#SharpeRatio

Explore tagged Tumblr posts

Text

Šarpo Rodiklis: Investicijų Efektyvumo Įvertinimo Vadovas

Sužinokite, kaip Šarpo rodiklis padeda vertinti investicijų efektyvumą, atsižvelgiant į riziką. Skaitykite apie šio rodiklio privalumus

https://www.aipt.lt/sarpo-rodiklis/

0 notes

Text

UNIFIED OVERNIGHT STRATEGY PORTFOLIO KEY INSIGHTS

The unified overnight strategy portfolio delivers robust performance with a 14.6% CAGR, a 62% win ratio, and a max drawdown of 15%. Over 1373 trades, the average gain per trade is 0.3%, proving consistent returns since 2017. Automated execution is recommended for practicality. Explore more details in our Amibroker course.

#tradingstrategies#OvernightTrading#AutomatedTrading#SharpeRatio#Backtested#StockMarketSuccess#QuantTrading#AmibrokerStrategies

1 note

·

View note

Text

https://blog.stockedge.com/use-sharpe-ratio-to-analyze-mutual-funds/

How to Calculate the Sharpe Ratio for Mutual Funds

The first step to calculate is to subtract the risk-free return of the mutual fund from its portfolio return.

#SharpeRatioinMutualFund#SharpeRatio#SharpeRatioFormula#StockScreenerIndia#StockScreener#StockMarketWebsite#ShareMarketWebsite#ToolforstockAnalysis#StockAnalysis

0 notes

Photo

https://m.youtube.com/watch?v=ZWe9BBzliTI&t=34s Du willst wissen was die Sharpe Ratio eigentlich ist, wie sie sich berechnet und wieso sie für Investoren bei der Bewertung von Aktienfonds ein wichtiges Entscheidungskriterium sein kann, dann wird dir dieses Video dabei helfen. #Finanzen #Investieren #sharpe #ratio #sharperatio #Index #Fonds #Aktien #Börse #Geld #Verdienen #etfs #ETF #Universität #BWL #student #lernen #finanzvorlesung #InvestScience #Mannheim (hier: Frankfurt, Germany) https://www.instagram.com/p/CBswKVFMVRk/?igshid=tzuw83v0enbb

#finanzen#investieren#sharpe#ratio#sharperatio#index#fonds#aktien#börse#geld#verdienen#etfs#etf#universität#bwl#student#lernen#finanzvorlesung#investscience#mannheim

0 notes

Text

quant and fundamental alpha 量化选股与基本面选股的阿尔法

基本面手段是对商业模式和基本面的理解;量化是种系统化追逐最大利润的手段。

纯量化有助于提高sharpe ratio,但需要牺牲收益。多数需要杠杆支持。

Fundamental助于maximize return where we dont need to utilize leverage。量化基本面打法相当于一种基本面筛选后的量化。只是分配的系数从normal distribution变成了条件筛选的binary variable。并且fundamental加了一层财务分析与商业分析,有助于最大化最高量化价值的选股。

显然,一个好的价值成长股,他往往是有alpha的,也就是既领涨,又抗跌。夏普往往高。

谁说纯fundamental就不能算sharpe ratio呢?这是个很好的课题。如何将你portfolio的基本面股尽量的量化化(alpha化),并且算出sharpe,以及correlation。能从量化手段进一步加强价值选股。

这是个非常好的量化与基本面选股的课题。

0 notes

Photo

2 ways to Short the VIX - Short Volatility - Options Trading http://ehelpdesk.tk/wp-content/uploads/2020/02/logo-header.png [ad_1] The VIX index is currently as hi... #accounting #algorithmictrading #brentosachoff #cfa #daytrading #excel #finance #financefundamentals #financialanalysis #financialmanagement #financialmodeling #financialtrading #forex #investing #investingforbeginners #investmentbanking #ironcondor #marketcrash #options #optionstrading #optionstradingbasics #optionstradingmarketcrash #personalfinance #recession #recession2020 #riskmanagement #safeshortvix #sharperatio #shortthevix #stockmarket #stocktrading #svxy #technicalanalysis #trading #tradingmarketcrash #tvix #uvxy #vix #vixcontango #vixindex #vixcentral #volatility #volatilitytrading #volatilitytradingstrategies #vtsoptions #vxx #waystoshortthevix

0 notes

Text

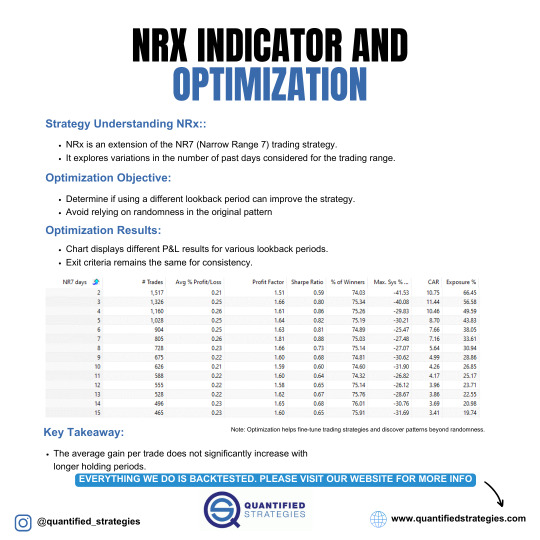

NRX INDICATOR AND OPTIMIZATION

The NRX Indicator extends the NR7 trading strategy by varying the lookback period for identifying narrow range days. The goal of optimization is to determine if altering the lookback period improves performance while avoiding randomness. Results show minimal improvement in the average profit with longer lookback periods, indicating diminishing returns. The strategy maintains consistent exit criteria, with higher profit factors and Sharpe ratios around the 3-7 day range.

#TradingStrategy#NR7#NRXIndicator#Optimization#Backtest#TradingPerformance#SharpeRatio#ProfitFactor#MarketAnalysis

1 note

·

View note

Text

UNIFIED OVERNIGHT STRATEGY PORTFOLIO: KEY INSIGHTS

Explore the key metrics of a unified overnight strategy portfolio, boasting a CAGR of 14.6%, a 62% win ratio, and a Sharpe Ratio of 2.05. With 1373 trades and an average gain per trade of 0.3%, these strategies, developed in 2017 and traded from 2021, showcase realistic returns without survivorship bias or curve fitting. Discover the stability in out-of-sample performance since 2018, with notable gains during the Covid-19 period in 2020.

0 notes

Text

How to Calculate the Sharpe Ratio for Mutual Funds

The first step to calculate is to subtract the risk-free return of the mutual fund from its portfolio return.

#SharpeRatioinMutualFund#SharpeRatio#SharpeRatioFormula#StockScreenerIndia#StockScreener#StockMarketWebsite#ShareMarketWebsite#ToolforstockAnalysis#StockAnalysis

0 notes

Text

https://blog.stockedge.com/use-sharpe-ratio-to-analyze-mutual-funds/

How to Calculate the Sharpe Ratio for Mutual Funds

The first step to calculate is to subtract the risk-free return of the mutual fund from its portfolio return.

#SharpeRatioinMutualFund#SharpeRatio#SharpeRatioFormula#StockScreenerIndia#StockScreener#StockMarketWebsite#ShareMarketWebsite#ToolforstockAnalysis#StockAnalysis

0 notes

Text

https://blog.stockedge.com/use-sharpe-ratio-to-analyze-mutual-funds/

How to Calculate the Sharpe Ratio for Mutual Funds

The first step to calculate is to subtract the risk-free return of the mutual fund from its portfolio return.

#SharpeRatioinMutualFund#SharpeRatio#SharpeRatioFormula#StockScreenerIndia#StockScreener#StockMarketWebsite#ShareMarketWebsite#ToolforstockAnalysis#StockAnalysis

0 notes