#allstate insurance commercial

Explore tagged Tumblr posts

Note

So, funny story; I work in a hospital, and because we have a TV in our waiting room, we tend to see a lot of the same commercials over and over, especially for things like Medicare and car insurance. It just made me picture Elvis being in one of those commercials if he had lived lol!

Like they have some the celebrities in them. Like that one guy I can’t remember what car insurance it is.. I think allstate? Lmao

2 notes

·

View notes

Text

Fun Facts. 100% verified.

Ariana Grande claims her hit "We Can't Be Friends" was inspired by Dean Winters, the actor who plays "Mayhem" in the Allstate Insurance commercials.

According to Chicago Life magazine, the most "under-appreciated iconic Chicago-style dish" is ribeye steak smothered in gyro.

Sir Laurence Olivier's last screen credit was in an episode of Doogie Howser, M.D.

A poster in Fidel Castro's office said "Get up, dress up and show up!"

While Truman Capote never did finish his book Answered Prayers he wrote more than a hundred saucy limericks about Bianca Jagger.

Saint Anthony of Padua with a sack of Whataburger.

#saint anthony of padua#whataburger#texas#san antonio#truman capote#bianca jagger#laurence olivier#doogie howser md#fidel castro#chicago#gyro#ariana grande#dean winters#mayhem

2 notes

·

View notes

Note

12, 21, 28, 46!

12. Favorite tv commercial? As far as nostalgia goes, I was fascinated with the Pillow Pet commercials and those cake filling mold one or the giant cupcake one. I remember those being on tv all the time and thinking that would taste so good, but now I'm just like...why lol. This also got me thinking of those commercials for Fushigi (had to look up that name) which were so stupid in retrospect for how they were trying to make a metal ball seem like the coolest thing ever invented. I'm going off topic. My actual favorite commercial would have to be the early 2000s and 2010s era of insurance commercials. Geico, Allstate, State Farm, Progressive. Idk what they were putting in those ads back then but I gotta admit they were funny.

21. Your first celebrity crush? This is so boring, but as a kid I didn't really have any crushes. Just didn't develop those kind of feelings until high school. I think the first one I actually had a clear attraction towards was Robert Plant 💀💀 which is funny 'cause I have no feelings for him now.

28. An unusual song that is your favorite? I HAVE SO MANY uhhhh

Every time I tell people I like this song I get the oddest reactions.

46. A christmas song you secretly like? Don't tell anyone....I don't mind the "All I Want For Christmas is You" song. I know I know.

2 notes

·

View notes

Text

Dennis Dexter Haysbert (born June 2, 1954) is an actor and voice actor. In the US he is known for his appearances in commercials for Allstate Insurance. He portrayed baseball player Pedro Cerrano in the Major League film trilogy, Secret Service Agent Tim Collin Absolute Power, and Sergeant Major Jonas Blane on The Unit. He is known for playing Senator (later President) David Palmer in the first 5 seasons of 24 and has appeared in the films Love Field, Heat, Waiting to Exhale, Far from Heaven, and the science fiction series Incorporated.

He has been acting in film and television since 1978, starting with a guest role in The White Shadow. His television guest-starring roles include Lou Grant, Growing Pains, Laverne & Shirley, The A-Team, Night Court, Dallas, The Incredible Hulk, Magnum, P.I., Buck Rogers in the 25th Century, and Duckman. He had a featured role in Return to Lonesome Dove as outlaw Cherokee Jack Jackson. He starred with Eric Close in Now and Again. #africanhistory365 #africanexcellence

2 notes

·

View notes

Text

Who understands auto insurance?

When you think of getting a new insurance policy, what is the first thing that comes to mind? HEADACHE! Avoid at all costs.. renew my current policy even if the cost keeps going up.

Insurance is an incredibly complex product and one that most consumers do not understand well. Auto insurance is no exception. As we learned in the Concha y Toro case, cognitive associations are particularly important when the product's quality attributes are opaque to consumers. Just like the average consumer cannot differentiate the quality of different wines, the average consumer does not know how to effectively evaluate the quality of auto insurance policies because the product is opaque and complex.

Dall E 3

Given that the quality of different policies is difficult to evaluate and consumer are sticky after having picked a policy, auto insurers invest significantly in brand as a tool for customer acquisition. Auto insurers use their brand in order to create strong cognitive associations of trust that will make it more likely for consumers to pick them when they are evaluating options. The importance of brand and trust in customer purchasing decisions for auto insurance makes insurers more likely to pursue a branded house strategy, in which they use a singular brand for all products and services, as opposed to a house of brands strategy. The branded house strategy enables insurers to scale their significant investments in creating cognitive associations of trust across all of their products and thus is more operationally efficient. Most auto insurance carriers also offer adjacent products, such as home insurance, liability insurance, and commercial insurance, so the branded house strategy further makes it easier to cross-sell customers because there is already the positive cognitive associations of trust.

While most auto insurance providers pursue a branded house strategy, there are some auto insurance providers than pursue a house of brands strategy in order to target different segments of consumers effectively. Just as Toyota created Lexus to target higher end consumers, American Family Insurance maintains a separate brand under The General to target non-standard and standard drivers (aka those that have not-great driving records) and Allstate operates a separate brand, Esurance, to target younger, more tech-enabled consumers. This strategy enables auto insurers to create separate brand strategies that speak to specific customer segments without harming their overall brand image which is so important to customer-purchasing decisions.

Just like in wine choice, cognitive associations play a huge role in insurance policy choice and so must be managed effectively in order to be successful.

2 notes

·

View notes

Text

State Farm said in May it won't offer new property and casualty insurance in California.

Allstate also stopped selling new home, condo, or commercial policies in California.

California has seen an average of over 7,000 wildfires per year in the past five years, per CNN.

Allstate, one of the largest US insurance companies, has joined State Farm in no longer accepting new applications for homeowners insurance in California, citing catastrophic events like natural disasters and higher construction costs.

Allstate quietly stopped issuing new policies in California months ago, but didn't announce the decision until Friday, CBSNews reported. "The cost to insure new home customers in California is far higher than the price they would pay for policies due to wildfires, higher costs for repairing homes, and higher reinsurance premiums."

9 notes

·

View notes

Text

Things with more AO3 works than Raid: Shadow Legends:

The Folgers Coffee incest commercial (135 works)

The Evergiven/Suez Canal tag (150 works)

Goncharov (798 works)

Allstate insurance commercials (56 works)

9 works (as of the date of this post) for Raid: Shadow Legends is super dire.

125K notes

·

View notes

Text

The Intersection of Restoration and Construction Excellence

Northwest Restoration bridges the gap between emergency restoration and new construction, offering a seamless service that ensures properties are not only repaired but also rebuilt better. After mitigating the immediate damage from disasters, their team is equipped to undertake reconstruction tasks, restoring structural integrity and enhancing aesthetic appeal.

This integrated approach eliminates the need for multiple contractors, saving time and reducing complexity. Their team’s expertise in handling both restoration and construction projects makes them a one-stop solution for property owners looking to recover and improve. Northwest Restoration’s commitment to quality and innovation ensures that every project—be it restoration or new construction—leaves clients with lasting satisfaction.

Discover how their comprehensive solutions can meet your needs by contacting Northwest Restoration today.

From initial consultations and free estimates to the final touches, Northwest Restoration emphasizes clear communication and attention to detail. Their skilled professionals work efficiently to meet deadlines without compromising on quality. Moreover, being deeply rooted in the Tri-Cities community, they bring a personalized touch to each project, reflecting their commitment to customer satisfaction.

Their expertise covers immediate interventions such as board-ups, water extraction, and smoke damage remediation, ensuring no time is wasted in safeguarding your property. Their use of advanced restoration techniques and tools allows them to deliver top-quality results, meeting industry standards and exceeding customer expectations. Moreover, Northwest Restoration works closely with insurance providers, making the claims process seamless and stress-free for property owners. Trust their A+ BBB-rated team to restore your home or office with precision and care.

Their services include fire and smoke damage repair, water extraction, structural drying, and wind damage remediation. Working closely with insurance providers like State Farm, Allstate, and USAA,North West Restoration ensures a seamless claims process. With over 30 skilled professionals on staff, the company brings decades of experience and a commitment to quality, making them a reliable choice for homeowners and businesses alike.

2. Building Dreams: North West Restoration’s New Construction ServicesNorth West Restoration isn't just about fixing damaged properties; they're also a leading name in residential and commercial new construction. Whether you're planning to build your dream home or a commercial space, their team offers a full range of services, from initial design consultations to the final walkthrough.

Using cutting-edge tools and industry-best practices, North West Restoration ensures that every project meets modern standards of safety, functionality, and aesthetic appeal. They take pride in offering free estimates, empowering clients to make informed decisions before breaking ground. Backed by their extensive expertise in construction and restoration, they provide a unique perspective that integrates durability with innovation.

3. Bridging Restoration and Construction for Comprehensive ServiceNorth West Restoration uniquely combines emergency restoration expertise with a full suite of construction capabilities. This dual focus enables them to handle projects holistically, ensuring that properties are not only restored to their pre-disaster state but also enhanced to prevent future issues.

Their approach begins with immediate damage control and restoration, followed by thorough assessments to identify structural improvements. Clients can then choose to leverage the company’s construction services for upgrades, renovations, or entirely new builds. With this comprehensive service model, North West Restoration has become a trusted partner for property owners across Washington looking to rebuild better and stronger.

Each article highlights North West Restoration’s professionalism, customer-centric approach, and ability to handle a wide array of restoration and construction challenges. For more information, visit North West Restoration’s website.

1 note

·

View note

Text

The Ultimate Guide: captive vs independent insurance agents uncovered

Let’s talk about a hot topic that’s been buzzing around lately: captive versus independent insurance agents. If you’re unsure which route to take for your insurance needs, keep reading because we’re diving deep into the differences and why Trailstone Insurance Group might just be your best bet.

So, what exactly is a captive insurance agent? Well, they’re essentially exclusive representatives of a single insurance company, like the big names you’ve heard of – State Farm, Farmers, Allstate, and GEICO. On the flip side, independent agents, like us at Trailstone Insurance Group, have the freedom to shop around and work with multiple insurance carriers. Captives are like being tied to one ship versus sailing the open seas with Trailstone.

Why does this matter, you ask? For starters, captive agents are bound to sell you only one brand of insurance, hence the term “captive.” Sure, they might offer stability and support from their parent company, but are you really getting the best deal when you’re limited to just one option? That’s where independent agents shine. We’ve got access to an assortment of insurance products from over 40 top-tier companies. Your needs, your choice – it’s as simple as that.

Here is something to think about, captive agents might flaunt their brand recognition and marketing prowess, but have you ever stopped to think about who’s paying the bill for those flashy commercials? Spoiler alert: it’s you, the customer, through higher premiums. Meanwhile, independent agencies like Trailstone save on advertising costs and pass those savings along to you. Plus, with so many options at our fingertips, insurance carriers know they have to compete for your business, resulting in better rates for you.

But don’t just take our word for it. Take Michaela Duke, for example, who saved a $1,500 a year by switching to Trailstone. And get this, Tiffany, the Trailstone agent who helped her out, used to work at a State Farm agency. Talk about insider knowledge!

At Trailstone, we pride ourselves on offering personalized coverage tailored to your unique needs. No one-size-fits-all solutions here. Our agents have the heart of teachers, guiding you through the maze of insurance jargon to find what’s best for you. Dave Ramsey would be proud.

Expertise? Yup. Trailstone agents are seasoned advisors who understand the ins and outs of insurance. We’ll provide advice on risks and regulations, so you can make informed decisions with confidence.

And when it comes to claims, we’ve got your back. Unlike some captive agents who might jump the gun by opening a claim when you call for advice, we’ll provide honest advice and support you every step of the way. Need a second opinion? Even if you’re not our client, give us a call. We’re here to help.

But our support doesn’t end once you sign on the dotted line. We’ll review your coverage each year with you to ensure it evolves with your changing needs. No call centers here, just real people dedicated to your peace of mind.

And let’s not forget about the bottom line. We’ll shop around to find you the most competitive rates and discounts, not just in year one, but every renewal thereafter. Sure, a captive might swoop in with a good deal once in a blue moon, but why leave it to chance when you can count on us year after year?

So, there you have it – the benefits of partnering with Trailstone Insurance Group are clear. From tailored coverage to top-notch service and the freedom to choose, we’ve got your back every step of the way. Give us a call today and let’s navigate the world of insurance together.

ORIGINALLY FOUND ON- Source: TrailStone Insurance Group(https://trailstoneinsurancegroup.com/blog/captive-vs-independent-insurance-agents-guide/)

1 note

·

View note

Text

Automotive Usage Based Insurance Market is Set To Fly High in Years to Come

Market Research Forecast released a new market study on Global Automotive Usage Based Insurance Market Research report which presents a complete assessment of the Market and contains a future trend, current growth factors, attentive opinions, facts, and industry validated market data. The research study provides estimates for Global Automotive Usage Based Insurance Forecast till 2032. The Automotive Usage Based Insurance Market size was valued at USD 50.35 USD Billion in 2023 and is projected to reach USD 152.02 USD Billion by 2032, exhibiting a CAGR of 17.1 % during the forecast period. Key Players included in the Research Coverage of Automotive Usage Based Insurance Market are: Allstate Insurance Company (U.S.), State Farm Mutual Automobile Insurance Company (U.S.), Liberty Mutual Insurance (U.S.), AXA (France), The Progressive Corporation (U.S.), Allianz (Germany), American International Group, Inc. (AIG) (U.S.), MAPFRE (Spain), Insurethebox (U.K.), Verisk Analytics, Inc. (U.S.), Arity, LLC (U.S.), Insurance & Mobility Solutions (IMS) (Canada) What's Trending in Market: Rising Adoption of Automation in Manufacturing to Drive Market Growth Market Growth Drivers: Increasing Demand for Forged Products in Power, Agriculture, Aerospace, and Defense to Drive Industry Expansion The Global Automotive Usage Based Insurance Market segments and Market Data Break Down Type [Pay-As-You-Drive: PAYD","Solution: Dongle, Black Box, Embedded, and Smartphones","Vehicle Type: Passenger Cars and Commercial Vehicles GET FREE SAMPLE PDF ON Automotive Usage Based Insurance MARKET To comprehend Global Automotive Usage Based Insurance market dynamics in the world mainly, the worldwide Automotive Usage Based Insurance market is analyzed across major global regions. MR Forecast also provides customized specific regional and country-level reports for the following areas.

• North America: United States, Canada, and Mexico. • South & Central America: Argentina, Chile, Colombia and Brazil. • Middle East & Africa: Saudi Arabia, United Arab Emirates, Israel, Turkey, Egypt and South Africa. • Europe: United Kingdom, France, Italy, Germany, Spain, Belgium, Netherlands and Russia. • Asia-Pacific: India, China, Japan, South Korea, Indonesia, Malaysia, Singapore, and Australia.

Extracts from Table of Contents Automotive Usage Based Insurance Market Research Report Chapter 1 Automotive Usage Based Insurance Market Overview Chapter 2 Global Economic Impact on Industry Chapter 3 Global Market Competition by Manufacturers Chapter 4 Global Revenue (Value, Volume*) by Region Chapter 5 Global Supplies (Production), Consumption, Export, Import by Regions Chapter 6 Global Revenue (Value, Volume*), Price* Trend by Type Chapter 7 Global Market Analysis by Application ………………….continued More Reports:

https://marketresearchforecast.com/reports/solar-vehicle-market-2990 For More Information Please Connect MR ForecastContact US: Craig Francis (PR & Marketing Manager) Market Research Forecast Unit No. 429, Parsonage Road Edison, NJ New Jersey USA – 08837 Phone: (+1 201 565 3262, +44 161 818 8166)[email protected]

#Global Automotive Usage Based Insurance Market#Automotive Usage Based Insurance Market Demand#Automotive Usage Based Insurance Market Trends#Automotive Usage Based Insurance Market Analysis#Automotive Usage Based Insurance Market Growth#Automotive Usage Based Insurance Market Share#Automotive Usage Based Insurance Market Forecast#Automotive Usage Based Insurance Market Challenges

0 notes

Text

To be blunt, your overall actions play out like mayhem insurance commercials from Allstate:

"chains fell off"

"doors fell off"

"wheels came off"

"screws came loose"

"service light is on"

"gaslight is on"

"chairs got flipped"

"tables got turned"

"roof crashed in"

"rug pulled out"

"wool pulled over"

Are you still reading this?

Whatever the metaphor used, christianity is definitely a "you" problem causing everyone else aggravation. Again, as in those Allstate commercials:

The majority of us around you are trying to get things done and BAM! Then, you just carelessly turn your back and simply walk away? No!

#no god know peace#religion is big business#religion is poison#are you still reading this?#4k religions#18k gods#one godzilla#all manmade#godzilla is big business too#apple has how much money offshore???

1K notes

·

View notes

Text

Top 10 Commercial Truck Insurance Companies: Protecting Your Business on the Road

In the world of commercial trucking, insurance is not just a necessity; it's a lifeline. With the ever-present risks on the road, from accidents to theft and damage, having robust insurance coverage is paramount for trucking companies to safeguard their assets and operations. However, with numerous insurance providers vying for attention, it can be challenging to discern the best options available. To help you navigate through this complex landscape, here's a comprehensive list of the top 10 commercial truck insurance companies.

Progressive Commercial: Renowned for its extensive coverage options and competitive rates, Progressive Commercial stands out as a top choice for trucking insurance. With tailored solutions for various types of commercial vehicles, including long-haul trucks, dump trucks, and tow trucks, Progressive offers flexibility and reliability.

GEICO Commercial: GEICO is synonymous with affordability and reliability in the insurance industry. Its commercial truck insurance division provides comprehensive coverage for businesses of all sizes, coupled with exceptional customer service and easy claims processing.

Nationwide Commercial: Nationwide is a trusted name in insurance, offering a wide array of coverage options for commercial trucking companies. From liability and cargo insurance to specialized coverage for hazardous materials transportation, Nationwide ensures that businesses are adequately protected against risks.

Travelers Commercial: With a rich history spanning over a century, Travelers Insurance Company is a powerhouse in the commercial insurance sector. Its commercial trucking insurance policies are tailored to meet the unique needs of trucking businesses, providing comprehensive protection and peace of mind.

Liberty Mutual Commercial: Liberty Mutual boasts a strong reputation for its customizable insurance solutions and unparalleled financial strength. Its commercial truck insurance policies offer extensive coverage options, including physical damage, liability, and cargo insurance, tailored to suit the specific requirements of each client.

The Hartford Commercial: Catering to small and large trucking fleets alike, The Hartford offers robust insurance solutions designed to mitigate risks and protect assets. With flexible coverage options and dedicated support from industry experts, The Hartford is a preferred choice for many trucking businesses.

State Farm Commercial: Known for its personalized approach to insurance, State Farm provides commercial trucking insurance that can be tailored to fit the unique needs of each business. With a vast network of agents across the country, State Farm offers localized service and support to trucking companies nationwide.

Farmers Commercial: Farmers Insurance Group offers comprehensive commercial trucking insurance policies backed by decades of industry experience. Whether it's coverage for a single truck or an entire fleet, Farmers provides customizable solutions to safeguard businesses against unforeseen events.

Allstate Commercial: Allstate's commercial truck insurance division offers a range of coverage options designed to protect businesses from the risks associated with trucking operations. With innovative tools and resources, Allstate empowers trucking companies to manage their risks effectively and mitigate potential losses.

AIG Commercial: As a global leader in insurance and risk management, AIG provides tailored solutions for commercial trucking companies operating in diverse industries. With its broad range of coverage options and expertise in risk assessment, AIG delivers peace of mind to trucking businesses worldwide.

In conclusion, choosing the right commercial truck insurance provider is crucial for safeguarding your business against potential risks and liabilities on the road. By considering factors such as coverage options, pricing, and customer service, trucking companies can select a provider that meets their specific needs and priorities. Whether it's a small fleet or a large transportation operation, investing in quality insurance coverage is essential for ensuring the long-term success and sustainability of your business.

Visit: https://www.bloggermamun.com/2023/12/top-10-commercial-truck-insurance.html

0 notes

Text

Auto Insurance Market Outlook for Forecast Period (2023 to 2030)

The Global Auto Insurance Market size is expected to grow from USD 7,68,198.17 Million in 2023 to USD 13,59,820.03 Million by 2030, at a CAGR of 8.50% during the forecast period (2023-2030).

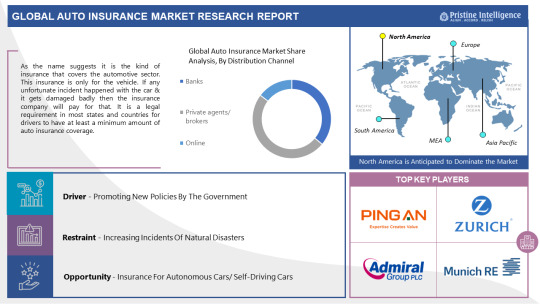

As the name suggests it is the kind of insurance that covers the automotive sector. This insurance is only for the vehicle. If any unfortunate incident happened with the car & it gets damaged badly then the insurance company will pay for that. It is a legal requirement in most states and countries for drivers to have at least a minimum amount of auto insurance coverage. It covers several policies which include liability of car, collision/ accident, and comprehensive. This coverage pays for damages or injuries you cause to others in an accident. It typically includes bodily injury liability and property damage liability. This coverage pays for damages to your vehicle that result from a collision with another vehicle or object.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://pristineintelligence.com/request-sample/auto-insurance-market-48

The latest research on the Auto Insurance market provides a comprehensive overview of the market for the years 2023 to 2030. It gives a comprehensive picture of the global Auto Insurance industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Auto Insurance market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses. The study is written with a specific goal in mind: to give business insights and consultancy to help customers make smart business decisions and achieve long-term success in their particular market areas.

Leading players involved in the Auto Insurance Market include:

"State Farm (USA), GEICO (USA), Progressive (USA), Allstate (USA), USAA (USA), Nationwide (USA), Travelers (USA), Liberty Mutual (USA), Farmers Insurance (USA), American Family Insurance (USA), AIG (USA), Zurich Insurance Group (Switzerland), AXA (France), Aviva (United Kingdom), Admiral Group (United Kingdom), Munich Re (Germany), Berkshire Hathaway (USA), Tokio Marine (Japan), Ping An Insurance (China), PICC (China) and Other Major Players."

If You Have Any Query Auto Insurance Market Report, Visit:

https://pristineintelligence.com/inquiry/auto-insurance-market-48

Segmentation of Auto Insurance Market:

By Vehicle age

Old

New

By Type

Commercial

Personal

By Distribution Channel

Banks

Private Agents/ Brokers

Online

An in-depth study of the Auto Insurance industry for the years 2023–2030 is provided in the latest research. North America, Europe, Asia-Pacific, South America, the Middle East, and Africa are only some of the regions included in the report's segmented and regional analyses. The research also includes key insights including market trends and potential opportunities based on these major insights. All these quantitative data, such as market size and revenue forecasts, and qualitative data, such as customers' values, needs, and buying inclinations, are integral parts of any thorough market analysis.

Market Segment by Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Reasons to Purchase this Market Report:

Market forecast analysis through recent trends and SWOT analysis

Auto Insurance Market Dynamics Scenarios with Market Growth Opportunities over the Next Year

Market segmentation analysis, including qualitative and quantitative studies that include economic and non-economic impacts

Auto Insurance Market Regional and country-level analysis that integrates demand and supply forces that impact the growth of the market.

Competitive environment related to the Auto Insurance market share for key players, along with new projects and strategies that players have adopted over the past five years

Acquire This Reports: -

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: [email protected]

#Auto Insurance#Auto Insurance Market#Auto Insurance Market Size#Auto Insurance Market Share#Auto Insurance Market Growth#Auto Insurance Market Trend#Auto Insurance Market segment#Auto Insurance Market Opportunity#Auto Insurance Market Analysis 2023#US Auto Insurance Market#Auto Insurance Market Forecast#Auto Insurance Industry#Auto Insurance Industry Size#china Auto Insurance Market#UK Auto Insurance Market

0 notes

Text

The Landscape of Insurance Companies in the USA A Comprehensive Overview

Insurance plays a pivotal role in safeguarding individuals and businesses from unforeseen risks and uncertainties. In the United States, the insurance industry is a dynamic and robust sector, offering a wide range of coverage options to meet the diverse needs of its population. This article aims to provide a comprehensive overview of the insurance landscape in the USA, highlighting key players, trends, and the evolving nature of the industry.

Key Players:-

The insurance market in the USA is populated by a myriad of companies, ranging from industry giants to niche players. Some of the major players in the industry include:-

State Farm:-

As the largest property and casualty insurance provider in the United States, State Farm has a significant market presence. The company offers a broad spectrum of insurance products, including auto, home, and life insurance.

Geico:-

Renowned for its humorous advertising campaigns, Geico is a major player in the auto insurance sector. It has gained a substantial market share by providing competitive rates and innovative coverage options.

Progressive:-

Progressive is known for its innovative approach to auto insurance, introducing services like usage-based insurance and comparison tools. The company has grown to be one of the largest auto insurers in the country.

Allstate:-

Allstate is a diversified insurance company offering auto, home, and life insurance, as well as other financial services. It is one of the oldest and most well-established insurance providers in the country.

Nationwide:-

With a wide range of insurance products, Nationwide caters to both personal and commercial clients. It has a strong presence in auto, home, and specialty insurance markets.

Industry Trends:-

The insurance industry in the USA is continually evolving, adapting to technological advancements, regulatory changes, and shifting consumer preferences. Some notable trends include:-

Digital Transformation:-

Insurance companies are increasingly leveraging digital technologies to enhance customer experience, streamline processes, and offer innovative products. Online platforms and mobile apps have become integral to insurance operations.

Data Analytics and Artificial Intelligence:-

Insurers are harnessing the power of data analytics and artificial intelligence to assess risk more accurately, detect fraud, and personalize insurance offerings. These technologies contribute to improved underwriting and claims management.

Evolving Regulatory Landscape:-

The insurance industry is subject to a complex regulatory environment. Changes in regulations, such as updates to insurance laws and consumer protection measures, impact how companies operate and compete in the market.

Climate Risk and Sustainability:-

Given the increasing frequency of natural disasters, insurers are focusing on climate risk and sustainability. Some companies are incorporating environmental, social, and governance (ESG) factors into their underwriting and investment strategies.

The insurance landscape in the USA is marked by a diverse array of companies competing to provide coverage for individuals and businesses. As technology continues to shape the industry, insurers must adapt to stay relevant and meet the evolving needs of their customers. The future of insurance in the USA will likely be influenced by ongoing technological innovations, regulatory changes, and a heightened awareness of environmental and social issues.

FOR MORE INFOMATION :-

Insurance Company In Usa

0 notes

Text

Ok, I don't know if anyone else has seen it, but I need to know I'm not crazy so you all get to hear about this weird ad I got while watching a YouTube video for...something. I can't for the life of me remember what it was for ( so not very effective ad ).

Anyhoo, it opened on a haunted house kind of shot and zoomed into a dark room where the mascots of different insurance companies (think the Geico gecko, Jake from State Farm, ect.) were gathered around the table, but they were actually showing an evil side to them, so they had slightly different names and looks but you could easily guess who was who. The Geico Gecko (dunno if it has a name, never thought that much about it.) called the meeting to order and, after a few seconds, asked Mayhem (Allstate-forgot which one he was,had to look that up. Remebered the commercials though) and Doug (Liberty Mutual-knew that one) role played a customer and company. Mayhem (customer) was trying to file a claim but Doug (company) was making it difficult and Mayhem eventually said the word Lawyer which all companies panicked over acting as if it were a curse. New guy (State farm) said it again, got the table panicked again saying not to say that word then the ad ended.

Again, I don't recall what it was trying to sell me, I think it was for a lawyer based on context, but yea, I don't remember that. I just remember the characters who, honestly, were kind of fun to watch. Did anyone else get this ad or did I weirdly imagine it? Pretty sure it was real, probably made for spoopy season, but I...yea. it was weird.

0 notes

Text

Motorcycle Insurance Market to Scale New Heights as Market Players Focus on Innovations 2023– 2028

Latest study released by AMA Research on Global Motorcycle Insurance Market research focuses on latest market trend, opportunities and various future aspects so you can get a variety of ways to maximize your profits. Motorcycle Insurance Market predicted until 2028*. Two-wheeler insurance refer to an insurance policy that is taken to cover the damage to the bike/ scooter or to the rider due to some unforeseen events such as road accidents, natural disaster, and theft or loss of a motor vehicle. Bike insurance essentially provides coverage against any third-party liability that may arise from injuries incurred to one or more individuals in case of an accident. The motorcycle insurance provides cover to the vehicles and cover all uses whether for personal, commercial or mixed purpose. Some of Key Players included in Motorcycle Insurance Market are:

Dai-ichi Mutual Life Insurance (Japan)

Farmers Insurance (United States)

Allianz SE (Germany)

Allstate (United States)

Zurich Insurance Group Ltd. (Switzerland)

State Farm Insurance (United States)

Assicurazioni Generali (Italy)

GEICO (United States)

Cardinal Health (United States)

Munich Re Group (Germany)

Aviva (United Kingdom)

AXA (France)

Market Trends: Development of New Offers and Schemes by Insurance Companies

Innovation in Motorcycle Insurance Products

Drivers: Increasing Incidence of Accidents Globally

Government Focus on Accident Insurance

Challenges: Longer Time for Claim Reimbursement

Opportunities: High Potential Growth in Emerging Countries

Addition of Attractive Features to the Plans by Insurance Companies

The titled segments and Market Data are Break Down 19819

Presented By

AMA Research & Media LLP

0 notes