#asset management company in dubai

Explore tagged Tumblr posts

Text

#logistics companies in dubai#asset management in dubai#asset management company in dubai#cargo services in dubai

0 notes

Text

Secure Computer Recycling and Data Destruction Solutions in Dubai

Recycle old computers and IT equipment with confidence through our secure recycling and data destruction services. Designed to prevent data breaches, our certified hard drive destruction service ensures sensitive data is removed before disposal. Promote sustainability and protect your business's information with our eco-friendly e-waste solutions in Dubai. Choose Recycle Emirates for safe and compliant computer recycling services. For more information visit: https://recycleemirates.com/

#recycling companies dubai#e waste recycling in dubai#computers recycling services dubai#electronics recycling dubai#certified data destruction dubai#hard drive destruction service#recycle old it equipment#it asset recovery services#e waste management dubai#data destruction company dubai

0 notes

Text

0 notes

Text

Navigating Excellence: Unveiling the Global Presence of Hedge and Sachs as a Premier Asset Management Company in Dubai and the UAE

In the ever-evolving landscape of global finance, effective asset management plays a pivotal role in optimizing returns and managing risks. One company that stands out in this arena is Hedge and Sachs, a leading Global Asset Management Company headquartered in Dubai. With a commitment to excellence, a diverse portfolio, and a strong presence in the United Arab Emirates (UAE), Hedge and Sachs has earned its reputation as a top-tier Asset Manager. In this article, we will explore the key aspects that make Hedge and Sachs a standout player, delve into the nuances of being an Asset Manager, and examine the landscape of the top Asset Management Companies in Dubai and the UAE.

Global Asset Management Expertise

Hedge and Sachs has positioned itself as a formidable player in the global asset management landscape. The company's expertise lies in its ability to navigate the complexities of financial markets worldwide, offering tailored solutions to a diverse clientele. From high-net-worth individuals to institutional investors, Hedge and Sachs caters to a broad spectrum of clients, providing them with sophisticated strategies to grow and preserve their wealth.

The Role of an Asset Manager

An Asset Manager is a financial professional or firm responsible for managing investments on behalf of clients. The primary goal is to maximize returns while minimizing risk, aligning investment strategies with the financial objectives of the client. Asset Managers like Hedge and Sachs play a crucial role in portfolio management, employing a range of investment vehicles such as stocks, bonds, real estate, and alternative investments to achieve optimal results.

Hedge and Sachs' Approach to Asset Management

Hedge and Sachs distinguishes itself through its client-centric approach to asset management. The company begins by understanding the unique financial goals, risk tolerance, and investment preferences of each client. Armed with this information, Hedge and Sachs crafts personalized investment strategies that align with the client's objectives. The company's commitment to transparency and communication ensures that clients are well-informed about their investments and the market conditions impacting their portfolios.

Top Asset Management Companies in Dubai and the UAE

Dubai and the UAE have emerged as global financial hubs, attracting investors and financial institutions from around the world. As the demand for sophisticated asset management services grows, several companies have risen to prominence. Hedge and Sachs proudly stands among the top Asset Management Companies in Dubai and the UAE, offering a combination of global expertise and local insights.

The competitive landscape of asset management in the region is characterized by companies with diverse strengths and specialties. While some firms excel in real estate investment, others may focus on private equity or Islamic finance. Hedge and Sachs, with its comprehensive approach, has positioned itself as a one-stop solution for a wide array of investment needs.

Challenges and Opportunities in Asset Management

Navigating the asset management industry comes with its set of challenges and opportunities. Volatility in financial markets, regulatory changes, and global economic shifts are just a few of the hurdles that Asset Managers must address. However, these challenges also present opportunities for innovation and strategic adaptation. Hedge and Sachs, with its dynamic approach, has successfully weathered various market conditions, showcasing resilience and foresight in an ever-changing financial landscape.

The Impact of Technology on Asset Management

In the digital age, technology plays a pivotal role in shaping the asset management industry. Automation, data analytics, and artificial intelligence have become integral tools for Asset Managers, enabling them to make informed decisions and optimize portfolio performance. Hedge and Sachs embraces cutting-edge technology, leveraging data-driven insights to enhance the precision and efficiency of its asset management strategies.

Conclusion

In conclusion, Hedge and Sachs stands tall as a Global Asset Management Company with a distinctive approach to wealth management. Its commitment to client-centric solutions, coupled with a global perspective and a strong presence in Dubai and the UAE, positions it among the top Asset Management Companies in the region. As the financial landscape continues to evolve, Hedge and Sachs remains at the forefront, navigating challenges, harnessing opportunities, and delivering excellence in asset management. Investors seeking a trusted partner for their financial journey need look no further than Hedge and Sachs for a truly global and comprehensive asset management experience.

0 notes

Text

stock counting solutions inventory counting services near me Gold inventory count asset tagging services in dubai best stock counting company in dubai inventory management services warehouse stock counting stock audit services in dubai pharmacy stocktaking services professional stock taking service healthcare stock counting

#stock counting solutions#inventory counting services near me#Gold inventory count#asset tagging services in dubai#best stock counting company in dubai#inventory management services#warehouse stock counting#stock audit services in dubai#pharmacy stocktaking services#professional stock taking service#healthcare stock counting

0 notes

Text

Hedge And Sachs is an investment and asset management company offering global financial services to people and institutions.

#asset management company#global asset management company#asset manager#top asset management companies in dubai

0 notes

Text

#FINANCIALBRANCH. Money makes the world go round, and the same saying was true for Spectre, and its' successor, Quantum. The finance branch was born the same day as Spectre itself, along with other ever-present branches like Counter-Intelligence and Tactical Operations [ known as Soldiery until the 70s ]. Despite those antique roots, the financial branch evolved constantly to remain at the vanguard of their trade, often being ahead of the competition.

The branch's primary reason to be was to manage Spectre's financial assets and keep those well invested, as well as making sure those funds were ready for use. As time passed it evolved to offering similar financial services for organizations that were, for one reason or another, restricted from accessing legitimate banking systems. Any organization was welcome to their services, as long as they could find it and afford it.

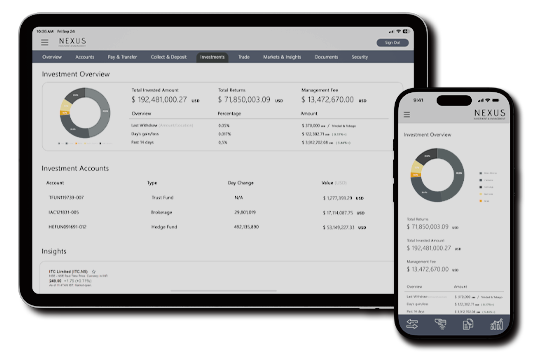

Like all other branches, the Finance Branch operates behind the mask of multiple other front companies, all in order to hide the true name and nature of their organization. There are five major companies that act as pillars to the branch: Nexus Investment & Management, Suisse de L'Industrie, Eisenband, CX Worldwide and Qoya Capital. All of those fronts operate in legal means, providing clean profit and a way to clean their own illegal funds.

The branch holds headquarters in 29 countries [ Monaco, New York, Dubai, London and Tokyo being the biggest ones ], servers in 9 countries and it operates in all 253 territories [ 193 U.N recognized countries, 55 dependent territories and 4 territories with ongoing struggles ] with only Antarctica being uncovered.

The current triad in control of the Financial Branch is composed by Le Chiffre [ Alias, real name Marcel Renè Venier-Couvillon, operating as Jacquin Allard and other 12 identities ], Beatrice Trauschke and Cissonius [ Alias, real name Daniel Wright, operating as Henry Thompson and other 5 identities ]. This is the team responsible for overseeing all the activities, legal and otherwise, under the umbrella of the Financial branch, and are the arbitrators behind every dispute regarding the path of the branch, furthermore, they each oversee one of the subsidiaries controlled by the branch, respectively Nexus, La Banque Suisse de L'Industrie and Eisenband Capital.

Nexus in an asset management company, with its expertise laid in private banking, brokerage, consultation and management of wealth for both individuals and companies. La Banque Suisse de L'Industrie is a multinational bank with focus in providing international banking services and financial support lines for companies and organizations. Eisenband Capital is a capital market group, specialized in locating and funding or acquiring companies that are branded as promising in their respective areas.

All those companies serve the true purpose of acting as the backbone of Quantum, controlling the entirety of the Group's financial transactions, investments, liquid assets and casinos.

The front companies have plenty legitimate clients, being well known companies in the international economic landscape, and their public services can be hired as any other bank, however that process is more complex when regarding their backdoor business. For an organization or individual to be able to utilize Quantum's international banking services they must be given referral by another organization that runs money through them or pass a screening process in person done by someone assigned by the Financial Branch [ this is the process that determines operational costs, liabilities, calculate management fee and open space for negotiation before drawing a contract ], as well as offer an initial amount of 50 millions USD or more. Management fee for illicit businesses vary between 3% and 12% of the total value, depending on region, risk, logistics and nature of business.

Those accounts must name a successor or benefactor for the managed assets in case of death of the account's responsible or the hiring organization's leadership. In case one of those stances happen, the successor musr claim ownership of the account within 90 days or the assets become permanent property of Quantum.

All of their financial services count on extensive infrastructure: offices in most major cities, digital applications and management tools, multiple payment methods, liquid assets transportation and storage services, and dedicated managers to larger accounts. For clients who can't afford any form of visibility, alternative methods of access are offered, such as in-person services for added management fees or 1-to-1 kinds of cryptocurrency.

The financial branch is also responsible for any transactions, payments and debt collections that might be necessary to Quantum's operations. For the funding of their underbelly operations, the financial branch provides the other branches or the service providing organizations with payment options in cryptocurrency or unmarked gold bars, as those are untraceable. For payment of bounties or first-serve-first-come opportunities, to-the-bearer medallions are given and can be collected in any casino controlled by Quantum in the currency of choice. And finally, for collaborators who need to take a large amount of cash abroad, torn playing cards [ digitally marked for authentication ] can be traded for money or gold in any CX Worldwide agency.

Debt is collected after a 90 days tolerance period, during which no large transactions are allowed to the debtor's account, and in case of failure to provide payment, all assets are seized. If the amount within the accounts lack enough funds to cover the debt, Tactical Operations are contacted for direct interference and seizing of any found liquid asset. Attempts to interrupt the seizing are answered with significant force.

FOR FURTHER DETAILS, DOUBTS OR WANTED INFORMATION: ASK!

9 notes

·

View notes

Text

حمدان بن محمد يزور معرض "إكسباند نورث ستار 2024" الأكبر عالميا للشركات الناشئة والرقمية والاستثمارية

زار سمو الشيخ حمدان بن محمد بن راشد آل مكتوم، ولي عهد دبي نائب رئيس مجلس الوزراء وزير الدفاع، رئيس المجلس التنفيذي لإمارة دبي، اليوم الأحد، معرض "إكسباند نورث ستار 2024 "، الحدث الأكبر من نوعه عالمياً للشركات الناشئة والمستثمرين في العالم والذي ينظمه مركز دبي التجاري العالمي وتستضيفه غرفة دبي للاقتصاد الرقمي، إحدى الغرف الثلاث العاملة تحت مظلة غرف دبي، خلال الفترة من 13 إلى 16 أكتوبر في "دبي هاربر".

سمو الشيخ حمدان بن محمد : زرت اليوم فعاليات معرض "إكسباند نورث ستار 2024"، الحدث الأكبر من نوعه عالمياً للشركات الناشئة والمستثمرين في العالم، والذي ينظمه مركز دبي التجاري العالمي وتستضيفه غرفة دبي للاقتصاد الرقمي، وتستمر فعالياته التي تنعقد بالتزامن مع معرض جايتكس العالمي حتى 16 أكتوبر … يجمع الحدث 70 ألف من المتخصصين وقيادات الأعمال وصناع القرار وشركات ناشئة من أكثر من 100 دولة وأهم 400 شركة في مجال الذكاء الاصطناعي إلى جانب أكثر من 1200 مستثمر يديرون أصولاً تتجاوز التريليون دولار… نرحب بضيوف دبي … وجهة الحاضر والمستقبل وعاصمة الاقتصاد الرقمي العالمية.

______________

His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai, Deputy Prime Minister and Minister of Defence of the UAE, and Chairman of The Executive Council of Dubai, today visited the Expand North Star 2024 exhibition, the world’s largest super connector event for startups and investors. Organised by the Dubai World Trade Centre and hosted by the Dubai Chamber of Digital Economy, the exhibition is being held from 13 to 16 October at Dubai Harbour.

H.H. Sheikh Hamdan bin Mohammed : Today, I toured the Expand North Star 2024 exhibition, the world’s largest gathering of startups and investors, organised by the Dubai World Trade Centre and hosted by the Dubai Chamber of Digital Economy from 13 to 16 October at Dubai Harbour. The unique event has attracted 70,000 specialists, business leaders, decision-makers, and startups from over 100 countries, as well as 400 leading AI companies and over 1,200 investors managing assets exceeding a trillion dollars. We welcome all participants to Dubai, a city that serves as a gateway to the future and a major global hub for the digital economy.

Sunday, 13 October 2024 الأحد

4 notes

·

View notes

Text

How PRO Services Simplify Business Setup in UAE

When you're venturing into the world of business setup in the UAE, especially within the bustling free zones of Dubai, you might find the process a bit overwhelming. This is where pro services come to the rescue. In this post, we'll explore how these services can streamline your business setup, making the process smoother and more efficient.

Pro services, or Public Relations Officer services, are specialized support services offered to businesses to handle governmental paperwork and legal documentation.

These services are invaluable when setting up a business in the UAE, where navigating the complex bureaucracy can be challenging. Pro services cover everything from visa applications to company registration, ensuring that all your paperwork is in order and compliant with UAE laws.

Benefits of PRO Services

Using pro services for your business setup in the UAE offers numerous benefits.

Firstly, they save you a significant amount of time. Handling paperwork and legal requirements can be time-consuming, but with a pro service, these tasks are managed efficiently, allowing you to focus on other critical aspects of your business.

Secondly, services ensure compliance with local regulations, minimizing the risk of errors that could lead to delays or legal issues.

Thirdly, they provide expert guidance, as PROs are well-versed in the latest regulations and procedures, ensuring your business setup process is seamless. Finally, utilizing pro services can also save you money in the long run by avoiding fines and penalties due to non-compliance.

Key Services Offered

Pro services encompass a wide range of offerings that are crucial for business setup in the UAE. These include visa processing for employees and dependents, business license applications, document attestation, and renewal of permits.

Additionally, Pro services handle immigration formalities, ensuring that all your staff and their families have the necessary visas and residency permits. They also assist with labor contracts and work permits, ensuring compliance with UAE labor laws.

For businesses setting up in free zones, pro services can help navigate the specific regulations and requirements unique to each free zone, making the process less daunting.

How to Choose the Right Service Provider

Choosing the right pro service provider is essential for a smooth business setup experience in the UAE.

Start by looking for providers with a strong track record and positive client testimonials. Experience matters, so choose a provider who has been in the industry for several years and has a deep understanding of UAE laws and regulations.

Additionally, ensure the provider offers comprehensive services that cover all your business needs, from visa processing to company registration. It's also important to consider the provider's customer service; they should be responsive and willing to answer any questions you may have throughout the process. Lastly, transparency is key. The provider should be upfront about their fees and the services included, so there are no surprises down the line.

In the bustling landscape of business setup in the UAE, particularly within the dynamic free zones of Dubai, Pro services stand out as an invaluable asset. They streamline the setup process, handle all the paperwork, and ensure compliance with local regulations, allowing you to focus on growing your business.

By choosing the right pro service provider, you can navigate the complexities of the UAE's business environment with ease and confidence. So, as you embark on your entrepreneurial journey in the UAE, consider leveraging pro services to simplify your business setup and set a strong foundation for success.

#PROservices#BusinessSetup#UAEBusiness#FreezoneBusinessSetupDubai#VisaProcessing#CompanyRegistration#DocumentAttestation#ImmigrationFormalities#UAElaborLaws#BusinessLicense#ResidencyPermits#FamilySponsorship#BusinessSetupServices#UAEPROservices#DubaiBusiness#EntrepreneurVisa#LegalCompliance#BusinessConsultancy#PublicRelationsOfficer#UAEentrepreneurship

5 notes

·

View notes

Text

Overview of WL COMPANY DMCC financial marketplace

The company we want to talk about today is called WL COMPANY DMCC. WL Company DMCC (License Number DMCC-89711, Registration Number DMCC19716, Account Number 411911), registered in Dubai, UAE whose registered office is Unit No BA95, DMCC Business Centre, Level No 1, represented by the Director, Stephanie Sandilands.

DMCC is the largest free trade zone in the United Arab Emirates, which is located in Dubai. It was established in 2002 and now serves as a commodity exchange that operates in four sectors: precious goods; energy; steel and metals; agricultural products.

Main services and activities

WL COMPANY DMCC is a financial marketplace, the direction of which is financial services, consulting, management, analysis of services, provision of services by third parties to the end user. The list also includes:

• Investment ideas;

• Active product trading;

• Analytical support for traders;

• Selection of an investment strategy in the market using various assets.

WL COMPANY DMCC operates on the MetaTrader 5 trading platform. There is a convenient registration, detailed instructions, as well as the ability to connect a demo account for self-study.

Among the main services:

1. Trading.

2. Social Services.

3.ESG Investment.

4. Analytics.

5. Wealth management.

Company managers will help with registration, with opening an account, with access to the platform. After training (if required), you can make a minimum deposit of 500 USD and start trading.

Main advantages and disadvantages of WL COMPANY DMCC

Before going directly to the benefits of the marketplace, it is worth saying a few words about the loyalty program. Depending on the amount of investment, the user receives one of three grades. Each of them gives certain privileges. The program itself makes it possible to get the maximum effect from investments in a short time.

Now about the benefits of WL COMPANY DMCC:

1. Availability of a license in the jurisdiction of the DMCC trading zone.

2. No commission when making SFD transactions on shares.

3. More than 6700 trading instruments.

4. High professional level of support.

5. Very strong analytical support (client confidence level 87%).

6. Weekly comments and summaries from WL COMPANY experts.

7. Modern analysis software.

8. Large selection of investment solutions.

9. Own exclusive market analysis services in various areas.

10. Own analytical department with the publication of materials in the public domain.

11. Modern focus on social services.

The feedback from WL COMPANY DMCC clients highlights the positive characteristics of the work of marketplace analysts, the convenience of a personal account, the speed of processing positions, analysis tools, and low commissions.

Negative reviews relate to the freezing of the system, delays in withdrawing funds for a day, and the small age of the company. Also, for some users, the application for withdrawal of funds was not processed the first time, and someone could not instantly replenish the deposit. North American traders complain that WL COMPANY DMCC only has a presence in Dubai.

At the same time, the financial group received several significant awards:

• Best MetaTrader 5 Broker 2022

• The Most Reliable Fintech Service 2023

Outcome

According to the information received, it can be concluded that WL COMPANY DMCC can be called a good financial marketplace in the modern market. By registering with the DMCC, the company can be called reliable and trustworthy. There are also negative reviews, but they relate mainly to the technical component.

For August, 2023 WL COMPANY DMCC has about 12000 clients worldwide. The main regions are North America, Europe and the Commonwealth of Independent States. Traders can act independently or use the advice of marketplace experts.

8 notes

·

View notes

Text

Business setup in Dubai

Business setup in Dubai refers to the process of establishing a business entity within the city of Dubai, which is one of the seven emirates of the United Arab Emirates (UAE). Dubai is a thriving business hub known for its strategic location, robust infrastructure, and business-friendly environment. Here is a detailed explanation of business setup in Dubai:

Mainland Business Setup: Mainland business setup allows businesses to operate within the local market of Dubai and the UAE. It requires partnering with a local Emirati sponsor or a local service agent, depending on the nature of the business activity. The sponsor holds a minority share (typically 51%) in the company, while the majority share can be owned by foreign investors.

Free Zone Business Setup: Free zones in Dubai are designated areas that offer attractive incentives and benefits to businesses. These include 100% foreign ownership, tax exemptions, full repatriation of profits, and simplified procedures. Each free zone in Dubai caters to specific industries or sectors, such as Dubai Multi Commodities Centre (DMCC) for commodities trading, Dubai Internet City (DIC) for technology companies, and Dubai Media City (DMC) for media and advertising companies.

Offshore Business Setup: Dubai also offers offshore company formation through jurisdictions such as JAFZA Offshore and RAK Offshore. Offshore companies are not allowed to operate within the UAE market but are ideal for international business activities, asset holding, or as a vehicle for investment and wealth management. They provide privacy, tax advantages, and ease of administration.

Legal Structures: Dubai offers various legal structures for business setup, including Limited Liability Company (LLC), Sole Proprietorship, Partnership, Branch of a Foreign Company, and more. The choice of legal structure depends on factors such as ownership requirements, liability considerations, and business objectives.

Licensing and Permits: Business setup in Dubai requires obtaining the necessary licenses and permits from the relevant authorities. This includes trade licenses, professional licenses, industrial licenses, and specialized permits based on the nature of the business activity. The requirements vary depending on the type of business and the jurisdiction in which it is established.

Office Space and Infrastructure: Businesses in Dubai need to secure suitable office space or facilities to operate. This can be done through leasing commercial spaces, utilizing shared office spaces, or renting virtual offices. Dubai offers state-of-the-art infrastructure, modern office buildings, and world-class amenities to support business operations.

Visa and Immigration Services: Business setup in Dubai includes visa and immigration services for company owners, employees, and their dependents. This involves obtaining residence permits, work permits, investor visas, and other necessary documents from the Dubai Department of Economic Development (DED) and the General Directorate of Residency and Foreigners Affairs (GDRFA).

Compliance and Regulations: Businesses in Dubai must comply with local regulations, including financial reporting, tax obligations, labor laws, and industry-specific regulations. Compliance requirements vary based on the legal structure and the nature of the business activity. It is important to stay updated with the regulations and engage professional advisors to ensure ongoing compliance.

Dubai offers numerous advantages for businesses, including a strategic location that serves as a gateway to the Middle East, Africa, and Asia, a robust infrastructure, a diverse and multicultural workforce, political stability, and a supportive business ecosystem. However, navigating the business setup process in Dubai can be complex, and it is advisable to seek the assistance of experienced business setup consultants who can guide you through the legal requirements, procedures, and best practices to ensure a successful and compliant business establishment.

#business#business services#business setup#business setup company in dubai#business setup consultants in dubai#business setup in uae#business setup services in dubai#businessinuae#businesssetup#businesssetupdubai

8 notes

·

View notes

Text

Transparent Internal and External Audit Solutions in Dubai with Goviin Bookkeeping

Auditing stands as a cornerstone for the seamless operation of businesses, and at Goviin Bookkeeping, we recognize its paramount importance. Our consultancy team specializes in delivering top-tier Internal and External Audit Services tailored to provide comprehensive insights into your company's financial health.

Internal Audit Service:

Our internal audit services are conducted by seasoned professionals committed to delving deep into your company's operations. We address significant issues, ensure compliance with UAE laws and regulations, and mitigate the risk of fraud. Key benefits include:

Ensuring adherence to relevant laws and regulations in the UAE.

Offering an objective assessment of risks.

Providing insights into organizational policies, procedures, and culture.

Enhancing the control environment.

Preventing hefty fines due to non-compliance.

Improving operational efficiency.

Identifying and safeguarding against potential risks to assets.

External Audit Service:

Our external audit service involves a meticulous analysis of financial statements and records by independent chartered accountants. This process delivers detailed financial information vital for investors, stakeholders, and management. Key advantages encompass:

Providing a comprehensive business report.

Boosting investor confidence and attracting more investments.

Ensuring compliance with jurisdictional requirements.

Gaining insights to prepare the business for the future.

Offering fresh perspectives on business management.

Enhancing the credibility of the business.

Delivering unbiased analysis and opinions from a third-party perspective.

With Goviin Bookkeeping's auditing services, you can be confident that your company's financial affairs are meticulously examined, ensuring compliance, transparency, and credibility

#GoviinBookkeeping#TransparencyWins#FinancialGovernance#AuditExcellence#ComplianceMatters#DubaiBusiness#FinancialIntegrity#ExpertAuditors#AuditProfessionals

3 notes

·

View notes

Text

Bracing for US sanctions, Russian financier in Budapest was busy securing personal offshore assets, leaked documents reveal

Bracing for US sanctions, the Budapest-based, Russian-led International Investment Bank’s (IIB) former head planned to move his offshore assets from tax havens in the British Isles to Dubai.

Until April 12, 2023, it looked as though Nikolay Kosov, former chairman of the Russian-dominated International Investment Bank (IIB) in Budapest, had avoided the fate of many other influential and wealthy Russians—i.e. getting sanctioned by the United States. However, he knew that his situation could change at any time and so, late last year, took steps to ensure that he did not lose his accumulated wealth of some £14 million, or almost €16 million.

According to internal bank documents obtained by , Kosov and his family planned to move their assets, held in tax havens in the British Isles, to Dubai in the United Arab Emirates. He and his wife had been corresponding with an investment adviser in Dubai and an accountant in Jersey who had been handling their offshore company affairs for decades. This all happened as Kosov’s workplace, IIB, was already in a critical financial situation and trying to fight bankruptcy.

Since then, events around the bank have accelerated. On April 12, not only Kosov himself but also IIB were placed on a US Treasury sanctions list. The next day, the last European ally of the Russian financial institution, Hungary, announced to quit the bank. Subsequently, IIB decided to leave Hungary and move its headquarters back to Moscow.

The bank has been in a constant state of crisis since Russia’s attack on Ukraine last year, managing both to become undesirable in the West and to some clear support from the Russian state. In this situation, the Hungarian government remained one of the last supporters of the Budapest-based financial institution. ( has previously published a detailed article on this based on hundreds of IIB’s leaked internal documents).

Among these documents were emails and attachments that shed insight into the private assets of Nikolay Kosov and his family. They also show that, during this turbulent period, Kosov lost his job as head of IIB, as he was not re-elected as acting chairman, and that the IIB tried to hide this information from the public.

Kosov may have been using offshore companies since the 1990s. There is evidence of this from years ago: in the offshore leak known as the Panama Papers, found dozens of documents featuring correspondence between Kosov’s family and their accountant. These documents revealed that, around 2015, the family had at least six offshore companies operating, all founded in the 2000s. Through these offshore companies, the Kosovs owned properties, mainly in London. The Jersey accountant whose name appears in the Panama Papers is the same one who helped the Kosovs late last year.

The plans to move the assets to Dubai are probably linked to the change of geopolitical situation due to the war. Andrea Binder, a German political scientist who studies offshore business, told that Dubai is still doing business with Russian investors who have been excluded from some of the world’s other major financial centers. Moreover, Dubai also offers a safe haven from Western sanctions.

Nikolay Kosov is a prominent member of the Russian financial elite, having served on the boards of several banks, a career path that his son Pavelfollowed. The family also has a KGB background: Nikolay Kosov’s parents were members of the top elite of Russian intelligence. His father, for example, was a KGB liaison in Budapest in the 1970s. Because of this, Kosov spent his youth in Hungary before returning to Budapest in 2019 as IIB’s chairman of the management board.

Before publishing this article, we have sent requests for comment to the IIB, Hungary’s foreign ministry, Nikolay Kosov and Natalya Kosova, the Kosovs’ Jersey accountant, as well as their Dubai-based financial advisors, but none of them replied.

14 million pounds sterling

On 15 December 2022, IIB’s management and Nikolay Kosov, whose term as chairman of the IIB had expired, received really bad news: the director-general of the Belgian Treasury informed them that the funds they had frozen would not be released. He justified this by saying that several members of the IIB’s governing bodies were linked to the Russian government, specifically mentioning the Russian deputy finance minister, who is a member of the bank’s board of governors.

The devastating effects of the decision were detailed in an internal briefing for the bank’s management. It said that, in 2022, the IIB had used up almost all its liquidity reserves, so that if it did not have access to funds, the bank would face insolvency or would have to restructure bonds in May 2023. According to the document, the bank was facing a cash shortage so severe that it could not make up for it even by selling the loan portfolio. In the days that followed, bank staff corresponded about what could be done about the situation, including the possibility that the bank would have to leave the EU.

But Nikolay Kosov’s attention was on something else: he was taking steps, with the help of his wife, to move his private assets to Dubai.

This is shown indocuments that are among the internal IIB files originating from a 2023 February leak. Among the hundreds of emails and other documents, mainly about the bank’s internal affairs, there are some that do not concern the bank’s business, but rather Nikolay Kosov and his family. The reason for this is presumably that Kosov also used his work email address for this purpose, and his wife at least forwarded a number of private correspondence to it.

The wife, Natalya Kosova, was, íon December 6, already in touch with an investment adviser named Anton Ionov, who was working in the United Arab Emirates and with whom the Kosovs were about to sign a contract. Kosova also sent a draft of this contract to her Swiss lawyer and her Jersey accountant, Jackie Ollerenshaw. The latter made a few comments on the draft, one of which reveals that the family may have owned two Jersey-based trusts and a company registered in the British Virgin Islands.

Other leaked documents suggest that the Kosovs were planning to transfer some or all of their assets to the United Arab Emirates. In a document dated December 27, Kosov declares that his assets were legally acquired and that he qualifies as a so-called politically exposed person (PEP), also reveals that such a declaration was necessary to set up a Dubai-based foundation called the Froxa Foundation. The text says that the capital of the foundation, which will be registered with the Dubai International Financial Centre (DIFC), will be paid in by Kosov.

Another document, which the file name suggests is dated December 14, 2022, also sheds light on how much money could be involved. This document is a so-called KYC, or “Know Your Client” form, which is designed to help financial service providers find out about their clients’ financial backgrounds to make sure their assets come from clean sources. The form, which is among the leaked documents, says that Natalya Kosova will be the prospective beneficial owner. The scanned, hand-filled document shows that Kosova is a Russian citizen, but also a Swiss resident and has a Swiss tax number. Handwritten notes on the paper also say that the “total asset value [is] approx[imately] £14 million” (almost €16 million). The source of the assets is described as “from existing trust structure in Jersey” and “c.v. of husband enclosed.”

The Dubai-based wealth management firm mentioned in several documents is M/HQ, which, among other things, provides wealth management services for wealthy families and specifically recommends the creation of trusts to manage family assets smoothly, to control inheritance, and to provide asset protection against “creditors, hostile takeovers.”

It is unclear whether the process has come to an end or is still ongoing, but at the time of publishing, there is no record of the Froxa Foundation or any entities in the name of Kosov or his family members in the Dubai company registers.

Unlike the big Western financial centers and Hong Kong or Singapore, Dubai has not yet stopped doing business with the Russians, so it is logical that money from Russian big investors flows there, Andrea Binder, a Berlin-based political scientist and researcher who has studied the offshore world, among other things, told On the other hand, Kosov could have expected to be subject to sanctions himself sooner or later. As both the British Virgin Islands and Jersey belong to the British Crown, they are not independent of its jurisdiction, Binder explained, adding that Dubai is, so the West’s hand does not reach there as easily.

From earlier investigations, we know that Kosov is no stranger to international investment and has been involved in offshore companies for decades. The huge internal dossier known as the Panama Papers, leaked from the law firm Mossack Fonseca, which set up and ran offshore companies, contains numerous references to Nikolay Kosov. These documents date back to 2015. Some of them contain internal correspondence, and include the name of the same accountant—Jackie Ollerenshaw—who was also one of the Kosovs’s correspondents last December in the leaked IIB documents.

Those older documents from the Panama Papers show, among other things, that in 2015 Kosov had six offshore interests, all registered in the 2000s in the British tax haven of the British Virgin Islands. https://offshoreleaks.icij.org/nodes/13001383 An email from Jackie Ollerenshaw from that time also shows that the offshore companies owned mainly London properties, one of them being used by the “client family” themselves. Others were occupied by tenants.

And in a 2014 email, the accountant mentioned that financial services firms in Jersey— another tax haven—had been handling Kosov’s offshore affairs since 1994. “At all times we have been happy with the information held for him and at no time have any regulatory issues been raised. He has always had the highest respect from service providers here,” wrote Ollerenshaw.

The exact origin of the Kosov family’s wealth, beyond the fact that senior bank executives are usually well paid, is unclear, but it has been previously revealed that they are indeed wealthy. A tabloid scandal in 2007, for example, gave an insight into this. Nikolay Kosov’s son Pavel was getting married at the time, and performers of his Moscow wedding included Mariah Carey (who has sung at multiple private events for Russian oligarchs) and Hollywood actor Mickey Rourke. However, Rourke drank too much vodka, became aggressive and was thrown out of the wedding party, according to media reports.

Kosov didn’t leave at his own will

At the end of last year, Nikolay Kosov had the headache not only of relocating his offshore assets, but also of losing his senior position at IIB. His mandate as bank chairman expired on September 17, 2022 and, according to the bank’s official website, no one has taken his place since then. The IIB has not made any public announcement about Kosov’s departure or his successor.

News of Kosov’s disappearance from IIB reached last year, when we asked the bank when and for what reason Kosov left the bank’s leadership. “In accordance with the Statutory Documents of IIB the term of the mandate of the Chairperson of the Management Board ended on September 17, 2022. Appointment of a new Chairperson lies within the responsibilities of the Board of Governors. The Bank shall await a decision on that matter. Until then responsibilities inside IIB are divided between existing members of the Management Board,” the bank wrote in response to our request at the time.

The leaked documents show that there were attempts by IIB’s management to keep Kosov as head of the bank, but these were unsuccessful. Indeed, at last year’s IIB board of governors meeting, Kosov, whose mandate starting in 2012 had expired, was to be re-elected as acting chairman for another two years. However, the proposal was defeated by opposition from Bulgaria, the Czech Republic, Romania and Slovakia, which announced their withdrawal from the bank because of the war in Ukraine.

According to a December 2022 document—minutes of a meeting of the board of governors—Russia, Hungary, Cuba, Mongolia and Vietnam voted in favor of Kosov’s re-election, while the four countries that left voted against it. Although this still gave Kosov 68.5 percent of the vote, the bank’s rules required a three-quarters qualified majority. Kosov’s unsuccessful re-election follows a letter last September in which Romania formally indicated that it did not want a Russian president at the helm of the bank. “That statement by Romania is racist. They […] are against anyone who has a Russian nationality. I find it utterly disgusting, and unfortunately not surprising,” IIB’s chief financial officer Elliott Auckland commented on Romania’s position.

According to internal emails from September, bank staff then wondered whether they could hide the fact that there was no bank chairman, or if they had to make the news public. According to the correspondence, the bank was aware that this news would have a negative impact on the bank’s financial prospects. “We didn’t just change our CEO but failed to elect a new one,” a senior Russian IIB official wrote. “From the point of view of corporate governance it should be considered as a major event. However, I propose to avoid the announce of the event, if there is no direct obligations,” wrote another staff member.

“It looks horrible for us. If we don’t have to legally publish, I am against publishing. We will create a media storm most likely, and ratings will come under pressure at a sensitive time. Our task is to not draw attention to ourselves, and quietly manage our problems,” argued Elliott Auckland. One of the bank’s Hungarian managers agreed with him and urged others to remain silent. “If we announce, there will be noise around us again. It is not good for our rating discussion,” he wrote.

KGB family

According to the leaked files, a formal document was forwarded to Kosov from the bank on November 28, informing him of the cancellation of his powers as bank chairman. Kosov wrote that he needed this to remove himself and his wife from the list of diplomats accredited to Budapest. This list is maintained by the Hungarian Ministry of Foreign Affairs and Trade (MFA) and includes persons with full diplomatic immunity. These are the people who, under the Vienna Convention on Diplomatic Relations, enjoy a number of advantages when traveling, shopping (tax exemption) and, most importantly, have immunity from investigations and criminal proceedings in the host country.

When the IIB’s headquarters relocated from Moscow to Hungary, the biggest controversy was caused by the fact that the Orbán government would have granted the institution and its staff extensive diplomatic immunity. The United States and other NATO allies feared that the IIB’s diplomatic immunity could have been used to allow Russia to deploy intelligence officers in Budapest. has previously revealed that the Orbán government, bowing to US pressure, eventually agreed to a compromise to limit the diplomatic privileges granted to the bank.

No concrete information has been published on the active relationship between the IIB and Russian intelligence, but the institution is often referred to as a “spy bank” in Hungarian and international media. Apart from the controversy surrounding diplomatic immunities, the main reason for this is the family background of Kosov himself: the former bank chairman’s parents were members of the Soviet Union’s intelligence elite and spied, among other places, in the United States. Kosov’s mother, Yelena Kosova, was officially the first female Soviet diplomat at the Soviet mission to the UN in New York—unofficially, she in fact helped steal US nuclear secrets.

Kosov’s father, Nikolay Kosov Sr., worked alongside her as a Soviet newspaper correspondent in New York, but he was in fact a spy too. Later, when the 1956 revolution was crushed, Kosov was part of a KGB task force sent to Hungary. KGB chief Ivan Serov directed agents to Budapest who, because of their previous Western contacts, could be involved in uncovering the alleged Western conspiracy behind the Hungarian revolution. Later, in the 1970s, Kosov Sr. became the KGB’s liaison officer in Budapest, so Kosov Jr. also spent his youth in Hungary.

Nikolay Kosov Jr. later became a diplomat himself in the 1980s at the Soviet Union’s embassy in London, where he worked—and became friends—with Andrey Kostin, who influenced him to switch to banking. As has previously reported, Kostin, a leading figure in the Russian financial elite, became chairman of Vneshekonombank and later VTB Bank (formerly Vneshtorgbank), while maintaining a close working relationship with the Kosov family. In 1998, for example, he took Nikolay Kosov as first vice-president of Vneshekonombank and then, as head of VTB, became the boss of Nikolay Kosov’s son, Pavel Kosov, who also became vice-president.

Pavel Kosov is not on any Western sanctions lists, but, as of October 2022, he is under sanctions by Ukraine’s National Security Council and its anti-corruption authority. Pavel Kosov is under sanctions because of his position as a state official—he is currently CEO of Russian state-owned agricultural lender Rosagroleasing. He was personally received and praised by Vladimir Putin in the Kremlin last June for the work of Rosagroleasing, including how they are helping to replace European imports.

Nikolay Kosov was exempt from Western sanctions until April 12, when the Treasury of the United States placed him on the sanctions list along with the IIB and two of its executives. This means that if the former bank chairman had any movable or real estate property in the US, he would no longer have access to it, nor would he be allowed to do business with US persons or entities.

Kosov was added to the US sanctions list despite the fact that he has not been officially a bank chairman since September last year. But it is not at all clear what his current role is, and internal emails show that he was still using his official bank email address at the end of last year.

Moreover, in the aforementioned document in which Kosov was asked to reply to the Dubai wealth adviser on whether he was a politically exposed person, he made contradictory statements about his own position. In one place, he referred to no longer holding a high position at the IIB, and in the next line he described himself as an active bank chairman.

In addition to Kosov, last Wednesday the IIB was separately placed on the US sanctions list. The decision was announced at a press conference by US Ambassador to Hungary David Pressman, who described the IIB as a tool for Moscow to increase its influence in Hungary and the region.

The day after the announcement, the Hungarian government announced that Hungary would also leave the bank—the last of the EU member states to do so. In response to this, the IIB announced on April 19 that it would leave Budapest and move its headquarters back to Russia, as its operations had become impossible.

2 notes

·

View notes

Text

Navigating Offshore Endeavours in Dubai

Introduction

On the other hand, we denounce with righteous indignation dislike men who are so beguiled demoralized by the charms of pleasure of the moment, so blinded by desire, that they cannot foresee the pain and trouble that are bound to ensue; and equal blame belongs to those who fail in their duty through weakness of will, which is the same as saying through shrinking from toil and pain. These cases are perfectly simple and easy to distinguish. In a free hour, when our power of choice is untrammelled and when nothing prevents our to do what we like best, every pleasure is to be welcomed and every pain avoided.

The Beacon of Professionalism

As entrepreneurs navigate the seas of offshore business, having a seasoned guide becomes paramount. Enter Professional Management Consultancy FZE, a stalwart in the industry. Specialising in the setup and management of offshore companies in Dubai, Professional Management Consultancy FZE brings a wealth of expertise and professionalism to the table. Their commitment to excellence is evident in the comprehensive range of services they offer, from initial company registration to ongoing compliance and strategic advisory.

The Allure of Offshore Companies

Offshore companies have emerged as a strategic choice for businesses worldwide, offering a host of advantages. From tax optimization and asset protection to streamlined business operations, the allure of setting up offshore has never been stronger. Dubai, with its business-friendly environment and robust legal framework, stands out as a premier destination for establishing offshore entities.

Unlocking the Benefits

Setting up an offshore company is not just about compliance; it's about unlocking a myriad of benefits. This section will delve into the advantages that businesses can enjoy, including tax optimization, enhanced privacy, and access to global markets. With Professional Management Consultancy FZE by your side, these benefits are not just theoretical but tangible advantages that contribute to the success of your offshore venture.

Dubai's Business Oasis

Dubai's appeal as a business destination extends beyond its iconic skyline. With a strategic location, world-class infrastructure, and a commitment to economic diversification, Dubai provides a fertile ground for businesses to flourish. The emirate's free zones, in particular, offer a haven for entrepreneurs, fostering innovation and growth. It's within this dynamic landscape that the concept of offshore companies finds its home.

The Professional Touch - Professional Management Consultancy FZE

Among the myriad of options available, Professional Management Consultancy FZE stands out as a beacon of professional expertise. Specializing in guiding businesses through the intricacies of setting up and managing offshore companies in Dubai, Professional Management Consultancy FZE brings a wealth of experience and a commitment to excellence to the table. Their services encompass everything from company registration to ongoing compliance, ensuring a smooth and hassle-free experience for entrepreneurs.

Navigating the Setup Process

Establishing an offshore company can be a daunting task, but with the right guidance, it becomes a seamless journey. In this section, we'll break down the setup process, exploring the steps involved and highlighting how Professional Management Consultancy FZE simplifies each stage. From documentation requirements to legal considerations, this segment aims to empower entrepreneurs with the knowledge needed to navigate the setup process confidently.

Conclusion

In the ever-evolving landscape of international business, Dubai's offshore companies shine as beacons of opportunity. As entrepreneurs seek to expand their horizons, the expertise of Professional Management Consultancy FZE becomes a valuable asset. Navigating the seas of offshore business has never been more accessible, and with the right partner, success becomes not just a destination but a journey. Explore the possibilities, unlock the potential, and set sail for a prosperous business venture in the heart of Dubai.

2 notes

·

View notes

Text

An international operation against a large-scale scheme for financial crimes, money laundering and violations of international sanctions against Russia is taking place in Sofia at the moment. According to BNT, it is the company NEXO.

The ownership of the company is related to a former member of parliament and the son of a former social minister from the NDSV political party.

The suspicions are that the Bulgarians behind the large company acted according to the scheme of Ruja Ignatova and the OneCoin pyramid led by her. The Bulgarian woman known as the "Queen of Cryptocurrencies" is in the top 10 most wanted persons by the FBI. Europol and Interpol are also on her trail.

Prosecutors, investigators from the National Investigation and SANS employees, together with foreign agents, have begun searches of the Bulgarian offices of the company that trades cryptocurrencies worldwide.

The company's operations were carried out from the Bulgarian capital, and depositors were invited to invest in bitcoins and other types of cryptocurrencies, with promises of high returns.

The interest rates that investors would receive were many times higher than those of classic banking institutions and various brokerage houses. There are reports that the owners of the company, who are Bulgarians, have appropriated part of the assets amounting to several billion dollars.

The investigation into the activities of the crypto company in Bulgaria began a few months ago, after foreign services detected suspicious transactions, which were reported to be aimed at circumventing the sanctions imposed by the European Union, Great Britain and the United States against Russian banks, as well as companies and citizens of the Russian Federation.

Georgi Shulev – representing Nexo, son of former Deputy Prime Minister Lidiya Shuleva;

Antoni Trenchev – co-founder and director of several Nexo companies, former MP from the DBG, Reform Bloc;

Kosta Kantchev – director of Nexo Bank;

Kalin Metodiev – co-founder and financial director of Nexo;

Sokol Yankov – representing Nexo;

The company, which Sokol Yankov currently manages, said that Yankov left Nexo in 2019 and has had nothing to do with the investigated group of companies since then.

Georgi Shulev's office stated to BNT that he participated in the founding of Nexo in 2018. A year later, however, he left the Nexo group of companies and is suing the co-founders in Great Britain.

According to the Bulgarian National Television, Georgi Shulev is currently being questioned as a witness.

The former MP from the Bulgarian political entity "Reform Bloc", Antoni Trenchev, and his partner in the cryptocurrency trading company Nexo, Kosta Kantchev, fled to Dubai already in the fall of last year, BNT reported. This came after allegations of particularly large-scale fraud were brought against Nexo by the prosecutors of eight US states.

Regulators in California, Kentucky, New York, Maryland, Oklahoma, South Carolina, Washington and Vermont have announced that they are suing crypto platform Nexo over tens of thousands of cases of fraud totaling at least 0 million.

Nexo claims to manage billion in digital assets.

In recent months, the FBI has been investigating the activities of the Bulgarian crypto platform due to data on a hidden hole in the amount of over 4 billion dollars from investors, due to illegal financial activity - granting loans in exchange for collateral, as well as due to reports of abuse of the securities and goods of its customers.

The DFPI announcement revealed that Nexo offered annual interest rates of up to 36% on deposited crypto-assets to investors, significantly higher than rates on short-term investment-grade fixed income securities or bank savings accounts.

More details about the police operation read here.

#nunyas news#I wonder how much of the global energy crisis#could be solved#by introducing a virus of some sort into all of the different#crypto curriencies#something simple like moving the decimal point in one#on the thermometer#so it reads 30 degrees instead of 300f

9 notes

·

View notes

Text

stock counting solutions inventory counting services near me Gold inventory count asset tagging services in dubai best stock counting company in dubai inventory management services warehouse stock counting stock audit services in dubai pharmacy stocktaking services professional stock taking service healthcare stock counting

#stock counting solutions#inventory counting services near me#Gold inventory count#asset tagging services in dubai#best stock counting company in dubai#inventory management services#warehouse stock counting#stock audit services in dubai#pharmacy stocktaking services#professional stock taking service#healthcare stock counting

0 notes