#amazon seller registration

Explore tagged Tumblr posts

Text

The Complete Guide to Amazon Seller Central

In the bustling world of e-commerce, Amazon stands as a towering giant, offering unparalleled opportunities for businesses of all sizes to reach millions of potential customers worldwide. One of the key gateways to this vast marketplace is Amazon Seller Central, a platform that empowers sellers to manage their inventory, fulfill orders, and optimize their presence on the Amazon marketplace. Whether you're a seasoned seller or just dipping your toes into the world of online retail, mastering Amazon Seller Central is crucial for success.

Understanding Amazon Seller Central

Amazon Seller Central serves as the nerve center for sellers, providing a suite of tools and resources to manage every aspect of their selling journey. From product listings to customer communication, here's a breakdown of its key features:

Dashboard Overview Upon logging in, sellers are greeted with a comprehensive dashboard that offers insights into their sales performance, inventory levels, and account health. This bird's-eye view allows sellers to quickly assess their business's status and take informed actions.

Inventory Management Central to any seller's success is effective inventory management. Amazon Seller Central enables sellers to add, edit, and remove product listings with ease, ensuring accurate representation of their offerings to customers.

Order Fulfillment Efficient order fulfillment is critical for maintaining customer satisfaction. Through Seller Central, sellers can process orders, track shipments, and handle returns seamlessly, fostering positive shopping experiences for buyers.

Advertising and Promotion To stand out in Amazon's crowded marketplace, sellers can leverage advertising and promotional tools available within Seller Central. From sponsored product ads to lightning deals, these features help sellers increase visibility and drive sales.

Performance Metrics Monitoring performance metrics is essential for optimizing selling strategies and identifying areas for improvement. Seller Central provides access to detailed analytics, including sales data, customer feedback, and inventory health, empowering sellers to make data-driven decisions.

Getting Started with Amazon Seller Central

Now that you understand the key features of Amazon Seller Central, here's a step-by-step guide to kickstart your journey:

Create a Seller Account Begin by signing up for a seller account on Amazon. Choose between an Individual or Professional selling plan based on your business needs.

Set Up Your Seller Profile Complete your seller profile with accurate information about your business, including contact details, shipping policies, and return policies.

List Your Products Create detailed listings for your products, including compelling titles, high-quality images, and informative descriptions to attract potential buyers.

Manage Inventory Regularly monitor your inventory levels and restock products as needed to prevent stockouts and meet customer demand.

Fulfill Orders Promptly Process orders promptly and provide timely updates to customers regarding shipping and delivery status to enhance their buying experience.

Optimize Your Listings Continuously optimize your product listings by analyzing keywords, monitoring competitors, and soliciting customer feedback to improve visibility and conversion rates.

Monitor Performance Metrics Regularly review performance metrics provided by Seller Central to track your sales performance, identify trends, and adjust your selling strategies accordingly.

Conclusion

Mastering Amazon Seller Central is a journey that requires dedication, attention to detail, and a commitment to continuous improvement. By leveraging the platform's robust features and following best practices, sellers can maximize their success on the Amazon marketplace and achieve their business goals. So, dive in, explore the possibilities, and unlock the full potential of selling on Amazon with Seller Central. Happy selling!

0 notes

Text

Boost Your Sales: Tailored Amazon Seller Services for Success

Amazon is noted as the most decisive, secure and exceptionally preferred e-market for the largest number of customers. Amazon Seller Services has gained as an “online retail dealer” a piece of the US retail industry. The organization is said to contribute 43% to online retail deals in the US. Amazon gives an entry to outreach to many customers a union cannot dream of coming alone. Amazon has the largest retail showcase the Globe has seen to date. At the current date, the Amazon ranks among the 10 most influential countries in the world. We are the acknowledged Amazon worldwide expert co-ops, committed to providing total consulting administration to guarantee your deals on Amazon advertising. We on Amazon regulate your process and assume your position on entry as an advertisement-liability obligation. Simply put, Arvian.in is a well-performing e-business consultancy that has worldwide expert co-op geared to serving online e-trade associations. With our group of dedicated experts in the fields of management, innovation and business we guarantee to help you through it all. We will also help you organize, perform and screen your results.

As an approved channel accomplice of Amazon, Arvian Business Solutions provide the best Amazon Seller Services in Jaipur to arrive at more clients and create more deals and increase the value of your image where we help you in these administrations, for example, Consultancy, Registration, Product Launch, Photography, Editing, Cataloging, Inventory Management, Training and coordination administrations for you. Our master administrations are ready to assist you with taking your business to the following level. Our thought process is to provide you with a worldwide alternative to the market. In fact, we have a huge record of serving a huge customer base at Amazon to guarantee their position in the worldwide market. We are fully committed to working for you and helping you grow in every angle. You are free to venture with us to every part of the road that drives a victorious end.

1 note

·

View note

Text

Succeeding with Amazon Seller Registration - Enterslice

In the ever-evolving world of e-commerce, Amazon stands as an e-commerce giant, offering a vast marketplace for businesses and entrepreneurs to prosper. To embark on this journey, Amazon seller registration is the pivotal first step. In this concise guide, we will explore the intricacies of Amazon seller registration, unraveling the process, and providing key insights for your success.

Understanding Amazon Seller Registration

Before we dive into the registration process, it's vital to understand the significance of this step and why it's essential for your business.

The Significance of Amazon as an E-commerce Platform

Amazon isn't just an online store; it's a global marketplace connecting buyers and sellers. With millions of daily visitors, it offers access to an extensive customer base, making it a highly attractive platform for businesses.

Why Seller Registration Matters

Seller registration on Amazon is paramount because it grants you access to this vast network of potential customers. Additionally, it provides essential tools and services for businesses to thrive.

Preparing for Amazon Seller Registration

Success on Amazon begins with careful preparation. Let's explore the essential steps you should take before registering as a seller.

Business Plan and Strategy

Before you proceed with registration, it's crucial to have a well-defined business plan and strategy. Define your niche, target audience, and your unique selling proposition (USP).

Product Sourcing and Quality Assurance

Choose your products carefully and ensure their quality meets Amazon's stringent guidelines. Adherence to these guidelines is essential for success on the platform.

Legal Structure and Documentation

Determine the legal structure of your business, whether it's a sole proprietorship, partnership, LLC, or corporation. Be prepared to provide the necessary documentation during registration.

Tax Identification and Financials

Obtain a tax identification number (TIN) or employer identification number (EIN) for your business. Additionally, ensure that your financial affairs are in order to facilitate seamless transactions.

The Amazon Seller Registration Process

This section provides a streamlined guide on how to complete the Amazon seller registration process.

Choose the Right Seller Plan

Amazon offers two primary seller plans: Individual and Professional. Understand the differences and select the one that aligns with your business goals.

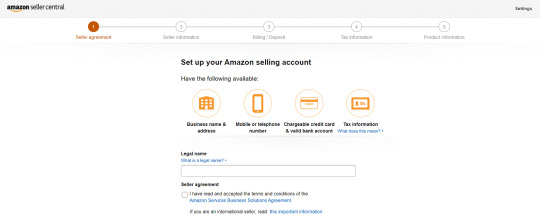

Creating Your Amazon Seller Account

Visit Amazon Seller Central and click "Register Now." You'll need an existing Amazon account or create one to proceed. Follow the prompts to set up your seller account.

Identity Verification

Depending on your location and the products you intend to sell, Amazon may require additional identity verification. Be prepared to provide personal identification and business documentation.

Payment Method Setup

Link your bank account to your Amazon seller account. Precision in this step is crucial as it directly affects when and how you'll receive payments.

Product Listing

Initiate the process of listing your products. Create comprehensive listings with high-quality images, accurate descriptions, and competitive pricing.

Optimize Your Amazon Store

Enhance your seller profile by adding a logo, cover photo, and an engaging description. A well-crafted store page builds trust with potential customers.

Challenges in Amazon Seller Registration

Although Amazon seller registration is relatively straightforward, challenges can arise along the way. In this section, we address common hurdles and provide strategies to overcome them.

Product Compliance

Ensure that your products adhere to Amazon's guidelines. Be ready to provide the necessary certifications or documentation to confirm compliance.

Competitive Pricing

Balancing competitive pricing while maintaining a profitable margin can be challenging. Conduct thorough research on your competitors and market trends.

Shipping and Fulfillment

Decide whether you'll fulfill orders yourself or use Amazon's fulfillment services. Your choice significantly impacts shipping times and costs.

Customer Service

Exceptional customer service is the cornerstone of building a positive reputation on Amazon. Be prepared to handle customer inquiries and resolve issues promptly.

Reviews and Ratings

Customer reviews play a substantial role in your success on Amazon. Encourage satisfied customers to leave reviews and address negative feedback professionally.

Conclusion

Amazon seller registration is the gateway to e-commerce success, and Enterslice is your trusted partner on this journey. Success on Amazon demands dedication, effective strategies, and a commitment to providing top-quality products and services. With Enterslice by your side, you can confidently embark on your Amazon seller journey, unlock the platform's full potential, and reach new heights in the world of e-commerce. Don't wait; take that crucial first step today with Enterslice's support and set your business on the path to e-commerce success on Amazon.

0 notes

Text

Unlock success on Amazon Seller Central with our comprehensive guide. Learn about Amazon Seller Central login and maximize your selling potential.

#ecommerce#amazon#amazon seller#amazon seller central#amazon seller account#amazon seller registration

0 notes

Text

How to fulfil the requirements of the FBA plan with a Virtual Office address?

FBA stands for Fulfillment by Amazon and is a program offered by Amazon that allows sellers to store their products at Amazon's fulfillment centers. When a customer places an order, Amazon picks, packs, and ships the product on behalf of the seller. Amazon is also responsible for customer service and returns of these orders.

The FBA program has several steps for sellers:

1. Listings: Sellers create product listings on the Amazon store.

2. Sending Products to Amazon: Sellers send their products to Amazon's fulfillment center. Amazon is responsible for storing, packaging and delivering the product.

3. Operation: When a customer places an order, Amazon's system automatically completes the order and staff completes the storage, packaging and shipping of the product to customers.

4. Customer Service and Returns: Amazon handles customer inquiries and returns for sellers.

A virtual office play an important role in fulfilling the requirements of the FBA plan in a few ways:

1. Business Address: Amazon Most, respectively, require sellers to provide a valid business address. The virtual office can provide a business address for registration.

2. Mail and Package Processing: Virtual Office can receive mail and packages on behalf of the seller. This is useful for receiving business-related newsletters and deliveries from suppliers or manufacturers.

3. Corporate Image: Some virtual office services also include additional features that can improve the image of employees, such as telephone answering services.

4. PPOB & APOB Registration: Virtual office is also economical and affordable for PPOB & APOB registration.

The use of virtual offices must be compatible with Amazon's services, and sellers must disclose their business address and contact information.

Conclusion: Integrating Fulfillment by Amazon (FBA) with the support of a virtual office from InstaSpaces can be a powerful combination for Amazon sellers looking to enhance their business operations. By leveraging FBA’s logistics expertise and virtual office services, sellers can expand their reach, improve customer satisfaction, and focus on growing their business without the burden of managing fulfillment logistics or maintaining a physical office space. This integrated approach allows sellers to operate more efficiently, scale their business effectively, and ultimately achieve greater success on the Amazon platform.

#virtual office#virtual office address#Virtual Office for Amazon sellers#virtual office space#virtual office pan india#virtual office for gst registration#Virtual Office for E-commerce sellers

0 notes

Text

Amazon Seller Registration Services | HighOnRank

Explore the sales growth opportunities through Amazon seller registration services! Let us handle the details while you focus on growing your business. HighOnRank is here to provide you all the support for Amazon Seller Registration. Contact us today.

0 notes

Text

Keir Starmer appoints Jeff Bezos as his “first buddy”

Picks and Shovels is a new, standalone technothriller starring Marty Hench, my two-fisted, hard-fighting, tech-scam-busting forensic accountant. You can pre-order it on my latest Kickstarter, which features a brilliant audiobook read by Wil Wheaton.

Turns out Donald Trump isn't the only world leader with a tech billionaire "first buddy" who gets to serve as an unaccountable, self-interested de facto business regulator. UK PM Keir Starmer has just handed the keys to the British economy over to Jeff Bezos.

Oh, not literally. But here's what's happened: the UK's Competitions and Markets Authority, an organisation charged with investigating and punishing tech monopolists (like Amazon) has just been turned over to Doug Gurr, the guy who used to run Amazon UK.

This is – incredibly – even worse than it sounds. Marcus Bokkerink, the outgoing head of the CMA, was amazing, and he had charge over the CMA's Digital Markets Unit, the largest, best-staffed technical body of any competition regulator, anywhere in the world. The DMU uses its investigatory powers to dig deep into complex monopolistic businesses like Amazon, and just last year, the DMU was given new enforcement powers that would let it custom-craft regulations to address tech monopolization (again, like Amazon's).

But it's even worse. The CMA and DMU are the headwaters of a global system of super-effective Big Tech regulation. The CMA's deeply investigated reports on tech monopolists are used as the basis for EU regulations and enforcement actions, and these actions are then re-run by other world governments, like South Korea and Japan:

https://pluralistic.net/2024/04/10/an-injury-to-one/#is-an-injury-to-all

The CMA is the global convener and ringleader in tech antitrust, in other words. Smaller and/or poorer countries that lack the resources to investigate and build a case against US Big Tech companies have been able to copy-paste the work of the CMA and hold these companies to account. The CMA invites (or used to invite) all of these competition regulators to its HQ in Canary Wharf for conferences where they plan global strategy against these monopolists:

https://www.eventbrite.co.uk/e/cma-data-technology-and-analytics-conference-2022-registration-308678625077

Firing the guy who is making all this happening and replacing him with Amazon's UK boss is a breathtaking display of regulatory capture by Starmer, his business secretary Jonathan Reynolds, and his exchequer, Rachel Reeves.

But it gets even worse, because Amazon isn't just any tech monopolist. Amazon is a many-tentacled kraken built around an e-commerce empire. Antitrust regulators elsewhere have laid bare how Amazon uses that retail monopoly to take control over whole economies, while raising prices and crushing small businesses.

To understand Amazon's market power, first you have to understand "monopsonies" – markets dominated by buyers (monopolies are markets dominated by sellers – Amazon is both a monopolist and a monopsonist). Monopsonies are far more dangerous than monopolies, because they are easier to establish and easier to defend against competitors. Say a single retailer accounts for 30% of your sales: there isn't a business in the world that can survive an overnight 30% drop in sales, so that 30% market share might as well be 100%. Once your order is big enough that canceling it would bankrupt your supplier, you have near-total control over that supplier.

Amazon boasts about this. They call it "the flywheel": Amazon locks in shoppers (by getting them to prepay for a year's worth of shipping in advance, via Prime). The fact that a business can't sell to a large proportion of households if it's not on Amazon gives Amazon near-total power over that business. Amazon uses that power to demand discounts and charge junk fees to the businesses that rely on it. This allows it to lower prices, which brings in more customers, which means that even more businesses have to do business with Amazon to stay afloat:

https://vimeo.com/739486256/00a0a7379a

That's Amazon's version, anyway. In reality, it's a lot scuzzier. Amazon doesn't just demand deep discounts from its suppliers – it demand unsustainable discounts from them. For example, Amazon targeted small publishers with a program called the "Gazelle Project." Jeff Bezos told his negotiators to bring down these publishers "the way a cheetah would pursue a sickly gazelle":

https://archive.nytimes.com/bits.blogs.nytimes.com/2013/10/22/a-new-book-portrays-amazon-as-bully/

The idea was to get a bunch of cheap books for the Kindle to help it achieve critical mass, at the expense of driving these publishers out of business. They were a kind of disposable rocket stage for Amazon.

Deep discounts aren't the only way that Amazon feeds off its suppliers: it also lards junk-fee atop junk-fee. For every pound Amazon makes from its customers, it rakes in 45-51p in fees:

https://pluralistic.net/2023/11/29/aethelred-the-unready/#not-one-penny-for-tribute

Now, just like there's no business that can survive losing 30% of its sales overnight, there's also no business that can afford to hand 45-51% of its gross margin to a retailer. For businesses to survive at all on Amazon, they have to jack their prices up – way up. However, Amazon has an anticompetitive deal called "most favoured nation status" that forces suppliers to sell their goods on Amazon at the same price as they sell them elsewhere (even from their own stores). So when companies raise their prices in order to pay ransom to Amazon, they have to raise their prices everywhere. Far from being a force for low prices, Amazon makes prices go up everywhere, from the big Tesco's to the corner shop:

https://pluralistic.net/2023/04/25/greedflation/#commissar-bezos

Amazon makes so much money off of this scam that it doesn't have to pay anything to ship its own goods – the profits from overcharging merchants for "fulfillment by Amazon" pay for all the shipping, on everything Amazon sells:

https://cdn.ilsr.org/wp-content/uploads/2023/03/AmazonMonopolyTollbooth-2023.pdf

Amazon competes with its own sellers, but unlike those sellers, it doesn't have to pay a 45-51% rake – and it can make its competitor-customers cover the full cost of its own shipping! On top of that, Amazon maintains the pretense that its headquarters are in Luxembourg, the tax- and crime-haven, and pays a fraction of the taxes that British businesses pay to HMRC (and that's not counting the 45-51% tax they pay to Jeff Bezos's monoposony).

That's not the only way that Amazon unfairly competes with British businesses, though: Amazon uses its position as a middleman between buyers and sellers to identify the most successful products sold by its own customers. Then it copies those products and sells them below the original inventor's costs (because it gets free shipping, pays no tax, and doesn't have to pay its own junk fees), and drives those businesses into the ground. Even Jeff "Project Gazelle" Bezos seems to understand that this is a bad look, which is why he perjured himself to the American Congress when he was questioned under oath about it:

https://www.bbc.com/news/business-58961836

Amazon then places its knockoff products above the original goods on its search results page. Amazon makes $38b selling off placement on these search pages, and the top results for an Amazon search aren't the best matches for your query – they're the ones that pay the most. On average, Amazon's top result for a search is 29% more expensive than the best match on the site. On average, the top row of results is 25% more expensive than the best match on the site. On average, Amazon buries the best result for your search 17 places down the results page:

https://pluralistic.net/2023/11/03/subprime-attention-rent-crisis/#euthanize-rentiers

Amazon, in other words, acts like the business regulator for the economies it dominates. It decides what can be sold, and at what prices. It decides whose products come up when you search, and thus which businesses deserve to live and which ones deserve to die. An economy dominated by Amazon isn't a market economy – it's a planned economy, run by Party Secretary Bezos for the benefit of Amazon's shareholders.

Now, there is a role for a business regulator, because some businesses really don't deserve to live (because they sell harmful products, engage in deceptive practices, etc). The UK has a regulator that's in charge of this stuff: the Competition and Markets Authority, which is now going to be run by Jeff Bezos's hand-picked UK Amazon boss. That means that Amazon is now both the official and the unofficial central planner of the UK economy, with a free hand to raise prices, lower quality, and destroy British businesses, while hiding its profits in Luxemourg and starving the exchequer of taxes.

The "first buddy" role that Keir Starmer just handed over to Jeff Bezos is, in every way, more generous than the first buddy deal Trump gave Elon Musk.

Starmer's government claims they're doing this for "growth" but Amazon isn't a force for growth, it's force for extraction. It is a notorious underpayer of its labour force, a notorious tax-cheat, and a world-beating destroyer of local economies, local jobs, and local tax bases. Contrary to Amazon's own self-mythologizing, it doesn't deliver lower prices – it raises prices throughout the economy. It doesn't improve quality – this is a company whose algorithmic recommendation system failed to recognize that an "energy drink" was actually its own drivers' bottled piss, which it then promoted until it was the best-selling energy drink on the platform:

https://pluralistic.net/2023/10/20/release-energy/#the-bitterest-lemon

There's a reason that the UK, the EU, Japan and South Korea found it so easy to collaborate on antitrust cases against American companies: these are all countries whose competition law was rewritten by American technocrats during the Marshall Plan, modeled on the US's own laws. The bedrock of US competition law is 1890's Sherman Act, whose author, Senator John Sherman, declared that:

If we will not endure a King as a political power we should not endure a King over the production, transportation, and sale of the necessaries of life. If we would not submit to an emperor we should not submit to an autocrat of trade with power to prevent competition and to fix the price of any commodity.

https://pluralistic.net/2022/02/20/we-should-not-endure-a-king/

Jeff Bezos is the autocrat of trade that John Sherman warned us about, 135 years ago. And Keir Starmer just abdicated in his favour.

Check out my Kickstarter to pre-order copies of my next novel, Picks and Shovels!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/01/22/autocrats-of-trade/#dingo-babysitter

Image: UK Parliament/Maria Unger (modified) https://commons.wikimedia.org/wiki/File:Keir_Starmer_2024.jpg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

--

Steve Jurvetson (modified) https://commons.wikimedia.org/wiki/File:Jeff_Bezos%27_iconic_laugh.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#cma#competition and markets authority#dmu#digital markets unit#guillotine watch#silicon roundabout#Marcus Bokkerink#doug gurr#industrial policy henhouse foxes#dingo babysitters#ukpoli#labour#competition#antitrust#trustbusting#marshall plan#Jonathan Reynolds#regulatory capture#keir starmer

316 notes

·

View notes

Text

What is the best way to start a Amazon business?

Starting an Amazon business can be an exciting venture with the potential for significant success. Here's a general guide to get you started:

1. Research and Product Selection: Begin by researching the Amazon marketplace and identifying potential products to sell. Look for products with good demand, low competition, and profit potential. Consider factors like product size, weight, and shipping costs.

2. Set Up an Amazon Seller Account: Choose between an Individual or Professional Seller account. The Professional account is suitable for serious sellers with more than a few products. Create a seller account and follow the registration process.

3. Source or Manufacture Products: Decide whether you'll source products from wholesalers, or manufacturers, or use drop shipping. Ensure you have a reliable supply chain to maintain inventory.

4. Create High-Quality Listings: Optimize your product listings with clear and compelling titles, well-written descriptions, and high-quality images. Use relevant keywords to improve visibility in search results.

5. Price Competitively: Price your products competitively to attract buyers. Consider factors like product costs, fees, and competitor prices.

6. Fulfillment Method: Choose between Fulfillment by Amazon (FBA) or Fulfillment by Merchant (FBM). FBA lets Amazon handle storage, packing, and shipping, while FBM requires you to manage these aspects.

7. Marketing and Promotion: Utilize various marketing strategies to promote your products, such as Amazon Sponsored Products, social media marketing, influencer collaborations, and email campaigns.

8. Provide Excellent Customer Service: Deliver exceptional customer service to build a positive reputation and earn positive reviews. Respond to customer inquiries promptly and resolve any issues efficiently.

To streamline your Amazon business and enhance its performance, consider using the CedCommerce Amazon Channel app. This app provides a centralized platform to manage multiple Amazon accounts along with your Shopify store. You can easily sync product listings, optimize them for Amazon's algorithm, and efficiently handle orders and inventory.

With CedCommerce, you gain access to expert support, ensuring that your queries are answered patiently and your business thrives. The app's user-friendly interface and powerful tools simplify multichannel eCommerce management, allowing you to focus on growing your Amazon business.

By leveraging the benefits of the CedCommerce Amazon Channel app, you can achieve greater success and elevate your Amazon business to new heights. Empower your entrepreneurial journey with the perfect partner by your side.

#cedcommerce#ecommerce#ecommercestore#ecommercebusiness#shopify#shopifyseller#amazonprime#amazonseller#amazon marketplace#amazon#ecommercesolutions

2 notes

·

View notes

Text

How to Start a successful Amazon FBA business in 2023? (Step-By-Step Guide)!

Starting an Amazon FBA (Fulfillment by Amazon) business is an excellent opportunity to create a profitable business with low overhead costs. FBA allows you to sell products on Amazon’s platform, while Amazon handles storage, shipping, and customer service. In this guide, we’ll take you through the steps to start a successful Amazon FBA business in 2023.

Step 1: Create an Amazon seller account The first step to starting an Amazon FBA business is to create an Amazon seller account. You can do this by visiting the Amazon Seller Central website and following the registration process. Amazon offers two types of seller accounts: individual and professional. Choose the type of account that best fits your needs and budget.

Step 2: Research profitable products The next step is to research profitable products that you can sell on Amazon. Look for products that have high demand, low competition, and a healthy profit margin. You can use Amazon’s Best Sellers list, Google Trends, and other market research tools to identify potential products.

One of the tools which helped me to reach 7-Figures in sales is Helium 10. This tool has many opportunities and training and when I started I was with 0 knowledge this tool helped me step-by-step to get into this business and to succeed.

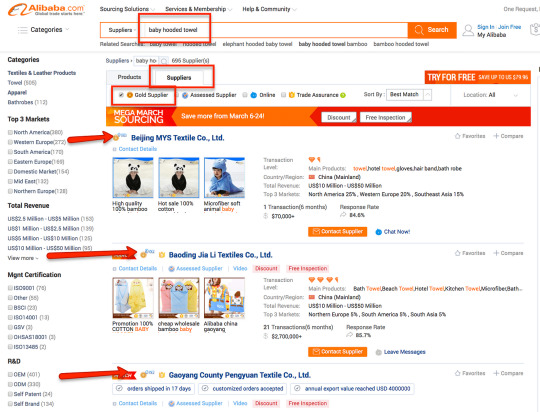

Step 3: Find a supplier Once you’ve identified a product to sell, you need to find a reliable supplier. You can search for suppliers on Alibaba, Global Sources, and other B2B marketplaces. Look for suppliers with a good track record, competitive pricing, and the ability to meet your product specifications.

Alibaba is the right source to get a verified supplier at a reasonable price point. Always remember to connect and take prices with at least 15 suppliers and negotiate as much as you can.

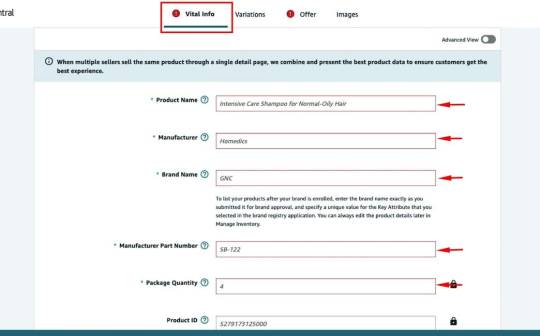

Step 4: Create a product listing With your product and supplier in place, the next step is to create a product listing on Amazon. Your product listing should include a title, bullet points, product description, and high-quality product images. Make sure to optimize your listing for Amazon’s search engine by using relevant keywords and including all the necessary product information.

This is the best time when you know everything is set and your product is going to be listed now. Just focus here is on getting Extraordinary photoshoots done for your products with the help of sample products you get from your supplier.

Step 5: Optimize your product listing Amazon’s search algorithm rewards listings that are optimized for the search engine. To optimize your listing, you should focus on the following areas: title, bullet points, description, and backend keywords. Make sure to use relevant keywords in each of these sections, but avoid keyword stuffing or using irrelevant keywords.

Optimization can be done in many ways. With 80% optimization things and steps Helium 10 will help you. Like to do keyword, Heading, Description, Key points, Images optimization.

Step 6: Launch your product With your product listing optimized, it’s time to launch your product. Use Amazon’s Pay Per Click (PPC) advertising platform to drive traffic to your product listing. Start with a small budget and gradually increase it as you get more sales.

Step 7: Monitor your performance As your product sells, make sure to monitor your performance metrics, such as your conversion rate, customer reviews, and seller feedback. Use this data to optimize your product listing and advertising campaigns.

Slightly, Monitor your performance and take action according to that if you are selling your products more than acceptations slow down your PPC and prepare to restock.

Step 8: Scale your business Once you’ve established a profitable product, you can start scaling your business by adding new products to your portfolio. Use the same research and optimization techniques to identify new products that will sell well on Amazon.

Conclusion: Starting a successful Amazon FBA business requires careful planning, research, and execution. By following the steps outlined in this guide, you can start your Amazon FBA business and build a profitable online business in 2023. Remember to stay focused, monitor your performance, and always be on the lookout for new opportunities to scale your business.

Just remember you are one product away! Focus on only improving and differentiating your product…

4 notes

·

View notes

Text

FSSAI Regulations for E-Commerce & Online Food Delivery

Online food delivery platforms alongside e-commerce have triggered an urgent need for stronger food safety measures because they dominate the modern market. All online food operations and cloud kitchens together with food aggregators and home-based food businesses operate under strict guidelines set by the Food Safety and Standards Authority of India (FSSAI). The following guide explains FSSAI instructions that apply to e-commerce food businesses and details their required elements and the FSSAI licensing process for digital food distribution.

Why is FSSAI Compliance Essential for Online Food Businesses?

The Food Safety and Standards Authority of India (FSSAI) ensures compliance with food safety regulations, helping online food businesses maintain hygiene and quality standards. Here’s why it is crucial:

The maintenance of food safety acts as a protection mechanism that ensures consumer health.

By having a food safety plan businesses avert legal repercussions that could result in penalties along with forced business shutdowns.

Building customer trust combined with enhancing brand credibility operates as a direct result of proper food safety standards.

Standardization practices in the food industry become possible through the implementation of fair business rules.

Who Needs an FSSAI License in the Online Food Business?

The operators in the online food sector need to register or obtain licenses through FSSAI for their business activity.

E-commerce food businesses (Swiggy, Zomato, Amazon Pantry, Flipkart Grocery, etc.)

Cloud kitchens and home-based food businesses

Restaurants partnering with food aggregators

Food packaging and labeling companies

Online bakery and homemade food sellers

Third-party food logistics and delivery services

Types of FSSAI Licenses for Online Food Businesses

1. Basic FSSAI Registration

Applicable for small businesses with an annual turnover of up to ₹12 lakh.

The service works well as a home-based food operation or for small-scale cloud kitchen establishments.

2. State FSSAI License

All enterprises with annual revenues between ₹12 lakh and ₹20 crore need to maintain this record.

This registration is suitable for medium-sized restaurants and e-commerce food sellers operating within a single state.

3. Central FSSAI License

Mandatory for large-scale businesses with an annual turnover above ₹20 crore.

The legal requirement applies to food aggregators as well as large e-commerce food enterprises and businesses which operate in several states.

Key FSSAI Guidelines for E-Commerce & Online Food Delivery Businesses

1. FSSAI Registration for Online Food Businesses

Every entity offering food sales through the internet must obtain a license from FSSAI for selling food items. The registration process includes:

Business operators must supply details consisting of food classification together with their sources of origin.

Providing food safety management documents.

The online platform provides visibility of FSSAI license information.

2. Compliance with Food Safety Standards

Online food businesses must ensure:

Hygienic handling, storage, and packaging of food products.

Proper labeling with ingredients, expiry date, and nutritional information.

Compliance with the Food Safety and Standards Act, 2006.

3. FSSAI Labeling and Packaging Rules

For packaged food sold online, the following labeling guidelines must be followed:

FSSAI logo and license number must be displayed.

Ingredients, allergens, nutritional value, and manufacturing details should be clearly mentioned.

Expiry date and batch number must be present.

4. Cloud Kitchen Compliance Requirements

Cloud kitchens, which operate without a dine-in facility, must:

Obtain an FSSAI license before starting operations.

Maintain food hygiene and storage standards.

Conduct periodic food safety audits and inspections.

5. FSSAI Rules for Food Aggregators Like Swiggy & Zomato

Food aggregators must:

Ensure that all registered restaurants and food vendors have a valid FSSAI license.

Display the FSSAI license number of partner restaurants on their platforms.

Implement a robust grievance redressal mechanism for food safety concerns.

6. FSSAI Compliance Checklist for Online Food Businesses

Obtain the appropriate FSSAI license (Basic, State, or Central). Ensure proper hygiene and food safety in preparation and storage. Follow packaging and labeling regulations for all online food sales. Display the FSSAI license number on the website, packaging, and invoices. Maintain a proper supply chain and temperature control for perishable foods. Conduct regular food safety audits to avoid non-compliance penalties.

Common Mistakes to Avoid in FSSAI Registration

Not obtaining the correct type of FSSAI license for business scale.

Incomplete documentation leading to registration delays.

Failure to renew FSSAI license on time, resulting in penalties.

Non-compliance with labeling regulations, leading to product bans.

Lack of proper food storage facilities, leading to food contamination risks.

How to Apply for an FSSAI License for an Online Food Business?

Follow these steps to obtain your FSSAI license:

Visit the FSSAI online portal (FoSCoS - https://foscos.fssai.gov.in/).

Choose an FSSAI license category based on company dimensions.

Submit the required documents.

Pay the license fee.

Undergo FSSAI inspection and verification.

You will obtain your FSSAI license which becomes valid for durations between one year to five years.

How to Renew an FSSAI License for Online Food Delivery?

To prevent legal issues businesses need to renew their FSSAI licenses during the expiration period. Here’s how:

Business operators need to initiate FSSAI license renewal through FSSAI FoSCoS portal at least thirty days before the license expires.

Business details together with food safety compliance records need to be submitted through the FSSAI FoSCoS portal.

Renewal payments must be made while completing any mandatory FSSAI inspection process.

A renewed FSSAI license becomes available after completing the process which maintains compliance.

FSSAI Penalties for Non-Compliance by Online Food Businesses

Failure to comply with FSSAI regulations can lead to heavy penalties:

Running business without an FSSAI license: Fine up to ₹5 lakh + business closure.

Misbranding or misleading food labels: Fine up to ₹3 lakh.

Selling unsafe or substandard food: Fine up to ₹10 lakh + legal action.

Failure to maintain hygiene standards: Fine up to ₹2 lakh.

Obstructing an FSSAI officer during an inspection: Fine up to ₹1 lakh.

Conclusion

FSSAI compliance is essential for businesses in the rapidly growing e-commerce food sector.

Every entrepreneur whose business involves running a cloud kitchen or home-based food business or partnering with food aggregators needs to follow FSSAI regulations since this ensures customer protection while creating trust and avoiding legal challenges.

It is essential for anyone who wants to launch or develop an online food business to acquire an FSSAI license. Your online business stays compliant and safe while you grow responsible operations through expert advice provided by The Legal Dost.

#foodbusiness#foodsafety#legalcompliance#fssairegistration#FSSAI#FoodSafety#OnlineFoodBusiness#CloudKitchen

0 notes

Text

Amazon Seller Account Registration in USA

YourSeller offers marketplace onboarding services in USA & India, including Amazon seller account creation, online seller registration for other platforms like Flipkart, Paytm & more.

Read More: https://youramzseller.com/services/amazon-seller-registration

0 notes

Text

GST Compliance Made Easy: Must-Have Software for E-commerce Sellers!

🚀 E-commerce Entrepreneurs!

Are GST compliance tasks bogging you down? Managing multiple GST registrations, diverse transactions, and strict deadlines can be overwhelming. But there's a solution! 🌟

Why You Need GST Software:

Automated GST Return Filing: Say goodbye to manual data entry; let the software handle GSTR-1, GSTR-3B, and more. E-Way Bill Generation: Effortlessly generate e-way bills directly from your sales data. GST Reconciliation: Ensure your sales data aligns with GST portal records to avoid mismatches and penalties. Multi-Platform Integration: Seamlessly connect with platforms like Amazon, Flipkart, Shopify, and accounting tools like Tally or Zoho Books. Real-Time Reporting and Analytics: Stay updated on your GST liabilities, ITC claims, and filing status with intuitive dashboards.

Implementing the right GST software can transform your compliance process, allowing you to focus on scaling your business. Don't let GST obligations hold you back!

Ready to Simplify Your GST Compliance?

Discover how GST software can be a game-changer for your e-commerce business. Read our comprehensive guide here: https://www.suvit.io/post/gst-software-for-ecommerce-sellers

Empower your business with the tools it needs to thrive in the digital marketplace! 🌐📈

#GSTSoftware#EcommerceSellers#GSTCompliance#TaxAutomation#OnlineBusiness#EcommerceGrowth#SmallBusinessIndia#GSTFiling#AccountingTech#Suvit#BusinessAutomation

0 notes

Text

GST Registration Services Provider in Delhi – SC Bhagat & Co.

Why GST Registration is Essential for Your Business?

Goods and Services Tax (GST) is a mandatory tax regime in India that has streamlined the indirect taxation system. Every business with an annual turnover above the prescribed limit must register for GST. Failure to do so can result in penalties and legal complications. SC Bhagat & Co. is a trusted GST registration services provider in Delhi, offering seamless registration and compliance support for businesses of all sizes.

Who Needs GST Registration?

GST registration is required for:

Businesses with an annual turnover exceeding ₹40 lakhs (for goods) and ₹20 lakhs (for services) in most states.

E-commerce sellers and aggregators.

Inter-state suppliers of goods and services.

Businesses involved in import-export transactions.

Entities registered under the previous tax regime (VAT, Service Tax, Excise, etc.).

Benefits of GST Registration

Legal Compliance & Avoiding Penalties

GST registration ensures that your business complies with Indian tax laws, avoiding unnecessary fines and legal hurdles.

Input Tax Credit (ITC)

Registered businesses can avail ITC on taxes paid on purchases, reducing their overall tax liability.

Increased Business Credibility

Having a GST registration number enhances the credibility and trustworthiness of your business among clients and partners.

Access to Online Marketplaces

GST registration is mandatory for selling on platforms like Amazon, Flipkart, and other e-commerce sites.

Ease of Business Expansion

A GST-registered business can operate seamlessly across India without multiple state-wise registrations.

Why Choose SC Bhagat & Co. for GST Registration Services?

SC Bhagat & Co. is one of the most reliable GST consultants in Delhi, known for its professional and hassle-free services. Our team ensures smooth registration while minimizing your compliance burden.

Our Services Include:

✔ GST Registration Assistance – Guidance on eligibility, documentation, and application process. ✔ GST Filing & Compliance – Timely GST returns filing to avoid penalties. ✔ GST Advisory – Expert insights on tax planning and compliance strategies. ✔ GST Refund Assistance – Support in claiming eligible refunds under GST. ✔ GST Audit & Assessment – Ensuring accurate tax reporting and compliance.

Step-by-Step Process for GST Registration

Document Preparation – PAN, Aadhaar, business incorporation proof, address proof, and bank details.

Online Application Submission – Filing GST REG-01 form on the GST portal.

Verification & ARN Generation – GST authorities verify documents and issue an Application Reference Number (ARN).

GST Number Issuance – Once approved, a unique GST Identification Number (GSTIN) is provided.

Get Started with SC Bhagat & Co.

If you are looking for reliable GST registration services in Delhi, SC Bhagat & Co. is here to assist you. Our experts ensure a hassle-free registration process, helping you stay compliant with the latest GST regulations. Contact us today to get started!

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances

1 note

·

View note

Text

#ecommerce#ecommerce service provider#amazon seller#amazon seller account#amazon seller account management#amazon seller registration

0 notes

Text

What is the GST limit for small business?

Goods and Services Tax (GST) is a mandatory tax system in India, applicable to businesses based on their annual turnover. However, small businesses enjoy a threshold exemption limit, allowing them to operate without GST registration in Coimbatore if their revenue falls below a certain level. With online GST registration in Coimbatore, small businesses can easily comply with tax regulations if required.

GST Exemption Limit for Small Businesses

The GST registration limit varies based on business type and location.

1. For Goods Suppliers (Traders & Manufacturers)

₹40 lakh – If operating in regular states like Tamil Nadu, Karnataka, Maharashtra, etc.

₹20 lakh – If located in special category states like Himachal Pradesh, Uttarakhand, and the North-Eastern states.

2. For Service Providers

₹20 lakh – For businesses in normal states.

₹10 lakh – For businesses in special category states.

If a business’s annual turnover remains below these thresholds, GST registration in Coimbatore online is not mandatory unless it falls under specific GST requirements.

Who Must Register for GST Regardless of Turnover?

Even if a business is below the GST exemption limit, certain businesses must register for GST under specific conditions:

Interstate Business Transactions

Businesses supplying goods or services across state borders must register under GST, regardless of turnover.

E-commerce Sellers

Businesses selling on platforms like Amazon, Flipkart, or their own e-commerce websites must register for GST.

Casual Taxable Persons

Individuals who occasionally supply goods or services in different states must obtain GST registration.

Businesses Under Reverse Charge Mechanism (RCM)

If a business falls under RCM, where the recipient must pay GST instead of the supplier, GST registration is required.

Voluntary GST Registration

Small businesses may opt for online GST registration in Coimbatore voluntarily to avail of input tax credit benefits and gain credibility.

Composition Scheme for Small Businesses

The Composition Scheme allows small businesses to pay GST at a lower fixed rate without filing monthly returns. It is beneficial for businesses with turnover:

₹1.5 crore or below for goods suppliers (₹75 lakh for special category states).

₹50 lakh or below for service providers.

Under this scheme:

Traders & manufacturers pay 1% GST

Restaurants pay 5% GST

Service providers pay 6% GST

However, businesses in the Composition Scheme cannot claim input tax credit (ITC).

Conclusion

The GST registration limit for small businesses depends on their turnover and type of business. While businesses below ₹40 lakh (for goods) and ₹20 lakh (for services) are generally exempt, those involved in interstate trade, e-commerce, or RCM must register. With GST registration in Coimbatore online, small businesses can easily comply with GST rules and operate legally. If unsure, consulting experts for GST registration in Coimbatore can ensure hassle-free compliance.

0 notes

Text

Online GST Registration in Chennai: How to Apply via the GST Portal

Chennai, the capital of Tamil Nadu, is a thriving business hub. It is home to a range of industries, from IT and manufacturing to textiles and retail. To operate legally and benefit from the tax system, businesses in Chennai must adhere to the Goods and Services Tax (GST) regulations. This article offers a comprehensive guide to GST Registration in Chennai, explaining its benefits, process, eligibility, and requirements.

What is GST?

The Goods and Services Tax (GST) is an indirect tax system introduced in India in July 2017. It subsumes multiple taxes like VAT, service tax, and excise duty into one unified tax, simplifying compliance and promoting ease of doing business. GST applies to the supply of goods and services and is mandatory for companies that exceed specific turnover limits.

Who Should Register for GST in Chennai?

GST registration is mandatory for businesses and individuals who meet the following criteria:

Turnover Threshold:

Businesses with an annual turnover exceeding ₹40 lakhs (₹10 lakhs for particular category states) must register for GST.

For service providers, the turnover threshold is ₹20 lakhs.

Interstate Business:

If your business involves the supply of goods or services between states, GST registration is mandatory, irrespective of turnover.

E-Commerce Sellers:

GST registration is required if you sell products or services through e-commerce platforms like Amazon, Flipkart, or your website.

Voluntary Registration:

Even if you don't meet the turnover threshold, you can voluntarily register for GST to avail of input tax credit and appear more credible to your customers.

Benefits of GST Registration

Legal Compliance:

GST registration ensures that your business operates legally and avoids any penalties or fines for non-compliance.

Input Tax Credit:

Businesses can claim input tax credits on purchases, allowing them to reduce their tax liability.

Expansion Opportunities:

Registered businesses can expand their operations across India without worrying about state-specific tax laws.

Enhanced Credibility:

Having a GST registration number adds to your business credibility, especially when dealing with larger enterprises or government contracts.

Documents Required for GST Registration in Chennai

The following documents are required to complete GST registration in Chennai:

PAN Card of the business or applicant

The Aadhaar Card of the applicant

Proof of business address: This could be a rent agreement, electricity bill, or property tax receipt.

Bank account details: A copy of a cancelled cheque or the first page of your bank passbook.

Digital Signature Certificate (DSC) for companies and LLPs

Incorporation certificate or partnership deed for businesses

Passport-size photograph of the applicant

Step-by-Step Process for GST Registration in Chennai

Follow these steps to complete GST registration in Chennai:

Step 1: Visit the GST Portal

Go to the official GST website https://www.gst.gov.in and click on the ‘Services’ tab. Under ‘Registration,’ choose ‘New Registration.’

Step 2: Fill in the Application

You’ll be asked to provide the following details:

PAN card number

Email ID and mobile number (to receive OTPs)

State and district where your business is located After filling in these details, click ‘Proceed.’

Step 3: Verification of Contact Details

You will receive OTPs on the mobile number and email address you provided. Enter the OTP to verify your contact details.

Step 4: Provide Business Details

Fill in details such as the trade name, constitution of the business, principal place of business, and additional place of business, if applicable.

Step 5: Upload Documents

Upload the required documents, such as proof of business address, PAN card, Aadhaar card, and bank details.

Step 6: Submit the Application

After reviewing the information you provided, apply to individuals using Digital Signature (DSC) or Electronic Verification Code (EVC).

Step 7: Receive ARN

Once the application is submitted, an Application Reference Number (ARN) will be generated. You can use this number to track the status of your application.

Step 8: Approval and GSTIN

If the authorities find your application in order, your GST Registration will be approved, and you will receive your GST Identification Number (GSTIN).

GST Registration Fees in Chennai

GST registration is free of government fees. However, if you prefer to seek the assistance of professionals, they may charge a fee.

Penalties for Non-Compliance

Failure to register for GST when required can result in penalties. The penalty for not registering is 10% of the tax due, subject to a minimum of ₹10,000. In cases of deliberate evasion, the penalty can go up to 100% of the tax due.

Conclusion

Registering for GST is a crucial step for businesses operating in Chennai. It ensures compliance with the law, offers tax benefits, and enhances credibility. The process is straightforward and can be done online, making it convenient for businesses of all sizes. Whether you are starting a new business or expanding an existing one, GST registration is an essential step towards success in the competitive Chennai market.

0 notes