#audit trail accounting software

Text

Manage Your Money With Best Bank Reconciliation Software - Approved

At TrustEasy, we understand that managing your finances can be a difficult and time-consuming task. That's why we've developed the best bank reconciliation software on the market. Our software helps you keep track of your income and expenses, so you can see where your money is going each month. In addition, our software makes it easy to reconcile your accounts and spot any discrepancies. As a result, you can have complete peace of mind knowing that your finances are in order. With TrustEasy, managing your money is easy! Visit us at https://trusteasy.com.au/bank-feeds-reconciliation/ to learn more!

#trust accounting#bank feeds reconciliation#tax refund in one hour#KYC for accounting firm#audit trail accounting software

0 notes

Text

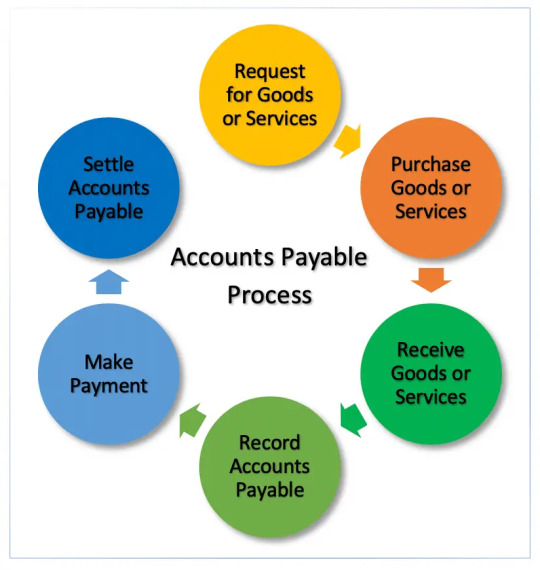

Melio is a financial technology platform designed to streamline accounts payable and receivable processes for small and medium-sized businesses. It aims to simplify bill payments, improve cash flow management, and enhance overall financial operations. Here is a detailed review of its features and functionalities:

Key Features

Bill Payments:

Multiple Payment Methods: Melio allows businesses to pay vendors using ACH bank transfers, credit cards, or checks. This flexibility helps businesses manage cash flow and earn credit card rewards, even if the vendor only accepts checks.

Schedule Payments: Users can schedule payments in advance, ensuring timely bill payments and avoiding late fees.

Batch Payments: The platform supports batch payments, allowing users to pay multiple bills at once, saving time and reducing administrative burden.

Accounts Receivable:

Payment Requests: Businesses can send payment requests to customers via email, including a link for customers to pay directly through the platform.

Customer Management: Track customer payments, manage outstanding invoices, and automate reminders to improve collection rates.

Integration and Syncing:

Accounting Software Integration: Melio integrates with popular accounting software like QuickBooks, Xero, and FreshBooks, ensuring seamless data synchronization and reducing manual data entry.

Bank Integration: Direct integration with banks facilitates easy payment processing and reconciliation.

User-Friendly Interface:

Dashboard: A clean and intuitive dashboard provides an overview of pending and completed payments, cash flow status, and upcoming bills.

Mobile Access: The platform is accessible via mobile devices, allowing users to manage payments and view financial data on the go.

Security and Compliance:

Secure Transactions: Melio employs robust security measures, including encryption and secure data storage, to protect user information and financial transactions.

Compliance: The platform adheres to financial regulations and industry standards, ensuring compliance with relevant laws.

Cash Flow Management:

Flexible Payment Options: By allowing credit card payments for bills, Melio helps businesses manage cash flow more effectively, providing the flexibility to defer payments while still meeting obligations.

Payment Scheduling: Advanced scheduling options enable better planning and control over outgoing cash flow.

Collaboration Tools:

Team Access: Multiple users can be granted access to the platform, allowing for collaborative financial management. Permission settings ensure that sensitive information is accessible only to authorized personnel.

Audit Trail: Detailed records of all transactions and activities help maintain transparency and accountability.

Pros

Flexibility in Payments: The ability to pay bills via credit card, even when vendors don’t accept them, provides a unique advantage in managing cash flow and earning rewards.

Ease of Use: The platform’s user-friendly interface and straightforward setup make it accessible for businesses of all sizes.

Integration with Accounting Software: Seamless integration with major accounting tools ensures accurate financial tracking and reduces manual workload.

Security: Strong security measures and compliance with industry standards provide peace of mind for users.

Batch Payments: Support for batch payments simplifies the process of paying multiple bills, saving time and reducing errors.

Cons

Cost: While Melio offers a free version, certain advanced features and payment methods (like credit card payments) incur fees, which might be a consideration for cost-sensitive businesses.

Limited Global Reach: Melio primarily serves businesses in the United States, which may limit its usefulness for companies with significant international operations or those based outside the U.S.

Learning Curve for Advanced Features: Some users might find the advanced features complex initially, requiring time to fully utilize all functionalities.

Melio is a powerful and flexible tool for small and medium-sized businesses looking to streamline their accounts payable and receivable processes. Its ability to manage payments through various methods, integration with popular accounting software, and user-friendly design make it an attractive option for businesses aiming to enhance their financial operations. While there are costs associated with some features and a learning curve for advanced functionalities, the overall benefits, including improved cash flow management and operational efficiency, make Melio a valuable tool for modern businesses.

2 notes

·

View notes

Text

Kaisa's defense: Are patrons who borrow books, liable to return them?

Kaisa gets annoyed with the committee of Three Witches

Happy Book Lovers' Day! On December 16, 2020, I submitted a post to I Love Libraries about Kaisa, the recurring librarian in the animated series, Hilda, titled "Witches, patrons, and the value of libraries in Netflix's Hilda," and included a section, where Kaisa argues that the "person who borrowed the book is liable for its return," with the obligation passed from the librarian to the patron, while the witches say SHE is the one responsible. While this was included in the final article, which was published on January 8, 2021, and re-titled "The Mysterious Librarian in Netflix's "Hilda" Finally Gets a Name," it was worded differently, [1] and I didn't explore it in-depth. So I'll re-examine that part of the episode and note its implications more broadly in terms of relations between librarians and patrons, and the ever-present problem of missing books from libraries.

This post is reprinted from Pop Culture Library Review and Wayback Machine.

In the episode "Chapter 3: The Witch," Kaisa comes before three witches who govern the tower and they tell her that she must return a book missing from the library for almost 30 years! She challenges this, saying that the person who borrowed the book is liable for its return, passing off the obligation from the librarian to the patron. The witches remind her of her responsibilities and say that if she does not find the book, she will be cast into the void! While librarians obviously are not cast into the void for misplaced books, the episode is right to highlight the problem of missing books and how librarians solve this problem. Later, Kaisa reveals why she had not tried to return the book until now: she was embarrassed that she could not use the right spell to find the book. They later return with the book and Tildy pleads with the witches to not punish them, the void of no return is unintentionally opened, trapping Kaisa, Hilda, and Frida.

The question at the title of this post still itches my brain: Are patrons who borrow books, liable to return them? Some on /r/Libraries and /r/librarians have shared that they give students who fail to return a book a warning, the terrible condition of returned books(which is kinda funny to read), stolen/lost book, and lending to the wrong person. Others shared the return of missing items, horrible patrons, weird sense of guilt when checking out books, getting patrons to return their books, presenting photo IDs to check out books, and libraries that give anyone a library card. [2] One of the most interesting discussions was one on /r/asklibrarians where librarians responded as to how a librarian could cover up a theft:

...Books disappear all the time. Depends on if the library uses any security measures like RFID tags...Here are a few ideas: Checking the book out to another user. Marking it as lost under that other users identity. Checking the book in but just taking it. Makes it appear lost in the shelves. Simply taking the book through an employee entrance with no security gates. Or simply desensitizing the security strip and walking the book out the front door. Or you can purge the user from the system making them not exist. Assuming a modern library, the librarian could alter the records if they had the right circulation authorizations. In most cases, there is likely to be an audit trail, but no one is likely to be looking for that unless alerted to the possibility that someone did that. Someone with the right IT privileges for the circulation software, could probably alter those audit trails as well.

In some ways, Kaisa may have done this when not getting the book back from Tildy. She probably as had to deal with those who return books with "illegal drugs, water damage, urine odors, cigarette burns, coffee stains, fecal matter, roaches, or peanut butter globs," those who have tried to argue that they don't need to pay library fines, while dealing with account issues, checking out books, and other tasks. [3] As one librarian put it, not only can the length of a loan period " have a big impact on staff workload and patron satisfaction with a library," but overdue materials are an issue "because they are not available to other library users" while fines lead to the perception that overdue fines allows the library to function and buy materials.

In fact, many libraries spend a lot of money and time "attempting to retrieve overdue materials and collect various fines," meaning these fines represent "a drop in the bucket for library revenues" and saying that while overdue fines may "provide some incentive for returning materials" some studies have shown they are "not a significant deterrent to the ultimate return of items. Libraries can also collect fines on lost and damaged materials or lost library identification cards, which are meant to " replace or repair the material...plus a processing fee," while it was said that there "should be some flexibility with overdue policies." It has also been said that if a book is lost, then a fine should be collected, while for a missing book, "the library does not know where the item is." [4]

The same librarian urged library personnel to be "familiar with registration procedures and be prepared to answer questions about the library’s services and resources," and to have specific "procedures for dealing with security and medical emergencies and all staff should be thoroughly familiar with them." This connects with the mission of a librarian to not only handling books, but books themselves serving a vital function, and the responsibility of the library to "adjust the time allotted for the patron to have the item to ensure it reaches the originating library on time." It was also said that librarians should take into account copyright, freedom of information, privacy, duty of care, censorship, and confidentiality which assisting a patron. [5]

Committee of Witches annoyed with Kaisa

When it comes to actual libraries, there appears to be agreement with the idea that patrons who borrow books are liable to return them. In fact, of library policies I read, there was a consensus that patrons are responsible for book replacement, returning books on time (late books hinder ability of other patrons to use book), have to pay for damaged or lost materials, and responsible for books they have checked out under their name. [6] Some librarians even said that those who abuse privileges may be banned from interlibrary loan, holds placed on their student accounts, suspension of borrowing privileges, or being reported to a collection agency. [7]

There were libraries which laid out their responsibilities even more clearly. Some said they had the "responsibility of ensuring the availability of materials for the use of the community," but that the person who borrows materials is responsible for materials borrowed and "agrees to return them in good condition and by the date they are due." Others absolved the library from "liability, damages, or expense" from misuse of library devices, library materials, and asserted that librarians are responsible for renewing and returning items, with fees imposed if items are not returned. However, in some cases, librarians had the discretion to stop or restrict loans of materials or the ability to waive fines, charges, or fees in cases of hardship. [8]

Kaisa stands by her view that patrons who borrow books are liable to return them, while the witches say it should be the library's responsibility after a book is overdue for 30 years. If this was the real world, the responsibility of the patron would likely still be emphasized, but at that point, the library would have declared the book "lost" and probably charged the patron a fee for the lost book. Kaisa does not do that as she knows exactly who has the book, but she doesn't want to take responsibility for getting the book back, not at first.

The answer to the question, are patrons who borrow books, liable to return them, is generally yes, but that does not justify patrons being treated in such a way that they are heavily penalized with fines which discourage them from borrowing from a library. It is certainly a "wonderful surprise" that Kaisa is the keeper of the books, i.e. the librarian who, with the help of Hilda and Frida, was able to convince an old lady to return a book. An impressive feat, you could say.

© 2022 Burkely Hermann. All rights reserved.

Notes

[1] Worded as "the person who borrowed the book is responsible for it and the witches threaten to cast her into a void if she cannot locate the lost item."

[2] See the "checking out books" (Nov. 2018), "Librarians: What's the worst condition someone has returned a book?" (Apr. 2014), "Most stolen book at your library" (Jul. 2018),"I (accudentally) lent a book to someone who is NOT authorized to use the library. What to do?" (Jun. 2020), "Lots of (probably) missing items were returned!" (Nov. 2020), "Horrible Patrons: CoVid Edition" (Feb. 2021), "I'm struggling with a weird sense of guilt when checking books out now, it's very irrational" (Sept. 2021), "Academic librarians: strategies for getting checked out books back from faculty?" (Mar. 2017), "Violating the spirit of the policy but not the letter of it..." (May 2017), "I think one of our patrons is a hoarder, and he isn't returning our books." (Aug. 2018), "Borrowing Policy Inquiry" (Dec. 2016), "Borrowing Out of Town" (Jun. 2016).

[3] See K.W. Colyard, "How To Piss Off Your Local Librarian," Bustle, Jul. 16, 2015; Oleg Kagan, "Day in the Life: Reference Librarian at a Public Library," Every Library, Nov. 29, 2017.

[4] "Basic library procedures: Circulation functions," Living in the Library World, Dec. 18, 2008; "Basic library procedures: Library inventory," Living in the Library World, Jan. 18, 2009.

[5] See "Circulation of nonbook materials," Living in the Library World, Dec. 28, 2008; "Circulation's role in security," Living in the Library World, Dec. 28, 2008; "Basic library procedures: Processing library materials," Living in the Library World, Jan. 7, 2009; "Library co-operation, interlibrary loan and document delivery," Living in the Library World, Jan. 25, 2010; "Ethics," Living in the Library World, Nov. 22, 2010.

[6] "Library Policies," Galveston College, accessed October 3, 2021; "Loan Periods," Richard E. Bjork Library at Stockton University, accessed October 3, 2021; "Overdue Materials," Richard E. Bjork Library at Stockton University, accessed October 3, 2021; "Lost/Damaged Item," Richard E. Bjork Library at Stockton University, accessed October 3, 2021; "Outside Borrowers," University Libraries of University of Georgia, accessed October 3, 2021; "Circulation Policies," Princeton University Library, accessed October 3, 2021; "Borrow," Pitts Theology Library at Emory University, accessed October 3, 2021;

"Library," Caswell County, NC, accessed October 3, 2021; "Interlibrary Loan Borrowing and Document Delivery Services," University of North Texas University Libraries, accessed October 3, 2021; "Library Fines and Fees," New York Public Library, accessed October 3, 2021; "Library Policies, Guidelines and Procedures: Lost or Damaged Materials," Calvin T. Ryan Library, University of Nebraska Kearney, accessed October 3, 2021; "Step by Step – Billing Patrons and Libraries for Lost Books in Horizon," Clinton-Essex-Franklin Library System, accessed October 3, 2021; "Loan Periods and Fines," Pasadena Public Library, accessed October 3, 2021; "Studio Use Policy," Pikes Peak Library District, Sept. 2019; "Interlibrary Loan (ILL)," SRSU Library & Archives, accessed October 3, 2021;

"Policies," Proctor Library, accessed October 3, 2021; "Borrow Materials," E.H. Butler Library, accessed October 3, 2021; "InterLibrary Loan (ILL)," Osceola Library System, accessed October 3, 2021; "Borrowing/Circulation," SCSU Research Guides at Southern Connecticut State University, accessed October 3, 2021; "Library Policies," Orange Coast College, accessed October 3, 2021; "Borrowing and Renewals," Marriott Library, University of Utah, accessed October 3, 2021; "Borrow," UC Berkeley Library, accessed October 3, 2021; "Borrowing," Hawai'i Pacific University, accessed October 3, 2021; "Fine Free Library," San Francisco Public Library, accessed October 3, 2021; "FAQ : Interlibrary Loan," Smithsonian Libraries, accessed October 3, 2021; "Checkout Periods and Protocols," Fulton Library, Utah Valley University, accessed October 3, 2021 (discussed secondary borrowers); "Borrow, Renew & Return," Georgia Tech Library, accessed October 3, 2021; "Borrowing Policies," Stewart B. Land Library, accessed October 3, 2021; "Borrowing Materials," Memorial Library of Nazereth & Vicinity," accessed October 3, 2021; "Hennepin County Library goes fine-free," Hennepin County Library, Mar. 9, 2021; "Borrow Items," Charleston County Public Library, accessed October 3, 2021;

"Interlibrary Loan," Omaha Public Library, accessed October 3, 2021; "Book Club in a Bag," Southeast Regional Library, accessed October 3, 2021; "Interlibrary Loan," Kenton County Public Library, accessed October 3, 2021; "Pageturners To Go," Multnomah Library, accessed October 3, 2021; "Remote Delivery," UW-Madison Libraries, accessed October 3, 2021; "Library," Thesophical Society of America, accessed October 3, 2021; "Borrowing Privileges," Penn State University Libraries, accessed October 3, 2021; "Borrowing Materials," Circulation Services, Research Guides at Broward College, accessed October 3, 2021; "Prince William libraries are now fine-free," InsideNOVA, Jul. 7, 2021; "Your Library Account," Boulder Public Library, accessed October 3, 2021; "Services - Libraries," LibGuides at St. Joseph's College New York, accessed October 3, 2021;

"Nevada State College Interlibrary Loan," Nevada State College, accessed October 3, 2021; "Get a Library Card," Laurel County Public Library, accessed October 3, 2021; "InterLibrary Loan," Queens College Libraries, accessed October 3, 2021; "Bradley Library eliminates late fees," Daily Journal, Sept. 9, 2021; "Library," Amridge University, accessed October 3, 2021; "Checkout Privileges," BYU Library, accessed October 3, 2021; "Using the Library," Linda Hall Library, accessed October 3, 2021; Borrowing from CSN Libraries," CSN Libraries, accessed October 3, 2021; "Interlibrary Loan (ILL)," Texas State Library and Archives Commission, accessed October 3, 2021; "Borrowing Library materials," Simon Fraser University, accessed October 3, 2021; "Library of Things: Home," LibGuides at Milton Public Library, accessed October 3, 2021;

"Onsite Borrowing Program," OCLC Research, accessed October 3, 2021; "Welcome to Your Library," Grand Rapids Public Library, accessed October 3, 2021; "Frequently Asked Questions," El Dorado County Library, accessed October 3, 2021; Liam Griffin, "Libraries Become Fine-Free In July In Prince William County," Manassas, VA, accessed October 3, 2021; "Circulation," Mary and John Gray Library, Lamar University, accessed October 3, 2021; "Prince William Public Libraries to Go Fine-Free Beginning July 1," Jul. 2021, accessed October 3, 2021; "James. E. Walker Library," Middle Tennessee State University, accessed October 3, 2021 (mentions proxy borrowers); "Interlibrary Loan (ILL)," University of Idaho Library, accessed October 3, 2021.

#hilda librarian#hilda#white women#patrons#books#borrowing#library users#library patrons#libraries#rfid#reddit

17 notes

·

View notes

Text

Ensuring Compliance and Security: Best Practices for Integrating NuclearStressTest.net DSOS into Regulated Industrie

In highly regulated industries such as healthcare, finance, and government, ensuring compliance and security in software testing processes is paramount. As organizations increasingly turn to outsourcing solutions like NuclearStressTest.net's Dedicated Staff Offshore Services (DSOS), it's essential to implement best practices to uphold regulatory requirements and protect sensitive data. In this article, we'll explore ten key practices for integrating NuclearStressTest.net DSOS into regulated industries while prioritizing compliance and security.

1. Understanding Regulatory Requirements

Before integrating NuclearStressTest.net DSOS into your testing processes, familiarize yourself with relevant regulatory frameworks such as HIPAA (Health Insurance Portability and Accountability Act), GDPR (General Data Protection Regulation), or PCI DSS (Payment Card Industry Data Security Standard). Understanding these requirements will guide your approach to compliance.

2. Conducting Risk Assessments

Perform comprehensive risk assessments to identify potential security vulnerabilities and compliance risks associated with outsourcing testing activities. Assess factors such as data privacy, confidentiality, integrity, and accessibility to ensure alignment with regulatory standards.

3. Implementing Secure Communication Channels

Establish secure communication channels between your organization and NuclearStressTest.net DSOS team to safeguard the exchange of sensitive information. Utilize encrypted email, secure file transfer protocols, and virtual private networks (VPNs) to protect data in transit.

4. Enforcing Data Protection Measures

Implement robust data protection measures to safeguard sensitive data handled during testing activities. Utilize encryption, access controls, and data masking techniques to prevent unauthorized access, disclosure, or alteration of sensitive information.

5. Securing Testing Environments

Ensure that testing environments used by NuclearStressTest.net DSOS adhere to stringent security standards. Implement measures such as network segmentation, intrusion detection systems, and regular security audits to mitigate risks and protect against cyber threats.

6. Establishing Clear Legal and Compliance Agreements

Define clear legal and compliance agreements with NuclearStressTest.net DSOS, outlining roles, responsibilities, and expectations regarding regulatory compliance and security measures. Include provisions for data protection, confidentiality, and breach notification procedures.

7. Providing Compliance Training and Education

Offer comprehensive compliance training and education to NuclearStressTest.net DSOS team members to ensure awareness of regulatory requirements and security best practices. Empower them with the knowledge and skills necessary to uphold compliance standards throughout the testing process.

8. Conducting Regular Audits and Assessments

Conduct regular audits and assessments of NuclearStressTest.net DSOS activities to monitor compliance with regulatory requirements and security policies. Review testing procedures, documentation, and controls to identify areas for improvement and address any non-compliance issues promptly.

9. Maintaining Documentation and Audit Trails

Maintain detailed documentation and audit trails of testing activities conducted by NuclearStressTest.net DSOS, including test plans, results, and compliance records. Keep comprehensive records to demonstrate adherence to regulatory standards and facilitate audits or investigations.

Conclusion: Upholding Compliance and Security in Outsourced Testing

In conclusion, integrating NuclearStressTest.net DSOS into regulated industries requires a proactive approach to compliance and security. By following best practices such as understanding regulatory requirements, conducting risk assessments, implementing secure communication channels, and enforcing data protection measures, organizations can mitigate risks and uphold compliance standards. With a strong focus on collaboration, education, and continuous improvement, NuclearStressTest.net DSOS can play a vital role in achieving regulatory compliance and maintaining security integrity in software testing processes within regulated industries. Read more

0 notes

Text

How Incident Reporting Software Enhance Workplace Safety and Compliance?

Incident reporting software enhances workplace safety and compliance by providing a streamlined and systematic approach to documenting incidents. It allows organizations to promptly report and investigate incidents, track corrective actions, and analyze trends to prevent future occurrences. This software promotes transparency, accountability, and regulatory adherence, fostering a proactive safety culture. By centralizing incident data and automating reporting processes, it enables timely interventions and continuous improvement efforts to mitigate risks and ensure a safer work environment.

Introduction to Incident Reporting Software

Incident reporting software plays a pivotal role in modern organizational safety and compliance strategies by providing a structured framework for documenting, tracking, and analyzing incidents. This software enables businesses across industries to streamline incident reporting processes, enhance data accuracy, and improve response times to mitigate risks effectively.

Features and Functionality Incident Reporting Software

Effective incident reporting software offers a range of essential features to support comprehensive incident management. These include intuitive user interfaces for easy data entry, customizable incident forms to capture relevant details, and workflow automation to route reports to appropriate personnel promptly. Additionally, real-time notifications and alerts ensure timely responses, while centralized databases facilitate secure data storage and retrieval for analysis and regulatory compliance.

Integration with Incident Reporting Software

Incident reporting software integrates seamlessly with broader incident management systems (IMS), enriching incident data with contextual information for more informed decision-making. By linking incident reports to response workflows, organizations can streamline communication, coordinate resources, and track resolution progress efficiently. This integration fosters a holistic approach to incident management, from initial reporting through investigation, resolution, and post-incident analysis.

Enhanced Data Analytics and Incident Reporting Software

Advanced incident reporting software leverages data analytics tools to derive actionable insights from incident data. Analytics dashboards and customizable reports enable stakeholders to identify trends, root causes, and recurring issues, empowering proactive risk mitigation strategies. Visualization tools such as charts, graphs, and heat maps enhance data interpretation, facilitating evidence-based decision-making and continuous improvement initiatives.

Mobile Accessibility and Remote Incident Reporting Software

The mobility of incident reporting software is increasingly vital in today's dynamic work environments. Mobile applications enable frontline workers to report incidents promptly from the field, capturing real-time data and multimedia evidence. Remote access capabilities ensure that incident reports can be submitted and reviewed from anywhere, supporting distributed teams and enhancing response agility.

Compliance and Regulatory Alignment

Incident reporting software plays a critical role in ensuring compliance with industry regulations and standards. By standardizing reporting processes and maintaining audit trails, organizations demonstrate accountability and transparency in incident management. Built-in compliance features, such as configurable workflows and automatic regulatory updates, help organizations adhere to legal requirements and regulatory frameworks seamlessly.

Future Trends and Innovations of Incident Reporting Software

Looking ahead, incident reporting software is poised for further innovation to meet evolving organizational needs and technological advancements. Future trends may include the integration of artificial intelligence (AI) for predictive analytics and anomaly detection, enhancing early incident detection and prevention capabilities. Enhanced data security measures, including blockchain technology for secure data storage and authentication, will further safeguard sensitive incident information. Additionally, interoperability with emerging technologies like IoT (Internet of Things) and wearable devices may enable automated incident reporting and proactive risk management in real-time.

Conclusion

Incident reporting software is indispensable for modern organizations seeking to enhance operational safety, compliance, and resilience. By leveraging advanced features, integration capabilities, and future-oriented innovations, incident reporting software empowers organizations to proactively manage incidents, mitigate risks, and foster a culture of safety and continuous improvement across all levels of the organization.

0 notes

Text

The Benefits of Implementing 3-Way Matching in Accounts Payable

In today’s dynamic business environment, efficiency and accuracy in financial processes are crucial for maintaining profitability and compliance. Accounts Payable (AP) departments play a pivotal role in managing supplier invoices and ensuring that payments are processed correctly and timely. One effective method used in AP to enhance accuracy and reduce errors is 3-way matching.

What is 3-Way Matching?

3-way matching is a standard AP practice that involves matching three key documents before processing a supplier invoice for payment. These documents typically include:

Purchase Order (PO): The document issued by a buyer to a seller, outlining the details of goods or services to be purchased, including quantities, prices, and terms.

Receipt of Goods/Services: Documentation confirming that the goods or services specified in the PO have been received or rendered satisfactorily.

Invoice: The supplier's invoice requesting payment for the goods or services delivered, detailing quantities, prices, and other relevant terms.

By comparing these three documents—PO, receipt, and invoice—AP departments can verify that what was ordered (PO), what was received (receipt), and what was billed (invoice) match up accurately. Here are the significant benefits of implementing 3-way matching in your accounts payable process:

1. Accuracy and Error Reduction

Implementing 3-way matching significantly enhances the accuracy of financial transactions by cross-verifying information across multiple documents. This process reduces the risk of overpayments, duplicate payments, and billing errors. By ensuring that invoices match both the purchase order and receipt of goods/services, AP departments can catch discrepancies early, preventing costly mistakes that could impact financial reporting and vendor relationships.

2. Fraud Prevention

3-way matching acts as a robust control mechanism against fraudulent activities. By validating invoices against purchase orders and receipts, organizations can detect discrepancies that may indicate fraudulent invoices or unauthorized purchases. This helps safeguard financial resources and ensures that payments are made only for legitimate transactions, enhancing overall financial security.

3. Improved Vendor Relations

Timely and accurate payments are essential for fostering positive relationships with suppliers and vendors. Implementing 3-way matching ensures that invoices are processed efficiently and accurately, leading to fewer payment delays and disputes. This reliability can enhance vendor trust and cooperation, potentially leading to preferential treatment and better terms for future transactions.

4. Operational Efficiency

Automating the 3-way matching process through AP software or ERP systems improves operational efficiency by reducing manual intervention and streamlining workflow. Automated matching algorithms can quickly compare large volumes of data across documents, identifying discrepancies faster than manual methods. This efficiency frees up AP staff to focus on strategic tasks and exception handling rather than routine data entry and reconciliation.

5. Compliance and Audit Readiness

Adherence to regulatory requirements and internal policies is critical for organizations across industries. 3-way matching helps ensure compliance by providing a clear audit trail of purchasing activities and payment processes. This documentation not only facilitates internal audits but also supports external audits by providing evidence of control measures and transaction accuracy.

6. Cost Savings

By minimizing errors, preventing fraud, and optimizing operational workflows, 3-way matching contributes to significant cost savings over time. Organizations can avoid penalties associated with payment errors, reduce labor costs related to manual reconciliation, and negotiate better terms with suppliers based on a reputation for accuracy and reliability.

youtube

Conclusion

In conclusion, implementing 3-way matching in accounts payable offers substantial benefits for organizations seeking to enhance financial accuracy, operational efficiency, and vendor relationships. By leveraging automated tools and rigorous verification processes, businesses can mitigate risks, ensure compliance, and achieve cost savings while maintaining a competitive edge in today’s marketplace.

For organizations looking to optimize their accounts payable processes, integrating 3-way matching is a strategic step towards achieving financial transparency and operational excellence.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS

Facebook

Twitter

LinkedIn

0 notes

Text

Insights on Simplified Contract Management Software and Regulatory Considerations

Impact of New Data Privacy Regulations

Enhanced Security Measures: Contract management software must incorporate robust security features to comply with new data privacy regulations.

User Consent Management: Tools for obtaining and managing user consent are essential.

Data Access and Deletion Requests: Mechanisms to handle data access and deletion requests must be integrated.

Data Breach Detection and Notification: Protocols for detecting and notifying data breaches are crucial.

Data Minimization Practices: Implementing data minimization practices to limit the collection and retention of personal data.

Regulatory Considerations for e-Signature Features

Compliance with Legislation: Adherence to the ESIGN Act, UETA in the U.S., and eIDAS Regulation in the EU.

Authentication and Verification: Robust processes to verify the identity of signers.

Clear Consent and Intent: Ensuring all parties clearly consent to and intend to use e-Signatures.

Security Measures: Protecting the integrity and confidentiality of signed documents.

Record-Keeping Practices: Maintaining proper records of e-Signature transactions.

Industry-Specific Regulations: Compliance with sector-specific regulations like HIPAA for healthcare.

Cross-Border Legal Recognition: Addressing the legal recognition and enforceability of e-Signatures across borders.

International Regulatory Considerations

Data Privacy Laws: Compliance with GDPR, CCPA, and PIPEDA.

Industry-Specific Regulations: Tailoring software to meet industry-specific standards like SOX and MiFID II.

Localization: Customizing software for language, currency, and local business practices.

Legal Compliance: Handling different legal frameworks and contract laws.

Security Standards: Adhering to regional security standards like ISO/IEC 27001 or SOC 2.

Cross-Border Data Transfers: Securely managing data transfers in compliance with international regulations.

Regulatory Risks of AI-Powered Data Extraction

Data Privacy Violations: Risk of processing sensitive personal data in violation of privacy laws.

Data Security Risks: Ensuring AI systems are secure from cyber-attacks.

Compliance with Legal Standards: Designing AI systems to comply with industry-specific regulations.

Bias and Discrimination: Avoiding biases in AI algorithms.

Transparency and Accountability: Ensuring AI decision-making processes are transparent.

Intellectual Property Issues: Avoiding unauthorized use of proprietary information.

Contractual Obligations: Accurate interpretation and management of contractual obligations.

Features of Contract Management Software for Compliance

Centralized Repository: Secure storage of all contracts.

Automated Alerts and Notifications: Alerts for key dates and compliance checks.

Audit Trails: Detailed logs of contract-related activities.

Standardized Templates: Use of pre-approved templates for compliance.

Regulatory Updates: Integration with regulatory databases for real-time updates.

Reporting and Analytics: Generating reports to monitor compliance status.

Access Control: Controlling access to sensitive contract information.

Actionable Insight

Stock Analysis: Contract Management Software Companies

Given the increasing regulatory requirements and the need for robust contract management solutions, companies in this sector are likely to see growing demand for their products. If you are considering investing in a company that develops contract management software, here are some actionable insights:

Buy: If the company has a strong track record of compliance, robust security features, and a comprehensive suite of tools that address the regulatory needs outlined above.

Hold: If the company is in the process of enhancing its features to meet new regulations but has a solid customer base and financial stability.

Sell: If the company is struggling to keep up with regulatory changes, has security vulnerabilities, or faces significant legal challenges.

Look for More Data: If the company is relatively new or if there is insufficient information about its compliance capabilities and market position.

Conclusion

The evolving regulatory landscape necessitates significant customization and careful planning for the deployment of contract management software. Companies must ensure their software solutions are compliant, secure, and user-friendly to meet the diverse regulatory requirements across different regions and industries. Investing in companies that excel in these areas could be a prudent decision given the growing importance of regulatory compliance in contract management.

0 notes

Text

Accounts Payable Software: Key Features to Look For

Accounts payable (AP) software plays a crucial role in managing and optimizing financial processes within organizations. As businesses grow and transactions increase, the need for efficient AP management becomes more pronounced. Choosing the right accounts payable software can significantly streamline operations, improve accuracy, and enhance financial visibility. In this blog, we'll explore the key features that businesses should look for when selecting AP software, ensuring it not only meets current needs but also supports future growth and scalability.

Introduction to Accounts Payable Software

Accounts payable software automates the processes involved in managing and paying supplier invoices. It replaces manual methods with digital workflows, reducing errors, accelerating processing times, and providing insights into financial obligations. Here are the essential features to consider when evaluating AP software:

Key Features of Accounts Payable Software

1. Invoice Processing Automation

Efficient AP software should automate invoice processing from receipt to payment. This includes:

Invoice Capture: Ability to capture invoices electronically from various sources such as email, scanned documents, and digital submissions.

Data Extraction: Automated extraction of key invoice data (e.g., invoice number, date, amount) using optical character recognition (OCR) or machine learning algorithms.

Workflow Automation: Routing invoices for approval based on predefined rules and workflows, reducing manual intervention and speeding up approval cycles.

2. Integration Capabilities

Look for AP software that integrates seamlessly with your existing ERP (Enterprise Resource Planning) or accounting systems. Integration ensures:

Data Synchronization: Automatic synchronization of invoice and payment data between AP software and other systems, eliminating the need for manual data entry and reducing errors.

Compatibility: Support for popular accounting software such as QuickBooks, Xero, SAP, and Oracle to ensure compatibility across platforms.

3. Electronic Payments

Modern AP software facilitates electronic payments (e.g., ACH transfers, virtual credit cards) to suppliers, offering benefits such as:

Faster Processing: Accelerated payment processing and reduced payment cycle times.

Cost Savings: Lower transaction fees compared to traditional paper checks.

Security: Enhanced security measures to protect sensitive payment information.

4. Document Management and Storage

Effective AP software includes robust document management capabilities:

Centralized Repository: Secure storage of invoices, receipts, and payment records in a centralized digital repository.

Document Retrieval: Quick and easy access to documents for auditing, compliance, and reporting purposes.

Retention Policies: Automated management of document retention policies to ensure compliance with regulatory requirements.

5. Reporting and Analytics

Insightful reporting features provide visibility into AP performance and financial metrics:

Customizable Dashboards: Interactive dashboards with real-time data visualization for monitoring invoice status, payment trends, and financial metrics.

Analytical Tools: Built-in analytics tools to identify cost-saving opportunities, track key performance indicators (KPIs), and forecast cash flow.

6. Compliance and Security

Ensure that AP software adheres to industry regulations (e.g., GDPR, SOX) and includes robust security measures:

Audit Trails: Comprehensive audit trails to track invoice approvals, payments, and user actions for compliance audits.

Data Encryption: Advanced encryption protocols to protect sensitive financial data from unauthorized access and cyber threats.

7. Scalability and Flexibility

Choose AP software that can scale with your business growth and adapt to evolving needs:

Multi-Entity Support: Ability to manage AP processes for multiple entities or subsidiaries from a single platform.

Customization: Flexibility to customize workflows, approval hierarchies, and payment schedules to align with organizational requirements.

8. User Interface and Accessibility

An intuitive user interface enhances user adoption and productivity:

Mobile Accessibility: Access to AP functions via mobile devices for on-the-go approvals and payments.

User Training and Support: Comprehensive training resources and responsive customer support to assist users with software implementation and ongoing use.

youtube

Conclusion

Choosing the right accounts payable software is essential for optimizing financial operations, improving efficiency, and maintaining compliance. By prioritizing features such as invoice processing automation, integration capabilities, electronic payments, document management, reporting tools, compliance, scalability, and user accessibility, businesses can streamline AP processes and achieve greater financial control. Evaluate potential AP software solutions carefully to ensure they align with your organization's current needs and future goals, enabling you to make informed decisions that drive operational excellence and business success.

By incorporating these key features into your search criteria, you can select AP software that not only meets your immediate requirements but also supports long-term growth and efficiency gains.

SITES WE SUPPORT

Modeling Management - Wix

SOCIAL LINKS

Facebook

Twitter

LinkedIn

0 notes

Text

Revolutionizing Healthcare: The Impact Of E-Clinical Solution Software

In the dynamic landscape of healthcare, where technological innovations are reshaping traditional practices, solution software emerges as a revolutionary force. These digital platforms are transforming the management of clinical trials, patient data, and healthcare delivery worldwide. In this comprehensive exploration, we delve into the core features, benefits, and transformative impact of e-clinical solution software on modern healthcare systems.

Understanding E-Clinical Solution Software

E-clinical software comprises a suite of digital tools meticulously designed to streamline various facets of clinical trials and healthcare management. These encompass Electronic Data Capture (EDC), Clinical Data Management (CDM), Clinical Trial Management Systems (CTMS), and Electronic Patient-Reported Outcomes (ePRO), among others, crucial for efficient trial conduct.

The primary objective of e-clinical solutions is to bolster the efficiency, accuracy, and compliance of clinical trials while concurrently reducing operational costs and timelines. These platforms foster seamless collaboration among stakeholders, including sponsors, investigators, site staff, and regulatory bodies, thereby optimizing the entire clinical trial lifecycle from inception to completion.

Features and Capabilities

Clinical Data Management (CDM): CDM modules streamline the organization, integration, and quality control of clinical trial data. These systems ensure data consistency, compliance with regulatory standards, and adherence to predefined protocols, thereby augmenting data integrity and reliability.

Clinical Trial Management Systems (CTMS): CTMS platforms streamline the planning, execution, and monitoring of clinical trials. They provide comprehensive oversight of study timelines, milestones, budgets, and resources, enabling efficient trial management and optimization of operational workflows.

Regulatory Compliance and Reporting: E-clinical solution software ensures compliance with regulatory requirements, such as Good Clinical Practice (GCP) guidelines, Health Insurance Portability and Accountability Act (HIPAA) regulations, and International Council for Harmonization (ICH) standards. These platforms facilitate the generation of regulatory submissions, audit trails, and safety reports, thereby simplifying regulatory compliance and reporting processes.

Benefits of Solution Software

Enhanced Efficiency: By automating manual processes, streamlining workflows, and facilitating real-time data access, e-clinical solutions significantly enhance the efficiency of clinical trials and healthcare management. These platforms accelerate study timelines, reduce administrative burden, and optimize resource utilization, ultimately improving overall productivity and cost-effectiveness.

Improved Data Quality: E-clinical solution software promotes data accuracy, completeness, and consistency throughout the clinical trial lifecycle. By implementing built-in validation checks, data cleaning algorithms, and electronic source data verification (SDV) mechanisms, these platforms minimize data errors and discrepancies, ensuring high-quality and reliable clinical trial data.

Enhanced Collaboration: E-clinical solutions foster seamless collaboration and communication among stakeholders involved in clinical trials, including sponsors, investigators, study coordinators, and regulatory agencies. These platforms provide centralized access to study information, facilitate real-time data sharing, and enable remote monitoring and oversight, thereby enhancing collaboration and coordination across geographically dispersed teams.

Comprehensive Analytics: E-clinical solution software enables advanced data analytics and reporting capabilities, allowing stakeholders to derive actionable insights from clinical trial data. These platforms support data visualization, trend analysis, risk identification, and predictive modeling, facilitating informed decision-making and continuous process improvement throughout the clinical trial lifecycle.

The Future of E-Clinical Solutions

As the healthcare landscape continues to evolve, the adoption of e-clinical solution software is poised to accelerate further, driven by technological advancements, regulatory requirements, and industry trends. Future developments in artificial intelligence (AI), machine learning (ML), blockchain, and digital health technologies are expected to further enhance the capabilities and functionalities of e-clinical solutions, paving the way for more efficient, patient-centric, and data-driven healthcare delivery models.

In conclusion, e-clinical solution software represents a paradigm shift in the way clinical trials are conducted and healthcare is delivered. By harnessing the power of digital technologies, these platforms offer myriad benefits, including enhanced efficiency, improved data quality, enhanced collaboration, patient-centricity, and comprehensive analytics. As healthcare organizations increasingly recognize the value of e-clinical solutions, the adoption and integration of these innovative platforms will continue to drive positive transformation across the entire healthcare ecosystem, ultimately leading to improved patient outcomes and population health.

0 notes

Text

How does cloud call center software support remote work and distributed teams?

In recent years, remote work has become increasingly prevalent, driven by advancements in technology and evolving workplace dynamics. The COVID-19 pandemic further accelerated this trend, compelling businesses to embrace remote work models to ensure business continuity and employee safety. Cloud call center software has emerged as a critical tool in supporting remote work and enabling distributed teams to thrive. Let's explore how cloud call center software facilitates seamless collaboration, enhances productivity, and empowers remote workforces.

Flexibility and Accessibility:

Anywhere, Anytime Access: Cloud call center software enables agents to work from any location with internet access, eliminating geographical constraints. Whether agents are working from home, satellite offices, or remote locations, they can easily connect to the cloud-based platform and access essential tools and resources.

Multi-Channel Support: Modern cloud call center software supports a wide range of communication channels, including phone calls, emails, chats, and social media messages. This flexibility allows remote agents to engage with customers across various channels seamlessly, ensuring consistent and personalized service regardless of location.

Collaboration and Communication:

Virtual Collaboration Tools: Cloud call center software often integrates with collaboration tools such as team messaging platforms, video conferencing, and document sharing tools. These integrations facilitate real-time communication and collaboration among remote team members, enabling them to share information, resolve issues, and coordinate tasks efficiently.

Centralized Information Hub: Cloud call center software serves as a centralized hub for customer data, interaction history, and knowledge resources. Remote agents can access this information from anywhere, enabling them to provide accurate and informed support to customers without relying on physical office infrastructure.

Performance Monitoring and Management:

Real-Time Monitoring: Cloud call center software provides supervisors and managers with real-time visibility into agent performance and call center metrics. Remote supervisors can monitor agent activity, track KPIs, and identify performance trends from a centralized dashboard, ensuring accountability and maintaining service quality.

Performance Analytics: Advanced reporting and analytics capabilities offered by cloud call center software enable remote teams to gain actionable insights into customer interactions, trends, and service levels. By analyzing key metrics, remote managers can identify areas for improvement, optimize processes, and make data-driven decisions to enhance overall performance.

Security and Compliance:

Robust Security Measures: Cloud call center software providers implement robust security measures to protect sensitive customer data and ensure compliance with data privacy regulations. Encryption, access controls, and regular security audits help mitigate security risks and safeguard remote work environments against cyber threats.

Compliance Management: Cloud call center software often includes features for compliance management, such as call recording and monitoring tools, GDPR compliance features, and audit trails. These capabilities ensure that remote teams adhere to regulatory requirements and industry standards, mitigating compliance risks.

Conclusion:

Cloud call center software plays a pivotal role in supporting remote work and enabling distributed teams to deliver exceptional customer service. By providing flexibility and accessibility, facilitating collaboration and communication, enabling performance monitoring and management, and ensuring security and compliance, cloud-based solutions empower remote workforces to thrive in today's digital age. As remote work continues to evolve, businesses that embrace cloud call center software will be well-positioned to adapt to changing workplace dynamics and deliver superior customer experiences, regardless of where their teams are located.

0 notes

Text

TrustEasy: Your Trusted Audit Trail in Accounting Software

Audit trail in accounting software is a feature that allows businesses to keep track of all changes made within the software. This feature is essential for businesses as it helps to ensure accuracy and prevent fraud. The audit trail can be used to track who made what changes, when the changes were made, and why the changes were made. This information can then be used to improve processes and prevent future mistakes. TrustEasy's audit trail feature is simple to use and provides businesses with the peace of mind that their data is accurate and safe. Reach us at https://trusteasy.com.au/ to learn more!

0 notes

Text

Automated Bank Reconciliation Software: Streamlining Financial Accuracy

Automated bank reconciliation software is revolutionizing the way businesses handle their financial processes. By automating the reconciliation of bank statements with accounting records, this software enhances accuracy, saves time, and reduces the risk of errors. In this article, we explore the benefits, features, and considerations for choosing the right automated bank reconciliation software for your business.

Benefits of Automated Bank Reconciliation Software

Increased Efficiency: Automated Bank Reconciliation Software is a time-consuming process that involves manually comparing transactions. Automated software significantly reduces the time spent on this task by automatically matching transactions and identifying discrepancies.

Improved Accuracy: Manual reconciliation is prone to human error, which can lead to financial discrepancies. Automated software minimizes these errors by using advanced algorithms to ensure precise matching of transactions.

Real-Time Updates: Automated bank reconciliation software can provide real-time updates, allowing businesses to have an up-to-date view of their financial status. This is particularly beneficial for making informed financial decisions and maintaining cash flow visibility.

Fraud Detection: By quickly identifying and flagging discrepancies, automated software helps in detecting potential fraud or unauthorized transactions. This enhances the overall security of the financial process.

Compliance and Reporting: Automated software ensures that all transactions are accurately recorded and reconciled, which is crucial for compliance with financial regulations. It also simplifies the process of generating financial reports for audits and management reviews.

Key Features of Automated Bank Reconciliation Software

Automated Transaction Matching: The core feature of reconciliation software is its ability to automatically match bank transactions with accounting records. Advanced systems use machine learning to improve matching accuracy over time.

Exception Management: When discrepancies are identified, the software flags these exceptions and provides tools for investigating and resolving them efficiently.

Integration with Banking Systems: Leading reconciliation software integrates seamlessly with various banking platforms, enabling automatic import of bank statements and real-time transaction data.

User-Friendly Interface: A user-friendly interface makes it easy for finance teams to navigate the software, review reconciled transactions, and address discrepancies without extensive training.

Customizable Rules and Filters: Businesses can customize the matching rules and filters to align with their specific reconciliation needs, enhancing the software’s flexibility and effectiveness.

Audit Trail and Reporting: Automated software maintains a detailed audit trail of all reconciliation activities, ensuring transparency and accountability. It also offers robust reporting capabilities for internal and external stakeholders.

Choosing the Right Automated Bank Reconciliation Software

Compatibility with Existing Systems: Ensure the software is compatible with your current accounting and banking systems to facilitate smooth integration and data flow.

Scalability: Choose a solution that can scale with your business growth. The software should accommodate an increasing volume of transactions and support multiple bank accounts.

Security Features: Given the sensitive nature of financial data, prioritize software that offers robust security features, such as data encryption, secure access controls, and regular security audits.

Customer Support: Opt for a provider that offers excellent customer support, including training, troubleshooting, and regular software updates to address any issues promptly.

Cost: Evaluate the cost of the software, including any setup fees, subscription costs, and potential hidden charges. Compare different options to find a solution that provides the best value for your budget.

Conclusion

Automated bank reconciliation software is a powerful tool that can transform the way businesses manage their financial processes. By increasing efficiency, improving accuracy, and enhancing security, this software offers significant benefits that streamline financial operations. When selecting the right software, consider factors such as compatibility, scalability, security, customer support, and cost to ensure you choose a solution that meets your business needs. Embracing automated bank reconciliation software can lead to better financial management, reduced operational costs, and a stronger foundation for business growth.

For more info. Visit us:

How AI is Paving the Way for a New Era in Financial Services

0 notes

Text

Simplifying the Audit Trail: A Guide to Easing Business Loan Calculation

When small business owners face the daunting requirement of extensive financial audits for securing loans, it can often lead to frustration and anxiety. A common concern is the sheer volume of detailed financial records needed, from income statements to balance sheets. To mitigate this issue, businesses can take several proactive steps to streamline their financial management and audit processes.

Firstly, adopting integrated accounting software is crucial. Tools like QuickBooks or Xero can automatically track financial transactions and generate necessary reports, ensuring accuracy and minimizing manual errors. By maintaining organized records throughout the year, businesses can significantly reduce the time and effort required during an audit.

Secondly, consider consulting with a financial advisor or an accountant regularly, not just during the audit period. These professionals can provide ongoing support and ensure that your financial practices meet industry standards, which can simplify the auditing process when it's time to apply for a loan.

Lastly, educate yourself and your team about the importance of compliance and the specifics of financial documentation required by lenders. Understanding what is expected can help demystify the process and reduce the stress associated with it.

By implementing these strategies, businesses can make financial audits less intimidating, paving the way for smoother business loan calculation.

0 notes

Text

BEST CRM SOFTWARE FOR BANKS

Talisma Corporation offers a comprehensive guide to the best CRM software for banks.

Customer relationship management (CRM) has emerged as a critical component of success in the fast-paced and highly competitive banking industry. Banks must manage massive volumes of client data, deliver personalized services, maintain regulatory compliance, and keep ahead of technological innovations. The correct CRM software may help you optimize your procedures, improve customer happiness, and increase revenue. Talisma Corporation understands the particular needs of the banking industry and has found the best CRM solutions to revolutionize your banking operations.

BEST CRM SOFTWARE FOR BANKS

1. Salesforce Financial Services Cloud Overview: Designed exclusively for the financial industry. It effortlessly connects with Salesforce's strong CRM platform, providing a comprehensive set of solutions customized to the needs of banks and financial institutions.

Key features:

Client Management: Offers a comprehensive perspective of clients' financial goals, accounts, and interactions.

Compliance: Built-in technologies for regulatory compliance, such as data encryption and secure communication.

Routine processes, such as customer onboarding and document management, are automated to free up staff time for higher-value activities.

Advanced analytics and AI-powered insights enable banks to make data-driven choices and anticipate client needs.

Benefits of Salesforce Financial Services Cloud include improved client interaction, operational efficiency, and regulatory compliance. Its scalability makes it appropriate for banks of all sizes, ranging from local credit unions to international corporations.

2. Microsoft Dynamics 365 for Finance and Operations Overview: Microsoft Dynamics 365 is a comprehensive CRM and ERP system with strong financial management features. It is intended to address the banking industry's complicated requirements by offering complete capabilities for client management, financial operations, and regulatory compliance.

Key features:

Unified Platform: Unifies CRM and ERP features on a single platform, ensuring smooth data flow and integration.

Customer Insights: Uses AI and machine learning to deliver actionable information about customer behavior and preferences.

Regulatory Compliance: Ensures compliance with industry regulations using built-in audit trails and security

features.

Scalability: Offers flexible deployment options, including cloud, on-premises, and hybrid solutions.

Benefits: Microsoft Dynamics 365 streamlines bank operations, improves customer service, and ensures regulatory compliance. Its connection with other Microsoft products, including as Office 365 and Azure, ensures a familiar and consistent user experience.

3. Talisma CRM Overview: Talisma CRM is a tailored solution for the banking sector. Talisma CRM, with a focus on improving customer relationships, provides a suite of solutions for managing client contacts, streamlining operations, and driving business success.

Key features:

Customer Interaction Management: Offers a consolidated picture of all customer interactions across numerous channels, such as email, phone, and social media.

Process Automation: Automates routine operations and procedures, decreasing manual labor and increasing efficiency.

Personalization: Provides individualized services and communication based on client data and preferences.

Analytics and Reporting: Delivers advanced analytics and customizable reports to monitor performance and identify opportunities.

Benefits: Talisma CRM helps banks increase client connections, operational efficiency, and obtain business insights. Its simple interface and extensive feature set make it an excellent alternative for banks seeking to improve their CRM skills.

4. Oracle CRM On Demand: Financial Services Edition

Overview: Oracle CRM On Demand Financial Services Edition is designed primarily for financial companies. It provides a comprehensive collection of tools for managing client interactions, streamlining processes, and complying with regulatory obligations.

Key features:

Customer Data Management: centralizes customer information, resulting in a single point of truth for all client interactions.

Compliance: Includes elements that help with regulatory compliance, such as data encryption and safe access restrictions.

Sales and Service Automation: automates sales and service procedures. improving efficiency and customer satisfaction.

Mobile Access: Provides mobile access to CRM data, enabling staff to stay connected and productive on the go.

Benefits:

Oracle CRM On Demand Financial Services Edition benefits banks by improving customer relationship management, streamlining operations, and ensuring regulatory compliance. Its mobile capabilities and broad feature set make it an adaptable solution for banks of any size.

5. SAP Client Experience (SAP CX)

SAP Customer Experience (SAP CX) is a package of CRM products that enable banks provide great customer experiences. It provides solutions for customer data management, marketing automation, sales automation, and customer support.

Key features:

Customer Data Platform: Centralizes customer data from several sources to provide a comprehensive view of customer interactions and preferences.

Marketing Automation: Automates marketing efforts and personalization to increase consumer engagement and conversion rates.

Sales Automation: Using advanced technologies and data, sales processes are streamlined from lead generation to deal closing.

Customer Service: Provides solutions for case management, knowledge management, and omnichannel assistance.

Benefits: SAP CX enables banks to provide personalized and efficient customer experiences. Its interaction with other SAP products, such as SAP S/4HANA, creates a unified platform for managing all aspects of the customer journey.

Conclusion

Choosing the correct CRM software is critical for banks that want to improve client interactions, optimize operations, and meet regulatory requirements. At Talisma Corporation, we understand the banking sector's unique needs and propose these top CRM solutions for their robust features, scalability, and ability to provide excellent client experiences.

Salesforce Financial Services Cloud is distinguished by its complete client management and superior analytics, making it an ideal choice for banks seeking to exploit data-driven insights. Microsoft Dynamics 365 provides a unified platform with robust integration features, making it suitable for banks looking for a streamlined and scalable solution. Talisma CRM is designed exclusively for the banking industry, with an intuitive interface and powerful features for improving client relationships. Oracle CRM On Demand Financial Services Edition and SAP Customer Experience (SAP CX) both offer robust features and compliance support, ensuring banks can manage their operations efficiently and stay ahead of regulatory requirements.

Investing in the right CRM software can transform your banking operations, driving customer satisfaction, operational efficiency, and business growth. As the banking industry continues to evolve, these CRM solutions provide the tools needed to stay competitive and meet the demands of today's customers.

0 notes

Text

Top Benefits of Using a Digital Purchase Requisition Form

In today’s digital era, businesses are increasingly shifting towards digital solutions to streamline operations and enhance efficiency. One such tool that has revolutionized procurement processes is the digital purchase requisition form. Traditionally, purchase requisitions involved manual paperwork, approval signatures, and lengthy processing times. However, digital purchase requisition forms offer numerous benefits that simplify the procurement process and improve overall business operations. Here are the top benefits of using a digital purchase requisition form:

1. Streamlined Workflow

Digital purchase requisition forms automate the entire procurement workflow, from request submission to approval and order fulfillment. Employees can easily fill out requisition forms online, specifying details such as item descriptions, quantities, and budgets. The forms are then routed electronically to approvers based on predefined approval hierarchies. This automation reduces delays, eliminates the need for physical paperwork, and ensures that requests are processed swiftly.

2. Improved Accuracy and Accountability

Manual purchase requisitions are prone to errors such as illegible handwriting, incorrect data entry, or missing information. Digital forms mitigate these risks by enforcing mandatory fields and providing drop-down menus for standardized selections. This improves data accuracy and ensures that all necessary information is captured upfront. Additionally, digital forms create a clear audit trail of requisition submissions, approvals, and purchases, enhancing accountability across the procurement process.

3. Enhanced Visibility and Transparency

Digital purchase requisition forms offer real-time visibility into the status of requisitions. Employees can track the progress of their requests, monitor approval stages, and receive notifications upon approval or rejection. This transparency fosters better communication between requestors and approvers, reducing the need for follow-up emails or phone calls to check on requisition status. Managers also gain insights into purchasing trends and expenditures, enabling informed decision-making and budget management.

4. Faster Approval Cycles

Traditional approval processes often involve physical signatures and routing documents through multiple departments or individuals. Digital purchase requisition forms streamline approval cycles by automating notifications and routing requisitions to the appropriate approvers electronically. Approvers can review and approve requests from anywhere, using any device with internet access. This agility reduces bottlenecks, accelerates decision-making, and ensures timely order processing.

5. Cost Savings

Implementing digital purchase requisition forms can lead to significant cost savings for organizations. By streamlining workflows and reducing manual processing times, businesses can allocate resources more efficiently and minimize administrative overhead associated with paper-based processes. Moreover, improved accuracy in requisition data reduces the risk of errors that could lead to unnecessary spending or delays in procurement activities.

6. Integration with ERP Systems

Many digital purchase requisition forms integrate seamlessly with Enterprise Resource Planning (ERP) systems or procurement software. This integration allows for automatic synchronization of requisition data with inventory management, accounting, and supplier databases. It facilitates seamless order processing, inventory tracking, and financial reporting, enhancing overall operational efficiency and compliance with organizational policies and procedures.

7. Support for Remote Work and Mobile Access

In an increasingly remote and mobile workforce environment, digital purchase requisition forms offer flexibility and accessibility. Employees can submit requisitions from any location, at any time, using their laptops, tablets, or smartphones. Approvers can review and approve requests on the go, enabling uninterrupted workflow management even outside traditional office hours or locations.

8. Environmental Sustainability

Transitioning from paper-based to digital purchase requisition forms aligns with corporate sustainability goals. By reducing paper usage and minimizing printing, organizations contribute to environmental conservation efforts and reduce their carbon footprint. Digital forms also eliminate the need for physical storage space for paper documents, promoting a paperless office environment and supporting eco-friendly business practices.

9. Scalability and Flexibility

Digital purchase requisition forms are scalable to accommodate business growth and evolving procurement needs. Whether handling a few requisitions per month or hundreds, the digital system can scale effortlessly to meet demand. Customizable templates and workflows allow organizations to adapt forms and approval processes to specific departments, projects, or purchasing categories, ensuring flexibility and alignment with organizational goals.

10. Continuous Improvement and Analytics

Digital purchase requisition forms provide valuable analytics and insights into procurement performance metrics. Organizations can analyze requisition data, track spending patterns, identify cost-saving opportunities, and optimize procurement processes based on actionable insights. This data-driven approach enables continuous improvement in procurement practices, fostering efficiency, and supporting strategic decision-making.

youtube

In conclusion, adopting a digital purchase requisition form offers numerous benefits that streamline procurement processes, enhance accuracy, improve transparency, and support organizational growth. By leveraging technology to automate workflows, businesses can achieve operational excellence, reduce costs, and position themselves for success in an increasingly competitive marketplace. Embracing digital transformation in procurement not only enhances efficiency but also drives innovation and supports sustainable business practices.

SITES WE SUPPORT

Process Requisition - Wix

SOCIAL LINKS

Facebook

Twitter

LinkedIn

0 notes

Text

Boost Efficiency in Healthcare facilities with EMAR Software

Enhance the operational efficiency of healthcare facilities with Electronic Medication Administration Record (EMAR) software, a robust solution designed to streamline medication management and improve patient care. EMAR software digitizes the traditionally paper-based process of administering medications, offering numerous benefits:

Accuracy and Safety: Reduce medication errors significantly by automating the recording and administration of medications. EMAR software ensures that the right patient receives the right medication in the correct dosage and at the appropriate time.

Time Efficiency: Streamline workflow for healthcare providers by automating routine tasks such as medication scheduling, administration documentation, and alerts for missed doses or potential interactions. This allows caregivers to spend more time directly with patients.

Compliance and Accountability: Maintain comprehensive, real-time records that enhance compliance with regulatory requirements and best practices. EMAR software tracks every medication administration instance, providing a clear audit trail and improving accountability across the healthcare facility.

Integration and Data Accessibility: Integrate emar software with Electronic Health Records (EHR) systems to ensure seamless data flow and accessibility. This integration supports better clinical decision-making by providing holistic patient information at the point of care.

0 notes