#and go ahead and extend that example to pretty much any policy

Explore tagged Tumblr posts

Text

ok here's my 1 election night post. bc i have no thoughts/opinions rn that im sure-enough-of to die on a hill for and also bc it simply doesn't matter what I say and im still a little high.

the thought of genocidal fascist #1 winning the race makes me horribly nauseous but the thought of genocidal fascist number #2 winning the race makes me want to fucking kill myself. and unfortunately there's no 3rd option. so here we are

#this is as best as i can sum up my feelings on this rn#the following are all true (to my understanding)#1) in the big picture is there going to be a big difference? not really. the imperial machine is run by both dems and reps#2) do i think if trump wins this will “be the last election”?? fuck no lmao#3) is the american empire doomed to collapse under its own weight? of course! any decade now!#4) does it still suck to be living through the collapse of the american empire. well. yeah lol#5) people will (as always) care more about trump's 'kids in cages' than the dem president's 'kids in cages'#and go ahead and extend that example to pretty much any policy#6) so there would be more leniency towards harris than towards trump. less civic action maybe#7) but also there DO exist swaths of people who will be better off under harris than trump#unfortunately not nearly as much as dems want you to think#anyways thats enough rambling for me. i should pop like 20-30mg melatonin now lmfao

3 notes

·

View notes

Text

ALL ABOUT SM GLOBAL PACKAGE & NEO CITY: SEOUL EXPERIENCE

by twitter user @sugnsook // @yudotaeil

Hello~ so i am not that good at explaining/vlogging or writing stuffs but in this thread? or blogpost or wherever u guys reading this, i will try to describe my experience as much as I can. Also for now, I am dividing this post, FAQ-style according to several topics, and I will put a separate detailed post on my own Neo City: SEOUL experience. I hope this will help for u guys deciding to splurge a bit on concert/global package!

Disclaimer: In the past, I got a few ccs complaining about my fangirl related-expensive expenses, I just want to note earlier here that as the whole prior to the actual concert, I was a part time student & working 30+ hours a week, working every chances I get. It was also my last semester of undergrad studies & I have been wanting to attend NCT’s first ever concert since 2017 and been really saved up since then, so I consider the large expenses is pretty much a treat for myself.

Tl;dr: if you worked hard enough and really wanted to attend your faves event, just go for it, as it was really worth it.

— General

What is included in Global Package?

Concert ticket (depending on days u wanna go), a good quality hotel for your stay, return transportation to & from the concert venue - hotel, preorder access to official merchandises, NCT 127 theme global package-special merchandises, NCT 127 theme snack boxes (after the concert), One themed lunch, a half day tour with tour guide before the concert, special event (varies according to what concert) - for NCT127’s we got a photoshoot session with NCT127’s life-size standee in SM’s infamous practice room itself.

How much does Global Package cost?

All i can say first thing first is….it IS costly. The ones I am paying is $949USD for Superior Single (Course C) as shown below:

The difference between the prices & packages are it depends on which hotel they will locate you & your seating in the concert. They also have Course A, Course B & Course C which depends on the concert days you are attending. Because I am flying out to Seoul just for the purpose of concert so why not just buy the two days ticket? And yeah that is why I chose Course C.

When does the ticketing open?

Usually the global package ticketing will only open at least one month prior to the actual concert, just like the concert announcement itself. Basically right after SM announce the concert, just be prepared as the ticketing will be shortly after it, right before the general ticketing starts. My advice is just, save up save up and save up as it is really well-known super costly.

How competitive the tickets are?

It is less competitive than general ticketing for sure, but pretty competitive in between ifans itself. When I bought mine, I initially planned for just economy ones but the ticket sold out WHEN i clicked “payment”. So, be quick or you might need to wait a bit more. I’m the type to be anxious if I dont have my ticket yet so I really want my ticketing matters to be settled up as soon as possible so-- when I figured out the economy package got sold out I quickly clicked on superior option - impulsively hehs.

During that ticketing, SM allows you to hold your payment up to 2 hours, as for twin package buyers can split payment. So if the tickets sold out, you might be able to get it after 2 hours. NOTE THAT: SM changed the policy from 2 hours to 30 mins now.

Eventually SM will release more packages and you CANNOT change your options once you have buy it. The packages will be available up until a week/or two before the concert, but the type of packages is really depends. I would say, Course C - Economy package sold out pretty quickly because that is what most people aiming for.

*also, keep refreshing the page if you are buying at the exact ticketing open time! The ticketing for mine opened 3 mins before the actual time so yeah….

How is the payment made?

Paypal only. Just be sure you have signed up to smtown travel account, and link you cards or have paypal balance to get your payment completed smoothly. Your package will only be confirmed once you get the payment confirmation so, having a working payment method is important. SM’s cancellation policy is ridiculous so I recommend everyone who is interested to join GP to do a thorough research beforehand.

Can international fans join general ticketing?

Yes, but not really feasible, as Yes24 sites require verification, unless you have connections with korean verifications or buy from 3rd party. The downside of 3rd party is you might get even more expensive ticket collectively compared to what Global Package has offered.

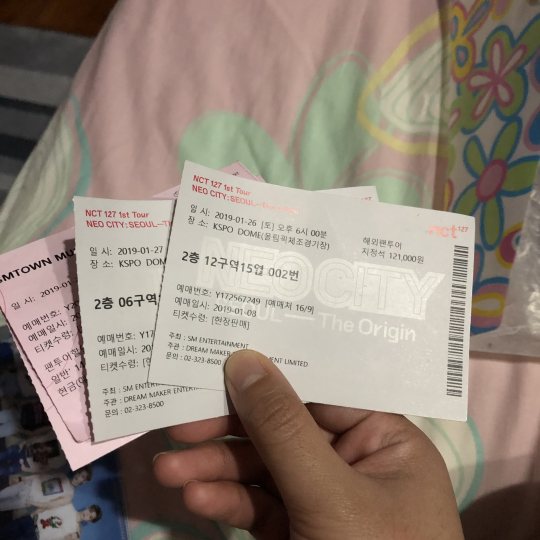

How good the seats are?

It depends on your luck as you will only draw your ticket basically the day before the concert. The more you paid for the package, the better the seats. For standing you might get a better queue number and in korea concerts you strictly go in by queue number. I chose seating, so for luckily one of my seat was right next to extended stage, and another seat was on the other side but center view. Also i luckily got both sides of seating so I can enjoy the concert with both views.

It is possible to trade your ticket between other global package holders tho - bcs i saw people did this at my hotel lol but you cannot ask sm to change your ticket. The concert ticket will be written as “해외팬투어” (intl fans tour), instead of your name.

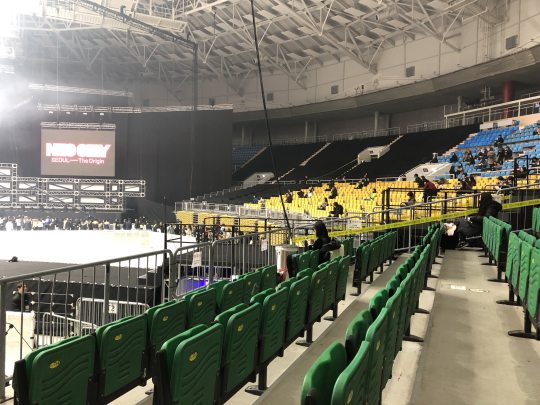

My seat on the first day

My seat on the second day, center view

My seat on the second day, side view

Is there a customer service page i can rely to?

Yes. If there is one thing i would applaud SMtown travel for, it is for their customer service. I used a lot of their “Q&A” page and they typically will reply you within one business day. If you ask on weekend, they will respond to you as quick as on Monday. So if you have any like literally, ANY question about your package, just send a question to them and they will reply personally as soon as they can. And it is in english.

— Logistics

After you have bought your package, SM will update the logistics & schedule 2 WEEKS before the concert. So don’t worry if they ghosted you out before that 2 weeks lol.

Technically, they will divide the hotels according to the package type (dlx/superior/econ), then they will divide you into bus numbers, according whether you are seating/standing. Also your schedule will depends on the bus number you get. And this is non-exchangeable, as they prepared everything according to the list that they grouped you out.

How is the hotel?

For me, i got located at Ibis Styles Ambassador Hotel in Gangnam. Because I got single package, i got the whole hotel room for myself, lol what a new experience, as for my solo travels i only go for budget hostels 🤣. The hotel location is only 15~20mins subway away from the venue, and it is walking distance from COEX. There are a bunch cafes & convenience store nearby so it is pretty easy to get something. The only thing is SM’s booth opens at 8pm, so because I arrived early, I just roamed around until the booth opens. At SM’s booth, it is where you pick up your preordered merchs, sm’s merchs and most importantly draw your tickets. Also I took the chance when gathering with fellow global package goers to trade anything i needed to exchange while everyone is there.

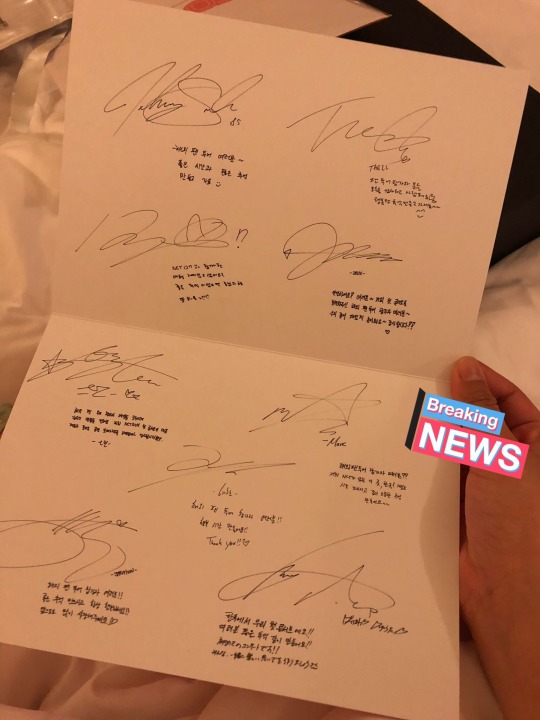

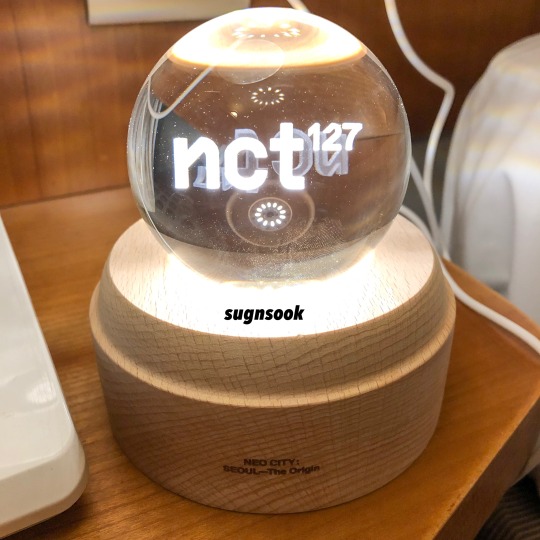

I dont know where to put this under, but for GP, We were given a greeting card from the boys, bunch of stickers, a letter set (with colour pencil), L-holders, bunch of posters and nct127’s moodlight. For the letter set, you can decorate and write fanletter to the members and hand it to your tour guide at the time they ask you. I bought some masking tape and stickers beforehand to decorate my letter, u can prepare it ahead too and transfer it to the letter they give as the time frame is really short.

Can I go to the concert by my own?

Yes you can~ Be sure to tell your tour guide so that they dont waste time waiting. You also have to tell them whether u want to go back to hotel with them or not, as that is when they will hand you the snack boxes. If you are not certain of travelling alone in Seoul, i recommend to travel by the bus they provide, because the tour guide will bring you right until the concert entrance. For me, I wanted to join fan-events and roam around the venue more, so I decided to go on my own. (Best thing about it was when you’re in a train with fellow NCTzens they just airdrop you a lot of nct related stuffs — including the selfies they airdropped at the venue!).

— Itinerary

How tight the schedules are?

It kinda not as tight as I thought? Except for pretty early schedule on the first day, also Maybe because I got a seating ticket so I dont go to venue after the tours right away (standing fans had to queue right away after the tour)

And for me, this was my schedule —

25th 8pm: pick up merchs, ticket etc from SM booth 26th 10am - gather at hotel lobby 10:30am - depart for lunch (at Bulgogi Brothers), it was NCT127-theme and they play nct’s songs! 11:50am - depart to COEX artium - u get 1 hr to roam around there, I chose to roam around smtown museum 1pm - depart to SM C&C building in cheongdam, for special event Around 2~ish - depart back to hotel

U get free time in between and gather back at 4:30pm to depart to concert venue as concert starts at 6. As concert ends around 8:30pm, they give you about 45mins~ to get back to the bus if you wanna go back with them. 27th Bus departs at around 2 pm if i recall, as concert starts at 4pm. I went out at 10am lols (also tell your tour guide!) and bus departs around 7:30pm after the concert. 28th - check out around 12pm.

Detailed itinerary will be updated in my experience post.

The best thing about the concert period was they give you discount on some SM-related stuffs. For example, they give 30% off (?) for beverages at sm cafe for ticket/GP holders, and also discounted smtown museum admission. There were also new merchs got released that time, and some other promotions going on.

Snack box after the concert!

Merchs I collected from kfans giveaways at the venue

The best part was NCTZens spreading out the fanproject - sing Paradise during Encore; using Airdrop. NEO indeed 😎

The amount of memes & stuffs being airdropped - lol

— Budgeting

General budgeting for my trip:

Flight - around 1.6K MYR return trip with 20kg luggage & meal (AirAsia)

Hotel - i only went during my GP stay period so it was all inclusive (hotel + concert ticket) with that $949 USD

Other expenses (tmoney, food, additional merchs) - about $250 usd is enough for me for 4 days, considering I spent on buying cosmetics & merchs a lot. My own preordered merchs was separate amt too, it depends on what u do/willing to spend around that period.

— For Muslim Fans

Do they provide halal meals?

They dont provide halal meat, but you can request for vegetarian option or seafood. During lunch, I got vegetarian bibimbap set. And for the snack boxes, too bad SM provided ham/bacon in the sandwiches, which I am not confident in removing it so I decided to not eat, just eat the cookies. Also they offer late-night meals after the concert (separate pay), but I didnt opt for that one and only went to eat at nearby places.

Can I pray before the concert?

Yes~ as I mentioned earlier, there are a few hours gap before you depart to concert so you can pray at your hotel beforehand. Or if you dont mind, like I did as I went to venue early on the 2nd day, I went to pray at Olympic Park area itself, there are a lot of benches or u can walk a bit further to isolated places to pray. I just sat down at some bench and pray while sitting down.

xxxxxxxxxxxxxxxxxxxxx

These are what I can think of, and as I said earlier I do have another separate post regarding my own NEO CITY: Seoul experience, and I will update under a thread. If you have any questions feel free to contact me via twitter (@sugnsook/@yudotaeil) or curiouscat.me/6sungjae. Also for neo city fancams/random pics about my trip, it will be updated eventually under the main thread where this entry is posted :) Hope it helps!

19 notes

·

View notes

Text

Rtl Sdr For Mac

Follow our tweets!

Rtl-sdr For Mac

Rtl Sdr For Mac Computers

Rtl-sdr Macports

Rtl Sdr For Mac Os

Home Purchase News macOS Software Windows Software Ham Radio iPhone/iPad Linux Software Documentation Support/FAQ Update Policy Lost Reg Code? USB Icom CI-V Interface MIL-STD-188 Interface Radio Hobbyist Products 22m Part 15 Beacon Kit CW Keyer For Beacons Kit Jellyfish Transformer Cyclops Antenna Transformer General Interest Programs Atomic Mac/PC Audiocorder Audio Toolbox Black Cat Timer Diet Sleuth iUnit Graffikon Graph Paper Maker Health Tracker Image Resizer Knitting Wizard Label Wizard Prog Audio Gen Sound Byte Synth 76477 Amateur Radio Programs AirSpyHF+ Server Audiocorder Black Cat ACARS Black Cat CW Keyer Black Cat HF Fax Black Cat SSTV Carrier Sleuth Cocoa 1090 Cocoa RTL Server DGPS Decoding DX Toolbox Elmer eQSL Factory MatchMaker KiwiSDR Sound Client KiwiSDR Monitor MININEC Pro Morse Mania MultiMode mySdrPlayback RF Toolbox SDRuno/SDRSharp UDP SelCall Sonde iPhone/iPad Apps ALE Atoms To Go dB Calc Clik Trak DGPS Decoder Drill Calc DX Toolbox Elmer Extra Elmer General Elmer Tech Feld Hellschreiber Field Strength Calc Function Generator Pad GMDSS Godafoss HF Weather Fax iAttenuate iFunctionGenerator iSoundex iSoundByte iSweep iUnit Morse Mania ACARS Pad Morse Pad NAVTEX Pad Packet Pad PSK31 Pad SSTV Pad Photon Calc Rad Map Tracker RF Link Calc SelCall Tone Gen Sound Byte Sound Byte Control Spectrum Pad SWBC Schedules Synth 76477 Synth Motion Transmission Line Calc Weather Calc Wire Calc iPhone/iPad Bundles RF Calculator Apps Ham Radio Decoder Apps Audio Utility Apps Shortwave Weather Apps Ham Radio Exam Study Apps Shortwave Decoder Apps Android Apps ACARS Audio Function Generator Audio Spectrum Analyzer DGPS Decoder HF Weather Fax NAVTEX Rad Map Tracker SelCall Tone Gen Sound Byte Control SWBC Schedules Wire Calc About Black Cat Systems Site Map Our software for Mac OSX Privacy Policy Press/Media HFunderground Apple /// Emulator

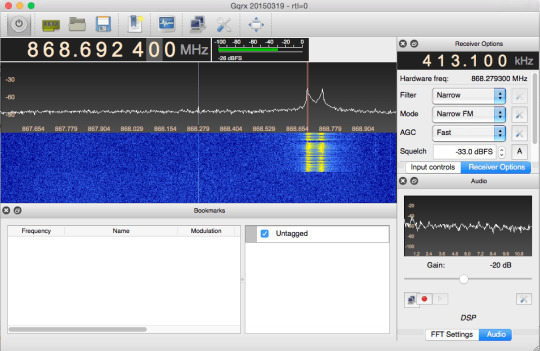

This video explains how the RTL-SDR dongle works. I will show you how to open the RTL-SDR dongle and show you (very detailed) what it inside this particular. Download rtltcp SDR for macOS 10.15 or later and enjoy it on your Mac. This is a macOS version of the iOS rtltcp SDR app. Connect, via the rtltcp network protocol, to a remote or directly connected RTL-SDR USB peripheral - Listen to AM, FM, SSB and CW radio signals - View an RF spectrum and waterfall This app requires either a local. Mac OSX users can have a hard time with the RTL-SDR as there are not many software packages available for it. One software package that is known to work well on OSX is GQRX, which is a general multi mode receiver GUI that is similar to the Windows software SDR#.

Macintosh Links Shortwave Radio Pirate Radio Spy Numbers Stations Science and Electronics Ham Radio Software

I’ve been working on developing OSX/Mac and Windows versions of SdrDx. At this time, SdrDx for OS X and Windows supports Ethernet-connected version of AFEDRI SDRs, the USB-connected Airspy (AirSpy HF+ under OS X only, via this OS X server), Ethernet-based Andrus MK1.5, USB FunCube Pro, USB FunCube Pro Plus, Peaberry, Ethernet based RFSPACE SDrs, USB RTL sticks (RTL supported under OS X only, via this OS X server) and Softrock SDR receivers. Both the Peaberry and Softrock SDRs require a lot of expertise to get working. The others are pretty much plug-and-play.

For this to work just install Tongbu Assistant, connect your device and look for the info. And email icloud id, doest work in all idevices it seems need not be restored, can be in lost mode not erased. Find email icloud apple idalso many people use this software because helps you download paid apps for free.In this app the good thing is have many options you can check about your idevice, and one of them is serial number, Imei, USUS, Phone number, etc. Tongbu assistant for mac download.

In addition, SdrDx can be made to support any SDR with a sound card interface, including I/Q input via your native or auxiliary sound card, with a little scripting work; the Peaberry and Softrock support use this mechanism via Python.

SdrDx (running on the Mac) is shown to the right. SdrDx is a closed-source, free application.

SdrDx, in combination with your SDR, is an extremely powerful receiver. Reception, recording, playback, analysis, processing — it’s all there, and it’s all been made as easy to use as possible. Extensive documentation covers every aspect of operating the software, as well as providing numerous examples and images to help you along. If you’re an expert radio user, you’re sure to settle right in. If you’re still learning, you can look forward to software that lets your capabilities grow with your knowledge.

Youtube converter to mp4 mac. While many want to download YouTube videos, the only way to do so responsibly is on iOS and Android, by paying the $11.99 for YouTube Premium. Otherwise, you're violating YouTube's terms of.

You can have real knobs and buttons

AirSpy HF+, RTL, SDR-IQ and SDR-14 users: You can download the executable application(s) appropriate to your OS (OS X or Windows) and the networking server for your OS (if you have an AirSpy HF+, SDR-IQ or SDR-14 and don’t already have a server) below. Remember, you must have a network server application installed to support these USB-based SDRs. Server applications for both OS X and Windows platforms for the SDR-IQ and SDR-14 are available in the list of downloads below; so far, the only available servers for the AirSpy HF+ and RTL sticks run under OS X. Other supported SDR types do not require a server application.

Buying an SDR?

Please consider the following makers of SDRs ahead of any others. These manufacturers have gone the extra mile to see that SDR software developers such as myself are provided with working SDR samples, technical support and interfacing data:

• AFEDRI (822, 822x) • AirSpy (HF+) • Andrus (MK 1.5) • Funcube (pro, pro plus)

The main application zip file will un-compress to a folder, inside which you will find the SdrDx application, and some other files. Please read

the documentation carefully. Take advantage of the extensive index. If you can’t find something in the index, please let me know. I try to keep the documentation up to date. It’s no trouble at all to add index entries, and generally speaking, I’m willing to expand the main manual itself if you find something I have not covered yet. Recent changes to the documentation may only be found in the beta documentation until a version update of the entire package is made; this is where to look if you ask me to add something, it’ll appear there first.

Note to Windows OS users: Only run SdrDx and SwDb out of the folders I supply them in. Don’t stick the executables somewhere else. That way lies madness. MaDnEsS!

Current Version and related downloads

Related Videos:

For Developers (and those who would encourage developers)

In order that SdrDx is able to support additional USB-based SDRs, a protocol-compatible server must be written by the SDR vendor or a third party. You can use this fully functional RTL USB-to-network server as a starting point — it does everything you need to do to talk to SdrDx. SdrDx will work with any SDR or SDR network server that acts like the sample server software; if you need to extend the network methods, for instance to control features unique to your SDR, let me know and I will do my best to support those extensions. However, note that I require that the actual SDR be provided to me for development and testing of those extensions.

Likewise, if you’re considering a new SDR design where you plan to have an Ethernet connection as one of, or the only, method of communication to the host computer, ideally it will be compliant with those protocols. If it is, it will “just work.” If it isn’t — it won’t, and software support for your design will be considerably more limited. Examples of such well-designed SDRs include the Andrus MK 1.5 and the AFEDRI, as well as the SDR-IQ via its network server applications. And of course all the RFSPACE networked SDRs.

If you’re looking for something to do, many USB-based receivers are desperately in need of precisely such a server. No, I don’t write these servers. I spend what time I have adding radio features to SdrDx. However, here is GPL’d source code for an SdrDx-compatible USB-to-Network server for the RTL 'stick' SDRs that can be refactored to support other USB devices. All you need to do with regard to SdrDx is tell me what device name you will use with the server (it currently reports in as 'RTLSVR', you need to pick a name for the device you’re supporting, and tell me what it is.)

For Everyone:

Is my SDR already supported? The answer is here: Check this list.

Wideband RF Recordings — these are useful if you’d like to try out SdrDx but you don’t have an SDR yet. You can start SdrDx, press '>play (click that link, then look for the green button) and then enjoy receiving the described band, event, etc. You can tune within the bandwidth of the recording. So for instance, if you play the 6100 kHz recording, which is 200 kHz wide, you can tune from 6000 kHz to 6200 kHz — most of the 49 meter band! Just download and install SdrDx, then the file of interest, start SdrDx, press > and select the file (if it’s zipped, you have to unzip it first.)

ISS space station on 145.800 MHz, April 13th 2018, with AFE822x HF/VHF SDR; SSTV transmission in PD120 mode – 84.0 MB download (image as received with Black Cat SSTV software can be viewed here)

ISS space station on 145.800 MHz, Dec 5th 2017, with AFE822x HF/VHF SDR; SSTV transmission in PD120 mode – 111.5 MB download (image as received with Multimode software can be viewed here)

Large (370 Mb download, 500 Mb file unzipped) wideband recording:6100kHz (49m band) SW, about 8 minutes. Settings: 200 khz span, fixed 6100.0 center, gridspacing=20, 6 db/div, Max=-54db

SdrDx-WOL-8474-KHz-FSL-RTTY-news.wav.gz 100 MB gzip file containing a recording of RTTY news station WLO as received here at my QTH a few years ago. You can try out SdrDx’s RTTY demodulator with it: 8474 KHz, , , demo to Lo=-1150 and Hi=-850, scope set for 1033 Hz center and 170 Hz shift.

Short (35Mb download) wideband recording:20m Pileup. 190 khz wide recording, fixed 14260.0 center, tune to 14207.0 and nearby USB, grid spacing 19, 0-3khz demod

Short (13.5Mb download) wideband recording:Lovely 5 khz wide USB signal with canary. 190 khz wide recording, fixed 14245.0 center, tune to 14178.0 USB, grid spacing 15, 0-5 khz wide demod. Adjust CWO for perfect man’s voice at end. After I recorded this, I played it back over the air, and the ham told me his bird acted super interested in what it was hearing!

Mac (Stable Version) for OS X 10.6.8 through 10.15

SwDb 0.1m for the Mac (feedback! I need feedback!)

Highly recommended:DX Toolbox

for USB SDRs:

USB Driver (you probably don’t need this):

Snow Leopard (OS X 10.6) and up USB-to-network server for the SDR-14 and SDR-IQ

Snow Leopard (OS X 10.6) and up USB-to-network server for the RTL stick SDRs

OS X RTL Stick Server (10.6 and later)

OS X AirSpy HF+ Server (10.6 and later, at Black Cat Systems)

OS X Beta

64-bitOS X Beta 2.20o ZIP archive Please Note: The OS X Beta changes at odd intervals, sometimes quite often. You can see when the beta build you have has been superseded by a new one by examining the SdrDx title bar at startup. Your SdrDx build time, and the latest SdrDx build time, are both displayed there. When there is a difference, there is a more recent Beta, and you can come right here and download it. Significant changes are indicated on the page below:

Windows

SdrDx 2.19n Beta for Windows (feedback! I need feedback!)

SwDb 0.1m for Windows (feedback! I need feedback!)

Highly recommended:DX Toolbox

For USB SDRs:

Windows USB-to-network server (SDRxx for the SDR-IQ only)

Help for AFEDRI (preliminary)

People have been having problems getting the AFEDRI to work with SdrDx; I’m not sure why, but here is some information on what I did to get mine going.

Before you start, make sure you’ve set the audio output within SdrDx using to the correct device. If this is not set correctly, SdrDx cannot run.

Now as to the AFEDRI itself: First of all, I could not make the AFEDRI’s DHCP settings work at all. I contacted Alex, the designer, and after quite a few emails back and forth, he suggested a static IP configuration. I set that up, got it working on my normal network, and then connected it to my 2nd ethernet port on the Mac (this is under OS X 10.6.8) under a second network of 192.168.10.1; this involved some fairly annoying screwing around with the OS X configuration files. I never did get the DHCP to work, though some SdrDx users have. So I strongly suggest you set the AFEDRI up using a static IP; I think there may be some fairly severe bugs in the AFEDRI’s DHCP handling, or at least, ways it can be set up that simply don’t work. Other SDRs, such as the Andrus MK 1.5, configure using DHCP no problem, so it’s definitely something unique to the AFEDRI.

Having said that, it could very well be something I did in the configuration utility of the AFEDRI; the version I had only provided a Windows-only program, and I only fired up the laptop to work with it until I got it to work in general, and never looked back. Running windows give me hives. Still, I know for sure you can get the AFEDRI working with OS X — the AFEDRI is the SDR I’ve been using for quite a few months now; it’s a great SDR. I would expect results to be similar for Windows, that is, static IP will definitely work, and DHCP might not.

Support for Andrus MK1.5 SDR

Connect Andrus MK1.5 to your LAN Ethernet

Start SdrDx 2.12p (or later)

Open NET dialog and use auto-find to locate Andrus

Close NET dialog

Open SDR dialog and set bandwidth as desired

Close SDR dialog

Press RUN

Support for Peaberry and (possibly) Softrock

Unzip and copy .py file from within the .zip to your home directory

Download and install PyUSB library

Start SdrDx 2.12p (or later)

Open a shell at your home directory and type ./tcp-to-peaberry.py

In SdrDx, left-click SND button, select “Peaberry Radio” as input sound card, OK

In SdrDx, right-click FCD button, check ON and AUDIO IQ, set OSX rate to 50000, or Windows rate to 48000, OK

In SdrDx, left-click SDR button, set sample rate to 50000, OK

In SdrDx, left-click FCD button — Peaberry should be running now

Acknowledgements and Notices

Changes

Please refer to this page for the release version documentation.

Please refer to this page for the beta version documentation. Adobe photoshop cs5 download windows.

System Requirements

SdrDx and SwDb for the Mac require an Intel CPU, running Snow Leopard 10.6.8 or later.

So far, I have numerous third-party reports of SdrDx working under 10.6, 10.7, 10.8, 10.9, 10.10, 10.11 10.12, and 10.13.

Users of 10.11 through 10.13 report mixed results, under these OS X versions, USB server based SDR users are facing driver installation and activation problems, and tooltips and drop-down menus are blank; Apple’s gone and broken perfectly stable APIs again. Steps required to compensate for Apple’s idiot USB shenanigans are in the docs under new installs. No fix in known for the tooltips issue at this time.

There are two tricks required as of 10.9 and later:

First, you need to turn the “App Nap” feature off or when SdrDx is not the front window, OS X will put it to sleep, which will break it. Right click on the SdrDx app icon, select “info”, turn off App Nap, and close the info window. If you’ve got an SDR-IQ where the server runs under 10.9, you’ll need to do the same thing to the server application. Note: I suggest the very first thing you do with any application you install is turn off App Nap — it’s one of Apple’s worst ideas ever. That’s all there is to that.

Second, under 10.9 and later, for users of the SDR-IQ, Apple thoroughly broke the USB driver that is required for the SDR-IQ and SDR-14 (and possibly the CloudIQ — anyone have a CloudIQ running?) So in order to use the USB driver in the SDR-IQ/SDR-14 server application instead (so the USB to Net server will work), you need to enter the following in a shell right after you boot your machine…

sudo kextunload -b com.apple.driver.AppleUSBFTDI

Rtl-sdr For Mac

…it��s not sticky, so you’ll have to do this every time you reboot your Mac.

And of course SdrDx requires an SDR as well if you want to receive live, although it can play back pre-recorded files without an SDR; in the specific cases of the AirSpy HF+, RTL SDR, SDR-IQ and SDR-14, you’ll need to use one of the server applications that puts these SDRs on the network. SdrDx’s support of RFSPACE SDRs and compatibles, and near-compatibles, is only via network connections, SdrDx does not directly interface with the USB connection of the SDR-IQ.

For the Mac, I am presently designing and testing and compiling under an OS X 10.6.8 (Snow Leopard) virtual machine (VMWARE) running under OS X / MacOS 10.12.6.

Rtl Sdr For Mac Computers

—

Rtl-sdr Macports

SdrDx and SwDb for the PC require an Intel CPU, running Windows XP or (possibly) a later version of the OS. SdrDx requires an RFSPACE, AFEDRI, Andrus MK1.5, FUNcube Dongle SDR, or a Soundcard-based SDR, or pre-recorded RF files (see above for some of these) in order to do anything useful; in the specific cases of the SDR-IQ and SDR-14, you’ll also need a server application that puts the SDR-IQ on the network. SdrDx handles the RFSPACE SDRs and compatibles (and near-compatibles) via the network, it does not directly interface with them via USB. You must run these applications out of the folders they are supplied in, as they depend on files in those folders.

Rtl Sdr For Mac Os

For Windows, I am presently cross-compiling under Windows XP (in a VMWARE VM under OS X / MacOS 10.12.6.)

0 notes

Text

Star Wars: The Bad Batch Episode 1 Review: Aftermath

https://ift.tt/eA8V8J

This Star Wars: The Bad Batch review contains spoilers.

The Bad Batch Episode 1

During the opening scene of The Bad Batch, the new animated series set during the rise of the Empire, the The Clone Wars logo burns away. At once blatant marketing and a promise of something new, the logo neatly explains what The Bad Batch is.

As Jennifer Corbett (producer and head writer) and Brad Rau (producer) said during a press junket ahead of the May 4 premiere, this show is a spiritual successor and also a direct sequel to The Clone Wars. The beginning of the new show draws from the epic scale of The Clone Wars‘ series finale (and the Star Wars Prequel Trilogy which it parallels). But while the action and heart are all there on paper, stock characters and a too-straightforward plot drag down the 70-minute premiere.

The five characters of the Bad Batch, lead by elite clone Hunter, never quite fit in. Like many other aspects of technology in Star Wars, cloning isn’t an exact science, and Clone Force 99 are “deviant” or “defective” depending on who’s talking, but they’re very good at their jobs of fighting on behalf of the Republic. But when the Republic transitions to the Empire, they’re immediately asked to start doing messier jobs, such as hunting down human rebels, whereas they’d usually fight droids. As you’d expect, the clones swap sides and, of course, end up having to fight their way out of their home base. A young girl clone named Omega helps them out, and the stage is set for the rest of the season, which will have at least 14 episodes.

Star Wars guru Dave Filoni is joined by Star Wars Resistance writer Jennifer Corbett on the creative side. Her pedigree in delivering stories for the Sequel-era animated show, and her experience in the U.S. Navy, make her an ideal guide for this war story. As military science fiction, The Bad Batch is serviceable, with the creative action and silly one-liners typical of The Clone Wars. The franchise’s approach to animation is always improving, which in this first long episode manifests mostly in impressive snow and a fun depth of field effect. The sharp corners of armor contrast nicely against soft, blurred lights in the out-of-focus backgrounds.

Stream your Star Wars favorites right here!

As far as plot goes, it’s pretty simple, leaving me to want to dig into some of the more weighty sections but not sure whether they’re actually statements. The Bad Batch see the other clones turn on the Jedi during Order 66, but for the same reason their other “defects” make them stronger, the inhibitor chips that should brainwash them according to the Emperor’s wishes don’t work. They choose to let the Jedi in their vicinity live. Future-Grand Moff Tarkin sees their rebelliousness as a good chance to prove the Clone Army is no longer effective. After all, conscripts would apparently be cheaper. But after the Batch uncover Tarkin’s true colors, they defect for good.

It’s cool to see this transition happening. What do clones become after the war? It’s a question hardcore Star Wars fans might leap to answer (they don’t all become stormtroopers, and not all stormtroopers are clones) but we haven’t seen it so directly on screen before. It’ll be nice if The Bad Batch addresses some of the practical questions around that.

Meanwhile, Tarkin’s clearly willing to shed civilian blood in a way the Jedi generals weren’t, replacing the clones bred for war with human volunteers. Like many other Star Wars stories set during the Prequel era, the Batch’s choice presents a moral decision with no right answers. The “good” choice here would be to maintain a status quo in which tens of thousands of people are born solely to fight wars with droids, which, while technically enemy soldiers, are also sapient. And while I can generally get lost in the military camaraderie fantasy here, the fact that other clones don’t like them makes what exactly the Bad Batch is fighting for even more muddled. Maybe this is about giving this squad a new cause they believe in outside of the definitely-bad Empire.

Or maybe the fact that it’s hard to tell the Republic’s policies from the Empire’s is the point. This is how the Republic fell after all: gradually.

The strongest character beats involve the characters learning to trust each other in new ways. Team leader Hunter’s superpowers are “enhanced senses,” although that isn’t really on display much. He begins to distrust team sniper Crosshair when Crosshair becomes over-eager to follow their grim mission by the book. Their arguments were most compelling before the inhibitor chip was introduced: while I know it fits with the lore, it defangs the story a little to have the main antagonist’s motivation be “he was brainwashed,” and I was a little unsure of how much the show was willing to either pin blame on him or absolve him of it. Either way, we haven’t seen the last of Crosshair.

The Bad Batch can’t even trust the Kaminoans, their creators and stewards of their beloved home. The one who shows this the best is team heavy Wrecker. His tendency to scream about blowing stuff up I generally find more annoying than funny, but toward the middle of the extended episode he adds pathos without getting away from this broad characterization. Wrecker isn’t programmed, he insists. He likes what he likes. His determination to hold on to a sense of himself as a person with free will feels like the real stakes of the show. It’s a section of the episode that quickly jumps back into goofy, fun action, but for a moment gets at something more serious and scary. Wrecker’s determination to hold on to his individuality shows exactly what Tarkin hates most about the clones. Ironically, in Tarkin’s estimation, he needs stormtroopers that can be even more tractable.

Unfortunately, the moments most important to this theme are undercut by repeating information the audience already knows. If you’ve watched The Clone Wars, you probably know about Fives’ discovery of the inhibitor chips and how Ahsoka helped Rex remove his. But moments like the one above sell the fact that the clones would be shocked to learn the truth about their new Empire.

cnx.cmd.push(function() { cnx({ playerId: "106e33c0-3911-473c-b599-b1426db57530", }).render("0270c398a82f44f49c23c16122516796"); });

The brand new member of the group is Omega, a young teenage clone introduced as both audience surrogate and mystery. (She’s also a particularly noticeable example of how the Empire is whitewashing the clones — those further from the Jango Fett template have lighter skin.) She’s a big fan of the Bad Batch because, like them, she’s an altered clone. It’s implied that she’s never really been able to make friends with other humans before, so it makes sense she’d latch on to the other unique clones in her orbit. Her fondness for them sometimes reads like a script for how much the audience is supposed to be fawning over the headliners, but the show never quite really shows the world from her perspective. Nevertheless, I think it’s overall a less jarring introduction than Ahsoka’s, who became a great character as she got more involved with the rest of the saga. It’s a “wait and see” with Omega as well.

I am a bit wary the series might be hurrying to repeat the sleight-of-hand pulled with Rey, presenting a character as both a point of view and a mystery at the same time. The first two episodes provided for review hint something bigger is going on with Omega, and how grounded that thing might be might determine whether it works. It’s become a bit tiring to use “who is this character?” as a jumping-off point rather than providing an answer in the first place and building from there.

As far as connecting to other Star Wars characters we do have answers for, The Bad Batch instantly announces that this will be a cameo-heavy episode, and…that’s okay? Now that they’re not being as coy about it as Rebels was, it’s a lot of fun to see Saw Gerrera and a young Kanan Jarrus. (Even if the latter cameo does instantly contradict the Kanan backstory comic released by Marvel a few years ago.)

When the Bad Batch were introduced in The Clone Wars I found them boring, their action figure-ready powers not any more compelling than the clones and Jedi we already had. They still seem a strange choice for headliners when characters like Ahsoka are operating at the same time. More so than The Clone Wars, The Bad Batch feels like a deep cut, a completionist tale that may struggle to hold fans. While comparisons between the avuncular Batch and Omega’s relationships with Din Djarin and Grogu are inevitable, this is no The Mandalorian in terms of either content or accessibility.

The post Star Wars: The Bad Batch Episode 1 Review: Aftermath appeared first on Den of Geek.

from Den of Geek https://ift.tt/3h0ihwc

0 notes

Text

If You’re in a Glasshouse …..

During Corbyn’s leadership, Labour was relentlessly attacked by the Tories, their supporters and cheerleaders in the press for the many failings which, they said, made Labour unfit to run the country. Worth dwelling on the accusations for what they tell us about today’s Tories.

A sympathiser with IRA terrorism: well-worn, repeated on every possible occasion and, combined with his associations with various dubious Palestinian groups and past statements about the causes of Islamist terrorism, the Tories happily painted a picture of a man who seemed, well, ambivalent about the use of terror against civilians, if it was in support of a cause he supported. A man who, a week after the Brighton bombing, invited the convicted IRA volunteers, Linda Quigley and Gerry MacLochlainn, to the Commons, to the disgust of many in his own party – let alone the Tories. 35 years later Johnson was still berating Corbyn about it.

Anti–semitism: little more to be said on this, at least until the EHRC report comes out. The damage was caused at least as much by who Corbyn had associated with (those Holocaust deniers would keep on popping up at events where Corbyn was present) as by his own actions. The Tories enthusiastically adopted the maxim that you can judge a man by the company he keeps.

An unwillingness to stand up to Russia: Corbyn’s response to the Salisbury poisonings was used to show a man who did not take the Russian threat seriously, whether because of ideological sympathy by him or his advisors (Seamus Milne being particularly helpful in this regard) or simple naivety about Russia’s intentions.

An automatic anti-Western bias: all too easy to present Corbyn’s approach to foreign policy as little more than “my enemy’s enemy is my friend”. Any country or cause which criticised the West, no matter how awful themselves, found favour: Iran, the Serbs during Yugoslavia’s bloody civil war, Venezuela. It sometimes seemed that concern for human rights was less about those deprived of them and more about how to use the concept to beat up whoever Corbyn disliked most.

An obsession with identity politics: as if all politics is not at some level about “identity” (the Brexit campaign waves hello). Still, the accusation went, Labour was unwilling to speak up for white working-class girls in its heartlands for fear of confronting other client groups and/or being accused of racism. It betrayed those suffering from child abuse on the altar of political correctness. Tom Watson’s parti pris accusations against senior Tories must have infuriated those thinking child abuse too vile a crime to be used for political advantage.

Nepotism and cronyism: Corbyn’s son working for McDonnell, Andrew Murray’s daughter appointed to a plum Labour Party role, McCluskey’s old squeeze to another. All very cosy and incestuous.

So you’d think, wouldn’t you, that the Tories would not fall into the same traps, that they would take care about who they associate with, who they promote, who they praise and elevate? Apparently not, if those nominated by the government to be peers is anything to go by. Deemed suitable to be a member of our legislature are:-

A woman who has consistently denied the war crimes carried out by the Bosnian Serbs against Bosnian Muslims, who – as publisher (of Living Marxism) – was found by a court to have libelled two ITV journalists who reported the facts about what was happening, who dismissed the court’s decision, after the verdict likening the two journalists to David Irving because they had both brought litigation – ignoring the critical difference between them. (Perhaps the differences between telling the truth and inventing facts might be a worthy topic for a future Moral Maze programme.) Certainly, disregard for facts and dismissal of court rulings is now very a la mode. Ms Fox was simply ahead of her time. If you want an example of the intellectually dishonest reasoning of the founder of The Academy of Ideas on this topic, read here. The inability to understand the difference between the denial of established facts and shutting down unpopular opinions would disgrace an averagely bright A-level student. As Deborah Lipstadt, a woman who knows a thing or two about genocide denial, has put it: everyone is free to have their own opinions; they are not free to invent their own facts.

Ms Fox did not have much regard then for freedom of speech though, strangely, when it came to child abuse and jihadist videos, her concern was all for freedom of speech including, apparently, the freedom to disseminate films of criminal offences, though she apparently knows (how?) that most child abuse videos are “simulated”. Nor – more grotesquely – has she ever resiled from or apologised for her pro-IRA views and their campaign of violence before 1998, a campaign which killed and injured, not just thousands of innocents in Ireland and Britain, but 3 Tory MPs, their wives and tried to assassinate a PM.

What a forgiving party the current Tory party now is! Poor Jeremy must be wondering why no forgiveness was extended to him. Perhaps it might have been, had he been pro-Brexit. After all, that’s why she has been elevated, isn’t it, pro-Brexit views being the British equivalent of medieval Catholic indulgences wiping away all other sins? But if the quota for pro-Brexit media loudmouths simply had to be filled, couldn’t Daniel Hannan be prevailed upon? Or Ann Widdecombe, in extremis?

A former editor of the Evening Standard (previously deputy editor of the Daily Telegraph, when Johnson was a columnist there) who strongly supported the PM in his first election for London Mayor 12 years ago. A 2018 CBE for services to the arts since did not suffice apparently.

The current owner of the Evening Standard, who together with his father, a former KGB agent until 1992, has made oodles of money which he has used to buy his way into the higher echelons of London society, much as described in the ISC’s recent report on Russia (pp.15-17). Look who’s being naïve now.

The PM’s brother, an MP for 9 years, a junior Minister for 3, mainly known for having resigned twice as a Minister, the second time from his brother’s government, over Brexit. He then chose not to stand again as an MP. However worthy, it’s not exactly a lifetime of public service.

Ambivalence towards violence, naivety about Britain’s enemies, associating with undesirables, cronyism, nepotism, revolting views. We have them all. Johnson has not just adopted Labour’s public spending but their less desirable “values” as well. And added some Grade A hypocrisy into the mix, so that we can enjoy the spectacle of those railing against unelected European bureaucrats appointing unelected legislators that the people can never get rid of or hold accountable.

What have we missed in the meanwhile? Well, the setting up of a panel to come up with curbs on judicial review, led by a QC and former Minister, who in February wrote that the government should limit the courts’ power (impartial tribunals are so passé). Edward Faulks’ other claim to fame was being advisor to Chris Grayling when he was Lord Chancellor and enacted reforms to Legal Aid which have pretty much destroyed it and, in consequence, the ability of anyone other than the wealthy to access justice.

The panel’s terms of reference are here, clause 4(b) being the important one, seeking to remove or limit the “duty of candour” by the government to the court and other parties. In short, if the government does not have to be honest in its explanations (and remember, this was a government which could find no-one willing to swear on oath what the reasons for proroguing Parliament last year were), how can it be effectively scrutinised or challenged? Why should the people know? They exist just to be venerated when it suits the government politically, not to be treated as adults and trusted with information so that they can hold the government properly accountable. Once again, the government gives the impression that its attitude to law is as described by Anarchasis: “Written laws are like spiders’ webs; they catch the weak and poor but are torn in pieces by the rich and powerful.”

There is one thing to be grateful for. We need never again be troubled by Tories railing about Labour’s attitude to terrorist violence or child abuse or fondness for unelected elites or being too pro-Russian or having dodgy friends or being run by cronies. We know now – if we did not before – that such concern is so much cant, useful only as a political weapon. And if they try, we can point at Johnson’s very own “Lavender List”, perfumed with the stink of hypocrisy, nepotism and cronyism, and laugh. Small mercies, these days.

Cyclefree

from politicalbetting.com https://www7.politicalbetting.com/index.php/archives/2020/08/04/if-youre-in-a-glasshouse/ https://dangky.ric.win/

0 notes

Text

Fed’s program for loaning to Main Street off to slow start

WASHINGTON — Michael Haith, owner and CEO of a Denver-based restaurant chain called Teriyaki Madness, is in an unusual position for people like him: He’s making money through food delivery and pickup and wants to borrow funds so he can expand.

Yet so far, a Federal Reserve lending program set up specifically for small and medium-sized businesses like his hasn’t been much help. He can’t find a bank that’s participating in the program, and he isn’t clear on a lot of the details about how it works. For example, he isn’t sure how much he could borrow.

“We are trying to figure it out, and trying to find a bank that is working with the government on this,” Haith said. “The guidance is pretty convoluted, and the banks seem a little wary.”

Haith’s experience underscores banks’ surprising lack of interest in the Fed’s Main Street Lending program, as well as the challenges potential buyers are having accessing the program. Fed officials say more than 200 banks have signed up to participate since the program began two weeks ago, but that’s a small slice of the nation’s roughly 5,000 lenders. None have made any loans yet.

The sluggish start is in sharp contrast to the reaction that greeted the Treasury Department’s small business lending efforts, known as the Paycheck Protection Program. That facility, launched in early April, set off a frenzied response from millions of desperate small companies seeking a loan. The first $350 billion in PPP funding ran out in just two weeks before being replenished. Congress agreed to forgive the loans if they were mostly spent paying workers.

The Fed has come under criticism from a congressional watchdog for quickly taking steps to ease the flow of credit for large corporations but doing little for smaller companies. The Fed this month began its first-ever purchases of corporate bonds issued by companies such as AT&T, Microsoft and Pfizer.

The delay in Main Street funding may arise during a Tuesday hearing before a House committee in which Fed Chair Jerome Powell and Treasury Secretary Steven Mnuchin are scheduled to testify.

Powell said in prepared remarks released Monday that the PPP has apparently met the immediate credit needs of many small businesses.

“In the months ahead, Main Street loans may prove a valuable resource for firms that were in sound financial condition prior to the pandemic,” Powell said.

The Fed’s Main Street Lending program is the central bank’s first attempt since the Great Depression to go beyond its typical financing for large banks and Wall Street firms and instead provide loans to businesses. Its goal is to help companies survive the pandemic by providing low-cost, five-year loans with no interest payments for the first year or principal payments for the first two years. Banks will make the loans, and the Fed will purchase 95% of the value, freeing up banks to do more lending.

Lauren Anderson, senior vice-president at the Bank Policy Institute, a lobbying group for large banks such as Bank of America and JPMorgan, said some of the group’s members have signed on, mostly as preparation in case the economy worsens later his year and more troubled companies need help. So far, business aren’t clamouring for the loans.

“There’s not huge borrower demand,” she said. “I don’t think we’re going to see a mass run to the banks and a huge amount of loans being written at this point.”

Eric Rosengren, president of the Boston Fed, said in an interview that the PPP attracted more interest because it essentially provided cash, not loans.

“So it’s not surprising that a grant program is more popular than a lending program,” he said. “Everybody wants a grant.”

The Main Street program is also more complicated than the PPP, Rosengren said, “because bank loans are complicated financial instruments” that are tailored to a specific company’s needs.

Companies with up to 15,000 employees or $5 billion in revenue are eligible for Main Street. The loans can range from a minimum of $250,000 to a maximum of $300 million. The Fed has said it will purchase up to $600 billion in Main Street loans from banks. Treasury has provided $75 billion in taxpayer funds to absorb any losses.

Rosengren said that the program aims to help companies that were successful before the pandemic and that can be successful again as the economy recovers. A deeply troubled borrower with no cash and no likelihood of rebounding won’t qualify for a loan, he said.

The program may be targeting too narrow a group, analysts say. Many companies with a clear path to survival will likely be able to successfully borrow from banks anyway.

Two former Fed economists, Nellie Liang and William English, suggested in a paper for the Brookings Institution that to attract more interest, the Fed should lengthen the term of the loan beyond five years, offer a lower interest rate for more credit-worthy companies, and pay higher fees to banks as an incentive for them to offer the loans. Main Street loans currently have a rate slightly above 3%.

Liang said in an interview that many struggling small companies probably don’t want more debt. By extending the terms of the loans to seven or 10 years, and offering some borrowers a lower rate, the loans would take on more of the features of a grant or equity investment, Liang said.

Still, that may not be enough. “Even with the recommended changes, the program may have limited demand, since many businesses need equity, not more credit,” English and Liang wrote.

Haith, meanwhile, said the interest rate on a Main Street loan is much lower than he would typically expect to pay, even in a healthy economy.

But the loan would also work for him because his business is healthy and he is actually trying to expand. He’s finding landlords a lot more accommodating and a lot of empty restaurant properties available. But there probably aren’t many others in the same boat, he acknowledged.

“I don’t know a lot of companies playing offence at this point,” he said.

Christopher Rugaber, The Associated Press

Do you need a Injury Attorney in Toronto?

Neinstein Personal Injury Lawyers is a leading Toronto personal injury law office. Our lawyers feel it is their responsibility to assist you to find the federal government and wellness organizations who can also assist you in your road to recovery.

Neinstein Accident Lawyers has actually handled serious injury claims throughout Greater Ontario for over Fifty years. Its areas of expertise consist of medical, legal, and insurance issues associated with medical carelessness, car crashes, disability claims, slip and falls, product liability, insurance disagreements, and more.

Neinstein Personal Injury Lawyers

1200 Bay St Suite 700, Toronto, ON M5R 2A5, Canada

MJ96+X3 Toronto, Ontario, Canada

neinstein.com

+1 416-920-4242

Visit Neinstein Personal Injury Lawyers https://neinstein.ca Follow Neinstein on Facebook Watch Neinstein Personal Injury Lawyers on Youtube

Contact Stacy Koumarelas at Neinstein Personal Injury Lawyers

Read More

#Neinstein Personal Injury Lawyers#Toronto Personal Injury Attorneys#Jeff Neinstein#bike accident attorneys

0 notes

Text

Why You Might Want To Play Borderlands 3 More Than Once

New Post has been published on https://gamerszone.tn/why-you-might-want-to-play-borderlands-3-more-than-once/

Why You Might Want To Play Borderlands 3 More Than Once

All four playable Vault Hunters in Borderlands 3 bring their own distinct flavor to the game, and not just in terms of their unique skill trees. In comparison to the Vault Hunters in previous games, Borderlands 3’s Zane, Moze, Amara, and FL4K talk a lot, constantly speaking their minds and responding to NPCs during conversations. Your choice of Vault Hunter won’t impact the final outcome of the main story at all, but it will influence how you perceive certain events and understand the relationships of specific characters–encouraging you to play through Borderlands 3’s campaign more than once.

“We wanted to make sure that if people said, ‘I want to play through this game all over again with a different character,’ that they would then feel rewarded,” co-lead writer Sam Winkler said in an interview with GameSpot. “Not just in terms of different mechanics but also a slightly different interpretation of some of the stories.” The emphasis on Sirens in Borderlands 3’s plot means Amara has a vested interest in the story’s events, for instance, and FL4K–a nonbinary AI–explores their growing sexual attraction to Ellie by flirting with her every chance they have.

You need a javascript enabled browser to watch videos.

Click To Unmute

Borderlands 3 – Breaking Down FL4K’s Skill Tree

Size:

Want us to remember this setting for all your devices?

Sign up or Sign in now!

Please use a html5 video capable browser to watch videos.

This video has an invalid file format.

Sorry, but you can’t access this content!

Please enter your date of birth to view this video

By clicking ‘enter’, you agree to GameSpot’s Terms of Use and Privacy Policy

enter

Having played as all four of the Vault Hunters now, I love how much each one changes how many of the interactions go. Previous Vault Hunters have rarely felt like carbon copies of each other–their unique abilities mean each one handles in a distinct way. But within their respective stories, each one typically reacts to every event in a similar way to their teammates. There’s no new insight playing as Brick instead of Mordecai or Maya instead of Zer0. So it’s a nice change of pace in Borderlands 3, and I’m already eager to see how each Vault Hunter uniquely responds to the streamer-like banter and violent habits of the Calypso Twins–especially Tyreen, a Siren whose curse-like Phase Leech ability and horrifying backstory (if true) write her as somewhat of a tragic figure.

To also encourage replayability, several side quests in Borderlands 3 contain choices, allowing you to impact the game in different ways. Don’t expect world-changing events but, for example, you can influence how certain characters will appear depending on what you do. In Borderlands 3’s prologue, for instance, Claptrap loses his antenna, and–for the rest of the game–he’ll just wear whatever you decide to give him as a replacement. “Maybe it’s a tin foil hat, or a human arm, or something else,” Winkler said.

Aside from the more vocal protagonists and additional agency in how certain side quests conclude, the story of Borderlands 3 is fundamentally the same character-driven tale of crass humor, murderous mayhem, and silly puns that defined Borderlands, Borderlands 2, Borderlands: The Pre-Sequel, and Tales from the Borderlands. Almost every major character from the previous four games returns in this newest installment, though many have changed in the seven in-game years since the events of Borderlands 2. Because there’s been so much history in the franchise, Gearbox wanted to avoid making any of the previously established characters–such as Tiny Tina, Sir Hammerlock, or Ellie–into playable Vault Hunters. It was important that players were forced to use characters who had never interacted with Pandora and its inhabitants before so the story would then have to reintroduce the franchise’s lore, helping out series newcomers.

“There’s that wonderful cadence of Borderlands where the previous rounds of Vault Hunters become characters in the world, and that allows you the opportunity to learn more about them and where they’re from,” co-lead writer Danny Homan said. “But as a result, with Borderlands 3, you need a new generation of Vault Hunters because you need to see an old world through a new perspective. It’s so useful when you have a new cast who have just made their way to Pandora and they’re asking all the [expositional] questions that the players may be asking, like, ‘What the heck is a Vault? What am I doing here? Who is Lilith? Why is this robot trying to insult me and also give me stuff?'”

You need a javascript enabled browser to watch videos.

Click To Unmute

Borderlands 3 Gun Manufacturers Explained

Size:

Want us to remember this setting for all your devices?

Sign up or Sign in now!

Please use a html5 video capable browser to watch videos.

This video has an invalid file format.

Sorry, but you can’t access this content!

Please enter your date of birth to view this video

By clicking ‘enter’, you agree to GameSpot’s Terms of Use and Privacy Policy

enter

“We never want Borderlands 3 to feel like you have to know everything about the franchise in order to understand why a character is important,” Winkler added. “We want it to be accessible to both new and old players.” Not every bit of information in regards to past events could be fit into Borderlands 3’s early chapters though. As a result, Borderlands 2–which hasn’t seen a story expansion since 2013’s Tiny Tina’s Assault on Dragon Keep–got new DLC earlier this summer, just ahead of Borderlands 3’s release.

“Our biggest goal with [Commander Lilith and the Fight for Sanctuary DLC] was to canonize some stuff from [Tales from the Borderlands],” Winkler said. “A lot more people played Borderlands 2 than Tales, and so we didn’t want people to ask, ‘Where’s Helios?’ when they picked up Borderlands 3.”

You need a javascript enabled browser to watch videos.

Click To Unmute

The First 20 Mins of Borderlands 2 DLC: Commander Lilith & The Fight For Sanctuary

Size:

Want us to remember this setting for all your devices?

Sign up or Sign in now!

Please use a html5 video capable browser to watch videos.

This video has an invalid file format.

Sorry, but you can’t access this content!

Please enter your date of birth to view this video

By clicking ‘enter’, you agree to GameSpot’s Terms of Use and Privacy Policy

enter

Tales from the Borderlands is an outlier in the franchise, the only game in the series that doesn’t star Vault Hunters as the main characters and also isn’t a first-person shooter. However, it took Borderlands’ ludicrous humor to new heights, and it’s this level of ridiculousness that Borderlands 3 strives for.

“A lot of people would say ‘Don’t do an extended five-minute gunfight without any guns,'” Winkler said. “And yet Tales did it and I still see that [finger gun fight] all the time on the internet. That’s the energy we want to bring to Borderlands 3. Have people say, ‘Did you play that one thing? It’s insane.'” In this, Borderlands 3 certainly seems to fit the bill. On Eden-6 (one of the new planets you’ll visit in the game), you meet an Ice-T-voiced AI that’s been trapped in a teddy bear by its angry ex-girlfriend. The jokes that follow in that particular chapter go to places that are as shocking and unsettling as they are morbidly amusing. Borderlands 3’s story is definitely closer to the creative weirdness and pretty-much-anything-goes tone of Tales, as opposed to the unhinged attitude of the previous mainline games.

You need a javascript enabled browser to watch videos.

Click To Unmute

Borderlands 3 – Sanctuary Ship Tour Gameplay

Size:

Want us to remember this setting for all your devices?

Sign up or Sign in now!

Please use a html5 video capable browser to watch videos.

This video has an invalid file format.

Sorry, but you can’t access this content!

Please enter your date of birth to view this video

By clicking ‘enter’, you agree to GameSpot’s Terms of Use and Privacy Policy

enter

If nothing else, the story told in Borderlands 3 seems to be somewhat of an apotheosis for the franchise up to this point–rewarding fans with the answers to many of the series’ most long-standing questions. You shouldn’t expect to have everything laid bare though, as Borderlands 3 expands upon the franchise’s lore with brand-new concepts as well. “There are definitely events from previous Borderlands games that kind of reach an interesting culmination in certain ways,” Homan said. “The focus on Lilith from Borderlands 1 to Borderlands 3–there are some interesting stories that we’re telling there. People love the Borderlands universe and there are always more stories out there, and so when we’re trying to wrap up a story, we’re always trying to see new stories.” Winkler added, “Whatever Borderlands ends up looking like after Borderlands 3, I think that people will be able to look back and see one, two, and three as maybe a trilogy. But not necessarily with walls on either side of it.”

Borderlands 3 is scheduled to release for Xbox One, PS4, and PC on September 13. On PC, Borderlands 3 has a limited-time exclusivity deal with the Epic Games Store that lasts until 2020. Borderlands 3 will also be a day one title on Google Stadia, a cloud-based game streaming service scheduled to launch in November 2019.

Source : Gamesport

0 notes

Text

Hemp CBD Across State Lines: What You Need to Know FDA, HEMP/CBD, STATES JULY 5TH, 2020 Daniel Shortt by Daniel Shortt hemp cbd interstate sales The Agriculture Improvement Act of 2018 (2018 Farm Bill) legalized hemp by removing the crop and its derivatives from the definition of marijuana under the Controlled Substances Act (CSA) and by providing a detailed framework for the cultivation of hemp. The 2018 Farm Bill gives the US Department of Agriculture (USDA) regulatory authority over hemp cultivation at the federal level. In turn, states have the option to maintain primary regulatory authority over the crop cultivated within their borders by submitting a plan to the USDA. This federal and state interplay has resulted in many legislative and regulatory changes at the state level. Indeed, most states have introduced (and adopted) bills that would authorize the commercial production of hemp within their borders. A smaller but growing number of states also regulate the sale of products derived from hemp. Our attorneys track these developments in real-time on behalf of multiple clients, and we provide a 50-state matrix showing how states regulate hemp and hemp products. Over the last year, we have written about hemp and hemp-derived cannabidiol (Hemp CBD) policies in all 50 states, Guam, Puerto Rico, the US Virgin Islands, and on Tribal land. Links to each of these posts are available below. Obviously, nothing happens in a vacuum so, at this point, some of our posts are out of date as of this writing. These things change fast. Now that we’ve covered the 50+ jurisdictions, we want to wrap up this series with some things we have learned throughout this series. States are (mostly) consistent when it comes to hemp production Both the 2014 Farm Bill and 2018 Farm Bill focused on the actual growing of hemp, not processing or handling hemp. As a result, there is not a ton of room for states to differ when it comes to the rules and regulations on growing hemp. This extends to testing hemp as well. Under the 2018 Farm Bill, states are required to develop plans pursuant to the law itself and the USDA’s interim hemp rules. However, a contingency of states are deciding to opt out of the 2018 Farm Bill, sticking with programs developed under the 2014 Farm Bill. The 2014 Farm Bill’s hemp provisions expire on October 31, 2020, meaning that several states will no longer have the regulatory authority over hemp production. For more on this, check out the letter the North Carolina Department of Agriculture sent the USDA. States Differ on Processing/Handling Rules There is some consistency in how states regulate growing hemp. The same is not true when it comes to “secondary” activities such as processing or handling hemp. Remember that the 2018 and 2014 Farm Bills focus on growing hemp, not turning that raw hemp into commodities, such as fiber, hempcrete, or oil. Some states, like Oregon, issue licenses or permits for these activities. Others, like Washington, do not. In states that do not issue handling or processing permits, these activities come with some risk. That’s because although hemp is not a controlled substance (like it’s very close cousin marijuana) it is heavily regulated. Possessing commercial quantities of hemp without any type of license can draw unwanted attention. Hemp looks and smells like marijuana after all. A government-issued license can come in handy. On the other hand, there are many hemp processors in states that do not issue processor or handler licenses who are doing fine without a permit. It’s not as if hemp processing is necessarily unlawful in these states. One thing is true for processors in all states: keeping records is key! You want strong and substantial evidence if Johnny Law starts inquiring about that funky-smelling crop. There are Various Schools of Thought on How to Regulate Finished Products, Including Hemp CBD Once hemp has been harvested and processed into a finished product it’s time to go to the market. For industrial products, like hemp textiles and hempcrete, this is pretty straightforward. That’s because these products are not absorbed into the human body. Anything containing hemp that is ingested, smoked, or placed on the skin has a more complicated path to market because there is no real federal oversight of these products and there is no uniform state model for regulating them either. The FDA regulates consumer products. It has determined that hemp-seed ingredients are generally safe for use in foods and approved Epidiolex, a CBD isolate used for the treatment of epilepsy. The FDA has also consistently said that other hemp derivates and Hemp CBD cannot be sold as drugs, foods, or dietary supplements. At the same time, FDA enforcement has been very limited, mainly consisting of sending warning letters to Hemp CBD distributors making medical or health claims about their products. This resistant tolerance of Hemp CBD at the federal level has left the states to decide how to treat Hemp CBD. The states have not adopted a unified approach to regulate Hemp CBD. Some states align with the FDA’s position, banning Hemp CBD in food and dietary supplements. California is the most prominent example of this school of thought. Several other states have gone in the opposite direction, tightly regulating the manufacture and sale of Hemp CBD. Utah and Texas are good examples of this model as both states impose manufacturing and labeling requirements. Some states even require that retail stores obtain a license to sell Hemp CBD products. Another complicating factor is the treatment of smokable hemp or Hemp CBD e-liquid (i.e., the liquid used in vape products). This is a hot button issue in many states. When it comes to smokable hemp, many politicians and law enforcement agencies are troubled by the fact that hemp is so close to marijuana. Some states, like Kentucky, ban the manufacture of hemp products that are akin to traditional tobacco products, like cigarettes. Most states do not explicitly address the legality of smokable hemp, making the sale of smokable hemp risky due to the lack of clarity. Very few states explicitly allow the sale of smokable hemp. Hemp CBD e-liquid is also complicated because of the dangers associated with vapor products generally. This area of the law is still developing, with very few states explicitly tackling the issue of Hemp CBD e-liquid. That’s because so much of the focus has been on the tobacco vapor products or marijuana vapor products. Washington is one of the few states that has addressed the issue by banning the sale of e-liquid that contains cannabinoids unless sold within the state’s regulated marijuana marketplace. Wrapping Up and Looking Ahead This is the last installment in our “Hemp CBD Across State Lines” series but it certainly will not be the last time we write about Hemp CBD. Hemp is here to stay and so too is CBD (along with CBG, CBN and other “new cannabinoids“). Eventually, the FDA is going to provide some guidance to the industry and we think that the agency will model its policies on states with robust regulations already in place. Once that happens, we expect state law and policy become more unified, making interstate transport easier. We hope that you have found this series informative and helpful. On behalf of the Canna Law Blog, thank you for reading and sharing these articles over the last year!