#automatedreminders

Explore tagged Tumblr posts

Text

Using WhatsApp for payment reminders is effective due to its personal approach and high engagement. Key tactics include sending personalized messages, scheduling reminders, and providing payment links. Businesses can automate and scale this with WhatsApp Business API, ensuring timely follow-ups and smoother payment experiences.

1 note

·

View note

Text

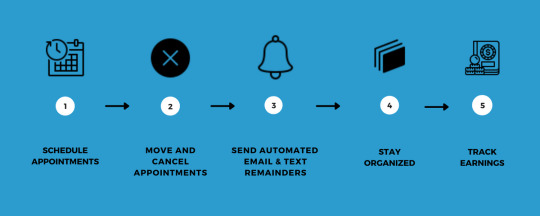

Say goodbye to missed follow-ups and hello to seamless efficiency with Skyward Cloud CRM. With our automated reminder system, you can sell more on Skyward CRM and ensure you never miss a crucial sales opportunity.

#automatedreminders#salesefficiency#crm#cloudsolutions#businessautomation#customersuccess#leadmanagement#crmsoftware#businessgrowth#productivityboost#techinnovation#smartbusiness#crmfeatures#cloudcrm

0 notes

Text

Top Technologies Revolutionizing the Collections Industry

The digital lending sector is expected to grow from $405.11 billion in 2023 to $710.76 billion by 2028. This is not surprising, as digitization has substantially improved the borrowing process by making it more convenient and user-friendly. At the same time, financial institutions have benefitted from a wider customer base and access to valuable data.

The collections industry is not, however, free from challenges. Concerns persist related to data privacy, lack of empathy, poor visibility into customer data, low agent productivity, etc. The good news is that the latest innovations in the market have reduced these hurdles significantly.

Here are some of the top technologies revolutionizing the collection industry:

AI Bots

Many interactions between agents and customers in the collections industry involve routine tasks, such as answering common queries or offering basic information about outstanding debts. Traditionally, these tasks were handled by human agents, which could be time-consuming and resource-intensive.

Humanized collections bots, like those offered by Exotel, are designed to replicate human-like interactions while automating these routine tasks. Notably, 47% of CX leaders have embraced AI-based initiatives, often employing this technology to develop chatbots. These bots can understand and respond to borrower inquiries in a conversational manner and resolve first-level queries without making customers wait. Moreover, they can meet more queries at a relatively lower cost.

Automated Reminders

The introduction of automated reminders is revolutionizing the collection industry by addressing a common challenge both borrowers and agencies face. Borrowers often find it easy to overlook their payment deadlines or struggle to locate the appropriate payment links. This leads to potential delays or missed payments. On the other hand, manually reaching out to each borrower to provide reminders can be a cumbersome task for collection agencies.

In response to these challenges, collection agencies have adopted automated reminder systems to boost debt recovery. These reminders are customized according to the borrower’s details and loan amount. They not only serve as a nudge to prompt borrowers to make their payments but also provide custom payment links for added convenience. Agencies can significantly enhance in-moment remittances by offering borrowers hassle-free means of fulfilling their obligations and guiding them to the correct payment links.

Predictive Dialers

Traditionally, collection agents spent significant time manually dialing numbers and waiting for debtors to answer their calls. This frustrating process led to several challenges, including incorrect or outdated contact numbers, unresponsive debtors, and non-contextual interactions. Predictive dialers have emerged as a solution to these challenges by automating the dialing process.

Calls are placed from a pre-uploaded list of debtors, and the dialer ensures that the numbers are validated and accurate. As a result, agents no longer need to spend valuable time dialing numbers manually. They are seamlessly connected with debtors who answer their calls. This automation also filters out busy tones and answer machines, ensuring that agents spend more time engaging in meaningful conversations and less time navigating unproductive interactions. Agents can now achieve 4-5 hours of talk time during an 8-hour shift, a significant increase from the past.

Advanced-Data Analytics

Historically, collection agencies had to resort to a one-size-fits-all approach while devising collection strategies. This was because they lacked sufficient customer data. However, with the advent of big data and advanced analytics, agencies now possess the tools to craft more targeted outreach strategies.

For instance, based on historical data, agents can decide the best time to reach the borrowers, leading to improved call pick-up rates. Additionally, they can categorize borrowers into different risk profiles, such as hard or soft buckets. They can then choose an online or field collections strategy and promptly identify delinquent customers. Furthermore, collection agencies can evaluate agent performance and monitor real-time conversations. This critical insight helps identify training needs, track outcomes, and ensure that borrowers are assigned to the right agents based on factors like region and predefined categories.

Omnichannel Communication

Borrowers have different preferences when it comes to communication. Omnichannel communication ensures that agencies can meet borrowers on multiple communication channels. This flexibility ensures that borrowers can engage in discussions regarding their debts through the most convenient means, ultimately enhancing response rates and fostering more productive interactions.

Unsurprisingly, around 80% of customers prefer omnichannel strategies due to the seamless communication experience. What makes omnichannel particularly powerful is its ability to integrate multiple channels seamlessly. This means that if a borrower initiates contact through one channel, such as a chatbot on a website, and later decides to call the agency, the agent has access to all relevant information. This eliminates the need for redundant explanations and boosts productivity for both borrowers and agents.

Customer Relationship Management (CRM) Systems

As agencies grow in scale, the sheer volume of customer interactions can become overwhelming. Agencies can not only end up losing valuable insights but also suffer negative consequences related to agent productivity. CRM systems, powered by technological advancements, are revolutionizing the collection industry by integrating various communication channels and data sources. This has streamlined collecting, storing, and retrieving borrower information.

Collection agencies now have a comprehensive and organized platform to manage interactions with borrowers. They have 100% visibility into borrowers’ profiles, which enables highly personalized conversations. CRM integration has also improved agent productivity by automating routine tasks, like data entry and follow-up reminders.

Partner with Exotel!

As the collections industry continues to adopt the latest technologies, it stands ready to deliver improved outcomes for all stakeholders involved. For borrowers, these innovations translate into more convenient and empathetic interactions. On the agency side, the benefits are equally compelling and include increased efficiency, reduced operational costs, and better compliance with regulations.

Collaborating with experienced industry leaders like Exotel can be particularly valuable for businesses seeking to maximize these advantages. Exotel’s solutions offer a range of benefits, from extending business reach and providing multilingual support to improving promise-to-pay ratios and lowering the cost of customer coverage. Importantly, Exotel’s collection platform ensures that customers feel supported like a trusted friend. This helps build synergy between technological innovation and customer-centric solutions, benefiting everyone involved.

#TopTechnologies#CollectionsIndustry#AIBots#AutomatedReminders#PredictiveDialers#OmnichannelCommunication#ExotelProducts#Exotel

0 notes

Text

Keep tenants informed and happy with automated notifications!

📲✨ Boost communication, reduce missed updates, and build stronger relationships with timely reminders.

Say goodbye to miscommunication and hello to tenant satisfaction!

TenantCommunication #PropertyManagement #AutomatedReminders

0 notes

Text

#appoinmentscheduler#virtualmedicalscribe#medicalscribe#health & fitness#automatedreminders#scribe4me app

0 notes

Photo

Alarms for missing documents? Now Possible with Kleeto. Automated reminders for expired documents to keep compliances in check. Never miss a document again. Know More @ https://www.kleeto.in/

#Softwares#BusinessSolutions#DocumentManagementSolution#GrowYourBusiness#DocumentManagementSoftware#AutomatedReminders#AutomatedProcesses#PaperlessDocumentManagement#OnlineDocumentManagement#DocumentDigitizationServices#DocumentManagementSystem#KleetoNextGen#Kleeto

0 notes