.

Sources : StockSharp.com

#downloading of historical market data#import market data#charting platform#export candles#trading view#backtesting#Youtube

1 note

·

View note

Text

Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

With the rapid development of the cryptocurrency market, arbitrage strategies have become one of the important means for many traders to pursue stable returns. This series of articles will explore an arbitrage strategy called Lead-Lag in depth, analyzing its principles, implementation methods, and key points in actual operation.

What Is Lead-Lag?

Lead-Lag arbitrage strategy, as the name implies, is an arbitrage operation based on the "lead-lag" phenomenon between different exchanges and different varieties in the market. Specifically, Lead-Lag arbitrage involves finding price differences between two or more markets, where price changes in one market are usually delayed in another market. This phenomenon gives traders a "preemptive" opportunity to take advantage of price lags to arbitrage.

Lead-Lag in Exchanges

The most common form of Lead-Lag arbitrage is the price difference between exchanges. Taking the carry bricks arbitrage (cross-exchange arbitrage) as an example, traders can use the price difference between exchanges with lower liquidity (usually referred to as "small exchanges") and exchanges with higher liquidity (i.e. "large exchanges") to conduct arbitrage operations. Large exchanges such as Binance and OKX usually lead market price fluctuations due to their large trading volume and good market depth; while small exchanges have poor market liquidity, lagging price changes, and are prone to price deviations.

In this case, arbitrageurs can place orders on small exchanges and take advantage of the price lead of large exchanges to close their positions on large exchanges. Due to the trading speed and liquidity advantages, traders can react quickly and seize arbitrage opportunities before other market participants notice the price difference. The core of this method is to discover and seize price lags in a timely manner, complete transactions through technical advantages and quick reactions, and profit from them.

Other Forms of Lead-Lag

In addition to the Lead-Lag phenomenon between exchanges, some other market situations can also form similar arbitrage opportunities. For example, the high correlation between the prices of some altcoins and mainstream currencies (such as ETH) means that when the prices of mainstream currencies fluctuate, altcoins tend to lag in corresponding fluctuations. In this case, traders can seize the opportunity of lagging altcoin prices quickly to arbitrage by monitoring the price changes of mainstream currencies.

In addition, news events are also a typical Lead-Lag phenomenon. For example, when a cryptocurrency is listed on an exchange, it usually causes the price of the currency to rise rapidly, especially before the news is spread to other markets quickly. In this case, some programmatic traders have made huge profits by obtaining news quickly and taking the lead before the market reacts.

Key Elements of Lead-Lag Arbitrage

1. Information gap

The essence of lead-lag arbitrage is to take advantage of information differences between markets. By analyzing price fluctuations between different exchanges or assets, traders can determine which markets are lagging, and then use speed advantages and technical means to arbitrage.

2. High-speed transactions

Since Lead-Lag arbitrage relies on the lag of market reaction, the speed of trading is crucial. In order to complete transactions and lock in profits in a short period of time, program trading has become the preferred method for executing Lead-Lag strategies. High-speed trading can ensure that traders complete transactions before the market reacts and maximize arbitrage profits.

3. Technical advantages

In order to seize lagging opportunities in the market, traders usually need to rely on advanced technical tools, such as automated trading systems, algorithmic trading, data capture, etc. These tools can help traders monitor market dynamics in real time, make decisions quickly and execute transactions.

4. Risk control

Although Lead-Lag arbitrage has a high degree of certainty in theory, there are still certain risks in its implementation. For example, rapid market price fluctuations may lead to failure to close positions in time, resulting in losses. Therefore, risk management measures (such as stop loss, position control, etc.) are particularly important in the Lead-Lag strategy.

Problems with the Lead-Lag Strategy

Although the Lead-Lag arbitrage strategy has high certainty and low risk, its implementation is not without challenges. First, market liquidity and price volatility are key factors for successful arbitrage. If market liquidity is insufficient or prices fluctuate too quickly, arbitrage opportunities may disappear quickly, making it impossible to complete arbitrage operations. Second, as many traders and institutions have become aware of the Lead-Lag phenomenon and arbitrage through high-frequency trading strategies, the efficiency of the market has increased gradually, which has gradually reduced such arbitrage opportunities.

In addition, since Lead-Lag arbitrage relies on price differences between markets, these differences often disappear in a short period of time. Therefore, technologies and tools that can execute transactions quickly and accurately, as well as analysis of market conditions timely, become the key to the successful implementation of this strategy.

Summary

In general, the Lead-Lag arbitrage strategy provides a relatively stable arbitrage opportunity by seizing the time difference between different markets. Although the successful implementation of this strategy depends on fast transaction execution and keen observation of market dynamics, it is still an arbitrage method that cannot be ignored in the cryptocurrency market. With the continuous development of technology and the increasing maturity of the market, Lead-Lag arbitrage may still play an important role in the future market. However, traders must always be vigilant about market risks and adjust strategies in time according to market conditions to ensure long-term profitability.

The next article will further analyze the algorithm implementation and optimization methods of Lead-Lag arbitrage to help readers better grasp the essence of this strategy.

1 note

·

View note

Text

With the modern world being much more reliant on technology, the financial market is not identical to other markets. Trading has, thus, also transformed thanks to the emergence of algorithmic trading systems which enable traders to make immediate trades based on technical indicators without manual execution.

0 notes

Text

Smart Money Trading Indicator on TradingView: A Comprehensive Guide

In the world of trading, the quest for actionable insights and reliable tools is never-ending. TradingView has emerged as a leading platform for chart analysis and trading strategies. Among its myriad features and tools, smart money trading indicators stand out as a powerful resource for both novice and professional traders. This article dives deep into the concept of smart money trading, the indicators available on TradingView, and how to effectively leverage them for optimal results.

What is Smart Money Trading?

Smart money trading is a strategy that tracks the moves of institutional investors, often referred to as the “smart money.” These large players, such as hedge funds, banks, and professional traders, have the resources and knowledge to influence market movements significantly. By observing their trading patterns, retail traders can align their strategies with the market’s broader trends, increasing their chances of success.

Smart money trading indicators are designed to help traders identify key market dynamics, such as:

Liquidity zones: Areas where institutional traders are likely to enter or exit positions.

Volume spikes: Indications of significant market activity driven by large players.

Price imbalances: Insights into market inefficiencies where opportunities may lie.

Key support and resistance levels: Zones of high activity and potential reversals.

Popular Smart Money Trading Indicators on TradingView

TradingView offers a variety of indicators that cater to smart money trading strategies. These indicators are highly customizable, user-friendly, and come with detailed documentation. Here are a few noteworthy options:

Order Block Indicators: Highlight areas of institutional buying or selling, giving traders insights into potential future price movements.

Volume Profile Tools: Analyze trading activity at different price levels, revealing strong support and resistance areas.

Liquidity Sweep Alerts: Detect stop-hunt zones where smart money clears liquidity before a major price move.

Market Structure Tools: Identify breakouts, consolidations, and reversals in real-time.

MiyagiTrading: Revolutionizing Smart Money Indicators

MiyagiTrading is a trusted name in the TradingView community, offering cutting-edge best paid TradingView indicators designed to simplify and enhance your trading journey. Their suite of indicators combines precision, reliability, and ease of use, making them an excellent choice for traders of all levels.

Miyagi 10in1 Alerts & Backtest

A comprehensive tool that integrates ten powerful indicators into one. This all-in-one package allows traders to:

Generate real-time alerts for various trading conditions.

Backtest strategies with historical data to optimize performance.

Save time and boost accuracy with its user-friendly interface.

Miyagi 6in1 Alerts & Backtest

This versatile tool is tailored for traders seeking flexibility and efficiency. Key features include:

Six essential indicators in a single package.

Customizable alerts for quick decision-making.

A robust backtesting engine to validate strategies.

Miyagi 4in1 Alerts & Backtest

Perfect for traders who prefer simplicity without compromising effectiveness. Highlights include:

Four indispensable indicators for market analysis.

Alerts and backtesting capabilities for streamlined trading.

Miyagi PSAR & STrend

Designed for trend traders, this indicator excels in identifying market trends and momentum shifts. Features include:

A refined Parabolic SAR (PSAR) with added functionalities.

STrend analysis for detecting trend strength and direction.

Miyagi Backtester

A standalone backtesting tool that empowers traders to test any strategy thoroughly. Its advanced analytics ensure that you have complete confidence in your trading plan.

Why Choose MiyagiTrading Indicators?

User-Friendly: Intuitive design ensures a seamless experience for traders of all skill levels.

Customizable: Tailor the settings to match your unique trading style.

Proven Accuracy: Trusted by thousands of traders for their precision and reliability.

Comprehensive Support: Access detailed guides, tutorials, and responsive customer support.

Get Started with MiyagiTrading Today!

Take your trading game to the next level with MiyagiTrading’s premium indicators on TradingView. Whether you’re a beginner or a seasoned trader, these tools provide the edge you need to succeed in today’s dynamic markets.

Explore their offerings and gain access to the best-paid indicators for TradingView:

Miyagi 10in1 Alerts & Backtest

Miyagi 6in1 Alerts & Backtest

Miyagi 4in1 Alerts & Backtest

Miyagi PSAR & STrend

Miyagi Backtester

Don’t miss the opportunity to revolutionize your trading experience. Visit MiyagiTrading and start your journey to smarter, more informed trading today!

0 notes

Text

Boost your Trading efficiency and do Backtesting with TradingView paid Indicator for free

Boost your trading efficiency and enhance strategies with Premium TradingView Indicators. Get access to advanced tools for precise market analysis and backtesting, all for free. Maximize your trading potential by leveraging powerful features designed to optimize your performance, improve decision-making, and test your strategies with ease.

0 notes

Text

Bullish Backtest

Stocks rallied in response to the election. After hitting resistance stocks retraced to backtest their breakout from the election. Stocks are currently in a daily uptrend. If stocks form a swing low and close back above the 10 day MA that will indicate a continuation of their daily uptrend and signal a cycle band buy signal.

View On WordPress

0 notes

Text

JUNK BOND TREND-FOLLOWING BACKTEST

The trend-following backtest analysis for junk bonds revealed that such strategies tend to perform better than those for stocks. A highlighted strategy demonstrated a compound annual growth rate (CAGR) of 9.6% while being invested 73% of the time, outperforming a buy-and-hold approach. The analysis also noted the positive impact of lower interest rates on junk bonds, but cautioned about potential changes as rates rise.

0 notes

Text

In the fast-paced world of trading, the integration of REST APIs with trading algorithms has become an essential tool for traders looking to enhance their strategies. REST APIs, or Representational State Transfer Application Programming Interfaces, allow seamless communication between different software applications. When integrated with trading algorithms, REST APIs enable traders to automate processes, access real-time data, and execute trades more efficiently.

#integrated with trading algorithms#API trading#trading algorithms#backtest your trading algorithm#trading platform

0 notes

Text

In-Depth Exploration of Algorithmic Trading: Strategies, Technologies, and Impact on Markets

Algorithmic trading, often referred to as algo trading, has revolutionized the financial markets by allowing traders to execute orders at lightning speed and with mathematical precision. It involves using complex mathematical models, automated systems, and advanced technologies to make decisions based on pre-set conditions or algorithms. This essay delves into the strategies employed in algorithmic trading, the technology driving it, and its overall impact on financial markets, providing an in-depth look at how algo trading has shaped modern finance.

1. Core Strategies in Algorithmic Trading

Algorithmic trading is built on various strategies that rely on historical data analysis, statistical methods, and predictive models. Some of the most prominent strategies used in this field include High-Frequency Trading (HFT), Statistical Arbitrage, Market Making, and Trend-Following Algorithms. These strategies cater to different market conditions and investor needs, from short-term profit opportunities to long-term market-making services.

A. High-Frequency Trading (HFT)

High-frequency trading (HFT) is one of the most well-known and controversial forms of algorithmic trading. It focuses on executing a large number of orders in fractions of a second. HFT firms use sophisticated algorithms to analyze vast amounts of market data and make split-second decisions. These strategies rely on speed—traders look to exploit very small price inefficiencies that exist for only milliseconds.

How It Works:

HFT algorithms rely on technologies such as low-latency networks and co-location services (where traders place their servers close to the exchange’s infrastructure) to reduce the time it takes to execute trades. These firms also leverage tick data, which refers to real-time price data that changes every time a trade is made.

Real-World Example:

A well-known HFT firm is Virtu Financial, which became famous for having only one day of trading losses over a five-year period between 2009 and 2014. Virtu’s algorithms analyzed market data to exploit tiny price inefficiencies, allowing it to profit on both rising and falling markets. Its success underscores the power of speed in HFT.

Impact and Controversy:

While HFT has contributed to increased liquidity and tighter bid-ask spreads, it has also attracted criticism. Critics argue that HFT can lead to increased volatility, and market “flash crashes” have been attributed to high-frequency algorithms. One such event occurred in May 2010, when the U.S. stock market experienced a sudden and dramatic crash, wiping out nearly $1 trillion in market value within minutes. Investigations revealed that HFT firms exacerbated the decline by pulling out of the market during the sell-off, creating a liquidity vacuum.

B. Statistical Arbitrage (StatArb)

Statistical arbitrage, often abbreviated as StatArb, is a type of algorithmic trading strategy that attempts to exploit the pricing inefficiencies between correlated securities. StatArb strategies involve identifying relationships between different securities and executing trades when these relationships deviate from historical norms.

How It Works:

StatArb algorithms use historical data to calculate the statistical likelihood of one asset’s price moving in relation to another. For example, the algorithm might identify a strong historical correlation between two stocks, and if one deviates from its expected relationship with the other, the algorithm will place trades anticipating a return to equilibrium.

Real-World Example:

During the 2007–2008 financial crisis, many hedge funds employing StatArb strategies saw significant losses due to the breakdown of historical correlations in highly stressed market conditions. However, firms that quickly adapted their algorithms to account for the new volatility, like D.E. Shaw and Renaissance Technologies, were able to capitalize on the increased market inefficiencies by identifying new relationships between assets.

Evidence:

StatArb remains one of the most popular algorithmic strategies among hedge funds, with quants (quantitative analysts) developing increasingly complex models to exploit ever smaller inefficiencies. The effectiveness of StatArb has been documented in academic research, such as Avellaneda and Lee (2010), who demonstrated that StatArb models outperform traditional arbitrage strategies during periods of high volatility.

C. Market Making

Market making is another algorithmic strategy where traders provide liquidity to the market by continuously quoting buy (bid) and sell (ask) prices for a security. Market makers profit from the bid-ask spread—the difference between the price at which they buy and sell an asset.

How It Works:

Market-making algorithms are designed to ensure that a market maker has an offer to both buy and sell an asset simultaneously, making money from the difference between these prices. They must carefully balance their inventory (the amount of stock they hold) to avoid significant exposure to market risk. These algorithms analyze the market’s depth, size of orders, and historical patterns to maintain liquidity efficiently.

Real-World Example:

The NYSE Designated Market Makers (DMM) use market-making algorithms to maintain orderly trading on the exchange. Firms like Citadel Securities and KCG Holdings have been instrumental in providing liquidity and ensuring that even during times of high volatility, buyers and sellers can still find counterparties.

Impact:

Market making is essential for maintaining liquidity in financial markets, especially in less liquid securities like small-cap stocks or thinly traded ETFs. Without market makers, these markets could become illiquid, leading to wider spreads and greater volatility. Algorithmic market makers ensure that liquidity is always present, reducing the costs for individual traders and investors.

D. Trend-Following Algorithms

Trend-following algorithms are designed to identify market trends and execute trades that follow the direction of these trends. Unlike HFT strategies that rely on ultra-short timeframes, trend-following algorithms operate on longer time horizons, typically days, weeks, or even months.

How It Works:

Trend-following algorithms use various technical indicators, such as moving averages, Bollinger Bands, and Relative Strength Index (RSI), to identify the onset of a new trend. Once a trend is detected, the algorithm will enter a trade in the direction of the trend, aiming to ride the wave until signs of a reversal appear.

Real-World Example:

A prime example of trend-following success comes from Winton Capital, a hedge fund known for using algorithmic trend-following strategies. Founded by David Harding in 1997, Winton has consistently outperformed many competitors by focusing on long-term trends across various asset classes, including equities, bonds, and commodities.

Evidence:

Trend-following strategies have proven effective in markets where clear trends develop over time, such as the commodities market. A study by Hurst et al. (2012) showed that trend-following strategies outperform during periods of economic uncertainty when large trends tend to develop as markets digest new information slowly. However, they can underperform in sideways or choppy markets where no clear trend exists.

2. Technological Advancements Driving Algorithmic Trading

The success of algorithmic trading is driven by the rapid advancement of technology. From machine learning (ML) to artificial intelligence (AI), these technologies are transforming the way algorithms are developed, tested, and deployed. Moreover, advancements in hardware infrastructure and cloud computing allow firms to process massive amounts of data at unprecedented speeds.

A. Machine Learning and AI in Algorithmic Trading

Machine learning and AI have become game-changers in algorithmic trading. These technologies allow algorithms to improve over time by learning from historical data and making predictions based on evolving market conditions. Traders no longer need to manually adjust their strategies; instead, AI-driven models adapt autonomously to new data.

How It Works:

In machine learning-based trading, algorithms are trained using historical price data, volume, and other market inputs. These models then identify patterns that have historically been profitable and apply them in real-time trading. Reinforcement learning, a branch of ML, is particularly suited to trading as it allows the algorithm to learn from both successful and unsuccessful trades, refining its strategy over time.

Evidence:

Hedge funds like Man AHL and Two Sigma are pioneers in using AI-driven strategies. These firms apply machine learning to vast datasets, ranging from price feeds to social media sentiment, to identify new trading opportunities. Two Sigma, for example, uses AI to scan millions of data points, including weather patterns, satellite imagery, and corporate earnings, to uncover hidden market signals.

B. Low-Latency Trading and Infrastructure

Low-latency trading refers to the practice of executing trades as quickly as possible to gain an advantage over competitors. Technological improvements in server infrastructure, fiber-optic cables, and co-location services have drastically reduced the time it takes for orders to reach exchanges.

Real-World Example:

One notable low-latency trade is the construction of the Spread Networks fiber-optic cable between Chicago and New York. This cable, completed in 2010, shortened the time it took for trading signals to travel between the two financial hubs from 17 milliseconds to 13 milliseconds. This 4-millisecond advantage was worth millions to HFT firms competing to execute trades faster than their rivals.

3. Impact of Algorithmic Trading on Markets

Algorithmic trading has transformed global financial markets, influencing everything from liquidity and market depth to volatility and price discovery. While algo trading has introduced efficiencies, it has also brought new challenges and risks.

A. Increased Liquidity

Algorithmic trading has significantly increased liquidity in many markets, particularly in equities and foreign exchange. By providing a continuous flow of buy and sell orders, algo traders reduce the bid-ask spread, making it cheaper for all market participants to trade.

B. Increased Liquidity

Algorithmic trading, especially through market-making strategies, ensures that there is a ready buyer and seller for various assets, even during volatile times. For example, during the COVID-19 pandemic, algorithmic traders played a crucial role in maintaining liquidity across multiple asset classes, allowing markets to function more smoothly despite the global uncertainty. Studies from financial institutions, such as Citadel Securities, showed that algorithmic liquidity providers absorbed market shocks better than traditional human market makers during this period.

Impact on Retail Traders:

For retail traders, the increase in liquidity means lower transaction costs and faster execution of trades. However, it also raises concerns about the fairness of market access, as large institutional players equipped with advanced algorithms often gain a competitive edge through technologies like low-latency trading and co-location.

C. Market Volatility and "Flash Crashes"

While algorithmic trading contributes to liquidity, it can also increase market volatility, especially when multiple algorithms interact in unexpected ways. One of the most prominent examples of this is the Flash Crash of May 6, 2010, when the U.S. stock market experienced a sharp decline within minutes, followed by a rapid recovery. This event wiped out approximately $1 trillion in market value within half an hour before bouncing back.

What Happened:

Investigations revealed that a large sell order, executed by a mutual fund using an algorithmic strategy, triggered a chain reaction. High-frequency trading algorithms began aggressively selling, creating a feedback loop that sent prices plummeting. The event demonstrated how interconnected and reactive algorithms can lead to systemic risks, especially when they amplify market movements rather than stabilize them.

Efforts to Mitigate Volatility:

In response to the Flash Crash and similar events, regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) have introduced measures like circuit breakers—temporary halts in trading when extreme volatility is detected. Moreover, algorithmic traders have become more cautious, implementing safeguards like throttle mechanisms that prevent excessive trading during volatile periods.

D. Impact on Price Discovery

Price discovery—the process of determining the market value of an asset based on supply and demand—has been significantly influenced by algorithmic trading. In many cases, algo trading improves price discovery by rapidly incorporating new information into asset prices. For example, news events, economic data releases, or corporate earnings reports are processed by algorithms in milliseconds, allowing markets to adjust almost instantaneously.

Challenges in Price Discovery:

However, some critics argue that the speed at which algorithms process information can distort price discovery, especially during periods of low liquidity. In certain cases, algorithms may react to false signals or minor market inefficiencies, creating temporary price distortions. These price anomalies, although short-lived, can impact retail and institutional traders alike, especially those who are slower to react.

Real-World Impact:

During the Brexit referendum in 2016, algorithmic traders played a critical role in driving market reactions. As the results of the vote became clear, algorithms began selling British assets, leading to a sharp drop in the value of the British pound. The rapid adjustment of prices reflected the efficiency of algorithmic trading in reacting to geopolitical events, but it also highlighted the potential for exacerbating sharp market movements.

4. Regulatory and Ethical Considerations

As algorithmic trading continues to evolve, regulators and market participants are faced with new ethical and legal challenges. The speed, complexity, and opacity of algorithmic trading make it difficult for traditional regulatory frameworks to keep pace with these developments.

A. Market Manipulation and Ethical Concerns

One of the primary concerns surrounding algorithmic trading is the potential for market manipulation. Algorithms can be designed to engage in practices such as spoofing—where traders place orders they do not intend to execute to create false demand or supply in the market. In 2015, the U.S. Department of Justice charged a British trader, Navinder Sarao, with using spoofing algorithms to contribute to the Flash Crash of 2010.

Spoofing Explained:

Spoofing involves placing large buy or sell orders with no intention of executing them. Once other market participants react by adjusting their orders in response to the perceived demand or supply, the spoofer cancels the initial orders and profits from the market’s reaction. While regulatory bodies such as the Commodity Futures Trading Commission (CFTC) and the SEC have cracked down on spoofing, the complexity of algorithms makes it challenging to detect and prevent such practices.

B. Regulatory Efforts

To address the risks associated with algorithmic trading, regulators around the world have implemented new rules aimed at increasing transparency, reducing systemic risks, and preventing market manipulation. For example, in Europe, the Markets in Financial Instruments Directive II (MiFID II) introduced stricter reporting requirements for algorithmic traders, including the need to register their algorithms and adhere to pre-trade risk controls.

In the U.S., the SEC and CFTC have taken steps to monitor high-frequency trading firms more closely. Additionally, exchanges have introduced mechanisms such as kill switches, which automatically shut down trading algorithms if they exhibit erratic behavior.

C. Ethical Considerations in AI-Driven Trading

As machine learning and artificial intelligence become more integrated into algorithmic trading, new ethical concerns have emerged. Unlike traditional algorithms that follow explicit instructions, AI-driven models often operate in "black box" systems, meaning that even their creators may not fully understand how the algorithms arrive at certain decisions. This lack of transparency raises questions about accountability, particularly if an AI-driven algorithm were to cause significant market disruptions.

Moreover, AI algorithms can potentially reinforce biases present in historical data, leading to unintended consequences in trading strategies. Ensuring fairness and preventing unintended discrimination in financial markets is a growing challenge for regulators and AI developers alike.

5. The Future of Algorithmic Trading

The future of algorithmic trading is poised to be shaped by several key developments, including advances in quantum computing, blockchain technology, and the democratization of algorithmic tools for retail investors.

A. Quantum Computing

Quantum computing has the potential to revolutionize algorithmic trading by vastly increasing computational power. Unlike classical computers, which process information in binary (0s and 1s), quantum computers can process multiple states simultaneously, allowing them to solve complex problems at speeds unimaginable with today’s technology.

Potential Impact on Trading:

In algorithmic trading, quantum computing could enable the development of more sophisticated models that consider an exponentially larger number of variables and scenarios. This could lead to more accurate predictive algorithms, faster arbitrage opportunities, and even the ability to model entire financial ecosystems. While quantum computing is still in its early stages, firms like IBM and Google are investing heavily in the technology, and its eventual impact on financial markets could be transformative.

B. Blockchain and Decentralized Finance (DeFi)

Blockchain technology, particularly its application in Decentralized Finance (DeFi), presents new opportunities and challenges for algorithmic trading. DeFi platforms, which allow for peer-to-peer financial transactions without intermediaries, are growing in popularity. Algorithms designed to trade on these platforms will need to adapt to decentralized exchanges (DEXs) and navigate the unique challenges of smart contracts and automated market makers (AMMs).

Example:

In the world of cryptocurrency, algorithmic traders are already active participants in automated liquidity pools on platforms like Uniswap and SushiSwap. These decentralized exchanges rely on algorithms to match buyers and sellers, and traders use bots to exploit price inefficiencies and arbitrage opportunities across different DeFi platforms.

C. Democratization of Algorithmic Trading

As technology continues to advance, algorithmic trading tools are becoming more accessible to retail investors. Platforms like QuantConnect, AlgoTrader, and MetaTrader offer retail traders the ability to develop and backtest their own algorithms using professional-grade tools. This democratization of algo trading has the potential to level the playing field, allowing individual investors to compete with institutional players in ways that were previously impossible.

Challenges:

However, with increased access comes increased risk. Retail traders may lack the technical expertise to develop robust algorithms, and without proper risk management, they could expose themselves to significant losses. Moreover, the proliferation of algorithmic trading among retail investors could introduce new forms of market volatility, as large numbers of amateur traders execute similar strategies simultaneously.

Conclusion

Algorithmic trading has undeniably transformed global financial markets, bringing increased liquidity, faster execution, and more efficient price discovery. However, it has also introduced new risks, including market volatility, ethical concerns, and the potential for market manipulation. As technology continues to evolve, particularly with the advent of quantum computing and AI, algorithmic trading will likely become even more sophisticated and widespread. Regulatory bodies must continue to adapt to these changes to ensure that markets remain fair, transparent, and stable.

The future of algorithmic trading is filled with both promise and challenges. With the right balance of innovation and regulation, algo trading can continue to drive the financial industry forward while mitigating the risks inherent in such a fast-paced and highly automated environment.

#AlgorithmicTrading#AlgoTrading#QuantitativeTrading#AutomatedTrading#HighFrequencyTrading#MathematicalFinance#FinancialMarkets#TradingStrategies#MachineLearning#ArtificialIntelligence#DataAnalysis#MarketEfficiency#Liquidity#RiskManagement#TradingSystems#FinancialTechnology#Fintech#MarketMicrostructure#TradingAlgorithms#Backtesting#Optimization#StatisticalArbitrage#EventDrivenTrading

0 notes

Text

How Composer Helps Investors Build and Automate Trading Strategies

Investing can be complex, especially when creating and executing sophisticated trading strategies. Composer simplifies this process by enabling investors to design, backtest, and automate trading strategies without coding.

Problem Statement: Investors often struggle with building trading strategies that respond to market conditions, as manual trading requires expertise, time, and discipline.

Application: With Composer, investors can describe their goals in natural language, and the AI builds a strategy accordingly. Composer then allows users to backtest the strategy to evaluate its performance before deploying it. Once satisfied, investors can fully automate the execution and rebalancing of their portfolio, eliminating the need for constant monitoring.

Outcome: Using Composer, investors can achieve better returns by automating data-driven strategies and eliminating emotional decision-making. The platform allows users to focus on high-level strategy while Composer handles the execution.

Industry Examples:

Retail Investors: Individuals can automate trading based on long-term growth or short-term market trends.

Financial Advisors: Use Composer to manage multiple client portfolios efficiently by automating strategy execution.

Crypto Enthusiasts: Automate trading strategies for cryptocurrencies based on market indicators and performance metrics.

Additional Scenarios: Composer can be used for retirement planning, risk-adjusted investment strategies, or even community-driven trading ideas.

Build and automate your trading strategies with Composer. Get started today at aiwikiweb.com/product/composer/

#Investing#TradingAutomation#Composer#AI#Finance#WealthManagement#Strategy#Fintech#Backtesting#RetirementPlanning

0 notes

Text

Why "One Size Fits All" Fails in Technical Analysis: The Case for Tailored Trading Strategies

Technical analysis is one of the most popular approaches to trading in financial markets, used by traders to analyze price movements and make informed decisions. While its principles are widely applicable, assuming that a single strategy can work for everyone is a recipe for disappointment. The reason is simple: trading strategies need to align with an individual’s specific trading style, risk…

#Backtesting#Crypto Trading#Custom Trading Plans#day trading#forex trading#learn technical analysis#Market Analysis#Risk Management#stock market#stock markets#stock trading#successful trading#swing trading#Tailored Trading#technical analysis#Trading Indicators#Trading Psychology#Trading Strategies#Volatility Strategies

0 notes

Text

India's financial sector has undergone a major transformation over the past few years, with an ever-important inclusion of technology as one of the aspects. Among the changes, the introduction of the use of trading applications has probably been the greatest development, usually referred to as algo trading applications.

0 notes