#Auto Insurance Market Analysis 2023

Explore tagged Tumblr posts

Text

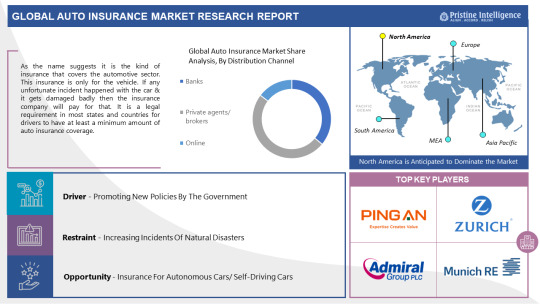

Auto Insurance Market Outlook for Forecast Period (2023 to 2030)

The Global Auto Insurance Market size is expected to grow from USD 7,68,198.17 Million in 2023 to USD 13,59,820.03 Million by 2030, at a CAGR of 8.50% during the forecast period (2023-2030).

As the name suggests it is the kind of insurance that covers the automotive sector. This insurance is only for the vehicle. If any unfortunate incident happened with the car & it gets damaged badly then the insurance company will pay for that. It is a legal requirement in most states and countries for drivers to have at least a minimum amount of auto insurance coverage. It covers several policies which include liability of car, collision/ accident, and comprehensive. This coverage pays for damages or injuries you cause to others in an accident. It typically includes bodily injury liability and property damage liability. This coverage pays for damages to your vehicle that result from a collision with another vehicle or object.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://pristineintelligence.com/request-sample/auto-insurance-market-48

The latest research on the Auto Insurance market provides a comprehensive overview of the market for the years 2023 to 2030. It gives a comprehensive picture of the global Auto Insurance industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Auto Insurance market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses. The study is written with a specific goal in mind: to give business insights and consultancy to help customers make smart business decisions and achieve long-term success in their particular market areas.

Leading players involved in the Auto Insurance Market include:

"State Farm (USA), GEICO (USA), Progressive (USA), Allstate (USA), USAA (USA), Nationwide (USA), Travelers (USA), Liberty Mutual (USA), Farmers Insurance (USA), American Family Insurance (USA), AIG (USA), Zurich Insurance Group (Switzerland), AXA (France), Aviva (United Kingdom), Admiral Group (United Kingdom), Munich Re (Germany), Berkshire Hathaway (USA), Tokio Marine (Japan), Ping An Insurance (China), PICC (China) and Other Major Players."

If You Have Any Query Auto Insurance Market Report, Visit:

https://pristineintelligence.com/inquiry/auto-insurance-market-48

Segmentation of Auto Insurance Market:

By Vehicle age

Old

New

By Type

Commercial

Personal

By Distribution Channel

Banks

Private Agents/ Brokers

Online

An in-depth study of the Auto Insurance industry for the years 2023–2030 is provided in the latest research. North America, Europe, Asia-Pacific, South America, the Middle East, and Africa are only some of the regions included in the report's segmented and regional analyses. The research also includes key insights including market trends and potential opportunities based on these major insights. All these quantitative data, such as market size and revenue forecasts, and qualitative data, such as customers' values, needs, and buying inclinations, are integral parts of any thorough market analysis.

Market Segment by Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Reasons to Purchase this Market Report:

Market forecast analysis through recent trends and SWOT analysis

Auto Insurance Market Dynamics Scenarios with Market Growth Opportunities over the Next Year

Market segmentation analysis, including qualitative and quantitative studies that include economic and non-economic impacts

Auto Insurance Market Regional and country-level analysis that integrates demand and supply forces that impact the growth of the market.

Competitive environment related to the Auto Insurance market share for key players, along with new projects and strategies that players have adopted over the past five years

Acquire This Reports: -

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: [email protected]

#Auto Insurance#Auto Insurance Market#Auto Insurance Market Size#Auto Insurance Market Share#Auto Insurance Market Growth#Auto Insurance Market Trend#Auto Insurance Market segment#Auto Insurance Market Opportunity#Auto Insurance Market Analysis 2023#US Auto Insurance Market#Auto Insurance Market Forecast#Auto Insurance Industry#Auto Insurance Industry Size#china Auto Insurance Market#UK Auto Insurance Market

0 notes

Text

Automotive Finance Market: Key Insights, Drivers, and Competitive Landscape

The global automotive finance market size is expected to reach USD 451.71 billion by 2030, registering a CAGR of 7.3% from 2023 to 2030, according to a new report by Grand View Research, Inc. Growing global demand for autonomous cars is expected to drive the market growth. Increasing government regulations on rising road safety are creating the need for autonomous cars with highly advanced technologies worldwide.

The investment made in the automotive finance industry is also creating new opportunities for market growth. For instance, in January 2021, MotoRefi, an automotive refinancing company, announced that it raised USD 10.0 million in a round that Moderna Ventures led. The company uses this funding to hire more employees and expand its offerings.

Various auto car manufacturers are entering into a partnership with automotive finance providers to enhance their customer experience. For instance, in March 2022, CIG Motors, a GAC brand distributor, announced its collaboration with Polaris Bank Limited. By means of this partnership, the former company aims to make vehicle ownership and acquisition easy for Nigerians through the Easy Buy scheme.

COVID-19 had a negative impact on the market growth in 2021. However, the global auto manufacturers, lenders, and dealers have got adjusted to the current COVID-19 situation. For instance, the automotive manufacturers incentivized their new car sales to grow their sales amid COVID-19. These efforts taken by the automakers are expected to improve the demand for automotive finance during the forecast period.

Automotive Finance Market Report Highlights

The banks segment is expected to dominate the market growth during the forecast period as banks offer secure financing to their customers. Banks also offer customers the facility to apply for pre-approval. This facility helps customers in comparing estimated loan offers

The direct segment is expected to dominate the market growth during the forecast period. Numerous customers across the globe prefer direct auto loans as they can easily access and get loans from the credit unions, banks, and other loan lending companies

The leasing segment is expected to register the highest CAGR during the forecast period. Customers are focusing on adopting the leasing model as it is a more flexible model in comparison to others for new, shared, and used vehicles that could comprise services such as insurance

The passenger segment dominated the market in 2022 and is expected to show similar trends during the forecast period. The number of passenger vehicles including pickup trucks and others on the road, continues to rise across the globe, thereby creating growth opportunities for the passenger vehicles segment during the forecast period

The presence of many prominent automotive finance providers in the European region and the adoption of innovative tools, such as biometrics, e-contracts, and machine learning, is expected to drive the regional market growth during the forecast period

Segments Covered in the Report

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Automotive Finance Market Report based on the provider type, finance type, purpose type, vehicle type, and region.

Provider Type Outlook (Revenue, USD Billion, 2017 - 2030)

Banks

OEMs

Other Financial Institutions

Finance Type Outlook (Revenue, USD Billion, 2017 - 2030)

Direct

Indirect

Purpose Type Outlook (Revenue, USD Billion, 2017 - 2030)

Loan

Leasing

Others

Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

Commercial Vehicles

Passenger Vehicles

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

North America

US

Canada

Europe

Germany

UK

Asia Pacific

China

India

Japan

Latin America

Brazil

Middle East & Africa

Order a free sample PDF of the Automotive Finance Market Intelligence Study, published by Grand View Research.

0 notes

Text

Innovations in Autologous Stem Cell Therapies: A Comprehensive Market Analysis

Autologous Stem Cell Therapies involve the use of a patient's own stem cells to treat various diseases and injuries. By using the patient's cells, these therapies eliminate the risk of immune rejection, which is often a challenge with donor cells. In autologous treatments, stem cells are harvested from the patient's own body, commonly from bone marrow, blood, or adipose tissue, then processed, and reintroduced to repair damaged tissues, treat degenerative diseases, or promote healing. These therapies have gained attention for their potential applications in regenerative medicine, particularly for treating conditions like osteoarthritis, cardiovascular diseases, and certain autoimmune conditions.

According to MRFR analysis, the market for autologous stem cell therapies was projected to be worth 14.2 billion USD in 2022. It is anticipated that the market for autologous stem cell therapies would increase from 16.45 billion USD in 2023 to 61.93 billion USD in 2032. During the projected period (2024-2032), the autologous stem cell therapies market is anticipated to develop at a CAGR of around 15.87%.

Autologous Stem Cell Therapies Size

The global market size for Autologous Stem Cell Therapies has been steadily increasing, fueled by the rising demand for personalized and regenerative medical treatments. Estimates indicate that the market is growing at a significant rate due to advancements in stem cell research, regulatory support, and rising awareness among patients. The North American region currently dominates this sector, followed closely by Europe and Asia-Pacific. Growth is expected to continue, driven by increased healthcare spending and research investments. Experts forecast that the Autologous Stem Cell Therapies market will expand further, driven by technological advancements and the acceptance of these therapies in mainstream medical treatments.

Autologous Stem Cell Therapies Share

Market share for Autologous Stem Cell Therapies is influenced by several key players who contribute to research, product development, and regulatory approval processes. Leading biotech firms, research institutions, and specialized hospitals have established a solid presence, collectively shaping the market landscape. Factors such as patent approvals, clinical trial successes, and product launches are critical to capturing and retaining market share. With companies striving to develop safe, effective, and minimally invasive procedures, competition is fierce, yet promising. This market segment is anticipated to witness substantial growth as stakeholders continue to invest in optimizing stem cell harvesting, culture, and transplantation techniques.

Autologous Stem Cell Therapies Analysis

The analysis of the Autologous Stem Cell Therapies market shows both opportunities and challenges. Key drivers include the growing prevalence of chronic diseases, an aging population, and technological advancements in stem cell processing and delivery methods. However, the sector also faces challenges, such as high costs, complex regulatory frameworks, and limited insurance coverage, which may hinder growth. The analysis reveals that increasing investments in R&D, government support for regenerative medicine, and collaboration between public and private entities are likely to propel the market. Furthermore, innovations in minimally invasive procedures and supportive clinical trial data strengthen the position of autologous stem cell solutions within regenerative medicine.

Autologous Stem Cell Therapies Trends

Current trends in Autologous Stem Cell Therapies emphasize the development of minimally invasive procedures, enhancing patient comfort and recovery times. Innovations in cell isolation and expansion techniques have enabled more efficient autologous therapies, facilitating applications across a broader spectrum of diseases. Another notable trend is the growing interest in using autologous stem cells for cosmetic and aesthetic procedures. Additionally, the trend of developing all-in-one kits for autologous cell isolation and treatment at the point of care is gaining momentum, enabling faster and more accessible therapy options. There is also a trend toward integrating artificial intelligence and data analytics to improve outcomes in stem cell research and therapy personalization.

Reasons to Buy Autologous Stem Cell Therapies Reports

Access comprehensive insights into current and future trends within the Autologous Stem Cell Therapies market.

Understand the competitive landscape, including key players, market share, and growth opportunities.

Gain data-driven projections on the market size, share, and growth potential in various regions.

Obtain valuable information on regulatory developments, which impact the approval and distribution of these therapies.

Stay updated on the latest technological advancements and innovations shaping the future of autologous stem cell applications.

Recent Developments in Autologous Stem Cell Therapies

In recent years, Autologous Stem Cell Therapies have achieved several significant milestones. First, advancements in 3D bioprinting and scaffold technology have facilitated more targeted treatments for complex conditions. Second, various clinical trials have shown promising results, particularly in treating osteoarthritis and spinal cord injuries. Third, emerging data on the use of autologous stem cells for heart regeneration has shown potential to restore cardiac function in post-myocardial infarction patients. Fourth, more point-of-care systems have been approved, allowing practitioners to process and deliver autologous stem cells more quickly. Finally, regulatory agencies worldwide are setting clearer frameworks, streamlining the path to market approval for these therapies.

Related reports:

healthcare facility management market

healthcare workforce management system market

hemato oncology testing market

hpv testing pap test market

0 notes

Text

Dashboard Camera Market – Size, Analysis, Forecast & Competition Benchmarking

Dashboard Camera Market Overview:

Access Sample Report

The market for Dashboard Camera was valued at XX Mn USD in the year 2023 and expected to reach XX Mn by the year 2030. The CAGR for the market is XX% during the period 2019 -2030.

Dashboard cameras also referred to as dashcams are small video recorders that are mounted on car dashboards to record footage of the road ahead and the interior of the vehicle. They are essential instruments for capturing live footage while driving, providing video proof in the event of collisions or disagreements. Dashcams have grown in popularity among drivers worldwide for improving road safety, providing a sense of security, and providing footage for insurance claims or legal purposes. Modern dashcams are more useful and relevant in the automotive industry since they have features like wide-angle lenses, high-resolution video recording, GPS tracking, and connectivity options. These features are the result of technological advancements.

Dashboard Camera Market Dynamics:

Dashboard Camera Market Drivers

Safety Concerns

Insurance Premium Discounts

Dashboard Camera Market Restraints

Privacy Concerns

Installation Complexity

Dashboard Camera Market Opportunities

Integration with Smart Features

Solutions for Fleet Management

Dashboard Camera Market Trends

Dual Channel & AI Integration

Network and Connectivity

Distribution Channel Segment Overview:

In-store spots have a major market as they provide direct customer interactions and hands-on experiences. However, due to the increasing shift toward online purchasing trends, in-store sales growth has been comparatively stable.The e-commerce and manufacturer websites that make up the online distribution channel are experiencing fastest growth. For consumers looking for dashboard cameras, online channels provide a multitude of choices, comparisons, and convenience.

End User Segment Overview:

Commercial vehicles have a major market. Dashboard camera systems are still a major investment for commercial vehicles, including fleets and logistics companies, in order to maintain safety, track driver behaviour, and meet legal requirements. Personal vehicles are experiencing growth at the fastest rate as individual consumers are looking for additional security, evidence of incidents, and possible insurance benefits. This indicates a growing trend in automotive technology toward personal safety and security.

Dashboard Camera Market Regional Outlook:

North America:

The US has held a major share of the dashboard camera. The nation gains from a robust auto sector and broad acceptance of dashcams’ benefits for security and safety. Canada has seen the fastest growth in the dashboard camera market due to a greater awareness of traffic safety and a propensity for embracing automotive technology.

Asia Pacific:

Countries such as South Korea, Japan, and China dominate the dashboard camera market in Asia Pacific. South Korea leads the market due to technological advancements and a high demand for automobiles safety solutions. Japan is the market with the fastest rate of growth because of its reputation for having consumers who are technologically savvy that value advanced automotive technology.

Europe:

Russia, Germany, and the United Kingdom have all been significant dashboard camera markets. Germany dominates in this region because of their highly developed automotive industries and emphasis on road safety initiatives. Russia is the fastest growing market. Dashcams are frequently used as evidence in traffic accidents in Russia, where they have proven to be a significant market owing to insurance-related incentives.

South America:

Brazil is a major player in the dashboard camera market, because of its growing automotive sector and rising traffic safety consciousness. Mexico is showing promise as a fastest expanding market in this region due to increasing car sales and a growing focus on security and safety features for vehicles.

Middle East & Africa:

UAE dominates the dashboard camera market in this region. A growing number of commercial vehicles and technological advancements have contributed to the United Arab Emirates growing adoption of dashboard cameras. South Africa is expanding at the fastest rate in this region with its comparatively advanced automotive sector.

Trending Report in the similar space:

Fuel Cell Vehicle Market – Size, Growth Analysis, Forecast & Competition Benchmarking ( 2019 – 2030)

Bus Validator Market – Size, Growth Analysis, Forecast & Competition Benchmarking ( 2019 – 2030)

Electric Vehicle Fluids Market – Size, Growth Analysis, Forecast & Competition Benchmarking (2019 – 2030)

Automotive Logistics Market – Size, Analysis, Forecast & Competition Benchmarking

1 note

·

View note

Text

Credit Bureau Services Procurement Intelligence: Key Trends and Insights

The credit bureau services market is expected to grow at a CAGR of 12.6% from 2024 to 2030. The market for credit bureaus is expected to grow in the next few years due to the rising demand for credit cards. Credit card benefits, such as unlimited reward points with usage, insurance protection, discounts, and cashback, help increase credit scores. Further, credit card issuers provide credit bureaus with details about cardholder activity that help them confirm each customer's credit ratings, which serve as the foundation for loan applications.

As per the U.S. Federal Reserve Bank report, 82% of adults had a credit card in 2023, and 36% of adults applied for some type of credit in 2023. The adults with a minimum income of USD 100,000 held a credit card in the U.S. in 2023. The rate of credit card applications remained robust throughout 2023 in the U.S.; it reached 29% in October 2023. Due to these factors, the usage of credit cards has increased, which in turn has led to an expansion in the market for credit bureaus.

A credit bureau acquires and maintains track of a variety of credit-related insights on users and organizations, such as loans taken, overdraft facilities, and credit card usage. Increasingly, credit bureaus are partnering or collaborating with fintech companies to provide custom data analytics due to increasing demand for credit from new-to-credit (NTC) consumers. For instance, in 2023, credit bureaus witnessed more pronounced changes in the consumer credit market. As per the TransUnion report, the demand for auto and home equity loans has been steadily increasing since 2023. However, with increasing preference for credit products, the delinquency levels for personal loans and credit cards also rose in 2023.

According to TransUnion’s 2023 Consumer Pulse study, 26% of Americans planned to seek a credit instrument in 2024. Of those, 53% wanted a credit card, 23% wanted a car lease or loan and 22% wanted a personal loan. Credit limits increased by 26% in 2023, as per Equifax estimates. The share of NTC customers dropped from 17% in September 2022 to 14% in September 2023. Despite this drop, consumption-led demand continues to drive the demand for credit globally. In India, between July to September 2023, in the MSME sector, NTC customers accounted for 46% of the credit demand. They are expected to drive growth notably.

The North American region accounts for the largest category share due to an increase in the number of people looking for credit products like loans and credit cards amidst rising consumer awareness of the importance of maintaining a good credit score and routinely checking credit reports. In most places, there are primarily three major credit bureaus in the world - Equifax, Experian, and TransUnion. However, a few medium-sized private credit bureaus are also present in a few countries apart from these three giant players.

Order your copy of the Credit Bureau Services Procurement Intelligence Report, 2024 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies are concentrating their efforts on introducing cutting-edge technologies to strengthen their position in the industry. Blockchain technology enables instantaneous and transparent transaction initiation and execution amongst many parties. For instance:

• In May 2024, Equifax collaborated with the commerce platform, VTEX, to help prevent fraud for merchants worldwide. VTEX’s platform will utilize Equifax’s robust fraud prevention and detection capabilities and “Kount Payment Fraud” solution in this partnership. This will help both B2C and B2B merchants secure their business while providing enhanced customer solutions.

• In March 2024, TransUnion introduced its new platform called “OneTru” for managing, analyzing and providing data-related insights about customers. The platform unifies separate data and analytical resources designed for fraud prevention, credit risk, and marketing and then consolidates them into a single unified integrated layer. This strategy enables TransUnion to provide a more accurate, comprehensive and compliant picture of customers, regardless of the use case.

Credit bureaus possess high bargaining power primarily due to their unique position as information aggregators and providers in the financial landscape. They collect and maintain detailed credit histories of individuals and businesses, which are crucial for lenders and other financial institutions to assess creditworthiness. This information asymmetry gives credit bureaus significant leverage when negotiating with clients, including banks, credit card companies, and other financial entities. Additionally, regulatory barriers and limited competition in the industry contribute to their strong bargaining position. As a result, credit bureaus can influence market dynamics and often dictate terms that favor their interests.

The credit bureau services industry is highly consolidated in nature. Globally, more than 50% - 60% of the market is dominated by three players - Experian, Equifax, and TransUnion. The concentrated industry structure of credit bureau services can be attributed to several factors. First, the nature of the industry requires a high level of trust, accuracy, and regulatory compliance. This leads to a preference for established players with proven track records. Additionally, the entry barriers are relatively high due to the complexity of the services, the need for extensive data management systems, and the regulatory environment. As a result, a few dominant players tend to dominate the market, creating a concentrated industry structure.

The major cost components are salaries of professionals, IT and infrastructure, operational and administrative expenses, legal and marketing. Credit bureaus and IT technology play a vital role in maintaining accurate and efficient credit reporting systems. The importance of investing in IT technology lies in its ability to streamline processes, reduce errors, and enhance security measures. This, in turn, ensures that consumers receive fair credit assessments and financial institutions can make informed decisions. While the cost of implementing and updating IT systems may be significant, the benefits of improved data management, faster access to information, and better risk management far outweigh the expenses.

The category is based on a subscription pricing model, where a full report can be generated with credit scores depending upon the subscription period. The subscription plan could be for one year, 6 months, monthly, or one time as per company requirement. For instance, TransUnion CIBIL, an India-based credit information company, charges Rs 550 for credit report with a credit score. The element affecting the cost structure for credit bureau services is labor cost and software cost used in this industry. Credit bureau services come with various features, such as identity theft insurance and card activity alerts which require investment in software and acquiring labor.

Countries such as the United States, Canada, the United Kingdom, India, and Australia are preferred business destinations for these services. People in these countries give significant importance to credit scores which determine their financial competency and self-esteem. One of the essential sourcing practices for this category is engaging and negotiating with more than one supplier to acquire a holistic package of services. For instance, different credit bureau companies are providing a different set of services with credit report services. Experian can provide services such as credit scores and reports along with offering loans. In contrast, CRIF High Mark can offer credit scores and reports along with analytics services such as the deduplication platform. Therefore, businesses are required to negotiate and source the appropriate suppliers to get a whole sum report at affordable prices. Other sourcing practices considered in the category are competitor pricing strategies evaluation and payment terms.

Browse through Grand View Research’s collection of procurement intelligence studies:

• Payment Processing Solutions Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

• Cash-in-Transit Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Credit Bureau Services Procurement Intelligence Report Scope

• Growth Rate: CAGR of 12.6% from 2024 to 2030

• Pricing growth Outlook: 3% - 5% (Annually)

• Pricing Models: Subscription pricing model

• Supplier Selection Scope: Cost and pricing, Past engagements, Productivity, Geographical presence

• Supplier Selection Criteria: Individual and Commercial Credit Report Services, Microfinance Credit Information Report, Credit Report Verification Services, Additional services (Loan Report, Score Simulator, Membership Access), operational capabilities and others

• Report Coverage: Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key companies

• CRIF High Mark Credit Information Services Pvt. Ltd

• Equifax Inc., Experian PLC

• Innovis (CBC Companies)

• TransUnion LLC

• Credit Bureau Malaysia Sdn. Bhd.

• Qatar Credit Bureau

• The Saudi Credit Bureau (SIMAH)

• Credit Bureau Singapore

• National Credit Bureau Company Limited (Credit Bureau)

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

#Credit Bureau Services Procurement Intelligence#Credit Bureau Services Procurement#Procurement Intelligence

0 notes

Text

Caravan and Motorhome Market: Forthcoming Trends and Share Analysis by 2030

Caravan And Motorhome Market Size Was Valued at USD 48.22 Billion in 2022, and is Projected to Reach USD 90.59 Billion by 2030, Growing at a CAGR of 8.2% From 2023-2030.

A caravan is a vehicle without an engine that can be pulled by towing vehicles. A caravan is towed by a towing vehicle, and a motorhome is a self-contained vehicle with its own cab. A caravan is used for a short stay because it can move easily from one place to another. Motorhomes are used for traveling and various activities such as shows, multi-day events, and parties. They reduce the costs of stays and flight costs as compared to everyday vacation activities. Individuals worldwide prefer recreational vehicles (RVs) due to increasing traveling habits and rising disposable income. Caravans are most commonly utilized for temporary accommodation when traveling. Besides, most people use them as their main residence due to benefits, such as easily towable units, low fuel consumption, lower maintenance and insurance costs, and depreciation value. The growth in travel schemes and the cost-effectiveness provided over other modes of travel are motivating customers to purchase recreational vehicles (RVs). This trend is witnessed in various geographical areas as the registration of caravans is increasing.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://introspectivemarketresearch.com/request/15808

The latest research on the Caravan and Motorhome market provides a comprehensive overview of the market for the years 2023 to 2030. It gives a comprehensive picture of the global Caravan and Motorhome industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Caravan and Motorhome market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses. The study is written with a specific goal in mind: to give business insights and consultancy to help customers make smart business decisions and achieve long-term success in their particular market areas.

Leading players involved in the Caravan and Motorhome Market include:

Thor Industries, Inc.(US), Forest River, Inc. (US), Winnebago Industries, Inc. (US), Coachmen RV (US)Bailey of Bristol (UK), Lunar Caravans Ltd. (UK), Auto-Trail VR Ltd. (UK), Concorde Reisemobile GmbH (Germany), and Other Major Player

If You Have Any Query Caravan and Motorhome Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/15808

Segmentation of Caravan and Motorhome Market:

By Caravan Type

Travel Trailers

Fifth-wheel Trailers

Folding Camp Trailers

Truck Campers

By Motorhome Type

A-Class Motorhomes

B-Class Motorhomes

C-Class Motorhomes

Campervans

By End User

Direct Buyers

Fleet Owners

By Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Highlights from the report:

Market Study: It includes key market segments, key manufacturers covered, product range offered in the years considered, Global Caravan and Motorhome Market, and research objectives. It also covers segmentation study provided in the report based on product type and application.

Market Executive Summary: This section highlights key studies, market growth rates, competitive landscape, market drivers, trends, and issues in addition to macro indicators.

Market Production by Region: The report provides data related to imports and exports, revenue, production and key players of all the studied regional markets are covered in this section.

Caravan and Motorhome Profiles of Top Key Competitors: Analysis of each profiled Roll Hardness Tester market player is detailed in this section. This segment also provides SWOT analysis of individual players, products, production, value, capacity, and other important factors.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=15808

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyse extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049

Email: [email protected]

#Caravan and Motorhome#Caravan and Motorhome Market#Caravan and Motorhome Market Size#Caravan and Motorhome Market Share#Caravan and Motorhome Market Growth#Caravan and Motorhome Market Trend#Caravan and Motorhome Market segment#Caravan and Motorhome Market Opportunity#Caravan and Motorhome Market Analysis 2023

0 notes

Text

The global telematics-based auto insurance market is expected to produce approximately US$ 2,513.9 million in revenue in the year 2023. This market is projected to experience substantial growth, with an anticipated annual increase of 18.7%, ultimately reaching US$ 13,998.3 million by the year 2033.

0 notes

Text

CPAP Systems Market Size, Type, segmentation, growth and forecast 2023-2030

CPAP Systems Market

The CPAP Systems Market is expected to grow from USD 2.10 Billion in 2022 to USD 3.80 Billion by 2030, at a CAGR of 7.60% during the forecast period.

Get the Sample Report: https://www.reportprime.com/enquiry/request-discount/11184

CPAP Systems Market Size

CPAP Systems, or Continuous Positive Airway Pressure Systems, are medical devices used to treat sleep apnea and other respiratory disorders by maintaining a consistent flow of air to the lungs throughout the night. The global CPAP Systems market research report segments the market by type (Fixed Pressure CPAP Device, Auto Adjusting CPAP Device), application (Hospital, Home Care, Others), and region (North America, Asia Pacific, Middle East, Africa, Australia, and Europe). Key market players include ResMed, Philips Respironics, DeVilbiss Healthcare, Apex, Teijin Pharma, Medtronic (Covidien), Koike Medical, Fosun Pharma, and BMC Medical. Regulatory and legal factors specific to market conditions may include government regulations regarding device safety, import/export regulations, and reimbursement policies for patient care.

CPAP Systems Market Key Player

ResMed

Philips Respironics

Company three

DeVilbiss Healthcare

Apex

Buy Now & Get Exclusive Discount on this https://www.reportprime.com/enquiry/request-discount/11178

CPAP Systems Market Segment Analysis

The CPAP Systems target market consists of individuals who suffer from obstructive sleep apnea (OSA) or other respiratory disorders that affect their breathing during sleep. CPAP (Continuous Positive Airway Pressure) Systems are used to treat these conditions by providing a steady flow of air pressure to keep the airway open and allow for uninterrupted breathing during sleep. The market size for CPAP Systems is growing due to increased awareness of sleep apnea and other respiratory disorders, an aging population, and rising healthcare expenditures.

One of the major factors driving revenue growth of the CPAP Systems market is the increasing prevalence of sleep apnea and other respiratory disorders. According to the American Sleep Apnea Association, an estimated 22 million Americans suffer from sleep apnea, which is one of the most common sleep disorders. The market is also being driven by the aging population, as sleep apnea becomes more prevalent with age. Additionally, the rise in healthcare expenditures is providing an opportunity for growth in the CPAP Systems market, as medical professionals are becoming more aware of the benefits of CPAP therapy and the need for sleep apnea screening.

The latest trends in the CPAP Systems market include technological advancements in CPAP devices, such as the development of smart CPAP machines that can adjust pressure levels based on the patient's needs. There is also a growing trend towards home-based sleep testing and telemedicine, which allows patients to receive care from the comfort of their own homes.

The major challenges faced by the CPAP Systems market include the high cost of CPAP devices and the lack of patient compliance with CPAP therapy. Many patients do not comply with CPAP therapy due to discomfort or inconvenience, which can lead to a lack of effectiveness in treatment. Also, the lack of reimbursement for CPAP devices by insurance companies can make it difficult for patients to afford therapy.

The main findings of this report indicate that the CPAP Systems market is growing due to the increasing prevalence of sleep apnea and other respiratory disorders, an aging population, and rising healthcare expenditures. Technological advancements and home-based sleep testing are also driving the market. However, challenges such as high costs and patient non-compliance need to be addressed to ensure the continued growth of this market.

To ensure continued growth in the CPAP Systems market, the report recommends focusing on improving patient compliance and developing less invasive and more affordable CPAP devices. Additionally, increasing awareness of sleep apnea and other respiratory disorders, as well as expanding insurance coverage for CPAP devices, can help increase access to care for individuals who need it.

This report covers impact on COVID-19 and Russia-Ukraine wars in detail.

Purchase This Report: https://www.reportprime.com/checkout?id=11184&price=3590

Market Segmentation (by Application):

Hospital

Home Care

Others

Information is sourced from www.reportprime.com

0 notes

Text

The global telematics-based auto insurance market is expected to grow at a CAGR of 18.2% during 2023-2028, as per RationalStat analysis. Telematics-based auto insurance is a type of usage-driven insurance (UBI) that utilizes telematics technology, which involves collecting data from a vehicle’s onboard sensors to assess the driving behavior and usage patterns of the insured driver.

0 notes

Text

Hot Stocks to Buy for Swing Trading for this week – Expert Stock Picks of the Week by StockXpo

Hello to all our readers including Traders, Investors, Analysts, and others!!!!

In the fast-paced world of stock trading, keeping up with the latest trends and movements is essential for investors to make informed decisions. Three important stories that have emerged in the stock market include companies making big moves after hours, the performance of Berkshire Hathaway during market turmoil, and Jim Cramer's analysis on the economy's future. Let's dive deeper into these stories to understand what they mean for investors.

Stocks Making the Biggest Moves After Hours

Several major companies, including Apple, Carvana, and DoorDash, made significant moves after hours on May 12, 2023. Apple's stock rose by 2.5% following the announcement of a new iPhone model, while Carvana's shares fell by 6.2% due to lower-than-expected earnings. DoorDash's stock also declined by 3.7% due to concerns over rising delivery costs.

These moves reflect the market's volatility and the need for investors to stay informed about company news and earnings reports. For swing traders, these fluctuations can provide opportunities for short-term gains. However, it is crucial to conduct thorough research and analysis before making any investment decisions.

Berkshire Hathaway Outperforms During Turmoil

Berkshire Hathaway, the conglomerate led by legendary investor Warren Buffett, has historically outperformed during market turmoil. Despite the recent market turbulence caused by inflation fears and geopolitical tensions, Berkshire Hathaway's stock has remained stable.

However, Berkshire Hathaway's subsidiary GEICO, the second-largest auto insurer in the US, is facing challenges due to rising costs and increased competition. This development highlights the importance of diversification and careful analysis of individual companies within a larger portfolio.

Jim Cramer's Analysis on the Economy's Future

Jim Cramer, the host of CNBC's “Mad Money," has offered his insights on the economy's future. He believes that the current economic expansion will continue but that it will likely experience a soft landing rather than a crash. Cramer cites factors such as low unemployment rates, increasing consumer confidence, and rising GDP as indicators of economic strength.

For investors, understanding the overall economic climate is crucial for making informed decisions about their portfolios. However, it is important to remember that individual companies' performance can vary significantly from the broader market trends.

In conclusion, the stock market is a complex and ever-changing landscape that requires constant attention and analysis. From monitoring after-hours movements to analyzing economic indicators, investors must stay informed to make the most informed decisions. By carefully considering technical and fundamental factors, swing traders can identify potential opportunities for short-term gains. However, it is crucial to conduct thorough research and analysis before making any investment decisions, as individual companies' performance can vary significantly from broader market trends.

Here we are again with this week’s recommendations. Please note that overall the market was very much on the upside, and whether you are following our recommendations or not, I am sure if you have been trading this week ending today then you must have collected a lot of profits. If not, and you are skeptical about the market, add swing trading to your trading strategy and get started to follow our recommendations. We are going to publish the performance results for the last few months and this year to date, to give you some ideas of how we have been compared against the S&P 500 and other major indexes.

If you are a regular reader, you may be already aware, that we recommend ValueGrowth, to fit different trading styles and strategies. You can find more details about these strategies in our FAQ section. This is more of a swing trading, as we keep balancing our portfolio every week, mostly on Friday. If you are new, welcome. Visit our site to get all relevant information about stocks and make sure to subscribe to our newsletter to get updates on our Swing Trading Stock Picks. We send out our newsletter as soon as we publish our stock picks. We hope that you love our articles and get all the details so keep coming to our site for more information. We have tested out our strategy with more than 20 years of data and it performed well against S&P 500.

Here we are again with this week’s recommendations. Please note that overall the market was very much on the upside, and whether you are following our recommendations or not, I am sure if you have been trading this week ending today then you must have collected a lot of profits. If not, and you are skeptical about the market, add swing trading to your trading strategy and get started to follow our recommendations. We are going to publish the performance results for the last few months and this year to date, to give you some ideas of how we have been compared against the S&P 500 and other major indexes.

Due to volatile market conditions, the performance of the TechFund strategy has been inconsistent. As a result, we have conducted a thorough analysis and decided to temporarily discontinue this alert. Our team of experienced professionals is actively developing alternative strategies, and we will announce them in the near future.

StockXpo's – ValueGrowth Strategy

As you know, this is more like Buffett's Value Strategy, but our stock-picking criterion is to pick the top 3 out of such value stocks. Moreover, we are more likely to hold them for the short term, not the long term. Our backtesting suggests that weekly balancing gives very good results week over week and year over year, it can grow your portfolio exponentially if you just consistently follow these strategies. So our picks are $WNC, $TGS, and $FOR in this category.

WNC(Wabash National Corporation): Wabash National Corporation (WNC) is an American diversified industrial manufacturer and supplier of transportation equipment. Its product portfolio includes semi-trailers, truck bodies, and liquid transportation systems, among others. The company operates in the Industrials sector and its stock symbol is WNC. In this article, we will discuss why WNC is technically and fundamentally strong for swing trading in the upcoming days or weeks.

Technical Analysis:

WNC's stock has been performing well in recent months. It has been trading in a bullish trend, consistently making higher highs and higher lows. The Relative Strength Index (RSI) is indicating that the stock is not yet overbought, which means that there is still room for the stock to gain more momentum. The Moving Average Convergence Divergence (MACD) line is also above the signal line, which is another bullish signal for the stock.

Furthermore, the stock is currently trading above its 50-day moving average, indicating that the stock is in an uptrend. The 50-day moving average is acting as a strong support level for the stock, which means that the stock is likely to bounce back if it falls to that level. Additionally, the stock has broken above its 200-day moving average, which is a bullish signal for the stock.

Fundamental Analysis:

WNC's financials are also strong. The company has a Price to Earnings (P/E) ratio of 11.02, which is lower than the industry average of 22.44. This means that the stock is undervalued compared to its peers. The company also has a Price to Sales (P/S) ratio of 0.52, which is lower than the industry average of 1.18, indicating that the stock is undervalued in terms of its sales. Moreover, the company has a healthy debt-to-equity ratio of 0.65, indicating that the company has a good balance between debt and equity.

Furthermore, WNC has a strong dividend history. The company has been paying dividends consistently since 2003 and has increased its dividend payout every year since 2011. The current dividend yield is 1.5%, which is relatively high compared to its peers in the industry.

Conclusion:

Wabash National Corporation (WNC) is technically and fundamentally strong for swing trading in the upcoming days or weeks. The stock has been performing well in recent months and is trading in a bullish trend. The company has a healthy financial position, with a low P/E ratio, low P/S ratio, and a healthy debt-to-equity ratio. Furthermore, the company has a strong dividend history, making it an attractive option for investors looking for stable returns. With these strong technical and fundamental indicators, WNC may present an opportunity for swing traders to profit from the bullish trend.

TGS(Transportadora de Gas del Sur S.A.): Transportadora de Gas del Sur S.A. (TGS) is an energy company that provides natural gas transportation services in Argentina. With a strong position in the natural gas market, TGS has been experiencing positive trends in both its technical and fundamental aspects, making it a potentially attractive option for swing trading.

From a technical standpoint, TGS has been showing a bullish trend in recent weeks. The stock has been trading above its 50-day and 200-day moving averages, indicating a positive trend in the short and long term. In addition, the Relative Strength Index (RSI) has been consistently above 50, signaling a bullish sentiment among traders.

Furthermore, TGS has been making strong fundamental moves that make it a potentially strong option for swing trading. In 2021, the company announced that it had invested $100 million in a new natural gas processing plant, which is expected to increase its production capacity and improve its bottom line. This investment is part of TGS's overall strategy to expand its operations and increase its presence in the natural gas market.

Another fundamental strength of TGS is its strong financial performance. The company has consistently reported positive earnings, with a net income of $35 million in the first quarter of 2021 alone. This performance is driven by TGS's solid business model, which includes a diverse portfolio of assets and a strong customer base.

In addition, TGS's financial position is stable, with a debt-to-equity ratio of 0.73 and a current ratio of 1.5. This indicates that the company is in a strong financial position and has the ability to weather any potential market downturns.

Overall, TGS is a company with a strong technical and fundamental outlook, making it a potentially attractive option for swing trading. Its bullish trend, strong financial performance, and strategic investments make it a company worth considering for traders looking to capitalize on market opportunities in the energy sector. However, as with any investment, it is important to conduct thorough research and analysis before making any trading decisions.

FOR(Forestar Group Inc.): Forestar Group Inc (NYSE: FOR) is a real estate development and investment company headquartered in Austin, Texas. With a focus on residential and mixed-use communities, Forestar has a diversified portfolio of assets that includes undeveloped land, finished lots, and income-producing properties.

In recent years, Forestar has seen steady growth and profitability, making it an attractive stock for swing traders looking for opportunities in the real estate sector. Here's why Forestar is technically and fundamentally strong for swing trading in the upcoming days or weeks.

Technical Analysis:

From a technical perspective, the stock has been in a steady uptrend since the COVID-19 crash in March 2020. Forestar's stock price has gained more than 200% in the last year, outperforming the S&P 500's returns.

Currently, the stock is trading above its 50-day and 200-day moving averages, indicating a strong bullish trend. The 50-day moving average has recently crossed above the 200-day moving average, forming a golden cross, which is a bullish signal for traders. The stock's Relative Strength Index (RSI) is hovering around 60, suggesting that it is not yet overbought.

Fundamental Analysis:

Forestar Group's financials are strong, making it a compelling investment opportunity for traders. The company has seen consistent revenue growth over the last five years, with a revenue of $364 million in 2020, up from $290 million in 2016. Forestar's net income has also shown steady growth, with a net income of $56 million in 2020, up from $18 million in 2016.

The company's debt-to-equity ratio is 0.79, indicating that it is managing its debt well. Forestar has a current ratio of 2.65, indicating that it has ample liquidity to meet its financial obligations.

Forestar's business model focuses on creating value through the acquisition, entitlement, and development of real estate assets. The company is well-positioned to benefit from the current boom in the US housing market. With the Federal Reserve keeping interest rates low, demand for residential properties is high, and Forestar has an extensive land bank, allowing it to capitalize on this trend.

Conclusion:

Forestar Group Inc is a solid real estate company with a proven track record of growth and profitability. The technical analysis suggests that the stock is in a strong uptrend and is currently trading in a bullish zone. The company's fundamentals are sound, with a healthy financial position and a well-defined business model that positions it well to capitalize on the current housing market. For swing traders looking for opportunities in the real estate sector, Forestar is a stock to watch in the upcoming days or weeks.

I hope this information will help you buy good stocks for your swing trading. See you next Friday. Keep coming to our website for stock-related queries and information.

If you haven’t subscribed yet, please subscribe to our newsletter so you can get the updates delivered to your mailbox. Subscribe to our newsletter so you get notified when we publish our future article like this every Friday about Best Stocks to Buy For the Short term for Swing Trading with clear directions on Buy vs Hold vs Sell. We recommend balancing your swing trading StockXpo alert-based portfolio every Friday following our recommendations closely. All you need is half an hour to an hour of your time on Friday depending on how quickly you can execute these trades. Subscriber today, it’s free forever

For more information please visit https://stockxpo.com/hot-stocks-to-buy-for-swing-trading-for-this-week-expert-stock-picks-of-the-week-by-stockxpo-05-05-2023/

Happy Trading!!!!

0 notes

Text

AI in Auto Insurance market Unidentified Segments – The Biggest Opportunity Of 2023

Latest business intelligence report released on Global AI in Auto Insurance Market, covers different industry elements and growth inclinations that helps in predicting market forecast. The report allows complete assessment of current and future scenario scaling top to bottom investigation about the market size, % share of key and emerging segment, major development, and technological advancements. Also, the statistical survey elaborates detailed commentary on changing market dynamics that includes market growth drivers, roadblocks and challenges, future opportunities, and influencing trends to better understand AI in Auto Insurance market outlook. List of Key Players Profiled in the study includes market overview, business strategies, financials, Development activities, Market Share and SWOT analysis are:

Ping An Insurance (Group) of China Ltd.(China)

New China Life Insurance (China)

Allstate(United States)

The Hartford Financial Services Group(United States)

China Pacific Insurance Group(China)

IFFCO Tokio General Insurance (Japan)

HDFC ERGO General Insurance(India)

Bajaj Allianz General Insurance(India)

AXA XL (Germany)

Trov Insurance Solutions, LLC (United States)

SkyWatch Insurance Services, Inc.(United States)

WorkFusion(United States)

Lemonade, Inc. (United States)

Attivio(United States)

Clearcover(United States)

Flyreel(United States)

Galaxy AI (United States)

Insurmi (United States)

Artificial intelligence is transforming every industry due to its innovative and revolutionary capabilities which may substantially affect the performance of an every business. AI enables auto insurance companies to offer their services resourcefully to its customers. AI in auto insurance enable all services with quicker pay-outs and customized policy prices. Further, AI in auto insurance market help insurance companies to reach out to its customers offers right set of products, and faster claim process. The generation of large volume of data through various software’s and mobile devices are providing growth to the insurance sector with significant rate. This data represents a huge opportunity for insurance companies to gain insights from their customers and various business aspects. Further, raising demand for auto insurance in emerging countries like Chin, Australia and India is impacting on the demand for AI in auto insurance market to provide quicker services by preventing fraud and risk associated with it. According to Microsoft release, in India there are more than 230 million vehicles and 1200 auto accidental cases are registered. Hence, the demand for insurance for safety purpose has been raised. Key Market Trends: Increasing demand of cognitive technologies for Auto insurance Opportunities: The use of Application Platform Interface (API) and Next Generation Platform (NGP) for claim analysis are providing new opportunity for AI in Auto insurance

Identification of customer termination risk by AI is boosting the market growth

Market Growth Drivers: Rising inclination towards the use of AI based programs owing to their quicker and safer process for access is impacting on the demand for AI in Auto insurance

Growing demand due to its ability to prevent and identify inconsistencies in applications, claims and premium assessments

The wide adoption of AI in insurance sector

Challenges: To lowers the risk associated with cybersecurity in data management with the help of AI is well known challenge for the market The Global AI in Auto Insurance Market segments and Market Data Break Down by Type (Liability, Collision, Comprehensive), Application (Claims Assessment, Chatbots for Customer Service, Policy Pricing), Auto Insurance Type (Usage-based insurance, On-demand insurance, Peer-to-peer (P2P) insurance)

Presented By

AMA Research & Media LLP

0 notes

Text

Canada Concrete Admixtures and Concrete Repair Mortars (CRM) Market 2023: Current and Future Market Potential by types and by end Canadae indCanadatries

https://www.prosebox.net/entry/1593490/europe-machine-vision-lenses-market-statistics-2023-analysis-research-study/https://www.prosebox.net/entry/1593495/usa-ac-to-dc-converter-market-trends-2023-updated-business-statistics/https://www.prosebox.net/entry/1593506/usa-iso-cylinders-market-analysis-outlooks-2023-size-cost-structure/https://www.prosebox.net/entry/1593537/europe-industrial-lenses-market-2023-by-types-amp-by-end-use-industries/https://www.prosebox.net/entry/1593541/usa-microscope-illumination-market-2023-outlook-channels-analysis-2029/https://www.prosebox.net/entry/1593548/europe-ecological-textile-fiber-market-2029-is-thriving-by-focuses-on-statestics/https://www.prosebox.net/entry/1593553/europe-auto-tempered-glass-market-2023-segment-top-players-driver-trends/https://www.prosebox.net/entry/1593556/europe-lanolin-oil-market-outlook-post-covid-19-scenario-by-2029/https://www.prosebox.net/entry/1593560/europe-pneumatic-knife-gate-valve-market-production-growth-share-demand-2029/https://www.prosebox.net/entry/1593569/usa-glass-mat-gypsum-wall-board-2023-market-huge-growth-in-size-share-trends/https://www.prosebox.net/entry/1593571/europe-portable-sound-level-meter-market-2023-2029-new-study-report-on-trends/https://www.prosebox.net/entry/1593576/usa-ccd-industrial-cameras-market-to-witness-significant-growth-by-2023-2029/https://www.prosebox.net/entry/1593582/europe-offshore-cable-market-witness-huge-growth-between-2023-2029/https://www.prosebox.net/entry/1593588/usa-drop-cable-market-2023-top-strategies-technological-innovation/https://www.prosebox.net/entry/1593593/europe-insulation-cable-market-how-it-is-going-to-impact-on-industry/https://www.prosebox.net/entry/1593602/usa-underwater-hybrid-cable-market-statistics-2023-explained-effective-movements/https://www.prosebox.net/entry/1593605/europe-mandrel-bars-market-expecting-an-outstanding-growth-till-2029/https://www.prosebox.net/entry/1593610/usa-plastic-mold-steel-market-2023-trends-with-descriptive-analysis/https://www.prosebox.net/entry/1593613/europe-tool-steeldie-steel-market-statistics-2023-analysis-research-study/https://www.prosebox.net/entry/1593615/usa-atomizing-metal-powder-market-trends-2023-updated-business-statistics/https://www.prosebox.net/entry/1593617/usa-ultra-high-speed-camera-market-analysis-outlooks-2023-size-cost-structure/https://www.prosebox.net/entry/1593619/europe-ultra-fine-artificial-graphite-powder-market-2023-by-types-amp-by-end-use-industries/https://www.prosebox.net/entry/1593622/usa-tyre-oils-market-2023-outlook-channels-analysis-2029/https://www.prosebox.net/entry/1593624/europe-innovation-management-tools-market-2029-is-thriving-by-focuses-on-statestics/https://www.prosebox.net/entry/1593626/europe-cut-and-bend-equipment-market-2023-segment-top-players-driver-trends/https://www.prosebox.net/entry/1593628/europe-borehole-extensometers-market-outlook-post-covid-19-scenario-by-2029/https://www.prosebox.net/entry/1593631/europe-inclinometers-sensors-market-production-growth-share-demand-2029/https://www.prosebox.net/entry/1593633/usa-cattle-insurance-2023-market-huge-growth-in-size-share-trends/https://www.prosebox.net/entry/1593635/europe-automotive-power-inverters-market-2023-2029-new-study-report-on-trends/https://www.prosebox.net/entry/1593637/usa-mirrorless-cameras-market-to-witness-significant-growth-by-2023-2029/

0 notes

Text

Four Ways to Save Money on Car Insurance as Rates Rise

Drivers who have been complaining about high gas prices can now shift gears and gripe about car-insurance rates instead. While the average cost of a gallon dropped about 26% since June, car-insurance premiums have risen 8.3% on average compared with a year ago, according to S&P Global Market Intelligence. Inflation is only partly to blame. More Americans are driving more miles again compared with during the height of the pandemic, leading to a higher rate of serious crashes, fender benders and road rage, said Dale Porfilio, chief insurance officer at the Insurance Information Institute, an industry trade group, also known as Triple-I. Car-related crime is also up, including the theft of valuable parts such as catalytic converters. According to the National Insurance Crime Bureau, a nonprofit focused on fighting insurance fraud and crime, 932,329 vehicles were reported stolen in 2021, a 17% increase since 2019. Get Wall Street Journal and Bloomberg Digital Subscription 5-years $89 These factors, coupled with rising prices for new and used cars, have sent the average annual cost of car insurance to $1,771, according to Bankrate. And premiums are expected to rise another 5% to 10% in 2023, Triple-I estimates. Driving those premium increases are higher costs for replacement parts, labor and the evolving technological sophistication, which makes repairs of new vehicles more expensive, Mr. Porfilio said. Auto insurers use several factors, many beyond a driver’s control, to set rates. Because of higher rates of vandalism, theft and accidents, city drivers typically pay higher rates than those in small towns or rural areas, he said. Get a 5-years subscription to the WSJ and Barrons News for $89 The most expensive states for car insurance are Louisiana, where drivers pay $2,986 a year on average, Florida ($2,775) and Nevada ($2,489), according to a recent analysis by NerdWallet Inc. The cheapest states are Idaho ($1,027), Ohio ($1,066) and Vermont ($1,074). You can lower your insurance rate whether you are shopping to insure a new vehicle or seeking a cheaper option when your policy is up for renewal. Here are four moves to consider: Reduce Your Coverage Before the pandemic, owners of older vehicles typically dropped collision and comprehensive coverage after about six years. But since the pandemic, used vehicles have surged in price, so owners need to be more cautious about when to forgo these options, Mr. Porfilio said. A good rule of thumb is to multiply your older car’s insurance premium by 10. If that number is more than the value of the car itself, collision or comprehensive coverage might not be worth it, according to Triple-I. For example, a 2013 Honda Pilot has a trade-in value of $7,691, according to Kelley Blue Book. If you were quoted an annual premium of $1,000, you might want to pass on comprehensive coverage. Chris Diodato says he recently waived collision and comprehensive coverage on his 15-year-old 2008 Hyundai Sonata, saving about $600 a year. The financial planner in Palm Beach Gardens, Fla., said his car’s estimated trade-in value is less than $2,000, so he thought it made financial sense to waive the extra coverage. Raise Your Deductible If you have a lower deductible, say $250, a solid emergency fund, call your insurer to find out how much raising your deductible would reduce your rate, said Lauren Lindsay, a financial planner in Houston. A deductible is the amount you pay for repairs before your insurance kicks in. A client of Ms. Lindsay saved $480 a year on premiums by increasing the deductible from $500 to $2,500. The client opted for this since her two sons are grown, with their own car insurance. The client also has about six months of expenses saved in an emergency fund. Ms. Lindsay suggests saving at least three months of expenses in an emergency fund before pursuing this option. Shop Around, Demand Discounts Get at least three quotes from insurers before signing onto a policy, according to AAA. Steve Sivak, a financial planner in Pittsburgh, tells his clients to spend two hours every year shopping around, which he said typically lands them a cheaper option. Jim Ciprich, a father of two from Florham Park, N.J., shaved about 5% off his insurance after taking advantage of his carrier’s “good student” discount by sending his agent a copy of his elder daughter’s grades twice a year. Most carriers that offer the good student discount require a B or better average. When his same daughter started college this fall, he qualified for an “away at school” discount, since she didn’t have a car on campus, saving him about $157 a year. Some insurers will give you a discount if you purchase two or more types of insurance from them—such as homeowners and auto—or have more than one vehicle insured, said Mr. Porfilio. Share Driving Data Putting a device in your car or using a smartphone app that tracks behavior on the road can also reduce premiums. Most big insurers including Progressive Corp., Allstate Corp., Nationwide, Farmers Insurance Group and USAA now offer programs that log behaviors such as hard braking, fast acceleration and idle time. Participation in usage-based insurance programs, which rely on technology to monitor driving habits and assign risk, has doubled since 2016, with 16% of auto-insurance customers enrolling in such initiatives, according to a recent survey by J.D. Power. The safer you drive, the more you are likely to save, said Cate Deventer, insurance analyst at Bankrate. A driver with an at-fault accident pays $832 more a year, on average, for full coverage than a driver with no traffic violations, according to recent NerdWallet analysis of nationwide car-insurance rates. Some companies might impose surcharges if your driving data indicates a riskier-than-average behavior, so make sure you check the company’s rules, Ms. Deventer said. Read the full article

0 notes

Link

0 notes

Text

The global telematics-based auto insurance market is expected to produce approximately US$ 2,513.9 million in revenue in the year 2023. This market is projected to experience substantial growth, with an anticipated annual increase of 18.7%, ultimately reaching US$ 13,998.3 million by the year 2033.

Governments want to develop the automotive industry by implementing cutting-edge telematics in cars. This is one of the key drivers of global market expansion. However, on-board Diagnosis (OBD)-ll dongles offer possible entry points that hackers use to steal information, cars, and remotely operate vehicles.

0 notes

Text

Telematics Market 2021 Growth Analysis, Industry Share, Business Opportunities Assessment, Challenges and Regional Forecast to 2027

The global telematics market is growing rapidly. Market growth attributes to the increasing demand for wireless connectivity in automobiles and the rising implementation of renewables in electric vehicles. Besides, the growing penetration of information and communication technology (ICT) and telecommunication devices in various industrial sectors drive the market demand hugely. Moreover, increasing government initiatives for on-road public safety and security escalate market growth.

According to Market Research Future (MRFR), the global telematics market is projected to grow at a substantial CAGR during the review period (2017 – 2023). The emergence of digital technology has made it possible to communicate with machines, which is expected further to enhance the growth of the telematics system market. Also, the rising demand for advanced surveillance & navigation systems pushes the growth of the telematics industry.

Artificial intelligence is developing its roots in transportation, automation, construction, and industrial applications, further improving technology. Besides, augmenting demand for border security and marine modernization programs boost the growth of the market. On the other hand, the high equipment cost of the technology and telematics devices are the major factors estimated to impede the market growth. Nevertheless, the increased demand from the defense sector would support market growth throughout the review period.

Request a Free Sample @ https://www.marketresearchfuture.com/sample_request/1121

Global Telematics Market - Segmentation

The market is segmented into four dynamics;

By Technology : Embedded, Portable, and Hybrid.

By Services : Navigation, Diagnostic, On-Demand Infotainment, Maintenance & Security, and others.

By Application : Commercial, Automotive, IT & Telecommunication, Healthcare, Government, and others.

By Regions : Americas, Europe, Asia Pacific, and Rest-of-the-World.

Global Telematics Industry - Regional Analysis

North America dominates the global telematics market. The largest share majorly attributes to the higher adoption rate of the technology and high demand for premium cars with advanced safety & comfort features. The US telematics market holds a significant share in the region. Although the technology is in its embryonic stage, American companies have already begun conducting experiments on the road, partnering with telecommunication service providers.

Moreover, the increasing demand for telematics in military & defense and high R & D investments drives the regional market growth. Besides, considerable demand for new and advanced marine navigation systems and growing product launches and technological upgrades push the growth of the regional market. Additionally, the presence of several notable players and state-of-the-art development centers in the region foster regional market growth.

Europe stands second in the global telematics market. The market is majorly driven by the growing application of analytics in industries like transportation, automotive, supply chain & logistics, retail, healthcare, and IT & telecommunication. Moreover, increasing deployments of advanced telematics features in the end product substantiate the regional market growth.

Growing investments in military and commercial aviation programs, alongside the considerable investments in France, Russia, Germany, and the UK, drive the regional market growth. Besides, increasing government R&D funding and support and rising defense budgets propel the regional market growth. The European telematics market is estimated to grow at a significant CAGR throughout the analysis period.

The Asia Pacific region holds a substantial share in the global marine navigation systems market. Factors such as the growing marine transportation industry and increased maritime border disputes in India, China, and South Korea drive the market growth in the region. Moreover, increasing military budgets and spending on advancing military equipment systems, positively impact market growth. Additionally, considerable developments in military technologies foster market growth excellently. The APAC telematics market is likely to grow at an impressive CAGR throughout the assessment period.

Get Report Details @ https://www.marketresearchfuture.com/reports/telematics-market-1121

Telematics Market Share-Competitive Landscape

Highly competitive, the telematics market looks fragmented due to the presence of several notable players. Also, due to the availability of a range of futuristic products, the market appears well-established. Industry players focus on strategies such as mergers & acquisitions, collaborations, and expansion to gain a larger competitive share. Product launch and technology upgrades trend in the market. As a result, market players make substantial R&D investments.

Major Players: