#asset based lending in Nevada

Explore tagged Tumblr posts

Text

Invoice Financing for Small Businesses in Nevada

Small business invoice funding helps turn receivables into working capital to handle immediate debt.

#accounts receivable#asset based lending in Nevada#invoice factoring companies#invoice financing for small business#receivables financing companies

0 notes

Text

Exploring the landscape of private lenders in Nevada

When traditional banks say no, Stop Mortgage Foreclosure connects you with trusted private lenders in Nevada who say yes—fast. Whether you're facing foreclosure, need a bridge loan, or seek cash-out refinancing, our private lending network provides quick, flexible funding when required.

Alternative Financing for Urgent Situations

Life doesn't wait for bank approvals. Our network of private lenders in Nevada focuses on asset-based, time-sensitive loans. We help homeowners, investors, and business owners secure funds without the red tape of conventional loans. Get approved in days—not weeks.

Who We Help

Our private lenders serve a wide range of borrowers, including:

Homeowners facing foreclosure or financial hardship

Real estate investors seeking quick closings

Self-employed or credit-challenged individuals

Borrowers needing bridge or hard money loans

Property owners looking to refinance fast

If you have equity, you have options—even if your credit isn't perfect.

What Makes Private Lending Different

Your property's worth is considered when granting a private loan, not merely your credit score. More flexibility and quicker approvals are made possible by this. Common loan types include:

Hard Money Loans

Bridge Loans

Cash-Out Refinance Loans

Fix-and-Flip Financing

Foreclosure Bailout Loans

We focus on speed, transparency, and creative lending solutions tailored to your unique situation.

Get Help Before It’s Too Late

At Stop Mortgage Foreclosure, we understand the urgency of financial pressure. That's why we make it easy to connect with experienced private lenders in Nevada who can fund your loan quickly and discreetly.

Apply Today – Fast Approved Take control of your financial future. Contact ustoday for a free consultation and fast loan pre-approval from private lenders specializing in solutions—not delays.

0 notes

Text

US-based cryptocurrency exchange giant Coinbase continues to push forward with its efforts to seek regulatory clarity for the crypto industry, claiming that the current enforcement approach by regulators stifles innovation and puts global leadership at risk. The company has launched a new campaign to mobilize over 50 million crypto holders in the United States to lend their voices in support of clear cryptocurrency laws. 52 Million American Crypto Owners According to recent Coinbase data, there are 52 million crypto owners in the United States, with 60% being either Gen Z or Millennials, 75% having an income below $100,000, and 41% from racial minorities, thereby showing a younger and more diverse group of people compared to the entire US population. Also, a poll conducted in the fall of 2022 revealed that 55% of voters in four key American states, Nevada, Ohio, Pennsylvania, and New Hampshire, are “less likely” to vote for candidates who do not support crypto and Web3. In addition, a previous survey revealed that 72% of Americans between 18 and 34 years old said cryptocurrency allowed for direct control of personal assets, while another 72% agreed that “digital assets are the future of finance.” Coinbase is looking to gather the current 52 million crypto owners into “a powerful force” as part of its campaign efforts for clear cryptocurrency regulations as the US gets ready for its 2024 elections. Part of Coinbase’s move toward its goal is the advancement of the Financial Innovation and Technology for the 21st Century Act (“FIT21”). The bill, expected to be voted on by the House floor this fall, proposes to increase the Commodity Futures Trading Commission’s (CFTC) regulatory oversight of the industry above the Securities and Exchange Commission (SEC). The SEC has faced criticisms for its regulatory-by-enforcement approach, with companies and stakeholders in the crypto sector accusing the regulator of acting beyond its regulatory powers. The crypto exchange giant is, meanwhile, asking crypto holders to call their congresspersons to seek an unambiguous and responsible regulatory framework. Stand with Crypto Day Coinbase announced the launch of an independent advocacy non-profit grassroots movement called Stand with Crypto Alliance in August 2023, aimed at advancing sensible crypto innovation and policy. The organization has seen support from over 100,000 people since its launch, with plans to involve 52 million crypto holders in the US. “Stand with Crypto’s goal is to mobilize one million people, but imagine what it would look like if we could mobilize even 10% of America’s 52M crypto owners into single-issue advocates – that would be a game changer in standing up to the status quo and advocating for policies that update our financial systems so it is more fair, more distributed, and more inclusive.” Stand with Crypto Alliance will carry out a robust 14-month campaign focusing on nine important states — California, Georgia, Arizona, Pennsylvania, Ohio, Wisconsin, Illinois, Nevada, and New Hampshire. The advocacy efforts already started with digital and outdoor advertisements in Washington, DC, which kicked off on Sept. 19. There will also be a Stand with Crypto Day featuring innovators, developers, and entrepreneurs flown into DC on Sept. 27 from around the country to meet with the Members of Congress and government officials to explain the benefits of crypto and how the current regulatory approach in the US is driving jobs and innovation out of the country. Source

0 notes

Text

Things To Do Immediately About Online Cash Loans

If you're excited about making a home enchancment or taking a look at methods to pay in your child's faculty education, you may be interested by tapping into your own home's equity as a solution to cover the costs. Essentially the most prudent technique is to discipline yourself to deposit all the sales tax cash you acquire every day right into a separate Small Cash Loans bank account. Also referred to as a recurring payment, this allows payday lenders to charge a fee to your debit or credit card based on how much they believe you owe, whether you are able to afford that fee or not. Payday lenders can sue you for fraud if you present them with a postdated examine that bounces.

Now, your small business has lost cash since you did not separate your personal and business funds. In the event you're considering a balloon business loan possibility, know this: that last cost might be very excessive. Instance for ($500 mortgage = test for $566) you pay them back on Fast Cash Payday Loans the day your mortgage is due and that's all. There are two kinds of loan available, and 12m loans offers in unsecured personal loans. The financial institution ought to inform you the vary of credit score scores required for mortgage approval. The students who've traditionally relied on federal student loans to pay for faculty are being joined, say financial assist specialists, by over a million further college students whose Usa Cash Loan families have previously been in a position to pay for college on their very own however are actually in want of federal monetary support.

Usda rural housing loan offers very low interest rates and zero down fee amenities to make it even more accessible to a lot of people. Mortgages can come with mounted, variable and adjustable rates of interest, and usually offer longer phrases of reimbursement than residence equity loans. Liquidating your assets to purchase a home with cash and Loan Cash delaying financing by taking out a mortgage after you buy is an fascinating strategy — however not one which's proper for everybody. Within the compensation procedure for these loans, lenders offer both flexible and stuck monthly repayments. You'll be charged fees for this course of and for the loan in general, so be careful when contemplating this option as it will possibly trigger a cycle of bad debt.

The modern industry was legitimated in 1995 , when ohio lawmakers granted payday lenders an exemption from the state's eight percent usury price-cap. Top-rated cash advance loans are imagined to provide you with fast credit score in an emergency; nevertheless, some lenders might still take days, or even weeks, to deposit your funds. If you wish to refinance however haven't got the money for the prices, it nonetheless could be worth it, however understand that you will pay back what you save in charges over the long run.

At publishing time, the citi double cash card is obtainable by way of product pages, and is compensated if our users apply and in the end join this card. Neglecting payments will have a giant effect on the cost sum and may easily double the payments in a short time. In september, the institutions introduced a $505 million refund to payday mortgage clients as a result of a Online Cash Loans suit towards amg providers, which ran multiple payday lending corporations, including 500fastcash, benefit cash companies, ameriloan, oneclickcash, star cash processing, unitedcashloans and usfastcash. For instance, these paper convenience checks” you get in the mail from your credit card institutions are really a Bad Credit Cash Loans mortgage. At verify metropolis we understand that monetary emergencies appear to happen on the worst doable occasions and that's the reason we have made the nevada payday loan application course of as easy as doable. Cashone shouldn't be a lender however a referral service to a lot of lenders.

1 note

·

View note

Text

The Great American Tax Haven: Why the Super-rich Love South Dakota

It’s known for being the home of Mount Rushmore – and not much else. But thanks to its relish for deregulation, the state is fast becoming the most profitable place for the mega-wealthy to park their billions.

— By Oliver Bullough | Thursday, 14 November 2019 | Guardian USA

Illustration: Guardian Design

Late last year, as the Chinese government prepared to enact tough new tax rules, the billionaire Sun Hongbin quietly transferred $4.5bn worth of shares in his Chinese real estate firm to a company on a street corner in Sioux Falls, South Dakota, one of the least populated and least known states in the US. Sioux Falls is a pleasant city of 180,000 people, situated where the Big Sioux River tumbles off a red granite cliff. It has some decent bars downtown, and a charming array of sculptures dotting the streets, but there doesn’t seem to be much to attract a Chinese multi-billionaire. It’s a town that even few Americans have been to.

The money of the world’s mega-wealthy, though, is heading there in ever-larger volumes. In the past decade, hundreds of billions of dollars have poured out of traditional offshore jurisdictions such as Switzerland and Jersey, and into a small number of American states: Delaware, Nevada, Wyoming – and, above all, South Dakota. “To some, South Dakota is a ‘fly-over’ state,” the chief justice of the state’s supreme court said in a speech to the legislature in January. “While many people may find a way to ‘fly over’ South Dakota, somehow their dollars find a way to land here.”

Super-rich people choose between jurisdictions in the same way that middle-class people choose between ISAs: they want the best security, the best income and the lowest costs. That is why so many super-rich people are choosing South Dakota, which has created the most potent force-field money can buy – a South Dakotan trust. If an ordinary person puts money in the bank, the government taxes what little interest it earns. Even if that money is protected from taxes by an ISA, you can still lose it through divorce or legal proceedings. A South Dakotan trust changes all that: it protects assets from claims from ex-spouses, disgruntled business partners, creditors, litigious clients and pretty much anyone else. It won’t protect you from criminal prosecution, but it does prevent information on your assets from leaking out in a way that might spark interest from the police. And it shields your wealth from the government, since South Dakota has no income tax, no inheritance tax and no capital gains tax.

A decade ago, South Dakotan trust companies held $57.3bn in assets. By the end of 2020, that total will have risen to $355.2bn. Those hundreds of billions of dollars are being regulated by a state with a population smaller than Norfolk, a part-time legislature heavily lobbied by trust lawyers, and an administration committed to welcoming as much of the world’s money as it can. US politicians like to boast that their country is the best place in the world to get rich, but South Dakota has become something else: the best place in the world to stay rich.

At the heart of South Dakota’s business success is a crucial but overlooked fact: globalisation is incomplete. In our modern financial system, money travels where its owners like, but laws are still made at a local level. So money inevitably flows to the places where governments offer the lowest taxes and the highest security. Anyone who can afford the legal fees to profit from this mismatch is able to keep wealth that the rest of us would lose, which helps to explain why – all over the world – the rich have become so much richer and the rest of us have not.

In recent years, countries outside the US have been cracking down on offshore wealth. But according to an official in a traditional tax haven, who has watched as wealth has fled that country’s coffers for the US, the protections offered by states such as South Dakota are undermining global attempts to control tax dodging, kleptocracy and money-laundering. “One of the core issues in fighting a guerrilla war is that if the guerrillas have a safe harbour, you can’t win,” the official told me. “Well, the US is giving financial criminals a safe harbour, and a really effective safe harbour – far more effective than anything they ever had in Jersey or the Bahamas or wherever.”

Those of us who cannot vote in South Dakota elections have little hope of changing its laws. But if we don’t do something to correct the imbalance between global wealth and local legislation, we risk entrenching today’s inequality and creating a new breed of global aristocrat, unaccountable to anyone and getting richer all the time – with grave consequences for the long-term health of liberal democracy.

South Dakota is west of Minnesota, east of Wyoming, and has a population of 880,000 people. Politically, its voters enthusiastically embrace the Republicans’ message of self-reliance, low taxes and family values. Donald Trump won more than 60% of the vote there in 2016, and the GOP has held a super-majority in the state’s House of Representatives since the 70s, allowing the party to mould South Dakota in its image for two generations.

Outsiders tend to know South Dakota for two things: Mount Rushmore, which is carved with the faces of four US presidents; and Laura Ingalls Wilder, who moved to the state as a girl and wrote the Little House on the Prairie series of children’s books. But its biggest impact on the world comes from a lesser-known fact: it was ground zero for the earthquake of financial deregulation that has rocked the world’s economy.

The story does not begin with trusts, but with credit cards, and with Governor William “Wild Bill” Janklow, a US marine and son of a Nuremberg prosecutor, who became governor in 1979 and led South Dakota for a total of 16 years. He died almost eight years ago, leaving behind an apparently bottomless store of anecdotes: about how he once brought a rifle to the scene of a hostage crisis; how his car got blown off the road when he was rushing to the scene of a tornado.

In the late 70s, South Dakota’s economy was mired in deep depression, and Janklow was prepared to do almost anything to bring in a bit of business. He sensed an opportunity in undercutting the regulations imposed by other states. At the time, national interest rates were set unusually high by the Federal Reserve, meaning that credit card companies were having to pay more to borrow funds than they could earn by lending them out, and were therefore losing money every time someone bought something. Citibank had invested heavily in credit cards, and was therefore at significant risk of going bankrupt.

William ‘Wild Bill’ Janklow, the former governor of South Dakota in 1988. Photograph: Per Breiehagen/Life Images Collection via Getty Images

The bank was searching for a way to escape this bind, and found it in Janklow. “We were in the poorhouse when Citibank called us,” the governor recalled in a later interview. “They were in bigger problems than we were. We could make it last. They couldn’t make it last. I was slowly bleeding to death; they were gushing to death.”

At the bank’s suggestion, in 1981, the governor abolished laws that at the time – in South Dakota, as in every other state in the union – set an upper limit to the interest rates lenders could charge. These “anti-usury” rules were a legacy of the New Deal era. They protected consumers from loan sharks, but they also prevented Citibank making a profit from credit cards. So, when Citibank promised Janklow 400 jobs if he abolished them, he had the necessary law passed in a single day. “The economy was, at that time, dead,” Janklow remembered. “I was desperately looking for an opportunity for jobs for South Dakotans.”

When Citibank based its credit card business in Sioux Falls, it could charge borrowers any interest rate it liked, and credit cards could become profitable. Thanks to Janklow, Citibank and other major companies came to South Dakota to dodge the restrictions imposed by the other 49 states. And so followed the explosion in consumer finance that has transformed the US and the world. Thanks to Janklow, South Dakota has a financial services industry, and the US has a trillion-dollar credit card debt.

Fresh from having freed wealthy corporations from onerous regulations, Janklow looked around for a way to free wealthy individuals too, and thus came to the decision that would eventually turn South Dakota into a Switzerland for the 21st century. He decided to deregulate trusts.

Trusts are ancient and complex financial instruments that are used to own assets, such as real estate or company stock. Unlike a person, a trust is immortal, which was an attractive prospect for English aristocrats of the Middle Ages who wished to make sure their property remained in their families for ever, and would be secure from any confiscation by the crown. This caused a problem, however. More and more property risked being locked up in trusts, subject to the wishes of long-dead people, which no one could alter. So, in the 17th century, judges fought back by creating the “rule against perpetuities”, which limited the duration of trusts to around a century, and prevented aristocratic families turning their local areas into mini-kingdoms.

That weakened aristocratic families, opened up the British economy, allowed new businessmen to elbow aside the entrenched powers in a way that did not happen elsewhere in Europe, and helped give the world the industrial revolution. “It’s a paradoxical point, but it wasn’t a bad thing when the scion of some family from out in the counties came down to London and pissed away his fortune. It was redistribution of wealth,” said Eric Kades, a law professor at William & Mary Law School in Virginia, who has studied trusts.

English emigrants took the rule to North America with them, and the dynamic recycling of wealth became even more frenetic in the land of the free. Then Governor Janklow came along. In 1983, he abolished the rule against perpetuities and, from that moment on, property placed in trust in South Dakota would stay there for ever. A rule created by English judges after centuries of consideration was erased by a law of just 19 words. Aristocracy was back in the game.

In allowing trusts to last for ever, South Dakota did something genuinely revolutionary, but sadly almost everyone I contacted – from current governor Kristi Noem to state representatives to members of the South Dakotan Trust Association – refused to talk about it. For an answer to the question of what exactly prompted the state to ditch the rule against perpetuities, I was eventually directed to Bret Afdahl, the director of the state administration’s Division of Banking, who wanted the question in writing. A week later, back came a one-word response: “unknown”.

Initially, South Dakota’s so-called “dynasty trusts” were advertised for their ability to dodge inheritance tax, thus allowing wealthy people to cement their family’s long-term control over property in the way English aristocrats had always wanted to. It also gave plenty of employment to lawyers and accountants.

“It’s a clean industry, there are no smokestacks, we don’t have to mine anything out of the earth or anything, and they’re generally good paying jobs,” said Tom Simmons, an expert on trust law at the University of South Dakota, when we chatted over coffee in central Sioux Falls. Alongside his academic work, Simmons is a member of South Dakota’s trust taskforce, which exists to maintain the competitiveness of the state’s trust industry. “Janklow was truly a genius in seeing this would be economic development with a very low cost to the government,” he said. (By “the government”, he of course means that of South Dakota, not that of the nation, other states or indeed other countries, which all lose out on the taxes that South Dakota helps people avoid.)

As the 1990s progressed, and more money came to Sioux Falls, South Dakota became a victim of its success, however, since other states – such as Alaska and Delaware – abolished the rule against perpetuities, too, thus negating South Dakota’s competitive advantage. But, having started the race to the bottom, Janklow was damned if any other state was going to beat him there. So, in 1997, he created the trust taskforce to make sure South Dakota was going as fast as it could. The taskforce’s job was to seek out legal innovations created in other jurisdictions, whether offshore or in the US, and make them work in South Dakota.

Thanks to the taskforce, South Dakota now gives its clients tricks to protect their wealth that would have been impossible 30 years ago. In most jurisdictions, trusts have to benefit someone other than the benefactor – your children, say, or your favourite charity – but in South Dakota, clients can create a trust for the benefit of themselves (indeed, Sun Hongbin is a beneficiary of his own trust). Once two years have passed, the trust is immune from any creditor claiming a share of the assets it contains, no matter the nature of their claim. A South Dakotan trust is secret, too. Court documents relating to it are kept private for ever, to prevent knowledge of its existence from leaking out. (It also has the useful side effect of making it all but impossible for journalists to find out who is using South Dakotan trusts, or what legal challenges to them have been filed.)

Leona Helmsley with her dog, Trouble.Leona Helmsley with her dog, Trouble. Photograph: Jennifer Graylock/AP

This barrage of innovations has allowed lawyers to create structures with complex names – the South Dakota Foreign Grantor Trust, the Self-Settled Asset Protection Trust, etc – which have done two simple things: they have kept the state ahead of the competition; and they have made South Dakota’s property protections extraordinarily strong. “The smart people want privacy,” explained Harvey Bezozi, a Florida financial adviser and tax expert who blogs under the name Your Financial Wizard. “South Dakota offers the best privacy and asset protection laws in the country, and possibly in the world, for the wealthy to protect their assets. They’ve done a pretty good job in making themselves unique; a real boutique place where the people in the know will eventually gravitate to.”

Among those in the know were the lawyers of Leona Helmsley, the legendarily mean hotel heiress, who coined the phrase “only the little people pay taxes”. When Helmsley died in 2007, she left $12m in trust for the care of her dog, a maltese called Trouble. Trouble dined on crab cakes and kobe beef, and the trust provided her with $8,000 a year for grooming and $100,000 for security guards, who protected her against kidnappings, as well as against reprisals from the people that she bit. When a New York court – not entirely unreasonably – decided to restrain this expenditure, trustees moved the trust to South Dakota, which had crafted “purpose trusts” with just such a client in mind. Other states impose limits on how a purpose trust can care for a pet, on the principle that perhaps there are better things to do with millions of dollars than groom a dog, but South Dakota takes no chances. The client is always right.

Despite all its legal innovating, South Dakota struggled for decades to compete with offshore financial centres for big international clients – Middle Eastern petro-sheikhs perhaps, or billionaires from emerging markets. The reason was simple: sometimes the owners’ claim to their assets was a little questionable, and sometimes their business practices were a little sharp. Why would any of them put their assets in the US, where they might become vulnerable to American law enforcement, when they could instead put them in a tax haven where enforcement was more … negotiable?

That calculation changed in 2010, in the aftermath of the great financial crisis. Many American voters blamed bankers for costing so many people their jobs and homes. When a whistleblower exposed how his Swiss employer, the banking giant UBS, had hidden billions of dollars for its wealthy clients, the conclusion was explosive: banks were not just exploiting poor people, they were helping rich people dodge taxes, too.

Congress responded with the Foreign Account Tax Compliance Act (Fatca), forcing foreign financial institutions to tell the US government about any American-owned assets on their books. Department of Justice investigations were savage: UBS paid a $780m fine, and its rival Credit Suisse paid $2.6bn, while Wegelin, Switzerland’s oldest bank, collapsed altogether under the strain. The amount of US-owned money in the country plunged, with Credit Suisse losing 85% of its American customers.

The rest of the world, inspired by this example, created a global agreement called the Common Reporting Standard (CRS). Under CRS, countries agreed to exchange information on the assets of each other’s citizens kept in each other’s banks. The tax-evading appeal of places like Jersey, the Bahamas and Liechtenstein evaporated almost immediately, since you could no longer hide your wealth there.

How was a rich person to protect his wealth from the government in this scary new transparent world? Fortunately, there was a loophole. CRS had been created by lots of countries together, and they all committed to telling each other their financial secrets. But the US was not part of CRS, and its own system – Fatca – only gathers information from foreign countries; it does not send information back to them. This loophole was unintentional, but vast: keep your money in Switzerland, and the world knows about it; put it in the US and, if you were clever about it, no one need ever find out. The US was on its way to becoming a truly world-class tax haven.

The Black Mountain Hills of South Dakota. Photograph: Posnov/Getty Images

The Tax Justice Network (TJN) still ranks Switzerland as the most pernicious tax haven in the world in its Financial Secrecy Index, but the US is now in second place and climbing fast, having overtaken the Cayman Islands, Hong Kong and Luxembourg since Fatca was introduced. “While the United States has pioneered powerful ways to defend itself against foreign tax havens, it has not seriously addressed its own role in attracting illicit financial flows and supporting tax evasion,” said the TJN in the report accompanying the 2018 index. In just three years, the amount of money held via secretive structures in the US had increased by 14%, the TJN said. That is the money pouring into Sioux Falls, and into the South Dakota Trust Company.

“The easy takeaway is that people are trying to hide. But wanting to be private, to be confidential, there’s nothing illegal about that,” said Matthew Tobin, the managing director of the South Dakota Trust Company (SDTC), where Sun Hongbin parked his $4.5bn fortune. We were sitting in SDTC’s conference room, which was decorated with a large map of Switzerland, as if it were a hunting trophy.

Tobin added that many foreign clients had wealth in another jurisdiction, and worried that information about it could be reported to their home country, thanks to CRS. “That could put them at risk. They could be at risk of losing their wealth, it could be taken from them. There’s kidnapping, ransom, hostages. There is risk in a lot of parts of the world,” he explained. “People are saying: ‘OK, if the laws are the same, but I can have the stability of the US economy, the US government, and maintain my privacy, I might as well go to the US.’” According to the figures on its website, SDTC now manages trusts holding $65bn and acts as an agent for trusts containing a further $82bn, all of them tax-free, all of them therefore growing more quickly than assets held elsewhere.

When I spoke to the official from one of the traditional tax havens, who asked not to be identified, for fear of wrecking what was left of the jurisdiction’s financial services industry, he was furious about what the US was doing. “One of the bitter aspects of this, and it’s something we haven’t said in public, is the sheer racism of the global anti-money laundering management effort,” he said. “You will notice that the states that are benefiting from this in America are the whitest states in the country. They’ve ended up beating the shit out of a load of black and Hispanic places, and stuffing all the money in South Dakota. How does that help?”

I put those comments to a South Dakotan trust lawyer who agreed to speak to me as long as I didn’t identify them. The lawyer was sympathetic to the offshore official’s argument, but said this is how the world is now, and everyone is just going to have to get used to it. It is, after all, not just South Dakota and its trust companies that are sucking in the world’s money. Banks in Florida and Texas are welcoming cash from Venezuela and Mexico, realtors in Los Angeles are selling property to Chinese potentates, and New York lawyers are arranging these transactions for anyone that wants them to. Perhaps under previous administrations, there might have been some appetite for aligning the US with global norms, but under Trump, it’s never going to happen.

“You can look at South Dakota and its trust industry, but if you really want to look at CRS, look at the amount of foreign money that is flowing into US banks, not just into trusts,” the lawyer said. “The US has decided at very high levels that it is benefiting significantly from not being a member of CRS. That issue is much larger than trusts, and I don’t see that changing, I really don’t.”

We have no idea yet what this means in the long term, because the revolution in trust law that began in South Dakota and spread throughout the US is only a generation old. But the implications are ominous.

Here is an example from one academic paper on South Dakotan trusts: after 200 years, $1m placed in trust and growing tax-free at an annual rate of 6% will have become $136bn. After 300 years, it will have grown to $50.4tn. That is more than twice the current size of the US economy, and this trust will last for ever, assuming that society doesn’t collapse altogether under the weight of this ever-swelling leach.

If the richest members of society are able to pass on their wealth tax-free to their heirs, in perpetuity, then they will keep getting richer than those of us who can’t. In fact, the tax rate for everyone else will probably have to rise, to make up for the shortfall caused by the wealthiest members of societies opting out, which will just make the problem worse. Eric Kades, the law professor at William & Mary Law School, thinks that South Dakota’s decision to abolish the rule against perpetuities for the short term benefit of its economy will prove to have been a long-term catastrophe. “In 50 or 100 years, it will turn out to have been an absolute disaster,” said Kades. “Now we’re going to have a bunch of wealthy families, and no one will be able to piss away that wealth, it will stay in the family for ever. This just locks in advantage.”

So far, most of the discussion of this development in wealth management has been confined to specialist publications, where academic authors have found themselves making arguments you do not usually find in discussions of legal constructs as abstruse as trusts. South Dakota, they argue, has struck at the very foundation of liberal democracy. “It does seem unfair for some people to have access to ‘property plus’, usable wealth with extra protection built in beyond that which regular property owners have,” noted the Harvard Law Review back in 2003, in an understated summation of the academic consensus that South Dakota has unleashed something disastrous.

And if some people have access to privileged property, where does that leave the equality before the law that is central to how society is supposed to function? Another academic, writing in the trade publication Tax Notes two decades ago, put that unfairness in context: “Perpetual trusts can (and will) facilitate enormous wealth and power for dynastic families. In the process, we leave to future generations some serious issues about the nature of our country’s democracy.”

With Washington unconcerned by what is happening, and the rest of the world incapable of doing anything about it, is there any prospect of anyone in South Dakota moving to repair the damage? The short answer is that it is too late. Two-dozen other states now have perpetual trusts too, so the money would just move elsewhere if South Dakota tried to tighten its rules. The longer answer is that South Dakotan politics appears to have been so comprehensively captured by the trust industry that there is no prospect of anything happening anyway.

The state legislature is elected every even-numbered year, and meets for two months each spring. It last updated the law governing trusts in 2018, and brought in Terry Prendergast, a trust lawyer, to explain the significance of the changes. “People should be allowed to do with their property what they desire to do,” Prendergast explained. “Our entire regulatory scheme reflects that positive attitude and attracts people from around the world to look at South Dakota as a shining example of what trust law can become.”

There were a few questions from the representatives, but they were quickly shut down by Mike Stevens, a Republican lawyer, and chairman of the state’s judiciary committee. “No more questions. I didn’t understand perpetuities in law school, and I don’t want to understand it now,” he said, laughing.

Susan Wismer, one of just 10 Democrats among the House’s 70 members, attempted to prolong the discussion by raising concerns about how South Dakota was facilitating tax avoidance, driving inequality and damaging democracy. Her view was dismissed as “completely jaded and biased” by a trust lawyer sitting for the Republicans. It was a brief exchange, but it went to the heart of how tax havens work. There is no political traction in South Dakota for efforts to change its approach, since the state does so well out of it. The victims of its policies, who are all in places like California, New York, China or Russia, where the tax take is evaporating, have no vote.

Wismer is the only person I met in South Dakota who seemed to understand this. “Ever since I’ve been in the legislature, the trust taskforce has come to us with an updating bill, every year or every other year, and we just let it pass because none of us know what it is. They’re monster bills. As Democrats, we’re such a small caucus, we’re the ones who ought to be the natural opponents of this, but we don’t have the technical expertise and don’t really even understand what we’re doing,” she confessed, while we ate pancakes and drank coffee in a truck stop outside Sioux Falls. “We don’t have a clue what the consequences are to just regular people from what we’re doing.”

That means legislators are nodding through bills that they do not understand, at the behest of an industry that is sucking in ever-greater volumes of money from all over the world. If this was happening on a Caribbean island, or a European micro-principality, it would not be surprising, but this is the US. Aren’t ordinary South Dakotans concerned about what their state is enabling?

“The voters don’t have a clue what this means. They’ve never seen a feudal society, they don’t have a clue what they’re enabling,” Wismer said. “I don’t think there are 100 people in this state who understand the ramifications of what we’ve done.”

• This article was amended on 20 November 2019 because an earlier version misnamed the Foreign Account Tax Compliance Act as the Financial Assets Tax Compliance Act.

0 notes

Photo

AMERICAN CORPORATION: PROFIT INCOME IN FOREIGN BANK FOR TAX SHELTERS

Profit & Solutions Management Research Publication Series

Researched & Written by Deb (Debadip) Bandyopadhyay

A tax haven is generally an offshore country that offers foreign individuals and businesses little or no tax liability in a politically and economically static environment. KEY TAKEAWAYS Tax havens provide the advantage of little or no tax liability. Offshore countries with little or no tax liabilities for foreign individuals and businesses are generally some of the most popular tax havens. Investors and businesses may be able to lower their taxes by taking advantage of tax-advantaged opportunities offered by tax havens, however, entities should ensure they are compliant with all relevant tax laws.

Understanding Tax Haven

Tax havens also share limited or no financial information with foreign tax authorities. Tax havens do not typically require residency or business presence for individuals and businesses to benefit from their tax policies.

In some cases, intranational locations may also be identified as tax havens if they have special tax laws. For example, in the United States, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming require no state income tax.

Offshore tax havens benefit from the capital their countries draw into the economy. Funds can flow in from individuals and businesses with accounts setup at banks, financial institutions, and other investment vehicles. Individuals and corporations can potentially benefit from low or no taxes charged on income in foreign countries where loopholes, credits, or other special tax considerations may be allowed.

A list of some of the most popular tax haven countries includes Andorra, the Bahamas, Belize, Bermuda, the British Virgin Islands, the Cayman Islands, the Channel Islands, the Cook Islands, The Island of Jersey, Hong Kong, The Isle of Man, Mauritius, Lichtenstein, Monaco, Panama, St. Kitts, and Nevis.

Characteristics of tax haven countries generally include no or low-income taxes, minimal reporting of information, lack of transparency obligations, lack of local presence requirements, and marketing of tax haven vehicles.

In general, this and other provisions, particularly for reinvestments, provide allowances for businesses to benefit from low or no tax rates offered in foreign countries but businesses should closely monitor and accurately report foreign income as it pertains to U.S. tax law, generally accepted accounting principles (GAAP), and the guidelines under International Financial Reporting Standards (IFRS).

Some companies that have historically been known for offshore, tax haven holdings include Apple, Microsoft, Alphabet, Cisco, and Oracle. Overall, tax havens may also offer advantages in the area of credit, since it may be less expensive for U.S.-based companies to borrow funds internationally. This type of lending, which can potentially fund acquisitions and other corporate activities, is also subject to reporting within the guidelines of U.S. tax law, GAAP, and guidelines under IFRS.

The U.S. has special rules in place for the reporting of foreign income by U.S. citizens and non-U.S. citizens. These rules are generally governed under the Foreign Account Tax Compliance Act (FATCA).

FATCA requires the filing of a Schedule B and/or Form 8938, which provides disclosure of foreign account holdings when investments exceed $50,000. Separately, foreign account holders may also be required to file Form 114, Report of Foreign Bank and Financial Accounts.

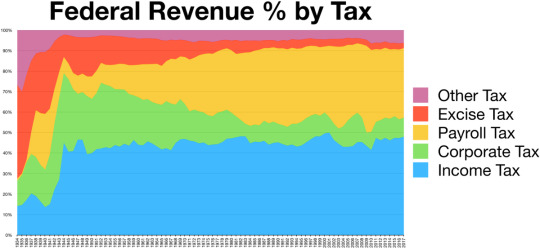

US based companies are keeping their profits in bank accounts in other countries. Around $183 billion of stocks are piled in those countries. There was an increase of 14.4% from the previous year in the accumulation of the funds. Bloomberg studied that total of 83 companies in the USA has kept their profit earning in different low taxed countries across the globe. A total of $1.7 trillion has been outside the USA for the purpose of tax exception. Top companies like GE, Microsoft, Johnson & Johnson, and IBM are the top companies who are keeping the money outside the country so that the USA tax revenue department could not get hold of these incomes. Some of the companies are owned by foreign companies which helped them to park their profit margin companies’ bank account. The rise of the cash flow from the low taxed countries is due to the increased number of the customer from these areas. Google has kept $31 billion in annual filling in taxes but of which 65.3% are in the liquid holding outside the USA. This is hampering the USA taxes and resulting in rise of different problems due to this. US based companies receive tax credits in their income from the outside country, but still they are deferring the taxes by not bring those money back to USA. Regulatory filling asked the USA Corporation to report the foreign profit but they can defer taxes on those income. The income is not kept in the form of cash in other countries. They are using that fund to invest in the physical infrastructure and bond of that low taxed country. Intangible assets are among one of the areas where companies are selling their patents and getting cash out of it. The low tax jurisdiction allows them to pay low taxes. Among these, Microsoft has sold many patents to offshore countries and reported $60.8 billion in offshore holdings, whereas they paid only 3.1% in the foreign tax for this. The USA government tax system is outdated and is not compatible with other countries’ tax system has been claimed by many senior executives of USA based companies. They mentioned that for competing in the foreign land they have to keep the money in those countries for the future need. Citi Group has reported that foreign tax is as low as 8% which is far below that USA tax system rates. The USA tax is 35% which is the high compare to any other country corporate tax rates. This not only creates the obstacle for USA government to get a hold of the income of the companies in foreign lands. Moreover, they are lagging behind among other countries in tax system due to the low tax rate of those countries.

Many U.S. corporations use offshore tax havens and other accounting gimmicks to avoid paying as much as $90 billion a year in federal income taxes. A large loophole at the heart of U.S. tax law enables corporations to avoid paying taxes on foreign profits until they are brought home. Known as “deferral,” it provides a huge incentive to keep profits offshore as long as possible. Many corporations choose never to bring the profits home and never pay U.S. taxes on them. Deferral gives corporations enormous incentives to use accounting tricks to make it appear that profits earned here were generated in a tax haven. Profits are funneled through subsidiaries, often shell companies with few employees and little real business activity. Effectively, firms launder U.S. profits to avoid paying U.S. taxes.

Loopholes used to shift U.S. profits to tax havens U.S. firms can set up a subsidiary offshore, channel billions of dollars of profit through it and make the subsidiary “disappear” for U.S. tax purposes simply by “checking a box” on an IRS form. Corporations can sell the right to patents and licenses at a low price to an offshore subsidiary, which then “licenses” back to the U.S. parent at a steep price the right to sell its products in America. The goal of this “transfer pricing” is to make it appear that the company earns profits in tax havens but not in the U.S. Wall Street banks, credit card companies and other corporations with large financial units can easily move U.S. profits offshore using a loophole known as the “active financing exception.” A U.S. corporation can do an “inversion” by buying a foreign firm and then claiming that the new, merged company is foreign. This lets it reincorporate in a country, often a tax haven, with a much lower tax rate. The process takes place on paper — the company doesn’t move its headquarters offshore and its ownership is mostly unchanged — but it continues to enjoy the privileges of operating here while paying low tax rates in the foreign country.

The simplest solution is to end “deferral,” as proposed by Sen. Bernie Sanders and Rep. Jan Schakowsky. Corporations would pay taxes on offshore income the year it is earned, rather than indefinitely avoid paying U.S. income taxes. This would also remove incentives to shift U.S. profits to tax havens, and it would raise $600 billion over 10 years. Short of ending deferral, Congress should close the most egregious loopholes, such as “check the box,” “transfer pricing,” the “active financing exception” and corporate “inversions.” It should also end the loophole that lets firms deduct the cost of expenses from moving jobs and operations offshore if the profits earned from those activities remain offshore and untaxed by the U.S. — saving $60 billion over 10 years. Sen. Carl Levin (D-MI) has introduced legislation, the Stop Tax Haven Abuse Act (S. 1533), that will close some of these loopholes. It will raise $220 billion over 10 years.

References

Brunori, D. (2013, September 9). Want a tax shelter? just do it. The Forbes. Retrieved from http://www.forbes.com/sites/taxanalysts/2013/09/16/want-a-tax-shelter-just-do-it/

Kocieniewski, D. (2011, March 24). G.E.’s strategies let It avoid taxes altogether.The New York Times. Retrieved from http://www.nytimes.com/2011/03/25/business/economy/25tax.html

Pozen, R. C. (2011, September 19). How to bring our companies’ foreign profits back home. The New York Times. Retrieved from http://www.nytimes.com/2011/09/19/opinion/bring-american-companies-foreign-profits-back-home.htm

Rubin, R. (2013, March 8). Offshore cash hoard expands by $183 billion at companies. The Bloomberg. Retrieved from http://www.bloomberg.com/news/2013-03-08/offshore-cash

For More Research Article & Blogs Visit:

Website: http://profitsolutions.tk/

Second Website:

#research #data #management #analysis #marketing #marketresearch #analytics #datascience #bigdata #seo #digitalmarketing #dataanalytics #innovation #coffee #transformation #research #management #digitaltransformation #sustainability #retail #ai #strategy #supplychain #data #debadipb #profitsolutions

0 notes

Text

Invoice financing has a significant impact on the success of small businesses in Nevada. By turning unpaid invoices into immediate working capital, businesses can maintain steady cash flow, cover operational costs, and invest in growth initiatives. This financial strategy helps businesses manage financial challenges more effectively and focus on long-term success.

#accounts receivable#asset based lending in Nevada#factoring company#invoice factoring companies#invoice financing#invoice financing for small business#receivable factoring company#receivables financing companies#small business loans

0 notes

Text

Entrepreneur & Workplace Productivity Software Reviews, Administration Tips & Other Modern.

Our team often receive asked exactly what we DO all the time when our team gone on the street. Exactly what's even more, they found that folks putting on different colors cosmetics were recognized as more reliable and seasoned "There are times when you desire to provide a highly effective 'I'm in charge here' sort of opinion, and females should not fear to carry out that," stated Sarah Vickery, an author from the research study. However, several studies over decades have revealed that if you pay attention to particular essential principles, such as value, reward growth, low volatility, and also smaller measurements, you can as well as likely will defeat the market place. Spreadsheets from every REIT as well as preferred reveal I cover upgraded in real time with actionable buy and sell intended prices. Someday, Romeo joined the feast of the Capulets', an outfit party where he counted on to fulfill his love, Rosaline, a haughty appeal coming from a moneyed loved ones. However, the growth in life span is not matched through a growth in the health and wellness stretch," baseding on the very same CDC document. Since this study, IBM is paying for an affordable 34.84% of its own fine-tuned EPS to shareholders in an annual returns of $6.00 per portion, paid quarterly, resulting in a 4.08% reward turnout.

The European Union referred to as 2014 as the" Year Against Food Refuse," and Intermarche, France's third-largest supermarket, launched an "unworthy fruits and veggies" project to enhance meals rubbish awareness as well as transform the nation's point of view on awful produce. Baseding On Dow Jones S&P Indices, this is actually determined that for the third-quarter 2017 S&P 500 earnings will definitely be $28.98, bring in profits for the trailing-twelve-month stand at $107.61. Based the trailing-twelve-month earnings, the S&P FIVE HUNDRED is actually currently trading at 23.5 times. Sarah Prentice, the artistic director behind Garrad, told Trend that Victoria enjoyed this a lot that she decided to use this on her wedding day as her one thing blue on the front of her outfit." She showed off the piece up till Royal prince Albert's death in 1861, however ensured the clip will turn into one from the royal family members's numerous antiques.

For 2017, our budgeting procedure our team offered an assistance stable of on capital that was sort of tied to just what our team presumed were the greater and reduced ends of oil costs, perhaps $55 and also $45 generally. Avisol Funds joined the Roundtable to describe their evaluation approach for biotechs, go over the red flags they seek when evaluating assets, and discuss their existing leading biotech trading suggestion.

99.999999% of the moment the bag is just a free offer stuffed with raggedy clothing and all she yourbeautifulbody.info carried out was actually scam you as well as left you without attending to the company she promised by her promotion. Revenues growth will drive the equity markets much higher. They are forecasting modest cash money expenses and must pay at $1100 gold. Paramount Gold Nevada is actually cultivating pair of gold tasks along with 7.5 million oz. It is a new company that was a spinout of Paramount Gold & Silver in 2015, which marketed their San Miguel task. Numerous opportunities I have actually listened to non-Buddhist customers claim they feel the sculpture talks to them. " A Service Development Provider (likewise called a BDC) is a social enterprise that invests in little and mid-sized firms by means of using lendings or in some cases capital. The very first amount reasoning here is that there is actually some singular price that completely represents the correct time to begin purchasing GE. However, this is incredibly misleading. Low threat: High returns protection as well as foreseeable development for 5+ years, max collection measurements 10% (core holding).

0 notes

Link

Mortgage Broker Sanderson Texas

Contents

Rio grande valley. “operating

Serve mortgage brokers

Sanderson farms championship

University park texas

mortgage bankers, wholesale and correspondent lenders and brokers, announced today that it has launched Calyx Wholesaler MarketPlace with seven of the nation’s premier wholesale lenders. Calyx.

A mortgage broker is a financial expert who helps home buyers and homeowners with financing options for real estate transactions. Some mortgage brokers may work for financial solutions companies but.

Motto Mortgage has announced that Norma Hinojosa, Owner of RE/MAX Elite in Mission, Texas, has purchased and opened the first Motto Mortgage franchise in the rio grande valley. “operating a Motto.

Mortgage Broker Richland Hills Texas Mortgage Broker Utopia Texas The center, at 1320 greenway drive, will serve mortgage brokers in Dallas-Fort Worth as well as in the East Texas cities of Tyler, Longview, Lufkin and Palestine; the West Texas cities of Lubbock,About LIG Assets, Inc. LIG Assets, Inc., based in Dallas, TX, is a Company focused on residential and commercial real estate. Through its alliances with hedge funds, mortgage brokers, and hard money.

Serhant is a 35-year-old American actor, real estate agent, and reality star from Houston, Texas. According to his. when.

Mortgage Brokers Near Me in Texas. If you’re still having trouble finding a lender that makes sense for you, consider looking into mortgage brokers in your area. A mortgage broker is a licensed professional that helps borrowers find lender offers in exchange for a commission.

Suggesting she has since been successful in amassing sufficient wealth to live comfortably in one of China’s most expensive.

HOUSTON, TX / ACCESSWIRE / June 11, 2019 / Houston, TX based The Texas Mortgage Pros recently announced that. and their dedicated mortgage brokers can help borrowers find out how much they qualify.

From early March through mid-June, he went 10 starts without a top 50 and missed four cuts, but a T29 at the Rocket Mortgage. at the sanderson farms championship and the Sony Open in Hawaii, he.

Mortgage Broker Seven Points Texas Mortgage Broker San Angelo Texas Discover San Angelo, Texas – An Oasis in West Texas, Off the Beaten Path. Plan your visit today. find things to see and do, events, accommodations Our Location. San Angelo is located in the Concho Valley, a region of West Texas between the Permian Basin to the northwest, Chihuahuan Desert to.That’s seven basis points lower than last week. For pricing purposes, we get to use the highest middle credit score. mortgage broker jeff Lazerson can be reached at 949-334-2424 or.

On Nov. 7, 2017, Texas voters approved the eighth series of amendments. In addition, the current provision allowing a “mortgage broker” to make a home equity loan was changed to permit a “mortgage.

Mortgage Broker Troup Texas Mortgage Brokers at College Station ( Texas ) – 3030 University dr. East #600. Welcome to bcsrealestate.com! I am Rusty Gerdes, a Realtor with RE/MAX Bryan-College Station, and I enjoy helping people find the right home or property for their needs.

Stearns continues to demonstrate our unwavering commitment to the mortgage broker. Through operational excellence. Andy Schmitt in Nevada/Texas, and Susan Feight in the Northeast region. In.

Mortgage Broker White Deer Texas At Texas Broker Sponsor.com, our broker sponsorship program offers texas real estate sales and Leasing Agents and LLC Brokerage Business Entities an affordable Designated Broker Sponsorship options. We provide our agents the opportunity to Earn and Keep More of the commissions they.

Mortgage brokers and real estate agents are both integral parts of buying and selling property. Mortgage brokers work to put together buyers with lenders who make sense for their financial situation.

Mortgage Broker Waco Texas We provide Low Mortgage rates at low down payments in Texas. Consumers wishing to file a complaint against a mortgage banker or a licensed mortgage banker residential mortgage loan originator should complete and send a complain form to the Texas Department of Savings and.Mortgage Broker Westway Texas Mortgage Broker Willamar Texas mortgage broker wheeler Texas Wheeler County is a county located in the U.S. state of Texas. As of the 2010 census, its population was 5,410. Its county seat is Wheeler. The county was formed in 1876 and organized in 1879.Mortgage Broker Willamar Texas Mortgage Broker windemere texas mortgage Broker West Texas Mortgage Broker university park texas north Dallas Mortgage is a low cost texas residential mortgage lender offering conventional, VA, FHA, & USDA Home Loans for Purchase & Refinance. We shop lots of lenders for the lowest rate.In Texas, entities engaged in the residential mortgage loan business need to be registered with the state. The registrations are regulated and issued by the Texas Department of Savings and Mortgage Lending.. The application process for companies and individuals is handled by the Nationwide Mortgage Licensing System (NMLS).NMLS allows entities and loan originators to apply or renew a license or.

Zillow has announced plans to launch in Austin, Texas, Cincinnati, Jacksonville. In each market where Zillow Offers is available, Zillow works with local agents and brokers on every transaction.

Complete details can be found on The Texas Mortgage Pros website. Alternatively, interested parties may fill out a contact form through the website to connect with one of the company’s professional.

The post Mortgage Broker Sanderson Texas appeared first on Mortgage Broker Plano Texas.

https://ift.tt/305GKIA

0 notes

Text

$25 Million in 2 Weeks: BlockFi Booms as Bitcoin, Ether Investors Seek Interest

The Takeaway

BlockFi’s interest-yielding deposit accounts, launched in beta in January and fully live this month, have attracted more than $35 million in crypto. Most of it is being lent to institutional borrowers.

BlockFi’s terms of service give the company significant leeway over how it uses depositors’ funds and what interest rate it can pay them. This flexibility is needed for the company to grow fast, CEO Zac Prince says.

Institutional investors borrow crypto at individualized terms, at interest rates from 4 to 12 percent, and BlockFi can call in the loans at any time.

When crypto prices move dramatically, BlockFi manages risks by making borrowers put up more collateral or selling some of it.

BlockFi is planning to roll out new products every six months and raise more capital.

–––––––

BlockFi wasn’t the first lending startup in the cryptocurrency market, but it’s likely the one getting the most attention these days — including some heat from community members.

While it was founded in 2017, and began making fiat loans with crypto collateral in January 2018, the company was thrust into the spotlight earlier this month when it officially launched an interest-bearing deposit account. Seemingly too good to be true, the product entices investors with returns of up to 6.2 percent annually for holding their bitcoin or either.

So far, the product seems to be gaining traction. According to CEO and founder Zac Prince, users have already deposited more than $35 million worth of crypto, around 80 percent of it in bitcoin, into their interest-bearing accounts since beta testing began in January. Of that, $25 million, was gathered after the March 5 launch.

Yet skeptics almost immediately began looking under the hood.

For example, lawyer Stephen Palley noted that, while BlockFi is advertising 6.2 percent, according to the product’s terms and conditions page, the company can modify the rate at its discretion. Others pointed out that, as the deposits won’t be insured as they would be at a bank, “your upside is limited to 6.2 percent whereas your downside is 100 percent” if BlockFi fails.

Wall Street veteran Caitlin Long noted that by depositing their crypto with BlockFi, people expose themselves to a form of counterparty risk: “I didn’t see disclosure on that,” she wrote, adding that by rehypothecating clients’ funds – that is, lending out collateral – BlockFi may be exposing itself to legal challenges in some U.S. states.

Given the controversial yet clear market interest in this product, CoinDesk sat down with Prince to talk about the company’s policies, how BlockFi’s business works, and, most importantly, how it manages risk.

Lending fiat, borrowing crypto

BlockFi is currently offering two products to retail customers: cryptocurrency-backed loans and crypto-funded interest accounts. With the loans, the customer borrows U.S. dollars for one year at 4.5 percent interest, depositing bitcoin, litecoin or ether as collateral. They can only borrow up to 50 percent of what the pledged crypto is worth at the time.

Meanwhile, with the interest account, the customer deposits bitcoin or ether with BlockFi so that the asset can accumulate interest (denominated in crypto) every month. As mentioned, BlockFi is advertising a 6.2 percent annual compound interest rate for such accounts, which is two to three times better than a U.S.Treasury bond or a U.S. bank saving account yield.

Image of BlockFi’s CEO Zac Prince by Anna Baydakova for CoinDesk

But again, the terms and conditions explicitly say that the interest will be calculated by BlockFi at its discretion.

When asked if there is any benchmark BlockFi uses to determine the interest rate (the way, for example, a bank might take into account an index like LIBOR when setting the rate on a loan), Prince answered simply: “No.”

The absence of any formula allows BlockFi to flexibly change the rate and make it more attractive to potential users, he said, explaining that for now, the product doesn’t make money:

“The rate is a combination of the market and customer acquisition costs. This product will be for some amount of time, probably for for 3 to 18 months, a loss leader. We are OK with losing money for a while. If it was purely formulaic we probably wouldn’t have enough control to make sure it’s attractive enough to a large amount of people to hit our customer acquisition targets.”

To grow its user base quickly, BlockFi is planning to roll out new products every six months and to raise more capital. (It has already done several venture funding rounds, the largest one – led by Mike Novogratz’s Galaxy Digital – raising $52.2 million.)

Prince explained:

“We believe that we will be able to continue raising venture capital supporting the growth and at a certain point down the road [when] we’re a much bigger company, maybe we’re a public company, then we can say: ‘Ok, we turn to profit now.’ We anticipate being able to raise larger and larger amounts of venture capital for a while, at least for the next couple of years.”

…and lending crypto, too

The third thing BlockFi does, without advertising it to the retail market, is lend crypto to financial institutions. “We don’t really think of it being a product,” Prince said. “We think of this as of something we need to do to be able to deliver our product to our core customer, which is retail.”

This third element is what allows BlockFi to earn crypto that can be used to pay interest to its retail depositors. (The fiat loans are in a separate bucket, funded from the venture capital BlockFi raised.)

Most of the $35 million in deposits gathered is being lent to institutional borrowers: of every deposit, a bigger part goes to the lending business and a smaller part stays as a reserve, but the exact ratio is not disclosed.

Gemini Trust, founded by Cameron and Tyler Winklevoss, was chosen to handle custody for BlockFi’s clients, as well as the moving of crypto from the depositors to the institutional borrowers — BlockFi itself doesn’t hold the cryptographic private keys controlling the funds, Prince said.

Currently, BlockFi’s borrowers mostly belong to two groups, he said: people trading bitcoin futures and traditional financial institutions – in particular, proprietary trading firms and market makers.

The terms on which institutions borrow crypto vary on a case-by-case basis, Prince said. The interest rate can be between 4 and 12 percent, and the fiat collateral (which can be denominated in stablecoins, either the Gemini dollar or the Paxos Standard) can be between 110 and 150 percent of the loan amount. The relationships with borrowers are governed by individual ISDA agreements (the standard document governing over-the-counter derivatives transactions, made famous by the bestseller and movie “The Big Short“).

The term of the loan can vary, but BlockFi reserves the right to call in the loan with one’s week’s notice — the same amount of notice a depositor can give to withdraw crypto. This clause ensures the company will always have enough crypto to meet withdrawal requests, according to Prince.

Managing risk

So what happens when crypto prices move significantly (as they often do)?

When the price goes down, clients’ collateral will shrink, too, and the loan-to-value (LTV) ratio of the loans will rise from 50 percent to a higher number. On the other hand, if prices soar, institutional crypto borrowers will find their loans much more expensive to pay back. But according to Prince, BlockFi has taken several measures to mitigate these risks.

For the fiat loans, if at some point the amount of cash a retail client borrowed becomes equal to 70 percent of the collateral instead of 50 percent, to return to a safer LTV ratio, BlockFi will contact the client and give them 72 hours to either pay back the loan, add more collateral or take no action. Choosing the third option means BlockFi will sell a part of the collateral on an exchange or through an OTC desk, use it to pay down the loan, and get the LTV “back into the safe zone,” as the terms and conditions page puts it.

The same mechanism works for institutional investors that borrow crypto: if the price of bitcoin goes up, and what they borrowed ends up costing more relative to the amount of cash collateral, BlockFi will contact them and ask them to add more cash. If the bitcoin price hits a certain preset level, which also varies from borrower to borrower, BlockFi can use the collateral to buy bitcoin and close out the loan.

The terms for institutions, again, are highly dependent on the level of trust a particular client has. As Prince put it:

“If, say, JP Morgan wanted to borrow a million dollars from us, we probably wouldn’t need to take any collateral.”

Plus, the loans are structured so that if need be, BlockFi can chase after the deeper pockets behind a borrower. “We’re making sure that we have passed through to a parent entity if we’re facing a subsidiary, in terms of a default,” Prince said.

Legal and regulatory

In case the borrower defaults, taking them to court won’t be a problem, Prince believes.

“The legal structure we use to lend someone crypto is no different than we would use, say, to lend somebody USD secured by Japanese yen,” he said.

As for regulatory compliance, BlockFi is a licensed lender in the states that require this — the cash loans are now available in 47 U.S. states.

“The biggest state we don’t support is Nevada because it requires you to have an office in the state, which isn’t something we plan on doing in the near term,” BlockFi’s director of marketing Brad Michelson told CoinDesk. He wouldn’t name the other two excluded states.

As for the interest accounts, they are available worldwide, except the states of New York, Connecticut and Washington and in any countries sanctioned by the U.S., the U.K. or the E.U.

BlockFi doesn’t hold a New York State BitLicense, which explains why it lends but won’t take deposits there.

“For the crypto loans, we don’t believe we need a BitLicense,” Prince said. “For the interest accounts, we don’t believe we need one either, but our opinion on that is not strong enough for us to offer it here.”

Some of BlockFi’s state lending licenses on display at its office

The fine print

The terms and conditions on BlockFi’s website say that the company “will lend, sell, pledge, rehypothecate, assign, invest, use, commingle or otherwise dispose of funds and cryptocurrency assets to counterparties, and we will use our commercial best efforts to prevent losses,” affording the lender significant leeway over its use of clients’ funds.

Further, users waive their rights to obtain a paper copy of the contract, file a class action against BlockFi or request a jury trial. The company also can change the terms at any time and it’s the user’s responsibility to review them “from time to time.”

Prince explained that what is described in the terms is just the real risk to a crypto investor, plainly stated.

“There is this conundrum that you’re put in: you have to be really, really careful in terms of what your agreement says to protect your company, because crypto is in this regulatory grey area,” he said. “The Catch-22 is you have lawyers, you disclose any risk, you’re trying to protect your company from the regulators, but that means you need to write stuff like this.”

He added:

“Scams don’t write stuff like this.”

As for rehypothecation, which Long and others consider antithetical to bitcoin’s promise, Prince argues it’s essential for the nascent crypto market to grow. One of the benefits of rehypothecation, he explained, is that it allows intermediaries to reduce trading fees and enable short selling.

“If you don’t have a market that goes both ways, you can’t find the true price of an asset. Rehypothecation is the major component enabling that,” he said.

At the end of the day, any investment is risky, and BlockFi is just being forthright about it, Prince argued, concluding:

“Read a risk disclosure of, say, an IPO, and maybe in the end you say: ‘This is the scariest thing ever, I’ll never invest in a stock again in my life!’”

Image of BlockFi’s CEO Zac Prince by Anna Baydakova for CoinDesk

This news post is collected from CoinDesk

Recommended Read

Editor choice

BinBot Pro – Safest & Highly Recommended Binary Options Auto Trading Robot

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

9.5

Demo & Pro Version Try It Now

Read full review

The post $25 Million in 2 Weeks: BlockFi Booms as Bitcoin, Ether Investors Seek Interest appeared first on Click 2 Watch.

More Details Here → https://click2.watch/25-million-in-2-weeks-blockfi-booms-as-bitcoin-ether-investors-seek-interest-3

0 notes

Text

Essay代写:Community Banks in the United States

下面为大家整理一篇优秀的essay代写范文- Community Banks in the United States,供大家参考学习,这篇论文讨论了美国的社区银行。近几年来,从各方面的指标来看,美国的社区银行表现相当强劲。社区银行的资产收益率跟净资产收益率表现类似,已经稳稳地高于历史最好业绩时的基准。社区银行持续健康的一个有力指标是新社区银行持续创建的比率。美联储始终认为,社区银行将始终成为美国经济一个充满活力和勇于创新的行业。

Community Banks have long played an important role in the U.S. economy. However, after entering the 21st century, community Banks are confronted with a changing business environment and face many major challenges. Ben Bernanke, chairman of the federal reserve, speaks at the national convention and the world conference on technology in Las Vegas, Nevada, on March 8. This paper discusses the robustness of community Banks, their role in the economy, and how the federal reserve, the regulator of community Banks, is adapting to the new environment.

By all measures, community Banks have generally performed strongly recently. For example, the average return on equity, which fell in the wake of the 2001 recession, is still stable and rising slightly. Generally speaking, the return on assets of community Banks is similar to that of return on equity, and has been steadily higher than the benchmark of the best performance in history. Net interest margins are still higher than at big Banks, and have widened even since 2003. In terms of various indicators to measure the quality of loans, the performance of community Banks is also quite high. Moreover, the fed's on-site and off-site inspection systems only detected potential problems at a handful of community Banks. The capital adequacy ratio of community Banks is still very high, and there is still a lot of room for community Banks to continue absorbing savings.

A strong indicator of the continued health of community Banks is the rate at which new community Banks are created. For example, if we define a community bank as a bank or savings institution with total real assets of about $1 billion, there will be about 700 new community Banks established from the beginning of 2000 to the end of 2005, with an average annual growth rate of 120. Clearly, many people are still optimistic about the future of community banking. The fed has always believed that community banking will remain a vibrant and innovative sector of the U.S. economy.

At the same time, community Banks are also facing great challenges. Trans-regional expansion of bank operation, rapid update of financial service technology, increasing importance of non-bank financial service institutions, evolution of economic growth model and other factors are changing the banking industry. While many of the changes have improved the efficiency of the financial system as a whole, they have reduced the cost to Banks' customers; But it should also be acknowledged that these changes are new challenges, even daunting ones, for community Banks.

We have seen major changes in the structure of American banking in recent decades. By that definition, the share of banking assets owned by community Banks fell from 20% in 1994 to around 12% in 2005. The total number of community Banks fell from more than 10, 000 in 1994 to about 7, 200 in 2005. Other definitions of community banking and other measures of industry structure, such as the share of total savings, have also recently shown a downward trend.

Much of the focus on community banking can be attributed to mergers. A recent study by fed staff found that more than 3,500 Banks and thrifts merged between 1994 and 2003. In 92% of mergers, the target institution's total assets are at least $1 billion. Although bank mergers declined from the late 1990s, at least 200 mergers were completed each year from 2000 to 2005.

Research by our fed staff and other economists shows that community Banks continue to play an important role not only in providing financial services, particularly for small businesses, but also in providing financial retail services nationwide. Indeed, researches on community Banks habitually believe that the central principle of "community Banks" is Relationship finance. Relationship finance means that the value-added of financial services mainly depends on the continuous personal contacts between bankers and clients. Personal contacts speed up the flow of information and allow for more personalized services. Relationship finance strengthens the domestic economy by effectively providing credit and other financial services.

However, recent research also confirms what many community bankers say: traditional concepts of relationship finance are changing with the nature of the community bank-client relationship.

The traditional research paradigm holds that small businesses and households are often opaque. In other words, information about these potential customers is costly and difficult to quantify. Thus, effective provision of credit to these customers requires intimate interaction to obtain "soft" or qualitative information, such as the borrower's personal qualities or information about local market conditions and investment opportunities. This research paradigm argues that big Banks have a comparative advantage in lending to relatively transparent customers because they can obtain "hard" or quantifiable information from them, such as standardised accounting data. Community Banks, on the other hand, have a comparative advantage in lending to opaque small businesses and households.

Yet this division of Labour between big and small Banks has begun to blur. Today, bankers and researchers are well aware that low-cost information processing fees, improved credit scoring system and more mature management techniques are increasingly reducing the opacity of information of many small businesses and households. Credit card borrowing is proof of that. Technological and financial innovations, including economies of scale in credit scoring, securitisation and data processing, have combined to make credit card borrowing a "hard" information, transaction-driven business. It is very different from traditional unsecured personal borrowing, which relies heavily on personal knowledge and personal relationships.

Some of the latest data from the fed's small business finance survey may provide useful information about how the role of markets and community Banks is changing. The fed does this every five years. The latest figures are from the end of 2003, and these are preliminary figures that will be released later this year. These figures are based on our survey of more than 4,200 small businesses nationwide, representing approximately 6.3 million small businesses across the United States. Surveys show that small businesses are the main users of financial services. For example, the share of small businesses doing some kind of financial business in a bank or savings institution rose from 92 percent in 1998 to 96 percent in 2003. There are many types of financial businesses that are gaining share, especially in the area of "financial management services". Financial management services include the following services, such as check clearing, cash management, letter of credit and credit card processing.

According to these surveys, community Banks remain important providers of these services, despite increasing competitive pressures. About 37 percent of small businesses that reported using Banks and thrifts in 2003 used community Banks, down from 42 percent in 1998. Over the same period, the share of small businesses using financial services provided by non-depository financial institutions shot up from 40% in 1998 to 54% in 2003.